Exhibit 4

Submitted by the Prime Minister

Enrico Letta

and the Minister of the Economy and Finance

Fabrizio Saccomanni

on 20 September 2013

TABLE OF CONTENTS

| | | | | | |

I. | | SUMMARY | | | 1 | |

| | |

II. | | MACROECONOMIC SCENARIO | | | 5 | |

| | |

| | [Focus] Validation of macroeconomic forecasts, as provided by the Two Pack | | | 8 | |

| | [Focus] Trend of the credit market and the effects on businesses | | | 10 | |

| | [Focus] Impact of the legislation to accelerate settlement of the PA’s debts | | | 11 | |

| | [Focus] Macroeconomic impact of certain measures of 2013 for relaunching the economy | | | 12 | |

| | |

III. | | EUROPEAN COUNCIL RECOMMENDATIONS TO ITALY | | | 13 | |

| | |

| | [Focus] Status of implementation of the measures and automatic applicability | | | 25 | |

| | |

IV. | | PUBLIC FINANCE | | | 27 | |

| | |

| IV.1 | | Public finance framework | | | 27 | |

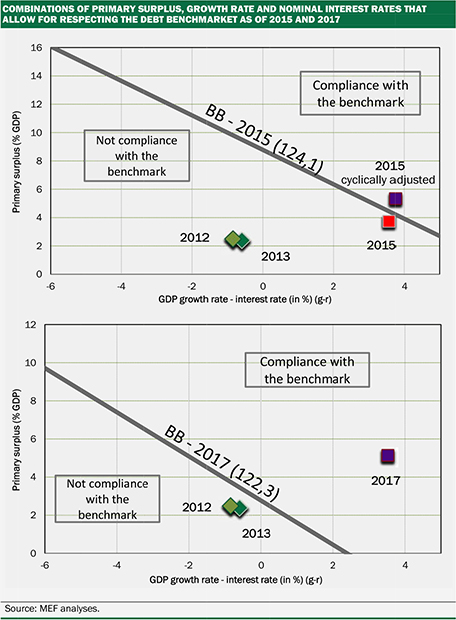

| | [Focus] The debt rule | | | 36 | |

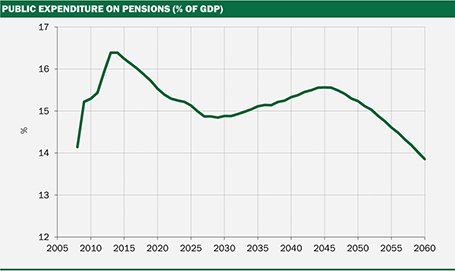

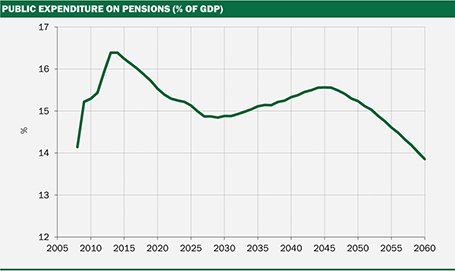

| | [Focus] Medium-/long-term trends in Italy’s pension system | | | 38 | |

| IV.2 | | Main public finance initiatives adopted in 2013 | | | 39 | |

| | [Focus] Measures adopted in the past four months | | | 43 | |

| | [Focus] Implications of the Two Pack on the planning documents provided by the law | | | 44 | |

| IV.3 | | Multi-year evaluation plan for public property | | | 45 | |

| IV.4 | | State budget under policy scenario | | | 47 | |

| IV.5 | | Content of the Domestic Stability Pact | | | 48 | |

| | |

V. | | REFORMS UPDATE | | | 49 | |

| | |

| V.1 | | Institutional reforms | | | 50 | |

| V.2 | | Structural rebalancing of the public accounts | | | 52 | |

| V.3 | | A modern and competitive tax system | | | 53 | |

| V.4 | | A more efficient and inclusive labour market | | | 56 | |

| V.5 | | A more efficient and modern public administration | | | 58 | |

| V.6 | | Support to businesses, industrial policies and stimulus to competition | | | 59 | |

| V.7 | | The strategic role of infrastructures and transport | | | 62 | |

| V.8 | | Priority actions for southern Italy | | | 64 | |

| V.9 | | University and research | | | 65 | |

| V.10 | | Education and human capital | | | 67 | |

| V.11 | | More effective and efficient justice system | | | 68 | |

| V.12 | | Responding to the grand challenges of healthcare and assistance | | | 70 | |

| V.13 | | Greater attention to the farming sector | | | 72 | |

| V.14 | | Getting back on the path of long-lasting development | | | 73 | |

| V.15 | | Cultural heritage, a common good to be exploited | | | 75 | |

| V.16 | | Growth diplomacy | | | 76 | |

| | |

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | | I |

UPDATE OF THE ECONOMIC AND FINANCIAL DOCUMENT 2013

| | | | | | |

| | |

VI. | | REPORT ON THE ARREARS OF PUBLIC ADMINISTRATIONS | | | 79 | |

| | |

VI.1 | | Introduction | | | 79 | |

VI.2 | | Payments made by public administrations | | | 79 | |

VI.3 | | Acknowledgement of the public sector arrears | | | 80 | |

VI.4 | | Measures for completing the settlement of the public sector arrears | | | 80 | |

| |

ANNEXES | | | | |

| |

Reports on investment expenditures and relevant multi-year laws (Volume I) | | | | |

Reports on investment expenditures and relevant multi-year laws (Volume II) | | | | |

Report on results achieved through measures to counter tax evasion | | | | |

| | |

| II | | MINISTERO DELL’ECONOMIA E DELLE FINANZE |

TABLE OF CONTENTS

| | | | |

| TABLES | | |

| | |

| Table I.1 | | Public finance indicators (% of GDP) | | |

| Table II.1 | | Macroeconomic framework (% change, unless otherwise indicated) | | |

| Table IV.1a | | General government account at unchanged legislation (in € mn) | | |

| Table IV.1b | | General government account at unchanged legislation (% of GDP) | | |

| Table IV. 1c | | General government account at unchanged legislation (% changes) | | |

| Table IV.2a | | Public finance aggregates – based on policy scenario (% of GDP) | | |

| Table IV.2b | | Cash balances based on policy scenario (% of GDP) | | |

| Table IV.3 | | Cyclically adjusted public finance (% of GDP) | | |

| Table IV.4 | | One-off measures (in € mn) | | |

| Table IV.5 | | General government debt by sub-sector (in € mn and % of GDP) | | |

| Table IV.6 | | Cumulative impact of the measures enacted in 2013 on general government net borrowing (in € mn; including induced effects) | | |

| Table IV.7 | | Cumulative impact of the 2013 budget measures on general government net borrowing (in € mn; including induced effects) | | |

| Table IV.8 | | Cumulative impact of the 2013 budget measures on general government net borrowing, by sub-sector (in € mn; including induced effects) | | |

| Table IV.9 | | State budget for 2014-2016 under policy scenario (in € bn and net of accounting, settlements payable and VAT refunds) | | |

| Table VI.1 | | Payments made by the public administrations as of September 2013 (in € mn) | | |

| |

| FIGURES | | |

| | |

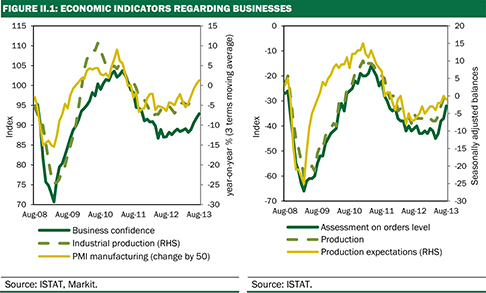

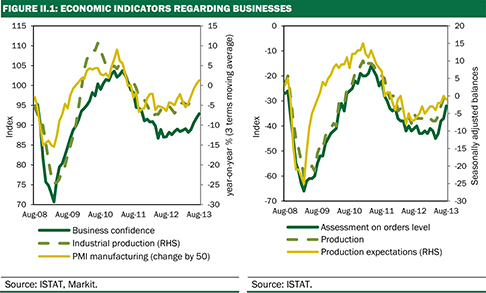

| Figure II.1 | | Economic indicators regarding businesses | | |

| |

| APPENDIX | | |

| | |

| Table A.1 | | Impact of Decree-Law No. 35/2013 on general government net borrowing | | |

| Table A.2 | | Impact of Decree-Law No. 54/2013 on general government net borrowing | | |

| Table A.3 | | Impact of Decree-Law No. 63/2013 on general government net borrowing | | |

| Table A.4 | | Impact of Decree-Law No. 69/2013 on general government net borrowing | | |

| Table A.5 | | Impact of Decree-Law No. 76/2013 on general government net borrowing | | |

| Table A.6 | | Impact of Decree-Law No. 91/2013 on general government net borrowing | | |

| Table A.7 | | Impact of Decree-Law No. 101/2013 on general government net borrowing | | |

| Table A.8 | | Impact of Decree-Law No. 102/2013 on general government net borrowing | | |

| Table A.9 | | Impact of Decree-Law No. 104/2013 on general government net borrowing | | |

| | |

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | | III |

I. SUMMARY

After eight quarters of contraction, the Italian economy appears to be finally on the verge of a recovery. During a recession without precedent in its history, Italy has lost more than 8 percentage points of GDP. Economic policy now has two priorities: to reinforce the recovery underway and to address the factors that limit competitiveness and productivity in order to increase economic growth and employment. Short-term economic policy and structural reforms must be closely coordinated.

