- IP Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

International Paper (IP) CORRESPCorrespondence with SEC

Filed: 4 May 07, 12:00am

MAURA ABELN SMITH SENIOR VICE PRESIDENT, GENERAL COUNSEL & CORPORATE SECRETARY | INTERNATIONAL PLACE III 6400 POPLAR AVENUE MEMPHIS, TN 38197

T 901-419-3829 F 901-214-1248 maura.abelnsmith@ipaper.com |

May 4, 2007

VIA Facsimile and EDGAR Correspondence

Stephen G. Krikorian

Accounting Branch Chief

Division of Corporation Finance

Room 4561

United States Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

| Re: | International Paper Company |

| Form 10-K for Fiscal Year Ended December 31, 2006 |

| File No. 1-03157 |

Dear Mr. Krikorian:

On behalf of International Paper Company (the “Company”), I am responding to comments of the staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission (the “Commission”) as set forth in your letter dated April 20, 2007 (the “Comment Letter”) relating to the above captioned Form 10-K (the “Form 10-K”). The numbered paragraphs below correspond to the numbered paragraphs in the Comment Letter. To facilitate your review, I have reproduced the text of the Staff’s comments in bold below.

The Company is filing this response letter via EDGAR submission in addition to providing you a facsimile copy of the submission.

Form 10-K

Introduction:

In order to fully respond to the four questions contained in the Comment Letter, we have provided an overview of the transactions which are the subject of your inquiry.

In connection with the sale in 2006 of approximately 5.6 million acres of forestlands, the Company and various wholly-owned subsidiaries received installment notes totaling approximately $4.8 billion with an initial term of 10 years, subject to extension for up to 4 five-year periods (resulting in a maximum term of 30 years), with interest earned based on the six- month LIBOR (the “Installment Notes”). The Installment Notes were credit-enhanced by

Mr. Krikorian

Page 2

May 4, 2007

irrevocable standby letters of credit from independent established lending institutions with a credit rating of at least AA/Aa2. The letters of credit guarantee timely payment of all principal and interest payable under the terms of the Installment Notes. The term of the letters of credit extend 105 days past the 30 year maximum term of the Installment Notes, and will be renegotiated and extended upon any extensions of the Installment Notes.

During the fourth quarter of 2006, the Company contributed these Installment Notes to three (3) newly formed entities (collectively referred to as the “Borrower Entities,” consisting of Basswood Forests LLC, Birch Forests LLC and Beech Forests LLC) in exchange for all of the membership interests (4% Class A and 96% Class B interests) in the Borrower Entities. The Company then subsequently contributed the Class A interests and International Paper promissory notes and demand loans (the “IP Notes”) to three (3) other newly formed entities (collectively referred to as the “Investor Entities,” consisting of Hickory Forests LLC, Hawthorn Forests LLC and Hazelnut Forests LLC) for Class A and Class B interests in the Investor Entities. The Company then sold all of these Class A interests to a third party investor, RBIP, Inc., a wholly-owned subsidiary of Cooperative Centrale Raiffeisenboerenleenbank, B.B. (“Rabobank”) (referred to herein as the “Investor”).

To facilitate your review of management’s analysis of the accounting for the formation and subsequent operation of the Borrower Entities and the Investor Entities, the following outlines the steps taken to form these entities.

Outline of Steps of the Transactions:

The Company’s forestland sales were made by three (3) separate International Paper legal entities (the “Sellers”). Consequently, separate legal entities were formed for the respective borrower and investor entities for each Seller. Since the formation and transaction steps for each of the Sellers were identical (except for the respective dollar amounts), the following steps apply to each:

| 1. | The Company sold forestlands to various independent third parties (unrelated to the Company or Investor) in exchange for cash and approximately $4.8 billion of Installment Notes. |

| 2. | The Company contributed the Installment Notes in exchange for all of the membership interests (4% Class A interests and 96% Class B interests) in the Borrower Entities. |

| 3. | The Company then contributed its Class A interests in the Borrower Entities, and the IP Notes totaling approximately $405 million, in exchange for all of the membership interests (32% Class A interests and 68% Class B interests) in the Investor Entities. |

| 4. | The Company then sold its 32% Class A interests in the Investor Entities to Investor for cash. |

| 5. | The Borrower Entities then borrowed approximately $4.8 billion from a third party lender, with the third party lender taking a security interest in the Installment Notes and long term International Paper Debt Securities (the “IP Debt Securities”) as described in step 6 below. |

