Interpublic Group July 24, 2024 SECOND QUARTER 2024 EARNINGS CONFERENCE CALL

2Interpublic Group of Companies, Inc. Organic change of Net Revenue, adjusted EBITA before Restructuring Charges and adjusted diluted EPS are non-GAAP measures. Management believes these metrics provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance. See our non-GAAP reconciliations of Organic Change of Net Revenue on pages 19-20 and adjusted results on pages 21-22. • Total revenue including billable expenses was $2.7 billion ◦ Organic growth of revenue before billable expenses (“net revenue”) was +1.7% ◦ US organic growth was +1.3% ◦ International organic growth was +2.6% • Net income as reported was $214.5 million • Adjusted EBITA before restructuring charges was $338.9 million, with 14.6% margin on revenue before billable expenses • Diluted EPS was $0.57 as reported and $0.61 as adjusted • Repurchased 2.2 million shares returning $67.7 million to shareholders Overview — Second Quarter 2024

3Interpublic Group of Companies, Inc. Three Months Ended June 30, 2024 2023 Revenue Before Billable Expenses $ 2,327.1 $ 2,328.5 Billable Expenses 382.9 338.0 Total Revenue 2,710.0 2,666.5 Salaries and Related Expenses 1,557.6 1,598.6 Office and Other Direct Expenses 358.4 340.5 Billable Expenses 382.9 338.0 Cost of Services 2,298.9 2,277.1 Selling, General and Administrative Expenses 27.6 13.9 Depreciation and Amortization 65.0 66.5 Restructuring Charges 0.3 (1.7) Total Operating Expenses 2,391.8 2,355.8 Operating Income 318.2 310.7 Interest Expense, Net (21.3) (27.7) Other Expense, Net (1.2) (4.4) Income Before Income Taxes 295.7 278.6 Provision for Income Taxes (1) 75.6 10.6 Equity in Net (Loss) Income of Unconsolidated Affiliates (0.5) 0.7 Net Income 219.6 268.7 Net Income Attributable to Non-controlling Interests (5.1) (3.2) Net Income Available to IPG Common Stockholders $ 214.5 $ 265.5 Earnings per Share Available to IPG Common Stockholders - Basic (2) $ 0.57 $ 0.69 Earnings per Share Available to IPG Common Stockholders - Diluted (2) $ 0.57 $ 0.68 Weighted-Average Number of Common Shares Outstanding - Basic 376.3 385.7 Weighted-Average Number of Common Shares Outstanding - Diluted 378.7 387.7 Dividends Declared per Common Share $ 0.330 $ 0.310 ($ in Millions, except per share amounts) Operating Performance (1) The provision for income taxes for the three months ended June 30, 2023 includes a benefit of $64.2 related to the settlement of U.S. Federal Income Tax Audits for the years 2017-2018, which is primarily non-cash. (2) Basic and Diluted earnings per share for the three months ended June 30, 2023 includes a positive impact of $0.17 related to the settlement of U.S. Federal Income Tax Audits for the years 2017-2018.

4Interpublic Group of Companies, Inc. Revenue Before Billable Expenses Three Months Ended June 30, Six Months Ended June 30, Change Change 2024 2023 (2) Organic Total 2024 2023 (2) Organic Total Media, Data & Engagement Solutions $ 1,063.5 $ 1,060.9 0.8% 0.2% $ 2,024.8 $ 2,026.8 0.2% (0.1%) IPG Mediabrands, Acxiom and our digital and commerce specialist agencies, which includes MRM, R/GA, and Huge Integrated Advertising & Creativity Led Solutions $ 910.1 $ 908.3 3.0% 0.2% $ 1,791.5 $ 1,778.8 3.1% 0.7% McCann Worldgroup, IPG Health, MullenLowe Group, Foote, Cone & Belding ("FCB"), and our domestic integrated agencies Specialized Communications & Experiential Solutions $ 353.5 $ 359.3 1.3% (1.6%) $ 693.7 $ 699.8 1.4% (0.9%) Weber Shandwick, Golin, our sports, entertainment and experiential agencies, and IPG DXTRA Health (1) "Net Revenue". (2) Results for the three and six months ended June 30, 2023 have been recast to reflect the transfer of certain agencies between reportable segments. See reconciliation of Organic Change of Net Revenue on pages 19-20. ($ in Millions) Three Months Ended Six Months Ended $ % Change $ % Change June 30, 2023 $ 2,328.5 $ 4,505.4 Foreign currency (12.7) (0.6%) (11.1) (0.2%) Net acquisitions/(divestitures) (28.9) (1.2%) (52.3) (1.2%) Organic 40.2 1.7% 68.0 1.5% Total change (1.4) (0.1%) 4.6 0.1% June 30, 2024 $ 2,327.1 $ 4,510.0 (1)

5Interpublic Group of Companies, Inc. Organic Change of Net Revenue by Region Three Months Ended June 30, 2024 +1.3% United States +3.4% United Kingdom +6.3% Continental Europe +4.1% Latin America -2.4% Asia Pacific +2.6% International +1.7% Worldwide +1.5% All Other Markets “All Other Markets” includes Canada, the Middle East and Africa. Circle proportions represent consolidated Net Revenue distribution. See reconciliation of Organic Change of Net Revenue, including total Net Revenue change, on page 19.

