On April 24, 2024, The Interpublic Group of Companies, Inc. held a conference call to discuss its first-quarter 2024 results. CALL PARTICIPANTS IPG PARTICIPANTS Philippe Krakowsky Chief Executive Officer Ellen Johnson Executive Vice President, Chief Financial Officer Jerry Leshne Senior Vice President, Investor Relations ANALYST PARTICIPANTS Adrien de Saint Hilaire BofA Securities David Karnovsky J.P.Morgan Steven Cahall Wells Fargo Equity Research Craig A. Huber Huber Research Partners Jason B. Bazinet Citi Research Tim Nollen Macquarie Equity Research Cameron McVeigh Morgan Stanley Research

2 COMPANY PRESENTATION AND REMARKS Operator: Good morning, and welcome to the Interpublic Group first-quarter 2024 conference call. . . . I would now like to introduce Mr. Jerry Leshne, Senior Vice President of Investor Relations. Sir, you may begin. Jerry Leshne, Senior Vice President, Investor Relations: Good morning. Thank you for joining us. This morning, we are joined by our CEO, Philippe Krakowsky, and by Ellen Johnson, our CFO. We have posted our earnings release and our slide presentation on our website, interpublic.com. We will begin with prepared remarks, to be followed by Q&A. We plan to conclude before market open at 9:30 a.m. Eastern time. During this call we will refer to forward-looking statements about our Company. These are subject to the uncertainties and the cautionary statement that are included in our earnings release and the slide presentation. These are further detailed in our 10-Q and other filings with the SEC. We will also refer to certain non-GAAP measures. We believe that these measures provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance. At this point, it is my pleasure to turn things over to Philippe Krakowsky. Philippe Krakowsky, Chief Executive Officer Thank you, Jerry. As usual, I’ll begin our call with a high-level view of our performance in the quarter. And Ellen will then provide additional details. I’ll conclude with highlights at our agencies and key strategic updates, to be followed by your Q&A. This morning, we are reporting a solid start to 2024, with Q1 performance fully consistent with the targets for growth and margin that we shared earlier this year. The organic growth of our revenue before billable expenses came in at 1.3%. Regionally, we were paced by strong growth in Europe, followed by growth in LatAm and the U.S. In keeping with our long-term record, we continued to see very strong growth at IPG Mediabrands in Q1. FCB’s offering of creativity informed by data insights and precision, as well as IPG Health, also marked strong quarters of growth. And our public relations discipline, specifically Golin, which posted double-digital organic growth, was a highlight of the first quarter.

3 From the standpoint of clients, we again had growth in six of eight client sectors worldwide, led by double-digit increases among our healthcare and food & beverage clients, followed by solid increases across the consumer goods and retail sectors, as well as our “Other” sector of public sector and diversified industrials. We also continued to see the trends within our portfolio that have been a drag on our growth and that we’ve identified during recent quarters. Those are the under- performance of our digital specialty agencies and our tech & telecom client sector. As we’ve indicated previously, heading into 2024, most of the weight from the tech & telecom sector will be due to the loss of a large AOR assignment with a telco client late last year. Outside of that item, same-client decreases in the sector have largely stabilized. Turning to expenses and margin, the quarter demonstrates that our teams continue to operate with a high degree of focus, as we keep investing in the growth areas of the business. Our adjusted EBITA margin was 9.4%, which is in line with expectations for our smallest seasonal quarter. That margin result is despite elevated expense for severance in Q1. Those actions should benefit our expenses for the balance of the year. It’s worth noting that we had 110 basis points of operating leverage in the first quarter on our expense for base payroll, benefits & tax from a year ago. Our diluted earnings per share in the quarter was $0.29 as reported and $0.36 as adjusted for acquired intangibles amortization and the impact of net business dispositions. During the quarter, we repurchased 1.9 million shares, returning $62 million. You’ll recall that in February our Board authorized another $320 million share repurchase program and increased our common share dividend by 6%. In terms of our outlook, we continue to expect to achieve full-year organic growth of 1% to 2%. A recent decision by an important ongoing client will adversely impact the balance of this year and likely make achieving the top end of our target more challenging. Within that range of growth, we continue to expect to deliver adjusted EBITA margin of 16.6% for the full year. As we look ahead, we anticipate that the strongest and most consistent growth areas of our business, such as our data and tech-driven media offerings, specialist healthcare marketing expertise, PR and experiential marketing capabilities are positioned to continue their strong performance over the long term. Additionally, these higher-value offerings, which include opportunities for outcome-based performance compensation, combined with our proven operational discipline, will result in sustained long-term margin improvement. As we move ahead, we’ll continue to enhance our existing offerings, providing holistic solutions that help marketers successfully deal with a media and marketing environment that’s increasingly complex and dynamic. This entails further embedding precision and performance into our media offering, as well as integrating the most

4 contemporary technologies, such as generative AI, at the core of our marketing services capabilities. I’ll come back with more detail on the evolution of our offerings after Ellen has had a chance to walk you through a more detailed view of our results.

5 Ellen Johnson, Executive Vice President, Chief Financial Officer: Thank you, Philippe. I hope that everyone is well. As a reminder, my remarks will track to the presentation slides that accompany our webcast. Beginning with the highlights on slide 2 of the presentation, our first-quarter revenue before billable expenses, or net revenue, increased 30 basis points from a year ago, with an organic increase of 1.3%. Our organic net revenue increase was 2.1% in the U.S., which was partially offset by an organic decrease in our international markets of 50 basis points. First-quarter adjusted EBITA, before a small restructuring adjustment, was $205.5 million, and margin was 9.4%. Diluted earnings per share was $0.29 cents as reported and $0.36 cents as adjusted. The adjustments exclude the after-tax impacts of the amortization of acquired intangibles and nonoperating losses on the sales of certain small, nonstrategic businesses. We repurchased 1.9 million shares during the quarter for $62 million. Turning to slide 3, you’ll see our P&L for the quarter. I’ll cover revenue and operating expenses in detail in the slides that follow. Turning to first-quarter revenue in more detail, on slide 4: Our net revenue in the quarter was $2.18 billion. Compared to Q1-23, the impact of the change in exchange rates was positive 10 basis points. The impact of net dispositions over the past twelve months was negative 1.1%. Our organic increase of net revenue was $27.8 million or 1.3%. At the bottom of this slide, we break out segment revenue: Our Media, Data & Engagement Solutions segment decreased 50 basis points organically. Very strong growth at our media businesses was offset by decreases elsewhere in the segment. As we have noted previously, our digital specialist agencies performance is challenged, and their results weighed significantly on the overall segment growth. At our Integrated Advertising & Creativity Led Solutions segment, organic growth in the quarter was 3.2%. We had very strong growth at FCB and IPG Health. That was partially offset by decreases at certain of our creativity-led integrated agencies, including the loss in the technology & telecom sector that Philippe mentioned previously. At our Specialized Communications & Experiential Solutions segment, organic growth was 1.5%. The segment was paced by double-digit percentage growth at Golin in public relations, while Jack Morton decreased from a year ago.

