Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ☒ | Definitive Proxy Statement | |||

| ☐ | Definitive Additional Materials | |||

| ☐ | Soliciting Material under Rule 14a-12 | |||

THE INTERPUBLIC GROUP OF COMPANIES, INC. | ||||

| Name of the Registrant as Specified In Its Charter | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| 1. | Title of each class of securities to which transaction applies:

| |||

| ||||

| 2. | Aggregate number of securities to which transaction applies:

| |||

| ||||

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| ||||

| 4. | Proposed maximum aggregate value of transaction:

| |||

| ||||

| 5. | Total fee paid: | |||

| ||||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1. | Amount Previously Paid:

| |||

| ||||

| 2. | Form, Schedule or Registration Statement No.:

| |||

| ||||

| 3. | Filing Party:

| |||

| ||||

| 4. | Date Filed:

| |||

| ||||

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

Table of Contents

The Interpublic Group of Companies, Inc.

909 Third Avenue, New York, NY 10022

April 9, 2020

Dear Stockholder:

You are cordially invited to attend the 2020 Annual Meeting of Stockholders of The Interpublic Group of Companies, Inc., to be held at 9:30 A.M. Eastern Time, on Thursday, May 21, 2020. The meeting will be held at the Paley Center for Media, 25 West 52nd Street, New York, NY 10019.

We are sensitive to the public health and travel concerns our stockholders may have and the protocols that federal, state, and local governments may impose in connection with the Coronavirus orCOVID-19 and, as such, we might hold a Virtual Annual Meeting instead of holding the meeting in New York. We would publicly announce a determination to hold a virtual Annual Meeting in a press release available at www.interpublic.com as soon as practicable before the meeting. In that event, the 2020 Annual Meeting of Stockholders would be conducted solely virtually, on the above date and time, via live audio webcast.

In accordance with the Securities and Exchange Commission rules allowing companies to furnish proxy materials to their

stockholders over the Internet, we have sent stockholders of record at the close of business on March 30, 2020 a Notice of Internet Availability of the proxy statement and our 2019 Annual Report. The notice contains instructions on how to access those documents online. The notice also contains instructions on how stockholders receiving the notice can request a paper copy of our proxy materials, including this proxy statement, our 2019 Annual Report and a form of proxy card or voting instruction card. This distribution method conserves natural resources and reduces the costs of printing and distributing our proxy materials.

The business to be considered is described in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement. In addition to these matters, we will present a report on the state of our Company.

We hope you will be able to attend.

Sincerely,

Michael I. Roth

Chairman of the Board

and Chief Executive Officer

Table of Contents

The Interpublic Group of Companies, Inc.

909 Third Avenue, New York, NY 10022

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Time and Date: | 9:30 a.m., local time, on Thursday, May 21, 2020 |

Place: | The Paley Center for Media, 25 West 52nd Street, New York, NY 10019 |

Items of Business:

| 1. | To elect the nine directors listed on pages 4-7 of the enclosed Proxy Statement; |

| 2. | To ratify the appointment of PricewaterhouseCoopers LLP as Interpublic’s independent registered public accounting firm for the year 2020; |

| 3. | To hold an advisory vote on named executive officer compensation; |

| 4. | To vote on a stockholder proposal described in the proxy statement if properly presented at the meeting; and |

| 5. | To transact such other business as may properly come before the meeting. |

Information about the foregoing matters to be voted upon at the 2020 Annual Meeting is contained in the Proxy Statement.

The close of business on March 30, 2020 has been established as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and any adjournment thereof.

Stockholders will need to present a valid photo identification to be admitted to the Annual Meeting. Please note that the use of photographic and recording devices is prohibited at the meeting.

Important Notice Regarding the Availability of Proxy Materials for the Stockholders Meeting to be held on May 21, 2020.

Interpublic’s 2020 Proxy Statement and 2019 Annual Report are available electronically athttp://www.interpublic.com.

By Order of the Board of Directors,

Andrew Bonzani

Executive Vice President, General Counsel and Secretary

Your vote is important! Whether or not you plan to attend the meeting, please take a moment to vote by Internet, telephone or completing a proxy card as described in theHow Do I Vote section of this document. Your prompt cooperation will save Interpublic additional solicitation costs. You may revoke your proxy as described in theHow Can I Revoke My Proxy or Change My Vote section of this document if you decide to change your vote or if you decide to attend the meeting and vote in person.

Dated: April 9, 2020

Table of Contents

Table of Contents

THE INTERPUBLIC GROUP OF COMPANIES, INC.

Proxy Statement

The Board of Directors (the “Board”) of The Interpublic Group of Companies, Inc. (“Interpublic,” “IPG,” the “Company,” “us,” “we” or “our”) is providing this Proxy Statement in connection with the 2020 Annual Meeting of Stockholders (the “Annual Meeting”), which will be held at the Paley Center for Media, 25 West 52nd Street, New York, NY, at 9:30 a.m., Eastern Time, on

Thursday, May 21, 2020. Interpublic’s principal executive office is located at 909 Third Avenue, New York, NY 10022. The proxy materials are first being sent to stockholders beginning on or about April 9, 2020.

This Proxy Statement is also available on our website athttp://www.interpublic.com.

Who Can Attend The Annual Meeting? How Do I Attend?

As part of our precautions regarding the coronavirus or COVID-19, we are planning for the possibility that the annual meeting may be held solely by means of remote communication. If we take this step, we will announce the decision to do so in advance, and details on how to participate will be available athttp://www.interpublic.com.

How are the proxy materials being distributed?

To expedite delivery, reduce our costs and decrease the environmental impact of our proxy materials, we used “Notice and Access” in accordance with the U.S. Securities and Exchange Commission (“SEC”) rule that allows companies to furnish their proxy materials over the internet. As a result, we are mailing to many of our stockholders of record a notice of the internet availability of the proxy materials in lieu of a paper copy of the proxy materials. All stockholders receiving this notice may access the proxy materials over the internet or request a paper copy of the proxy materials by mail. In addition, the notice has instructions on how you may request access to proxy materials by mail or electronically on an ongoing basis.

Choosing to access your future proxy materials electronically will reduce the costs of distributing our proxy materials and helps conserve natural resources. If you choose to access future proxy materials electronically in connection with future meetings, you will receive an email of a Notice and Access with instructions containing a link to the website where the proxy materials are available and a link to the proxy-voting website. Your election to access proxy materials electronically will remain in effect until it is terminated by you.

Who can vote?

You are entitled to vote or direct the voting of your shares of Interpublic common stock (the “Common Stock”) if you were a stockholder on March 30, 2020, the record date for the Annual Meeting. On March 30, 2020, approximately 389,439,374 shares of Common Stock were outstanding.

Who is the holder of record?

You may own your shares of Common Stock either:

| • | directly registered in your name at our transfer agent, Computershare; or |

| • | indirectly through a broker, bank or other intermediary. |

If your shares are registered directly in your name, you are the holder of record of these shares, and we are sending these proxy materials directly to you. If you hold shares indirectly through a broker, bank or other intermediary, these materials are being sent to you by or on behalf of that entity.

How do I vote?

Your vote is important. We encourage you to vote promptly. You may vote in any one of the following ways:

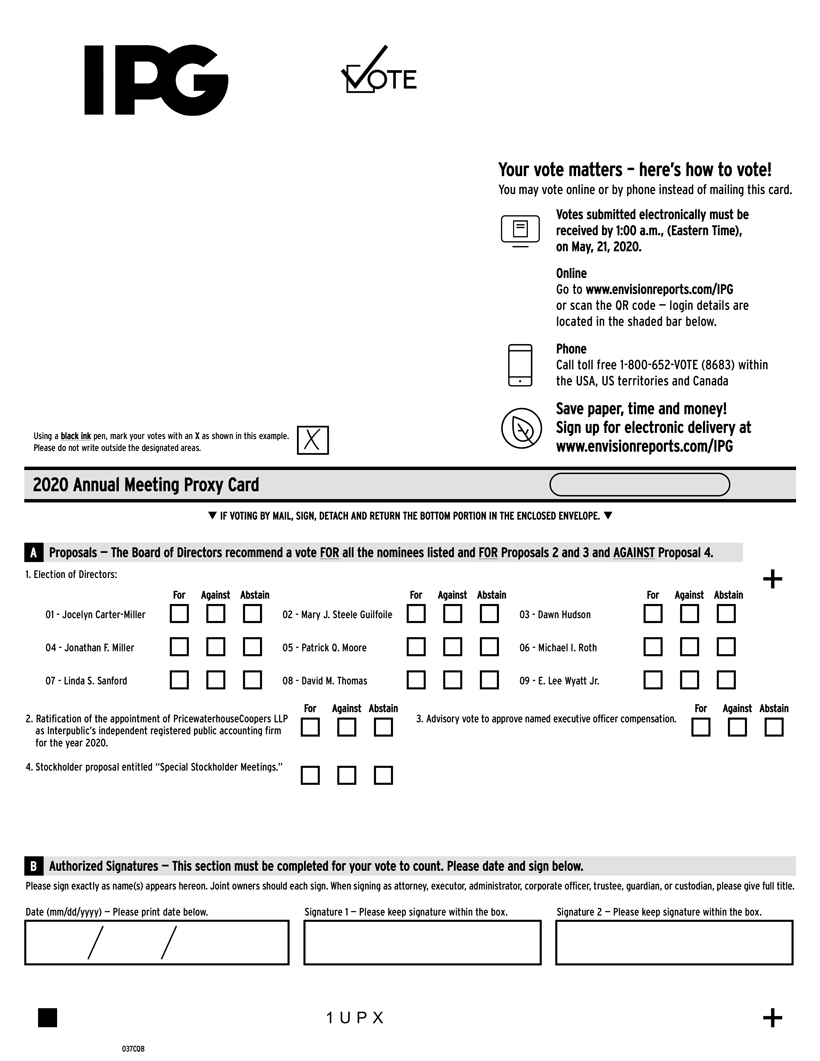

Holders of record

| • | By Telephone. You can vote your shares by telephone, by calling1-800-652-VOTE (8683). Telephone voting is available 24 hours a day and 7 days a week. If you vote by telephone, you do not need to return a proxy card. Your vote by telephone must be received by 1 a.m. EDT, May 21, 2020. |

| • | By Internet. You can also vote on the internet. The website address for Internet voting is www.envisionreports.com/IPG. Internet voting is available 24 hours a day and 7 days a week. If you vote by internet, you do not need to return your proxy card. Your vote by internet must be received by 1 a.m. EDT, May 21, 2020. |

| • | By Mail. If you choose to vote by mail, complete the proxy card enclosed with the mailed proxy material, date and sign it, and return it in the postage-paid envelope provided. Your vote by mail must be received by 5 p.m. EDT, May 20, 2020. |

| • | By Attending the Annual Meeting. If you attend the Annual Meeting, you can vote your shares in person by written ballot. You must present a valid photo identification for admission to the Annual Meeting. Please refer to the instructions set forth on the proxy card. |

| Interpublic Group 2020 Proxy Statement | 1 |

Table of Contents

Frequently Asked Questions

Shares Held by Brokers, Banks and Other Intermediaries

| • | If your shares of Common Stock are held through a broker, bank or other intermediary, you will receive instructions from that entity regarding the voting of your shares. |

| • | If you plan to attend the Annual Meeting and vote in person, you will need to contact your broker, bank or other intermediary in advance of the meeting to obtain a “legal proxy” to permit you to vote by written ballot at the Annual Meeting. |

How many shares must be present to hold the annual meeting?

A quorum is required to transact business at the Annual Meeting. We will have a quorum at the Annual Meeting if the holders of more than 50% of the outstanding shares of Common Stock entitled to vote are present at the meeting, either in person or by proxy.

How are votes counted?

For all matters being submitted to a vote of stockholders, only proxies and ballots that indicate votes ‘‘FOR,’’ ‘‘AGAINST’’ or ‘‘ABSTAIN’’ on the proposals, or that provide the designated proxies with the right to vote in their judgment and discretion on the proposals are counted to determine the number of shares present and entitled to vote.

A New York Stock Exchange (“NYSE”) member broker that holds shares for the account of a customer has the authority to vote on certain limited matters without instructions from the customer. Of the matters being submitted to a vote of stockholders at the Annual Meeting, NYSE rules permit member brokers to vote without instructions only on the proposal to ratify the appointment of our independent auditor. On each of the other matters, NYSE members may not vote without customer instruction. A notation by a broker on a returned proxy that it is not permitted to vote on particular matters due to the NYSE rules is referred to as a “brokernon-vote.”

How will my shares be voted at the Annual Meeting?

The individuals named as proxies on the proxy card will vote your shares in accordance with your instructions. Please review the voting instructions and read the entire text of the proposals and the positions of the Board of Directors in this

Proxy Statement prior to marking your vote. If your proxy card is signed and returned without specifying a vote or an abstention on a proposal, it will be voted according to the recommendation of the Board of Directors on that proposal. That recommendation is shown for each proposal on the proxy card.

What are the Board of Directors’ voting recommendations?

For the reasons set forth in more detail later in this Proxy Statement, our Board of Directors recommends a vote:

| • | FOR the Board’s nominees for election as directors; |

| • | FOR the ratification of the appointment of PricewaterhouseCoopers LLP as Interpublic’s independent registered public accounting firm for 2020; |

| • | FOR the advisory vote to approve named executive officer compensation; and |

| • | AGAINST the stockholder proposal. |

What vote is required to approve each proposal?

The table below shows the vote required to approve the matters being submitted to a vote of stockholders at the Annual Meeting:

| Proposals | Vote Required | Do abstentions count as shares present and entitled to vote? | Do broker non-votes count as shares present and entitled to vote? | |||

| Election of each Director | Majority of shares present and entitled to vote | Yes | No | |||

| Ratification of the Appointment of Pricewaterhouse-Coopers LLP* | Majority of shares present and entitled to vote | Yes | N/A | |||

| Advisory Vote to Approve Named Executive Officer Compensation* | Majority of shares present and entitled to vote | Yes | No | |||

| Stockholder Proposal | Majority of shares present and entitled to vote | Yes | No |

* Advisory andnon-binding

| 2 | Interpublic Group 2020 Proxy Statement |

Table of Contents

Frequently Asked Questions

How can I revoke my proxy or change my vote?

You can revoke your proxy or change your vote by:

Holders of Record

| • | Sending written notice of revocation to the EVP, General Counsel & Secretary of Interpublic prior to the Annual Meeting; |

| • | Submitting a later dated proxy by mail or, prior to 1 a.m., EDT, on May 21, 2020, by telephone or internet; or |

| • | Attending the Annual Meeting and voting in person by written ballot. |

Stock Held by Brokers, Banks and Other Intermediaries

| • | You must contact your broker, bank or other intermediary to obtain instructions on how to revoke your proxy or change your vote. |

Who will count the vote?

The Board of Directors has appointed Computershare to act as Inspector of Election at the 2020 Annual Meeting.

Who is the proxy solicitor?

D.F. King & Co., Inc. has been retained by Interpublic to assist with the Annual Meeting, including the distribution of proxy materials and solicitation of votes, for a fee of $18,000, plus reimbursement of expenses to be paid by Interpublic. In addition, our directors, officers or employees may solicit proxies for us in person or by telephone, facsimile, Internet

or other electronic means for which they will not receive any compensation other than their regular compensation as directors, officers and employees. Banks, brokers and others holding stock for the account of their customers will be reimbursed by Interpublic forout-of-pocket expenses incurred in sending proxy materials to the beneficial owners of such shares.

How do I submit a proposal for inclusion in Interpublic’s 2021 proxy materials?

Stockholder proposals submitted for inclusion in Interpublic’s proxy statement and form of proxy for the 2021 Annual Meeting of Stockholders scheduled to be held on May 27, 2021, should be addressed to: The Interpublic Group of Companies, Inc., 909 Third Avenue, New York, NY 10022, Attention: EVP, General Counsel & Secretary, and must be received by Interpublic by December 13, 2020, in order to be considered for inclusion. Such proposals must comply with all applicable SEC regulations.

How do I submit an item of business for consideration at the 2021 Annual Meeting?

