The 2016 Economic and Financial Document (EFD) is the third prepared by this government. This document is thus part of a longer term economic planning strategy that started with the implementation of the initial measures in 2014. The main objectives of this strategy are widely known: the revival of growth and the relaunching of employment. The operational mechanisms can be summed up in four points: i) ongoing structural reform of the country, and stimulus to private and public investment; ii) a budget-policy orientation that is both favourable to growth and aimed at ensuring gradual, but robust, fiscal consolidation, so as to allow for a gradual reduction of the debt-to-GDP ratio; iii) the reduction of the tax burden, which is associated with more efficient expenditure and more efficient general government; and iv) the improvement of the business environment and the Italian economy’s competitive capacity.

The government’s effort in recent years has been extensive and incisive, and it has produced rather significant results in relatively brief timespan, with the return to growth and the increase in employment in 2015 representing the incontestable evidence thereof. Looking ahead, the reform effort is also designed to improve the framework for investment decisions, which will be favoured by greater efficiency of the civil justice system and government overall, the gradual reduction of the tax burden, the growing availability of financing, and measures to stimulate demand. Alongside the new measures to be adopted in the near term, a special emphasis goes to the full-scale implementation of the reforms already initiated.

The government’s extensive reform effort is to be paired with new stimulus measures, including further reduction of the tax burden and a gradual increase in public investments. These measures will serve to bolster the recovery at a time when there is significant economic uncertainty at an international level.

The government has conducted its economic policy in recent months in the face of an external environment that has gradually grown more problematic. In 2015, the ongoing deceleration of the large emerging economies and the Euro Area’s continuing weakness negatively influenced the trend of foreign demand for Italian goods and services; the performance of the international economy was also affected by increased volatility in the financial markets and the threat of terrorism.

Persistent deflationary pressure in the Euro Area (partly due to continuing decreases in commodity prices, but also due to weak domestic demand) has impeded the transmission to the real economy of the exceptionally expansionist monetary-policy measures adopted by the European Central Bank; this has slowed investment, while also increasing the burden of private and public debt.

The Euro Area is also characterised by uneven distribution of growth and employment that periodically exposes it to shocks, with serious risks for the sustainability of the European project. The less-than-satisfactory convergence process – including in areas in which the integration is proceeding with greater decision, for example, in banking and finance – is perpetuating the segmentation of the area, impeding the necessary structural reform of the various economies.

The inflow of migrants and asylum seekers constitutes only one of the new and exceptional challenges for Europe, which are vividly revealing the weaknesses of the European project incapable of adopting coordinated policies and outlining common initiatives. Euroscepticism and the consensus for populist proposals are on the rise in almost all of the Member States. Given the material risk of national interests prevailing over the common good, the Italian government has proposed a detailed European strategy for growth, work and stability, so to make Europe a part of the solution to the problems that it is facing and to restore the confidence among citizens and among Member States.

Despite the fragile framework of reference, the Italian economy was once again expanding in 2015 after three consecutive years of contraction, with GDP growing by 0.8 percent in real terms and 1.5 percent in nominal terms. The growth produced benefits for employment, which rose considerably, and the unemployment rate, which was significantly lower; the improvement in labour market conditions was also associated with a positive trend of households consumption.

The positive data on industrial production in the first months of 2016 suggest a new acceleration of GDP in the quarters ahead. In line with these trends, the EFD forecasts 1.2 percent growth of GDP for 2016; under the policy scenario, growth would continue to accelerate in 2017 and 2018, also benefitting from a budget policy supporting business activity and employment.

Whereas Italy’s economic recovery in 2015 was mainly driven by exports and consumption, in 2016, it will be necessary to weigh the less-than-satisfactory growth of world trade; further improvements in competitiveness and an acceleration of investment (the component of demand that suffered the most during Italy’s economic crisis) will also be necessary for propelling GDP growth.

In 2015, capital investment, including public investment, was once again on the rise. This is an important indication of a turnaround after years of contraction, when it became evident that it was rather easy to cut public investment spending, but also rather difficult to revive it in a relatively short time span.

The 2016 Stability Law has appropriated significant resources for the purpose of stimulating an acceleration in private and public investments. These measures have been rounded out by the request for the application of the public investments clause provided by European Union fiscal rules. The Stability Law’s key initiatives in this regard include the allowance of accelerated tax depreciation for investments made in 2016 and a tax credit for investment in southern Italy during the 2016-2019 four-year period. In addition to the aforementioned resources, the government has outlined measures capable of further improving the investment climate in Italy, and these specifically concern financing instruments, the efficiency of government and the civil justice system, as well as territorial cohesion.

In consideration of the financing difficulties encountered by small- and medium-sized businesses and start-ups, the government has made available several instruments, which are also aimed at supporting technological innovation, expenditure in research and development, and business expansion. New measures have been introduced to simplify credit access, and to encourage the capitalisation and the stock-market listing of businesses, as well as the value enhancement of patents and other intellectual property.

In order to facilitate business investment decisions, the Italian justice system must become more equitable and efficient, by conforming to European standards. In view of this objective, changes in the past two years have included: introduction of online proceedings, new tax incentives for assisted negotiation and arbitration, the geographic restructuring and rationalisation of the courts, and the expansion of the sphere of application of out-of-court agreements. Reforms have also been initiated with respect to the civil process and the regulations governing troubled companies and insolvency – with the aim of increasing the opportunities for the turnaround of companies in crisis, and

limiting their damage to the surrounding economic environment. The objectives are to simplify and streamline the judicial apparatus, with the transition aimed at engendering a more management-oriented approach for the court process.

Greater efficiency of the public administration is also essential to improving the investment climate in Italy. The public administration must be capable of delivering quality services to the public and businesses, and in this respect, regulations have already been approved regarding: the simplification and the acceleration of the administrative proceedings; the digital administration code; transparency in public tenders; and the restructuring of the police forces, port authorities, local public services, State-owned enterprises held by central and local government, and the chambers of commerce. Other initiatives will regard: the fight against corruption; reform of the managerial staff within the public administration; rules for full-time workers in the public sector; and the reorganisation of the Office of the Presidency of the Council of Ministers and non-economic public entities. The programme to reform the public administration will be rounded out by the implementation of the Agenda for Simplification.

National policies common to all regions need to be strengthened where delays continue to exist in developing the training of human capital, productivity and infrastructure. The changes will need to be supported with appropriate macroeconomic incentives, including those contained in the 2016 Stability Law. With the objective of contributing to reducing regional imbalances, the Masterplan for Southern Italy aims to develop productive chains, starting from areas most vital to the local economy, and increasing their entrepreneurial capacities and job skills.

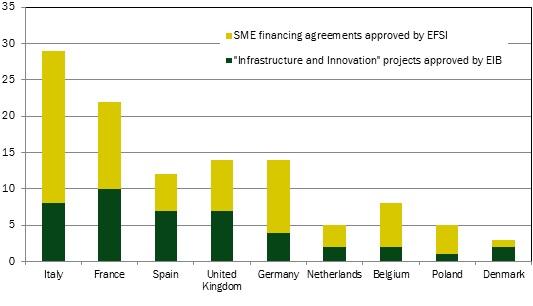

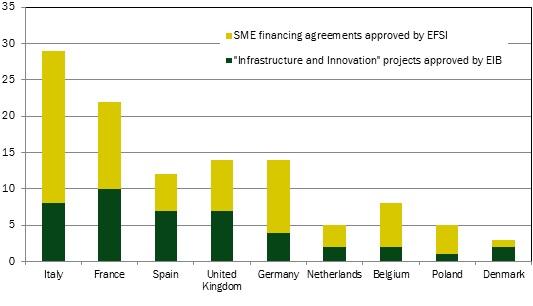

The development of the projects promoted by the European Fund for Strategic Investments (the heart of the so-called Juncker Plan) is also contributing to the revival of private investment. According to the latest data in reference, Italy has 29 initiatives in process, between financing agreements and infrastructure projects, for €1.7 billion of resources. Considering the leverage effect, additional investments of approximately €12 billion can be made.

The trend of Italy’s public finances is subject to certain limitations, first and foremost of which is the need to reduce the public debt as a percentage of GDP.

The debt-to-GDP ratio essentially stabilised in 2015; it is projected to decrease from 132.7 to 132.4 percent in 2016, and eventually drop to 123.8 percent by 2019. Reversing the trend of the debt is a strategic objective for the government. With the target of cutting net borrowing to 2.6 percent of GDP in 2015 having been met, the deficit is slated to decline further, to 2.3 percent in 2016. Additional budget leeway in later years should be provided from savings on expenditure, achieved through the expansion of the spending review process,

which will also address tax expenditure, and tools to increase fiscal compliance and reduce the margins for tax avoidance. With the combination of these measures, the ratio of net borrowing to GDP should descend to 1.8 percent in 2017.

