EXHIBIT 99.1

Management Presentation

October 2004

Safe Harbor Statement Under Private Securities Litigation

Reform Act of 1995

Forward-looking statements in this presentation involve risk and uncertainty.

These forward-looking statements are based on management’s current views

and assumptions and are neither promises nor guarantees but are subject to

risks, uncertainties and other factors that could cause actual results to differ

materially from management’s current expectations as described in such forward-

looking statements, including overall economic and business conditions;

competitive factors, such as acceptance of new products, pricing pressures and

competition from competitors larger that the Company; risks of nonpayment of

accounts receivable, including those from affiliated companies; risks associated

with foreign operations; technological and product development risks; availability

of manufacturing capacity; and other factors described in the Company’s filings

with the Securities and Exchange Commission, including its annual report on

Form 10-K for the year ended December 31, 2003. You should not place undue

reliance on the forward-looking statements in this presentation, and the Company

disavows any obligation to update or supplement those statements in the event

of any changes in the facts, circumstances, or expectations that underlie th

ose statements.

1

Introduction to Ionics

Core Business

Broad technology utilization

Deep applications/process expertise

Extensive plant operating experience

Comprehensive service offering

Core

Competencies

Water treatment equipment and services

2

New Management Team

Note:

Parenthesis “( )” indicate years of experience in the industry

Douglas Brown

President and CEO

(10)

Edward Cichon

VP, Special Projects

(23)

John Curtis

VP, Strategy and

Operations

(1)

Daniel Kuzmak

VP and CFO

(3)

Stephen Korn

VP and General Counsel

(15)

“Skip” Dickerson

VP, Water Systems

(32)

Michael Routh

VP, Instruments

(26)

Alan Crosby

VP, Consumer

(25)

3

Operations (48%)

Long-term outsourcing

Emergency services

Supplemental services

Service DI

Plant operation service

Sodium hypochlorite sales

Consumer (5%)

Home water purifications

systems

Point-of-use systems

Consumer financing

Products/Services

Instruments (7%)

TOC analyzers

Boron analyzers

Oil-on-water detection

systems

Equipment (40%)

Seawater desalination

Water and wastewater

treatment

Ultrapure water

Food processing

Sodium hypochlorite

production

Spares

2003 Revenue: $453mm

Pro forma including 2003 revenue from Ecolochem, Inc. and related entities.

4

Realigned and Efficient Operating Structure

Patent Portfolio

Ionics U.S. Patents and Applications by Type

1

Issued Patents

Applications

Membranes

21

1

Equipment

27

10

Instruments

20

3

Process/System

21

5

TOTAL

89

19

Note:

1

Excludes two US design patents having a scope not am

enable to the listed four categories

7

In addition to its U.S. patent portfolio, Ionics has over a dozen foreign patents and pending patent applications

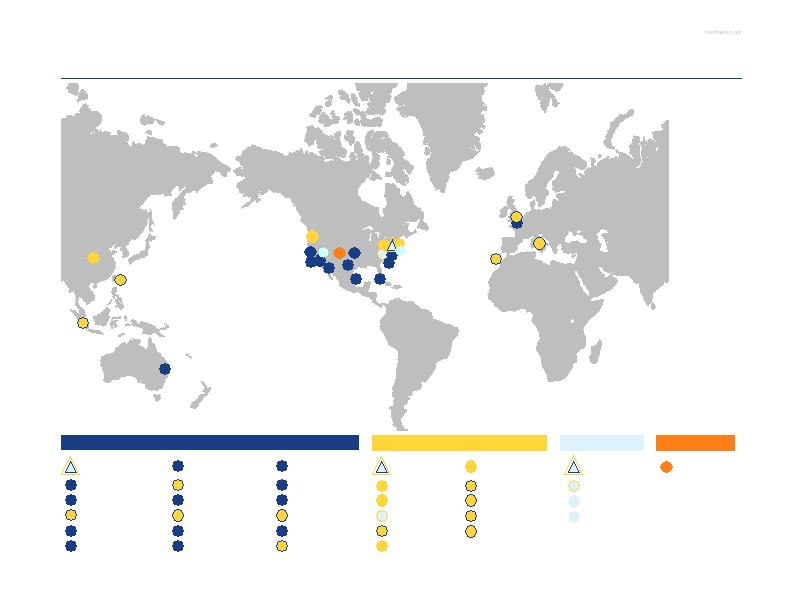

Major Facilities Overview

Instruments

Boulder, CO

5

Equipment

Consumer

Bridgeville, PA

6

Watertown, MA

(headquarters)