2

Mr. Krikorian

Page 3

May 4, 2007

| 6. | The Borrower Entities then transferred the majority of the borrowing proceeds described in step 5 above, again approximately $4.8 billion, to the Company in exchange for IP Debt Securities. |

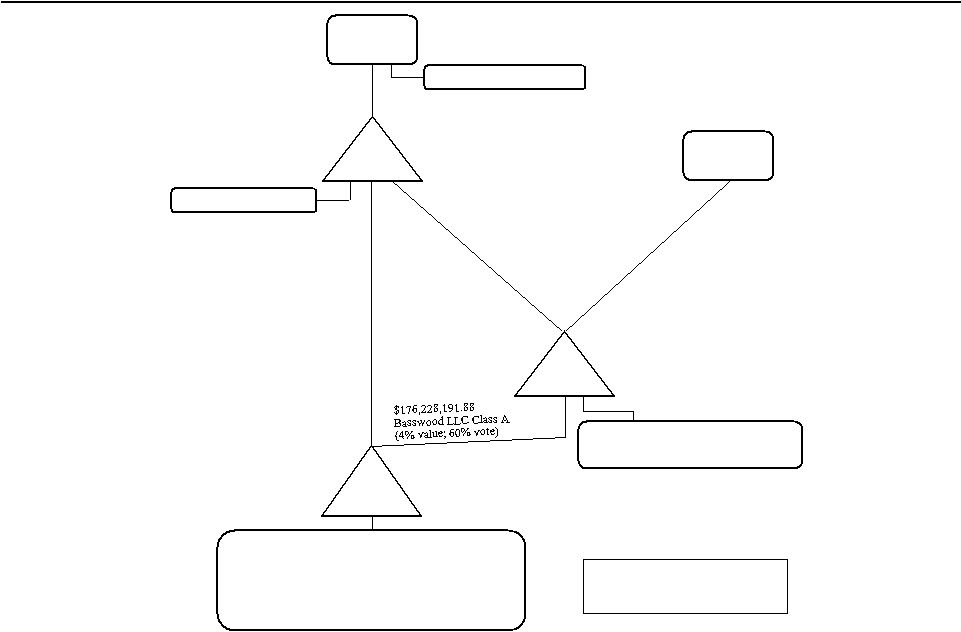

The resulting structures of the Borrower and Investor Entities are depicted inExhibit 1 (as an example for one of the three series of transactions.) As noted above, each of the three structures is identical except for the dollar amounts. Thus, the dollar amounts set forth below do not tie to the dollar amounts onExhibit 1 because the amounts set forth below represent the three transactions in the aggregate.

As a result of these transactions, the resulting opening balance sheets for the Borrower Entities and Investor Entities are shown below. Note that the Class A interests in the Investor Entities are held by the Investor, and the Class B interests in the Investor Entities are held by the Company.

Borrower Entity opening balance sheet:

| (in millions) | |||

Assets: | |||

Cash * | $ | 3.05 | |

Timber Notes | 4,828.78 | ||

IP Debt Securities | 4,847.20 | ||

Total Assets | $ | 9,679.03 | |

Liabilities and Partners’ Equity: | |||

Third Party Debt | $ | 4,850.25 | |

Investor Entity Interest in Borrower Entity | 193.15 | ||

IP Seller Interest in Borrower Entity | 4,635.63 | ||

Total Liabilities and Shareholder’s Equity | $ | 9,679.03 | |

| * | Cash balance before payment of fees |

Investor Entity opening balance sheet:

| (in millions) | |||

Assets: | |||

IP Notes and Demand Loans | $ | 405.04 | |

Interest in Borrower Entity | 193.15 | ||

Total Assets | $ | 598.19 | |

Liabilities and Partners’ Equity: | |||

Investor Entity Class A Interest | $ | 191.42 | |

Investor Entity Class B Interest | 406.77 | ||

Total Liabilities and Shareholder’s Equity | $ | 598.19 | |

3

Mr. Krikorian

Page 4

May 4, 2007

Management of the Entities:

Borrower Entities

The Investor Entities are the Managing Members of the Borrower Entities and manage the day-to-day operations of the Borrower Entities. However, the Investor Entities, as managing members of the Borrower Entities, will not have the ability to sell the notes or debt securities without first offering the Company the right to “receive a distribution of the notes or debt securities…in retirement of all or any portion of its (Class B) Interest…or purchase the notes or debt securities …for cash.” The Investor Entities cannot incur, assume, or guarantee any debt without the consent of the Company, but do have the ability to “possess, sell, transfer or otherwise assign rights in specific Property,” other than the right of first refusal described above.