A stockholder wishing to introduce an item of business (including the nomination of any person for election as a director of Interpublic) for consideration by stockholders at the 2021 Annual Meeting, other than a stockholder proposal included in the proxy statement as described in response to the preceding question, must comply with Section 2.13(a)(2) of Interpublic’s Bylaws, which requires notice to Interpublic no later than February 20, 2021, and no earlier than January 21, 2021, accompanied by the information required by Section 2.13(a)(2).

| Interpublic Group 2020 Proxy Statement | 3 |

Table of Contents

At the Annual Meeting, nine directors are to be elected, each for aone-year term. The directors so elected will hold office until the Annual Meeting of Stockholders to be held in 2021 and until his or her successor is duly elected and qualified or until his or her earlier death, resignation or removal. In accordance with Interpublic’s director retirement age policy, H. John Greeniaus, William T. Kerr and Henry S. Miller will not stand forre-election to the Board and the Board has approved the reduction of the Board to nine directors as of May 21, 2020.

Unless authority is withheld by the stockholder, it is the intention of persons named by Interpublic as proxies on the proxy card to vote “for” the nominees identified in this Proxy

Statement or, in the event that any of the nominees is unable to serve (an event not now anticipated), to vote “for” the balance of the nominees and “for” the replacement nominee, if any, designated by the Board of Directors. If no replacement is nominated, the size of the Board of Directors will be reduced.

Each of the nominees is currently a director, and each has been recommended forre-election to the Board of Directors by the Corporate Governance Committee and approved and nominated forre-election by the Board of Directors.

The Board of Directors recommends that stockholders vote “FOR” each of the nominees.

Nominees for Director

The following information on each director nominee is as of March 30, 2020, and has been provided or confirmed to Interpublic by the nominee.

| JOCELYN CARTER-MILLER

Age:62

Director Since:2007 | Interpublic Committees: • Audit • Corporate Governance (Chair) • Executive | Public Directorships: • Arlo Technologies, Inc. • The Principal Financial Group, Inc.

Former Directorships • Netgear, Inc. |

JOCELYN CARTER-MILLER is President of TechEdVentures, Inc., a community and personal empowerment firm that develops and markets educational and community-based programs. Ms. Carter-Miller was Executive Vice President and Chief Marketing Officer of Office Depot, Inc. from February 2002 until March 2004. Prior to that time, Ms. Carter-Miller was Corporate Vice President and Chief Marketing Officer of Motorola, Inc. from February 1999 until February 2002. Ms. Carter-Miller is also a former board member of the Association of National Advertisers.

Qualifications: Ms. Carter-Miller provides the Board with an important perspective in the marketing field, which is a critical component of Interpublic’s business, based on her extensive executive and marketing experience acquired during her time at Motorola, where she served as its Chief Marketing Officer and more recently as Executive Vice President and Chief Marketing Officer of Office Depot, Inc. Her current work as President of TechEdVentures provides the Board with a meaningful voice in keeping Interpublic focused on its corporate social responsibilities.

| MARY J. STEELE GUILFOILE

Age:66

Director Since: 2007 | Interpublic Committees: • Audit (Chair) • Corporate Governance • Executive | Public Directorships: • C.H. Robinson Worldwide, Inc. • Hudson Ltd. • Pitney Bowes Inc.

Former Public Directorships: • Valley National Bancorp. • Viasys Healthcare, Inc. |

MARY J. STEELE GUILFOILE, is currently Chairman of MG Advisors, Inc., a privately owned financial services merger and acquisitions advisory and consulting firm. From 2000 to 2002, Ms. Guilfoile was Executive Vice President and Corporate Treasurer at JPMorgan Chase & Co. and also served as Chief Administrative Officer of its investment bank. Ms. Guilfoile is a former Partner, CFO and COO of The Beacon Group, LLC, a private equity, strategic advisory and wealth management partnership, from 1996 through 2000. Ms. Guilfoile, a licensed CPA, continues as a Partner of The Beacon Group, LP, a private investment group.

| 4 | Interpublic Group 2020 Proxy Statement |

Table of Contents

Item 1: Election of Directors

Qualifications: Ms. Guilfoile’s knowledge and expertise as a financial industry executive and her training as a certified public accountant contributes an important perspective to the Board. Ms. Guilfoile’s tenure at JP Morgan Chase, and its predecessor companies, serving as Corporate Treasurer, Chief Administrative Officer for its investment bank, and in various merger integration, executive management and strategic planning positions, as well as her current role as Chairman of MG Advisors, Inc., brings to the Board someone with valuable experience and expertise in corporate governance, accounting, risk management and auditing matters.

| DAWN HUDSON

Age:62

Director Since:2011 | Interpublic Committees: • Compensation and Leadership Talent • Corporate Governance | Public Directorships: • NVIDIA Corporation

Former Public Directorships: • Amplify Snack Brands, Inc. • Allergan, Inc. • Lowe’s Companies, Inc. • PF Chang’s china Bistro, Inc. |

DAWN HUDSON was Chief Marketing Officer for the National Football League (the “NFL”), serving in that role from October 2014 through April 2018. Previously, she served from 2009 to 2014 as vice chairman of The Parthenon Group, an advisory firm focused on strategy consulting. Prior to that time, Ms. Hudson served as President and Chief Executive Officer of Pepsi-Cola North America, or PCNA, the multi-billion dollar refreshment beverage unit of PepsiCo, Inc. in the United States and Canada from 2005 until 2007. From 2002 to 2005, Ms. Hudson served as President of PCNA. In addition, Ms. Hudson served as Chief Executive Officer of the PepsiCo Foodservice Division from 2005 to 2007. Prior to joining PepsiCo, Ms. Hudson was Managing Director at D’Arcy Masius Benton & Bowles, a leading advertising agency based in New York. Ms. Hudson is a former Chair and board member of the Association of National Advertisers (the “ANA”). In 2006 and 2007, she was named among Fortune Magazine’s “50 Most Powerful Women in Business.” In 2002, she received the honor of “Advertising Woman of the Year” by Advertising Women of New York. Ms. Hudson was also inducted into the American Advertising Federation’s Advertising Hall of Achievement, and has been featured twice in Advertising Age’s “Top 50 Marketers.” Ms. Hudson is the former Chairman of the Board of the Ladies Professional Golf Association.

Qualifications: Ms. Hudson’s extensive experience in strategy and marketing, with the NFL, at PepsiCo and at major advertising agencies, and her time as Chair of the ANA brings valuable expertise to the Board on matters which are vital to the Company’s business. In addition, her experience as Vice Chair of The Parthenon Group, and as the former Chief Executive Officer ofPepsi-Co North America, provides the Board with valuable insight and perspective on matters involving the Company’s business strategy and planning. Ms. Hudson also provides a unique perspective of having been both on the agency and client side of the industry. Her sixteen years of experience on various public company boards is a valuable resource on corporate governance matters.

| JONATHAN F. MILLER

Age:63

Director Since:2015 | Interpublic Committees: • Compensation and Leadership Talent • Corporate Governance

Public Directorships: • Akamai Technologies Inc. • AMC Networks Inc. • j2 Global, Inc. | Former Public Directorships: • Houghton Mifflin Harcourt Company • Live Nation Entertainment, Inc. • RTL Group SA • Shutterstock, Inc. • TripAdvisor, Inc. |

JONATHAN F. MILLER is the Chief Executive Officer of Integrated Media Co., a special purpose digital media investment company, and began serving in that role in February 2018. Prior to that time, Mr. Miller was a Partner of Advancit Capital, LLC, a venture capital investment fund, from July 2013 through January 2018. Previously, Mr. Miller served as Chairman and Chief Executive of News Corporation’s digital media group and as News Corporation’s Chief Digital Officer from April 2009 until October 2012. Mr. Miller had previously been a founding partner of Velocity Interactive Group (“Velocity”), an investment firm focusing on digital media and the consumer Internet, from its inception in February 2007 until April 2009. Prior to founding Velocity, Mr. Miller served as Chief Executive Officer of AOL LLC (“AOL”) from August 2002 to December 2006. Prior to joining AOL, Mr. Miller served as Chief Executive Officer and President of USA Information and Services, of USA Networks Interactive, a predecessor to IAC/InterActiveCorp.

| Interpublic Group 2020 Proxy Statement | 5 |

Table of Contents

Item 1: Election of Directors

Qualifications: Mr. Miller’s extensive knowledge and senior leadership positions in the media industry, including executive roles at News Corporation, AOL and USA Networks Interactive, provides the Board with a broad and valuable perspective and expertise on the complex media and advertising landscape.

| PATRICK Q. MOORE

Age:50

Director Since:2018 | Interpublic Committees: • Audit • Compensation and Leadership Talent | Public Directorships: • Ryman Hospitality Properties, Inc. |

PATRICK Q. MOORE became Executive Vice President, North American Retail at Carter’s Inc., a global leader in children’s apparel and related products, in 2019. Prior to that time he served as Carter’s Executive Vice President, Strategy and Business Development from 2017 to 2019. From 2013 to 2017, Mr. Moore was Executive Vice President, Chief Strategy Officer with YP Holdings, a portfolio company of Cerberus Capital Management, and one of the largest local digital media businesses in the U.S. Prior to his time at YP Holdings, Mr. Moore spent more than 10 years at McKinsey & Company, a global management consulting firm, serving as a Partner and leader in the firm’s Consumer Practice. Mr. Moore also led McKinsey’s North American Consumer Digital Excellence initiative while with the firm.

