UPDATE OF THE

ECONOMIC

AND FINANCIAL

DOCUMENT 2014

Submitted by the Prime Minister

Matteo Renzi

and the Minister of the Economy and Finance

Pier Carlo Padoan

Approved by the Cabinet on 30 September 2014

INTRODUCTION

Macroeconomic scenario

Recent macroeconomic developments point to a decidedly problematic scenario for the Euro Area: the economy is significantly slowing, and in Italy in particular, it is visibly struggling to recover. Until just a few months ago, the outlook for 2014 incorporated moderately positive growth; that scenario now needs to be revised downward; at the same time, inflation remains extremely low, and is in a continuous and alarming downward spiral.

When faced with disappointing economic data in recent years, both the Italian government and international organisations have repeatedly been overly optimistic and have then been forced to delay the forecasts of a recovery for Italy and the Euro Area. The sluggishness of the economy, the fragility of the recovery, and the prompt setbacks of economic activity are factors to suggest a weak structural situation that is partly the consequence of the damage caused by the severe, lengthy recession of recent years.

Given the exceptional circumstances enveloping Italy and Europe, it is realistic to assume that: i) the continuing uncertainty has changed the behaviour of businesses and households, reducing their propensity to invest and to consume; ii) the drying up of sources of income and fewer possibilities for accessing credit have decreased spending capacity to an extent greater than initially expected; iii) monetary policy alone will not be sufficient to relaunch growth, despite its crucial contribution to financial stability; iv) the benefits of structural reforms will materialise with a greater delay and/or less intensity as a result of the continuing weakness of aggregate demand; and v) weak demand in the Euro Area, including in relation to the broad-based and long-lasting current imbalances within the Area, has limited the contribution that exports normally make to economic recovery.

In cumulative terms, the decline of GDP in Italy is greater than that which occurred during the Great Depression of 1929; though to a lesser extent, the rest of the Euro Area is also struggling to recover to the pre-crisis levels. In view of the growing risks of stagnation, it is necessary to assume a recovery that is less robust and delayed with respect to the scenario contemplated in April 2014.

More in general, the current framework suggests that the Euro Area is facing a defining moment. Barring any significant intervention, the European countries risk spiralling into a state of stagnation and deflation, in which high unemployment and flat nominal growth will make the recovery of competitiveness and debt sustainability even more difficult.

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | I |

| | UPDATE OF THE ECONOMIC AND FINANCIAL DOCUMENT 2014 |

In facing this defining moment, the Italian Presidency has proposed concentrating the European Union’s strategy on growth and employment, through the relaunching of investments, reforms and the domestic market. Each country has its own specific characteristics and challenges. Italy entered the crisis with serious structural and competitiveness problems, which were reflected in a lower-than-average potential growth rate and an unfavourable productivity trend. Supply-side problems were present well before the crisis, and they weakened Italy's capacity to compete at an international level at a time when several emerging countries initially appeared on the scene and then later forcefully established themselves in the global trade arena; today, these problems are hindering Italy's capacity to respond to the crisis.

It appears evident that i) Italy – like the Euro Area as a whole - is feeling the effects of both supply and demand problems; changing the direction of growth requires using all of the economic-policy mechanisms available - namely, monetary policy, structural measures and fiscal policy – in a coordinated and synergetic manner; and ii) when considering the threat of deflation and the related implications for debt sustainability, it is better to err by risking the definition of too many measures, rather too few.

Against this backdrop, the government's duty is to implement structural reforms, thereby favouring positive interaction with fiscal policy, in a single coordinated strategy to stimulate and support aggregate demand in the short term and to increase the economy's potential.

Structural reforms

Italy must return to growing its competitive capacity, reversing its lengthy deterioration, through a broad range of structural reforms, that are even more necessary today, given the growing risks of stagnation; it is a challenge that must be met in order to favour: the creation of new businesses; and the growth of the size of existing businesses, and their capacity to serve the markets abroad. It is only from this process that a long-lasting increase in employment can be achieved.

Action must be taken both in the labour market and with respect to the set of rules, including the tax burden, that define the environment in which businesses are required to operate.

Labour market reform will allow the economic system to adapt itself better to a framework of rapid change, facilitating the deployment of resources to sectors with higher productivity growth. The network of social safety nets is to be strengthened and made more inclusive. Businesses will be able to manage productive activity more efficiently, reacting more quickly to cyclical changes and structural discontinuities; this should yield an increase in investments, including from abroad, and a reduction in the segmentation of the work force, which is particularly pronounced at a generational level. The related growth of employment will encourage an increase in labour market participation, paired

| II | MINISTERO DELL’ECONOMIA E DELLE FINANZE |

with a reduction in the long-term unemployment rate and greater availability of skilled jobs.

The simplification of regulations and procedures, the streamlining of the taxation system and the general government, and the drastic reduction in the timing required for civil court proceedings are all developments to make it possible to reward economic enterprises, excellence and innovation, resetting the mechanisms of impartiality and social mobility; Italy will accordingly be poised to ascend the international ranks of enterprise creation, increasing investor confidence.

The reforms have immediate economic, political and/or fiscal costs, while their benefits are mostly concentrated in the future. This equation makes the introduction of reforms even more urgent, with an awareness that the impact of the reforms depends more than ever on the effectiveness of the implementation.

Economic activity in Italy has been visibly held back by a dysfunctional political-institutional system, the low efficiency of the general government, the significant magnitude of tax evasion and the underground economy, a high level of corruption, and the considerable influence of organised crime. It is for this reason that the government has prioritised measures related to these issues, with the objective of reducing the uncertainty for businesses and households resulting from the inefficient management of public policies; the normalisation of the trade debts of the general government and the substantial revision of the Domestic Stability Pact are two actions to make a contribution in this regard.

The reform programme inaugurated will continue into the months and years ahead. Indeed, the government's "1,000 days" agenda is due to unfold over approximately three years. During such period, the government will be involved not only in developing and introducing legislative provisions, but also in the delicate implementation phase that has often failed to meet the expectations of the Italian public and foreign investors in the past. In this regard, the Update provides an account of the status of the structural reform process, presenting a broad update of the measures planned and/or inaugurated, some of which have been agreed with European institutions within the framework of the Macroeconomic Imbalances Procedure.

Investments

Investments, and especially private investments, will continue to be strengthened alongside the structural reforms. Investments represent the crucial point between the need for sustaining demand and the need for bolstering supply. As a result, the priorities will be placed on both administrative simplification and incentives to non-bank financing. During its six-month Presidency of the European Union, Italy has supported the adoption of a common EU infrastructure investment policy coordinated among Member States, with expected positive effects on demand and supply, both of which can be reinforced by positive externalities between countries.

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | III |

| | UPDATE OF THE ECONOMIC AND FINANCIAL DOCUMENT 2014 |

In the meantime, in order to avoid the risk of a long-lasting human and physical capital drain from Italy, the government has adopted measures aimed at renewing corporate plants (decree-law on competitiveness) and accelerating the construction of infrastructures (the so-called Sblocca Italia decree). These measures will benefit from increased private capital flows to the economy as a result of changes made to the financial system (Finance for Growth), that are intended to expand the role of non-bank intermediaries and to deploy savings into small- and medium-sized enterprise (SMEs) in a more efficient manner.

With a view toward facilitating the financing of SMEs, the government has also acted to simplify securitisations and to make such transactions more transparent, thereby supporting the ECB's programme to purchase asset-backed securities.

Italy also needs greater investment in human capital, which will help the country to position its economic system at higher levels within the international rankings. The government intends to move in two directions: i) it is inaugurating a reform of the education system designed to upgrade educational standards, while also setting the quantitative objectives for evaluating the progress achieved; and ii) it is introducing measures to support research and development activity, including with the intention of facilitating a presence of foreign research centres in Italy.

Fiscal policy

Italy's public finances are solid and sustainable as a result of pension system reforms and the consistently high primary surpluses achieved by the country over many years (as also illustrated by the European Commission's long-term analyses). The efforts on this front have been rewarded by the positive valuation of the markets, whose momentum has grown over time. At the same time, the less favourable trend of GDP and inflation has narrowed the manoeuvring room for supporting growth and strengthening the public finances.

In accordance with common EU rules, it is therefore appropriate to adopt an approach to consolidation that considers the ongoing contraction of the economy and allows the structural reforms to fully wield their positive effects. The cyclically adjusted budget balance is significantly better than suggested by the forecasts as a result of the sizeable underestimation of potential GDP, which, in turn, is due to the continuation of abnormally low growth.

Fiscal policy will facilitate the recovery, including through the mix of measures. In an effort to revive consumption and investments, the Stability Law measures are concentrated on low- and middle-income households and businesses; the government will act in the wake of the already approved reduction of personal and corporate income taxes and the recent measures aimed at stimulating private investments and facilitating credit access for SMEs. The reform of the education system and the support to foreign research and development activities are part of this effort.

| IV | MINISTERO DELL’ECONOMIA E DELLE FINANZE |

The spending review process has been charged with reducing and requalifying public expenditure, while also limiting the negative effects on growth and employment, with measures to eliminate waste and overcharging; the public procurement reform introduced, with the centralisation of purchasing, and better control over prices applied will allow for immediately freeing up resources for a significant, permanent reduction in taxation that the government considers crucial. Furthermore, the law known as the Delega Fiscale is designed to provide stability and certainty to the taxation system.

***

The detailed definition and the implementation of structural reforms and the implementation of fiscal and monetary policies that reinforce one another will make the policy mix available to Euro Area countries more effective, thereby increasing their flexibility, their resistance to the crisis, and their capacity to generate growth and employment.

Macroeconomic policies that are accommodating – within the framework of the space available - will facilitate the adoption of structural measures, thereby enhancing the policies' effectiveness and increasing their impact on investments, growth and employment. At the same time, there is a need for the continuing sustainability of the public finances so as to reduce the uncertainty about the level of fiscal burden in the future, with a positive effect on current consumption and investment.

It is for this reason that Italy's fiscal policy will continue the pursuit of the fiscal consolidation shown in recent years, which has been one of the most significant efforts at a European level. In terms of its mix, fiscal policy will emphasise growth, including as a result of the decrease in the tax wedge primarily financed through the spending review.

Against this backdrop, investment policy constitutes one of the cornerstones of the government's action; in view of the continuing weakness of economic activity, the relaunching of private and public investment - promoted in a coordinated manner within the entire European Union - will allow for simultaneously reviving demand and supply in Member States, with significant effects for the Euro Area as a whole.

