|

Exhibit 99.2

|

John V. Faraci Second Quarter Chairman & 2011 Review Chief Executive Officer

July 28, 2011

Tim S. Nicholls Senior Vice President & Chief Financial Officer

Forward-Looking Statements

Certain statements in these slides and made during this presentation may be considered forward-looking statements. These statements reflect management’s current views and are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these statements. Factors which could cause actual results to differ include but are not limited to: (i) increases in interest rates; (ii) industry conditions, including but not limited to changes in the cost or availability of raw materials, energy and transportation costs, competition we face, cyclicality and changes in consumer preferences, demand and pricing for our products; (iii) global economic conditions and political changes, including but not limited to the impairment of financial institutions, changes in currency exchange rates, credit ratings issued by recognized credit rating organizations, the amount of our future pension funding obligation, changes in tax laws and pension and health care costs; (iv) unanticipated expenditures related to the cost of compliance with existing and new environmental and other governmental regulations and to actual or potential litigation; (v) whether we experience a material disruption at one of our manufacturing facilities and risks inherent in conducting business through a joint venture; and (vi) our ability to achieve the benefits we expect from strategic acquisitions and divestitures. These and other factors that could cause or contribute to actual results differing materially from such forward looking statements are discussed in greater detail in the company’s Securities and Exchange Commission (“SEC”) filings. Other important factors that could cause or contribute to actual results differing materially are included but are not limited to those discussed in the SEC filings of Temple-Inland Inc. (“Temple-Inland”). We undertake no obligation to publicly update any forward-looking statements or other information related to this presentation or the tender offer for the outstanding shares of common stock (including the associated preferred stock purchase rights) of Temple-Inland, whether as a result of new information, future events or otherwise.

Statements Relating to Non-GAAP Financial Measures

During the course of this presentation, certain non-U.S. GAAP financial information will be presented.

A reconciliation of those numbers to U.S. GAAP financial measures is available on the company ‘s website at internationalpaper.com under Investors.

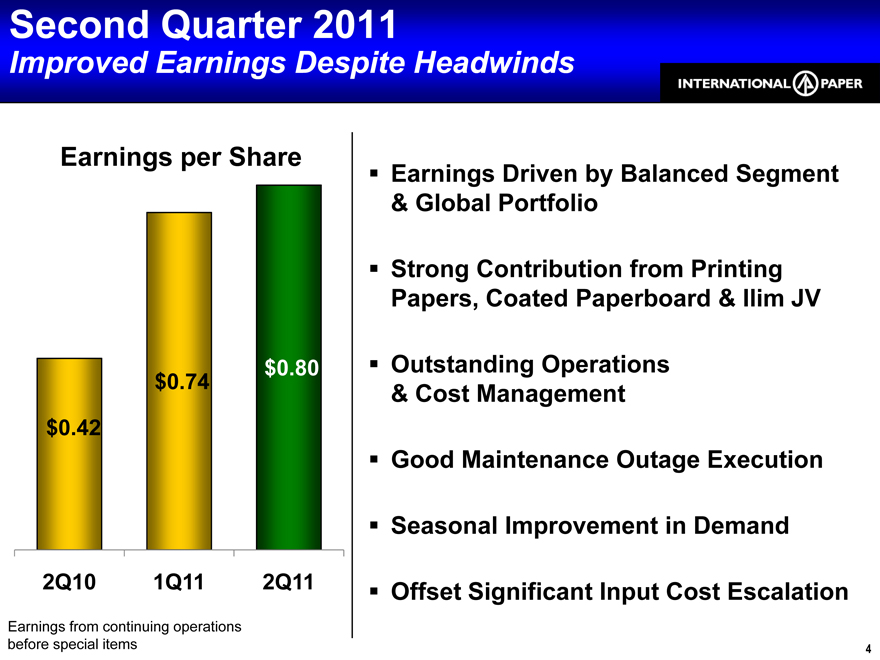

Second Quarter 2011

Improved Earnings Despite Headwinds

Earnings per Share

$0.80 $0.74

$0.42

2Q10 1Q11 2Q11

Earnings from continuing operations before special items

Earnings Driven by Balanced Segment

& Global Portfolio

Strong Contribution from Printing Papers, Coated Paperboard & Ilim JV

Outstanding Operations

& Cost Management

Good Maintenance Outage Execution Seasonal Improvement in Demand Offset Significant Input Cost Escalation

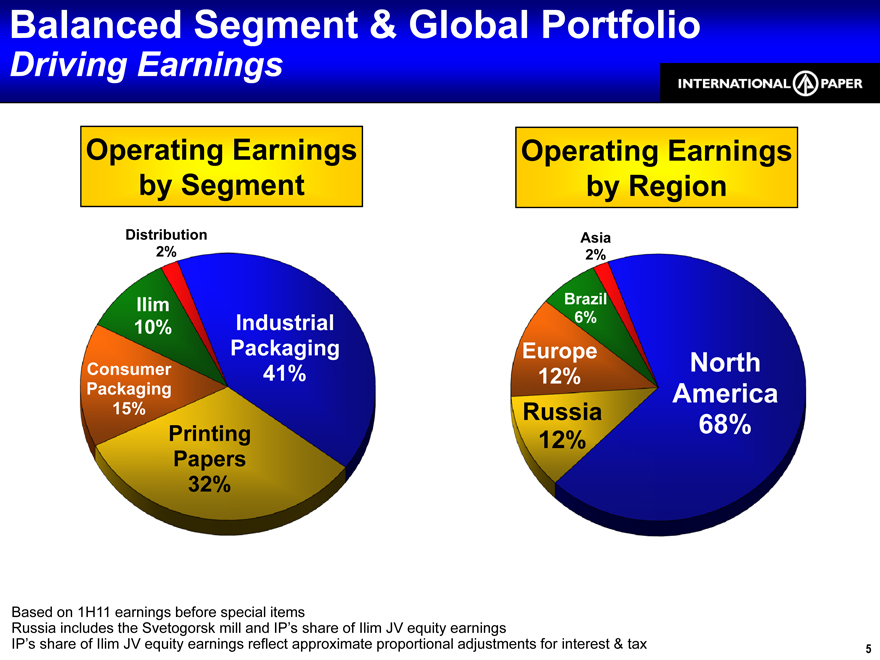

Balanced Segment & Global Portfolio

Driving Earnings

Operating Earnings by Segment

Distribution 2%

Ilim

10% Industrial Packaging

Consumer 41% Packaging 15%

Printing Papers 32%

Operating Earnings by Region

Asia 2%

Brazil 6%

Europe North 12%

America

Russia

68%

12%

Based on 1H11 earnings before special items

Russia includes the Svetogorsk mill and IP’s share of Ilim JV equity earnings

IP’s share of Ilim JV equity earnings reflect approximate proportional adjustments for interest & tax 5

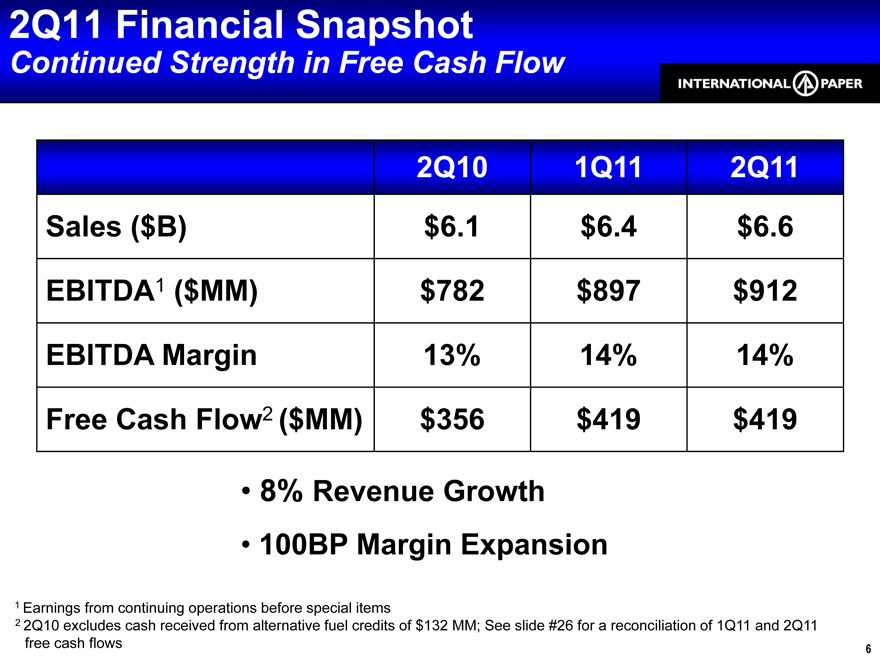

2Q11 Financial Snapshot

Continued Strength in Free Cash Flow

2Q10 1Q11 2Q11 Sales ($B) $6.1 $6.4 $6.6

EBITDA1 ($MM) $782 $897 $912 EBITDA Margin 13% 14% 14% Free Cash Flow2 ($MM) $356 $419 $419

• 8% Revenue Growth

• 100BP Margin Expansion

1 Earnings from continuing operations before special items

2 2Q10 excludes cash received from alternative fuel credits of $132 MM; See slide #26 for a reconciliation of 1Q11 and 2Q11 free cash flows 6

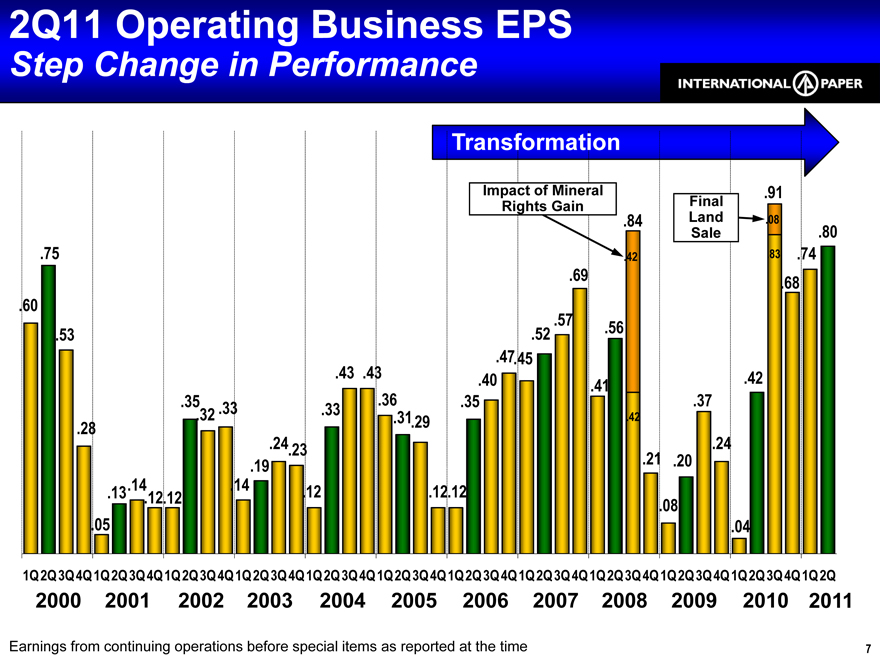

2Q11 Operating Business EPS

Step Change in Performance

Transformation

Impact of Mineral .91 Rights Gain Final

.84 Land ..08 .80

Sale

.75 .42 .83 .74 .69 .68 .60 .57 .56 .53 .52 .43 .43 .47.45 .40 .41 .42 .35 .36 .35 .37 .32 .33 .33 .31.29 .42 .28 .24.23 .21 .24 .19 .20 .13.14 .14 .12 .12.12 .12.12 .08 .05 .04

1Q 2Q 3Q4Q 1Q2Q 3Q4Q 1Q 2Q3Q 4Q1Q 2Q3Q 4Q1Q 2Q 3Q4Q 1Q2Q 3Q4Q 1Q2Q 3Q 4Q1Q 2Q3Q 4Q1Q 2Q3Q 4Q 1Q2Q 3Q4Q 1Q2Q 3Q 4Q1Q 2Q

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Earnings from continuing operations before special items as reported at the time 7

