Exhibit 22

INDEX

| I | DEBT MANAGEMENT OBJECTIVES FOR 2019 | 1 |

| | | |

| I.1 | The Treasury’s objectives and international debt management practices | 1 |

| I.2 | 2019 Objectives: The institutional framework of reference | 4 |

| I.3 | Curbing the cost of debt while paying attention to the cost/risk profile | 8 |

| I.4 | Monitoring and managing the Cash Account to stabilise the balance | 17 |

| | | |

| II. | THE ITALIAN GOVERNMENT SECURITIES MARKET: PERFORMANCE IN THE INTERNATIONAL CONTEXT | 21 |

| | | |

| II.1 | Monetary policies and effects on the Euro area money market | 21 |

| II.2 | Euro area bond markets | 24 |

| II.3 | Trends in the Italian government securities market | 28 |

| | | |

| III. | PUBLIC DEBT MANAGEMENT IN 2019 | 47 |

| | | |

| III.1 | Outstanding General Government debt | 47 |

| III.2 | Government securities activities | 48 |

| III.3 | Derivatives portfolio management | 76 |

| III.4 | Debt management results in relation to objectives | 78 |

III.5

| The Treasury’s cash management | 90 |

| ANNEXES | 99 |

| | |

| Annex 1: | The Treasury's involvement in international discussions on debt management | 99 |

| Annex 2: | The Department of the Treasury's Public Debt Directorate: organisational structure | 101 |

| Annex 3: | SAPE (Issuance Portfolio Analysis Software) | 104 |

Annex 4:

| Derivatives used by the Treasury: role, types and collateralisation system | 106 |

| | | |

| STATISTICAL ANNEX | 111 |

| ITALIAN MINISTRY OF ECONOMY AND FINANCE | I |

INDEX OF TABLES

| Table I.1: | Domestic government securities | 5 |

| Table I.2 | Objectives for the end of 2019: percentage composition of the debt portfolio | 6 |

| Table III.1: | Issues1, maturities and funding Government borrowing requirements (€ million) | 49 |

| Table III.2: | Government securities issued, net of exchange transactions (€ million) | 50 |

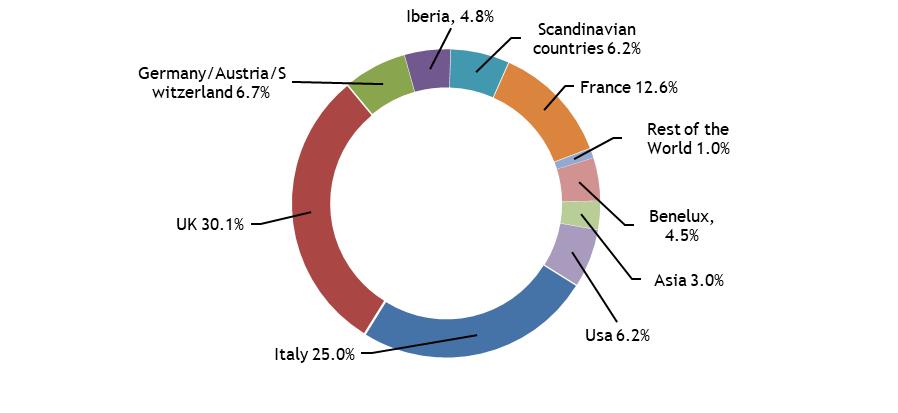

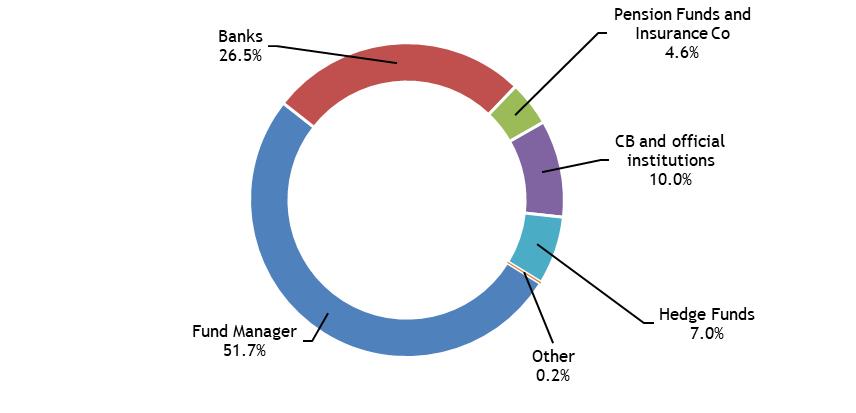

| Table III.3: | Allocations of nominal BTPs made through syndicated issue in 2019: geographical distribution | 56 |

| Table III.4: | Allocations of nominal BTPs made through syndicated issue in 2019: distribution by type of investor | 56 |

| Table III.5: | Electronic exchange on 20/03/2019 (€ million) | 74 |

| Table III.6: | Exchange via marginal auction on 21/06/2019 (€ million) | 74 |

| Table III.7: | Summary of buybacks funded by the Cash Account (nominal amounts in € million) | 75 |

| Table III.8: | Composition of 2017-2019 issues, in absolute and percentage terms, excluding exchanges* | 78 |

| Table III.9: | Composition of 2017-2019 issues, in absolute and percentage terms, including exchanges* | 80 |

| Table III.10: | Average life of the stock of government securities | 82 |

| Table III.11: | Duration and ARP trend during the 2017-2019 period, relating to the stock of government securities before derivatives (in years) | 82 |

| Table III.12: | Duration and ARP trend during the 2017-2019 period, relating to the stock of government securities after derivatives (in years) | 83 |

| Table III.13: | Market value trend of the stock of government securities (€ million) | 85 |

| Table III.14: | Derivatives portfolio - 2018 and 2019 (€ million) | 86 |

Table III.15:

| Cash Account and investments of the treasury's liquidity at the end of each month - 2019 (€ million) | 97 |

| Gross issues at nominal value – securities up to two years (€ million) | 112 |

| Gross issues at nominal value – securities exceeding two years (€ million) | 114 |

| Gross issues at nominal value – re-opening of off-the-run securities (€ million) | 115 |

| Compounded gross yields at issuance of government bonds (weighted monthly average) | 116 |

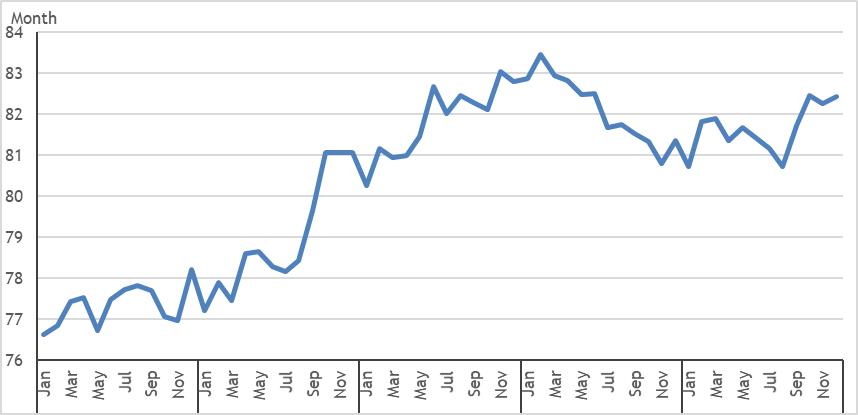

| Weighted average residual life of government bonds (months) | 117 |

| Compounded gross yields at issuance of government bonds – re-opening of off-the-run securities (weighted monthly average) | 118 |

| II | ITALIAN MINISTRY OF ECONOMY AND FINANCE |

I. DEBT MANAGEMENT OBJECTIVES FOR 2019 |

INDEX OF CHARTS AND FIGURES

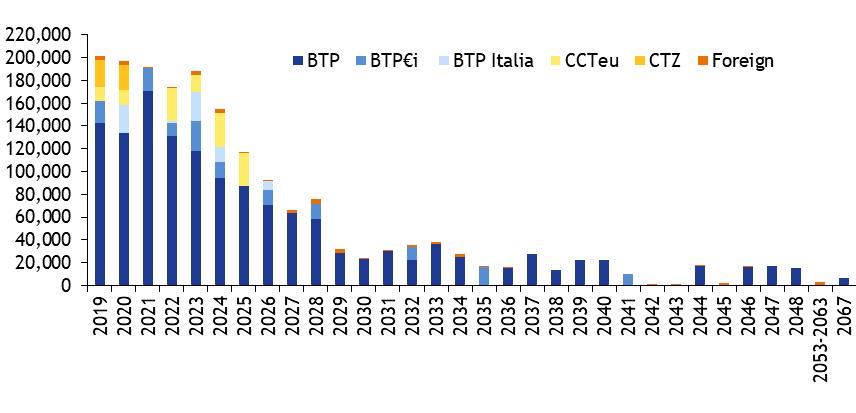

| Chart I.1: | Annual maturity profile of medium/long-term securities outstanding as at 31.12.2018 (€ million) | 9 |

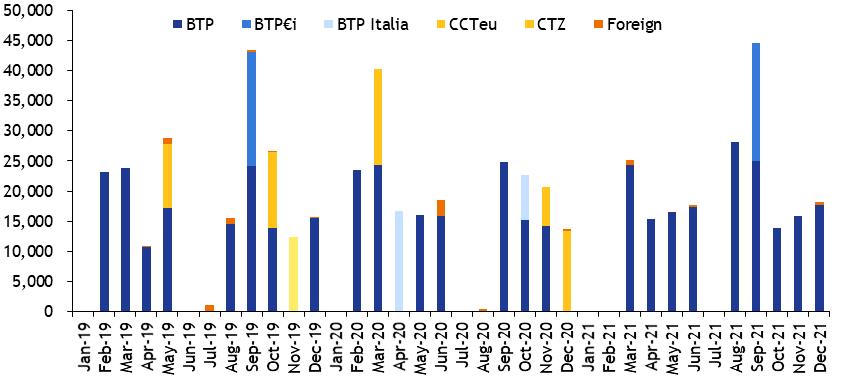

| Chart I.2 | Monthly maturity profile of medium/long-term securities outstanding as at 31.12.2018 (€ million) | 10 |

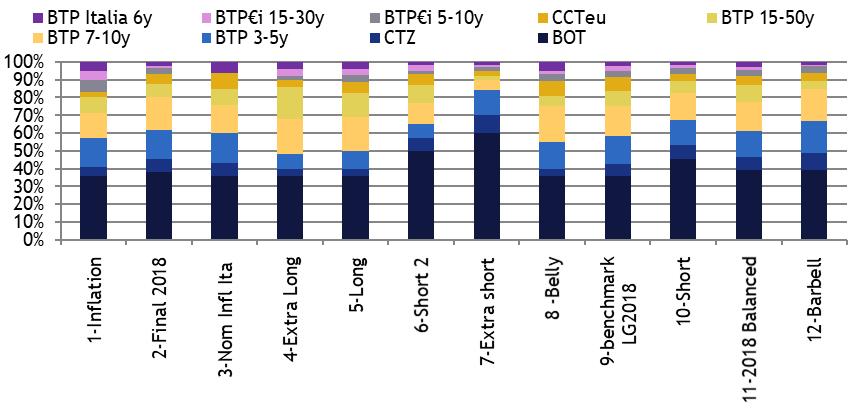

| Chart I.3: | Composition of the alternative issuance portfolios analysed for 2019 (€ million) | 13 |

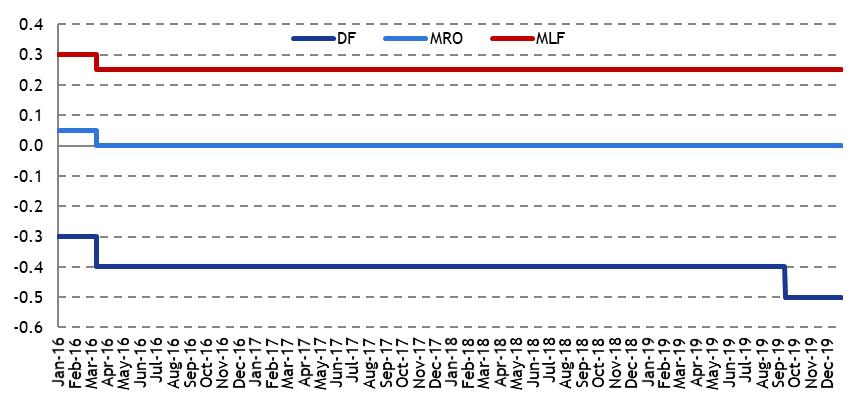

| Chart II.1: | Monetary policy interest rate corridor, 2016-2019 (percentage values) | 23 |

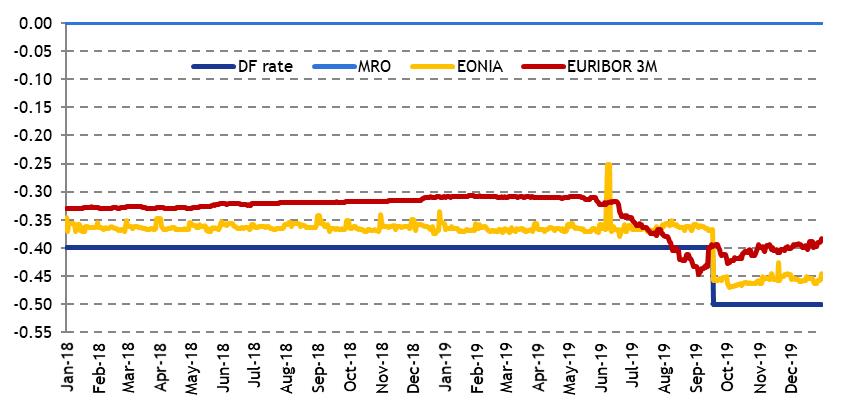

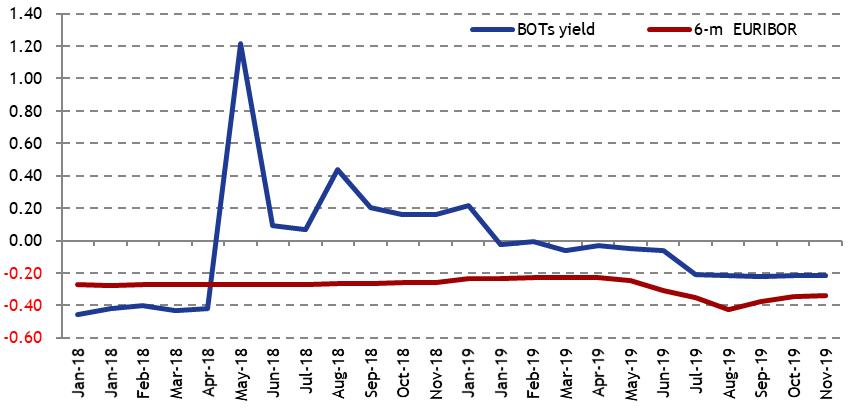

| Chart II.2: | Performance of the main money market rates, 2018-2019 (percentage values) | 24 |

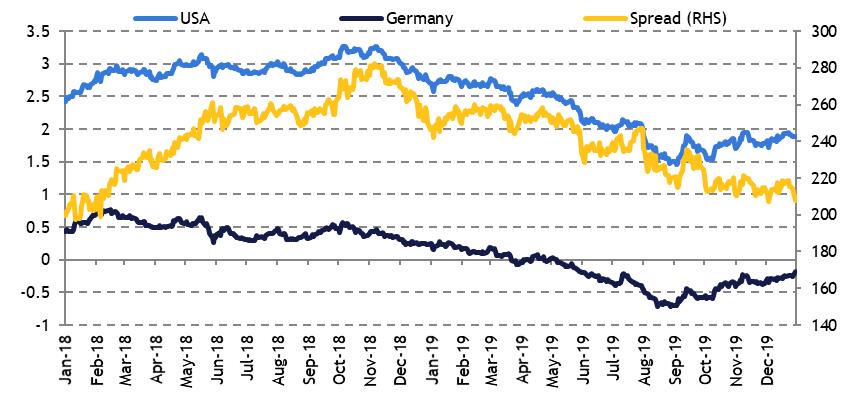

| Chart II.3: | Trend of German and US government bond yields - 10-year maturity (percentage values and spread in basis points) | 25 |

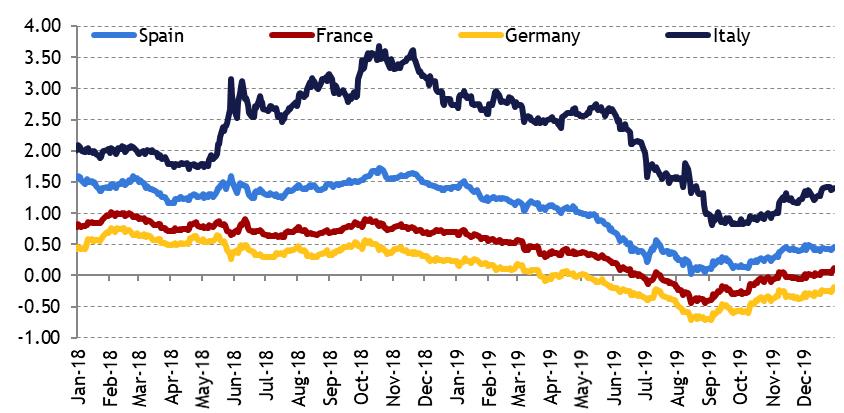

| Chart II.4: | Trend of european government bond yields - 10-year maturity (percentage values) | 26 |

