Exhibit 99.1

|

Exhibit 99.1

ANIXTER

3Q 2014 INVESTOR PRESENTATION

Products. Technology. Services. Delivered Globally.

|

SAFE HARBOR STATEMENTNCIAL

The statements in this presentation other than historical facts are forward-looking statements made in reliance upon the safe harbor of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to a number of factors that could cause our actual results to differ materially from what is indicated here. These factors include but are not limited to general economic conditions, the level of customer demand particularly for capital projects in the markets we serve, changes in supplier sales strategies or financial viability, risks associated with the sale of nonconforming products and services, political, economic or currency risks related to foreign operations, inventory obsolescence, copper price fluctuations, customer viability, risks associated with accounts receivable, the impact of regulation and regulatory, investigative and legal proceedings and legal compliance risks and risks associated with integration of acquired companies. These uncertainties may cause our actual results to be materially different than those expressed in any forward looking statements. We do not undertake to update any forward looking statements.

Please see our Securities and Exchange Commission (“SEC”) filings for more information.

This presentation includes certain financial measures computed using non-Generally Accepted Accounting Principles (“non-GAAP”) components as defined by the SEC. Certain sales, profitability, earnings per share and other non -GAAP financial measures in this presentation exclude special items which have been identified in our earnings releases as we believe that by reporting such information, both management and investors are provided with meaningful supplemental information to understand and analyze our underlying trends and other aspects of our financial performance.

Non-GAAP financial measures provide insight into selected financial information and should be evaluated in the context in which they are presented. These non -GAAP financial measures have limitations as analytical tools, and should not be considered in isolation from, or as a substitute for, financial information presented in compliance with GAAP, and non-GAAP financial measures as reported by us may not be comparable to similarly titled amounts reported by other companies. The non-GAAP financial measures should be considered in conjunction with the consolidated financial statements, including the related notes, and Management’s Discussion and Analysis of Financial Condition and Results of Operations included in our Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q as filed with the SEC. We do not use these non-GAAP financial measures for any purpose other than the reasons stated above.

Proprietary and Confidential. © 2014 Anixter Inc. 2

|

I. Anixter Overview Pp. 4— 14

II. Tri-Ed Acquisition Pp. 15 — 22

III. 2Q 2014 Review Pp. 23 — 37

IV. 2H 2014 Outlook Pp. 38 — 43

V. Appendix Pp. 44 — 45

VI. Investor Contacts P. 46

Proprietary and Confidential. © 2014 Anixter Inc.

3 |

|

|

ANIXTER: A COMPELLING VALUE PROPOSITION

Leading position in large, diverse and fragmented businesses Differentiated by our global capabilities, customized supply chain solutions and technical expertise Globally scalable business model creates value for stakeholders Strategies and people in place to achieve our long-term growth goals

Financial strength and capital efficiency

Anixter reduces cost and complexity in the supply chain, lowering our customers’ risk, creating value for our stakeholders

Proprietary and Confidential. © 2014 Anixter Inc.

4 |

|

|

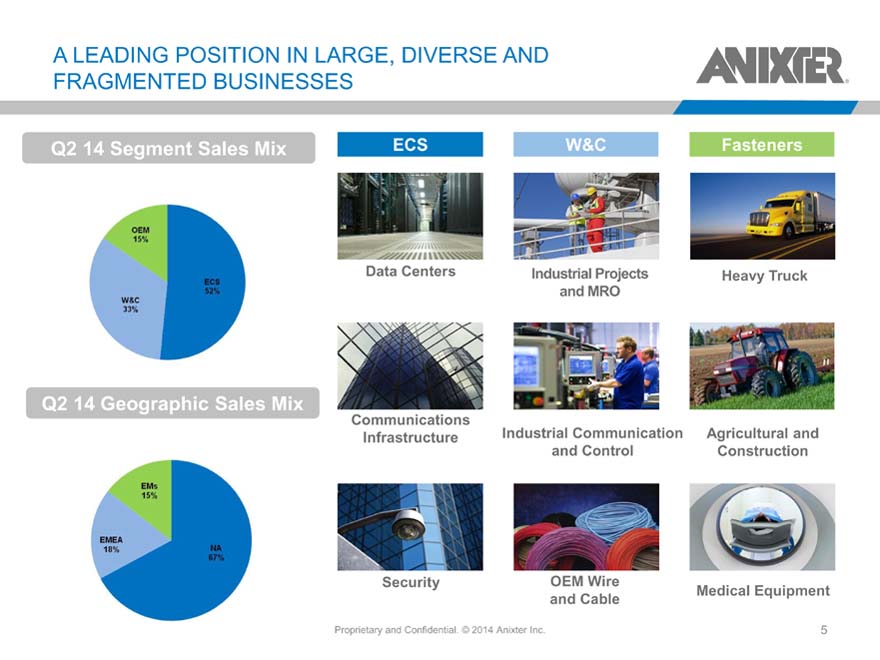

A LEADING POSITION IN LARGE, DIVERSE AND FRAGMENTED BUSINESSES

Q2 14 Segment Sales Mix

Q2 14 Geographic Sales Mix

ECS W&C Fasteners

Data Centers Industrial Projects Heavy Truck

and MRO

Communications

Infrastructure Industrial Communication Agricultural and

and Control Construction

Security OEM Wire

and Cable Medical Equipment

Proprietary and Confidential. © 2014 Anixter Inc.

5 |

|

|

HIGHLY FRAGMENTED SUPPLIER AND CUSTOMER MIX

Proprietary and Confidential. © 2014 Anixter Inc.