Italy's long decline has multiples causes and deep roots. Decisive action is needed on several fronts, with the awareness that in the absence of a robust recovery, the resiliency of the productive and social fabric will be at risk, the wealth of households will be threatened, and the prospects for young people will be compromised.

| | Pier Carlo Padoan |

| | The Minister of the Economy and Finance |

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | V |

| VI | MINISTERO DELL’ECONOMIA E DELLE FINANZE |

CONTENTS

| I. | | OVERALL FRAMEWORK AND ECONOMIC-POLICY OBJECTIVES |

| | | |

| II. | | MACROECONOMIC FRAMEWORK |

| | | |

| III. | | NET BORROWING AND PUBLIC DEBT |

| III.1 | | Final outcomes and projections at unchanged legislation |

| III.2 | | Public finance policy scenario |

| III.3 | | Trend of the debt-to-GDP ratio |

| III.4 | | The debt rule |

| III.5 | | Main public finance measures adopted in 2014 |

| III.6 | | Public property evaluation plan and privatisations |

| III.7 | | Content of the Domestic Stability Pact |

| | | |

| IV. | | ANALYSIS OF PUBLIC FINANCE SUSTAINABILITY |

| IV.1 | | Short-term scenarios |

| IV.2 | | Medium-term scenarios |

| IV.3 | | Long-term scenarios |

| | | |

| V. | | NATIONAL STRATEGY AND EUROPEAN COUNCIL RECOMMENDATIONS |

| V.1 | | Introduction |

| V.2 | | Responses to the European Council recommendations |

| V.3 | | Reforms implementation status |

| | | Reports on investment expenditure and relevant multi-year laws (Volume I and II) |

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | VII |

| | UPDATE OF THE ECONOMIC AND FINANCIAL DOCUMENT 2014 |

TABLES

| Table I.1 | | Public finance indicators |

| Table II.1 | | International exogenous variables |

| Table II.2 | | Macroeconomic framework based on unchanged legislation |

| Table II.3 | | Policy-scenario macroeconomic framework |

| Table II.4 | | Impact of the new measures on the rate of growth based on unchanged legislation |

| Table III.1a | | General government account at unchanged legislation (in € mn) |

| Table III.1b | | General government account at unchanged legislation (% of GDP) |

| Table III.1c | | General government account at unchanged legislation (% change) |

| Table III.2 | | Public finance aggregates based on policy scenario |

| Table III.3 | | The cyclically adjusted public finance |

| Table III.4 | | One-off measures |

| Table III.5 | | General government debt by sub-sector |

| Table III.6 | | Minimum linear structural adjustment (MLSA) and change needed in the structural balance so as to guarantee respect of the debt rule |

| Table III.7 | | Impact on debt-to-GDP ratio of financial aid to Euro Area and settlement of general government debt arrears |

| Table III.8 | | Cumulative net impact of the last budget measures approved in 2014 on general government net borrowing |

| Table III.9 | | Cumulative impact of the last budget measures approved in 2014 on general government net borrowing |

| Table III.10 | | Cumulative net impact of the last budget measures approved in 2014 on general government net borrowing by sub-sector |

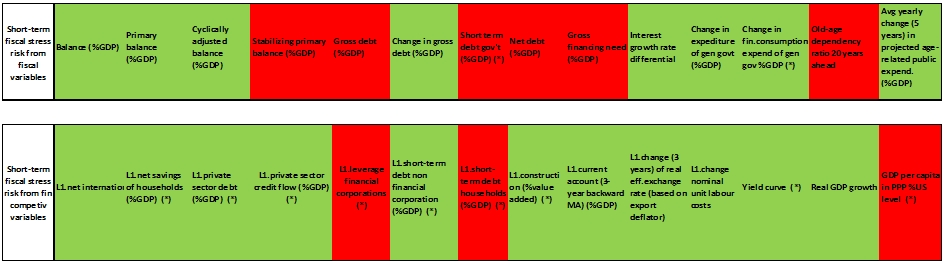

| Table IV.1 | | Heat map on variables underlying the S0 for 2014 |

| Table IV.2 | | Summary of macro-fiscal shocks |

| Table IV.3 | | Sensitivity to growth and to interest expenditure |

| Table IV.4 | | Sustainability indicators |

| Table V.1 | | Schedule for reforms |

FIGURES

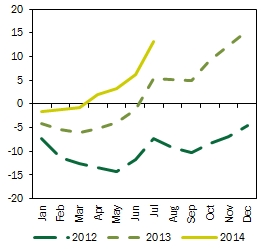

| Figure II.1 | | Net flows of employment and new businesses |

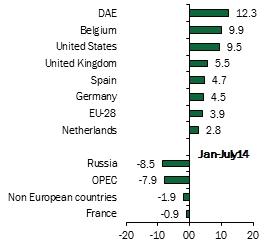

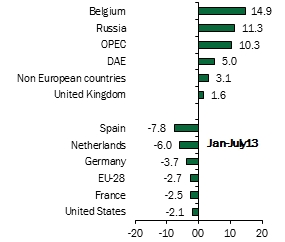

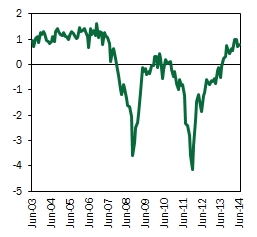

| Figure II.2 | | Italy's exports by country of destination |

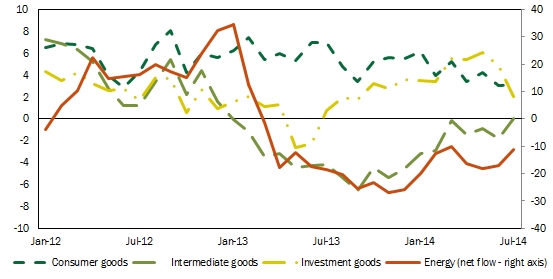

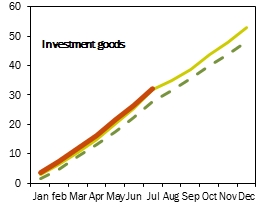

| Figure II.3 | | Exports by main industry groups |

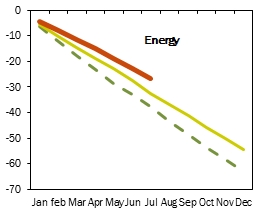

| Figure II.4 | | Sector breakdown of trade balance |

| Figure II.5 | | Current balance of the balance of payments |

| Figure IV.1 | | Public debt determinants |

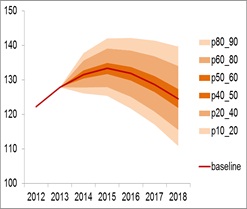

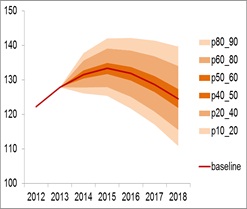

| Figure IV.2a | | Stochastic projection of the debt-to-GDP ratio with temporary shocks |

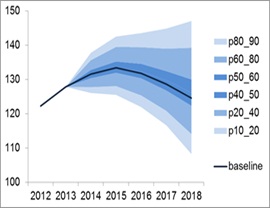

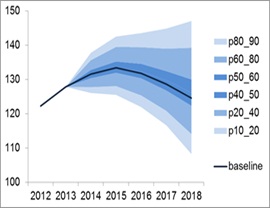

| Figure IV.2b | | Stochastic projection of the debt-to-GDP ratio with permanent shocks |

| VIII | MINISTERO DELL’ECONOMIA E DELLE FINANZE |

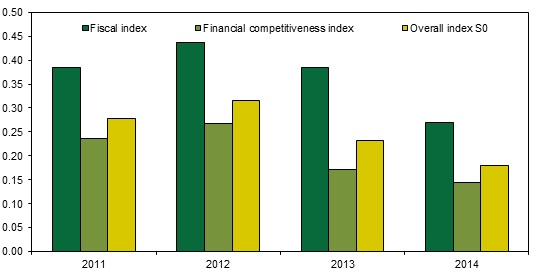

| Figure IV.3 | | S0 indicator and sub-components |

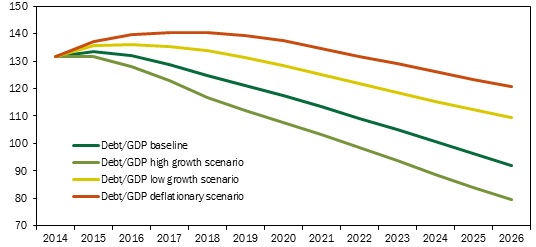

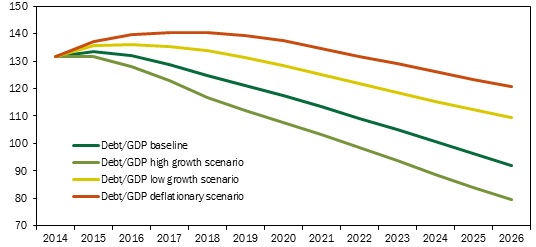

| Figure IV.4 | | Medium-term projection of debt-to-GDP ratio in the different scenarios |

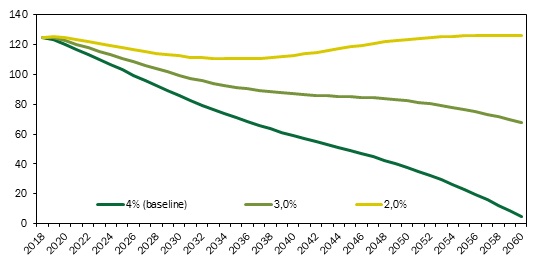

| Figure IV.5 | | Public debt sensitivity to the structural primary surplus |

FOCUS TOPICS

| Chapter II | | Revision of the growth estimates |

| | | The forecasting errors in official estimates |

| | | Validation of the macroeconomic forecasts |

| | | Impact of the reforms |

| | | Trend of the financial markets, the banking sector, and the financing of businesses |

| | | Changeover to new European system of national and regional accounts |

| Chapter III | | The assessment of significant deviations |

| | | Estimate of potential GDP |

| | | Assessments of amounts collected through activities to fight against tax evasion |

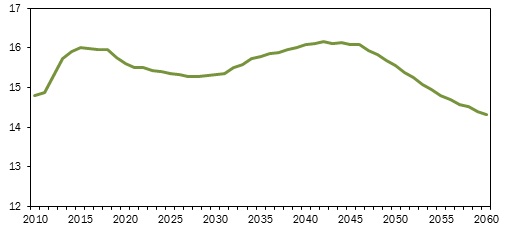

| Chapter IV | | Medium/long-term trends for Italy's pension system |

| Chapter V | | Rationalisation programme of subsidiaries held by local administrations |

| | | Constitutional reform |

| | | The draft of the delegated law on the reorganisation of the public administrations |

| | | Drastic cut in the average duration of civil proceedings and significant savings in spending for the entire system |

| | | Bills related to the civil justice system |

| | | Bills in relation to the criminal justice system |

| | | Bills related to the labour market |

| | | School reform |

| Table A.1 | | Impact of Decree-Law No. 66/2014 on general government net borrowing |

| Table A.2 | | Impact of Decree-Law No. 90/2014 on general government net borrowing |

| Table A.3 | | Impact of Decree-Law No. 91/2014 on general government net borrowing |

| Table A.4 | | Impact of Decree-Law No. 133/2014 on general government net borrowing |

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | IX |

| I. | OVERALL FRAMEWORK AND ECONOMIC-POLICY OBJECTIVES |

The recent weakening of the economic cycle and the leading indicators are signs to suggest another contraction of GDP of three decimal points for the current year. For 2015, on the basis of the policy scenario, the economy is expected to grow by 0.6 per cent. The growth is forecast to strengthen gradually in subsequent years, partly due to the policies that the government will introduce with the Stability Law and to the reforms planned and those now being implemented.

