- IBM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

International Business Machines (IBM) 8-KRegulation FD Disclosure

Filed: 20 May 05, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15 (d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: May 20, 2005

(Date of earliest event reported)

INTERNATIONAL BUSINESS MACHINES CORPORATION

(Exact name of registrant as specified in its charter)

New York |

| 1-2360 |

| 13-0871985 |

(State of Incorporation) |

| (Commission File Number) |

| (IRS employer Identification No.) |

|

|

|

|

|

ARMONK, NEW YORK |

| 10504 | ||

(Address of principal executive offices) |

| (Zip Code) | ||

914-499-1900

(Registrant’s telephone number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01 (Regulation FD Disclosure)

Attachment I contains presentation materials for IBM’s May 20, 2005 Investors’ Briefing by IBM’s Chairman and CEO and other senior IBM executives. This information is hereby furnished.

IBM’s web site (www.ibm.com) contains a significant amount of information about IBM, including financial and other information for investors (www.ibm.com/investor/). IBM encourages investors to visit its various web sites from time to time, as information is updated and new information is posted.

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

Date: May 20, 2005

| By: | /s/ | Andrew Bonzani |

|

|

|

| (Andrew Bonzani) | |

|

|

| Assistant Secretary & | |

|

| Associate General Counsel | ||

3

ATTACHMENT I

4

Exhibit 99.1

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Good morning. I’d like to welcome you to this briefing for IBM investors.

I’m joined today by Mark Loughridge, our CFO, and the senior leaders of our major business units. Together, we’ll provide a perspective on IBM’s strategy and operations.

This is an important time for the industry and for IBM. It’s also a potentially confusing time for investors. It’s easy to intermix near-term issues with longer-term shifts, cyclical effects with more fundamental change.

That’s why we changed the agenda for today’s meeting. In previous years, you will recall that we used to separate these two sets of issues. We would give you a strategic update at the spring meeting, and focus on operational issues in the fall.

This year, we have combined the two. I will cover our long-term, strategic business model with you. Then the leaders of our business units will cover the executional actions we are taking to improve our performance and address opportunities going forward.

So before I turn it over to my colleagues, I’d like to provide some context. I think it would be helpful in understanding what we’ve been doing at IBM and why.

All of the major moves we’ve made at IBM over the past three or four years have been based on a small number of strategic choices ...

• choices that were made based on our understanding of where technology, client requirements, and global business were headed ...

1

• choices designed to maintain IBM’s leadership of a rapidly changing industry ...

• and to continue to generate consistent, high returns on invested capital for our owners.

Let me briefly review and comment on the major strategic choices. There are three.

First, we decided that IBM would lead the IT industry shift to the era of on demand business.

As we have discussed with you before, on demand business is our way of describing a fundamental industry shift in computing architecture and how it is applied to business. Others have referred to this as the “organic enterprise” or “adaptive enterprise.”

Whatever name you choose, it represents a shift in enterprise client buying behavior toward integrated solutions that draw on point products, and a shift toward providing quantifiable business value, not just technology features and functions. These shifts are well underway.

As you know, over many years the IT industry has progressively automated distinct operations and processes within companies — the back office, the factory floor, the desktop, the supply chain. Now, technology can enable — and our clients’ business demands require — a more integrated, end-to-end approach.

At the business process level, this means breaking down the silos that segregate one business operation from another, and creating common, optimized, and integrated processes that operate horizontally, across the enterprise.

2

This may sound simplistic, but implementing this kind of operating model requires extensive business transformation. And that, in turn, requires process-specific and industry-specific expertise.

The goal: Fusing advanced technology with business design to create an integrated, more flexible and responsive enterprise.

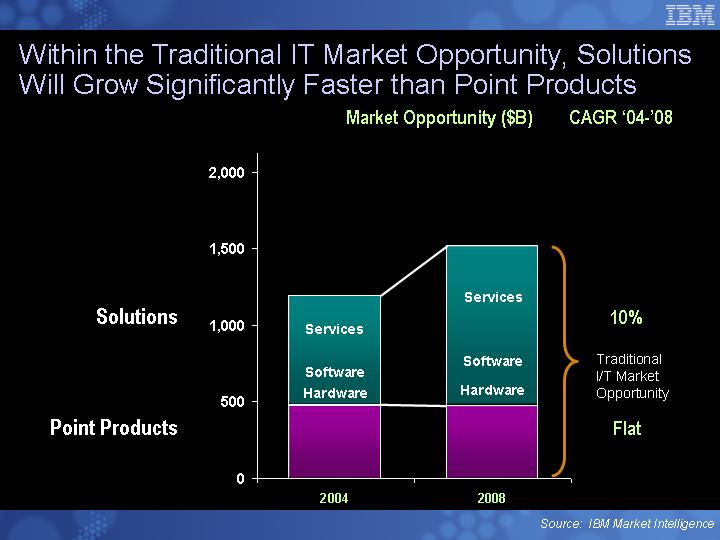

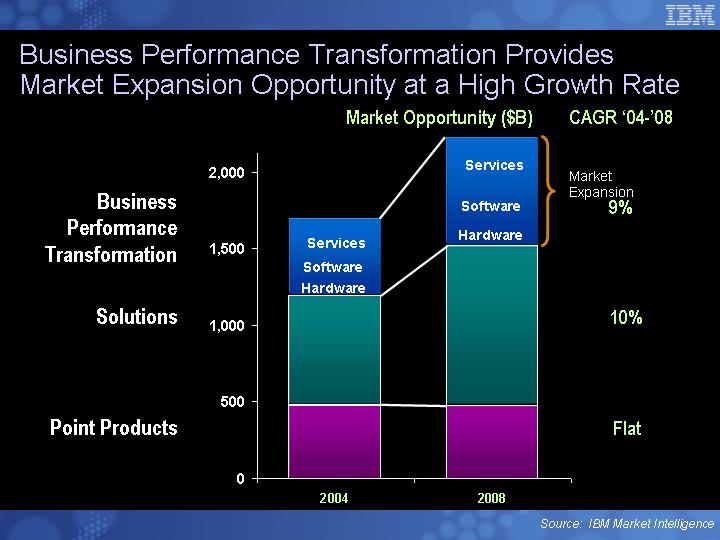

This is a change in how the IT industry engages with enterprise customers and in how it applies technology. This shift is reflected in market opportunity, which Mark Loughridge will show you in more detail.

The bottom line is that these business value opportunities are growing faster than traditional point products, and they give us a much stronger relationship with enterprises.

You know what we have done in recent years to strengthen our capability in business process and industry expertise — not just consulting skills, but also software and delivery capability specific to business processes and industry requirements.

Enabling these new business designs requires a different computing infrastructure.

• Instead of islands of computing distributed throughout the enterprise, it is more integrated.

• Instead of proprietary architectures, which impede integration and interoperability, it is based on open standards.

• And it exploits powerful new technologies like self-management and virtualization, which lower the cost of computing, while improving resiliency and security.

3

We have made significant investments in the strategic technologies to build out this new computing infrastructure.

It is well known that IBM is committed to open standards. This was recently confirmed when we announced our intent to acquire Gluecode, an open-source software company.

We have also substantially strengthened our middleware business, and — after years of R&D — brought to market game-changing technologies.

One example is the more than $1 billion we have invested in our Power 4 and 5 architectures. This has enabled our servers to gain 10 points of share over the last four and a half years.

It has also put IBM at the core of future video game consoles, where Power is the technology of choice for the top three players in this market.

Steve Mills and Bill Zeitler will expand upon what we’ve done to strengthen our software and hardware businesses today.

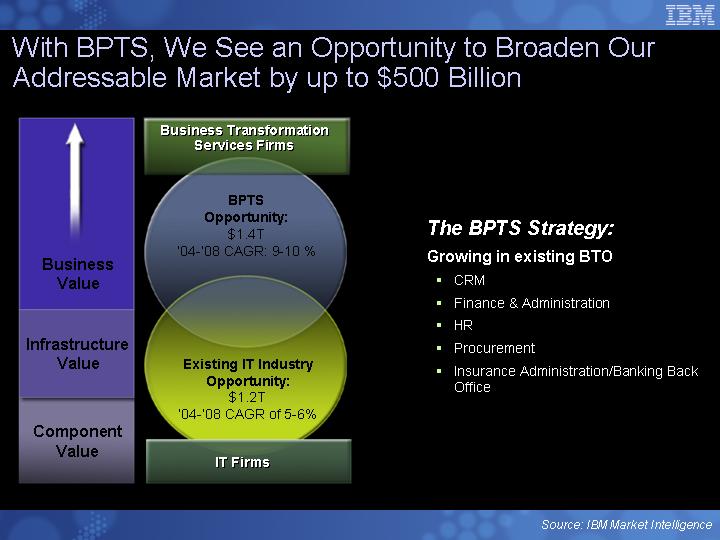

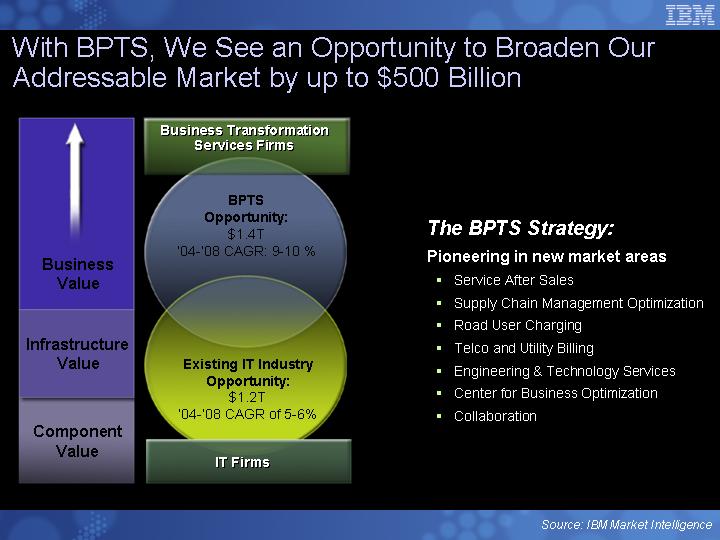

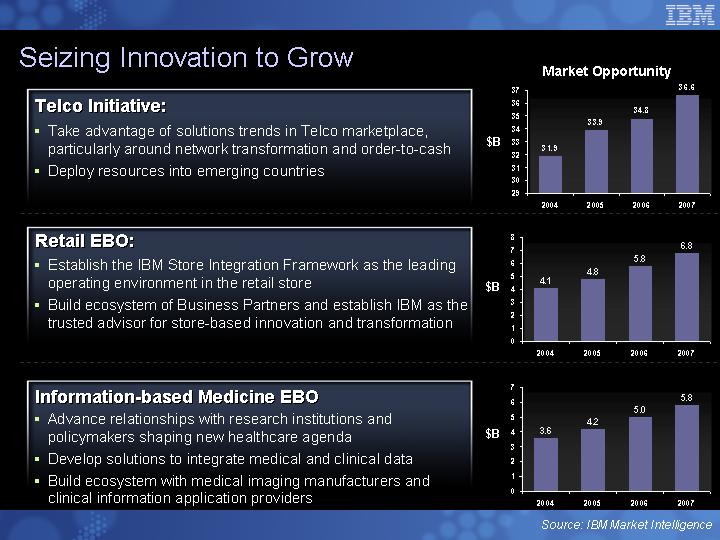

At our session with investors last year, I described a substantial growth opportunity stemming from the shift to on demand business.

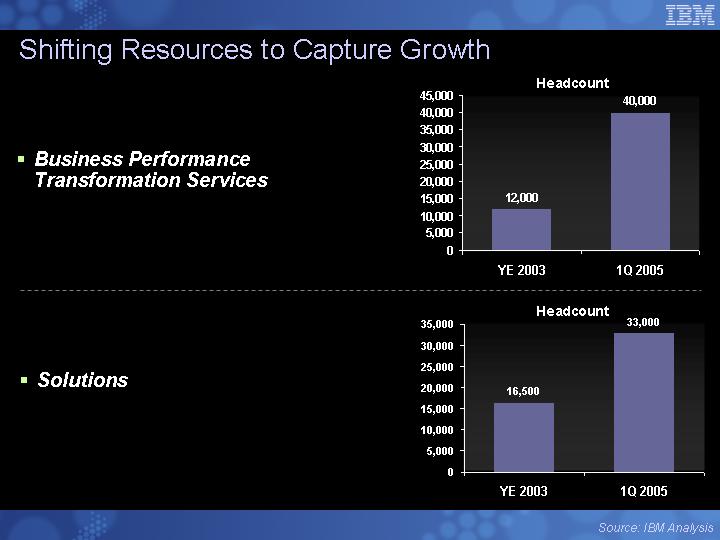

We call it business performance transformation services, or BPTS. It involves the application of technology to transform a client’s business processes and, in some cases, operate those processes for them.

Although BPTS draws on the full breadth of IBM’s capabilities in services, software and systems, we focus on four specific parts of the portfolio when we report our BPTS revenues — strategy and change consulting, business performance management software,

4

engineering and technology services, and business transformation outsourcing.

This portfolio already represents a $3 billion business for us. It grew 45% last year, and another 40% in the first quarter.

In BPTS, we work with clients in a variety of ways.

• We provide clients the counsel and technologies they need to transform their operations themselves.

• Our work with the German retailer Metro Group is a good example of this.

• IBM’s strategy consultants redesigned the supply chain and inventory management system for Metro’s “future store,” a prototype supermarket that integrates IBM’s business performance management software with RFID and wireless technologies.

• Other clients want to collaborate with us.

• Yesterday, we signed a strategic agreement with Nortel to establish a joint development center in Research Triangle Park, where IBM will collaborate in the research, design and development of Nortel’s “Next Generation Networks” products and services.

• An initial project will be a new class of blade servers for telecommunications networks. This project will combine IBM’s server technology and software with Nortel’s communications expertise.

• In some cases, we transform and actually manage the operations for the client.

• With Nextel, we worked with the client as it transformed its customer care processes, and we now manage that operation for them. Over the course of this engagement, Nextel’s customer satisfaction ratings

5

have improved, customer churn has declined, and we are on target to achieve $1 billion in cost savings for Nextel over eight years.

• With BP, where we recently extended our engagement, we transformed and manage their finance and accounting operations. We have accelerated BP’s ability to integrate new acquisitions and reduced F&A costs by a third.

• And we are among a group of partners managing the networks and IT infrastructure for Bharti Tele-Ventures, the largest private-sector telecommunications provider in India.

As I hope you can see from these examples, we will work with clients in whatever way they want to work with us — assist them, collaborate with them, or manage it for them.

Virtually every core process or operation has the potential for this kind of transformation — from supply chain management and customer care, to finance and administration, human resources management and, of course, information technology.

So this first strategic choice — to lead the era of on demand business — draws upon and leverages the entire IBM portfolio — services, software, hardware, technology and research.

The emphasis is on pulling together the right combinations of our technologies and services into business solutions for clients, which is increasingly how they want to buy and apply IT.