The fiscal consolidation effort is benefitting from the programme to privatise State-owned companies and real estate. This programme is an essential tool for modernising the State-held companies, and contributing to reduction of the public debt.

Current budget policy is in line with that adopted in the past two years in that it impacts the mix of revenue and expenditure in a manner favourable to growth, but it is also focused on budgetary discipline and respect of the European rules. It is sufficient to note that Italy is the country that reported the highest cyclically adjusted primary surplus on average in the Euro Area during the years of the financial crisis; Italy was one of the few countries to have achieved a positive primary balance, while most Euro Area countries witnessed deterioration in their position during the period considered.

The government believes fiscal tightening is inappropriate and counterproductive in consideration of various factors: i) real risks of deflation and stagnation, referable to the international economy; ii) insufficient coordination of budget policies in the Euro Area, whose overall budget policy is inadequate when considering the evident lack of aggregate demand; and iii) the undesired effects of excessive fiscal tightening, which could end up exacerbating, rather than improving, the path of adjustment of the debt-to-GDP ratio.

Over the years, Italy has accumulated a high debt whose management has been made more difficult by i) the contraction of the economy caused by the recession, and ii) increasing deflationary pressures. In spite of this, budget policy can favour growth by synchronising the expectations of businesses and households with a credible outlook for reduction of the debt-to-GDP ratio and by an improved mix of public policy. With reference to the first objective, it is noted that budget policy achieved its targets in the past two years, without any corrective measures during the year and without increases in taxation on income from employment, corporate taxes or consumption; by contrast, a decrease in the tax burden of 0.8 percentage points was achieved during the period. With reference to the second objective, the spending review will be made more effective by the reform of the process for State budget preparation. This reform will help to overcome the ‘state of emergency’ reasoning that has inspired budget policy and economic policy in recent years; it will increase the accountability of the owners of spending decisions, while also facilitating an examination of the entire budget structure, instead of only changes implemented with the Stability Law.

The institutional reforms approved by Parliament are also functional to an economic policy geared to the medium/long term. The reform of the electoral law, the abandonment of bicameral legislature, and the revision of the allocation of responsibility between the central and local governments will ensure more stable and effective political governance. These crucial reforms, which will allow Italy to get beyond some of its historical limitations, have been made even more significant by the growing fragility that the long economic crisis has been injecting into the political-institutional systems of various European countries. Given the prospect of uncertainty and weakness that is spreading across the global panorama, these reforms will reinstate Italy’s capacity to compete with, and to measure up to, the world’s leading economies.

Over the past two years Italy's reform effort has been ambitious and far-reaching. The results achieved in a short period of time have been significant, as noted by the European Commission in the 2016 Country Report. However, considering the extent of the effort made, there is still a lot that needs to be done. Economic recovery needs to be fostered by both macroeconomic stimulus policies and structural reforms to strengthen potential growth.

The structural reform strategy must be accompanied and supported by a policy of fiscal responsibility which, by reducing the burden of taxation, enables business and household expenditure to be sustained and growth to be strengthened at a time of substantial global economic uncertainty, while the fiscal consolidation and debt reduction efforts are continued.

Last year Italy's economic recovery was mainly led by export and then driven by household consumption. In the second half of 2015 a worsening of the economic situation in the newly industrialised countries and the still sluggish growth of the European economy affected export performance. Further worldwide competitiveness gains are therefore needed to increase market shares to offset the unsatisfactory growth of global trade in the short term. Increased competitiveness is needed to support GDP growth over the medium and long term.

In 2015 gross fixed investment increased by 0.8 per cent in real terms. Public investment increased by 1.0 per cent. After years of contraction this signals a major trend reversal. However, in order to return to more sustained economic growth, the ratio of investment to GDP, which reached the minimum level of 16.5 per cent in 2015, needs to increase again over the next few years and reach 20 per cent, which is the percentage it stood at before the crisis. Significant fiscal measures have been introduced by the 2016 Stability Law to stimulate gross fixed investment and their government component, including the specific request for flexibility. These measures must be supported by reforms to further improve the ‘investment climate’ in Italy, especially the propensity to invest in venture capital.

A major contribution to investment will also be made by the implementation of projects included in the so-called 'Juncker Plan', as Italy is one of the countries that stand to gain from the plan. As far as Italy is concerned, the latest data on the European Fund for Strategic Investment (EFSI) show 29 initiatives, including funding agreements and infrastructural projects, for a total of €1.7 billion worth of funding. If financial leverage is considered, €12 billion worth of investment will be mobilised.

preferential votes; it gives the list which has received the highest number of votes (or which wins the highest number of votes in a later run-off, in the event that no list wins at least 40 per cent of valid votes in the first round at national level) a number of seats sufficient to reach 340 seats out of an unchanged total of 630 seats.

The Chamber of Deputies has already approved new regulations on the conflict of interests, which are now being considered by the Senate.

The first legislative decree on regulatory simplification has been adopted and during its preliminary consideration the government has already approved twelve implementing decrees concerning the simplification and acceleration of administrative measures, the digital administration code, transparency in public procurement, the reorganisation of law-enforcement agencies and port authorities, rules governing employee dismissal, local public services, companies partly owned by the State or local authorities as well as the Chambers of Commerce.

The Enabling Law on the Reform of Public Administration provides for the adoption of additional legislative decrees containing provisions on corruption, the reform of public sector management positions, the reorganisation of provisions governing civil servants, the reorganisation of the Prime Minister's office and of non-economic public bodies.

set up a research committee on conciliation tools (mediation, assisted negotiation and arbitration) with the aim of streamlining the regulatory framework and ensuring these tools are easy to use.

With a view to strengthening its policy to counter delinquency, not just through law-enforcement, the government intends to strengthen prevention, including by raising the awareness of entrepreneurs operating in the local community.

To this end a joint Ministry of Finance/Ministry of Justice Committee has been set up which has been tasked with i) drawing up a series of proposals over the next few months aimed at addressing a number of problems that have arisen in connection with the enforcement of Legislative Decree 231 of 2001 and ii) revitalising the prevention approach introduced by the decree.

The Italian banking system continues to be viable. However, the high level of non-performing loans in the system and the spillover effects of the introduction of

European regulations on the resolution of financial institutions require that its resilience, both actual and perceived, be increased.

The government is planning to introduce a new package of measures to further develop policy orientations that have emerged as part of the 'Finance for Growth' initiative, by strengthening existing tools and introducing new ones with a view to consolidating the positive performance of investment in 2015.

The reintroduction of the tax exemption through a 10 per cent concessionary rate is linked to productivity hikes, to be measured with well-defined criteria set out in an interministerial decree. The criteria relate to productivity increase, savings in the use of inputs and improvement of the quality of products and

processes. The decree will be supplemented by an addendum containing the indicators to monitor decentralised bargaining.

In addition, in 2016 the government will concentrate on a reform of firm-level bargaining to make firm-level contracts more enforceable and effective and ensure industrial peace during the term of the agreement. Firm-level agreement may also override national agreements in areas such as work organisation and production.

2017 three-year period (and €4.7 billion for the whole 2015-2020 period) in areas that are considered key sectors for Italy's research system. In addition, for the same 2015-2017 three-year period, additional resources have been made available for a total of €3.8 billion (€9.4 billion for the whole 2015-2020 period), from Regional Operational Programmes and the Horizon 2020 Framework Programme.

The action plan to reduce poverty will involve all social actors, starting from non-profit sector organisations to the social private sector. An important role will also be played by foundations of banking origin, which will participate with the government in the establishment of a fund to combat educational poverty, which will fund projects for poor children with €130 million a year over the 2016-2018 period to improve access to quality education and educational tools and out-of-school personal development tools.

The reforms introduced over the past two years are those contained in Enabling Law no. 23 of 2014. A number of elements of the taxation system and the relationship between taxpayers and the tax authorities have been changed. In addition, the Government has taken tax policy decisions that have reduced the tax wedge on labour, incentivised hiring of permanent employees and reduced taxation for households, especially low-income households, and on main residences, so-called 'bolted' equipment and agricultural land. The 2016 Stability Law has also introduced a reduction of the IRES (corporate income tax) tax rate on corporate profits, which will be applied as of 2017.

sector is taxed, greater ability to monitor gaming devices and advertising; the latter will be governed by rules in compliance with EU policies.