Investor Entities

Investor is the Managing Member of Investor Entities and manages the day-to-day operations of Investor Entities. However, Investor, as the managing member of the Investor Entities, will not have the ability to sell the notes without first offering the Company the right to “receive a distribution of the notes in retirement of all or any portion of its (Class B) Interest…or purchase the notes …for cash.” Investor cannot incur, assume, or guarantee any debt without the consent of the Company, but does have the ability to “possess, sell, transfer or otherwise assign rights in specific Property,” other than the right of first refusal described above.

There are no other documents or arrangements between the parties to this transaction which would provide the Company with any “veto” rights, special voting rights, or other rights not described herein.

Profit and Loss Allocations for Borrower and Investor Entities:

The following outlines the allocations of profits and losses for the Borrower and Investor Entities pursuant to the terms of their respective operating agreements. All allocations are the same for all Borrower and Investor Entities except for items noted parenthetically for the Investor Entities:

| a. | Profits: |

| • | First, 99% of profits are allocated to the Class A Member and 1% to the Class B Member, until the Class A Member has been allocated the cumulative Class A Member First Priority Return, which is LIBOR plus 325 basis points, less any cumulative profits allocated to such Member for all prior years. |

| • | Second, profits remaining after the first allocation are allocated to the Members in proportion to and to the extent of an amount equal to the remainder, if any, of cumulative losses allocated to each Member pursuant to the loss allocation described below, less any cumulative profits allocated to such Member for all prior years. |

4

Mr. Krikorian

Page 5

May 4, 2007

| • | Third, 99% of profits are allocated to the Class B Member and 1% to the Class A Member, until the Class B Member has been allocated the cumulative Class B Member Second Priority Return, which is equal to LIBOR (LIBOR plus 149 basis points for the Investor Entities), less any cumulative profits previously allocated to such Member for all prior years. |

| • | Fourth, residual profits are allocated to the Members in proportion to their defined membership interests. |

| b. | Losses: |

| • | First, losses that are the remainder, if any, of the cumulative profits allocated to each Member pursuant to the fourth profit allocation described above, less any cumulative losses pursuant to this first loss allocation that has been allocated to such Member for all prior years. |

| • | Second, losses that are the remainder, if any, of the cumulative profits allocated to each Member pursuant to the third profit allocation described above, less any cumulative losses pursuant to this second loss allocation that has been allocated to such Member for all prior years. |

| • | Third, residual losses are allocated to the Members in proportion to their respective capital accounts. |

| c. | Special Allocations – gains or losses on sales or adjustments in value of the Installments Notes are allocated as follows: |

| • | Special Losses - First, 75% to the Class A Member and 25% to the Class B Member until the capital account of the Class A Member has been reduced to zero. Second, 100% to the Class B Member. |

| • | Special Gains - Gains are allocated to the Members in proportion to an amount equal to the remainder, if any, of the cumulative items of loss allocated to each Member pursuant to the special loss allocation described above less the cumulative items of gain allocated to each Member pursuant to this special gain allocation for all prior years. |

5

Mr. Krikorian

Page 6

May 4, 2007

Questions and Company Responses:

Question 1, part (a). “We note that based on your analysis of the Borrower and Investor Entities under the provisions of FIN 46(R) you determined that those entities are variable interest entities and that you are not the primary beneficiary. Provide us with details of your FIN 46(R) analysis that support your conclusions.”

Response to Question 1, part (a):

Basis for Accounting Under FIN 46(R):

Management determined that the accounting for these entities was subject to consolidation according to the provisions of FIN 46(R) since (1) none of the exceptions in paragraph 4 of FIN 46R apply, and (2) the entities are variable interest entities as determined in paragraph 5(c) whereby “the voting rights of some investors are not proportional to their obligations to absorb the expected losses of the entity, their rights to receive the expected residual returns of the entity, or both, and (ii) substantially all of the entity’s activities are conducted on behalf of an investor (the Company) that has disproportionately few voting rights.”

Analysis Under FIN 46(R):

The Company’s analysis of the transactions determined that the sources of variability of earnings/losses with respect to the Borrower Entities relate to the Installment Notes and the IP Debt Securities. However, it was determined that since the Company cannot bear its own credit risk (i.e. for risk associated with the IP Debt Securities), only the variability in the Installment Notes should be considered with respect to the Borrower Entities.

