Table of Contents

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C.

FORM S-1

POST-EFFECTIVE AMENDMENT NUMBER 47

TO

REGISTRATION STATEMENT NUMBER 2-68296

Ameriprise Cash Reserve Certificate

UNDER

THE SECURITIES ACT OF 1933

AMERIPRISE CERTIFICATE COMPANY

--------------------------------------------------------------------------------

(Exact name of registrant as specified in charter)

DELAWARE

--------------------------------------------------------------------------------

(State or other jurisdiction of incorporation or organization)

6725

--------------------------------------------------------------------------------

(Primary Standard Industrial Classification Code Number)

41-6009975

--------------------------------------------------------------------------------

(I.R.S. Employer Identification No.)

70100 Ameriprise Financial Center, Minneapolis, MN 55474, (612) 671-3131

--------------------------------------------------------------------------------

(Address, including zip code, and telephone number, including area code, of

registrant's principal executive offices)

Megan Garcy – 71 S. Wacker Drive, Suite 2500,

Chicago, IL 60606, (312) 634-9280

--------------------------------------------------------------------------------

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Table of Contents

| Ameriprise Cash Reserve Certificate | • Purchase this certificate in any amount from $1,000 through $2 million or with monthly investments of at least $50. • Earn a fixed rate of interest declared every three months. • Keep your certificate for up to 20 years from its issue date. • No withdrawal charges. |

| Earn competitive rates with ready access to your cash reserves. | |

| Ameriprise Flexible Savings Certificate | • Purchase this certificate in any amount from $1,000 through $2 million. • Select a term of 3, 6, 7, 9, 12, 13, 18, 24, 30 or 36 months. • Add up to 25% of your original investment during the term. • Invest in successive terms up to a total of 20 years from the issue date of the certificate. • 2% withdrawal charge applies for withdrawals during a term in excess of 10% of principal*. |

| Earn rates guaranteed by Ameriprise Certificate Company for the term you choose. | |

| Ameriprise Stock Market Certificate | • Purchase this certificate in any amount from $1,000 through $2 million. • Select a term of 1, 2 or 3 years. • Participate in any increase of the stock market based on the S&P 500 Index while protecting your principal, up to a maximum return, or cap. • Decide whether to choose a partial participation term in order to guarantee a minimum return or whether to link all of your return to the market. • Keep your certificate for up to 15 years from the issue date depending on the term. • 2% withdrawal charge applies to principal withdrawn during a term*. |

| Potential for stock market growth with safety of principal. | |

| Ameriprise Installment Certificate | • Purchase this certificate with monthly investments in any amount from $50 through $5,000. • Earn a fixed rate of interest declared every three months. • Keep your certificate for up to 10 years from its issue date. • 2% withdrawal charge applies to principal withdrawn during the first three years*. |

| Establish a disciplined approach to saving |

| * | Certain waivers apply. See product specific pages. |

| 1 | |

| 2 | |

| 3 | |

| 4 | |

| 4 | |

| 8 | |

| 9 | |

| 9 | |

| 13 | |

| 17 | |

| 17 | |

| 23 | |

| 29 | |

| 29 | |

| 40 | |

| 44 | |

| 44 | |

| 46 | |

| 50 | |

| 50 | |

| 54 | |

| 59 | |

| 64 | |

| 75 |

| Investment amount | Interest rate* | Effective annualized yield** |

| $50 to $9,999.99 | 0.55% | 0.55% |

| $10,000 to $24,999.99 | 0.60% | 0.60% |

| $25,000 or more | 0.60% | 0.60% |

| * | Rates may depend on factors described in “Rates for New Purchases” under “About the Certificate.” |

| ** | Assuming monthly compounding. |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 1 |

| Term | Interest rate* | Effective annualized yield** |

| 3 month | 0.80% | 0.80% |

| 6 month | 0.90% | 0.90% |

| 7 month | 0.90% | 0.90% |

| 9 month | 0.90% | 0.90% |

| 12 month | 0.90% | 0.90% |

| 13 month | 1.15% | 1.15% |

| 18 month | 0.90% | 0.90% |

| 24 month | 0.90% | 0.90% |

| 30 month | 0.90% | 0.90% |

| 36 month | 0.90% | 0.90% |

| * | These are the rates for investments under $100,000 except for the 13-month term, which may require a minimum investment of $1 million. The 7-month term may require a minimum investment of $10,000. Rates may depend on the factors described in “Rates for New Purchases” and “Promotions and Pricing Flexibility” under “About the Certificate.” |

| ** | Assuming monthly compounding. |

| 2 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| Maximum return | Market participation percentage | Minimum return interest |

| 1.35% | 100% (full) | None |

| 1.35% | 25% (partial) | 0.10% |

| Maximum return | Market participation percentage | Minimum return interest |

| 3.20% | 100% (full) | None |

| 3.20% | 25% (partial) | 0.35% |

| Maximum return | Market participation percentage | Minimum return interest |

| 6.50% | 100% (full) | None |

| 6.50% | 25% (partial) | 0.95% |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 3 |

| 4 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 5 |

| 6 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 7 |

| Company Name | Services |

| Columbia Management Investment Advisers, LLC | Investment Management Services |

| Ameriprise Financial, Inc. (Ameriprise Financial) | Administrative Services |

| Ameriprise Financial Services, LLC (Ameriprise Financial Services) | Distribution Services |

| Columbia Management Investment Services Corp. | Transfer Agent Services |

| Ameriprise Trust Company | Custodian Services |

| 8 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| Principal equals | Face amount (initial investment) |

| plus | At the end of a period, interest credited to your account during the period |

| minus | Any interest paid to you in cash |

| plus | Any additional investments |

| minus | Any withdrawals |

| $5,000 | Face amount (initial investment) | |

| plus | 75 | Interest credited to your account |

| minus | (0) | Interest paid to you in cash |

| plus | 2,500 | Additional investment |

| minus | (0) | Withdrawals |

| $7,575 | Principal at the beginning of the next period |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 9 |

| • | applying the interest rate then in effect to your balance each day, and |

| • | adding these daily amounts to get a monthly total. |

| 10 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| Investment Amount | Rate For New Purchases |

| From $50 to $9,999.99 | Within a range from 10 basis points (0.10%) below to 90 basis points (0.90%) above the Non-Jumbo Deposits National Rate published for 3-month CDs |

| From $10,000 to $24,999.99 | Within a range from 5 basis points (0.05%) below to 95 basis points (0.95%) above the Non-Jumbo Deposits National Rate published for 3-month CDs |

| $25,000 and above | Within a range from 5 basis points (0.05%) below to 95 basis points (0.95%) above the Non-Jumbo Deposits National Rate published for 3-month CDs |

| • | the rate in effect on the date your payment is applied and your account is activated, or |

| • | the rate in effect seven days before that date, |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 11 |

| Investment Amount | Promotion Rate |

| From $50 to $9,999.99 | Within a range from 15 basis points (0.15%) above to 115 basis points (1.15%) above the Non-Jumbo Deposits National Rate published for 3-month CDs |

| From $10,000 to $24,999.99 | Within a range from 20 basis points (0.20%) above to 120 basis points (1.20%) above the Non-Jumbo Deposits National Rate published for 3-month CDs |

| $25,000 and above | Within a range from 20 basis points (0.20%) above to 120 basis points (1.20%) above the Non-Jumbo Deposits National Rate published for 3-month CDs |

| 12 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 13 |

| • | Investments must be received and accepted in the Minneapolis headquarters on a business day before 3 p.m. Central time to be included in your account that day. Otherwise your purchase will be processed the next business day. We reserve the right to change this cut-off time in the future. |

| • | You have 15 days from the date of purchase to cancel your investment by contacting us at the address or telephone number inside the back cover. If you decide to cancel your certificate within this 15-day period, you will not earn any interest. |

| • | If you purchase a certificate with a personal check or other non-guaranteed funds, we will wait one business day for the process of converting your check to federal funds (e.g., monies of member banks with the Federal Reserve Bank) before your purchase will be accepted and you begin earning interest. For information on how to avoid this delay, please call us at the telephone number listed inside the back cover. |

| • | ACC has complete discretion to determine whether to accept an application and sell a certificate. |

| • | You must maintain a balance of at least $1,000 in your account unless you are using an authorized systematic pay-in arrangement. If you use a scheduled pay-in arrangement, your minimum balance requirement is $50. |

| • | If your additional investment increases the principal of your certificate so that your certificate’s principal has exceeded a breakpoint for a higher interest rate, the certificate will earn this higher interest rate from the date the additional investment is accepted. |

| 14 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| • | You may withdraw your certificate for its full value or make a partial withdrawal of $100 or more at any time. Only one withdrawal is permitted per day. We reserve the right to change the minimum withdrawal amount in the future. If you purchase this certificate for an IRA, 401(k) or other retirement plan account, early withdrawals or cash payments of interest taken prematurely may be subject to IRS tax and penalty. |

| • | Complete withdrawal of your certificate is made by giving us proper instructions. To complete these transactions, see “How to Request a Withdrawal or Transfer.” |

| • | If you take a withdrawal during the certificate month, you will earn interest on the amount withdrawn up to the date of withdrawal. |

| • | Interest payments in cash may be sent to you at the end of each certificate month, quarter, or on a semiannual or annual basis, if a $1,000 balance is maintained. |

| • | If a withdrawal reduces your account value to a point where we pay a lower interest rate, you will earn the lower rate from the date of the withdrawal. This rate will be the rate in effect at the beginning of the current 3-month period. |

| • | Scheduled partial withdrawals may be sent to you monthly, quarterly, semiannually or annually. The minimum scheduled withdrawal amount is $50. |

| • | You may not make a withdrawal from your certificate if that withdrawal causes your balance to fall below $1,000 unless you are using an authorized systematic investment arrangement or taking systematic payments from your certificate. In these instances, the remaining balance will earn the lower interest rate in effect for balances of less than $1,000. |

| • | In certain circumstances, at your request, ACC may allow you to receive the proceeds of your redemption “in-kind”, meaning that you receive securities instead of cash. |

| • | If you request a partial or full withdrawal of a certificate recently purchased or added to by a check, ACH or money order that is not guaranteed, we will wait for your payment to clear. Please expect a minimum of 10 calendar days from the date of your payment before the partial or full withdrawal is processed and proceeds are sent to you. |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 15 |

| • | If you request a partial or full withdrawal of the funds that may include at-risk or non-guaranteed funds, we will wait 10 calendar days before completing the request. |

| • | If your certificate is pledged as collateral, any withdrawal will be delayed until we get approval from the secured party. |

| • | Any payments to you may be delayed under applicable rules, regulations or orders of the Securities and Exchange Commission (SEC). |

| 16 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| Principal equals | Face amount (initial investment) |

| plus | At the end of a term, interest credited to your account during the term |

| minus | Any interest paid to you in cash |

| plus | Any additional investments |

| minus | Any withdrawals, fees and applicable penalties |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 17 |

| $5,000 | Face amount (initial investment) | |

| plus | 75 | Interest credited to your account |

| minus | (0) | Interest paid to you in cash |

| plus | 2,500 | Additional investment |

| minus | (0) | Withdrawals |

| $7,575 | Principal at the beginning of the next term |

| • | applying the interest rate then in effect to your balance each day, |

| • | adding these daily amounts to get a monthly total, and |

| • | subtracting interest accrued on any amount you withdraw during the certificate month. |

| 18 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| 3 months | Within a range from 15 basis points (0.15%) above to 115 basis points (1.15%) above the Non-Jumbo Deposits National Rate published for 3-month CDs. |

| 6 months | Within a range from 20 basis points (0.20%) above to 120 basis points (1.20%) above the Non-Jumbo Deposits National Rate published for 6-month CDs. |

| 9 months | Within a range from 20 basis points (0.20%) above to 120 basis points (1.20%) above the Non-Jumbo Deposits National Rate published for 6-month CDs. |

| 12 months | Within a range from 10 basis points (0.10%) above to 110 basis points (1.10%) above the Non-Jumbo Deposits National Rate published for 12-month CDs. |

| 18 months | Within a range from 10 basis points (0.10%) above to 110 basis points (1.10%) above the Non-Jumbo Deposits National Rate published for 12-month CDs. |

| 24 months | Within a range from 0 basis points (0.00%) above to 100 basis points (1.00%) above the Non-Jumbo Deposits National Rate published for 24-month CDs. |

| 30 months | Within a range from 0 basis points (0.00%) above to 100 basis points (1.00%) above the Non-Jumbo Deposits National Rate published for 24-month CDs. |

| 36 months | Within a range from 5 basis points (0.05%) below to 95 basis points (0.95%) above the Non-Jumbo Deposits National Rate published for 36-month CDs. |

| 3 months | Within a range from 20 basis points (0.20%) above to 120 basis points (1.20%) above the Non-Jumbo Deposits National Rate published for 3-month CDs. |

| 6 months | Within a range from 25 basis points (0.25%) above to 125 basis points (1.25%) above the Non-Jumbo Deposits National Rate published for 6-month CDs. |

| 9 months | Within a range from 25 basis points (0.25%) above to 125 basis points (1.25%) above the Non-Jumbo Deposits National Rate published for 6-month CDs. |

| 12 months | Within a range from 15 basis points (0.15%) above to 115 basis points (1.15%) above the Non-Jumbo Deposits National Rate published for 12-month CDs. |

| 18 months | Within a range from 15 basis points (0.15%) above to 115 basis points (1.15%) above the Non-Jumbo Deposits National Rate published for 12-month CDs. |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 19 |

| 24 months | Within a range from 5 basis points (0.05%) above to 105 basis points (1.05%) above the Non-Jumbo Deposits National Rate published for 24-month CDs. |

| 30 months | Within a range from 5 basis points (0.05%) above to 105 basis points (1.05%) above the Non-Jumbo Deposits National Rate published for 24-month CDs. |

| 36 months | Within a range from 0 basis points (0.00%) above to 100 basis points (1.00%) above the Non-Jumbo Deposits National Rate published for 36-month CDs. |

| • | In the case of the 9-month term, because the FDIC does not typically publish a 9-month Non-Jumbo Deposits National Rate, ACC uses a range based on the 6-month Non-Jumbo Deposits National Rate. |

| • | In the case of the 18-month term, because the FDIC does not typically publish an 18-month Non-Jumbo Deposits National Rate, ACC uses a range based on the 12-month Non-Jumbo Deposits National Rate. |

| • | Similarly, in the case of the 30-month term, because the FDIC does not typically publish a 30-month Non-Jumbo Deposits National Rate, ACC uses a range based on the 24-month Non-Jumbo Deposits National Rate. |

| 7 months* | Within a range from 20 basis points (0.20%) above to 120 basis points (1.20%) above the Non-Jumbo Deposits National Rate published for 6-month CDs. |

| 11 months | Within a range from 35 basis points (0.35%) above to 135 basis points (1.35%) above the Non-Jumbo Deposits National Rate published for 12-month CDs. |

| 19 months | Within a range from 35 basis points (0.35%) above to 135 basis points (1.35%) above the Non-Jumbo Deposits National Rate published for 12-month CDs. |

| 25 months | Within a range from 25 basis points (0.25%) above to 125 basis points (1.25%) above the Non-Jumbo Deposits National Rate published for 24-month CDs. |

| 31 months | Within a range from 25 basis points (0.25%) above to 125 basis points (1.25%) above the Non-Jumbo Deposits National Rate published for 24-month CDs. |

| 37 months | Within a range from 20 basis points (0.20%) above to 120 basis points (1.20%) above the Non-Jumbo Deposits National Rate published for 36-month CDs. |

| * | See section entitled “Investment Amounts and Terms” about minimum investment requirements. |

| 7 months* | Within a range from 25 basis points (0.25%) above to 125 basis points (1.25%) above the Non-Jumbo Deposits National Rate published for 6-month CDs. |

| 11 months | Within a range from 40 basis points (0.40%) above to 140 basis points (1.40%) above the Non-Jumbo Deposits National Rate published for 12-month CDs. |

| 20 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| 13 months* | Within a range from 35 basis points (0.35%) above to 135 basis points (1.35%) above the Non-Jumbo Deposits National Rate published for 12-month CDs. |

| 19 months | Within a range from 40 basis points (0.40%) above to 140 basis points (1.40%) above the Non-Jumbo Deposits National Rate published for 12-month CDs. |

| 25 months | Within a range from 30 basis points (0.30%) above to 130 basis points (1.30%) above the Non-Jumbo Deposits National Rate published for 24-month CDs. |

| 31 months | Within a range from 30 basis points (0.30%) above to 130 basis points (1.30%) above the Non-Jumbo Deposits National Rate published for 24-month CDs. |

| 37 months | Within a range from 25 basis points (0.25%) above to 125 basis points (1.25%) above the Non-Jumbo Deposits National Rate published for 36-month CDs. |

| * | See section entitled “Investment Amounts and Terms” about minimum investment requirements. |

| • | the rate in effect on the date your payment is applied and your account is activated, or |

| • | the rate in effect seven days before that date, |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 21 |

| 22 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| • | Investments must be received and accepted in the Minneapolis headquarters on a business day before 3 p.m. Central time to be included in your account that day. Otherwise your purchase will be processed the next business day. We reserve the right to change this cut-off time in the future. |

| • | You have 15 days from the date of purchase to cancel your investment without penalty by contacting us at the address or telephone number inside the back cover. If you decide to cancel your certificate within this 15-day period, you will not earn any interest. |

| • | If you purchase a certificate with a personal check or other non-guaranteed funds, we will wait one business day for the process of converting your check to federal funds (e.g., monies of member banks with the Federal Reserve Bank) before your purchase will be accepted and you begin earning interest. For information on how to avoid this delay, please call us at the telephone number listed inside the back cover. |

| • | ACC has complete discretion to determine whether to accept an application and sell a certificate. |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 23 |

| • | If your additional investment increases the principal of your certificate so that your certificate’s principal has exceeded a breakpoint for a higher interest rate, the certificate will earn this higher interest rate from the date the additional investment is accepted. |

| 24 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| • | You may withdraw your certificate for its full value or make a partial withdrawal of $100 or more at any time. Only one withdrawal is permitted per day. We reserve the right to change the minimum withdrawal amount in the future. If you purchase this certificate for an IRA, 401(k) or other retirement plan account, early withdrawals or cash payments of interest taken prematurely may be subject to IRS tax and penalty. |

| • | If you withdraw during a certificate month, you will not earn interest for the month on the amount withdrawn. |

| • | Complete withdrawal of your certificate is made by giving us proper instructions. To complete these transactions, see “How to Request a Withdrawal or Transfer.” |

| • | Full and partial withdrawals of principal may be subject to penalties, described below. |

| • | Interest payments in cash may be sent to you at the end of each certificate month, quarter, or on a semiannual or annual basis. |

| • | If a withdrawal reduces your account value to a point where we pay a lower interest rate, you will earn the lower rate from the date of the withdrawal. |

| • | You may not otherwise make a partial withdrawal if it would reduce your certificate balance to less than $1,000. If you request such a withdrawal, we will contact you for revised instructions. |

| • | Scheduled partial withdrawals may be made monthly, quarterly, semiannually, annually and at term end. Such withdrawals may be subject to penalties, described below. |

| • | Because we credit interest on your certificate’s monthly anniversary, withdrawals before the end of the certificate month will result in loss of accrued interest on the amount withdrawn. You will get the best result by timing a withdrawal at the end of the certificate month, that is, on an interest crediting date. |

| • | In certain circumstances, at your request, ACC may allow you to receive the proceeds of your redemption “in-kind,” meaning that you receive securities instead of cash. |

| • | first from interest credited during the current term, |

| • | then from the principal of your certificate. |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 25 |

| Total investments | $20,000 |

| Interest credited | 600 |

| Total balance | $20,600 |

| Requested check | $5,000 |

| Credited interest withdrawn | (600) |

| 10% of principal — not subject to penalty | (2,000) |

| Remaining portion of requested withdrawal — subject to penalty | $2,400 |

| Withdrawal penalty percent | 2% |

| Actual withdrawal penalty | $48 |

| Balance prior to withdrawal | $20,600 |

| Requested withdrawal check | (5,000) |

| Withdrawal penalty | (48) |

| Total balance after withdrawal | $15,552 |

| 26 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| • | upon death of the certificate owner up to a maximum of six months after the estate settlement has been processed by ACC. |

| • | when this certificate is owned by a revocable or irrevocable trust upon death of any grantor of the revocable or irrevocable trust up to a maximum of six months from the date of death. |

| • | on withdrawals for IRA certificate accounts and for certificate accounts in other qualified plans after age 70.5. See “Retirement Plans: Special Policies.” |

| • | If you request a partial or full withdrawal of a certificate recently purchased or added to by a check, ACH or money order that is not guaranteed, we will wait for your payment to clear. Please expect a minimum of 10 calendar days from the date of your payment before the partial or full withdrawal is processed and proceeds are sent to you. |

| • | If you request a partial or full withdrawal of the funds that may include at-risk or non-guaranteed funds, we will wait 10 calendar days before completing the request. |

| • | If your certificate is pledged as collateral, any withdrawal or maturity will be delayed until we get approval from the secured party. |

| • | Any payments to you may be delayed under applicable rules, regulations or orders of the SEC. |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 27 |

| • | Select a different term; however, you will not be allowed to select a term that would carry the certificate past its maturity date, |

| • | Withdraw your certificate without a withdrawal charge, or |

| • | Add to your investment. See “Additional Investments” under “How to Invest and Withdraw Funds.” |

| 28 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| $10,000 | Face amount (initial investment) | |

| plus | 100 | Interest credited to your account at the end of the term |

| plus | 5 | Interim interest (See “Interim interest” under “Interest”) |

| minus | (0) | Interest paid to you in cash |

| plus | 2,500 | Additional investment |

| minus | (0) | Withdrawals and applicable penalties |

| $12,605 | Principal at the beginning of the next term |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 29 |

| 30 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 31 |

| • | you participate 100% in any percentage increase in the S&P 500 Index up to the maximum return. For the maximum return in effect on the date of this prospectus, see “Initial Interest and Participation Rates for Ameriprise Stock Market Certificate” at the front of this prospectus; |

| • | you earn interest only if the value of the S&P 500 Index is higher on the last day of your term than it was on the first day of your term; and |

| • | your return is linked to stock market performance. |

| • | a percentage of any increase in the S&P 500 Index, and |

| • | a rate of interest guaranteed by ACC in advance for each term. |

| 32 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 33 |

| 34 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

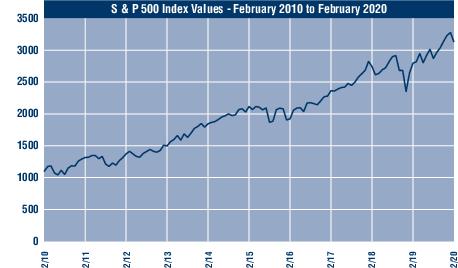

| Beginning date Feb. | Period held in years | Average annual return |

| 2010 | 10 | 11.07% |

| 2015 | 5 | 8.14% |

| 2019 | 1 | 11.97% |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 35 |

| Term ending value of S&P 500 Index | minus |

| Term beginning value of S&P 500 Index | divided by |

| Term beginning value of S&P 500 Index | equals |

| Rate of return on S&P 500 Index |

| Term ending value of S&P 500 Index | 1842 |

| 36 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| Term beginning value of S&P 500 Index | 1800 |

| Maximum return | 3% |

| Minimum return | 0.50% |

| Partial participation rate | 25% |

| 1842 | Term ending value of S&P 500 Index | |

| minus | 1800 | Term beginning value of S&P 500 Index |

| equals | 42 | Difference between beginning and ending values |

| 42 | Difference between beginning and ending values | |

| divided by | 1800 | Term beginning value of S&P 500 Index |

| equals | 2.33% | Percent increase — full participation return |

| 2.33% | Percent increase or decrease | |

| times | 25% | Partial participation rate |

| equals | 0.58% | |

| plus | 0.50% | Minimum interest rate |

| equals | 1.08% | Partial participation return |

| • | you purchased the certificate with a $10,000 original investment, |

| • | the partial participation rate is 25%, |

| • | the minimum interest rate for partial participation is 0.50%, |

| • | the maximum total return for full and partial participation is 3%. |

| Week 1/Wed S&P 500 Index 1,000 | 2% increase in the S&P 500 Index | Week 52/Tues S&P 500 Index 1,020 | ||

| Full participation interest | Partial participation interest and minimum interest | |||

| $10,000 | Original investment | $10,000 | Original investment | |

| +200 | 2% x $10,000 | +50 | 0.50% (Minimum interest rate) x $10,000 | |

| Participation interest | +50 | 25% x 2% x $10,000 Participation interest | ||

| $10,200 | Ending balance | $10,100 | Ending balance | |

| (2% Total return) | (1.00% Total return) | |||

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 37 |

| Week 1/Wed S&P 500 Index 1,000 | 4% decrease in the S&P 500 Index | Week 52/Tues S&P 500 Index 960 | ||

| Full participation interest | Partial participation interest and minimum interest | |||

| $10,000 | Original investment | $10,000 | Original investment | |

| +0 | Participation interest | +50 | 0.50% (Minimum interest rate) x $10,000 | |

| +0 | Participation interest | |||

| $10,000 | Ending balance | $10,050 | Ending balance | |

| (0% Total return) | (0.50% Total return) | |||

| Week 1/Wed S&P 500 Index 1,000 | 8% increase in the S&P 500 Index | Week 52/Tues S&P 500 Index 1,080 | ||

| Full participation interest | Partial participation interest and minimum interest | |||

| $10,000 | Original investment | $10,000 | Original investment | |

| +300 | 3% x $10,000 | +50 | 0.50% (Minimum interest rate) x $10,000 | |

| Maximum interest | +200 | 25% x 8% x $10,000 Participation interest | ||

| $10,300 | Ending balance | $10,250 | Ending balance | |

| (3% Total return) | (2.50% Total return) | |||

| Week 1/Wed S&P 500 Index 1,000 | 20% increase in the S&P 500 Index | Week 52/Tues S&P 500 Index 1,200 | ||

| Full participation interest | Partial participation interest and minimum interest | |||

| $10,000 | Original investment | $10,000 | Original investment | |

| +300 | 3% x $10,000 | +50 | 0.50% (Minimum interest rate) x $10,000 | |

| Maximum interest | +250 | 25% x 20% = 5.0%; capped at | ||

| (3%-0.50%) x $10,000 Participation interest | ||||

| $10,300 | Ending balance | $10,300 | Ending balance | |

| (3% Total return) | (3% Total return) | |||

| Investment amount | $10,000 |

| Maximum return | 8% |

| Minimum return | 0.50% |

| Partial participation rate | 25% |

| Week 1/Wed S&P 500 Index 1,000 | Week 52/Wed S&P 500 Index 1,100 | Week 156/Tues S&P 500 Index 1,070 | ||

| 7% increase in the S&P 500 Index | ||||

| Full participation interest | Partial participation interest | |||

| $10,000 | Original investment | $10,000 | Original investment | |

| +700 | 7% x $10,000 | +50 | 0.50% (Minimum interest rate) x $10,000 | |

| Participation interest | +175 | 25% x 7% x $10,000 Participation interest | ||

| $10,700 | Ending balance | $10,225 | Ending balance | |

| (7% Total return) | (2.25% Total return) | |||

| 38 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 39 |

| • | Investments must be received and accepted in the Minneapolis headquarters on a business day before 3 p.m. Central time to be included in your account that day. Otherwise your purchase will be processed the next business day. We reserve the right to change the cut-off time in the future. |

| • | If you purchase a certificate with a personal check or other non-guaranteed funds, we will wait one day for the process of converting your check to federal funds (e.g., monies of member banks within the Federal Reserve Bank) before your purchase will be accepted and you begin earning interest. For information on how to avoid this delay, please call us at the telephone number listed inside the back cover. |

| • | ACC has complete discretion to determine whether to accept an application and sell a certificate. |

| 40 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| • | You can withdraw the full value of your certificate net any applicable penalties, by giving us proper instructions. To complete these transactions, see “How to Request a Withdrawal or Transfer.” |

| • | Full and partial withdrawals of principal during a term may be subject to penalties, described below. |

| • | You may not make a partial withdrawal if it would reduce your certificate balance to less than $1,000. If you request such a withdrawal, we will contact you for revised instructions. |

| • | In certain circumstances, at your request, ACC may allow you to receive the proceeds of your redemption “in-kind,” meaning that you receive securities instead of cash. |

| • | upon death of the certificate owner up to a maximum of six months after the estate settlement has been processed by ACC. |

| • | when this certificate is owned by a revocable or irrevocable trust upon death of any grantor of the revocable or irrevocable trust up to a maximum of six months from the date of death. |

| • | on withdrawals for IRA certificate accounts and for certificate accounts in other qualified plans after age 70.5. See “Retirement Plans: Special Policies.” |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 41 |

| Account balance | $10,000 |

| Interest (interest is credited at the end of the term) | 0 |

| Withdrawal of principal | (2,000) |

| 2% withdrawal penalty | (40) |

| Balance after withdrawal | $7,960 |

| Account balance | $10,000 |

| Interest accrued to date | 100 |

| Withdrawal of accrued interest | (100) |

| Withdrawal of principal | (1,900) |

| 2% withdrawal penalty (on $1,900 principal withdrawn) | (38) |

| Balance after withdrawal | $8,062 |

| • | If you request a partial or full withdrawal of a certificate recently purchased or added to by a check, ACH or money order that is not guaranteed, we will wait for your payment to clear. Please expect a minimum of 10 calendar days from the date of your payment before the partial or full withdrawal is processed and proceeds are sent to you. |

| • | If you request a partial or full withdrawal of the funds that may include at-risk or non-guaranteed funds, we will wait 10 calendar days before completing the request. |

| • | If your certificate is pledged as collateral, any withdrawal will be delayed until we get approval from the secured party. |

| • | Any payments to you may be delayed under applicable rules, regulations or orders of the SEC. |

| • | change your interest selection, |

| 42 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| • | add money to your certificate, |

| • | change your term start date, |

| • | withdraw part or all of your money without a withdrawal penalty or loss of interest, or |

| • | receive your interest in cash. |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 43 |

| 44 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| • | applying the interest rate then in effect to your balance each day; |

| • | adding these daily amounts to get a monthly total; and |

| • | subtracting interest accrued on any amount you withdraw during the certificate month. |

| • | the rate in effect on the date your payment is applied and your account is activated, or |

| • | the rate in effect seven days prior to that date, |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 45 |

| • | Investments must be received and accepted in the Minneapolis headquarters on a business day before 3 p.m. Central time to be included in your account that day. Otherwise your purchase will be processed the next business day. We reserve the right to change this cut-off time in the future. |

| • | You have 15 days from the date of purchase to cancel your investment without penalty by contacting us at the address or telephone number inside the back cover. If you decide to cancel your certificate within this 15-day period, you will not earn any interest. |

| • | If you purchase a certificate with a personal check or other non-guaranteed funds, we will wait one day for the process of converting your check to federal funds (e.g., monies of member banks within the Federal Reserve Bank) before your purchase will be accepted and you begin earning interest. For information on how to avoid this delay, please call us at the telephone number listed inside the back cover. |

| 46 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| • | If you establish a systematic investment arrangement, you will receive a confirmation when the arrangement is set-up, but you will not receive a confirmation each time we receive a payment. |

| • | ACC has complete discretion to determine whether to accept an application and sell a certificate. |

| • | If you make no investments for a period of at least six consecutive months and your principal is less than $500, we may send you a notice of our intent to cancel the certificate. After the notice, if an investment is not made within 60 days, your certificate will be canceled, and we will send you a check for its full value. |

| • | You may withdraw your certificate for its full value or make a partial withdrawal of $100 or more at any time. Only one withdrawal is permitted per day. We reserve the right to change the minimum withdrawal amount in the future. If you purchase this certificate for an IRA, 401(k), or other retirement plan account, early withdrawals or cash payments of interest taken prematurely may be subject to IRS tax and penalty. |

| • | If you withdraw during a certificate month, you will not earn interest for the month on the amount withdrawn. |

| • | Complete withdrawal of your certificate is made by giving us proper instructions. To complete these transactions, see “How to Request a Withdrawal or Transfer.” |

| • | Full and partial withdrawals of principal in the first three years are subject to penalties, described below. |

| • | You may not make a partial withdrawal if it would reduce your certificate balance to less than $250. If you request such a withdrawal, we will contact you for revised instructions. |

| • | You may withdraw accumulated interest during any term without paying an early withdrawal penalty. A withdrawal of interest must be at least $100 and not reduce your certificate balance below $250. |

| • | In certain circumstances, at your request, ACC may allow you to receive the proceeds of your redemption “in-kind,” meaning that you receive securities instead of cash. |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 47 |

| • | upon death of the certificate owner up to a maximum of six months after the estate settlement has been processed by ACC. |

| • | when this certificate is owned by a revocable or irrevocable trust upon death of any grantor of the revocable or irrevocable trust up to a maximum of six months from the date of death. |

| • | on withdrawals for IRA certificate accounts and for certificate accounts in other qualified plans after age 70.5. See “Retirement Plans: Special Policies.” |

| • | first from interest credited to your account, |

| • | then from the principal of your certificate. |

| Total investments | $7,200.00 |

| Interest credited | 75.48 |

| Total balance | $7,275.48 |

| Credited interest | $75.48 |

| Withdrawal of principal | 924.52 |

| Total requested withdrawal | $1,000.00 |

| Principal withdrawn | $924.52 |

| Withdrawal penalty % | 2% |

| Withdrawal penalty | $18.49 |

| Beginning balance | $7,275.48 |

| Credited interest withdrawn | (75.48) |

| Principal withdrawn | (924.52) |

| Withdrawal penalty (also from principal) | (18.49) |

| Remaining balance | $6,256.99 |

| 48 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| • | If you request a partial or full withdrawal of a certificate recently purchased or added to by a check, ACH or money order that is not guaranteed, we will wait for your payment to clear. Please expect a minimum of 10 calendar days from the date of your payment before the partial or full withdrawal is processed and proceeds are sent to you. |

| • | If you request a partial or full withdrawal of the funds that may include at-risk or non-guaranteed funds, we will wait 10 calendar days before completing the request. |

| • | If your certificate is pledged as collateral, any withdrawal will be delayed until we get approval from the secured party. |

| • | Any payments to you may be delayed under applicable rules, regulations or orders of the SEC. |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 49 |

| • | Recurring and one-time ACH payments from your pre-authorized bank account |

| • | Automatic payroll deduction |

| • | Direct deposit of social security check |

| • | Other plan approved by ACC |

| • | Monthly minimum investment must be $50 (not applicable to Ameriprise Flexible Savings Certificate and Ameriprise Stock Market Certificate) |

70200 Ameriprise Financial Center

Minneapolis, MN 55474

6th Street Marquette Ave

Minneapolis, MN 55479

ABA Routing Transit Number: 121000248

| 50 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| • | Minimum amount for each wire investment: $1,000. |

| • | Wire orders can be accepted only on days when your bank, Ameriprise Financial and its affiliates and Wells Fargo Bank Minnesota, N.A. are open for business. |

| • | Wire purchases are completed when wired payment is received and we accept the purchase. |

| • | Wire investments must be received and accepted in our Minneapolis headquarters on a business day before 3 p.m. Central time to be credited that day. Otherwise your purchase will be processed the next business day. |

| • | We are not responsible for any delays that occur in wiring funds, including delays in processing by the bank. |

| • | You must pay for any fee the bank charges for wiring. |

| • | Telephone withdrawals may be subject to maximum withdrawal limits as defined by the broker/dealer. |

| • | A form may be required for certain withdrawals or transfers as defined by the broker/dealer. |

| • | Transfers may be made into an Ameriprise Financial Services account within the same household group for owners of those accounts. |

| • | We will honor any eligible telephone withdrawal or transfer request believed to be authentic and will use reasonable procedures to confirm authenticity. |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 51 |

70100 Ameriprise Financial Center

Minneapolis, MN 55474

| • | Checks or ACH withdrawals over the maximum limit set by the broker/dealer. |

| • | Certain transfers to another Ameriprise Financial Services account. |

| • | Checks sent to anyone other than the listed owner(s) of the account. |

| • | Checks sent to an address not on file. |

| • | Transfers to your Brokerage accounts within the same household group in which you are an owner on both accounts. |

| • | ACH transfers to your pre-authorized bank account. |

| • | Fee for express mail: We will deduct the fee from your remaining certificate balance, provided that the balance would not be less than $1,000. If the balance would be less than $1,000, we will deduct the fee from the proceeds of the withdrawal. |

| • | Timing: checks are mailed the business day following the transaction. Allow for seven days if sent regular mail, two days for express mail. |

| • | Phone Restrictions: Checks will be mailed to the address on file, payable to the name(s) listed on the account. |

| • | Fee: We will deduct the fee from your remaining certificate balance, provided that the balance would not be less than $1,000. If the balance would be less than $1,000, we will deduct the fee from the proceeds of the withdrawal. |

| • | Timing: wires are sent the business day following the transaction. |

| • | Phone Restrictions: Bank instructions must be pre-authorized. |

| 52 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| • | Fee: no charge. |

| • | Timing: ACH is sent the business day following the transaction. Allow 2-3 business days to deposit. |

| • | Bank instructions must be pre-authorized for requests made via phone or in writing. |

| • | If the certificate is purchased for a 401(k) plan or other qualified retirement plan account, the terms and conditions of the certificate apply to the plan as the owner of the certificate. However, the terms of the plan, as interpreted by the plan trustee or administrator, will determine how a participant’s benefit under the plan is administered. These terms may differ from the terms of the certificate. |

| • | If your certificate is held in a custodial or investment only retirement plan, special rules may apply at maturity. If no other investment instructions are provided directing how to handle your certificate at maturity, the full value of the certificate may transfer to a new or existing Ameriprise Cash product within the plan. |

| • | Ameriprise certificates do not charge IRA custodial fees; however, fees (including custodial fees) related to non-certificate products (e.g., brokerage accounts) you may hold may be withdrawn from your certificate according to the terms of your plan. It may reduce the amount payable at maturity or the amount received upon an early withdrawal. |

| • | Retirement plan withdrawals may be subject to withdrawal penalties or loss of interest even if they are not subject to federal tax withholding or penalties. |

| • | If applicable, we will waive withdrawal penalties on withdrawals for qualified retirement plan and IRA certificate accounts for withdrawals after age 70.5. |

| • | If your certificate is held in an IRA, special rules may apply at maturity. If no other investment instructions are provided directing how to handle your certificate at maturity, you will receive a distribution for the full value of your |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 53 |

| certificate, less 10% federal withholding unless we are notified ahead of time not to withhold. Depending on your individual circumstances, you may have 60 days to roll the distribution amount (i.e. the proceeds plus the amount withheld) to another eligible retirement plan. |

| • | If you withdraw all funds from your last account in an IRA at Ameriprise Trust Company, a plan termination fee may apply as set out in the applicable Your Guide to IRAs, the disclosure information received when you opened your account. This fee may be paid from your certificate proceeds. |

| • | The termination fee will be waived if a withdrawal is due to a required minimum distribution or upon the owner’s death. |

| • | Ameriprise certificates are not offered in 403(b) plans. |

| 54 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 55 |

| 56 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 57 |

| 58 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| • | interest to certificate owners; and |

| • | various expenses, including taxes, fees to Columbia Management Investment Advisers, LLC for advisory and other services, distribution fees to Ameriprise Financial Services, selling agent fees to selling agents, custody fees to Ameriprise Trust Company, and transfer agent fees to Columbia Management Investment Services Corp. |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 59 |

| Type of investment | Net amount invested |

| Mortgage and other asset backed securities | 64% |

| Corporate and other bonds | 28% |

| Mortgage loans and other loans | 3% |

| Cash and cash equivalents | 5% |

| 60 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 61 |

| 62 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 63 |

| • | providing investment research, |

| • | making specific investment recommendations, and |

| • | executing purchase and sale orders according to our policy of seeking to obtain the best price and execution. |

| 64 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| • | other assets (such as deferred tax assets, taxes receivable from parent, and other amounts due from related parties); |

| • | leveraged loans; |

| • | other receivables (such as state and local income taxes receivable); |

| • | payable for investment securities purchased (available-for-sale securities and derivatives); |

| • | derivative liabilities, at fair value; and |

| • | certificate loans. |

| Included assets | Percentage of net invested assets |

| First $250 million | 0.350% |

| Next $250 million | 0.300% |

| Next $500 million | 0.250% |

| Any amount over $1 billion | 0.200% |

| Year | Total fees |

| 2019 | $17,933,010 |

| 2018 | $15,683,052 |

| 2017 | $14,222,156 |

| • | costs incurred by ACC in connection with the acquisition, management, servicing or disposition of real estate mortgages, real estate or property improvement loans; |

| • | taxes; |

| • | depository and custodian fees incurred by ACC; |

| • | brokerage commissions and charges in the purchase and sale of ACC’s assets; |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 65 |

| • | fees and expenses for services not covered by other agreements and provided to ACC at our request, or by requirement, by attorneys, auditors, examiners and professional consultants who are not officers or employees of Columbia Management Investment Advisers, LLC (Columbia Management); |

| • | fees and expenses of ACC’s directors who are not officers or employees of Columbia Management or its affiliates; |

| • | provision for certificate reserves (interest accrued on certificate owner accounts); |

| • | expenses of customer settlements not attributable to sales functions; |

| • | transfer agency fees and expenses; |

| • | filing fees and charges incurred by ACC in connection with filing documents with the State of Minnesota or its political subdivisions; |

| • | organizational expenses paid by ACC; and |

| • | expenses properly payable by ACC, approved by the ACC board of directors. |

| • | 0.03% of the initial payment on the issue date of the certificate, and |

| • | 0.03% of the certificate’s reserve at the beginning of the second and subsequent quarters from issue date. |

| • | For all terms except 7 and 13 months, 0.08% of the initial investment amount on the first day of the certificate’s term; |

| • | For all terms except 7 and 13 months, 0.08% of the certificate’s reserve at the beginning of the second and subsequent quarters from issue date of the certificate or at the end of the renewal grace period when the renewal corresponds with the quarterly reserve payment; |

| • | For 7-month terms, 0.08% of the initial investment amount on the first day of the certificate’s term, 0.08% of the certificate’s reserve at the beginning of the second quarter from issue date of the certificate and 0.027% of the certificate’s reserve at the beginning of the last month of the certificate term; and |

| • | For 13-month terms, 0.032% of the initial investment amount on the first day |

| 66 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| of the certificate’s term, 0.032% of the certificate’s reserve at the beginning of the second, third and fourth quarters from issue date of the certificate and 0.011% of the certificate’s reserve at the beginning of the last month of the certificate term. |

| • | 0.50% of all payments. This fee is paid on all payments received on or after issue of the certificate until the certificate’s maturity date. |

| • | 0.50% of each payment made prior to the beginning of the first certificate’s participation term, and |

| • | 0.50% of the certificate’s reserve at the beginning of each subsequent participation term. |

| • | 1.00% of each payment made prior to the beginning of the first certificate’s participation term, and |

| • | 1.00% of the certificate’s reserve at the beginning of each subsequent participation term. |

| • | 1.50% of each payment made prior to the beginning of the first certificate’s participation term, and |

| • | 1.50% of the certificate’s reserve at the beginning of each subsequent participation term. |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 67 |

| 68 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| Name, address, age | Position held with ACC and length of service | Principal occupations during past ten years | Other directorships | Committee memberships |

| Karen M. Bohn* 5228 Ameriprise Financial Center H27/5228 Minneapolis, MN 55474 Born in 1953 | Chair of the Board since 2009; Board member since 2001 | President, Galeo Group LLC, a management consulting firm, since 1998; business consultant | Alerus Financial Corp., Otter Tail Corporation, Riversource Life Insurance Company of New York | Audit |

| Lorna P. Gleason 5228 Ameriprise Financial Center H27/5228 Minneapolis, MN 55474 Born in 1956 | Board member since 2011 | President, Financial Assets Advisors, LLC, a consulting firm, since 2010; Senior Vice President, UMB, since 2010; Vice President and Senior Vice President, Wells Fargo, 2008-2010; Senior Managing Director, GMAC Health Capital, 2000-2007 | None | Audit |

| Jean B. Keffeler* 5228 Ameriprise Financial Center H27/5228 Minneapolis, MN 55474 Born in 1945 | Board member since 1999 | Retired business executive and independent management consultant, prior to 1991 held senior management positions with HealthOne Corporation and Control Data Corporation | Riversource Life Insurance Company of New York | Audit |

| Robert McReavy 5228 Ameriprise Financial Center H27/5228 Minneapolis, MN 55474 Born in 1959 | Board member since 2012 | COO, CFO and General Counsel, Jeffrey Slocum & Associates 2007-2017 | None | Audit |

| * | Ms. Bohn and Ms. Keffeler serve as directors of RiverSource Life Insurance Company of New York. RiverSource Life Insurance Company of New York is indirectly controlled by Ameriprise Financial or its affiliates. |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 69 |

| Name, address, age | Position held with ACC and length of service | Principal occupations during past ten years | Other directorships | Committee memberships |

| Abu M. Arif One World Trade Center 78th Floor New York, NY 10007 Born in 1967 | Board member since 2013; President and Chief Executive Officer since August 2012 | President, Ameriprise Bank, FSB (formerly Ameriprise National Trust Bank) since September 1, 2018; Senior Vice President AWM and General Manager Banking & Cash Solutions since January 1, 2013; Senior Vice President and General Manager AWM Cash & Payment Solutions, Ameriprise Bank FSB 2007 – 2012 | Ameriprise Bank, FSB | None |

| ** | Interested person by reason of being an officer, director and/or employee of Ameriprise Financial or its affiliates. |

| 70 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 71 |

| Independent Directors | Total Cash Compensation |

| Karen M. Bohn | $77,500 |

| Lorna P. Gleason | $53,500 |

| Jean Keffeler | $53,500 |

| Robert McReavy | $68,000 |

| Interested Director | Total Cash Compensation |

| Abu M. Arif | $0.00 |

| Name, address, age | Position held with ACC and length of service | Principal occupations during past five years | Other directorships | Committee memberships |

| Abu M. Arif One World Trade Center 78th Floor New York, NY 10007 Born in 1967 | Board member since 2013; President and Chief Executive Officer since August 2012 | President, Ameriprise Bank, FSB (formerly Ameriprise National Trust Bank) since September 1, 2018; Senior Vice President AWM and General Manager Banking & Cash Solutions since January 1, 2013 | Ameriprise Bank, FSB | None |

| Jason S. Bartylla 50642 Ameriprise Financial Center Minneapolis, MN 55474 Born in 1972 | Vice President and Chief Financial Officer since 2018 | Vice President, Ameriprise Financial Inc. since 2010; Chief Financial Officer of Ameriprise Bank, FSB (formerly Ameriprise National Trust Bank) since February 2018 | Ameriprise Bank, FSB | None |

| Jeanne Stadtlander 50642 Ameriprise Financial Center Minneapolis, MN 55474 Born in 1966 | Vice President, Controller and Chief Accounting Officer since March 2020 | Vice President -Technical Accounting and SEC Reporting since 2013 | None | None |

| 72 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| Name, address, age | Position held with ACC and length of service | Principal occupations during past five years | Other directorships | Committee memberships |

| Megan E. Garcy 71 S. Wacker Drive Suite 2500 Chicago, IL 60606 Born in 1985 | Vice President, General Counsel and Secretary since September 2018 (previously Assistant Secretary, November 2014-September 2018) | Senior Counsel – Asset Management since March 2020 (previously, Counsel - Asset Management, August 2015 - March 2020 and Associate Counsel - Asset Management, February 2013 - August 2015); Assistant Secretary for Columbia Funds and affiliated Funds since 2016 | None | None |

| Sony Malhotra 1041 Ameriprise Financial Center Minneapolis, MN 55474 Born in 1974 | Chief Operating Officer since June 2019 | Vice President & Officer, American Enterprise Investment Services, Inc. since August 2017 (previously Vice President of Service, June 2011 – August 2017); Chief Operating Officer, Ameriprise Bank, FSB, since May 2019 | None | None |

| Thomas P. McGuire 225 Franklin Street BX 29 20661 Boston, MA 02110 Born in 1972 | Chief Compliance Officer since 2010 | Vice President, Asset Management Compliance, Ameriprise Financial, Inc. since 2010; Chief Compliance Officer, Columbia Funds, since 2012; Chief Compliance Officer, Acorn Funds, since 2015 | None | None |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 73 |

| 74 | AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 |

| AMERIPRISE CERTIFICATES – PROSPECTUS – 2020 | 75 |

| (800) 862-7919 | Ameriprise Financial Account value, cash transaction information, current rate information, withdrawals, transfers, inquiries (automated response for Touchtone® phones only) |

70100 Ameriprise Financial Center

Minneapolis, MN 55474

ameriprise.com

Ameriprise Financial Services, LLC

| Investment Company Act File #811-00002 | S-6000 AT (4/20) |

Table of Contents

PART II. INFORMATION NOT REQUIRED IN PROSPECTUS

Item

Number

Item 13. Other Expenses of Issuance and Distribution.

The expenses in connection with the issuance and distribution of the securities being registered are to be borne by the registrant.

Item 14. Indemnification of Directors and Officers.

The By-Laws of Ameriprise Certificate Company provide that it shall indemnify any person who was or is a party or is threatened to be made a party, by reason of the fact that he was or is a director, officer, employee or agent of the company, or was or is serving at the direction of the company, or any predecessor corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, to

any threatened, pending or completed action, suit or proceeding, wherever brought, to the fullest extent permitted by the laws of the state of Delaware, as now existing or hereafter amended.

The By-Laws further provide that indemnification questions applicable to a corporation which has been merged into the company relating to causes of action arising prior to the date of such merger shall be governed exclusively by the applicable laws of the state of incorporation and by the by-laws of such merged corporation then in effect. See also Item 17.

Item 15. Recent Sales of Unregistered Securities.

N/A

Item 16. Exhibits and Financial Statement Schedules.

(a)Exhibits

The information required by this Item is set forth in the Index of Exhibits that precedes the signature page of this Post-Effective Amendment.

(b) The financial schedules for Ameriprise Certificate Company filed electronically on February 26, 2020 with Ameriprise Certificate Company's 2019 annual report filed on Form 10-K are incorporated by reference.

Item 17. Undertakings.

Without limiting or restricting any liability on the part of the

other, Ameriprise Financial Services, Inc., as underwriter, will assume any actionable civil liability which may arise under the Federal

Securities Act of 1933, the Federal Securities Exchange Act of

1934 or the Federal Investment Company Act of 1940, in addition to

any such liability arising at law or in equity, out of any untrue statement of a material fact made by its agents in the due course of their business in selling or offering for sale, or soliciting applications for, securities issued by the Company or any omission on the part of its agents to state a material fact necessary in

order to make the statements so made, in the light of the circumstances in which they were made, not misleading (no such untrue statements or omissions, however, being admitted or contemplated), but such liability shall be subject to the conditions and limitations described in said Acts. Ameriprise Financial Services, Inc. will also assume any liability of the

Company for any amount or amounts which the Company legally may be compelled to pay to any purchaser under said Acts because of any untrue statements of a material fact, or any omission to state a

material fact, on the part of the agents of Ameriprise Financial Services, Inc. to the extent of any actual loss to, or expense of,

the Company in connection therewith. The By-Laws of the Registrant contain a provision relating to Indemnification of Officers and Directors as permitted by applicable law.

Exhibit Index

Exhibit |

|

|

|

|

|

|

|

| Post-Effective |

| Incorporated |

|

|

| |

|

|

|

|

|

|

|

| Amendment |

| by reference |

| Filing | Filed | ||

Number |

| Exhibit Description |

| Form |

| File No. |

| Registrant |

| NO. |

| Exhibit |

| Date | Herewith |

1(a) |

| S-1 | 2-95577 |

| Ameriprise Flexible | 35 | 1 | 2/26/2007 |

| ||||||

|

|

|

|

|

|

| Savings Certificate |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1(b) |

| 10-K | 811-00002 |

| Ameriprise |

| N/A |

| 10(b) | 2/27/2013 |

| ||||

|

|

|

|

|

|

| Certificate |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Company |

|

|

|

|

|

|

| |

1(c) |

| S-1 | 333-200195 |

| Ameriprise Step-Up |

| Registration |

| 1(c) | 11/14/2014 |

| ||||

|

|

|

|

|

|

| Rate Certificate |

| Statement |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1(d) |

| 10-Q | 811-00002 |

| Ameriprise |

| N/A |

| 10(b)i | 8/3/2015 |

| ||||

|

|

|

|

|

|

| Certificate |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Company |

|

|

|

|

|

|

| |

1(e) |

| 10-K | 811-00002 |

| Ameriprise |

| N/A |

| 10(c) | 2/23/2018 |

| ||||

|

|

|

|

|

|

| Certificate |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Company |

|

|

|

|

|

|

| |

2 |

| Not Applicable |

|

|

|

|

|

|

|

|

|

|

|

|

|

3(a) |

| 10-K | 811-00002 |

| Ameriprise |

| N/A |

| 3(a) | 3/10/2006 |

| ||||

|

|

|

|

|

|

| Certificate |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Company |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

3(b) |

| 10-Q | 811-00002 |

| Ameriprise |

| N/A |

| 3(b) | 11/5/2010 |

| ||||

|

|

|

|

|

|

| Certificate |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Company |

|

|

|

|

|

|

|

4 |

| Not applicable |

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

| S-1 | 2-68296 | Ameriprise Cash | 45 | N/A | 4/20/2018 | ||||||||

Reserve Certificate | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||

6 through 9 | Not Applicable |

|

|

|

|

|

|

|

|

|

|

|

|

| |

10(a) |

| 10-K | 811-00002 |

| Ameriprise Certificate |

| N/A |

| 10(a) | 2/27/2019 |

| ||||

|

|

|

|

|

|

| Company |

|

|

|

|

|

|

| |

Exhibit |

|

|

|

|

|

|

|

| Post-Effective |

| Incorporated |

|

|

| |

|

|

|

|

|

|

|

| Amendment |

| by reference |

| Filing | Filed | ||

Number |

| Exhibit Description |

| Form |

| File No. |

| Registrant |

| NO. |

| Exhibit |

| Date | Herewith |

10(b) |

| 10-K | 811-00002 |

| Ameriprise |

| N/A |

| 10(s) | 3/10/2006 |

| ||||

|

|

|

|

|

|

| Certificate |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Company |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

10(c) |

| S-1 | 2-95577 |

| Ameriprise Flexible | 35 |

| 10(c) | 2/26/2007 |

| |||||

|

|

|

|

|

|

| Savings Certificate |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

10(c)(i) |

| S-1 | 2-95577 |

| Ameriprise Flexible | 45 |

| 10(c)(i) | 4/25/2014 |

| |||||

|

|

|

|

|

|

| Savings Certificate |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

10(d) |

| S-1 | 2-95577 |

| Ameriprise Flexible | 35 |

| 10(e) | 2/26/2007 |

| |||||

|

|

|

|

|

|

| Savings Certificate |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

10(d)(i) |

| 10-K | 811-00002 |

| Ameriprise |

| N/A |

| 10(d) | 2/27/2013 |

| ||||

|

|

|

|

|

|

| Certificate |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Company |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

10(d)(ii) |

| 10-K | 811-00002 |

| Ameriprise |

| N/A |

| 10(d) | 2/23/2017 |

| ||||

|

|

|

|

|

|

| Certificate |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Company |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

10(e) |

| 10-K | 811-00002 |

| Ameriprise |

| N/A |

| 10(f) | 3/2/2009 |

| ||||

|

|

|

|

|

|

| Certificate |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Company |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

10(e)(i) |

| S-1 | 2-68296 |

| Ameriprise Cash | 41 |

| 10(f)(i) | 4/30/2014 |

| |||||

|

|

|

|

|

|

| Reserve Certificate |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Exhibit |

|

|

|

|

|

|

|

|

| Post-Effective |

| Incorporated |

|

|

|

|

|

|

|

|

|

|

|

| Amendment |

| by reference |

| Filing | Filed | |

Number |

| Exhibit Description |

| Form |

| File No. |

| Registrant |

| NO. |

| Exhibit |

| Date | Herewith |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

10(f) |

|

| 10-K | 811-00002 |

| Ameriprise |

| N/A |

| 10(l) | 2/23/2018 |

| |||

|

|

|

|

|

|

| Certificate |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Company |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

10(g) |

|

| 10-K | 811-00002 |

| Ameriprise |

| N/A |

| 10(m) | 2/23/2018 |

| |||

|

|

|

|

|

|

| Certificate |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Company |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|