6 |

|

|

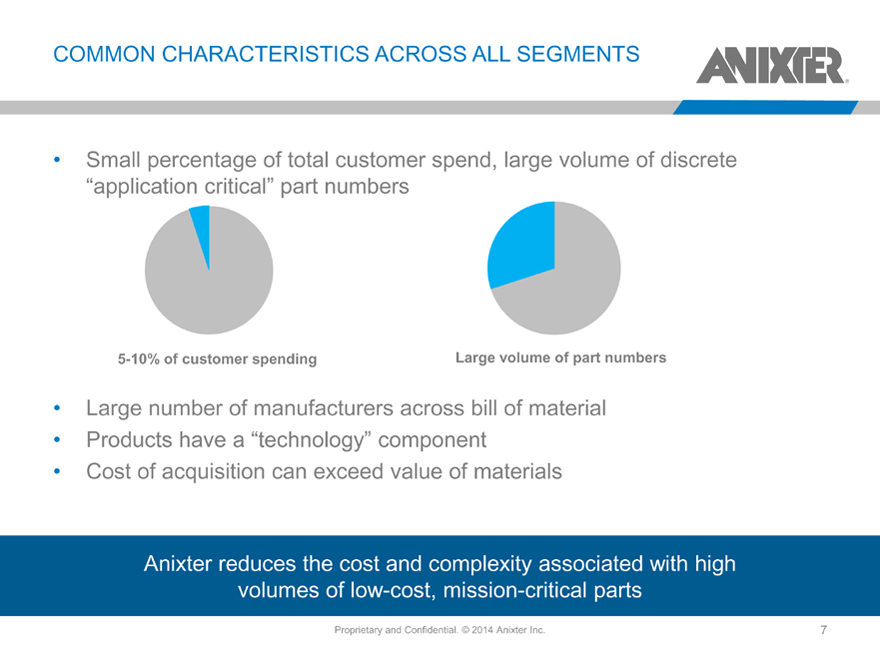

COMMON CHARACTERISTICS ACROSS ALL SEGMENTS

Small percentage of total customer spend, large volume of discrete

“application critical” part numbers

5-10% of customer spending Large volume of part numbers

Large number of manufacturers across bill of material

Products have a “technology” component

Cost of acquisition can exceed value of materials

Anixter reduces the cost and complexity associated with high volumes of low-cost, mission-critical parts

Proprietary and Confidential. © 2014 Anixter Inc.

7 |

|

|

GROWTH DRIVEN BY LONG TERM GLOBAL TRENDS

Data and Mobility Trends / The Internet of Everything

– Constant connectivity and big data

– Security

– ICC

Infrastructure Investment

– Natural resource development

– Utility capital investment

Productivity and Sustainability Demands

– Outsourcing and lean supply chain

– Sustainability initiatives

– Sourcing trends / outsourcing of the supply chain

Globalization

– Shift in growth to emerging markets

– Multi-national corporations preference for global suppliers

Proprietary and Confidential. © 2014 Anixter Inc.

8 |

|

|

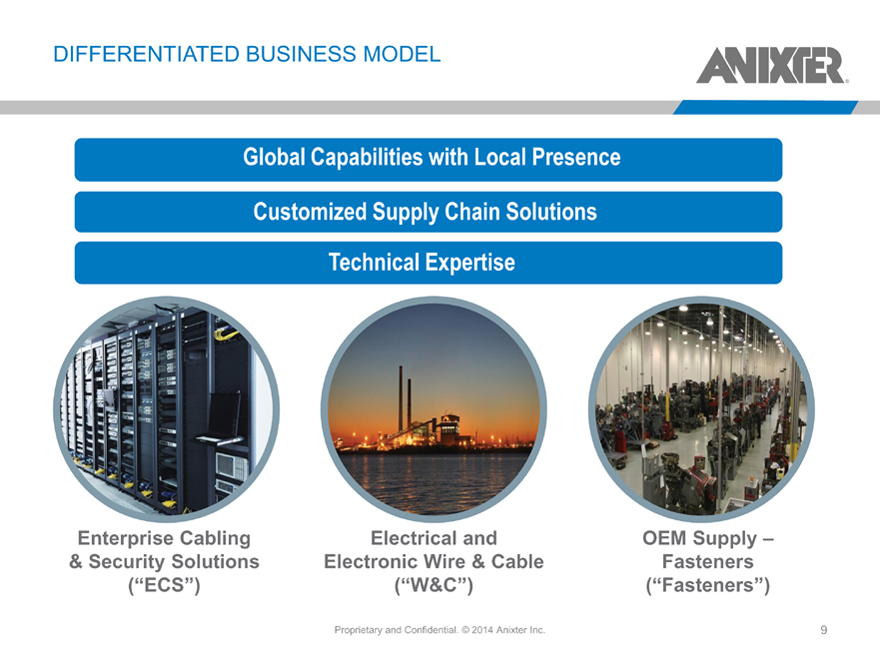

DIFFERENTIATED BUSINESS MODEL

Global Capabilities with Local Presence

Customized Supply Chain Solutions Technical Expertise

Enterprise Cabling

& Security Solutions

(“ECS”)

Electrical and Electronic Wire & Cable

(“W&C”)

OEM Supply – Fasteners

(“Fasteners”)

Proprietary and Confidential. © 2014 Anixter Inc.