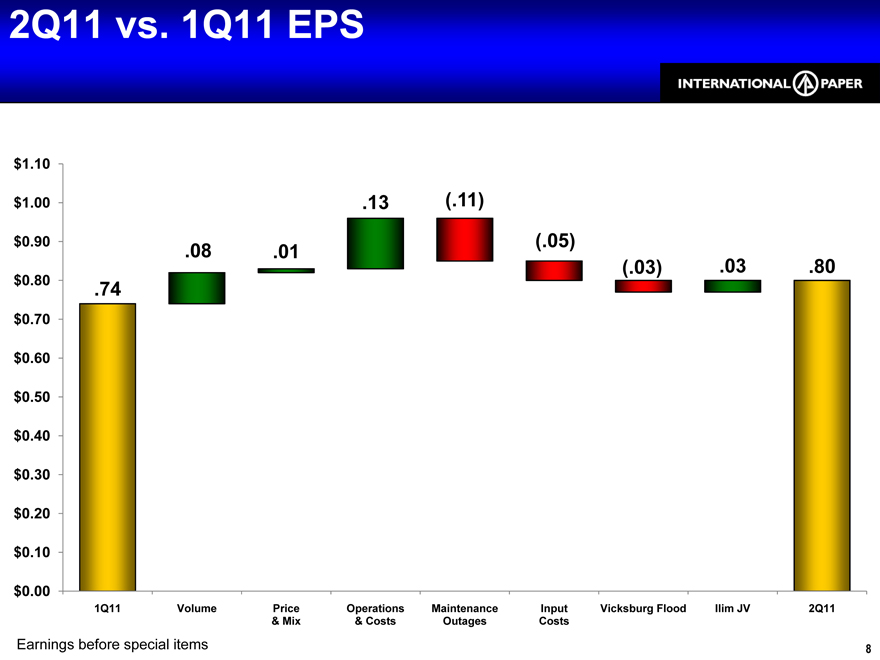

2Q11 vs. 1Q11 EPS

$1.10

$1.00 .13 (.11) $0.90 .08 (.05) .01 $0.80 (.03) .03 .80 .74

$0.70 $0.60 $0.50 $0.40 $0.30 $0.20 $0.10

$0.00

1Q11 Volume Price Operations Maintenance Input Vicksburg Flood Ilim JV 2Q11

& Mix & Costs Outages Costs

Earnings before special items 8

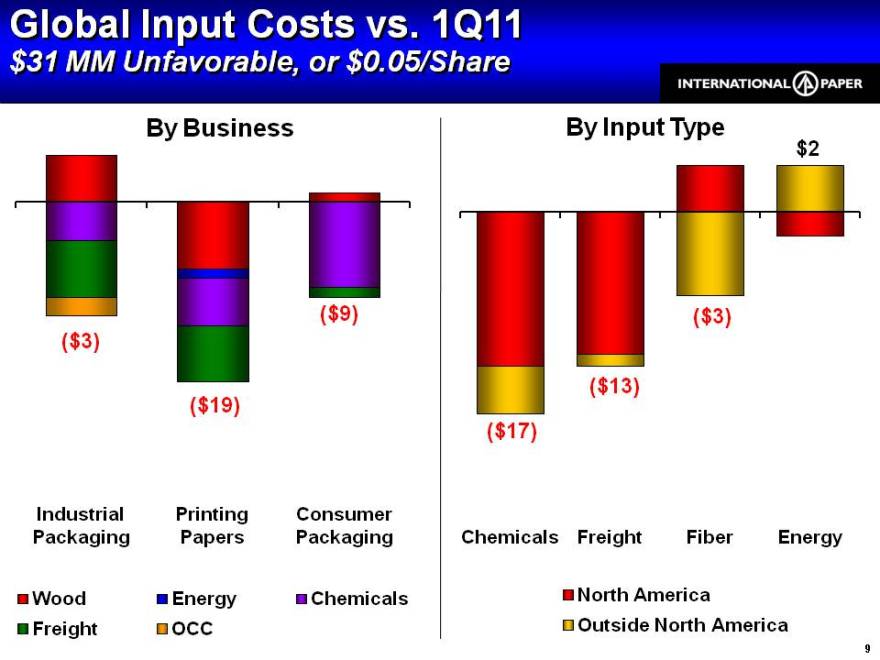

Global Input Costs vs. 1Q11

$31 MM Unfavorable, or $0.05/Share

By Business

($9)

($3)

($19)

Industrial Printing Consumer Packaging Papers Packaging

OCC Freight Chemicals Energy Wood

By Input Type $2

($3)

($13)

($17)

Chemicals Freight Fiber Energy

Outside North America North America

9

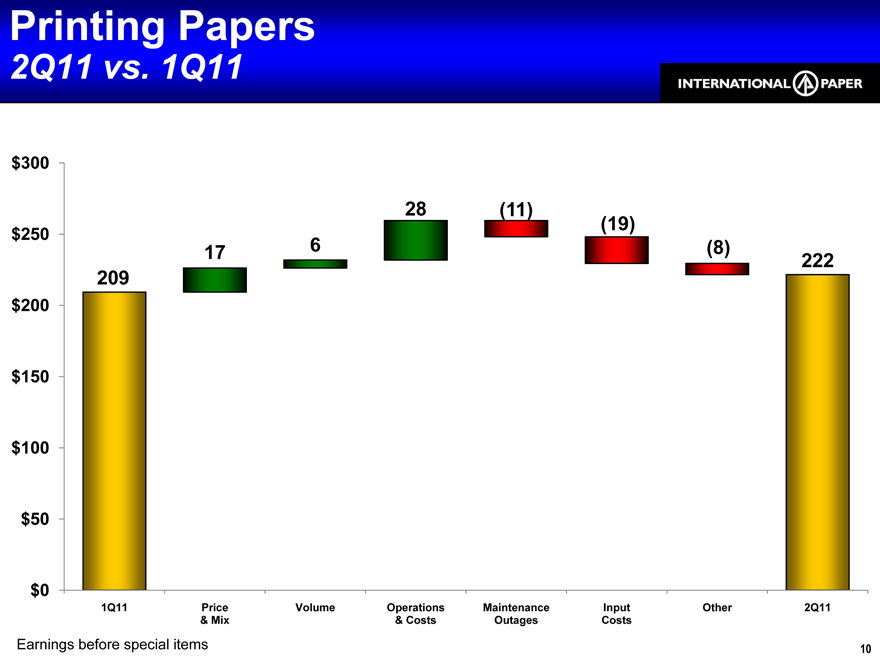

Printing Papers

2Q11 vs. 1Q11

$300

28 (11)

$250

17 6 (8)

209 222

$200 $150 $100 $50

$0

1Q11 Price Volume Operations Maintenance Input Other 2Q11

& Mix & Costs Outages Costs

Earnings before special items 10

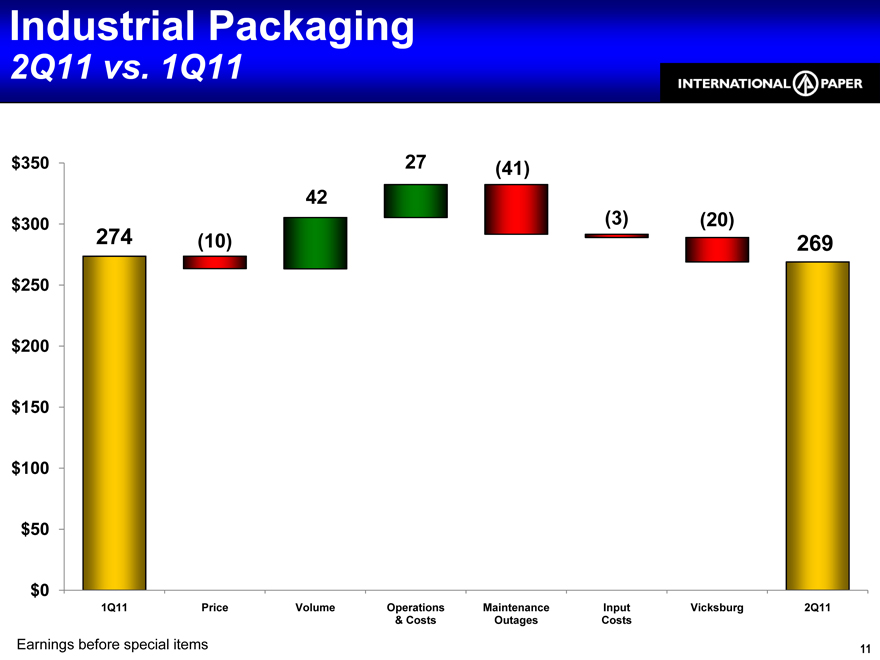

Industrial Packaging

2Q11 vs. 1Q11

$350 27 (41) 42 $300 274 (3) (20)

$250 $200 $150 $100 $50

$0

1Q11 Price Volume Operations Maintenance Input Vicksburg 2Q11

& Costs Outages Costs

Earnings before special items 11

N.A. Industrial Packaging Relative EBITDA Margins

18.5%

17.6% 17.5% 17.0%

15.8% 16.1%

12.8%

12.2% 9.7%

IP Competitor A Competitor B 2Q10 1Q11 2Q11

IP EBITDA margins based on North American Industrial Packaging operating profit before special items. Competitor EBITDA margin estimates obtained from public filings and IP analysis

Excludes revenue from trade volumes 12

U.S. Box Demand

Agriculture West Impacted by Weather

1H11 vs. 1H10 Box Shipments

1.5% 1.4%

1.2%

1.0%

0.6% 0.5%

0.0%

(0.3%) -0.5%

IP Industry

Total Shipments Total Shipments Excluding West Region

Box demand on an FBA reporting basis 13

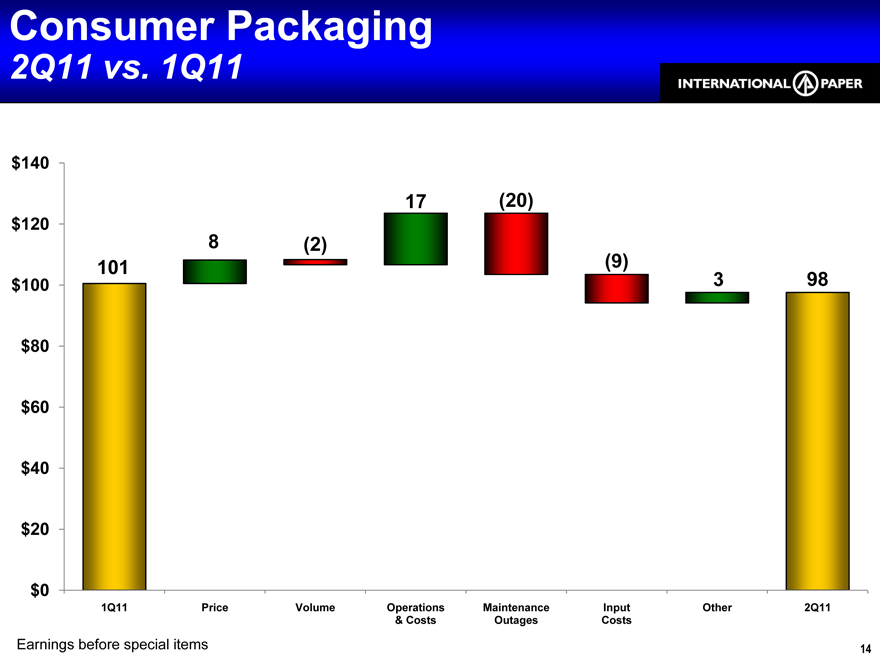

Consumer Packaging

2Q11 vs. 1Q11

$140

17 (20)

$120

8 (2)

