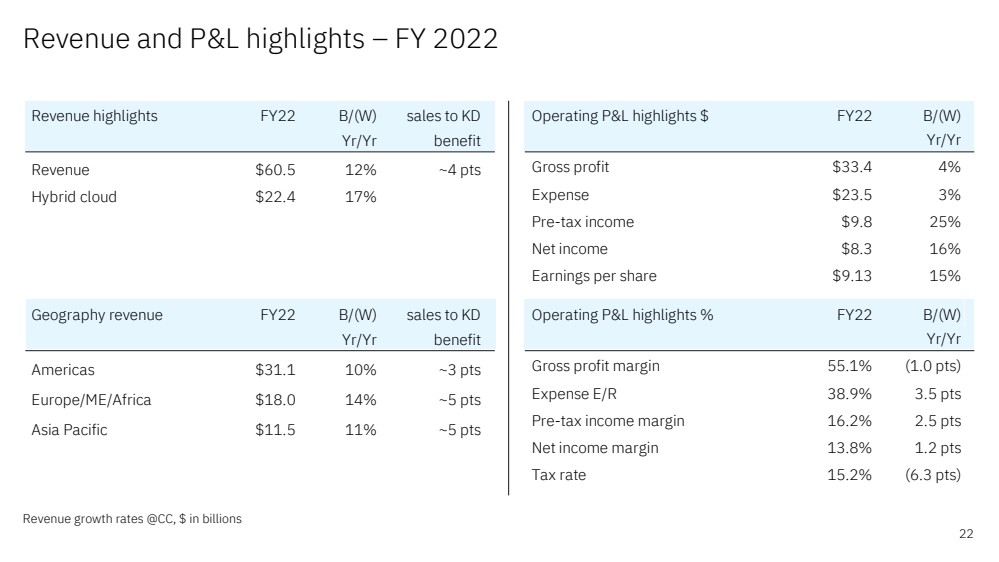

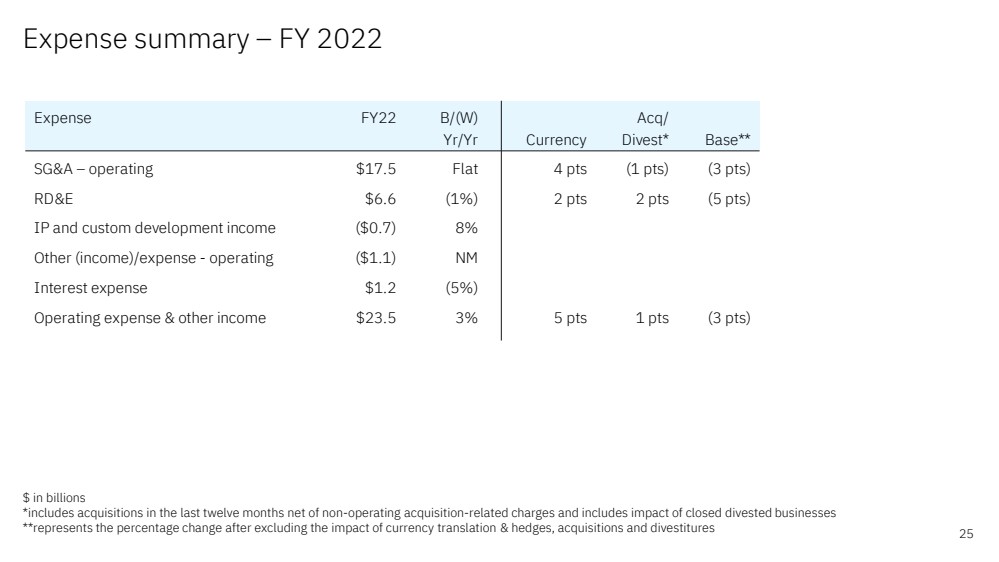

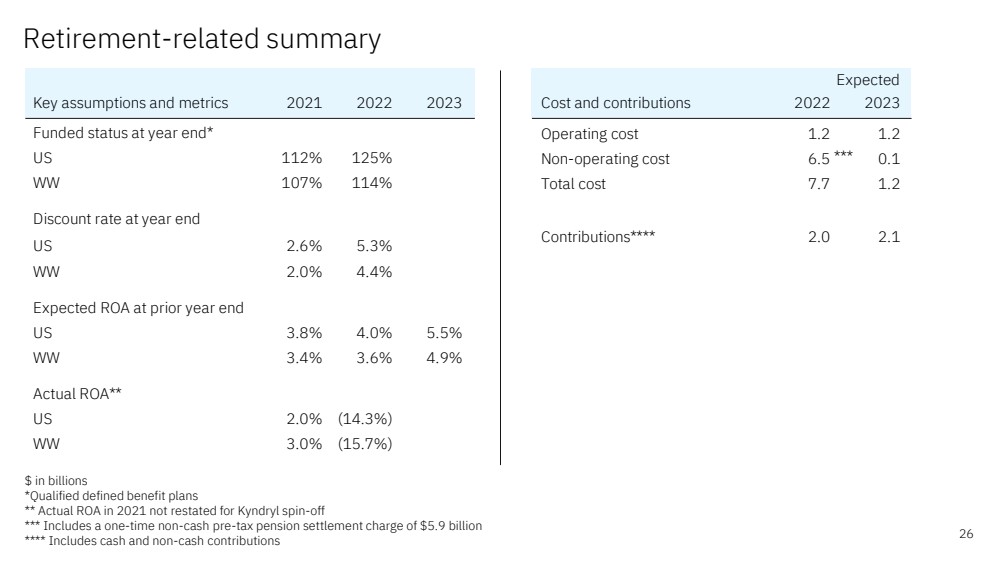

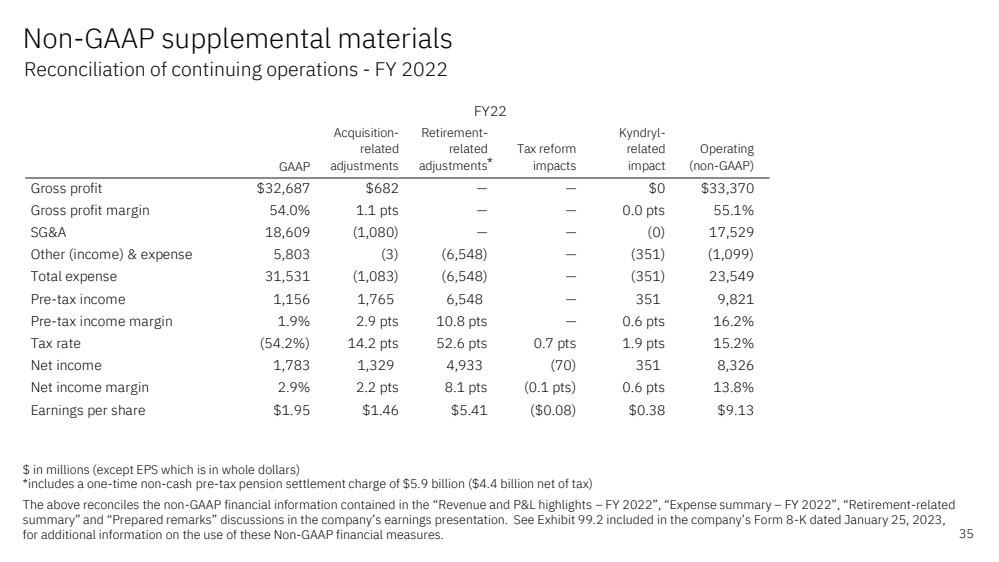

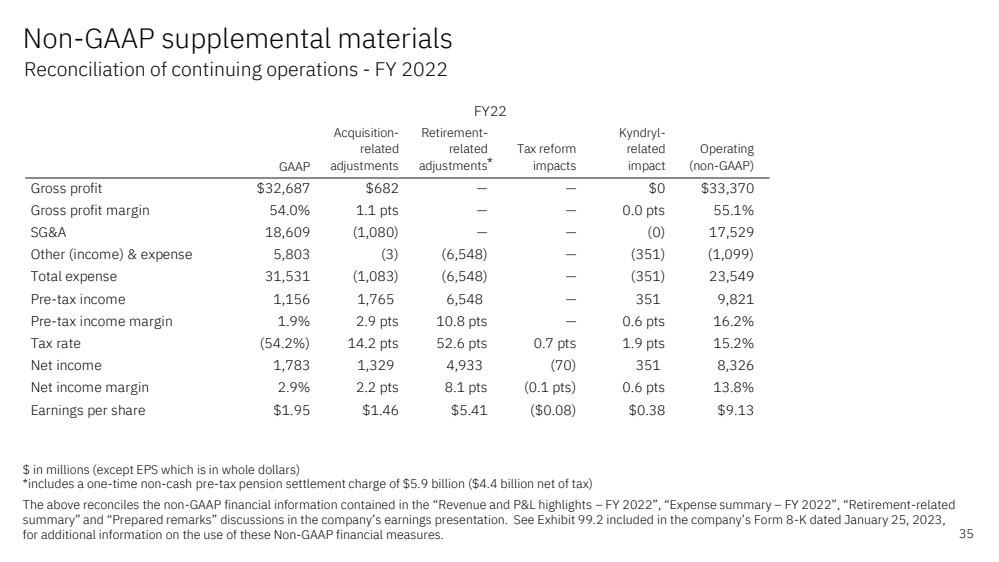

| 35 Non - GAAP supplemental materials $ in millions (except EPS which is in whole dollars) *includes a one - time non - cash pre - tax pension settlement charge of $5.9 billion ($4.4 billion net of tax) The above reconciles the non - GAAP financial information contained in the “Revenue and P&L highlights – FY 2022”, “Expense summar y – FY 2022”, “Retirement - related summary” and “Prepared remarks” discussions in the company’s earnings presentation. See Exhibit 99.2 included in the company’s Form 8 - K dated January 25, 2023, for additional information on the use of these Non - GAAP financial measures .. Reconciliation of continuing operations - FY 2022 GAAP Acquisition- related adjustments Retirement- related adjustments Tax reform impacts Kyndryl- related impact Operating (non-GAAP) Gross profit $32,687 $682 — — $0 $33,370 Gross profit margin 54.0% 1.1 pts — — 0.0 pts 55.1% SG&A 18,609 (1,080) — — (0) 17,529 Other (income) & expense 5,803 (3) (6,548) — (351) (1,099) Total expense 31,531 (1,083) (6,548) — (351) 23,549 Pre-tax income 1,156 1,765 6,548 — 351 9,821 Pre-tax income margin 1.9% 2.9 pts 10.8 pts — 0.6 pts 16.2% Tax rate (54.2%) 14.2 pts 52.6 pts 0.7 pts 1.9 pts 15.2% Net income 1,783 1,329 4,933 (70) 351 8,326 Net income margin 2.9% 2.2 pts 8.1 pts (0.1 pts) 0.6 pts 13.8% Earnings per share $1.95 $1.46 $5.41 ($0.08) $0.38 $9.13 FY22 * |