The profile of the public accounts contained in this document shows a more gradual fiscal adjustment than that indicated in the Economic and Financial Document (EFD) in April 2014. In confirming its staunch commitment to keep the deficit within the threshold of 3.0 per cent of GDP and in considering the flexibility clauses provided by European rules, the government believes it is appropriate to slow the path toward achievement of a structural budget balance (Medium-Term Objective).

The net borrowing targets have accordingly been revised to 3.0 per cent and 2.9 per cent of GDP for 2014 and 2015, respectively. For 2015, the difference between the balance based on unchanged legislation and that incorporated into the policy scenario (0.7 percentage points of GDP) is based on decisions to finance expenditure in the sectors deemed most important for economic growth and to reduce the fiscal burden on households and businesses, with the dual objective of supporting aggregate demand and the nation's competitiveness. Additional initiatives to cut public spending will ensure the partial financing of the measures described and more quality-oriented expenditure.

A slight improvement in the structural budget balance should be assured from 2014 to 2015. Finally, the fiscal consolidation process is to be reinforced starting from 2016, ensuring a net borrowing profile under the policy scenario that is consistent with an improvement of the structural budget balance (0.5 points of GDP) until breakeven is reached in 2017. The primary surplus under the policy scenario grows over the years, until reaching almost 4.0 per cent of GDP in 2018. The fiscal consolidation measures needed for achieving Medium-Term Objective will be detailed in the Stability Law for 2015.

In full compliance with European regulations, the macroeconomic forecasts contained in this Update have been validated by the Parliamentary Budget Office (PBO), the independent fiscal institution established in 2012 within the Parliament and become fully operational in recent months. The macroeconomic trend scenario for 2014 and 2015 has already secured the PBO's validation.

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | 1 |

UPDATE OF THE ECONOMIC AND FINANCIAL DOCUMENT 2014 |

TABLE I.1: PUBLIC FINANCE INDICATORS (% of GDP)1 |

| | | 2013 | | 2014 | | 2015 | | 2016 | | 2017 | | 2018 |

| SCENARIO BASED ON UNCHANGED LEGISLATION |

| Net borrowing | | -2.8 | | -3.0 | | -2.2 | | -1.8 | | -1.2 | | -0.8 |

| Primary balance | | 2.0 | | 1.7 | | 2.3 | | 2.7 | | 3.1 | | 3.4 |

| Interest | | 4.8 | | 4.7 | | 4.5 | | 4.5 | | 4.3 | | 4.2 |

| Net structural borrowing (2) | | -0.9 | | -1.2 | | -0.5 | | -0.6 | | -0.5 | | -0.6 |

| Change in structural balance | | 0.7 | | -0.3 | | 0.7 | | -0.1 | | 0.1 | | -0.1 |

| Public debt (including support and PA debt) (3) | | 127.9 | | 131.7 | | 133.7 | | 133.7 | | 132.1 | | 129.9 |

| Public debt (net of support) (3) | | 124.4 | | 127.9 | | 129.9 | | 129.9 | | 128.5 | | 126.3 |

| Public debt (net of support and PA debt) (3) | | 123.2 | | 125.0 | | 127.2 | | 127.3 | | 126.0 | | 124.0 |

| Planned annual reduction of public debt stock (proceeds from privatisations and other financial transactions) | | | | 0.3 | | 0.7 | | 0.7 | | 0.7 | | 0.7 |

| POLICY SCENARIO (5) |

| Net borrowing | | -2.8 | | -3.0 | | -2.9 | | -1.8 | | -0.8 | | -0.2 |

| Primary balance | | 2.0 | | 1.7 | | 1.6 | | 2.7 | | 3.4 | | 3.9 |

| Interest | | 4.8 | | 4.7 | | 4.5 | | 4.5 | | 4.2 | | 4.1 |

| Net structural borrowing (2) | | -0.7 | | -0.9 | | -0.9 | | -0.4 | | 0.0 | | 0.0 |

| Change in structural balance | | 0.8 | | -0.3 | | 0.1 | | 0.5 | | 0.4 | | 0.0 |

| Public debt (including support and PA debt) (3) | | 127.9 | | 131.6 | | 133.4 | | 131.9 | | 128.6 | | 124.6 |

| Public debt (net of support) (3) | | 124.4 | | 127.8 | | 129.7 | | 128.2 | | 125.0 | | 121.0 |

| Public debt (net of support and PA debt) (3) | | 123.2 | | 125.0 | | 126.9 | | 125.6 | | 122.6 | | 118.8 |

| MEMO: Economic and Financial Document (April 2014) |

| Net borrowing | | -3.0 | | -2.6 | | -1.8 | | -0.9 | | -0.3 | | 0.3 |

| Primary balance | | 2.2 | | 2.6 | | 3.3 | | 4.2 | | 4.6 | | 5.0 |

| Interest | | 5.3 | | 5.2 | | 5.1 | | 5.1 | | 4.9 | | 4.7 |

| Net structural borrowing (2) | | -0.8 | | -0.6 | | -0.1 | | 0.0 | | 0.0 | | 0.0 |

| Change in structural balance | | -0.6 | | -0.2 | | -0.5 | | -0.1 | | 0.0 | | 0.0 |

| Public debt (including support) (4) | | 132.6 | | 134.9 | | 133.3 | | 129.8 | | 125.1 | | 120.5 |

| Public debt (net of support) (4) | | 129.1 | | 131.1 | | 129.5 | | 126.1 | | 121.5 | | 116.9 |

| Nominal GDP (absolute value x 1,000) - unchanged legis. | | 1,618.9 | | 1,626.5 | | 1,642.8 | | 1,677.7 | | 1,723.1 | | 1.,770.9 |

| Nominal GDP (absolute value x 1,000) - policy scenario | | 1,618.9 | | 1,626.5 | | 1,646.5 | | 1,690.0 | | 1,742.3 | | 1,799.7 |

1) Slight discrepancies, if any, are due to rounding. 2) Net of one-off measures and cyclical component. 3) Inclusive or net of Italy's portion of EFSF loans to Greece and the ESM programme. For 2013, the amount of the loans to Member States of the EMU (bilateral or through the EFSF) was €44,156 billion. The value of the ESM programme at the end of 2013 was €11,465 billion (see Bank of Italy, Supplement to Statistical Bulletin The Public Finances, Borrowing Requirement and Debt, No. 49 of 12 September 2014). The policy-scenario estimates take into account proceeds from privatisations amounting to 0.28 per cent of GDP in 2014 and approximately 0.7 per cent of GDP for each year from 2015 to 2018. In addition, such estimates incorporate the assumption of a deferral of the exit from the Unified Public Treasury (starting in 2018 instead of 2015). The estimates include the proceeds from the repayment of bonds financed by the Treasury for the account of Monte dei Paschi di Siena, in an amount equal to approximately €3.0 billion in 2014 (first tranche paid in July 2014) and approximately €1.0 billion during the 2015-2016 period. The current scenario assumes that the spread between yields on 10-year Italian government securities and those on 10-year German bonds will fall from the current level in 2014 to 150 basis points in 2015 and 100 basis points in 2016 and 2017. 4) Inclusive or net of Italy's portion of loans to Member States of the EMU (bilateral or through the EFSF) and the ESM programme. For 2013, the amount of loans to Member States of the EMU (bilateral or through the EFSF) and the ESM programme was €55,620 billion. The estimates for the years 2014-2017 include the proceeds from privatisations amounting to approximately 0.7 percentage points of GDP per year. The year-on-year estimates included in the policy scenario include the proceeds from the repayment of the bonds financed by the Treasury for the account of Monte dei Paschi di Siena in the amount of approximately €4.0 billion with tranches during the 2014-2017 period. 5) The 2015 Stability Law includes a clause referring to VAT rates and other indirect taxes, with related revenues of €12.4 billion in 2016, €17.8 billion in 2017 and €21.4 billion in 2018. The effects of this clause, estimated with the ITEM macroeconomic model, would cause a decrease in GDP of 0.7 percentage points at the end of the period, due to an overall contraction of consumption and investment amounting to 1.3 percentage points and an increase in the GDP deflator of the same amount. |

| 2 | MINISTERO DELL’ECONOMIA E DELLE FINANZE |

I. OVERALL FRAMEWORK AND ECONOMIC-POLICY OBJECTIVES |

The Update to the 2014 EFD was presented by the government to the Italian Parliament after the deadline of 20 September set out in the law on public finance and accounting, with the delay occurring in consideration of the publication of annual data based on the new European system of national and regional accounts (ESA 2010). The use of the new ISTAT data is the premise for the preparation of a document consistent with the new statistical reporting method adopted at a European level.

The new data published by ISTAT used as the basis for the forecasts contained in this document are to be considered provisional. Should the release of the quarterly data on 15 October reflect significant changes in the quarterly growth rates of the various aggregates, so as to require significant adjustments to the forecasts, the government will present a special report to Parliament to revise the forecasts and, as a result, the fiscal policy targets, as required by the law on public finance and accounting.

In accordance with the provisions of the law on public finance and accounting regarding the mandatory content of the Update of the EFD, the net balance of the State budget to be financed under the policy scenario, net of any accounting adjustments, debt and VAT refunds, is equal to €-58 billion in 2015, €-27 billion in 2016 and €-15 billion in 2017.

Along with this Update, the government is presenting a special report to Parliament, as required by the law to implement the principle of a balanced structural budget, in order to update the Medium Term Objective realignment plan in view of the significant slowdown of the economy, which has made it necessary to revise the policy scenario targets.