Qualifications: Mr. Moore’s experience at a digital media company and at a management consulting firm provide him with a unique perspective on the challenges and opportunities faced by the Company. Mr. Moore’s experience and expertise in corporate strategy provides the Board with valuable perspective in the Board’s oversight of the organization’s strategic objectives.

| MICHAEL I. ROTH

Age:74

Director Since:2002 | Interpublic Committees: • Executive (Chair) | Public Directorships: • Pitney Bowes Inc. • Ryman Hospitality Properties, Inc. |

MICHAEL I. ROTH became Chairman of the Board and Chief Executive Officer of Interpublic in January 2005. Prior to that time Mr. Roth served as Chairman of the Board of Interpublic from July 2004 to January 2005 and has been a director of Interpublic since 2002. Mr. Roth served as Chairman and Chief Executive Officer of The MONY Group Inc. from February 1994 to June 2004.

Qualifications: Mr. Roth’s leadership and perspective as Interpublic’s Chief Executive Officer gives him an intimate knowledge of the Company’s operations and his role as Chairman of the Board is aided by his successful tenure as Chairman and Chief Executive Officer of The MONY Group. Mr. Roth’s other directorships, and his accounting, tax and legal background, as a certified public accountant and holding an L.L.M. degree from New York University Law School, also adds significant value to his overall contributions as a member of the Board and in his role as Chairman.

| LINDA S. SANFORD Age:67 Director Since:2019 | Interpublic Committees: • Audit • Corporate Governance | Public Directorships: • Consolidated Edison, Inc. • Pitney Bowes Inc. • RELX Group |

LINDA S. SANFORD is a former Senior Vice President, Enterprise Transformation, International Business Machines Corporation (IBM), a global technology and services company, where she served in that role from January 2003 until her retirement in 2014. Prior to that, Ms. Sanford was senior vice president and group executive, IBM Storage Systems Group. Ms. Sanford joined IBM in 1975. Sanford is a member of the Women in Technology International Hall of Fame and the National Academy of Engineering.

| 6 | Interpublic Group 2020 Proxy Statement |

Table of Contents

Item 1. Election of Directors

Qualifications: Ms. Sanford’s expertise in the technology sector and her extensive experience, in innovation and global operations and business transformation provides the Board with an invaluable perspective and knowledge in areas of business transformation and data governance, matters that are vital to the Company’s business.

| DAVID M. THOMAS

Age:70

Director Since:2004 | Interpublic Committees: • Compensation and Leadership Talent • Corporate Governance • Executive | Public Directorships: • Fortune Brands Home & Security, Inc.(Non-executive Chairman)

Former Public Directorships: • IMS Health Inc. • The MONY Group, Inc. |

DAVID M. THOMAS retired as executive chairman of IMS Health Inc. (“IMS”), a healthcare information, services and technology company, in March 2006, after serving in that position since January 2005. From November 2000 until January 2005, Mr. Thomas served as Chairman and Chief Executive Officer of IMS. Prior to joining IMS, Mr. Thomas was Senior Vice President and Group Executive of IBM from January 1998 to July 2000. Mr. Thomas also serves on the Board of Trustees of Fidelity Investments.

Qualifications: Mr. Thomas’ experience as a Chief Executive Officer and overall management experience at premier global technology companies provides a vital perspective for the Board as it addresses the rapidly changing and growing landscape in advertising and marketing. Such leadership experience is also vital in his role as Presiding Director. Mr. Thomas also provides the Board with a great deal of insight and perspective in the healthcare advertising field having served as Chairman and Chief Executive Officer of IMS.

| E. LEE WYATT JR.

Age:67

Director Since:2017 | Interpublic Committees: • Audit • Compensation and Leadership Talent |

E. LEE WYATT JR. Mr. Wyatt is a former Executive Vice President of Fortune Brands Home & Security, Inc., a consumer home products company, where he served in that role from July 2017 until his retirement in December 2017. Prior to that, Mr. Wyatt served as Senior Vice President and Chief Financial Officer of Fortune Brands, where he served in that role from 2011 to July 2017. Mr. Wyatt also served as Chief Financial Officer and Executive Vice President of Hanesbrands Inc. (formerly, Sara Lee Branded Apparel) from 2005 to 2011. He has held various financial roles at Sonic Automotive Inc., ultimately serving as Chief Financial Officer through 2005. Mr. Wyatt has more than 40 years of experience working with public and private companies.

Qualifications: Mr. Wyatt’s experience as Chief Financial Officer of several publicly traded companies for 19 years and his deep financial and business expertise contributes an important perspective to the Board on accounting, risk management and auditing matters. In addition, Mr. Wyatt’s experience in overseeing and managing complex businesses at major global marketers is vital for Interpublic given its organizational structure.

| Interpublic Group 2020 Proxy Statement | 7 |

Table of Contents

Our corporate governance framework is designed to ensure strong commitment to maintaining sound corporate governance practices. Our governance framework enables independent and skilled directors to provide oversight, advice, and counsel to promote the interests of Interpublic and its stockholders. Key governance policies and processes include our Code of Conduct, our comprehensive enterprise-wide risk management program, our commitment to transparent financial reporting and our systems of internal checks and balances.

You may view our Corporate Governance Guidelines, the charters of each of our board committees and the Code of

Conduct for our employees and directors on Interpublic’s website athttp://www.interpublic.com or you may obtain copies free of charge by writing to The Interpublic Group of Companies, Inc., 909 Third Avenue, New York, NY 10022, Attention: EVP, General Counsel & Secretary. These documents provide the framework for our governance at the board level. Our directors understand that they serve you as stockholders in carrying out their responsibility to oversee the operation and strategic direction of our company. To do so effectively, our Board along with management regularly reviews our Corporate Governance Guidelines, our committee charters and governance practices to assure that they are appropriate and reflect high standards.

INTERPUBLIC GOVERNANCE HIGHLIGHTS

| Key Governance Principles | • | All directors are elected annually. | ||

| • | In uncontested director elections, each director is elected by a majority of shares present and entitled to vote. | |||

| • | Directors may not stand for reelection after age 74, unless otherwise determined by the Board that waiving this restriction is in the best interests of stockholders. | |||

| • | Directors annually review and assess board performance and the overall skills and areas of expertise present on the Board and, when determined to be in the best interests of the Company, recommend to stockholders the election of new directors to add a fresh perspective and ensure adequate succession planning. | |||

| • | No member of the Audit Committee may serve on the audit committees of more than two other public companies. | |||

| Board Independence | • | 11 of the 12 directors, and 8 of the 9 director nominees, are independent. | ||

| • | Our CEO is the only member of management who serves as a director. | |||

| • | Our Audit, Compensation and Leadership Talent and Corporate Governance Committees are comprised solely of independent directors. | |||

| • | The committee chairs play a key role in shaping the agendas and information presented to their committees. | |||

| • | The Board and the committees have the authority to hire independent advisors, as they deem appropriate. | |||

| Presiding Director | • | The independent directors annually elect an independent Presiding Director. | ||

| • | The Presiding Director chairs regularly scheduled executive sessions. | |||

| • | The Presiding Director, together with the Chairman, plays a key role in forming the agendas and information presented to the Board. | |||

| • | The Presiding Director, as appropriate, is available for direct communication with stockholders who request such a communication. | |||

| • | The Presiding Director has additional duties and responsibilities set forth on page 14. | |||

| Board Oversight of Risk and Strategy | • | Enterprise-wide risk management is overseen by our Audit Committee, which reports on such matters to the Board. | ||

| • | Our Compensation Committee reviews compensation practices to ensure that they do not encourage imprudent risk taking. | |||

| • | Our Board directly oversees and advises management on development and execution of corporate strategy. |

| 8 | Interpublic Group 2020 Proxy Statement |

Table of Contents

Our Corporate Governance Framework

| Stockholder Rights | • | No “poison pill” or similar stockholder rights plan. | ||

| • | No supermajority voting requirements. | |||

| • | Stockholders owning 3% or more of our outstanding shares of Common Stock for a period of at least three years have the right to include in our proxy statement nominees for election equal to the greater of two directors or 20% of our Board of Directors. | |||

| • | Stockholders holding 25% or more of our Common Stock have the right to require that we hold a special meeting of stockholders to consider matters that are the proper subject of stockholder action. | |||

| • | Regular outreach and engagement with stockholders is a key objective. | |||

