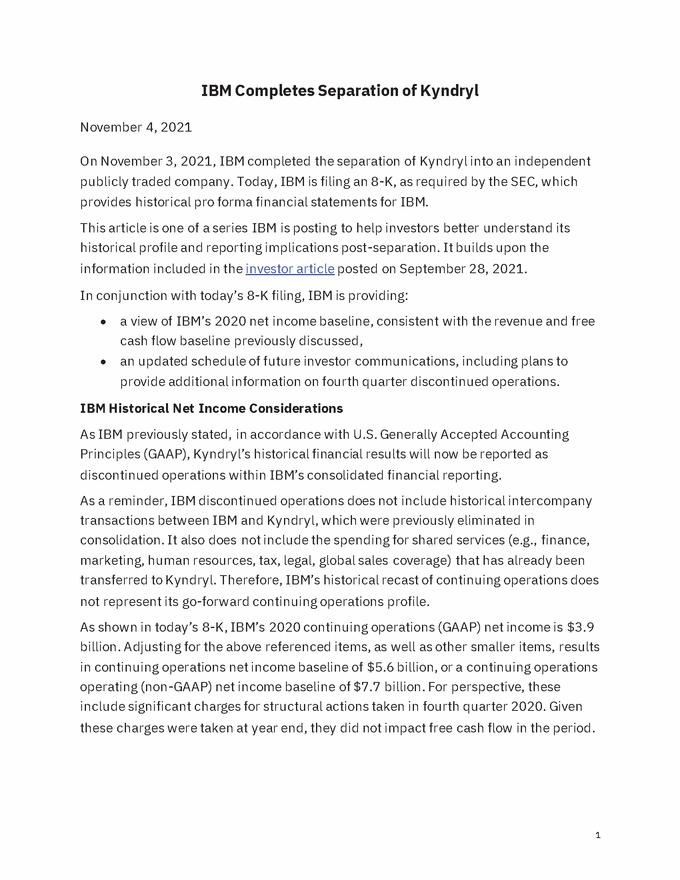

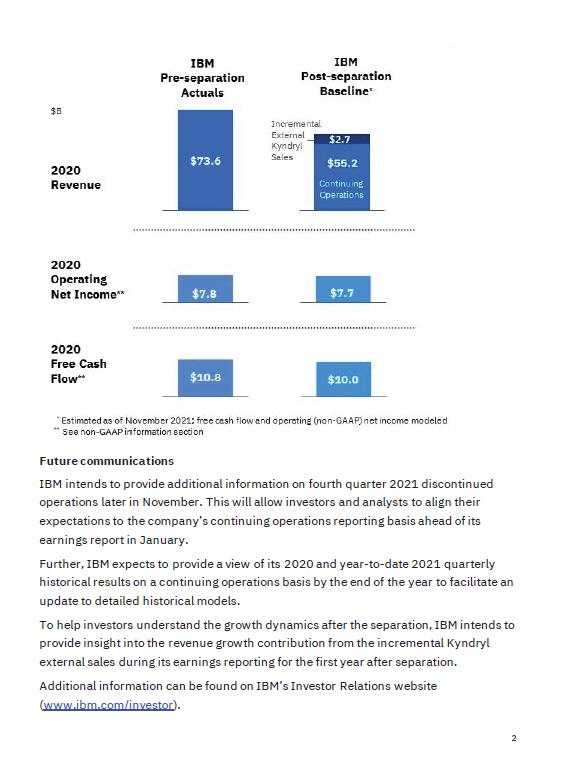

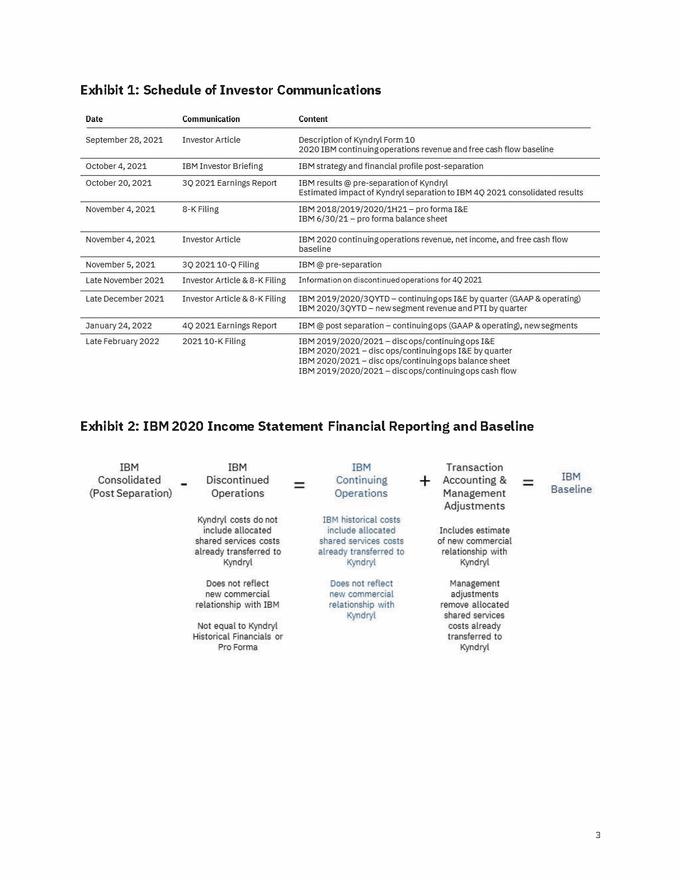

| IBM Completes Separation of Kyndryl November 4, 2021 On November 3, 2021, IBM completed the separation of Kyndryl into an independent publicly traded company. Today, IBM is filing an 8-K, as required by the SEC, which provides historical pro forma financial statements for IBM. This article is one of a series IBM is posting to help investors better understand its historical profile and reporting implications post-separation. It builds upon the information included in the investor article posted on September 28, 2021. In conjunction with today’s 8-K filing, IBM is providing: x a view of IBM’s 2020 net income baseline, consistent with the revenue and free cash flow baseline previously discussed, an updated schedule of future investor communications, including plans to provide additional information on fourth quarter discontinued operations. x IBM Historical Net Income Considerations As IBM previously stated, in accordance with U.S. Generally Accepted Accounting Principles (GAAP), Kyndryl’s historical financial results will now be reported as discontinued operations within IBM’s consolidated financial reporting. As a reminder, IBM discontinued operations does not include historical intercompany transactions between IBM and Kyndryl, which were previously eliminated in consolidation. It also does not include the spending for shared services (e.g., finance, marketing, human resources, tax, legal, global sales coverage) that has already been transferred to Kyndryl. Therefore, IBM’s historical recast of continuing operations does not represent its go-forward continuing operations profile. As shown in today’s 8-K, IBM’s 2020 continuing operations (GAAP) net income is $3.9 billion. Adjusting for the above referenced items, as well as other smaller items, results in continuing operations net income baseline of $5.6 billion, or a continuing operations operating (non-GAAP) net income baseline of $7.7 billion. For perspective, these include significant charges for structural actions taken in fourth quarter 2020. Given these charges were taken at year end, they did not impact free cash flow in the period. 1 |