Exhibit 99.2

Second Quarter 2005 Review

July 26, 2005

John V. Faraci

Chairman & CEO

Marianne M. Parrs

EVP & CFO

Forward-Looking Statements

These slides contain forward-looking statements. Such statements reflect management’s current views and are subject to risks and uncertainties that could cause actual results to differ materially, including but not limited to, the ability of the company to accomplish its transformation plan and to realize anticipated cost savings, the demand and pricing for the company’s products and changes in overall demand, the effects of competition from foreign and domestic producers, the level of housing starts, changes in the cost or availability of raw materials, changes in energy costs, unanticipated expenditures related to the cost of compliance with environmental and other governmental regulations, performance of the company’s manufacturing operations, results of legal proceedings, changes related to international economic conditions, specifically in Brazil, Russia and China, changes in currency exchange rates, particularly the relative value of the U.S. dollar to the Euro, and the war on terrorism. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise. These and other factors that could cause or contribute to actual results differing materially from such forward looking statements are discussed in greater detail in the company’s Securities and Exchange Commission filings.

2

During the course of this presentation, certain non-

U.S. GAAP financial information will be presented.

A reconciliation of those numbers to U.S. GAAP

financial measures is available on the company’s

website at www.internationalpaper.com under

Investors.

Statements Relating to

Non-GAAP Financial Measures

3

Agenda

Second Quarter Review Third Quarter Outlook Transformation Plan Summary

4

Second Quarter 2005 Summary

Volumes down from first quarter

Balanced our supply with customer demand by taking downtime

Continued to realize our announced price increases in coated and printing papers, and bleached board. Benefited from higher lumber prices Mill operations improved Raw material costs increased

5

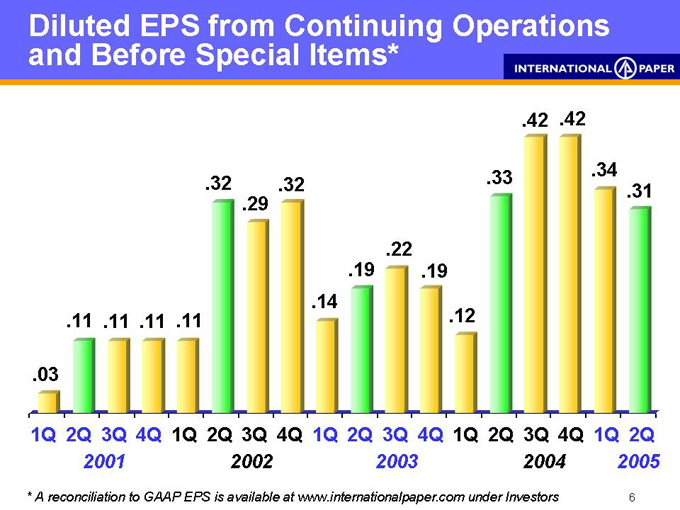

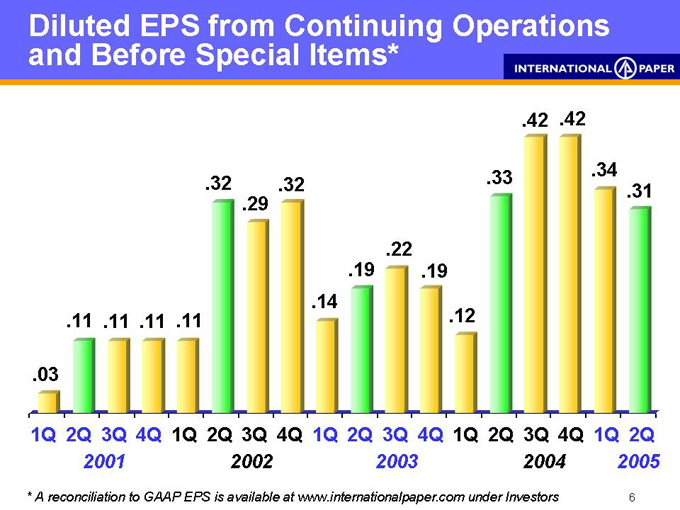

Diluted EPS from Continuing Operations and Before Special Items*

.03

.11 .11 .11 .11

.32

.29

.32

.14

.19

.22

.19

.12

.33

.42 .42

.34

.31

1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q

2001 2002 2003 2004 2005

* A reconciliation to GAAP EPS is available at www.internationalpaper.com under Investors

6

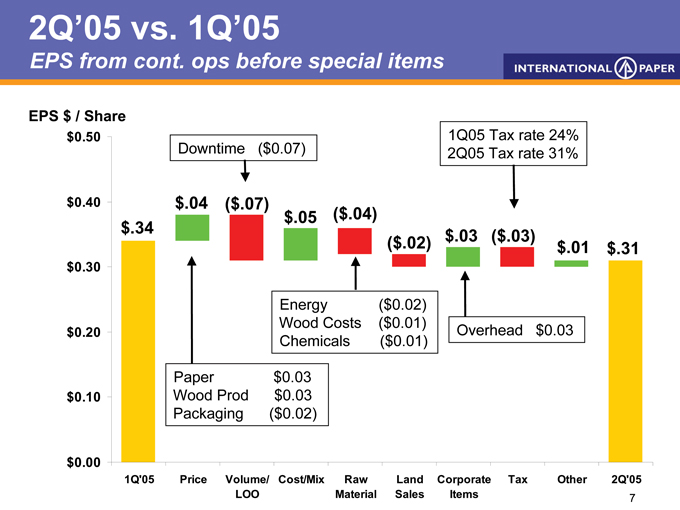

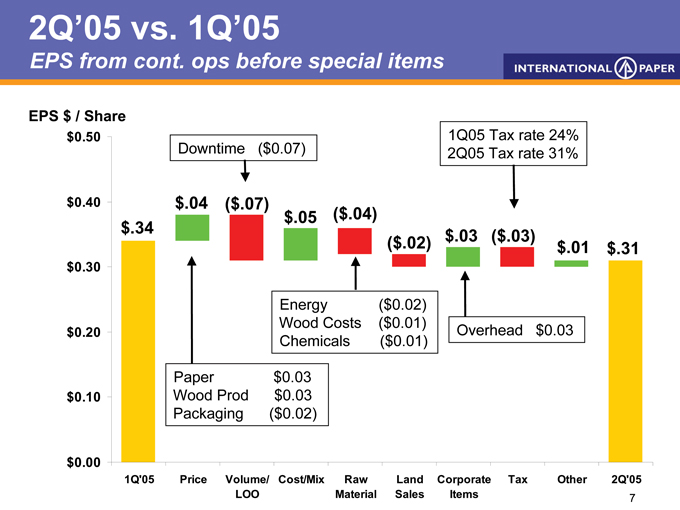

2Q’05 vs. 1Q’05

EPS from cont. ops before special items

EPS $ / Share $0.50 $0.40 $0.30 $0.20 $0.10 $0.00

Downtime ($0.07)

1Q05 Tax rate 24% 2Q05 Tax rate 31% $.34 $.04 ($.07) $.05 ($.04)

($.02) $.03 ($.03) $.01 $.31

Energy ($0.02) Wood Costs ($0.01) Chemicals ($0.01)

Overhead $0.03

Paper $0.03 Wood Prod $0.03 Packaging ($0.02)