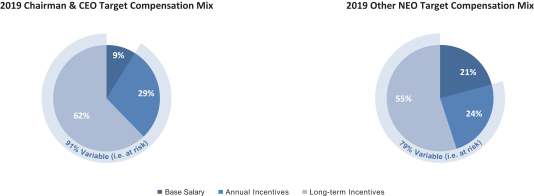

| Compensation Governance | • | A significant percentage of the compensation paid to our named executive officers is performance-based and exposed to fluctuations in the price of our Common Stock (page 28). | ||

| • | We maintain robust share ownership guidelines for our directors, named executive officers and other senior executives (pages 15 and 42). | |||

| • | The Compensation and Leadership Talent Committee (the “Compensation Committee”) engages an independent consultant on executive compensation matters. | |||

| Succession Planning | • | CEO and management succession planning is one of the Board’s highest priorities. | ||

| • | Our Board devotes significant attention to identifying and developing talented senior leaders. | |||

CORPORATE GOVERNANCE PRINCIPLES AND PRACTICES

Director Independence

In accordance with NYSE listing standards (the “NYSE Listing Standards”), the Board annually evaluates the independence of each member of the Board of Directors under the independence standards set forth in Interpublic’s Corporate Governance Guidelines, and under the NYSE Listing Standards.

Interpublic has twelve directors, one of whom, Michael I. Roth, is an employee of Interpublic and, eleven of whom are not employees of Interpublic or its subsidiaries (referred to in this Proxy Statement as“Non-Management Directors”). At their meetings held in February of this year, the Corporate Governance Committee and the full Board determined that each of theNon-Management Directors is an independent director under Interpublic’s Corporate Governance Guidelines and the NYSE Listing Standards.

Meeting of Independent Directors

The NYSE Listing Standards require that if the group ofNon-Management Directors includes one or more directors who are not independent, then at least once annually, theNon-Management Directors should hold an executive session attended by only independent directors. Although not required under the NYSE Listing Standards (because all of theNon-Management Directors are independent), the Board nevertheless held several executive sessions of its independent directors during 2019, with Mr. Thomas, in his role as Presiding Director, serving as the chairperson of the sessions.

Director Selection Process

The Corporate Governance Committee is charged with the responsibilities described below under the heading “Committees of the Board of Directors—Corporate Governance Committee.”

One of the Corporate Governance Committee’s responsibilities is to identify and recommend to the Board candidates for election as directors. The committee, together with the Presiding Director, considers candidates suggested by its members, other directors, senior management and stockholders as necessary in anticipation of upcoming director elections or due to Board vacancies. The committee is given broad authorization to retain, at the expense of Interpublic, external legal, accounting or other advisers, including search firms to identify candidates and to perform background reviews of potential candidates. The committee is expected to provide guidance to search firms it retains about the particular qualifications the Board is then seeking.

On October 15, 2020, the Board of Directors elected Linda S. Sanford to become a member of the Board of Directors following the review and assessment of her candidacy which first began in February of 2020. Ms. Sanford was presented and recommended to the Board as a possible nominee by other current members of the Board. Prior to her election, the Corporate Governance Committee performed a review of Ms. Sanford’s background and qualifications and members of the Executive Committee and other directors conducted interviews and met with Ms. Sanford and provided their recommendations to the Corporate Governance Committee. On the basis of this process for Ms. Sanford, the Corporate Governance Committee recommended her election.

| Interpublic Group 2020 Proxy Statement | 9 |

Table of Contents

Our Corporate Governance Framework

Each of the directors nominated for election at the Annual Meeting were evaluated and recommended to the Board for nomination by the Corporate Governance Committee, and nominated by the Board for election.

All director candidates, including those recommended by stockholders, are evaluated on the same basis. Candidates are considered in light of the entirety of their credentials. As part of the evaluation of individual candidates, the following factors are taken into consideration:

| • | Their business and professional achievements, knowledge, experience and background, particularly in light of the principal current and prospective businesses of Interpublic and the general strategic challenges facing Interpublic and its industry as a whole; |

| • | Their integrity and independence of judgment; |

| • | Their ability and willingness to devote the time necessary to fulfill Board duties; |

| • | Their qualifications for membership on one or more of the committees of the Board; |

| • | Their educational background; |

| • | Their independence from management under NYSE Listing Standards and Interpublic’s Corporate Governance Guidelines; |

| • | The continued focus on maintaining a diverse and inclusive Board; |

| • | The needs of the Board and Interpublic; and |

| • | The Board’s policies regarding the number of boards on which a director may sit, director tenure, retirement and succession, as set out in Interpublic’s Corporate Governance Guidelines. |

In determining the needs of the Board and Interpublic, the Corporate Governance Committee considers the qualifications of sitting directors and consults with the Presiding Director, other members of the Board (including as part of the Board’s annual self-evaluation), the CEO and other members of senior management and, where appropriate, external advisers. All directors are expected to exemplify the highest standards of personal and professional integrity and to assume the responsibility of challenging management through their active and constructive participation in meetings of the Board and its various committees, as well as through less formal communications with management.

Director candidates, other than sitting directors, are interviewed by members of the Executive Committee and by other directors, the CEO and other key management personnel, and the results of those interviews are considered by the Corporate Governance Committee in its deliberations. The Corporate Governance Committee also reviews sitting

directors who are considered potential candidates forre-election, in light of the above considerations and their past contributions to the Board.

Stockholders wishing to recommend a director candidate to the Corporate Governance Committee for its consideration should write to the Corporate Governance Committee, in care of its Chairperson, at The Interpublic Group of Companies, Inc., 909 Third Avenue, New York, NY 10022. Any recommendations will be considered for the next annual election of directors in 2021. A recommendation should include the proposed candidate’s name, biographical data and a description of his or her qualifications in light of the criteria listed above.

Succession Planning

Interpublic’s Board of Directors is actively involved in talent management. Annually, the Board reviews and analyzes the alignment of Interpublic’s strategy on personnel and succession with its overall business strategy. This includes a detailed discussion of Interpublic’s global leadership bench, strength and succession plans with a focus on key positions at the senior officer level. In addition, the committees of the Board regularly discuss the talent pipeline for specific critical roles at Interpublic and each of its global agencies. The Board seeks opportunities to provide potential leaders with exposure and visibility to Board members through formal presentations and by periodically holding Board and committee meetings at key operating units. In addition, the Board is regularly updated on key talent indicators for the overall workforce, including work environment, diversity, recruiting and development programs.

Code of Conduct

Interpublic has adopted a set of ethical standards known as the Code of Conduct, which applies to all employees of Interpublic and its subsidiaries and affiliates. Interpublic’s Corporate Governance Guidelines provide that members of the Board of Directors and officers (which includes Interpublic’s Chief Executive Officer, Chief Financial Officer, Controller and Chief Accounting Officer and other persons performing similar functions) must comply with the Code of Conduct. In addition, the Corporate Governance Guidelines state that the Board will not waive any provision of the Code of Conduct for any director or executive officer. The Code of Conduct, including future amendments, may be viewed on Interpublic’s website athttp://www.interpublic.com or a copy may be obtained free of charge by writing to The Interpublic Group of Companies, Inc., 909 Third Avenue, New York, NY 10022, Attention: EVP, General Counsel & Secretary.

| 10 | Interpublic Group 2020 Proxy Statement |

Table of Contents

Our Corporate Governance Framework

COMMUNICATIONS WITH THE BOARD OF DIRECTORS

Interested parties may contact Interpublic’s Board of Directors, theNon-Management Directors as a group, or any individual director, as applicable, by writing to them at the following address:

c/o EVP, General Counsel & Secretary

The Interpublic Group of Companies, Inc.