101 (9) 98

$100 3 $80 $60 $40 $20

$0

1Q11 Price Volume Operations Maintenance Input Other 2Q11

& Costs Outages Costs

Earnings before special items 14

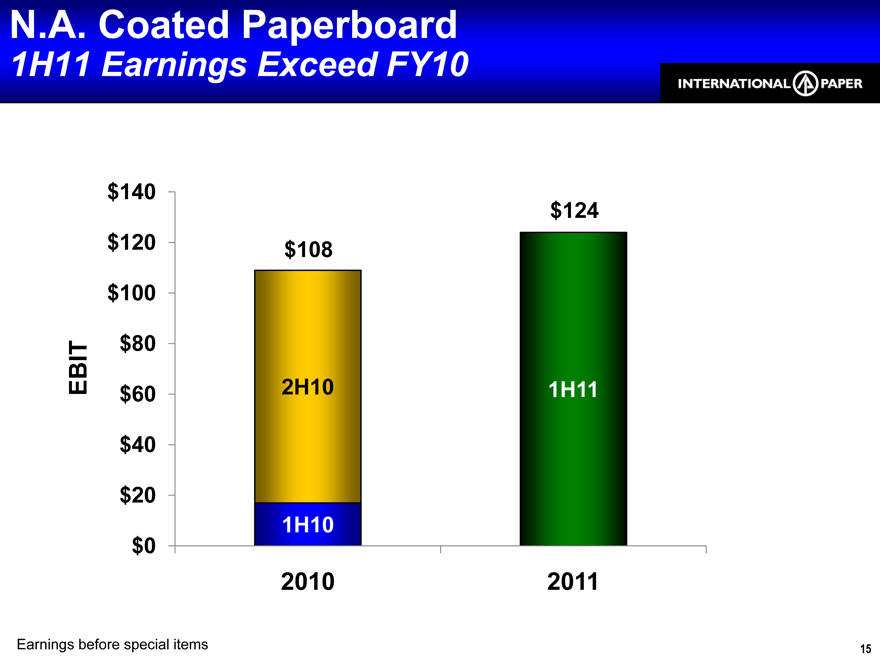

N.A. Coated Paperboard

1H11 Earnings Exceed FY10

$140 $124 $120 $108 $100

IT $80

EB $60 2H10 1H11 $40

$20

1H10 $0

2010 2011

Earnings before special items 15

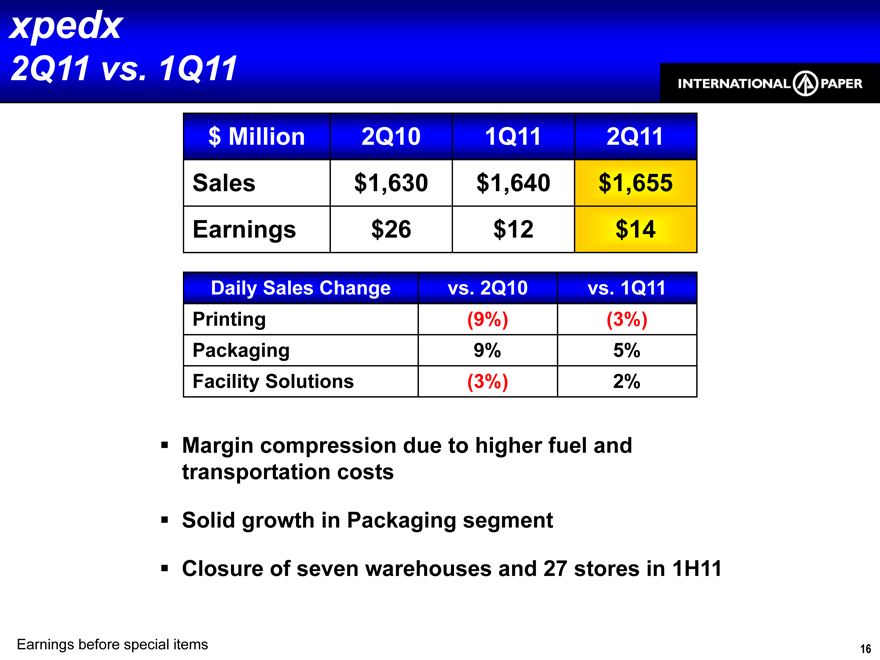

xpedx

2Q11 vs. 1Q11

$ Million 2Q10 1Q11 2Q11 Sales $1,630 $1,640 $1,655 Earnings $26 $12 $14

Daily Sales Change vs. 2Q10 vs. 1Q11 Printing (9%) (3%) Packaging 9% 5% Facility Solutions (3%) 2%

Margin compression due to higher fuel and transportation costs

Solid growth in Packaging segment

Closure of seven warehouses and 27 stores in 1H11

Earnings before special items 16

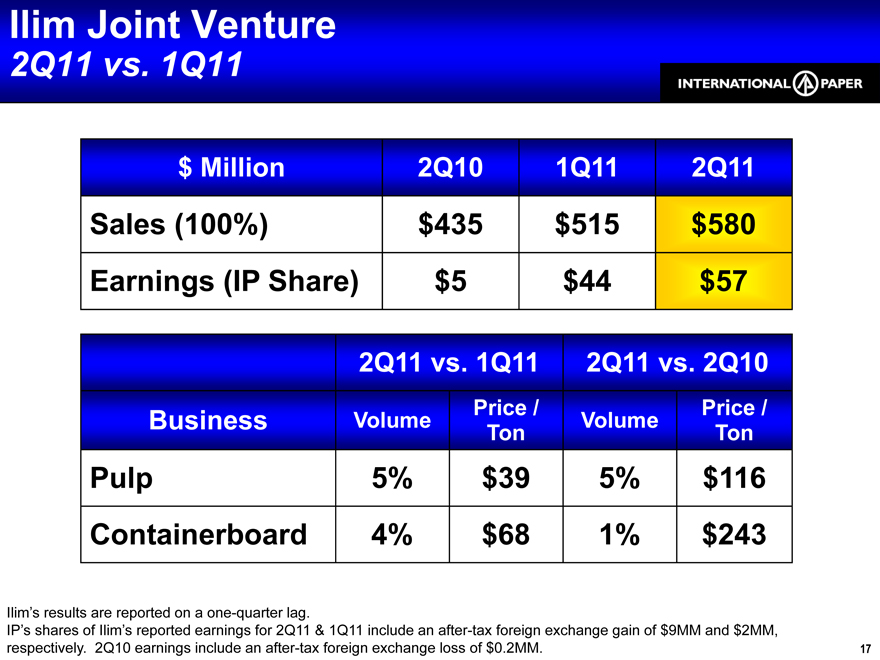

Ilim Joint Venture

2Q11 vs. 1Q11

$ Million 2Q10 1Q11 2Q11

Sales (100%) $435 $515 $580 Earnings (IP Share) $5 $44 $57

2Q11 vs. 1Q11 2Q11 vs. 2Q10

Price / Price / Business Volume Volume Ton Ton

Pulp 5% $39 5% $116 Containerboard 4% $68 1% $243

Ilim’s results are reported on a one-quarter lag.

IP’s shares of Ilim’s reported earnings for 2Q11 & 1Q11 include an after-tax foreign exchange gain of $9MM and $2MM, respectively. 2Q10 earnings include an after-tax foreign exchange loss of $0.2MM. 17

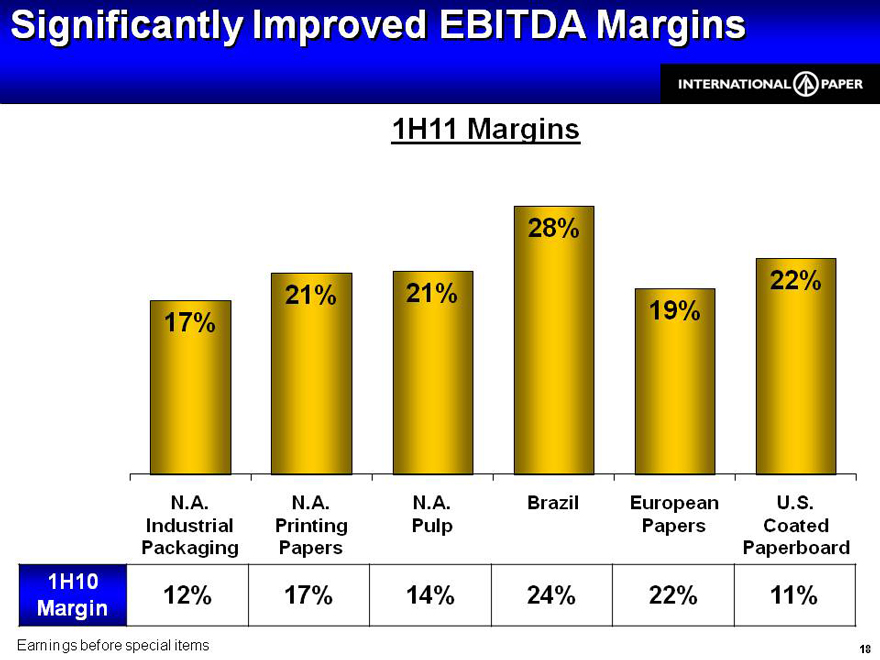

Significantly Improved EBITDA Margins

1H11 Margins

28%

22% 21% 21% 17% 19%

N.A. N.A. N.A. Brazil European U.S. Industrial Printing Pulp Papers Coated Packaging Papers Paperboard 1H10 12% 17% 14% 24% 22% 11% Margin

Earnings before special items 18

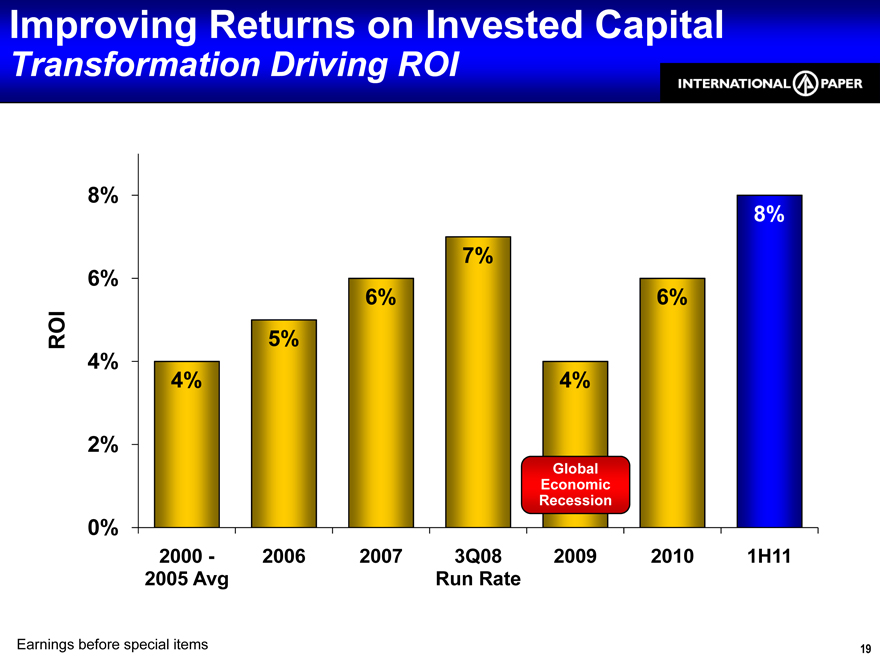

Improving Returns on Invested Capital

Transformation Driving ROI

8%

8% 7% 6%

6% 6% ROI 5% 4%

4% 4%

2%

Global Economic Recession

0%

2000—2006 2007 3Q08 2009 2010 1H11 2005 Avg Run Rate

Earnings before special items 19

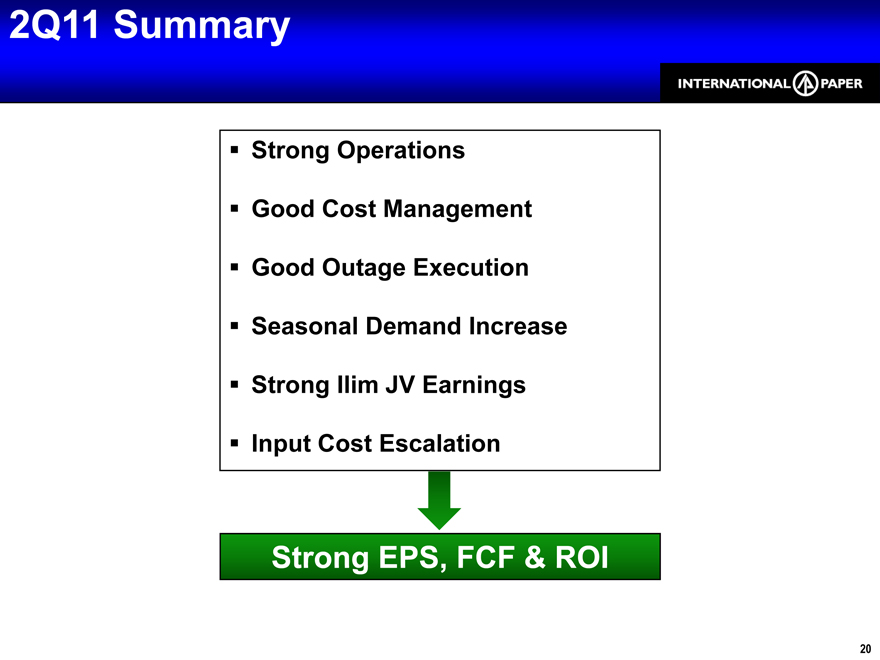

2Q11 Summary

Strong Operations Good Cost Management Good Outage Execution Seasonal Demand Increase Strong Ilim JV Earnings Input Cost Escalation