9

|

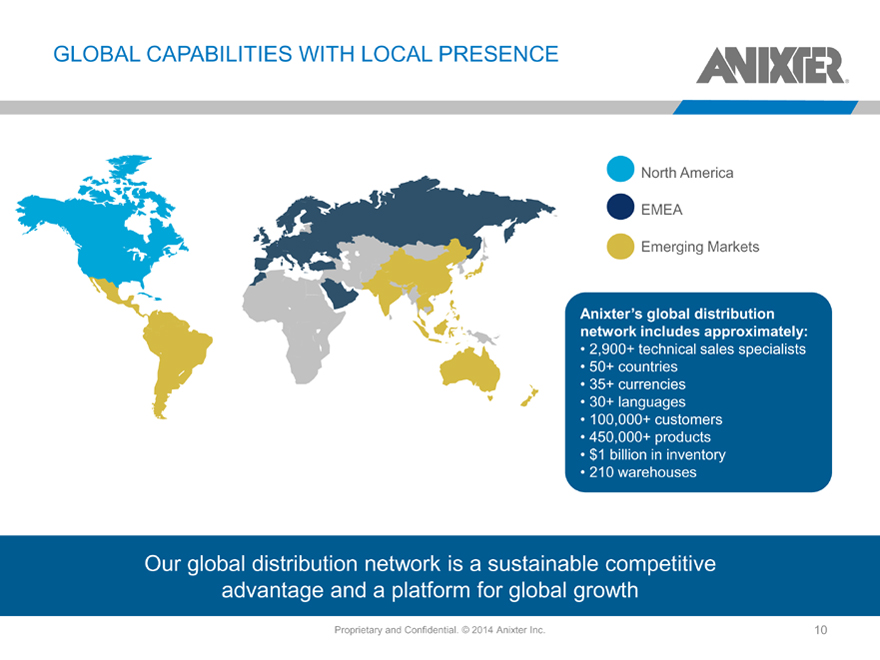

GLOBAL CAPABILITIES WITH LOCAL PRESENCE

North America EMEA

Emerging Markets

Anixter ’s global distribution

network includes approximately:

2,900+ technical sales specialists

50+ countries

35+ currencies

30+ languages

100,000+ customers

450,000+ products

$1 billion in inventory

210 warehouses

Our global distribution network is a sustainable competitive advantage and a platform for global growth

Proprietary and Confidential. © 2014 Anixter Inc.

10

|

CUSTOMIZED SUPPLY CHAIN SOLUTIONS

Over 60 supply chain experts Delivering solutions such as:

– Pre-assembled data center cabinets and surveillance kits

– JIT cable management

– Direct-line-feed and custom-engineered fasteners

Delivering measurable results to our customers

Result is higher margins and increased customer loyalty to Anixter

Anixter Supply Chain Solutions help our customers achieve their goals

Proprietary and Confidential. © 2014 Anixter Inc.

11

|

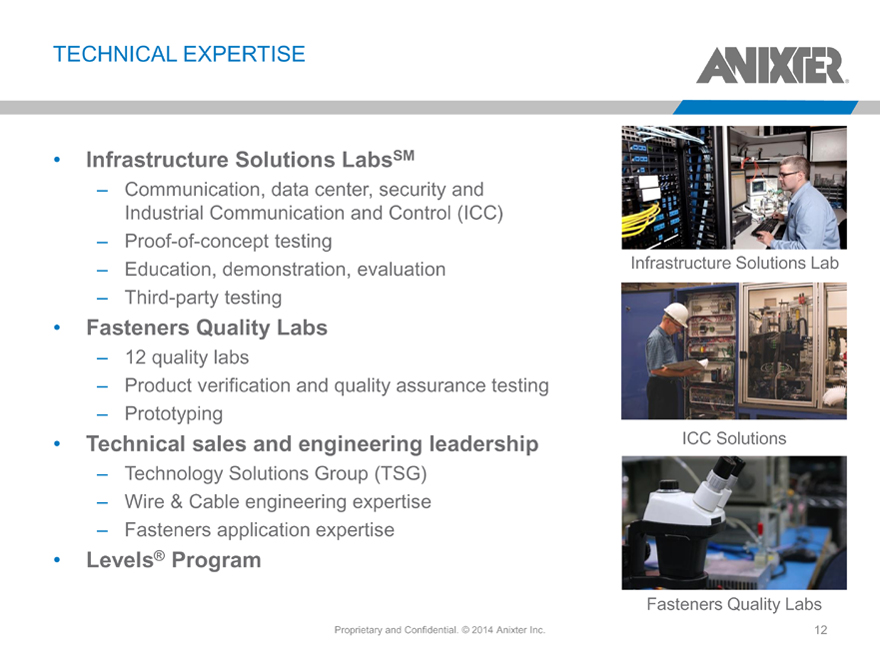

TECHNICAL EXPERTISE

Infrastructure Solutions LabsSM

– Communication, data center, security and Industrial Communication and Control (ICC)

– Proof-of-concept testing

– Education, demonstration, evaluation

– Third-party testing

Fasteners Quality Labs

– 12 quality labs

– Product verification and quality assurance testing

– Prototyping

Technical sales and engineering leadership

– Technology Solutions Group (TSG)

– Wire & Cable engineering expertise

– Fasteners application expertise

Levels® Program

Infrastructure Solutions Lab

ICC Solutions

Fasteners Quality Labs

Proprietary and Confidential. © 2014 Anixter Inc.