6Interpublic Group of Companies, Inc. Operating Expenses % of Revenue Before Billable Expenses (1) Excludes amortization of acquired intangibles. (1) Three Months Ended June 30

7Interpublic Group of Companies, Inc. Three Months Ended June 30, 2024 As Reported Amortization of Acquired Intangibles Restructuring Charges (1) Net Gains on Sales of Businesses (2) Adjusted Results (Non-GAAP) Operating Income and Adjusted EBITA before Restructuring Charges (3) $ 318.2 $ (20.4) $ (0.3) $ 338.9 Total (Expenses) and Other Income (4) (22.5) $ 2.1 (24.6) Income Before Income Taxes 295.7 (20.4) (0.3) 2.1 314.3 Provision for Income Taxes 75.6 4.2 0.1 (0.6) 79.3 Effective Tax Rate 25.6 % 25.2 % Equity in Net Loss of Unconsolidated Affiliates (0.5) (0.5) Net Income Attributable to Non-controlling Interests (5.1) (5.1) DILUTED EPS COMPONENTS: Net Income Available to IPG Common Stockholders $ 214.5 $ (16.2) $ (0.2) $ 1.5 $ 229.4 Weighted-Average Number of Common Shares Outstanding 378.7 378.7 Earnings per Share Available to IPG Common Stockholders (5) $ 0.57 $ (0.04) $ (0.00) $ 0.00 $ 0.61 ($ in Millions, except per share amounts) (1) Restructuring charges of $0.3 in the second quarter of 2024 are related to adjustments to our restructuring actions taken in 2022 and 2020. (2) Primarily relates to gains on complete dispositions of businesses and the classification of certain assets as held for sale. (3) Refer to non-GAAP reconciliation of Adjusted EBITA before Restructuring Charges on page 23. (4) Consists of non-operating expenses including interest expense, interest income, and other expense, net. (5) Earnings per share amounts are calculated on an unrounded basis but rounded for purposes of presentation. See full non-GAAP reconciliation of adjusted diluted earnings per share on page 21. Adjusted Diluted Earnings Per Share

8Interpublic Group of Companies, Inc. Six Months Ended June 30, 2024 As Reported Amortization of Acquired Intangibles Restructuring Charges (1) Net Losses on Sales of Businesses (2) Adjusted Results (Non-GAAP) Operating Income and Adjusted EBITA before Restructuring Charges (3) $ 502.4 $ (41.1) $ (0.9) $ 544.4 Total (Expenses) and Other Income (4) (46.1) $ (4.7) (41.4) Income Before Income Taxes 456.3 (41.1) (0.9) (4.7) 503.0 Provision for Income Taxes 122.9 8.4 0.2 (1.7) 129.8 Effective Tax Rate 26.9 % 25.8 % Equity in Net Loss of Unconsolidated Affiliates (0.2) (0.2) Net Income Attributable to Non-controlling Interests (8.3) (8.3) DILUTED EPS COMPONENTS: Net Income Available to IPG Common Stockholders $ 324.9 $ (32.7) $ (0.7) $ (6.4) $ 364.7 Weighted-Average Number of Common Shares Outstanding 379.7 379.7 Earnings per Share Available to IPG Common Stockholders (5) $ 0.86 $ (0.09) $ (0.00) $ (0.02) $ 0.96 ($ in Millions, except per share amounts) (1) Restructuring charges of $0.9 in the first half of 2024 are related to adjustments to our restructuring actions taken in 2022 and 2020. (2) Primarily relates to losses on complete dispositions of businesses and the classification of certain assets as held for sale. (3) Refer to non-GAAP reconciliation of Adjusted EBITA before Restructuring Charges on page 23. (4) Consists of non-operating expenses including interest expense, interest income, and other expense, net. (5) Earnings per share amounts are calculated on an unrounded basis but rounded for purposes of presentation. See full non-GAAP reconciliation of adjusted diluted earnings per share on page 22. Adjusted Diluted Earnings Per Share

9Interpublic Group of Companies, Inc. Three Months Ended June 30, 2024 2023 Net Income $ 219.6 $ 268.7 OPERATING ACTIVITIES: Depreciation & amortization 83.6 80.0 Other non-cash items 12.8 7.5 Net (gains) losses on sales of businesses (2.1) 2.6 Deferred taxes (49.9) (43.2) Change in working capital, net (128.4) (281.2) Change in other non-current assets & liabilities (14.9) (69.6) Net cash provided by (used in) Operating Activities $ 120.7 $ (35.2) INVESTING ACTIVITIES: Capital expenditures (34.8) (46.4) Net proceeds from sale of businesses, net of cash sold (10.8) 0.4 Purchase of short-term marketable securities — (97.5) Acquisitions, net of cash acquired — (2.3) Net proceeds from investments 2.3 21.7 Other investing activities 2.9 3.1 Net cash used in Investing Activities $ (40.4) $ (121.0) FINANCING ACTIVITIES: Repayment of long-term debt (250.1) (0.1) Common stock dividends (123.9) (119.4) Repurchases of common stock (67.7) (50.2) Distributions to noncontrolling interests (4.3) (5.4) Acquisition-related payments (2.1) (9.0) Net (decrease) increase in short-term borrowings (1.2) 1.0 Tax payments for employee shares withheld (0.3) (0.7) Proceeds from long-term debt — 296.3 Other financing activities (1.6) (2.7) Net cash used in Financing Activities $ (451.2) $ 109.8 Currency effect (12.7) (4.0) Net decrease in cash, cash equivalents and restricted cash $ (383.6) $ (50.4) ($ in Millions) Cash Flow

10Interpublic Group of Companies, Inc. June 30, 2024 December 31, 2023 June 30, 2023 CURRENT ASSETS: Cash and cash equivalents $ 1,545.5 $ 2,386.1 $ 1,628.1 Accounts receivable, net 4,505.9 5,768.8 4,170.0 Accounts receivable, billable to clients 2,163.9 2,229.2 2,215.9 Prepaid expenses 527.3 415.8 454.7 Assets held for sale 8.3 21.9 6.0 Other current assets 74.7 128.6 166.3 Total current assets $ 8,825.6 $ 10,950.4 $ 8,641.0 CURRENT LIABILITIES: Accounts payable $ 6,909.3 $ 8,355.0 $ 6,573.2 Accrued liabilities 488.1 705.8 562.3 Contract liabilities 609.4 684.7 690.5 Short-term borrowings 20.5 34.2 30.2 Current portion of long-term debt 0.1 250.1 250.3 Current portion of operating leases 246.6 252.6 243.5 Liabilities held for sale 13.3 48.5 5.3 Total current liabilities $ 8,287.3 $ 10,330.9 $ 8,355.3 ($ in Millions) Balance Sheet — Current Portion

11Interpublic Group of Companies, Inc. Senior Notes 4.65% 5.40%2.40% Total Debt = $2.9 billion ($ in Millions) 4.75% 3.375% ... ... Short-Term Debt ... 5.375% Debt Maturity Schedule Note: Our 4.200% unsecured senior notes in aggregate principal amount of $250.0 matured on April 15, 2024, and we used cash on hand to fund the principal repayment.

