UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-00242

Natixis Funds Trust II

(Exact name of Registrant as specified in charter)

| | |

| 399 Boylston Street, Boston, Massachusetts 02116 |

| (Address of principal executive offices) (Zip code) |

Coleen Downs Dinneen, Esq.

Natixis Distributors, L.P.

399 Boylston Street

Boston, Massachusetts 02116

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 449-2810

Date of fiscal year end: September 30

Date of reporting period: March 31, 2008

| Item 1. | Reports to Stockholders. |

The Registrant’s semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

INCOME FUNDS

SEMIANNUAL REPORT

March 31, 2008

Loomis Sayles Core Plus Bond Fund

Loomis Sayles High Income Fund

Loomis Sayles International Bond Fund

Loomis Sayles Limited Term Government and Agency Fund

Loomis Sayles Massachusetts Tax Free Income Fund

Loomis Sayles Municipal Income Fund

Loomis Sayles Strategic Income Fund

TABLE OF CONTENTS

Management Discussion and Performancepage 1

Portfolio of Investmentspage 23

Financial Statementspage 53

LOOMIS SAYLES CORE PLUS BOND FUND

PORTFOLIO PROFILE

Objective:

Seeks a high level of current income consistent with what the fund considers reasonable risk

Strategy:

Invests primarily in U.S. corporate and U.S. government bonds

Fund Inception:

November 7, 1973

Managers:

Peter W. Palfrey, CFA

Richard G. Raczkowski

Loomis, Sayles & Company, L.P.

Symbols:

| | |

| Class A | | NEFRX |

| Class B | | NERBX |

| Class C | | NECRX |

| Class Y | | NERYX |

What You Should Know:

Fixed-income securities are subject to credit risk and interest rate risk; their value generally rises when prevailing interest rates fall and falls when rates rise.

The fund can invest a significant percentage of assets in debt securities that are rated below investment grade and the value of fund shares can be adversely affected by changes in economic conditions or other circumstances. Lower rated debt securities have speculative characteristics and may be subject to greater price volatility than higher rated investments. In addition, the secondary market for these securities may lack liquidity. Accordingly, the purchase of fund shares should be viewed as a long-term investment. The fund can also invest a significant percentage of assets in foreign securities and the value of the fund shares can be adversely affected by changes in currency exchange rates, political, and economic developments. In emerging markets, these risks can be significant. Fund shares should be viewed as a long-term investment.

Management Discussion

As the credit crunch gained momentum and economic conditions deteriorated during the six months ended March 31, 2008, investors put a premium on safety. The housing market continued to slump, consumer confidence fell, banks became less willing to lend money and the subprime mortgage crisis spread to the prime markets. The Federal Reserve Board’s efforts to restore normalcy by giving banks access to its lending window and cutting interest rates by 2% during the period did little to stem the tide.

Despite all the negative news, for the six months ended March 31, 2008, Loomis Sayles Core Plus Bond Fund provided a total return of 3.58%, based on the net asset value of Class A shares and $0.32 in reinvested dividends. Although the fund underperformed the 5.23% return on its benchmark, Lehman Aggregate Bond Index, it outperformed the 2.23% average return on the funds in its Morningstar Intermediate-Term Bond peer group. The fund’s 30-day SEC yield as of March 31, 2008 was 4.60%.

NON-US DOLLAR HOLDINGS, HIGHER-QUALITY ISSUES PROVIDED SOME SUPPORT

As the U.S. dollar continued to slide, we built up the fund’s allocation to non-dollar securities, notably in Asian countries, reflecting our positive outlook for the region. Although the Asian markets were also volatile, the Japanese yen gained in five out of the past six months, and the net effect of our strategy was positive.

Domestically we were biased toward higher-quality securities, including U.S. government and agency mortgage-backed securities (MBS). Agency-backed MBS fared relatively well, but still lagged Treasury securities, as spreads (the difference in yield available from higher-risk assets versus U.S. Treasuries) widened. Moreover, concerns about defaults pushed spreads on commercial MBS to record highs, while U.S. investment-grade and high-yield corporate bonds were hurt as economic fears spread to broader markets. Bright spots included bonds issued by financial companies, which recovered somewhat after JP Morgan Chase announced plans to buy out Bear Stearns, and the energy sector, which benefited from the rise in oil and gas prices.

The fund’s allocation to Treasury Inflation-Protected Securities (TIPS) has been positive for the past several quarters. However, we believe the TIPS market peaked late in the first quarter so we sold the position, locking in significant gains. The fund’s holdings in long-duration Treasury securities added to returns as this sector rallied. We also added to the fund’s agency-backed MBS at increasingly attractive levels during the fiscal period including a significant position in GNMA MBS.

ECONOMIC AND MARKET CONDITIONS DEPRESSED CORPORATE BONDS

Growing concerns about a U.S. recession and illiquidity in the corporate markets weighed on corporate bonds during the past six months, and investors’ risk appetite decreased markedly. In particular, long-term bonds issued by cable and telecommunications companies were hard hit, as investors grew increasingly concerned that companies’ access to capital would be limited. While higher-yielding, longer-dated issues provide more income, they lagged higher-quality and shorter-term issues during the period, as rising interest rates caused prices to fall. Our very modest exposure to the ABS home-equity sector also did poorly despite their high ratings and solid performance of the underlying assets.

U.S. ECONOMY APPEARS TO HAVE POCKETS OF STRENGTH

We think bond values in many sectors may already reflect a more negative scenario than is warranted, and some securities may be undervalued. Positive factors we perceive include the relative strength of industrials, the prospect that the weak U.S. dollar will stimulate exports, disciplined corporate spending and solid non-residential construction. We believe the Fed may ease interest rates once more and then hold them steady, while continuing to use other methods to support business. In fact, we believe the real economy (adjusted for inflation) may show signs of a modest recovery in momentum by the end of 2008. The shaky economic picture poses a high-risk environment, but we believe patient investors willing to accept the risks should be rewarded.

1

LOOMIS SAYLES CORE PLUS BOND FUND

Investment Results through March 31, 2008

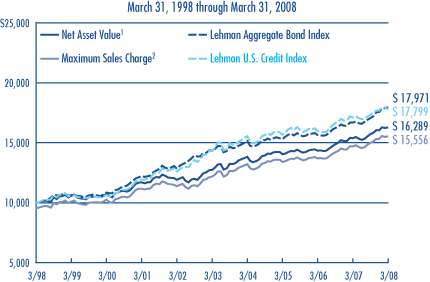

PERFORMANCE IN PERSPECTIVE

The charts comparing the fund’s performance to an index provide you with a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, the index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

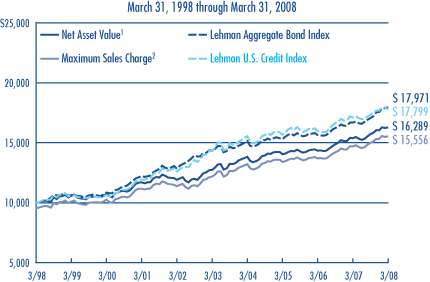

Growth of a $10,000 Investment in Class A Shares4

Average Annual Returns — March 31, 20084

| | | | | | | | | | | | |

| | | | | |

| | | 6 MONTHS | | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | |

CLASS A (Inception 11/7/73) | | | | | | | | | | | | |

Net Asset Value1 | | 3.58 | % | | 5.78 | % | | 5.02 | % | | 5.00 | % |

With Maximum Sales Charge2 | | -1.06 | | | 0.98 | | | 4.05 | | | 4.51 | |

| | | | | |

CLASS B (inception 9/13/93) | | | | | | | | | | | | |

Net Asset Value1 | | 3.34 | | | 5.06 | | | 4.25 | | | 4.24 | |

With CDSC3 | | -1.66 | | | 0.06 | | | 3.91 | | | 4.24 | |

| | | | | |

CLASS C (Inception 12/30/94) | | | | | | | | | | | | |

Net Asset Value1 | | 3.20 | | | 5.02 | | | 4.22 | | | 4.22 | |

With CDSC3 | | 2.20 | | | 4.02 | | | 4.22 | | | 4.22 | |

| | | | | |

CLASS Y (Inception 12/30/94) | | | | | | | | | | | | |

Net Asset Value1 | | 3.69 | | | 6.03 | | | 5.31 | | | 5.36 | |

| | | | | |

| COMPARATIVE PERFORMANCE | | 6 MONTHS | | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | |

Lehman Aggregate Bond Index | | 5.23 | % | | 7.67 | % | | 4.58 | % | | 6.04 | % |

Lehman U.S. Credit Index | | 2.63 | | | 3.99 | | | 4.43 | | | 5.93 | |

Morningstar Int.-Term Bond Fund Avg. | | 2.23 | | | 3.73 | | | 3.75 | | | 5.06 | |

See page 15 for a description of the indexes.