Strong EPS, FCF & ROI

20

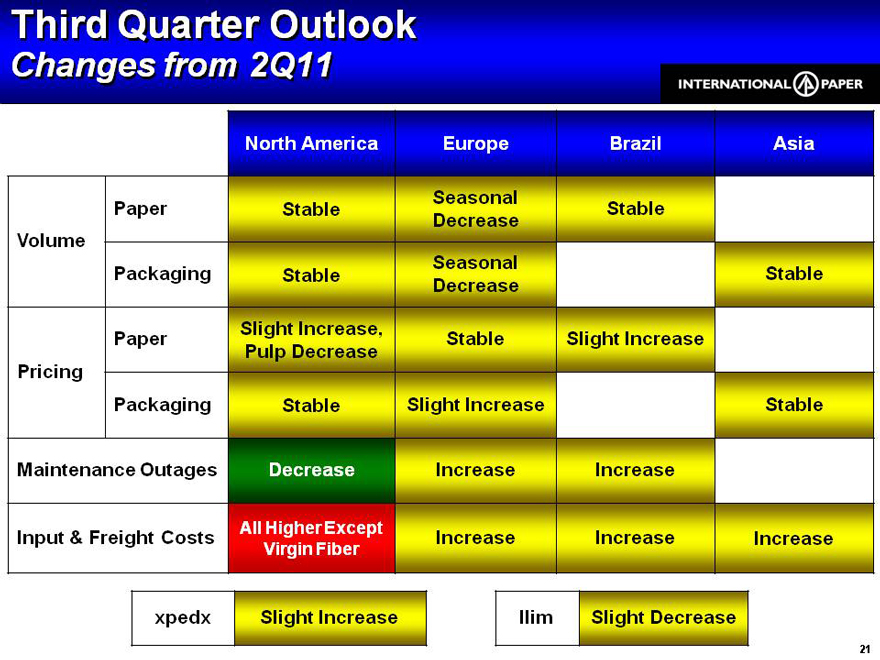

Third Quarter Outlook

Changes from 2Q11

North America Europe Brazil Asia

Seasonal

Paper Stable Stable Decrease Volume Seasonal

Packaging Stable Decrease

Slight Increase,

Paper Stable Slight Increase Pulp Decrease Pricing

Packaging Stable Slight Increase Stable

Maintenance Outages

Decrease Increase Increase

All Higher Except

Input & Freight Costs Increase Increase Increase

Virgin Fiber

xpedx Slight Increase Ilim Slight Decrease

21

Other Information

Additional Information

This communication does not constitute an offer to buy or solicitation of an offer to sell any securities. The offer and solicitation to purchase shares of common stock, par value $1.00 per share (and the associated preferred stock purchase rights), of Temple-Inland is only being made pursuant to a Tender Offer Statement on Schedule TO (including the Offer to Purchase, Letter of Transmittal and other related tender offer materials) filed by International Paper Company (the “Company”) and Metal Acquisition Inc. with the SEC on July 12, 2011 (as they may be amended and supplemented from time to time). INVESTORS AND SECURITY HOLDERS OF TEMPLE-INLAND ARE URGED TO READ THESE AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of these documents and other documents filed with the SEC by the Company through the web site maintained by the SEC at http://www.sec.gov. The tender offer expires at 5:00 p.m., Eastern time, on August 9, 2011, unless it is extended. If the tender offer is extended, the Company will issue a press release announcing the extension at or before 9:00 a.m., Eastern time, on the next business day after the date the tender offer was scheduled to expire.

In connection with the proposed transaction, the Company may file a proxy statement with the SEC. Any definitive proxy statement will be mailed to stockholders of Temple-Inland. INVESTORS AND SECURITY HOLDERS OF TEMPLE-INLAND ARE URGED TO READ THESE AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by the Company through the web site maintained by the SEC at http://www.sec.gov. 22

Other Information

Certain Information Regarding Participants

The Company and certain of its respective directors and executive officers may be deemed to be participants in the proposed transaction under the rules of the SEC. Security holders may obtain information regarding the names, affiliations and interests of the Company’s directors and executive officers in the Company’s Annual Report on Form 10–K for the year ended December 31, 2010 which was filed with the SEC on February 25, 2011, and its proxy statement for the 2011 Annual Meeting, which was filed with the SEC on April 8, 2011. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the interests of these participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will also be included in any proxy statement and other relevant materials to be filed with the SEC when they become available.

23

Appendix

Investor Relations Contacts

Glenn R. Landau 901-419-1731 Emily Nix 901-419-4987

Media Contact

Tom Ryan 901-419-4333

24

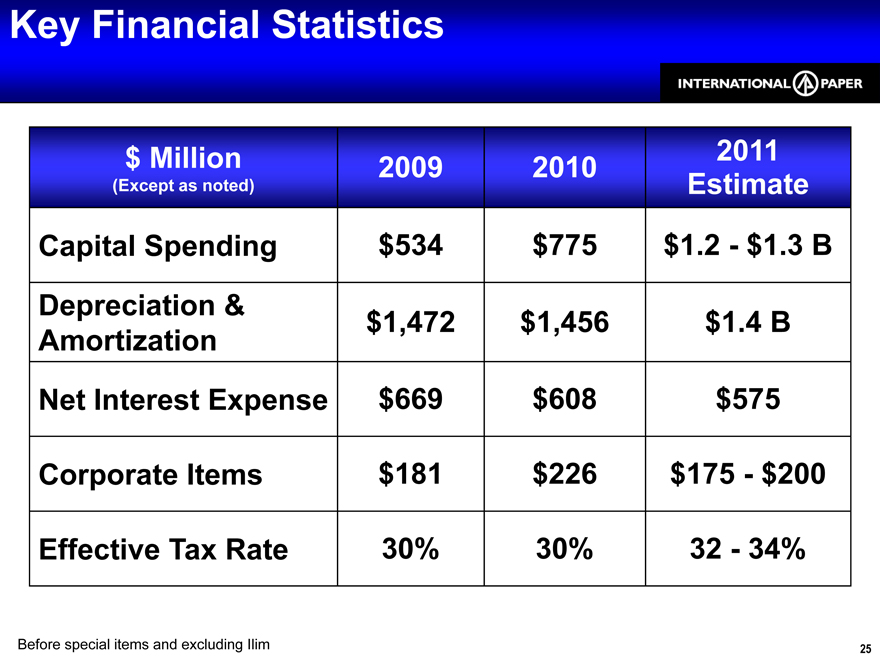

Key Financial Statistics

$ Million 2011 2009 2010

(Except as noted) Estimate

Capital Spending $534 $775 $1.2 - $1.3 B Depreciation & $1,472 $1,456 $1.4 B Amortization Net Interest Expense $669 $608 $575

Corporate Items $181 $226 $175 - $200

Effective Tax Rate 30% 30% 32 - 34%

Before special items and excluding Ilim 25

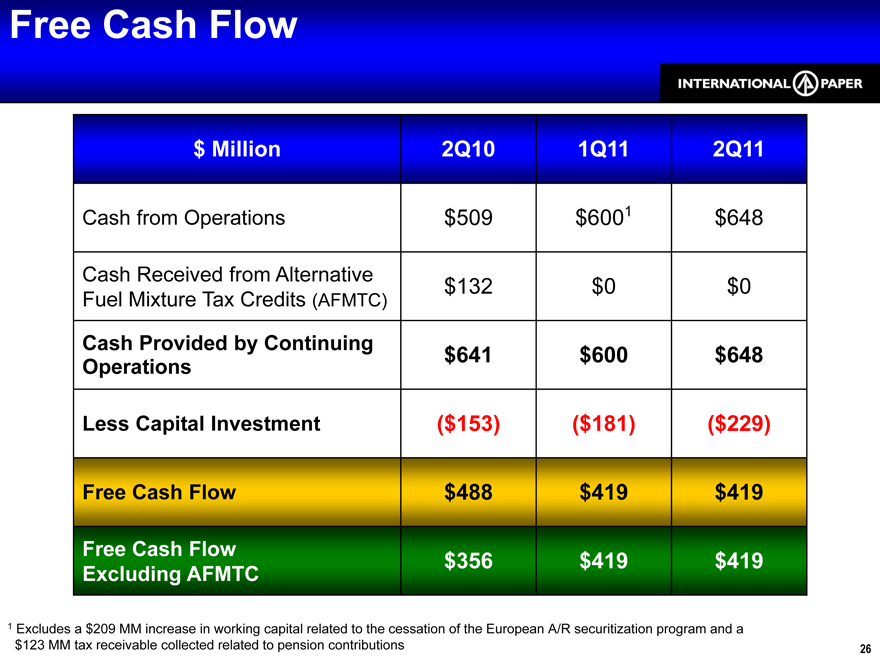

Free Cash Flow

$ Million 2Q10 1Q11 2Q11

Cash from Operations $509 $6001 $648

Cash Received from Alternative $132 $0 $0 Fuel Mixture Tax Credits (AFMTC)

Cash Provided by Continuing $641 $600 $648 Operations

Less Capital Investment ($153) ($181) ($229)

Free Cash Flow $488 $419 $419

Free Cash Flow $356 $419 $419 Excluding AFMTC

1 Excludes a $209 MM increase in working capital related to the cessation of the European A/R securitization program and a $123 MM tax receivable collected related to pension contributions 26

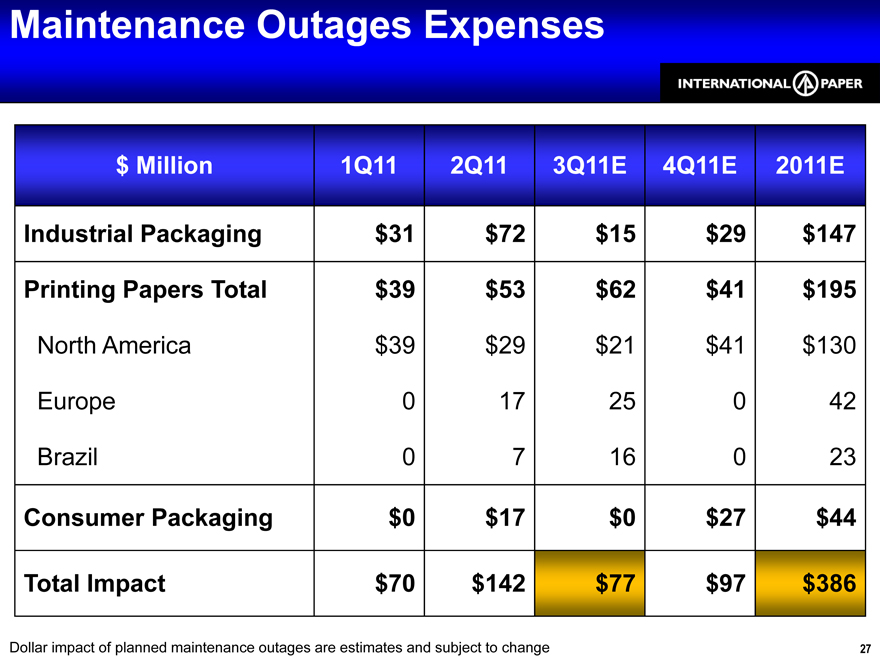

Maintenance Outages Expenses

$ Million 1Q11 2Q11 3Q11E 4Q11E 2011E

Industrial Packaging $31 $72 $15 $29 $147

Printing Papers Total $39 $53 $62 $41 $195

North America $39 $29 $21 $41 $130 Europe 0 17 25 0 42 Brazil 0 7 16 0 23

Consumer Packaging $0 $17 $0 $27 $44

Total Impact $70 $142 $77 $97 $386

Dollar impact of planned maintenance outages are estimates and subject to change 27