In connection with the Investor Entities, the sources of variability of earnings/losses would relate to changes in the value of the interests in the Borrower Entities and changes in the value of the IP Notes. Again, since the Company cannot bear its own credit risk, the variability with respect to the Investor Entities would come from the interests in the Borrower Entities, which as discussed above, would relate to changes in the value of the Installment Notes.

Thus, the Company concluded that all variability for both entities that relate to changes in the value of the IP Debt Securities would be borne by the Investor.

Based on the provisions in the agreements governing allocations of losses due to adjustments in the value of the Installment Notes whereby Investor, as holder of the Class A interests, absorbs 75% of any such losses until its capital account is reduced to zero, the Company concluded that 56.25% (i.e. 75% at the Investor Entities of 75% at the Borrower Entities) of such variability is borne by Investor.

Accordingly, the Company concluded that, as outlined in paragraph 14 of FIN 46(R), the Investor has an interest in the Investor Entities that will absorb a majority of the variable interests; and accordingly that under the provisions of FIN 46R, the Investor Entities should be consolidated by the Investor and not by the Company. It should be noted that the Investor agreed with this analysis and has confirmed to the Company that it is consolidating these entities in its consolidated financial statements.

To assist us in our analysis of these variable interests under FIN 46(R), management engaged Ernst & Young LLP to prepare financial analyses of these entities. These analyses were consistent with the preceding discussion and supportive of management’s conclusions.

6

Mr. Krikorian

Page 7

May 4, 2007

Question 1, part (b). “In addition, identify the reasons why you have accounted for these investments under the equity method of accounting. See paragraph 17 of APB 18.”

Response to Question 1, part (b):

We advise you, on a supplemental basis, that the Company hasnot accounted for its investments in the Class B member interests of the Borrower Entities and the Investor Entities under the equity method of accounting. As discussed below, the Company concluded upon final analysis of the nature of the Class B member interests that these investments should be accounted for as SFAS No. 115 “held-to-maturity” debt instruments and carried at amortized cost. This is consistent with the accounting treatment subsequent to the initial investment in the entities.

The disclosure in footnote 8, Variable Interest Entities and Preferred Securities of Subsidiaries, stating “International Paper determined that it is not the primary beneficiary of these newly formed entities and therefore its investments should be accounted for under the equity method of accounting” was not correct. This footnote was intended to focus on the fact that the Company determined that, under the provisions of FIN 46(R), it would not consolidate these entities. Instead we inadvertently mentioned equity accounting. The correct disclosure should have indicated that “International Paper determined that it is not the primary beneficiary of these newly formed entities and therefore should not consolidate its investments in these entities.” The Company will correct this error in future financial statements.

As discussed above, the Company’s investment in the Borrower Entities and the Investor Entities were in the Class B member interests of each respective entity. In evaluating how to account for its investment in these Class B interests, the Company considered various factors including: the Class B interests’ right of preference in distributions of cumulative earnings through dividends; liquidation preferences; the ability of the Class B holders to exercise significant influence over the operating and financial decisions of the respective Borrower and Investor Entities; the fixed face value and the right to a fixed rate of dividend (stated as a percentage of its fixed dollar face value); as well as the redemption rights associated with the interests. Based on this evaluation, the Company determined that these Class B interests represent preferred interests in the Borrower and Investor Entities. Further, the Company evaluated the accounting for these preferred interests under SFAS No. 115. Paragraph 3 of SFAS 115 states that, “Except as indicated in paragraph 4, this Statement establishes standards of financial accounting and reporting for investments in equity securities that have readily determinable fair values and for all investments in debt securities.” The glossary of SFAS 115 defines a debt security as follows, “Any security representing a creditor relationship with an enterprise. It also includes (a) preferred stock that by its terms either must be redeemed by the issuing enterprise or is redeemable at the option of the investor.”

Based on the evaluation of the various factors considered above, and since the Class B interests contain a redemption feature that provides the Company with the option to redeem

7

Mr. Krikorian

Page 8

May 4, 2007

its interests, the Company concluded that they represent debt securities under SFAS 115 and should not be accounted for under the equity method of accounting.