The second strategic choice was our decision to be the leader in high-value, innovation-based technologies and services.

Again, this is familiar to you. For several years I’ve talked about the bifurcation of the industry — between companies that create

6

and monetize intellectual capital in all its forms, and those that efficiently market and distribute other people’s innovations.

The cycle of innovation and commoditization that drives this bifurcation has never been faster or, I would say, more unforgiving than it is today.

IBM, as you know, has chosen to lead in the high-value, innovation space. And the changes in our business mix over the last several years reflect this strategic choice.

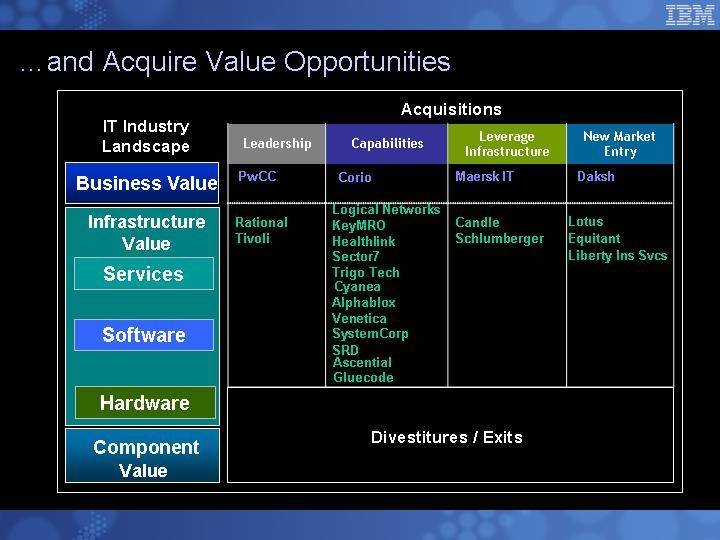

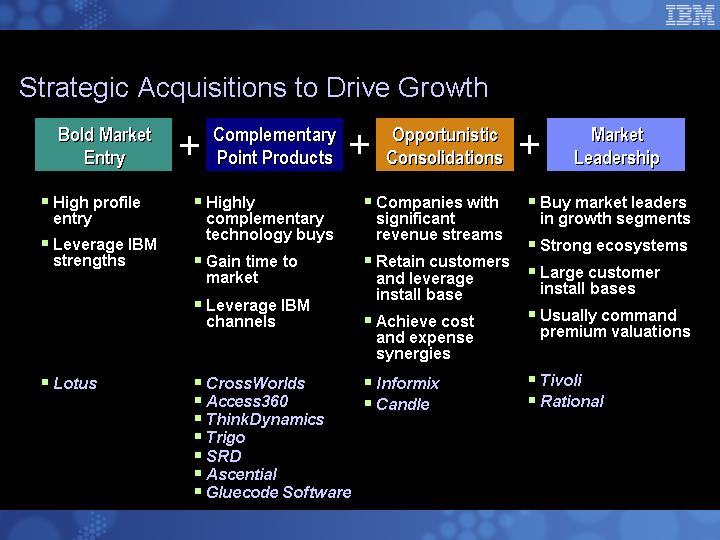

Through acquisitions and organic investments, we have strengthened our capabilities in software, high-value services and advanced technology. Since 2002, and through the first quarter of this year, we have acquired 38 companies, primarily in these spaces.

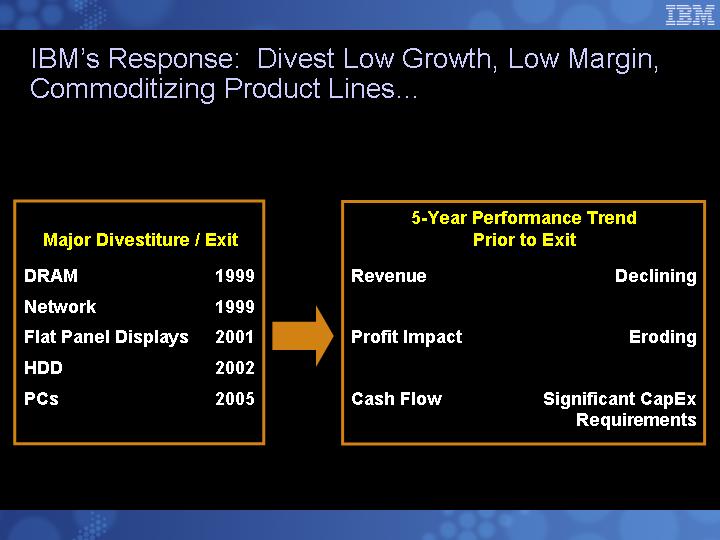

At the same time, we have exited low-margin businesses whose differentiating value was declining — hard disk drives, displays, memory chips and, most recently, PCs, through our alliance with Lenovo.

But it’s important to understand that, while highly visible, acquisitions and divestitures represent only one way that we continuously re-invent the company to stay in the high-value spaces.

The primary way we do this is by capitalizing on innovation to constantly move our hardware, software, services and core technology businesses into high growth and more profitable segments.

Our efforts in BPTS and integrating middleware to high-performance servers and the expansion of our Power architecture into the home market — are all examples of this.

7

It requires constant reinvention of the base business, investments in emerging business opportunities and extending our core franchises into adjacent spaces.

Our engineering and technology services business, which is only two and a half years old, is an example of how we’ve leveraged an important franchise — in this case, our core technologies and engineering tools and expertise — into wholly new spaces.

We are working with companies in aerospace, consumer electronics, defense and telecommunications to help them create advanced products. In many cases, they are using our technologies, such as Power, and open standard software like Linux, which provide compelling economic and speed of deployment advantages to these companies.

Engineering & Technology Services demonstrates how we monetize our R&D in ways that extend far beyond patent licensing.

I think you’d agree that companies like Honeywell, Lockheed Martin, Cisco and Sony would not simply outsource elements of their engineering and development operations to the lowest bidder. These are high-value engagements that draw on our recognized innovation capabilities.

We have essentially created a new services business around a set of technology assets. And it is allowing us to move into important adjacent spaces. Bill Zeitler will build on this.

So, we’ve decided that IBM will lead in identifying, creating and capturing the profit zones of our industry, and that we would differentiate IBM by our ability to give clients value and capability they cannot get from others.

8

This has compelled us to make many changes in our businesses. Some of those changes are already paying off; others are underway.

And yes, this strategic shift can lead to short-term performance issues. But this is what you do if you want to stay ahead of commoditization, and it’s what is required to deliver sustainable, high returns on invested capital for our owners.

As Mark will discuss with you in a moment, shifts that we have made in the model can have significant impact on our business profile. As we’ve pointed out to you before, eliminating the lower-margin PC business improves our profitability by one point.

At the same time, we are increasing the investments required for business value and solutions selling.

The third strategic choice we have made is to globally integrate the company.

This may sound surprising, given that IBM has been an international company since its founding. There are two aspects to this.

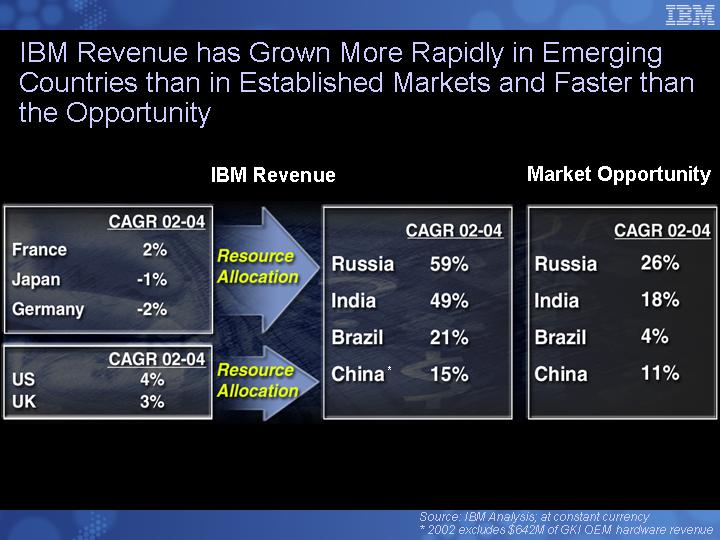

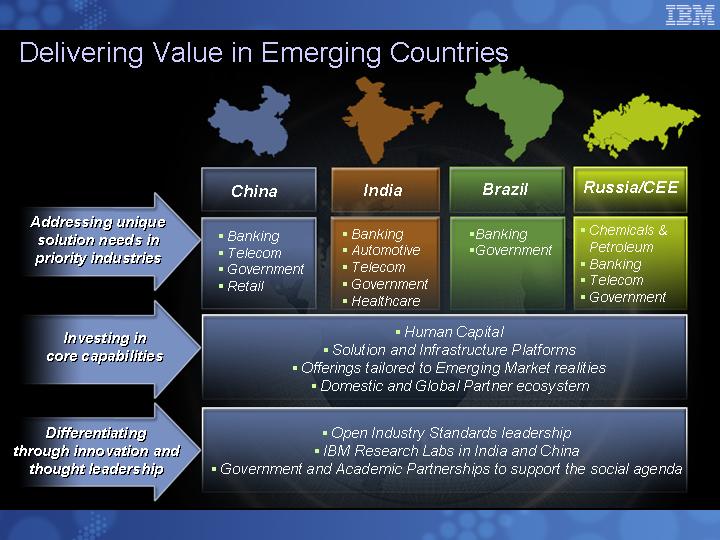

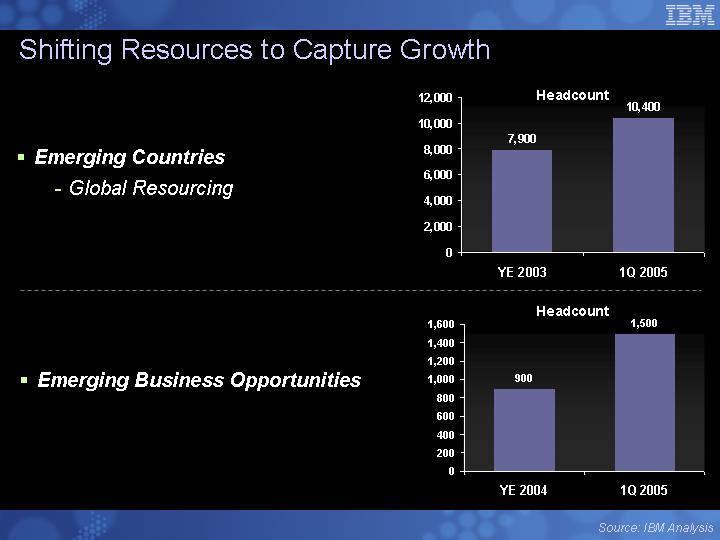

First, we are extending our reach into local markets around the world, particularly in high-growth economies such as China, India, Brazil and Russia. Last year, our business in these four countries grew more than 25%.

We are fueling our investments in these high-growth markets by reallocating resources from slower-growing, maturing markets. Over the past two years, we have increased our investment in these high-growth, developing markets by 40%, and expanded our work force by 30%.

9

This is a phenomenon that goes beyond cyclical economics.

We’re all aware that populations in western Europe and Japan are shrinking and also aging. Last week I heard that in 15 years, Italy will have just one worker supporting every retiree. In Germany and France, the ratio will be fewer than three workers for every retiree by the year 2025.

This will radically change the economics of these markets, with investments increasingly going to support the aging populations.

Also, consider that over the next five years, emerging parts of Asia, Eastern Europe and Latin America will grow to become more than one-fifth of the global GDP. This represents an economic gain of $2.5 trillion. These regions will account for 35% of global GDP growth in this period.

IBM’s share position in these markets is strong, and we are making the investments to strengthen it. We are number one in Brazil and China, and number two in India and eastern Europe.

The implications of this are clear — IBM is growing as fast or faster than the markets in these emerging nations, and we are reprioritizing our investments to continue to grow with them.

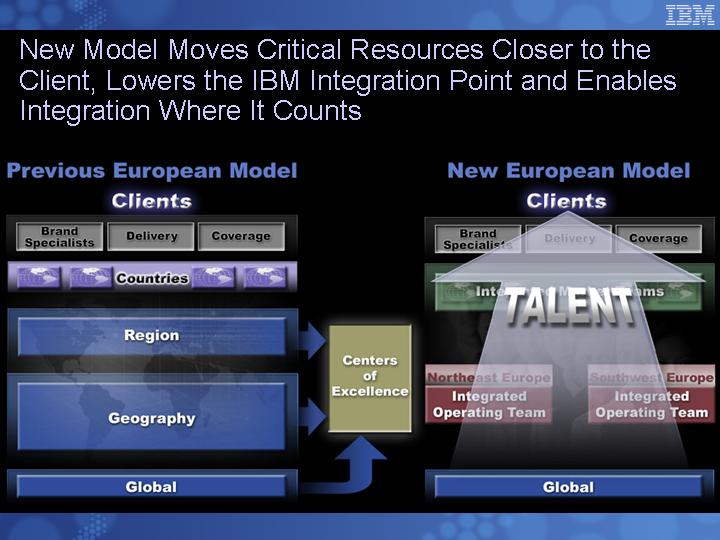

You see this in the restructuring of our operations in Europe, which we announced earlier this month.

This is freeing up resources that we can reinvest in higher-growth markets. It will also enable us to reduce overhead, eliminate layers of hierarchy, and deploy more resources out in the field, where they can execute closer to our clients.

10

But we are not lowering the center of gravity in Europe only to build it up again in places like China and India. Rather, we are moving to a new model, which is the second aspect of globally integrating IBM. Let me explain what I mean.

During the first half of the 20th century, IBM was the prototypical international enterprise. We set up sales offices overseas and exported our products to customers around the world. We did some customizing for local markets, but by and large our intellectual capital was created and managed in the U.S.

In the second half of the century — when Germany, France, the UK, Italy and Japan were in recovery — a new strategy emerged. To capitalize on the human resources available in those countries, and to make a stronger contribution to rebuilding their economies, we built largely self-contained and self-sufficient IBMs in each national market.

IBM Japan, IBM U.K., IBM Germany — each had its own headquarters, its own support operations and, in many cases, its own labs and plants. The result: a multinational IBM.

Today, we are evolving to a new model — the globally integrated company. It’s made possible by the emergence of skills in new parts of the world, high-growth markets in developing nations, the WTO and free trade agreements, and the rise of a global networked infrastructure.

