CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

During the period ended April 16, 2004, Westwood Computer Corporation (“Westwood”) held a note receivable from a company controlled by its former stockholders which was repaid through periodic payments. In connection with the Darr’s acquisition of Westwood’s capital stock, completed April 16, 2004, the note receivable was distributed to the former stockholders of Westwood through a dividend in the amount of $399,958. Interest income recorded on this note for the period ended April 16, 2004 totaled $21,483. There were no other dividends paid to common stockholders during the five year period ended on August 31, 2005.

Pursuant to a Management Services Agreement dated April 16, 2004 by and between DARR Global Holdings, Inc. and Westwood, Westwood is being charged a monthly management fee of $29,166 by DARR Global Holdings, Inc. DARR Global Holdings, Inc. is a management consulting firm, which is 100% owned by Mr. Dinesh Desai, our Chairman and Chief Executive Officer. The initial term of this agreement runs through April 2009.

We occupy approximately 43,000 square feet of office and warehouse space in Springfield, New Jersey. This space is leased from Westwood Property Holdings, LLC, in which Mr. Keith Grabel, our director and an executive officer, Mrs. Mary Margaret Grabel, spouse of our director and an executive officer, and Mr. David Micales, our Vice President of Operations are members. The lease term is through April 2009 with monthly base rent of $15,000.

We are occupying approximately 21,000 square feet of office and warehouse space in a 70,000 square foot building in Suwannee, Georgia. This space is leased from GS&T Properties, LLC, in which Messrs. John Howlett and Ronald Seitz, each an executive officer of our company, are passive investors, each owning an approximate 10% equity interest. The lease term is through November 2009 with monthly base rent of $12,500.

In connection with our self tender offer, two of our current officers, John Howlett and Ronald Seitz, tendered shares. After accounting for proration, 805,152 shares were accepted for tender from Mr. Howlett, with an aggregate purchase price of $1,545,891 and 476,754 shares were accepted for tender from Mr. Seitz, with an aggregate purchase price of $915,367.

Other Agreements

Subordinated Note held by Darr Westwood LLC. Westwood has issued a promissory note dated April 16, 2004 to Darr Westwood LLC, a Delaware limited liability company, of which Mr. Desai is the sole member, or permitted assigns, whereby Westwood promises to pay to the holder of such note the principal sum of $750,000. Interest on the unpaid balance of the principal amount of the note is calculated at a floating rate per month equal to the prime rate as published in the Wall Street Journal under “Money Rates” plus four percent (4%), up to a maximum of ten percent (10%). The note reaches maturity on April 16, 2009. Until that date, Westwood must pay to the holder of the note (i) $194,482 on April 16, 2007, (ii) $323,859 on April 16, 2008, and (iii) $231,659 on April 16, 2009, the date the note matures. Accrued interest from April 16, 2004, until March 28, 2007, is due on March 28, 2007. Accrued interest from March 28, 2007 until March 28, 2008 is due on March 28, 2008. Accrued interest from March 28, 2008 until April 16, 2009 is due on April 16, 2009. In addition, the holder of the note is entitled to a quarterly revenue participation fee of 0.0875% of the gross revenue of Westwood, subject to annual adjustments, total payments are capped at $120,000 per year.

Subordinated Note held by Four Kings Management LLC. Westwood has issued a promissory note dated April 16, 2004 to Four Kings Management LLC, a Delaware limited liability company, which is an affiliate of Keith Grabel, or permitted assigns, whereby it promises to pay to the holder of such note the principal sum of $750,000. Interest on the unpaid balance of the principal amount of the note is calculated at a floating rate per month equal to the prime rate as

- 22 -

published in the Wall Street Journal under “Money Rates” plus four percent (4%), up to a maximum of ten percent (10%). The note reaches maturity on April 16, 2009. Until that date, Westwood must pay to the holder of the note a principal monthly repayment beginning on May 16, 2005 of $9,000 until the note has matured. Interest is payable on the last business day of each month beginning on April 30, 2004. In addition, the holder of the note is entitled to a quarterly revenue participation fee of 0.0875% of the gross revenue of Westwood, subject to annual adjustments, total payments are capped at $120,000 per year.

8% Subordinated Promissory Note held by Darr Westwood LLC. In connection with the Merger and in exchange for certain preferred stock in Darr held by Darr Westwood LLC, Darr issued a promissory note dated August 5, 2005 to Darr Westwood LLC whereby it promises to pay to the holder of such note the principal sum of $1.102,794. Interest on the unpaid balance of the principal amount of the note is payable at a rate of eight percent (8%) per annum. The note matures on April 16, 2009. Principal on the note is due in a single payment on the maturity date. Interest is payable annually beginning on August 5, 2008.

