Exhibit 99.2

Michael DeVeau

VP, Global Communications & Investor Relations

Cautionary Statement

Statements made in this presentation that relate to our future performance or future financial results or other future events (identified by such terms as “expect”, “anticipate”, “believe”, “outlook”, “guidance”, “may”, “target” or similar terms and variations thereof) are forward-looking statements, including the Company’s 2015 guidance, its long-term financial guidance and the Company’s expectations regarding the impact of its 2020 strategy on its financial and operational results, including its ability to fund through cost-savings and the impact of acquisitions. These statements are based on our current beliefs and expectations and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements. Factors that could cause IFF’s actual results to differ materially include (1) risks associated with the Company’s supply chain, including availability and pricing of raw materials, energy and transportation; (2) economic, regulatory and political risks associated with the Company’s international operations; (3) changes in consumer demand, either due changes in preferences or consumer confidence; (4) the Company’s ability to successfully increase its sales through acquisitions, collaborations and joint ventures including its ability to identify, acquire on terms consistent with the Company’s return criteria and successfully integrate bolt-on or adjacent companies and (5) the Company’s ability to implement its business strategy, including the ability to fund growth through anticipated cost saving and (6) the impact of currency fluctuations or devaluations in the Company’s principal foreign markets as well as those risks described in the Risk Factor forward-looking statements sections of our Annual Report on Form 10-K for the year ended December 31, 2014 and in our other periodic reports filed with the SEC, all of which are available on our website under Investor Relations, at www.iff.com. We do not undertake to update the forward-looking statements to reflect the impact of circumstances or events that may arise after the date of the forward-looking statements.

We have disclosed certain non-GAAP measures within this presentation. Please see reconciliations to their respective measures prescribed by accounting principles generally accepted in the U.S., all of which are available on our website under Investor Relations, at www.iff.com.

Andreas Fibig

Chairman and Chief Executive Officer

Vision 2020

Accelerating

Growth

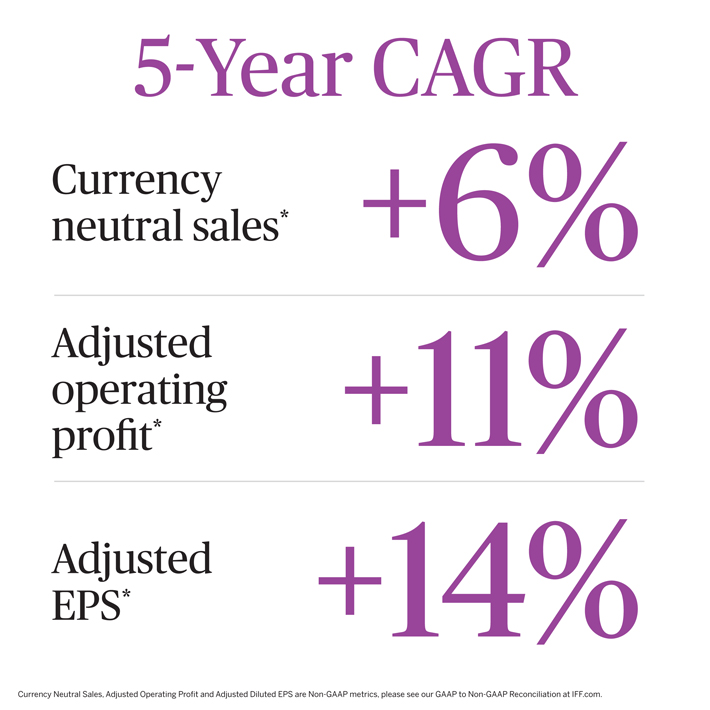

5-Year CAGR

Currency neutral sales* +6% Adjusted operating profit* +11% Adjusted

EPS* +14%

Currency Neutral Sales, Adjusted Operating Profit and Adjusted Diluted EPS are Non-GAAP metrics, please see our GAAP to Non-GAAP Reconciliation at IFF.com.

$117

June 1, 2015

17% CAGR

Top-Quartile Total Shareholder Return

$53

March 15, 2011

Consumer Dynamics Are Changing

What if?