GDP is expected to stabilise in the third quarter of this year, and should reflect a moderate increase in the fourth quarter. In 2013, GDP is forecast to contract by 1.7 per cent, incorporating the negative carryover of one percentage point from 2012. In recent months, the Government has supported the recovery of economic activity through various initiatives: the acceleration of the payments of the Public Administrations (PA), aimed at injecting liquidity into the economy and alleviating the difficulties of businesses in accessing credit; the incentives to reduce the labour costs for young workers; the various programmes to support the construction and infrastructure sectors, which, in recent years, have witnessed a drastic decline in output; and important programmes for improving the quality of public expenditure and providing support to domestic demand.

These initiatives should fully show their effects in the coming months. In 2014, the growth of GDP should be equal to 1.0 per cent. The forecast also reflects the strengthening of the global economy and the gradual waning of specific factors that adversely impacted the economy’s performance in 2013. The growth of GDP should increasingly strengthen in future years, until reaching 1.9 per cent in 2017. The scenario presented in this note is based on the continuation of the Government’s reform efforts.

For a country with a high public debt, the process of fiscal consolidation is an essential part of a growth-oriented economic policy. In past years, the increase in the PA’s net borrowing has been limited, despite the sharp drop in GDP, and in 2012, the deficit was kept below the threshold of 3.0 per cent of GDP.

In 2013, the net borrowing based on unchanged legislation could reach 3.1 per cent of GDP absent additional policy measures, exceeding the forecast indicated in the Economic and Financial Document (EFD) by 0.2 percentage points. The increase in the deficit stems from the trend of revenues, which reflects less favourable growth than that forecast in the EFD. Conversely, the trend of expenditure is essentially in line with the April estimates. The Government intends to adopt timely initiatives in order to keep the deficit within the 3.0 per cent threshold.

Associated with this figure is a structural deficit equal to 0.4 per cent of GDP in 2013. The improvements in the structural balance in 2013 and in the average obtained over the 2012-2013 two-year period (equal to 0.9 and 1.6 percentage points of GDP, respectively) are well above those required of the countries still far

| | |

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | | 1 |

UPDATE OF THE ECONOMIC AND FINANCIAL DOCUMENT 2013

from the Medium Term Objective (0.5 percentage points of GDP per year). Finally, it should be noted that the payments of the PA’s past-due debts due to capital expenditure, as agreed with the European Union, will account for approximately 0.5 percentage points of GDP in 2013.

TABLE I.1: PUBLIC FINANCE INDICATORS (% of GDP)1

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2011 | | | 2012 | | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | 2017 | |

UPDATED SCENARIO BASED ON UNCHANGED LEGISLATION | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net borrowing | | | -3.8 | | | | -3.0 | | | | -3.1 | | | | -2.3 | | | | -1.8 | | | | -1.2 | | | | -0.7 | |

Primary balance | | | 1.2 | | | | 2.5 | | | | 2.3 | | | | 3.0 | | | | 3.5 | | | | 4.1 | | | | 4.5 | |

Interest | | | 5.0 | | | | 5.5 | | | | 5.4 | | | | 5.4 | | | | 5.3 | | | | 5.3 | | | | 5.2 | |

Net structural borrowing (2) | | | -3.6 | | | | -1.3 | | | | -0.5 | | | | -0.1 | | | | -0.2 | | | | -0.5 | | | | -0.6 | |

Change in structural balance | | | -0.2 | | | | -2.3 | | | | -0.7 | | | | -0.4 | | | | 0.1 | | | | 0.2 | | | | 0.2 | |

Public debt (including Euro Area aid and PA payables) (3) | | | 120.8 | | | | 127.0 | | | | 133.0 | | | | 133.2 | | | | 130.5 | | | | 127.1 | | | | 123.2 | |

Public debt (net of Euro Area aid) (3) | | | 120.0 | | | | 124.3 | | | | 129.5 | | | | 129.4 | | | | 126.8 | | | | 123.5 | | | | 119.7 | |

Public debt (net of Euro Area aid and PA payables) (3) | | | 120.0 | | | | 124.3 | | | | 127.7 | | | | 126.3 | | | | 123.8 | | | | 120.6 | | | | 116.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Fiscal adjustment on the primary balance | | | | | | | | | | | 0.1 | | | | -0.3 | | | | 0.4 | | | | 0.2 | | | | 0.2 | |

Annual reduction in public debt stock | | | | | | | | | | | | | | | 0.5 | | | | 0.5 | | | | 0.5 | | | | 0.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

HYPOTHESIS OF POLICY SCENARIO FRAMEWORK | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net borrowing | | | -3.8 | | | | -3.0 | | | | -3.0 | | | | -2.5 | (5) | | | -1.6 | | | | -0.8 | | | | -0.1 | |

Primary balance | | | 1.2 | | | | 2.5 | | | | 2.4 | | | | 2.9 | | | | 3.7 | | | | 4.5 | | | | 5.1 | |

Interest | | | 5.0 | | | | 5.5 | | | | 5.4 | | | | 5.4 | | | | 5.3 | | | | 5.3 | | | | 5.1 | |

Net structural borrowing (2) | | | -3.6 | | | | -1.3 | | | | -0.4 | | | | -0.3 | | | | 0.0 | | | | 0.0 | | | | 0.0 | |

Change in structural balance | | | -0.2 | | | | -2.3 | | | | -0.9 | | | | -0.1 | | | | -0.3 | | | | 0.0 | | | | 0.0 | |

Public debt (including Euro Area aid and PA payables) (3) | | | 120.8 | | | | 127.0 | | | | 132.9 | | | | 132.8 | | | | 129.4 | | | | 125.0 | | | | 120.1 | |

Public debt (net of Euro Area aid) (3) | | | 120.0 | | | | 124.3 | | | | 129.3 | | | | 129.0 | | | | 125.7 | | | | 121.4 | | | | 116.6 | |

Public debt (net of Euro Area aid and PA payables) (3) | | | 120.0 | | | | 124.3 | | | | 127.6 | | | | 125.8 | | | | 122.7 | | | | 118.5 | | | | 113.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Memo: Economic and Financial Document (April 2013) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net borrowing | | | -3.8 | | | | -3.0 | | | | -2.9 | | | | -1.8 | | | | -1.5 | | | | -0.9 | | | | -0.4 | |

Primary balance | | | 1.2 | | | | 2.5 | | | | 2.4 | | | | 3.8 | | | | 4.3 | | | | 5.1 | | | | 5.7 | |

Interest | | | 5.0 | | | | 5.5 | | | | 5.3 | | | | 5.6 | | | | 5.8 | | | | 6.0 | | | | 6.1 | |

Net structural borrowing (2) | | | -3.5 | | | | -1.2 | | | | 0.0 | | | | 0.4 | | | | 0.0 | | | | 0.0 | | | | 0.0 | |

Change in structural balance | | | -0.2 | | | | -2.3 | | | | -1.1 | | | | -0.4 | | | | 0.4 | | | | 0.0 | | | | 0.0 | |

Public debt (including Euro Area aid) (4) | | | 120.8 | | | | 127.0 | | | | 130.4 | | | | 129.0 | | | | 125.5 | | | | 121.4 | | | | 117.3 | |

Public debt (net of Euro Area aid) (4) | | | 120.0 | | | | 124.3 | | | | 126.9 | | | | 125.2 | | | | 121.8 | | | | 117.8 | | | | 113.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Nominal GDP (absolute value x 1,000) | | | 1,578.5 | | | | 1,565.9 | | | | 1,557.3 | | | | 1,602.9 | | | | 1,660.7 | | | | 1,718.4 | | | | 1,779.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 1) | Slight discrepancies, if any, are due to rounding. |

| 2) | Net of one-off measures and cyclical component. |

| 3) | Inclusive or net of Italy’s portion of the EFSF loans to Greece and the ESM programme. For the years of 2011 and 2012, the amounts of such loans to Member States of the EMU (bilateral or through the EFSF) were respectively €13.118 million and €36.932 million. The values, net of the amounts to cover the PA’s past-due trade payables, incorporate fewer issues for €27.2 million in 2013 and €20 million in 2014. The estimates for 2014-2017 based on the policy scenario include the proceeds from privatisations and real property sales amounting to approximately 0.5 percentage points of GDP per year. The current scenario assumes that spreads between the yields on 10-year Italian government securities and those on comparable German securities will gradually contract to 200 basis points in 2014, 150 in 2015, and 100 in 2016 and 2017. |

| 4) | Inclusive or net of Italy’s portion of the EFSF loans to Greece and the ESM programme. For the years of 2011 and 2012, the amounts of such loans to Member States of the EMU (bilateral or through the EFSF) were respectively €13.118 million and €36.932 million. The estimates for the years 2013-2017 include the proceeds from privatizations and real property sales amounting to approximately 1.0 percentage points of GDP per year. |

| 5) | The use of 0.2 percentage points of the fiscal balance in 2014 (difference between the balance on unchanged legislation and the balance based on the policy scenario) is explained by the intention to finance several capital expenditure items not included in the balance on unchanged legislation. |

Note: The revenue forecasts consider the continuation of the experimental taxation of real property instituted by Decree-Law No. 201/2011 over the entire forecast period.

| | |

| 2 | | MINISTERO DELL’ECONOMIA E DELLE FINANZE |

I. SUMMARY

In later years, the net borrowing based on the policy scenario is expected to fall gradually, from 2.5 per cent of GDP in 2014 (corresponding to a structural deficit of 0.3 percentage points) to 0.1 per cent in 2017, a figure that is lower than that indicated in the EFD.