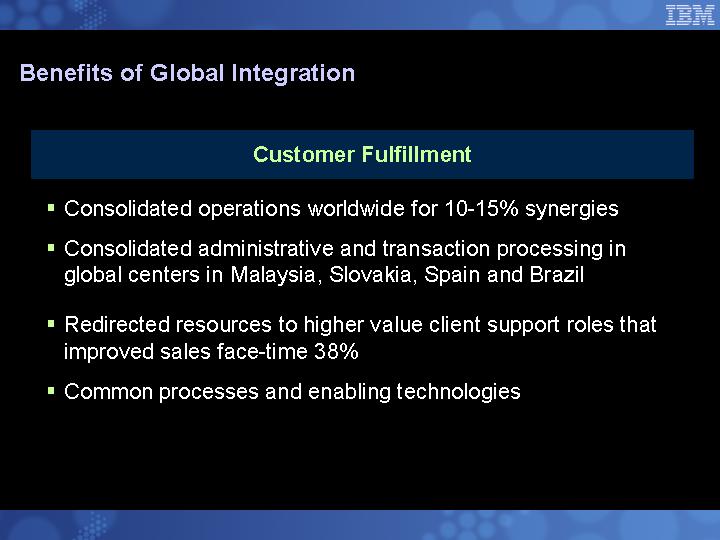

We no longer have to replicate IBM from floor to ceiling in every country. We are optimizing key operations in the right places in the world — eliminating the redundancies and excess overhead — and integrating those operations horizontally and globally.

We’ve been working toward this for several years.

11

• We used to process purchase orders in 300 places around the world. Today, it’s three — Shanghai, Bangalore and Budapest.

• In customer support, we’ve moved certain functions closest to the client, and others we’ve consolidated into shared service centers in Malaysia, Slovakia, Spain and Brazil.

These moves are not just about lower labor cost. They’re about doing the right tasks, with the right skills, in the right places.

• We’ve centralized strategic sourcing for our procurement BTO practice in Greenock, Scotland ...

• Consolidated services operations for financial management and accounting in, among other places, Tulsa, Oklahoma ...

• And created a center of excellence for the shipping industry in Scandinavia and New York City.

• Our primary software development centers are in Toronto, San Jose, Texas and England.

• Our research labs are in New York, Austin, Silicon Valley, Switzerland, Israel, Japan, China and India.

Why? Because that’s where the right skills and the right business conditions exist.

Creating a globally integrated IBM — an “on demand IBM” — will result in a flatter operating model with more resources working with clients in the field.

This will drive productivity, as Bob Moffat will discuss. And importantly, it will improve our ability to execute at the point of contact with the client, which Doug Elix will describe for you.

12

As we execute each of these strategies — leading the industry shift we describe as on demand business; reinventing our portfolio to be the innovation, high-value leader, and creating a globally integrated company — there will be bumps along the way.

Some will be due to exogenous factors — recessions, market corrections and the like — and some to execution missteps.

We hit a bump in the first quarter. We understand the issues and have taken corrective action. The issues mostly involve transitions of one type or another.

In services, for instance, our revenue mix is shifting away from the large, long-term engagements toward smaller, shorter-term contracts. In just the last two years, short-term contracts as a share of total signings have grown from 38% to 47%.

John Joyce will tell you about the actions he has taken to address this shift, including sales incentives and the deployment of sales resources to go after more of this opportunity.

Another transition reflects the changing interplay of customized and standardized capabilities. Traditionally in our services business, standardized capabilities referred to infrastructure assets — data centers, parts inventories, tools and the like.

Through increased automation techniques, we are able to manage these types of assets with fewer people. As a result, a greater share of our people are now focused on strategic consulting and business transformation.

Many of our top minds in IBM Research are collaborating with business consulting teams through our On Demand Innovation Services practice and the Center for Business Optimization, the

13

unit that deploys all of the deep, mathematical and analytic capability of IBM to solve some of our clients’ hardest problems.

Of course, not every client needs a high-end, custom-built solution. So we are translating more of our intellectual capital into replicable, software-based designs that are scalable to multiple clients, faster to deploy, and deliver faster time to value for the client.

For example, we have documented our methodology and standardized many of the processes and technologies involved in building wireless broadband infrastructures. These kinds of services packages are helping us keep ahead of the explosive growth in demand for such technologies as WiFi and RFID.

We are also expanding our capabilities to deliver standardized processes and applications as a service to our clients.

• Our acquisition of Corio, which we completed in March, gives us a global platform to deliver hosted applications like SAP, Oracle and Siebel to both our SMB and enterprise clients.

• We are integrating IBM’s custom hosted capabilities into Corio’s platform for faster deployment of these services. We can also use this platform to provide related capabilities, such as application deployment and automated application management.

Each of these examples represents a shift from custom services to more cost-efficient, scalable offerings.

This shift, as well as the steps we have taken to drive down cost in our strategic outsourcing business, will help us to improve our services margins and penetrate new market opportunities.

14

The other transitions you will hear about today involve our other two units — systems and software.

In systems, Bill will talk about transitions in some key products — specifically in our server and storage lines, where late availability of our some new offerings dampened our first-quarter performance. But we’ll now have the benefit of a full quarter of availability of these products.

These kinds of transitions are not unusual, and the effects are often short-lived. As you may remember, the Regatta and the T-Rex products also went through short, somewhat rocky transition periods before ultimately delivering significant growth.

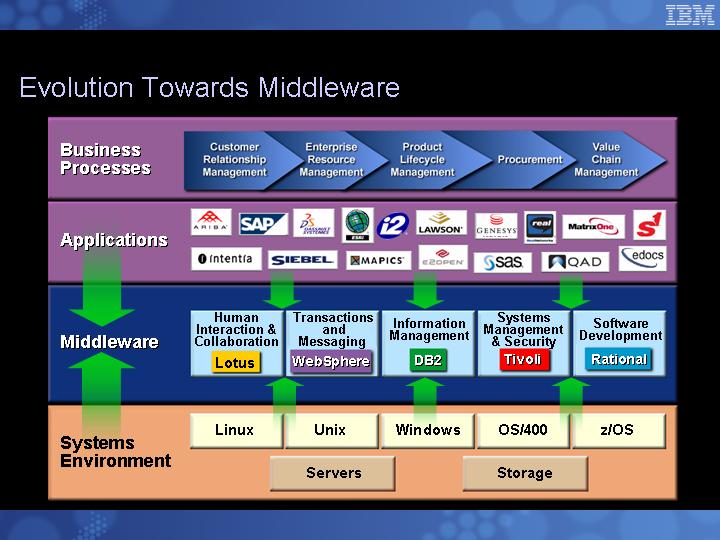

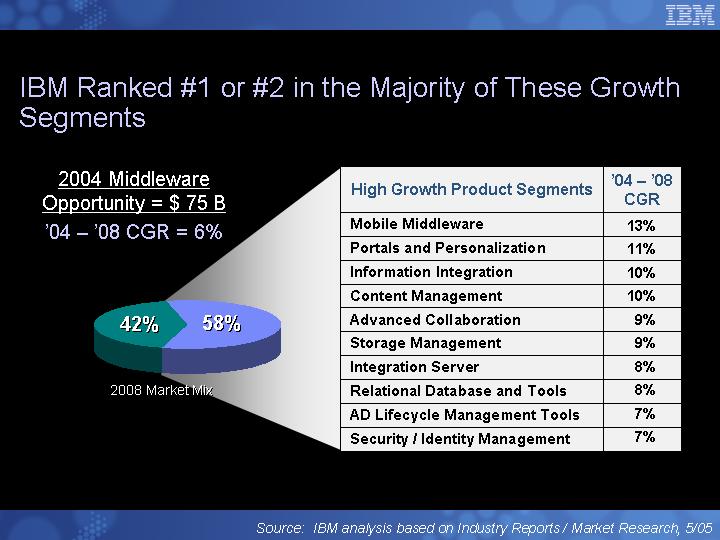

After Bill, Steve Mills will describe to you the progress we’ve made to re-mix our software portfolio to capture the high-growth middleware opportunity.

During the course of the day you will hear — in much greater detail — about all of the issues I just laid out for you.

As I said at the beginning, we are talking about two sets of issues here.

The first are the long-term, strategic actions we are taking to capitalize on the shifts we see in client demand, technology and global economics. These areas are the fastest-growing segments in the IT industry.

The second set of issues involves the actions we are taking to improve business performance in the near term. We know what the executional issues are. We are managing through them. And we are confident that they will get IBM back on track.

15

But I think it’s more important to keep the overall game plan in mind.

16

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

[LOGO]

Agenda

9:00 AM |

| Strategy Overview |

| Sam Palmisano |

9:20 |

| Business Model |

| Mark Loughridge |

9:50 |

| Global Services |

| John Joyce |

10:20 |

| Systems and Technology |

| Bill Zeitler |

|

|

|

|

|

10:40 |

| Break |

|

|

|

|

|

|

|

11:00 |

| Software |

| Steve Mills |

11:20 |

| Global Integration |

| Bob Moffat |

11:40 |

| Sales and Distribution |

| Doug Elix |

12:00 PM |

| Q&A |

| All |

|

|

|

|

|

Lunch / Breakouts | ||||

Certain comments made in this presentation may be characterized as forward looking under the Private Securities Litigation Reform Act of 1995.

Those statements involve a number of factors that could cause actual results to differ materially.

Additional information concerning these factors is contained in the Company’s filing with the SEC. Copies are available from the SEC, from the IBM web site, or from IBM Investor Relations.

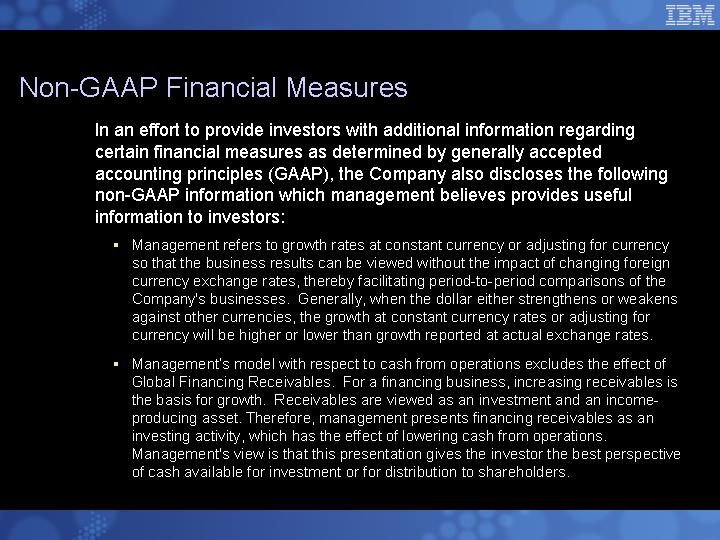

See IBM’s Form 8-K dated May 20, 2005 for reconciliation and other information in connection with certain non-GAAP financial measures in this presentation.

Strategy Overview

Sam Palmisano

Chairman and Chief Executive Officer

Good morning. I’d like to welcome you to this briefing for IBM investors.

I’m joined today by Mark Loughridge, our CFO, and the senior leaders of our major business units. Together, we’ll provide a perspective on IBM’s strategy and operations.

This is an important time for the industry and for IBM. It’s also a potentially confusing time for investors. It’s easy to intermix near-term issues with longer-term shifts, cyclical effects with more fundamental change.

That’s why we changed the agenda for today’s meeting. In previous years, you will recall that we used to separate these two sets of issues. We would give you a strategic update at the spring meeting, and focus on operational issues in the fall.

This year, we have combined the two. I will cover our long-term, strategic business model with you. Then the leaders of our business units will cover the executional actions we are taking to improve our performance and address opportunities going forward.

So before I turn it over to my colleagues, I’d like to provide some context. I think it would be helpful in understanding what we’ve been doing at IBM and why.

All of the major moves we’ve made at IBM over the past three or four years have been based on a small number of strategic choices ...

• choices that were made based on our understanding of where technology, client requirements, and global business were headed ...

1

• choices designed to maintain IBM’s leadership of a rapidly changing industry ...

• and to continue to generate consistent, high returns on invested capital for our owners.

Let me briefly review and comment on the major strategic choices. There are three.

First, we decided that IBM would lead the IT industry shift to the era of on demand business.

As we have discussed with you before, on demand business is our way of describing a fundamental industry shift in computing architecture and how it is applied to business. Others have referred to this as the “organic enterprise” or “adaptive enterprise.”

Whatever name you choose, it represents a shift in enterprise client buying behavior toward integrated solutions that draw on point products, and a shift toward providing quantifiable business value, not just technology features and functions. These shifts are well underway.

As you know, over many years the IT industry has progressively automated distinct operations and processes within companies — the back office, the factory floor, the desktop, the supply chain. Now, technology can enable — and our clients’ business demands require — a more integrated, end-to-end approach.

At the business process level, this means breaking down the silos that segregate one business operation from another, and creating common, optimized, and integrated processes that operate horizontally, across the enterprise.

2

This may sound simplistic, but implementing this kind of operating model requires extensive business transformation. And that, in turn, requires process-specific and industry-specific expertise.

The goal: Fusing advanced technology with business design to create an integrated, more flexible and responsive enterprise.

This is a change in how the IT industry engages with enterprise customers and in how it applies technology. This shift is reflected in market opportunity, which Mark Loughridge will show you in more detail.

The bottom line is that these business value opportunities are growing faster than traditional point products, and they give us a much stronger relationship with enterprises.

You know what we have done in recent years to strengthen our capability in business process and industry expertise — not just consulting skills, but also software and delivery capability specific to business processes and industry requirements.

Enabling these new business designs requires a different computing infrastructure.

• Instead of islands of computing distributed throughout the enterprise, it is more integrated.

• Instead of proprietary architectures, which impede integration and interoperability, it is based on open standards.

• And it exploits powerful new technologies like self-management and virtualization, which lower the cost of computing, while improving resiliency and security.

3

We have made significant investments in the strategic technologies to build out this new computing infrastructure.

It is well known that IBM is committed to open standards. This was recently confirmed when we announced our intent to acquire Gluecode, an open-source software company.

We have also substantially strengthened our middleware business, and — after years of R&D — brought to market game-changing technologies.

One example is the more than $1 billion we have invested in our Power 4 and 5 architectures. This has enabled our servers to gain 10 points of share over the last four and a half years.

It has also put IBM at the core of future video game consoles, where Power is the technology of choice for the top three players in this market.

Steve Mills and Bill Zeitler will expand upon what we’ve done to strengthen our software and hardware businesses today.

At our session with investors last year, I described a substantial growth opportunity stemming from the shift to on demand business.

We call it business performance transformation services, or BPTS. It involves the application of technology to transform a client’s business processes and, in some cases, operate those processes for them.

Although BPTS draws on the full breadth of IBM’s capabilities in services, software and systems, we focus on four specific parts of the portfolio when we report our BPTS revenues — strategy and change consulting, business performance management software,

4

engineering and technology services, and business transformation outsourcing.

This portfolio already represents a $3 billion business for us. It grew 45% last year, and another 40% in the first quarter.

In BPTS, we work with clients in a variety of ways.

• We provide clients the counsel and technologies they need to transform their operations themselves.

• Our work with the German retailer Metro Group is a good example of this.

• IBM’s strategy consultants redesigned the supply chain and inventory management system for Metro’s “future store,” a prototype supermarket that integrates IBM’s business performance management software with RFID and wireless technologies.

• Other clients want to collaborate with us.