1Q’05 Price Volume Cost/Mix

Raw Material

Land Sales

Corporate Items

Tax Other 2Q’05

7

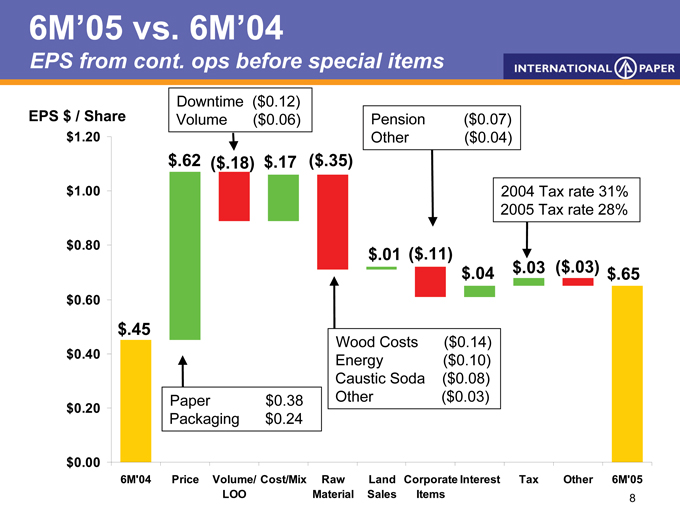

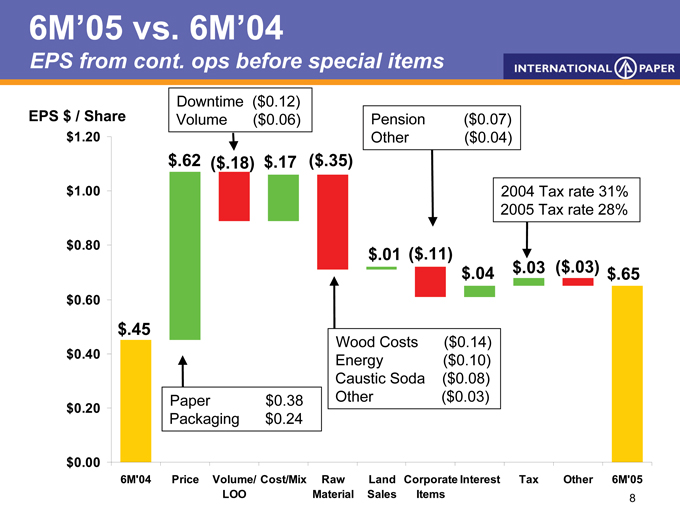

6M’05 vs. 6M’04

EPS from cont. ops before special items

EPS $ / Share $1.20 $1.00 $0.80

$0.60 $0.40 $0.20 $0.00

Downtime ($0.12) Volume ($0.06)

LIFO/Other ($0.04) Pension ($0.07) $.45 $.62 ($.18) $.17 ($.35)

2004 Tax rate 31% 2005 Tax rate 28% $.01 ($.11) $.04 $.03 ($.03) $.65

Paper $0.38 Packaging $0.24

Wood Costs ($0.14) Energy ($0.10) Caustic Soda ($0.08) Other ($0.03)

6M’04 Price Volume Cost/Mix

Raw Material

Land Sales

Corporate Interest Items

Tax Other 6M’05

9

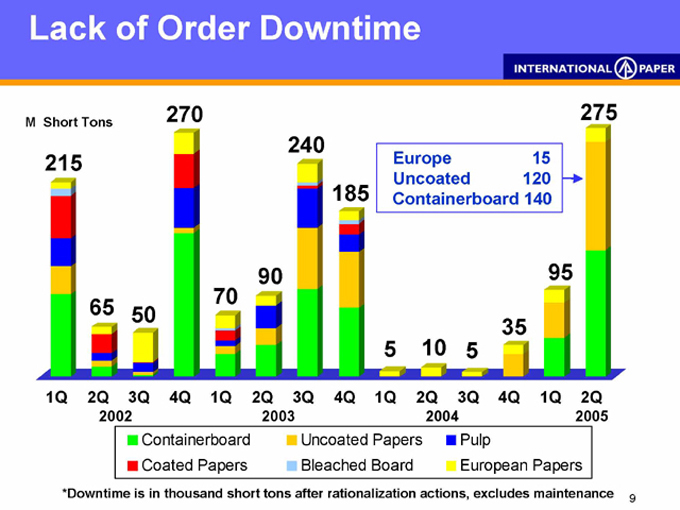

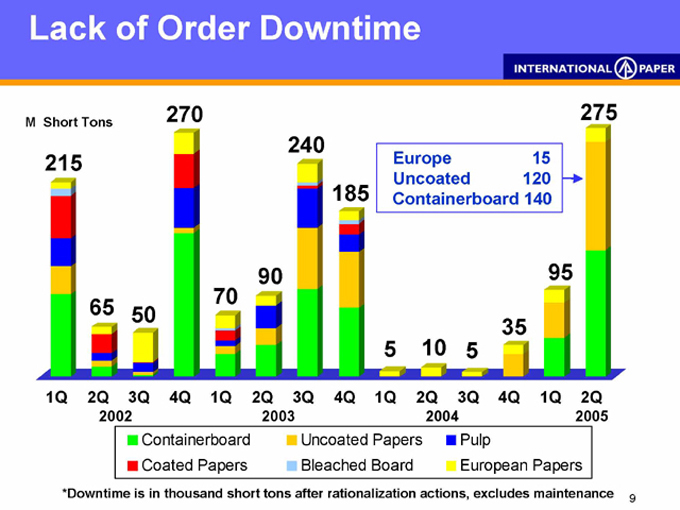

Lack of Order Downtime

M Short Tons

215

65 50

270

70 90

240

185

5

10

5

35

95

275

Europe 15 Uncoated 120 Containerboard 140

1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q

2002 2003 2004 2005

Containerboard Coated Papers

Uncoated Papers Bleached Board

Pulp

European Papers

*Downtime is in thousand short tons after rationalization actions, excludes maintenance

11

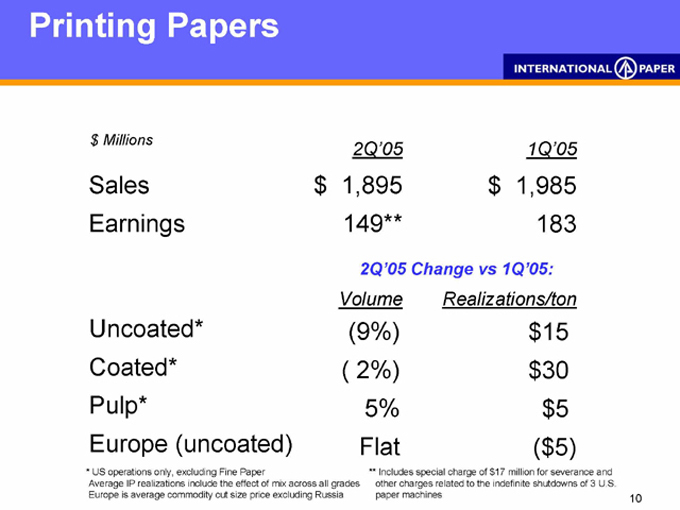

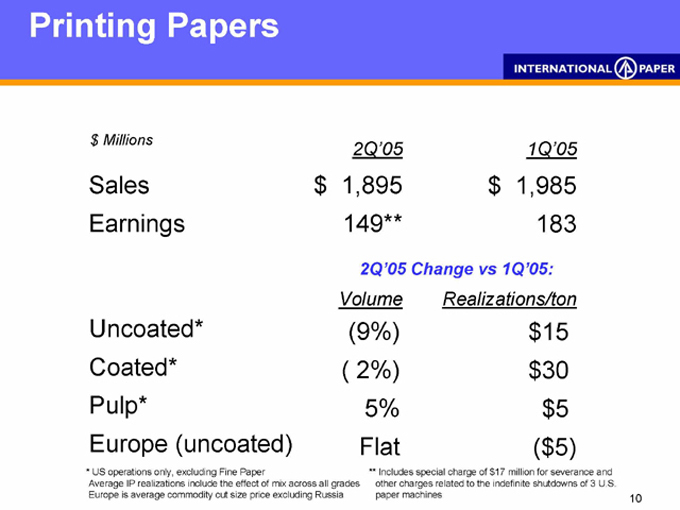

Printing Papers

$ Millions 2Q’05

1Q’05

Sales $1,895 $1,985

Earnings 149** 183

2Q’05 Change vs 1Q’05:

Volume Realizations/ton

Uncoated* (9%) $15

Coated* ( 2%) $30

Pulp* 5% $5

Europe (uncoated) Flat ( $5)

* US operations only, excluding Fine Paper

Average IP realizations include the effect of mix across all grades Europe is average commodity cut size price excluding Russia

** Includes special charge of $17 million for severance and other charges related to the indefinite shutdowns of 3 U.S. paper machines