12Interpublic Group of Companies, Inc. Summary • Key drivers of growth ◦ Dynamic media offering, leading healthcare capabilities, and exceptional talent in marketing services ◦ Scaled data management and proprietary identity resolution products ◦ Seamless delivery of integrated client solutions ◦ Evolving our asset mix to focus on strongest growth opportunities • Furthering investment in emerging opportunities ◦ High-growth media channels and digital commerce ◦ Development of new media buying models ◦ Personalized, data-infused creativity, increasingly powered by Gen AI • Effective and proven expense management remains an ongoing priority ◦ Continued streamlining of operations and processes for greater efficiency ◦ Further deployment of enterprise systems • Financial strength is a continued source of value creation

13Interpublic Group of Companies, Inc. Appendix

14Interpublic Group of Companies, Inc. Six Months Ended June 30, 2024 2023 Revenue Before Billable Expenses $ 4,510.0 $ 4,505.4 Billable Expenses 695.9 682.1 Total Revenue 5,205.9 5,187.5 Salaries and Related Expenses 3,130.4 3,175.9 Office and Other Direct Expenses 680.5 670.8 Billable Expenses 695.9 682.1 Cost of Services 4,506.8 4,528.8 Selling, General and Administrative Expenses 65.6 26.8 Depreciation and Amortization 130.2 133.0 Restructuring Charges 0.9 (0.1) Total Operating Expenses 4,703.5 4,688.5 Operating Income 502.4 499.0 Interest Expense, Net (35.4) (43.3) Other Expense, Net (10.7) (11.1) Income Before Income Taxes 456.3 444.6 Provision for Income Taxes (1) 122.9 44.4 Equity in Net (Loss) Income of Unconsolidated Affiliates (0.2) 0.6 Net Income 333.2 400.8 Net Income Attributable to Non-controlling Interests (8.3) (9.3) Net Income Available to IPG Common Stockholders $ 324.9 $ 391.5 Earnings per Share Available to IPG Common Stockholders - Basic (2) $ 0.86 $ 1.01 Earnings per Share Available to IPG Common Stockholders - Diluted (2) $ 0.86 $ 1.01 Weighted-Average Number of Common Shares Outstanding - Basic 377.4 385.8 Weighted-Average Number of Common Shares Outstanding - Diluted 379.7 387.6 Dividends Declared per Common Share $ 0.660 $ 0.620 ($ in Millions, except per share amounts) Operating Performance (1) The provision for income taxes for the six months ended June 30, 2023 includes a benefit of $64.2 related to the settlement of U.S. Federal Income Tax Audits for the years 2017-2018, which is primarily non-cash. (2) Basic and Diluted earnings per share for the six months ended June 30, 2023 includes a positive impact of $0.17 related to the settlement of U.S. Federal Income Tax Audits for the years 2017-2018.

15Interpublic Group of Companies, Inc. Organic Change of Net Revenue by Region “All Other Markets” includes Canada, the Middle East and Africa. Circle proportions represent consolidated Net Revenue distribution. See reconciliation of Organic Change of Net Revenue, including total Net Revenue change, on page 20. Six Months Ended June 30, 2024 +1.7% United States +1.9% United Kingdom +7.5% Continental Europe +3.6% Latin America -5.1% Asia Pacific +1.1% International +1.5% Worldwide -2.3% All Other Markets

16Interpublic Group of Companies, Inc. Operating Expenses % of Revenue Before Billable Expenses (1) Excludes amortization of acquired intangibles. . Six Months Ended June 30 (1)