1

Operations

15

Livermore, CA

13

Elkbridge, MD

2

22

21

25

4

6

3

19

9

14

12

23

7

17

5

20

11

1

24

18

15

13

26

10

8

16

Milan, Italy

18

Singapore

24

26

Taiwan

Kunshan, China

10

16

Manchester, UK

Bridgeville, PA

6

Canonsburg, PA

9

Bellevue, WA

3

Watertown, MA

(headquarters)

1

Watertown, MA

2

12

East Hartford, CT

4

Baytown, TX

7

Brisbane, Australia

11

Dallas, TX

Watertown, MA

(headquarters)

1

8

Canary Islands

25

St. Peters, MO

Singapore

24

23

San Jose, CA

22

Pico Rivera, CA

21

Phoenix, AZ

26

Taiwan

17

Miami, FL

20

Peterborough, UK

19

Norfolk, VA

14

Fontana, CA

Milan, Italy

18

16

Manchester, UK

8

Canary Islands

8

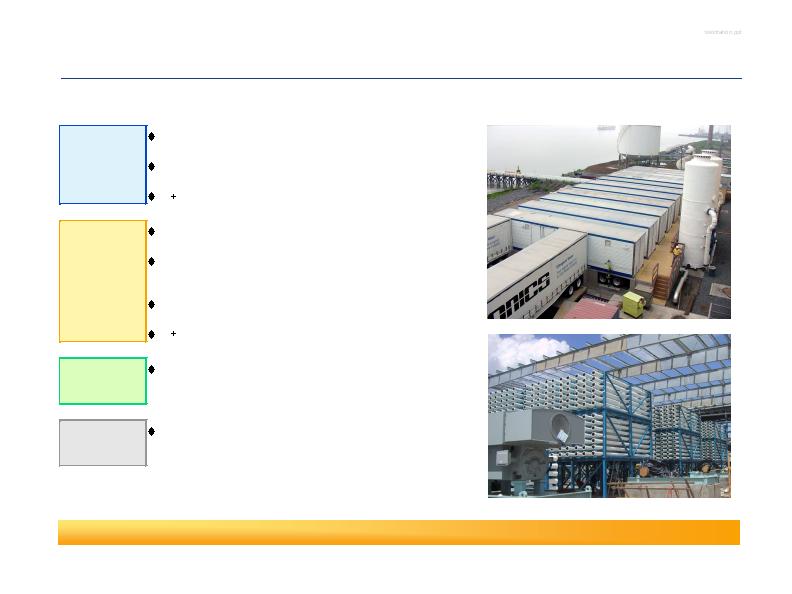

Operations Segment

Mobile

Long

-

term outsourcing of water treatment

services

Emergency and supplemental mobile water

treatment services

+

500 trailers

Plants

(BOO/BOOT)

Water supply for industrial and municipal

consumption

Operation of wholly-owned facilities

—

strong in-house technology and

proven track record

Outsourcing trends driving industrial and

municipal growth

150 facilities

Service DI

Regeneration of ion-exchange resin for

industrial customers—low capacity/high

quality

Cloromats

Production of sodium hypochlorite and

related chlor-alkali chemicals for industrial

and municipal applications

9

Leading supplier of desalinated water and mobile water treatment

Generated 48% of 2003 revenue

384

759

959

0

200

400

600

800

1,000

1,200

2004

2005

2007

10

(m3/day in ‘000s)

Ionics Production Capacity

Virtually 100% recurring revenue stream

High, stable margins

20–30% EBIT margins typical

Strong cash flow generation

IRR above 15% (After-tax cash-on-cash)

Price escalation leads to improving

financial performance over time

Attractive growth potential

Highlights of BOO Plant Operations

Ionics’ BOO projects are a significant source of recurring and high margin revenue

with attractive long-term growth prospects

Notes:

1 Excludes Ecolochem

2 Based on an average $1.8mm investment

3 Pending financing

4 Water sales to start in January 2005

11

Ownership

Number

Own / Operate

Ionics

Investment

($mm)

m

3

/day

(‘000s)

Recourse

Debt

($mm)

100%

77

-

Ionics

1

Own

138.6

2

182

—

70%

1 (Hamma

-

Algeria)

3

Own

30.0

200

—

51%

1 (Barbados)

Own

1.1

28

3.0

49%

1 (Magan

-

Israel)

Own

1.3

24

4.3

40%

1 (Desalcott

-

Trinidad)

Own

30.0

109

—

25%

1 (UDC

-

Kuwait)

4

Own

16.3

375

—

0%

18

Operate

—

41

—

Total

217.3

959

7.3

Overview of BOO Plant Operations

Algeria 1

Caribbean Group

Approximately 50 plants on ~25 islands

Aggregate throughput of 50,000 m3/day

Seawater RO (SWRO)

200,000 m3/day production

25 year guaranteed take-or-pay

supply agreement

price escalators built in

Long-term financing

January 2005 completion

8.0% interest rate

15-year term

$50+ mm annual revenue

$30+ mm EBITDA

20+ % projected after-tax cash-on-cash IRR

1 Hamma-Algeria project -- pending financing

12

Aggregated Income Statement

2

($mm)

Revenues

24.5

COGS

15.2

SG&A

3.7

EBIT

5.6

Margin (%)

22.8

EBITDA

10.0

Margin (%)

40.7

2

Based on 2004 estimates

Examples of BOO Plant Operations

Equipment Segment

Manufactures and sells water purification equipment

Large municipal customer base, with strong

microelectronics, power and petrochemical industrial

presence

Key contracts include Kuwait JV (reuse), City of

Minneapolis (surface water)

Leading positions in seawater desalination, wastewater

reuse, and Zero Liquid Discharge

Water scarcity, growing pressure for reuse and legislative

requirements in certain markets driving demand

Demand trends expected to increase as water needs

outpace GDP

Strategic initiatives to increase aftermarket sales (i.e.

spares)

Generated 40% of 2003 revenue

13

Instruments Segment

Designs and manufactures analytical instruments to

measure impurities in water

Recurring revenues are a strong growth component

more than 40% of revenue derived from

aftermarket requirements of 8,000 + unit

installed base

Strong patent position and superior contaminant

measurement capability differentiate

Ionics Instruments

Legal compliance (pharmaceutical, municipal) and

economic benefits (microelectronics, petrochemical)

drive instrument sales

Future focus on expansion in Asia, municipal, and

recurring revenue generation

Key customers include: Abbott, Vivendi, Novo

Nordisk, Pfizer, LA Metro Water District, Lilly, Beijing

Semiconductor, Intel, ST Microelectronics,

ExxonMobil

Generated 7% of 2003 revenue

14

Strategic Initiatives

2003

Initiatives

2004

Initiatives

Announced restructuring plan in September 2003

Initial organization structure simplification

$15mm of cost savings

Consolidated manufacturing and purchasing

Started portfolio management and divested certain non-core

businesses

Began Oracle implementation

Real estate restructuring/closures + operating cost associated with facilities

Rationalized medical benefits program

Continued organization structure simplification

Reduced pension costs

Integrated materials purchasing program

reduces COGS by $15+ mm1

1 Based on estimated aggregate percentage savings

16

Declining One-time Charges

25.0

10.8

4.5

1.4

1.5

1.4

0.0

5.0

10.0

15.0

20.0

25.0

30.0

Q3 '03

Q4 '03

Q1 '04

Q2 '04

Q3 '04E

Q4 '04E

($mm)

* Includes items that impact EBIT.

17

Ionics Is An Attractive Opportunity

A recognized leader in water purification

technology

reputation

experience

Substantial skills/expertise

seawater

ultrapure water

plant operations

water services (mobile and fixed base)

Significant profitability improvement potential

cost reductions

increasing percentage of plant operations

Strong growth prospects

Ionics is one of the few remaining pure-play platforms in the water treatment industry

18