All returns represent past performance and do not guarantee future results. Periods of less than one year are not annualized. Share price and return will vary and you may have a gain or loss when you sell your shares. All results include reinvestment of any dividends and capital gains. Current returns may be higher or lower than those shown. For performance current to the most recent month-end, visit www.funds.natixis.com. Class Y shares are available to certain investors, as described in the prospectus.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

PORTFOLIO FACTS

| | | | |

| |

| | | % of Net Assets as of |

| CREDIT QUALITY | | 3/31/08 | | 9/30/07 |

Aaa | | 60.5 | | 66.4 |

Aa | | 3.0 | | 1.4 |

A | | 5.1 | | 3.4 |

Baa | | 13.9 | | 13.1 |

Ba | | 5.5 | | 6.4 |

B | | 6.1 | | 3.9 |

Caa | | 0.7 | | 0.8 |

Not Rated* | | 2.7 | | 1.9 |

Short-term and other | | 2.5 | | 2.7 |

Credit quality is based on ratings from Moody’s Investors Service.

* Securities that are not rated by Moody’s may be rated by another rating agency or by Loomis Sayles.

| | | | | | |

| |

| | | % of Net Assets as of | |

| EFFECTIVE DURATION | | 3/31/08 | | | 9/30/07 | |

1 year or less | | 5.1 | | | 6.5 | |

1-5 years | | 50.7 | | | 46.8 | |

5-10 years | | 28.1 | | | 27.0 | |

10+ years | | 16.1 | | | 19.7 | |

Average Effective Duration | | 5.9 | years | | 5.8 | years |

Portfolio characteristics will vary.

EXPENSE RATIOS AS STATED IN THE MOST RECENT PROSPECTUS

| | | | | | |

| Share Class | | Gross Expense Ratio5 | | | Net Expense Ratio6 | |

A | | 1.09 | % | | 0.90 | % |

B | | 1.85 | | | 1.65 | |

C | | 1.82 | | | 1.65 | |

Y | | 0.75 | | | 0.65 | |

NOTES TO CHARTS

1 | Does not include a sales charge. |

2 | Includes maximum sales charge of 4.50%. |

3 | Performance for Class B shares assumes a maximum of 5% contingent deferred sales charge (“CDSC”) applied when you sell shares, which declines annually between years 1-6 according to the following schedule: 5, 4, 3, 3, 2, 1, 0%. Class C shares performance assumes a 1% CDSC applied when you sell shares within one year of purchase. |

4 | Fund performance has been increased by expense reductions and reimbursements, if any, without which performance would have been lower. |

5 | Before reductions and reimbursements. |

6 | After reductions and reimbursements. Expense reductions are contractual and are set to expire on 1/31/09. |

2

LOOMIS SAYLES HIGH INCOME FUND

PORTFOLIO PROFILE

Objective:

Seeks high current income plus the opportunity for capital appreciation to produce a high total return

Strategy:

Invests primarily in lower-quality fixed-income securities

Fund Inception:

February 22, 1984

Managers:

Matthew J. Eagan, CFA

Kathleen C. Gaffney, CFA

Elaine M. Stokes

Loomis, Sayles & Company, L.P.

Symbols:

| | |

| Class A | | NEFHX |

| Class B | | NEHBX |

| Class C | | NEHCX |

| Class Y | | NEHYX |

What You Should Know:

Fixed-income securities are subject to credit risk and interest rate risk; their value generally rises when prevailing interest rates fall and falls when rates rise.

The fund can invest a significant percentage of assets in debt securities that are rated below investment grade and the value of fund shares can be adversely affected by changes in economic conditions or other circumstances. Lower rated debt securities have speculative characteristics and may be subject to greater price volatility than higher rated investments. In addition, the secondary market for these securities may lack liquidity. Accordingly, the purchase of fund shares should be viewed as a long-term investment. The fund can also invest a significant percentage of assets in foreign securities and the value of the fund shares can be adversely affected by changes in currency exchange rates, political, and economic developments. In emerging markets, these risks can be significant. Fund shares should be viewed as a long-term investment.

Management Discussion

With the subprime mortgage debacle and ensuing credit crisis undermining the economy, investors moved out of corporate bonds and sought safety in high-quality government securities. Treasuries delivered strong performance, while lower-quality markets declined. The Federal Reserve Board cut short-term interest rates twice in the first quarter of 2008 and sought to calm markets by opening its lending operations to brokerage firms. Overseas credit markets fared better, thanks in part to the weak U.S. dollar.

For the six months ended March 31, 2008, the total return on Loomis Sayles High Income Fund was -2.54% based on the net asset value of Class A shares and $0.18 in reinvested dividends. The fund held up better than its benchmark, the Lehman High Yield Composite Index, which returned -4.27% for the period, and surpassed the -5.02% average return on the funds in Morningstar’s High Yield Bond category. As of March 31, 2008, the fund’s 30-day SEC yield was 7.25%.

FUND’S RETURNS BENEFITED FROM MOVING AMONG MARKETS

The fund’s flexible investment policies allowed us to shift its emphasis from U.S. Treasuries to overseas markets, where the weak dollar benefited bonds denominated in stronger currencies. Neither Treasuries nor foreign bonds are represented in the benchmark, which gave the fund an edge. Strong security selection among high-quality corporate issues also contributed to the fund’s performance. In strategic terms, we trimmed long-term Treasuries as valuations rose during the period, using the proceeds to purchase selected issues where valuations looked more attractive.

DOLLAR WEAKNESS BROUGHT GAINS OVERSEAS

Non-dollar issues led fund performance during the period. The U.S. dollar’s persistent weakness, combined with falling interest rates and a dimming economic outlook, fueled gains in markets whose currencies gained ground. Yen-denominated issues rode the strength of Japan’s currency, and the fund’s holdings denominated in the Brazilian real contributed, as that country’s economy continued to expand. Economic growth in Mexico aided the fund’s peso-based investments. In Asia, healthy business conditions and favorable exchange rates brought solid returns on issues denominated in Singapore’s dollar and the Malaysian ringgit.

Foreign government bonds did not match the strength of U.S. Treasuries in absolute terms, but when currency gains are factored in, the sector was a net positive. Domestically, successful selection among high-quality financial services issues contributed to the fund’s return despite the turmoil in the sector as a whole. Natural gas and other energy issues also rose, but the fund was underweight in these issues relative to the Index.

CREDIT CONCERNS UNDERCUT HIGH-YIELD ISSUES

As investors turned away from corporate issues, yield spreads – the yield difference between bonds of higher and lower quality – expanded to levels not seen in years, depressing bond prices. High-yield, lower-quality holdings were particularly hard hit, which detracted from the fund’s results. Disappointments were greatest among lower-rated financial companies, transportation firms and consumer cyclicals, but the fund’s underweight stake in these sectors relative to the benchmark partially offset their negative impact. Bonds issued by technology and telecommunications companies also declined, as a large supply of new issues found very few buyers. Chemical and electric companies were also weak, and sectors relying on consumer spending suffered, as falling housing prices and rising fuel prices shrank household wealth. Equities also lagged, due to heightened market volatility and company-specific factors.

DESPITE SLUGGISH OUTLOOK, MANAGER SEES OPPORTUNITIES

Although overall economic expectations remain spotty, we see enough areas of strength to doubt that a recession is inevitable. We anticipate some renewed momentum by the end of 2008. Industrial activity is fairly healthy, exporters may benefit from the weak dollar and trends in non-residential construction are solid. In addition, the upcoming federal tax rebate program could rekindle consumer spending.

3

LOOMIS SAYLES HIGH INCOME FUND

Investment Results through March 31, 2008

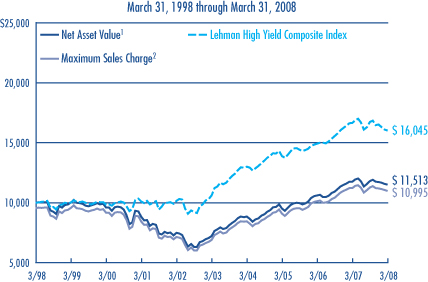

PERFORMANCE IN PERSPECTIVE

The charts comparing the fund’s performance to an index provide you with a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, the index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

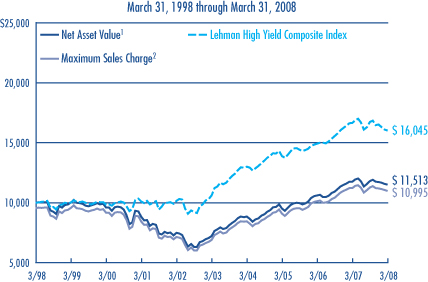

Growth of a $10,000 Investment in Class A Shares4

Average Annual Returns — March 31, 20084

| | | | | | | | | | | | | | | |

| | | | | | |

| | | 6 MONTHS | | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | | | SINCE

INCEPTION | |

CLASS A (Inception 2/22/84) | | | | | | | | | | | | | | | |

Net Asset Value1 | | -2.54 | % | | -2.04 | % | | 9.71 | % | | 1.42 | % | | — | |

With Maximum Sales Charge2 | | -6.90 | | | -6.48 | | | 8.72 | | | 0.96 | | | — | |

| | | | | | |

CLASS B (Inception 9/20/93) | | | | | | | | | | | | | | | |

Net Asset Value1 | | -2.91 | | | -2.79 | | | 8.87 | | | 0.68 | | | — | |

With CDSC3 | | -7.61 | | | -7.35 | | | 8.59 | | | 0.68 | | | — | |

| | | | | | |

CLASS C (Inception 3/2/98) | | | | | | | | | | | | | | | |

Net Asset Value1 | | -2.90 | | | -2.96 | | | 8.83 | | | 0.66 | | | — | |

With CDSC3 | | -3.84 | | | -3.87 | | | 8.83 | | | 0.66 | | | — | |

| | | | | | |

CLASS Y (Inception 2/29/08) | | | | | | | | | | | | | | | |

Net Asset Value1 | | — | | | — | | | — | | | — | | | -0.59 | % |

| | | | | | |

| COMPARATIVE PERFORMANCE | | 6 MONTHS | | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | | | SINCE CLASS Y

INCEPTION7 | |

Lehman High Yield Composite Index | | -4.27 | % | | -3.74 | % | | 8.62 | % | | 4.84 | % | | -0.34 | % |

Morningstar High Yield Bond Fund Avg. | | -5.02 | | | -4.65 | | | 7.47 | | | 3.44 | | | -0.28 | |

See page 15 for a description of the indexes.