12

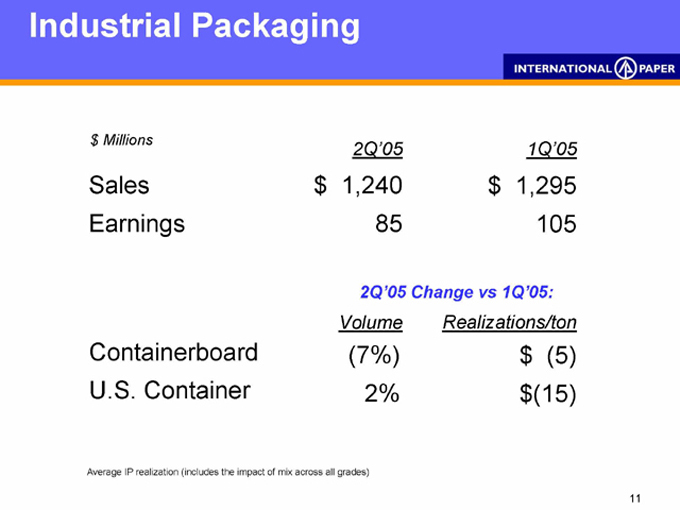

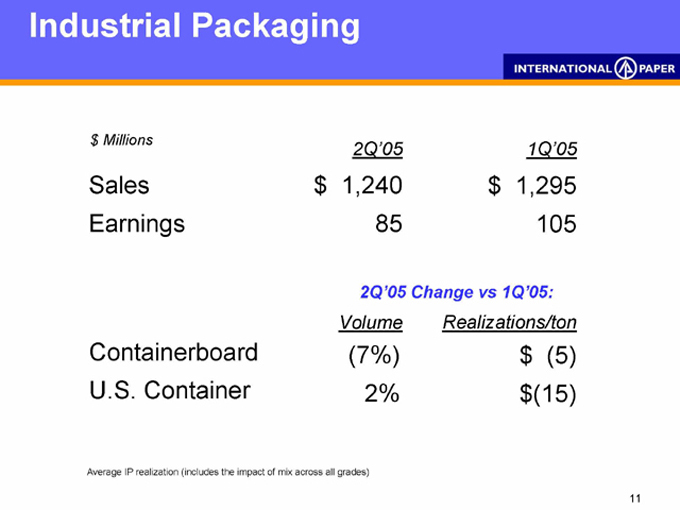

Industrial Packaging

$ Millions 2Q’05

1Q’05

Sales $1,240 $1,295

Earnings 85 105

2Q’05 Change vs 1Q’05:

Volume Realizations/ton

Containerboard (7%) $(5)

U.S. Container 2% $(15)

Average IP realization (includes the impact of mix across all grades)

13

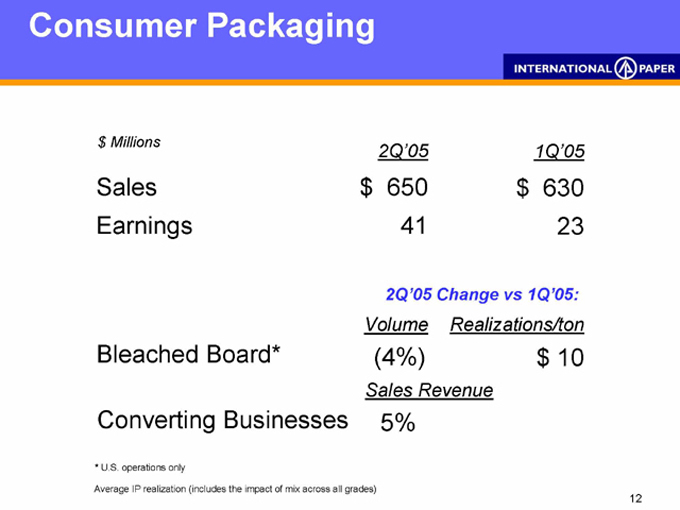

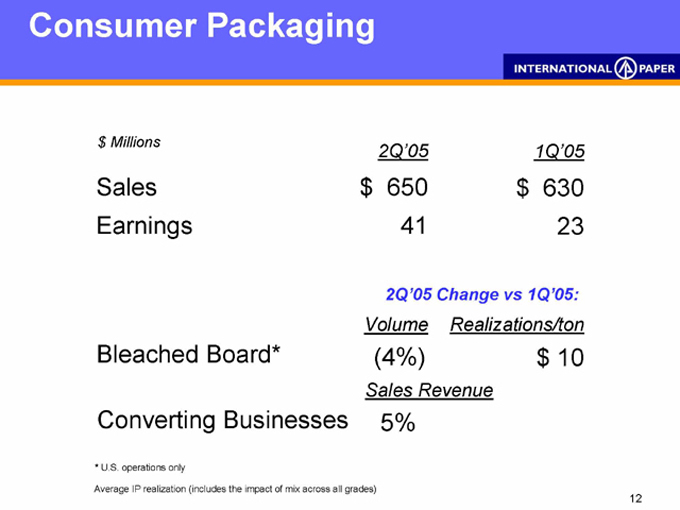

Consumer Packaging

$ Millions 2Q’05

1Q’05

Sales $650 $630

Earnings 41 23

2Q’05 Change vs 1Q’05:

Volume Realizations/ton

Bleached Board* (4%) $ 10

Sales Revenue

Converting Businesses 5%

* U.S. operations only

Average IP realization (includes the impact of mix across all grades)

14

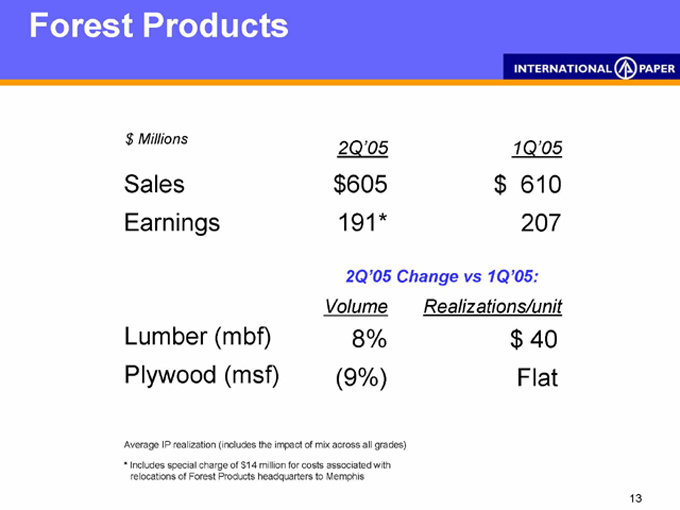

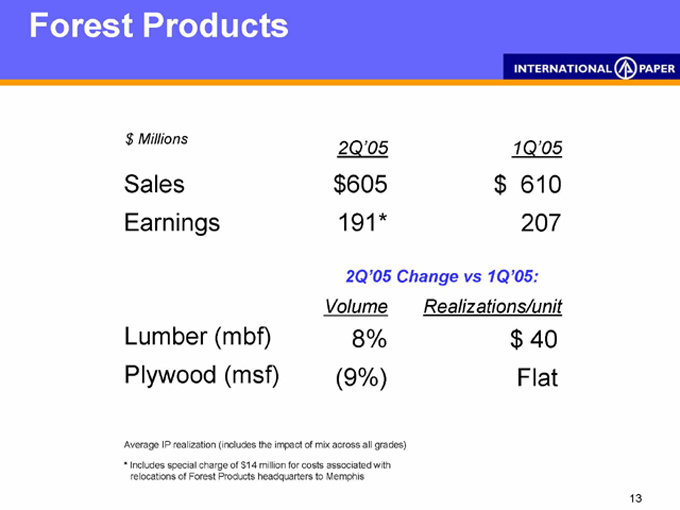

Forest Products

$ Millions 2Q’05

1Q’05

Sales $605 $610

Earnings 191* 207

2Q’05 Change vs 1Q’05:

Lumber (mbf) 8% $40

Plywood (msf) (9%) Flat

Average IP realization (includes the impact of mix across all grades)

* Includes special charge of $14 million for costs associated with relocations of Forest Products headquarters to Memphis