Finally, in line with the programmes of the European and Italian Digital Agenda, in December 2015 electronic filing of tax proceedings has been introduced as a pilot project in the Tuscany and Umbria regions, and it will be extended to all other Italian regions within two years. The range of web-based services has also been broadened, thus improving the possibility of 'remote' interaction between the tax authorities and citizens as well as companies.

II. MACROECONOMIC FRAMEWORK

II.1 MACROECONOMIC FRAMEWORK

In 2015, the trend of real GDP was back in positive territory after three consecutive years of contraction: the result achieved (+0.8 per cent) is essentially in line with the official estimates published in October in the Draft Budgetary Plan (+0.9 per cent).

The most recent data point to a positive trend for the macroeconomic framework at the start of 2016. Following an unexpected decline in the final two months of 2015, industrial production experienced a greater than expected increase in January. Other economic indicators, such as new car registrations and airport and road traffic, suggest that economic activity continued to expand in the first months of the year.

Under the policy scenario, GDP grows by 1.2 per cent in 2016, which is equal to the growth rate in the scenario based on unchanged legislation. Despite the favourable prospects for the first quarter of 2016, the 2016 growth forecast has been revised downward with respect to the figures indicated in the 2015 EFD Update published in September. The revision is partially based on a real GDP growth profile in the second half of 2015 that was weaker than expected (in the summer of 2015). The positive trend of domestic demand was initially more than offset by a drop in exports linked to the slowdown of the large emerging economies, and later, in the fourth quarter, by a decline in production. It is highly probable that the weakness on the supply side is also linked to the new international economic framework. The growth in the 2017-2019 period would be higher, taking into account a budget policy continuing to focus on achievement of a balanced budget in the medium term, but more concentrated on promoting economic activity and employment. Real GDP is projected to grow by 1.4 per cent in 2017, 1.5 per cent in 2018, and finally, 1.4 per cent in 2019.

When compared with the scenario based on unchanged legislation, the repeal of the safeguard clause under the policy scenario should entail lower revenue from indirect taxes and a more modest increase in consumer prices. Inflation is projected to be 1.3 per cent in 2017 and 1.6 per cent in 2018. Against this backdrop, consumer spending can be expected to increase, with repercussions also on investment. Stronger domestic demand would cause an increase in imports and as a result, the contribution of net foreign demand would be negative over the entire forecast horizon.

The improvement in economic conditions should impact the labour market, with the unemployment rate declining to 9.6 per cent at the end of the period. Greater productivity matched with moderate wage growth is then expected to translate into even lower unit labour costs.

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | 13 |

ECONOMIC AND FINANCIAL DOCUMENT - SECTION III NATIONAL REFORM PROGRAMME |

| TABLE II.1: MACROECONOMIC FRAMEWORK BASED ON UNCHANGED LEGISLATION (% changes, unless indicated otherwise) |

| | 2015 | 2016 | 2017 | 2018 | 2019 |

| INTERNATIONAL EXOGENOUS VARIABLES | | | | | |

| International trade | 2.5 | 3.0 | 3.8 | 4.6 | 4.8 |

| Oil price (Brent, USD/barrel, futures) | 52.3 | 39.4 | 45.7 | 48.1 | 49.8 |

| USD-EUR exchange rate | 1.11 | 1.10 | 1.09 | 1.09 | 1.09 |

| ITALY MACRO DATA (VOLUMES) | | | | | |

| GDP | 0.8 | 1.2 | 1.4 | 1.5 | 1.4 |

| Imports | 6.0 | 2.5 | 3.8 | 4.6 | 4.2 |

| Final national consumption | 0.5 | 1.2 | 1.0 | 1.2 | 1.4 |

| Household consumption and NPISH | 0.9 | 1.4 | 1.4 | 1.7 | 1.6 |

| Government expenditure | -0.7 | 0.4 | -0.3 | -0.5 | 0.8 |

| Investments | 0.8 | 2.2 | 3.0 | 3.2 | 2.4 |

- machinery, equipment and other fixed assets | 0.5 | 2.2 | 3.9 | 4.1 | 2.8 |

| - transportation means | 19.7 | 14.3 | 5.2 | 4.1 | 2.2 |

| - construction | -0.5 | 1.0 | 1.9 | 2.2 | 2.1 |

| Exports | 4.3 | 1.6 | 3.8 | 3.7 | 3.4 |

| Memo item: Current account balance (% of GDP) | 2.1 | 2.5 | 2.5 | 2.4 | 2.2 |

| CONTRIBUTIONS TO GDP GROWTH (1) | | | | | |

| Net exports | -0.3 | -0.2 | 0.1 | -0.2 | -0.2 |

| Inventories | 0.5 | 0.0 | 0.0 | 0.1 | 0.0 |

| Domestic demand, net of inventories | 0.5 | 1.3 | 1.3 | 1.5 | 1.5 |

| PRICES | | | | | |

| Import deflator | -2.7 | -2.3 | 2.2 | 1.9 | 1.7 |

| Export deflator | -0.4 | 0.0 | 1.7 | 1.9 | 1.7 |

| GDP deflator | 0.8 | 1.0 | 1.1 | 1.6 | 1.8 |

| Nominal GDP | 1.5 | 2.2 | 2.5 | 3.1 | 3.2 |

| Consumption deflator | 0.1 | 0.2 | 1.3 | 1.6 | 2.0 |

| Memo item: Planned inflation | 0.2 | 0.2 | 1.5 | | |

Memo item: HICP, net of imported energy, % change (2) | 0.3 | 1.1 | 1.3 | 1.5 | |

| LABOUR | | | | | |

| Labour cost | 0.5 | 0.4 | 1.0 | 2.0 | 1.8 |

| Productivity (measured against GDP) | -0.1 | 0.3 | 0.6 | 0.6 | 0.6 |

| Unit labour cost (measured against GDP) | 0.6 | 0.1 | 0.4 | 1.4 | 1.2 |

| Employment (FTEs) | 0.8 | 0.8 | 0.8 | 0.9 | 0.7 |

| Unemployment rate | 11.9 | 11.4 | 10.8 | 10.2 | 9.6 |

| Employment (ages 15 to 64) | 56.3 | 57.0 | 57.5 | 57.9 | 58.4 |

Memo item: Nominal GDP (in EUR mn) | 1,636,372 | 1,671,584 | 1,712,933 | 1,765,250 | 1,822,211 |

(1) Discrepancies, if any, are due to rounding. |

| (2) Source: ISTAT. |

Note: The macroeconomic framework has been developed on the basis of information available at 16 March 2016. GDP and components in volume (concatenated values, base year of 2010), data not adjusted for business days. |

II. 2 THE MACROECONOMIC IMPACT OF STRUCTURAL REFORMS

In this section we document our estimates of the macroeconomic impact of structural reforms by focusing on a scenario where only the most recent reforms are considered, namely those eligible for the application of the structural reforms clause recently introduced by the European Commission. In particular, this scenario envisages only the new reforms of the Government, both approved and in the process of approval, which are expected to generate their effects starting from 2016. The estimates of the macroeconomic effects have been obtained through the quantitative models used at the Italian Ministry of the Economy and Finance (ITEM, QUEST III and IGEM). Moreover, the simulation results for this scenario of the recent reforms take into account some methodological revisions

| 14 | MINISTERO DELL’ECONOMIA E DELLE FINANZE |

II. MACROECONOMIC FRAMEWORK |

pertaining to the ways in which the provisions in each reform are translated into corresponding modifications of some of the relevant structural parameters of the models1. The main areas of reforms are the following: Public Administration (PA) and Simplification, Competitiveness, Labour Market, Justice, the reduction of the tax wedge and the school system. Moreover, interventions related to the nonperforming loans (NPL) in the bank balance sheets2 and the ‘Finance for growth’ have been included further relative to the NRP 2015.

| TABLE II.2: MACROECONOMIC EFFECTS OF STRUCTURAL REFORMS FOR AREA OF INTERVENTIONS (percentage deviation of gdp from the baseline scenario) |

| | | 2020 | | 2025 | | Long run |

| Public Administration | | 0.4 | | 0.7 | | 1.2 |

| Competitiveness | | 0.4 | | 0.7 | | 1.2 |

| Labour Market | | 0.6 | | 0.9 | | 1.3 |

| Justice | | 0.1 | | 0.2 | | 0.9 |

| School System | | 0.3 | | 0.6 | | 2.4 |

| Tax Shift (total) | | 0.2 | | 0.2 | | 0.2 |

| of which: Reduction of tax wedge (IRAP-IRPEF) | | 0.4 | | 0.4 | | 0.4 |

| Increase in the taxation of capital income + VAT | | -0.2 | | -0.2 | | -0.2 |

| Spending Review | | -0.2 | | -0.3 | | 0.0 |

| Nonperforming loans | | 0.2 | | -- | | -- |

| Finance for growth | | 0.2 | | 0.4 | | 1.0 |

| TOTAL | | 2.2 | | 3.4 | | 8.2 |

In Table II.2 the impact on output of each of the main reforms is presented. The overall effect of the reforms here considered is a GDP increase with respect to the baseline scenario of 2.2 per cent in 2020 and of 3.4 per cent in 2025. In the long run, the estimated impact on output is a 8.2 per cent increase.