• Yesterday, we signed a strategic agreement with Nortel to establish a joint development center in Research Triangle Park, where IBM will collaborate in the research, design and development of Nortel’s “Next Generation Networks” products and services.

• An initial project will be a new class of blade servers for telecommunications networks. This project will combine IBM’s server technology and software with Nortel’s communications expertise.

• In some cases, we transform and actually manage the operations for the client.

• With Nextel, we worked with the client as it transformed its customer care processes, and we now manage that operation for them. Over the course of this engagement, Nextel’s customer satisfaction ratings

5

have improved, customer churn has declined, and we are on target to achieve $1 billion in cost savings for Nextel over eight years.

• With BP, where we recently extended our engagement, we transformed and manage their finance and accounting operations. We have accelerated BP’s ability to integrate new acquisitions and reduced F&A costs by a third.

• And we are among a group of partners managing the networks and IT infrastructure for Bharti Tele-Ventures, the largest private-sector telecommunications provider in India.

As I hope you can see from these examples, we will work with clients in whatever way they want to work with us — assist them, collaborate with them, or manage it for them.

Virtually every core process or operation has the potential for this kind of transformation — from supply chain management and customer care, to finance and administration, human resources management and, of course, information technology.

So this first strategic choice — to lead the era of on demand business — draws upon and leverages the entire IBM portfolio — services, software, hardware, technology and research.

The emphasis is on pulling together the right combinations of our technologies and services into business solutions for clients, which is increasingly how they want to buy and apply IT.

The second strategic choice was our decision to be the leader in high-value, innovation-based technologies and services.

Again, this is familiar to you. For several years I’ve talked about the bifurcation of the industry — between companies that create

6

and monetize intellectual capital in all its forms, and those that efficiently market and distribute other people’s innovations.

The cycle of innovation and commoditization that drives this bifurcation has never been faster or, I would say, more unforgiving than it is today.

IBM, as you know, has chosen to lead in the high-value, innovation space. And the changes in our business mix over the last several years reflect this strategic choice.

Through acquisitions and organic investments, we have strengthened our capabilities in software, high-value services and advanced technology. Since 2002, and through the first quarter of this year, we have acquired 38 companies, primarily in these spaces.

At the same time, we have exited low-margin businesses whose differentiating value was declining — hard disk drives, displays, memory chips and, most recently, PCs, through our alliance with Lenovo.

But it’s important to understand that, while highly visible, acquisitions and divestitures represent only one way that we continuously re-invent the company to stay in the high-value spaces.

The primary way we do this is by capitalizing on innovation to constantly move our hardware, software, services and core technology businesses into high growth and more profitable segments.

Our efforts in BPTS and integrating middleware to high-performance servers and the expansion of our Power architecture into the home market — are all examples of this.

7

It requires constant reinvention of the base business, investments in emerging business opportunities and extending our core franchises into adjacent spaces.

Our engineering and technology services business, which is only two and a half years old, is an example of how we’ve leveraged an important franchise — in this case, our core technologies and engineering tools and expertise — into wholly new spaces.

We are working with companies in aerospace, consumer electronics, defense and telecommunications to help them create advanced products. In many cases, they are using our technologies, such as Power, and open standard software like Linux, which provide compelling economic and speed of deployment advantages to these companies.

Engineering & Technology Services demonstrates how we monetize our R&D in ways that extend far beyond patent licensing.

I think you’d agree that companies like Honeywell, Lockheed Martin, Cisco and Sony would not simply outsource elements of their engineering and development operations to the lowest bidder. These are high-value engagements that draw on our recognized innovation capabilities.

We have essentially created a new services business around a set of technology assets. And it is allowing us to move into important adjacent spaces. Bill Zeitler will build on this.

So, we’ve decided that IBM will lead in identifying, creating and capturing the profit zones of our industry, and that we would differentiate IBM by our ability to give clients value and capability they cannot get from others.

8

This has compelled us to make many changes in our businesses. Some of those changes are already paying off; others are underway.

And yes, this strategic shift can lead to short-term performance issues. But this is what you do if you want to stay ahead of commoditization, and it’s what is required to deliver sustainable, high returns on invested capital for our owners.

As Mark will discuss with you in a moment, shifts that we have made in the model can have significant impact on our business profile. As we’ve pointed out to you before, eliminating the lower-margin PC business improves our profitability by one point.

At the same time, we are increasing the investments required for business value and solutions selling.

The third strategic choice we have made is to globally integrate the company.

This may sound surprising, given that IBM has been an international company since its founding. There are two aspects to this.

First, we are extending our reach into local markets around the world, particularly in high-growth economies such as China, India, Brazil and Russia. Last year, our business in these four countries grew more than 25%.

We are fueling our investments in these high-growth markets by reallocating resources from slower-growing, maturing markets. Over the past two years, we have increased our investment in these high-growth, developing markets by 40%, and expanded our work force by 30%.

9

This is a phenomenon that goes beyond cyclical economics.

We’re all aware that populations in western Europe and Japan are shrinking and also aging. Last week I heard that in 15 years, Italy will have just one worker supporting every retiree. In Germany and France, the ratio will be fewer than three workers for every retiree by the year 2025.

This will radically change the economics of these markets, with investments increasingly going to support the aging populations.

Also, consider that over the next five years, emerging parts of Asia, Eastern Europe and Latin America will grow to become more than one-fifth of the global GDP. This represents an economic gain of $2.5 trillion. These regions will account for 35% of global GDP growth in this period.

IBM’s share position in these markets is strong, and we are making the investments to strengthen it. We are number one in Brazil and China, and number two in India and eastern Europe.

The implications of this are clear — IBM is growing as fast or faster than the markets in these emerging nations, and we are reprioritizing our investments to continue to grow with them.

You see this in the restructuring of our operations in Europe, which we announced earlier this month.

This is freeing up resources that we can reinvest in higher-growth markets. It will also enable us to reduce overhead, eliminate layers of hierarchy, and deploy more resources out in the field, where they can execute closer to our clients.

10

But we are not lowering the center of gravity in Europe only to build it up again in places like China and India. Rather, we are moving to a new model, which is the second aspect of globally integrating IBM. Let me explain what I mean.

During the first half of the 20th century, IBM was the prototypical international enterprise. We set up sales offices overseas and exported our products to customers around the world. We did some customizing for local markets, but by and large our intellectual capital was created and managed in the U.S.

In the second half of the century — when Germany, France, the UK, Italy and Japan were in recovery — a new strategy emerged. To capitalize on the human resources available in those countries, and to make a stronger contribution to rebuilding their economies, we built largely self-contained and self-sufficient IBMs in each national market.

IBM Japan, IBM U.K., IBM Germany — each had its own headquarters, its own support operations and, in many cases, its own labs and plants. The result: a multinational IBM.

Today, we are evolving to a new model — the globally integrated company. It’s made possible by the emergence of skills in new parts of the world, high-growth markets in developing nations, the WTO and free trade agreements, and the rise of a global networked infrastructure.

We no longer have to replicate IBM from floor to ceiling in every country. We are optimizing key operations in the right places in the world — eliminating the redundancies and excess overhead — and integrating those operations horizontally and globally.

We’ve been working toward this for several years.

11

• We used to process purchase orders in 300 places around the world. Today, it’s three — Shanghai, Bangalore and Budapest.

• In customer support, we’ve moved certain functions closest to the client, and others we’ve consolidated into shared service centers in Malaysia, Slovakia, Spain and Brazil.

These moves are not just about lower labor cost. They’re about doing the right tasks, with the right skills, in the right places.

• We’ve centralized strategic sourcing for our procurement BTO practice in Greenock, Scotland ...

• Consolidated services operations for financial management and accounting in, among other places, Tulsa, Oklahoma ...

• And created a center of excellence for the shipping industry in Scandinavia and New York City.

• Our primary software development centers are in Toronto, San Jose, Texas and England.

• Our research labs are in New York, Austin, Silicon Valley, Switzerland, Israel, Japan, China and India.

Why? Because that’s where the right skills and the right business conditions exist.

Creating a globally integrated IBM — an “on demand IBM” — will result in a flatter operating model with more resources working with clients in the field.

This will drive productivity, as Bob Moffat will discuss. And importantly, it will improve our ability to execute at the point of contact with the client, which Doug Elix will describe for you.

12

As we execute each of these strategies — leading the industry shift we describe as on demand business; reinventing our portfolio to be the innovation, high-value leader, and creating a globally integrated company — there will be bumps along the way.

Some will be due to exogenous factors — recessions, market corrections and the like — and some to execution missteps.

We hit a bump in the first quarter. We understand the issues and have taken corrective action. The issues mostly involve transitions of one type or another.

In services, for instance, our revenue mix is shifting away from the large, long-term engagements toward smaller, shorter-term contracts. In just the last two years, short-term contracts as a share of total signings have grown from 38% to 47%.

John Joyce will tell you about the actions he has taken to address this shift, including sales incentives and the deployment of sales resources to go after more of this opportunity.

Another transition reflects the changing interplay of customized and standardized capabilities. Traditionally in our services business, standardized capabilities referred to infrastructure assets — data centers, parts inventories, tools and the like.

Through increased automation techniques, we are able to manage these types of assets with fewer people. As a result, a greater share of our people are now focused on strategic consulting and business transformation.

Many of our top minds in IBM Research are collaborating with business consulting teams through our On Demand Innovation Services practice and the Center for Business Optimization, the

13

unit that deploys all of the deep, mathematical and analytic capability of IBM to solve some of our clients’ hardest problems.

Of course, not every client needs a high-end, custom-built solution. So we are translating more of our intellectual capital into replicable, software-based designs that are scalable to multiple clients, faster to deploy, and deliver faster time to value for the client.

For example, we have documented our methodology and standardized many of the processes and technologies involved in building wireless broadband infrastructures. These kinds of services packages are helping us keep ahead of the explosive growth in demand for such technologies as WiFi and RFID.

We are also expanding our capabilities to deliver standardized processes and applications as a service to our clients.

• Our acquisition of Corio, which we completed in March, gives us a global platform to deliver hosted applications like SAP, Oracle and Siebel to both our SMB and enterprise clients.

• We are integrating IBM’s custom hosted capabilities into Corio’s platform for faster deployment of these services. We can also use this platform to provide related capabilities, such as application deployment and automated application management.

Each of these examples represents a shift from custom services to more cost-efficient, scalable offerings.

This shift, as well as the steps we have taken to drive down cost in our strategic outsourcing business, will help us to improve our services margins and penetrate new market opportunities.

14

The other transitions you will hear about today involve our other two units — systems and software.

In systems, Bill will talk about transitions in some key products — specifically in our server and storage lines, where late availability of our some new offerings dampened our first-quarter performance. But we’ll now have the benefit of a full quarter of availability of these products.

These kinds of transitions are not unusual, and the effects are often short-lived. As you may remember, the Regatta and the T-Rex products also went through short, somewhat rocky transition periods before ultimately delivering significant growth.

After Bill, Steve Mills will describe to you the progress we’ve made to re-mix our software portfolio to capture the high-growth middleware opportunity.

During the course of the day you will hear — in much greater detail — about all of the issues I just laid out for you.

As I said at the beginning, we are talking about two sets of issues here.

The first are the long-term, strategic actions we are taking to capitalize on the shifts we see in client demand, technology and global economics. These areas are the fastest-growing segments in the IT industry.

The second set of issues involves the actions we are taking to improve business performance in the near term. We know what the executional issues are. We are managing through them. And we are confident that they will get IBM back on track.

15

But I think it’s more important to keep the overall game plan in mind.

16

Business Model

Mark Loughridge

Senior Vice President and Chief Financial Officer

IBM Corporation

The Traditional View of the Technology Sector Opportunity Reflects Moderate Growth

[CHART]

Source: IBM analysis based on Industry Reports / Market Research

Within the Traditional IT Market Opportunity, Solutions Will Grow Significantly Faster than Point Products

[CHART]

Source: IBM Market Intelligence

Business Performance Transformation Provides Market Expansion Opportunity at a High Growth Rate

[CHART]

Source: IBM Market Intelligence

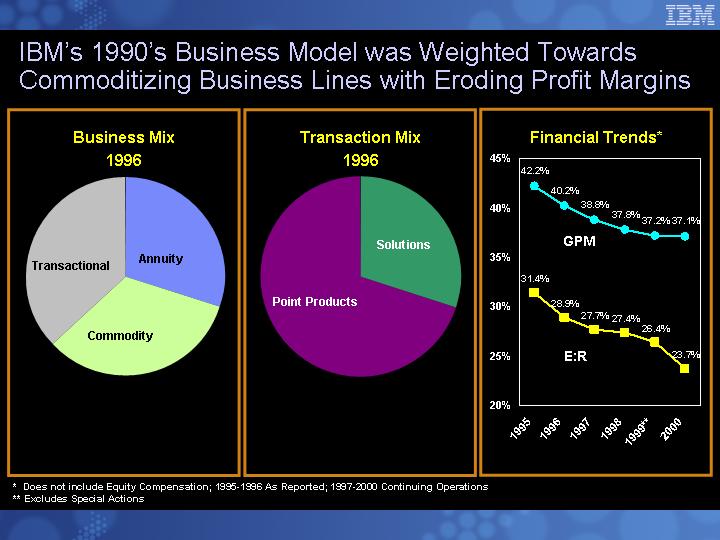

IBM’s 1990’s Business Model was Weighted Towards Commoditizing Business Lines with Eroding Profit Margins

Business Mix 1996

[CHART]

Transaction Mix 1996

[CHART]

Financial Trends*

[CHART]

* Does not include Equity Compensation; 1995-1996 As Reported; 1997-2000 Continuing Operations

** Excludes Special Actions

IBM’s Response: Divest Low Growth, Low Margin, Commoditizing Product Lines…

Major Divestiture / Exit

DRAM |

| 1999 |

|

Network |

| 1999 |

|

Flat Panel Displays |

| 2001 |

|

HDD |

| 2002 |

|

PCs |

| 2005 |

|

5-Year Performance Trend

Prior to Exit

Revenue |

| Declining |

|

|

|

Profit Impact |

| Eroding |

|

|

|

Cash Flow |

| Significant CapEx Requirements |

…and Acquire Value Opportunities

IT Industry Landscape

Business Value

Infrastructure Value

Services

Software

Hardware

Component Value

Acquisitions

Leadership |

| Capabilities |

| Leverage |

| New Market |

|

|

|

|

|

|

|

|

|

PwCC |

| Corio |

| Maersk IT |

| Daksh |

|

|

|

|

|

|

|

|

|

|

| Logical Networks |

|

|

|

|

|

Rational |

| KeyMRO |

| Candle |

| Lotus |

|

Tivoli |

| Healthlink |

| Schlumberger |

| Equitant |

|

|

| Sector7 |

|

|

| Liberty Ins Svcs |

|

|

| Trigo Tech |

|

|

|

|

|

|

| Cyanea |

|

|

|

|

|

|

| Alphablox |

|

|

|

|

|

|

| Venetica |

|

|

|

|

|

|

| SystemCorp |

|

|

|

|

|

|

| SRD |

|

|

|

|

|

|

| Ascential |

|

|

|

|

|

|

| Gluecode |

|

|

|

|

|

Divestitures / Exits

We Have Shifted Our Business from Commoditizing Business Lines to Higher Value

Business Mix 1996

[CHART]