6 Moving on to slide 5, our organic net revenue growth by region: In the U.S., which comprised 68% of our revenue before billable expenses in the quarter, organic growth was 2.1%. We were led by very strong sector growth in healthcare and food & beverage, reflecting significant new business wins. That growth was partially offset by decreases at our specialty digital offerings and by a loss in the technology & telecom sector. International markets were 32% of net revenue in the quarter and decreased 50 basis points organically, with mixed performance by region: o The U.K. was 8% of net revenue in the quarter and grew 20 basis points organically. We had very strong growth at McCann, FCB and Golin. Those gains were largely offset in the quarter by decreases in the healthcare sector and in the events space. o Continental Europe was 8% of net revenue in the quarter and increased 8.9% organically; we saw strong performance, with double-digit growth in markets that include Spain, the Netherlands and Italy, and modest growth in France and Germany. o AsiaPac, which was 7% of net revenue in the quarter, decreased 8.1% organically. Most national markets decreased from a year ago, due to reductions in spend by existing clients in the region. Organic growth in India was the exception. o LatAm was 4% of net revenue, and our organic growth was 3.0% in the quarter. We were led by growth at IPG Mediabrands, which was somewhat offset by softness at our other offerings. o Our Other Markets group, which is Canada, the Middle East and Africa, was 5% of net revenue in the quarter. The group decreased 6.5% organically, which comes on top of a 9% increase last year and a 20% increase the year before. Revenue decreased in several national markets in the Middle East, including Israel, and Canada. Moving on to slide 6 and operating expenses in the quarter: Our net operating expenses, which exclude billable expenses, the amortization of acquired intangibles, and the small restructuring adjustment, increased only 50 basis points from a year ago, which includes notably higher severance expense. The result was our first-quarter margin of 9.4%. As you can see on this slide, our ratio of total salaries & related expense as a percentage of net revenue was 72.1%, compared with 72.5% a year ago. Again, all of these ratios are against our smallest quarterly net revenue base of the year. Underneath that SRS result: o We drove leverage on our expense for base payroll, benefits & tax, which decreased 110 basis points as a percent of net revenue.

7 o Our average headcount in the quarter decreased 2.1% from the first quarter of last year. o Our expense for performance-based incentive compensation increased slightly from a year ago, to 2.6% from 2.5% of net revenue. o Severance expense was 2.2% of net revenue, an increase of 70 basis points from the first quarter a year ago. We expect to see the benefits of these actions on margin as we move forward through the year. o Our expense for temporary labor was 3.3% of net revenue compared with 3.4% in Q1-23. Also on this slide, our office & other direct expense ratio was 14.8% in the quarter, compared with 15.2% a year ago. Underneath that: o Our occupancy expense ratio was flat against last year at 4.4%. o Through disciplined cost management, we continued to leverage our expense for “all other” office & other direct, which was 10.4% of net revenue compared with 10.8% a year ago. Our SG&A expense was 1.7% of net revenue, compared with 60 basis points of net revenue a year ago. The change reflects the higher levels of strategic investments in both senior enterprise leadership and information technology. On slide 7 we present detail on adjustments to our reported first-quarter results in order to provide better transparency and a picture of comparable performance. This begins on the left-hand side with our reported results and steps through to adjusted EBITA and our adjusted diluted EPS. Our expense for the amortization of acquired intangibles, in the second column, was $20.7 million. The restructuring charges were $0.6 million, which represents adjustments in the quarter related to previous actions. Below operating expenses, in column 4, we had a pre-tax loss in the quarter of $6.8 million in “other” expenses, due to the disposition of a few small, nonstrategic businesses. At the foot of this slide, we present the after-tax impact per diluted share of each of these adjustments, which bridges our diluted EPS as reported at $0.29 to adjusted earnings of $0.36 per diluted share. On slide 8 we turn to our cash flow in the quarter: Cash used in operations was $157.4 million, compared with $547.6 million a year ago. As a reminder, our operating cash flow is highly seasonal. We typically generate significant cash from working capital in the fourth quarter and use cash in the first quarter. During this year’s first quarter, our working capital use was $340.3 million, which is near the low end of the range of first-quarter uses over a period of at least the past 15 years. It’s worth noting that cash generated

8 from operations before working capital changes was $182.9 million in the quarter. In our investing activities, we used $50.0 million in the quarter, mainly for cap- ex. Our financing activities in the quarter used $227.1 million, primarily for our common stock dividend and share repurchases. Our net decrease in cash for the quarter was $454.5 million. Slide 9 is the current portion of our balance sheet. We ended the quarter with $1.93 billion of cash and equivalents. Slide 10 depicts the maturities of our outstanding debt as of March 31st. As you can see on this schedule, total debt at quarter end was $3.2 billion. It is worth noting that, earlier this month, the $250 million maturity depicted in the first column was repaid from cash. With that, our next maturity is not until 2028. In summary, on slide 11, our teams are focused on executing at a high level. I would like to express our pride in and gratitude for the efforts of our people. The strength of our balance sheet and liquidity mean that we remain well-positioned both financially and commercially. And with that, I’ll turn it back to Philippe.