909 Third Avenue

New York, NY 10022

Communications to the Board, theNon-Management Directors or to any individual director that relate to Interpublic’s accounting, internal accounting controls or auditing matters will also be referred to the chairperson of the Audit Committee. Other communications will be referred to the Presiding Director (whose responsibilities are described below) or the appropriate committee chairperson.

MEETINGS AND COMMITTEES OF THE BOARD

Attendance at Board of Directors and Committee Meetings

The Corporate Governance Guidelines provide that each director is expected to be prepared for, attend and participate in, at least 75% of all regularly scheduled and special meetings of the Board and meetings of the Committees on which a Board member serves, absent special circumstances. The Board of Directors held 7 meetings in 2019 and committees of the Board held a total of 21 meetings. During 2019, each director attended more than 75% of the total number of meetings of the Board of Directors and committees on which he or she served.

Attendance at Annual Meeting of Stockholders

While Interpublic does not have a specific policy for attendance by directors at the Annual Meeting of Stockholders, each Director who was a member of the Board at the time of the 2019 annual meeting was in attendance.

Board Structure and Committees

The standing committees of the Board consist of the Audit Committee, the Compensation and Leadership Talent Committee, the Corporate Governance Committee and the Executive Committee. The activities of the Audit Committee, Compensation and Leadership Talent Committee, and the Corporate Governance Committee are each governed by a charter that may be viewed on Interpublic’s website athttp://www.interpublic.com or may be obtained free of charge by writing to The Interpublic Group of Companies, Inc., 909 Third Avenue, New York, NY 10022, Attention: EVP, General Counsel & Secretary. A description of the responsibilities of each standing committee of the Board is provided below under the heading “Committees of the Board of Directors.”

Committees of the Board of Directors

The following table shows the directors who are currently members or chairpersons of each of the standing Board committees and the number of meetings each committee held in 2019.

| Name | Audit | Compensation and Leadership Talent | Corporate Governance | Executive | ||||||

Joceyln Carter-Miller | I | ● | C | ● | ||||||

H. John Greeniaus | I | ● | ● | |||||||

Mary J. Steele Guilfoile | I | C | ● | ● | ||||||

Dawn Hudson | I | ● | ● | |||||||

William T. Kerr | I | ● | C | ● | ||||||

Henry S. Miller | I | ● | ● | |||||||

Jonathan F. Miller | I | ● | ● | |||||||

Patrick Q. Moore | I | ● | ● | |||||||

Michael I. Roth | ◆ | C | ||||||||

Linda S. Sanford | I | ● | ● | |||||||

David M. Thomas | PD I | ● | ● | ● | ||||||

E. Lee Wyatt Jr. | I | ● | ● | |||||||

Number of Meetings in 2019 | 9 | 7 | 5 | 0 | ||||||

◆ Chairman of the Board C Committee Chair ● Member I Independent Director PD Presiding Director

| Interpublic Group 2020 Proxy Statement | 11 |

Table of Contents

Our Corporate Governance Framework

Audit Committee

| ||

Roles and Responsibilities:

• Reviews the annual financial information to be provided to stockholders and filed with the SEC;

• Reviews the system of internal controls established by management;

• Reviews financial reporting policies, procedures and internal controls;

• Reviews and oversees the internal and external audit processes;

• Responsible for the selection, compensation, retention and oversight of Interpublic’s registered independent public accounting firm;

• Responsible for the other activities described in greater detail in the Audit Committee Report on page 22; and

• Responsible for other activities described in greater detail under the heading:

– “The Board’s Role in Risk Oversight” on page 14; and

– “Transactions with Related Persons” on page 14.

Independence and Financial Literacy

Each member of the Audit Committee is independent in accordance with the standards set forth in Interpublic’s Corporate Governance Guidelines and the NYSE Listing Standards.

The Board has determined that each member of the Audit Committee qualifies as an “audit committee financial expert” as defined under applicable SEC rules and regulations. | Committee Members:

Carter-Miller (F, I) Greeniaus (F, I) Guilfoile (C, F, I) Kerr (F, I) H. Miller (F, I) Moore (F, I) Sanford (F, I) Wyatt (F, I)

Number of meetings during 2019:9 | |

| C = | Committee Chair |

| F = | Determined by the Board to be an Audit Committee Financial Expert as defined under applicable SEC rules and regulations |

| I = | Determined by the Board to be independent under the NYSE Listing Standards and applicable SEC rules and regulations |

Compensation and Leadership Talent Committee

| ||

Roles and Responsibilities:

• Reviews and adopts the executive compensation philosophy for the Company;

• Reviews the Company’s initiatives to attract, develop and retain key employees on an ongoing basis and, with the full Board, reviews succession plans for key executive positions;

• Reviews and recommends to the Board, the compensation of the CEO;

• In consultation with the CEO, approves the compensation of the executive officers, other than the CEO, and approves the compensation of other senior executives of the Company and its subsidiaries;

• Oversees and administers the Company’s equity performance incentive plans;

• Establishes the performance measures and goals and verifies the achievement of performance goals under performance-based incentive compensation and equity plans; and

• Reviews the Company’s share ownership guidelines for selected senior executives.

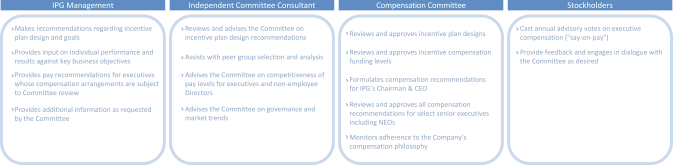

The Compensation Committee’s primary processes for establishing and overseeing executive compensation are described in the Compensation Discussion & Analysis under the heading “Compensation Philosophy and Basic Principles” on page 37.

Independence

Each member of the Compensation and Leadership Talent Committee is independent in accordance with the standards set forth in Interpublic’s Corporate Governance Guidelines and the NYSE Listing Standards. | Committee Members:

Greeniaus (I) Hudson (I) Kerr (C, I) J. Miller (I) Moore (I) Thomas (I) Wyatt (I)

Number of meetings during 2019:7 | |

| 12 | Interpublic Group 2020 Proxy Statement |

Table of Contents

Our Corporate Governance Framework

Corporate Governance Committee

| ||

Roles and Responsibilities:

• Oversees corporate governance issues and makes recommendations to the Board;

• Identifies, evaluates, and recommends candidates for nomination to the Board and the appointment of committee members;

• Reviews and makes recommendations to the Board regarding director independence;

• Reviews and advises management on the Company’s sustainability and social responsibility initiatives;

• Oversees and recommends to the Board the CEO succession planning;

• Oversees the annual self-evaluation process of the Board and committees; and

• Responsible for approving the compensation paid to the Board and committee members.

Independence

Each member of the Corporate Governance Committee is independent in accordance with the standards set forth in Interpublic’s Corporate Governance Guidelines and the NYSE Listing Standards. | Committee Members:

Carter-Miller (C, I) Guilfoile (I) Hudson (I) H. Miller (I) J. Miller (I) Sanford (I) Thomas (I)

Number of meetings during 2019:5 | |

| C = | Committee Chair |

| I = | Determined by the Board to be independent under the NYSE Listing Standards and applicable SEC rules and regulations |

Executive Committee

| ||

Roles and Responsibilities:

• Acts on the Board’s behalf between Board meetings. | Committee Members:

Carter-Miller (I) Guilfoile (I) Kerr (I) Roth (C) Thomas (I)

Number of meetings | |

| C = | Committee Chair |

| I = | Determined by the Board to be independent under the NYSE Listing Standards and applicable SEC rules and regulations |

The Board continually examines its policies to ensure that Interpublic’s corporate governance and Board structure are designed to maximize the Company’s effectiveness. Currently, the Board believes that Interpublic’s Chief Executive Officer is best situated to serve as Chairman because he is the director most familiar with the operations of the Company, and most capable of determining the strategic and operational priorities of Interpublic and leading discussions with the Board. To ensure a proper level of independent board oversight, the Board has also designated a Presiding Director, who has the duties described below. The Board believes that the corporate governance measures it has in place ensure that strong, independent directors effectively oversee our management and provide vigorous oversight of our key issues relating to strategy, risk and integrity.