12

|

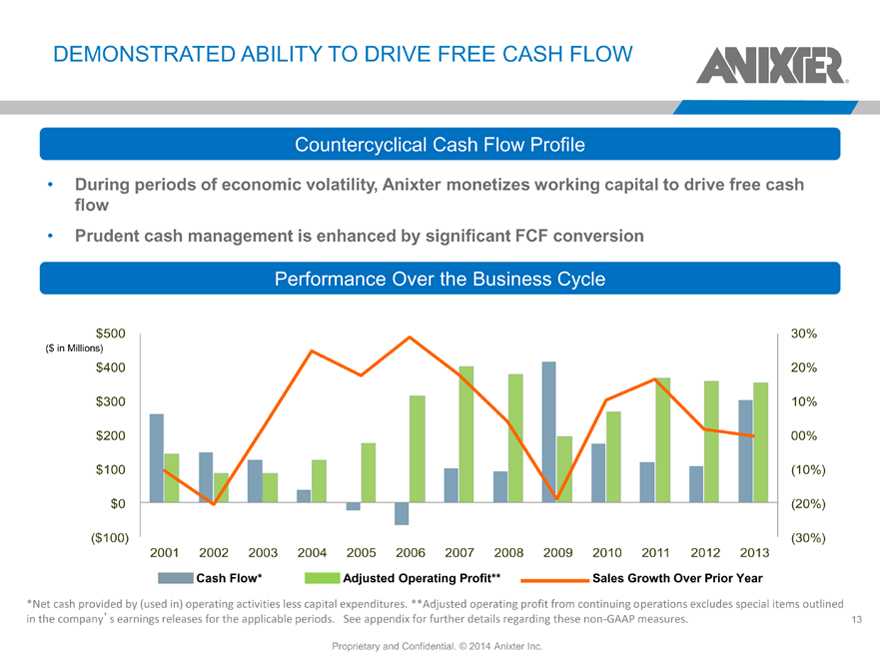

DEMONSTRATED ABILITY TO DRIVE FREE CASH FLOW

Countercyclical Cash Flow Profile

During periods of economic volatility, Anixter monetizes working capital to drive free cash flow Prudent cash management is enhanced by significant FCF conversion

Performance Over the Business Cycle

$500 30%

($ in Millions)

$400 20%

$300 10%

$200 00%

$100 (10%)

$0 (20%)

($100) (30%)

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

Cash Flow* Adjusted Operating Profit** Sales Growth Over Prior Year

*Net cash provided by (used in) operating activities less capital expenditures. **Adjusted operating profit from continuing operations excludes special items outlined in the company’s earnings releases for the applicable periods. See appendix for further details regarding these non-GAAP measures.

Proprietary and Confidential. © 2014 Anixter Inc.

13

|

DISCIPLINED AND PRUDENT CAPITAL ALLOCATION

Organic growth

– Support mature markets

– Accelerate growth in newer markets

Strategic acquisitions

– Enhance geographic segment position

– Expand product lines and service offerings

Opportunistic return of value to shareholders

– Share repurchases

– Special dividends

– From 2010 – 2013 Anixter returned $754 million to shareholders, representing 72% of available cash

In August 2014 AXE announced the acquisition of Tri-Ed, a leading independent security distributor with June 2014 trailing twelve months sales of ~$570 million

Proprietary and Confidential. © 2014 Anixter Inc.

14

|

Tri-Ed Acquisition

Proprietary and Confidential. © 2014 Anixter Inc.

15

|

TRI-ED ACQUISITION: STRATEGIC RATIONALE

We continually evaluate opportunities, highly selective in pursuing transactions

Focus on strategic fit, appropriate valuation and risk profile

Expand geographic reach and accelerate growth into target markets

Extend product line and service offerings

Tri-Ed will accelerate our security growth initiative, create a leading global security business, and provide a platform for sustainable profitable growth

Complements our existing enterprise-focused security business

Creates opportunities in the intrusion detection and fire/life safety businesses

Enables expansion with mid-sized integrators

Extensive branch network provides access to the residential end market

Acquisition Highlights

Acquisition multiple of approximately 11.5x (excluding synergies)

Accretive in the first full year of operation, excluding one-time costs

Anixter’s acquisition strategy focuses on opportunities that complement our existing capabilities and help further geographic expansion in targeted regions 16

16

|

TRI-ED OVERVIEW

Leading independent distributor of security and low-voltage technology products

Broad product portfolio serves four major segments of the security business

– Video Surveillance

– Access Control

– Intrusion Detection

– Fire and Life Safety

Over 20,000 active dealer and integrator customers and over 600 vendor partners

Approximately 110,000 active SKU’s

61 local branches and 2 technical sales centers throughout North America Fast-growing eCommerce platform Over 600 employees

The Tri-Ed acquisition creates a leading global security platform across video, access control, intrusion detection and fire/life safety segments

Proprietary and Confidential. © 2014 Anixter Inc.