9 Mr. Krakowsky: Thanks, Ellen. As mentioned, the results we are reporting today are in line with our forecast coming into the year. We continue to see strength at our media offerings, in healthcare and marketing services, and at those agencies that are leading in the adoption of audience- led capabilities enabled by our data spine. Broadly speaking, marketer sentiment has begun to improve relative to most of last year, and the new business pipeline is more active. We’ve also entered the year with strong levels of industry recognition. On the prestigious AdAge A-List, as well as Fast Company’s list of “Most Innovative Companies,” both of which were announced during the first quarter, IPG was better represented than any other holding company group. We’re continuing to live through a period of significant technological disruption, and we’re finding that innovation has never been more important. Organizations in every industry and across every geographical region are looking to reinvent themselves, in order to adapt to and thrive in this highly competitive environment. And Interpublic remains a trusted partner at the heart of the transformation journeys of many of the world’s most ambitious businesses. Of course, that’s an ambition that we also share. And in recent years, that has meant developing a strong technology and data foundation, with centralized resources in strategic capabilities such as audience definition, identity resolution, commerce and production. Over the course of 2023, we added senior functional leaders at the corporate IPG level to ensure that we are connecting more of the portfolio to these horizontal capabilities, in order to make precision and performance a part of all our services. Last quarter, we spoke to the fact that in our media, data and CRM practices, machine learning has for quite a number of years been essential to the predictive modeling and analytics work that have led to our long-term success. During Q1, we announced a global partnership with Adobe that will see us become the first company to integrate their GenStudio product, which unites all facets of the content supply chain through the use of generative AI, into our marketing technology platform. This will allow us to accelerate the adoption of AI in our creative and content businesses, from ideation through production and activation. These emerging technologies provide new canvasses for us to work with in engaging consumers at every touchpoint in their brand journey. And we’re therefore empowering our teams with AI tools that strategists and creative people can use to quickly scale insights and ideas. At the enterprise level, all of this is underpinned by a unified operating system, what we call the IPG marketing engine. This builds on segmentation and insights fueled by our Acxiom data and identity products and seamlessly connects media strategies and targeting, including the predictive modeling that I called out earlier of what we call

10 high-value audiences, connect that all the way through to creative concepts and messaging for every marketing discipline. We can then move all the way through to activation, the production and dissemination of campaigns, whether on marketing technology platforms or in media investments across all formats and channels. Our engine can then analyze attribution, optimize next-best decisions and assess the effectiveness of campaigns. And this end-to-end solution positions us to help our clients better engage with, convert and retain customers through the entire marketing funnel. As you’ve heard from us in the past, we are also using AI as a part of our ongoing internal transformation efforts, to improve structure and processes across the Company. Now with that as a high-level view strategically, I guess I’ll turn to just a few specific highlights from the quarter. Within Media, Data & Engagement Solutions, we saw very strong growth, as mentioned, as well as industry recognition for our media and data operations. IPG Mediabrands continues to expand and integrate our Unified Retail Media Solution, which is delivering cross-retailer audience identification, planning and optimization that spans a range of retailer platforms and marketing tactics. We’re doing this for clients now in much of the Mediabrands portfolio and in conjunction with leading partners across the retail ecosystem, from media networks to aggregators. In other news relating to our partnership with Amazon, we became the first company to integrate Amazon Ads APIs into our proprietary media platform. And our updated reach maps now include Prime Video Ads, so our planning teams can view historical data for Prime Video Ads alongside those of other key partners and digital media inventory. In Q1, we also rolled out an Amazon Marketing Cloud suite of analytics solutions that was developed by our Platforms and Intelligence teams at Kinesso. Our media operations continued to receive the industry’s highest honors. On AdAge’s A-list, as I mentioned, IPG Mediabrands was named “U.S. Network of the Year,” and UM was named “Media Agency of the Year.” In a world in which audience segmentation and insights are key to delivering performance for our clients, and one in which AI will play an increasingly important role, access to proprietary data at scale will be essential to success. Acxiom continues to have the industry’s top-performing audience data to engage with consumers at an individual level, without the need for proxies. Our tech stack and marketing engine optimize performance using this data spine, which is anchored by a deep understanding of 2.5 billion real people. The attributes per Acxiom ID are a third greater than those available with any other industry data set, and we can match them to significantly more global device IDs than our closest competitor. We’re also able to connect our people data to abundant consumer transaction data and to refresh that at rates equivalent to those of anyone in the sector. Our clients benefit from the trust earned through decades of experience in scaled first-party data management, since Acxiom teams work inside of large

11 enterprises, consulting on and writing the software that architects first-, second- and third-party data, for use both in adtech and martech. Turning to our Integrated Advertising & Creativity Led Solutions segment, as we’ve mentioned, FCB and IPG Health led sector performance. The leadership team at FCB has focused on bringing both media planning and production closer to its traditional creative work, with planners at FCB using Acxiom’s data and tools as the foundations for how they interact with both clients and, ultimately, consumers. This strategy results in creative ideas that are grounded in audience segments and insights and lead to creative work that drives in-market results. During the quarter, FCB won “Global Network of the Year” at The One Show, an important creative competition, and FCB New York was also named “Global Agency of the Year” and “North American Agency of the Year” as part of The One Show. IPG Health continued to make strong contributions to our performance, and, notably, the company launched a suite of data tools in Europe that enable highly-targeted and personalized data-driven marketing to healthcare professionals, which is a first for this region and particularly important given the regulatory environment there. The agency was named “Healthcare Network of the Year” on the AdAge A-List for the second consecutive year. Deutsch LA and The Martin Agency were cited among Fast Company’s “Most Innovative Companies” and consistently partner with our media and marketing services companies as part of integrated client delivery teams. And McCann was also featured on the Fast Company list. During the quarter, the agency won AOR responsibilities for PwC, and McCann’s production and content studios are increasingly doing global work for major clients like Reckitt Benckiser and IKEA. Within our Specialized Communications & Experiential Solutions segment, Weber Shandwick had a solid start to the year, driven by the firm’s corporate and public affairs capabilities, as well as its wellness practice. And the agency led a pan-IPG and IPG DXTRA Health AOR win for Boehringer Ingelheim’s Mental Health franchise, and that includes everything from thought leadership to data and regulatory communications work. Weber was named to AdAge’s A-List and Fast Company’s “Most Innovative Companies” list, making it a leader in its field. As I mentioned, Golin saw very strong growth in the quarter. It was named PR Week’s “U.S. Agency of the Year” and recently introduced an interesting AI-enabled platform that helps its clients detect and combat threats from bots, malicious actors and disinformation, including disinformation generated by AI. In the experiential marketing space, Momentum created an AI-powered art experience in New York for the launch of the new Coca-Cola Spiced beverage and continued to build on the AI patents we’ve mentioned to you previously to deliver improved efficiency in event logistics for its clients.