Interpublic’s Board structure allows for independent directors to bring experience, oversight and expertise from outside Interpublic and other industries, while the Chief Executive Officer brings a company-specific knowledge base and expertise. The Board believes that based on the particular needs of Interpublic at this time and the experience of Mr. Roth, that the combined role of Chairman and Chief Executive Officer promotes more effective strategy development and execution, enhances the information flow between management and the Board, which are essential to effective governance and, coupled with the appointment of a Presiding Director, provides the most efficient and effective leadership structure for Interpublic, which is in the best interests of Interpublic and our stockholders.

| Interpublic Group 2020 Proxy Statement | 13 |

Table of Contents

Our Corporate Governance Framework

Presiding Director

The Presiding Director of the Board helps to coordinate communications between the Board and management of Interpublic. In this role, the Presiding Director convenes and chairs meetings and executive sessions of theNon-Management Directors, coordinates feedback to the Chairman and Chief Executive Officer on behalf of the

Non-Management Directors on business issues and management, coordinates and develops with the Chairman and Chief Executive Officer the agendas and presentations for meetings of the Board and, as appropriate, is available for direct communication with stockholders who request such a communication. Mr. Thomas currently serves as the Presiding Director.

THE BOARD’S ROLE IN RISK OVERSIGHT

The Board has an active role in the oversight of the Company’s enterprise risk management activities. Elements of the Board’s risk management practices include:

| • | An annual review and assessment by the Board of the primary operational and regulatory risks facing Interpublic, their relative magnitude and management’s plan for mitigating these risks; |

| • | Specific oversight by the Audit Committee of Interpublic’s financial risk exposure, including Interpublic’s credit and liquidity position. Such oversight includes discussions with management and internal auditors on the magnitude and steps taken to address and mitigate any such risks; |

| • | Audit Committee oversight of Interpublic’s compliance with its Code of Conduct, including establishing procedures for the receipt of anonymous complaints or concerns from employees on accounting, internal accounting controls and auditing matters; |

| • | Audit Committee administration of Interpublic’s Related Person Transaction Policy (as discussed below); |

| • | Corporate Governance Committee management and oversight of potential risks associated with potential issues of independence of any directors and potential conflicts of interest and oversight of the Company’s practices and policies on sustainability and corporate social responsibility matters; |

| • | Compensation Committee evaluation and management of risks relating to Interpublic’s compensation plans and arrangements, as well as Interpublic’s overall compensation philosophy and practices; and |

| • | The establishment of standard policies specifically designed to mitigate potential risks, including requiring Board approval for all business acquisitions above a certain dollar amount. |

Each committee also regularly informs the Board of any potential issues or concerns raised when performing its risk management duties.

TRANSACTIONS WITH RELATED PERSONS

Interpublic’s Code of Conduct requires directors and employees to avoid activities that could conflict with the interests of Interpublic, except for transactions that are disclosed and approved in advance. Interpublic has adopted a Related Person Transaction Policy under which approval is required for any transaction, agreement or relationship between Interpublic or any of its consolidated subsidiaries and a Related Person (a “Related Person Transaction”).

Under the Related Person Transaction Policy, a “Related Person” is defined as (i) any director, nominee for election as a director, an executive officer or any of their “immediate family members” (as defined by the Related Person Transaction Policy); (ii) any entity, includingnot-for-profit and charitable organizations, controlled by or in which any of the foregoing persons have a substantial beneficial ownership interest; or (iii) any person who is known to be, at the time of the transaction, the beneficial owner of more than 5% of the voting securities of Interpublic or an immediate family member of such person.

Under the policy, Related Person Transactions do not include any employee benefit plan, program, agreement or arrangement that has been approved by the Compensation Committee or recommended by the Compensation Committee for approval by the Board.

To facilitate compliance with the policy, the Code of Conduct requires that employees, including directors and executive officers, report circumstances that may create or appear to create a conflict between the personal interests of the individual and the interests of Interpublic, regardless of the amount involved, to Interpublic’s Chief Risk Officer using Interpublic’s Compliance Report Form. Each director and executive officer annually confirms to the Company his or her compliance with the Related Person Transaction Policy as part of the preparation of Interpublic’s Annual Report on Form10-K and its annual proxy statement. Director nominees and persons promoted to executive officer positions must also confirm such compliance at the time of their nomination or promotion. Management also reviews its records and makes additional inquiries of management

| 14 | Interpublic Group 2020 Proxy Statement |

Table of Contents

Our Corporate Governance Framework

personnel and, as appropriate, third parties and other sources of information for the purpose of identifying Related Person Transactions, including Related Person Transactions involving beneficial owners of more than 5% of Interpublic’s voting securities.

The Audit Committee reviews transactions subject to the Related Person Transaction Policy and determines whether to approve or disapprove those transactions, by examining whether or not the transactions are fair, reasonable and within Interpublic policy. The Audit Committee makes its determination by taking into account all relevant factors and any controls that may be implemented to protect the interests of Interpublic and its stockholders. Among the factors that the Audit Committee takes into account in determining whether a transaction is fair and reasonable, as applicable, are the following:

| • | The benefits of the transaction to Interpublic; |

| • | The terms of the transaction and whether they arearm’s-length and in the ordinary course of Interpublic’s business; |

| • | The direct or indirect nature of the Related Person’s interest in the transaction; |

| • | The size and expected term of the transaction; and |

| • | Other facts and circumstances that bear on the materiality of the Related Person Transaction under applicable law and listing standards. |

No director may participate in any consideration or approval of a Related Person Transaction with respect to which he or she or any of his or her immediate family members is the Related Person. Related Person Transactions not approved or ratified as required by the Related Person Transaction Policy are subject to termination by Interpublic. If the transaction has been completed, the Audit Committee will consider if rescission of the transaction is appropriate and whether disciplinary action is warranted.

Related Person Transactions

Andrew Roth, Michael Roth’s son, has been an employee of the Constituency Management Group and its operating subsidiaries (“CMG”) since November 2017. Andrew is not an officer or director of Interpublic and does not report to any executive officer of Interpublic. Andrew’s compensation at CMG is in excess of the $120,000 reporting threshold and has been determined in a manner consistent with the Company’s human resources and compensation policies.

The Audit Committee and the independent members of the Board assessed and approved the foregoing matter, taking into account and in accordance with the Company’s Related Person Transaction Policy.

DIRECTOR SHARE OWNERSHIP GUIDELINES

EachNon-Management Director is expected, within 5 years of joining the Board, to accumulate a minimum share ownership in Interpublic stock equal to five times the annual cash retainer paid toNon-Management Directors. Outstanding shares of restricted stock are included in a director’s share ownership. AllNon-Management Directors standing forre-election, as of December 31, 2019, have met or exceeded these guidelines, with the exception of Messrs. Moore and Wyatt and Ms. Sanford, each of whom have not yet reached his/her respective guideline compliance date. The Company

believes that the equity component of director compensation serves to further align theNon-Management Directors with the interests of our stockholders. For information about share ownership of ourNon-Management Directors, see“Non-Management Director Compensation” on page 19 and “Share Ownership of Management” on page 67. For a discussion of the share ownership guidelines applicable to Interpublic’s executives, see “Compensation Discussion & Analysis — Share Ownership Guidelines” on page 42.

Directors and only executive employees subject to the share ownership guidelines are prohibited from engaging in any transaction involving:

| • | a short sale or derivative that is designed to hedge against the market risk associated with ownership of IPG shares; and |

| • | the pledging of IPG shares that he or she owns as security or collateral for any obligation, including, but not limited to, holding shares in a margin account. |

| Interpublic Group 2020 Proxy Statement | 15 |

Table of Contents

OUR VALUES

This section describes how IPG embraces corporate values and responsibility by committing to:

| • | Building an inclusive and diverse culture; |

| • | Bettering the communities where we live and work; and |

| • | Respecting the environment and reducing our carbon footprint. |

IPG IS FORGING A CULTURE OF INCLUSION

In today’s business environment, diversity and inclusion are essential priorities as the global talent streams are changing, as consumer demographics and values are shifting, and as the speed of change demands innovative and creative solutions to complex problems. Diversity and inclusion are key elements in how we deliver extraordinary value to our

stockholders, our clients, and our people. We are creating a representative and highly talented workforce at every level, with a culture that drives belonging, well-being and growth for all our people and the cultural insights and sensitivity to help our clients make authentic and responsible connections with their customers.

LEADERSHIP COMMITMENT AND ACCOUNTABILITY ON DIVERSITY

In 2006, IPG formalized its commitment to making progress and holding key executives at IPG and our agencies accountable for achieving tangible diversity goals. This commitment included increasing the diversity of our board and including D&I metrics in our incentive compensation awards for executives. We were the first holding company in our industry to appoint dedicated leadership to drive progress and we are one of very few global enterprises identified byThe Wall Street Journal to have established this role as a member of the senior executive team with direct reporting to our Chairman and CEO, as well as our Chief Operating Officer.