17

|

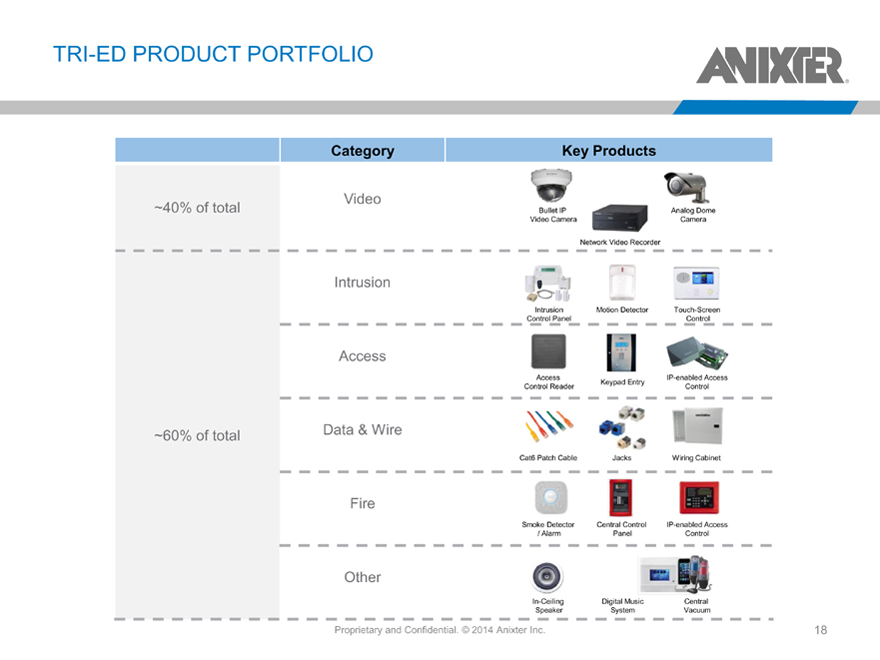

TRI-ED PRODUCT PORTFOLIO

Category Key Products

Video

~40% of total Bullet IP Analog Dome

Video Camera Camera

Network Video Recorder

Intrusion

Intrusion Motion Detector Touch-Screen

Control Panel Control

Access

Access IP-enabled Access

Keypad Entry

Control Reader Control

~60% of total Data & Wire

Cat6 Patch Cable Jacks Wiring Cabinet

Fire

Smoke Detector Central Control IP-enabled Access

/ Alarm Panel Control

Other

In-Ceiling Digital Music Central

Speaker System Vacuum

Proprietary and Confidential. © 2014 Anixter Inc.

18

|

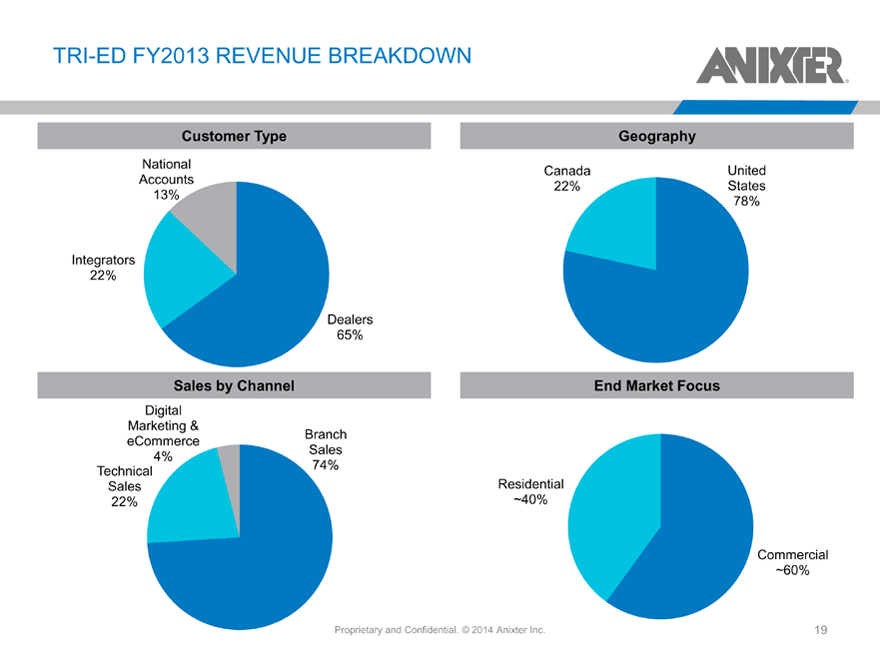

TRI-ED FY2013 REVENUE BREAKDOWN

Customer Type

National

Accounts

13%

Integrators

22%

Dealers

65%

Geography

Canada United

22% States

78%

Sales by Channel

Digital

Marketing &

eCommerce Branch

4% Sales

Technical 74%

Sales

22%

End Market Focus

Residential

~40%

Commercial

~60%

Proprietary and Confidential. © 2014 Anixter Inc.

19

|

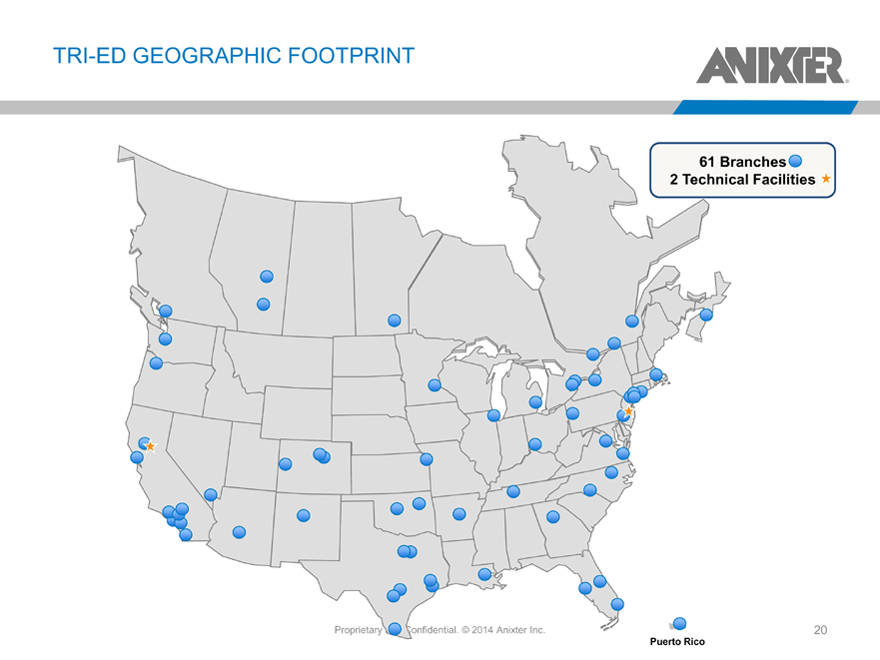

TRI-ED GEOGRAPHIC FOOTPRINT

61 Branches

2 |

| Technical Facilities |

Proprietary and Confidential. © 2014 Anixter Inc.