Business Mix Today*

[CHART]

* Post PC divestiture

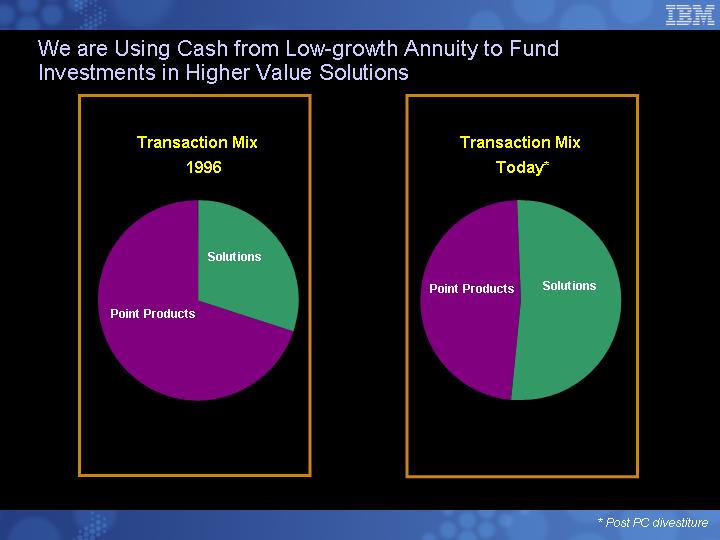

We are Using Cash from Low-growth Annuity to Fund Investments in Higher Value Solutions

Transaction Mix 1996

[CHART]

Transaction Mix Today*

[CHART]

* Post PC divestiture

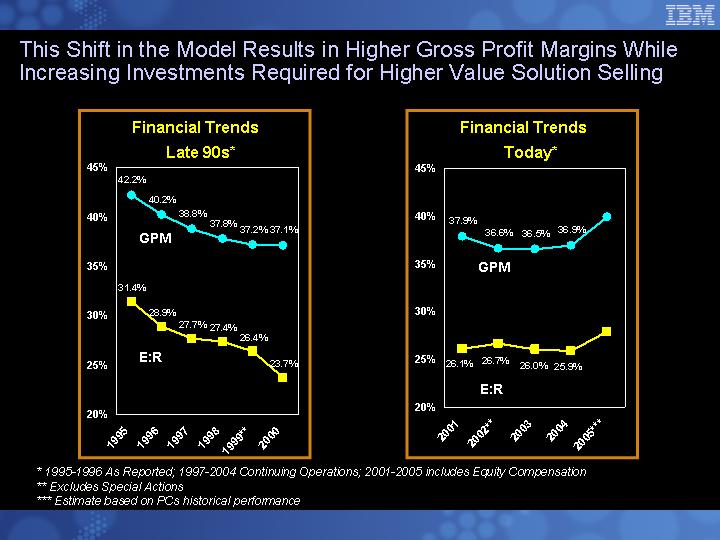

This Shift in the Model Results in Higher Gross Profit Margins While Increasing Investments Required for Higher Value Solution Selling

Financial Trends Late 90s*

[CHART]

Financial Trends Today*

[CHART]

* 1995-1996 As Reported; 1997-2004 Continuing Operations; 2001-2005 includes Equity Compensation

** Excludes Special Actions

*** Estimate based on PCs historical performance

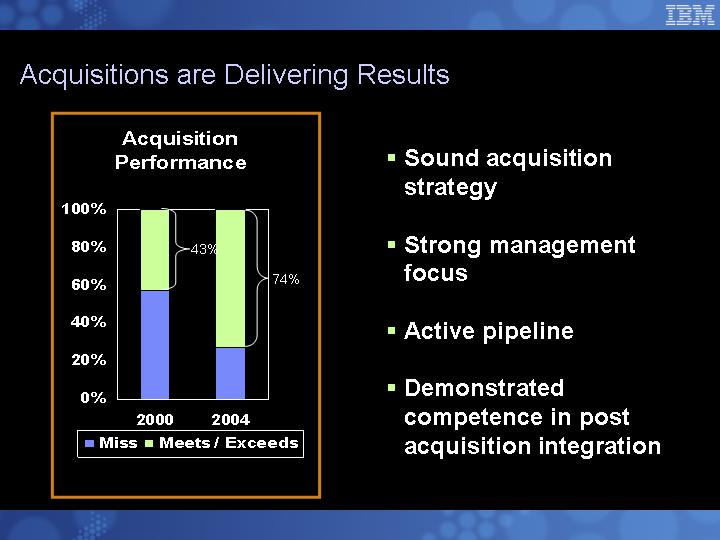

Acquisitions are Delivering Results

Acquisitions Performance

[CHART]

• Sound acquisition strategy

• Strong management focus

• Active pipeline

• Demonstrated competence in post acquisition integration

Financial Objectives

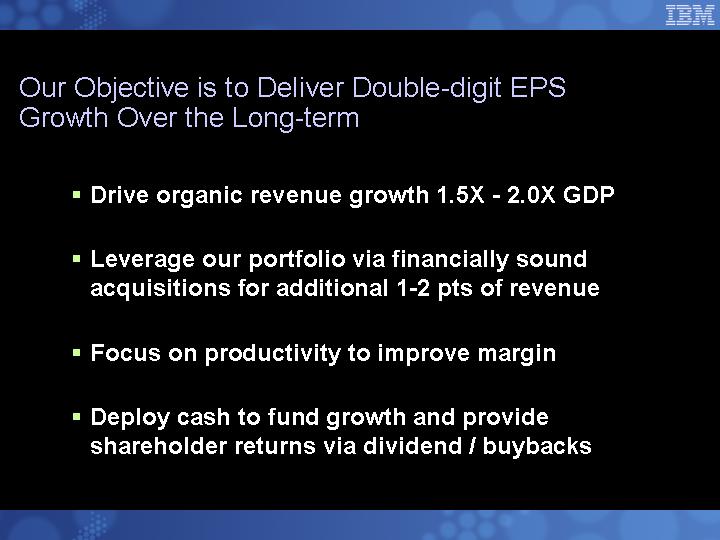

Our Objective is to Deliver Double-digit EPS Growth Over the Long-term

• Drive organic revenue growth 1.5X - 2.0X GDP

• Leverage our portfolio via financially sound acquisitions for additional 1-2 pts of revenue

• Focus on productivity to improve margin

• Deploy cash to fund growth and provide shareholder returns via dividend / buybacks

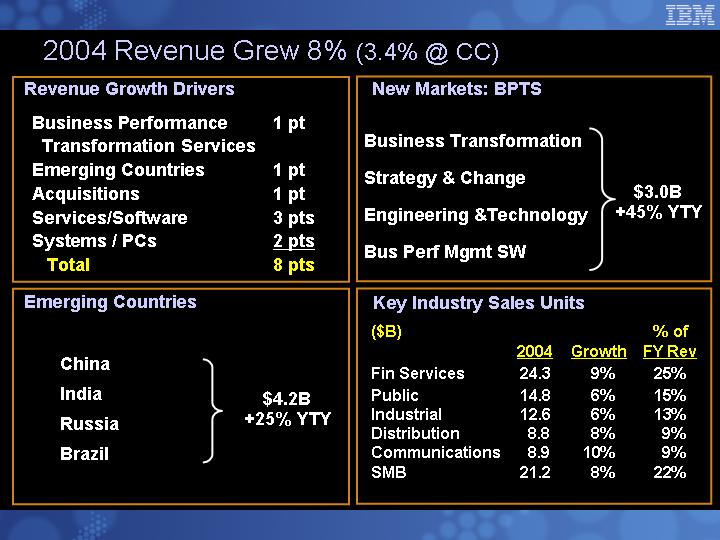

2004 Revenue Grew 8% (3.4% @ CC)

Revenue Growth Drivers

Business Performance |

| 1pt |

Transformation Services |

|

|

Emerging Countries |

| 1pt |

Acquisitions |

| 1pt |

Services/Software |

| 3pts |

Systems / PCs |

| 2pts |

Total |

| 8pts |

Emerging Countries

China |

|

|

|

|

|

India |

|

|

|

| $4.2B |

Russia |

| +25% YTY |

|

|

|

Brazil |

|

|

New Markets: BPTS

Business Transformation |

|

|

|

|

|

Strategy & Change |

|

|

|

| $3.0B |

Engineering &Technology |

| +45% YTY |

|

|

|

Bus Perf Mgmt SW |

|

|

Key Industry Sales Units

($B)

|

| 2004 |

| Growth |

| % of |

|

Fin Services |

| 24.3 |

| 9 | % | 25 | % |

Public |

| 14.8 |

| 6 | % | 15 | % |

Industrial |

| 12.6 |

| 6 | % | 13 | % |

Distribution |

| 8.8 |

| 8 | % | 9 | % |

Communications |

| 8.9 |

| 10 | % | 9 | % |

SMB |

| 21.2 |

| 8 | % | 22 | % |

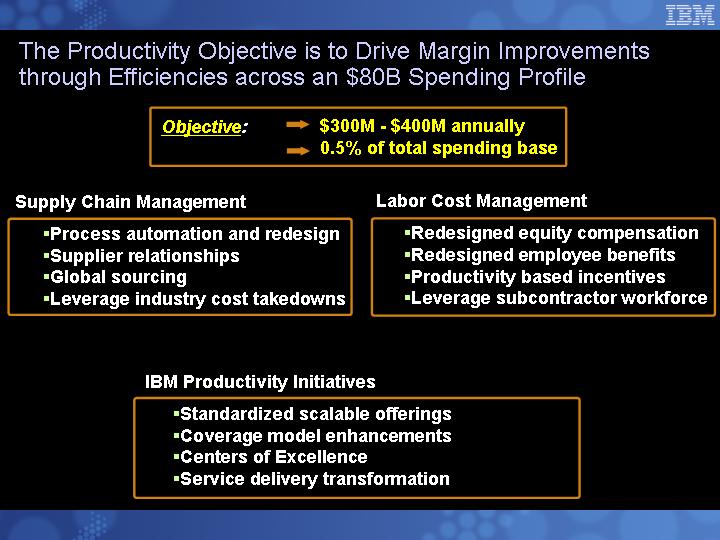

The Productivity Objective is to Drive Margin Improvements through Efficiencies across an $80B Spending Profile

Objective: | • | $300M - $400M annually |

| • | 0.5% of total spending base |

Supply Chain Management

• Process automation and redesign

• Supplier relationships

• Global sourcing

• Leverage industry cost takedowns

Labor Cost Management

• Redesigned equity compensation

• Redesigned employee benefits

• Productivity based incentives

• Leverage subcontractor workforce

IBM Productivity Initiatives

• Standardized scalable offerings

• Coverage model enhancements

• Centers of Excellence

• Service delivery transformation

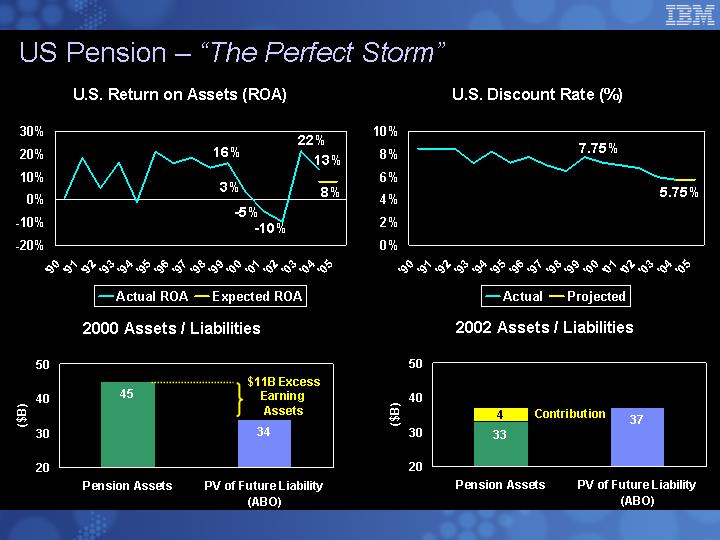

US Pension – “The Perfect Storm”

U.S. Return on Assets (ROA)

[CHART]

U.S. Discount Rate (%)

[CHART]

2000 Assets / Liabilities

[CHART]

2002 Assets / Liabilities

[CHART]

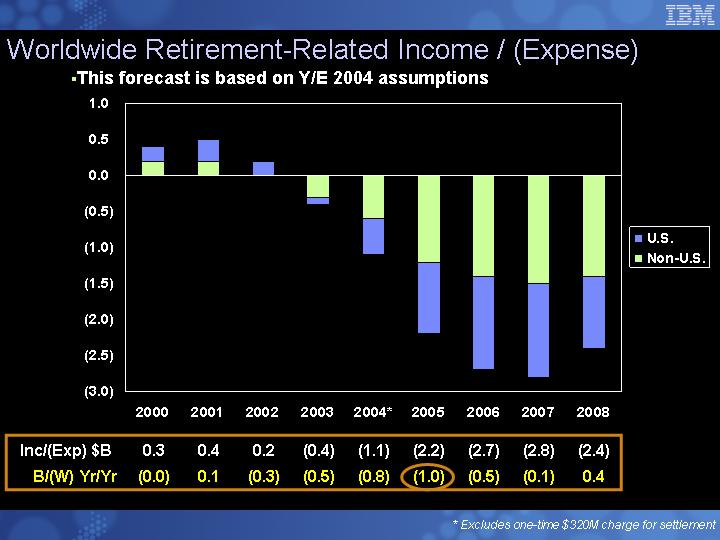

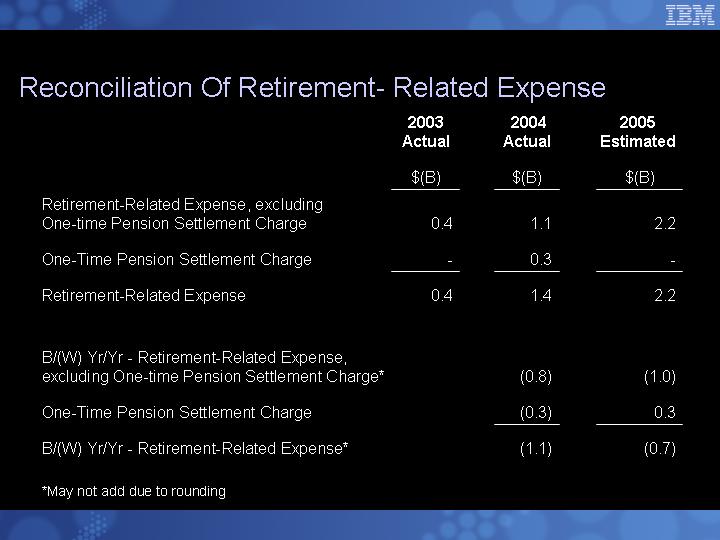

Worldwide Retirement-Related Income / (Expense)