Our Board reviews our strategic plan and progress against priorities at least once annually and IPG supports the global diversity and inclusion team with staffing, resources and investments in vital measurement tools and programs to help our agencies succeed on such priorities and objectives.

IPG’s Global CEO Diversity Council includes Chief Executives from all IPG companies, and works to promote collaboration as well as provide tools and resources to our top executives.

Representation -In the US, for the 2018 EEO1 report filing, over half of all IPG managers, including executive, senior andmid-level management were women.

In addition,one-third of IPG’s current Board and over 40% of this year’s director nominees are women, and IPG considers diversity as a key component when reviewing candidates to join its Board.

Culture -In our annual Climate for Inclusion Survey, which measures employee responses to our diversity and inclusion initiatives, over 80% of individuals would recommend their company as a good place to work.

POLICIES THAT FOSTER INCLUSION

Our global Code of Conduct sets expectations for a work environment that embodies respect and dignity for all employees.

Pay Equity - Our commitment to pay equity for women and under-represented groups is robust. In keeping with the pay equity reporting framework used for the Bloomberg Gender Equality Index, which looks at representation by quartile, our results show that more than half of our female employees are in the upper-middle quartile of full-time employees by compensation at the end of the fiscal year.

Family Leave -For all of our global employees, we offer a minimum of six weeks of parental leave to a primary care-giver before and after the birth of a child. Some of our agencies offer unlimited PTO to help support family caregivers and for parental leave. We also offer flexible work hours and remote working options.

Human Rights -For 10 years, IPG has repeatedly received a perfect score of 100 percent on the Human Rights Campaign Corporate Equality Index (CEI), which is a measure of inclusive benefits, policies, and activities that support LGBTQ+ employees.

Inclusive Sourcing -IPG also supports diverse suppliers, and partners with influential minority businesses and women’s organizations. Several of our agencies also partner with Free the Work, anot-for-profit curated talent-discovery platform where marketers can search for underrepresented creators.

IPG Inclusion Learning and Culture Initiatives -IPG executes year-long learning and engagement opportunities to provide career, professional and development training as well as skills-based training to our global employees.

| 16 | Interpublic Group 2020 Proxy Statement |

Table of Contents

Our Values

Furthering our commitment to a diverse and welcoming workplace, IPG agencies are required to apply a diversity lens

on succession planning and leadership development.

BUSINESS RESOURCE GROUPS

Our business resource groups, under the MERGE umbrella produce programming around topics across all facets of diversity and inclusion, and are comprised of:

| • | Asian Heritage Group |

| • | Black Employee Network |

| • | IPGBLT |

| • | SOMOS: Hispanic/Latino Heritage Group |

| • | Women’s Leadership Network (WLN) |

The MERGE groups also address career development and management training, executive presence, and the importance of mentors and sponsors and cultivate allies and foster Diversity IQ for the workplace and marketplace.

COMMUNITY PARTNERSHIPS

CEO Action - IPG is a member of the CEO Action for Diversity & Inclusion™, which is the largestCEO-driven business commitment to advance diversity and inclusion in the workplace.

Unstereotype Alliance - IPG’s Chairman and CEO, Michael Roth, is a founding Vice Chair and IPG is an active participant of the UN Women’s Unstereotype Alliance which seeks to

eradicate harmful stereotypes in media and advertising content.

Center for Talent Innovation - IPG partners with The Center for Talent Innovation on research studies to inform diversity objectives and execute diversity processes. We apply what we learn from those studies and improve our analytics to identify where and why we are having success, as well as our pain points and solutions.

SUSTAINABILITY AND PURPOSE

IPG is committed to operating as sustainably as possible, and in a way that is in sync with the long-term health of our environment. We are also dedicated to three core principles of purpose: we use our expertise as marketers to make a difference in communities around the world; we take care of and invest in our people; and we ensure a fair governance structure at our Company.

Reporting-IPG has implemented a corporate sustainability program that includes the company’s work on the GRI (Global Reporting Initiative) which tracks energy use and greenhouse gas emissions at the company. IPG has also set goals for reduction in this area and has implemented a comprehensive Sustainability and Environmental Impact policy.

IPG was the first U.S.-based industry holding company to issue a sustainability report that conforms with the guidelines of the Global Reporting Initiative and the first U.S.-based industry holding company to become a signatory of the United Nations Global Compact.

In 2018, IPG began measuring its emissions and other environmental impacts using GHG Protocol Corporate Standards at all of our buildings in North America and 75% of our global portfolio.

IPG also responds annually to the CDP Climate Change Questionnaire.

Supporting United Nations Sustainable Development Goals -IPG is an active supporter of the United Nations Sustainable Development Goals and has adopted Goal #6, access to water and sanitation for all. IPG has funded two wells in Ethiopia, partnering with charity: water to bring clean water to hundreds in communities there, and this year, will fund spring protection in the same region, which will safeguard water supplies from animals, trash and other contaminants.

In addition to IPG’s support of UN SDG#6, our agencies around the world regularly work on issues that include ensuring LGBTQ rights, working with the physically challenged, and hunger relief.

Policies and Programs -Our policies and programs ensure we are accountable to all of our stakeholders — investors, clients, employees and consumers — around the world. These include the IPG Code of Conduct, our Anti-Harassment and Equal Employment Policy, our Anti-Corruption Policy, our Alert Line and our Corporate Governance Committee Charter, and our Supplier Code of Conduct. The Corporate Governance Committee of IPG’s Board of Directors oversees the Company’s sustainability initiatives.

| Interpublic Group 2020 Proxy Statement | 17 |

Table of Contents

Our Values

RECOGNITION

Sustainability Stock and Reporting Indices- IPG has been recognized for its efforts in sustainability with inclusion in the S&P 500 ESG and S&P Global 1200 ESG, two new indices that recognize sustainability leadership, and the FTSE4Good Index, which identifies companies that demonstrate strong environmental, social and governance (ESG) practices measured against international standards. In 2019, IPG was added to the Bloomberg Gender Equality Index, a premier ranking of global companies that publicly demonstrate their commitment to equality and advancing women in the workplace.

IPG and our executives have continually been recognized as leaders of diversity and inclusion:

| • | Michael Roth, Chairman and CEO of IPG, is one of four CEOs mentioned in theHarvard Business Review’s article, “Toward a Racially Just Workplace,” who have initiated company-wide discussions of race. |

| • | IPG also won The Company AwardfromWomen in Marketing/UK for best practices in sustained D&I initiatives. |

| • | Heide Gardner, IPG’s, Chief Diversity & Inclusion Officer, was named one of the most Powerful Women of the Year byMoves Magazine, andBlack Enterprise Magazinenamed Heide Gardner a Top Corporate Diversity Executive. |

| 18 | Interpublic Group 2020 Proxy Statement |

Table of Contents

Annual Board/Committee Retainer Fees

During 2019, eachNon-Management Director received as cash compensation for services rendered an annual retainer of $100,000. No additional compensation was paid for attendance at Board or committee meetings.

For 2019, each chairperson of the committees received the following additional annual retainers:

| • | Audit Committee — $30,000 |

| • | Compensation and Leadership Talent Committee — $25,000; and |

| • | Corporate Governance Committee — $20,000. |

Presiding Director Retainer Fees

For 2019, the Presiding Director received a retainer of $75,000. This retainer was in addition to the retainer Mr. Thomas received for service as aNon-Management Director.

Director Annual Equity Awards

EachNon-Management Director in 2019 also received, as consideration for services rendered as a member of the Board, an award of restricted shares of Common Stock (the “Restricted Shares”) having a market value of $200,000 on the date of grant. Through May of 2019, grants of Restricted Shares toNon-Management Directors have been

administered under the 2009 Interpublic Non-Management Directors’ Stock Incentive Plan (the “2009 Directors’ Plan”).

On April 30, 2019, in accordance with the 2009 Directors’ Plan, each Non-Management Director received a grant of 8,650 Restricted Shares (the “2019 Restricted Share Grant”).

Future grants of Restricted Shares toNon-Management Directors will be administered through The Interpublic Group 2019 Performance Incentive Plan (the “2019 PIP”), which was approved by stockholders at the 2019 Annual Meeting.