15

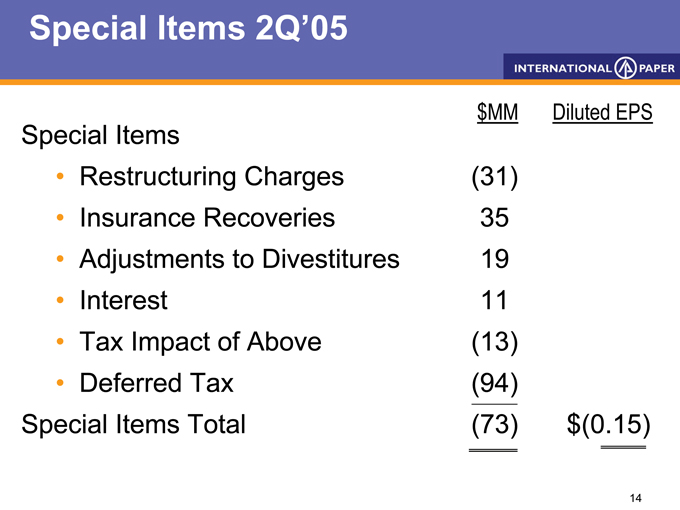

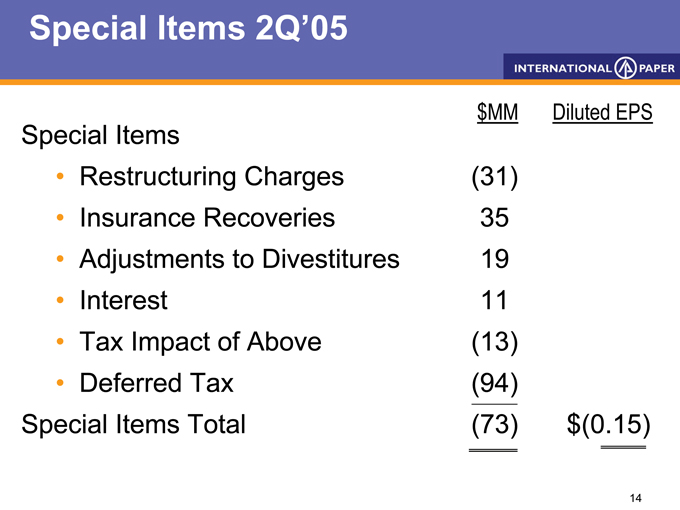

Special Items 2Q’05 $MM Diluted EPS

Special Items

Insurance Recoveries 35

Restructuring Charges (31)

Adjustments to Divestitures 19

Interest 11

Tax Impact of Above (13)

Deferred Tax (94)

Special Items Total (73) $(0.15)

16

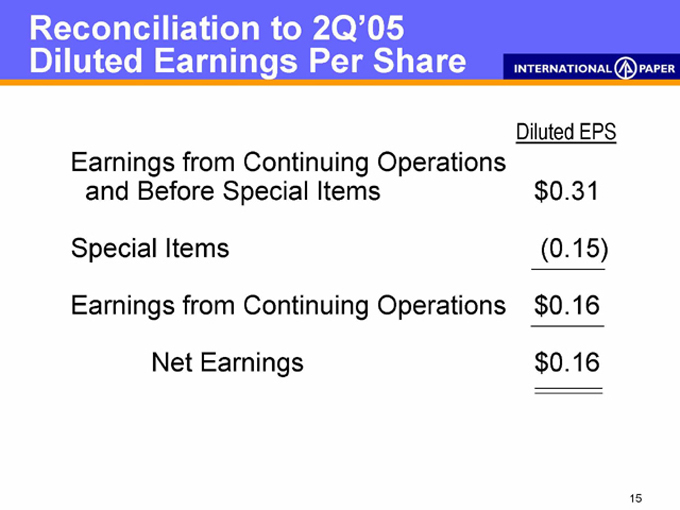

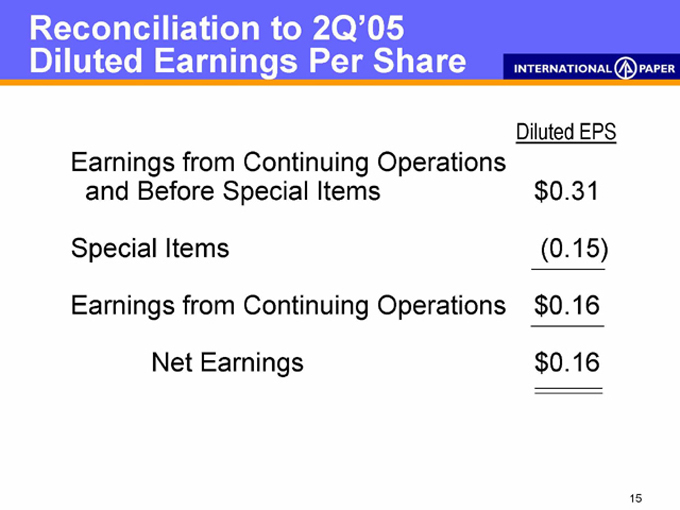

Reconciliation to 2Q’05 Diluted Earnings Per Share

Diluted EPS

Earnings from Continuing Operations

and Before Special Items $0.31

Special Items (0.15)

Earnings from Continuing Operations $0.16

Net Earnings $0.16

17

Third Quarter 2005 Outlook

Volumes mixed

Some pricing pressures in uncoated papers and industrial packaging offset our announced increases in coated paper Operational improvements should continue to be realized Raw material costs expected to be flat versus second quarter

18

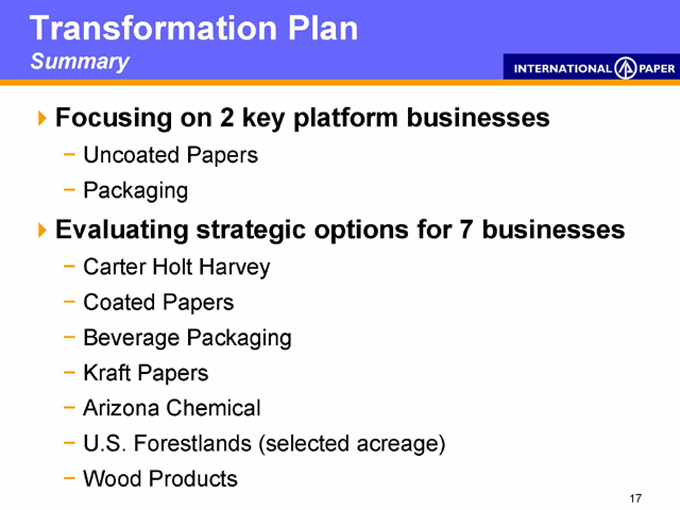

Transformation Plan

Summary

Focusing on 2 key platform businesses

Uncoated Papers Packaging

Evaluating strategic options for 7 businesses

Carter Holt Harvey Coated Papers Beverage Packaging Kraft Papers Arizona Chemical

U.S. Forestlands (selected acreage) Wood Products

19

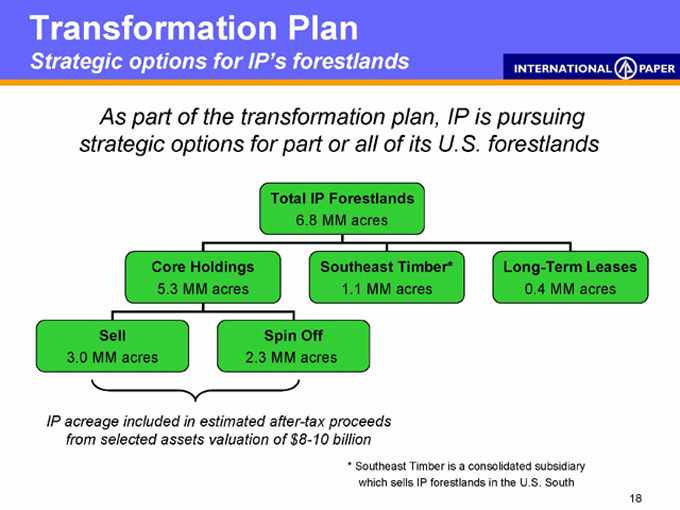

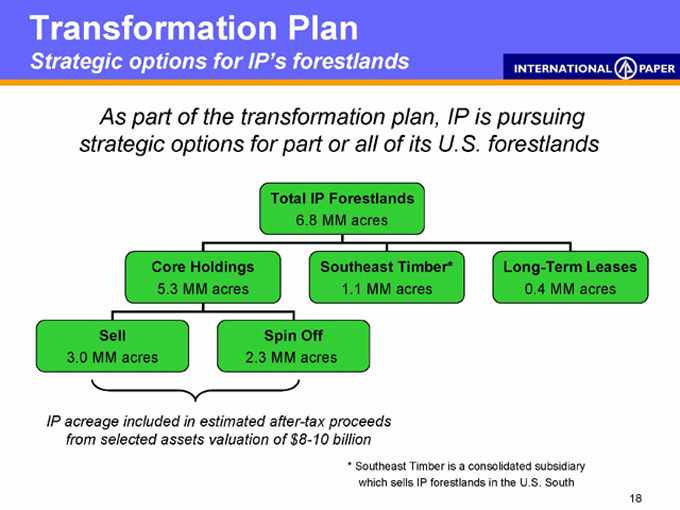

Transformation Plan

Strategic options for IP’s forestlands

As part of the transformation plan, IP is pursuing strategic options for part or all of its U.S. forestlands

