Exhibit 99.5

Discussion Materials

May 26, 2011

Preliminary Draft—Confidential

? $30.60 offer price

– 37% premium to closing price of $22.33 as of May 23, 2011

– 30% premium to 30 day average of $23.45

– 18% premium to 52 week closing high of $25.90

? Obtained committed financing from UBS in an amount sufficient to consummate this transaction

– Hired Evercore and UBS as financial advisors

? Carefully reviewed regulatory implications of this combination and are confident that we will receive all

required approvals

? Ability to move quickly to complete confirmatory diligence and announce a transaction

? Our board of directors fully supports the transaction and is committed to this proposal

1

Overview

Preliminary Draft—Confidential

? Very attractive premium and very compelling multiple relative to relevant data points

– Premium on top of substantial stock price run up over last 2.5 years

? 37% premium is above most recent relevant precedent

– 27% premium in Smurfit-Stone transaction

? Premium above historical precedent paper and packaging transactions

– Over the last 10 years for all cash transactions, average premium of 29%

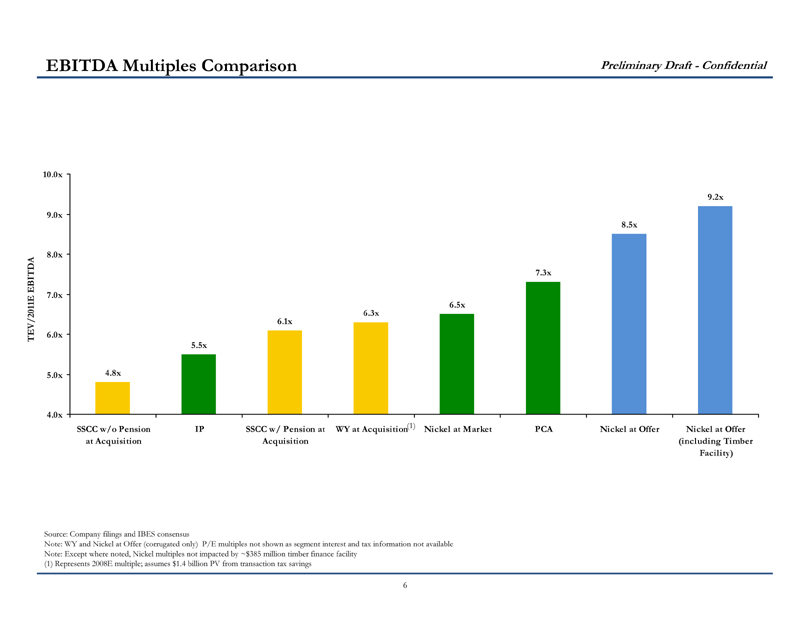

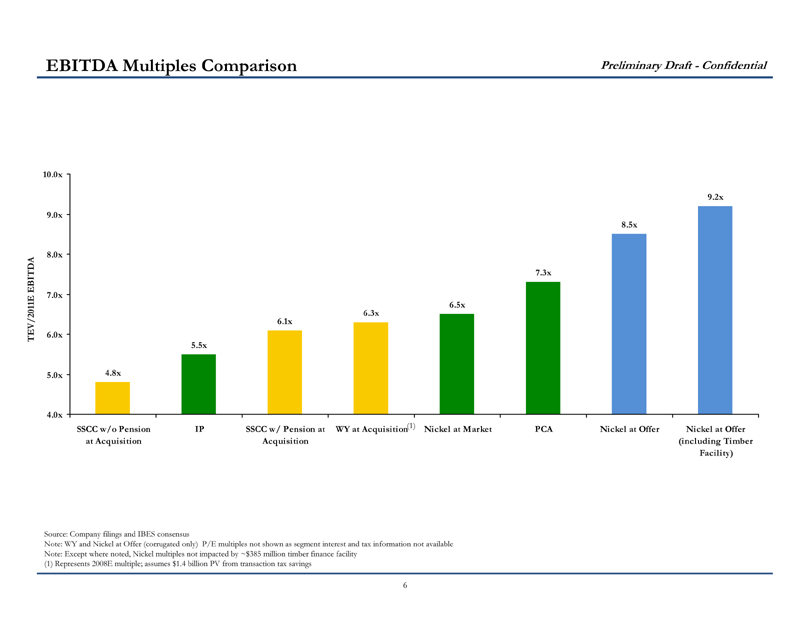

? 9.2x 2011 EBITDA offer multiple compares very favorably to sector multiples (includes $828mm of net

debt plus timber liability of $385mm, 8.5x excluding timber liability)