As an investment in a debt security, paragraph 7 of SFAS 115 permits investments to be classified as held-to-maturity (which are measured at amortized cost in the statement of financial position) only if the reporting enterprise has the positive intent and ability to hold those securities to maturity. Although the Company has the ability to redeem its investments in the Class B interests, Q&A 19 of SFAS 115 Q&A’s published by the FASB acknowledges that the classification of an investment as held to maturity is not inconsistent with the ability to call or redeem the securities, and is also not inconsistent with the Company’s intent to offset the debt under Question 2 below. Accordingly, the Company has accounted for the investment in the Class B Interests of Borrower LLC and Investor LLC as held to maturity SFAS 115 investments.

Question 2. “We also note that you have offset $5.0 billion of Class B interests in the entities against $5.0 billion of International Paper debt obligations held by these entities pursuant to the provisions of FIN 39. Provide us with details of your FIN 39 analysis sufficient to support your conclusions. Explain why an investment in stock of an entity can be offset against debt under FIN 39.”

Response to Question 2:

As noted in the above response to Question 1, part b, the Company determined that its investments in the Class B Interests in the Borrower Entities and Investor Entities did not represent an equity method investment, rather represents investments in debt securities under SFAS No. 115.

As discussed in paragraph 5 of FIN 39, “the offsetting of assets and liabilities in the balance sheet is improper except where a right of setoff exists. A right of setoff is a debtor’s legal right, by contract or otherwise, to discharge all or a portion of the debt owed to another party by applying against the debt an amount that the other party owes to the debtor. A right of setoff exists when all of the following conditions are met:

| a. | Each of two parties owes the other determinable amounts. |

| b. | The reporting party has the right to set off the amount owed with the amount owed by the other party. |

| c. | The reporting party intends to set off. |

| d. | The right of setoff is enforceable at law. |

A debtor having a valid right of setoff may offset the related asset and liability and report the net amount.”

Based on its analysis under the provisions of FIN 39, the Company determined that it has a right of setoff of its obligations under the IP Debt Securities with its investments in the respective Class B member interests. The Company executed Master Offset Agreements between the Company and each Borrower Entity and Investor Entity, providing that the

8

Mr. Krikorian

Page 9

May 4, 2007

Company (or its respective wholly owned subsidiary) shall have the legally enforceable right to require the entity to retire all or a portion of the Company’s Class B member interest by distributing to the Company the IP Debt Securities. Thus, the Company determined that it has a legally enforceable right of offset.

Based upon this analysis, at December 31, 2006 the Company offset $5.0 billion of its investments in Class B member interests against $5.0 billion of a total of $5.2 billion of IP Debt Securities held by the Borrower and Investor Entities, leaving net debt of approximately $200 million that was included in long-term debt in the Company’s consolidated balance sheet at December 31, 2006. The offset treatment and remaining net debt amount were disclosed in Note 8 of the Company’s financial statements included in its Form 10-K for the year ended December 31, 2006. This footnote also contains a reference to Note 12. Debt and Lines of Credit, where the $200 million is included in floating rate notes due 2001-2016 in the summary of long-term debt.

Question 3. “Describe how you considered the provisions of Rules 3-09 and 4-08(g) of Regulation S-X in determining that the presentation of separate financial statements or summarized financial information of equity investments accounted for under the equity method of accounting is not required for these entities. Also, you should address your consideration of paragraph 20(d) of APB No. 18 in your response. Tell us whether the offsetting of your Class B interests in the entities against your debt obligations held by these entities impacted your consideration of these Rules. If so, tell us why you believe that the testing for significances using the net amount (“the offset amount”) was a proper method for conducting this test.”

Response to Question 3:

The Company notes that Rule 3-09 and Rule 4-08(g) require separate financial statements or summarized financial information for certain investments in majority owned subsidiaries not consolidated by the registrant and/or less than majority owned subsidiaries accounted for by the equity method. The Company determined that its investment in the Class B debt securities did not meet the definition of a subsidiary as provided in 210.1-02(x) as the Company does not control the Borrower Entities or the Investor Entities. In addition, as discussed in Question 1, the Company’s investments in the Class B Interests are not accounted for under the equity method of accounting. Accordingly, the Company believes that the provisions of Rule 3-09 and Rule 4-08(g) are not applicable.

The Company also considered paragraph 20(d) of APB 18 which requires that when investments accounted for under the equity method are, in the aggregate, material in relation to the financial position or results of operations of an investor, it may be necessary for summarized information as to assets, liabilities, and results of operations of the investees to be presented in the notes or in separate statements. However as discussed in Question 1, the Company’s investment in the Class B Interests are not accounted for under the equity

9

Mr. Krikorian

Page 10

May 4, 2007

method of accounting, and accordingly, the Company believes that the disclosure provisions of paragraph 20(d) of APB 18 are not applicable.