In rounding out the 2015-2017 budget measures, the government presents the following legislative bills together with its budget proposal:

| | i. | the legislative bill incorporating measures for the reorganisation of the public administrations (A.S. 1577); |

| | ii. | the legislative bill incorporating measures for the spending review and the promotion of employment and investment in the cinema and live entertainment sectors; |

| | iii. | the draft of a delegated law for revision of the system of local government. |

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | 3 |

II. | MACROECONOMIC FRAMEWORK1 |

International scenario

The expansion of the global economy during the first half of 2014 was modest, and marked by a gradual slowdown in the growth of industrial production. A quarter-on-quarter decline in international trade in the first quarter was followed by growth in the second quarter.

The recovery varied from one economic area to another, with some countries gradually winding down the exceptional measures previously introduced to deal with the crisis, while other countries having to continue the pursuit of unconventional monetary-policy measures and reforms in order to consolidate their economic growth.

In the United States, the change in GDP in the second quarter of 2014 (+4.6 per cent on an annualised basis) signalled a decisive upturn after the first-quarter decline partly related to the wave of bad weather. Altogether, the U.S. economy seems to have embarked on a solid recovery, with the unemployment rate declining to 6.1 per cent and inflation at 1.7 per cent for the month of August. At its meeting on 17 September, the Federal Reserve's Federal Open Market Committee elected to pursue a tapering policy2, reducing its purchases of financial assets by USD 10 billion to position them at USD 15 billion per month, thereby nearing the end of the expansion of the U.S. central bank's activities.

With reference to the Asian economies, Japan is slowly moving back in the direction of moderate growth, after the broad-based decline in the levels of economic activity prompted by the increase of indirect taxation.

The Chinese economy logged a quarter-on-quarter change in GDP of 2.0 per cent in the second quarter of 2014 (up from 1.5 per cent in the first quarter), partly due to foreign demand and government incentives. However, the latest data point to a slowdown of the growth in the manufacturing sector.

The area of emerging countries has continued overall to contribute significantly to the growth of the international economy, even though some countries have suffered phases of difficulty.

After growing quarter-on-quarter by 0.2 per cent in the first quarter, the GDP for the Euro Area remained flat in the second quarter. In September, the European Central Bank (ECB) slightly revised downward the economic forecasts for the Euro Area, estimating GDP growth of 0.9 per cent in 2014, 1.6 per cent in 2015 and 1.9 per cent in 2016. The continuing weakness of domestic demand (and in particular, demand for investments) has been accompanied by underutilised plant capacity and high unemployment. In the credit market, the issuing of mortgage

1 This chapter has been prepared on the basis of information available at 22 September, on a basis consistent with the new ESA 2010 system. At such date, the quarterly profile of national accounting data was not available.

2 The term tapering refers to the reduction of the central bank's purchases of mortgage-backed securities (MBS) and long-term government securities.

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | 5 |

UPDATE OF THE ECONOMIC AND FINANCIAL DOCUMENT 2014 |

loans has stalled (whereas it is still contracting in some of the peripheral countries) and the steady decline of the inflation rate are factors presenting a risk of an anchoring medium-term expectations concerning the objective of an inflation rate of just under 2 per cent. To counter this trend, on 4 September, the ECB elected to cut interest rates once again, in the wake of similar intervention announced on 5 June. The easing regarded main refinancing operations (cut by 10 basis points), deposits and marginal lending facilities, whose rates are now set at 0.05 per cent, -0.20 per cent and 0.30 per cent, respectively. Alongside these measures, the ECB has decided to proceed with the purchase of asset-backed securities for the non-financial sector and securities issued by financial companies resident in the Euro Area (covered bond purchase programme). In addition, on 18 September, the central bank allocated €82.6 billion in the first of eight transactions announced to refinance the banking system (Targeted Longer-Term Refinancing Operation (TLTRO)). Those transactions are designed to facilitate the revival of credit and to improve the monetary-policy transmission mechanism.

The international macroeconomic scenario continues to improve overall. In August, the global PMI for the manufacturing sector improved slightly, and has remained firmly above the expansion indicator for some time. Expansionist tendencies are also evident in the services sector at a global level.

However, the trends of the main exogenous variables incorporated in the Update of the EFD are less favourable than those considered for the EFD. The downward revision began in the summer months (see, for example, the update of the IMF World Economic Outlook published in July). The forecast growth of global trade was reduced by 1 percentage point in 2014 (to 4.0 per cent) and by 0.8 percentage points in 2015 (to 5.1 per cent). The price of oil is projected to average USD 104.70/barrel in 2014, and to fall to USD 98.50/barrel in 2015. Finally, the euro is forecast to depreciate against the dollar, with the EUR/USD rate at 1.34 in 2014 and progressing further to 1.29 in 20153.

| TABLE II.1: INTERNATIONAL EXOGENOUS VARIABLES | |

| | | 2014 | | | 2015 | |

| | EFD 2014 | | | EFD Update | | | EFD 2014 | | | EFD Update | |

| International trade (% change) | | | 5.0 | | | | 4.0 | | | | 5.9 | | | | 5.1 | |

| Oil price (USD/barrel, Brent) | | | 104.1 | | | | 104.7 | | | | 99.6 | | | | 98.5 | |

EUR/USD exchange rate | | | 1.362 | | | | 1.340 | | | | 1.362 | | | | 1.294 | |

The risks to growth in relation to geopolitical tensions in some areas of the world have continued, and indeed intensified. Adverse developments in the crises in Ukraine and the Middle East could drive the price of oil higher, along with the prices of other energy goods. In addition, the sanctions taken against Russia are starting to negatively influence economic performance, particularly in Europe. If maintained over a long period, the sanctions could diminish growth prospects. Additional risks regard i) the American and Chinese property markets and ii) the

3 For the price of oil and the EUR/USD exchange rate, reference has been made to the traditional technical assumption of the average for the ten business days ending on 17 September. The changes in these variables between 2014 and 2015 are therefore based on such levels, which are less than those recorded on average during the first half of 2014.

| 6 | MINISTERO DELL’ECONOMIA E DELLE FINANZE |

II. MACROECONOMIC FRAMEWORK |

Euro Area's difficulties in returning to significant rates of growth while reducing the sharp domestic imbalances. The bilateral nominal exchange rates between the world's leading currencies have shown relative stability. The ECB's recent intervention and its introduction of additional measures could depress the value of the euro against other currencies. Unless appropriately addressed through accommodating monetary and fiscal policies, the weakness of domestic demand and the steady decline of inflation in the Euro Area could trigger risks of a deflationary spiral.

The Italian economy

Contrary to what had been expected until the spring, the first half of 2014 was marked by another contraction of Italy's GDP. The gradual easing of the recession during 2013, the year-on-year growth of GDP in the final quarter (the most recent statistical figure available), and additional, significant improvement in confidence and order indicators had oriented the expectations in the direction of a gradual recovery of the economy during 2014.

The data for the first two quarters of 2014, which were announced by ISTAT subsequent to the publication of the EFD, have presented a different picture of the situation. From a technical point of view, the contraction of GDP for two consecutive quarters (-0.1 per cent and -0.2 per cent, respectively) has confirmed that Italy's economy has entered into recession for the third time since 2009. However, the intense contraction of employment and of the productive capacity (decrease in the number of businesses) that occurred during 2012-2013 can essentially be considered to have ended. In view of the very limited year-on-year changes in GDP in the most recent four quarters, the current phase can be more correctly described as a period of stagnation. Despite slight improvement in financial conditions, a less restrictive fiscal policy, and an international economic scenario which remains uncertain but is no longer recessionary, Italy's GDP shows no signs of growth yet.

Although starting to cause structural improvement, the reforms effected have not yet been capable of reversing the cyclical trend, whereas the policy mix continues to remain unfavourable, thus negatively influencing the trend of aggregate demand.

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | 7 |

UPDATE OF THE ECONOMIC AND FINANCIAL DOCUMENT 2014 |

| FIGURE II.1: NET FLOWS OF EMPLOYMENT AND NEW BUSINESSES |

| |

| Note: The seasonally adjusted data related to new businesses are MEF calculations using Infocamere data. |

| Source: ISTAT, Infocamere. |

Modestly encouraging indications come from the slight expansion of private consumption (+0.1 per cent for two consecutive quarters) in the first half of 2014. Instead, investments contracted by approximately 2 percentage points. The negative figure is not only due to the construction sector, which by now has been in difficulty for several years, but also to a decrease in the purchases of machinery and equipment, which reflects the weakness of the economic cycle and the persistence of negative expectations about near-term development of the economy. Exports have continued to grow, albeit at a modest pace; in contrast, a rebound in imports in the second quarter of the year eroded the foreign sector's positive contribution to growth generally recorded during recent years.

The labour market has felt the effects of the economy's weakness. The unemployment rate remains close to an historical high (12.6 per cent in the second quarter of 2014) and is at an unacceptable level for the population under 25 years old (more than 40 per cent). The level of employment has essentially stabilised, but it has not yet shown any signs of recovery.

Also worth noting is the drop in the inflation rate; in the month of August, the level of the prices experienced a negative change for the first time. Although a part of the reduction is related to volatile components, the trend was seen in the majority of economic sectors.

Forecasts

During recent months, the leading indicators, and in particular, the confidence indices, suffered setbacks with respect to the decidedly encouraging levels posted during the first part of the year. The most recent figure available on manufacturing production (month of July) reflects a contraction of approximately 1.0 percentage point; the result for production in the construction sector was even worse. Despite the presence of some encouraging data vis-à-vis the data for

| 8 | MINISTERO DELL’ECONOMIA E DELLE FINANZE |

II. MACROECONOMIC FRAMEWORK |

industry (such as, for example, the trend of registrations of new auto vehicles, and more in general, signs of the substantial resilience of consumption), the GDP profile looks poised to remain flat in the second half of 2014, with a possible further slight contraction in the third quarter. In terms of annual growth, 2014 should end with a negative year-on-year change of 0.3 percentage points.

FOCUS | Revision of the growth estimates This Update of the EFD incorporates a downward revision of the official growth forecasts for 2014 and 2015. The purpose of this box is to provide clarification on the significant shift (approximately 1.0 percentage point) compared with the values set out in the EFD published in April. The projection contained in the EFD, which was prepared near the end of March, was consistent with all of the information then available. During 2013, the economic crisis had gradually abated, and the year ended with a positive quarter-on-quarter change in the final quarter; in addition, the leading indicators (such as consumer confidence and business confidence) had reached particularly favourable levels, continuing the strong trend of improvement already seen in the second half of 2013. The international exogenous framework (containing growth assumptions about global demand, the trends of prices for goods, services and commodities at an international level, and the trends of the financial markets) was in line with that outlined by leading institutions that prepare macroeconomic forecasts; from this standpoint, as clarified various times in the official planning documents, there is a precise restriction on alignment with the exogenous variables used by the European Commission. At the time of publication, the Italian government's GDP growth forecasts were very close to the forecasts published by leading Italian and foreign institutions that prepare macroeconomic forecasts (see table on page 7 of the 2014 Stability Programme) and just above the averages published by Consensus Economics in March. However, consensus estimates have time and again been slow to reflect changes in the economy; not all research institutes change their estimates every month; at a time when growth estimates are revised upward, the average consensus estimate rises only gradually and vice versa. This is also true during the current phase, when forecasts are being revised down. Indeed, the consensus estimates for September do not completely incorporate the contraction of GDP in the second quarter of 2014, and indicate an annual change in GDP of -0.1 per cent; this figure is more optimistic than the forecasts just updated by the government. The models used at the Department of the Treasury can explain most of the downward revision of the growth forecasts, attributing it to the change in assumptions in comparison with the estimates published in the EFD. The attached table presents the effects of the principal determinants for 2014 and 2015. A significant factor behind the revision is the change in the international framework, which appeared more favourable at the end of March. Putting the new assumptions and ‘re-simulating’ the econometric model as from the first quarter of 2014, the annual growth is approximately 0.5 percentage points lower. A more detailed analysis points to lower growth of international trade and different behaviour of the prices of international competitors (in particular, those within the Euro Area), as the most significant factors among the exogenous variables. With reference to this latter aspect, it is noted that the decrease in prices of the manufactured goods of competitor countries is greater than that assumed, and the expected gain in Italy's price competitiveness did not fully materialise. The shifts with respect to the assumptions about exchange rates, interest rates (for the most part) and commodities are more modest, and have only a minor impact on the revision. |

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | 9 |

UPDATE OF THE ECONOMIC AND FINANCIAL DOCUMENT 2014 |

| | FACTORS BEHIND THE REVISION OF THE RATES OF GROWTH ESTIMATED BY THE 2014 EFD |

| | | 2014 | 2015 |

| | Effect of international exogenous variables | -0.5 | -0.5 |

| | Introduction of Decree-Law No. 66/2014 | 0.0 | 0.1 |

| | Revision of the effects of the payment of general government trade debts | -0.5 | -0.1 |

| | Revision of the effects of 2012-2013 reforms | -0.2 | -0.2 |

| | Another aspect that contributes to explaining the revision is the estimate of the effects of economic policy on growth. The policy-scenario forecasts for 2014 incorporate the new measures undertaken (and made operative) by the government following the approval of the EFD. This is the case of Decree-Law No. 66/2014 which, unlike the other factors influencing the revision, has led to an upward revision of the growth estimates4. Instead, there is a significant downward revision of the estimate of the effects of the measures already in effect at the time of the approval of the EFD, and it refers to two items. The first is related to the payment of the general government's trade debts. Even though budget appropriations were made and adequate sums were made available to the debtor entities, the schedule of the payments made has been more gradual (due to administrative problems) than that incorporated into the EFD forecasts. As a result, the expansionist stimulus estimated is now less immediate and spread over a longer period. In addition, without prejudice to the other positive effects of the measure and its fundamental validity in supporting businesses, the impact on private investments is believed to have been overstated. The revision of the effects of economic-policy measures also refers to some of the reform measures implemented in 2012-2013. In this case, the short- and medium-term impact of several measures has been scaled down in view of the existing delays in implementation. The revision of the growth forecasts for 2016 and the later years, especially in terms of the policy scenario, is mainly due to this component; however, the reduction of the expected rates of growth of international trade has also had an impact. |

FOCUS | The forecasting errors in official estimates This section analyzes the forecasting errors contained in the official planning documents of recent years, comparing them with the errors made by other entities preparing forecasts. Tables R1 and R2 report the results of an analysis carried out with respect to the economic growth forecasts formulated roughly on a semi-annual basis for the 2006-2013 period. In particular, table R1 presents an analysis of the errors made by the government and by leading Italian and foreign institutions preparing macroeconomic projections with respect to current-year growth forecasts prepared during the spring (S columns) and the autumn (A columns)5. The table also contains several summary indicators about the forecast, such as the mean error, the mean absolute error and the mean squared error. As shown by the table regarding current-year forecasts, the government overestimated economic growth by an average of 0.5 percentage points with its spring forecast and by 0.2 percentage points with its autumn forecast. This overestimation is, however, a common trait of all of the forecasts considered; the government's overestimation is just 0.1 percentage points over the average overestimation of the other forecasts considered with reference to |

4 The decree, though fully implemented as of the second half of 2014, presents a positive value only in 2015. The delays of transmission to the economy within the econometric model's structure suggest that the greatest effects will be seen in 2015; although present, the positive impact on 2014 is smaller and not visible in the table. It is noted that the Decree-Law No. 66 affects the structure of taxation only for 2014; the effects of a permanent reduction in the personal income tax rates and rates for the regional tax on productive activity, and the related financial coverage, are included within the policy-scenario macroeconomic framework.

5 For example, in the EFD presented in the spring of 2013, the government indicated a decrease of GDP of -1.3 per cent in 2013. Later (on 1 March 2014), ISTAT announced a change of -1.9 per cent, which corresponds to a forecast error of 0.6 per cent as reported in the second part of the table, together with the corresponding errors committed by the leading institutions chosen for a comparison.

| 10 | MINISTERO DELL’ECONOMIA E DELLE FINANZE |

II. MACROECONOMIC FRAMEWORK |

| | the spring forecasts, whereas it is practically equal with regard to the autumn forecasts. It is also noted that the forecast error was particularly significant for 2008 and for 2012. With regard to subsequent-year forecasts (table R2), the government overestimated growth by an average of 2.2 per cent. In this case, the errors are concentrated in the years of 2009, 2012 and 2013. The error is thus likely to be largely attributable to the difficulty of accurately evaluating the intensity of the ongoing recessions (for current-year forecasts) and of predicting the start of a crisis (for subsequent-year forecasts). The overestimation was seen in all of the forecasts prepared by the leading institutions. |

| | TABLE R1 - GOVERNMENT'S CURRENT-YEAR FORECASTS |

| | | Forecasts for the year t |

| | | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 |

| | | S (a) | A | S | A | S | A | S | A | S | A | S | A | S | A | S | A |

| | Government | 1.5 | 1.6 | 2.0 | 1.9 | 0.5 | 0.1 | -5.2 | -4.8 | 1.0 | 1.2 | 1.1 | 0.7 | -1.2 | -2.4 | -1.3 | -1.7 |

| | Consensus forecast | 1.2 | 1.6 | 1.8 | 1.8 | 0.6 | 0.2 | -3.6 | -5.0 | 0.8 | 1.0 | 1.0 | 0.7 | -1.5 | -2.2 | -1.4 | -1.7 |

| | OECD | 1.4 | 1.8 | 2.0 | 1.8 | 0.5 | -0.4 | -5.5 | -4.8 | 1.1 | 1.0 | 1.1 | 0.7 | -1.7 | -2.2 | -1.5 | -1.9 |

| | IMF | 1.2 | 1.5 | 1.8 | 1.7 | 0.3 | -0.1 | -4.5 | -5.1 | 0.8 | 1.0 | 1.1 | 0.6 | -1.9 | -2.3 | -1.5 | -1.8 |

| | EU Commission | 1.3 | 1.7 | 1.9 | 1.9 | 0.5 | 0.0 | -4.4 | -4.7 | 0.8 | 1.1 | 1.0 | 0.5 | -1.4 | -2.3 | -1.3 | -1.8 |

| | GDP ISTAT | 1.9 | 1.5 | -1.0 | -5.0 | 1.3 | 0.4 | -2.4 | -1.9 |

| | | Forecast error for the year t |

| | | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 |

| | | S | A | S | A | S | A | S | A | S | A | S | A | S | A | S | A |

| | Government | -0.4 | -0.3 | 0.5 | 0.4 | 1.5 | 1.1 | -0.2 | 0.2 | -0.3 | -0.1 | 0.7 | 0.3 | 1.2 | 0.0 | 0.6 | 0.2 |

| | Average (b) | -0.6 | -0.2 | 0.4 | 0.3 | 1.5 | 1.0 | 0.5 | 0.1 | -0.4 | -0.3 | 0.6 | 0.2 | 0.8 | 0.2 | 0.5 | 0.1 |

| | Consensus forecast | -0.7 | -0.3 | 0.3 | 0.3 | 1.6 | 1.2 | 1.4 | 0.0 | -0.5 | -0.3 | 0.6 | 0.3 | 0.9 | 0.2 | 0.5 | 0.2 |

| | OECD | -0.5 | -0.1 | 0.5 | 0.3 | 1.5 | 0.6 | -0.5 | 0.2 | -0.2 | -0.3 | 0.7 | 0.3 | 0.7 | 0.2 | 0.4 | 0.0 |

| | IMF | -0.7 | -0.4 | 0.3 | 0.2 | 1.3 | 1.0 | 0.6 | -0.1 | -0.5 | -0.3 | 0.7 | 0.2 | 0.5 | 0.1 | 0.4 | 0.1 |

| | EU Commission | -0.6 | -0.2 | 0.4 | 0.4 | 1.5 | 1.0 | 0.6 | 0.3 | -0.5 | -0.2 | 0.6 | 0.1 | 1.0 | 0.1 | 0.6 | 0.1 |

| | | | |

| | | Forecast error statistics | |

| | | Mean error | Mean absolute error | Mean squared error | |

| | | S | A | S | A | S | A | |

| | Government | 0.5 | 0.2 | 0.7 | 0.3 | 0.8 | 0.5 | |

| | Average (b) | 0.4 | 0.2 | 0.7 | 0.3 | 0.7 | 0.4 | |

| | Consensus forecast | 0.5 | 0.2 | 0.8 | 0.4 | 0.9 | 0.5 | |

| | OECD | 0.3 | 0.2 | 0.6 | 0.3 | 0.7 | 0.3 | |

| | IMF | 0.3 | 0.1 | 0.6 | 0.3 | 0.7 | 0.4 | |

| | EU Commission | 0.5 | 0.2 | 0.7 | 0.3 | 0.8 | 0.4 | |

| | (a) S and A indicate, respectively, the forecasts prepared in the spring and autumn. (b) Average between Consensus forecast, OECD, IMF and EU Commission. Source: Analyses using data from ISTAT, MEF, Consensus Economics, OECD, IMF, EU Commission. | |