Puerto Rico

20

|

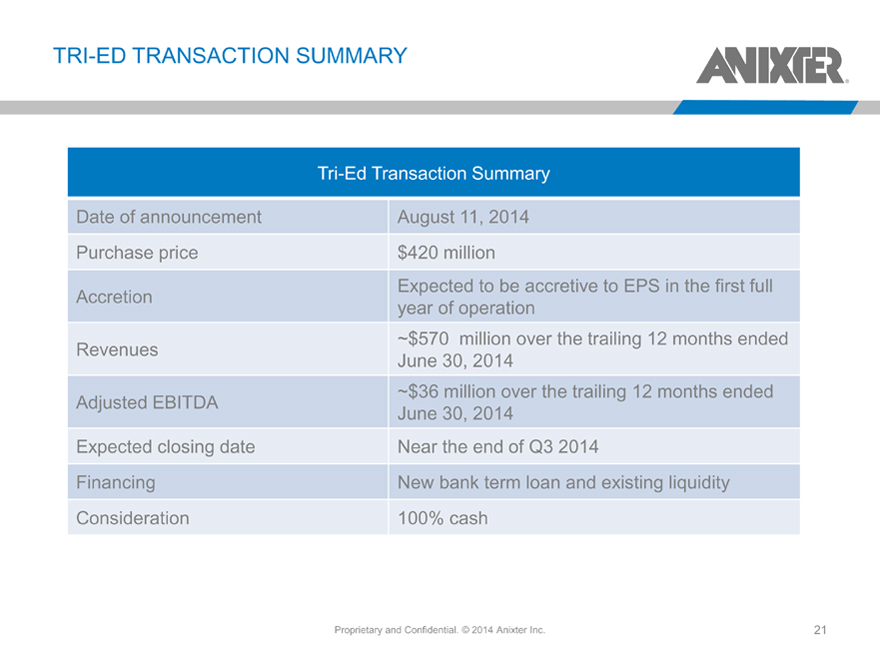

TRI-ED TRANSACTION SUMMARY

Tri-Ed Transaction Summary

Date of announcement August 11, 2014

Purchase price $420 million

Accretion Expected to be accretive to EPS in the first full

year of operation

Revenues ~$570 million over the trailing 12 months ended

June 30, 2014

~$36 million over the trailing 12 months ended

Adjusted EBITDA June 30, 2014

Expected closing date Near the end of Q3 2014

Financing New bank term loan and existing liquidity

Consideration 100% cash

Proprietary and Confidential. © 2014 Anixter Inc.

21

|

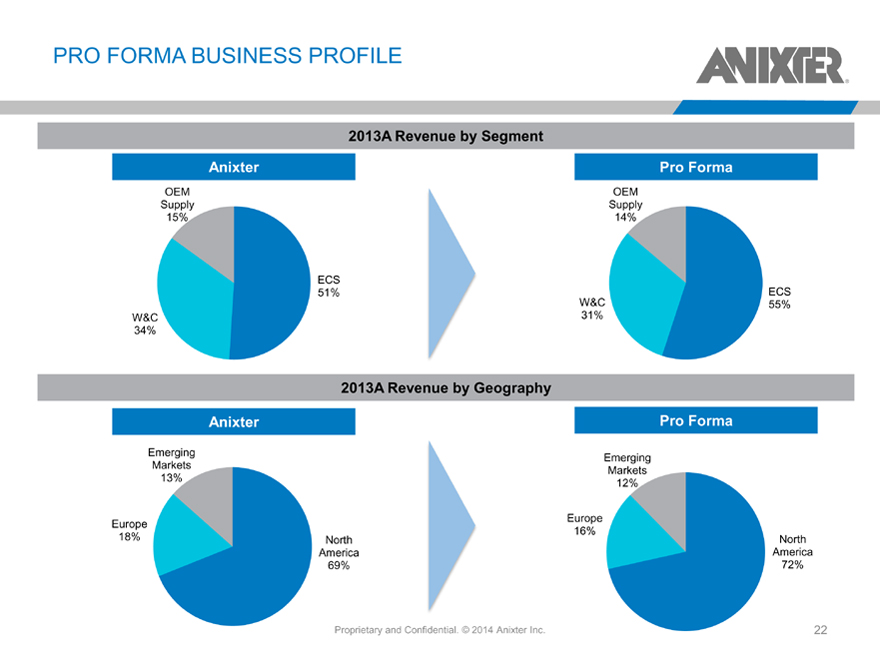

PRO FORMA BUSINESS PROFILE

2013A Revenue by Segment

Anixter

OEM

Supply

15%

ECS

51%

W&C

34%

Pro Forma

OEM

Supply

14%

ECS

W&C 55%

31%

2013A Revenue by Geography

Anixter

Emerging

Markets

13%

Europe

18% North

America

69%

Pro Forma

Emerging

Markets

12%

Europe

16%

North

America

72%

Proprietary and Confidential. © 2014 Anixter Inc.

22

|

2Q 2014 Review

Proprietary and Confidential. © 2014 Anixter Inc.

23

|

Q2 2014 OVERVIEW AND HIGHLIGHTS

(ALL COMPARISONS VERSUS PRIOR YEAR)

Record Q2 Sales of $1.59 billion up 0.4%

– Organic sales* up 0.6%

– Fasteners segment sales up 3.4% to $243.1 million

– Emerging Markets sales up 10.6% to a record $229.1 million

ECS up 4.7%

W&C up 19.4%

Fasteners up 25.1%

– EMEA sales up 8.0% to $291.9 million driven by 15.5% increase in W&C

– Trailing 12-month (“TTM”) ICC sales up 11.5% to $245.4 million

Gross margin up 40 basis points to 22.9% Operating income of $92.4 million, up 7.8% Diluted EPS up 15.0% to $1.61 Adjusted diluted EPS up 12.1% to $1.57**

Cash flow from operations up 25.9% to $78.7 million

*Organic sales excludes the impact of foreign exchange and copper price fluctuations.