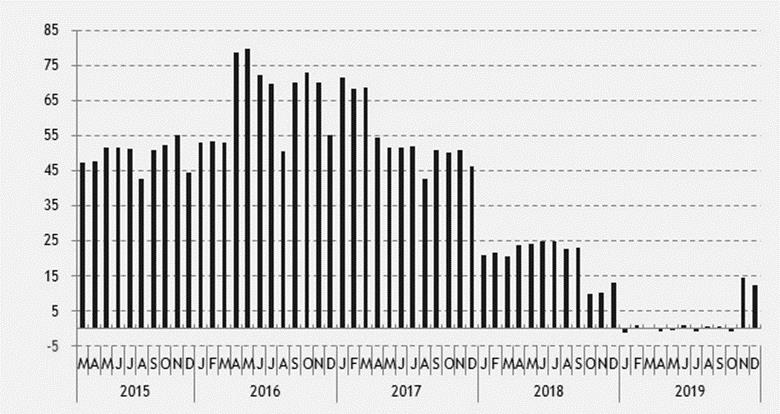

| Figure 1: | Net purchases under the APP programmes (€ billion) | 27 |

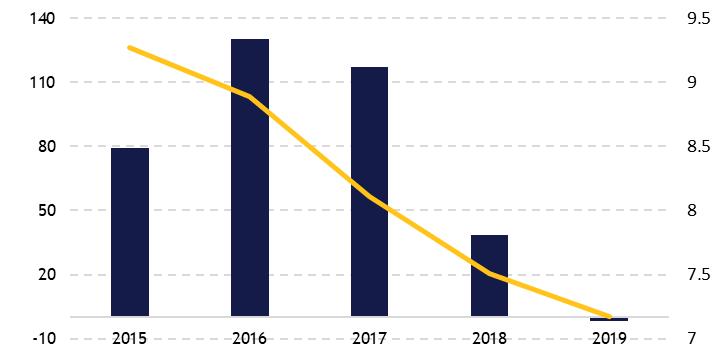

| Figure 2: | Volume and average life of the stock of Italian government securities purchased by the ECB | 28 |

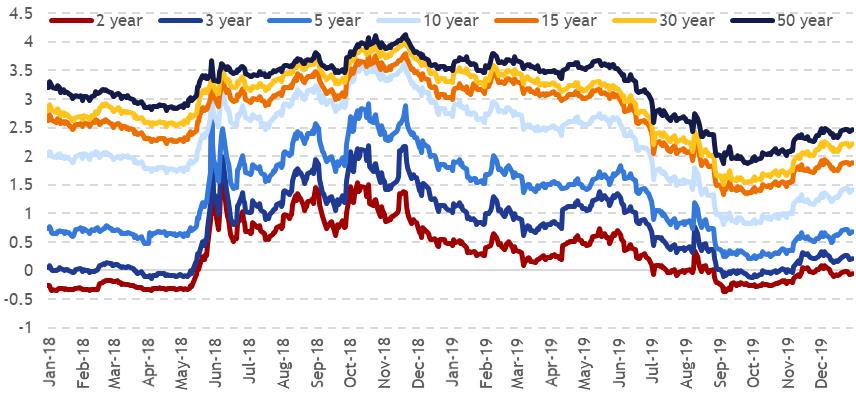

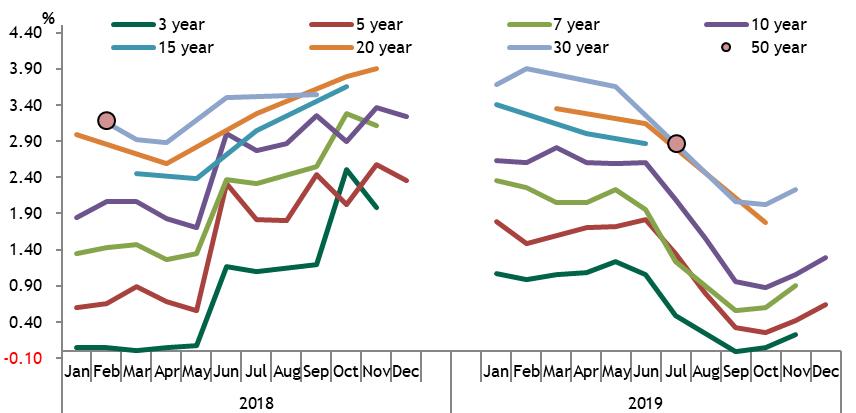

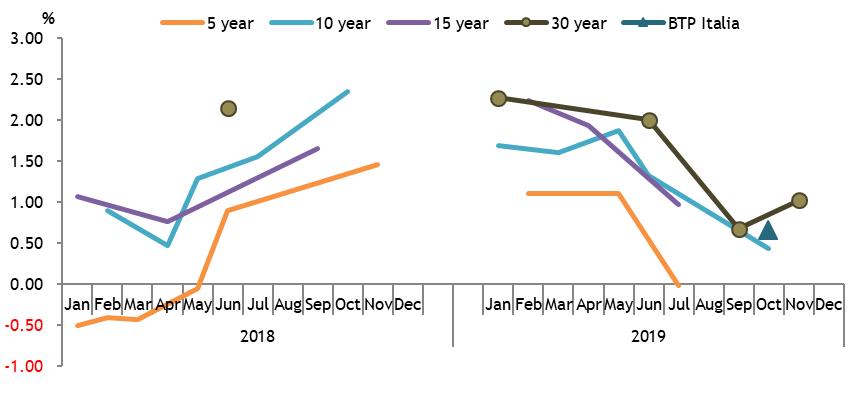

| Chart II.5: | Market yields on 2-, 3-, 5-, 10-, 15-, 30- and 50-year government securities (percentage values) | 29 |

| Chart II.6: | Government securities yield spread, 10-year vs. 2-year (basis points) | 29 |

| Chart II.7: | Government securities yield spread, 30-year vs. 10-year (basis points) | 30 |

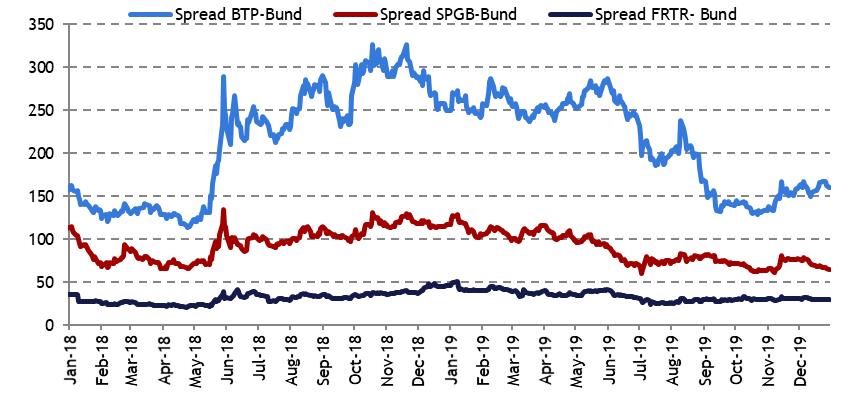

| Chart II.8: | Yield spread: BTP-Bund, OAT-Bund and Bonos-Bund, 10-year benchmark (basis points) | 30 |

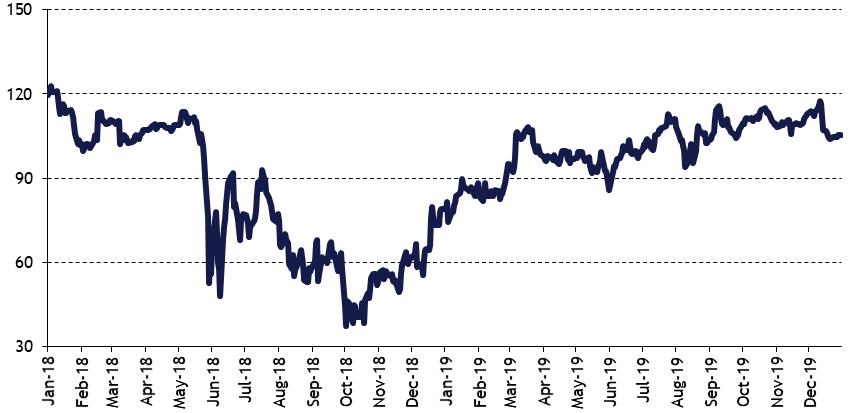

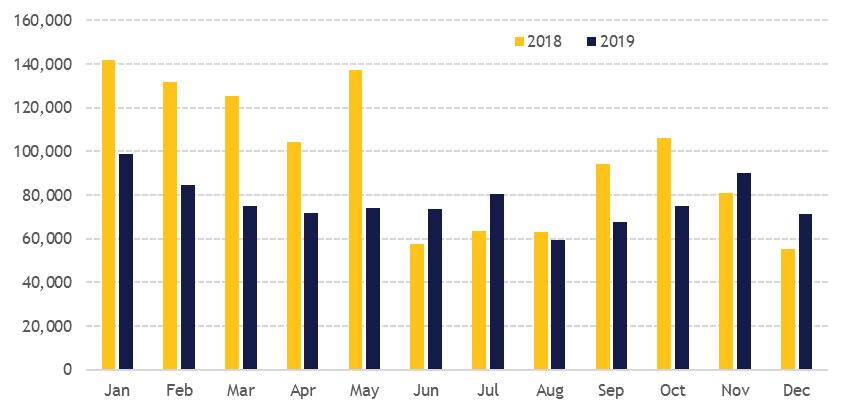

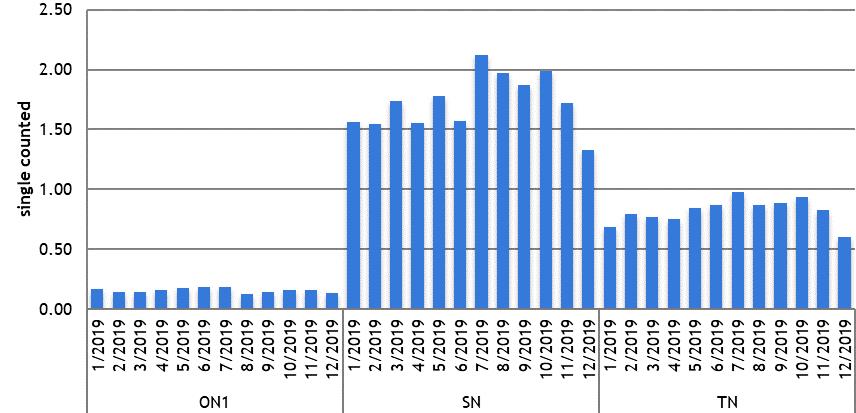

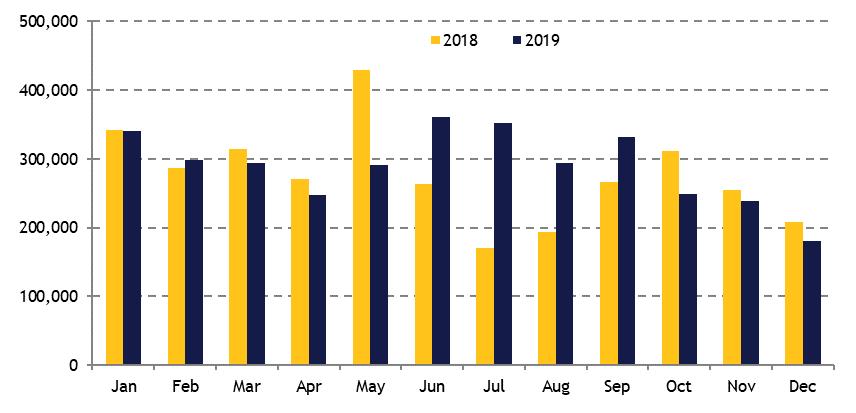

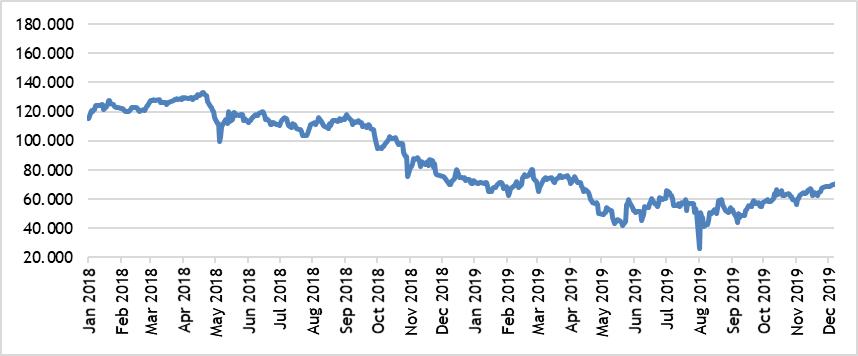

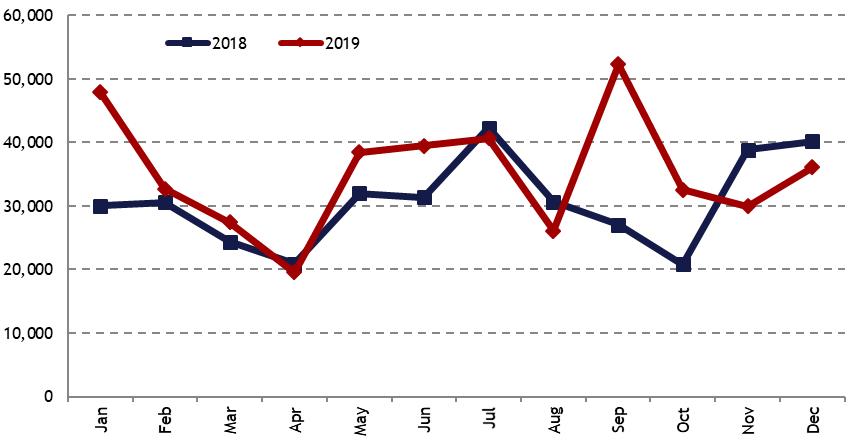

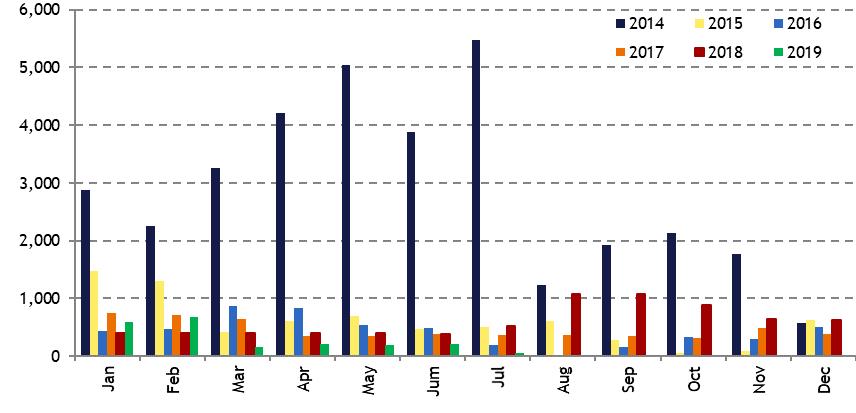

| Chart II.9: | Monthly volumes traded on the MTS platform (€ million; double-counted) | 32 |

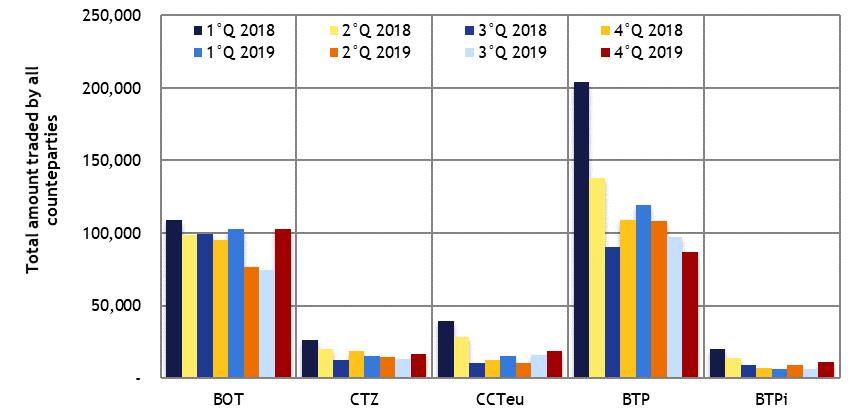

| Chart II.10: | Quarterly volumes traded on the MTS platform, by segment (€ million; double-counted) | 33 |

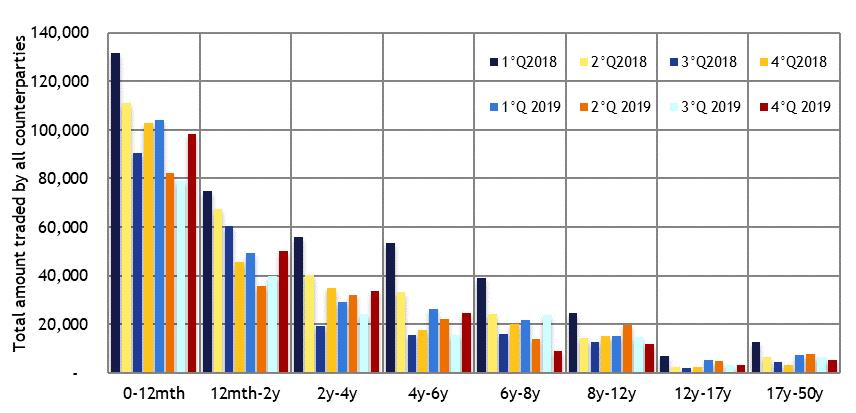

| Chart II.11: | Quarterly volumes traded on the MTS platform, by maturity (€ million; double-counted) | 34 |

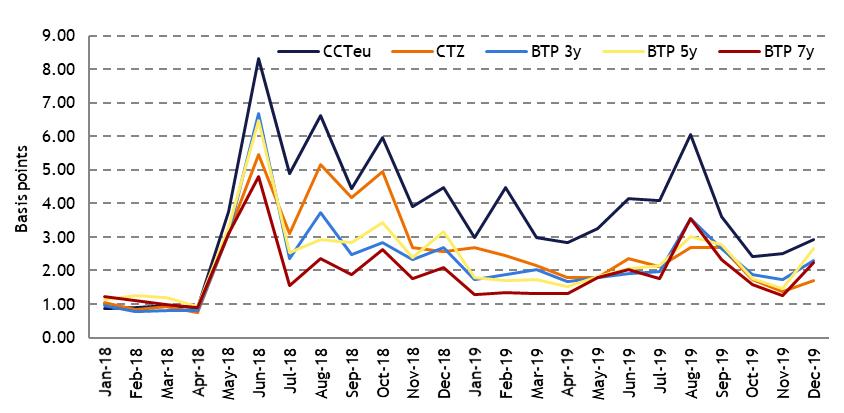

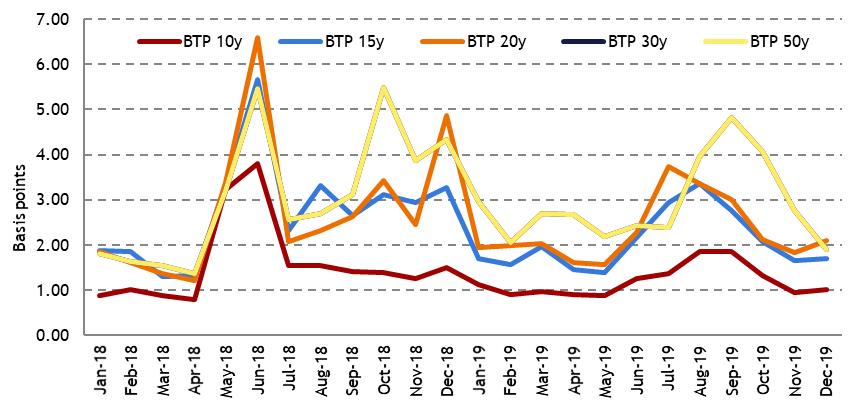

| Chart II.12a: | Bid-ask spread (in basis points) for CTZs, CCTeus, 3-, 5- and 7-year benchmark BTPs, as recorded on the MTS platform - monthly averages | 35 |

| Chart II.12b: | Bid-ask spread (in basis points) for 10-, 15-, 20-, 30- and 50-year benchmark BTPs, as recorded on the MTS platform - monthly averages | 35 |