Question 4. “Tell us what consideration you gave to providing supplemental information about the impact of these transactions on noncash investing and financing activities pursuant to paragraph 32 of SFAS No. 95.”

Response to Question 4:

Paragraph 32 of SFAS No. 95 provides that “Information about all investing and financing activities of an enterprise during a period that affect recognized assets or liabilities but that do not result in cash receipts or cash payments shall be reported in related disclosures. These disclosures may be either narrative or summarized in a schedule, and they shall clearly relate the cash and noncash aspects of transactions involving similar items.”

The Company concluded that the above transactions consisted principally of three categories:

| 1. | A noncash sale of timberlands for Installment Notes, |

| 2. | The noncash contribution of the Installment Notes by the Company for investments in the Borrower Entities, |

| 3. | Cash borrowings from the entities. |

The noncash sale of timberlands for Installment Notes is described in the beginning of Note 8, and is further described in the Forestlands section of Note 7 which states “the Company completed sales totaling approximately 5.6 million acres of forestland for proceeds of approximately $6.6 billion, including $1.8 billion in cash and $4.8 billion of Installment Notes supported by irrevocable letters of credit (See Note 8).” Furthermore, the Company’s consolidated statement of cash flows for the year ended December 31, 2006 includes under Operating Activities, a noncash add-back to net earnings of $4.8 billion for this noncash item.

Since both the contribution of the Installment Notes and the receipt of the investments in the Borrower Entities were both noncash transactions, they do not appear in the consolidated statement of cash flows. However, the contribution of the Installment Notes to the Borrower Entities for Class A and Class B interests in the entities, the contribution of the Class A interests in the Borrower Entities along with $400 million of IP Notes to the Investor Entities for Class A and Class B member interests, and the subsequent sale of the investment in the Class A interests in the Investor Entities are all disclosed in Note 8, together with the Company’s resulting $5.0 billion investment in the Class B interests in the entities at December 31, 2006. Thus, the Company concluded that the requirements of paragraph 32 of the cash and noncash aspects of these contributions were adequately disclosed in narrative form that would facilitate the understanding of a user of the Company’s financial statements in Note 8.

10

Mr. Krikorian

Page 11

May 4, 2007

Finally, the $4.8 billion of cash borrowings from the entities is discussed in the second paragraph of Note 8, and is also included in the caption Monetization of Timber Notes in Financing Activities in the consolidated statement of cash flows, including a separate reference next to the caption to Note 8 to further facilitate the understanding of the transaction for a financial statement user.

Thus, the Company believes that its disclosures in its 2006 financial statements relating to these transactions were consistent with the requirements of paragraph 32 of SFAS No. 95.

* * *

In addition, to the Staff’s request for responses in connection with the Comment Letter, I, on behalf of the Company, provide the following acknowledgement:

| • | the Company is responsible for the adequacy and accuracy of the disclosure in the filing; |

| • | Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| • | the Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

* * *

If you have any questions or require further information with regard to the foregoing, you may contact me by phone at (901) 419-3829 or by facsimile transmission at (901) 214-1248. Thank you for your time and consideration.

| Sincerely, |

| /s/ Maura A. Smith |

Maura A. Smith Senior Vice President, General Counsel and Corporate Secretary |

11

Exhibit 1

Timber Note Structure

12

1 Timber Note Financing EXHIBIT 1 Resulting Structure $4,229,476,605.03 Basswood LLC Class B (96% value; 40% vote) Basswood LLC IP Hickory LLC $369,350,000.00 IP Note $206,025.49 Hickory IP Demand Loan Timber Notes Face Amt.: $4,425,505,324.86 Timber Notes FMV: $4,405,704,796.91 IP Debt Securities: $4,423,000,000.00 Capitalized Costs (book): $ 888,695.31 Cash balance: $ 564,839.10 Debt: ($4,425,505,000.00) $4,423,000,000.00 $174,650,949.55 $174,650,949.55 Hickory LLC Class A $371,133,267.82 Hickory LLC Class B Investor SF LLC Capitalized costs for Tax purposes: Basswood $1,721,584.49 Hickory $ 206,076.41 (Investor Entity) (Borrower Entity) The structure set forth below is an example for one of the three series of transactions. Thus, the dollar amounts below do not tie to the dollar amounts on page 3 because the amounts set forth below represent one of the three series of transactions. |