As shown by the public finance outcomes for 2012, as well as the estimated trends for 2013 and subsequent years, the fiscal consolidation process made it possible to close out the Excessive Deficit Procedure initiated with respect to Italy. It is an important result, but Italy still needs to maintain a rigorous approach. The Government believes that the achievement of a balanced budget in structural terms remains an essential condition for ensuring sustainability of the public debt and maintaining the confidence of both businesses and the financial markets. The policy scenario outlines a convergence path towards this target, with a balanced position achieved as from 2015, in line with national and European rules.

While acknowledging the binding nature of these constraints, the Government is committed to promoting a review of national and European economic policies in order to place even greater priority on economic growth and employment.

In the future, the definition of a target for the PA’s primary expenditure could increase the effectiveness of the spending review processes and contribute to paving the way for a reduction of the tax burden. The corrective measures outlined in 2015 and beyond will need to revolve around a reduction of public expenditure, with intense spending review activity to be inaugurated in 2014 in order to reduce the tax burden.

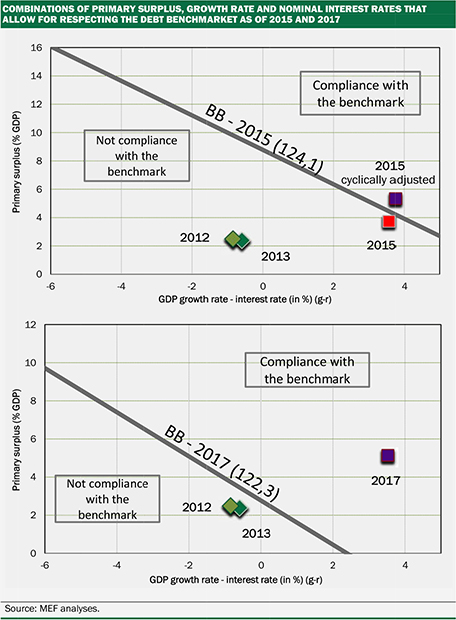

The policy scenario debt-to-GDP ratio (inclusive of the financial aid to other Member States of the Euro Area and the settlement of the PA’s past-due debts) increases from 127.0 per cent in 2012 to 132.9 per cent in 2013 and to 132.8 per cent in 2014. With the gradual settlement of the PA’s payables (forecast to equal 1.2 points of GDP in 2014), the reduction of the debt-to-GDP ratio becomes more evident, falling to 120.1 per cent in 2017. Net of the aid to European financial support programmes, the public debt is equal to 124.3 per cent of GDP in 2012, rises to 129.3 per cent in 2013 and descends to 116.6 per cent in 2017. The decline is also affected by the estimated proceeds from privatisations (0.5 percentage points of GDP per year), which take into account the instruments already operational for proceeding with the valuation and subsequent sale of State property, including both buildings and shareholdings.

This path ensures the compliance with the new debt rule introduced by the European Union (translated into the Minimum Linear Structural Adjustment). The substitution of measures currently incorporated into the scenario on unchanged legislation with non-structural measures would make it more difficult to comply with the rule, and would introduce the risk of the opening of another Excessive Deficit Procedure.

In addition to its usual content, this EFD Update provides an update of the reform actions in process and those to be introduced in the future, in response to the EU Council Recommendations, and more in general, in response to the need to increase the country’s competitiveness and economic growth. Finally, as provided by the first decree for the acceleration of the payments in arrears of the PA to its suppliers, this document incorporates a Report containing information related to the status of the PA’s payments, as well as the initiatives to be undertaken in order to complete the payment of the PA’s debts accrued as of 31 December 2012.

| | |

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | | 3 |

UPDATE OF THE ECONOMIC AND FINANCIAL DOCUMENT 2013

To complete the 2014-2016 fiscal package, the Government will introduce legislative bills on the following subjects:

| | i. | Development and simplifications; |

| | ii. | Labour and social equality; |

| | iv. | Green economy and the fight against environmental waste (‘Provisions aimed at promoting green economy measures and at containing excessive consumption of environmental resources’); |

| | v. | Local government bodies; |

| | vi. | Measures for relaunching the farming and agro-food sector. |

| | |

| 4 | | MINISTERO DELL’ECONOMIA E DELLE FINANZE |

II. MACROECONOMIC SCENARIO

The international macroeconomic scenario is marked by a gradual recovery, with mixed performance among the various geographic areas. During the second quarter of 2013, international trade and global production decelerated slightly with respect to the pace of expansion during the preceding quarter. In August, the global Purchasing Managers Index (PMI) for the manufacturing sector was once again above the expansion threshold, as occurred during the first part of 2013.

According to main international financial institutions, the slow recovery of the world’s most industrialised economies in the near term can be attributed to the deleveraging still occurring within the banking system and among corporations, and to the continuation of fiscal consolidation. The forecasts for global demand anticipate a more pronounced recovery in the medium term.

In the Euro Area, the economy is once again growing after six quarters of contraction. In the second quarter of 2013, the Euro Area GDP rose by 0.3 per cent with respect to the preceding quarter, after having declined by 0.2 per cent in the first quarter. In its September forecasts, the European Central Bank estimated that the Euro Area GDP would contract by 0.4 per cent in 2013 and expand by 1.0 per cent in 2014, thus revising its June forecast upward by 0.2 percentage points and downward by 0.1 percentage points, respectively. Even so, the scenario is marked by a continuation of weak domestic demand and high unemployment, aggravated by fears of reduced demand from emerging markets. Credit institutions have already repaid a part of the funds obtained from the ECB refinancing transactions, thereby suggesting a gradual return to normal conditions in the financial market. However credit market rigidities are still evident. Alongside a decrease in the supply of credit, the drop in loan demand from households and businesses, due principally to uncertain prospects about the future, is a cause for concern. Against this backdrop, the European Parliament’s recent approval of the single supervisory system for the banking sector represents an important step toward European banking union which should become a reality within another year.

The main risks to the international framework concern: the geo-political tensions in Middle East, with possible repercussions on commodity prices; the possibility of a shift in the direction of monetary policy with the rise of interest rates and a further slowdown in the rates of growth in emerging nations; and new tensions in the financial and credit markets.

The recession in Italy reached its peak in the final months of 2012, followed by a gradual reduction in the rate of contraction of GDP. In the first and second quarters of 2013, the quarter-on-quarter decrease in GDP amounted to 0.6 per cent and 0.3 per cent, respectively.

The negative contribution of domestic demand to growth was less pronounced in the case of both private consumption and investment. The trend of investments incorporates mixed results: spending on machinery, equipment and transportation was slightly higher starting from the second quarter, while investment in

| | |

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | | 5 |

UPDATE OF THE ECONOMIC AND FINANCIAL DOCUMENT 2013

construction continued to fall. Over the first six months of the year, the flow of exports remained essentially stable, while imports again decreased. In the second quarter, inventories once again made a significant negative contribution to growth (equal to -0.4 percentage points), thereby largely explaining the contraction of GDP.

All of the main leading indicators have been providing favourable signs for several months. The data on manufacturing businesses published in September show further increases in both business confidence and the PMI. In particular, the indications related to orders are positive, including those coming from the domestic market.

The improvement of consumer confidence indicators suggests a gradual recovery of domestic demand in the next few quarters, with beneficial effects on the services sector.

The still slightly negative trend of lending to the private sector is likely to continue to impede growth for some months, thus softening the expansionist effects of the Government’s latest measures.

The expected gradual strengthening of industrial production in the next few months is likely to lead to a full recovery of the country’s economic activity by year end. However, the most recent figure (a month-on-month decrease of 1.1 per cent in July) has prompted some caution with respect to the growth estimates for the third quarter. Moreover, a negative trend in July was also seen in other European countries, and particularly in Germany.

Accordingly, considering that the contraction of GDP in the first part of 2013 was slightly higher than contemplated in the macroeconomic projections contained in the Economic and Financial Document (EFD), the estimate of GDP growth is now -1.7 per cent. The figure incorporates a very significant negative carryover effect of 1.0 percentage point from the year 2012.

| | |

| 6 | | MINISTERO DELL’ECONOMIA E DELLE FINANZE |

II. MACROECONOMIC SCENARIO

The prospects of recovery in economic activity in 2014 are fully confirmed, including in light of the legislation to accelerate the payment of the arrears of the Public Administrations (PA); however, in relation to a reduced positive statistical carryover effect from 2013, the 2014 annual change in GDP is now estimated to be 1.0 per cent. The growth of Italy’s economy should climb above 1.0 per cent starting in 2015, with the negative output gap (currently equal to more than 4 percentage points of GDP) expected to gradually close.