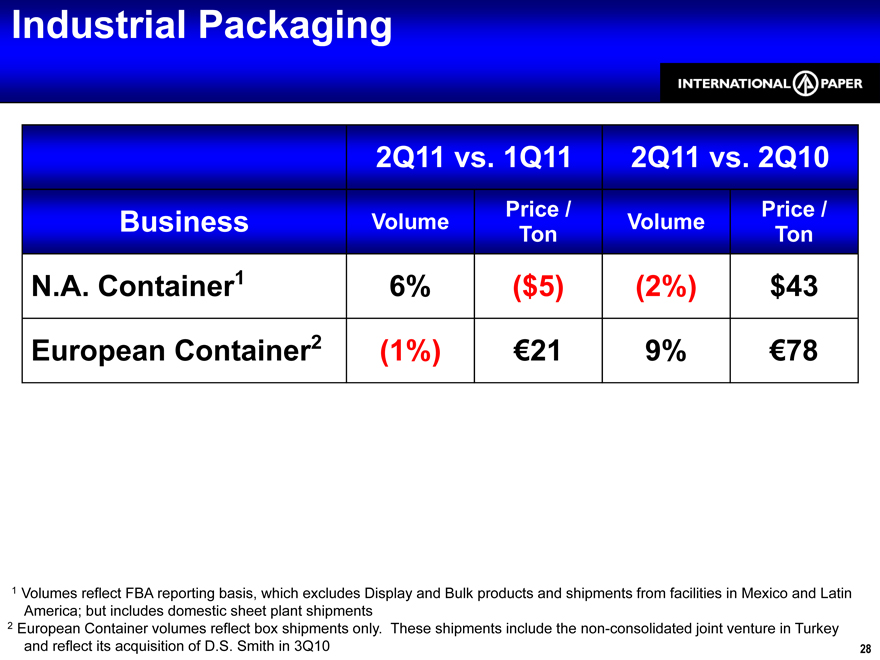

Industrial Packaging

2Q11 vs. 1Q11 2Q11 vs. 2Q10

Price / Price / Business Volume Volume Ton Ton

N.A. Container1 6% ($5) (2%) $43 European Container2 (1%) €21 9% €78

1 Volumes reflect FBA reporting basis, which excludes Display and Bulk products and shipments from facilities in Mexico and Latin America; but includes domestic sheet plant shipments

2 European Container volumes reflect box shipments only. These shipments include the non-consolidated joint venture in Turkey and reflect its acquisition of D.S. Smith in 3Q10 28

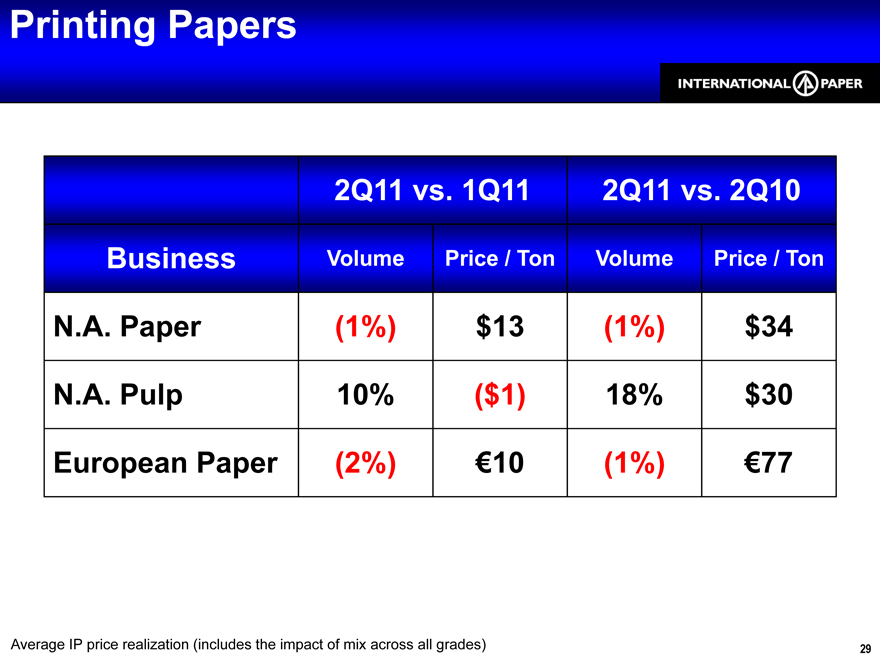

Printing Papers

2Q11 vs. 1Q11 2Q11 vs. 2Q10

Business Volume Price / Ton Volume Price / Ton

N.A. Paper (1%) $13 (1%) $34 N.A. Pulp 10% ($1) 18% $30 European Paper (2%) €10 (1%) €77

Average IP price realization (includes the impact of mix across all grades) 29

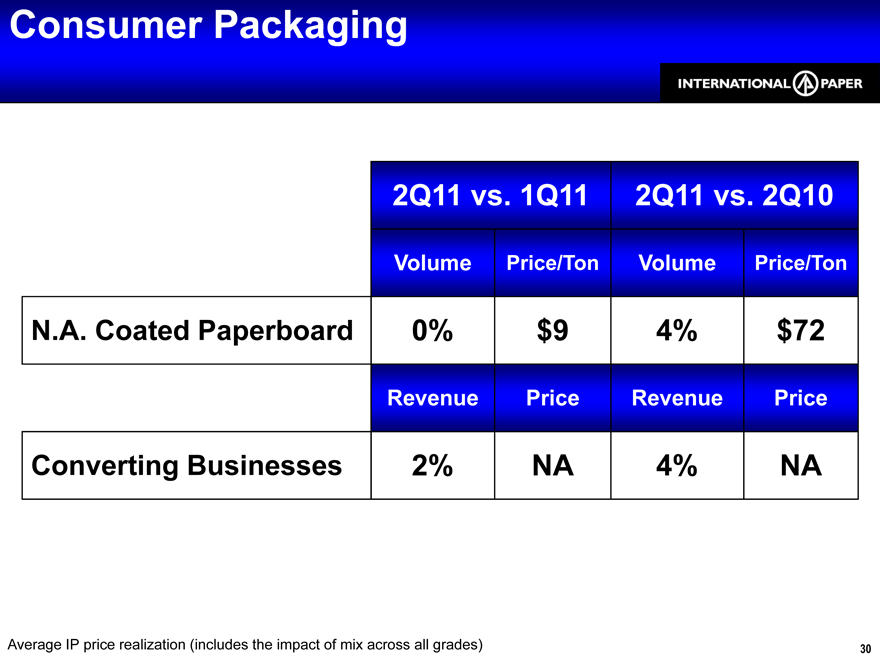

Consumer Packaging

2Q11 vs. 1Q11 2Q11 vs. 2Q10

Volume Price/Ton Volume Price/Ton

N.A. Coated Paperboard 0% $9 4% $72

Revenue Price Revenue Price

Converting Businesses 2% NA 4% NA

Average IP price realization (includes the impact of mix across all grades) 30

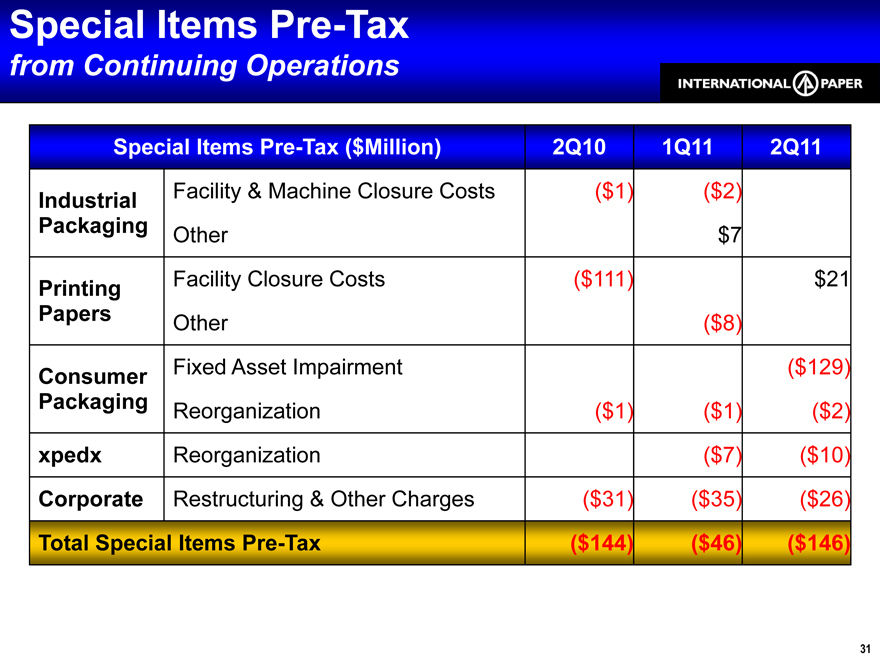

Special Items Pre-Tax

from Continuing Operations

Special Items Pre-Tax ($Million) 2Q10 1Q11 2Q11 Industrial Facility & Machine Closure Costs ($1) ($2)

Packaging Other $7

Printing Facility Closure Costs ($111) $21

Papers Other ($8)

Consumer Fixed Asset Impairment ($129) Packaging Reorganization ($1) ($1) ($2) xpedx Reorganization ($7) ($10) Corporate Restructuring & Other Charges ($31) ($35) ($26)

Total Special Items Pre-Tax ($144) ($46) ($146)

31

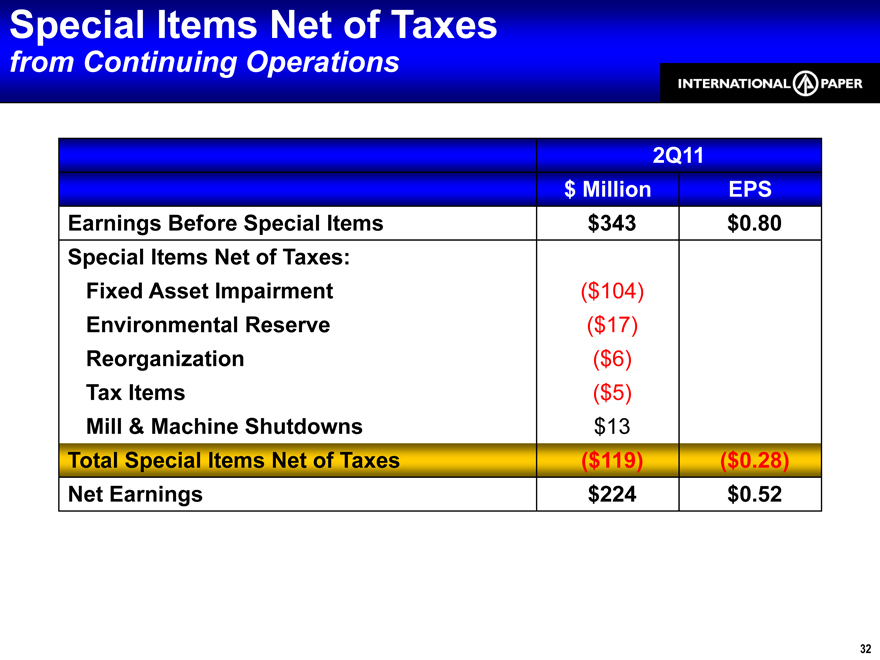

Special Items Net of Taxes

from Continuing Operations

2Q11 $ Million EPS

Earnings Before Special Items $343 $0.80 Special Items Net of Taxes: Fixed Asset Impairment ($104) Environmental Reserve ($17) Reorganization ($6) Tax Items ($5) Mill & Machine Shutdowns $13 Total Special Items Net of Taxes ($119) ($0.28) Net Earnings $224 $0.52

32

2Q11 EBITDA

Operating

D & A Tons EBITDA EBITDA Profit $ Million Thousand per Ton Margin $ Million

Industrial Packaging

North America1 $250 $120 2,578 $144 17.9% Europe $16 $7 266 $86 7.8%

Printing Papers

North America2 $101 $50 681 $222 21.7% Europe3 $45 $20 306 $212 19.7% Brazil $39 $38 270 $285 26.1% U.S. Market Pulp $35 $13 252 $190 24.6%