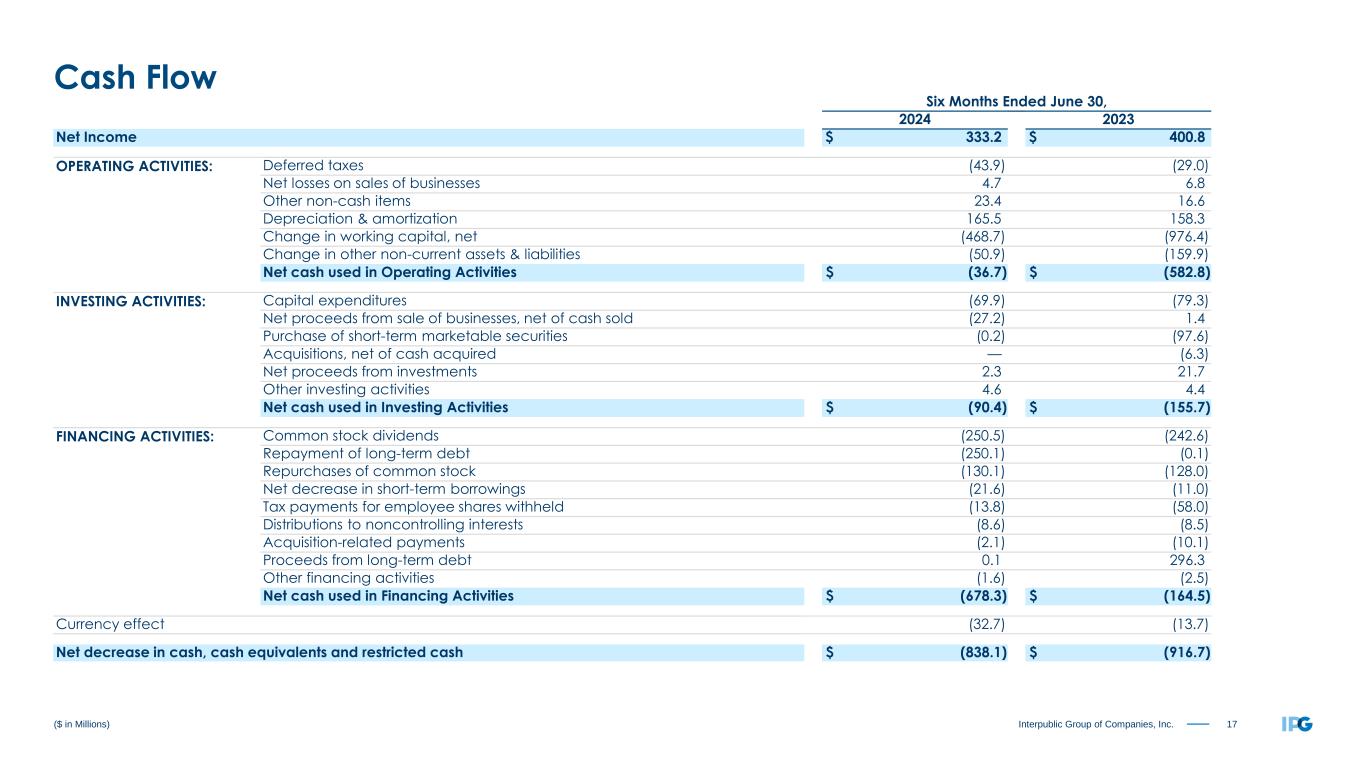

17Interpublic Group of Companies, Inc. Six Months Ended June 30, 2024 2023 Net Income $ 333.2 $ 400.8 OPERATING ACTIVITIES: Deferred taxes (43.9) (29.0) Net losses on sales of businesses 4.7 6.8 Other non-cash items 23.4 16.6 Depreciation & amortization 165.5 158.3 Change in working capital, net (468.7) (976.4) Change in other non-current assets & liabilities (50.9) (159.9) Net cash used in Operating Activities $ (36.7) $ (582.8) INVESTING ACTIVITIES: Capital expenditures (69.9) (79.3) Net proceeds from sale of businesses, net of cash sold (27.2) 1.4 Purchase of short-term marketable securities (0.2) (97.6) Acquisitions, net of cash acquired — (6.3) Net proceeds from investments 2.3 21.7 Other investing activities 4.6 4.4 Net cash used in Investing Activities $ (90.4) $ (155.7) FINANCING ACTIVITIES: Common stock dividends (250.5) (242.6) Repayment of long-term debt (250.1) (0.1) Repurchases of common stock (130.1) (128.0) Net decrease in short-term borrowings (21.6) (11.0) Tax payments for employee shares withheld (13.8) (58.0) Distributions to noncontrolling interests (8.6) (8.5) Acquisition-related payments (2.1) (10.1) Proceeds from long-term debt 0.1 296.3 Other financing activities (1.6) (2.5) Net cash used in Financing Activities $ (678.3) $ (164.5) Currency effect (32.7) (13.7) Net decrease in cash, cash equivalents and restricted cash $ (838.1) $ (916.7) ($ in Millions) Cash Flow

18Interpublic Group of Companies, Inc. 2024 Q1 Q2 Q3 Q4 YTD 2024 Depreciation and amortization (1) $ 44.5 $ 44.6 89.1 Amortization of acquired intangibles 20.7 20.4 41.1 Amortization of restricted stock and other non-cash compensation 16.4 18.1 34.5 Net amortization of bond discounts and deferred financing costs 0.3 0.5 0.8 2023 Q1 Q2 Q3 Q4 FY 2023 Depreciation and amortization (1) $ 45.6 $ 45.3 $ 45.0 $ 44.4 $ 180.3 Amortization of acquired intangibles 20.9 21.2 21.0 20.9 84.0 Amortization of restricted stock and other non-cash compensation 11.1 12.8 12.1 10.7 46.7 Net amortization of bond discounts and deferred financing costs 0.7 0.7 0.3 0.3 2.0 ($ in Millions) (1) Excludes amortization of acquired intangibles. Depreciation and Amortization

19Interpublic Group of Companies, Inc. Components of Change Change Three Months Ended June 30, 2023 (1) Foreign Currency Net Acquisitions / (Divestitures) Organic Three Months Ended June 30, 2024 Organic Total SEGMENT: Media, Data & Engagement Solutions (2) $ 1,060.9 $ (5.7) $ — $ 8.3 $ 1,063.5 0.8% 0.2% Integrated Advertising & Creativity Led Solutions (3) 908.3 (6.2) (19.4) 27.4 910.1 3.0% 0.2% Specialized Communications & Experiential Solutions (4) 359.3 (0.8) (9.5) 4.5 353.5 1.3% (1.6%) Total $ 2,328.5 $ (12.7) $ (28.9) $ 40.2 $ 2,327.1 1.7% (0.1%) GEOGRAPHIC: United States $ 1,531.8 $ — $ (25.9) $ 19.6 $ 1,525.5 1.3% (0.4%) International 796.7 (12.7) (3.0) 20.6 801.6 2.6% 0.6% United Kingdom 184.9 2.5 — 6.3 193.7 3.4% 4.8% Continental Europe 192.5 (2.5) (3.0) 12.2 199.2 6.3% 3.5% Asia Pacific 177.3 (5.8) — (4.2) 167.3 (2.4%) (5.6%) Latin America 102.4 (4.4) — 4.2 102.2 4.1% (0.2%) All Other Markets 139.6 (2.5) — 2.1 139.2 1.5% (0.3%) Worldwide $ 2,328.5 $ (12.7) $ (28.9) $ 40.2 $ 2,327.1 1.7% (0.1%) ($ in Millions) Reconciliation of Organic Change of Net Revenue (1) Results for the three months ended June 30, 2023 have been recast to reflect the transfer of certain agencies between reportable segments. (2) Comprised of IPG Mediabrands, Acxiom and our digital and commerce specialist agencies, which includes MRM, R/GA, and Huge. (3) Comprised of McCann Worldgroup, IPG Health, MullenLowe Group, Foote, Cone & Belding ("FCB"), and our domestic integrated agencies. (4) Comprised of Weber Shandwick, Golin, our sports, entertainment and experiential agencies, and IPG DXTRA Health.