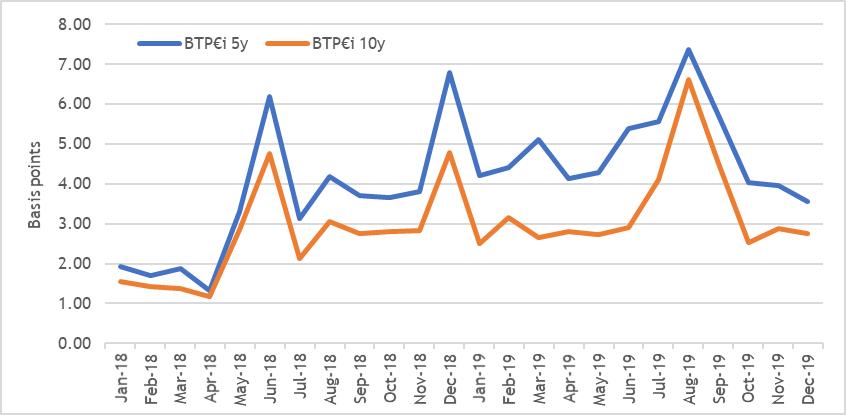

| Chart II.12c: | Bid-ask spread (in basis points) for 5- and 10-year benchmark BTP€is, as recorded on the MTS platform - monthly averages | 36 |

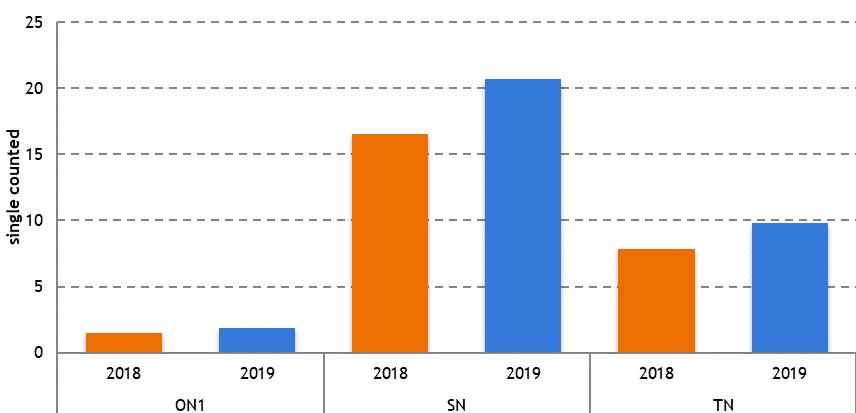

Chart II.12d:

| Daily slope on 10-year benchmark BTP (logarithmic scale), as recorded on the MTS platform | 37 |

Chart II.13:

| Annual volumes traded on the MTS platform in 2018 and 2019, by contract maturity (€ million) | 38 |

| ITALIAN MINISTRY OF ECONOMY AND FINANCE | III |

| Chart II.14: | Monthly volumes traded on the MTS platform in 2019, by contract maturity (€ million) | 38 |

| Chart II.15: | Monthly special repo volumes traded on the MTS platform (€ million) | 39 |

| Chart II.16: | Annual volumes traded by Specialists on the MTS platform (%) | 40 |

| Chart II.17: | Monthly volumes traded by Specialists on platforms other than the MTS (€ million) | 41 |

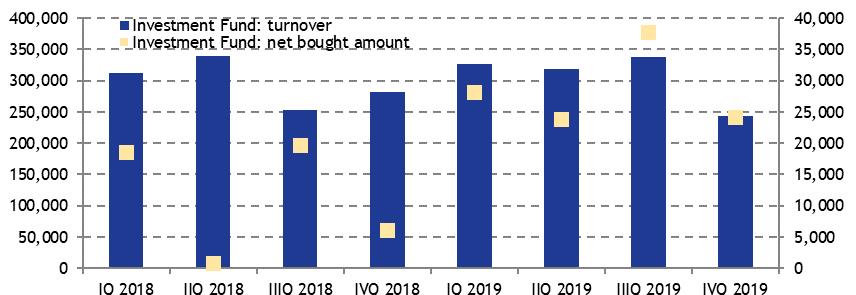

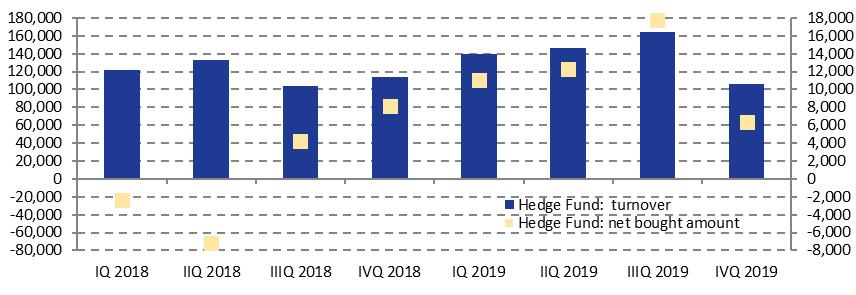

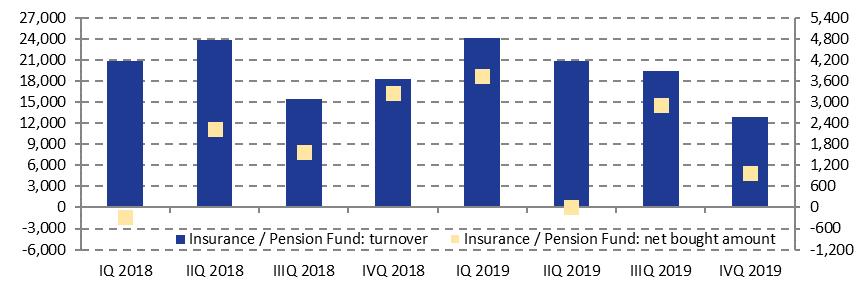

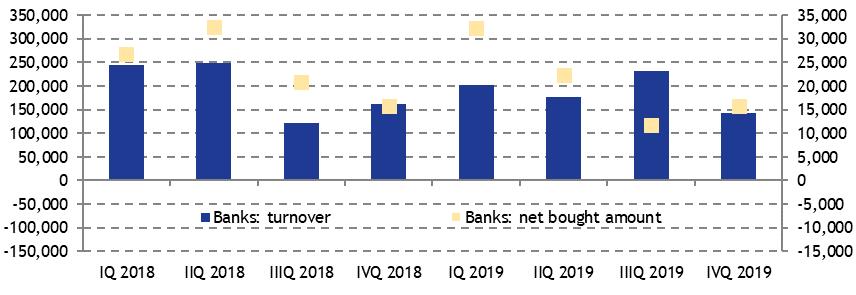

| Chart II.18: | Quarterly volumes traded by specialists, by type of counterparty - fund managers, banks, pension funds and insurance companies, hedge funds (€ million) | 43 |

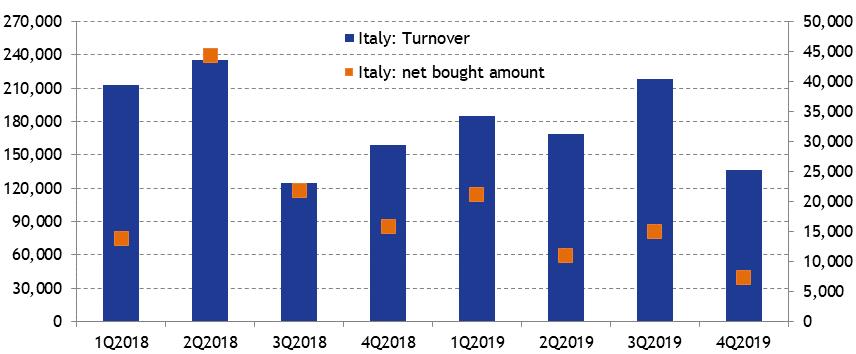

| Chart II.19: | Quarterly volumes traded by Specialists according to counterparty residence (€ million) | 44 |

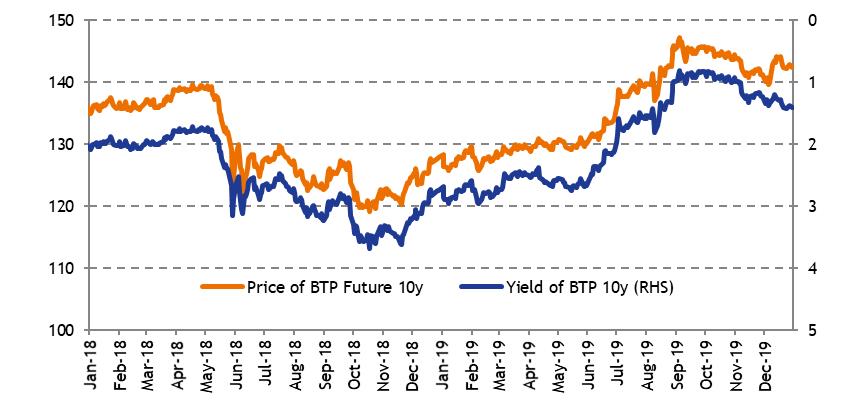

| Chart II.20: | Prices of the BTP Future and yield of the 10-year benchmark BTP (right-hand scale inverted, in %) | 45 |

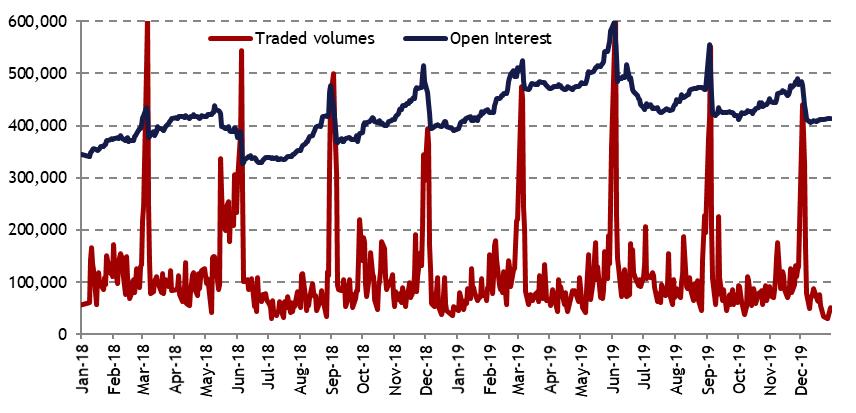

| Chart II.21: | Volumes of lots traded and open interest for the 10-year BTP Future contract traded on the eurex market | 46 |

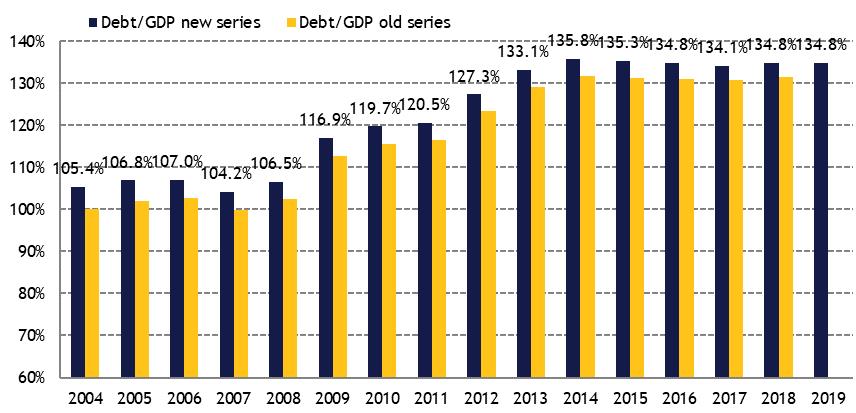

| Chart III.1: | Debt-to-GDP ratio trend 2005-2019 | 48 |

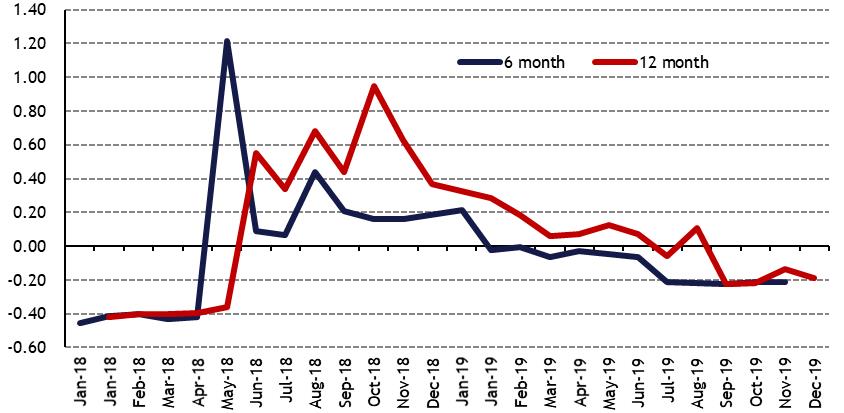

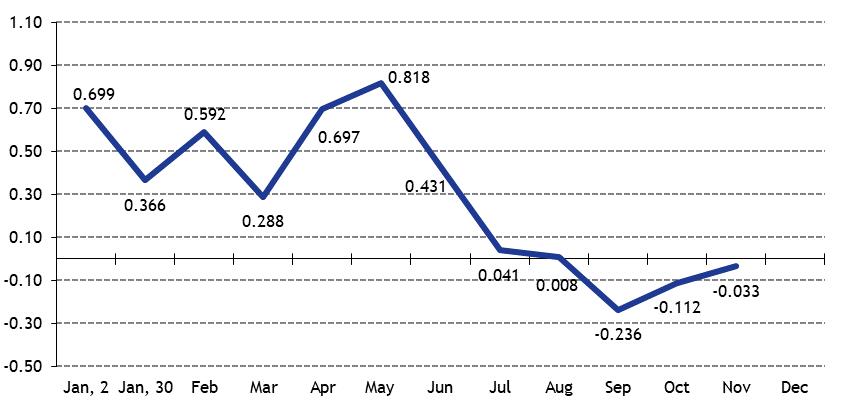

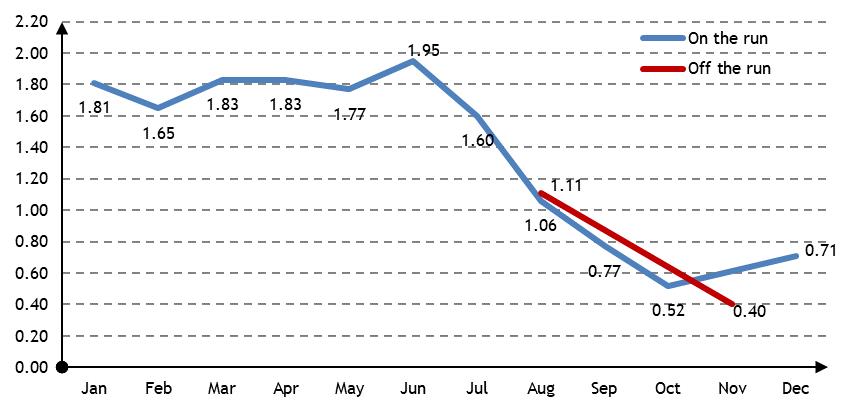

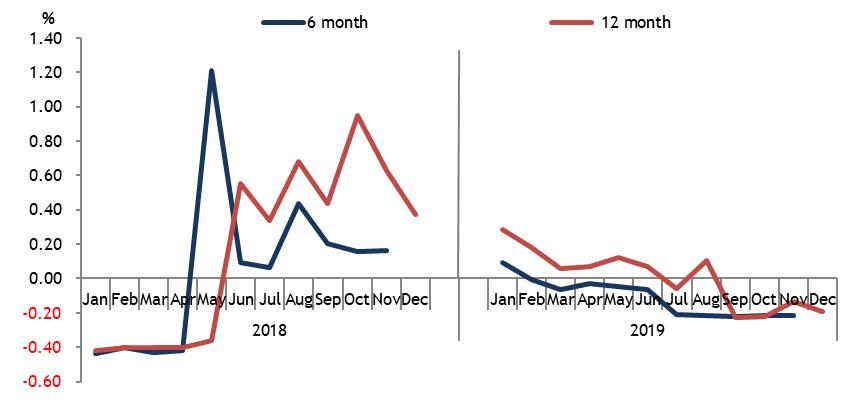

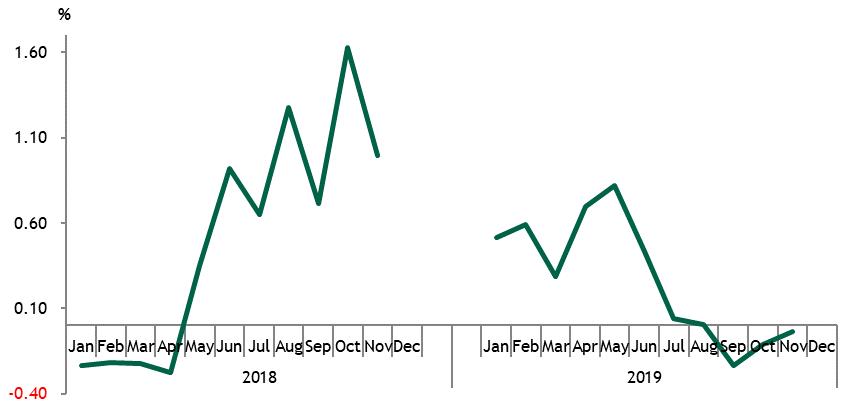

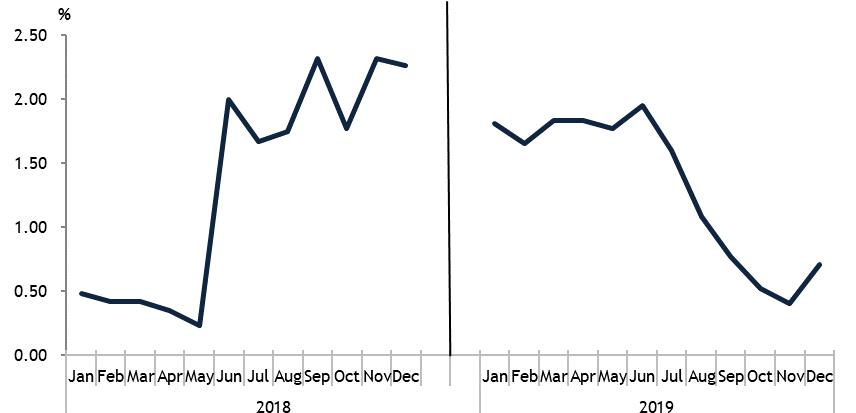

| Chart III.2: | Gross compound yields at issuance for 6-month and 12-month BOTs, 2018-2019 (percentage points) | 51 |

