Exhibit 99.1

Exhibit 99.1

Investor Day

2013

Operations

Francisco Fortanet

SVP, Operations

June 5, 2013

Operations Strategy

Reliable Service and Quality

#1 Priority is Customer Satisfaction

Reduce Cost and Optimize

Cash Flow

Productivity and Quality Agenda driven by Continuous Improvement

Manufacturing Footprint Strategy

Support growth of the business in all regions; focus on emerging markets

Reduce cost in all geographies; with emphasis in mature markets

29 Manufacturing Sites

Manufacturing Footprint Strategy:

Leverage Geographic Reach

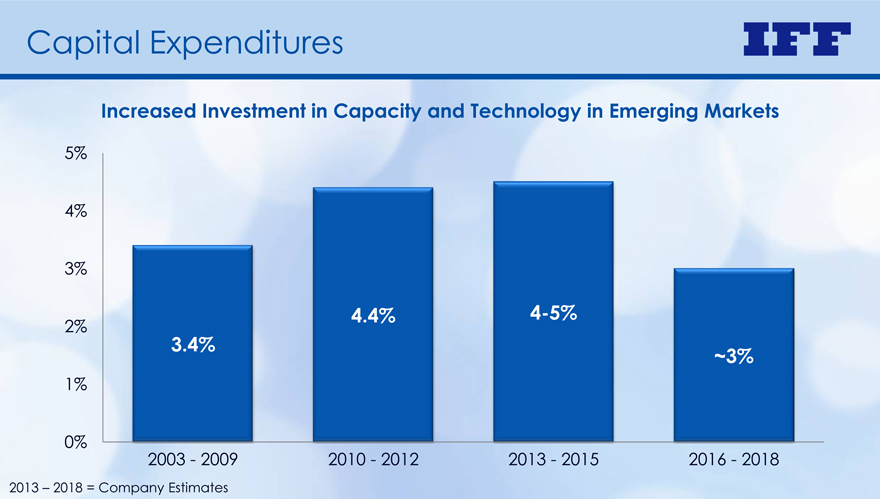

Capex as % of Sales

5%

4%

3%

2% 4.4% 4-5%

3.1% ~3%

1%

0%

2003 - 2009 2010 - 2012 2013 - 2015 2016 - 2018

Singapore

2012

China

2013

Turkey

2015

Manufacturing Footprint Strategy:

Maximize Our Portfolio

Revenue in the Mature Markets is Now < 50% of the Global Compounds Business, while Labor Cost is ~ 75%

Europe – From 10 to 7 plants*, including Sweden

USA – From 7 to 4 plants*, including Augusta

Oceania – from 2 to 1 plants

Move activities to lower labor cost geographies leveraging the IT platform

*Since 2004

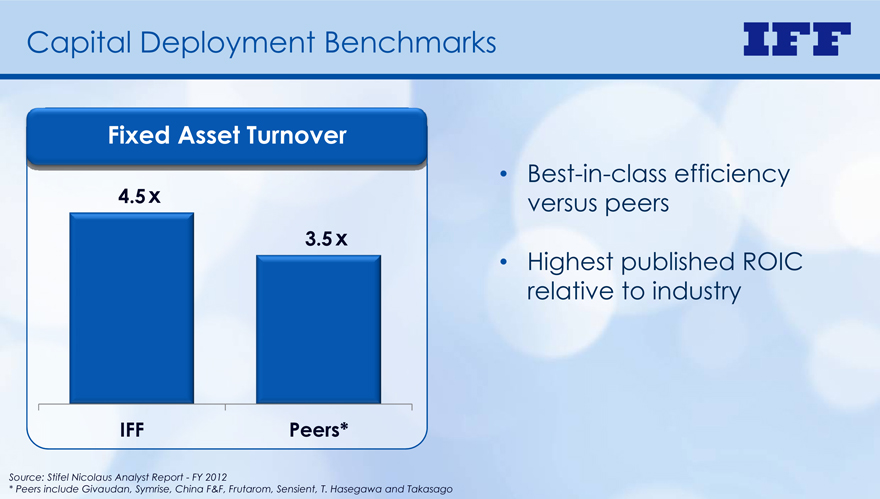

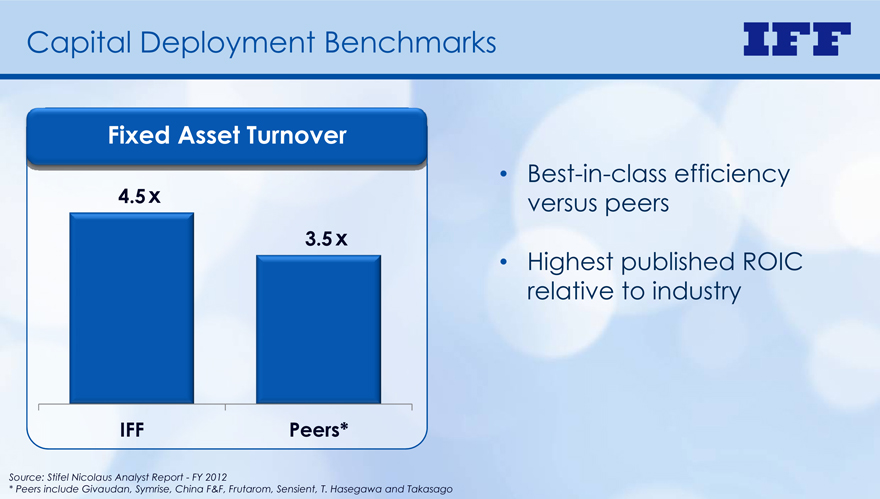

Capital Deployment Benchmarks

Fixed Asset Turnover

4.5 X

3.5 x

IFF Peers*

Best-in-class efficiency versus peers

Highest published ROIC relative to industry

Source: Stifel Nicolaus Analyst Report - FY 2012

* Peers include Givaudan, Symrise, China F&F, Frutarom, Sensient, T. Hasegawa and Takasago

Productivity and Quality:

The Cornerstone of Our Operations Strategy

Innovation in Operations = Finding a Better Way

People

Tools

Processes

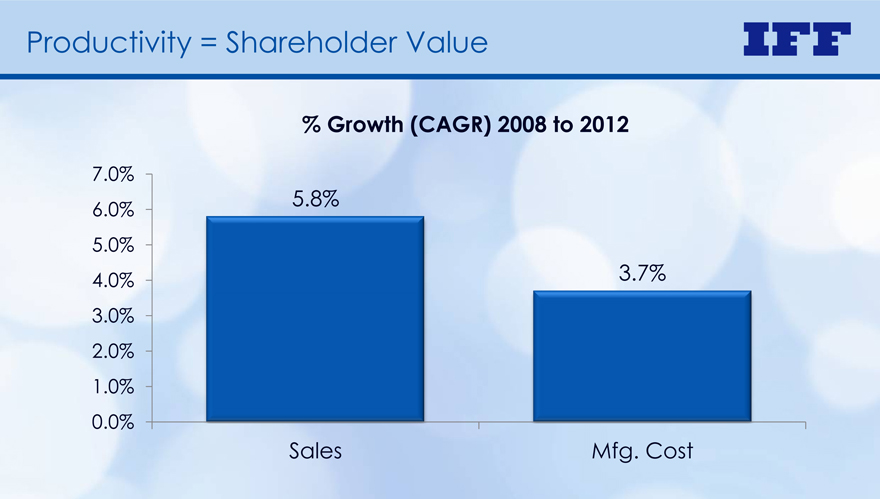

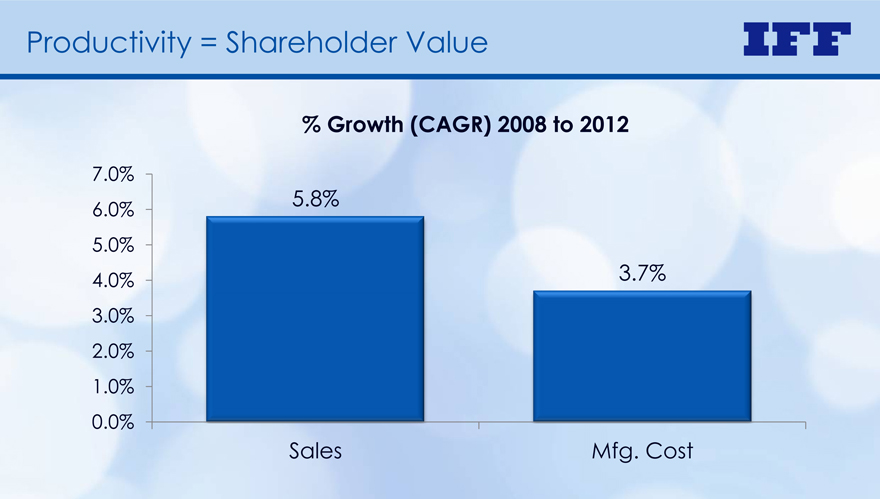

Productivity = Shareholder Value

% Growth (CAGR) 2008 to 2012

7.0%

6.0% 5.8%

5.0%

4.0% 3.7%

3.0%

2.0%

1.0%

0.0%

Sales Mfg. Cost

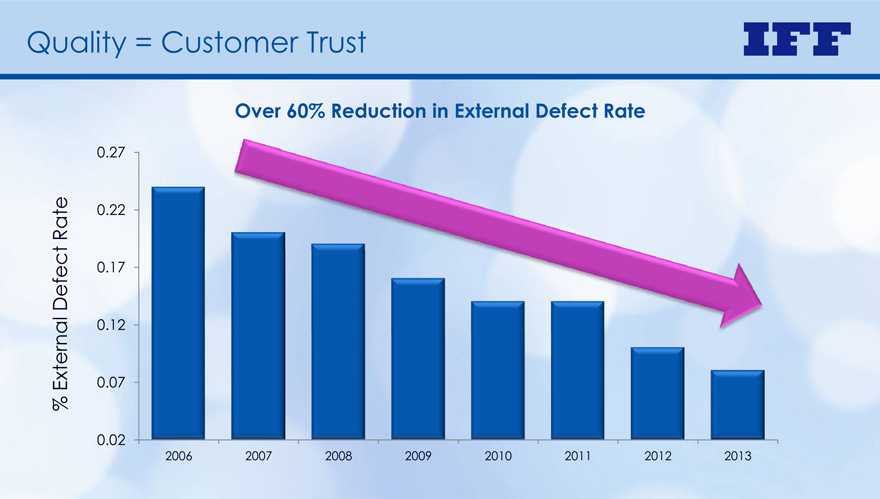

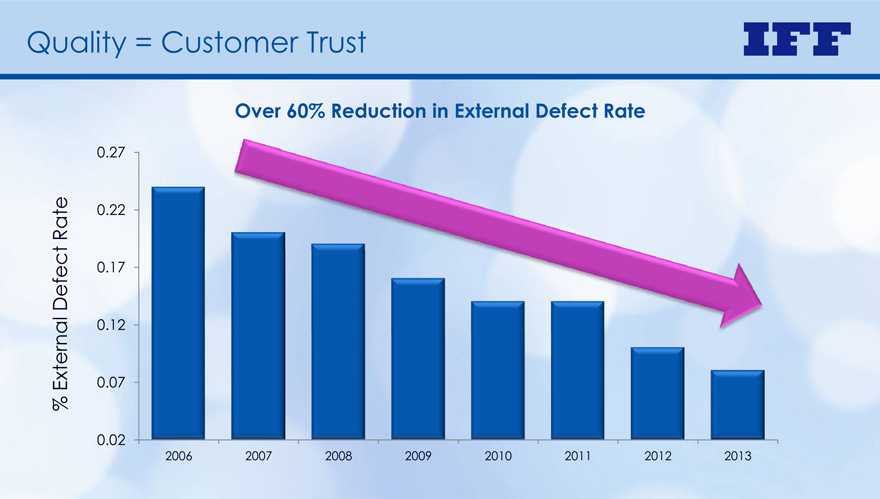

Quality = Customer Trust

Over 60% Reduction in External Defect Rate

% External Defect Rate

0.27 0.22 0.17 0.12 0.07 0.02

2006 2007 2008 2009 2010 2011 2012 2013

Global Procurement Strategy

Our Approach…

People

Processes and Systems

~70% of COGS is Raw Materials

Sourcing Strategies

IFF’s Sustainability Strategy

Our Products:

Creating Innovative Customer Solutions

Our Impact:

Strengthening Eco-Efficiency

& Community Relationships

Our Sources:

Sourcing Responsibly

Our People:

Engaging & Inspiring Our Employees

Sustainability Performance 2010-2012

Eco-efficiency

-11.4 % Scope 1 & 2 carbon emissions

-9.1 % Energy use

-27.4 % Water use

-29.2 % Hazardous waste

Right Direction!

Summary

Our #1 job is to satisfy our customers

Productivity and quality are the cornerstone of the operations strategy

Our best asset is our people

We are delivering results – strong manufacturing leverage, excellent reduction in waste and highest published industry ROIC

Well-Positioned to Capture Future Growth

Investor Day

2013

Operations

Investor Day 2013

Innovation

The Foundation of our Success

Kevin Berryman

EVP & CFO

June 5, 2013

Execution on Strategic Growth Pillars

Leverage

Geographic Reach

Strengthen

Innovation Platform

Maximize

Portfolio

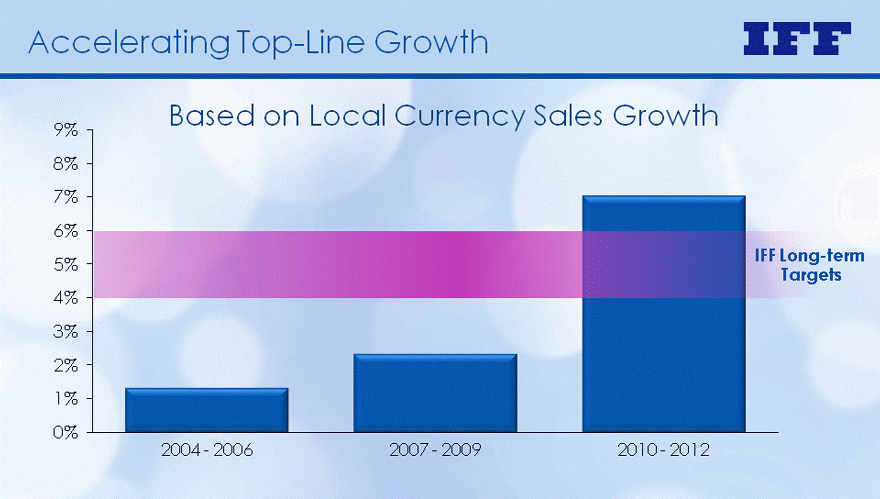

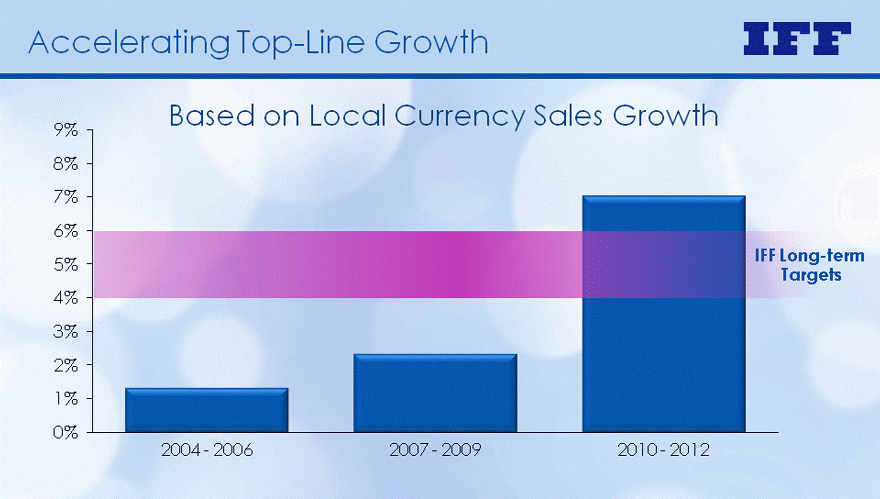

Accelerating Top-Line Growth

8%

9% Based on Local Currency Sales Growth

6%

7%

3%

4%

5% IFF Long-term

Targets

1%

2%

0%

2004-2006

2007-2009

2010-2012

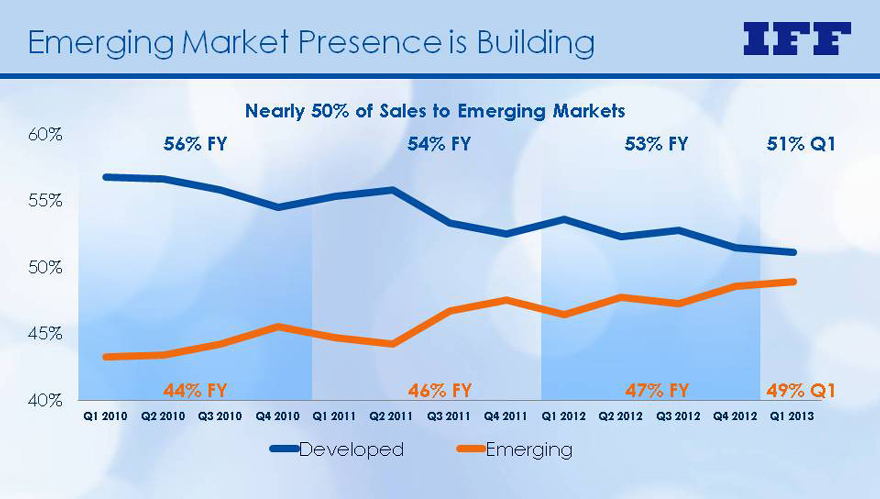

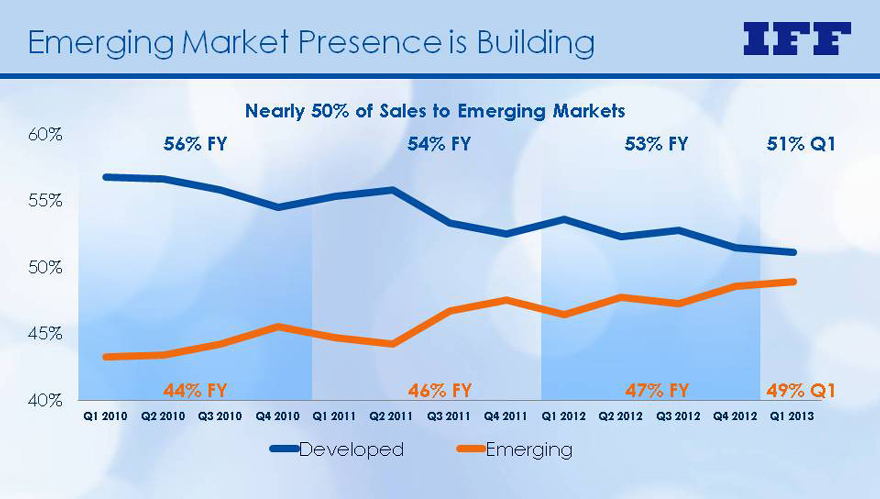

Emerging Market Presence is Building

60%

Nearly 50% of Sales to Emerging Markets

56% FY 54% FY 53% FY 51% Q1

55%

45%

50%

40%

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 44% FY 46% FY 47% FY 49% Q1

2010 2010 2010 2010 2011 2011 2011 2011 2012 2012 2012 2012 2013

Developed Emerging

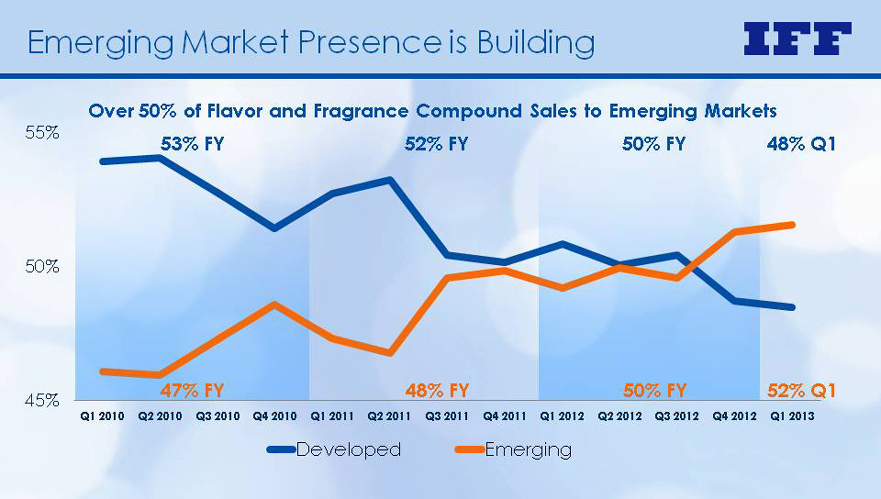

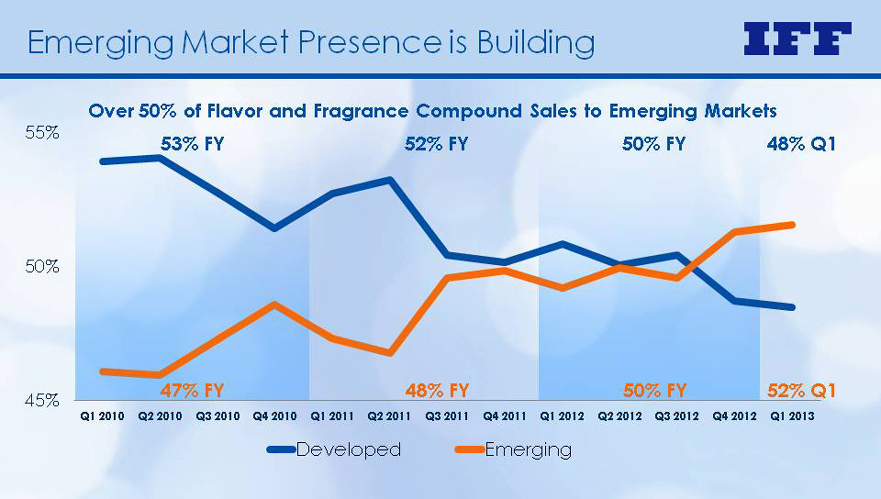

Emerging Market Presence is Building

55%

Over 50% of Flavor and Fragrance Compound Sales to Emerging Markets

53% FY 52% FY 50% FY 48% Q1

50%

45%

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 47% FY 48% FY 50% FY 52% Q1

2010 2010 2010 2010 2011 2011 2011 2011 2012 2012 2012 2012 2013

Developed Emerging

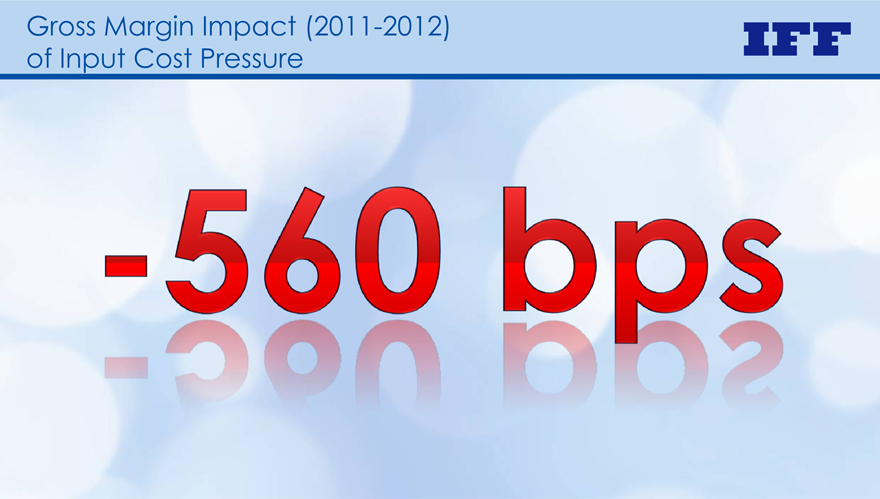

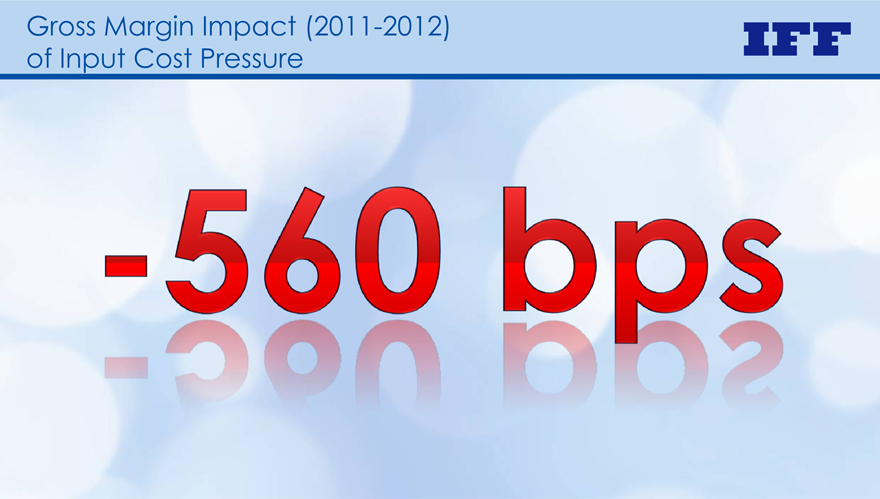

Gross Margin Impact (2011-2012) of Input Cost Pressure

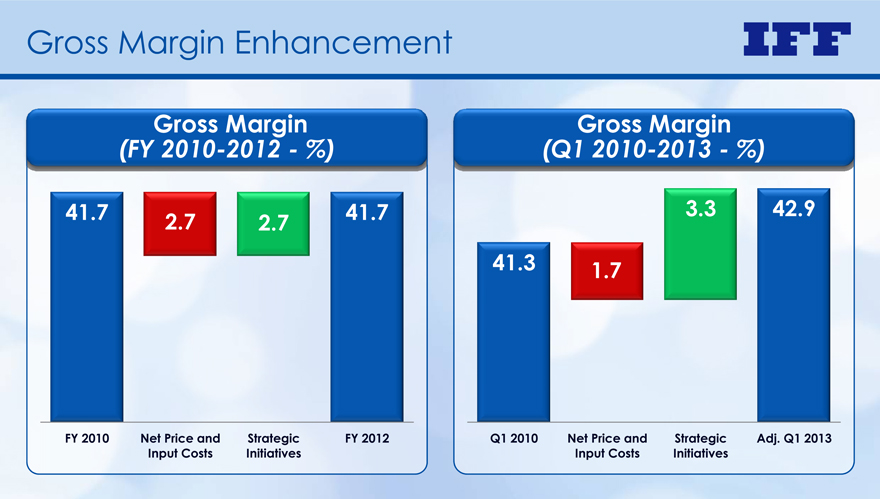

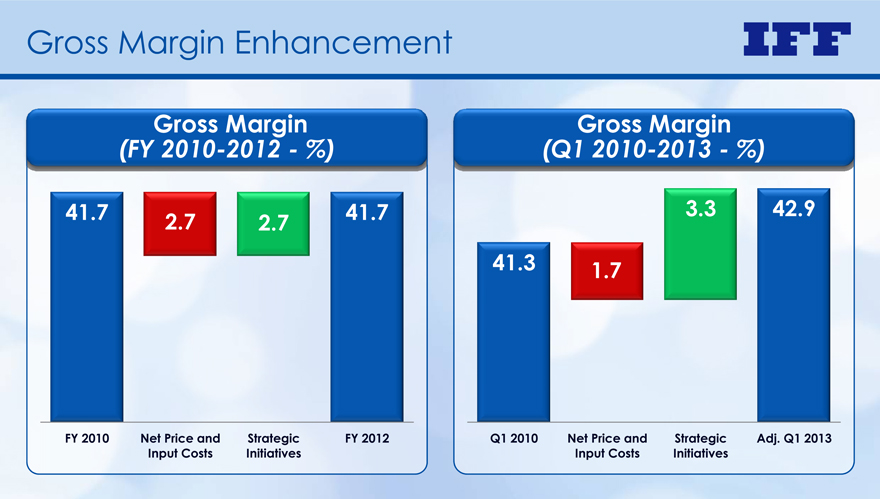

Gross Margin Enhancement

Gross Margin

(FY 2010-2012 - %)

Gross Margin

(Q1 2010-2013 - %)

41.7 2.7 2.7 41.7 3.3 42.9

41.3 1.7

FY 2010 Net Price and

Input Costs

Strategic

Initiatives

FY 2012 Q1 2010 Net Price and

Input Costs

Strategic

Initiatives

Adj. Q1 2013

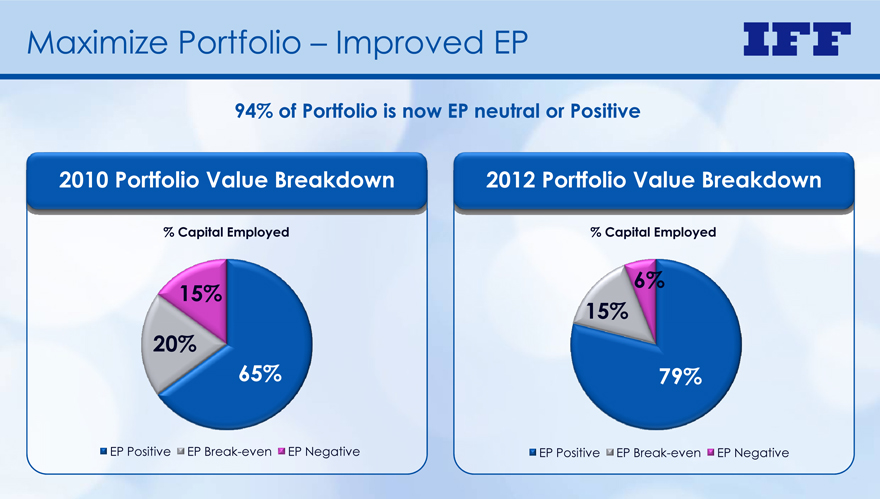

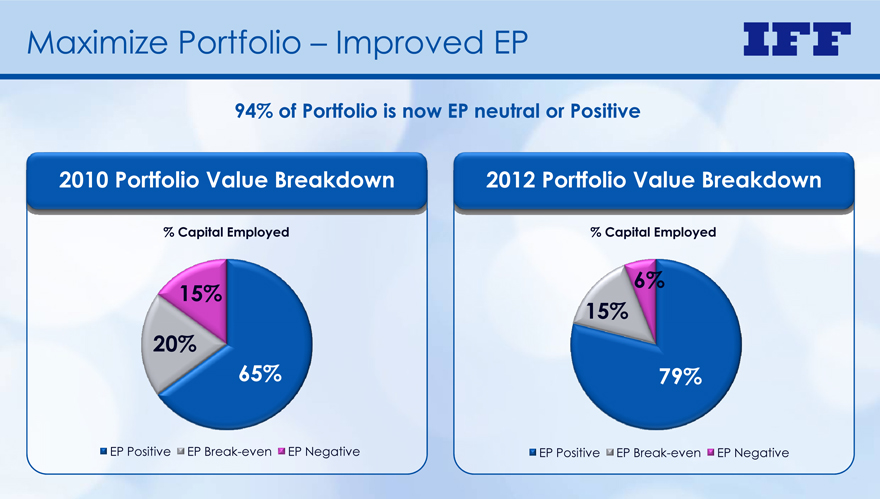

Maximize Portfolio – Improved EP

94% of Portfolio is now EP neutral or Positive

2010 Portfolio Value Breakdown 2012 Portfolio Value Breakdown

% Capital Employed % Capital Employed

15%

15%

6%

65%

20%

79%

EP Positive EP Break-even EP Negative EP Positive EP Break-even EP Negative

Adjusted Operating Profit Growth

12%

8%

10%

IFF Long-term

Targets

4%

6%

g

2%

7-9%

0%

2004-2006

2007-2009

2010-2012

2013-2015

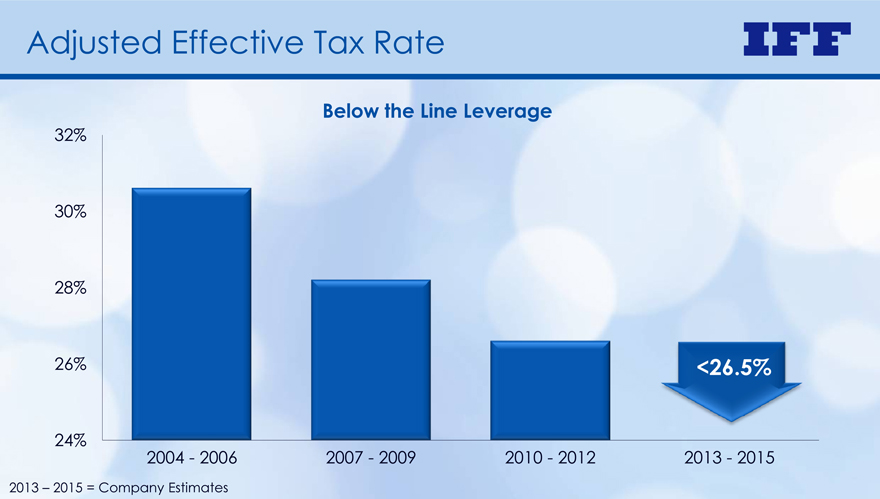

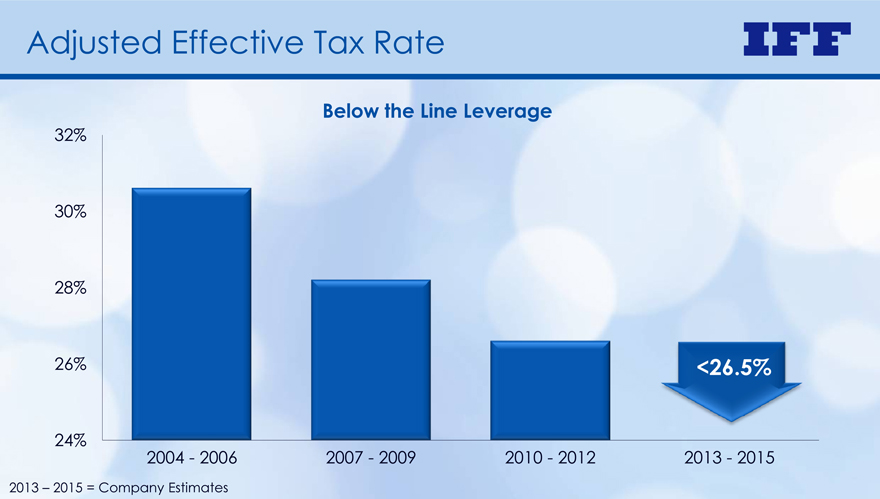

Adjusted Effective Tax Rate

32%

Below the Line Leverage

30%

28%

26% <26.5%

24%

2004 - 2006 2007 - 2009 2010 - 2012 2013 - 2015

2013 – 2015 = Company Estimates

Adjusted EPS Growth (3-Year CAGR)

4%

16%

10%

12%

14%

IFF Long-term

Targets

6%

8%

2%

4%

10+%

0%

2004-2006

2007-2009

2010-2012

2013-2015

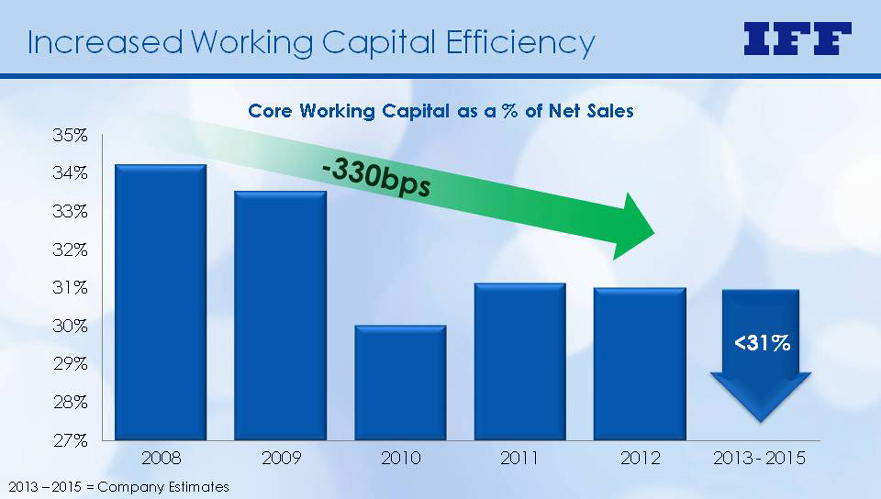

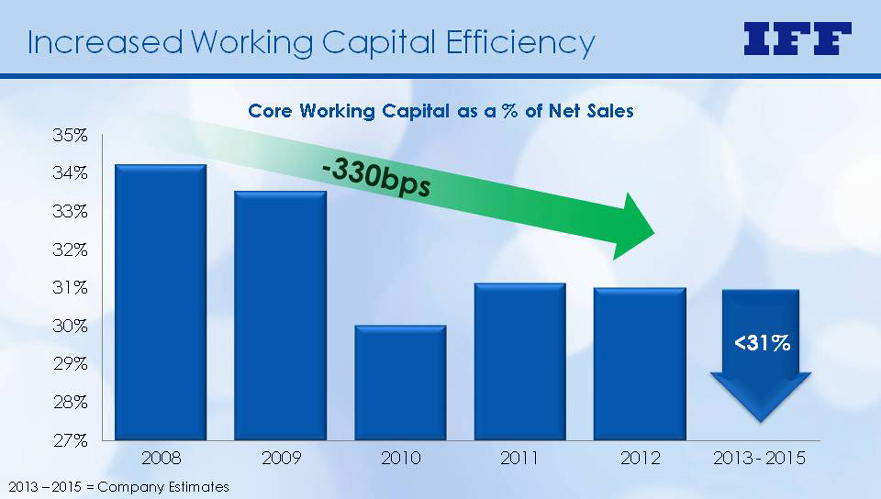

Increased Working Capital Efficiency

%

35%

Core Working Capital as a % of Net Sales

32%

33%

34%

30%

31%

28%

29%

<31%

27%

2008 2009 2010 2011 2012 2013 - 2015

2013 – 2015 = Company Estimates

Adjusted Return on Invested Capital

20%

3-Year Average

15%

14%

16% 18% 10% 18+%

5%

0%

2004 - 2006 2007 - 2009 2010 - 2012 2013 - 2015

2013 – 2015 = Company Estimates

Adjusted Operating Cash Flow

1,200

In $ Millions 3-Year Cumulative

800

1,000

600

$1B +

200

400

0

2004 - 2006 2007 - 2009 2010 - 2012 2013 - 2015

2013 – 2015 = Company Estimates

Uses of Cash

Allocation based on principles of Financial Flexibility

Capital

Expenditures

Financial

Acquisition/ Flexibility

Development

Opportunities

Cash

Returned to

shareholders

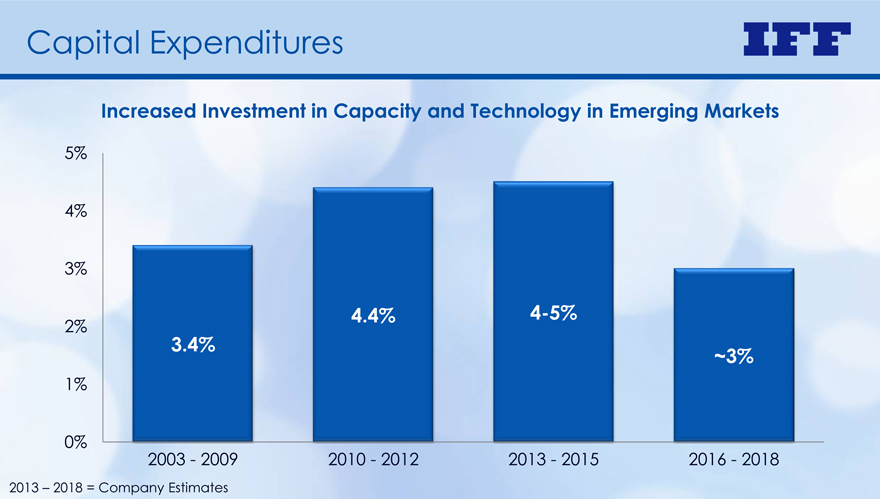

Capital Expenditures

5%

Increased Investment in Capacity and Technology in Emerging Markets

4%

4.4% 4-5%

2%

3%

3.4% ~3%

1%

%

0%

2003 - 2009 2010 - 2012 2013 - 2015 2016 - 2018

2013 – 2018 = Company Estimates

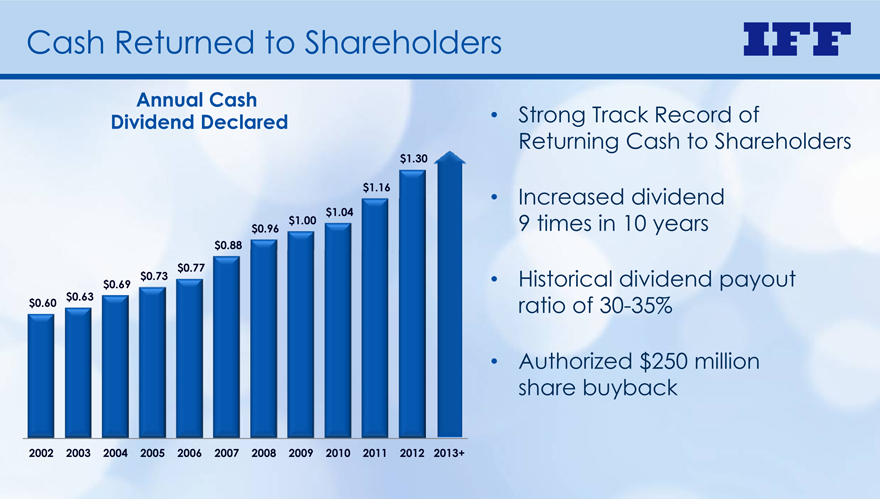

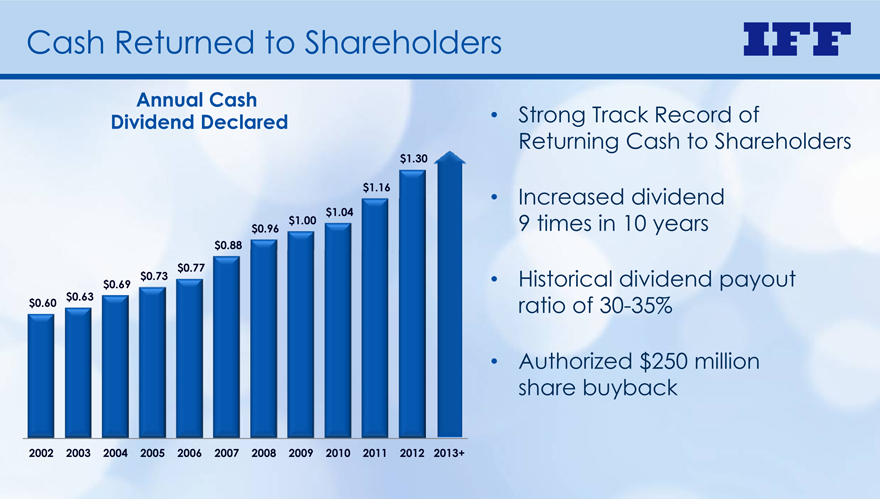

Cash Returned to Shareholders

• Strong Track Record of

Returning Cash to Shareholders

Annual Cash

Dividend Declared

$1.30

• Increased dividend

9 times in 10 years

$

0.88

$0.96

$1.00

$1.04

$1.16

• Historical dividend payout

$0.60 $0.63 ratio of 30-35%

$0.69

$0.73

$0.77

• Authorized $250 million

share buyback

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013+

M&A Activity

• Routinely evaluate M&A opportunities

Augment our Organic Growth Strategy

– F&F companies participating in attractive markets

– F&F companies operating in geographies

where we are under- represented

– F&F companies with differentiated technology

• Evaluate consistent with principles

of Economic Profit

• Will consider adjacencies that bolster long-term growth prospects

Reconfirming Our Long-Term Financial Targets

Local Currency

Sales Growth

Adjusted Operating

Profit Growth

Adjusted EPS

Growth

4- 6% 7- 9% 10+%

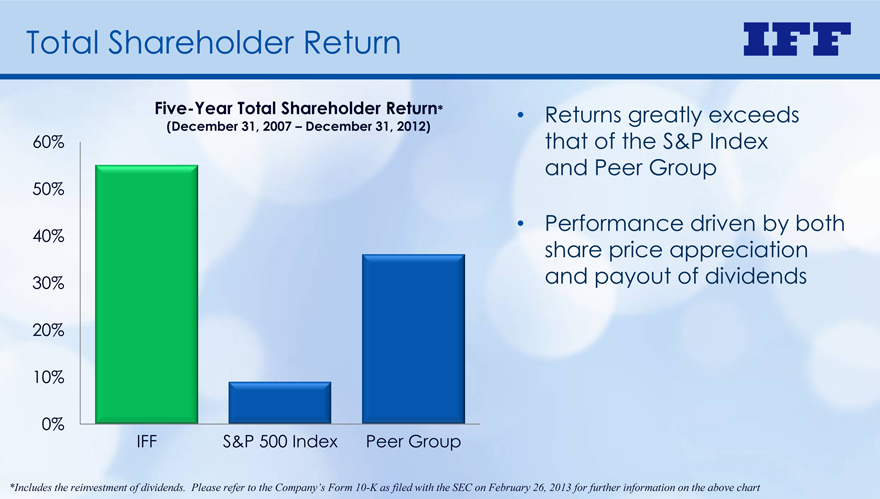

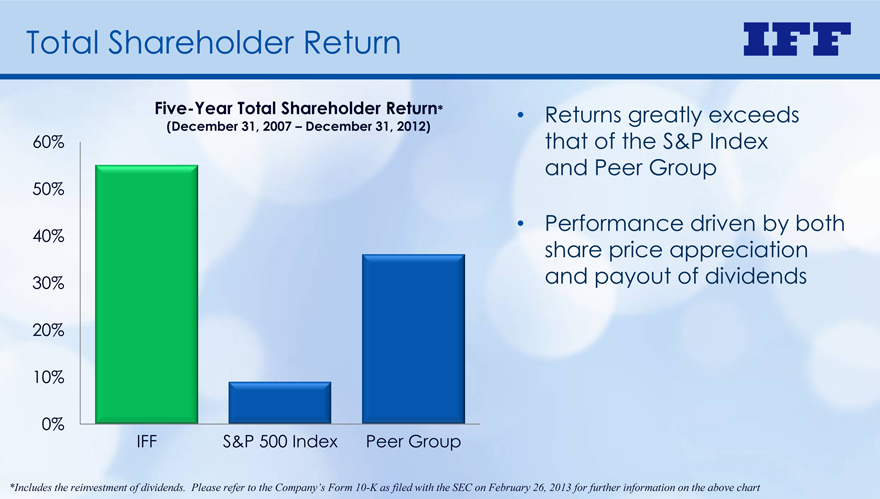

Total Shareholder Return

60%

Five-Year Total Shareholder Return*

(December 31, 2007 – December 31, 2012) • Returns greatly exceeds

that of the S&P Index

Group

40%

50%

and Peer • Performance driven by both

share price 20%

30%

appreciation

and payout of dividends

10%

0%

IFF S&P 500 Index Peer Group

*Includes the reinvestment of dividends. Please refer to the Company’s Form 10-K as filed with the SEC on February 26, 2013 for further information on the above chart

Summary

Geographically Diversified Company with Steady Growth

Partnered with Leading Global Consumer Companies

Strong Innovation Platforms – Focused on Consumer

Strong Financial Performance and Cash Flow

Abilityto Deliver Strong Returns Longer-Term

Investor Day 2013

Innovation

The Foundation of our Success

Investor Day

2013

Closing Remarks

Doug Tough

Chairman of the Board & Chief Executive Officersw

June 5, 2013

Innovation - Foundation for Our Success

Allocate resources to seize growth opportunities in emerging markets Align R&D Spend with Opportunities – in terms of category growth and EP profile Use EP principles to develop a stronger portfolio to deliver a higher ROIC

Invest behind advantaged businesses and remediate less profitable areas

Innovation - discovering new ways to create unique experiences that enhance consumers’ lives

Strategy Recap

Leverage Geographic Reach

Growth rates in emerging markets are 2-3x developed markets

New manufacturing capacity being added

Increase regional coverage via labs & commercial offices

Strengthen Innovation Platform

R&D pipeline has significantly strengthened

Research programs are well aligned with BU strategies

Align research spend with opportunities

Maximize Portfolio

Exiting of cumulative $55 million of Flavors sales

Significant progress made in driving EP improvements

Adjusted ROIC has improved

basis points over last

years

Strategic Priorities Going Forward

Leverage Geographic Reach

Increasing investments in emerging markets to support growth

$50 investment in Turkey to serve customers in Africa, Eastern Europe and Middle East and Central Asia

Leverage Singapore liquid Fragrances & Flavors plant, and ensure Southeast Asia capacity needs are met

China plant fully operational in 2013; leverage Satellite Labs in Chengdu and Beijing

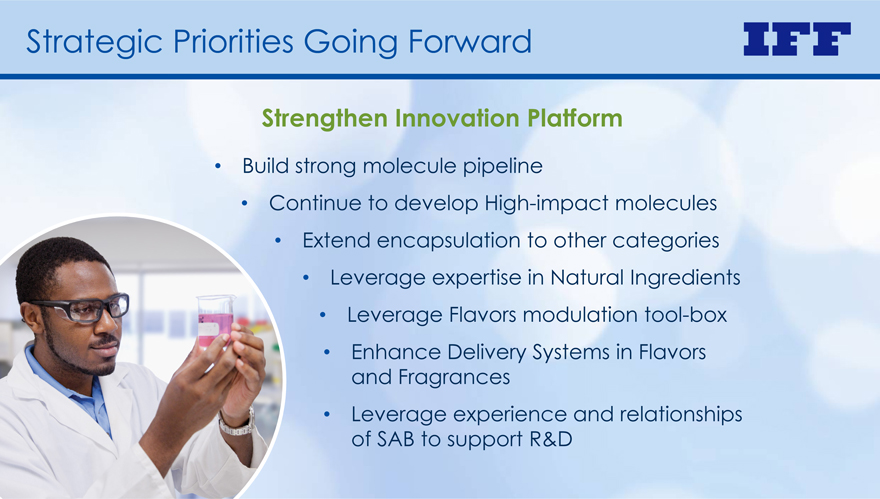

Strategic Priorities Going Forward

Strengthen Innovation Platform

Build strong molecule pipeline

Continue to develop High-impact molecules

Extend encapsulation to other categories

Leverage expertise in Natural Ingredients

Leverage Flavors modulation tool-box

Enhance Delivery Systems in Flavors and Fragrances

Leverage experience and relationships of SAB to support R&D

Strategic Priorities Going Forward

Maximize Portfolio

Improve Economic Profile of business

Realize remaining $25 million operating profit opportunity

Focus on innovation, profitability and return on investment

Apply a disciplined approach to investing

Leverage strong margin profile and cash flow generation

Summary

Strategic Priorities

Invest in Innovation

Grow Footprint in Emerging Markets and Improve Coverage

Improve Value of Portfolio by Prioritizing Higher Margin Businesses

Drive Greater Efficiency to Gain Operational Leverage

Long-Term Financial Expectations

Local currency sales growth of 4% to 6%

Adjusted Operating Profit growth of 7 – 9%

Adjusted EPS growth of 10+%

Through Portfolio Mix, Product

Innovation & Manufacturing Leverage

Investor Day

2013

Innovation

The Foundation of Our Success

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

ANNUAL REVENUE GROWTH | |

| | | 2004 | | | 2005 | | | 2006 | | | 3-Year | | | 2007 | | | 2008 | | | 2009 | | | 3-Year | | | 2010 | | | 2011 | | | 2012 | | | 3-Year | |

Total Company | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Reported Sales Growth | | | 7 | % | | | -2 | % | | | 5 | % | | | 3 | % | | | 9 | % | | | 5 | % | | | -3 | % | | | 4 | % | | | 13 | % | | | 6 | % | | | 1 | % | | | 7 | % |

Currency Impact | | | -5 | % | | | -1 | % | | | 0 | % | | | | | | | -4 | % | | | -3 | % | | | 3 | % | | | | | | | 0 | % | | | -2 | % | | | 3 | % | | | | |

Local Currency Sales Growth | | | 2 | % | | | -3 | % | | | 5 | % | | | 1 | % | | | 5 | % | | | 2 | % | | | 0 | % | | | 2 | % | | | 13 | % | | | 4 | % | | | 4 | % | | | 7 | % |

Flavors | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Reported Sales Growth | | | | | | | | | | | | | | | | | | | 12 | % | | | 9 | % | | | -1 | % | | | 7 | % | | | 11 | % | | | 12 | % | | | 2 | % | | | 8 | % |

Currency Impact | | | | | | | | | | | | | | | | | | | -3 | % | | | -3 | % | | | 3 | % | | | | | | | -1 | % | | | -3 | % | | | 3 | % | | | | |

Local Currency Sales Growth | | | | | | | | | | | | | | | | | | | 9 | % | | | 6 | % | | | 2 | % | | | 6 | % | | | 10 | % | | | 9 | % | | | 5 | % | | | 8 | % |

Exit of Flavors Low Margin Sales Activities | | | | | | | | | | | | | | | | | | | 0 | % | | | 0 | % | | | 0 | % | | | | | | | 0 | % | | | 0 | % | | | 3 | % | | | | |

Like-For-Like Local Currency Sales Growth | | | | | | | | | | | | | | | | | | | 9 | % | | | 6 | % | | | 2 | % | | | 6 | % | | | 10 | % | | | 9 | % | | | 8 | % | | | 9 | % |

| | | | | | | | | | | | |

Fragrance Compounds | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Reported Sales Growth | | | | | | | | | | | | | | | | | | | 5 | % | | | 1 | % | | | -4 | % | | | 1 | % | | | 14 | % | | | 4 | % | | | 3 | % | | | 7 | % |

Currency Impact | | | | | | | | | | | | | | | | | | | -4 | % | | | -2 | % | | | 3 | % | | | | | | | 1 | % | | | -3 | % | | | 4 | % | | | | |

Local Currency Sales Growth | | | | | | | | | | | | | | | | | | | 1 | % | | | -1 | % | | | -1 | % | | | 0 | % | | | 15 | % | | | 1 | % | | | 7 | % | | | 8 | % |

| | | | | | | | | | | | |

Ingredients | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Reported Sales Growth | | | | | | | | | | | | | | | | | | | 9 | % | | | 5 | % | | | -4 | % | | | 3 | % | | | 15 | % | | | -6 | % | | | -12 | % | | | -1 | % |

Currency Impact | | | | | | | | | | | | | | | | | | | -4 | % | | | -4 | % | | | 2 | % | | | | | | | 3 | % | | | -3 | % | | | 2 | % | | | | |

Local Currency Sales Growth | | | | | | | | | | | | | | | | | | | 5 | % | | | 1 | % | | | -2 | % | | | 1 | % | | | 18 | % | | | -9 | % | | | -10 | % | | | 0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

QUARTERLY REVENUE GROWTH | |

| | | Q1 2010 | | | Q2 2010 | | | Q3 2010 | | | Q4 2010 | | | Q1 2011 | | | Q2 2011 | | | Q3 2011 | | | Q4 2011 | | | Q1 2012 | | | Q2 2012 | | | Q3 2012 | | | Q4 2012 | |

Flavors | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Reported Sales Growth | | | 13 | % | | | 13 | % | | | 9 | % | | | 10 | % | | | 13 | % | | | 14 | % | | | 13 | % | | | 8 | % | | | 3 | % | | | 5 | % | | | 0 | % | | | 1 | % |

Currency Impact | | | -5 | % | | | -2 | % | | | 1 | % | | | 1 | % | | | -1 | % | | | -6 | % | | | -5 | % | | | 0 | % | | | 2 | % | | | 3 | % | | | 6 | %�� | | | 2 | % |

Local Currency Sales Growth | | | 8 | % | | | 11 | % | | | 10 | % | | | 11 | % | | | 12 | % | | | 8 | % | | | 8 | % | | | 8 | % | | | 5 | % | | | 8 | % | | | 6 | % | | | 3 | % |

Exit of Flavors Low Margin Sales Activities | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 1 | % | | | 1 | % | | | 3 | % | | | 4 | % |

Like-For-Like Local Currency Sales Growth | | | 8 | % | | | 11 | % | | | 10 | % | | | 11 | % | | | 12 | % | | | 8 | % | | | 8 | % | | | 8 | % | | | 6 | % | | | 9 | % | | | 9 | % | | | 7 | % |

The Company uses non-GAAP financial measures such as (i) local currency sales (which eliminates the effects that result from translating its international sales in U.S. dollars) and (ii) like-for-like sales (which excludes the impact of exiting low-margin sales activities, the impact of selling the Company’s fruit preparations business in Europe and foreign exchange) as the Company believes that these non-GAAP financial measures provide investors with an overall perspective of the period-to-period performance of our core business. Such information is supplemental to information presented in accordance with GAAP and is not intended to represent a presentation in accordance with GAAP. These non-GAAP measures may not be comparable to similarly titled measures used by other companies.

| | | | | | | | | | | | |

Adjusted Gross Margin | |

(IN THOUSANDS U.S. $) | | FY 2010 | | | Q1 2013 | | | Margin Improvement | |

As Reported Gross Profit | | | 1,092,602 | | | | 311,360 | | | | | |

Operational Improvement Initiative Costs | | | — | | | | 1,198 | | | | | |

| | | | | | | | | | | | |

Adjusted Gross Profit | | | 1,092,602 | | | | 312,558 | | | | | |

| | | | | | | | | | | | |

Net Sales | | | 2,622,862 | | | | 727,836 | | | | | |

| | | |

Adjusted Gross Margin | | | 41.7 | % | | | 42.9 | % | | | 1.2 | % |

The Company uses non-GAAP financial measures such as Adjusted Gross Profit and Adjusted Gross Margin (which exclude operational improvement initiative costs) as the Company believes that these non-GAAP financial measures provide investors with an overall perspective of the period-to-period performance of our core business. Such information is supplemental to information presented in accordance with GAAP and is not intended to represent a presentation in accordance with GAAP. These non-GAAP measures may not be comparable to similarly titled measures used by other companies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

ADJUSTED OPERATING PROFIT | |

(IN THOUSANDS U.S. $) | | 2003 | | | 2006 | | | 3-Year CAGR | | | 2009 | | | 3-Year CAGR | | | 2012 | | | 3-Year CAGR | |

As Reported Operating Profit | | | 285,774 | | | | 331,173 | | | | 5.0 | % | | | 340,288 | | | | 0.9 | % | | | 486,618 | | | | 12.7 | % |

Restructuring and Other Charges | | | 42,421 | | | | 2,680 | | | | | | | | 18,301 | | | | | | | | 1,668 | | | | | |

Employee Separation Costs | | | — | | | | — | | | | | | | | 6,320 | | | | | | | | — | | | | | |

Insurance Recovery | | | — | | | | (3,565 | ) | | | | | | | — | | | | | | | | — | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted Operating Profit | | | 328,195 | | | | 330,288 | | | | 0.2 | % | | | 364,909 | | | | 3.4 | % | | | 488,286 | | | | 10.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

ADJUSTED EARNINGS PER SHARE (EPS) | |

(PER SHARE DATA U.S. $) | | 2003 | | | 2006 | | | 3-Year CAGR | | | 2009 | | | 3-Year CAGR | | | 2012 | | | 3-Year CAGR | |

As Reported EPS | | | 1.83 | | | | 2.48 | | | | 10.7 | % | | | 2.46 | | | | -0.3 | % | | | 3.09 | | | | 7.9 | % |

Restructuring and Other Charges | | | 0.29 | | | | 0.02 | | | | | | | | 0.19 | | | | | | | | 0.01 | | | | | |

Employee Separation Costs | | | — | | | | — | | | | | | | | 0.05 | | | | | | | | — | | | | | |

Insurance Recovery | | | — | | | | (0.03 | ) | | | | | | | — | | | | | | | | — | | | | | |

Tax Settlement | | | — | | | | (0.04 | ) | | | | | | | — | | | | | | | | — | | | | | |

Other Income (Primarily Asset Gains) | | | — | | | | (0.11 | ) | | | | | | | — | | | | | | | | — | | | | | |

Spanish Tax Settlement | | | — | | | | — | | | | | | | | — | | | | | | | | 0.88 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted EPS | | | 2.12 | | | | 2.32 | | | | 3.1 | % | | | 2.69 | ¹ | | | 5.1 | % | | | 3.98 | | | | 13.9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 1 | The sum of Reported EPS plus the per share effects of items added back to reconcile to Adjusted EPS may not equal the total Adjusted EPS due to rounding differences. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

ADJUSTED EFFECTIVE TAX RATE | |

| | | 2004 | | | 2005 | | | 2006 | | | 2007 | | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | 2012 | |

As Reported Effective Tax Rate | | | 30.2 | % | | | 21.6 | % | | | 28.2 | % | | | 25.3 | % | | | 19.1 | % | | | 29.3 | % | | | 26.7 | % | | | 28.6 | % | | | 42.7 | % |

Restructuring and Other Charges Tax Benefit | | | 0.6 | % | | | 1.0 | % | | | 0.0 | % | | | — | | | | 0.7 | % | | | -0.6 | % | | | -0.4 | % | | | 0.0 | % | | | 0.0 | % |

AJCA Tax Benefit | | | — | | | | 9.3 | % | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Tax Settlements | | | — | | | | — | | | | 1.2 | % | | | 3.0 | % | | | 7.6 | % | | | — | | | | — | | | | — | | | | — | |

Curtailment Tax Benefit | | | — | | | | — | | | | — | | | | 0.2 | % | | | — | | | | — | | | | — | | | | — | | | | — | |

Asset Gain Tax Expense | | | — | | | | — | | | | — | | | | -0.1 | % | | | — | | | | — | | | | — | | | | — | | | | — | |

Employee Separation Costs Tax Benefit | | | — | | | | — | | | | — | | | | — | | | | 0.2 | % | | | 0.1 | % | | | — | | | | — | | | | — | |

Shared Service Implementation Tax Benefit | | | — | | | | — | | | | — | | | | — | | | | 0.1 | % | | | — | | | | — | | | | — | | | | — | |

Insurance Recovery Tax Expense | | | — | | | | — | | | | 0.0 | % | | | — | | | | -0.2 | % | | | — | | | | — | | | | — | | | | — | |

Other Income (Primarily Asset Gains) | | | — | | | | — | | | | -0.3 | % | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Patent Litigation Settlement Benefit | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | -1.5 | % | | | — | |

Spanish Tax Settlement | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | -16.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted Effective Tax Rate | | | 30.8 | % | | | 31.9 | % | | | 29.1 | % | | | 28.4 | % | | | 27.5 | % | | | 28.8 | % | | | 26.3 | % | | | 27.1 | % | | | 26.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The Company uses non-GAAP financial measures such as Adjusted Operating Profit, Adjusted Effective Tax Rate and Adjusted EPS (which excludes the impact of our restructuring and strategic initiatives, the AJCA tax benefit, tax settlements, curtailments, gains on asset sales, employee separation costs, cost associated with the implementation of our shared services, insurance recoveries, the Mane patent litigation settlement and the Spanish tax settlement) as the Company believes that these non-GAAP financial measures provide investors with an overall perspective of the period-to-period performance of our core business. Such information is supplemental to information presented in accordance with GAAP and is not intended to represent a presentation in accordance with GAAP. These non-GAAP measures may not be comparable to similarly titled measures used by other companies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

FLAVORS | | | | | | | |

(IN THOUSANDS U.S. $) | | 2006 | | | 2007 | | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | 2012 | | | 2006 - 2009 CAGR | | | Since 2009 | |

As Reported Segment Profit* | | | 153,099 | | | | 187,275 | | | | 197,838 | | | | 208,966 | | | | 242,528 | | | | 284,246 | | | | 298,326 | | | | 10.9 | % | | | 12.6 | % |

Insurance Recovery | | | (3,565 | ) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | | | | | | |

Restructuring and Other Charges | | | (463 | ) | | | — | | | | 3,538 | | | | — | | | | — | | | | — | | | | — | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted Segment Profit | | | 149,071 | | | | 187,275 | | | | 201,376 | | | | 208,966 | | | | 242,528 | | | | 284,246 | | | | 298,326 | | | | 11.9 | % | | | 12.6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Sales | | | 894,775 | | | | 1,005,544 | | | | 1,092,544 | | | | 1,081,488 | | | | 1,203,274 | | | | 1,347,340 | | | | 1,378,377 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted Segment Margin | | | 16.7 | % | | | 18.6 | % | | | 18.4 | % | | | 19.3 | % | | | 20.2 | % | | | 21.1 | % | | | 21.6 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

FRAGRANCES | | | | | | | |

(IN THOUSANDS U.S. $) | | 2006 | | | 2007 | | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | 2012 | | | 2006 - 2009 CAGR | | | 2009 - 2012 CAGR | |

As Reported Segment Profit* | | | 212,240 | | | | 211,942 | | | | 202,081 | | | | 188,561 | | | | 244,966 | | | | 226,560 | | | | 238,379 | | | | -3.9 | % | | | 8.1 | % |

R&D Tax Credit | | | 2,180 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Revised Reported Segment Profit | | | 214,420 | | | | 211,942 | | | | 202,081 | | | | 188,561 | | | | 244,966 | | | | 226,560 | | | | 238,379 | | | | | | | | | |

Restructuring and Other Charges | | | 2,639 | | | | — | | | | 4,396 | | | | — | | | | — | | | | — | | | | — | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted Segment Profit | | | 217,059 | | | | 211,942 | | | | 206,477 | | | | 188,561 | | | | 244,966 | | | | 226,560 | | | | 238,379 | | | | -4.6 | % | | | 8.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Sales | | | 1,200,615 | | | | 1,271,094 | | | | 1,296,828 | | | | 1,244,670 | | | | 1,419,588 | | | | 1,440,678 | | | | 1,443,069 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted Segment Margin | | | 18.1 | % | | | 16.7 | % | | | 15.9 | % | | | 15.1 | % | | | 17.3 | % | | | 15.7 | % | | | 16.5 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| * | In the 2009 period, segment profit was referred to as adjusted operating profit and excluded amounts related to restructuring and other costs. In the 2006 - 2008 periods, segment profit was referred to as operating income and included restructuring and other costs as well as insurance recoveries. |

The Company uses non-GAAP financial measures such as Adjusted Segment Profit (which excludes the impact of our restructuring and strategic initiatives and insurance recoveries) as the Company believes that these non-GAAP financial measures provide investors with an overall perspective of the period-to-period performance of our core business. Such information is supplemental to information presented in accordance with GAAP and is not intended to represent a presentation in accordance with GAAP. These non-GAAP measures may not be comparable to similarly titled measures used by other companies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

ADJUSTED RETURN ON AVERAGE INVESTED CAPITAL | |

| (IN THOUSANDS U.S. $) | | 2003 | | | 2004 | | | 2005 | | | 2006 | | | 2007 | | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | 2012 | |

Debt | | | 884,535 | | | | 684,926 | | | | 950,673 | | | | 807,340 | | | | 1,212,641 | | | | 1,255,654 | | | | 1,011,529 | | | | 921,567 | | | | 894,936 | | | | 1,031,175 | |

Deferred gain on interest rate swaps | | | (39,685 | ) | | | (24,104 | ) | | | (2,296 | ) | | | (817 | ) | | | (151 | ) | | | (16,893 | ) | | | (14,953 | ) | | | (12,897 | ) | | | (10,965 | ) | | | (9,028 | ) |

Cash and cash equivalents | | | (12,081 | ) | | | (32,596 | ) | | | (272,545 | ) | | | (114,508 | ) | | | (151,471 | ) | | | (178,467 | ) | | | (80,135 | ) | | | (131,332 | ) | | | (88,279 | ) | | | (324,422 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Debt | | | 832,769 | | | | 628,226 | | | | 675,832 | | | | 692,015 | | | | 1,061,019 | | | | 1,060,294 | | | | 916,441 | | | | 777,338 | | | | 795,692 | | | | 697,725 | |

Equity | | | 742,631 | | | | 910,487 | | | | 915,347 | | | | 916,056 | | | | 626,359 | | | | 580,642 | | | | 771,910 | | | | 1,003,155 | | | | 1,107,407 | | | | 1,252,555 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Invested Capital | | | 1,575,400 | | | | 1,538,713 | | | | 1,591,179 | | | | 1,608,071 | | | | 1,687,378 | | | | 1,640,936 | | | | 1,688,351 | | | | 1,780,493 | | | | 1,903,099 | | | | 1,950,280 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Restructuring and Other Charges, net of tax | | | 27,514 | | | | 20,370 | | | | 15,857 | | | | 1,982 | | | | — | | | | 12,543 | | | | 14,763 | | | | 8,928 | | | | 9,444 | | | | 1,047 | |

AJCA Tax Benefit | | | — | | | | — | | | | (25,000 | ) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Tax Settlements | | | — | | | | — | | | | — | | | | (3,511 | ) | | | (9,718 | ) | | | (23,070 | ) | | | — | | | | — | | | | — | | | | — | |

Curtailment, net of tax | | | — | | | | — | | | | — | | | | — | | | | 3,685 | | | | — | | | | — | | | | — | | | | — | | | | — | |

Asset Gain, net of tax | | | — | | | | — | | | | — | | | | — | | | | (7,719 | ) | | | — | | | | — | | | | — | | | | — | | | | — | |

Employee Separation Costs, net of tax | | | — | | | | — | | | | — | | | | — | | | | — | | | | 2,217 | | | | 4,028 | | | | — | | | | — | | | | — | |

Shared Service Implementation, net of tax | | | — | | | | — | | | | — | | | | — | | | | — | | | | 1,377 | | | | — | | | | — | | | | — | | | | — | |

Insurance Recovery, net of tax | | | — | | | | — | | | | — | | | | (2,496 | ) | | | — | | | | (1,612 | ) | | | — | | | | — | | | | — | | | | — | |

Other Income (Primarily Asset Gains), net of tax | | | — | | | | — | | | | — | | | | (10,068 | ) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Patent Litigation Settlement, net of tax | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 29,846 | | | | — | |

Spanish Tax Settlement | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 72,362 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Non-recurring Items | | | 27,514 | | | | 20,370 | | | | (9,143 | ) | | | (14,093 | ) | | | (13,752 | ) | | | (8,545 | ) | | | 18,791 | | | | 8,928 | | | | 39,290 | | | | 73,409 | |

| | | | | | | | | | |

Cumulative Non-recurring Items | | | 27,514 | | | | 47,884 | | | | 38,741 | | | | 24,648 | | | | 10,896 | | | | 2,351 | | | | 21,142 | | | | 30,070 | | | | 69,360 | | | | 142,769 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted Total Invested Capital | | | 1,602,914 | | | | 1,586,597 | | | | 1,629,920 | | | | 1,632,719 | | | | 1,698,274 | | | | 1,643,287 | | | | 1,709,493 | | | | 1,810,563 | | | | 1,972,459 | | | | 2,093,049 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

As Reported Operating Profit | | | | | | | 310,279 | | | | 266,876 | | | | 331,173 | | | | 361,213 | | | | 355,133 | | | | 340,288 | | | | 416,361 | | | | 427,729 | | | | 486,618 | |

Restructuring and Other Charges | | | | | | | 31,830 | | | | 23,319 | | | | 2,680 | | | | — | | | | 18,212 | | | | 18,301 | | | | 10,077 | | | | 13,172 | | | | 1,668 | |

Curtailment | | | | | | | — | | | | — | | | | — | | | | 5,943 | | | | — | | | | — | | | | — | | | | — | | | | — | |

Employee Separation Costs | | | | | | | — | | | | — | | | | — | | | | — | | | | 3,391 | | | | 6,320 | | | | — | | | | — | | | | — | |

Shared Service Implementation | | | | | | | — | | | | — | | | | — | | | | — | | | | 2,079 | | | | — | | | | — | | | | — | | | | — | |

Insurance Recovery | | | | | | | — | | | | — | | | | (3,565 | ) | | | — | | | | (2,600 | ) | | | — | | | | — | | | | — | | | | — | |

Patent Litigation Settlement | | | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 33,495 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted Operating Profit | | | | | | | 342,109 | | | | 290,195 | | | | 330,288 | | | | 367,156 | | | | 376,215 | | | | 364,909 | | | | 426,438 | | | | 474,396 | | | | 488,286 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

As Reported Effective Tax Rate | | | | | | | 30.2 | % | | | 21.6 | % | | | 28.2 | % | | | 25.3 | % | | | 19.1 | % | | | 29.3 | % | | | 26.7 | % | | | 28.6 | % | | | 42.7 | % |

Restructuring and Other Charges Tax Benefit | | | | | | | 0.6 | % | | | 1.0 | % | | | 0.0 | % | | | — | | | | 0.7 | % | | | -0.6 | % | | | -0.4 | % | | | 0.0 | % | | | 0.0 | % |

AJCA Tax Benefit | | | | | | | — | | | | 9.3 | % | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Tax Settlements | | | | | | | — | | | | — | | | | 1.2 | % | | | 3.0 | % | | | 7.6 | % | | | — | | | | — | | | | — | | | | — | |

Curtailment Tax Benefit | | | | | | | — | | | | — | | | | — | | | | 0.2 | % | | | — | | | | — | | | | — | | | | — | | | | — | |

Asset Gain Tax Expense | | | | | | | — | | | | — | | | | — | | | | -0.1 | % | | | — | | | | — | | | | — | | | | — | | | | — | |

Employee Separation Costs Tax Benefit | | | | | | | — | | | | — | | | | — | | | | — | | | | 0.2 | % | | | 0.1 | % | | | — | | | | — | | | | — | |

Shared Service Implementation Tax Benefit | | | | | | | — | | | | — | | | | — | | | | — | | | | 0.1 | % | | | — | | | | — | | | | — | | | | — | |

Insurance Recovery Tax Expense | | | | | | | — | | | | — | | | | 0.0 | % | | | — | | | | -0.2 | % | | | — | | | | — | | | | — | | | | — | |

Other Income (Primarily Asset Gains) | | | | | | | — | | | | — | | | | -0.3 | % | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Patent Litigation Settlement Benefit | | | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | -1.5 | % | | | — | |

Spanish Tax Settlement | | | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | -16.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted Effective Tax Rate | | | | | | | 30.8 | % | | | 31.9 | % | | | 29.1 | % | | | 28.4 | % | | | 27.5 | % | | | 28.8 | % | | | 26.3 | % | | | 27.1 | % | | | 26.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted Operating Profit After Tax | | | | | | | 236,739 | | | | 197,623 | | | | 234,174 | | | | 262,884 | | | | 272,756 | | | | 259,815 | | | | 314,285 | | | | 345,835 | | | | 359,378 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted Return on Invested Capital * | | | | | | | 14.8 | % | | | 12.3 | % | | | 14.4 | % | | | 15.8 | % | | | 16.3 | % | | | 15.5 | % | | | 17.9 | % | | | 18.3 | % | | | 17.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| * | Return on average invested capital is defined as adjusted operating profit after tax divided by 2-year average adjusted invested capital. |

The Company uses non-GAAP financial measures such as Adjusted Return on Invested Capital (ROIC) (which excludes the net impact of our restructuring and strategic initiatives, the AJCA tax benefit, tax settlements, curtailments, gains on asset sales, employee separation costs, cost associated with the implementation of our shared services, insurance recoveries, the Mane patent litigation settlement and the Spanish tax settlement) as the Company believes that these non-GAAP financial measures provide investors with an overall perspective of the period-to-period performance of our core business. Such information is supplemental to information presented in accordance with GAAP and is not intended to represent a presentation in accordance with GAAP. These non-GAAP measures may not be comparable to similarly titled measures used by other companies.

| | | | | | | | | | | | | | | | | | | | |

WORKING CAPITAL EFFEICIENCY | |

| (IN THOUSANDS U.S. $) | | Q4 2011 | | | Q1 2012 | | | Q2 2012 | | | Q3 2012 | | | Q4 2012 | |

Trade Receivables (1) | | | 478,177 | | | | 527,709 | | | | 523,389 | | | | 543,133 | | | | 508,736 | |

Inventories | | | 544,439 | | | | 555,017 | | | | 539,267 | | | | 547,676 | | | | 540,658 | |

Accounts Payable | | | (208,759 | ) | | | (189,223 | ) | | | (169,673 | ) | | | (160,956 | ) | | | (199,272 | ) |

| | | | | | | | | | | | | | | | | | | | |

Core Working Capital | | | 813,857 | | | | 893,503 | | | | 892,983 | | | | 929,853 | | | | 850,122 | |

| | | | | |

FY 2012 Net Sales | | | | | | | | | | | | | | | | | | | 2,821,446 | |

| | | | | | | | | | | | | | | | | | | | |

Core Working Capital as a % of Net Sales* | | | | | | | | | | | | | | | | | | | 31.1 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| (IN THOUSANDS U.S. $) | | Q4 2010 | | | Q1 2011 | | | Q2 2011 | | | Q3 2011 | | | Q4 2011 | |

Trade Receivables (1) | | | 460,274 | | | | 528,541 | | | | 553,335 | | | | 524,893 | | | | 478,177 | |

Inventories | | | 531,675 | | | | 559,550 | | | | 568,162 | | | | 534,765 | | | | 544,439 | |

Accounts Payable | | | (200,153 | ) | | | (185,205 | ) | | | (166,438 | ) | | | (180,931 | ) | | | (208,759 | ) |

| | | | | | | | | | | | | | | | | | | | |

Core Working Capital | | | 791,796 | | | | 902,886 | | | | 955,059 | | | | 878,727 | | | | 813,857 | |

| | | | | |

FY 2011 Net Sales | | | | | | | | | | | | | | | | | | | 2,788,018 | |

| | | | | | | | | | | | | | | | | | | | |

Core Working Capital as a % of Net Sales* | | | | | | | | | | | | | | | | | | | 31.1 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| (IN THOUSANDS U.S. $) | | Q4 2009 | | | Q1 2010 | | | Q2 2010 | | | Q3 2010 | | | Q4 2010 | |

Trade Receivables (1) | | | 456,674 | | | | 480,553 | | | | 486,638 | | | | 521,524 | | | | 460,274 | |

Inventories | | | 444,977 | | | | 446,912 | | | | 454,608 | | | | 503,991 | | | | 531,675 | |

Accounts Payable | | | (161,027 | ) | | | (154,451 | ) | | | (155,056 | ) | | | (169,652 | ) | | | (200,153 | ) |

| | | | | | | | | | | | | | | | | | | | |

Core Working Capital | | | 740,624 | | | | 773,014 | | | | 786,190 | | | | 855,863 | | | | 791,796 | |

| | | | | |

FY 2010 Net Sales | | | | | | | | | | | | | | | | | | | 2,622,862 | |

| | | | | | | | | | | | | | | | | | | | |

Core Working Capital as a % of Net Sales* | | | | | | | | | | | | | | | | | | | 30.1 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| (IN THOUSANDS U.S. $) | | Q4 2008 | | | Q1 2009 | | | Q2 2009 | | | Q3 2009 | | | Q4 2009 | |

Trade Receivables (1) | | | 412,127 | | | | 430,219 | | | | 484,550 | | | | 490,549 | | | | 456,674 | |

Inventories | | | 479,567 | | | | 452,282 | | | | 441,007 | | | | 435,744 | | | | 444,977 | |

Accounts Payable | | | (114,997 | ) | | | (95,303 | ) | | | (117,892 | ) | | | (140,597 | ) | | | (161,027 | ) |

| | | | | | | | | | | | | | | | | | | | |

Core Working Capital | | | 776,697 | | | | 787,198 | | | | 807,665 | | | | 785,696 | | | | 740,624 | |

| | | | | |

FY 2009 Net Sales | | | | | | | | | | | | | | | | | | | 2,326,158 | |

| | | | | | | | | | | | | | | | | | | | |

Core Working Capital as a % of Net Sales* | | | | | | | | | | | | | | | | | | | 33.5 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| (IN THOUSANDS U.S. $) | | Q4 2007 | | | Q1 2008 | | | Q2 2008 | | | Q3 2008 | | | Q4 2008 | |

Trade Receivables | | | 412,221 | | | | 464,251 | | | | 477,195 | | | | 470,363 | | | | 412,127 | |

Inventories | | | 484,222 | | | | 512,034 | | | | 525,651 | | | | 509,281 | | | | 479,567 | |

Accounts Payable | | | (130,992 | ) | | | (133,236 | ) | | | (137,178 | ) | | | (115,511 | ) | | | (114,997 | ) |

| | | | | | | | | | | | | | | | | | | | |

Core Working Capital | | | 765,451 | | | | 843,049 | | | | 865,668 | | | | 864,133 | | | | 776,697 | |

| | | | | |

FY 2008 Net Sales | | | | | | | | | | | | | | | | | | | 2,389,372 | |

| | | | | | | | | | | | | | | | | | | | |

Core Working Capital as a % of Net Sales* | | | | | | | | | | | | | | | | | | | 34.4 | % |

| | | | | | | | | | | | | | | | | | | | |

| * | Core working capital as a % of net sales is defined as 5-quarter average core working capital divided by full year net sales |

| (1) | Q1 2013, Q1 - Q3 2011, Q1 - Q4 2010 and Q4 2009 have been revised to be consistent with other periods presented. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

ADJUSTED CASH FLOWS FROM OPERATIONS | |

| (IN THOUSANDS U.S. $) | | 2004 | | | 2005 | | | 2006 | | | 2004 - 2006 | | | 2007 | | | 2008 | | | 2009 | | | 2007 - 2009 | | | 2010 | | | 2011 | | | 2012 | | | 2010 - 2012 | |

Cash Flows Provided By Operating Activities | | | 295,847 | | | | 177,160 | | | | 281,619 | | | | 754,626 | | | | 314,062 | | | | 220,613 | | | | 291,637 | | | | 826,312 | | | | 315,136 | | | | 189,190 | | | | 323,796 | | | | 828,122 | |

Payments Pursuant To Patent Litigation Settlement | | | — | | | | — | | | | — | | | | | | | | — | | | | — | | | | — | | | | | | | | — | | | | 39,995 | | | | — | | | | | |

Payments Pursuant To Spanish Tax Settlement | | | — | | | | — | | | | — | | | | | | | | — | | | | — | | | | — | | | | | | | | — | | | | — | | | | 105,503 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted Cash Flows Provided By Operating Activities | | | 295,847 | | | | 177,160 | | | | 281,619 | | | | 754,626 | | | | 314,062 | | | | 220,613 | | | | 291,637 | | | | 826,312 | | | | 315,136 | | | | 229,185 | | | | 429,299 | | | | 973,620 | |

The Company uses non-GAAP financial measures such as adjusted cash flows provided by operations (which excludes payments made related to the Mane patent litigation settlement an Spanish tax settlement) as the Company believes that these non-GAAP financial measures provide investors with an overall perspective of the period-to-period performance of our core business. Such information is supplemental to information presented in accordance with GAAP and is not intended to represent a presentation in accordance with GAAP. These non-GAAP measures may not be comparable to similarly titled measures used by other companies.