20Interpublic Group of Companies, Inc. ($ in Millions) Components of Change Change Six Months Ended June 30, 2023 (1) Foreign Currency Net Acquisitions / (Divestitures) Organic Six Months Ended June 30, 2024 Organic Total SEGMENT: Media, Data & Engagement Solutions (2) $ 2,026.8 $ (5.6) — $ 3.6 $ 2,024.8 0.2% (0.1%) Integrated Advertising & Creativity Led Solutions (3) 1,778.8 (6.0) (36.2) 54.9 1,791.5 3.1% 0.7% Specialized Communications & Experiential Solutions (4) 699.8 0.5 (16.1) 9.5 693.7 1.4% (0.9%) Total $ 4,505.4 $ (11.1) $ (52.3) $ 68.0 $ 4,510.0 1.5% 0.1% GEOGRAPHIC: United States $ 3,002.4 $ — $ (51.8) $ 51.2 $ 3,001.8 1.7% 0.0% International 1,503.0 (11.1) (0.5) 16.8 1,508.2 1.1% 0.3% United Kingdom 355.1 9.9 — 6.7 371.7 1.9% 4.7% Continental Europe 356.2 (1.3) (3.0) 26.8 378.7 7.5% 6.3% Asia Pacific 336.5 (11.8) 2.5 (17.1) 310.1 (5.1%) (7.8%) Latin America 187.1 (4.5) — 6.7 189.3 3.6% 1.2% All Other Markets 268.1 (3.4) — (6.3) 258.4 (2.3%) (3.6%) Worldwide $ 4,505.4 $ (11.1) $ (52.3) $ 68.0 $ 4,510.0 1.5% 0.1% Reconciliation of Organic Change of Net Revenue (1) Results for the six months ended June 30, 2023 have been recast to reflect the transfer of certain agencies between reportable segments. (2) Comprised of IPG Mediabrands, Acxiom and our digital and commerce specialist agencies, which includes MRM, R/GA, and Huge. (3) Comprised of McCann Worldgroup, IPG Health, MullenLowe Group, Foote, Cone & Belding ("FCB"), and our domestic integrated agencies. (4) Comprised of Weber Shandwick, Golin, our sports, entertainment and experiential agencies, and IPG DXTRA Health.

21Interpublic Group of Companies, Inc. Three Months Ended June 30, 2024 As Reported Amortization of Acquired Intangibles Restructuring Charges (2) Net Gains on Sales of Businesses (3) Adjusted Results (Non-GAAP) Operating Income and Adjusted EBITA before Restructuring Charges (4) $ 318.2 $ (20.4) $ (0.3) $ 338.9 Total (Expenses) and Other Income (5) (22.5) $ 2.1 (24.6) Income Before Income Taxes 295.7 (20.4) (0.3) 2.1 314.3 Provision for Income Taxes 75.6 4.2 0.1 (0.6) 79.3 Effective Tax Rate 25.6 % 25.2 % Equity in Net Loss of Unconsolidated Affiliates (0.5) (0.5) Net Income Attributable to Non-controlling Interests (5.1) (5.1) Net Income Available to IPG Common Stockholders $ 214.5 $ (16.2) $ (0.2) $ 1.5 $ 229.4 Weighted-Average Number of Common Shares Outstanding - Basic 376.3 376.3 Dilutive effect of stock options and restricted shares 2.4 2.4 Weighted-Average Number of Common Shares Outstanding - Diluted 378.7 378.7 Earnings per Share Available to IPG Common Stockholders (6): Basic $ 0.57 $ (0.04) $ (0.00) $ 0.00 $ 0.61 Diluted $ 0.57 $ (0.04) $ (0.00) $ 0.00 $ 0.61 ($ in Millions, except per share amounts) (1) The table reconciles our reported results to our adjusted non-GAAP results. Management believes the resulting comparisons provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance. (2) Restructuring charges of $0.3 in the second quarter of 2024 are related to adjustments to our restructuring actions taken 2022 and 2020. (3) Primarily relates to gains on complete dispositions of businesses and the classification of certain assets as held for sale. (4) Refer to non-GAAP reconciliation of Adjusted EBITA before Restructuring Charges on page 23. (5) Consists of non-operating expenses including interest expense, interest income, and other expense, net. (6) Earnings per share amounts are calculated on an unrounded basis but rounded for purposes of presentation. Reconciliation of Adjusted Results (1)

22Interpublic Group of Companies, Inc. ($ in Millions, except per share amounts) Reconciliation of Adjusted Results (1) (1) The table reconciles our reported results to our adjusted non-GAAP results. Management believes the resulting comparisons provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance. (2) Restructuring charges of $0.9 in the first half of 2024 represent adjustments to our restructuring actions taken in 2022 and 2020. (3) Primarily relates to losses on complete dispositions of businesses and the classification of certain assets as held for sale. (4) Refer to non-GAAP reconciliation of Adjusted EBITA before Restructuring Charges on page 23. (5) Consists of non-operating expenses including interest expense, interest income, and other expense, net. (6) Earnings per share amounts are calculated on an unrounded basis but rounded for purposes of presentation. Six Months Ended June 30, 2024 As Reported Amortization of Acquired Intangibles Restructuring Charges (2) Net Losses on Sales of Businesses (3) Adjusted Results (Non-GAAP) Operating Income and Adjusted EBITA before Restructuring Charges (4) $ 502.4 $ (41.1) $ (0.9) $ 544.4 Total (Expenses) and Other Income (5) (46.1) $ (4.7) (41.4) Income Before Income Taxes 456.3 (41.1) (0.9) (4.7) 503.0 Provision for Income Taxes 122.9 8.4 0.2 (1.7) 129.8 Effective Tax Rate 26.9 % 25.8 % Equity in Net Loss of Unconsolidated Affiliates (0.2) (0.2) Net Income Attributable to Non-controlling Interests (8.3) (8.3) Net Income Available to IPG Common Stockholders $ 324.9 $ (32.7) $ (0.7) $ (6.4) $ 364.7 Weighted-Average Number of Common Shares Outstanding - Basic 377.4 377.4 Dilutive effect of stock options and restricted shares 2.3 2.3 Weighted-Average Number of Common Shares Outstanding - Diluted 379.7 379.7 Earnings per Share Available to IPG Common Stockholders (6): Basic $ 0.86 $ (0.09) $ (0.00) $ (0.02) $ 0.97 Diluted $ 0.86 $ (0.09) $ (0.00) $ (0.02) $ 0.96