| Chart III.3: | Yield at issuance for 6-month BOTs and comparison with the Euribor rate - 2018-19 (percentage rates) | 52 |

| Chart III.4: | Yield at issuance for CTZs (percentage rates) in 2019 | 54 |

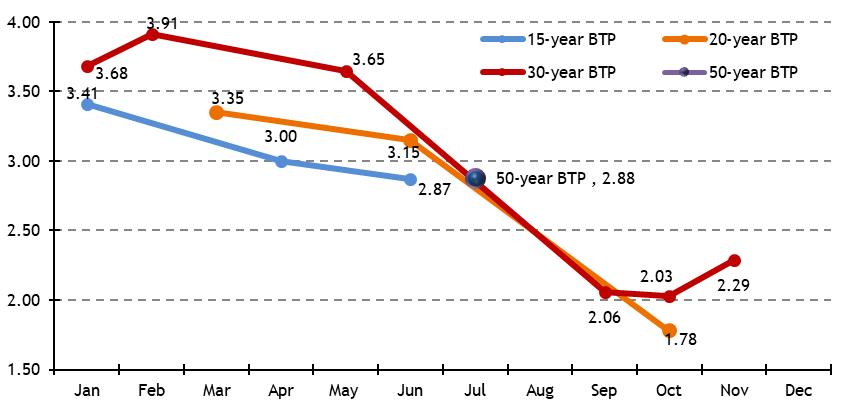

| Chart III.5: | Yield at issuance of long-term BTPs in 2019 (percentage rates) | 57 |

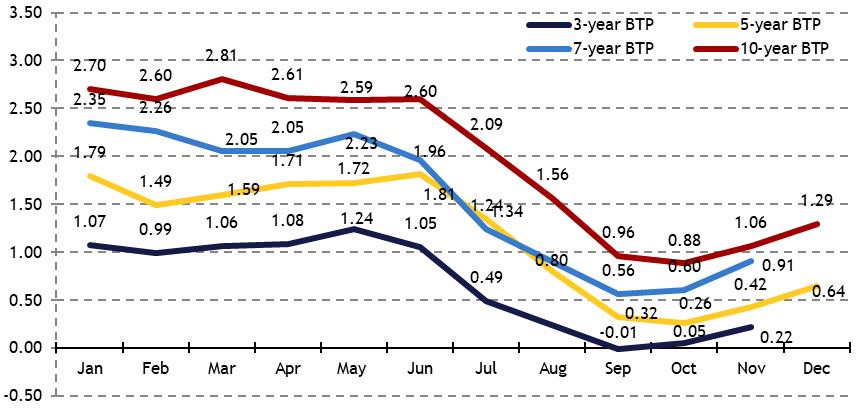

| Chart III.6: | Yield at issuance of BTPs with a maturity of between 3 and 10 years in 2019 (percentage rates) | 60 |

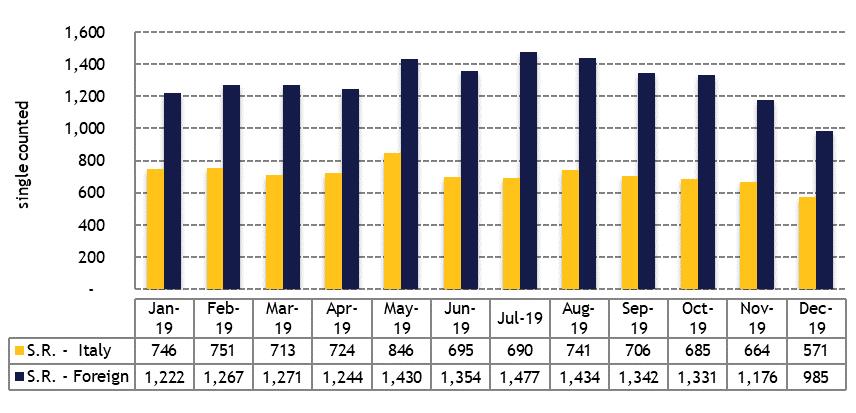

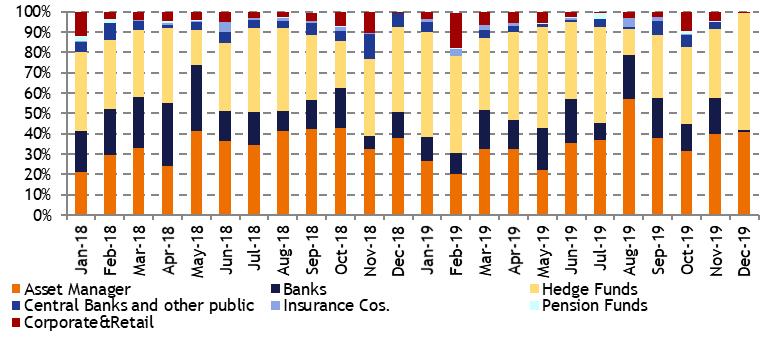

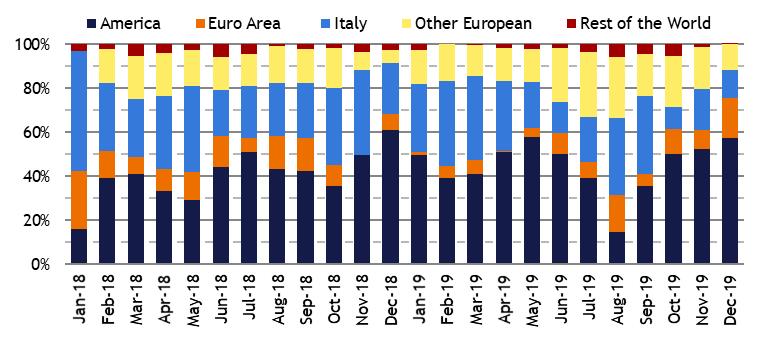

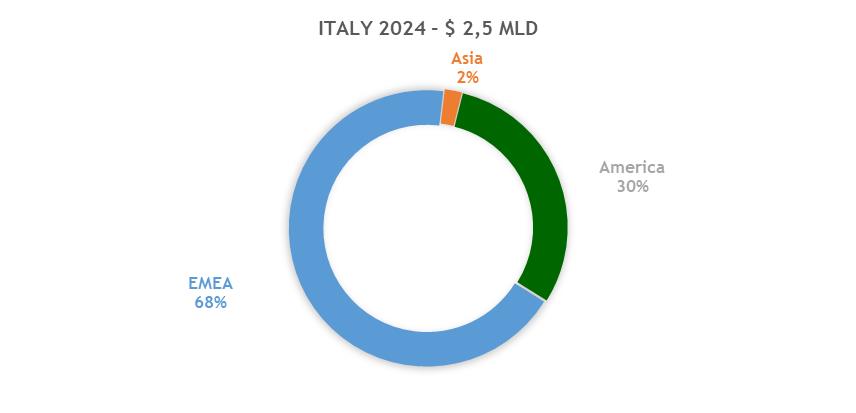

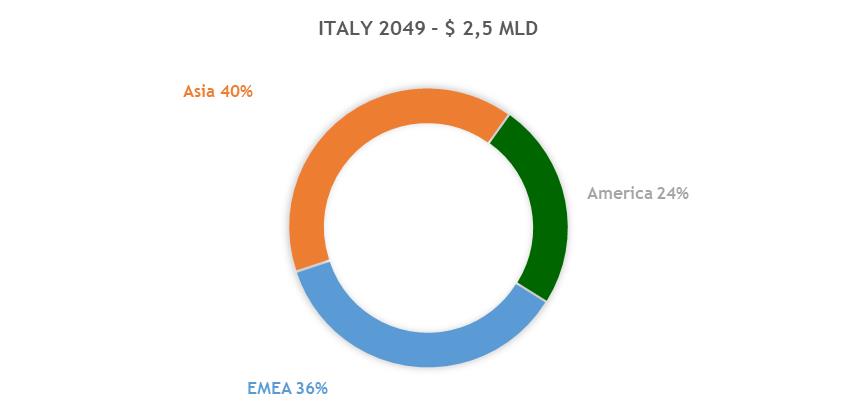

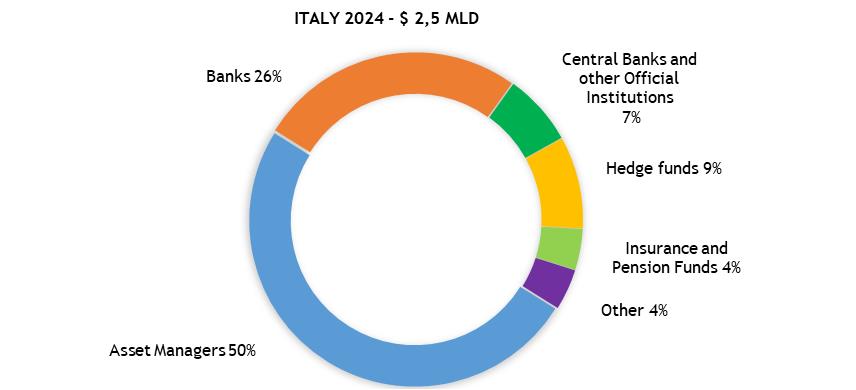

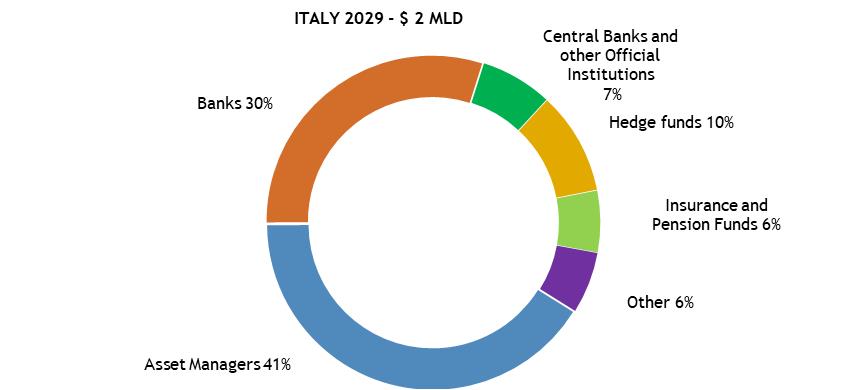

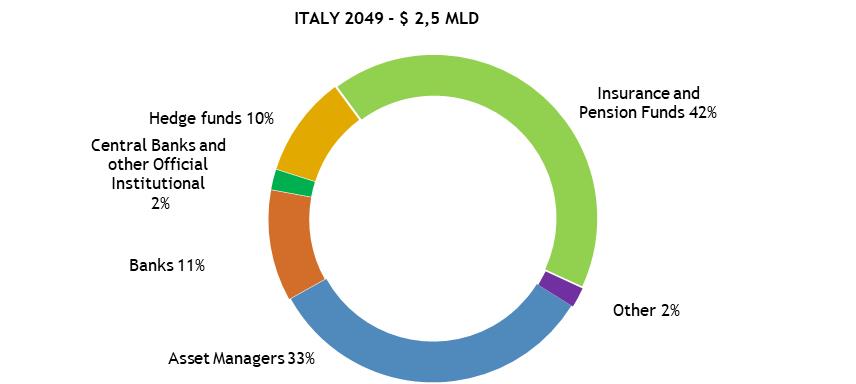

| Figure 3: | Orders taken to nominal BTP auctions by government Bond Specialists: composition by type of investor - 2019 | 61 |

| Figure 4: | Orders taken to nominal BTP auctions by government Bond Specialists: composition by geographical area - 2018-2019 | 62 |

| Chart III.7: | The new 10-year BTP€i 15/05/2030: geographical distribution | 63 |

| Chart III.8: | The new 10-year BTP€i 15/05/2030: distribution by type of investor | 63 |

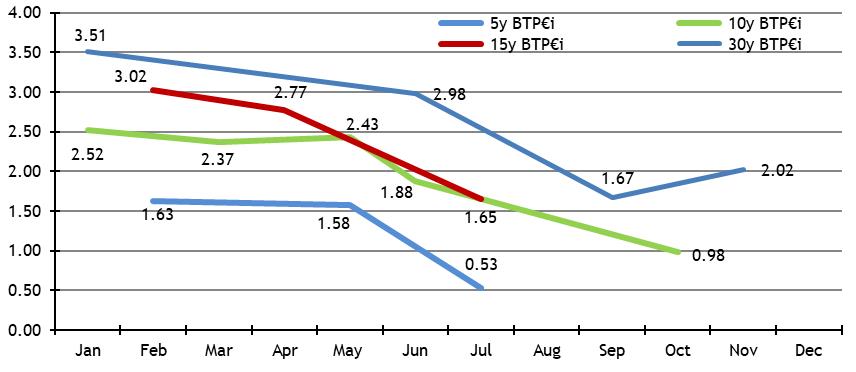

| Chart III.9: | Real yields at issuance for BTP€Is In 2019 (percentage rates) | 65 |

| Chart III.10: | 10-year break-even inflation (BEI), 2018-2019 (basis points) | 65 |

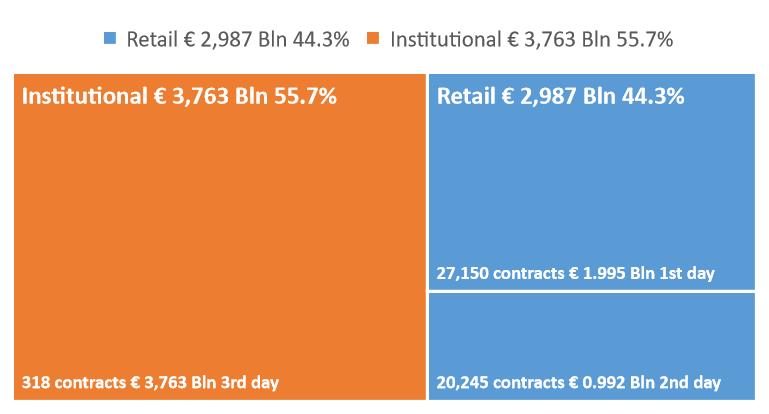

| Chart III.11: | Results of the placement of the BTP Italia maturing on 28 october 2027, for € 6,750 million | 66 |

| Chart III.12: | Yields at issuance of CCTeus in 2019 (percentage rates) | 68 |

| Chart III.13: | Geographical distribution of the usd issue | 70 |

| Chart III.14: | Distribution of the USD issue by type of investor | 71 |

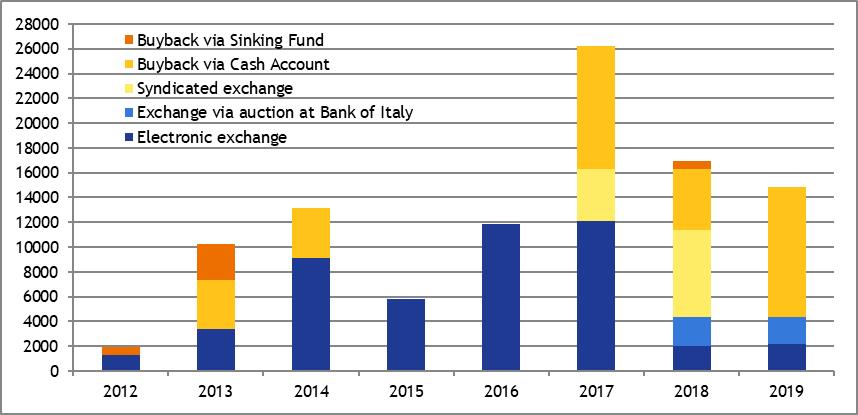

| Chart III.15: | Buyback amount as part of extraordinary transactions - 2012-2019 (nominal amounts in € million) | 73 |

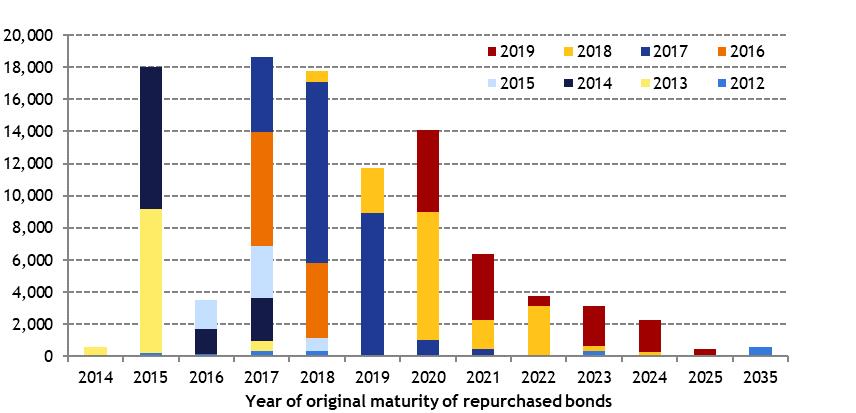

| Chart III.16: | Effects on government Bonds repurchased in extraordinary transactions between 2012 and 2019 (nominal amounts in € million) | 75 |