Consumer Packaging

N.A. Coated Paperboard $60 $35 364 $261 21.6%

1 Excludes Recycling & Bag businesses; includes Saturating Kraft business

2 Includes Bleached Kraft business

3 Excludes Market Pulp 33

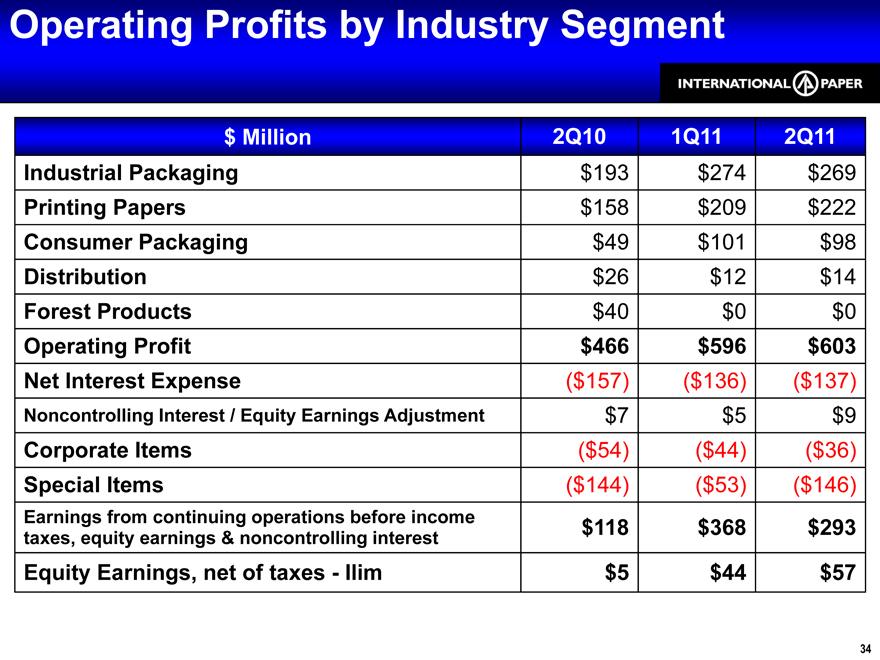

Operating Profits by Industry Segment

$ Million 2Q10 1Q11 2Q11 Industrial Packaging $193 $274 $269 Printing Papers $158 $209 $222 Consumer Packaging $49 $101 $98 Distribution $26 $12 $14 Forest Products $40 $0 $0 Operating Profit $466 $596 $603 Net Interest Expense ($157) ($136) ($137)

Noncontrolling Interest / Equity Earnings Adjustment $7 $5 $9

Corporate Items ($54) ($44) ($36) Special Items ($144) ($53) ($146)

Earnings from continuing operations before income

$118 $368 $293

taxes, equity earnings & noncontrolling interest

Equity Earnings, net of taxes—Ilim $5 $44 $57

34

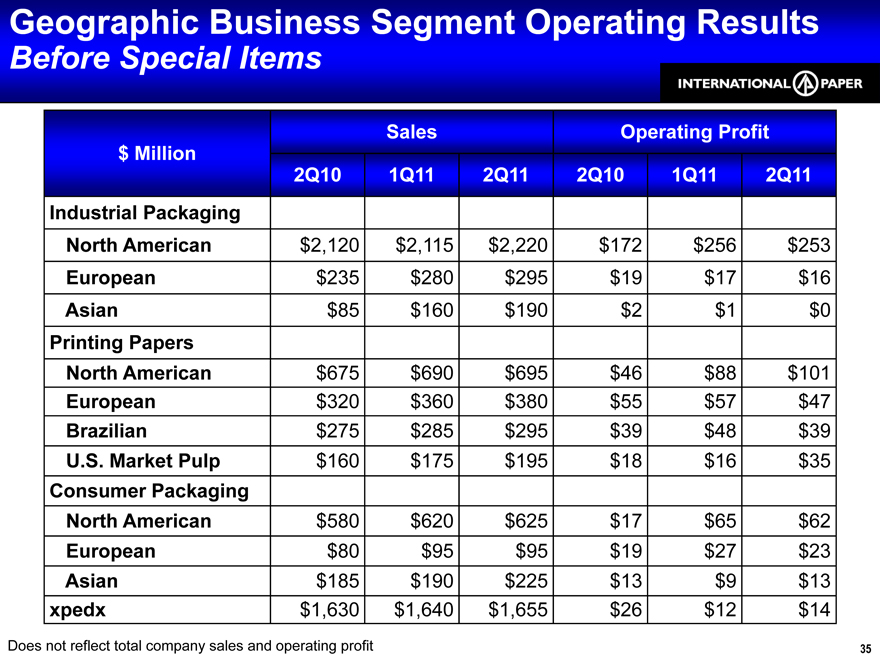

Geographic Business Segment Operating Results

Before Special Items

Sales Operating Profit $ Million 2Q10 1Q11 2Q11 2Q10 1Q11 2Q11 Industrial Packaging North American $2,120 $2,115 $2,220 $172 $256 $253

European $235 $280 $295 $19 $17 $16

Asian $85 $160 $190 $2 $1 $0

Printing Papers

North American $675 $690 $695 $46 $88 $101 European $320 $360 $380 $55 $57 $47 Brazilian $275 $285 $295 $39 $48 $39 U.S. Market Pulp $160 $175 $195 $18 $16 $35

Consumer Packaging

North American $580 $620 $625 $17 $65 $62 European $80 $95 $95 $19 $27 $23 Asian $185 $190 $225 $13 $9 $13 xpedx $1,630 $1,640 $1,655 $26 $12 $14

Does not reflect total company sales and operating profit 35

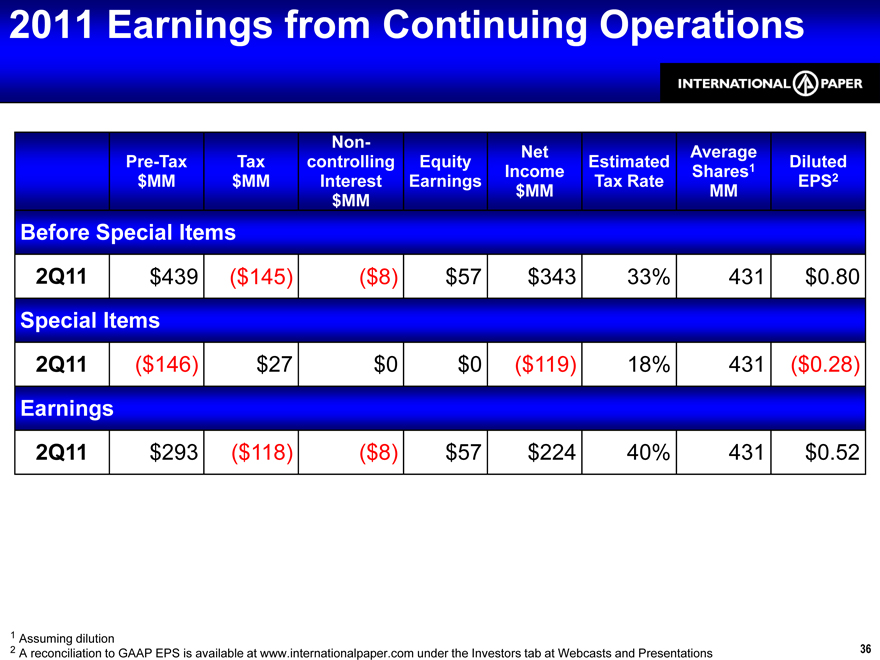

2011 Earnings from Continuing Operations

Non-

Net Average

Pre-Tax Tax controlling Equity Estimated 1 Diluted Income Shares 2 $MM $MM Interest Earnings Tax Rate EPS $MM MM $MM

Before Special Items

2Q11 $439 ($145) ($8) $57 $343 33% 431 $0.80

Special Items

2Q11 ($146) $27 $0 $0 ($119) 18% 431 ($0.28)

Earnings

2Q11 $293 ($118) ($8) $57 $224 40% 431 $0.52

1 Assuming dilution

2 A reconciliation to GAAP EPS is available at www.internationalpaper.com under the Investors tab at Webcasts and Presentations 36

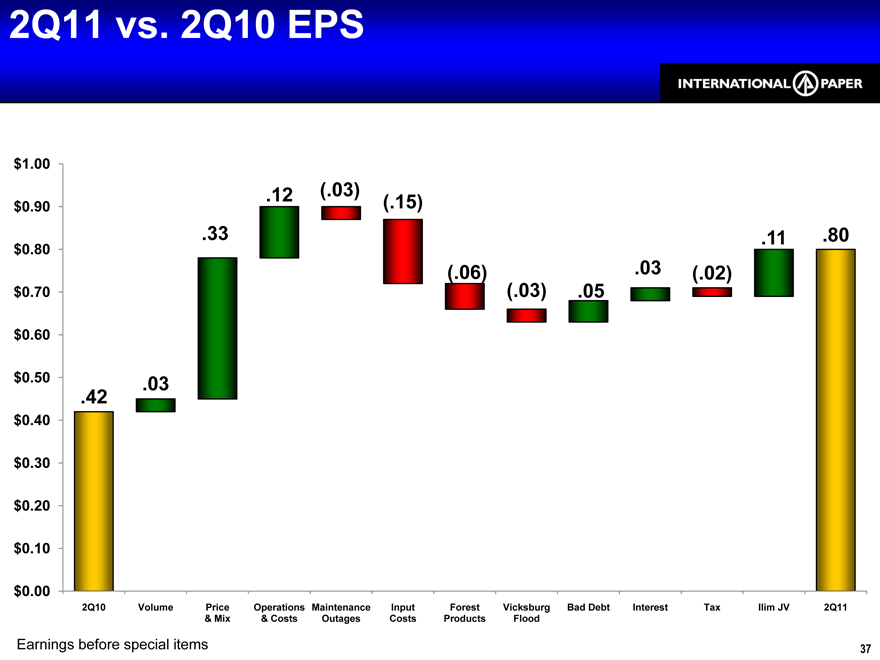

2Q11 vs. 2Q10 EPS

$1.00

.12 (.03)

$0.90 (.15)

.33 .11 .80

$0.80

( .06) .03 ( .02) $0.70 (.03) .05

$0.60

$0.50 .03

.42

$0.40 $0.30 $0.20 $0.10

$0.00

2Q10 Volume Price Operations Maintenance Input Forest Vicksburg Bad Debt Interest Tax Ilim JV 2Q11

& Mix & Costs Outages Costs Products Flood

Earnings before special items 37

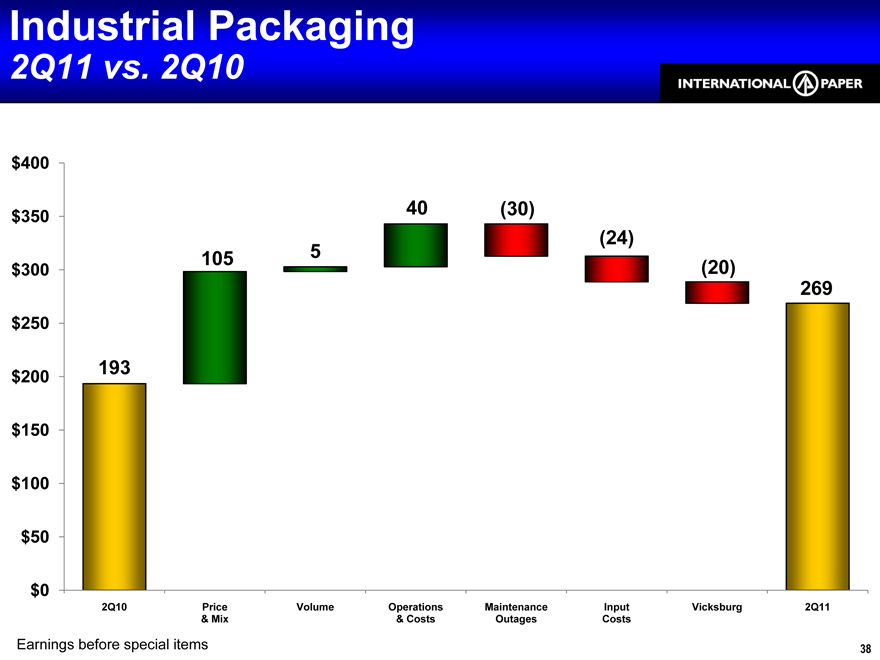

Industrial Packaging

2Q11 vs. 2Q10

$400

$350 40 (30)

$300 (20)