All returns represent past performance and do not guarantee future results. Periods of less than one year are not annualized. Share price and return will vary and you may have a gain or loss when you sell your shares. All results include reinvestment of dividends and capital gains. Current returns may be higher or lower than those shown. For performance current to the most recent month-end, visit www.funds.natixis.com. Performance history includes periods from a predecessor fund. Class Y shares are available to certain investors, as described in the prospectus.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

PORTFOLIO FACTS

| | | | |

| |

| | | % of Net Assets as of |

| CREDIT QUALITY | | 3/31/08 | | 9/30/07 |

Aaa | | 11.6 | | 15.5 |

Aa | | 2.0 | | 1.9 |

A | | 0.3 | | 0.7 |

Baa | | 9.8 | | 8.9 |

Ba | | 12.9 | | 17.4 |

B | | 27.7 | | 24.9 |

Caa | | 20.4 | | 15.9 |

Not Rated* | | 8.2 | | 11.7 |

Short-term and other | | 7.1 | | 3.1 |

Credit quality is based on ratings from Moody’s Investors Service.

* Securities that are not rated by Moody’s may be rated by another rating agency or by Loomis Sayles.

| | | | | | |

| |

| | | % of Net Assets as of | |

| EFFECTIVE MATURITY | | 3/31/08 | | | 9/30/07 | |

1 year or less | | 9.2 | | | 4.2 | |

1-5 years | | 28.4 | | | 21.9 | |

5-10 years | | 19.9 | | | 19.4 | |

10+ years | | 42.5 | | | 54.5 | |

Average Effective Maturity | | 10.6 | years | | 13.8 | years |

Portfolio characteristics will vary.

EXPENSE RATIOS AS STATED IN THE MOST RECENT PROSPECTUS

| | | | | | |

| Share Class | | Gross Expense Ratio5 | | | Net Expense Ratio6 | |

A | | 1.43 | % | | 1.15 | % |

B | | 2.18 | | | 1.90 | |

C | | 2.17 | | | 1.90 | |

Y | | 1.16 | | | 0.90 | |

NOTES TO CHARTS

1 | Does not include a sales charge. |

2 | Includes maximum sales charge of 4.50%. |

3 | Performance for Class B shares assumes a maximum of 5% contingent deferred sales charge (“CDSC”) applied when you sell shares, which declines annually between years 1-6 according to the following schedule: 5, 4, 3, 3, 2, 1, 0%. Class C shares performance assumes a 1% CDSC applied when you sell shares within one year of purchase. |

4 | Fund performance has been increased by expense reductions and reimbursements, if any, without which performance would have been lower. |

5 | Before reductions and reimbursements. |

6 | After reductions and reimbursements. Expense reductions are contractual and are set to expire on 1/31/09. |

7 | The since-inception comparative performance figures shown for Class Y shares are calculated from 3/1/08. |

4

LOOMIS SAYLES INTERNATIONAL BOND FUND

PORTFOLIO PROFILE

Objective:

Seeks high total return through a combination of current income and capital appreciation

Strategy:

Invests primarily in fixed-income securities located outside the U.S.

Fund Inception:

February 1, 2008

Managers:

Lynda L. Schweitzer, CFA

Kenneth M. Buntrock, CFA, CIC

David W. Rolley, CFA

Loomis, Sayles & Company, L.P.

Symbols:

| | |

| Class A | | LSIAX |

| Class C | | LSICX |

| Class Y | | LSIYX |

What You Should Know:

Fixed-income securities are subject to credit risk and interest rate risk; their value generally rises when prevailing interest rates fall and falls when interest rates rise. The fund may also invest in public or private debt obligations issued or guaranteed by U.S. or non-U.S. issuers. The fund can invest a significant percentage of assets in foreign securities and the value of the fund shares can be adversely affected by changes in currency exchange rates, political, and economic developments. In emerging markets these risks can be significant. The fund can invest a significant percentage of assets in debt securities that are rated below investment grade. Lower-rated debt securities have speculative characteristics and may be subject to greater price volatility than higher-rated investments. In addition, the secondary market for these securities may lack liquidity. Fund shares should be viewed as a long-term investment.

Management Discussion

Concerns about the credit markets spread throughout the global fixed-income markets early in 2008, as part of the fallout from the U.S. credit crisis. This prompted investors to seek out the highest quality securities in order to minimize credit risk. Sovereign debt of developed economies produced the best relative returns in this environment, while corporate bonds generally lagged other fixed-income sectors.

Loomis Sayles International Bond Fund began operations on February 1, 2008 with a strategy of investing in foreign, investment-grade, fixed-income securities. It has the flexibility to invest in fixed-income markets around the world. While the fund’s portfolio is focused on international fixed-income investments, investors may benefit from exposure to this market because, historically, it tends to have a low correlation with the performance of U.S. fixed-income and equity investments.

From its inception at the beginning of February through March 31, 2008, the fund’s Class A shares generated a total return of 4.82% based on net asset value and $0.04 in reinvested dividends. During the same two months, the benchmark Lehman Global Aggregate Bond ex-USD Index, returned 5.74%, while the average return on the funds in Morningstar’s World Bond category was 2.65%. Bear in mind that the fund was not fully invested during this two-month period because the portfolio was under construction.

FUND’S CURRENCY EXPOSURE, U.K. TREASURIES AND MATURITY WERE POSITIVE

In the fund’s first two months of investment operations, we constructed a portfolio that overweighted positions in the Singapore dollar, Mexican peso and Swiss franc, all of which contributed positively to performance. The fund’s top-performing securities during the two-month period included U.K. Treasury securities and currency-linked notes denominated in the Malaysian ringgit. Relative to its benchmark, the fund was overweight in corporate and government-related securities and underweight both in Treasury securities of sovereign governments and in securitized fixed-income issues.

EMPHASIS ON CORPORATE BONDS DETRACTED

The fund’s emphasis on higher-yielding corporate bonds, particularly those issued by European companies, detracted from its performance during the period. The potential for a worldwide economic slowdown, stemming largely from a tightening of bank lending standards, remains a concern, as even major companies have difficulty raising capital to fund expansion. The fund’s underweight in the Japanese yen also detracted as the currency rose sharply. However, we believe the yen’s strength primarily reflected technical market conditions rather than any economic fundamentals. In fact, we are anticipating a softening of the Japanese economy, with decelerating manufacturing activity and declining consumer confidence.

OUTLOOK FAVORS CORPORATE BONDS

We believe the U.S. economy will experience a slowdown before returning to a cycle of positive growth. Consequently, we favor corporate securities in general, including high-yield bonds issued by companies with the potential to sustain consistent cash flows. We have been rotating out of the securitized sector and adding to corporate bonds. Securitized investments are collections of similar debt instruments, like mortgages, that are sold as negotiable securities. Because they are diversified over multiple loans, securitized investments may pose less risk of default than a single security, but they may also cut into returns.

We are approaching a duration-neutral position in the euro and the Japanese yen. We also expect to maintain an overweight position in Asian currencies (other than Japan) where we anticipate the strongest growth.

5

LOOMIS SAYLES INTERNATIONAL BOND FUND

Average Annual Returns — March 31, 20084

PERFORMANCE IN PERSPECTIVE

The table comparing the fund’s performance to an index and a Morningstar average provides a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, an index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

| | | |

| | |

| | | SINCE

INCEPTION | |

CLASS A (Inception 2/1/08) | | | |

Net Asset Value1 | | 4.82 | % |

With Maximum Sales Charge2 | | 0.11 | |

| | |

CLASS C (Inception 2/1/08) | | | |

Net Asset Value1 | | 4.74 | |

With CDSC3 | | 3.74 | |

| | |

CLASS Y (Inception 2/1/08) | | | |

Net Asset Value1 | | 4.84 | |

| | |

| COMPARATIVE PERFORMANCE | | SINCE

INCEPTION7 | |

Lehman Global Aggregate Bond ex-USD Index | | 5.74 | % |

Morningstar World Bond Fund Avg. | | 2.65 | |

See page 15 for a description of the indexes.

All returns represent past performance and do not guarantee future results. Periods of less than one year are not annualized. Share price and return will vary and you may have a gain or loss when you sell your shares. All results include reinvestment of dividends and capital gains. Current returns may be higher or lower than those shown. For performance current to the most recent month-end, visit www.funds.natixis.com. Performance history includes periods from a predecessor fund. Class Y shares are available to certain investors, as described in the prospectus.