23Interpublic Group of Companies, Inc. Reconciliation of Adjusted EBITA Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Revenue Before Billable Expenses $ 2,327.1 $ 2,328.5 $ 4,510.0 $ 4,505.4 Non-GAAP Reconciliation: Net Income Available to IPG Common Stockholders $ 214.5 $ 265.5 $ 324.9 $ 391.5 Add Back: Provision for Income Taxes 75.6 10.6 122.9 44.4 Subtract: Total (Expenses) and Other Income (22.5) (32.1) (46.1) (54.4) Equity in Net (Loss) Income of Unconsolidated Affiliates (0.5) 0.7 (0.2) 0.6 Net Income Attributable to Non-controlling Interests (5.1) (3.2) (8.3) (9.3) Operating Income $ 318.2 $ 310.7 $ 502.4 $ 499.0 Add Back: Amortization of Acquired Intangibles 20.4 21.2 41.1 42.1 Adjusted EBITA $ 338.6 $ 331.9 $ 543.5 $ 541.1 Adjusted EBITA Margin on Revenue Before Billable Expenses % 14.6 % 14.3 % 12.1 % 12.0 % Restructuring Charges (2) 0.3 (1.7) 0.9 (0.1) Adjusted EBITA before Restructuring Charges $ 338.9 $ 330.2 $ 544.4 $ 541.0 Adjusted EBITA before Restructuring Charges Margin on Revenue Before Billable Expenses % 14.6 % 14.2 % 12.1 % 12.0 % (1) ($ in Millions) (1) The table reconciles our reported results to our adjusted non-GAAP results. Management believes the resulting comparisons provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance. (2) Restructuring charges of $0.3 and ($1.7) in the second quarter of 2024 and 2023, respectively, and restructuring charges of $0.9 and ($0.1) in the first half of 2024 and 2023, respectively, are related to adjustments to our restructuring actions taken in 2022 and 2020.

24Interpublic Group of Companies, Inc. Media, Data & Engagement Solutions (2) Integrated Advertising & Creativity Led Solutions (3) Specialized Communications & Experiential Solutions (4) Corporate and Other (5) IPG Consolidated (1) Three Months Ended June 30, Three Months Ended June 30, Three Months Ended June 30, Three Months Ended June 30, Three Months Ended June 30, 2024 2023 (6) 2024 2023 (6) 2024 2023 (6) 2024 2023 2024 2023 Revenue Before Billable Expenses $ 1,063.5 $ 1,060.9 $ 910.1 $ 908.3 $ 353.5 $ 359.3 $ 2,327.1 $ 2,328.5 Segment/Adjusted EBITA $ 181.4 $ 144.6 $ 132.7 $ 131.0 $ 53.5 $ 71.3 $ (29.0) $ (15.0) $ 338.6 $ 331.9 Restructuring Charges (7) 0.3 (1.2) — — — (0.4) — (0.1) 0.3 (1.7) Segment/Adjusted EBITA before Restructuring Charges $ 181.7 $ 143.4 $ 132.7 $ 131.0 $ 53.5 $ 70.9 $ (29.0) $ (15.1) $ 338.9 $ 330.2 Margin (%) of Revenue Before Billable Expenses 17.1 % 13.5 % 14.6 % 14.4 % 15.1 % 19.7 % 14.6 % 14.2 % ($ in Millions) (1) Adjusted EBITA before restructuring charges is calculated as net income available to IPG common stockholders before provision for incomes taxes, total (expenses) and other income, equity in net (loss) income of unconsolidated affiliates, net income attributable to non-controlling interests, amortization of acquired intangibles and restructuring charges. (2) Comprised of IPG Mediabrands, Acxiom and our digital and commerce specialist agencies, which includes MRM, R/GA, and Huge. (3) Comprised of McCann Worldgroup, IPG Health, MullenLowe Group, Foote, Cone & Belding ("FCB"), and our domestic integrated agencies. (4) Comprised of Weber Shandwick, Golin, our sports, entertainment and experiential agencies, and IPG DXTRA Health. (5) Corporate and Other is primarily comprised of selling, general and administrative expenses including corporate office expenses as well as shared service center and certain other centrally managed expenses that are not fully allocated to operating divisions. (6) Results for the three months ended June 30, 2023 have been recast to reflect the transfer of certain agencies between reportable segments. (7) Restructuring charges of $0.3 and ($1.7) in the second quarter of 2024 and 2023, respectively, are related to adjustments to our restructuring actions taken in 2022 and 2020. Adjusted EBITA before Restructuring Charges by Segment (1)