12 Across IPG, we have long been clear that our commitment to ESG is a key priority, and it’s core to our culture. During the first quarter, we published our ninth annual ESG report, which combines various reporting frameworks into one comprehensive disclosure and represents our third year in which we’ve engaged external experts to provide assurances on ESG metrics. We were also recently listed on the CDP Supplier Engagement Leaderboard in recognition of the work we do to engage suppliers on climate change. Looking forward, as mentioned earlier, it bears noting that the tenor of our conversations with clients has been more positive since the start of the year compared to the last three quarters of 2023. We continue to expect to achieve full-year organic growth of 1% to 2%, though as mentioned earlier, a recent decision by a significant ongoing client will likely make achieving the top end of that target more challenging. And within that range of growth, we continue to expect that we’ll deliver adjusted EBITA margin of 16.6% for the full year. As you know, over time, we have consistently demonstrated that we can expand margins with growth. And a number of the areas of strength, which consistently perform very well — we called them out today: media and healthcare, experiential and PR — are accretive to our overall profitability as well. Our flexible cost model is an important lever for improving margins, and some of the new offerings that we have that are more precise and accountable will further enhance that opportunity as they lead to more performance-driven compensation models. Another important area for value creation is our strong balance sheet, which will allow us to stay committed to capital returns, as was evident in our recent dividend increase and our continued share repurchases, while also positioning us to augment our offerings and our asset mix with M&A, with a particular focus on further broadening our commerce and scaled digital transformation capabilities. Across the Company, our teams remain highly focused on delivering by continuing to provide these higher-order business solutions to clients, which help, in turn, them to succeed in this digital economy. So thanks again to our partners, to our people for their continued commitment and support, to all of those of you on this call for your time. And with that, let’s open the floor to questions.

13 QUESTIONS AND ANSWERS Operator: . . . . Our first question comes from Adrien de Saint Hilaire with Bank of America. You may go ahead. Adrien de Saint Hilaire, BofA Securities: Thank you very much, Philippe, Ellen and Jerry, for the comprehensive presentation. I’ve got a few questions, if you don’t mind. Philippe, I think in your intro you said that tech has largely stabilized. Could you see that segment growing in Q2 and later on this year? Or is it too early at this moment to talk about growth for that space? Secondly, Philippe, you talked about a more active new business pipeline. There are a couple of big accounts which are under review right now, like Amazon, for example. Can you just tell us how much of your revenue you are actually defending, or do you expect to defend this year? And then a third one, more for housekeeping, but what was the drag from R/GA and Huge on your organic growth this quarter, and how much should we expect going forward? It’s a lot of questions, sorry. Philippe Krakowsky, Chief Executive Officer: No, please. I don’t know that I can help you with the middle question, just because, as you know, we don’t really speak to the particulars or things that are proprietary relative to our clients. And there is one large review ongoing that you called out, which is very important to us, but there are clearly others where we are theoretically a beneficiary, where we’re not defending. But I really can’t speak to that. On the other one, I’m happy to unpack that for you, and I’ll probably do it all at one go. So I would say, if you look at the digital specialist agencies, through ’23, the drag on a quarter-to-quarter basis to IPG overall was about a point and a half at any given point in time, and that continues to be the case. So we’re seeing about a 1.5% drag from them in Q1. Tech & telco as a client sector, over the course of ’23, was probably in the 2% to 2.5% range, and, again, it varied quarter to quarter. And that has come down to about 1.5% in Q1 of this year. And significant, say, somewhere between 60% and 70% of that 1.5% is due to the one AOR loss that we called out. So we’re clearly seeing progress, as it were, or at least less damaging to our results. And if you sort of take a cross-section, we’ve always said that the tech & telco space has been a function of large names, not small, medium-sized clients. Not kind of the leading edge of digital; it was not crypto, etc. So if you look at the bellwether tech & telco clients, the big names, in Q1, those were just a hair below flat. So that’s why we say stabilization. Now to my mind, that doesn’t say that we can tell you that we’re

14 seeing them come back to growth definitively at a moment in time in Q2 or in Q3, but clearly that’s progress. And so if I take both of those ex client overlap — because the digital agencies do overindex into that client sector — that in Q1, it was just shy of 30 basis points to our growth number. But the tenor of that or sort of the — and when you get to the granularity of that, you’re definitely seeing some movement. And then the last reminder I would add is just that, our full-year guidance doesn’t factor in a return to growth for either of those agencies or the client sector in order for us to achieve the targets. So if tech improves faster, that would clearly be something that we hadn’t baked in, and that would be a net positive. Operator: Thank you. Our next question is from David Karnovsky with J.P.Morgan. You may go ahead. David Karnovsky, J.P.Morgan: Hey, thank you. Philippe, I know you’re generally hesitant to talk about any clients on these calls, but you did call out the impact of a significant client decision to ’24 organic growth. So I wanted to see if you could unpack a bit more what happened in this particular instance, given it’s not very common to see large accounts shift over short periods. And then it would seem there is an extended off-boarding period here. I don’t know if you and Ellen can frame how to think about the organic impact to 2024 versus what might show up in the out year? And then just separately, you had fairly direct commentary in the release on the potential for M&A. Can you speak a bit to both commerce and digital transformation? Why are these areas where acquisitions are potentially attractive, and how does that fit with the broader portfolio? Philippe Krakowsky, Chief Executive Officer: On the large client, there’s — we don’t speak for our clients. We don’t disclose proprietary information, and that’s obviously as it should be. So I’m not sure there’s much we can add to the news that’s out there already. I think what I would point out to you is, it’s a significant and important ongoing relationship with us. So this is a client with whom we continue to do medical communications work, public relations work, globally. It was a sizable consolidation last year. We were obviously very proud of the talent that helped us win the creative assignment. And the client, as we understand it — and as I said, it’s what’s in the public domain — they’ve chosen to evolve their marketing model, they’re looking to rapidly drive change within their organization. So that’s a decision that we understand. And in terms of trying to dimensionalize that for you or the magnitude of that shift, I think it’s fair to say our best estimate is baked into the remarks that we’ve shared with