The upward revision of the medium-term forecasts has been done on the basis of a careful evaluation of the reforms introduced to date. The EFD presented in April only partially incorporated the effect of the reforms that were enacted during the previous legislature and examined within the National Reform Programme. The conservative evaluation stemmed from the methodological premise that the estimates of the impact of the reforms incorporated a still-incomplete process of implementation (for example, through the approval of the necessary secondary legislation). The Government is committed to making the reforms already enacted fully effective, and where opportune, to reviewing certain elements in order to improve their scope and effectiveness. This approach has been appropriately reflected in the impact estimates. In addition, the Government has put in place the conditions for greater use of structural and convergence funds, which will also support the recovery. Chapter III of this report contains a focus topic on the “Status of implementation of the reforms” which provides an account of the progress made thus far.

Added to this are important structural reform measures introduced in recent months that are discussed in a focus topic in this chapter. These measures, for example, include: various initiatives to improve the quality of public expenditure (spending reviews) that should gradually pave the way to a reduction of taxation; the fiscal initiatives that have actually accelerated some of the measures of the enabling act; the privatisation process initiated; and additional institutional reforms in process. More specifically, the Interministerial Committee for Economic Programming (CIPE) recently approved measures for EXPO 2015, and efforts are now under way to define initiatives in relation to the ‘Destinazione Italia’ programme. It is therefore possible to reflect a greater effect of the past measures within the GDP growth estimates.

The impact of the various measures that are to be introduced as part of, or in conjunction with, the Stability Law will be assessed as soon as the details are available. The next commitment in this regard is the preparation of the Draft Budgetary Plan (DBP) that will estimate the effects on the budget balances and on the economy of the main measures to be included in the Stability Law. The DBP is to be drafted and sent to the European Commission by 15 October.

| | |

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | | 7 |

UPDATE OF THE ECONOMIC AND FINANCIAL DOCUMENT 2013

TABLE II.1: MACROECONOMIC FRAMEWORK (% change, unless otherwise indicated)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2012 | | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | 2017 | |

EXOGENOUS INTERNATIONAL VARIABLES | | | | | | | | | | | | | | | | | | | | | | | | |

International trade | | | 2.5 | | | | 3.0 | | | | 4.9 | | | | 6.0 | | | | 6.1 | | | | 6.2 | |

Oil price (FOB Brent US$/barrel) | | | 111.6 | | | | 109.9 | | | | 113.6 | | | | 113.6 | | | | 113.6 | | | | 113.6 | |

USD/EUR exchange rate | | | 1.286 | | | | 1.317 | | | | 1.322 | | | | 1.322 | | | | 1.322 | | | | 1.322 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

ITALY'S MACRO VARIABLES (VOLUMES) | | | | | | | | | | | | | | | | | | | | | | | | |

GDP | | | -2.4 | | | | -1.7 | | | | 1.0 | | | | 1.7 | | | | 1.8 | | | | 1.9 | |

Imports | | | -7.7 | | | | -2.9 | | | | 4.2 | | | | 4.8 | | | | 4.5 | | | | 4.5 | |

Final national consumption | | | -3.9 | | | | -1.9 | | | | 0.3 | | | | 1.0 | | | | 1.2 | | | | 1.4 | |

- Household consumption (residents) | | | -4.3 | | | | -2.5 | | | | 0.5 | | | | 1.1 | | | | 1.5 | | | | 1.8 | |

- General government expenditure and NPISH | | | -2.9 | | | | -0.3 | | | | -0.1 | | | | 0.7 | | | | 0.3 | | | | 0.1 | |

Gross fixed investment | | | -8.0 | | | | -5.3 | | | | 2.0 | | | | 3.6 | | | | 3.8 | | | | 3.5 | |

- Machinery, equipment and other | | | -9.9 | | | | -3.5 | | | | 3.4 | | | | 4.7 | | | | 5.1 | | | | 4.6 | |

- Construction | | | -6.2 | | | | -7.0 | | | | 0.6 | | | | 2.5 | | | | 2.4 | | | | 2.4 | |

Exports | | | 2.3 | | | | 0.2 | | | | 4.2 | | | | 4.5 | | | | 4.4 | | | | 4.3 | |

Memo item: current account balance (% of GDP) | | | -0.5 | | | | 0.3 | | | | 0.4 | | | | 0.4 | | | | 0.5 | | | | 0.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

CONTRIBUTION TO GDP GROWTH (1) | | | | | | | | | | | | | | | | | | | | | | | | |

Net exports | | | 3.0 | | | | 0.9 | | | | 0.2 | | | | 0.1 | | | | 0.1 | | | | 0.1 | |

Inventories | | | -0.6 | | | | 0.0 | | | | 0.2 | | | | 0.2 | | | | 0.0 | | | | 0.0 | |

Domestic demand, net of inventories | | | -4.8 | | | | -2.5 | | | | 0.6 | | | | 1.4 | | | | 1.6 | | | | 1.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

PRICES | | | | | | | | | | | | | | | | | | | | | | | | |

Import deflator | | | 3.1 | | | | -1.4 | | | | 1.1 | | | | 1.8 | | | | 1.7 | | | | 1.9 | |

Export deflator | | | 1.9 | | | | 0.0 | | | | 1.6 | | | | 2.1 | | | | 1.9 | | | | 1.8 | |

GDP deflator | | | 1.6 | | | | 1.2 | | | | 1.9 | | | | 1.9 | | | | 1.7 | | | | 1.7 | |

Nominal GDP | | | -0.8 | | | | -0.5 | | | | 2.9 | | | | 3.6 | | | | 3.5 | | | | 3.6 | |

Consumption deflator | | | 2.8 | | | | 1.5 | | | | 2.1 | | | | 1.9 | | | | 1.7 | | | | 1.7 | |

Inflation (planned) | | | 1.5 | | | | 1.5 | | | | 1.5 | | | | 1.5 | | | | | | | | | |

HICP, net of imported energy (2) | | | 3.0 | | | | 2.0 | | | | 1.8 | | | | 2.1 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

LABOUR | | | | | | | | | | | | | | | | | | | | | | | | |

Labour cost | | | 1.0 | | | | 1.4 | | | | 1.0 | | | | 1.4 | | | | 1.3 | | | | 1.3 | |

Productivity (measured on GDP) | | | -1.3 | | | | 0.1 | | | | 1.0 | | | | 0.8 | | | | 0.9 | | | | 0.9 | |

Unit labour cost (measured on GDP) | | | 2.3 | | | | 1.3 | | | | -0.1 | | | | 0.5 | | | | 0.4 | | | | 0.5 | |

Employment (FTE) | | | -1.1 | | | | -1.8 | | | | -0.1 | | | | 0.9 | | | | 0.9 | | | | 1.0 | |

Unemployment rate | | | 10.7 | | | | 12.2 | | | | 12.4 | | | | 12.1 | | | | 11.8 | | | | 11.4 | |

Employment rate (15-64 years) | | | 56.7 | | | | 55.9 | | | | 55.8 | | | | 56.3 | | | | 56.8 | | | | 57.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Memo item: Nominal GDP (in € mn) | | | 1565916 | | | | 1557307 | | | | 1602937 | | | | 1660701 | | | | 1718365 | | | | 1779568 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| 1) | Slight discrepancies, if any, are due to rounding. |

| Note: | The macroeconomic framework has been prepared based on information available as of 12 September 2013. |

| GDP | and components in volume (concatenated prices, base year of 2005), data not adjusted for number of business days. |

FOCUS

Validation of macroeconomic forecasts, as provided by the Two Pack

The Two Pack refers to two regulations of the European Parliament and European Council (no. 472 and no. 473) in effect as of 30 May 2013 and aimed at reinforcing the monitoring of public finance aggregates for the Euro Area countries. A more detailed description of the effects of the regulations on Italy’s budgeting process is illustrated in Chapter IV of this Update (“Implications of the Two Pack on the programming documents cycle provided by law”). Europe’s new governance system requires the use of independent macroeconomic forecasts (prepared or certified by institutions independent of the Government) for the preparation of each country’s programming documents.

| | |

| 8 | | MINISTERO DELL’ECONOMIA E DELLE FINANZE |

II. MACROECONOMIC SCENARIO

More specifically, the Two Pack provides that Member States must: i) explicitly state in the document if the macroeconomic forecasts are prepared or certified (endorsed) by the independent entity; and ii) define and adopt transparent procedures for the validation of the macroeconomic forecasts on the part of the independent entity.

The regulations suggest that specific reconcilement mechanisms be provided should the assessments about growth prospects differ between the Ministry of the Economy and Finance and the independent entity.

Exhibit II of the Code of Conduct defines the contents of the Draft Budgetary Plan and supplies some suggestions for defining procedures that could be followed by the parties involved in the forecast process, such as the adoption of a Code of Practice to be publicly disclosed.

In Italy, in line with the Two Pack requirements, the independent entity was instituted with the implementation of Constitutional Law no. 1 of 2012, will be attached to parliament and named Parliamentary Budget Office (PBO. The PBO will be operational as of 2014, following the appointment of its directors. Italy has elected a model that provides for the PBO’s validation (certification) of the macroeconomic forecasts. The law ensures that the PBO will have full autonomy and independence of judgement and evaluation. With reference to the procedures for the forecasting process, the law establishes that “should the PBO come up with valuations that are significantly different from those of the Government, upon the request of at least one-third of the members of a parliamentary commission responsible for public finance, the Government will either illustrate the reasons for which it believes its assessments are to be confirmed, or the reasons for which it elects to align its forecasts to PBO’s”. 1

In absence of the validation of the forecasts by the newly created PBO, the growth forecasts contained in the Update to the 2013 EFD are to be compared with the consensus forecasts and the most recent forecasts published by national and international entities.

The year-on-year growth estimates of the macroeconomic framework are substantially in line with the forecasting entities’ average for 2013. With regard to 2014, it is believed that the consensus forecasts of the entities surveyed do not yet incorporate fully the updating of the estimates. The forecasting entities will have to take into account both the additional measures adopted by the Government in recent months and the recent confirmations of improvement of the overall macroeconomic framework.

GROWTH FORECASTS FOR ITALY

| | | | | | | | | | | | | | | | |

Real GDP (% change y/y) | | Forecast

Date | | | 2013 | | | 2014 | | | 2015 | |

Update to EFD (y/y) | | | 09/2013 | | | | -1.7 | | | | 1.0 | | | | 1.7 | |

| | | | | | | | | | | | | | | | |

Prometeia (Forecast Report) (*) | | | 09/2013 | | | | -1.6 | | | | 0.8 | | | | n.a. | |

Confindustria (Economic Scenarios no. 18) | | | 09/2013 | | | | -1.6 | | | | 0.7 | | | | n.a. | |

REF | | | 08/2013 | | | | -1.6 | | | | 1.0 | | | | n.a. | |

Bank of Italy (Economic Bulletin no. 73) | | | 07/2013 | | | | -1.9 | | | | 0.7 | | | | n.a. | |

IMF (Update WEO) | | | 07/2013 | | | | -1.8 | | | | 0.7 | | | | n.a. | |

OECD (Economic Outlook n. 93) | | | 05/2013 | | | | -1.8 | | | | 0.4 | | | | n.a. | |

ISTAT | | | 05/2013 | | | | -1.4 | | | | 0.7 | | | | n.a. | |

European Commission (Spring Forecast) | | | 05/2013 | | | | -1.3 | | | | 0.7 | | | | n.a. | |

| | | | | | | | | | | | | | | | |

Forecasting entities averages | | | | | | | -1.6 | | | | 0.7 | | | | n.a. | |

| | | | | | | | | | | | | | | | |

Consensus forecasts | | | 09/2013 | | | | -1.7 | | | | 0.5 | | | | n.a. | |

Euro Zone Barometer | | | 09/2013 | | | | -1.7 | | | | 0.4 | | | | n.a. | |

| | | | | | | | | | | | | | | | |

| 1 | Law no. 243/2012, Article 18, Paragraph 3. |

| | |

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | | 9 |

UPDATE OF THE ECONOMIC AND FINANCIAL DOCUMENT 2013

FOCUS

Trend of the credit market and the effects on businesses

The tensions in the financial markets manifested near the end of 2011 have mostly abated as a result of the ECB Governing Council’s decision to initiate Outright Monetary Transactions (OMT), extraordinary transactions for the purchasing of government securities. On the other hand, the significant reduction in the spreads between yields on Italian and German government securities occurring as from autumn 2012 has not yet fully realized its beneficial effects on Italy’s credit system.

An increase in non-performing loans and growing risk aversion on the part of banks, combined with the need for bank recapitalization as dictated by financial authorities and new international regulations, have created a substantial stall in the credit market in Italy and in other countries.

Significant differences continue to exist in the average cost of financing new loans to businesses, due both to the need for recovering profit margins, and to the fragmentation still present in the euro money market. In June, the cost of lending in Italy was 1.3 percentage points higher than in Germany). The spreads are even higher in the case of small- and medium-sized businesses (SMEs) which represent the backbone of Italy’s economy.

On the basis of data published by the Bank of Italy in its latest Report on Financial Stability, the reduction of bank credit has started to influence not only firms in precarious financial conditions, but also those with solid balance sheets. Larger companies have partially avoided the problem by financing themselves through bond issues, leaving smaller companies more strongly impacted by the effects of the credit crunch. According to the Bank Lending Survey, credit conditions continued to deteriorate in the second quarter of 2013, especially in the case of long-term financing.

The credit market is still fragile, although the foundations for its gradual return to normal do seem to exist. With the improvement of the prospects for the economy, corporate loan demand should gradually increase, while credit conditions will likely be eased due to a reduction in the perception of risk associated with business activity. Total funding is still contracting, although a rebound in funding from abroad is discernible. In addition, when compared year on year, the funding gap in May 2013 had fallen by 3.6 percentage points; this trend appears likely to continue in the next few months. 2 Therefore, as the economy recovers, banks should be ready to satisfy credit demand.

The Government has played an active role in creating conditions conducive to well-functioning markets, facilitating the access to credit by businesses and generally favouring an improvement in the liquidity of the financial system. Several measures for improving businesses’ access to the credit market have already been implemented, and are explained in Chapter III of this Update.

The trend of the spread between yields on 10-year Italian government securities and comparable German securities remains nonetheless anomalous. In essence, following an initial contraction due to the policies of the previous Government, the spread stabilised around 250 basis points. This was offset by the narrowing and virtual disappearance of a similar sized spread between Spanish and Italian securities. These movements thus suggest that political uncertainty and hesitations about the stability of Italy’s Government are continuing to affect investor perceptions somewhat. With the reform process and the successes in fiscal consolidation, the conditions are in place for a significant reduction of the yield spread in the next few years.

| 2 | Italian Banking Association Forecast Report, July 2013. |

| | |

| 10 | | MINISTERO DELL’ECONOMIA E DELLE FINANZE |

II. MACROECONOMIC SCENARIO

FOCUS

Impact of the legislation to accelerate settlement of the PA’s debts

With the Decree-Law no. 102/2013, the Government authorised a €7.2 billion increase in allocations to settle the past-due debts of territorial entities, in addition to the €20 billion of payments authorised by Decree-Law no. 35/2013, with the former amount representing an advance of the tranche planned for 2014. Note that a payment of up to €20 billion has also been provided for 2014. The Government’s commitment is to reach a total of €50 billion, although the need for identifying subsequent allocations can only be fully evaluated after a determination of the amount of the debt still outstanding covered by the existing measures.

The impact of the additional €7.2 billion on the economy was evaluated in a report to Parliament, prepared in accordance with Article 10-bis, Paragraph 6 of Law no. 196/2009, submitted to the Council of Ministers on 28 August and subsequently transmitted to both chambers of Parliament.

The estimation of the impact on GDP growth of the measure authorising the additional debt settlements was prepared using the same criteria employed for evaluating the effects of the allocation approved during the spring months. The table below shows the additional impact due exclusively to the increased payments; additional details are outlined in the aforementioned report. The greater injection of liquidity in 2013, if done quickly enough, will provide more intense and immediate benefits to businesses in terms of greater investments and production, and should consequently provide positive effects on consumption.

IMPACT ON THE ECONOMY OF THE INCREMENTAL PAYMENTS (% shift compared with baseline simulation)

| | | | | | | | | | | | |

| | | 2013 | | | 2014 | | | 2015 | |

GDP | | | 0.1 | | | | 0.3 | | | | 0.0 | |

Consumption | | | 0.2 | | | | 0.4 | | | | 0.1 | |

Investments | | | 0.4 | | | | 0.7 | | | | 0.1 | |

| | | | | | | | | | | | |

The policy scenario presented in this Update incorporates these effects. The expansionist effects corresponding to another €2.8 million (whose expenditure still needs to be authorised) are instead not included.

The payments made by the PA to date are summarised in the following table (see Chapter VI for additional information).