25Interpublic Group of Companies, Inc. Media, Data & Engagement Solutions (2) Integrated Advertising & Creativity Led Solutions (3) Specialized Communications & Experiential Solutions (4) Corporate and Other (5) IPG Consolidated (1) Six Months Ended June 30, Six Months Ended June 30, Six Months Ended June 30, Six Months Ended June 30, Six Months Ended June 30, 2024 2023 (6) 2024 2023 (6) 2024 2023 (6) 2024 2023 2024 2023 Revenue Before Billable Expenses $ 2,024.8 $ 2,026.8 $ 1,791.5 $ 1,778.8 $ 693.7 $ 699.8 $ 4,510.0 $ 4,505.4 Segment/Adjusted EBITA $ 274.6 $ 224.4 $ 240.6 $ 229.1 $ 97.4 $ 116.5 $ (69.1) $ (28.9) $ 543.5 $ 541.1 Restructuring Charges (7) 0.3 (1.2) 0.3 0.3 0.3 0.9 — (0.1) 0.9 (0.1) Segment/Adjusted EBITA before Restructuring Charges $ 274.9 $ 223.2 $ 240.9 $ 229.4 $ 97.7 $ 117.4 $ (69.1) $ (29.0) $ 544.4 $ 541.0 Margin (%) of Revenue Before Billable Expenses 13.6 % 11.0 % 13.4 % 12.9 % 14.1 % 16.8 % 12.1 % 12.0 % ($ in Millions) Adjusted EBITA before Restructuring Charges by Segment (1) (1) Adjusted EBITA before restructuring charges is calculated as net income available to IPG common stockholders before provision for incomes taxes, total (expenses) and other income, equity in net (loss) income of unconsolidated affiliates, net income attributable to non-controlling interests, amortization of acquired intangibles and restructuring charges. (2) Comprised of IPG Mediabrands, Acxiom and our digital and commerce specialist agencies, which includes MRM, R/GA, and Huge. (3) Comprised of McCann Worldgroup, IPG Health, MullenLowe Group, Foote, Cone & Belding ("FCB"), and our domestic integrated agencies. (4) Comprised of Weber Shandwick, Golin, our sports, entertainment and experiential agencies, and IPG DXTRA Health. (5) Corporate and Other is primarily comprised of selling, general and administrative expenses including corporate office expenses as well as shared service center and certain other centrally managed expenses that are not fully allocated to operating divisions. (6) Results for the six months ended June 30, 2023 have been recast to reflect the transfer of certain agencies between reportable segments. (7) Restructuring charges of $0.9 and ($0.1) in the first half of 2024 and 2023, respectively, are related to adjustments to our restructuring actions taken in 2022 and 2020.

26Interpublic Group of Companies, Inc. Three Months Ended June 30, 2023 As Reported Amortization of Acquired Intangibles Restructuring Charges (2) Net Losses on Sales of Businesses (3) Adjusted Results (Non-GAAP) Operating Income and Adjusted EBITA before Restructuring Charges (4) $ 310.7 $ (21.2) $ 1.7 $ 330.2 Total (Expenses) and Other Income (5) (32.1) $ (4.1) (28.0) Income Before Income Taxes 278.6 (21.2) 1.7 (4.1) 302.2 Provision for Income Taxes 10.6 4.2 (0.4) 0.1 14.5 Effective Tax Rate 3.8 % 4.8 % Equity in Net Income of Unconsolidated Affiliates 0.7 0.7 Net Income Attributable to Non-controlling Interests (3.2) (3.2) Net Income Available to IPG Common Stockholders $ 265.5 $ (17.0) $ 1.3 $ (4.0) $ 285.2 Weighted-Average Number of Common Shares Outstanding - Basic 385.7 385.7 Dilutive effect of stock options and restricted shares 2.0 2.0 Weighted-Average Number of Common Shares Outstanding - Diluted 387.7 387.7 Earnings per Share Available to IPG Common Stockholders (6)(7): Basic $ 0.69 $ (0.04) $ 0.00 $ (0.01) $ 0.74 Diluted $ 0.68 $ (0.04) $ 0.00 $ (0.01) $ 0.74 ($ in Millions, except per share amounts) (1) The table reconciles our reported results to our adjusted non-GAAP results. Management believes the resulting comparisons provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance. (2) Restructuring charges of ($1.7) in the second quarter of 2023 are related to adjustments to our restructuring actions taken 2022 and 2020. (3) Primarily relates to losses on complete dispositions of businesses and the classification of certain assets as held for sale, as well as a loss related to the sale of an equity investment. (4) Refer to non-GAAP reconciliation of Adjusted EBITA before Restructuring Charges on page 23. (5) Consists of non-operating expenses including interest expense, interest income, and other expense, net. (6) Earnings per share amounts are calculated on an unrounded basis but rounded for purposes of presentation. (7) Basic and diluted earnings per share, both As Reported and Adjusted Results (Non-GAAP), includes a positive impact of $0.17 related to the settlement of U.S. Federal Income Tax Audits for the years 2017-2018. Reconciliation of Adjusted Results (1)

27Interpublic Group of Companies, Inc. ($ in Millions, except per share amounts) Reconciliation of Adjusted Results (1) Six Months Ended June 30, 2023 As Reported Amortization of Acquired Intangibles Restructuring Charges (2) Net Losses on Sales of Businesses (3) Adjusted Results (Non-GAAP) Operating Income and Adjusted EBITA before Restructuring Charges (4) $ 499.0 $ (42.1) $ 0.1 $ 541.0 Total (Expenses) and Other Income (5) (54.4) $ (8.3) (46.1) Income Before Income Taxes 444.6 (42.1) 0.1 (8.3) 494.9 Provision for Income Taxes 44.4 8.4 (0.1) 1.4 54.1 Effective Tax Rate 10.0 % 10.9 % Equity in Net Income of Unconsolidated Affiliates 0.6 0.6 Net Income Attributable to Non-controlling Interests (9.3) (9.3) Net Income Available to IPG Common Stockholders $ 391.5 $ (33.7) $ 0.0 $ (6.9) $ 432.1 Weighted-Average Number of Common Shares Outstanding - Basic 385.8 385.8 Dilutive effect of stock options and restricted shares 1.8 1.8 Weighted-Average Number of Common Shares Outstanding - Diluted 387.6 387.6 Earnings per Share Available to IPG Common Stockholders (6)(7): Basic $ 1.01 $ (0.09) $ 0.00 $ (0.02) $ 1.12 Diluted $ 1.01 $ (0.09) $ 0.00 $ (0.02) $ 1.11 (1) The table reconciles our reported results to our adjusted non-GAAP results. Management believes the resulting comparisons provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance. (2) Restructuring charges of ($0.1) in the first half of 2023 are related to adjustments to our restructuring actions taken 2022 and 2020. (3) Primarily relates to losses on complete dispositions of businesses and the classification of certain assets as held for sale, as well as a loss related to the sale of an equity investment. (4) Refer to non-GAAP reconciliation of Adjusted EBITA before Restructuring Charges on page 23. (5) Consists of non-operating expenses including interest expense, interest income, and other expense, net. (6) Earnings per share amounts are calculated on an unrounded basis but rounded for purposes of presentation. (7) Basic and diluted earnings per share, both As Reported and Adjusted Results (Non-GAAP), includes a positive impact of $0.17 related to the settlement of U.S. Federal Income Tax Audits for the years 2017-2018.