• This forecast is based on Y/E 2004 assumptions

[CHART]

Inc/(Exp) $B |

| 0.3 |

| 0.4 |

| 0.2 |

| (0.4 | ) | (1.1 | ) | (2.2 | ) | (2.7 | ) | (2.8 | ) | (2.4 | ) |

B/(W) Yr/Yr |

| (0.0 | ) | 0.1 |

| (0.3 | ) | (0.5 | ) | (0.8 | ) | (1.0 | ) | (0.5 | ) | (0.1 | ) | 0.4 |

|

* Excludes one-time $320M charge for settlement

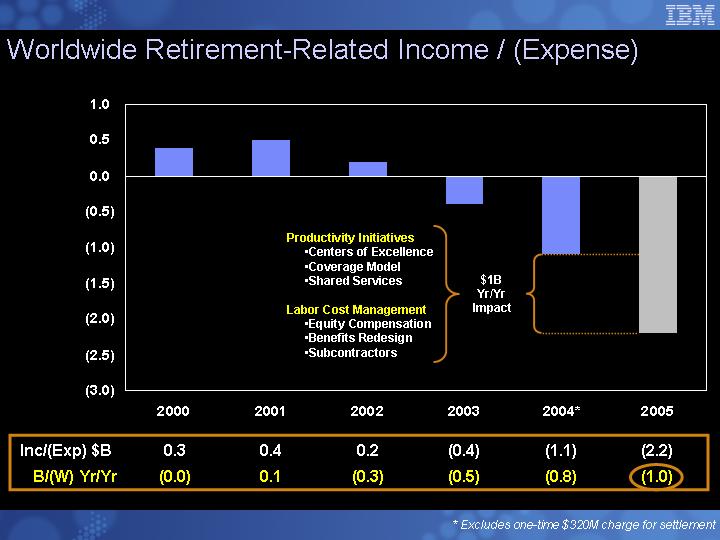

[CHART]

$1B Yr/Yr Impact

Productivity Initiatives

• Centers of Excellence

• Coverage Model

• Shared Services

Labor Cost Management

• Equity Compensation

• Benefits Redesign

• Subcontractors

Inc/(Exp) $B |

| 0.3 |

| 0.4 |

| 0.2 |

| (0.4 | ) | (1.1 | ) | (2.2 | ) |

B/(W) Yr/Yr |

| (0.0 | ) | 0.1 |

| (0.3 | ) | (0.5 | ) | (0.8 | ) | (1.0 | ) |

* Excludes one-time $320M charge for settlement

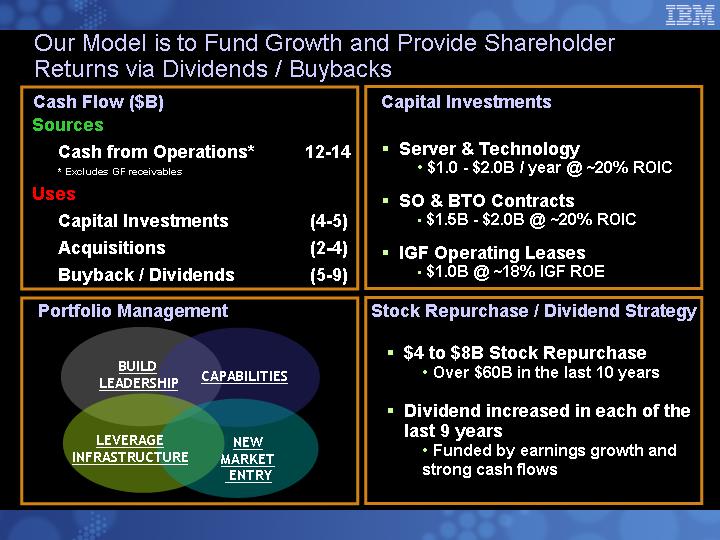

Our Model is to Fund Growth and Provide Shareholder Returns via Dividends / Buybacks

Cash Flow ($B)

Sources

Cash from Operations* |

| 12-14 |

|

* Excludes GF receivables

Uses

Capital Investments |

| (4-5) |

|

Acquisitions |

| (2-4) |

|

Buyback / Dividends |

| (5-9) |

|

Portfolio Management

BUILD |

|

|

LEADERSHIP |

| CAPABILITIES |

|

|

|

LEVERAGE |

| NEW |

INFRASTRUCTURE |

| MARKET |

|

| ENTRY |

Capital Investments

• Server & Technology

• $1.0 - $2.0B / year @ ~20% ROIC

• SO & BTO Contracts

• $1.5B - $2.0B @ ~20% ROIC

• IGF Operating Leases

• $1.0B @ ~18% IGF ROE

Stock Repurchase / Dividend Strategy

• $4 to $8B Stock Repurchase

• Over $60B in the last 10 years

• Dividend increased in each of the last 9 years

• Funded by earnings growth and strong cash flows

First Quarter Overview

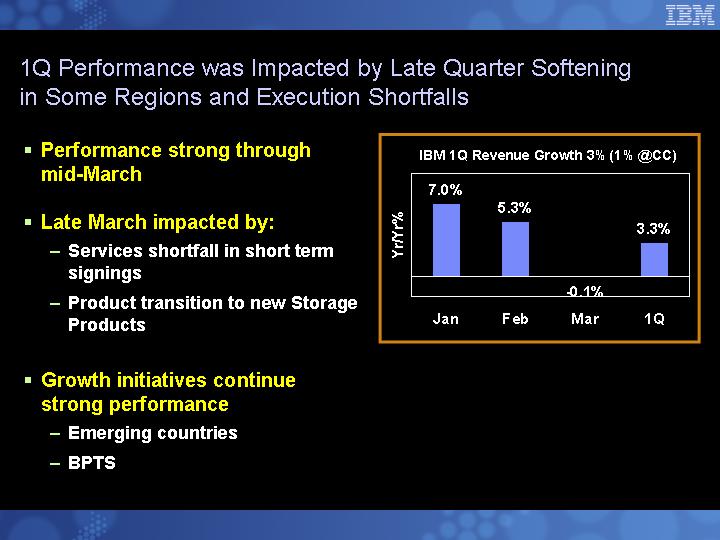

1Q Performance was Impacted by Late Quarter Softening in Some Regions and Execution Shortfalls

• Performance strong through mid-March

• Late March impacted by:

• Services shortfall in short term signings

• Product transition to new Storage Products

• Growth initiatives continue strong performance

• Emerging countries

• BPTS

IBM 1Q Revenue Growth 3% (1% @CC)

[CHART]

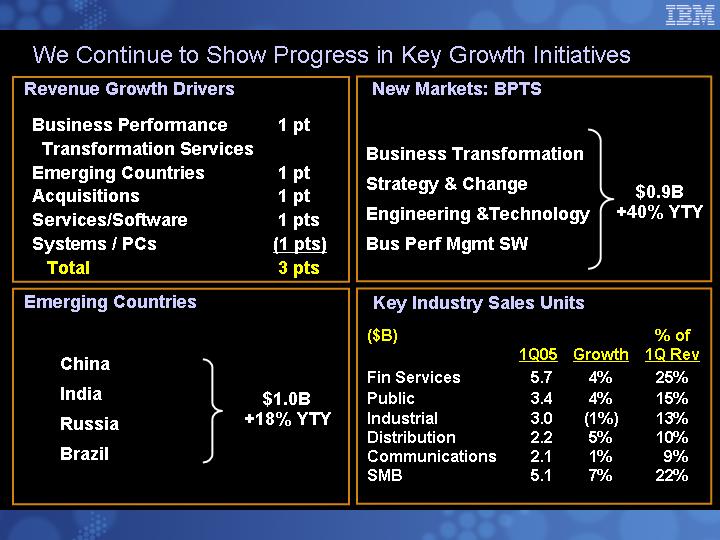

We Continue to Show Progress in Key Growth Initiatives

Revenue Growth Drivers

Business Performance |

| 1 | pt |

Transformation Services |

|

|

|

Emerging Countries |

| 1 | pt |

Acquisitions |

| 1 | pt |

Services/Software |

| 1 | pts |

Systems / PCs |

| (1 | pts) |

Total |

| 3 | pts |

Emerging Countries

China |

|

|

|

|

|

India |

|

|

|

| $1.0B |

Russia |

| +18% YTY |

|

|

|

Brazil |

|

|

New Markets: BPTS

Business Transformation |

|

|

|

|

|

Strategy & Change |

|

|

|

| $0.9B |

Engineering &Technology |

| +40% YTY |

|

|

|

Bus Perf Mgmt SW |

|

|

Key Industry Sales Units

($B)

|

| 1Q05 |

| Growth |

| % of |

|

Fin Services |

| 5.7 |

| 4 | % | 25 | % |

Public |

| 3.4 |

| 4 | % | 15 | % |

Industrial |

| 3.0 |

| (1 | )% | 13 | % |

Distribution |

| 2.2 |

| 5 | % | 10 | % |

Communications |

| 2.1 |

| 1 | % | 9 | % |

SMB |

| 5.1 |

| 7 | % | 22 | % |

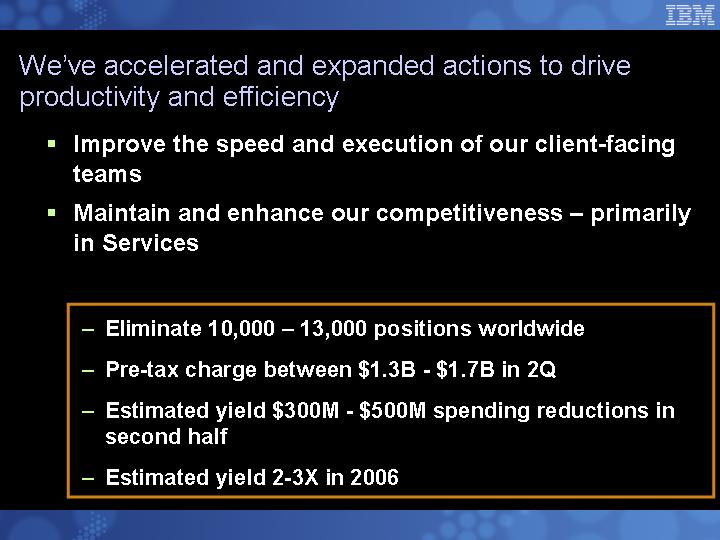

We’ve accelerated and expanded actions to drive productivity and efficiency

• Improve the speed and execution of our client-facing teams

• Maintain and enhance our competitiveness – primarily in Services

• Eliminate 10,000 – 13,000 positions worldwide

• Pre-tax charge between $1.3B - - $1.7B in 2Q

• Estimated yield $300M - $500M spending reductions in second half

• Estimated yield 2-3X in 2006

Summary

• Strong financial profile

• Investments in new products, new offerings and new markets

• Strategy that maintains leadership

• Committed to deliver double digit EPS growth over the long-term

[LOGO]

Global Services

John Joyce

Senior Vice President and Group Executive

IBM Global Services

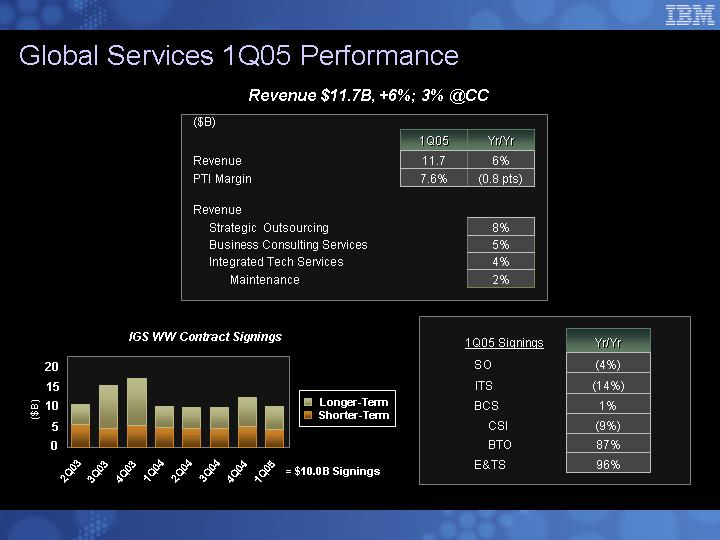

Global Services 1Q05 Performance

Revenue $11.7B, +6%; 3% @CC

($B)

|

| 1Q05 |

| Yr/Yr |

|

Revenue |

| 11.7 |

| 6 | % |

PTI Margin |

| 7.6 | % | (0.8 | pts) |

|

|

|

|

|

|

Revenue |

|

|

|

|

|

Strategic Outsourcing |

|

|

| 8 | % |

Business Consulting Services |

|

|

| 5 | % |

Integrated Tech Services |

|

|

| 4 | % |

Maintenance |

|

|

| 2 | % |

IGS WW Contract Signings

[CHART]

1Q05 Signings |

| Yr/Yr |

|

|

|

|

|

SO |

| (4 | )% |

ITS |

| (14 | )% |

BCS |

| 1 | % |

CSI |

| (9 | )% |

BTO |

| 87 | % |

E&TS |

| 96 | % |

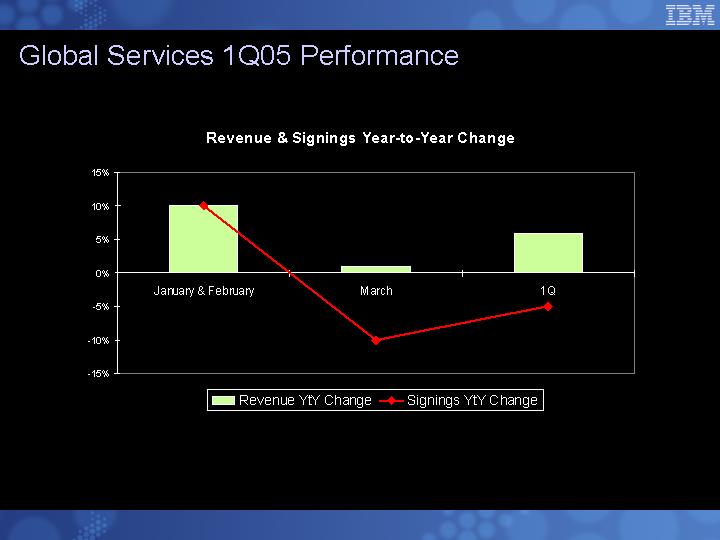

Revenue & Signings Year-to-Year Change

[CHART]

1Q05 Strengths and Weaknesses

Strengths

• Americas Competitiveness

• Signings Growth

• BTO Growth

• Asia Growth (w/o Japan)

Weaknesses

• Short-term Signings, Revenue, and Profitability (in March)

• Europe Performance

• Japan Performance

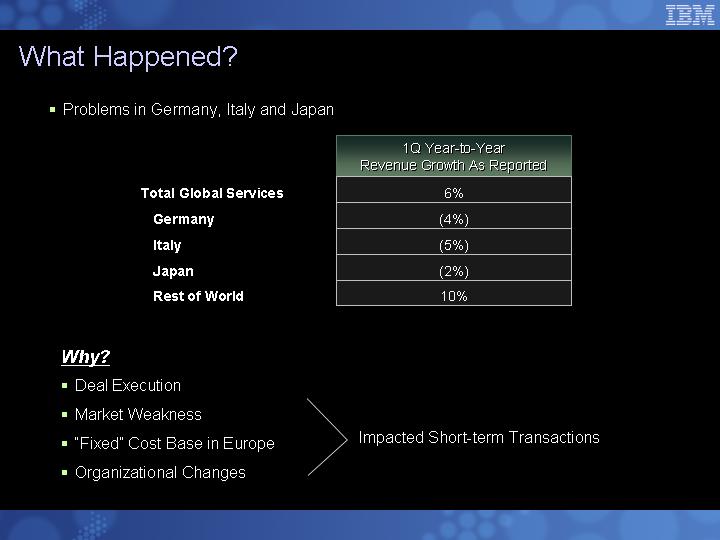

What Happened?