PAYMENTS MADE BY THE PUBLIC ADMINISTRATIONS AS OF SEPTEMBER 2013 (in €mn)

| | | | | | | | | | | | |

Debtor entities | | Resources

appropriated by

Decree-Law 35/2013 | | | Resources actually

made available to the

debtor entities | | | Payments

made | |

Central Government | | | 3,000 | | | | 3,000 | | | | 2,613 | |

Payment of off-balance sheet debt of Ministries | | | 500 | | | | 500 | | | | 113 | |

Increase in tax refunds | | | 2,500 | | | | 2,500 | | | | 2,500 | |

| | | | | | | | | | | | |

Regions and autonomous Provinces | | | 10,200 | | | | 8,301 | | | | 5,350 | |

Liquidity advances | | | 8,000 | | | | 6,101 | | | | 5,350 | |

Credit lines | | | 2,200 | | | | 2,200 | | | | | |

| | | | | | | | | | | | |

Provinces and Municipalities | | | 6,800 | | | | 6,606 | | | | 3,341 | |

Liquidity advances | | | 1,800 | | | | 1,606 | | | | 1,506 | |

Credit lines | | | 5,000 | | | | 5,000 | | | | 1,835 | |

| | | | | | | | | | | | |

Total amounts (absolute values) | | | 20,000 | | | | 17,907 | | | | 11,304 | |

| | | | | | | | | | | | |

Total amounts (% of allocated resources) | | | | | | | 90 | % | | | 57 | % |

| | | | | | | | | | | | |

| | |

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | | 11 |

UPDATE OF THE ECONOMIC AND FINANCIAL DOCUMENT 2013

FOCUS

Macroeconomic impact of certain measures of 2013 for relaunching the economy

The Government’s main measures for relaunching the economy as introduced following the approval of the 2013 EFD have been evaluated with respect to their macroeconomic impact3. The measures considered are the following:

1) Decree-Law no. 54/2013 incorporating measures for the financing of social safety nets and the suspension of the single municipal property tax (IMU);

2) Decree-Law no. 63/2013 incorporating measures regarding the energy performance of buildings and tax relief for the recovery of the housing stock;

3) Decree-Law no. 69/2013 incorporating “Urgent provisions for relaunching the economy” (“Decreto Fare”);

4) Legislation containing simplification measures;

5) Decree-Law no. 76/2013 incorporating measures for employment (in particular, the employment of young people), and value-added taxes;

6) Decree-Law no. 102/2013 incorporating measures regarding IMU, other taxation of real property, support to housing policies and local finance, as well as long-term wage supplementation and pension schemes.

In comparison with the baseline scenario, all of the measures contained in the legislation examined would translate into a 0.1 per cent increase of GDP starting in 2013 (see table below). For 2013, this increase is almost exclusively attributable to energy-savings and building-renovation incentives (Decree-Law no. 63/2013) that should contribute to boosting investments. Instead, from 2014 and thereafter, the greatest impact comes from the simplification measures that contribute to growing both household consumption and investments. The stimulus to aggregate demand is accompanied by a slight increase in prices, with the exception of 2013, when the increase in value-added tax (deferred to 1 October) will cause a reduction in prices vis-à-vis the baseline scenario.

THE MACROECONOMIC IMPACT OF SEVERAL MEASURES ADOPTED IN 2013 FOR RELAUNCHING

THE ECONOMY (% shift compared with baseline simulation)

| | | | | | | | | | | | |

| | | 2013 | | | 2014 | | | 2015 | |

GDP | | | 0.1 | | | | 0.1 | | | | 0.1 | |

Consumption | | | 0.1 | | | | 0.1 | | | | 0.1 | |

Investments | | | 0.6 | | | | 0.0 | | | | 0.0 | |

Employment | | | 0.0 | | | | 0.1 | | | | 0.0 | |

Prices | | | -0.1 | | | | 0.1 | | | | 0.1 | |

| | | | | | | | | | | | |

| 3 | The macroeconomic impact of the measures considered has been evaluated with the ITEM model, with the exception of the simplification measures that were simulated with the QUEST III mode for Italy. |

| | |

| 12 | | MINISTERO DELL’ECONOMIA E DELLE FINANZE |

III. EUROPEAN COUNCIL RECOMMENDATIONS TO ITALY

In July, following the end of the 2013 European Semester, the EU Council made specific recommendations to Italy on the basis of the European Commission's assessments of the country’s macroeconomic and budget situation, as outlined in the Stability Programme and the National Reform Programme.

Amongst other things, these recommendations stress that the macroeconomic imbalances linked to problems of competitiveness and high public debt will require very strong, clear and effective economic-policy actions, particularly in view of the sluggish growth in recent years.

Following is a brief summary of the actions already taken by the Government in response to these recommendations, whereas reference should be made to Chapter V of this document for indications about the reform efforts in process and/or those to be introduced in the future.

DEBT REDUCTION

RECOMMENDATION 1. Ensure that the deficit remains below 3% of GDP in 2013, by fully implementing the adopted measures. Pursue the structural adjustment at an appropriate pace and through growth-friendly fiscal consolidation so as to achieve and maintain the MTO as from 2014. Achieve the planned structural primary surpluses in order to put the very high debt-to-GDP ratio on a steadily declining path. Continue pursuing a durable improvement of the efficiency and quality of public expenditure by fully implementing the measures adopted in 2012 and taking the effort forward through regular in-depth spending reviews at all levels of government.

| • | | Ensured convergence of the public finance balances toward the agreed European thresholds through: i) public finance balances that are under control and ii) the budget strategy indicated in this Update. |

| • | | Used safeguard clauses to guarantee financial coverage of the legislation enacted. |

| • | | Adopted measures, mostly with no impact on public finance balances. |

| • | | Implemented provisions for containing expenditures related to the exercise of political activity, including the elimination of separate compensation to Government ministers who already draw a salary as members of Parliament. |

| • | | Adopted provisions to pursue the streamlining of the expenditure of the Public Administrations (PA) (e.g., freeze on the purchase of official cars, reduction of spending on consulting services, simplification of procedures for hiring and internal transfers within the PA). |

| • | | Passed legislation to abolish public financing of political parties, and to regulate voluntary contributions to the same. The measures take a completely new approach to governing contributions and financing to political parties, by eliminating direct public financing and introducing a new system for private contributions and indirect public contributions. |

| | |

| MINISTRY OF ECONOMY AND FINANCE | | 13 |

UPDATE OF THE ECONOMIC AND FINANCIAL DOCUMENT 2013

| • | | Passed a constitutional law bill to abolish the Provinces. The bill calls for the elimination of the Provinces from Article 114 of the Constitution, leaving the Regions and Municipalities intact. |

| • | | Approved a decree-law restructuring the functions of the Provinces. In advance of, and consistent with, the related constitutional reform, the decree-law contains measures about Large Cities, Provinces and unions of Municipalities, for the purpose of adjusting their administration. |

| • | | Introduced simplified procedures to transfer buildings to territorial entities, as part of the implementation of the federal state property system. As of 1 September 2013 and until 30 November 2013, Municipalities, Provinces, Large Cities and Regions may submit applications to acquire the State’s real property assets. |

| • | | The funds management company, Investimenti Immobiliari Italiani (Invimit) SGR, was set up by the Ministry of Economy and Finance (MEF) with the objective of enhancing the value of public property assets and providing for the disposal thereof. The new company’s three-year business plan has been submitted for the approval of the Bank of Italy and the Italian securities market regulator (CONSOB). Invimit is to receive initial funding of approximately €450 million for 2013 from the National Insurance Institute for Industrial Accidents (INAIL), with most of the funding to be dedicated to enhancing the value of public services. Before the end of 2013, the State Property Office will transfer a total of 350 properties to Invimit. |

| • | | Reinforced the role of the Concessionaria Servizi Informativi Pubblici (CONSIP) purchasing centre, with the unit presiding over some €35 billion of expenditures for goods and services in 2013, with the comparable total for 2014 expected to rise to more than €40 billion. |

| • | | Approved a plan for reducing the work force of Italy’s Army, Navy and Air Force to a total of 150,000 by 2024. The total work force of civilian personnel employed by the Ministry of Defence is to be reduced to 20,000 by 2024. |

EFFICIENCY AND QUALITY OF THE PUBLIC ADMINISTRATION

RECOMMENDATION 2. Ensure timely implementation of on-going reforms by swiftly adopting the necessary enacting legislation, following it up with concrete delivery at all levels of government and with all relevant stakeholders, and monitoring impact. Reinforce the efficiency of public administration and improve coordination between layers of government. Simplify the administrative and regulatory framework for citizens and business and reduce the duration of case-handling and the high levels of litigation in civil justice, including by fostering out-of-court settlement procedures. Strengthen the legal framework for the repression of corruption, including by revising the rules governing limitation periods. Adopt structural measures to improve the management of EU funds in the southern regions with regard to the 2014-2020 programming period.