5% Junior Subordinated Note held by Keith Grabel. Westwood has issued certain promissory notes dated April 16, 2004 to Keith Grabel and certain of his family members, whereby it promises to pay to the holders of the notes the aggregate principal sum of $313,695. Interest on the unpaid balance of the aggregate principal amount of the notes is payable at a rate of five percent (5%) per annum. The notes reach maturity on April 16, 2009. Until that date, Westwood must pay to the holders of the notes (i) thirty percent (30%) of the principal amount on April 16, 2006, (ii) thirty percent (30%) of the principal amount on April 16, 2007, (iii) twenty percent (20%) of the principal amount on April 16, 2008, and (iv) twenty percent (20%) of the principal amount on April 16, 2009. Each principal payment is accompanied by all interest then accrued and unpaid on the notes. These notes were paid in full on December 13, 2006.

8% Junior Subordinated Note held by Keith Grabel. Westwood has issued certain promissory notes dated April 16, 2004 to Keith Grabel and certain of his family members, whereby it promises to pay to the holders of the notes the aggregate principal sum of $941,083. Interest on the unpaid balance of the aggregate principal amount of the notes is payable at a rate of eight percent (8%) per annum. The notes reach maturity on April 16, 2007. Until the date of maturity, Westwood must pay to the holders of the notes 16.67% of the aggregate principal amount due every six months. The first such payment took place on October 16, 2004, and the last payment is scheduled for April 16, 2007, the date the notes mature. Each principal payment is accompanied by all interest then accrued and unpaid on the notes. These notes were paid in full on December 13, 2006.

Family Relationships

Mary Margaret Grabel, the spouse of Keith Grabel, is an employee of Westwood and is the owner of approximately fifteen percent (15%) of our outstanding Common Stock. There are no other family relationships among our director or officers.

- 23 -

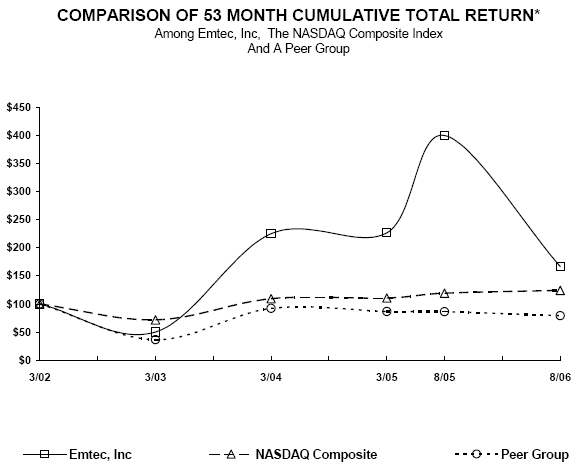

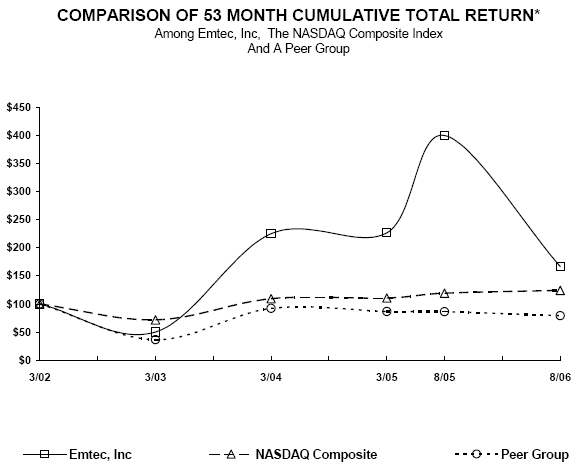

PERFORMANCE GRAPH

The following graph illustrates the cumulative total stockholder return (rounded to the nearest whole dollar) of our Common Stock during the period from March 31, 2002 through August 31, 2006 and compares it to the cumulative total return on (i) the Nasdaq Composite Index and (ii) the Peer Group Index (capitalization weighted). The comparison assumes a $100 investment on March 31, 2002 in our Common Stock and in each of the foregoing indices and assumes reinvestment of dividends, if any. This table is not intended to forecast future performance of our Common Stock.

EMTEC, INC.

RELATIVE MARKET PERFORMANCE

TOTAL RETURN MARCH 31, 2002 – AUGUST 31, 2006

* $100 invested on 3/31/02 in stock or index-including reinvestment of dividends. Fiscal year ending August 31.

- 24 -

(1) Graph assumes $100 invested on March 31, 2002 in the Company’s Common Stock, the Nasdaq Composite Index and the Peer Group Index (capitalization weighted).

(2) Cumulative total return assumes reinvestment of dividends, if any.

(3) The Company has constructed a Peer Group Index consisting of computer systems integrators that also provide information technology services and products to their clients, including MTM Technologies, Inc., Pomeroy IT Solutions, Inc., TransNet Corporation, GTSI, Enpointe Technologies, Halifax and INSIGHT Enterprises. The Company believes that these companies most closely resemble the Company’s business mix and that their performance is representative of the industry.