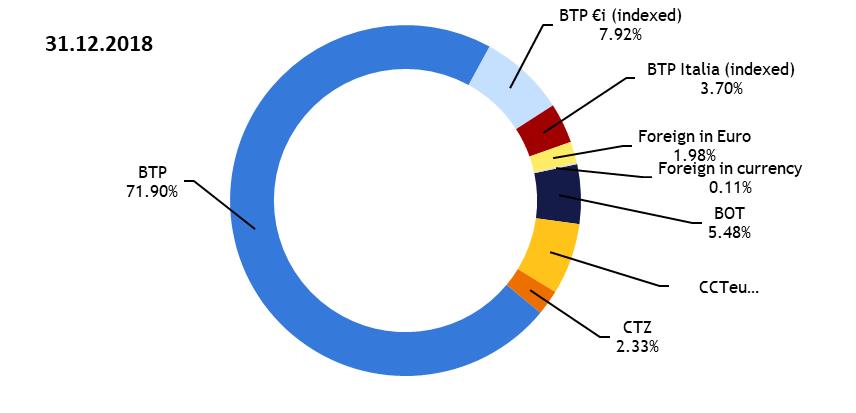

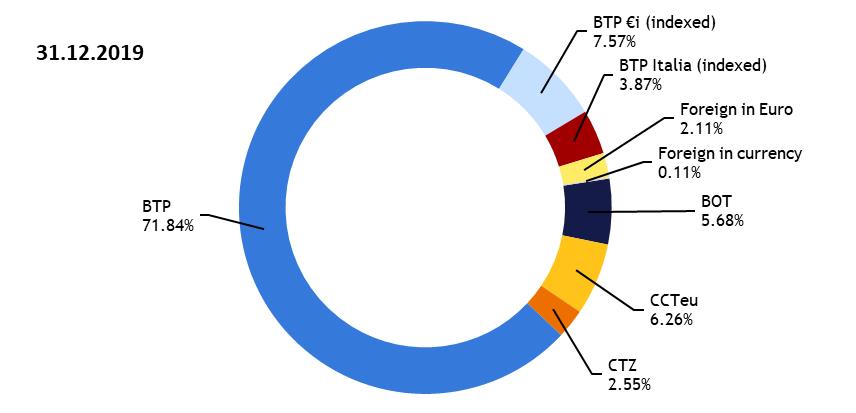

| Chart III.17: | Composition of the stock of government securities at 31 december 2018 and at 31 december 2019 | 81 |

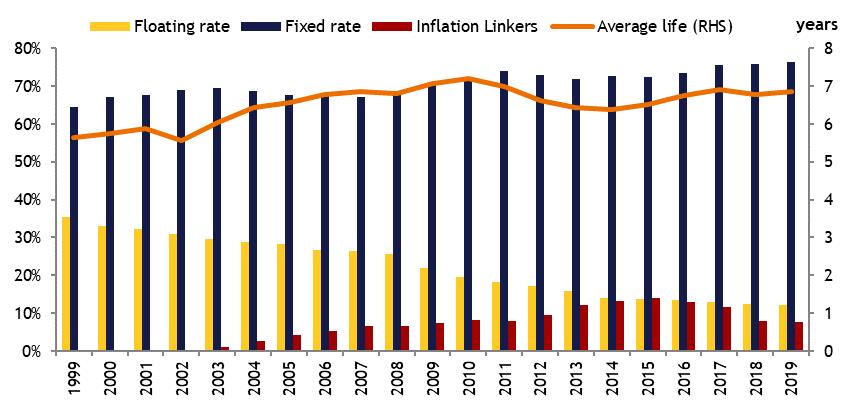

| Chart III.18: | Evolution of the structure and average life of debt (in years) | 82 |

Chart III.19:

| Maturities by residual life, 2017-2019 | 83 |

| IV | ITALIAN MINISTRY OF ECONOMY AND FINANCE |

I. DEBT MANAGEMENT OBJECTIVES FOR 2019 |

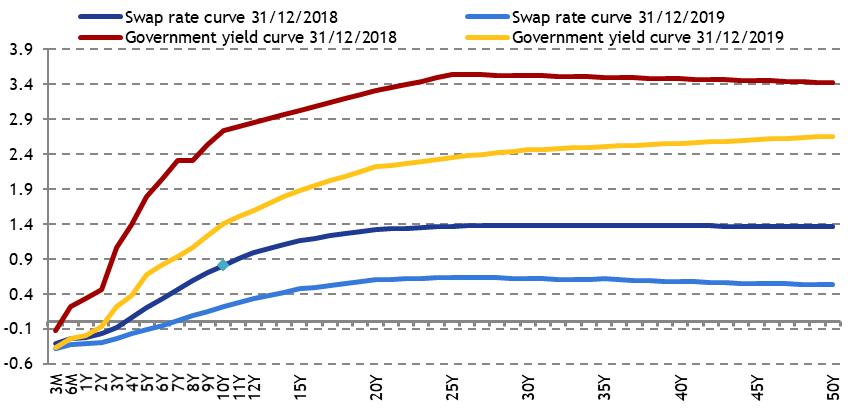

| Chart III.20: | Euro swap curve and italian government securities yield curve at 31/12/2018 and 31/12/2019 | 85 |

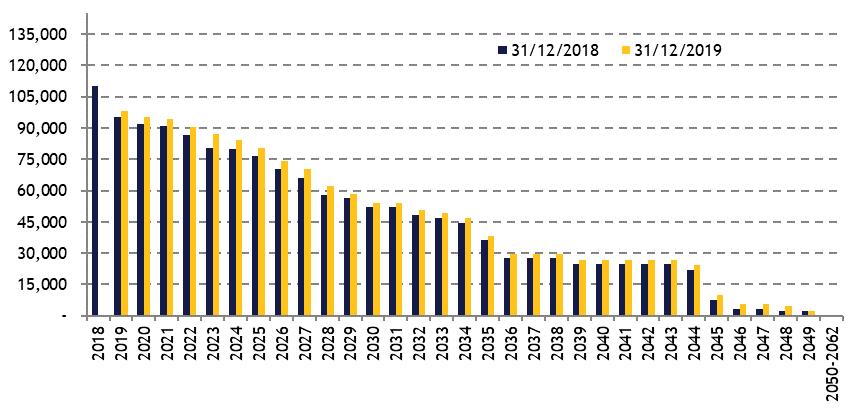

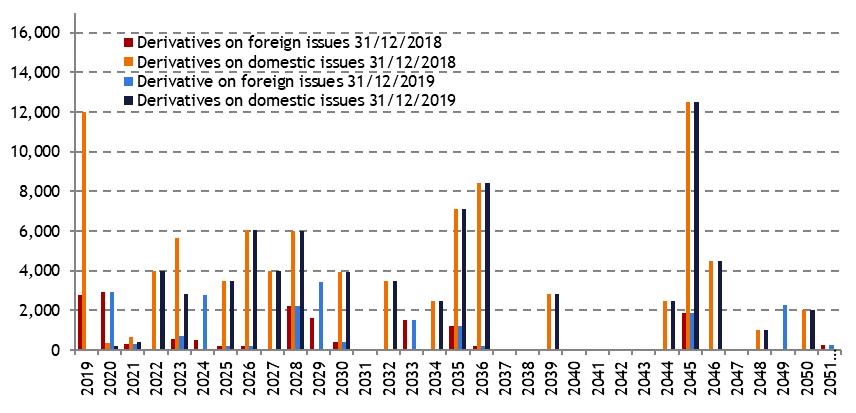

| Chart III.21: | Comparison between the prospective trend of the notional amount for the existing derivatives portfolio, as at 31/12/2018 and 31/12/2019 respectively, assuming that all swaptions are exercised (€ million) | 88 |

| Chart III.22: | Comparison between the maturity structure of the existing derivatives portfolio, as at 31/12/2018 and 31/12/2019 respectively, assuming that all swaptions are exercised (€ million) | 88 |

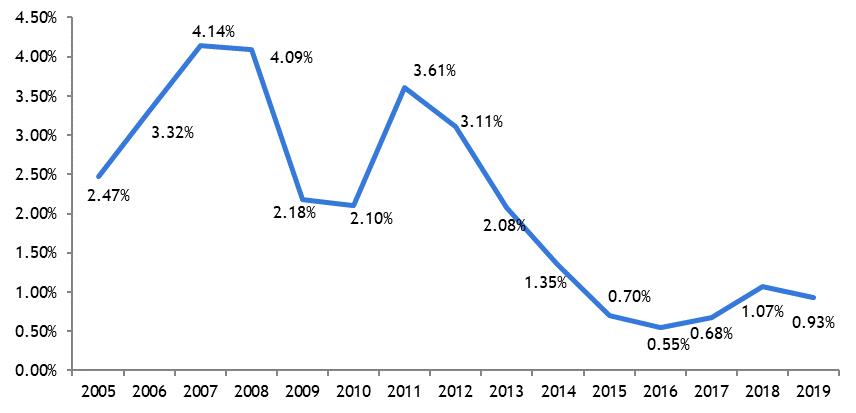

| Chart III.23: | Average cost at issuance of government securities - 2005-2019 (percentage rates) | 89 |

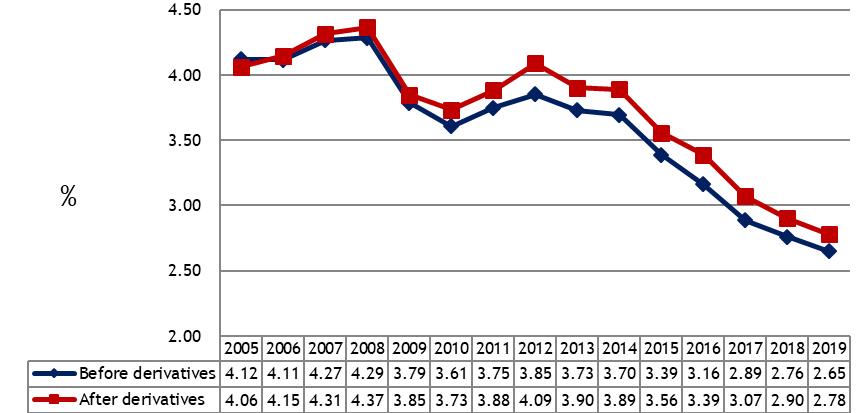

| Chart III.24: | Average cost of the stock of government securities, before and after derivatives - 2005-2019 (percentage rates) | 90 |

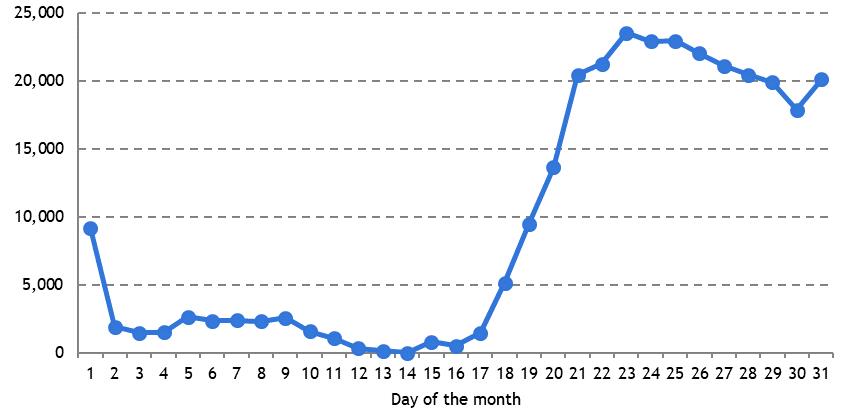

| Chart III.25: | Average intra-monthly changes in the treasury’s available cash - differences compared with the monthly minimum - 2019 (€ million) | 92 |

| Chart III.26: | Difference between the maximum and minimum monthly balance of the Treasury’s Cash Account (€ million) | 93 |

| Chart III.27: | Average investment at daily OPTES auctions (€ million) | 94 |

| Chart III.28: | Trend in overnight rates on the money market and weighted average rate at OPTES auctions - 2015-19 (percentage rates) | 95 |

| Chart III.29: | Average monthly investment at daily OPTES auctions - 2014-2019 (€ million) | 96 |

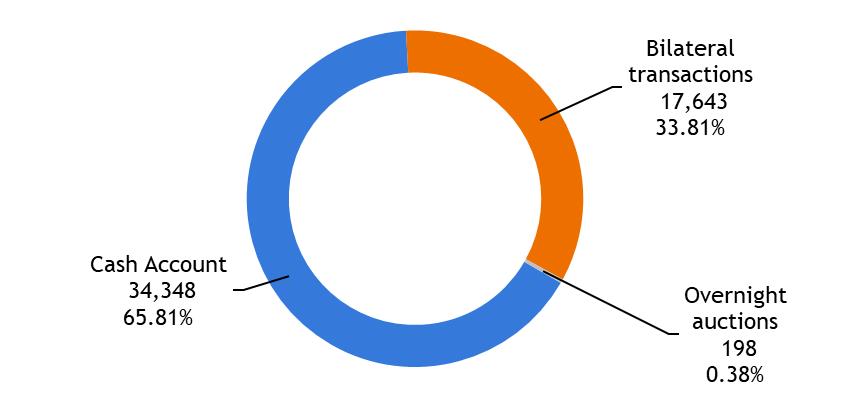

Chart III.30:

| Breakdown of the treasury’s liquidity - average values for 2019 (€ million) | 96 |

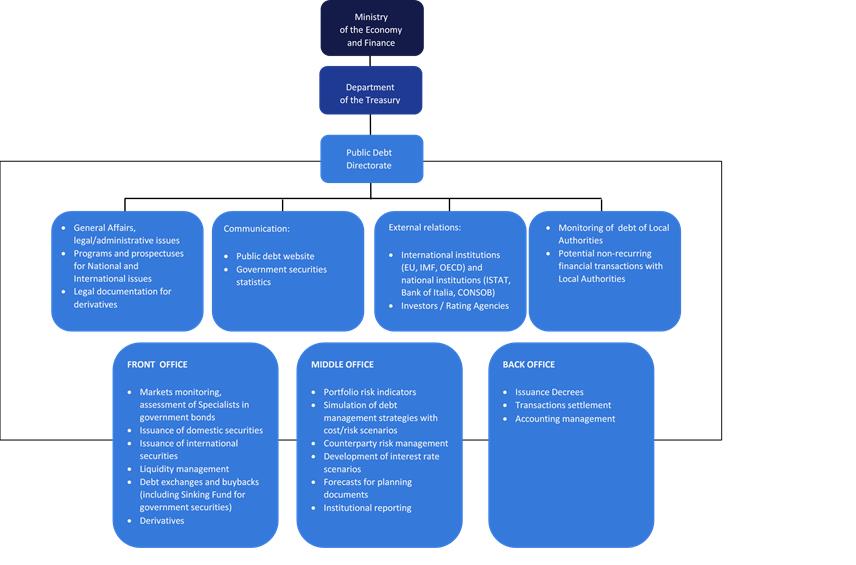

| The organisation of the Public Debt Directorate | 101 |

| BOT: Compounded gross yields at issuance | 119 |

| CTZ: Compounded gross yields at issuance | 119 |

| BTP: Compounded gross yields at issuance | 120 |

| BTP Italia and BTP€i: expected yields | 120 |

| CCTeu: Compounded gross yield at issuance | 121 |

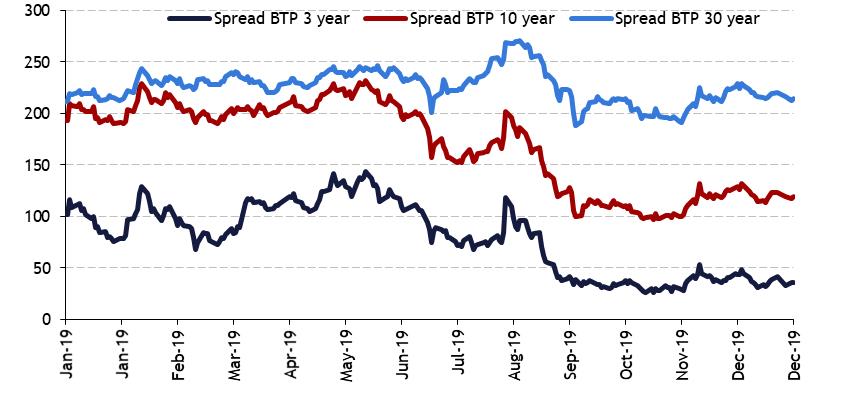

| Euro area 10-year benchmark spreads over Bund (basis points) | 121 |

| Asset SWAP spread (basis points) | 122 |

| Monthly trend of weighted average residual life of Government Bonds (months) | 122 |

| ITALIAN MINISTRY OF ECONOMY AND FINANCE | V

|

| VI | ITALIAN MINISTRY OF ECONOMY AND FINANCE |

| I. | DEBT MANAGEMENT OBJECTIVES FOR 2019 |

| I.1 | THE TREASURY’S OBJECTIVES AND INTERNATIONAL DEBT MANAGEMENT PRACTICES |

Debt management objectives and risks: international practices

As already mentioned in previous editions of this report, the Italian Treasury’s public debt management is in line with international best practices and fully complies with the recommendations of the main multilateral financial institutions as well as with the approaches adopted by other Debt Management Offices (DMOs) in advanced countries.

International best practices have developed over time1, thanks to a continuous sharing and analysis of the practical experiences gathered by the various DMOs in their respective economic and legal contexts. Firstly, these experiences highlight an inverse relationship between costs and risks (refinancing risk and interest rate risk) in the structure of a debt portfolio. They also define the following main objectives for public debt management:

• covering the Central Government's funding needs;

• minimising funding costs, subject to maintaining acceptable levels of risk over a medium- to long-term horizon2;

• maintaining access to domestic and international markets in the long term.

The main types of risk faced by DMOs refer to market risk, which includes interest rate risk and exchange rate risk, refinancing risk, liquidity risk and credit risk, in addition to the operational risk. Many of these risks involve rapid increases in the cost of debt jeopardising debt sustainability, albeit in different ways.