The table does not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

PORTFOLIO FACTS

| | | |

| | | % of Net

Assets as of | |

CREDIT QUALITY | | 3/31/08 | |

Aaa | | 71.0 | |

Aa | | 14.1 | |

A | | 8.4 | |

Baa | | 3.0 | |

Ba | | 0.2 | |

Caa | | 0.4 | |

Not Rated* | | 0.0 | |

Short-term and other | | 2.9 | |

|

Credit quality is based on ratings from Moody’s Investors Service. * Securities that are not rated by Moody’s may be rated by another rating agency or by Loomis Sayles. | |

| | | % of Net

Assets

as of | |

| EFFECTIVE MATURITY | | 3/31/08 | |

1 year or less | | 5.8 | |

1-5 years | | 46.3 | |

5-10 years | | 36.4 | |

10+ years | | 11.5 | |

Average Effective Maturity | | 7.2 | years |

Portfolio characteristics will vary.

EXPENSE RATIOS AS STATED IN THE MOST RECENT PROSPECTUS

| | | | | | |

| Share Class | | Gross Expense Ratio5 | | | Net Expense Ratio6 | |

A | | 1.15 | % | | 1.10 | % |

C | | 1.90 | | | 1.85 | |

Y | | 0.90 | | | 0.85 | |

NOTES TO CHARTS

1 | Does not include a sales charge. |

2 | Includes maximum sales charge of 4.50%. |

3 | Class C shares performance assumes a 1% CDSC applied when you sell shares within one year of purchase. |

4 | Fund performance has been increased by expense reductions and reimbursements, if any, without which performance would have been lower. |

5 | Before reductions and reimbursements. |

6 | After reductions and reimbursements. Expense reductions are contractual and are set to expire on 1/31/09. |

7 | The since-inception comparative performance figures shown for Class Y shares are calculated from 2/1/08. |

6

LOOMIS SAYLES LIMITED TERM GOVERNMENTAND AGENCY FUND

PORTFOLIO PROFILE

Objective:

Seeks a high current return consistent with preservation of capital

Strategy:

Invests primarily in securities issued or guaranteed by the U.S. government, its agencies or instrumentalities

Fund Inception:

January 3, 1989

Managers:

John Hyll

Clifton V. Rowe, CFA

Loomis, Sayles & Company, L.P.

Symbols:

| | |

| Class A | | NEFLX |

| Class B | | NELBX |

| Class C | | NECLX |

| Class Y | | NELYX |

What You Should Know:

Fixed-income securities are subject to credit risk and interest rate risk; their value generally rises when prevailing interest rates fall and falls when rates rise. Securities issued by the U.S. government are guaranteed by the U.S. government if held to maturity; mutual funds that invest in these securities are not guaranteed. Securities issued by U.S. government agencies may not be government guaranteed.

Management Discussion

As the credit crunch gained momentum and economic conditions deteriorated during the six months ended March 31, 2008, investors put a premium on safety. The housing market continued to slump, consumer confidence fell, banks became less willing to lend money and the subprime mortgage crisis spread to prime markets. This occurred despite the Federal Reserve Board’s efforts to restore normalcy by giving banks access to its lending window and cutting the federal funds rate to 2.25% as of the end of the fiscal period.

For the fiscal period ended March 31, 2008, Loomis Sayles Limited Term Government and Agency Fund’s total return was 3.75% based on the net asset value of Class A shares and $0.26 in reinvested dividends. However, the fund lagged its benchmark and a peer group of mutual funds for the period. The Lehman 1-5 Year Government Bond Index returned 6.41%, and the average return on the funds in Morningstar’s Short Government category was 4.16%. The fund’s 30-day SEC yield was 3.57% as of March 31, 2008.

SHORTER-TERM SECURITIES DETRACTED FROM PERFORMANCE

The Fed’s recent rate cuts caused bond prices to rise, and short-term Treasury securities were among the first to respond, followed by intermediate- and long-term bonds. For the period as a whole, Treasury bonds with relatively long maturities were the best performers as their prices are more sensitive to interest rate moves. The fund’s emphasis on high quality was a positive, but its orientation toward shorter-term, more liquid securities limited its participation in the rally and contributed to its performance lag.

REAL ESTATE MARKET WOES HURT MORTGAGE-BACKED MARKETS

The principal reason the fund underperformed its benchmark was its emphasis on mortgage-backed securities (MBS). During the fiscal period, credit concerns spread from the subprime mortgage market to higher quality mortgages and corporate bonds. MBS fell from favor partly because they are associated with the troubled mortgage market. This was true even for MBS issued by government-sponsored entities (GSEs). While the U.S. government does not guarantee GSE MBS, their credit is enhanced by guarantees from the issuing government agency and, like other government agency securities, they are viewed as having very low default risk. Although MBS issued by government agencies outperformed privately issued MBS, they still underperformed U.S. Treasuries as the real estate market continued to languish. By the end of March 2008, MBS backed by commercial issuers had partially recovered, but the market as a whole appears undervalued.

FUND STRATEGY SEEKS COMBINATION OF CURRENT INCOME AND SAFETY

During the period we emphasized mortgage-backed securities issued by GSEs because we appreciate the combination of strong credit quality and their yield advantage over Treasuries. We also added to the fund’s position in short-duration, high-quality, asset-backed securities, including bonds backed by automobile loans and credit-card receivables, as well as some high-quality, commercial mortgage-backed securities at attractive yields.

SELECTIVITY WILL BE KEY IF MARKET OUTLOOK IMPROVES

As a result of the Federal Reserve rate cuts, the yield curve is steep by historical standards, so that longer-maturity issues now offer an unusually wide yield advantage over shorter alternatives. Consequently, we are looking for specific opportunities to take advantage of this situation.

We believe bond valuations in many sectors may already reflect the possibility of a recession, or something close to it. We view this as an overreaction typical in periods of uncertainty and we are anticipating a recovery, with improving risk appetites. However, we expect the recovery to focus on specific market sectors, as numerous sector-specific hurdles remain. Although the outlook is brightening, the ride is likely to remain a bumpy one.

7

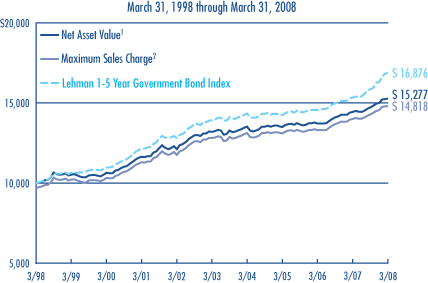

LOOMIS SAYLES LIMITED TERM GOVERNMENTAND AGENCY FUND

Investment Results through March 31, 2008

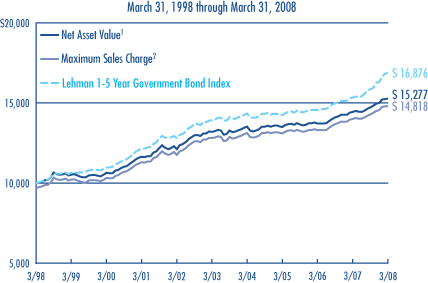

PERFORMANCE IN PERSPECTIVE

The charts comparing the fund’s performance to an index provide you with a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, the index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

Growth of a $10,000 Investment in Class A Shares4

Average Annual Returns — March 31, 20084

| | | | | | | | | | | | |

| | | | | |

| | | 6 MONTHS | | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | |

Class A (Inception 1/3/89) | | | | | | | | | | | | |

Net Asset Value1 | | 3.75 | % | | 5.87 | % | | 2.96 | % | | 4.33 | % |

With Maximum Sales Charge2 | | 0.64 | | | 2.70 | | | 2.33 | | | 4.01 | |

| | | | | |

Class B (Inception 9/27/93) | | | | | | | | | | | | |

Net Asset Value1 | | 3.37 | | | 5.09 | | | 2.21 | | | 3.61 | |

With CDSC3 | | -1.63 | | | 0.09 | | | 1.85 | | | 3.61 | |

| | | | | |

Class C (Inception 12/30/94) | | | | | | | | | | | | |

Net Asset Value1 | | 3.36 | | | 4.99 | | | 2.21 | | | 3.61 | |

With CDSC3 | | 2.36 | | | 3.99 | | | 2.21 | | | 3.61 | |

| | | | | |

Class Y (Inception 3/31/94) | | | | | | | | | | | | |

Net Asset Value1 | | 3.87 | | | 6.04 | | | 3.22 | | | 4.68 | |

| | | | | |

| COMPARATIVE PERFORMANCE | | 6 MONTHS | | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | |

Lehman 1-5 Yr Gov’t Bond Index | | 6.41 | % | | 9.98 | % | | 3.93 | % | | 5.37 | % |

Morningstar Short Gov’t Fund Avg. | | 4.16 | | | 6.71 | | | 2.95 | | | 4.38 | |

See page 15 for a description of the indexes.