Total IP Forestlands

6.8 MM acres

Core Holdings

5.3 MM acres

Southeast Timber*

1.1 MM acres

Long-Term Leases

0.4 MM acres

Sell

3.0 MM acres

Spin Off

2.3 MM acres

IP acreage included in estimated after-tax proceeds from selected assets valuation of $8-10 billion

* Southeast Timber is a consolidated subsidiary which sells IP forestlands in the U.S. South

20

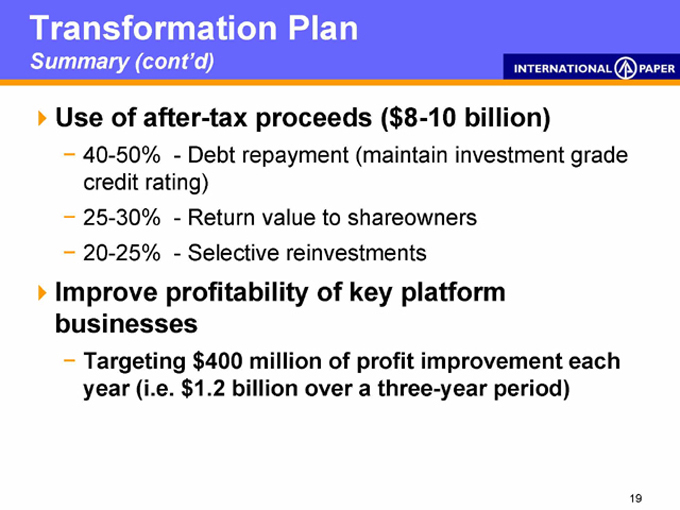

Transformation Plan

Summary (cont’d)

Use of after-tax proceeds ($8-10 billion)

40-50% - Debt repayment (maintain investment grade credit rating) 25-30% - Return value to shareowners 20-25% - Selective reinvestments

Improve profitability of key platform businesses

Targeting $400 million of profit improvement each year (i.e. $1.2 billion over a three-year period) .

21

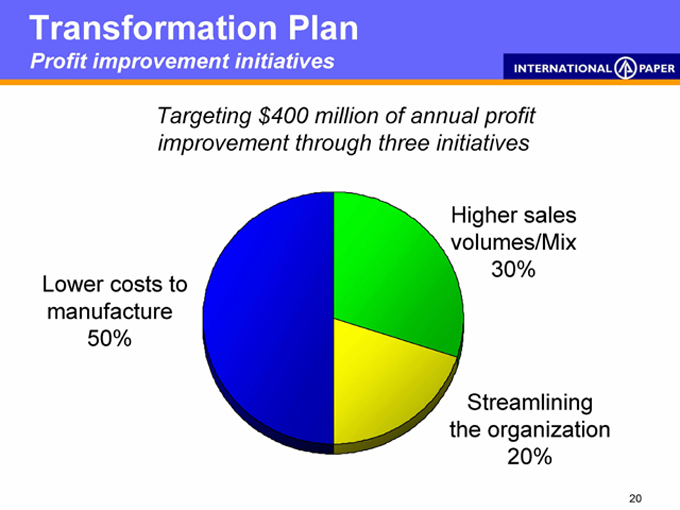

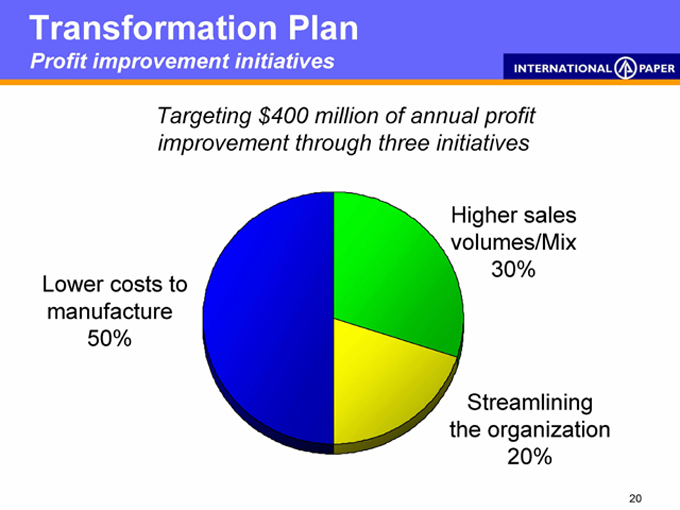

Transformation Plan

Profit improvement initiatives

Targeting $400 million of annual profit improvement through three initiatives

Lower costs to manufacture 50%

Higher sales volumes/Mix 30%

Streamlining the organization 20%

22

Q & A

22

Appendix

23

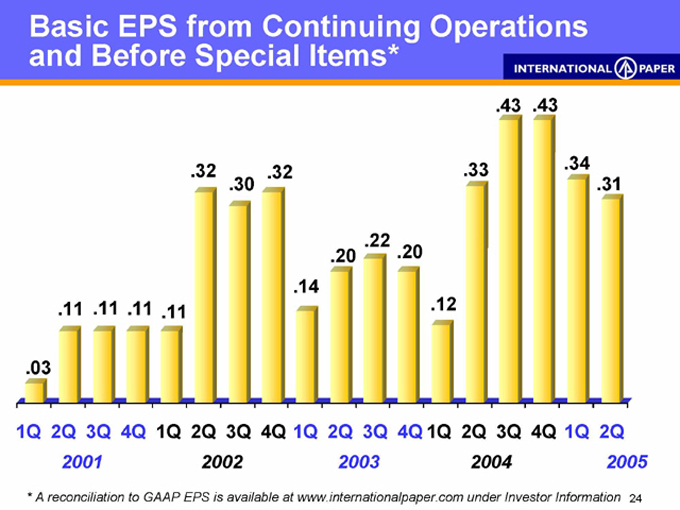

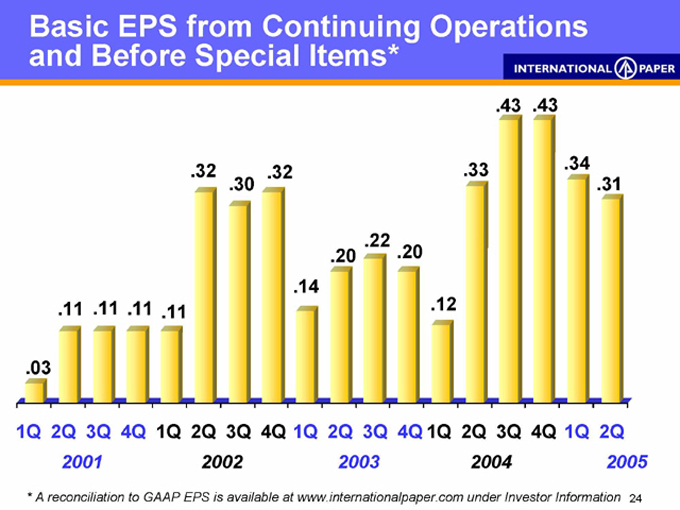

Basic EPS from Continuing Operations and Before Special Items*

.03

.11 .11 .11 .11

.32 .32 .30

.14

.20 .22 .20

.12

.33

.43 .43

.34 .31

1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q

2001 2002 2003 2004 2005

* A reconciliation to GAAP EPS is available at www.internationalpaper.com under Investor Information