A public debt portfolio may be more or less exposed to each of these risks, depending on its actual composition. In other words, we must consider the ratio between short-term and medium/long-term debt and between fixed-rate and floating-rate debt, as well as between the amount of domestic debt and foreign

___

1 By way of example, the first 2-volume edition of the OECD’s Green Book on Government Debt Management was published in 1983. Other updates followed in 1993, 2002 and 2005. The various editions of the ‘Guidelines for Public Debt Management’, jointly drawn up by the World Bank and the International Monetary Fund, also continue to be a main reference, the last of which was prepared in 2014 and published in 2015 (please see the text available from:

http://www.worldbank.org/content/dam/Worldbank/document/Debt/Revised%20Guidelines%20for%20Public%20Debt%20Management%202014_v2.pdf).

2 The most recent edition of the International Monetary Fund and World Bank guidelines on the management of the public debt states (p. 17 of the text referred to by the link above): “The main objective of public debt management is to ensure that the government’s financing needs and its payment obligations are met at the lowest possible cost over the medium to long run, consistent with a prudent degree of risk” [...] “Governments should try to minimize expected debt servicing costs […], subject to an acceptable level of risk, over a medium- to long-term horizon.”

| ITALIAN MINISTRY OF ECONOMY AND FINANCE | 1 |

currency debt. Another important element that an issuing country must take into consideration when assessing the aforementioned risks is its ability to maintain, at the higher possible extent, a broad, liquid and deep market for the placement and trade of government securities.

International best practices recommend avoiding public debt portfolio structures that are too heavily weighted towards short-term and floating-rate instruments. Such structures may increase a country's economic and financial vulnerability3.

In fact, despite reducing interest expenditure in the short term, these structures make it more volatile, while also increase the market risks inherent in the debt portfolio (specifically, refinancing risk and interest rate risk) and, consequently, in the government budget4. On the other hand, under normal financial market conditions and regardless of the issuer’s creditworthiness, interest expenditure is higher for longer-term maturities, although longer maturities offer the benefit of effectively reducing the refinancing risk and interest rate risk.

Therefore, with regard to the rate type and debt maturity, the most prudent choice is generally more costly, while the less expensive option involves greater risks.

However, DMOs are required to pursue both objectives: reducing the cost of debt at the same time as curbing market risks. Therefore, in practice, public debt managers must forego maximising both of these objectives and must instead focus on managing their relative trade-off.

In other words, out of all the feasible options, they must select the cost-risk combination deemed satisfactory5 in relation to both portfolio characteristics and overall strategies. This trade-off is therefore not the same for all DMOs, but rather is handled differently by public debt managers in each country, based on the characteristics of their respective portfolios, reference market and fiscal policies. Italy has taken a particularly prudent approach to this trade-off due to the size of its debt (among the highest in the world in absolute terms); this approach does not allow for opportunistic tactics, but instead imposes a need to prioritise continuity, predictability and long-term strategies.

It goes without saying that the DMO’s task of minimising the cost of debt while maintaining an acceptable level of risk cannot be deemed to have been completed upon each issuance and in relation to the market conditions at the time of

___

3 Considerations in this regard can be found in the Guide to the Debt Management Performance Assessment (DeMPA) Tool, World Bank 2009.

4 However, it should be noted that this risk assessment approach may only be considered optimal if focusing exclusively on government liabilities (and therefore on debt). Indeed, a different and broader point of view could also include government assets. Under this approach, debt management could thus aim to achieve a liability structure consistent with the risks inherent to assets (following a so-called ‘ALM’ - ‘Asset Liability Management’ approach). This may lead to choices that - in principle - could differ even quite significantly from those made by taking into account the debt composition alone. However, many countries, including Italy, have come across significant hurdles in implementing such an approach, due to both the practical difficulty of calculating the financial risk exposure of the government’s substantial assets - especially non-financial assets - and, in many cases, the fact that there is incomplete knowledge of the size and characteristics of said assets. Further information can be found in the World Bank Policy Research Working Paper ‘How Do Countries Use an Asset and Liability Management Approach?A Survey on Sovereign Balance Sheet Management’.

5 In this regard, the International Monetary Fund and World Bank guidelines note that "Minimizing cost, while ignoring risk, should not be an objective. Transactions that appear to lower debt servicing costs often embody significant risks for the government and can limit its capacity to repay lenders. Managing cost and risk therefore involves a trade-off”.

| 2 | ITALIAN MINISTRY OF ECONOMY AND FINANCE |

I. DEBT MANAGEMENT OBJECTIVES FOR 2019 |

placement. Indeed, the structure of public debt, consisting of a wide and diversified portfolio of financial instruments with different characteristics and maturities, requires continuous, dynamic management even after issuance, in line with market developments.

Public debt management objectives and results must therefore be pursued and assessed over a sufficiently long period and must take into consideration the entire portfolio.

The Treasury's involvement in international discussions on debt management

When identifying and setting its objectives, the Treasury benefits from ongoing international cooperation with the relevant foreign and supranational institutions, as well as from close contact with institutional investors, both in Italy and abroad, and with rating agencies.

LEARN MORE | | The Treasury's contribution to international dialogue on debt management As in the previous edition, this Report includes a number of annexes that illustrate general issues concerning debt management (not specifically relating to the year of reference for the Report). The first of these annexes provides details of international discussions on debt management in which the Treasury regularly participates. These include the ESDM (European Sovereign Debt Markets) Subcommittee of the EU Economic and Financial Committee, several working groups organised by supranational institutions such as the OECD, the IMF and the World Bank, and the International Retail Debt Management Conference. This annex also illustrates the role of the Treasury in setting up and managing the Public Debt Management Network (as the only government institution alongside the OECD and the World Bank). • See Annex 1 on page.99 |

The process of defining debt management objectives within the Treasury’s organisational model

The Second Directorate at the Department of the Treasury is in charge of public debt management6.

The Directorate has front, middle and back office functions, as is typically the case for other DMOs in advanced countries and financial intermediaries. It also has other offices in charge of legal documentation, communication and statistics as well as relations with external institutions, in addition to IT activities and all the other legal-administrative and accounting roles common to ministerial organisations.

The middle office deals with identifying and monitoring annual debt management objectives, which includes the following activities: a) analysis to define the cost/risk profile for operations and to identify the most appropriate

___

6 The section of the Department of the Treasury’s website dedicated to public debt (http://www.dt.tesoro.it/en/debito_pubblico/index.html) provides continuously updated information and documents on all activities relating to public debt management.

| ITALIAN MINISTRY OF ECONOMY AND FINANCE | 3 |

issuance and hedging strategies; b) multi-annual forecasts on interest expenditure and the general government debt level for policy documents and institutional reporting purposes7; c) monitoring of counterparty risk, which determines certain constraints that must be met when managing the derivatives portfolio and transactions invest liquidity.

LEARN MORE | | Directorate II - Public Debt: organisational structure The Department of the Treasury's ‘Second Directorate’ is made up of eleven offices. Annex 2 provides a summary of the Directorate’s responsibilities, grouped by role. This annex also includes a detailed explanation of the various activities and how they are shared out among the different offices. Finally, there is a brief description of how these offices interact with the work carried out by other Directorates and other entities. • See Annex 2 on page 101 |

I.2 2019 OBJECTIVES: THE INSTITUTIONAL FRAMEWORK OF REFERENCE

General government’s total debt is made up of the consolidated gross liabilities of Central Government, local authorities and public social security institutions. It includes outstanding government securities, i.e. the securities issued by the government on both the domestic and foreign market.

As was also the case in previous years8, this Report refers to outstanding government securities, which are subject to the special legislation represented by Italy's ‘Consolidated Law on Public Debt’9 ('TUDP’). As at 31 December 2019, government securities represented approximately 83.4% of total public debt.

The main characteristics of outstanding government securities - maturity, type of remuneration and issuance procedure and frequency - are summarised in Table I.1.

___

7 In particular, the Economic and Financial Document (‘DEF’) pursuant to Italian Law no. 39 of 7 April 2011 (specifically, the Public Debt Directorate contributes to both Section I, "Italy’s Stability Programme", and Section II, "Analyses and Trends in Public Finances"), the DEF Update, the Draft Budgetary Plan (‘DBP’) as required by EU Regulation no 473/2013, the Annex to the so-called ‘Quarterly Cash Report’ (referred to by Art. 14 of Italian Law no. 196/2009 as the ‘Report on the General Government’s Consolidated Cash Account’), the Report to Parliament on the sinking fund for government securities (an annex to the General Financial Statement of the Italian State) as referred to by Art. 44, paragraph 3, of Italian Presidential Decree no. 398/2003, and the half-yearly Report to the Court of Auditors on public debt management pursuant to the Italian Ministerial Decree dated 10/11/1995.

8 All editions of the Public Debt Report are available at http://www.dt.tesoro.it/en/debito_pubblico/presentazioni_studi_relazioni/

9 Consolidated Law on Public Debt ('Testo Unico del Debito Pubblico’ – ‘TUDP’, Italian Presidential Decree no. 398 of 30 December 2003).

| 4 | ITALIAN MINISTRY OF ECONOMY AND FINANCE |

I. DEBT MANAGEMENT OBJECTIVES FOR 2019 |

| TABLE I.1: DOMESTIC GOVERNMENT SECURITIES |

| | BOT | CTZ | CCT/CCTeu | BTP | BTP€i | BTP Italia |

| | Treasury Bills | Zero-Coupon Treasury Bonds | Treasury Credit Certificates | Long-term Treasury Bonds | Long-term Treasury Bonds indexed to European inflation | Long-term Treasury Bonds indexed to Italian inflation |

| Maturity | 3, 6, 12 months and less than 12 months (flexible BOTs) | 24 months | 5, 7 years | 3, 5, 7, 10, 15, 20, 30 and 50 years | 5, 10, 15, 30 years | 4, 6, 8 years |

| Remuneration | Issue discount | Issue discount | Half-yearly variable coupons indexed to the 6-month BOT auction rate or the 6-month Euribor, possible issue discount | Half-yearly fixed coupons, possible issue discount | Half-yearly coupons indexed to European inflation (HICP index net of tobacco), possible issue discount and revaluation of principal at maturity | Half-yearly coupons indexed to Italian inflation (‘FOI’ index net of tobacco), half-yearly revaluation of principal and loyalty premium* at maturity |

| Issuance procedure | Competitive, yield-based auction | Marginal auction with discretionary determination of the price and quantity issued | Marginal auction with discretionary determination of the price and quantity issued | Marginal auction ** with discretionary determination of the price and quantity issued | Marginal auction ** with discretionary determination of the price and quantity issued | Through the MOT (Borsa Italiana), the electronic market dedicated to retail trading |

| Issuance frequency | Monthly | Monthly | Monthly | Monthly and based on market conditions for 15- and 30-year BTPs | Monthly | Once/twice a year |

*) For individual savers and similar investors who purchase the security at issuance during the first phase of the placement period. **) The first tranches of new long-term BTPs (over 10 years) or BTP€is may be offered on the market through placement syndicate. |

The part of public debt represented by government securities was managed in accordance with: (i) the Italian Ministry of Economy and Finance’s general Directive for administrative procedures and management for 2019; and (ii) the "Framework Decree" for 201910, which defined the reference objectives for administrative action regarding financial transactions for the management of public debt. The provisions contained in these decrees were then converted into the operational "Public debt management guidelines"11 for 2019 (hereinafter, "Guidelines").

___

10 The Italian Ministry of Economy and Finance’s general Directive for administrative procedures and management - 2019: http://www.mef.gov.it/ministero/oiv/direttivo_generale.html

Italian Decree of 2 January 2019, published in the ‘Gazzetta Ufficiale’ (Official Journal of the Italian Republic) no. 11 on 14 January 2019:

http://www.dt.mef.gov.it/export/sites/sitodt/modules/documenti_en/debito_pubblico/normativa_spalla_destra/2019_Framework_Decree_-_Directives_for_conducting_financial_transactions_xD_M_02.01.2019x.pdf

11 The Public Debt Management Guidelines are published on the Department of the Treasury's website - Directorate of Public Debt, as part of the Ministry of Economy and Finance, at http://www.dt.mef.gov.it/en/debito_pubblico/presentazioni_studi_relazioni/archivio_presentazioni/elem_0007.html

| ITALIAN MINISTRY OF ECONOMY AND FINANCE | 5 |

The general Directive turned the policy priority into two strategic objectives: (i) to curb the cost of debt, with a particular focus on the cost/risk profile; and (ii) to monitor and manage the cash account12, with the aim of efficiently managing its balance.

As was the case in previous years, the Framework Decree for 2019 provided guidance for the work of the Public Debt Directorate as well as a number of specific objectives. In particular, Art. 2 states that debt should be "in accordance with the limit established annually by the law approving the State budget", equal to the amount to cover the securities maturing during the year and the Central Government’s borrowing requirements, being sure to "... reconcile the need to meet market demand with that of containing the overall borrowing cost in a medium-long term horizon, having considered the need to protect against the refinancing risk and exposure to interest rate fluctuations".

The same article also sets objectives in terms of the percentage composition of debt at the end of 2019, broken down as follows:

| TABLE I.2 OBJECTIVES FOR THE END OF 2019: PERCENTAGE COMPOSITION OF THE DEBT PORTFOLIO |

| Type of security | Min. | Max. | Differences compared to 2018 |

| BOT (short-term) | 3% | 8% | up from the 2%-8% range |

| BTP (fixed-rate, nominal) | 65% | 78% | -- |

| CCT/CCTeu | 5% | 10% | - |

| CTZ | - | 4% | -- |

| BTP€i and BTP Italia (“real” securities) | -- | 15% | - |

| Securities issued on foreign markets | -- | 5% | -- |

| Source: ‘Framework Decree’ for 2019 |

In order to pursue the objectives of "curbing the overall debt cost, protecting against market risks and refinancing risks and ensuring the proper functioning of the secondary market for government securities”, Art. 3 authorises the use of public debt management transactions13, also through derivative financial instruments, exchanges or buy-back of government securities.

In order to mitigate the credit risk stemming from derivatives, Art. 4 requires counterparties to have a high level of creditworthiness, according to the rating given by the main rating agencies, also providing for possible agreements with the counterparties for mutual guarantees (collateralisation)14.

Lastly, Art. 6 states that the aim of cash account management15 must be "the efficient movement of cash balances, in relation to the government securities issuance, prevailing market conditions and the constraints imposed by monetary policy provisions".

___

12 Information about the nature of the cash account and the context of the related operations is provided in Par. I.IV below.

13 Art. 3 of the ‘TUDP’ (Italian Consolidated Law on Public Debt) authorises the use of transactions on a consensual basis that restructure certain features of the existing debt portfolio.

14 For more information about these mutual guarantee agreements, please see Chap. III.3 ‘Derivatives portfolio management’).

15 Regulations regarding the Treasury’s cash movements and the selection of the counterparties participating in the relative transactions are based on the Italian Ministerial Decree dated 25 October 2011.

| 6 | ITALIAN MINISTRY OF ECONOMY AND FINANCE |

I. DEBT MANAGEMENT OBJECTIVES FOR 2019 |

In terms of debt composition at the end of 2019, the assigned debt management objectives therefore aimed at a slight increase in short-term debt, keeping the 2018 portfolio stable with regard to medium- and long-term maturities. The aim of this was to ensure that requirements are met at costs that are as aligned as possible with market trends, and to consolidate the results already achieved in terms of exposure to interest rate risk and refinancing risk, with the goal of continuing the results achieved in recent years 16 in terms of the average life of government securities.

Based on the outstanding securities portfolio at the end of 2018, € 201 billion worth of securities were scheduled to mature in 2019 (excluding BOTs), of which € 3.7 billion referring to the foreign programme. This figure was therefore € 17 billion higher than the volume of securities maturing in 2018 that were outstanding at the end of 2017.

Considering that Central Government cash needs were expected to be around € 50 billion, again higher than in 2018, an increase in the volumes of short and medium/long-term securities offered to the market was therefore to be expected for 2019.

The Treasury therefore set the following objectives as part of the 2019 Guidelines:

1) to ensure that borrowing requirements are met at costs as aligned as possible with market trends;

2) to consolidate the results already achieved in terms of exposure to the main risks, in particular the interest rate risk and refinancing risk;

3) to contribute to a gradual improvement in liquidity conditions on the secondary market, especially for those segments and sectors that had shown the most difficulties in this regard during the second half of 2018;

4) to make the Treasury’s cash management even more efficient, also through more diversified instruments.

The Treasury’s strategy was therefore set to develop along the following lines:

1) ensure predictable and regular issues for all the main segments of domestic securities;

2) adjust the volumes offered to the market in order to give greater weighting to sectors with better liquidity on the secondary market and greater depth of demand;

3) use liability management tools (such as exchanges and buybacks), in line with the approach followed in 2018, with a frequency and intensity in line with market trends, with the aim of reducing dislocations on specific securities, improving liquidity on the secondary market and managing the redemption profile for future years;

4) diversify the investor base also through foreign currency issues in Global format as well as EMTNs, in particular in USD;

5) possibly use innovative tools, also specifically dedicated to retail investors, after in-depth assessments, feasibility analyses and market surveys.

___

16 The average life of the stock of government securities rose from 6.38 to 6.52 years in 2015 and reached 6.76 years in 2016 and 6.90 years in 2017, before falling slightly to 6.78 years in 2018.

| ITALIAN MINISTRY OF ECONOMY AND FINANCE | 7 |

| I.3 | CURBING THE COST OF DEBT WHILE PAYING ATTENTION TO THE COST/RISK PROFILE |

The cost-risk trade-off: Italy's specific features

As in previous years, public debt management in Italy focuses on two main risks: the interest rate risk and the refinancing risk.

With regard to the first of these risks, the management objective is to minimise the impacts on interest expenditu17 caused by fluctuations of the interest rates at which the debt is placed.

With regard to the refinancing risk, the management objective is to distribute the maturities of securities more evenly over time in order to facilitate the placement of new issues. In fact, by offering volumes that are in line with the market’s ability to absorb debt, undesired rises in financing costs can be avoided.