15 you in terms of expectations for the full-year organic. So barring this news, I think, we’d be very comfortable at the upper end of our target growth range. And now we’re telling you we think that will be challenging, but we’re still in the 1% to 2% band. And we’re going to be very thoughtful about supporting the client through a transitional period, so I think that you’ll see some of that impact or deceleration in the back half of the year for us, and then some in the early part of ’25. But I can’t really unpack it for you more than that. And then on M&A, I’d say that where we’ve got strength in commerce — some of our CRM agencies; we’ve got strength in commerce at Mediabrands, where we’re using Acxiom data and powering the Unified Retail Media Solution — we’re seeing that grow well. As I called out, we’re seeing adoption across a number of clients. But incremental scale in commerce — in the digital transformation area, I think in digital services, an observation, I guess, would be that deep engineering capabilities and scale are growing in importance in those areas. And so when I talk about our asset mix, you’ve seen where our strong assets that are very future-forward have meaningfully benefited the Group as a whole, so that’s a place where we see the opportunity to both get bigger, be bigger, and it’s where there’s demand on the client side. Mr. Karnovsky: Thank you. Mr. Krakowsky: Thank you. Operator: And thank you. Our next question comes from Steven Cahall with Wells Fargo. You may go ahead. Steven Cahall, Wells Fargo Equity Research: Thanks. So, Philippe, you talked about strong long-term performance expectations at data and tech and healthcare and experiential. So I was wondering, first, if you could just talk about how healthcare is performing year-to-date in line with that comment? I think data and experiential were both kind of flat organically in the first quarter. So should we also think that those will probably accelerate as you move through the year, and that’s part of what gives you that confidence in the organic guide, despite some of that creative work moving off? And then, Ellen, could you just talk to your expectations for working capital in 2024? The last couple of years, net working capital has been a pretty big drag. So I’m wondering, if you have any guidance or expectations for that and for free cashflow to start to improve in 2024? Thank you. Philippe Krakowsky, Chief Executive Officer: Sure. So on healthcare, I’d say IPG Health: in all likelihood largest in the space, recognized as a leader in the space; to your point, accretive to our overall results for

16 some time, and very, very broad penetration. We work with pretty much every major pharmaceutical company in the world. There’s opportunity there because we’ve got a range of agencies inside of that group. And as long as you are servicing the client in a — without any sort of direct competition at the drug or therapeutic area level — there’s continued opportunity there. And then we also have media competence embedded there, data and analytics, which we’re obviously looking to connect more closely to those horizontal enterprise-wide capability layers that we’ve been putting in place. So that represents opportunity. So I think that health performed well, and we continue to see that as something. We also have healthcare inside of PR. We have it inside of our media operations as well, large healthcare clients. I’m not sure I’m tracking to your question around data and experiential flat, because we sort of — they sit in different segments. As we’ve always said, the Acxiom data and capabilities are very closely embedded to the very strong media performance because it informs the product and the way that we deliver in that space. And then on the experiential side, which is in the smallest of our segments and specialized, we did talk about the fact that we’ve got a couple of those brands performing well and one of them which did not have a strong quarter. But I’m not sure that I can get to where you see that as flat or how that is going to inform our view. I think we still see those all as areas that are, secularly, as it were, stronger and should continue to be accretive to our growth. Mr. Cahall: Yeah, the question was kind of, do you expect those to accelerate a bit this year, assuming that creative is probably going to decelerate a bit? Mr. Krakowsky: I mean, look, they have been, and, as we said, we see them continuing to. We see PR performing well as well. Mr. Cahall: Great. And working capital? Ellen Johnson, Executive Vice President, Chief Financial Officer: As far as working capital, it’s an area of focus for us. It always is. We’re very consistent to our approach, very disciplined, starting from when we take on new clients to how we manage payables. As I talk about very frequently, it’s volatile. Whether you get paid on the 31st or you get paid on the 1st, it creates volatility, but doesn’t really impact the underlying result. That said, if you look at our use for the first quarter, as I mentioned in my remarks, it’s probably the lowest in about 15 years. So I do expect this year to be a much more normalized result. Mr. Cahall: Thank you.

17 Mr. Krakowsky: Thanks, Steve. Operator: Thank you. Our next question comes from Craig Huber with Huber Research Partners. You may go ahead. Philippe Krakowsky, Chief Executive Officer: Hey, Craig. Craig A. Huber, Huber Research Partners: Hi, there. Good morning. Two questions, if I could. Can you talk a little bit of updated thoughts on AI and the opportunity on your side for more efficiencies, but also enhancements into products and services that you guys put out there? And I guess on the same token, do you feel that it might be an added competitive threat out there for third parties entering the space, perhaps hurting you? That’s my first question. And then my second question is, just give us a little bit more meat on the bones about what happened in Asia here. It was obviously a tough quarter, as it’s been for the last five quarters. A little bit more of what’s going on there. Thank you. Mr. Krakowsky: I guess, maybe we’ll do the latter first because it’s relatively straightforward. You see the size it represents relative to our overall. So in absolute terms, in a small quarter, you’re not talking about a huge dollar amount. And it was just small. There’s no one event that took place. It was a lot of smaller cuts with a broad range of clients across the region. And the exception being India, where we have significant scale and a lot of very strong agency brands and capabilities. I mean, I’m not sure, Ellen, if there’s anything else on Asia that — Ellen Johnson, Executive Vice President, Chief Financial Officer: No, I think you’ve covered it. It was 7% of our revenue. Mr. Krakowsky: And then the AI question is obviously a very broad one. And on our last call and even in the prepared remarks, we talked a bit about the extent to which it has been part of our business for some time in the places where you have more data, and more precision, the ability to do addressable work, a lot of modeling being done to identify not only audiences but business opportunity. So it’s really baked into what we do at — in our media business, what we’ve been doing, obviously, at Acxiom for a long time. And then for some of our larger clients where we do integrated solutions that use the breadth of IPG and our engine. I think the thing that is clearly evolving, and maybe it’s just an opportunity to talk a little bit about what we announced with Adobe, is how and to what extent do you — you want the benefit of what the creative parts of the business and ideation brings to

18 the party, because clients’ brands are so valuable, and the way in which they leverage that IP is so important. And yet, any part of what we do, if it’s not connected to a larger whole, and if it’s not increasingly quantifiable, risks being less valuable over time. And so, for us, the connectivity that GenStudio gives us, I was sort of talking about that content supply chain technology. So it integrates GenAI in a way where literally any piece of content we produce for a client, how it’s created, where we store it, how teams share it, and it gets passed back and forth, approved, iterated, often with the use of AI: all of that happens in one place. And then we connect that into what we’re doing with Acxiom and Kinesso and what we’ve been doing with data. So then when you tag it, when you push it out to the segments that you’ve identified, we have the ability to link up all that information, and then we can really understand creative effectiveness in a way that we haven’t before, right? How often was the asset used? How did consumers react to it, or interact with it? So clearly, AI is going to give us this incremental layer in these solutions that we build for clients. And so for more of our creative agencies for — the experiential and PR agencies are leaning in. And so what you’re trying to do is demonstrate that you can connect the data layer to content, and then iterate and optimize that content, and then connect it all the way through to an event, to commerce. I think as with any tech, there is lots of focus. We’ve talked about how we’re beyond the point of where we’re experimenting with it. We’re actually implementing it pretty broadly across the board with lots of clients and also bringing them up to speed on how it gets used. But we’re clearly looking at things that could be disruptive, and yet, as an industry, we’ve fared pretty well in the past when there have been disruptive technologies that have come along, going back 15 years ago to the advent of the platforms. Mr. Huber: Great. Thank you. Mr. Krakowsky: Thank you. Operator: Thank you. Our next question comes from Jason Bazinet with Citi. You may go ahead. Philippe Krakowsky, Chief Executive Officer: Hi, Jason. Jason .B. Bazinet, Citi Research: I just had a quick — Hey, how’s it going? I just had a quick question on M&A, since you called it out in your prepared remarks. Other than the strategic fit, are there any sort of financial guidelines that are important to you if you do M&A? Like, additive to organic growth, or helpful to margins, or accretive to adjusted earnings?

