- IP Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

International Paper (IP) 8-KResults of Operations and Financial Condition

Filed: 26 Oct 04, 12:00am

Third Quarter

2004 Review

October 26, 2004

John V. Faraci

Chairman & CEO

Christopher P. Liddell

SVP & CFO

Forward Looking Statements

Statements on these slides or in this presentation that are not historical are

2

forward-looking. These statements are subject to risks and uncertainties that

could cause actual results to differ materially, including but not limited to,

uncertainty as to whether the sale of Weldwood of Canada, Ltd. will be completed,

the ability of International Paper and West Fraser Timber Co. to meet closing

conditions, the strength of demand for the company’s products and changes in

overall demand, the effects of competition from foreign and domestic producers,

the level of housing starts, changes in the cost or availability of raw materials,

unanticipated expenditures related to the cost of compliance with environmental

and other governmental regulations, the ability of the company to continue to

realize anticipated cost savings, performance of the company’s manufacturing

operations, results of legal proceedings, changes related to international

economic conditions and changes in currency exchange rates. We undertake no

obligation to publicly update any forward-looking statements, whether as a result

of new information, future events or otherwise. These and other factors that could

cause or contribute to actual results differing materially from such forward looking

statements are discussed in greater detail in the company’s Securities and

Exchange Commission filings.

During the course of this presentation, certain non-

Statements Relating to

Non-GAAP Financial Measures

3

U.S. GAAP financial information will be presented.

A reconciliation of those numbers to U.S. GAAP

financial measures is available on the company’s

website at www.internationalpaper.com under

Investor Information

Agenda

Third Quarter Review

Business Performance

Outlook

4

Third Quarter 2004 Summary

Revenues growing, volumes remained strong,

reflecting healthy demand

Continued to implement IP announced price

increases

Raw material costs remained high and rising

Negative impact on earnings from hurricanes

Continued to focus on non-price improvement

5

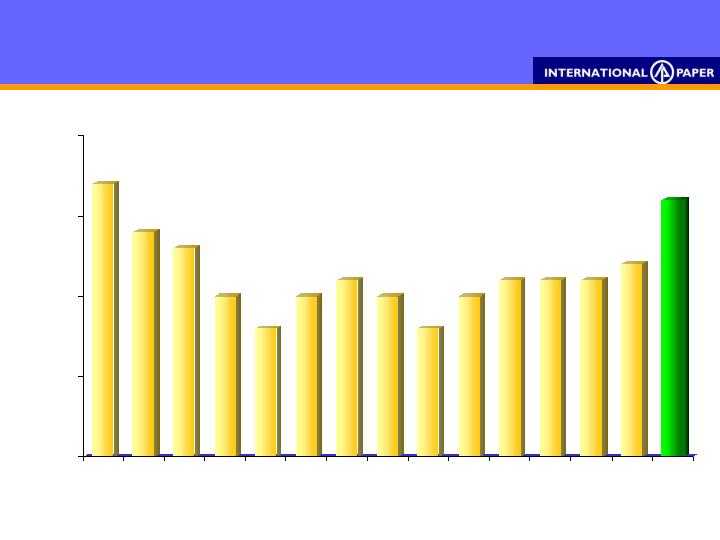

IP Net Sales Revenue

1Q

3Q

1Q

2001

2002

2Q

4Q

2Q

3Q

4Q

1Q

2Q

2003

3Q

4Q

1Q

2004

2Q

3Q

$B

3Q’04 highest net sales revenue since 1Q’01

6

5

5.5

6

6.5

7

EPS from Continuing Operations

and Before Special Items*

1Q

1Q

3Q

1Q

3Q

.75

.49

.24

2001

2002

2Q

.03

.59

4Q

2Q

4Q

2000

.11

.11

.11

.11

.32

2Q

3Q

4Q

1Q

2Q

2003

.32

3Q

.30

4Q

.14

1Q

* A reconciliation to GAAP EPS is available at www.internationalpaper.com under Investor Information

.20

.22

.20

.12

2004

2Q

.43

.33

3Q

7

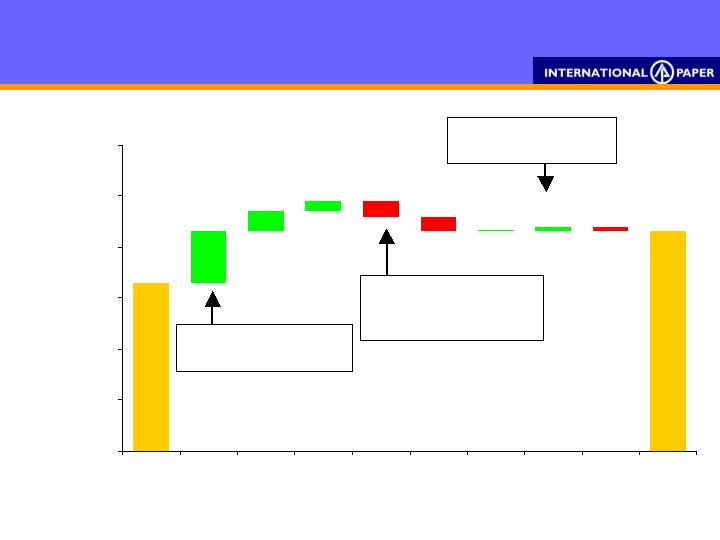

3Q’04 vs. 2Q’04

($.03)

EPS $ / Share

$.33

$.04

($.01)

$.01

($.03)

Wood Costs $0.00

Energy ($0.01)

Other ($0.02)

2Q’04 Tax Rate 31%

3Q’04 Tax Rate 29%

Paper/Pkg. $0.15

Wood Prod ($0.05)

EPS from cont. ops. before special items

$.10

$.43

$.00

$.02

8

$0.00

$0.10

$0.20

$0.30

$0.40

$0.50

$0.60

2Q'04

Price

Volume

Cost/Mix

Raw

Material

Hurricane

Land

Sales

Tax

Other

3Q'04

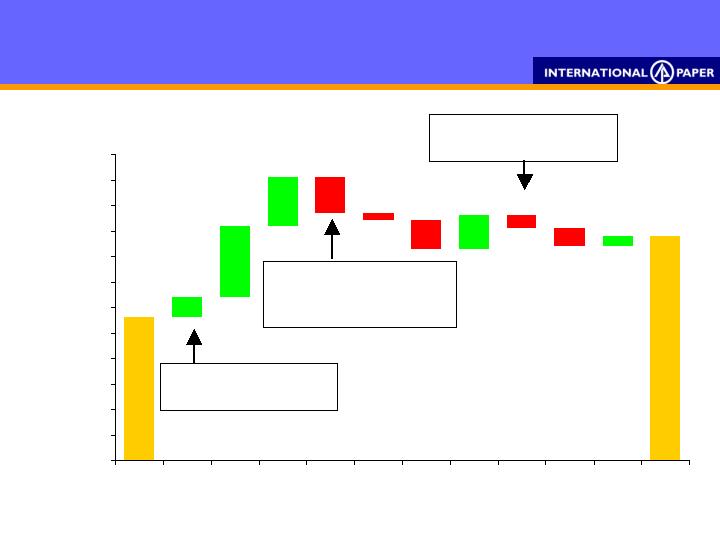

9M’04 vs. 9M’03

$0.00

$0.10

$0.20

$0.30

$0.40

$0.50

$0.60

$0.70

$0.80

$0.90

$1.00

$1.10

$1.20

9M'03

Price

Volume

Cost/Mix

Raw

Material

Hurricane

Land

Sales

Interest

Tax

Pension

Other

9M'04

($.14)

EPS $ / Share

$.56

$.28

$.13

($.05)

($.03)

$.19

Sep’03 Tax Rate 25%

Sep’04 Tax Rate 30%

Paper/Pkg. ($0.22)

Wood Prod $0.30

$.08

$.04

$.88

($.11)

EPS from cont. ops before special items

($.07)

9

Wood Costs

Energy

Other

($0.07)

($0.04)

($0.03)

(200)

(160)

(120)

(80)

(40)

0

Wood

Natural

Gas

LDPE

Oil/Coal

Impact of Higher Raw Material Cost

EBIT impact 2004 vs. 2002

EBIT ($)

(140)

(55)

(30)

(175)

(30)

Material costs $430 million negative EBIT

impact 2004 full year estimate versus 2002

Caustic/

Other

10

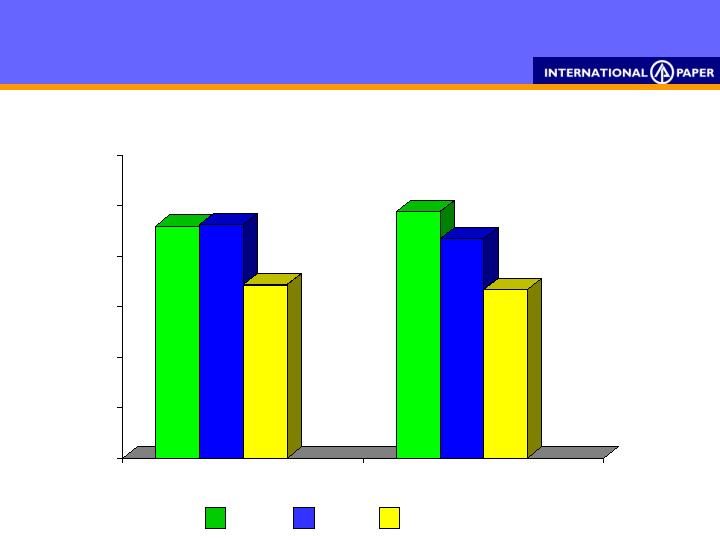

Cost Reduction Initiatives

Reducing purchased energy consumption

11

Purchased energy consumption in key

businesses reduced by 8-10% since 2002

10

11

12

13

14

15

16

Printing Papers

Bleached Board

2002

2004 YTD

2003

OSC

Earnings and ROI Improving

3Q’04

3.6

5.0

2Q’04

3.2

4.2

2003

2.9

3.8

EBITDA ($B)

ROI (%)

Annualized

12

Printing Papers

$ 1,920

160

Sales

Earnings

3Q’04

2Q’04

$ Millions

Uncoated*

Coated*

Pulp*

Europe

(1%)

8%

1%

(2%)

3Q’04 Change vs 2Q’04:

Volume

Realizations/ton

* U.S. operations only

Average IP realization (includes the impact of mix across all grades)

Europe is average commodity cut size price excluding Russia

$ 1,850

141

Cut size

Printing

Papers

Envelope

Bristols

13

$50

$50

$10

$35

$35

$10

(€20)

$30

$50

Forms

Packaging

$ 2,005

183

Sales

Earnings

3Q’04

2Q’04

$ Millions

Containerboard

U.S. Container

Bleached Board

$40

$40

$15

Volume

Realizations/ton

$ 1,775

115

3Q’04 Change vs 2Q’04:

Average IP realization (includes the impact of mix across all grades)

5%

21%

1%

14

Forest Products

$ 600

191

Sales

Earnings

3Q’04

2Q’04

$ Millions

Lumber (mbf)

Plywood (msf)

2%

2%

($5)

($65)

Volume

Realizations/unit

Average IP realization (includes the impact of mix across all grades)

$ 625

222

3Q’04 Change vs 2Q’04:

15

Reconciliation to Net Earnings

Per share

16

($1.13)

Net Earnings

Earnings from Continuing Operations

and Before Special Items

$0.43

Special Items

0.00

Earnings from Continuing Operations

$0.43

Discontinued Operations

(Weldwood)

($1.56)

$MM

EPS

Special Items & Discontinued

Operations – 3Q04

17

Special Items

Insurance Recoveries

103

Divestitures

(38)

Restructuring & Others

(49)

16

Tax & Min. Int. Impact of Above

(17)

Special Items Total

(1)

(0.00)

Discontinued Operations (Weldwood)

Loss on Sale

(385)

Tax Expense

(410)

3Q’04 Earnings

38

(757)

(1.56)

Net Loss

(758)

(1.56)

Outlook

Demand remains solid

Previously announced IP paper and packaging price

increases continue to be implemented

Higher prices in paper and packaging partly offset by

lower prices in wood products and higher raw material

costs

Operations improving

4Q’04 corporate expenses ~ $130 million; Tax rate 30%*

Continuing focus on non-price improvement

18

* Before special charges

Q & A

19

Appendix

20

* U.S. only. Uncoated excludes fine papers

Average Sales Realizations

Forest

Products

$/ton

Packaging

$/ton

Printing

Papers*

283

368

303

325

332

373

368

364

629

649

689

701

376

406

445

458

425

473

481

477

730

715

749

752

749

747

780

790

3Q’03

Segments

3Q’04

Average Sales Realizations

2Q’04

Sept 2004

Plywood, $/MSF

Lumber, $/MBF

Corrugated boxes

Containerboard

Pulp

Coated

Uncoated

Grades

21

Average IP realization (includes the impact of mix across all grades)

Hurricane Impact

Paper

Packaging

Forest Products

Other

$ (11)

(2)

(3)

(2)

Total

$ (18)

3Q’04 Earnings impact by segment

22

$ Millions

2004 Earnings from Continuing

Operations

MI – Minority Interest; Net – Net Income; ETR – Effective Tax Rate; EPS – Earnings per Share

* A reconciliation to GAAP EPS is available at www.internationalpaper.com under Investor Information

23

Pre-Tax

$ MM

Tax

$ MM

MI

$ MM

ETR

Avg. Shares

MM Shares

EPS

$/Share

Net

$ MM

Before Special Items

Q1

110

(36)

(14)

60

33%

484.4

.12

Q2

248

(77)

(12)

159

31%

485.6

.33

Q3

316

(90)

(17)

209

29%

486.4

.43

Special Items

Q1

(14)

5

-

(9)

36%

484.4

(.02)

Q2

(138)

62

(21)

(97)

45%

485.6

(.20)

Q3

16

(32)

15

(1)

200%

486.4

-

Earnings from Operations

Q1

96

(31)

(14)

51*

32%

484.4

.10

Q2

110

(15)

(33)

62*

14%

485.6

.13

Q3

332

(122)

(2)

208*

37%

486.4

.43

24