**The second quarter of 2014 includes a net tax benefit of $2.0 million primarily related to the reversal of a deferred tax val uation allowance in Europe. Also, due to the change in the country level mix in the full year forecast of earnings, the second quarter of 2014 t ax expense includes $0.4 million of additional expense to forecast an effective tax rate of 34.4% for the full year, excluding the tax b enefit described above. These items increased earnings per diluted share by $0.04 in Q2 2014.

Proprietary and Confidential. © 2014 Anixter Inc.

24

|

ENTERPRISE CABLING AND SECURITY SOLUTIONS REVIEW

Q2 2014 ECS sales of $817.4 million

– Up 0.4% versus Q2 2013 (organic* sales up 0.8%)

– Up 7.5% versus Q1 2014

– 63 billing days in the current quarter versus 64 in Q2 2013 and 65 in Q1 2014

Overall the global data infrastructure market is gradually improving

– Operating margin of 5.4% up 20 bps YOY, up 70 bps sequentially

– North American market trends improving, reflected in the 8.0% organic* sequential revenue growth

– Emerging Markets region remains strong, up 6.6% on an organic* basis

– Security sales decreased 2%, accounting for approximately 26% of ECS

– Operating leverage of 60.4% reflecting improved margins and excellent expense control

Q2 2014 ECS Sales Mix

$138 North America

$83 Europe

$596

Emerging

Markets

$ Millions

ECS Quarterly Sales ($ millions)

and YOY Growth

$ 850 3.0%

$ 825 2.0%

1.0%

$ 800 0.0%

$ 775 -1.0%

$ 750 -2.0%

-3.0%

$ 725 -4.0%

$ 700 -5.0%

2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q 14 2Q14

* |

| Organic sales excludes the impact of foreign exchange |

Proprietary and Confidential. © 2014 Anixter Inc.

25

|

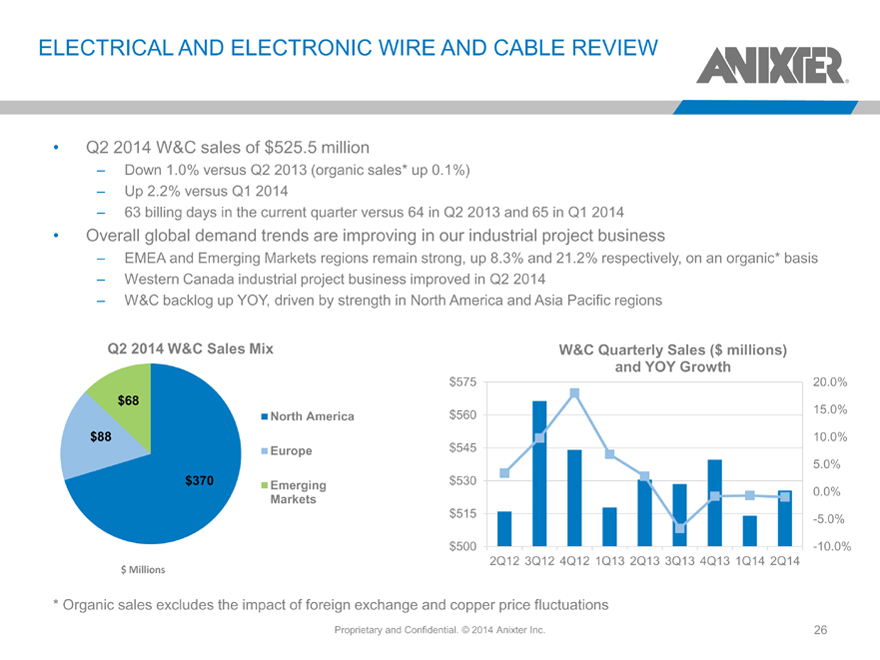

ELECTRICAL AND ELECTRONIC WIRE AND CABLE REVIEW

Q2 2014 W&C sales of $525.5 million

– Down 1.0% versus Q2 2013 (organic sales* up 0.1%)

– Up 2.2% versus Q1 2014

– 63 billing days in the current quarter versus 64 in Q2 2013 and 65 in Q1 2014

Overall global demand trends are improving in our industrial project business

– EMEA and Emerging Markets regions remain strong, up 8.3% and 21.2% respectively, on an organic* basis

– Western Canada industrial project business improved in Q2 2014

– W&C backlog up YOY, driven by strength in North America and Asia Pacific regions

Q2 2014 W&C Sales Mix

$68

North America

$88

Europe

$370 Emerging

Markets

$ Millions

W&C Quarterly Sales ($ millions)

and YOY Growth

$ 575 20.0%

$ 560 15.0%

10.0%

$ 545

5.0%

$ 530

0.0%

$ 515 -5.0%

$ 500 -10.0%

2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14

* |

| Organic sales excludes the impact of foreign exchange and copper price fluctuations |

Proprietary and Confidential. © 2014 Anixter Inc.