19 Mr. Krakowsky: I mean, look, I think we’ve always been very disciplined in the way that we approach this. And I think that notwithstanding the fact that, obviously, the — you need something which strategically is going to, as I said, enhance capabilities or be complementary to what we do in the areas where we’re seeing more demand from clients. But we’re always going to be disciplined in keeping some of the parameters you laid out in mind. And even the one time when we did something very, very significant for us — and we’ve had competitors who are kind of much more consistently in market for deals at that scale, and I don’t think that’s what we’re talking about here — you saw us be very thoughtful about and disciplined in terms of de-levering and in terms of, sort of, how we incorporated that into the Group. So I don’t know that I can give you a specific guideline. It’s also not going to impact, as I said, our commitment to capital return. Mr. Bazinet: Understood. Thank you. Mr. Krakowsky: Thank you. Operator: Thank you. Our next question comes from Tim Nollen with Macquarie. You may go ahead. Tim Nollen, Macquarie Equity Research: Thanks very much. I have actually an industry question, and curious how it ties into your work specifically, Philippe. I’m wondering about Google’s decision to delay the deprecation of the Chrome cookie, which they announced last night. Just wondering in general, what kind of work are you doing with brand advertiser clients to prepare for deprecation of the cookie? And how, if at all, does this delay affect your business? Philippe Krakowsky, Chief Executive Officer: Well, look, I think, to your point, it’s not news, in that this is something that was announced and that has now been delayed a number of times. I think marketers have been thinking about and asking for advice on how it is that we’re going to continue to get the benefits of a certain kind of data. And again, I think people have become much more sophisticated over time in understanding that there are also limitations to proxy data. Or many clients have been much more focused on leveraging their own first-party data and creating their own identity graph and having, I’d say, more control over their own destiny, or more autonomy when it comes to operating in this world, where you’ve got all sorts of disparate data sources and obviously the kinds of changes that were announced yesterday.

20 So given the strength of our data capabilities, we’ve been ready for this for some time. We think it probably represents incremental opportunity. And then it hasn’t really changed conversations with marketers because we’ve been thinking through how it is that you use cohorts, how it is that you find, as I said, ways to leverage your own first- party data or do data sharing and create sort of second-party data pools with any number of partners. So I don’t see it as a particularly dramatic development. I don’t think our people do. Mr. Nollen: Okay. Thanks. Mr. Krakowsky: Thank you. Operator: Thank you. Our next question comes from Cameron McVeigh with Morgan Stanley. You may go ahead. Philippe Krakowsky, Chief Executive Officer: Hi, Cameron. Cameron McVeigh, Morgan Stanley Research: Hey, guys. Just a couple of quick ones. I’m curious if you could quantify the very strong growth in media that you saw this quarter. And then secondly, the increase in SG&A due to some senior enterprise leadership investment in IT, just maybe any more color on that and if we should expect increased investment over the year? Thanks. Mr. Krakowsky: Well, seeing as I can’t help you on the first one because, as you know, it’s not really a — Ellen can unpack the latter for you in detail. Ellen Johnson, Executive Vice President, Chief Financial Officer: Sure. Good morning. SG&A will be higher going forward as we are making strategic investments, as Philippe mentioned in his remarks, in senior enterprise talent and technology. That should lead to both increased growth and efficiency going forward. These were all considered, as we mentioned in the guidance that we’ve given. Q1 was slightly higher due to discrete items, but, in general, that ratio should be higher this year. Mr. Krakowsky: And given the nature of the work that we do, there’s definitely an increased need for — we’ve always talked about the integration of services in Open Architecture®, but now, as we’re saying, you’re talking about the need to centralize some of these horizontal capabilities at scale: a data layer, a production and GenAI-driven content layer, clearly, what Kinesso does for us in terms of activating that data into the media ecosystem.

21 And so, it does just shift where the focus is and the fact that you need folks at the center who can operate things at that scale and get the agencies plugged into that. So it’s just going to be shifts inside of our model. To Ellen’s point, it’s factored into our thinking. Operator: Thank you. And that was our last question, I’ll now turn it back to Philippe for any final thoughts. Philippe Krakowsky, Chief Executive Officer: Thank you, Sue. Thank you all for the time. Obviously, some progress, but work in progress. So we look forward to reporting back again next quarter. Operator: Thank you. And that concludes today’s conference. You may disconnect at this time.

22 Cautionary Statement This transcript contains forward-looking statements. Statements in this transcript that are not historical facts, including statements regarding goals, intentions and expectations as to future plans, trends, events, or future results of operations or financial position, constitute forward- looking statements. Without limiting the generality of the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” “estimate,” “project,” “forecast,” “plan,” “intend,” “could,” “would,” “should,” “will likely result” or comparable terminology are intended to identify forward-looking statements. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results and outcomes to differ materially from those reflected in the forward-looking statements. Actual results and outcomes could differ materially for a variety of reasons, including, among others: the effects of a challenging economy on the demand for our advertising and marketing services, on our clients’ financial condition and on our business or financial condition; our ability to attract new clients and retain existing clients; our ability to retain and attract key employees; risks associated with the effects of global, national and regional economic and political conditions, including counterparty risks and fluctuations in interest rates, inflation rates and currency exchange rates; the economic or business impact of military or political conflict; the impacts on our business of any pandemics, epidemics, disease outbreaks or other public health crises; risks associated with assumptions we make in connection with our critical accounting estimates, including changes in assumptions associated with any effects of a challenging economy; potential adverse effects if we are required to recognize impairment charges or other adverse accounting-related developments; developments from changes in the regulatory and legal environment for advertising and marketing services companies around the world, including laws and regulations related to data protection and consumer privacy; and the impact on our operations of general or directed cybersecurity events. Investors should carefully consider the foregoing factors and the other risks and uncertainties that may affect our business, including those outlined under Item 1A, Risk Factors, in our most recent Annual Report on Form 10-K and our other SEC filings. Investors are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date they are made. We undertake no obligation to update or revise publicly any of them in light of new information, future events, or otherwise.