FOCUS | | Macroeconomic Impact of Finance for Growth measures The economic crisis of recent years has exacerbated the problem of the credit crisis and, more generally, the difficulties for companies in raising funds. Credit market rigidities represent a major obstacle on the path of recovery and a strong limitation for investment and employment expansion. The constraint is particularly burdensome for the peculiarities of the production structure of the country, characterised by a large network of small and medium-sized enterprises, which represent the real backbone of the Italian economy. In a context in which public resources tend to be scarce, it is crucial to implement the effective incentives to improve the propensity to invest of private enterprises. New tools available to businesses have been then introduced to facilitate access to credit, to promote productive investment and innovation, to encourage the capitalisation and stock exchange listing. New measures have broadened the variety of alternative sources of financing to the traditional ones: mini-bonds, credit-funds, equity crowdfunding and stock market. This represents a fundamental cultural shift, because access to the capital market implies more growth for firms which take advantage of them. Similarly new incentives for productive investment and capitalisation of the companies have been set, along with measures to support innovation. |

___

1 The simulations have been revised also in the wake of technical suggestions recommended in the report of the European Commission prepared in accordance with Article 126(3) of the Treaty (see http://ec.europa.eu/economy_finance/economic_governance/sgp/pdf/30_edps/126-03_commission/2015-02-27_it_126-3_en.pdf).

2 L. 132/2015 and more recently the D.L. 18/2016 and AC 3671/2016.

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | 15 |

ECONOMIC AND FINANCIAL DOCUMENT - SECTION III NATIONAL REFORM PROGRAMME |

| | | MEASURES | | RELATED LEGISLATION |

| | | Measures for innovation |

| | | Enlargement of the pool of innovative startup and simplification measures | | art. 4 of D.L. 3/2015 (Investment Compact) |

| | | Tax credit for R&D activities | | art. 3 of D.L. 145/2013, modified by art. 1, subparagraphs 35 - 36 of Law 190/2014 (LDS2015) |

| | | Patent box | | art. 1, subparagraphs 37 – 45 of Law. 190/2014 (LDS 2015) modified by art. 5, subpar. 1 of D.L. 3/2015 |

| | | | | art. 1, subparagraph 148 Law 208/2015 (LDS2016) |

| | | PMI (SME) Innovative | | D.L. 3/2015 (Investment Compact) art. 4 |

| | | Incentives for productive investments | | |

| | | Revision of New Sabatini | | art. 2 of D.L. 69/2013, Law 190/2014 (LDS2015), art. 1, subparagraph 243, D.L. 3/2015 Art. 8 |

| | | Guidi – Padoan provision | | art. 18 D.L. 91/2014 |

| | | Super amortisation | | art. 1, subparagraphs 1 91 -94 of Law 208/2015 (SL2016) |

| | | Access to capital market |

| | | Minibond | | art. 32 of D.L. 83/ 2012, (Decree for Development) modified by art. 36, of D.L. 179/ 2012, (Decree for Development bis) and by art. 12 of D.L.. 145/ 2013, (Destinazione Italia), art. 21 of D.L.. 91/2014 |

| | | Simplification measures for SMEs going public | | art. 20 of D.L. 91/2014 |

| | | Introduction of multiple vote securities and loyalty shares | | art. 20 of D.L. 91/2014 |

| | | Development of Equity Crowdfunding | | art. 4 of D.L. 3/2015 (Investment Compact) |

| | | Measures for credit liberalisation |

| | | Direct lending for credit funds, insurance companies and and securitization vehicles | | art. 22 of D.L. 91/2014, |

| | | System of public guarantees, FCG, Confidi and Juncker investment platforms |

| | | Guarantee Fund for SME | | art. 8 - 8 bis of D.L. 3/2015 |

| | | Juncker investment platforms | | Reg. (UE) 2015/1017, Art. 1, subparagraphs 822-830 of Law 208/2015 (LDS2016) |

| | | Incentives to capitalization |

| | | ACE | | art. 1. of D.L.. 201/2011 (Salva Italia), modified by art. 1, subparagraph 138 of Law 147/ 2013 (LDS2014) and art. 19 of D.L. 91/2014 |

| | | Deductibility of goodwill | | art. 1, subparagraphs 95 and 96 of Law 208/2015 (SL 2016) |

| | | Easier investment in infrastructure, real estate and project bonds |

| | | Revision of the legislation on project bond | | art. 1 of D.L. 83/2012 and art. 13 of D.L. 133/2014 |

| | | Revision of the legislation on SIIQ (REIT) | | art. 20 D.L. 133/2014 (Sblocca Italia) |

| | | Measures to attract investments |

| | | International standard ruling | | art. 8 of D.L. 269/2003 |

| | | Consulting services for foreign investors provided by Agenzia delle Entrate (Revenue agency) | | Provision of the Revenue Agency no. 149505 of 16 December 2013 (envisaged in D.L. 145/2013 art. 10 (Destinazione Italia) |

| | | Court for companies with headquarter abroad | | D.L. 145/2013 art. 10 (Destinazione Italia) |

| | | Increase of the threshold above which to notify the acquisition or disposal of major holdings | | art. 20 of D.L. 91/ 2014 converted with modifications into L. 116/2014 |

| | | A recent study by the European Commission shows how the financial distortions are particularly restrictive for some types of businesses, such as start-ups, innovative companies and small businesses3. The empirical analysis, based on an extensive survey |

___

3 European Commission, European Competitiveness Report, 2014 Report: Helping Firms Grow, chapter 2, available online at: http://ec.europa.eu/growth/industry/competitiveness/reports/eu-competitiveness-report/index_ehtm.

| 16 | MINISTERO DELL’ECONOMIA E DELLE FINANZE |

II. MACROECONOMIC FRAMEWORK |

| | | of various European countries, documents how during the recent crisis the financial factors have greatly constrained the investment decisions of firms, although in a rather different way for countries and regions and depending on type of enterprise (in particular, the negative effects are different among micro-enterprises, companies in the manufacturing and high-tech companies). |

| | | MACROECONOMIC EFFECTS OF FINANCE FOR GROWTH MEASURES |

| | | (percentage deviation from the baseline) |

| | | | | 2020 | | 2025 | | Long run |

| | | GDP | | 0.2 | | 0.4 | | 1.0 |

| | | Consumption | | 0.1 | | 0.4 | | 0.8 |

| | | Investment | | 0.6 | | 1.4 | | 3.3 |

| | | An impact assessment of the measures contained in the package ‘Finance for Growth’ is reported in the Table. The simulation of these measures has been implemented with the IGEM model, assuming a rise in capital accumulation induced by easier access to credit businesses. In particular, it is assumed that in the long run the enhanced conditions of access to credit will result in a greater willingness of companies to invest. The assumption used in the simulation incorporates estimates by the European Commission (EC) about the impact on investment of an expansion in the availability of capital credit enterprise. In detail, it is considered the estimated impact of the increase of the flow of credit in the long term on the tangible investment, which, according to the EC of the estimates, is equal to 0.144. It was therefore suggested that the full implementation of these rules over a period of ten years (until 2025) gives rise to an increase in the flow of loans to enterprises up to 10 per cent, which translates into an overall change in investments equal to 1.4 per cent. In IGEM model, this increase in investment has been achieved through an increase in the growth rate of physical capital by 0.07 per cent in four years5. The results of the model simulations show how the positive effects of these measures translate into higher investments by 0.6 per cent already in 2020 and into higher GDP by 0.2 per cent. In the long run, investments increases by 3.3 per cent and GDP grows by 1.0 per cent compared to the baseline scenario. |

FOCUS | | The macroeconomic effects of the reforms for reducing non-performing loans (NPL) in the bank balance sheets In this note we document the macroeconomic effects of three Government measures adopted between 2015 and 2016 with the aim of reducing the stock of non-performing loans (NPL) in the bank balance sheets (D.L. 18/20166) and increasing the speed and efficiency of the insolvency and liquidation procedures (D.L. 83/20157 and AC 3671/20168). The first measure envisages the possibility of providing a State guarantee to banks for securitization operations with non-performing loans as the underlying assets (GACS). The |

___

4 See the Table on p. 58 of the cited paper.

5 In the IGEM model the increase in the growth rate of physical capital is induced by an increase in the value of installed capital and therefore an increase of capital per unit of investment. In the simulation exercise the variation in the growth rate of capital (set at 0.07 per cent in four years) is such to generate an overall increase of investment equal to 1.4 per cent in ten years.