All returns represent past performance and do not guarantee future results. Periods of less than one year are not annualized. Share price and return will vary and you may have a gain or loss when you sell your shares. All results include reinvestment of dividends and capital gains. Current returns may be higher or lower than those shown. For performance current to the most recent month-end, visit www.funds.natixis.com. Performance history includes periods from a predecessor fund. Class Y shares are available to certain investors, as described in the prospectus.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

PORTFOLIO FACTS

| | | | | | |

| |

| | | % of Net Assets as of | |

| FUND COMPOSITION | | 3/31/08 | | | 9/30/07 | |

Mortgage Related | | 57.6 | | | 60.7 | |

Treasuries | | 9.1 | | | 9.3 | |

Asset-Backed Securities | | 5.7 | | | 5.7 | |

Agency | | 3.4 | | | 3.3 | |

Hybrid ARMs | | 2.4 | | | 2.5 | |

Mortgage Backed Securities | | 2.4 | | | 1.1 | |

Credit Card ABS | | 1.6 | | | — | |

Automotive | | 1.0 | | | — | |

Collateralized Mortgage Obligation | | 0.2 | | | 0.2 | |

Short Term Investments & Other | | 16.6 | | | 17.2 | |

| |

| | | % of Net Assets as of | |

| EFFECTIVE MATURITY | | 3/31/08 | | | 9/30/07 | |

1 year or less | | 24.7 | | | 20.9 | |

1-5 years | | 56.2 | | | 63.2 | |

5-10 years | | 19.1 | | | 15.9 | |

10+ years | | n/a | | | n/a | |

Average Effective Maturity | | 3.4 | years | | 3.2 | years |

Portfolio characteristics will vary.

EXPENSE RATIOS AS STATED IN THE MOST RECENT PROSPECTUS

| | | | | | |

| Share Class | | Gross Expense Ratio5 | | | Net Expense Ratio6 | |

A | | 1.10 | % | | 0.90 | % |

B | | 1.85 | | | 1.65 | |

C | | 1.85 | | | 1.65 | |

Y | | 0.75 | | | 0.65 | |

NOTES TO CHARTS

1 | Does not include a sales charge. |

2 | Includes maximum sales charge of 3.00%. |

3 | Performance for Class B shares assumes a maximum of 5% contingent deferred sales charge (“CDSC”) applied when you sell shares, which declines annually between years 1-6 according to the following schedule: 5, 4, 3, 3, 2, 1, 0%. Class C shares performance assumes a 1% CDSC applied when you sell shares within one year of purchase. |

4 | Fund performance has been increased by expense reductions and reimbursements, if any, without which performance would have been lower. |

5 | Before reductions and reimbursements. |

6 | After reductions and reimbursements. Expense reductions are contractual and are set to expire on 1/31/09. |

8

LOOMIS SAYLES MASSACHUSETTS TAX FREE INCOME FUND

PORTFOLIO PROFILE

Objective:

Seeks to maintain a high level of current income exempt from federal and Massachusetts personal income taxes

Strategy:

Invests primarily in Massachusetts municipal bonds, including general obligation bonds and issues secured by specific revenue streams

Inception Date:

March 23, 1984

Manager:

Martha A. Strom

Loomis, Sayles & Company, L.P.

Symbols:

| | |

| Class A | | NEFMX |

| Class B | | NEMBX |

What You Should Know:

Fixed-income securities are subject to credit risk and interest rate risk; their value generally rises when prevailing interest rates fall and falls when rates rise. This fund concentrates in a single geographic region, which can affect your fund’s performance. Some income may be subject to federal and state taxes. Realized capital gains are fully taxable. Some investors may be subject to the Alternative Minimum Tax (AMT). Lower-rated bonds entail higher risks.

Special Notice to Shareholders

On February 29, 2008, the fund’s Board of Trustees approved the liquidation and termination of the fund. After extensive analysis, the Trustees concluded that this fund’s small asset level does not provide the scale needed to remain viable for shareholders. It is expected that the sale of the fund’s assets and the corresponding liquidating distributions will be completed on or about June 13, 2008. The following is a discussion of the factors that materially affected the fund’s performance during the six months ended March 31, 2008. Because the fund is being liquidated, the discussion does not include forward-looking comments.

MANAGEMENT DISCUSSION

For the six months ended March 31, 2008, the total return on Loomis Sayles Massachusetts Tax Free Income Fund was -0.37%, based on the net asset value of Class A shares and $0.32 in reinvested dividends. The fund’s results were below the 0.75% return on the fund’s benchmark, the Lehman Municipal Bond Index, and about the same as the -0.38% average return on Morningstar’s Muni Massachusetts category. The fund’s 30-day SEC yield at the end of March was 3.86%, equivalent to a taxable yield of 6.31% based on the combined maximum federal income tax rate and the Massachusetts income tax rate of 38.45%.

NEGATIVE PRESS ABOUT INSURERS UNDERMINES INSURED MUNICIPAL BONDS

Recent news stories regarding monoline insurers caused safety-conscious investors to retreat from municipal bonds. Monoline insurers – so named because they provide services to only one industry – guarantee the timely repayment of bond principal and interest if an issuer defaults. AMBAC Financial and MBIA are two of the biggest U.S. insurers of municipal bonds. In exchange for their premium payments, the insured municipalities receive the benefit of the insurers’ AAA rating, which helps them attract safety-conscious investors. However, monoline insurers started covering collateralized debt obligations, which are mortgage-related securities. As the mortgage crisis eroded the credit status of mortgagors, ratings companies like Standard & Poor’s and Moody’s Investor Services began cutting ratings of monoline insurers, including AMBAC, MBIA and other similar companies. Even though defaults by municipalities are rare, the credit ratings and market value of many insured municipal bonds declined as safety-oriented investors retreated to Treasuries and other top-rated (but taxable) securities.

INSURED LONG-TERM BONDS AND HOUSING-RELATED ISSUES DECLINED

Insured bonds issued for Simmons College had the most negative impact on fund performance due to news stories about monoline insurers’ rating downgrades. Municipal bonds issued for housing also declined in value because their exposure to a troubled industry and their longer maturity structure caused them to fall out of favor with investors. The fund’s healthcare bonds issued in Texas were also poor performers because they were long-term and lower rated. In general, this fund’s relatively aggressive posture did not work in its favor during the fiscal period.

UTILITIES AND SHORT-TERM BONDS WERE POSITIVE

The utilities sector benefited the fund during the six-month period because their relatively high income and short maturity structure appealed to safety-conscious investors. Some of the fund’s shorter maturity, higher coupon bonds issued by municipalities in Puerto Rico also found favor during the first quarter of 2008, recovering from poor performance late in 2007. Although the fund was underweight in shorter maturity bonds relative to the Index, the issues in the portfolio provided price support during a difficult period for the market.

9

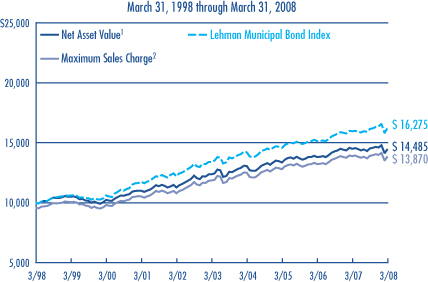

LOOMIS SAYLES MASSACHUSETTS TAX FREE INCOME FUND

Investment Results through March 31, 2008

PERFORMANCE IN PERSPECTIVE

The charts comparing the fund’s performance to an index provide you with a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, the index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

Growth of a $10,000 Investment in Class A Shares4

Average Annual Returns — March 31, 20084

| | | | | | | | | | | | |

| | | | | |

| | | 6 MONTHS | | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | |

CLASS A (Inception 3/23/84) | | | | | | | | | | | | |

Net Asset Value1 | | -0.37 | % | | -0.24 | % | | 3.18 | % | | 3.78 | % |

With Maximum Sales Charge2 | | -4.59 | | | -4.50 | | | 2.29 | | | 3.34 | |

| | | | | |

CLASS B (Inception 9/13/93) | | | | | | | | | | | | |

Net Asset Value1 | | -0.75 | | | -0.94 | | | 2.45 | | | 3.08 | |

With CDSC3 | | -5.64 | | | -5.74 | | | 2.10 | | | 3.08 | |

| | | | | |

| COMPARATIVE PERFORMANCE | | 6 MONTHS | | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | |

Lehman Municipal Bond Index | | 0.75 | % | | 1.90 | % | | 3.92 | % | | 4.99 | % |

Morningstar Muni Massachusetts Fund Avg. | | -0.38 | | | 0.18 | | | 3.07 | | | 4.03 | |

Yields as of March 31, 2008

| | | | | | |

| | | |

| | | CLASS A | | | CLASS B | |

SEC 30-Day Yield5 | | 3.86 | % | | 3.33 | % |

Taxable Equivalent Yield6 | | 6.31 | | | 5.47 | |

See page 15 for a description of the indexes.

All returns represent past performance and do not guarantee future results. Periods of less than one year are not annualized. Share price and return will vary and you may have a gain or loss when you sell your shares. All results include reinvestment of dividends and capital gains. Current returns may be higher or lower than those shown. For performance current to the most recent month-end, visit www.funds.natixis.com.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

PORTFOLIO FACTS

| | | | |

| |

| | | % of Net Assets as of |

| CREDIT QUALITY | | 3/31/08 | | 9/30/07 |

Aaa | | 27.3 | | 38.7 |

Aa | | 20.4 | | 18.0 |

A | | 27.4 | | 16.1 |

Baa | | 12.8 | | 12.2 |

Ba | | 5.4 | | 4.7 |

Not Rated* | | 2.3 | | 8.4 |

Short-term and other | | 4.4 | | 1.9 |

Credit quality is based on ratings from Moody’s Investors Service.