28Interpublic Group of Companies, Inc. Metrics Update

29Interpublic Group of Companies, Inc. Metrics Update CATEGORY: SALARIES & RELATED OFFICE & OTHER DIRECT FINANCIAL (% of Revenue Before Billable Expenses) (% of Revenue Before Billable Expenses) METRIC: Trailing Twelve Months Trailing Twelve Months Available Liquidity Base, Benefits & Tax Occupancy Expense Credit Facility Covenant Incentive Expense All Other Office & Other Direct Expenses Severance Expense Temporary Help

30Interpublic Group of Companies, Inc. Salaries & Related Expenses % of Revenue Before Billable Expenses, Trailing Twelve Months

31Interpublic Group of Companies, Inc. Salaries & Related Expenses (% of Revenue Before Billable Expenses) “All Other Salaries & Related,” not shown, was 1.1% and 1.0% for the three months ended June 30, 2024 and 2023, respectively, and 1.0% for both the six months ended June 30, 2024 and 2023. Three and Six Months Ended June 30 2024 2023

32Interpublic Group of Companies, Inc. Office & Other Direct Expenses % of Revenue Before Billable Expenses, Trailing Twelve Months

33Interpublic Group of Companies, Inc. Office & Other Direct Expenses (% of Revenue Before Billable Expenses) “All Other” primarily includes software and cloud based expenses, client service costs, travel and entertainment, professional fees, spending to support new business activity, telecommunications, non-pass through production expenses, office supplies, bad debt expense, foreign currency losses (gains), adjustments to contingent acquisition obligations and other expenses. 2024 2023 Three and Six Months Ended June 30

34Interpublic Group of Companies, Inc. ($ in Millions) Available Liquidity Cash, Cash Equivalents + Available Committed Credit Facilities Available Committed Credit FacilityCash and Cash Equivalents

35Interpublic Group of Companies, Inc. Financial Covenant Four Quarters Ended June 30, 2024 Leverage Ratio (not greater than) (1) 3.50x Actual Leverage Ratio 1.63x CREDIT AGREEMENT EBITDA RECONCILIATION: Four Quarters Ended June 30, 2024 Net Income Available to IPG Common Stockholders $ 1,031.8 Non-Operating Adjustments (2) 454.2 Operating Income $ 1,486.0 + Depreciation and Amortization 319.0 + Other Non-cash Charges Reducing Operating Income 0.9 Credit Agreement EBITDA (1): $ 1,805.9 ($ in Millions) Credit Facility Covenant (1) The leverage ratio is defined as debt as of the last day of such fiscal quarter to EBITDA (as defined in the Credit Agreement) for the four quarters then ended. Management utilizes Credit Agreement EBITDA, which is a non-GAAP financial measure, as well as the amounts shown in the table above, calculated as required by the Credit Agreement, in order to assess our compliance with such covenants. (2) Includes adjustments of the following items from our consolidated statement of operations: provision for income taxes, total (expenses) and other income, equity in net (loss) income of unconsolidated affiliates, and net income attributable to non-controlling interests.

36Interpublic Group of Companies, Inc. Cautionary Statement This investor presentation contains forward-looking statements. Statements in this investor presentation that are not historical facts, including statements regarding guidance, goals, intentions, and expectations as to future plans, trends, events, or future results of operations or financial position, constitute forward-looking statements. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results and outcomes to differ materially from those reflected in the forward-looking statements, and are subject to change based on a number of factors, including those outlined under Item 1A, Risk Factors, in our most recent Annual Report on Form 10-K, and our other filings with the Securities and Exchange Commission ("SEC"). Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update publicly any of them in light of new information or future events. Forward-looking statements involve inherent risks and uncertainties. A number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. Such factors include, but are not limited to, the following: ▪ the effects of a challenging economy on the demand for our advertising and marketing services, on our clients’ financial condition and on our business or financial condition; ▪ our ability to attract new clients and retain existing clients; ▪ our ability to retain and attract key employees; ▪ risks associated with the effects of global, national and regional economic conditions, including counterparty risks and fluctuations in interest rates, inflation rates and currency exchange rates; ▪ the economic or business impact of military or political conflict in key markets; ▪ the impacts on our business of any pandemics, epidemics, disease outbreaks or other public health crises; ▪ risks associated with assumptions we make in connection with our critical accounting estimates, including changes in assumptions associated with any effects of a challenging economy; ▪ potential adverse effects if we are required to recognize impairment charges or other adverse accounting-related developments; ▪ developments from changes in the regulatory and legal environment for advertising and marketing services companies around the world, including laws and regulations related to data protection and consumer privacy; and ▪ the impact on our operations of general or directed cybersecurity events. Investors should carefully consider the foregoing factors and the other risks and uncertainties that may affect our business, including those outlined under Item 1A, Risk Factors, in our most recent annual report on Form 10-K, and our other SEC filings. Investors are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date they are made. We undertake no obligation to update or revise publicly any of them in light of new information, future events, or otherwise.