24

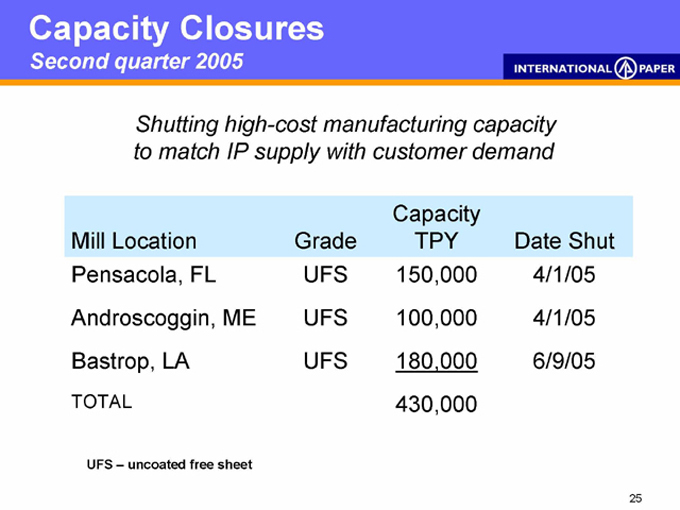

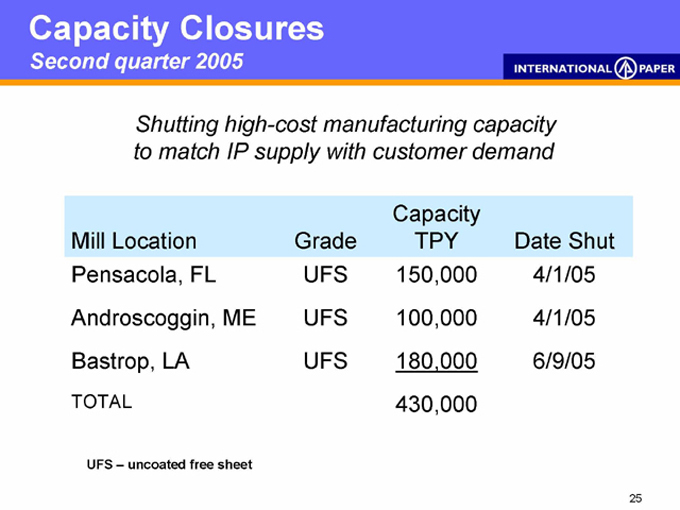

Capacity Closures

Second quarter 2005

Shutting high-cost manufacturing capacity to match IP supply with customer demand

Capacity

Mill Location Grade TPY Date Shut

Pensacola, FL UFS 150,000 4/1/05

Androscoggin, ME UFS 100,000 4/1/05

Bastrop, LA UFS 180,000 6/9/05

TOTAL 430,000

UFS – uncoated free sheet

25

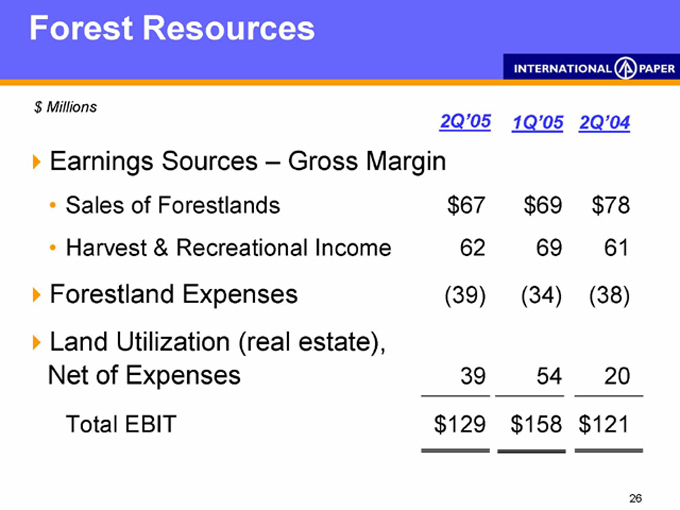

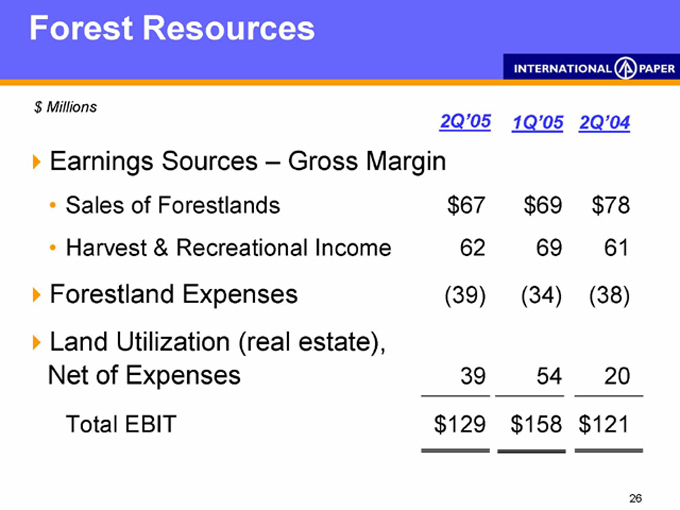

Forest Resources $ Millions

2Q’05 1Q’05 2Q’04

Earnings Sources – Gross Margin

Sales of Forestlands $67 $69 $78

Harvest & Recreational Income 62 69 61

Forestland Expenses (39) (34) (38)

Land Utilization (real estate),

Net of Expenses 39 54 20

Total EBIT $129 $158 $121

26

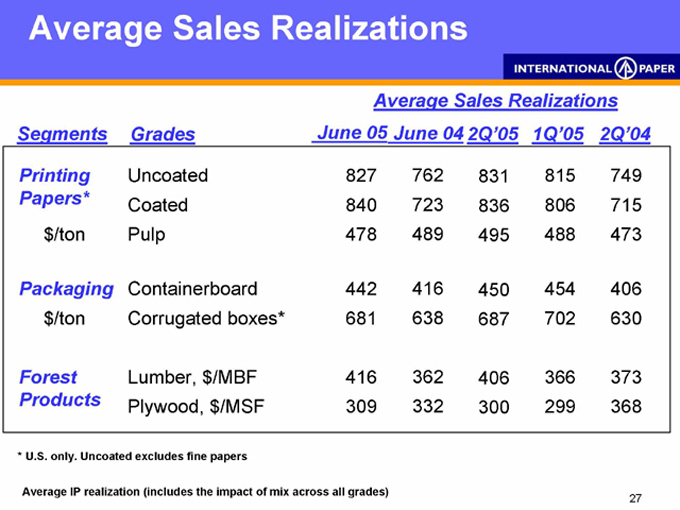

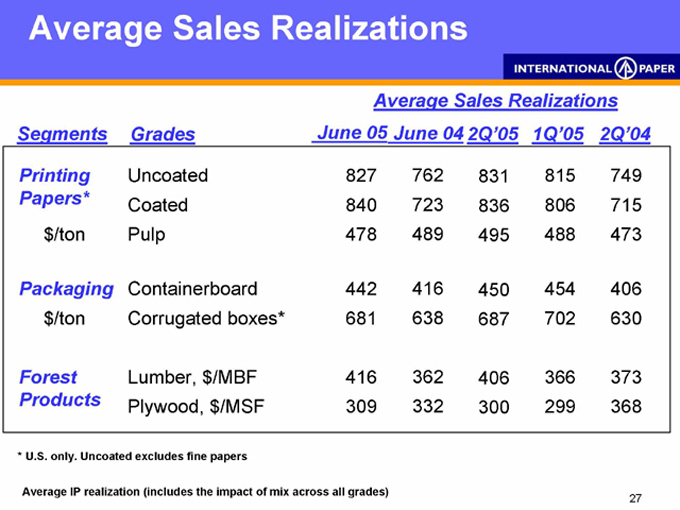

Average Sales Realizations

Average Sales Realizations

Segments Grades June 05 June 04 2Q’05 1Q’05 2Q’04

Printing Uncoated 827 762 831 815 749

Papers* Coated 840 723 836 806 715

$/ton Pulp 478 489 495 488 473

Packaging Containerboard 442 416 450 454 406

$/ton Corrugated boxes* 681 638 687 702 630

Forest Lumber, $/MBF 416 362 406 366 373

Products Plywood, $/MSF 309 332 300 299 368

* U.S. only. Uncoated excludes fine papers

Average IP realization (includes the impact of mix across all grades)