* Securities that are not rated by Moody’s may be rated by another rating agency or by Loomis Sayles.

| | | | | | |

| |

| | | % of Net Assets as of | |

| EFFECTIVE MATURITY | | 3/31/08 | | | 9/30/07 | |

1 year or less | | 4.4 | | | 1.0 | |

1-5 years | | 31.4 | | | 31.1 | |

5-10 years | | 24.6 | | | 40.6 | |

10+ years | | 39.6 | | | 27.3 | |

Average Effective Maturity | | 11.6 | years | | 8.9 | years |

Portfolio characteristics will vary.

EXPENSE RATIOS AS STATED IN THE MOST RECENT PROSPECTUS

| | | | |

| Share Class | | Gross Expense Ratio7 | | Net Expense Ratio8 |

A | | 1.16% | | 0.90% |

B | | 1.91 | | 1.65 |

NOTES TO CHARTS

1 | Does not include a sales charge. |

2 | Includes maximum sales charge of 4.25%. |

3 | Performance for Class B shares assumes a maximum of 5% contingent deferred sales charge (“CDSC”) applied when you sell shares, which declines annually between years 1-6 according to the following schedule: 5, 4, 3, 3, 2, 1, 0%. |

4 | Fund performance has been increased by expense reductions and reimbursements, if any, without which performance would have been lower. |

5 | SEC Yield is based on the fund’s net investment income over a 30-day period and is calculated in accordance with SEC guidelines. |

6 | Taxable equivalent yield is based on the maximum combined federal and MA income tax bracket of 38.45%. A portion of income may be subject to federal, state and/or alternative minimum tax. Capital gains, if any, are subject to capital gains tax. |

7 | Before reductions and reimbursements. |

8 | After reductions and reimbursements. Expense reductions are contractual and are set to expire on 1/31/09. |

10

LOOMIS SAYLES MUNICIPAL INCOME FUND

PORTFOLIO PROFILE

Objective:

Seeks as high a level of current income exempt from federal income taxes as is consistent with reasonable risk and protection of shareholders’ capital

Strategy:

Invests primarily in municipal securities that pay interest exempt from federal income tax other than the alternative minimum tax

Fund Inception:

May 9, 1977

Managers:

Martha A. Strom

Loomis, Sayles & Company, L.P.

Symbols:

| | |

| Class A | | NEFTX |

| Class B | | NETBX |

What You Should Know:

Fixed-income securities are subject to credit risk and interest rate risk; their value generally rises when prevailing interest rates fall and falls when rates rise. Some income may be subject to federal and state taxes. Realized capital gains are fully taxable. Some investors may be subject to the Alternative Minimum Tax (AMT). Lower-rated bonds entail higher risks.

Special Notice to Shareholders

On February 29, 2008, the fund’s Board of Trustees approved the liquidation and termination of the fund. After extensive analysis, the Trustees concluded that this fund’s small asset level does not provide the scale needed to remain viable for shareholders. It is expected that the sale of the fund’s assets and the corresponding liquidating distributions will be completed on or about June 13, 2008. The following is a discussion of the factors that materially affected the fund’s performance during the six months ended March 31, 2008. Because the fund is being liquidated, the discussion does not include forward-looking comments.

MANAGEMENT DISCUSSION

For the six months ended March 31, 2008, the total return on Loomis Sayles Municipal Income Fund was -2.34%, based on the net asset value of Class A shares, $0.14 in dividends and $0.06 in capital gains reinvested during the period. The fund’s results were below the 0.75% return on its benchmark, the Lehman Municipal Bond Index, and the -1.08% average return on Morningstar’s Muni National Long category. The fund’s 30-day SEC yield at the end of March was 3.91%, equivalent to a taxable yield of 6.04% based on the maximum federal income tax rate of 35.00%.

NEGATIVE PRESS ABOUT INSURERS UNDERMINES INSURED MUNICIPAL MARKETS

Recent news stories regarding monoline insurers caused safety-conscious investors to retreat from municipal bonds. Monoline insurers – so named because they provide services to only one industry – guarantee the timely repayment of bond principal and interest if an issuer defaults. AMBAC Financial and MBIA are two of the biggest U.S. insurers of municipal bonds. In exchange for their premium payments, the insured municipalities receive the benefit of the insurers’ AAA rating, which help them attract safety-conscious investors. However, monoline insurers started covering collateralized debt obligations, which are mortgage-related securities. As the credit crisis and rising mortgage default rates eroded the credit status of mortgagors, ratings companies like Standard & Poor’s and Moody’s Investor Services began cutting ratings of monoline insurers, including AMBAC, MBIA and other similar companies. Even though defaults by municipalities are rare, the credit ratings and market value of many insured municipal bonds declined as safety-oriented investors fled to Treasuries and other top-rated (but taxable) securities.

LONG-MATURITY, INSURED BONDS HURT FUND PERFORMANCE

Not surprisingly, long maturity, insured municipal bonds had the most negative impact on fund performance, as their maturity structure and the controversy surrounding monoline insurers caused investors to look elsewhere. Relative to its national benchmark, the fund was underweight in higher-quality, shorter-term bonds, which provide lower yields but are regarded as safer. Industrial development bonds issued for corporations had the most negative impact on fund performance, as demand for this type of issue declined. The fund’s healthcare bonds issued in Texas were the worst performers, because they were long-term and lower-rated. In general, this fund’s relatively aggressive posture did not work in its favor during the period.

HIGHER EDUCATION AND TWO SHORTER-TERM NEW YORK BONDS WERE POSITIVE

The higher education sector contributed most to the fund’s performance during the six-month period because their higher income and shorter maturity structure appealed to retail investors. Two higher-yielding New York municipal bonds were also positive contributors over the period, as their shorter maturity structure and short supply combined to stimulate demand. Although the fund was underweight in shorter maturity bonds relative to the index, those held in the fund provided price support in a volatile market environment.

11

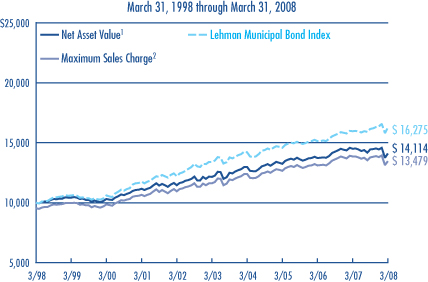

LOOMIS SAYLES MUNICIPAL INCOME FUND

Investment Results through March 31, 2008

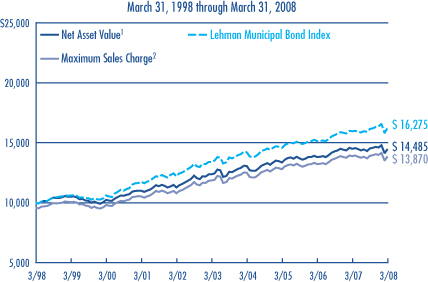

PERFORMANCE IN PERSPECTIVE

The charts comparing the fund’s performance to an index provide you with a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, the index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

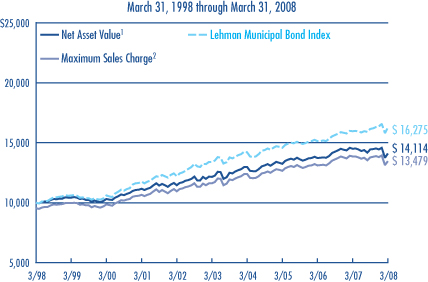

Growth of a $10,000 Investment in Class A Shares6

Average Annual Returns — March 31, 20086

| | | | | | | | | | | | |

| | | | | |

| | | 6 MONTHS | | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | |

CLASS A (Inception 5/9/77) | | | | | | | | | | | | |

Net Asset Value1 | | -2.34 | % | | -2.77 | % | | 3.01 | % | | 3.50 | % |

With Maximum Sales Charge2 | | -6.79 | | | -7.10 | | | 2.05 | | | 3.03 | |

| | | | | |

CLASS B (Inception 9/13/93) | | | | | | | | | | | | |

Net Asset Value1 | | -2.70 | | | -3.48 | | | 2.24 | | | 2.71 | |

With CDSC3 | | -7.46 | | | -8.13 | | | 1.89 | | | 2.71 | |

| | | | | |

| COMPARATIVE PERFORMANCE | | 6 MONTHS | | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | |

Lehman Municipal Bond Index | | 0.75 | % | | 1.90 | % | | 3.92 | % | | 4.99 | % |

Morningstar Muni National Long Fund Avg. | | -1.08 | | | -0.87 | | | 3.13 | | | 3.91 | |

Yields as of March 31, 2008

| | | | | | |

| | | |

| | | CLASS A | | | CLASS B | |

SEC 30-Day Yield4 | | 3.91 | % | | 3.33 | % |

Taxable Equivalent Yield5 | | 6.04 | | | 5.16 | |

See page 15 for a description of the indexes.

All returns represent past performance and do not guarantee future results. Periods of less than one year are not annualized. Share price and return will vary and you may have a gain or loss when you sell your shares. All results include reinvestment of dividends and capital gains. Current returns may be higher or lower than those shown. Performance history includes performance from a predecessor fund. For performance current to the most recent month-end, visit www.funds.natixis.com.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

PORTFOLIO FACTS

| | | | |

| |

| | | % of Net Assets as of |

| CREDIT QUALITY | | 3/31/08 | | 9/30/07 |

Aaa | | 26.2 | | 31.2 |

Aa | | 21.6 | | 18.3 |

A | | 28.8 | | 22.5 |

Baa | | 10.1 | | 12.9 |

Ba | | 4.0 | | 3.7 |

Not Rated* | | 5.4 | | 10.2 |

Short-term and other | | 3.9 | | 1.2 |

Credit quality is based on ratings from Moody’s Investors Service.