– Iron at 5.5x 2011 EBITDA and average in the sector of 6.3x

– IP / WY effective precedent transaction multiple of 6.3x

– RKT / SSCC precedent transaction multiple of 4.8x – 6.1x (depending on pension treatment)

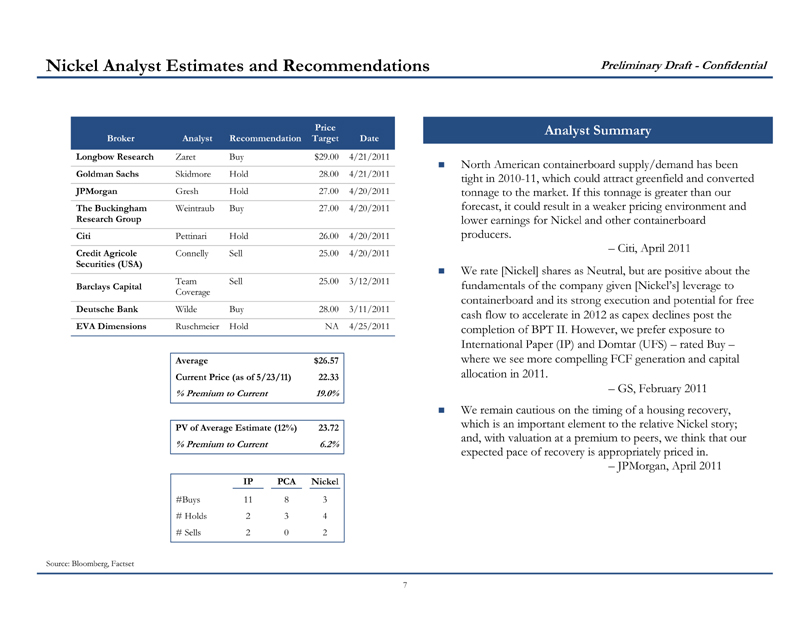

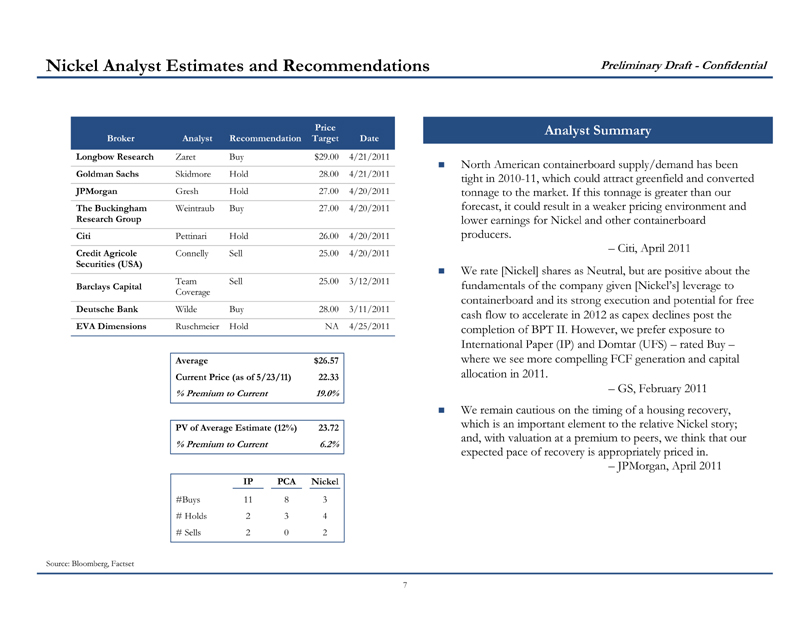

? Well in excess of the 1 year analyst price target average of $26.57 and above the highest price target of

$29.00

– 29% premium to the average price target discounted to today of $23.72

2

Compelling Value

Preliminary Draft—Confidential

Good assets / lower cost mills

Complementary converting facilities

Broad presence in North America

Substantial cost savings in a combination

Financing is committed

Low growth industry remains cyclical

Most of cost / production improvement

already underway and reflected in current

price

Recovery of building products is highly

uncertain

Timber finance facility represents an NPV

liability of ~$385mm

Positives Issues

3

Rationale

Preliminary Draft—Confidential

4

$30.60

$0.00

$5.00

$10.00

$15.00

$20.00

$25.00

$30.00

$35.00

5/23/2006 11/21/2006 5/23/2007 11/21/2007 5/22/2008 11/21/2008 5/22/2009 11/21/2009 5/22/2010 11/21/2010 5/23/2011

Offer price represents a substantial premium to historical trading price

Source: Factset

Note: Prices adjusted by Factset for splits, spin-offs and one-time cash dividend in Dec 2007

Price

Offer

Premium

Current $22.33 37%

52-Week High $25.90 18%

52-Week Low $15.58 96%

1 Month Avg $23.45 30%

2 Month Avg $23.17 32%

3 Month Avg $23.03 33%

2008 Low $2.13 1337%

Nickel 5-Year Stock Price Performance

Preliminary Draft—Confidential

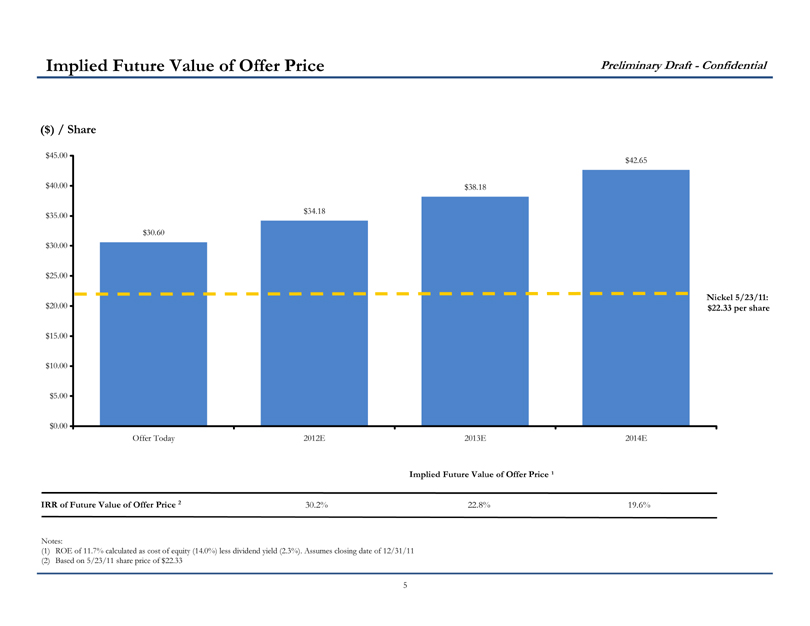

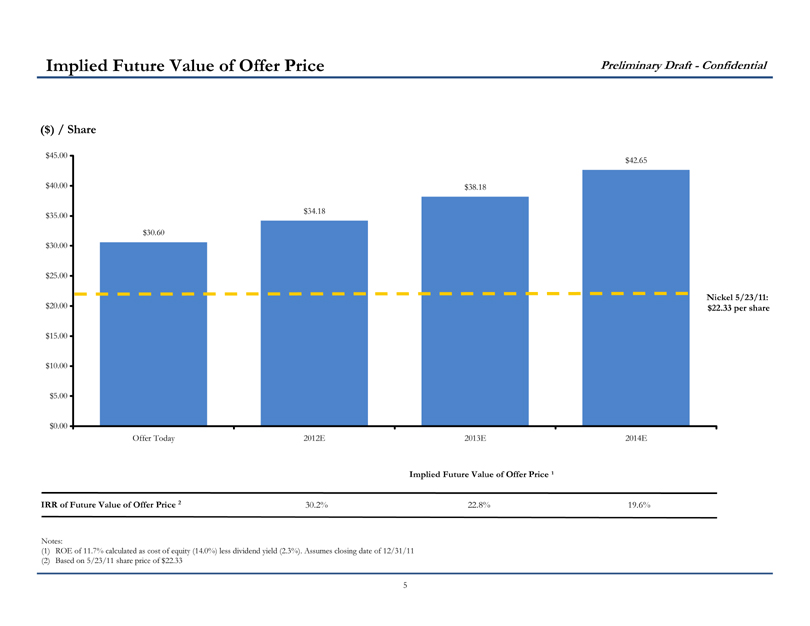

$30.60

$34.18

$38.18

$42.65

$0.00

$5.00

$10.00

$15.00

$20.00

$25.00

$30.00

$35.00

$40.00

$45.00

Offer Today 2012E 2013E 2014E

Notes:

(1) ROE of 11.7% calculated as cost of equity (14.0%) less dividend yield (2.3%). Assumes closing date of 12/31/11

(2) Based on 5/23/11 share price of $22.33

IRR of Future Value of Offer Price 2 30.2% 22.8% 19.6%

Nickel 5/23/11:

$22.33 per share

Implied Future Value of Offer Price ¹

5

($) / Share

Implied Future Value of Offer Price

Preliminary Draft—Confidential

6

Source: Company filings and IBES consensus

Note: WY and Nickel at Offer (corrugated only) P/E multiples not shown as segment interest and tax information not available

Note: Except where noted, Nickel multiples not impacted by ~$385 million timber finance facility

(1) Represents 2008E multiple; assumes $1.4 billion PV from transaction tax savings