| • | | Accelerated the settlement of the past-due payables of the PA, with the payment of €40 billion for 2013-2014 (inclusive of €17.9 billion already made available to public debtor entities in 2013). In September, a total of €11.3 billion was settled, including approximately €3.9 billion for the healthcare sector, in particular, for the account of hospitals and local healthcare units. Another reinforcement of the financial commitment is planned, up to an amount of €10 billion (including €7.2 billion already authorised). |

| | |

| 14 | | MINISTERO DELL’ECONOMIA E DELLE FINANZE |

III. EUROPEAN COUNCIL RECOMMENDATIONS TO ITALY

| • | | Inaugurated the process of constitutional and electoral reforms: the Commission for Constitutional Reforms was appointed and presented its final report in September 2013. Parliament is debating the legislative bill presented by the Government that calls for setting up a Parliamentary Committee for Constitutional Reforms. Public consultation about the constitutional reforms was also undertaken (from July to October 2013). |

| • | | Adopted a new Digital Administration Code, with additional measures approved for the digitalisation of the PA (mandatory use of certified electronic mail between the PA and companies, with the use of faxing abolished). |

| • | | Simplified the governance of the Digital Agenda, and the tasks of the Steering Committee have been redefined. The Committee, which is headed by the Prime Minister or one of his delegates, is scheduled to present to Parliament an overview of prevailing regulations, the programmes inaugurated, and their status of completion. |

| • | | The National Corruption Prevention Plan has been approved by the National Corruption Prevention Authority. |

| • | | Guidelines have been adopted by the Independent Commission for the Valuation, Transparency and Integrity (CIVIT) of the PA, for the updating of the 2014-2016 three-year programmes for transparency and integrity within the PA. The jurisdiction over the subject of the prevention of corruption is being transferred to the Public Function Department. |

| • | | The commission set up at the Ministry of Justice to study possible reform of the law of prescription (i.e., statute of limitations) has concluded its work. |

| • | | Presented a legislative bill to simplify compliance matters for individuals and businesses, and to re-order regulations, with measures regarding: abolition of certificates; the issuance of academic diplomas in the English language; the digitalisation of the procedures for the Public Automobile Register; and the creation of a position known as ‘business tutor’ staffed by the manager of the one-stop shop (Sportello Unico per Attività Produttiva (SUAP)) or a person delegated by such manager. The bill also contains: the authorisation to reduce the regulatory charges paid by citizens that will allow for some €9 billion of savings for businesses; the authorisation to re-order and codify matters concerning education, research, the environment, fiduciary companies, etc.; fiscal simplification measures regarding inheritance and reduction of the terms for the disbursement of tax refunds (starting in 2014). |

| • | | Adopted other simplification measures through the ‘Decreto Fare’ (Decree- Law no. 69/2013 converted by Law no. 98/2013) for the purpose of overcoming Italy’s competitive disadvantage and freeing up resources for the country’s growth and development. The measures refer to bureaucratic compliance matters that have an estimated cost (based on the computation of the charges done by the Public Function Department with the technical assistance of ISTAT) of approximately €7.7 billion per year for small and medium-sized enterprise (SMEs). The estimated savings have already been |

| | |

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | | 15 |

UPDATE OF THE ECONOMIC AND FINANCIAL DOCUMENT 2013

| | quantified at approximately €500 million per year. In addition to the general initiatives that are essential for providing certainty about the timing for concluding the procedures, such as the automatic and lump-sum indemnity, there are numerous measures that will allow for reducing the costs of bureaucracy and will contribute to triggering investments and to facilitating the recovery in key sectors (such as the building sector). The other simplification measures affect several matters particularly burdensome for businesses, such as the compliance formalities for labour and the single insurance contribution payment certificate (DURC), the environment and taxation. The legislative bill on the subject of simplification currently under review by the Senate (A.S. 958) provides not only for relaunching the codification, but also other important measures for matters that are fundamental to running businesses and to the everyday life of individuals (e.g., timing for building permits, environmental clean-ups and other environmental measures, the Automotive Public Register (PRA), the agenda for simplification, etc.). |

| • | | On the subject of construction, the timing for the issuance of building permits is to be reduced for municipalities with more than 100,000 inhabitants, except in the case of particularly complex projects. The process for authorising changes to building permits has also been simplified for non-essential modifications, with those changes to be handled through the so-called Reporting of Initiation of Activity ‘Segnalazione certificata di inzio attività’ (SCIA). |

| • | | The ‘Decreto Fare’ also includes the following provisions pertaining to the judicial system: the reduction of the number of new lawsuits through mandatory mediation for various types of proceedings; the institution of law clerk apprenticeships at the courts for the purposes of training and support to the case load; and the creation of a task force of 400 honorary magistrates for settling cases pending with the Courts of Appeal. In addition, the timing for settling disputes concerning the recovery of receivables has been reduced, while the so-called ‘Blank Pre-Bankruptcy Agreement’ has been amended, through the institution of a court-appointed administrator who will monitor the integrity of the debtor’s conduct. |

| • | | The Agency for Cohesion was established to ensure more efficient use of European structural funds, and to strengthen the technical and administrative capacity of the Regions and Central Administrations. |

FINANCIAL SYSTEM

RECOMMENDATION 3. Extend good corporate governance practices to the whole banking sector conducive to higher efficiency and profitability to support the flow of credit to productive activities. Take forward the on-going work as regards asset-quality screening across the banking sector and facilitate the resolution of non-performing loans on banks’ balance sheets. Promote further the development of capital markets to diversify and enhance firms' access to finance, especially into equity, and in turn foster their innovation capacity and growth.

| | |

| 16 | | MINISTERO DELL’ECONOMIA E DELLE FINANZE |

III. EUROPEAN COUNCIL RECOMMENDATIONS TO ITALY

| • | | CONSOB has published guidelines for the use of equity crowd-funding, namely, the tapping of capital through online portals in order to support newly created, innovative businesses. |

| • | | The Bank of Italy has updated provisions regarding the prudential oversight of banks with reference to internal controls systems, information systems and operating continuity. The new regulations, in line with the best international practices and the recommendations of leading international organisations, are based on several fundamental principles: the involvement of top management; the integrated vision of risks; the efficiency, effectiveness and independence of the controls; and the application of the regulations in relation to the size and operational complexity of the banks. |

| • | | The Cassa Depositi e Prestiti has made a credit line (€2 billion) available to banks for the disbursement of new mortgages for the purchase of the main dwelling, and for the acquisition of bank bonds as part of credit securitisation transactions arising from mortgages guaranteed by liens on residential properties, with the aim of facilitating the banks’ disbursement of new mortgages to individuals for the purchase of their main dwelling. |

| • | | Simplified the means of accessing the Central Guarantee Fund and enhanced the instruments available to the Fund. |

| • | | Adopted the decrees providing for the implementation of the use of mini-bonds by SMEs. |

| • | | Made operational the financing of start-ups with the ‘Start and Smart’ project through the National Agency for the Attraction of Investments and Development of Business (INVITALIA), and subsidies have been paid into a sinking fund to cover the costs of running the businesses during their first years of activity. |

| • | | The ‘2013 Credit Agreement’ consummated between the Italian Banking Association (ABI) and business trade associations has provided for the suspension of payment of loan instalments and the lengthening of maturities for financing granted to SMEs, while also includes provisions to promote the recovery and development of SME business activities. |

| • | | ABI has also set up a Business Enhancement Fund (FVI). The Fund is a new intermediary created and managed by a management company for the purpose of relaunching and enhancing the value of otherwise healthy firms that are experiencing financial stress. The Fund is authorised to acquire credits from banks and financial resources from investors, stepping in to strengthen the business enough to the point of divestiture. |

| • | | The Cassa Depositi e Prestiti has made €2.5 billion available for subsidised financing to SMEs, to be used for productive investments (purchase of plant, machinery and equipment, and other capital goods, such as computer hardware and software). The financing, for up to €2 million per firm, will be granted through 31 December 2016 by banks that are partners to the initiative, and will have a maximum term of five years. |

| • | | Refinanced with €150 million, through the Fund for Sustainable Growth, the development programmes in the industrial sector for regional areas currently lacking resources to provide subsidised credit. |

| | |

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | | 17 |

UPDATE OF THE ECONOMIC AND FINANCIAL DOCUMENT 2013

| • | | Activated the risk-capital line of the National Fund for Innovation (FNI) to facilitate the financing of innovative projects based on the industrial application of intellectual property assets (patents, designs and models). A special closed-end fund, IPGEST, with resources of €40.9 million (€20 million of which are public) has been set up for investing SMEs that are carrying out investment programmes for the development and use of patents. The portion of investment available to each SME is up to €1.5 million over a 12-month period. |

LABOUR MARKET

RECOMMENDATION 4. Ensure the effective implementation of the labour market and wage setting reforms to allow better alignment of wages to productivity. Take further action to foster labour market participation, especially of women and young people, for example through a Youth Guarantee. Strengthen vocational education and training, ensure more efficient public employment services and improve career and counselling services for tertiary students. Reduce financial disincentives for second earners to work and improve the provision of care, especially child- and long-term care, and out-of-school services. Step up efforts to prevent early school leaving. Improve school quality and outcomes, also by enhancing teachers’ professional development and diversifying career development. Ensure effectiveness of social transfers, notably through better targeting of benefits, especially for low-income households with children.