• Problems in Germany, Italy and Japan

|

| 1Q Year-to-Year |

|

|

|

|

|

Total Global Services |

| 6 | % |

Germany |

| (4 | )% |

Italy |

| (5 | )% |

Japan |

| (2 | )% |

Rest of World |

| 10 | % |

Why?

Impacted Short-term Transactions

• Deal Execution

• Market Weakness

• “Fixed” Cost Base in Europe

• Organizational Changes

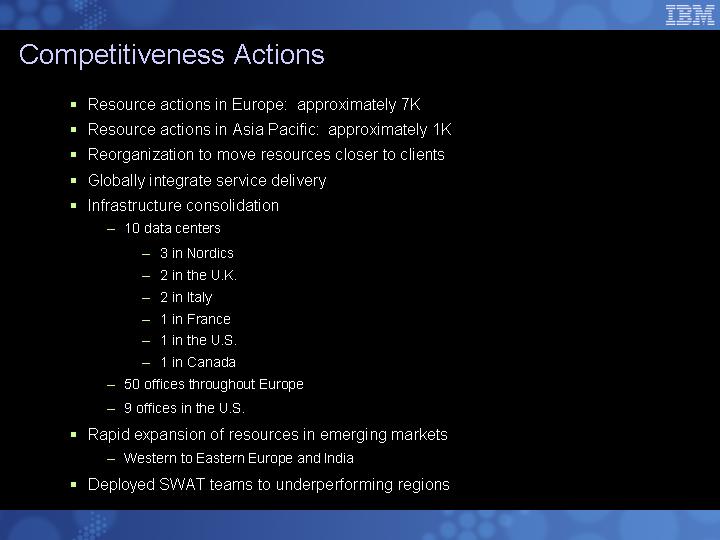

Competitiveness Actions

• Resource actions in Europe: approximately 7K

• Resource actions in Asia Pacific: approximately 1K

• Reorganization to move resources closer to clients

• Globally integrate service delivery

• Infrastructure consolidation

• 10 data centers

• 3 in Nordics

• 2 in the U.K.

• 2 in Italy

• 1 in France

• 1 in the U.S.

• 1 in Canada

• 50 offices throughout Europe

• 9 offices in the U.S.

• Rapid expansion of resources in emerging markets

• Western to Eastern Europe and India

• Deployed SWAT teams to underperforming regions

Business Line Actions

Integrated Technology Services & Consulting

• Coverage

• Increased coverage and technical sales resources

• Business Partners:

• Aggressively recruiting smaller, regional IT systems integrators

• Investing $300 million in new programs, consulting and education for Business Partners

• 300+ consultants redeployed to client-facing work

• Incentives

• Increased incentives on short-term contracts

• Offerings

• IT infrastructure services: wireless, security, networking/Voice Over IP, and storage

• New “Express” offerings targeted at fastest-growing segment of SMB

Strategic Outsourcing & Business Transformation Outsourcing

• Added experienced deal makers

• Increased incentives and resources to drive account growth

• Pipeline development initiatives and incentives

• Dedicated global management for BTO

Short-term Impacts

• More competitive pricing

• Improved pipeline

• Higher win rates

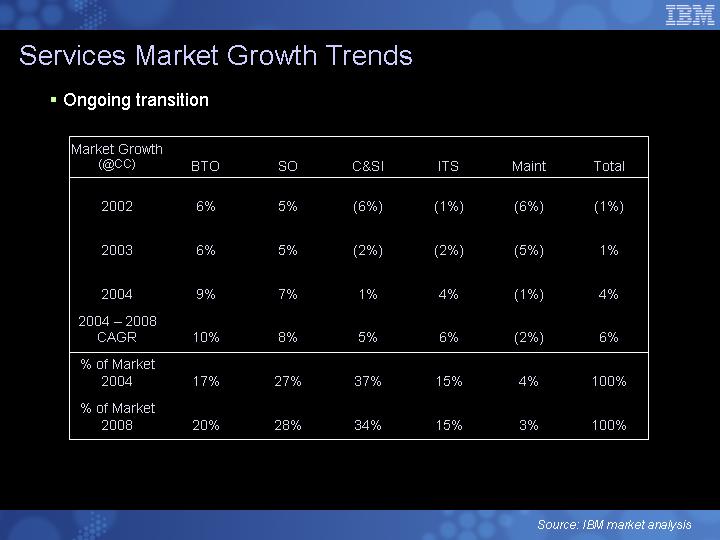

Services Market Growth Trends

• Ongoing transition

Market Growth |

| BTO |

| SO |

| C&SI |

| ITS |

| Maint |

| Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2002 |

| 6 | % | 5 | % | (6 | )% | (1 | )% | (6 | )% | (1 | )% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2003 |

| 6 | % | 5 | % | (2 | )% | (2 | )% | (5 | )% | 1 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2004 |

| 9 | % | 7 | % | 1 | % | 4 | % | (1 | )% | 4 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2004 – 2008 |

| 10 | % | 8 | % | 5 | % | 6 | % | (2 | )% | 6 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% of Market |

| 17 | % | 27 | % | 37 | % | 15 | % | 4 | % | 100 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% of Market |

| 20 | % | 28 | % | 34 | % | 15 | % | 3 | % | 100 | % |

Source: IBM market analysis

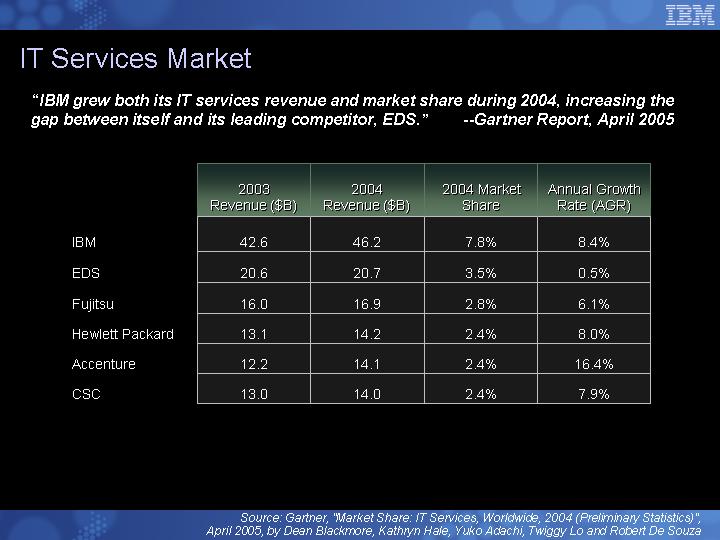

IT Services Market

“IBM grew both its IT services revenue and market share during 2004, increasing the gap between itself and its leading competitor, EDS.” �� —Gartner Report, April 2005

|

| 2003 |

| 2004 |

| 2004 Market |

| Annual Growth |

|

|

|

|

|

|

|

|

|

|

|

IBM |

| 42.6 |

| 46.2 |

| 7.8 | % | 8.4 | % |

|

|

|

|

|

|

|

|

|

|

EDS |

| 20.6 |

| 20.7 |

| 3.5 | % | 0.5 | % |

|

|

|

|

|

|

|

|

|

|

Fujitsu |

| 16.0 |

| 16.9 |

| 2.8 | % | 6.1 | % |

|

|

|

|

|

|

|

|

|

|

Hewlett Packard |

| 13.1 |

| 14.2 |

| 2.4 | % | 8.0 | % |

|

|

|

|

|

|

|

|

|

|

Accenture |

| 12.2 |

| 14.1 |

| 2.4 | % | 16.4 | % |

|

|

|

|

|

|

|

|

|

|

CSC |

| 13.0 |

| 14.0 |

| 2.4 | % | 7.9 | % |

Source: Gartner, “Market Share: IT Services, Worldwide, 2004 (Preliminary Statistics)”, |

April 2005, by Dean Blackmore, Kathryn Hale, Yuko Adachi, Twiggy Lo and Robert De Souza |

Accelerating Standardized Asset Strategy in Services

• Entire company mobilizing

• Development of intellectual property, including business process frameworks, IT architectures, and thousands of software assets

• Top priority of technical community; standard scalable offerings

• Directing more of our $5.7B R&D investment toward services assets

• Assets from engagements

• Strategic acquisitions

[LOGO]

• Benefits

• Clients: decreased time to value, increase quality and predictability of delivery, lower total cost

• IBM: differentiated, higher-value offerings

• Investors: margin improvement, top-line growth

Business Performance Transformation Services Market

BPTS Market Opportunity

[CHART]

Summary

Short-term

• More competitive pricing

• Improved pipeline

• Higher win rates

Long-term

• Market growth

• Well positioned

• Will continue to grow

• Will improve profitability

Good Start in Second Quarter

[LOGO]

[LOGO]

Systems and Technology

Bill Zeitler

Senior Vice President and Group Executive

IBM Systems and Technology

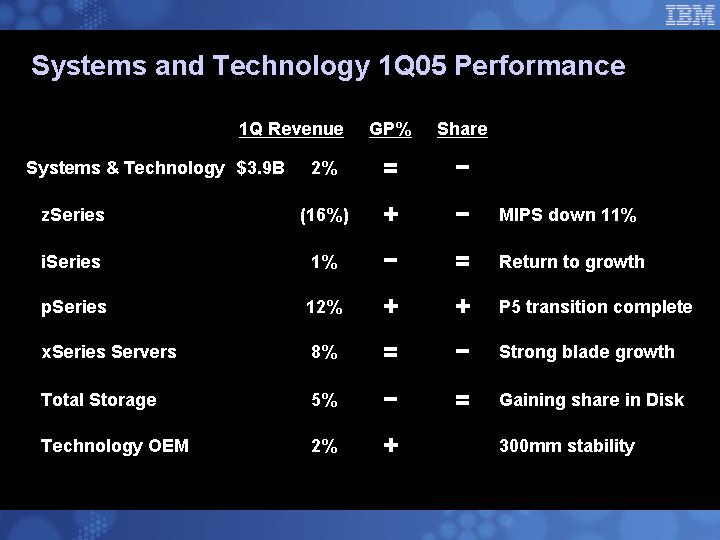

Systems and Technology 1Q05 Performance

|

| 1Q Revenue |

| GP% |

| Share |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Systems & Technology | $3.9B |

| 2 | % | = |

| - |

|

|

|

|

|

|

|

|

|

|

|

|

| |

zSeries |

| (16 | )% | + |

| - |

| MIPS down 11% |

| |

|

|

|

|

|

|

|

|

|

| |

iSeries |

| 1 | % | - |

| = |

| Return to growth |

| |

|

|

|

|

|

|

|

|

|

| |

pSeries |

| 12 | % | + |

| + |

| P5 transition complete |

| |

|

|

|

|

|

|

|

|

|

| |

xSeries Servers |

| 8 | % | = |

| - |

| Strong blade growth |

| |

|

|

|

|

|

|

|

|

|

| |

Total Storage |

| 5 | % | - |

| = |

| Gaining share in Disk |

| |

|

|

|

|

|

|

|

|

|

| |

Technology OEM |

| 2 | % | + |

|

|

| 300mm stability |

| |

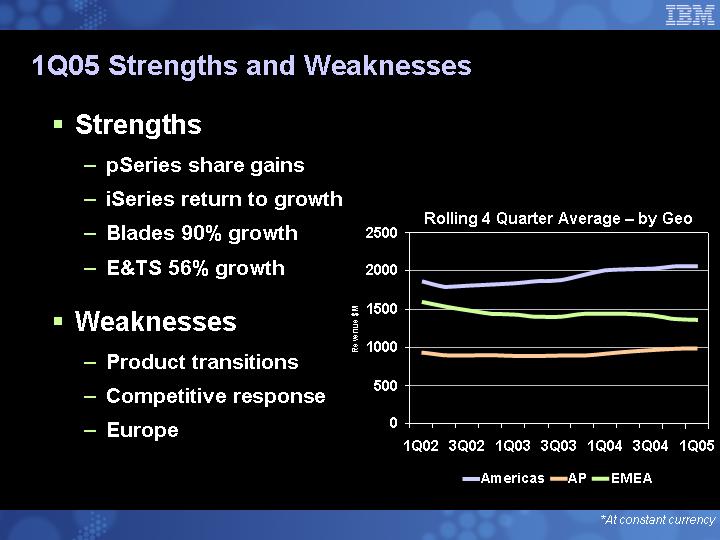

1Q05 Strengths and Weaknesses

• Strengths

• pSeries share gains

• iSeries return to growth

• Blades 90% growth

• E&TS 56% growth

• Weaknesses

• Product transitions

• Competitive response

• Europe

Rolling 4 Quarter Average – by Geo

[CHART]

*At constant currency

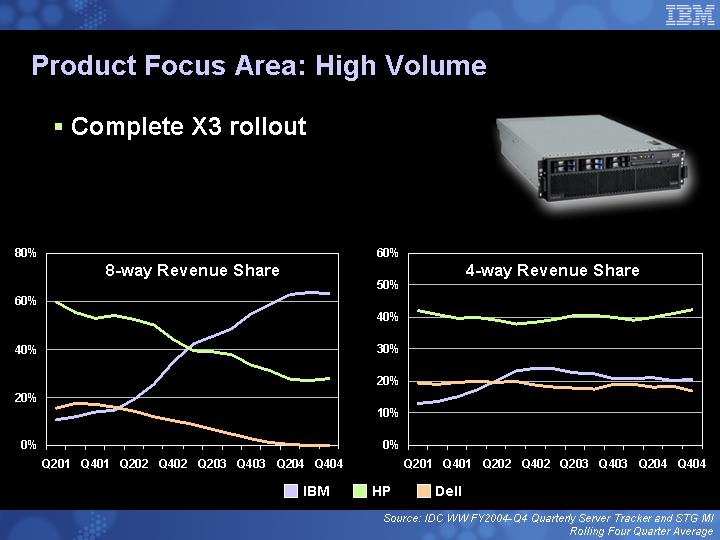

Product Focus Area: High Volume

• Complete X3 rollout

[GRAPHIC]