* Securities that are not rated by Moody’s may be rated by another rating agency or by Loomis Sayles.

| | | | | | |

| |

| | | % of Net Assets as of | |

| EFFECTIVE MATURITY | | 3/31/08 | | | 9/30/07 | |

1 year or less | | 3.9 | | | 0.2 | |

1-5 years | | 18.9 | | | 12.1 | |

5-10 years | | 31.1 | | | 58.4 | |

10+ years | | 46.1 | | | 29.3 | |

Average Effective Maturity | | 12.7 | years | | 10.1 | years |

Portfolio characteristics will vary.

EXPENSE RATIOS AS STATED IN THE MOST RECENT PROSPECTUS

| | | | |

| Share Class | | Gross Expense Ratio7 | | Net Expense Ratio8 |

A | | 1.03% | | 0.90% |

B | | 1.78 | | 1.65 |

NOTES TO CHARTS

1 | Does not include a sales charge. |

2 | Includes maximum sales charge of 4.50%. |

3 | Performance for Class B shares assumes a maximum of 5% contingent deferred sales charge (“CDSC”) applied when you sell shares, which declines annually between years 1-6 according to the following schedule: 5, 4, 3, 3, 2, 1, 0%. |

4 | SEC Yield is based on the fund’s net investment income over a 30-day period and is calculated in accordance with SEC guidelines. |

5 | Taxable equivalent yield is based on the maximum federal income tax bracket of 35%. A portion of income may be subject to federal, state and/or alternative minimum tax. Capital gains, if any, are subject to capital gains tax. |

6 | Fund performance has been increased by expense reductions and reimbursements, if any, without which performance would have been lower. |

7 | Before reductions and reimbursements. |

8 | After reductions and reimbursements. Expense reductions are contractual and are set to expire on 1/31/09. |

12

LOOMIS SAYLES STRATEGIC INCOME FUND

PORTFOLIO PROFILE

Objective:

Seeks high current income, with a secondary objective of capital growth

Strategy:

Invests primarily in income-producing securities in the U.S. and around the world

Fund Inception:

May 1, 1995

Managers:

Daniel J. Fuss, CFA, CIC

Kathleen C. Gaffney, CFA

Associate Managers:

Matthew J. Eagan, CFA

Elaine M. Stokes

Loomis, Sayles & Company, L.P.

Symbols:

| | |

| Class A | | NEFZX |

| Class B | | NEZBX |

| Class C | | NECZX |

| Class Y | | NEZYX |

What You Should Know:

Fixed-income securities are subject to credit risk and interest rate risk; their value generally rises when prevailing interest rates fall and falls when rates rise.

The fund can invest a significant percentage of assets in debt securities that are rated below investment grade and the value of fund shares can be adversely affected by changes in economic conditions or other circumstances. Lower rated debt securities have speculative characteristics and may be subject to greater price volatility than higher rated investments. In addition, the secondary market for these securities may lack liquidity. Accordingly, the purchase of fund shares should be viewed as a long-term investment. The fund can also invest a significant percentage of assets in foreign securities and the value of the fund shares can be adversely affected by changes in currency exchange rates, political, and economic developments. In emerging markets, these risks can be significant. Fund shares should be viewed as a long-term investment.

Management Discussion

Risk aversion has characterized investors for the past several months, as the credit crisis in the United States intensified and the economy slowed. Investors sought greater safety by moving out of corporate issues and into Treasury securities, while the weakening U.S. dollar boosted bonds denominated in stronger foreign currencies. In an effort to stabilize the markets, the Federal Reserve Board cut the federal funds rate twice in the past six months and opened its lending facility to brokerage firms.

For the six months ended March 31, 2008, Loomis Sayles Strategic Income Fund’s total return was -1.34%, based on the net asset value of Class A shares and $0.52 in reinvested dividends. The fund’s results trailed those of its benchmark, the Lehman Aggregate Bond Index, which returned 5.23% for the period. Its results also lagged Morningstar’s Multisector Bond category, which had an average return of 0.20%. The fund’s 30-day SEC yield on March 31, 2008 was 6.47%.

TREASURIES, BETTER-GRADE CORPORATES AND NON-DOLLAR HOLDINGS WERE POSITIVE

As concerns mounted that the slowing economy would increase default risks for some issuers, demand for higher-quality bonds grew. Heavy demand enhanced returns in the Treasury markets, but led to falling prices for corporate issues in most rating categories. Investors in lower-rated market tiers continued to demand wider spreads (extra yield) over Treasuries, extending the decline in high-yield issues that began last year.

We increased the fund’s emphasis on Treasuries and higher-grade corporate bonds during the period, and this defensive positioning helped. However, this was not sufficient to overcome declines among the fund’s lower-quality holdings. The financial sector was especially hard hit, although the price recovery in Bear Stearns securities that followed its takeover by JP Morgan Chase had a positive effect on this sector, and rising energy prices powered positive results among energy providers.

Despite weakness in municipal bonds and selected real estate investment trusts (REITs), our security selection in these areas provided some price support. Overseas, bonds denominated in Singapore’s dollar and Malaysia’s ringgit added to the fund’s returns as the U.S. dollar slid further. Record commodity prices keyed the strong performance of bonds denominated in the Mexican peso and the Australian dollar. However, the fund’s commitment to Canadian securities, which was large relative to the benchmark, detracted from performance as Canada’s close ties to the sagging U.S. economy had a negative impact on its currency.

A RANGE OF CORPORATE ISSUES HELD BACK PERFORMANCE

High-yield issues, especially those rated BB and B, were important detractors from the fund’s performance during the period. Our sizeable stake among lower-rated industrial holdings hurt results, as economic uncertainty meant diminishing order flow for many manufacturers. Even some better-rated industrial issues suffered, as turmoil in the credit markets undercut investment-grade financial issuers. Communications companies were weighed down by concerns over reduced access to capital. Consumer cyclicals – companies whose profits tend to track economic cycles – fell victim to wavering consumer confidence and rising energy prices, which also dampened consumer spending. In addition, the portfolio was underweight in AAA-rated issues relative to its benchmark, which detracted from performance comparisons.

DESPITE SLOWING ECONOMY, MANAGERS SEE AREAS OF STRENGTH

Although overall economic expectations remain spotty, we see enough areas of strength to doubt that a recession is inevitable. We also believe there could be some recovery by year-end. We believe the Federal Reserve Board may cut interest rates once more, and a lower cost of capital could stimulate corporate spending. Persistent dollar weakness brightens the outlook for U.S. exports, and the upcoming federal rebate program could rekindle consumer spending. Although housing remains in a slump, non-residential construction is strong. Selected U.S. high-yield bonds appear to offer compelling value, but there are many good reasons for caution.

13

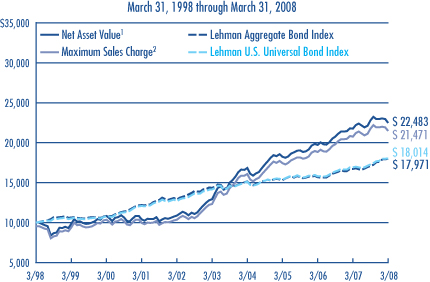

LOOMIS SAYLES STRATEGIC INCOME FUND

Investment Results through March 31, 2008

PERFORMANCE IN PERSPECTIVE

The charts comparing the fund’s performance to an index provide you with a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, the index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

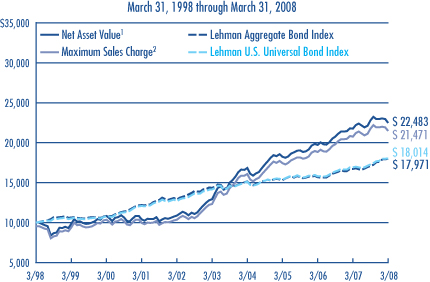

Growth of a $10,000 Investment in Class A Shares4

Average Annual Returns — March 31, 20084

| | | | | | | | | | | | | | | |

| | | | | | |

| | | 6 MONTHS | | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | | | SINCE

INCEPTION | |

CLASS A (Inception 5/1/95) | | | | | | | | | | | | | | | |

Net Asset Value1 | | -1.34 | % | | 3.40 | % | | 11.74 | % | | 8.44 | % | | — | |

With Maximum Sales Charge2 | | -5.80 | | | -1.24 | | | 10.71 | | | 7.94 | | | — | |

| | | | | | |

CLASS B (Inception 5/1/95) | | | | | | | | | | | | | | | |

Net Asset Value1 | | -1.71 | | | 2.61 | | | 10.89 | | | 7.62 | | | — | |

With CDSC3 | | -6.47 | | | -2.25 | | | 10.63 | | | 7.62 | | | — | |

| | | | | | |

CLASS C (Inception 5/1/95) | | | | | | | | | | | | | | | |

Net Asset Value1 | | -1.63 | | | 2.62 | | | 10.91 | | | 7.63 | | | — | |

With CDSC3 | | -2.59 | | | 1.65 | | | 10.91 | | | 7.63 | | | — | |

| | | | | | |

CLASS Y (Inception 12/1/99) | | | | | | | | | | | | | | | |

Net Asset Value1 | | -1.15 | | | 3.67 | | | 12.04 | | | — | | | 10.34 | % |

| | | | | | |

| COMPARATIVE PERFORMANCE | | 6 MONTHS | | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | | | SINCE

CLASS Y

INCEPTION5 | |

Lehman Aggregate Bond Index | | 5.23 | % | | 7.67 | % | | 4.58 | % | | 6.04 | % | | 6.46 | % |

Lehman U.S. Universal Bond Index | | 4.37 | | | 6.57 | | | 4.96 | | | 6.06 | | | 6.60 | |

Morningstar Multisector Bond Fund Avg. | | 0.20 | | | 2.09 | | | 7.29 | | | 5.35 | | | 6.59 | |

See page 15 for a description of the indexes.