| • | | Introduced incentives amounting to €794 million over the 2013-2016 period (€500 million for the Southern Regions and €294 million for the rest of the country) for the hiring of employees under open-ended contract. The incentives are targeted to the hiring, by 30 June 2015, of workers between the ages of 18 and 29 who fall within the category of underprivileged workers, namely, young people who (i) have not had a regularly paying job for at least six months, or (ii) do not have a secondary school or professional diploma. The incentive to the employer is equal to one-third of the total gross taxable wage for a period of 18 months and cannot exceed more than €650 per worker per month. For an employer that converts an existing fixed term contract into an open-ended contract, the incentive period is equal to 12 months. The hiring activity must lead to a net occupational increase. |

| • | | Instituted a new incentive for the hiring on a full-time basis with an open-ended contract of unemployed workers who receive Social Insurance for Employment (ASpI) equals to 50 per cent of the residual monthly indemnity. |

| • | | Began the dialogue within the State-Regions Conference in order to guarantee national standards of hiring under the professional training contract. |

| • | | Approved several additions to the regulations provided by Law 92/2012. Such integrations aim at eliminating several constraints related to ‘atypical’ fixed term contracts (e.g., derogation enabling fixed term contracts and delegation to collective agreements for establishing the reasons to derogate from the reasons validating the fixed term contract), and reducing the minimum period elapsing between two successive term contracts with the same employer. The procedures have been simplified for individual dismissals due to just cause and for on-call work. |

| • | | Reinforced worker protections and improved transparency. In particular, in case of attempted settlement, the absence of one of the parties will be taken into consideration by the judge in the final ruling; extension of norms preventing the so-called ‘blank resignations’ to workers hired for specific |

| | |

| 18 | | MINISTERO DELL’ECONOMIA E DELLE FINANZE |

III. EUROPEAN COUNCIL RECOMMENDATIONS TO ITALY

| | projects; a revaluation of 9.6% of the fines, with a reallocation of one-half of this amount to the reinforcement of oversight and prevention measures relating to security and safety in the work place; and mandatory communications in relation to hiring, termination, transformation and extension of contracts fully display their effects. |

| • | | Introduced provisions to facilitate the early retirement of older workers, namely, those who are close to meeting the requisites for retiring, so as to facilitate their retirement from firms with excess personnel. |

| • | | Planned an expansion of the measures to safeguard former workers whose employment terminated before the entering into force of the last pension reform and who ended up without either a wage or a pension. The benefit will be granted to 6,500 individuals, for a maximum amount of €151 million for 2014, of €164 million for 2015, €124 million for 2016, €85 million for 2017, €47 million for 2018 and €12 million for 2019. |

| • | | Refinanced the exceptional wage supplementation scheme (Cassa Integrazione in Deroga) for 2013 with a total appropriation of €2.5 billion. |

| • | | Set up a fund at the Labour Ministry with annual resources of €2 million in order to allow the State Administrations to pay allowances for participation in training apprenticeships during the 2013-2015 period. |

| • | | Authorized an expenditure of €10.6 million to promote vocational apprenticeship for students enrolled in university degree programmes over the 2013-2014 academic year. |

| • | | Instituted a special mission at the Labour Ministry in view of the inauguration of the ‘Youth Employment Initiative’. The unit will collaborate at different government levels for the implementation of employment policies and the planning of active labour policies initiatives. In addition, a database of active and passive labour policies will be created in order to collect data about individuals seeking job and the demand for labour. |

| • | | Areas of Southern Italy received the following financing: i) €80 million for self-employment and entrepreneurial measures; ii) €80 million for projects promoted by young people and underprivileged individuals for the social infrastructure and value enhancement of public assets; and iii) €168 million for training scholarships for unemployed young people who are neither enrolled in school nor participating in any training activity. |

| • | | Allocated a total of €100 million for increasing the Fund for Scholarships for University Studies. Scholarships are also planned for assisting worthy students who wish to study in areas outside of their Regions of residence. |

| • | | Enhanced the courses for students of the upper secondary school. The courses offered in technical and professional institutes have also been enriched, as have those for artistic, musical and choral studies. |

| • | | In order to facilitate a better balance between school and the labour market, a three-year plan is currently being prepared for extracurricular training assignments for students in level four of upper secondary school, with the priority going to students enrolled in technical and professional institutes. The students will be assigned to businesses or public entities. |

| | |

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | | 19 |

UPDATE OF THE ECONOMIC AND FINANCIAL DOCUMENT 2013

| • | | Increased the flexibility of the annual hourly schedule for professional institutes by up to 25%. By guaranteeing greater flexibility of lesson times, the initiative favours a natural link between professional institute programmes and the regional professional training and education programmes, thereby specifically responding to the needs to train young people and make access to the labour market easier. |

| • | | Extended the Social Inclusion Programme to all areas of Southern Italy, with the adoption of the purchases card on an experimental basis. A total of €167 million has been allocated to the initiative. |

| • | | The report entitled ‘Proposals for New Measures to Fight Poverty’ developed by a work group set up at the Labour Ministry has been presented in its final form, and outlines measures for supporting active inclusion. |

| • | | Allocated funds totalling €200 million for making the burden of home mortgage or rental payments more sustainable. More specifically, the following are provided: i) €40 million to a fund for suspension of mortgage instalments up to 18 months; ii) €60 million to the Guarantee Fund (Decree- Law no. 112/2008) for mortgages granted to young people (couples, single-parent households with children, and people employed under atypical contracts); iii) €60 million to the fund that disburses additional subsidies for the payment of property rents; iv) €40 million to a new fund set up to cover unintentional arrearage; and v) a reduction to 15 per cent of the lump-sum tax payable on rent income from the contracts with rents set at controlled prices. |

| • | | Appropriated funds totalling €420 million for scholastic publishing. In addition, the Regions that are building new school facilities may obtain subsidised-rate mortgages from the European Investment Bank, the European Council Development Bank, the Cassa Depositi e Prestiti or other banking institutions. The State will shoulder the amortisation charges. |

| • | | Actions planned for improving the educational aids and environment include: i) greater availability of textbooks; ii) improved canteen services at schools; iii) public transport subsidies; and iv) wireless Internet in secondary school buildings. |

| • | | New measures have been introduced in the fight against school dropouts, with the financing of a programme specifically aimed at supplemental assistance to reinforce core skills, with €15 million appropriated therefor during 2013- 2014. |

| • | | The hiring of full-time employees with open-ended contracts for the 2013- 2014 academic year provides for: 672 school managers and 11,268 teachers and other educational personnel. |

| • | | New rules have been approved for the hiring of personnel employed by universities and research entities. As of 2014, the turnover (hiring of replacement personnel) is to be raised to 50 per cent of departing personnel, versus the 20 per cent ratio previously. |

| • | | Approved a disability plan, while the fund for hiring the disabled has been refinanced. The PA are also authorised to hire the disabled, as an exception to the hiring limitations currently in effect. |

| | |

| 20 | | MINISTERO DELL’ECONOMIA E DELLE FINANZE |

III. EUROPEAN COUNCIL RECOMMENDATIONS TO ITALY

TAXATION SYSTEM

RECOMMENDATION 5. Shift the tax burden from labour and capital to consumption, property and the environment in a budgetary neutral manner. To this purpose, review the scope of vat exemptions and reduced rates and of direct tax expenditures, and reform the cadastral system to align the tax base of recurrent immovable property to market values. Pursue the fight against tax evasion, improve tax compliance and take decisive steps against the shadow economy and undeclared work.

| • | | The Government has committed to a review of property taxes, from the standpoint of ensuring greater equity and eliminating the burden for the weakest sectors of society. The municipal property tax (IMU) is to be replaced with a service tax that will foster the fiscal federalism. The part of the tax on the property has been maintained, while a direct component for taxing shared services and waste management has been introduced. The service tax shifts the taxation base to consumption as well as possession, and thus it will be applied not only to owners but also to renters. In addition, the Government intends to re-assign to Municipalities their territorial real property base and the full power to reconfigure tax exemptions and tax rates, within the framework of a national ceiling. As part of this review, the first instalment of IMU was cancelled for 2013 in relation to the properties that had benefited from the suspension provided by Decree-Law no. 54 of 2013: main dwellings (with the exception of the A1-A8-A9 categories, such as villas, castles, and luxury properties) land, and farm buildings. |

| • | | Increased the value-added tax rate from 21 per cent to 22 per cent starting in October 2013. |

| • | | The delegated tax law is under debate at the Parliament. Among its most main objectives, the law aims to provide stability and certainty to the taxation system. With the aim of simplifying and streamlining corporate income taxes, the legislation will eliminate or correct distortionary taxation measures containing loopholes or measures that generate uncertainty and complexity in terms of application, in particular with the objective of favouring the development of cross-border activity through the elimination of certain limitations on the international expansion of businesses. |

| • | | The operating plans of the Italian tax police have been ratified for the fight against undeclared labour and the prevention of money laundering. |

| • | | The new system for income assessment and bank account records has become fully operational. The Italian tax agency has also finalized a strategy for the constant monitoring of the fiscal conduct of 3,200 large taxpayers subjected to agency oversight in 2013. |

| • | | Implemented new rules governing the tax authorities’ seizure of assets and tax collection. The minimum tax debt for which the tax collector can take a lien on real property has been raised from €20,000 to €120,000. In addition, the tax collecting entity, Equitalia, can grant the tax debtor an instalment plan of up to 120 months for the extinction of the debt. If the only real property owned by the debtor is the debtor’s main dwelling, it cannot be seized, except in cases in which the dwelling classifies as luxury property. In the case of businesses, the limits on the ability to seize assets have been extended. |

| | |

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | | 21 |

UPDATE OF THE ECONOMIC AND FINANCIAL DOCUMENT 2013

| • | | Renewed the concession to Equitalia for the collection of taxes for local entities. |

| • | | Several measures to simplify fiscal compliance have also been ratified at the administrative and legislative levels. |

| • | | Abolished joint fiscal responsibility of contractors and sub-contractors for the payment of value-added tax. |