When it comes to these risks, the Treasury's objectives are in line with the practices followed by other DMOs. However, in Italy’s case, it is necessary to take an even more prudent approach in order to consider two specific aspects, both of which are linked to the country’s particularly high level of debt.

The first aspect is the fact that a significant component of the interest rate level at issuance for Italian government securities is the credit risk premium requested by investors18. This premium is not very closely linked to the economic cycle and affects Italy in a more significant way than in countries with lower levels of debt or whose creditworthiness is perceived as being higher. In fact, for these countries, changes to debt interest rates are more in line with the economic cycle, making it easier to manage the interest rate risk based on the debt-to-GDP ratio. For Italy, on the other hand, the medium-term risk premium tends to be correlated with the perception of debt sustainability rather than with economic performance. To support debt sustainability, debt composition must therefore be as resilient as possible to deal with any future unfavourable developments regarding refinancing conditions (yields, demand structure, etc.).

The second aspect relates to the greater importance of having interest expenditure that is as stable and predictable as possible for the management of the Italian state budget. This helps to avoid the need to increase taxation should government-security yields be affected by possible shocks, and makes it easier to manage public finance commitments stemming from European requirements, mainly based on deficit control and debt dynamics.

The two aforementioned aspects therefore significantly contribute to guiding Italy's debt management strategy with regard to keeping refinancing and interest rate risks under control.

___

17 In order to manage public finances correctly, it is necessary, where possible, to reduce costs and to plan outgoings with as much certainty as possible. This avoids unwanted and unexpected increases in the deficit and/or fiscal pressure, perhaps also significantly and in a short amount of time, as a result of costs or expenses not being duly planned for. Correct management of public finances therefore guarantees a framework of financial stability, which in turn allows for effective debt management.

18 Following the introduction of the single currency, there was a significant reduction in the perception and valorisation of the credit risk for highly indebted euro area countries; however, these re-emerged with the global financial crisis of 2007-2008, and, above all, with the subsequent sovereign debt crisis, after which the credit spreads between highly indebted countries and other countries failed to return to pre-crisis levels.

| 8 | ITALIAN MINISTRY OF ECONOMY AND FINANCE |

I. DEBT MANAGEMENT OBJECTIVES FOR 2019 |

Refinancing risk metrics and management tools

The average life of the stock of government securities is the benchmark metric used to measure refinancing risk: this is calculated as the average of the maturities of all outstanding securities, weighted according to the nominal value19 of each security. At the end of 2018, the average life of government securities had gone down again, albeit only slightly, to 6.78 years after three consecutive years of increases (6.52 in 2015, 6.76 in 2016 and 6.90 in 2017).

Given the annual profile of maturities at the end of 2018 (Chart I.1), as well as the monthly profile up to 2021 (Chart I.2), the objective was to keep the same approach taken in 2018, by reducing dislocations on specific securities through buyback and exchange transactions, in order to improve liquidity on the secondary market and manage the redemption profile for future years.

| CHART I.1: ANNUAL MATURITY PROFILE OF MEDIUM/LONG-TERM SECURITIES OUTSTANDING AS AT 31.12.2018 (€ MILLION) |

|

| Source: MEF |

___

19 For "nominal value", the definition adopted in EC Regulation no. 479/2009 of 25 May 2009 is used: “…. The nominal value of a liability outstanding at the end of the year is the face value. The nominal value of an index-linked liability corresponds to its face value adjusted by the index-related change in the value of the principal accrued to the end of the year. Liabilities denominated in a foreign currency […] shall be converted into the national currency on the basis of the representative market exchange rate prevailing on the last working day of each year. Liabilities denominated in a foreign currency and exchanged through contractual agreements to the national currency shall be converted into the national currency at the rate agreed on in those contracts”.

| ITALIAN MINISTRY OF ECONOMY AND FINANCE | 9 |

| CHART I.2: MONTHLY MATURITY PROFILE OF MEDIUM/LONG-TERM SECURITIES OUTSTANDING AS AT 31.12.2018 (€ MILLION) |

|

| Source: MEF |

Interest rate risk metrics and the SAPE model and software used by the Italian Treasury

Art. 2, paragraph 2, of the 2019 'Framework Decree’ states the need to curb the overall cost of debt, taking into consideration both the need to protect against the refinancing risk and the exposure to the risk of interest rate fluctuations.

The three main indicators used to quantify the interest rate risk are (i) financial duration, equal to the weighted average payment time for both principal and interest; (ii) the average refixing period, i.e. the average time taken by the debt portfolio to "integrate" interest rate changes, and, lastly, (iii) Cost-at-Risk, which quantifies the maximum additional cost in terms of interest expenditure in the event of adverse interest rate scenarios, along with the probability of actually having to bear this additional cost, deriving in turn from the probability that these adverse scenarios shall occur20. Cost-at-Risk (CaR) analysis is therefore used to identify, with a given probability, an expected cost level that may not be exceeded, as well as all the compositions of the securities issuances whose cost-risk combinations are classed as being efficient, i.e. are such as to become dominant - for a given level of cost or risk - over any other hypothetical composition of the issuance portfolio.

In this way, it is possible to test the characteristics of a series of hypothetical issuance portfolios, estimating both the cost in terms of interest expenditure and the interest rate risk (Cost-at-Risk) for each over a given amount of time in the future, calculated with different possible scenarios as to how the interest and inflation rates will evolve.

From a technical point of view, the tool used for this analysis is an in-house developed model which the Public Debt Directorate has been using for a number of

___

20 Please see the focus point on "The main quantitative indicators of interest rate risk" on page 22 of the 2014 Annual Public Debt Report, available at the address already provided in note 8 of this Chapter.

| 10 | ITALIAN MINISTRY OF ECONOMY AND FINANCE |

I. DEBT MANAGEMENT OBJECTIVES FOR 2019 |

years, called ‘SAPE’ (‘Software di Analisi dei Portafogli di Emissione’ - Issuance Portfolio Analysis Software).

LEARN MORE | | The SAPE model and software used by the Italian Treasury The acronym ‘SAPE’ refers to a set of specially designed models and software that the Italian Treasury has been using for many years to select issuance portfolios which not only meet funding needs and comply with applicable regulatory constraints, but are also able to provide a satisfactory cost-risk trade-off with efficient results. These models and software were created, in collaboration with the Treasury, by experts from prestigious research institutions such as the “M.Picone” Institute for Calculation Applications (‘IAC’) - the Italian National Research Council (‘CNR’) and the Cambridge Judge Business School at the University of Cambridge, as well as by SOGEI, the Italian Treasury's IT solutions provider for the public administration. The models and software are updated continuously. A detailed description of the implications of the model and how it works can be found in the recently published paper, available at the following link: http://www.dt.mef.gov.it/en/debito_pubblico/Public_Debt_Management_Network/ebook/index.html A summary of how the model was developed is provided in the following annex: • See Annex 3 on page.104 |

The outstanding debt database used by SAPE at the end of 2018 was made up of domestic securities, derivatives and securities in USD. With regard to the latter, the Treasury’s policy is to issue any securities in a foreign currency at generally better (or at least equal) cost conditions21 than those available for equivalent domestic instruments. Therefore, when estimating the refinancing costs of future redemptions for securities in USD, data on domestic securities were used, with no new derivative transactions expected to manage the rate risk.

The role of the issuance strategy in managing the interest rate risk-cost trade-off in 2019

For debt managers, especially ones handling a large amount of debt, it is essential to identify a cost-risk combination that minimises costs without increasing risk. This may also be interpreted as promoting a medium- and long-term perspective, which not only aims at reducing costs as much as possible in the present, but also creates the conditions for a lasting and gradual reduction in borrowing costs (which also depend on investors' perception of credit risk).

For this reason, improvements in refinancing and interest rate risk metrics should always be evaluated by also taking into account the higher costs involved with this strategy. In fact, as already mentioned, the market demands higher remuneration for securities with longer maturities. This trade-off must therefore be taken into consideration when planning the issuance portfolio, i.e. estimating the marginal cost required by the market to improve the aforementioned risk metrics.

To do this, when drawing up the "2019 Guidelines", the Public Debt Directorate identified a set of hypothetical issuance portfolios for domestic securities, modelled

___

21 Including costs to hedge against exchange rate risks.

| ITALIAN MINISTRY OF ECONOMY AND FINANCE | 11 |

based on their actual feasibility and in order to test their sensitivity to certain market elements using the tools described in the previous paragraph.

As a precondition, all portfolios must make it possible to fund:

1) the redemptions of medium- and long-term securities scheduled for 2019 (amounting to approximately € 201 billion),

2) outstanding BOTs (amounting to approximately € 107 billion), together with the so-called ‘BOT rollover’ during the year, i.e. the BOT issues necessary to cover the redemptions of the BOTs issued in the same year,

3) Central Government cash requirements, which, at the time, were estimated to be around € 50 billion22,

4) as well as ensuring that the Treasury has sufficient liquidity available to cater for all cash needs.

It goes without saying that the portfolio initially used for the analysis reflected the composition of domestic issues in 2018, characterised in gross terms by approximately 38% of BOT issuances (almost equally divided between annual and 6-months maturities), just under 7% of CTZs, around 6% of CCTeus and almost 7% of index-linked securities (including BTP€i and BTP Italia). Nominal BTPs therefore represented a considerable 42% of the total, of which approximately 17% were represented by securities with the shortest durations (3 and 5 years), more than 18% by 7- and 10-year maturities and, lastly, around 7% relating to the segment with the longest duration.

This portfolio was used as a basis to make a number of changes to the composition of the various instruments, also altering the maturities within each category. In a first hypothesis, in order to verify and highlight the impact that an increase in debt exposure to inflation would have had on cost and risk, the component of securities linked to inflation (both European and Italian) was increased significantly, consequently reducing the share of nominal BTPs, CCTs and CTZs, while keeping basically the same amount of BOTs.

On the flip side, another simulation was carried out, removing the share of securities linked to European inflation.

Other simulations focused on the weightings given to the various segments of the curve, each time increasing the presence on the medium- and long-term stretch at the expense of the shorter-term stretch or vice versa, estimating the cost increase involved with extending the duration and average life of the debt, or the increase in risk involved with reducing short-term costs.

Finally, attention was paid to adjusting issuances based on so-called ‘barbell’ strategies, balancing short- and long-term components and reducing the presence along the middle stretch of the curve.

___

22 This figure formed the basis for public finance forecasts for 2019, included in the 2018 ‘DEF Update’ and remaining unchanged in the subsequent DBP (Draft Budgetary Plan).

| 12 | ITALIAN MINISTRY OF ECONOMY AND FINANCE |

I. DEBT MANAGEMENT OBJECTIVES FOR 2019 |

| CHART I.3: COMPOSITION OF THE ALTERNATIVE ISSUANCE PORTFOLIOS ANALYSED FOR 2019 (€ MILLION) |

|

| Source: MEF |

For each issuance portfolio, an analysis was carried out over a thirty-year horizon, examining the relative effects during the four-year period between 2019 and 2022. Italian yield curves (generated by applying the SAPE model scenarios), zero coupon inflation swap curves for securities indexed to Italian and European inflation and the half-yearly Euribor were applied to the various issuance portfolios.

With regard to cost, the expected trend in average monthly interest expenditure for the four-year period in question was used. With regard to risk, two metrics were adopted: (1) the difference between the trend in average monthly interest expenditure in the four-year period, which leaves only a 5% chance that this may be higher than the expected trend referred to above (Relative Cost-at-Risk), and (2) the standard deviation of the average monthly increase in interest expenditure.

Among all the portfolios analysed, the one that showed feasibility and an effective improvement in the cost-risk trade-off was portfolio 12 (the barbell strategy), which leaned more, in relative terms, towards issuances along the 3-year stretch and along the longest section (10 years and above).

The role of derivative transactions in managing the interest rate risk-cost trade-off for 2019

It is clear that an effective management strategy cannot be limited to incorporating newly issued securities into the portfolio, passively leaving the subsequent changes in the risk composition to the outcome of placement auctions and redemptions. It must instead allow for the debt portfolio’s cost and interest rate risks to be managed on an ongoing basis, even after issuance of the securities held therein. For this purpose, like many other sovereign issuers, the Italian Treasury uses derivatives, as well as exchange and buyback transactions.

| ITALIAN MINISTRY OF ECONOMY AND FINANCE | 13 |

LEARN MORE | | The role and type of derivative transactions used by the Treasury In principle, the derivatives sector is considerably vast, encompassing transactions that have very different structures and purposes and refer to almost all areas of finance and the economy. Sovereign issuers such as the Italian Treasury only use a few types of derivative transactions for specific risk management objectives underlying its debt portfolio, with particular regard to interest rate and exchange rate risks. The annex cited below describes the role played by derivatives in managing Italy’s public debt and the types of transactions that are used. • See Annex 4 on page 106 |

| | | |

In authorising the use of derivatives, the Framework Decree stated that they should contribute to achieving the general management objectives of curbing overall borrowing costs, protecting against market risks and refinancing risks and ensuring the proper functioning of the secondary market for government securities.

Management of the derivatives portfolio must also take into account two main aspects: (i) the availability of collateralisation agreements for any new derivative positions, which can also be used to reduce the cost of cross-currency swaps to act as a hedge for any new foreign currency issuances, and (ii) existing constraints for some types of derivatives.

With regard to the first aspect, the system of mutual guarantee agreements regarding derivative transactions (the so-called ‘Credit Support Annex’ or ‘CSA’) provided for by the secondary legislation23 introduced in December 2017 was implemented24 in 2018. This system may be applied to both selected existing contracts (therefore supporting the management of existing positions) and, above all, cross-currency swaps to hedge against the exchange rate risk stemming from any new foreign currency issuances. Therefore, in 2019, all the technical requirements were met for the Treasury to return to markets other than the euro and to expand its investor base.

With regard to the second aspect, in September 2014 Eurostat issued rules on how to record the market value of derivatives, only applicable to swaps arising from the restructuring of pre-existing swaps or to swaptions being exercised. In fact, for these specific cases, it was established that these transactions affect debt stock levels (although purely from an accounting point of view, since they do not entail recourse to the capital market). In 2019, derivative transactions were therefore meant to complement issuances, also taking into account more general public finance objectives, in light of the accounting impacts of European legislation, while continuing to contribute to increasing the average refixing period and debt duration25.

___

23 Italian Ministerial Decree of 20 December 2017, as already referred to above.

24 In this regard, please see pages 77-80 of the 2018 Public Debt Report.

25 Pursuant to Italy's 2005 Finance Law (Italian Law no. 311 of 30 December 2004), certain derivative contracts were concluded relating to public entities’ loan receivables, transferred to the Treasury from the books of the ‘Cassa Depositi e Prestiti’ after the latter became a limited liability company (Article 5 of Italian Legislative Decree no. 269 of 2003 - "attached" to the 2004 Finance Law - as converted, with amendments, by Italian Law no. 326 of 2003). The notional amount of these contracts is less than 1% of the Treasury’s entire derivatives portfolio, as

| 14 | ITALIAN MINISTRY OF ECONOMY AND FINANCE |

I. DEBT MANAGEMENT OBJECTIVES FOR 2019 |

Therefore, to sum up, management of the derivatives portfolio in 2019 was set to focus on (i) hedging the exchange rate risk for any issuances in a foreign currency and implementing the related collateral guarantees; (ii) restructuring the transactions already present in the derivatives portfolio, for which critical issues arose following the aforementioned statistical and accounting changes; and (iii) managing the collateral already in place.

Measures to achieve debt issuance and management objectives for 2019

In relation to the set objectives, the Italian Treasury’s strategy for 2019 was structured as follows, covering the two phases of debt management:

Policies at issuance of domestic and foreign securities

The Guidelines defined the issuance policy for 2019 taking into consideration the above mentioned objectives in terms of average life, duration and the average refixing period, as well as the results of the cost-risk trade-off analysis.

Given the higher volumes to be offered to the market compared with the previous year, and in line with market conditions, the guidelines stated that issuance choices in 2019 should therefore aim:

1) to adjust BOT issuances in order to ensure a stock at the end of 2019 which would include the refinancing of redemptions, while also increasing net issuances for the annual security, taking market conditions into account;

2) to keep CTZ issued amounts in line with redemptions and with previous years. Given the positive demand trend recorded in the last months of 2018, achieving slightly positive net issuances was also a possibility;

3) for 3- and 5-year BTPs, to adjust the amounts to be issued in the two segments, keeping a similar overall amount than in the previous year, but with a tendency to overweight the three-year segment compared with the five-year one;

4) to keep largely positive net issuances of 7-year BTPs, with gross issuances also lower than in previous years, so as to ensure an increase in the share of seven-year BTPs within the stock of government securities at the end of the year, thereby consolidating the average life of the debt; given the benchmark role of the 10-year BTP, to continue to offer this maturity through regular monthly auctions. Despite a significant volume expiring in 2019 (over € 48 billion), net issuances could have been marginally negative;

5) for longer-term nominal maturities, to provide liquidity on all available instruments (15, 20, 30 and 50 years) by resorting to both the reopening of outstanding securities and the issuance of new ones, deciding which of the available maturities to offer to the market on a case-by-case basis. With regard to long-term securities, the plan was to keep overall issuance levels similar to those of last year, thereby achieving positive net issuances (given scheduled redemption of over € 23 billion on the 15-year security). In the presence of favourable market conditions, it

___

shown in detail in Table III.14 (Chapter III). These contracts do not form part of debt management and are therefore not addressed in this Report.

| ITALIAN MINISTRY OF ECONOMY AND FINANCE | 15 |

was also planned to use a placement syndicate for a new security with a 15-year and/or 30-year maturity;

6) to issue CCTeus for a lower absolute amount than in the previous year, given the decline in maturing volumes, continuing with exchanges and buybacks where necessary to keep the sector tensions, that had already arisen in 2018, under control. Net issuances were nonetheless expected to be positive, thus keeping the share stable with respect to the overall stock of outstanding securities;

7) to continue to ensure a constant presence for the various maturities of BTP€is, with the monthly volumes on offer remaining practically in line with redemptions. The conditions for launching a new security on the 10-year and longer-term segments were also to be examined;

8) to ensure at least one issuance of the BTP Italia, keeping maximum flexibility regarding the most appropriate maturity, in any case between 4 and 8 years. As was the case in the last two years, the guidelines stated that the Treasury would have considered the possibility of carrying out exchange or buyback transactions on securities with a particularly high outstanding amount, in order to contribute to the management of the redemption profile for the coming years. The lack of scheduled redemptions for the BTP Italia was expected to result in positive net issuances and, therefore, to a slight increase in the share of this security within the overall stock;

9) to assess the possibility of returning to the USD market26 for the most popular maturity among investors, depending on market conditions. Compared to previous years, in 2019, the Italian Treasury could in fact benefit from both the recent enlargement of the Global Programme Lead Managers list (which now included all Primary dealers), and the operational availability of mutual guarantee agreements on derivatives (‘Credit Support Annex’, ‘CSA’). Lastly, the guidelines provided for the possibility to resume recourse to the issuance of securities under the MTN program, in euro /foreign currency, to meet the demand for private placements among primary institutional investors, subject to minimum requirements being met27 regarding the issue format.