6 It is in the process of being converted into law.

7 Converted with modifications into L. 6, August 2015, no. 132).

8 Draft law (DDL) delegating the Government on the overall reform of the legislative tools to manage company crises and insolvency procedures. It has been approved by the Council of Ministers in February 10th 2016 and is currently under approval at the Chamber of Deputies (A.C. 3671).

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | 17 |

ECONOMIC AND FINANCIAL DOCUMENT - SECTION III NATIONAL REFORM PROGRAMME |

| | | State guarantees on NPLs can be requested by banks which securitize in return for a commission to be paid to the Treasury whose amount is a percentage on the guaranteed assets. The price of the guarantee is in line with market prices. This provision is temporary, as the opportunity of requesting state guarantees in the securitizations of NPLs has been introduced over a 18-month period, with the possibility, however, of extending the application of the provision for other 18 months (until February 2019). The other two measures are aimed at reforming the legislative tools for managing the company crises, on the one side, and at reforming the bankruptcy, civil and civil procedure legislation as well as the functioning of the judicial system, on the other. In particular, important provisions have been introduced to reduce the foreclosure times and the length of the insolvency and liquidation procedures. This enhances the efficiency of the judicial procedures for debt recovery, thus increasing the prices that investors are willing to pay for the NPLs. The macroeconomic effects of the first decree, the one on the bankruptcy legislation aimed at accelerating the liquidation procedures, have already been documented in the Draft Budgetary Plan (DBP) and they are now amplified as a result of the recent Draft Law delegating the Government to pursue further reforms on this area. In the simulation exercise with the ITEM model to assess these effects, we assumed that those reforms would induce an increased incidence of disposed nonperforming loans and a parallel reduction of the gap between book values on bank balance sheets and the price that investors are willing to pay (pricing gap). This was implemented in the simulation of the model through a gradual reduction of the discount that investors require for purchasing the nonperforming loans. In addition to the effects from the measures in the first decree, the new provision introducing a state guarantee on securitization operations for NPL’s is likely to amplify the incidence of disposed nonperforming loans. In particular, the assumption in the simulation associated with the first decree was an increase in the amount of disposed NPLs as a fraction of its overall stock (in net value) by 10 percentage points (from 5 to 15 per cent). In light of the new provisions of 2016, the increase in the incidence of disposed NPLs is assumed to be more pronounced, reaching 30 per cent in 2019. Moreover, the higher easiness in disposing NPLs and reducing their burden in banks’ balance sheets, combined with the interventions on bankruptcy law to accelerate the judicial procedures for debt recovery, may induce banks to ameliorate the cost of lending. In the simulation we therefore assumed a reduction by 10 basis point of the bank lending rate with respect to the baseline scenario up to 2019. The improvement in the banks’ financial conditions due to the increased incidence of disposed NPLs has a positive impact on the credit supply to the economy. This increase, combined with the slight drop of the bank lending rate, would imply an increase of output with respect to the baseline scenario reaching 0.2 percentage points in 2020, driven by higher investment (0.7 per cent) and consumption expenditure (0.2 per cent). A possible reduction of credit, however, might be obtained in the first year of simulation (2016) with respect to the baseline scenario, as a negative effect on loans is induced by the reduction of total assets following the realized losses associated with the larger number of disposals of nonperforming loans. The impact on GDP would be therefore slightly negative in the first year, with a 0.1 per cent reduction with respect to the baseline scenario, driven primarily by a drop of investment by 0.4 per cent. In the subsequent years, on the contrary, the expansionary effects on credit supply and output would prevail. Given the temporary nature of the mechanism for providing state guarantee to banks in the securitization operations, the simulation exercise does not extend its focus beyond 2020. |

Table II.3 reports the effects of the interventions eligible for the flexibility clause associated to structural reforms with a focus on the main macroeconomic variables. The expansionary character of these reforms clearly emerges, especially

| 18 | MINISTERO DELL’ECONOMIA E DELLE FINANZE |

II. MACROECONOMIC FRAMEWORK |

in the medium to long run, with an impact on both consumption and investment broadly in line with that estimated for output. By using the models it was also possible to calculate the impact of the reforms on public finance and the results point to an improvement in the indicators of the performance of public finance with the only exception of 2016, when a short run deterioration of the deficit-to-GDP and a slight improvement of the debt-to-GDP ratios is obtained with respect to the baseline scenario.

| TABLE II.3: MACROECONOMIC EFFECTS OF REFORMS (percentage deviation from the baseline scenario) |

| | | 2020 | | 2025 | | Long run |

| GDP | | 2.2 | | 3.4 | | 8.2 |

| Consumption | | 2.7 | | 4.2 | | 6.3 |

| Investment | | 3.3 | | 4.8 | | 11.5 |

| Labour | | 1.5 | | 2.1 | | 3.7 |

II.3 THE FINANCIAL IMPACT OF NEW MEASURES IN THE 2016 NRP

The National Reform Programme is accompanied by the national grids of policy measures - born from the need to organically show the set of reform measures that the country is realizing - subdivided into 10 policy areas9. The grids contain both updates of the measures approved in preceding years, and new measures emerging during the review of provisions going into effect between April 2015 and March 2016. More specifically, there are 20 new measures and around 240 updates to measures already presented in the grids (equal to 55 per cent of the total).

The measures are thoroughly described in the grids, with respect to both regulatory and financial details10. The financial effects in the grids are stated in terms of higher/lower revenue and higher/lower expenditure both for the State budget and the public administrations and quantified with reference to the related balances. With the exception of certain cases, the quantification of the impacts in the grids highlights the measures' costs and benefits for the public finances, regardless of the financial coverage found in any measure.

Table II.4 summarizes the impact on the State budget11 of the updates of the grids made on the basis of the measures entered into force from April 2015 to March 2016. Various measures entailing higher or lower expenditure refer to refinancing, new institution, or reductions of budget funds.

For the five-year period 2015 - 2019, the most significant updates12 from the financial point of view are therefore:

___

9 Grids and its "Guide to reading the grids" are available online in the section of the DEF 2016 "PNR - measures organized by area of intervention (grids)" http://www.mef.gov.it/documenti-pubblicazioni/doc-finanza-pubblica/index.html#cont1.

10 See. ‘Guide to reading the grids’.

11 This decision is mainly due to the significance of the central government in defining and implementing the measures. In order to analyze the impacts in terms of net indebtedness, please see the column "impact on the public budget" for each policy area.

12 It is recalled that in the measures of the grids are traditionally excluded contributions to public finance of local governments, either because they are better suited to the achievement of balance targets rather than to reform actions, and because in terms of net borrowing should be reported as "incremental revenue". To details on the contributions and the Understanding reached at the State - Regions Conference of 11 February 2016, see "Summary table of actions for CSR". In the area “Public expenditure and taxation” it is, instead, included the shift to the balanced budget of regional and local authorities, given the importance of the reform. Traditionally, variations of tables C and D of the Stability Law are not included. For the table E, see “Infrastructures and development” area.

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | 19 |

ECONOMIC AND FINANCIAL DOCUMENT - SECTION III NATIONAL REFORM PROGRAMME |

- lower expenditures13 for about €31.9 billion for the State budget resulting mainly from measures of both "Public expenditure and taxation" (various reductions applied on State administrations, on the resources of the National Health Service and on purchases, as well as for the lower tax credit, deriving from the different fiscal discipline of write-downs and credit losses of credit and financial institutions and insurance companies) and "Labour and pensions" (including the reduction of the Fund for arduous work and measures of de-indexation of pensions) policy areas;

- reduced revenues for about €85.5 billion in the period under consideration. The measures that give rise to lower receipts for the State budget concern several areas of intervention, including "Energy and Environment" (tax deductions), “Public expenditure and taxation” (for the extension of the deductibility of losses for the IRES and IRAP taxes for credit institutions and insurance companies; the sterilization of the safeguard clause of the 2014 Stability Law and of the increase in excise duty provided by the 2015 Stability Law; the postponement of the increase in VAT rates; and for the removal of payments due to the State by the Concession holders of authorized games), “Labour and pensions” (increase of the no-tax area for pensioners; tax exemption of productivity bonuses for compensation of employees not exceeding €50,000);

- incremental revenue for about €22.3 billion are due, for the most part, to the interventions reported in “Public expenditure and taxation” policy area (including, different fiscal discipline of write-downs and losses; voluntary disclosure; increase of the State charge (PREU) on new slot (AWP) and video lotteries (VLT));

- incremental expenditure for about €86.1 billion related to all policy areas14, except for "Federalism" and "Products and competition”. With specific reference to the area "Infrastructures and development", the incremental expenditure contained in Table II.4 (more than €3.8 billion over the five reference years) relate school buildings, the development of the intermodal chain for congestion of roads and railways, the great "cultural heritage" project, etc., but does not include the more than €8 billion provided in Table E attached to the 2016 Stability Law (including appropriations for ANAS and RFI investment program contracts - see. measures no. 4 and 615.

___

13 In certain measures what is considered as incremental/lower expenditures for the State budget, is classified as incremental/lower revenue in terms of net indebtedness (for example see measure n. 7 of the “Support to businesses” area).

14 For instance, note the bridge financing to the single resolution Fund, measure n. 21 of the area “Financial system”.

15 It must also be considered the measure no. 28 of the area “Energy and Environment”, with regard to resources of Table E allocated for refinancing the mitigation of landslide risk.

| 20 | MINISTERO DELL’ECONOMIA E DELLE FINANZE |

II. MACROECONOMIC FRAMEWORK |

| TABLE II.4: FINANCIAL IMPACT OF MEASURES IN GRIDS ON NRP (in € mn) |

| | | 2015 | | 2016 | | 2017 | | 2018 | | 2019 |

| Public expenditure and taxation | | | | | | | | | | |

| Incremental expenditure | | 51 | | 4,489 | | 4,476 | | 5,380 | | 4,427 |

| Incremental revenue | | 0 | | 6,494 | | 3,344 | | 5,598 | | 1,908 |

| Lower expenditure | | 2,099 | | 6,131 | | 5,216 | | 5,996 | | 5,336 |

| Lower revenue | | 0 | | 20,091 | | 14,935 | | 15,394 | | 12,217 |

| Administrative efficiency | | | | | | | | | | |

| Incremental expenditure | | 3 | | 498 | | 346 | | 209 | | 197 |

| Incremental revenue | | 0 | | 3 | | 9 | | 9 | | 9 |

| Lower revenue | | 0 | | 2 | | 2 | | 2 | | 2 |

| Infrastructures and development* | | | | | | | | | | |

| Incremental expenditure | | 451 | | 1,231 | | 684 | | 672 | | 793 |

| Lower revenue | | 0 | | 132 | | 76 | | 76 | | 76 |

| Products and competition | | | | | | | | | | |

| Incremental expenditure | | 0 | | 15 | | 15 | | 15 | | 15 |

| Labour and pensions | | | | | | | | | | |

| Incremental expenditure | | 1,779 | | 4,723 | | 5,973 | | 5,763 | | 4,555 |

| Incremental revenue | | 0 | | 138 | | 607 | | 450 | | 160 |

| Lower expenditure | | 0 | | 706 | | 1,492 | | 1,927 | | 1,775 |

| Lower revenue | | 0 | | 599 | | 946 | | 1,114 | | 1,114 |

| Innovation and human capital | | | | | | | | | | |

| Incremental expenditure | | 1,019 | | 3,375 | | 3,219 | | 3,227 | | 3,023 |

| Incremental revenue | | 0 | | 16 | | 0 | | 0 | | 0 |

| Lower expenditure | | 0 | | 7 | | 7 | | 7 | | 4 |

| Lower revenue | | 0 | | 13 | | 13 | | 14 | | 16 |

| Support to businesses | | | | | | | | | | |

| Incremental expenditure | | 22 | | 2,465 | | 3,981 | | 3,116 | | 3,016 |

| Incremental revenue | | 300 | | 232 | | 1,125 | | 657 | | 109 |

| Lower expenditure | | 0 | | 330 | | 280 | | 454 | | 7 |

| Lower revenue | | 0 | | 738 | | 5,422 | | 5,831 | | 4,467 |

| Energy and environment * | | | | | | | | | | |

| Incremental expenditure | | 501 | | 658 | | 238 | | 74 | | 12 |

| Incremental revenue | | 0 | | 545 | | 553 | | 0 | | 0 |

| Lower expenditure | | 0 | | 0 | | 85 | | 0 | | 0 |

| Lower revenue | | 0 | | 106 | | 1,103 | | 927 | | 11 |

| Financial system | | | | | | | | | | |

| Incremental expenditure | | 0 | | 2,756 | | 103 | | 103 | | 103 |

| Federalism | | | | | | | | | | |

| Lower revenue | | 0 | | 6 | | 6 | | 5 | | 5 |

*Net of amounts included in Table E annexed to the 2016 Stability Law. Source: Analyses of the State General Accounting Office, technical reports and the information reported in official documents. The table excludes the resources of the Action & Cohesion Plan and of the various funds allocated to the interventions with a European dimension. |

The update of the interventions planned under the Strategic Infrastructure Program this year is contained in the Appendix to Annex 2016 DEF 'Strategies for the transport and logistics infrastructure'.

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | 21 |

III. POLICY RESPONSES TO KEY ECONOMIC CHALLENGES

| III.1 | IMPLEMENTATION: THE FOCAL POINT OF THE GOVERNMENT’S ACTION |

The 2016 National Reform Programme (NRP) represents the link between the planning of the reforms and their full implementation. It is an essential part of a three-year reform plan inaugurated by the current government upon its investiture; this reform plan has been enhanced over time, in response to the economic challenges that the country has faced in moving beyond the crisis. The reforms promoted in these years also originate from an awareness of the macroeconomic imbalances that have troubled Italy for decades, and that are at the core of continuing structural weaknesses: low productivity and high public debt.

The gradual recovery taking shape is mainly the result of the structural measures inaugurated by the government to respond to Italy’s long-standing problems. At the same time, the fragile economy still necessitates constant attention to the continuation of the reform process. In this regard, it is significant that the OECD’s recent report, “Going for Growth”, ranked Italy among the European countries having the highest rates of reform implementation, unlike the northern European countries where the pace of reform seems to have come to a halt.

The government is also aware that changes with such a strong structural impact (such as those legislated in the past two years) need to be carefully monitored and continually checked for their effectiveness. The 2016 NRP focuses on this implementation and verification process, while also outlining plans for new structural measures.

The government’s efforts are based on a strategy of supporting the growth and the competitiveness of the Italian economy, and promoting the excellence that distinguish some of its sectors. The Italian economy has been marked by the mediocre performance of productivity in recent decades. The government intends to revive the growth of various elements of productivity: labour productivity (with regard to employees and the self-employed), also through alignment of wages to productivity, including by means of enhancements to decentralised collective bargaining (with particular reference to recent measures contained in the 2016 Stability Law); capital productivity, through instruments aimed at stimulating investment, research and development, and measures to facilitate access to credit; and finally, total factor productivity, through a package of structural reforms, measures for deregulation, and policies to favour start-ups.

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | 23 |

ECONOMIC AND FINANCIAL DOCUMENT - SECTION III NATIONAL REFORM PROGRAMME |

Against this backdrop, the government remains committed to responsible management of the public finances, with the objective of gradually reducing the debt and consolidating growth (growth-friendly consolidation). With this objective in mind, the attention on budget discipline has been flanked by measures to support and revive public investment, which has been particularly weak in the wake of the economic crisis. These efforts will be undertaken in line with the EU flexibility designed to promote investment spending.

The government’s action with respect to key economic sectors (such as the labour market, training and education, the judicial system, tangible and intangible infrastructure, public spending and taxation, the banking system and the public administration) represents an effort without precedent in recent decades.

This chapter examines the principal measures approved in recent months and the status of implementation of the reforms inaugurated by the government upon its investiture, using an approach consistent with the 2015 NRP. In its recent Country Report1, the European Commission acknowledged that the Italian government has acted in accordance with the specific recommendations made by the European Council in 2015, achieving significant progress in the areas indicated as critical, and that this progress has been achieved notwithstanding the structural weaknesses that have continued to inhibit growth and Italy’s capacity to react to economic shocks. In any event, the crisis has shown how the effectiveness of national measures is also dependent on simultaneous reforms, including in other countries, and that the focus on the positive externalities of European integration needs to be revived.

Along with the measures to support businesses and the continuing attention on public expenditure, the reforms inaugurated by Italy are in line with the European Commission’s indications in the Annual Growth Surveys2, which identifies investments, structural reforms and responsible budget policies as the EU’s three economic-policy priorities. The government remains convinced3 that the growth of the country, and more importantly, of the entire European Union, is linked to greater convergence of the economies, the acceleration of structural reforms, and the strengthening of domestic demand. These objectives can be reached only if there is simultaneous strengthening of mutually reinforcing coordinated socio-economic policies.

The positive spillover effects of the reforms are the proof of the need (for each country) to move toward greater convergence and symmetry in macroeconomic adjustments. The EU Member States need to work together in order to complete processes crucial for the entire EU, from banking union to capital markets union to the completion of the Single Market, the promotion of investment, and the challenge of migrant flows.

___

1 http://ec.europa.eu/economy_finance/eu/countries/italy_en.htm

2 http://ec.europa.eu/europe2020/making-it-happen/annual-growth-surveys/index_en.htm

3 In this regard, see Italy’s contribution about the future of the European Union, ‘A shared European strategy for growth, jobs and stability’

http://www.governo.it/sites/governo.it/files/ASharedPolicyStrategy_20160222.pdf

| 24 | MINISTERO DELL’ECONOMIA E DELLE FINANZE |

III. POLICY RESPONSES TO KEY ECONOMIC CHALLENGES |

This chapter is organised according to the Commission’s guidelines for the preparation of National Reform Programmes, and is much more condensed than in the past, with the presentation by policy challenges and areas of intervention. The more condensed form of this chapter is rounded out by an intermediate report published on the MEF web site4, which provides greater detail about the state of completion of the reforms5.

Finally, the NRP also includes an appendix that reports the overall time schedule for the reforms and summary tables regarding: the quantitative impact of the reforms; the measures for implementation of the country-specific recommendations; the implementation of the Europe 2020 targets.

Monitoring and legislative implementation

The data about the actual implementation of the reforms have shown the validity of the specific actions taken since the government’s investiture just a little over two years: with reference to the extent of implementation of the reforms launched by the government, the current rate of 69 per cent is more than triple than the rate reported at June 2014. The stock of 889 implementation decrees left behind by the two previous administrations has been reduced to 211 decrees (-76 per cent), with a rate of adoption of 79.3 per cent.

From 22 February 2014 to 29 March 2016, the government approved 328 Legislative Decrees; 201 were published in the Official Gazette of the Italian Republic, with 55.7 per cent thereof automatically going into effect without the need for any second-level implementation decrees.

This acceleration in implementation is the result of the first measures approved; in the second half of 2015, additional related and convergent measures were approved, both at a regulatory level6 and at an administrative level, in order to strengthen the coordination on the part of the Office of the Presidency of the Council of Ministers (for example, the organisation of technical working groups to resolve the complexities of inter-ministerial provisions).

With the full-scale use of the Monitor System as of June 2015, the ministries are making use of a shared operational dashboard to accelerate the process of implementing legislation. The month of April 2016 marked the start-up of the procedures contained in a protocol of intent signed in May 2015 by the State General Accounting Department and the Government Programme Office, with respect to indicators especially designed for measuring the status of implementation of the legislative measures for which each ministry is responsible. During 2016, the Government Programme Office will conduct special training sessions for officials of the cabinet and the legislative offices of the ministries, to consolidate and accelerate the administrative processes behind the reforms.

___

4 #leriformeinItalia

http://www.dt.mef.gov.it/it/attivita_istituzionali/analisi_programmazione_economico_finanziaria/strategia_crescita/index.html (Italian text only).

5 The first report published regarded April-September 2015, and was a support to the EFD Update. The second report is related to October 2015-March 2016, and supports this EFD.

6 For example, the institution of the silent consent for the issuance of statements of agreement and opinions between administrations, as introduced by Law No.124 of 7 August 2015.

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | 25 |

ECONOMIC AND FINANCIAL DOCUMENT - SECTION III NATIONAL REFORM PROGRAMME |

Implementation of legislation also entails the continuous process of adjustment to European laws and regulations and reduction of the number of infractions. The European Policies Department is responsible for coordination of this process, and is committed to further reducing the number of pending infraction procedures, already cut by 30.25 per cent (from 119 to 83) between the date of the investiture of the Renzi government (February 2014) and March 2016.

This positive trend has been rounded out by the 2016 approval of the Law of European Delegation and the European Law, which will allow for settlement of other infractions pending at the time of the approval.

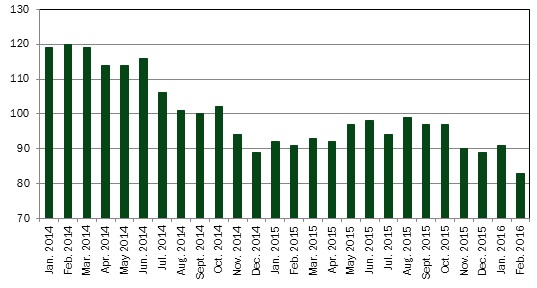

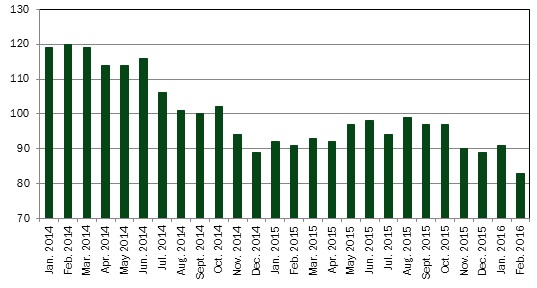

FIGURE III.1: INFRACTION PROCEDURES UNDER RENZI GOVERNMENT |

|

Source: Office of the Presidency of the Council of Ministers – European Policies Department |

III.2 PUBLIC DEBT REDUCTION

Public finance

Consolidation and growth7

Between 2009 (the first year in which the Euro Area’s GDP contracted) and 2015, Italy maintained an average deficit of 3.5 per cent; only six Euro Area countries produced a lower deficit (Austria, Malta, Finland, Germany, Estonia and Luxembourg). Considering the significant fall in GDP during the same period, this was an extraordinary fiscal effort. If one looks at the primary balance, excluding the public debt burden, Italy is the country that maintained the highest primary surplus on average (1.1 per cent) in the Euro Area, and was one of the few

___

1 For details, see the paper ‘Consolidation and support to growth’, published on the MEF web site.

http://www.tesoro.it/focus/consolidamento/Consolidamento_e_sostegno_alla_crescita.pdf (Italian text only).

| 26 | MINISTERO DELL’ECONOMIA E DELLE FINANZE |

III. POLICY RESPONSES TO KEY ECONOMIC CHALLENGES |

countries to have produced a positive balance, with most of the other countries having witnessed a deterioration in their position during the period considered.

In addition, when assessing the cyclically adjusted primary balance, fiscal consolidation is even more evident, with Italy being the Euro Area country to have achieved the most significant consolidation. Italy’s prudent budget policy is related to the existence of a high public debt, which, however, has increased during the period at a considerably lower rate with respect other countries considered.

The new policy scenario (for additional details, see the 2016 Stability Programme, Section III.3) provides for cutting the net borrowing from 2.3 per cent of GDP in 2016 to 1.8 per cent in 2017 and 0.9 per cent in 2018, before getting to a slight surplus in 2019 (0.1 per cent of GDP). On a structural basis, the balance should improve from -1.2 per cent of GDP in 2016 to -1.1 per cent in 2017, -0.8 per cent in 2018, and -0.2 per cent in 20198. Under the policy scenario, the debt-to-GDP ratio is projected to equal 132.4 per cent in 2016, before declining significantly in the years thereafter, to reach 123.8 per cent.

Spending review

CSR1 – ‘Ensure that the spending review is an integral part of the budgeting process’. |

Spending review: objectives and results

The ratio of current expenditure to GDP decreased by 1.4 percentage points (from 47.4 percent to 46.0 per cent) from 2013 to 2016. Net of expenditure for social benefits (which reflects cyclical phases of the economy and factors linked to the ageing of the population), primary current expenditure had an average annual change that was close to zero or negative during the 2009-2015 period, notwithstanding the lengthy economic and financial crisis, which caused a significant contraction in the economic growth rate. Such expenditure aggregate is forecast to remain virtually stable in the next three-year period, thus falling gradually in real terms. The containment of spending made a significant contribution to the reduction of the deficit, which goes from 3 per cent of GDP of 2014 to an estimated 2.3 per cent in 2016, which is a 9-year low.