27

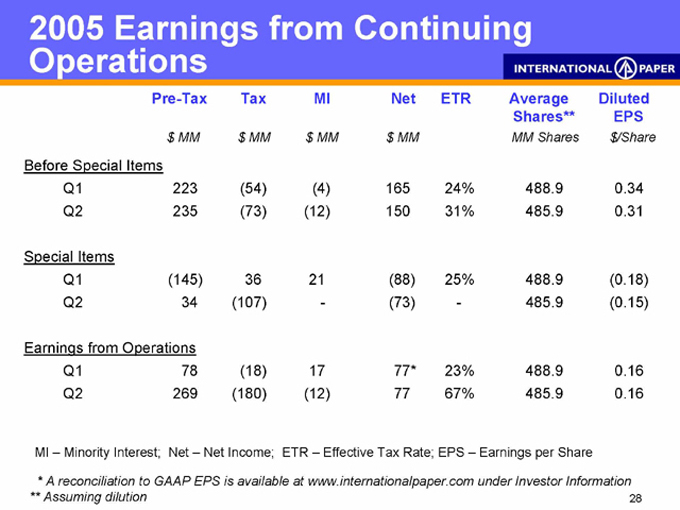

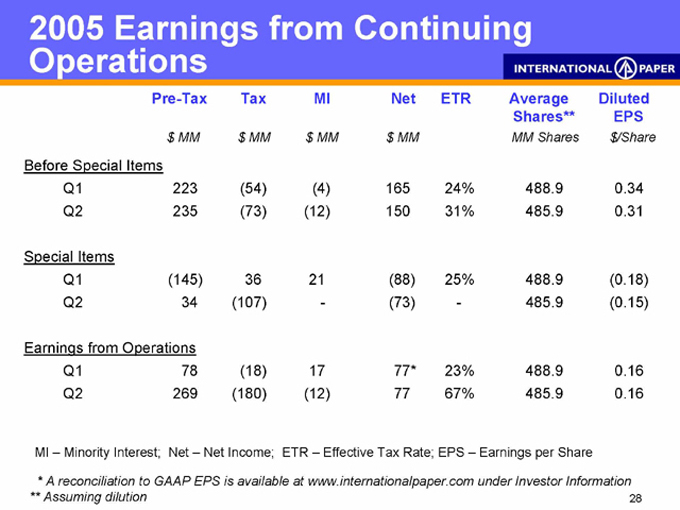

2005 Earnings from Continuing

Operations

Pre-Tax Tax MI Net ETR Average Diluted

Shares** EPS

$MM $MM $MM $MM MM Shares $/Share

Before Special Items

Q1 223 (54) (4) 165 24% 488.9 0.34

Q2 235 (73) (12) 150 31% 0.31

Special Items

Q1 (145) 36 21 (88) 25% 488.9 (0.18)

Q2 34 (107) - (73) - (0.15)

Earnings from Operations

Q1 78 (18) 17 77* 23% 488.9 0.16

Q2 269 (180) (12) 77 67% 0.16

MI – Minority Interest; Net – Net Income; ETR – Effective Tax Rate; EPS – Earnings per Share

* A reconciliation to GAAP EPS is available at www.internationalpaper.com under Investor Information

** Assuming dilution

28

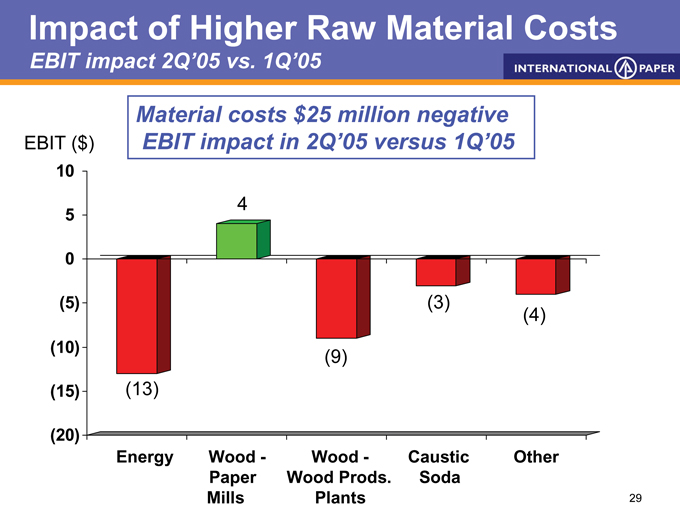

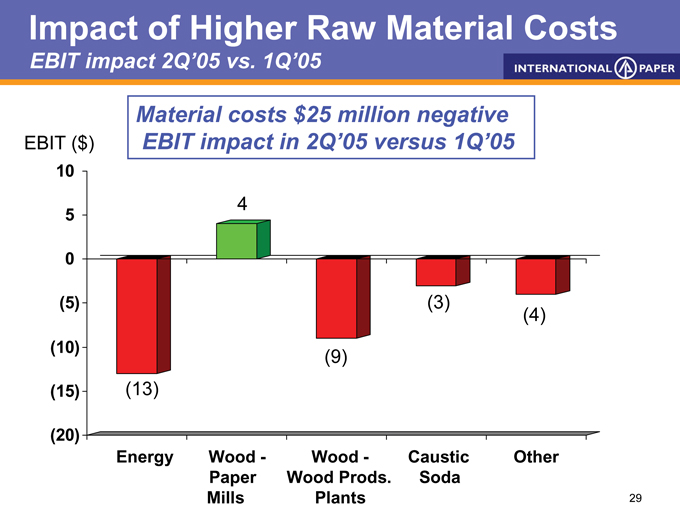

Impact of Higher Raw Material Costs

EBIT impact 2Q’05 vs. 1Q’05

Material costs $25 million negative EBIT impact in 2Q’05 versus 1Q’05

EBIT ($)

5 0 (5) (10) (15)

(5)

(3)

(8)

(5)

(4)

Wood

Caustic Soda

Oil/Coal/Electricity

Natural Gas

Other

29

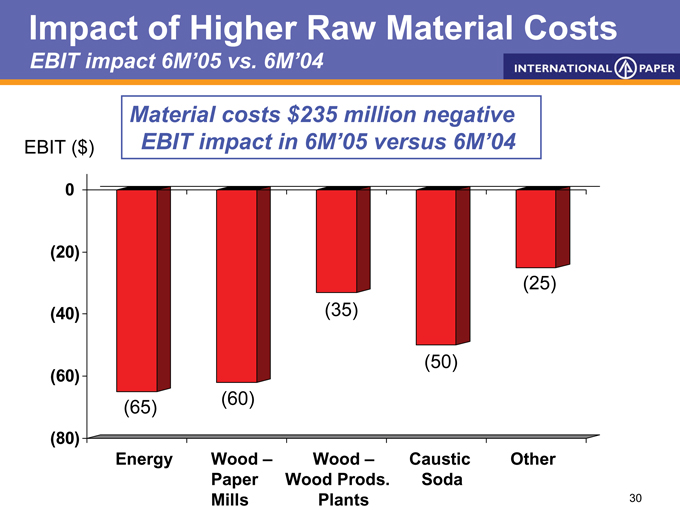

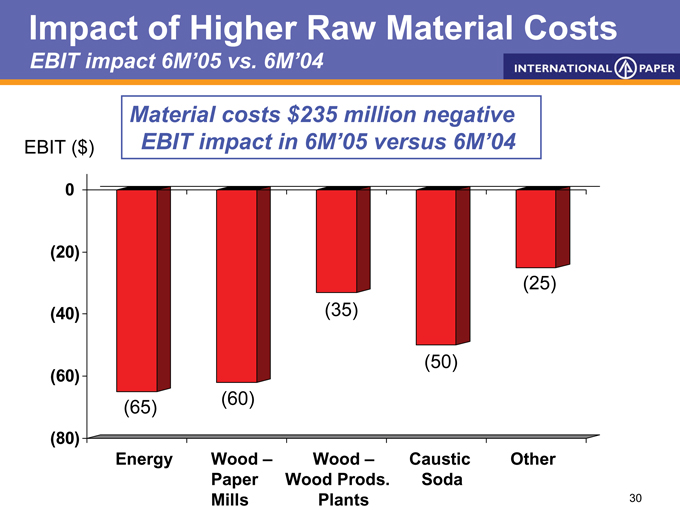

Impact of Higher Raw Material Costs

EBIT impact 6M’05 vs. 6M’04

Material costs $235 million negative EBIT impact in 6M’05 versus 6M’04

EBIT ($)

0 (20) (40) (60) (80) (100) (120)

(95)