23 THE INTERPUBLIC GROUP OF COMPANIES, INC. AND SUBSIDIARIES U.S. GAAP RECONCILIATION OF NON-GAAP ADJUSTED RESULTS (Amounts in Millions except Per Share Data) (UNAUDITED) Three Months Ended March 31, 2024 As Reported Amortization of Acquired Intangibles Restructuring Charges Net Losses on Sales of Businesses1 Adjusted Results (Non-GAAP) Operating Income and Adjusted EBITA before Restructuring Charges2 $ 184.2 $ (20.7) $ (0.6) $ 205.5 Total (Expenses) and Other Income3 (23.6) $ (6.8) (16.8) Income Before Income Taxes 160.6 (20.7) (0.6) (6.8) 188.7 Provision for Income Taxes 47.3 4.2 0.1 (1.1) 50.5 Equity in Net Income of Unconsolidated Affiliates 0.3 0.3 Net Income Attributable to Non-controlling Interests (3.2) (3.2) Net Income Available to IPG Common Stockholders $ 110.4 $ (16.5) $ (0.5) $ (7.9) $ 135.3 Weighted-Average Number of Common Shares Outstanding - Basic 378.4 378.4 Dilutive effect of stock options and restricted shares 2.2 2.2 Weighted-Average Number of Common Shares Outstanding - Diluted 380.6 380.6 Earnings per Share Available to IPG Common Stockholders4: Basic $ 0.29 $ (0.04) $ (0.00) $ (0.02) $ 0.36 Diluted $ 0.29 $ (0.04) $ (0.00) $ (0.02) $ 0.36 1 Primarily relates to losses on complete dispositions of businesses and the classification of certain assets as held for sale. 2 Refer to non-GAAP reconciliation of Adjusted EBITA before Restructuring Charges on page 24. 3 Consists of non-operating expenses including interest expense, interest income and other expense, net. 4 Earnings per share amounts are calculated on an unrounded basis but rounded for purposes of presentation. Note: Management believes the resulting comparisons provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance.

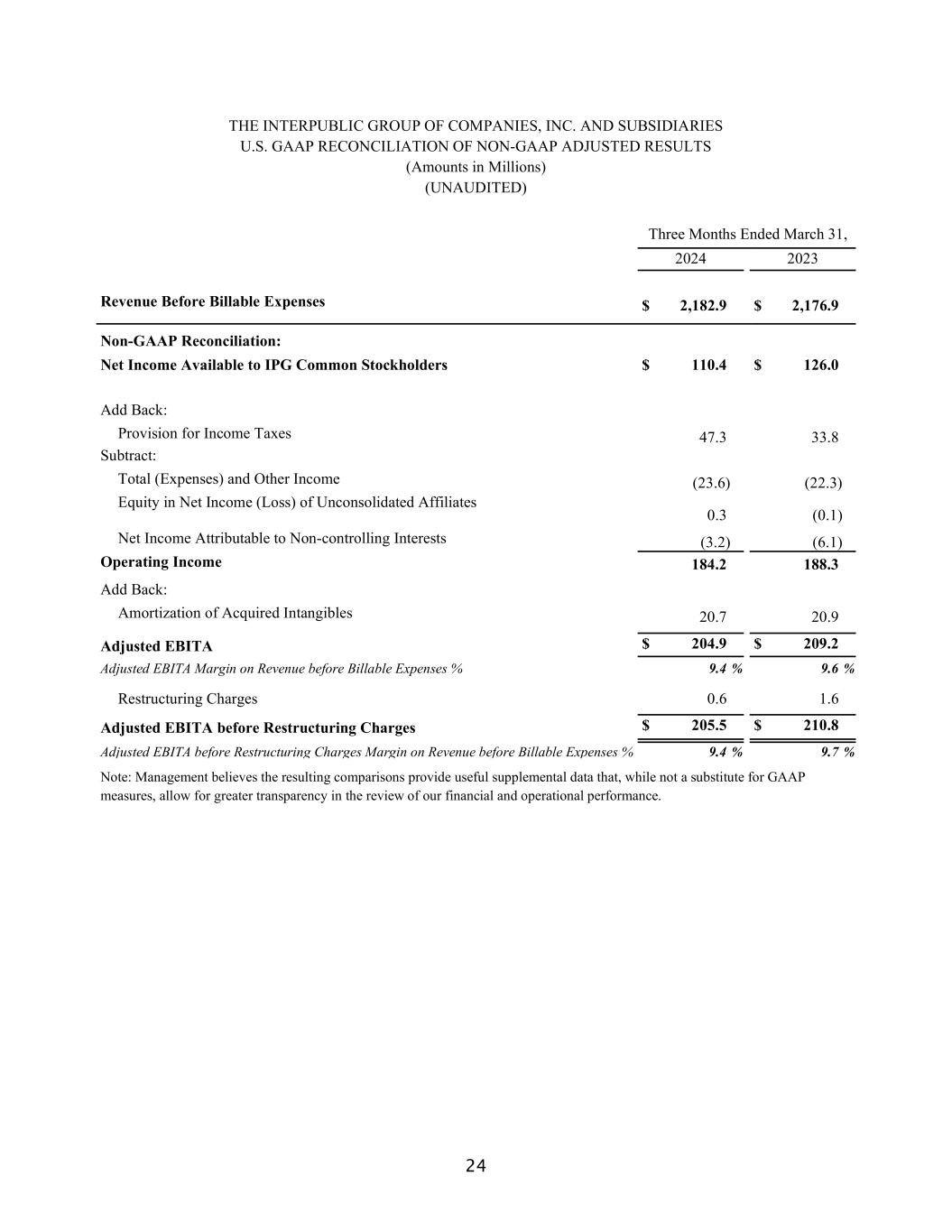

24 THE INTERPUBLIC GROUP OF COMPANIES, INC. AND SUBSIDIARIES U.S. GAAP RECONCILIATION OF NON-GAAP ADJUSTED RESULTS (Amounts in Millions) (UNAUDITED) Three Months Ended March 31, 2024 2023 Revenue Before Billable Expenses $ 2,182.9 $ 2,176.9 Non-GAAP Reconciliation: Net Income Available to IPG Common Stockholders $ 110.4 $ 126.0 Add Back: Provision for Income Taxes 47.3 33.8 Subtract: Total (Expenses) and Other Income (23.6) (22.3) Equity in Net Income (Loss) of Unconsolidated Affiliates 0.3 (0.1) Net Income Attributable to Non-controlling Interests (3.2) (6.1) Operating Income 184.2 188.3 Add Back: Amortization of Acquired Intangibles 20.7 20.9 Adjusted EBITA $ 204.9 $ 209.2 Adjusted EBITA Margin on Revenue before Billable Expenses % 9.4 % 9.6 % Restructuring Charges 0.6 1.6 Adjusted EBITA before Restructuring Charges $ 205.5 $ 210.8 Adjusted EBITA before Restructuring Charges Margin on Revenue before Billable Expenses % 9.4 % 9.7 % Note: Management believes the resulting comparisons provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance.