“We are the catalyst for discoveries that spark the senses & transform the everyday”

Win

WhereWe

Compete

Defi ned as #1 or #2

Innovating

Firsts

Drive differentiation in key technologies

BecomeOur

Customers’

Partnerof

Choice

Go-to supplier

Investin

People

Fund the Journey

Createa

Sustainable

Future

Vision

2020Accelerating Growth

Strategic Pillars

Win Where1 We Compete Innovating 2 Firsts

Become Our Customers’ 3 Partner of Choice Strengthen &4 Expand Portfolio

Matthias Haeni

Group President, Flavors

Vi 2020

Accelerating

Growth

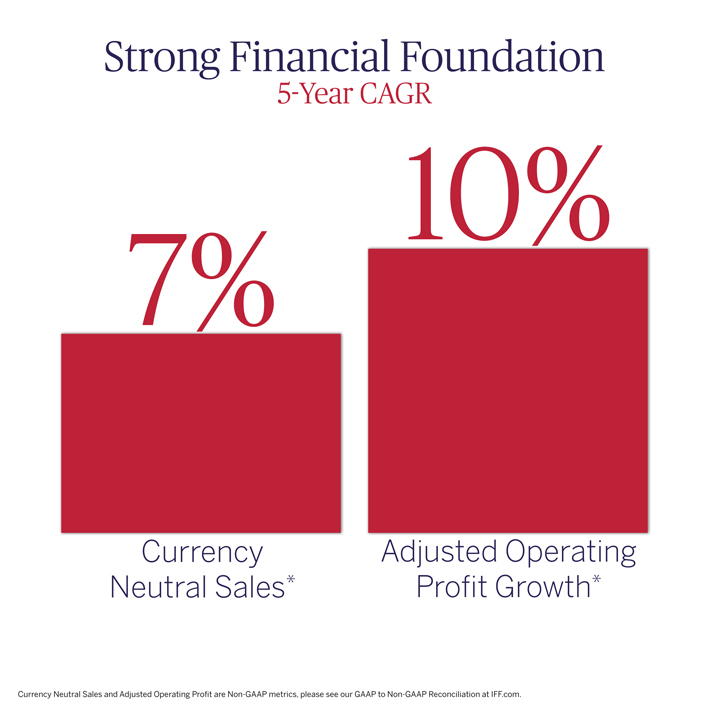

Strong Financial Foundation

5-Year CAGR

10% 7%

Currency Adjusted Operating Neutral Sales* Profit Growth*

Expansion in Key Markets

Consumer Dynamics Are Changing

What if?

Become our

Customers’

Partner

of

Choice

Leader in Strategic Insights

Centers of Excellence

Early Partnerships with Customers

Innovating

Firsts

Modulation

Delivery Systems

Protein & Texture

Where Win

We

Compete

North America Africa & Middle-East Key Customers and Categories

Strengthen

and Expand

Portfolio

M&A, partnerships & collaborations

Invest inPeople &Science

Flavor to taste

Vi sion2020

Accelerating

Growth

Nicolas Mirzayantz

Group President, Fragrances

Vi sion2020

Accelerating

Growth

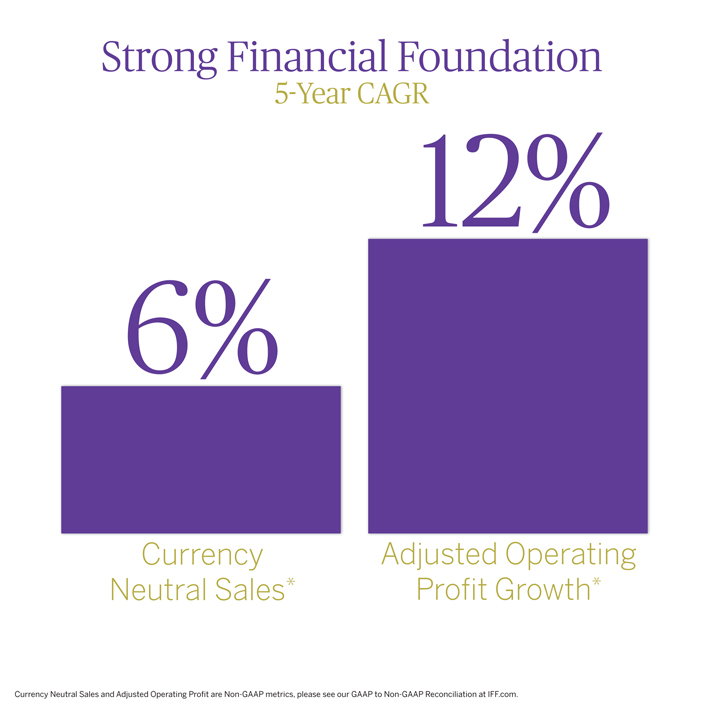

Strong Financial Foundation

5-Year CAGR

12% 6%

Currency Adjusted Operating Neutral Sales* Pro?t Growth*

Currency Neutral Sales and Adjusted Operating Pro?t are Non-GAAP metrics, please see our GAAP to Non-GAAP Reconciliation at IFF.com.

Expansion in Key Markets

Consumer Dynamics Are Changing

What if?

Innovating

Firsts

Delivery Systems New Molecules Naturals Futures Project

Win North America

Africa & Middle East

Where We China

Compete Home Care

Fine Fragrance

Becomeour

Customers’ Leader in Strategic Insights Centers of Excellence Partnerof Redesigned Creative Model Choice Early Customer Partnerships

Strengthen

and

Expand Portfolio

M&A

Strategic Partnerships

External Collaborations

Invest

inPeople

&

Expertise

Vision2020

Accelerating

Growth

Ahmet Baydar

Senior Vice President, Research & Development

Vision2020

Firsts

What if?

Modulation

Healthier products

Delivery

Extended release

New

Molecules

Delivering novel ingredients

Naturals

Pure & sustainable

Protein

and

Texture

Talent isCritical

to our

Success

Strengthen Prof. Linda B. Buck

Nobel Laureate &Expand IFF Board of Directors

Partnershipsand

Prof. Leslie B. Vosshall

Collaborations The Rockefeller University IFF Scientific Advisory Board

Prof. Steven V. Ley, CBE

Cambridge University, UK IFF Scientific Advisory Board

Dr. Shekhar Mitra

President, Innopreneur IFF Scientific Advisory Board

Prof. Thomas D. Sharkey

Michigan State University IFF Scientific Advisory Board

Cheryl Perkins, M.S.

President, Innovationedge IFF Scientific Advisory Board

Vision 2020

Firsts

Rich O’Leary

Interim CFO

Vision 2020

Accelerating

Growth

Excellent Financial Results

5-Year CAGR

14% 11%

10%

target

6% 7-9%

target

4-6%

target

Currency Adjusted Adjusted Neutral Sales* Operating EPS* Profit*

Currency Neutral Sales, Adjusted Operating Profit and Adjusted Diluted EPS are Non-GAAP metrics, please see our GAAP to Non-GAAP Reconciliation at IFF.com.

Identifying Incremental Growth Initiatives

1 Strategic Importance

2Execution Risk

3Value to Cost

4Payback Period

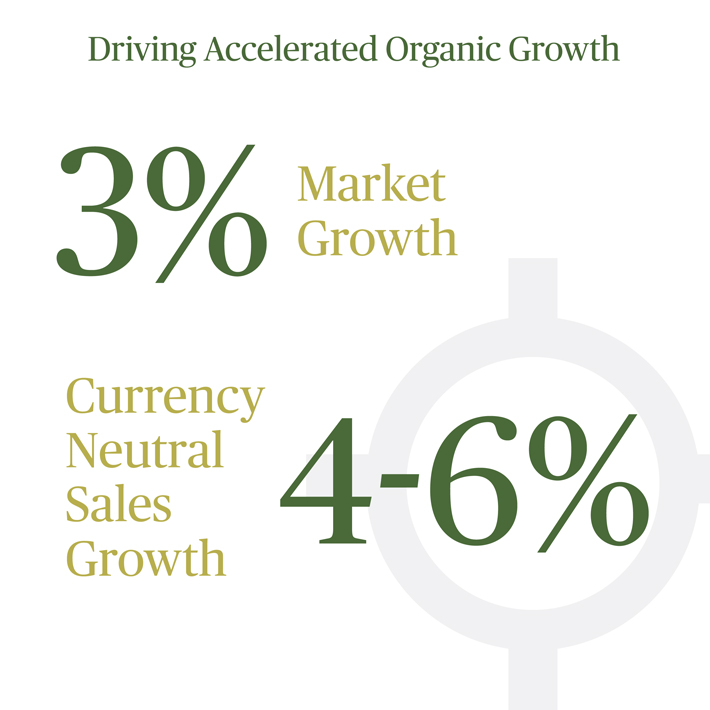

Driving Accelerated Organic Growth

Market

3% Growth Currency Neutral

Sales 4-6% Growth

Fund

theJourney

Unlock Value

Standardize global functions & business services

Optimize global supply chain & facilities

Realize greater procurement savings

Implement zero-based budgeting

2016 to 2020 Financial Targets

Currency neutral sales growth 4-6% Currency neutral operating 7-9% profit growth

Currency neutral 10% EPS growth

Accelerate Growth Through M&A

Targeting $500M to $1B of sales through acquisitions by 2020

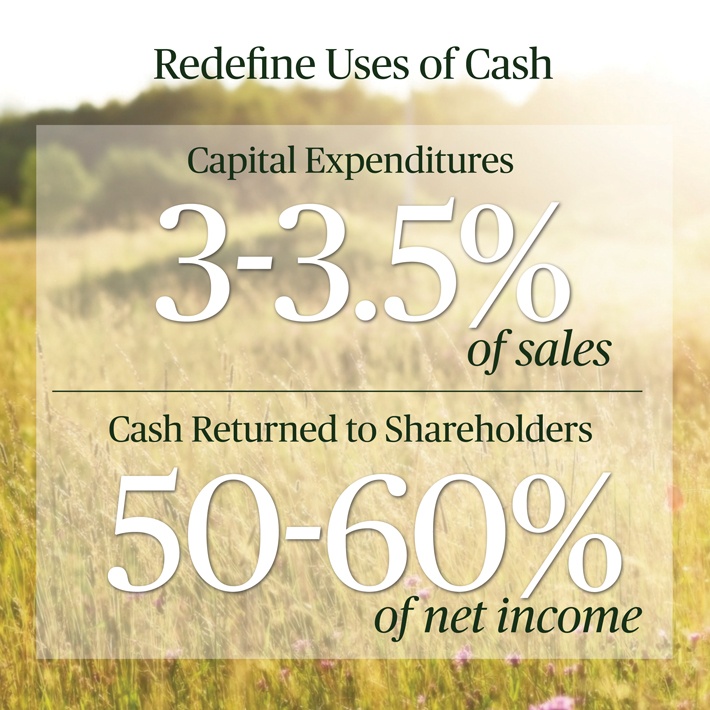

Redefine Uses of Cash

3-3.5%

of sales

50-60%

of net income

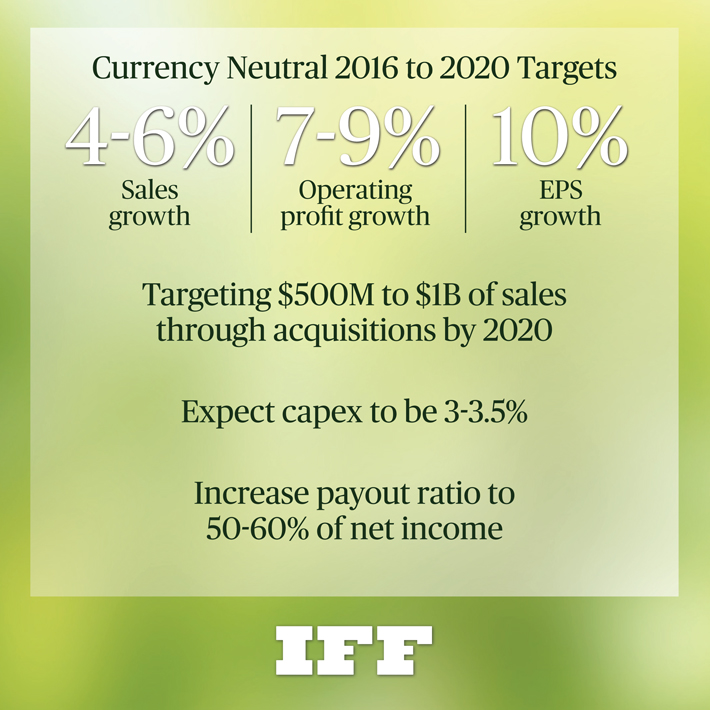

Currency Neutral 2016 to 2020 Targets

4-6% 7-9% 10%

Sales Operating EPS growth profit growth growth

Targeting $500M to $1B of sales through acquisitions by 2020

Expect capex to be 3-3.5%

Increase payout ratio to 50-60% of net income

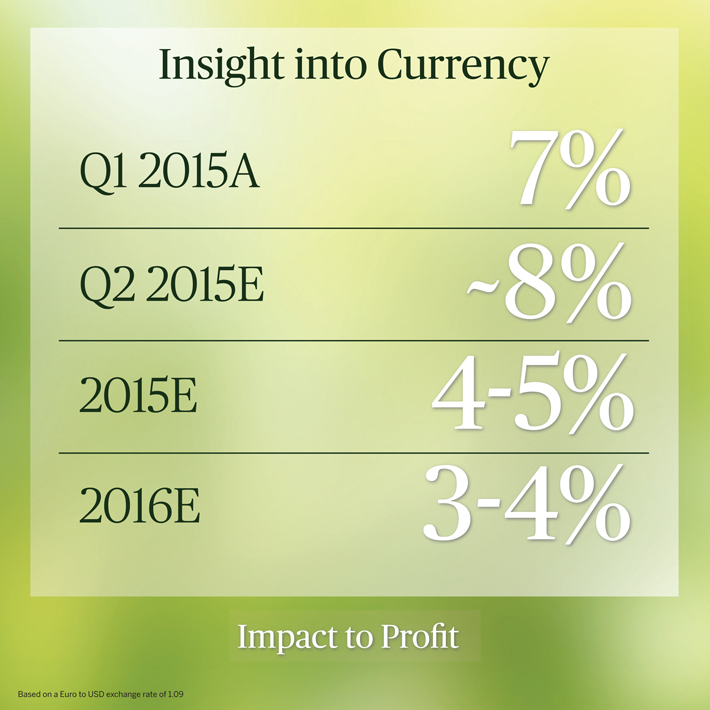

Insight into Currency

Q1 2015A 7% Q2 2015E ~8% 2015E 4-5% 2016E 3-4%

Impact to Pro?t

Based on a Euro to USD exchange rate of 1.09

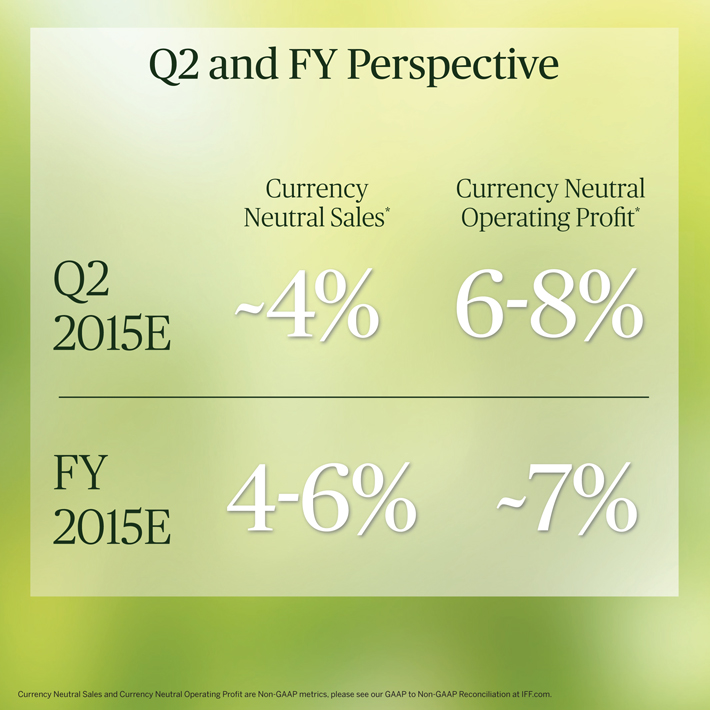

Q2 and FY Perspective

Currency Currency Neutral Neutral Sales* Operating Profit*

Q2 ~4% 6-8%

2015E

FY 4-6% ~7%

2015E

Currency Neutral Sales and Currency Neutral Operating Profit are Non-GAAP metrics, please see our GAAP to Non-GAAP Reconciliation at IFF.com.

Andreas Fibig

Chairman and Chief Executive Officer

Vision

2020Accelerating Growth

Strategic Pillars

Win Where1 We Compete Innovating 2 Firsts

Become Our Customers’ 3 Partner of Choice Strengthen &4 Expand Portfolio

Vision

2020Accelerating Growth

Enablers

Building Our Talent & Organization Continuous Improvement Creating a Sustainable Future

Currency Neutral 2016 to 2020 Targets

4-6% 7-9% 10%

Sales Operating EPS growth profit growth growth

Targeting $500M to $1B of sales through acquisitions by 2020

Expect capex to be 3-3.5%

Increase payout ratio to 50-60% of net income