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | 11 |

UPDATE OF THE ECONOMIC AND FINANCIAL DOCUMENT 2014 |

| | TABLE R2 - GOVERNMENT'S SUBSEQUENT-YEAR FORECASTS |

| | | Forecasts for the year t+1 |

| | | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 |

| | | S (a) | A | S | A | S | A | S | A | S | A | S | A | S | A |

| | Government | 1.5 | 1.3 | 1.9 | 1.5 | 0.9 | 0.5 | 0.5 | 0.7 | 1.5 | 1.3 | 1.3 | 0.6 | 0.5 | -0.2 |

| | Consensus forecast | 1.2 | 1.2 | 1.6 | 1.5 | 1.1 | 0.5 | 0.0 | 0.5 | 1.1 | 1.0 | 1.1 | 0.3 | 0.2 | -0.6 |

| | OECD | 1.3 | 1.4 | 1.7 | 1.3 | 0.9 | -1.0 | 0.4 | 1.1 | 1.5 | 1.3 | 1.6 | -0.5 | -0.4 | -1.0 |

| | IMF | 1.4 | 1.3 | 1.7 | 1.3 | 0.3 | -0.2 | -0.4 | 0.2 | 1.2 | 1.0 | 1.3 | 0.3 | -0.3 | -0.7 |

| | EU Commission | 1.2 | 1.4 | 1.7 | 1.4 | 0.8 | 0.0 | 0.1 | 0.7 | 1.4 | 1.1 | 1.3 | 0.1 | 0.4 | -0.5 |

| | GDP ISTAT | 1.5 | -1.0 | -5.0 | 1.3 | 0.4 | -2.4 | -1.9 |

| | | Forecast error for the year t+1 |

| | | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 |

| | | S | A | S | A | S | A | S | A | S | A | S | A | S | A |

| | Government | 0.0 | -0.2 | 2.9 | 2.5 | 5.9 | 5.5 | -0.8 | -0.6 | 1.1 | 0.9 | 3.7 | 3.0 | 2.4 | 1.7 |

| | Average (b) | -0.2 | -0.1 | 2.7 | 2.4 | 5.8 | 4.9 | -1.3 | -0.7 | 0.9 | 0.7 | 3.7 | 2.5 | 1.9 | 1.2 |

| | Consensus forecast | -0.2 | -0.3 | 2.6 | 2.5 | 6.1 | 5.6 | -1.3 | -0.8 | 0.7 | 0.6 | 3.5 | 2.7 | 2.1 | 1.3 |

| | OECD | -0.2 | -0.1 | 2.7 | 2.3 | 5.9 | 4.0 | -0.9 | -0.2 | 1.1 | 0.9 | 4.0 | 1.9 | 1.5 | 0.9 |

| | IMF | -0.1 | -0.2 | 2.7 | 2.3 | 5.3 | 4.8 | -1.7 | -1.1 | 0.8 | 0.6 | 3.7 | 2.7 | 1.6 | 1.2 |

| | EU Commission | -0.3 | -0.1 | 2.7 | 2.4 | 5.8 | 5.0 | -1.2 | -0.6 | 1.0 | 0.7 | 3.7 | 2.5 | 2.3 | 1.4 |

| | | | Forecast error statistics | | | |

| | | | | Mean error | | Mean absolute error | | Mean squared error | | | | |

| | | | | S | A | | S | A | | S | A | | | | |

| | Government | | | 2.2 | 1.8 | | 2.1 | 1.8 | | 2.9 | 2.5 | | | | |

| | Average (b) | | | 1.9 | 1.5 | | 2.1 | 1.6 | | 2.8 | 2.2 | | | | |

| | Consensus forecast | | | 1.9 | 1.7 | | 2.1 | 1.7 | | 2.8 | 2.4 | | | | |

| | OECD | | | 2.0 | 1.4 | | 2.0 | 1.3 | | 2.8 | 1.8 | | | | |

| | IMF | | | 1.8 | 1.5 | | 2.0 | 1.6 | | 2.6 | 2.2 | | | | |

| | EU Commission | | | 2.0 | 1.6 | | 2.1 | 1.6 | | 2.8 | 2.2 | | | | |

| | (a)(a) S and A indicate, respectively, the forecasts prepared in the spring and autumn. (b)Average between Consensus forecast, OECD, IMF and EU Commission. |

| | The same analysis was carried out with regard to the inflation forecast. In this case, however, it was not possible to effect a precise comparison of perfectly standard aggregates. While the government publishes the forecast based on the consumption deflator, the only forecast available for the other institutions jointly considered is that with reference to consumer prices. In order to make the estimates comparable, the government's forecast error (tables R3 and R4) is computed by assuming that the forecast with reference to consumer prices implicit in the official documents is equal to the forecast with reference to the private consumption deflator, plus the differential historically observed, during the period examined, between i) the consumer price index and ii) the private consumption deflator, which is equal to just under 0.2 per cent. Based on the analysis done with reference to current-year forecasts, the government's error was close to zero. The forecast error for the other institutions is also close to zero for the same period. The analysis of the errors relative to subsequent-year forecasts show that the government's forecasts of inflation were substantially correct on average, whereas the forecasts of the other institutions were slightly underestimated. Similar considerations apply for the magnitude of the mean absolute error and mean squared error. |

| 12 | MINISTERO DELL’ECONOMIA E DELLE FINANZE |

II. MACROECONOMIC FRAMEWORK |

| | TABLE R3 - GOVERNMENT'S CURRENT-YEAR FORECASTS |

| | | Forecasts for the year t |

| | | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 |

| | | S (a) | A | S | A | S | A | S | A | S | A | S | A | S | A | S | A |

| | Government (b) | 2.5 | 2.6 | 1.9 | 1.8 | 3.4 | 3.8 | 0.1 | 0.1 | 1.4 | 1.6 | 2.3 | 2.6 | 2.8 | 2.6 | 2.0 | 1.5 |

| | Deflator-prices link | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 |

| | Government (c) | 2.7 | 2.8 | 2.1 | 2.0 | 3.6 | 4.0 | 0.3 | 0.3 | 1.6 | 1.8 | 2.5 | 2.8 | 3.0 | 2.8 | 2.2 | 1.7 |

| | Consensus forecast (d) | 2.0 | 2.2 | 1.8 | 1.8 | 2.9 | 3.6 | 0.8 | 0.8 | 1.5 | 1.5 | 2.4 | 2.6 | 3.0 | 3.1 | 1.9 | 1.5 |

| | OECD (e) | 2.4 | 2.2 | 2.0 | 1.8 | 3.3 | 3.5 | 0.9 | 0.8 | 1.2 | 1.6 | 2.5 | 2.7 | 3.3 | 3.2 | 1.6 | 1.4 |

| | IMF (e) | 2.5 | 2.4 | 2.1 | 1.9 | 2.5 | 3.4 | 0.7 | 0.7 | 1.4 | 1.6 | 2.0 | 2.6 | 2.5 | 3.0 | 2.0 | 1.6 |

| | EU Commission (e) | 2.2 | 2.3 | 1.9 | 1.9 | 3.0 | 3.6 | 0.8 | 0.8 | 1.8 | 1.6 | 2.6 | 2.7 | 3.2 | 3.3 | 1.6 | 1.5 |

| | Consumption deflator | 2.6 | 2.2 | 3.1 | -0.1 | 1.5 | 2.8 | 2.7 | 1.3 |

| | Consumer prices (e) | 2.2 | 2.0 | 3.5 | 0.8 | 1.6 | 2.9 | 3.3 | 1.3 |

| | | Forecast error for the year t |

| | | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 |

| | | S | A | S | A | S | A | S | A | S | A | S | A | S | A | S | A |

| | Government (b) | -0.1 | 0.0 | -0.3 | -0.4 | 0.3 | 0.7 | 0.2 | 0.2 | -0.1 | 0.1 | -0.5 | -0.2 | 0.1 | -0.1 | 0.7 | 0.2 |

| | Government (c) | 0.5 | 0.6 | 0.1 | 0.0 | 0.1 | 0.5 | -0.5 | -0.5 | 0.0 | 0.2 | -0.4 | -0.1 | -0.3 | -0.5 | 0.9 | 0.4 |

| | Average (f) | 0.1 | 0.1 | -0.1 | -0.2 | -0.6 | 0.0 | 0.0 | 0.0 | -0.1 | 0.0 | -0.5 | -0.3 | -0.3 | -0.2 | 0.5 | 0.2 |

| | Consensus | -0.2 | 0.0 | -0.2 | -0.2 | -0.6 | 0.1 | 0.0 | 0.0 | -0.1 | -0.1 | -0.5 | -0.3 | -0.3 | -0.2 | 0.6 | 0.2 |

| | OECD | 0.2 | 0.0 | 0.0 | -0.2 | -0.2 | 0.0 | 0.1 | 0.0 | -0.4 | 0.0 | -0.4 | -0.2 | 0.0 | -0.1 | 0.3 | 0.1 |

| | IMF | 0.3 | 0.2 | 0.1 | -0.1 | -1.0 | -0.1 | -0.1 | -0.1 | -0.2 | 0.0 | -0.9 | -0.3 | -0.8 | -0.3 | 0.7 | 0.3 |

| | EU Commission | 0.0 | 0.1 | -0.1 | -0.1 | -0.5 | 0.1 | 0.0 | 0.0 | 0.2 | 0.0 | -0.3 | -0.2 | -0.1 | 0.0 | 0.3 | 0.2 |

| | | Forecast error statistics |

| | | | | Mean error | | Mean absolute error | | Mean squared error | | | | | | |

| | | | | S | A | | S | A | | S | A | | | | | | |

| | Government (b) | | | 0.0 | 0.1 | | 0.3 | 0.3 | | 0.3 | 0.3 | | | | | | |

| | Government (c) | | | 0.0 | 0.1 | | 0.4 | 0.4 | | 0.4 | 0.4 | | | | | | |

| | Average (f) | | | -0.1 | 0.0 | | 0.3 | 0.1 | | 0.3 | 0.1 | | | | | | |

| | Consensus forecast | | | -0.2 | -0.1 | | 0.3 | 0.1 | | 0.4 | 0.2 | | | | | | |

| | OECD | | | -0.1 | 0.0 | | 0.2 | 0.1 | | 0.3 | 0.1 | | | | | | |

| | IMF | | | -0.2 | -0.1 | | 0.5 | 0.2 | | 0.6 | 0.2 | | | | | | |

| | EU Commission | | | -0.1 | 0.0 | | 0.2 | 0.1 | | 0.2 | 0.1 | | | | | | |

| | (a) S and A indicate, respectively, the forecasts prepared in the spring and autumn. (b) Private consumption deflator. (c) Forecast of consumer prices is consistent with the forecast of the private consumption deflator. (d) Consumer prices. (e) Harmonised index of consumer prices. (f) Average between Consensus forecast, OECD, IMF and EU Commission. Source: Analyses using data from ISTAT, MEF, Consensus Economics, OECD, IMF, EU Commission. |