The government’s commitment to the spending review has played a role in the achievement of these results. Altogether, since 2014, the savings associated with the initiatives to streamline spending amount, in terms of net borrowing, to approximately €3.6 billion in 2014, €18 billion in 2015, €25 billion in 2016, €27.6 billion in 2017 and approximately €28.7 billion in 2018, and regard all levels of government9. These savings are mostly derived from: i) changes in spending

___

8 This last level would ensure the achievement of Italy’s Medium-Term Objective (MTO), which was set at zero in 2012, but which the country has the option of setting at -0.25 according to Commission’s most recent three-year assessments.

9 The savings are quantified net of fiscal and social-security effects, and, in the case of the regions and local entities, are indicated prior to their usage as part of the easing of the restrictions of the Domestic Stability Pact or from the changeover to new public finance target balance (as from 2016). It is noted that the legislative measures indicated have provided for spending cuts that exceed the amounts outlined in the spending review. The table presents only those amounts that refer to measures for streamlining expenditure and to make expenditure more efficient. In addition, some measures are booked as part of revenue in the general government account.

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | 27 |

ECONOMIC AND FINANCIAL DOCUMENT - SECTION III NATIONAL REFORM PROGRAMME |

mechanisms and the organisational structure of the administrations; ii) increased efficiency in public procurement of goods and services; and iii) the abandonment of initiatives considered obsolete.

The spending review was initially conducted by extraordinary commissioners appointed by the government, who mainly concentrated on cutting expenditure for the procurement of goods and services.

Later, a working relationship was established between the spending administrations and the MEF in order to identify i) areas where spending could be reduced, and ii) programmes that were less than efficient. This effort also included analysis of the individual budget items.

| TABLE III. 1 SPENDING REVIEW |

| Legislative measures | | 2014 | | 2015 | | 2016 | | 2017 | | 2018 |

| Decree-Law No. 4/2014 | | 488 | | 773 | | 565 | | 565 | | 565 |

| Decree-Law No. 66/2014 | | 3,120 | | 2,972 | | 2,800 | | 2,727 | | 503 |

| Decree-Law No. 90/2014 | | 0 | | 75 | | 113 | | 123 | | 153 |

| 2015 Stability Law | | 0 | | 12,159 | | 13,001 | | 4,154 | | 15,814 |

| 2015 Stability Law, revision at unchanged policies | | 0 | | 2,024 | | 1,375 | | 1,921 | | 1,668 |

| 2016 Stability Law | | 0 | | 0 | | 7,176 | | 8,155 | | 9,976 |

| Total | | 3,608 | | 18,003 | | 25,030 | | 27,645 | | 28,678 |

Due to rounding, the totals may not correspond to the sum of the components.

Source: State General Accounting Department analyses and estimates using data included in the summaries of the financial effects of the legislation.

More specifically, the 2016 Stability Law estimates savings (in terms of net borrowing) of approximately €7.2 billion in 2016, €8.2 billion in 2017, and €10 billion in 2018, with initiatives to be applied at all levels of government. The most significant savings are represented by cuts in appropriations to the ministries, the contribution of territorial autonomies, and the provisions to streamline the purchasing of goods and services.

| 28 | MINISTERO DELL’ECONOMIA E DELLE FINANZE |

III. POLICY RESPONSES TO KEY ECONOMIC CHALLENGES |

| REFORM TIMETABLE |

| Policy Area | Done | In Progress | Timetable |

| | | | |

| Spending Review and tax expenditures | | With the new regulatory framework for tax expenditures (Lgs. D. 160/2015) the Gov.t will annually review existing tax expenditures according to their economic impact and present a Report to Parliament together with the Budget Law. | October 2016 |

| Spending review – Phase I (rationalisation of purchasing centres, processes digitalisation and standard costs) savings achieved: 3.6 bn in 2014 and 18 bn in 2015 | | 2015 |

| Strengthening the programme of rationalization for e-procurement and of the central buyers bodies (‘centrali di committenza’); setting up of the ‘aggregators Table’; extension of the obligations for the PA and its subsidiaries to use Consip (the National e-procurement Agency) for their purchases. | |

| | Annual decrees on market categories and maximum thresholds for independent tenders (if exceeded authorities must resort to Consip or to another party aggregator). Definition of new benchmark prices based on ‘essential characteristics’ of the goods and services | By 2016 |

| | Standard requirements and fiscal capacity rules (Fiscal Federalism) for local authorities. Updating of the methodological notes |

| | Phase II of spending review (revision of Budget Law). Estimated savings: €25 billion in 2016, €28 billion in 2017 and 29 billion in 2018 | Structural savings planned until 2018. |

| | Bill modifying L. 243/2012 providing for the implementation of the principle of balanced budget for regional and local authorities. | July 2016 |

Spending review: target areas

The savings projected for the State are largely based on selective initiatives to cut the expenditure of the ministries for approximately €2.7 billion in 2016, €2.1 billion in 2017, and €2.3 billion in 201810.

___

10 Which, in terms of reduction of the appropriations available, amount to approximately €3.3 billion in 2016, €2.4 billion in 2017, and €1.8 billion in 2018.

| MINISTERO DELL’ECONOMIA E DELLE FINANZE | 29 |

ECONOMIC AND FINANCIAL DOCUMENT - SECTION III NATIONAL REFORM PROGRAMME |

Other reductions have been achieved through the revision of transfers and subsidies to public and private businesses11.

Additional measures include, inter alia, the replanning of resources for healthcare-related construction projects (€0.3 billion in 2016 and €0.6 billion in each of the years 2017 and 2018) and the sale of buildings used by the Ministry of Defence (€0.2 billion in 2016).

The national social-welfare and public social assistance entities have been charged with cutting current expenditure, excluding that for pensions and assistance, by at least €53 million in the 2016-2018 three-year period. The provisions already provided for the 2014-2016 three-year period are to be temporarily continued with respect to the revision of the indexing of pension payments that are three times greater than the minimum pension, with savings, net of fiscal effects, amounting to approximately €335 million in 2017 and approximately €750 million in 2018.

The standard national healthcare funding requirement has been set at €111 billion for 2016, with a consequent impact of lowering net borrowing by approximately €1.8 billion. One portion of the financing of the national healthcare service (€0.8 billion) is subject the adoption of the new Essential Levels of Care (ELC). With further reference to the healthcare sector, the 2016 Stability Law supplies various tools for improving efficiency, including enhancements to centralised purchasing procedures and the introduction of deficit reduction plans for hospitals (including university hospitals), Scientific Institutes for Research, Hospitalisation and Health Care (IRCCS) and, as from 2017, local healthcare units (ASL).

The production of electronic personal healthcare records is to be completed through the institution of a national record hub that will get involved in the process, pending the activation of the regional hubs, which are expected to ensure optimal interaction between healthcare facilities and individuals, and efficient monitoring of healthcare expenditure.

Turning to the regions, a significant saving is expected from the changeover to the new public finance target balance (approximately €1.8 billion in 2016, approximately €1 billion in 2017 and €660 million in 2018). In addition, the regions and autonomous provinces have been charged with improving their contribution by approximately €4 billion in 2017 and approximately €5.5 billion in 201812.

With reference to public-sector employment, the freeze on turnover has been enhanced for the 2016-2018 period, with 25 per cent of the savings coming from terminations (which, net of the fiscal and social-security effects, amount to €23 million in 2016, €81 million in 2017 and €164 million in 2018). In addition, the resources for ancillary employee compensation have been limited and reduced (€36 million per year).

___

11 Including the Italian National Railways (€0.4 billion in 2016), the fund for tax relief to businesses (€35 million in 2016, €41 million in 2017, and €60 million in 2018) and interest subsidies related to the financing made available by the Revolving Fund for Support to Businesses (€55 million in 2016 and 50 million in each of the years thereafter). Cuts have also been made to the compensation paid to authorised tax assistance centres (€40 million in 2016 and €70 million for the years of 2017 and 2018) and social services assistance centres (€15 million per year).

12 Inclusive of the savings on expenditure derived from the regions’ use of procurement centres for the purchases goods and services, which are equal to €480 million in each of the years of 2017 and 2018.

| 30 | MINISTERO DELL’ECONOMIA E DELLE FINANZE |

III. POLICY RESPONSES TO KEY ECONOMIC CHALLENGES |

Procurement units, public administration’s electronic market and streamlining of ICT purchases

Enhanced centralised procurement and e-procurement remain important elements of the spending review, as they allow for efficiency gains in purchasing processes and costs (including the administrative charges related to the execution of purchasing procedures) and greater traceability, transparency and simplification of administrative action. The start-up of the technical working group of aggregating entities is one of the more important initiatives already implemented. The group is charged with figuring out the requirements of the administrations in terms of purchases of goods and services, and facilitating coordinated planning of purchases, so as to increase the portion of purchases done in aggregate form.