All returns represent past performance and do not guarantee future results. Periods of less than one year are not annualized. Share price and return will vary and you may have a gain or loss when you sell your shares. All results include reinvestment of dividends and capital gains. Current returns may be higher or lower than those shown. Performance history includes periods from a predecessor fund. For performance current to the most recent month-end, visit www.funds.natixis.com. Class Y shares are available to certain investors, as described in the prospectus.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

PORTFOLIO FACTS

| | | | |

| |

| | | % of Net Assets as of |

| CREDIT QUALITY | | 3/31/08 | | 9/30/07 |

Aaa | | 21.9 | | 32.6 |

Aa | | 4.4 | | 2.7 |

A | | 11.0 | | 6.5 |

Baa | | 26.1 | | 22.7 |

Ba | | 8.9 | | 9.9 |

B | | 10.8 | | 9.5 |

Caa | | 7.7 | | 5.6 |

Not Rated* | | 5.8 | | 7.4 |

Short-term and other | | 3.4 | | 3.1 |

Credit quality is based on ratings from Moody’s Investor Service.

* Securities that are not rated by Moody’s may be rated by another rating agency or by Loomis Sayles.

| | | | | | |

| |

| | | % of Net Assets as of | |

| EFFECTIVE MATURITY | | 3/31/08 | | | 9/30/07 | |

1 year or less | | 11.7 | | | 10.9 | |

1-5 years | | 17.4 | | | 17.6 | |

5-10 years | | 26.1 | | | 19.4 | |

10+ years | | 44.8 | | | 52.1 | |

Average Effective Maturity | | 14.3 | years | | 15.6 | years |

Portfolio characteristics will vary.

EXPENSE RATIOS AS STATED IN THE MOST RECENT PROSPECTUS

| | | | |

| Share Class | | Gross Expense Ratio6 | | Net Expense Ratio7 |

A | | 1.01% | | 1.01% |

B | | 1.77 | | 1.77 |

C | | 1.75 | | 1.75 |

Y | | 0.74 | | 0.74 |

NOTES TO CHARTS

1 | Does not include a sales charge. |

2 | Includes maximum sales charge of 4.50%. |

3 | Performance for Class B shares assumes a maximum of 5% contingent deferred sales charge (“CDSC”) applied when you sell shares, which declines annually between years 1-6 according to the following schedule: 5, 4, 3, 3, 2, 1, 0%. Class C share performance assumes a 1.00% CDSC applied when you sell shares within one year of purchase. |

4 | Fund performance has been increased by expense reductions and reimbursements, if any, without which performance would have been lower. |

5 | The since-inception comparative performance figures shown for Class Y are calculated from 12/1/99. |

6 | Before reductions and reimbursements. |

7 | After reductions and reimbursements. Expense reductions are contractual and are set to expire on 1/31/09. |

14

ADDITIONAL INFORMATION

The views expressed in this report reflect those of the portfolio managers as of the dates indicated. The managers’ views are subject to change at any time without notice based on changes in market or other conditions. References to specific securities or industries should not be regarded as investment advice. Because the funds are actively managed, there is no assurance that they will continue to invest in the securities or industries mentioned.

For more complete information on any Natixis Fund, contact your financial professional or call Natixis Funds and ask for a free prospectus, which contains more complete information including charges and other ongoing expenses. Investors should consider a fund’s objective, risks and expenses carefully before investing. This and other fund information can be found in the prospectus. Please read the prospectus carefully before investing.

INDEX/AVERAGE DESCRIPTIONS

Lehman Aggregate Bond Index is an unmanaged index of investment-grade bonds with one- to ten-year maturities issued by the U.S. government, its agencies and U.S. corporations.

Lehman Global Aggregate Bond ex-USD Index is an unmanaged index which provides a broad-based measure of the international investment-grade bond market.

Lehman High Yield Composite Index is a market-weighted, unmanaged index of fixed-rate, non-investment grade debt.

Lehman Municipal Bond Index is an unmanaged index of bonds issued by municipalities and other government entities having maturities of more than one year.

Lehman 1-5 Year Government Bond Index is an unmanaged, market-weighted index of bonds issued by the U.S. government and its agencies, with maturities between one and five years.

Lehman U.S. Credit Index is an unmanaged index that includes all publicly issued, fixed-rate, nonconvertible, dollar-denominated, SEC-registered, U.S. investment-grade corporate debt, and foreign debt that meets specific maturity, liquidity and quality requirements.

Lehman U.S. Universal Bond Index is an unmanaged index representing a blend of the Lehman Aggregate Bond Index, the High Yield Index, and the Emerging Market Index, among other indexes.

Morningstar Fund Averages are the average performance without sales charge of funds with similar investment objectives, as calculated by Morningstar, Inc.

PROXY VOTING INFORMATION

A description of the funds’ proxy voting policies and procedures is available without charge, upon request, by calling Natixis Funds at 800-225-5478; on the funds’ website at www.funds.natixis.com; and on the Securities and Exchange Commission’s (SEC’s) website at www.sec.gov. Information regarding how the funds voted proxies relating to portfolio securities during the 12-month period ended June 30, 2007 is available from the funds’ website and the SEC’s website.

QUARTERLY PORTFOLIO SCHEDULES

The funds file a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The funds’ Forms N-Q are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

| | | | |

| NOT FDIC INSURED | | MAY LOSE VALUE | | NO BANK GUARANTEE |

15

UNDERSTANDING FUND EXPENSES

As a mutual fund shareholder, you incur different costs: transaction costs, including sales charges (loads) on purchases, redemption fees and certain exchange fees and ongoing costs, including management fees, distribution and/or service fees (12b-1 fees), and other fund expenses. In addition, each fund assesses a minimum balance fee of $20 on an annual basis for accounts that fall below the required minimum to establish an account. Certain exemptions may apply. These costs are described in more detail in the funds’ prospectus. The examples below are intended to help you understand the ongoing costs of investing in the funds and help you compare these with the ongoing costs of investing in other mutual funds.

The first line in the table of each Class of fund shares shows the actual account values and actual fund expenses you would have paid on a $1,000 investment in the fund from October 1, 2007 through March 31, 2008. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example $8,600 account value divided by $1,000 = 8.60) and multiply the result by the number in the Expenses Paid During Period column as shown below for your Class.

The second line in the table of each Class of fund shares provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid on your investment for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown reflect ongoing costs only, and do not include any transaction costs such as sales charges, redemption fees, or exchange fees. Therefore, the second line in the table of each fund is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. If transaction costs were included, total costs would be higher.

| | | | | | |

| LOOMIS SAYLES CORE PLUS BOND FUND | | BEGINNING ACCOUNT VALUE

10/1/2007 | | ENDING ACCOUNT VALUE

3/31/2008 | | EXPENSES PAID DURING PERIOD*

10/1/2007 – 3/31/2008 |

CLASS A | | | | | | |

Actual | | $1,000.00 | | $1,035.80 | | $4.94 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,020.15 | | $4.90 |

CLASS B | | | | | | |

Actual | | $1,000.00 | | $1,033.40 | | $8.79 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,016.35 | | $8.72 |

CLASS C | | | | | | |

Actual | | $1,000.00 | | $1,032.00 | | $8.69 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,016.45 | | $8.62 |

CLASS Y | | | | | | |

Actual | | $1,000.00 | | $1,036.90 | | $3.67 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,021.40 | | $3.64 |

| * | Expenses are equal to the Fund’s annualized expense ratio (after fee reduction/reimbursement) :0.97%, 1.73%, 1.71% and 0.72% for Class A, B, C and Y respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, divided by 366 (to reflect the half-year period). |

16

UNDERSTANDING FUND EXPENSES

| | | | | | |

| LOOMIS SAYLES HIGH INCOME FUND | | BEGINNING ACCOUNT VALUE

10/1/2007 | | ENDING ACCOUNT VALUE

3/31/2008 | | EXPENSES PAID DURING PERIOD*

10/1/2007 – 3/31/2008 |

CLASS A | | | | | | |

Actual | | $1,000.00 | | $974.60 | | $5.68 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,019.25 | | $5.81 |

CLASS B | | | | | | |

Actual | | $1,000.00 | | $970.90 | | $9.36 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,015.50 | | $9.57 |

CLASS C | | | | | | |

Actual | | $1,000.00 | | $971.00 | | $9.36 |