8-way Revenue Share

[CHART]

4-way Revenue Share

[CHART]

Source: IDC WW FY2004-Q4 Quarterly Server Tracker and STG MI

Rolling Four Quarter Average

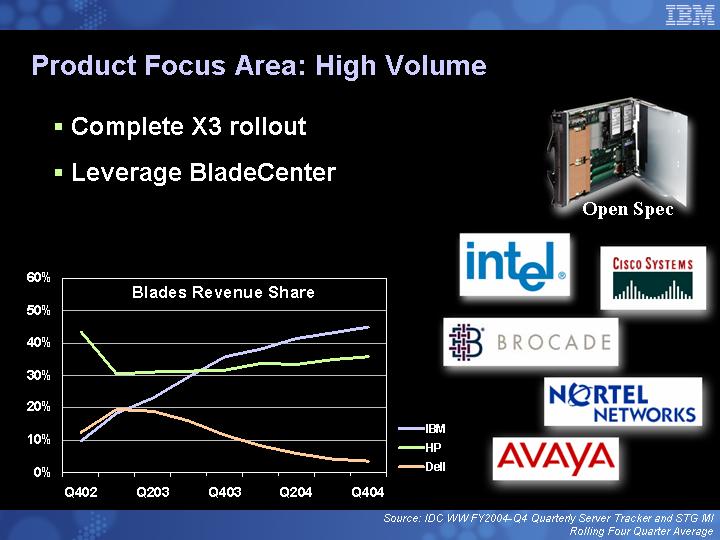

• Complete X3 rollout

• Leverage BladeCenter

Blades Revenue Share

[CHART]

[GRAPHIC]

Open Spec

[LOGO]

Source: IDC WW FY2004-Q4 Quarterly Server Tracker and STG MI

Rolling Four Quarter Average

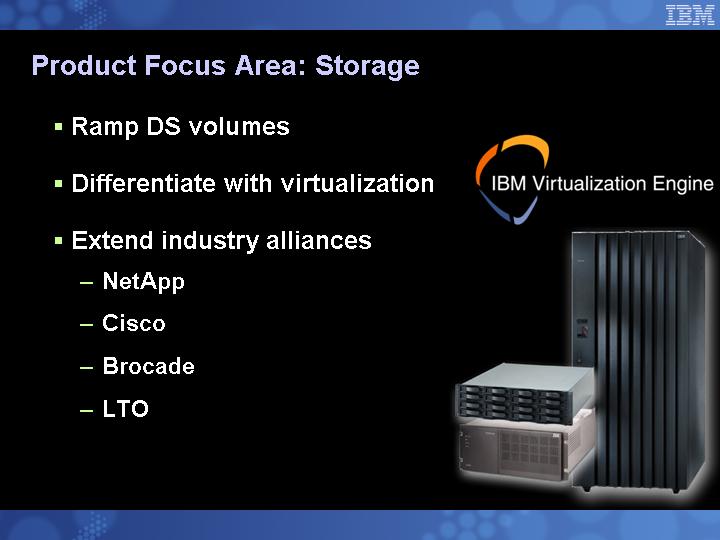

Product Focus Area: Storage

• Ramp DS volumes

• Differentiate with virtualization

• Extend industry alliances

• NetApp

• Cisco

• Brocade

• LTO

[LOGO]

[GRAPHIC]

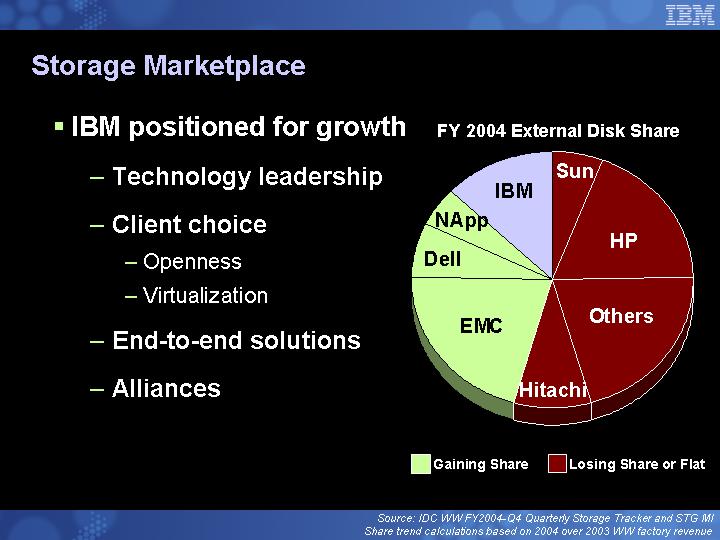

Storage Marketplace

• IBM positioned for growth

• Technology leadership

• Client choice

• Openness

• Virtualization

• End-to-end solutions

• Alliances

FY 2004 External Disk Share

[CHART]

Source: IDC WW FY2004-Q4 Quarterly Storage Tracker and STG MI

Share trend calculations based on 2004 over 2003 WW factory revenue

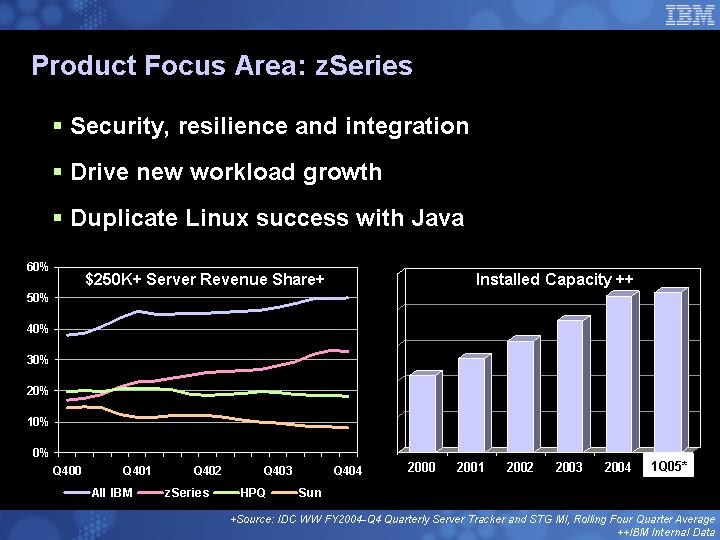

Product Focus Area: zSeries

• Security, resilience and integration

• Drive new workload growth

• Duplicate Linux success with Java

$250K+ Server Revenue Share+

[CHART]

Installed Capacity ++

[CHART]

+Source: IDC WW FY2004-Q4 Quarterly Server Tracker and STG MI, Rolling Four Quarter Average

++IBM Internal Data

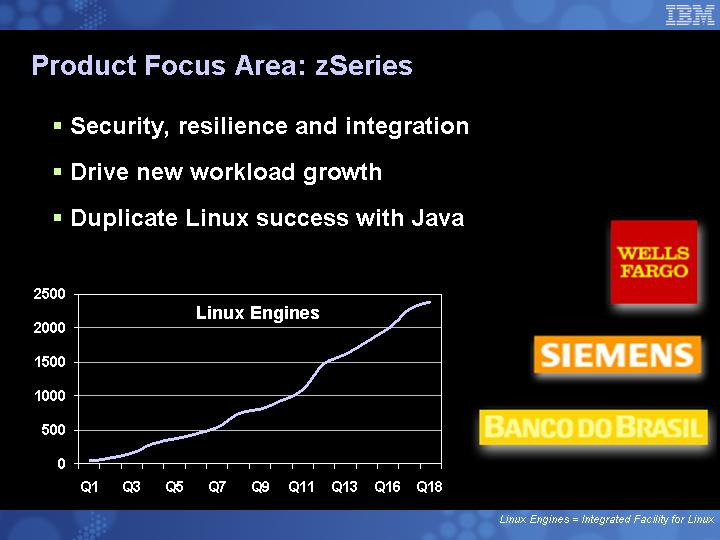

• Security, resilience and integration

• Drive new workload growth

• Duplicate Linux success with Java

Linux Engines

[CHART]

[LOGO]

Linux Engines = Integrated Facility for Linux

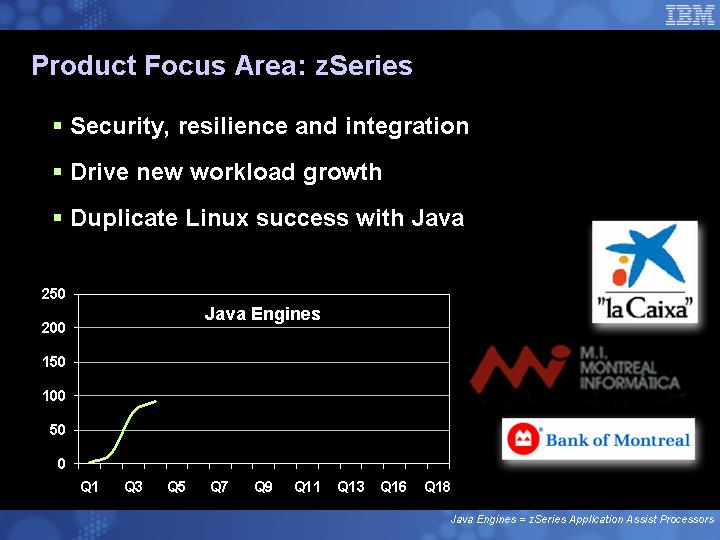

• Security, resilience and integration

• Drive new workload growth

• Duplicate Linux success with Java

Java Engines

[CHART]

[LOGO]

Java Engines = zSeries Application Assist Processors

Opportunities

• Innovation Solutions

• STG OEM and Intellectual Property

• Deep Computing

• Engineering & Technology Services

• Technology Assets

• Open Collaboration

• Expertise

[LOGO]

• Innovation Solutions

• STG OEM and Intellectual Property

• Deep Computing

• Engineering & Technology Services

• Infrastructure Solutions

• Linux

• Grid

• Virtualization

• Technology

[LOGO]

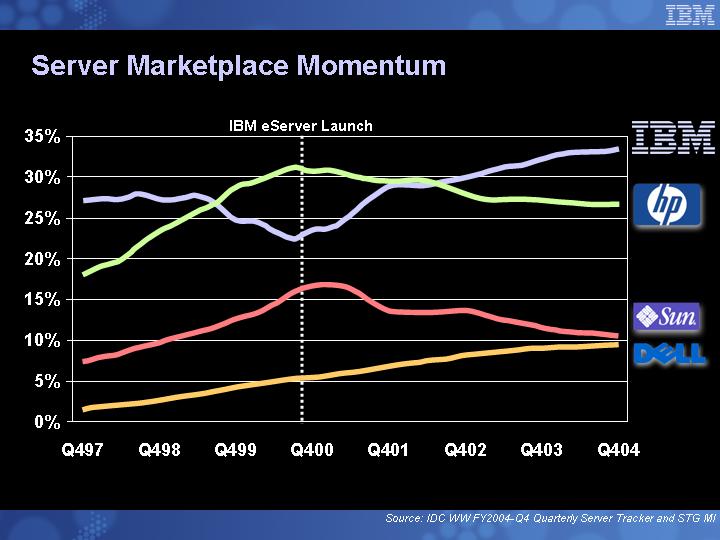

Server Marketplace Momentum

IBM eServer Launch

[CHART]

[LOGO]

Source: IDC WW FY2004-Q4 Quarterly Server Tracker and STG MI

Summary

• Execution focus

• Leadership offerings

• Positioned for growth

Software

Steve Mills

Senior Vice President and Group Executive

IBM Software

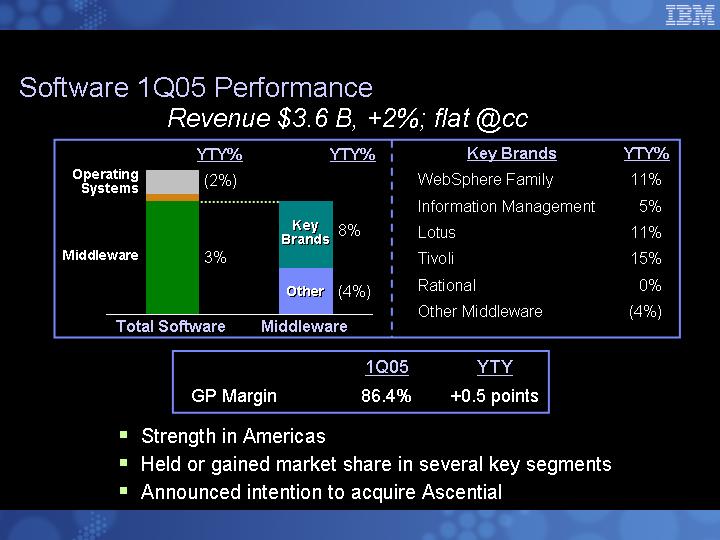

Software 1Q05 Performance

Revenue $3.6 B, +2%; flat @cc

[CHART]

Key Brands |

| YTY% |

|

WebSphere Family |

| 11 | % |

Information Management |

| 5 | % |

Lotus |

| 11 | % |

Tivoli |

| 15 | % |

Rational |

| 0 | % |

Other Middleware |

| (4 | )% |

|

| 1Q05 |

| YTY |

|

GP Margin |

| 86.4 | % | +0.5 points |

|

• Strength in Americas

• Held or gained market share in several key segments

• Announced intention to acquire Ascential

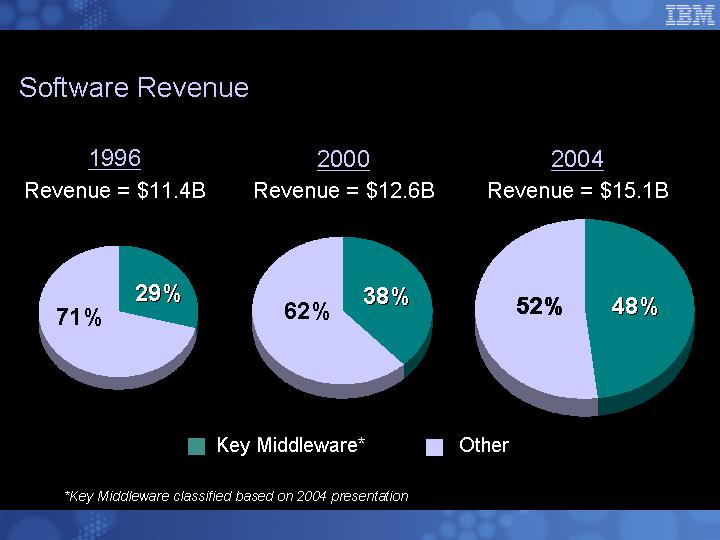

Software Revenue

1996 |

| 2000 |

| 2004 |

|

Revenue = $11.4B |

| Revenue = $12.6B |

| Revenue = $15.1B |

|

[CHART] |

| [CHART] |

| [CHART] |

|

*Key Middleware classified based on 2004 presentation

Software

2004 Revenue = $15.1 B