269

$250

193

$200 $150 $100 $50

$0

2Q10 Price Volume Operations Maintenance Input Vicksburg 2Q11

& Mix & Costs Outages Costs

Earnings before special items 38

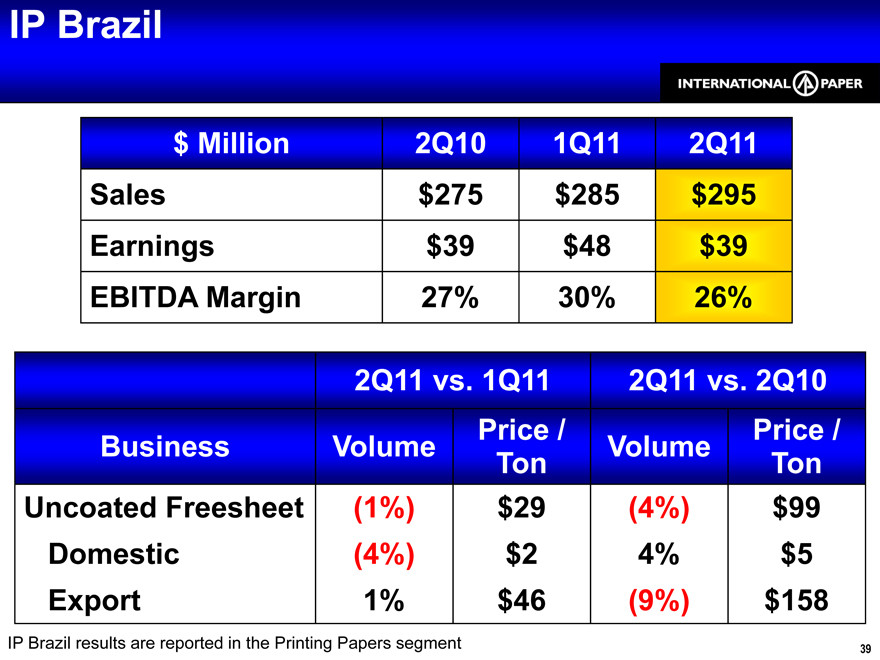

IP Brazil

$ Million 2Q10 1Q11 2Q11 Sales $275 $285 $295 Earnings $39 $48 $39 EBITDA Margin 27% 30% 26%

2Q11 vs. 1Q11 2Q11 vs. 2Q10 Price / Price / Business Volume Volume Ton Ton Uncoated Freesheet (1%) $29 (4%) $99 Domestic (4%) $2 4% $5 Export 1% $46 (9%) $158

IP Brazil results are reported in the Printing Papers segment 39

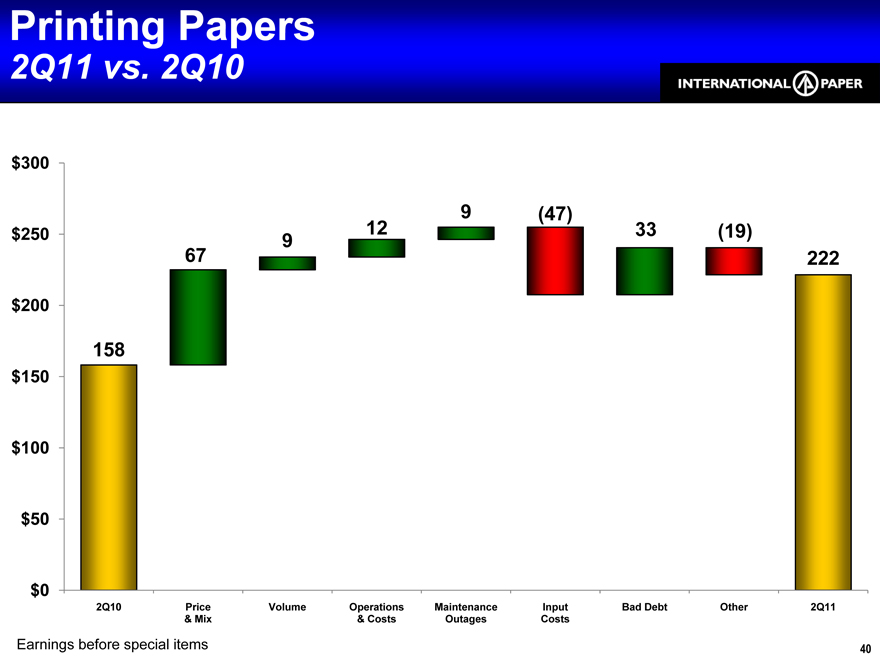

Printing Papers

2Q11 vs. 2Q10

$300

9 (47) $250 12 33 (19) 9

67 222

$200

158

$150 $100 $50

$0

2Q10 Price Volume Operations Maintenance Input Bad Debt Other 2Q11

& Mix & Costs Outages Costs

Earnings before special items 40

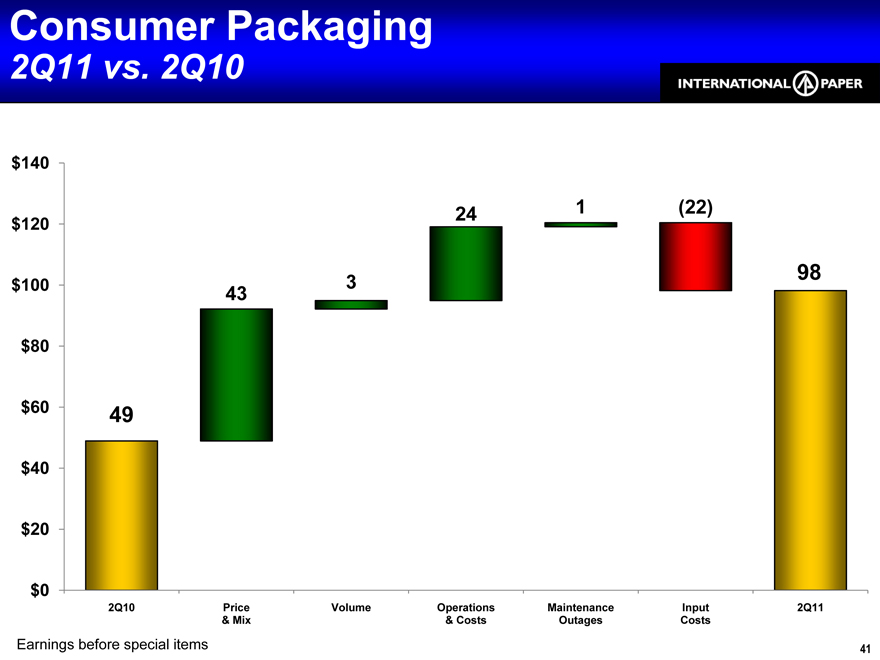

Consumer Packaging

2Q11 vs. 2Q10

$140

24 1 (22)

$120

98

$100 3

43

$80

$60 49 $40

$20

$0

2Q10 Price Volume Operations Maintenance Input 2Q11

& Mix & Costs Outages Costs

Earnings before special items 41

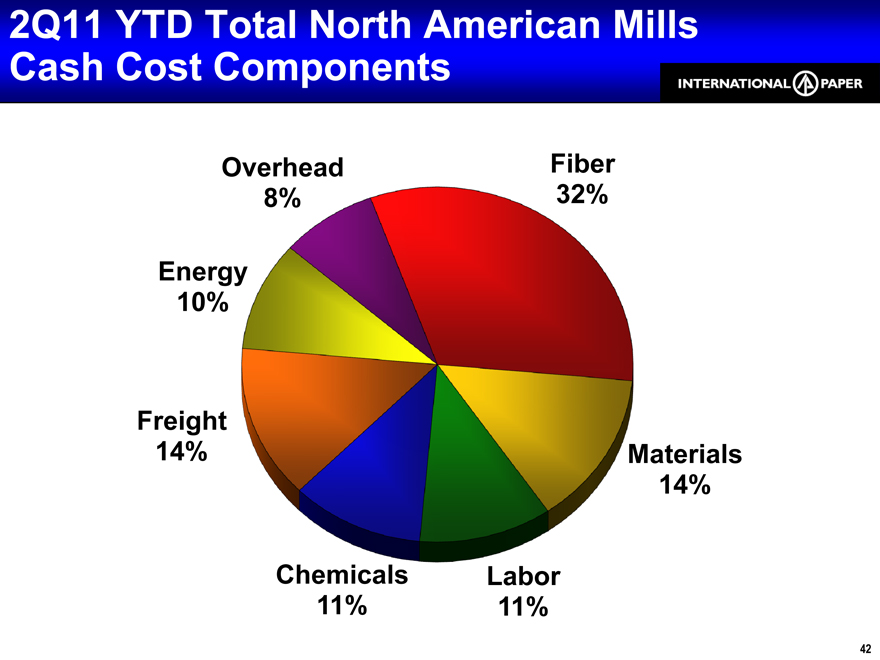

2Q11 YTD Total North American Mills Cash Cost Components

Overhead Fiber

8% 32%

Energy 10%

Freight

14% Materials 14%

Chemicals Labor 11% 11%

42

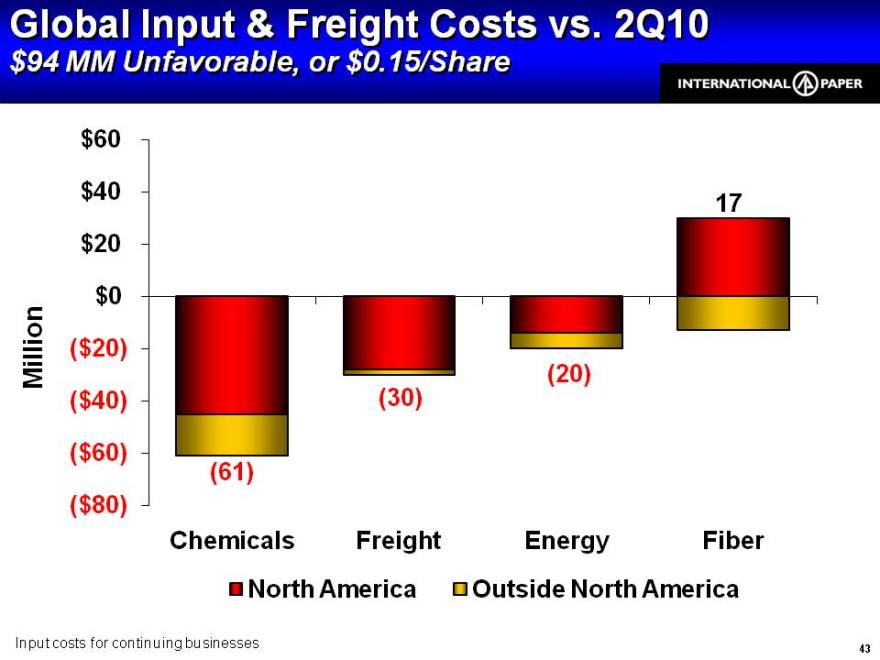

Global Input & Freight Costs vs. 2Q10

$94 MM Unfavorable, or $0.15/Share

$60

$40

17 $20

$0

Million ($20)

(20)

($40) (30)

($60)

($80)