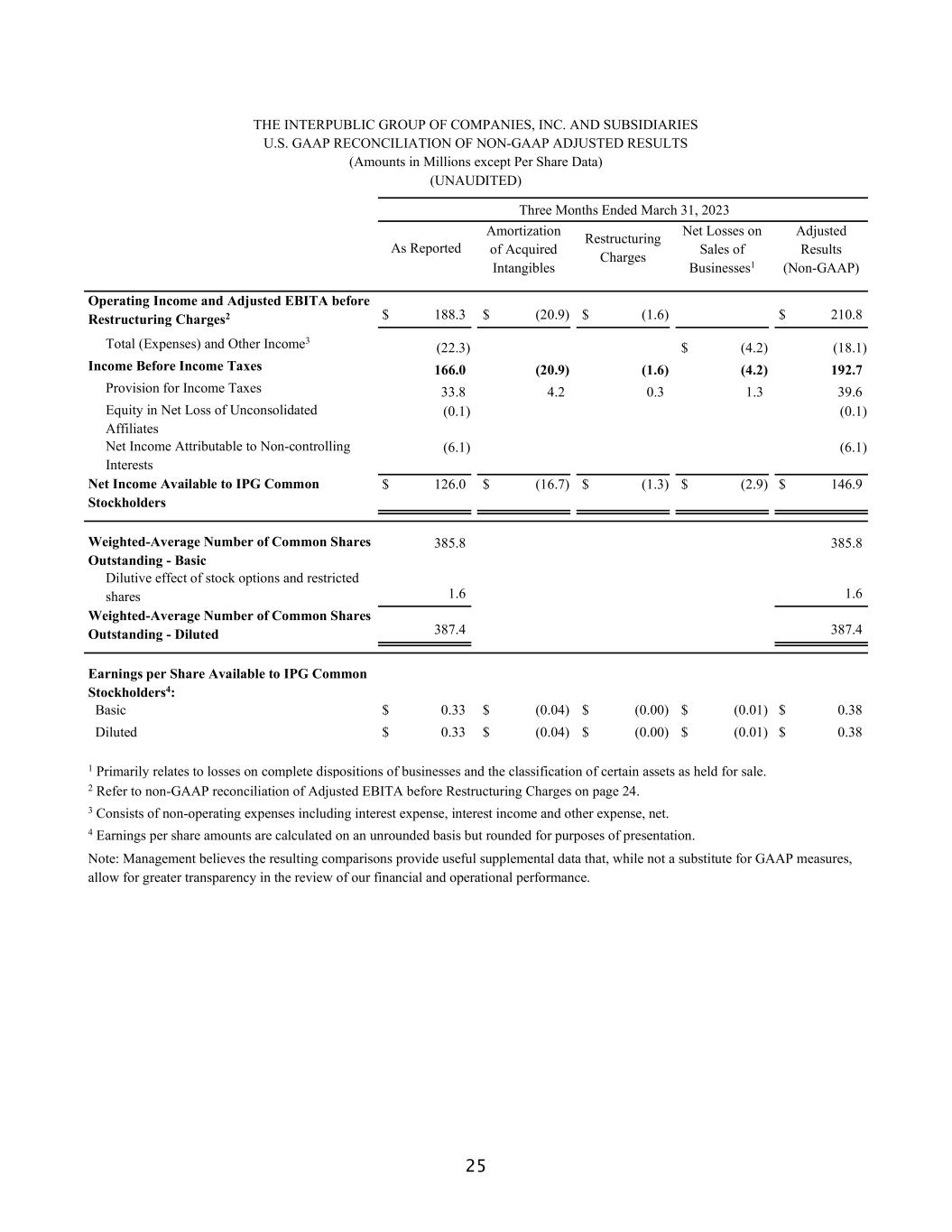

25 THE INTERPUBLIC GROUP OF COMPANIES, INC. AND SUBSIDIARIES U.S. GAAP RECONCILIATION OF NON-GAAP ADJUSTED RESULTS (Amounts in Millions except Per Share Data) (UNAUDITED) Three Months Ended March 31, 2023 As Reported Amortization of Acquired Intangibles Restructuring Charges Net Losses on Sales of Businesses1 Adjusted Results (Non-GAAP) Operating Income and Adjusted EBITA before Restructuring Charges2 $ 188.3 $ (20.9) $ (1.6) $ 210.8 Total (Expenses) and Other Income3 (22.3) $ (4.2) (18.1) Income Before Income Taxes 166.0 (20.9) (1.6) (4.2) 192.7 Provision for Income Taxes 33.8 4.2 0.3 1.3 39.6 Equity in Net Loss of Unconsolidated Affiliates (0.1) (0.1) Net Income Attributable to Non-controlling Interests (6.1) (6.1) Net Income Available to IPG Common Stockholders $ 126.0 $ (16.7) $ (1.3) $ (2.9) $ 146.9 Weighted-Average Number of Common Shares Outstanding - Basic 385.8 385.8 Dilutive effect of stock options and restricted shares 1.6 1.6 Weighted-Average Number of Common Shares Outstanding - Diluted 387.4 387.4 Earnings per Share Available to IPG Common Stockholders4: Basic $ 0.33 $ (0.04) $ (0.00) $ (0.01) $ 0.38 Diluted $ 0.33 $ (0.04) $ (0.00) $ (0.01) $ 0.38 1 Primarily relates to losses on complete dispositions of businesses and the classification of certain assets as held for sale. 2 Refer to non-GAAP reconciliation of Adjusted EBITA before Restructuring Charges on page 24. 3 Consists of non-operating expenses including interest expense, interest income and other expense, net. 4 Earnings per share amounts are calculated on an unrounded basis but rounded for purposes of presentation. Note: Management believes the resulting comparisons provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance.