EXHIBIT 99

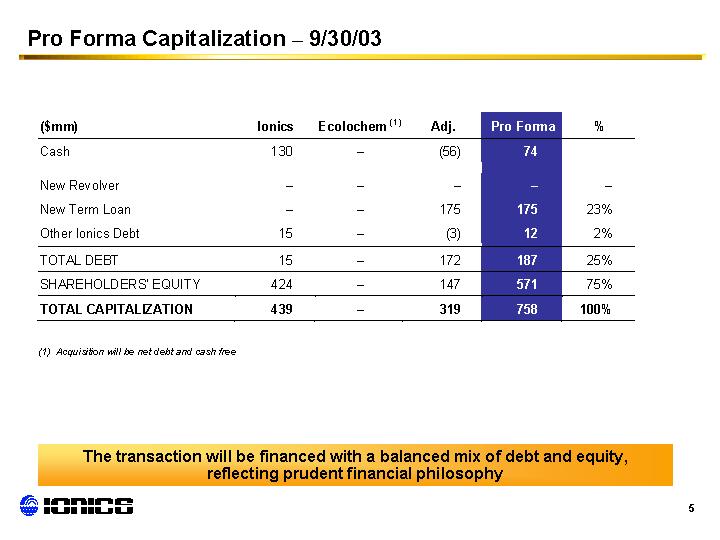

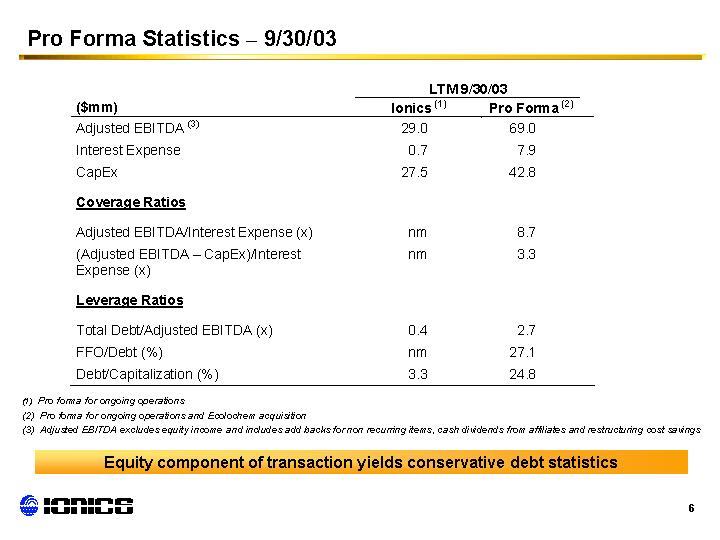

| Pro Forma Adjusted EBITDA Reconciliation | |||

|---|---|---|---|

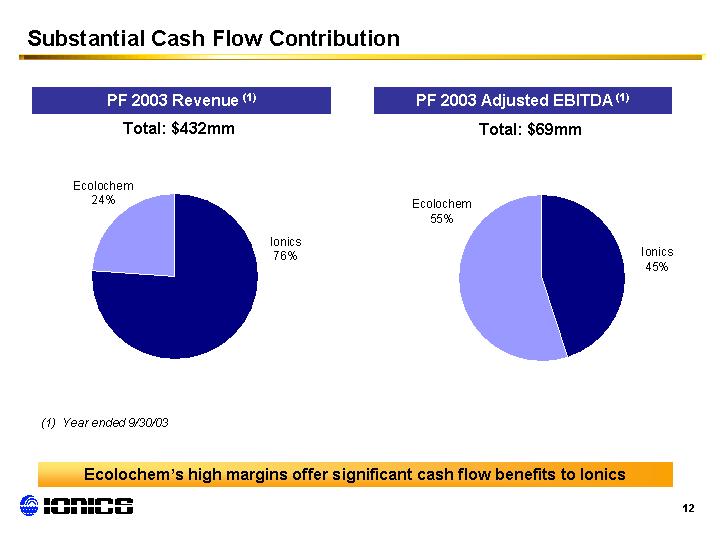

| Ionics (FYE December 31) | |||

| LTM | |||

| ($mm) | 9/30/2003 | ||

| Reported EBT | (32.8 | ) | |

| Equity Income | 1.8 | ||

| Net Interest Expense | (2.3 | ) | |

| Reported EBIT | (33.3 | ) | |

| Goodwill Impairment | 12.7 | ||

| Non Recurring Items (1) | 13.7 | ||

| EBIT excluding Goodwill Impairment and | |||

| Non Recurring Items | (6.9 | ) | |

| EBIT - Elite New England (2) | 0.3 | ||

| EBIT - Custom Fabrication (3) | (0.4 | ) | |

| EBIT - Watertec (4) | 0.1 | ||

| EBIT excluding Goodwill Impairment, | |||

| Non Recurring Items, and Divestitures | (6.9 | ) | |

| Reported Depreciation & Amortization | 26.5 | ||

| Divestiture Depr. & Amort. Adjustment | (2.1 | ) | |

| EBITDA excluding Goodwill Impairment, | |||

| Non Recurring Items, and Divestitures | 17.5 | ||

| Cash from Affiliates | 1.9 | ||

| Cost Savings | 9.5 | ||

| Adjusted EBITDA (5) | 29.0 | ||

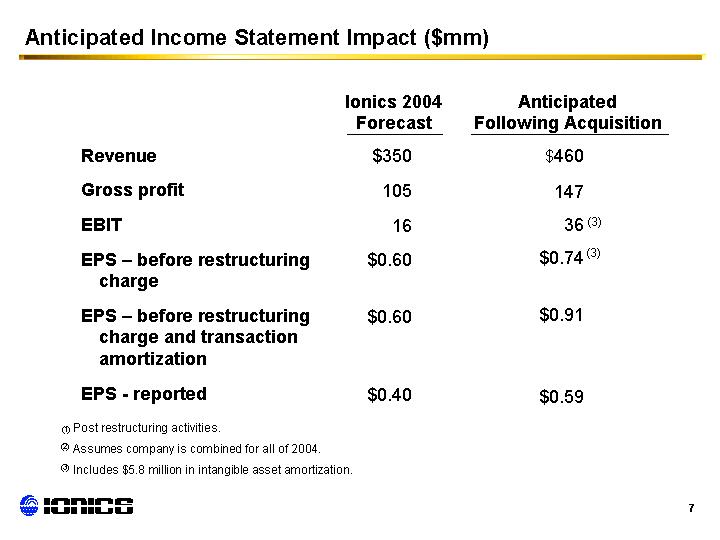

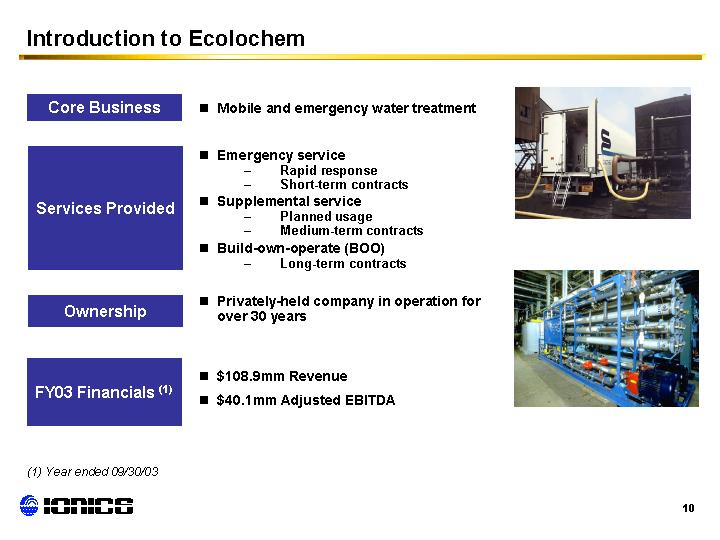

| Ecolochem (FYE September 30) | |||

|---|---|---|---|

| 12 Months | |||

| ($mm) | 9/30/2003 | ||

| Reported EBT | 38.7 | ||

| Other, net | (13.2 | ) | |

| Net Interest Expense | 0.4 | ||

| Reported EBIT | 25.8 | ||

| Gain on sale of property | (0.2 | ) | |

| Non Recurring Items (6) | 2.5 | ||

| Adjusted EBIT | 28.1 | ||

| Reported Depreciation & Amortization | 11.9 | ||

| Adjusted EBITDA (7) | 40.1 | ||

| (1) | $5.0mm in restructuring and impairment of long-lived assets reported in latest 10Q, $4.8mm product retrofit, $2.1mm Ireland Home Water shutdown, $0.8mm Watertec shutdown, and $1.0mm other |

| (2) | Expected to be divested in 1Q 2004 |

| (3) | Expected to be divested in 2004 |

| (4) | Expected to be divested/shutdown 2004 |

| (5) | Appears on slides 6 and 12 |

| (6) | Patent infringement, legal fees and officer salaries |

| (7) | Appears on slide 4 |