Chemicals Freight Energy Fiber Outside North America North America

Input costs for continuing businesses 43

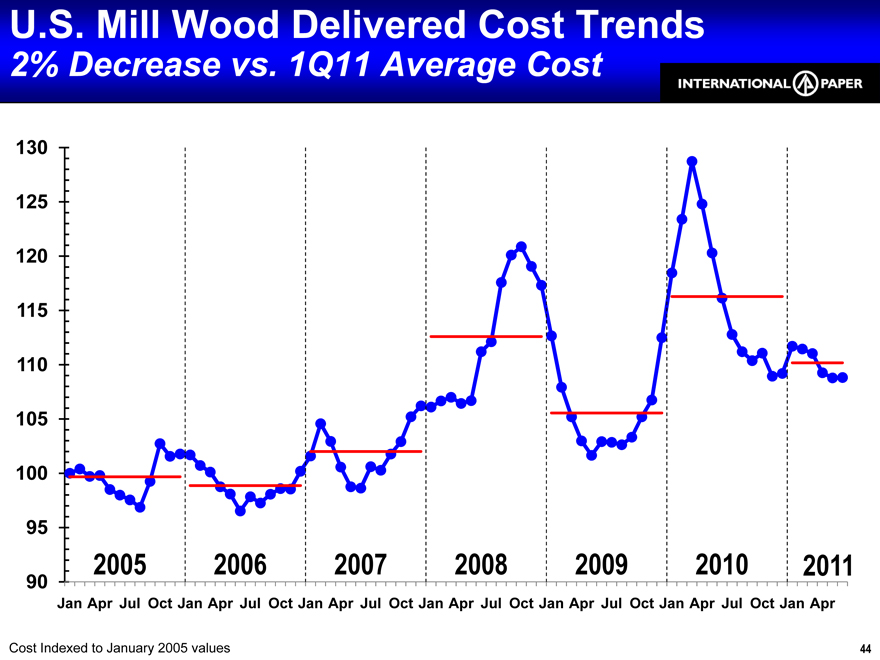

U.S. Mill Wood Delivered Cost Trends

2% Decrease vs. 1Q11 Average Cost

130 125 120 115 110 105 100

95

2005 2006 2007 2008 2009 2010 2011

90

Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr

Cost Indexed to January 2005 values 44

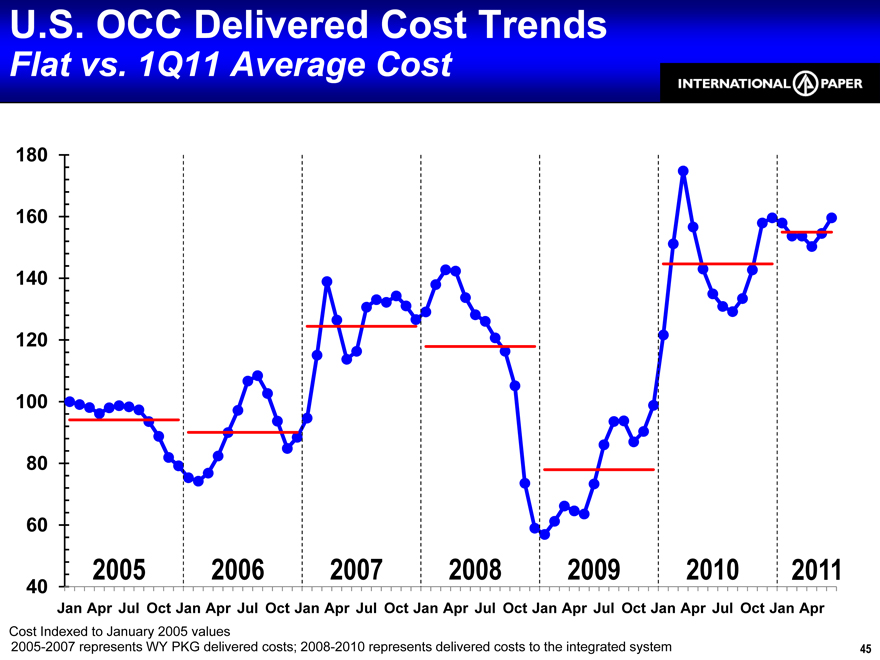

U.S. OCC Delivered Cost Trends

Flat vs. 1Q11 Average Cost

180 160 140 120 100 80

60

2005 2006 2007 2008 2009 2010 2011

40

Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr

Cost Indexed to January 2005 values

2005-2007 represents WY PKG delivered costs; 2008-2010 represents delivered costs to the integrated system 45

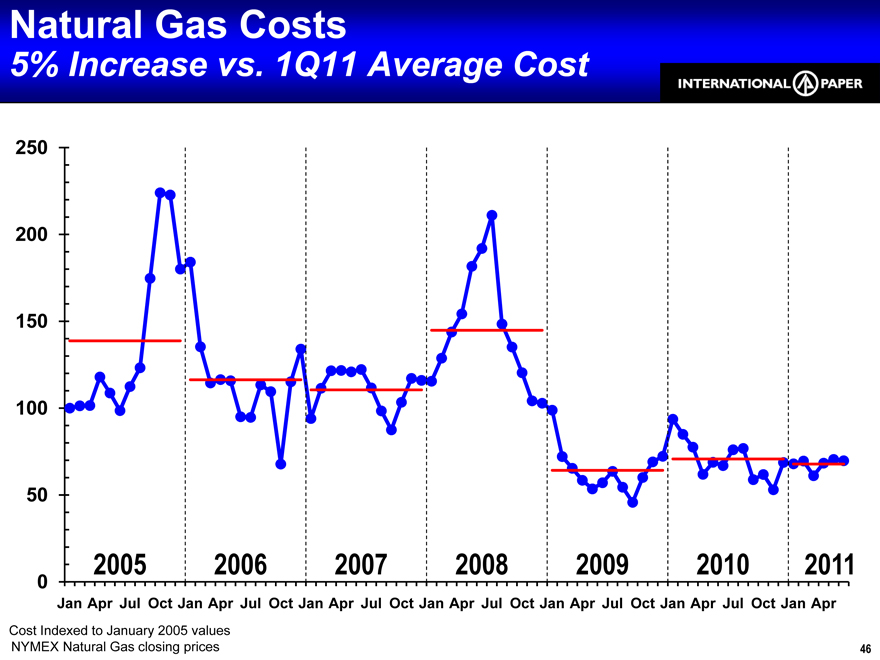

Natural Gas Costs

5% Increase vs. 1Q11 Average Cost

250 200 150 100

50

2005 2006 2007 2008 2009 2010 2011

0

Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr

Cost Indexed to January 2005 values

NYMEX Natural Gas closing prices 46

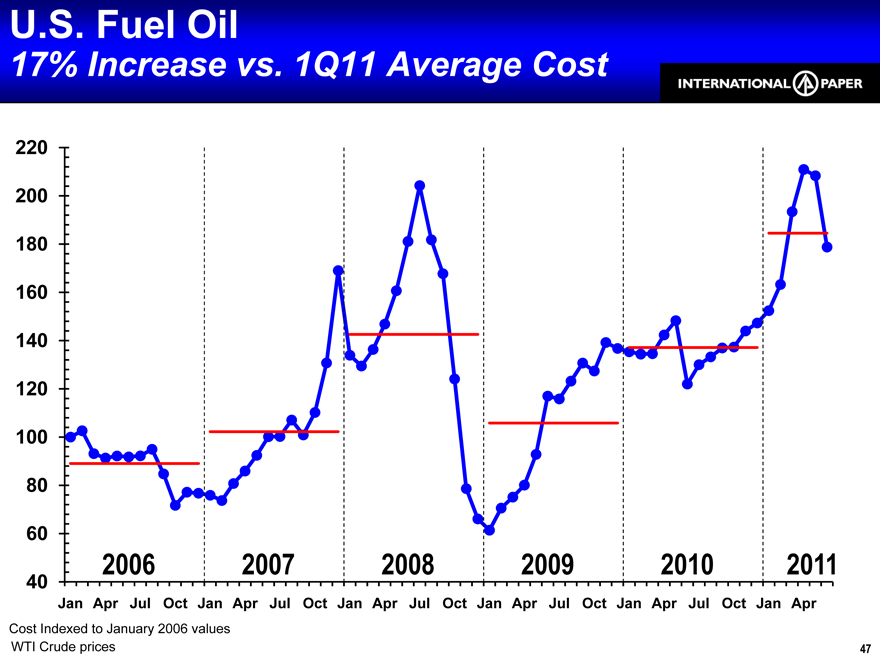

U.S. Fuel Oil

17% Increase vs. 1Q11 Average Cost

220 200 180 160 140 120 100 80

60

2006 2007 2008 2009 2010 2011

40

Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr

Cost Indexed to January 2006 values

WTI Crude prices 47

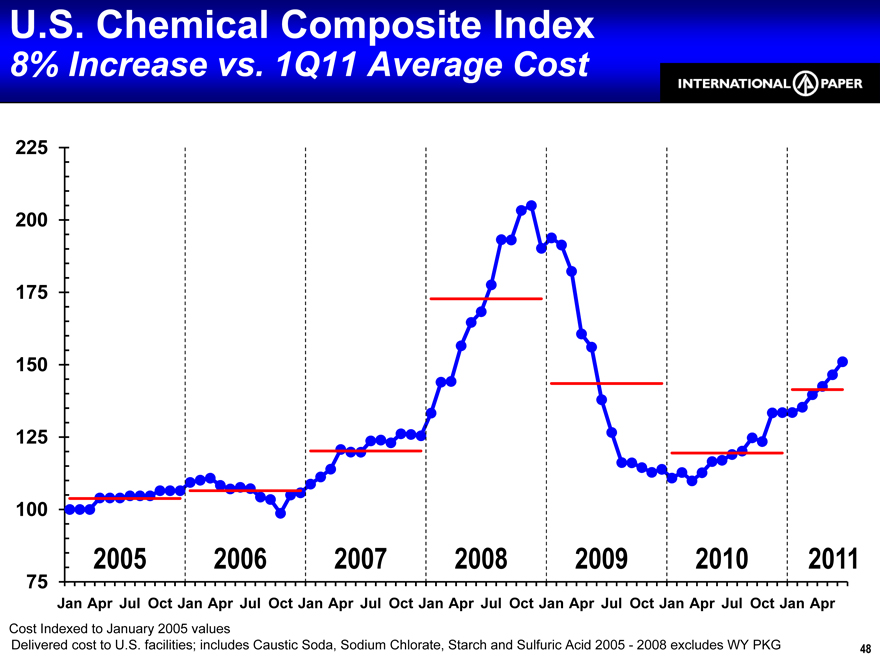

U.S. Chemical Composite Index

8% Increase vs. 1Q11 Average Cost

225 200 175 150 125

100

2005 2006 2007 2008 2009 2010 2011

75

Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr

Cost Indexed to January 2005 values

Delivered cost to U.S. facilities; includes Caustic Soda, Sodium Chlorate, Starch and Sulfuric Acid 2005—2008 excludes WY PKG 48

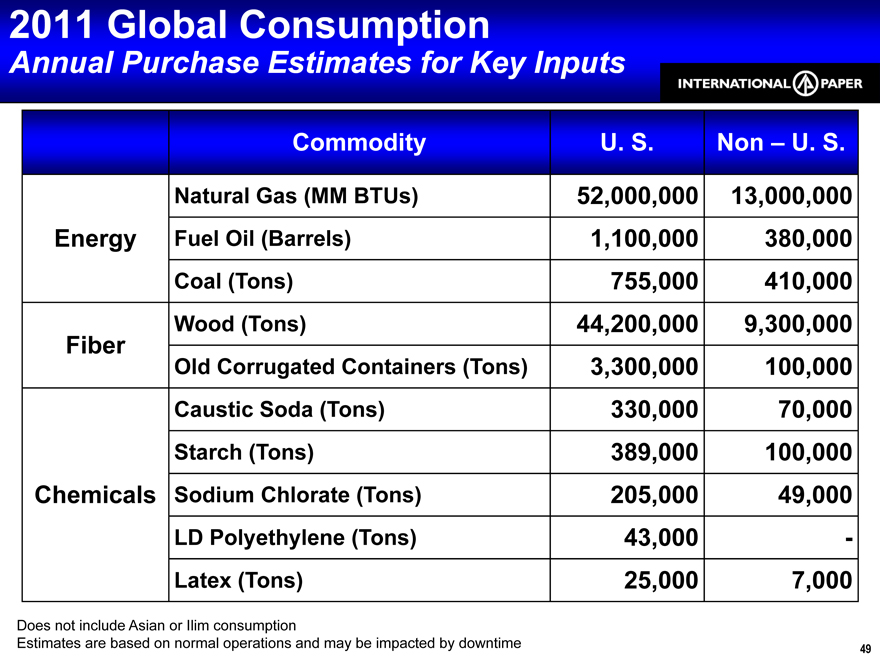

2011 Global Consumption

Annual Purchase Estimates for Key Inputs

Commodity U. S. Non – U. S.

Natural Gas (MM BTUs) 52,000,000 13,000,000 Energy Fuel Oil (Barrels) 1,100,000 380,000 Coal (Tons) 755,000 410,000 Fiber Wood (Tons) 44,200,000 9,300,000 Old Corrugated Containers (Tons) 3,300,000 100,000 Caustic Soda (Tons) 330,000 70,000 Starch (Tons) 389,000 100,000 Chemicals Sodium Chlorate (Tons) 205,000 49,000 LD Polyethylene (Tons) 43,000 -Latex (Tons) 25,000 7,000

Does not include Asian or Ilim consumption

Estimates are based on normal operations and may be impacted by downtime 49