- 25 -

COMPLIANCE WITH SECTION 16(A) OF THE SECURITIES EXCHANGE ACT OF 1934

Section 16(a) of the Exchange Act requires our directors and executive officers and persons who own beneficially more than 10% of our Common Stock to file reports of ownership and changes in ownership of such common stock with the Securities and Exchange Commission, and to file copies of such reports with us. Based solely upon a review of the copies of such reports filed with Emtec, Emtec believes that during the past two fiscal years, such reporting persons complied with the filing requirements of said Section 16(a) or any filing delinquencies by such persons were reported under the Exchange Act, except that Dinesh Desai, Brian McAdams, Keith Grabel, Stephen Donnelly, Robert Mannarino, Philip Spagnola, and Gregory Chandler did not file on a timely basis a Form 3 reflecting their initial statement of beneficial ownership and John Howlett and Ronald Seitz did not file on a timely basis Form 4s reflecting one transaction, respectively.

STOCKHOLDER PROPOSALS FOR THE 2008 ANNUAL MEETING

Under SEC rules, qualified stockholders intending to present a proposal at the 2008 Annual Meeting and have it included in our proxy statement must submit the proposal in writing to Stephen C. Donnelly, Chief Financial Officer, Emtec, Inc., 525 Lincoln Drive, 5 Greentree Center, Suite 117, Marlton, New Jersey 08053. We must receive the proposal no later than October 15, 2007, and the proposal must comply in all other respects with applicable rules and regulations of the SEC relating to such inclusion.

OTHER MATTERS

The Board of Directors knows of no other matter that may be presented for Stockholders’ action at the Annual Meeting, but if other matters do properly come before the Annual Meeting, or if any of the persons named above to serve as Directors are unable to serve, it is intended that the persons named in the proxy statement or their substitutes will vote on such matters and for other nominees in accordance with their best judgment.

The Company filed its Annual Report on Form 10-K for the year ended August 31, 2006 with the Securities and Exchange Commission on December 1, 2006. A copy of the Annual Report, including the financial statements and schedules thereto and a list describing all the exhibits not contained therein, may be obtained without charge by any Stockholder. Requests for copies of the Annual Report should be sent to: Sam Bhatt, Secretary, 525 Lincoln Drive, 5 Greentree Center, Suite 117, Marlton, New Jersey 08619.

| | By Order of the Board of Directors | |

| | | |

| /s/ Sam Bhatt | |

| | Sam Bhatt

Corporate Secretary | |

| | |

- 26 -

EMTEC, INC.

2007 ANNUAL MEETING OF STOCKHOLDERS

This Proxy is Solicited on Behalf of the Board of Directors

The undersigned Stockholder of Emtec, Inc. (the “Company”), hereby revoking any contrary proxy previously given, hereby appoints Dinesh R. Desai, our Chairman, President and Chief Executive Officer, and Stephen C. Donnelly, our Chief Financial Officer, or any one of them (with full power to act alone and to designate substitutes and to make revocations) as proxies, each with the power to appoint his substitute, and hereby authorizes them, and each of them, to represent and vote, as designated on the reverse side, all shares of common stock of the Company held of record by the undersigned on December 29, 2006, at the 2007 Annual Meeting of Stockholders, to be held at the 309 Fellowship Road 2nd floor Mt. Laurel, NJ 08054, on Monday, January 22, 2007 at 10:00 a.m., or any adjournment or postponement thereof, for the items shown on the reverse and, in the discretion of the proxies, in any other matter that may properly come before the meeting or any adjournments thereof.

You are encouraged to specify your choices by marking the appropriate boxes (see reverse side). When properly executed, this proxy will be voted in the manner directed herein by the undersigned stockholder. If no direction is given, this proxy will be voted “FOR” each of the proposals set forth on the reverse side.

(Continued and to be Completed on Reverse Side.)

| | |

| | | | | FOR | AGAINST | ABSTAIN |

1. | To elect the nominees listed below as Class A Director (three year term). | 3. | To ratify the Board’s selection of the firm of McGladrey & Pullen, LLP as independent registered public accounting firm of the Company.

| | | |

| | | NOMINEES | This proxy confers authority to vote “FOR” the proposals listed unless otherwise indicated. If any other business is transacted at said meeting this proxy shall be voted in accordance with the judgment of the proxies. The Board of Directors recommends a vote “FOR” the listed proposals. Your shares will be voted as recommended by the Board of Directors unless you otherwise indicate in which case they will be voted as marked. This proxy is solicited on behalf of the Board of Directors of Emtec, Inc. and may be revoked prior to its exercise. |

| FOR ALL NOMINEES |  | Robert Mannarino |

| | | | |

| WITHHOLD AUTHORITY

FOR ALL NOMINEES | | |

| | |

| 2. | To elect the nominees listed below as Class B Director (one year term). |

| | | |

| | | NOMINEES |

| FOR ALL NOMINEES |  | Keith Grabel | |

| | | | |

| WITHHOLD AUTHORITY

FOR ALL NOMINEES | | |

INSTRUCTIONS To withhold authority to vote for any individual nominee(s)

Mark “FOR ALL EXCEPT” and fill in the circle next to each nominee you wish to

withhold as shown here:

|

|

To change the address on your account, please check the box at right and indicate your new address in the address space above. Please note that changes to the registered name(s) on the account may not be submitted via this method. |  |

Signature of Stockholder: _____________________________________________________ Date: _______________________ Signature of Stockholder: _____________________________________________________ Date: _______________________ Note: Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person. |