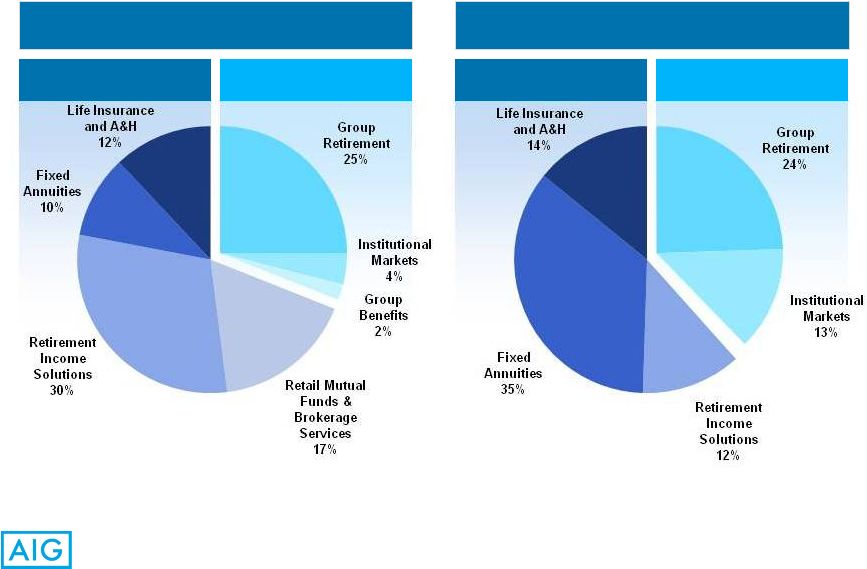

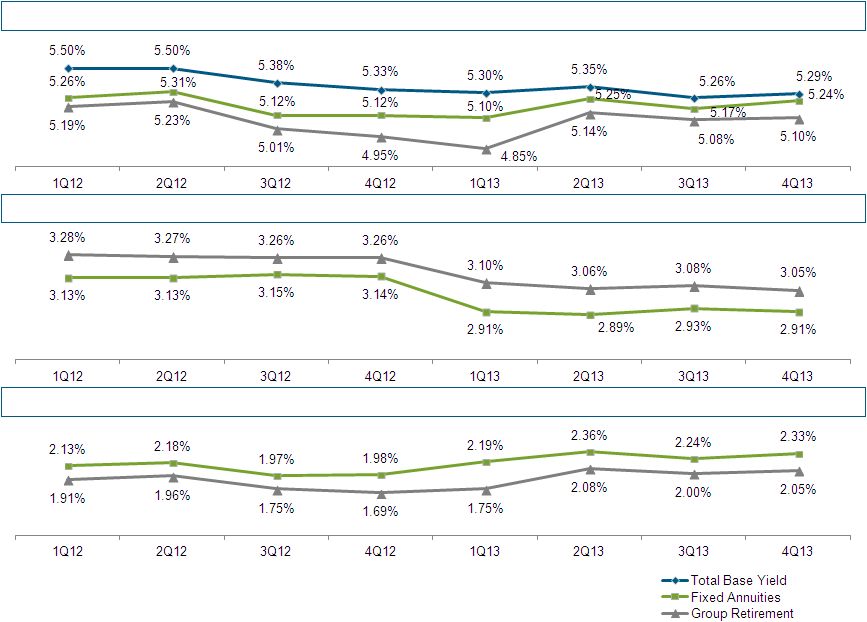

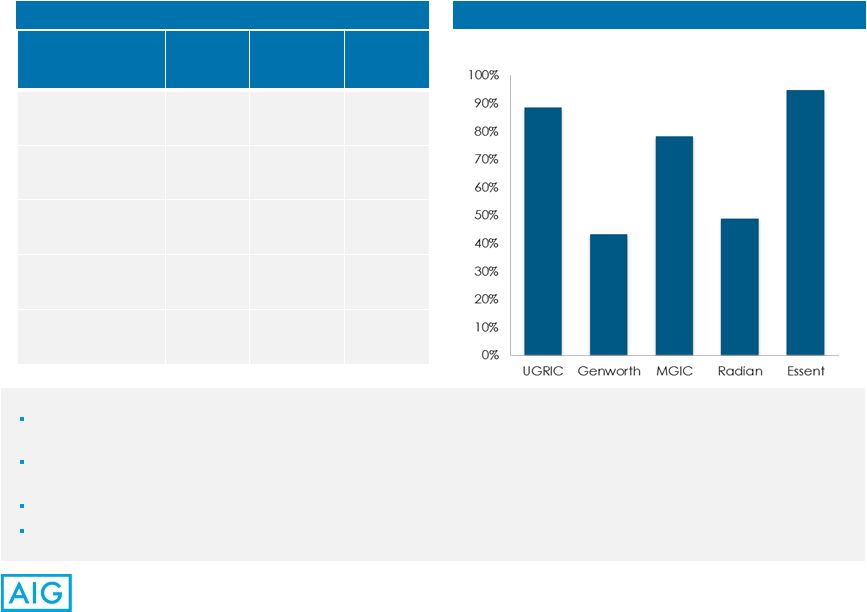

3 AIG – An Established Global Insurance Franchise Core Insurance Businesses Strategies Key Accomplishments AIG Property Casualty Grow high value lines and optimize business mix Full year 2013 NPW growth of 3.8%, excluding FX, compared to full year 2012 Optimizing Casualty lines business Execute on technical underwriting, improved claims management, and analytics 2013 Accident year loss ratio, as adjusted, improvement of 5.4 pts since beginning of 2011 Capitalize on global footprint; presence in over 90 countries HSBC agreement / PICC joint venture 12.9% of 2013 NPW from growth economies (1) AIG Life and Retirement Maintain balanced portfolio of products and leverage scale advantage Diversified sources of net flows and earnings Optimize spread management through new business pricing and active crediting rate management Profitability enhanced through ongoing spread management actions Expand distribution network and increase penetration of multiple products through each distribution partner Approximately $0.8 bn – $1.4 bn in quarterly pre-tax operating income since 4Q11 Mortgage Guaranty Selectively underwrite based on multivariate model to achieve higher risk adjusted returns Earnings reflect new business; 59% of net premiums earned in 4Q13 were from business written after 2008 Actively manage legacy book Delinquency ratio of 5.9% at 4Q13, lowest since 4Q07 A platform for delivering sustainable profitable growth. 1) Growth economies are those within Central Europe, Middle East, Africa, Latin America and Asia Pacific, excluding Japan. |