Post-issuance debt management operations

As already mentioned, the Italian Treasury may also use extraordinary exchange and buyback transactions regarding government securities and derivative transactions in order to achieve the aforementioned objectives for the existing debt portfolio.

Exchanges and buybacks are public debt management tools used to curb the refinancing risk, modify the redemption profile and support the liquidity and efficiency of the government securities market.

Unlike ordinary issuance activity, these transactions do not follow a predefined timetable, but rather depend on both the Treasury's specific requirements and market conditions. Only Primary dealers are allowed to participate in these extraordinary transactions.

___

26 The last issuance in the Global format took place in September 2010

27 Maturity of at least three years, minimum amount of at least € 200 million and a minimum negotiable amount of at least € 500,000

| 16 | ITALIAN MINISTRY OF ECONOMY AND FINANCE |

I. DEBT MANAGEMENT OBJECTIVES FOR 2019 |

Exchange transactions generally consist of one security being issued against the simultaneous buyback of one or more outstanding securities. They therefore exchange government securities with a different maturity, which may help to mitigate the refinancing risk. For these transactions, the Treasury may make use of the Bank of Italy’s auction system or electronic trading system.

Buybacks, on the other hand, are transactions which the Treasury can use to reimburse outstanding government securities, both partially and in advance. The financial resources used for this purpose may be drawn from deposits in the cash account or taken from the sinking fund for government securities. Buybacks can be performed through Bank of Italy auctions or through bilateral transactions.

As was the case in recent years, the 2019 Guidelines stated that the frequency of these extraordinary transactions was to be guided by specific market situations, always taking into account the aforementioned purposes of these instruments. The Guidelines also specified that, in 2018, these transactions had contributed to restoring an adequate gradient to the yield curve and to partially restoring orderly trading in the CCTeu sector. As was the case in 2018, exchange and buyback transactions were also allowed to be carried out through syndication and would also have been aimed at facilitating the process of reducing the stock of outstanding nominal debt.

Finally, the Guidelines stated that new derivative transactions would consist of possible restructuring of the existing portfolio, as part of active management aimed at transforming its financial profile and/or impacts in terms of debt (as was also the case in previous years). Furthermore, new cross-currency swaps, backed by collateralisation agreements, would have to be completed for the purpose of hedging against the exchange rate risk involved with any new issuances in a foreign currency.

| I.4 | MONITORING AND MANAGING THE CASH ACCOUNT TO STABILISE THE BALANCE |

The cash account for Treasury services

In collaboration with the Bank of Italy, the Italian Treasury manages its liquidity based on its expected cash flows and the relative balances. This management - known as ‘OPTES’ operations - also meets the ECB requirement of facilitating monetary policy through an efficient forecasting of the cash balances held by public institutions with the euro area’s national central banks.

In Italy, this liquidity is mainly held in the Cash Account, i.e. the account held by the Treasury with the Bank of Italy, where its incoming cash flows and payments are recorded. The balance of this account is essentially the sum of all the accounts held by the Treasury28. In compliance with EU legislation, which forbids central

___

28 For further details, please refer to Italian Ministerial Decree no. 51961 of 26 June 2015 concerning the identification of government deposits held with the Bank of Italy, implementing Article 5, paragraph 5, of Italian Presidential Decree no. 398/2003.

| ITALIAN MINISTRY OF ECONOMY AND FINANCE | 17 |

banks from granting any form of funding to member states’ governments, the account may not be overdrawn.

The balance of the Cash Account is characterised by strong volatility, due to both the large number of entities that move funds with the Treasury and a number of significant cyclical cash flows (normally monthly). In particular, with regard to incoming cash flows, tax revenues have a strong impact and are concentrated over a few days in the second half of the month, while payments include pensions which mainly go out on the first working day of the month. Issuances and - to an even greater extent - redemptions of government securities can also cause significant fluctuations in the Cash Account.

Bearing in mind these critical issues, 2019 once again saw the Treasury adopt measures aimed at managing the liquidity of the cash account in such a way as to achieve “efficient movement of the cash balances, in relation to the issuance strategy for government securities, at the prevailing market conditions and within the limits imposed by monetary policy provisions”, as was the case in previous years.

OPTES operations

Cash management consists of daily operations aimed at ensuring an adequate level of cash with regard to the multiple movements on the Treasury's system. These operations are closely linked to public debt management, representing the tool connecting the issuances of securities with the daily fluctuations of the Cash Account. As mentioned above, cash management forms part of the so-called ‘OPTES’ operations, which consist of monitoring the Treasury’s balances and cash flows and completing money market transactions.

Monitoring is based on information being continuously exchanged between the Bank of Italy and the MEF (State General Accounting Department and Department of the Treasury - Public Debt Directorate), including forecasts and final data on all amounts going in and out of the Treasury’s accounts, as well as the resulting estimate as to the balance of the Cash Account. These information exchanges are updated several times throughout the course of each working day in order to estimate the end-of-day account balance; the liquidity estimates made by the MEF and the Bank of Italy also include more long-term scenarios, which are shared on a weekly basis and are based on a forecast period in line with monetary policy requirements.

Cash management tools, on the other hand, refer to money market operations, using daily auctions and, where appropriate, bilateral transactions under which the Treasury is generally an investor of its own liquidity. The Treasury’s available cash is therefore made up of the liquidity in the Cash Account and the investments made with financial intermediaries through the Treasury’s daily OPTES operations.

The regulatory context for cash management in 2019

Cash management principles were established in the MEF's general Directive for administrative procedures and management and in the Framework Decree, as well as in the 2019 Public Debt Management Guidelines. In particular, the general

| 18 | ITALIAN MINISTRY OF ECONOMY AND FINANCE |

I. DEBT MANAGEMENT OBJECTIVES FOR 2019 |

guidelines stated that the focus should be on improving the model to process daily cash forecasts for the cash account and that the monitoring and management of said account must be geared towards stabilising the balance. The Framework Decree stated that management of the cash account must aim at efficient cash movements, in line with the government security issuance strategy and the prevailing market conditions, at the same time as complying with the constraints imposed by monetary policy provisions. Lastly, the Public Debt Management Guidelines set the objective of maintaining a constant presence in the money market for short- and very short-term maturities, through daily OPTES operations, mainly characterised by auctions to invest liquidity, with overnight duration, in line with cash requirements and market conditions. These guidelines also provided for the possibility to introduce other liquidity investment tools through bilateral transactions with a maturity of more than one day, for the purpose of improving the diversification and profitability of cash management, with a view to curbing counterparty risks.

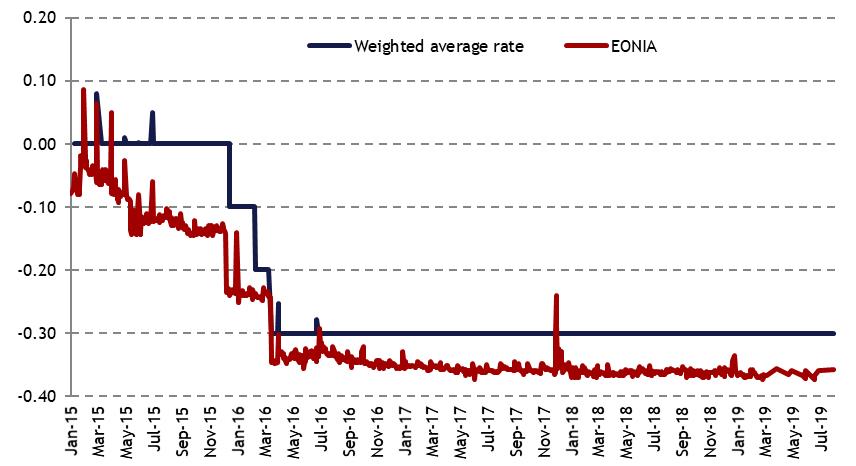

With regard to legislation governing the movement and management of the cash deposited in the cash account, reference continues to be made to the Framework Decree, which substantially refers to the Italian Ministerial Decree dated 25 October 201129. In April 2019, the ECB altered the procedure to pay interest on government deposits held with the central banks. These provisions, to be applied at a later date or only potentially, did not have any practical effects in 201930.

Cash management activities were therefore duly carried out as normal, through daily auctions and using bilateral transactions with maturities longer than overnight, with the aim of limiting the effects of monetary policy decisions that may penalise government deposits in a context of negative rates. More precisely, any liquidity that does not exceed the threshold of 0.04% of GDP (for Italy, equal to € 706 million for 2019), shall be subject to the EONIA rate, with the Deposit Facility rate applying to any liquidity in excess of this threshold, if negative. In 2019, the level applied was initially equal to -0.40%, which then further reduced to -0.50% in September following the decisions of the ECB's Governing Council.

In conclusion, cash management has not only had to adapt to changes in European legislation, but has also had to deal with a money market that has often been difficult to interpret, with interest rates that have been negative for several years now.

___

29 For further details on the Italian Ministerial Decree in question, please refer to the following link: http://www.dt.mef.gov.it/it/debito_pubblico/gestione_liquidita/normativa_comunicati/.

30 There are essentially two important changes, which commenced on 1 October 2019 but shall only become applicable in 2022 or depending on possible changes to the Deposit Facility rate:

1) for government deposits up to a maximum balance equal to either € 200 million or 0.04% of GDP, whichever is higher, the EONIA (Euro OverNight Index Average) rate shall continue to be applied until 3 January 2022, which is when the new €STR (€uro Short-Term Rate) shall come into force;

2) the previous ECB guidelines, which came into force in 2014, stated that zero interest was to be paid on any liquidity in excess of the threshold, in the case of a positive or zero deposit facility rate applied by the ECB, or at negative rates in the event of a negative DF rate. The new ECB guidelines state that, should the DF rate be higher than the rate applied to the sums within the threshold, then interest shall be paid on all government deposits at the same rate applied to said sums (i.e. EONIA or €STR).

For more information, please refer to ECB Guideline ECB/2019/7: (https://eur-lex.europa.eu/legal-content/IT/TXT/PDF/?uri=CELEX:32019O0007&from=IT) and ECB Decision ECB/2019/8 (https://eur-lex.europa.eu/legal-content/IT/TXT/PDF/?uri=CELEX:32019D0008&from=EN).

| ITALIAN MINISTRY OF ECONOMY AND FINANCE | 19 |

| 20 | ITALIAN MINISTRY OF ECONOMY AND FINANCE |

| II. | THE ITALIAN GOVERNMENT SECURITIES MARKET: PERFORMANCE IN THE INTERNATIONAL CONTEXT |

| II.1 | MONETARY POLICIES AND EFFECTS ON THE EURO AREA MONEY MARKET |

Monetary policies in the euro area and the USA

Towards the end of 2018, global economic activity slowed and world trade contracted, due to various sources of uncertainty. These included: ongoing trade tensions (despite some signs of easing), China's economy slowing down more than expected and the effects of the process for the United Kingdom to leave the European Union (Brexit). All of these factors had an impact on the global economy, also affecting the euro area’s economic growth prospects for 2019, with the year therefore not getting off to the best of starts. In fact, growth forecasts for 2019 were revised downwards, due to both weaker foreign demand and some country and sector-specific factors. In particular, ongoing uncertainties relating to geopolitical factors and the threat of protectionism weighed on economic sentiment. At the same time, supportive financing conditions, favourable labour market dynamics and rising wage growth continued to underpin the euro area expansion and gradually

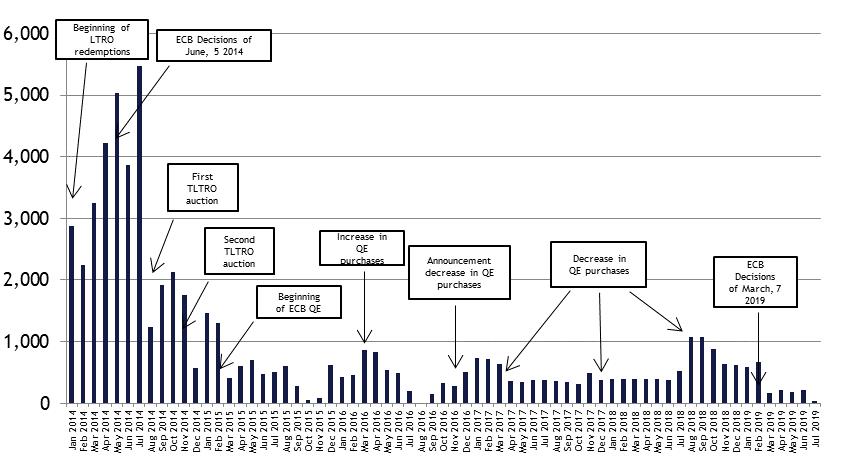

rising inflation pressures. This underlying strength of the economy confirmed the ECB's Governing Council's belief that inflation would continue to converge steadily at levels below but close to 2% in the medium term. On this basis, during its meeting held on 7 March 2019, the Council announced measures able to maintain expansionary conditions for longer: the ECB would keep its key rates unchanged for all of 2019 at least and, at the same time, it announced a new series of targeted longer-term refinancing operations1, with the relative price conditions being defined over the following months, taking into account economic developments.

At the end of the first half of the year, economic activity in the euro area was still weak and subject to downside risks, with inflation remaining low and, in any case, lower than expected. During its meeting in July, the ECB's Governing Council therefore announced that the ECB would be keeping its key interest rates at or below current levels, at least until the end of the first half of 2020, and defined the details of targeted longer-term refinancing operations (TLTRO3) that had been announced at the meeting held in March that year. These decisions were aimed at ensuring that inflation would continue to converge towards the medium-term target value. Should this not be sufficient, the Governing Council stated that it would use all of its available instruments, in the manner deemed most appropriate, to steer inflation steadily towards the target level. As growth prospects were struggling to increase, during its monetary policy meeting held on 12 September 20192, the ECB's

___

1 https://www.ecb.europa.eu/press/pr/date/2019/html/ecb.mp190307~7d8a9d2665.en.html

2 https://www.ecb.europa.eu/press/pr/date/2019/html/ecb.mp190912~08de50b4d2.it.html

| ITALIAN MINISTRY OF ECONOMY AND FINANCE | 21 |

Governing Council took several decisions aimed at pursuing the objective of price stability. To sum up, at this meeting, the Council:

1) reduced the interest rate on deposits with the ECB by 10 basis points, from -0.40% to -0.50%. No changes were made, on the other hand, to the interest rates on the main refinancing operations (MRO) and on the marginal lending facility (MLF), at 0% and 0.25% respectively;

2) announced that net purchases would restart under the Governing Council’s asset purchase programme (APP), at a monthly pace of € 20 billion as from 1 November;

3) reiterated that reinvestments of principal payments from maturing securities purchased under the APP would continue, in full, for an extended period of time;

4) defined the modalities of the new series of targeted longer-term refinancing operations (TLTRO III), stating that they would be changed to preserve favourable bank lending conditions, ensure the smooth transmission of monetary policy and further support the accommodative stance of monetary policy. It stated that the interest rate for each operation would now be set at the level of the average rate applied in the Eurosystem’s main refinancing operations over the life of the respective TLTRO. Banks whose net lending exceeded a benchmark would benefit from a lower interest rate, equal to the average interest rate applied to deposits with the central bank over the life of the operation. It would also possible to extend the maturity of operations from two to three years;

5) in order to support the bank-based transmission of monetary policy, it introduced a two-tier system for reserve remuneration3, in which part of banks’ holdings of excess liquidity would be exempt from payment of the negative interest rate on deposits held with the central bank. This strategy began to be implemented on 30 October 2019.

The year ended with modest inflation prospects, which is why the Council reaffirmed the need to maintain a highly accommodating monetary policy stance for an extended period of time, in order to support underlying inflationary pressures and overall inflation dynamics over the medium term.

During 2019, the United States once again saw economic growth continue at a fairly steady rate (real growth of around 2% on a quarterly basis), with unemployment rates slowly but continuously falling, at around 3.5%. However, signs of a slowdown were in sight, due to the exceptionally long recovery phase of the US economic cycle and as a result of the fiscal support from the US Administration, which certainly could not be considered as structural, let alone sustainable in the long term. In addition, there were the aforementioned uncertainties relating to the ongoing geopolitical tensions with China. In this context, the FED put a stop to a long cycle of rate hikes, with rates remaining unchanged until June 2019. It then began an initial cycle of reductions, which were initially limited and then gradually accelerated towards the end of 2019, altering the rates from 2.25% to 1.5%. The acceleration of expansionary monetary policy during the last months of 2019 was not only the result of the growth outlook becoming gradually less sustained, but was also aimed at mitigating some money market tensions that emerged in September

___

3 See https://www.ecb.europa.eu/ecb/legal/pdf/celex_32019d0031_it_txt.pdf

| 22 | ITALIAN MINISTRY OF ECONOMY AND FINANCE |

II. THE ITALIAN GOVERNMENT SECURITIES MARKET: PERFORMANCE IN THE INTERNATIONAL CONTEXT |

and affected the repo market, where rates increased by over 60 basis points. In order to deal with this problem, the FED also took action to pour vast amounts of liquidity into the system through reverse repo operations.

The euro area money market

At the start of 2019, the ECB's key rates were anchored at the level of the previous year, and remained unchanged until September, when the ECB introduced the rather broad set of monetary policy measures described above, including a reduction in interest rates on the deposit facility (DF), while no changes were made to the MRO and MLF rates (see Chart II.1).