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | 13 |

UPDATE OF THE ECONOMIC AND FINANCIAL DOCUMENT 2014 |

| | TABLE R4 - GOVERNMENT'S CURRENT-YEAR FORECASTS |

| | | Forecasts for the year t+1 |

| | | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 |

| | | S | A | S | A | S | A | S | A | S | A | S | A | S | A |

| | Government (b) | 2.0 | 2.0 | 1.9 | 2.0 | 2.1 | 2.8 | 1.4 | 1.5 | 1.8 | 1.8 | 2.0 | 1.9 | 2.1 | 2.0 |

| | Deflator-prices link | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 |

| | Government (c) | 2.2 | 2.2 | 2.1 | 2.2 | 2.3 | 3.0 | 1.6 | 1.7 | 2.0 | 2.0 | 2.2 | 2.1 | 2.3 | 2.2 |

| | Consensus forecast (d) | 1.9 | 1.9 | 1.9 | 1.9 | 2.1 | 2.7 | 1.6 | 1.5 | 1.8 | 1.8 | 2.0 | 1.9 | 2.4 | 2.2 |

| | OECD (e) | 2.1 | 1.9 | 2.1 | 2.3 | 2.0 | 1.7 | 1.2 | 1.1 | 1.0 | 1.5 | 1.7 | 1.7 | 2.3 | 1.9 |

| | IMF (e) | 2.1 | 2.1 | 2.0 | 1.9 | 1.9 | 1.9 | 0.6 | 0.9 | 1.7 | 1.7 | 2.1 | 1.6 | 1.8 | 1.8 |

| | EU Commission (e) | 2.0 | 2.0 | 2.0 | 2.0 | 2.2 | 2.0 | 1.8 | 1.8 | 2.0 | 1.8 | 1.9 | 2.0 | 2.3 | 2.0 |

| | Consumption deflator | 2.2 | 3.1 | -0.1 | 1.5 | 2.8 | 2.7 | 1.3 |

| | Consumer prices (e) | 2.0 | 3.5 | 0.8 | 1.6 | 2.9 | 3.3 | 1.3 |

| | | Forecast error for the year t+1 |

| | | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 |

| | | S | A | S | A | S | A | S | A | S | A | S | A | S | A |

| | Government (b) | -0.2 | -0.2 | -1.2 | -1.1 | 2.2 | 2.9 | -0.1 | 0.0 | -1.0 | -1.0 | -0.7 | -0.8 | 0.8 | 0.7 |

| | Government (c) | 0.2 | 0.2 | -1.4 | -1.3 | 1.5 | 2.2 | 0.0 | 0.1 | -0.9 | -0.9 | -1.1 | -1.2 | 1.0 | 0.9 |

| | Average (f) | 0.0 | -0.1 | -1.4 | -1.4 | 1.5 | 1.5 | -0.3 | .0.2 | -1.3 | -1.2 | -1.2 | -1.4 | 0.9 | 0.7 |

| | Consensus forecast | -0.1 | -0.1 | -1.6 | -1.6 | 1.3 | 1.9 | 0.0 | -0.1 | -1.1 | -1.1 | -1.3 | -1.4 | 1.1 | 0.9 |

| | OECD | -0.1 | -0.3 | -1.0 | -0.8 | 2.1 | 1.8 | -0.3 | -0.4 | -1.8 | -1.3 | -1.0 | -1.0 | 1.0 | 0.6 |

| | IMF | 0.1 | 0.1 | -1.5 | -1.6 | 1.1 | 1.1 | -1.0 | -0.7 | -1.2 | -1.2 | -1.2 | -1.7 | 0.5 | 0.5 |

| | EU Commission | 0.0 | 0.0 | -1.5 | -1.5 | 1.4 | 1.2 | 0.2 | 0.2 | -0.9 | -1.1 | -1.4 | -1.3 | 1.0 | 0.7 |

| | | Forecast error statistics |

| | | Mean error | | Mean absolute error | | Mean squared error | | | | | | |

| | | S | A | | S | A | | S | A | | | | | | |

| | Government (b) | 0.0 | 0.1 | | 0.9 | 1.0 | | 1.1 | 1.3 | | | | | | |

| | Government (c) | -0.1 | 0.0 | | 0.9 | 1.0 | | 1.0 | 1.2 | | | | | | |

| | Average (f) | -0.3 | -0.3 | | 0.9 | 0.9 | | 1.1 | 1.1 | | | | | | |

| | Consensus forecast | -0.2 | -0.2 | | 0.9 | 1.0 | | 1.1 | 1.2 | | | | | | |

| | OECD | -0.2 | -0.2 | | 1.0 | 0.9 | | 1.2 | 1.0 | | | | | | |

| | IMF | -0.5 | -0.5 | | 0.9 | 1.0 | | 1.0 | 1.1 | | | | | | |

| | EU Commission | -0.2 | -0.3 | | 0.9 | 0.9 | | 1.1 | 1.0 | | | | | | |

| | (a) S and A indicate, respectively, the forecasts prepared in the spring and autumn. (b) Private consumption deflator. (c) Forecast with reference to consumer prices consistent with the forecast referring to the private consumption deflator. (d) Consumer prices. (e) Harmonised index of consumer prices. (f) Average between Consensus forecast, OECD, IMF and EU Commission. Source: Analyses using data from ISTAT, MEF, Consensus Economics, OECD, IMF, EU Commission. |

This Update of the EFD makes a distinction between a forecast based on unchanged legislation and a forecast based on the policy scenario. The difference in terms of economic growth for 2014 is nil, whereas the two forecasts gradually diverge in the later years. The two scenarios incorporate the same assumptions with reference to the international macroeconomic framework, on a basis consistent with the most recent projections of leading international institutions, but they differ with respect to the assumptions about economic reforms.

The projections based on unchanged legislation incorporate the effects on the economy of the economic-policy actions, structural reforms and fiscal policy, implemented prior to the presentation of the Update, including measures taken by previous governments. In the case of the initiatives approved by the previous governments, the projections take into account only those that were immediately effective (namely, those that did not require any implementation measures by the general government) or those that are in the phase of realisation.

The forecasts based on unchanged legislation suggest that Italy's overall economic situation could be more favourable starting from the first quarters of 2015. Financing conditions, which have already improved during recent months, should contribute to creating a framework more supportive to the recovery of domestic demand. Finally, there are increased signs that the credit crunch is easing, and that credit should be expanding once again during the coming year.

| 14 | MINISTERO DELL’ECONOMIA E DELLE FINANZE |

II. MACROECONOMIC FRAMEWORK |

The initiatives undertaken by the ECB (see the Focus ‘Trend of the financial markets, the banking sector and the financing of businesses’) should also contribute to stimulating the financing of the productive sector; the effects of the measures adopted in recent years designed to facilitate SMEs' access to credit, including outside of the banking industry, should also be more visible.

At the same time, the conditions are in place that will allow Italian exports to continue to support aggregate demand. The stagnation of demand within the Euro Area and other important end markets in 2014 should be gradually overcome. Leaving aside the government's other actions, the Italian economy looks capable of growing by 0.5 percentage points during 2015, inclusive of the negative statistical carry-over effect from 2014 (equal to -0.2 percentage points).

| TABLE II.2: MACROECONOMIC FRAMEWORK BASED ON UNCHANGED LEGISLATION (% changes, unless indicated otherwise) | |

| | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | 2018 | |

| INTERNATIONAL EXOGENOUS VARIABLES | | | | | | | | | | | | | | | | | | |

| International trade | | | 3.0 | | | | 4.0 | | | | 5.1 | | | | 5.2 | | | | 5.2 | | | | 5.4 | |

| Oil price (Fob, Brent) | | | 108.6 | | | | 104.7 | | | | 98.5 | | | | 98.5 | | | | 98.5 | | | | 98.5 | |

EUR/USD exchange rate | | | 1.328 | | | | 1.340 | | | | 1.294 | | | | 1.294 | | | | 1.294 | | | | 1.294 | |

| ITALY MACRO DATA (VOLUMES) | | | | | | | | | | | | | | | | | | | | | | | | |

| GDP | | | -1.9 | | | | -0.3 | | | | 0.5 | | | | 0.8 | | | | 1.1 | | | | 1.2 | |

| Imports | | | -2.7 | | | | 1.8 | | | | 3.3 | | | | 3.2 | | | | 3.3 | | | | 3.3 | |

| Final national consumption (1) | | | -2.3 | | | | 0.2 | | | | 0.3 | | | | 0.6 | | | | 0.9 | | | | 1.0 | |

| Household consumption | | | -2.8 | | | | 0.1 | | | | 0.5 | | | | 0.9 | | | | 1.2 | | | | 1.2 | |

| Government expenditure | | | -0.7 | | | | 0.3 | | | | -0.2 | | | | -0.3 | | | | 0.0 | | | | 0.1 | |

| Investments | | | -5.4 | | | | -2.1 | | | | 0.5 | | | | 1.6 | | | | 2.0 | | | | 2.3 | |

| - machinery, equipment and other | | | -3.8 | | | | -1.4 | | | | 1.2 | | | | 2.2 | | | | 2.6 | | | | 2.9 | |

| - construction | | | -6.8 | | | | -2.8 | | | | -0.2 | | | | 1.1 | | | | 1.5 | | | | 1.6 | |

| Exports | | | 0.6 | | | | 1.9 | | | | 2.8 | | | | 3.0 | | | | 3.1 | | | | 3.2 | |

| Memo item: Current account balance (% GDP) | | | 1.0 | | | | 1.1 | | | | 1.0 | | | | 0.9 | | | | 0.9 | | | | 0.9 | |