4.8x

5.5x

6.1x

6.3x

6.5x

7.3x

8.5x

9.2x

4.0x

5.0x

6.0x

7.0x

8.0x

9.0x

10.0x

SSCC w/o Pension

at Acquisition

IP SSCC w/ Pension at

Acquisition

WY at Acquisition Nickel at Market PCA Nickel at Offer Nickel at Offer

(including Timber

Facility)

TEV/2011E EBITDA

(1)

EBITDA Multiples Comparison

Preliminary Draft—Confidential

7

North American containerboard supply/demand has been

tight in 2010-11, which could attract greenfield and converted

tonnage to the market. If this tonnage is greater than our

forecast, it could result in a weaker pricing environment and

lower earnings for Nickel and other containerboard

producers.

– Citi, April 2011

We rate [Nickel] shares as Neutral, but are positive about the

fundamentals of the company given [Nickel’s] leverage to

containerboard and its strong execution and potential for free

cash flow to accelerate in 2012 as capex declines post the

completion of BPT II. However, we prefer exposure to

International Paper (IP) and Domtar (UFS) – rated Buy –

where we see more compelling FCF generation and capital

allocation in 2011.

– GS, February 2011

We remain cautious on the timing of a housing recovery,

which is an important element to the relative Nickel story;

and, with valuation at a premium to peers, we think that our

expected pace of recovery is appropriately priced in.

– JPMorgan, April 2011

Analyst Summary

Source: Bloomberg, Factset

Broker Analyst Recommendation

Price

Target Date

Longbow Research Zaret Buy $29.00 4/21/2011

Goldman Sachs Skidmore Hold 28.00 4/21/2011

JPMorgan Gresh Hold 27.00 4/20/2011

The Buckingham

Research Group

Weintraub Buy 27.00 4/20/2011

Citi Pettinari Hold 26.00 4/20/2011

Credit Agricole

Securities (USA)

Connelly Sell 25.00 4/20/2011

Barclays Capital Team

Coverage

Sell 25.00 3/12/2011

Deutsche Bank Wilde Buy 28.00 3/11/2011

EVA Dimensions Ruschmeier Hold NA 4/25/2011

Average $26.57

Current Price (as of 5/23/11) 22.33

% Premium to Current 19.0%

PV of Average Estimate (12%) 23.72

% Premium to Current 6.2%

IP PCA Nickel

#Buys 11 8 3

# Holds 2 3 4

# Sells 2 0 2

Nickel Analyst Estimates and Recommendations