(50)

(50)

(15)

(25)

Wood

Caustic Soda

Oil/Coal/Electricity

Natural Gas

Other

30

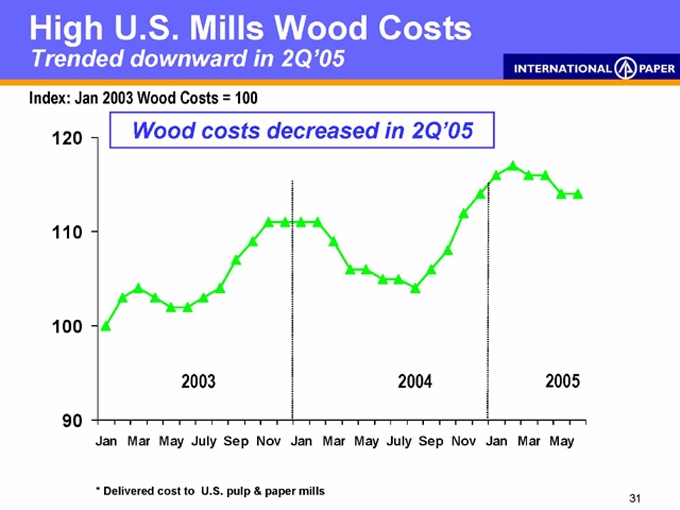

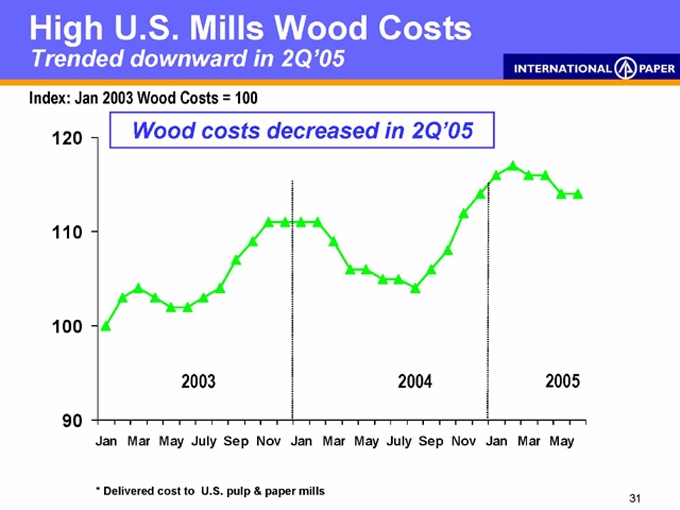

High U.S. Mills Wood Costs

Trended downward in 2Q’05

Index: Jan 2003 Wood Costs = 100

Wood costs decreased in 2Q’05 and should trend lower in 3Q’05

120 110 100 90

2003

2004

2005

Jan Mar May July Sep Nov Jan Mar May July Sep Nov Jan Mar May

* Delivered cost to U.S. pulp & paper mills

31

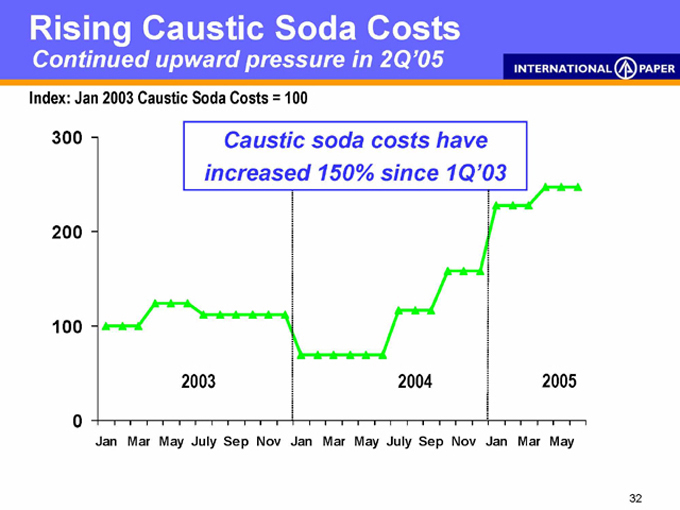

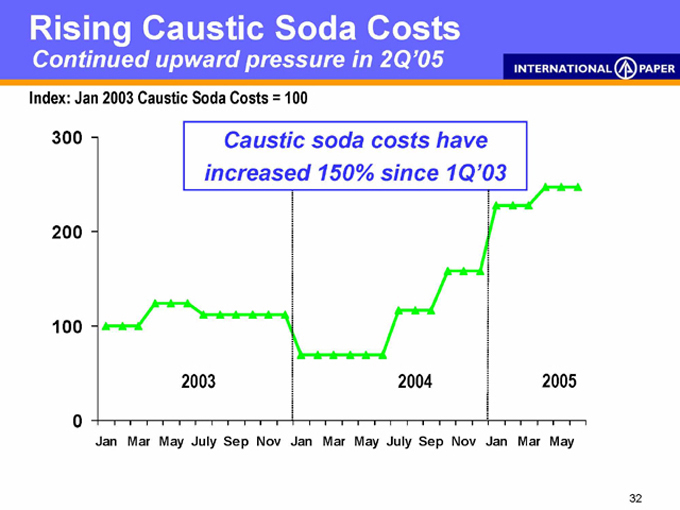

Rising Caustic Soda Costs

Continued upward pressure in 2Q’05

Index: Jan 2003 Caustic Soda Costs = 100

Caustic soda costs have increased 150% since 1Q’03

300 200 100 0

2003

2004

2005

Jan Mar May July Sep Nov Jan Mar May July Sep Nov Jan Mar May

32

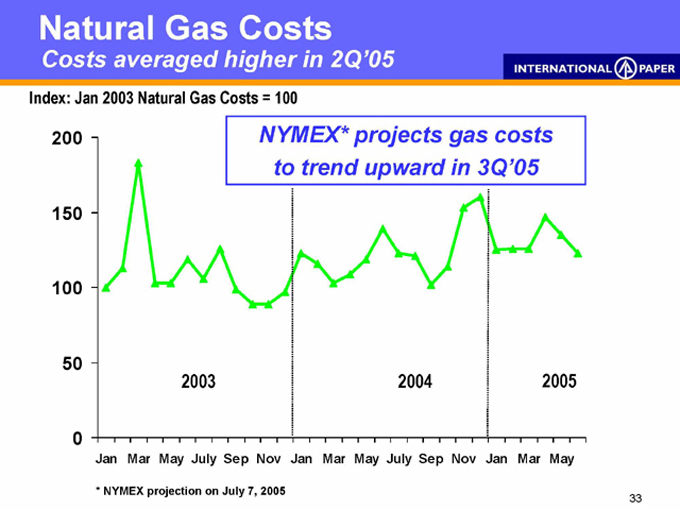

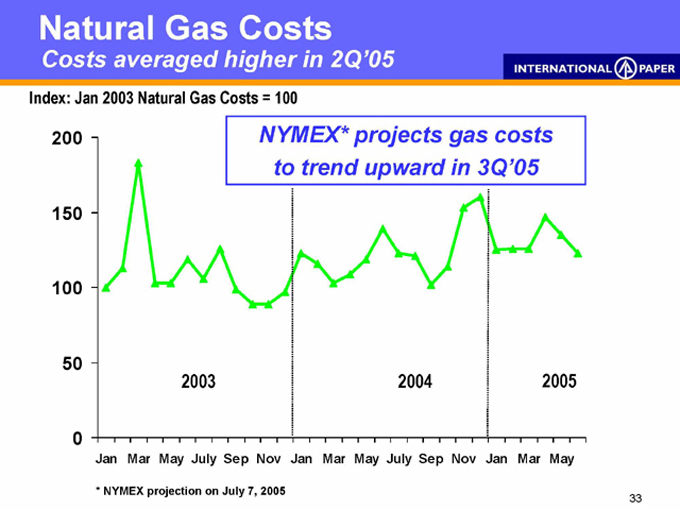

Natural Gas Costs

Costs averaged higher in 2Q’05

Index: Jan 2003 Natural Gas Costs = 100

Natural gas costs projected to trend upward in 3Q’05

200

150

100

50

0

2003

2004

2005

Jan Mar May July Sep Nov Jan Mar May July Sep Nov Jan Mar May

33

INTERNATIONAL PAPER

34