CONTRIBUTIONS TO GDP GROWTH (2) | | | | | | | | | | | | | | | | | | | | | | | | |

| Net exports | | | 0.9 | | | | 0.1 | | | | -0.1 | | | | 0.0 | | | | 0.0 | | | | 0.0 | |

| Inventories | | | 0.0 | | | | -0.1 | | | | 0.1 | | | | 0.0 | | | | 0.0 | | | | 0.0 | |

| Domestic demand, net of inventories | | | -2.8 | | | | -0.3 | | | | 0.4 | | | | 0.8 | | | | 1.1 | | | | 1.2 | |

| PRICES | | | | | | | | | | | | | | | | | | | | | | | | |

| Import deflator | | | -1.8 | | | | -1.7 | | | | 0.9 | | | | 1.4 | | | | 1.4 | | | | 1.5 | |

| Export deflator | | | -0.1 | | | | -0.5 | | | | 1.0 | | | | 1.4 | | | | 1.6 | | | | 1.6 | |

| GDP deflator | | | 1.4 | | | | 0.8 | | | | 0.5 | | | | 1.4 | | | | 1.6 | | | | 1.6 | |

| Nominal GDP | | | -0.6 | | | | 0.5 | | | | 1.0 | | | | 2.1 | | | | 2.7 | | | | 2.8 | |

| Consumption deflator | | | 1.2 | | | | 0.4 | | | | 0.6 | | | | 1.2 | | | | 1.5 | | | | 1.5 | |

| Target inflation | | | 1.5 | | | | 0.2 | | | | 0.6 | | | | | | | | | | | | | |

| HICP, net of imported energy, % change (3) | | | 1.3 | | | | 0.8 | | | | 1.3 | | | | 1.5 | | | | 1.6 | | | | | |

| LABOUR | | | | | | | | | | | | | | | | | | | | | | | | |

| Labour cost | | | 1.2 | | | | 0.8 | | | | 0.8 | | | | 1.2 | | | | 1.3 | | | | 1.4 | |

| Productivity (measured against GDP) | | | -0.2 | | | | 0.5 | | | | 0.5 | | | | 0.4 | | | | 0.6 | | | | 0.6 | |

| Unit labour costs (measured against GDP) | | | 1.4 | | | | 0.3 | | | | 0.3 | | | | 0.8 | | | | 0.7 | | | | 0.8 | |

| Employment (FTE) | | | -1.7 | | | | -0.9 | | | | 0.0 | | | | 0.4 | | | | 0.5 | | | | 0.6 | |

| Unemployment rate | | | 12.2 | | | | 12.6 | | | | 12.6 | | | | 12.4 | | | | 12.1 | | | | 11.8 | |

| Employment rate (ages 15 to 64) | | | 55.6 | | | | 55.6 | | | | 55.7 | | | | 55.9 | | | | 56.2 | | | | 56.6 | |

| Memo item: Nominal GDP (in € mn) | | | 1618904 | | | | 1626516 | | | | 1642809 | | | | 1677680 | | | | 1723116 | | | | 1770901 | |

(1) Includes NPISH. (2) Discrepancies, if any, are due to rounding. (3) Source: ISTAT. Note: The macroeconomic framework has been developed on the basis of information available at 22 September 2014. For the international exogenous variables, reference is made to the data through 17 September 2014. GDP and components in volume (concatenated values, base year of 2010), data not adjusted for business days. | |

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | 15 |

UPDATE OF THE ECONOMIC AND FINANCIAL DOCUMENT 2014 |

| TABLE II.3: POLICY-SCENARIO MACROECONOMIC FRAMEWORK (% changes, unless indicated otherwise) | |

| | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | 2018 | |

| INTERNATIONAL EXOGENOUS VARIABLES | | | | | | | | | | | | | | | | | | |

| International trade | | | 3.0 | | | | 4.0 | | | | 5.1 | | | | 5.2 | | | | 5.2 | | | | 5.4 | |

| Oil price (Fob, Brent) | | | 108.6 | | | | 104.7 | | | | 98.5 | | | | 98.5 | | | | 98.5 | | | | 98.5 | |

| EUR/USD exchange rate | | | 1.328 | | | | 1.340 | | | | 1.294 | | | | 1.294 | | | | 1.294 | | | | 1.294 | |

| ITALY MACRO DATA (VOLUMES) | | | | | | | | | | | | | | | | | | | | | | | | |

| GDP | | | -1.9 | | | | -0.3 | | | | 0.6 | | | | 1.0 | | | | 1.3 | | | | 1.4 | |

| Imports | | | -2.7 | | | | 1.8 | | | | 3.4 | | | | 3.2 | | | | 3.4 | | | | 3.4 | |

| Final national consumption (1) | | | -2.3 | | | | 0.1 | | | | 0.6 | | | | 0.7 | | | | 1.0 | | | | 1.0 | |

| Household consumption | | | -2.8 | | | | 0.1 | | | | 1.0 | | | | 1.0 | | | | 1.3 | | | | 1.3 | |

| Government expenditure | | | -0.7 | | | | 0.1 | | | | -0.5 | | | | -0.3 | | | | 0.0 | | | | 0.2 | |

| Investments | | | -5.4 | | | | -2.1 | | | | 1.5 | | | | 2.1 | | | | 2.0 | | | | 1.8 | |

| - machinery, equipment and other | | | -3.8 | | | | -1.4 | | | | 2.2 | | | | 2.7 | | | | 2.6 | | | | 2.3 | |

| - construction | | | -6.8 | | | | -2.8 | | | | 0.8 | | | | 1.5 | | | | 1.5 | | | | 1.2 | |

| Exports | | | 0.6 | | | | 1.9 | | | | 2.8 | | | | 3.1 | | | | 3.3 | | | | 3.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Memo item: Current account balance (% GDP) | | | 1.0 | | | | 1.1 | | | | 0.9 | | | | 0.9 | | | | 0.9 | | | | 1.1 | |

CONTRIBUTIONS TO GDP GROWTH (2) | | | | | | | | | | | | | | | | | | | | | | | | |

| Net exports | | | 0.9 | | | | 0.1 | | | | -0.1 | | | | 0.1 | | | | 0.1 | | | | 0.0 | |

| Inventories | | | 0.0 | | | | -0.1 | | | | 0.0 | | | | 0.0 | | | | 0.1 | | | | 0.1 | |

| Domestic demand, net of inventories | | | -2.8 | | | | -0.3 | | | | 0.7 | | | | 1.0 | | | | 1.1 | | | | 1.1 | |

| PRICES | | | | | | | | | | | | | | | | | | | | | | | | |

| Import deflator | | | -1.8 | | | | -1.7 | | | | 0.9 | | | | 1.4 | | | | 1.5 | | | | 1.5 | |

| Export deflator | | | -0.1 | | | | -0.5 | | | | 1.0 | | | | 1.4 | | | | 1.6 | | | | 1.6 | |

| GDP deflator | | | 1.4 | | | | 0.8 | | | | 0.6 | | | | 1.6 | | | | 1.8 | | | | 1.8 | |

| Nominal GDP | | | -0.6 | | | | 0.5 | | | | 1.2 | | | | 2.6 | | | | 3.1 | | | | 3.3 | |

| Consumption deflator | | | 1.2 | | | | 0.4 | | | | 0.5 | | | | 1.8 | | | | 2.0 | | | | 1.9 | |

| Target inflation | | | 1.5 | | | | 0.2 | | | | 0.6 | | | | | | | | | | | | | |

| HICP, net of imported energy, % change(3) | | | 1.3 | | | | 0.8 | | | | 1.3 | | | | 1.5 | | | | 1.6 | | | | | |

| LABOUR | | | | | | | | | | | | | | | | | | | | | | | | |

| Labour cost | | | 1.2 | | | | 0.8 | | | | 0.8 | | | | 1.1 | | | | 1.4 | | | | 1.4 | |

| Productivity (measured against GDP) | | | -0.2 | | | | 0.5 | | | | 0.5 | | | | 0.6 | | | | 0.7 | | | | 0.7 | |

| Unit labour costs (measured against GDP) | | | 1.4 | | | | 0.3 | | | | 0.3 | | | | 0.6 | | | | 0.7 | | | | 0.8 | |

| Employment (FTE) | | | -1.7 | | | | -0.9 | | | | 0.1 | | | | 0.5 | | | | 0.6 | | | | 0.7 | |

| Unemployment rate | | | 12.2 | | | | 12.6 | | | | 12.5 | | | | 12.1 | | | | 11.6 | | | | 11.2 | |

| Employment rate (ages 15 to 64) | | | 55.6 | | | | 55.6 | | | | 55.8 | | | | 56.1 | | | | 56.3 | | | | 56.7 | |

| Memo item: Nominal GDP (in € mn) | | | 1618904 | | | | 1626516 | | | | 1646550 | | | | 1690027 | | | | 1742327 | | | | 1799706 | |

(1) Includes NPISH. (2) Discrepancies, if any, are due to rounding. (3) Source: ISTAT. Note: The macroeconomic framework has been developed on the basis of information available at 22 September 2014. For the international exogenous variables, reference is made to the data through 17 September 2014. GDP and components in volume (concatenated values, base year of 2010), data not adjusted for business days. | |

During the later years, in the midst of an improving international framework and in the absence of unfavourable shocks, the Italian economy's growth profile should tend to accelerate slightly, gradually reducing the existing wide gap between GDP and potential GDP (output gap).

Currently substantially inhibited by particularly weak demand conditions, the favourable effects of the reforms already implemented should start to unfold over time. GDP growth is thus forecast to rise gradually to reach more than 1.0 per cent starting in 2017.

| 16 | MINISTERO DELL’ECONOMIA E DELLE FINANZE |

II. MACROECONOMIC FRAMEWORK |

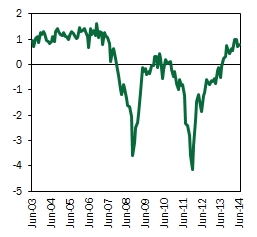

FOCUS | Validation of the macroeconomic forecasts With the European economic governance measures introduced by the Two Pack, the macroeconomic forecasts used in the preparation of planning documents must be either be computed or certified by institutions independent of the government. In Italy, such independent institution was set up in April 2014 as part of the implementation of the Constitutional Law No. 1 of 2012, and is known as the Parliamentary Budget Office (PBO). Law No. 243/2012 provides that the PBO is to effect analyses, inspections and assessments in relation to the macroeconomic forecasts on the basis of an annual programme, in accordance with the functions assigned by European regulations. The protocol of intent signed by the Ministry of the Economy and Finance (MEF) and the PBO on 15 September 2014 governs the process of the validation of the macroeconomic forecasts. The parties agreed to carry out the validation with respect to the macroeconomic forecasts based on unchanged legislation that are contained in this Update of the EFD. The MEF has respected all of the rules provided by the protocol of intent in relation to the exchange of information between the two institutional entities. In particular, the MEF transmitted a provisional macroeconomic framework based on unchanged legislation on 9 September 2014, with the PBO subsequently expressing findings in relation thereto. In developing the definitive macroeconomic framework based on unchanged legislation, the MEF took into account the PBO's observations, and sent other forecasts to the PBO on 25 September. On 29 September, the PBO validated the forecasts based on unchanged legislation for the years of 2014 and 2015, considering them acceptable on the basis of the information available. |