26

|

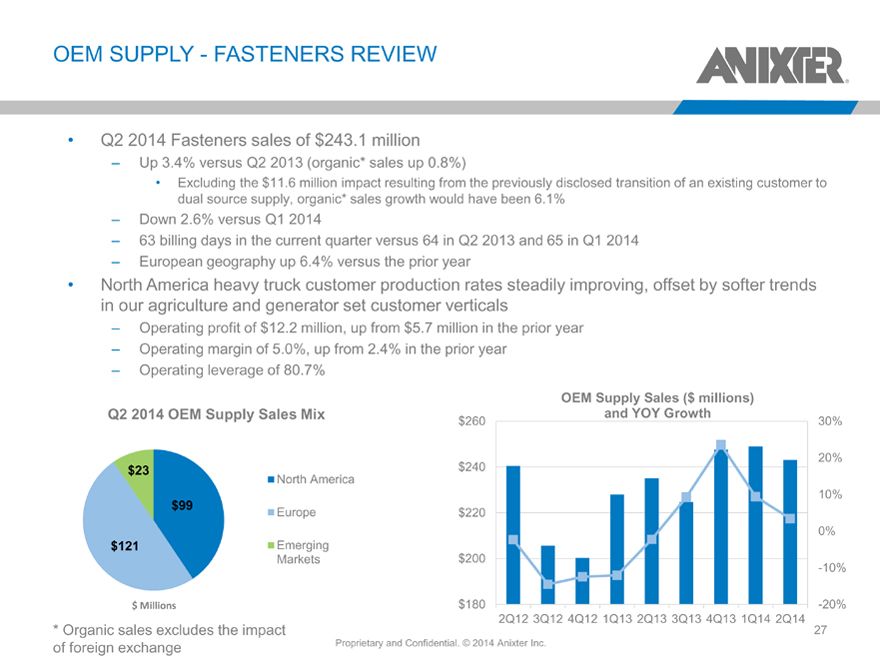

OEM SUPPLY—FASTENERS REVIEW

Q2 2014 Fasteners sales of $243.1 million

– Up 3.4% versus Q2 2013 (organic* sales up 0.8%)

Excluding the $11.6 million impact resulting from the previously disclosed transition of an existing customer to dual source supply, organic* sales growth would have been 6.1%

– Down 2.6% versus Q1 2014

– 63 billing days in the current quarter versus 64 in Q2 2013 and 65 in Q1 2014

– European geography up 6.4% versus the prior year

North America heavy truck customer production rates steadily improving, offset by softer trends in our agriculture and generator set customer verticals

– Operating profit of $12.2 million, up from $5.7 million in the prior year

– Operating margin of 5.0%, up from 2.4% in the prior year

– Operating leverage of 80.7%

Q2 2014 OEM Supply Sales Mix

$23

North America

$99 Europe

$121 Emerging

Markets

$ Millions

OEM Supply Sales ($ millions)

and YOY Growth

$ 260 30%

20%

$ 240

10%

$ 220

0%

$ 200

-10%

$ 180 -20%

2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14

* |

| Organic sales excludes the impact of foreign exchange |

Proprietary and Confidential. © 2014 Anixter Inc.

27

|

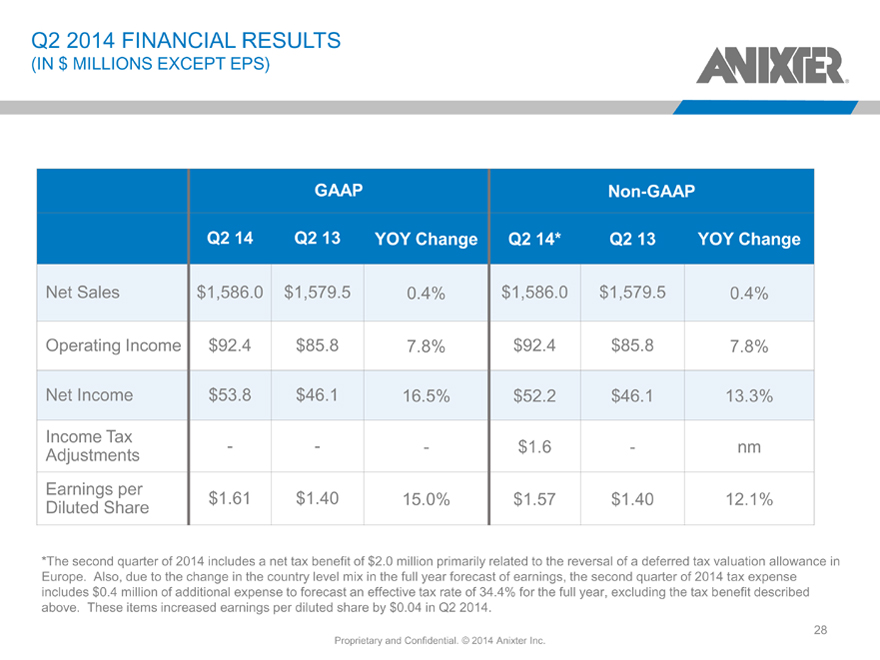

Q2 2014 FINANCIAL RESULTS

(IN $ MILLIONS EXCEPT EPS)

GAAP Non-GAAP

Q2 14 Q2 13 YOY Change Q2 14* Q2 13 YOY Change

Net Sales $1,586.0 $1,579.5 0.4% $1,586.0 $1,579.5 0.4%

Operating Income $92.4 $85.8 7.8% $92.4 $85.8 7.8%

Net Income $53.8 $46.1 16.5% $52.2 $46.1 13.3%

Income Tax

Adjustments ——— $1.6 — nm

Earnings per

Diluted Share $1.61 $1.40 15.0% $1.57 $1.40 12.1%

*The second quarter of 2014 includes a net tax benefit of $2.0 million primarily related to the reversal of a deferred tax val uation allowance in Europe. Also, due to the change in the country level mix in the full year forecast of earnings, the second quarter of 2014 t ax expense includes $0.4 million of additional expense to forecast an effective tax rate of 34.4% for the full year, excluding the tax b enefit described above. These items increased earnings per diluted share by $0.04 in Q2 2014.

Proprietary and Confidential. © 2014 Anixter Inc.

28

|

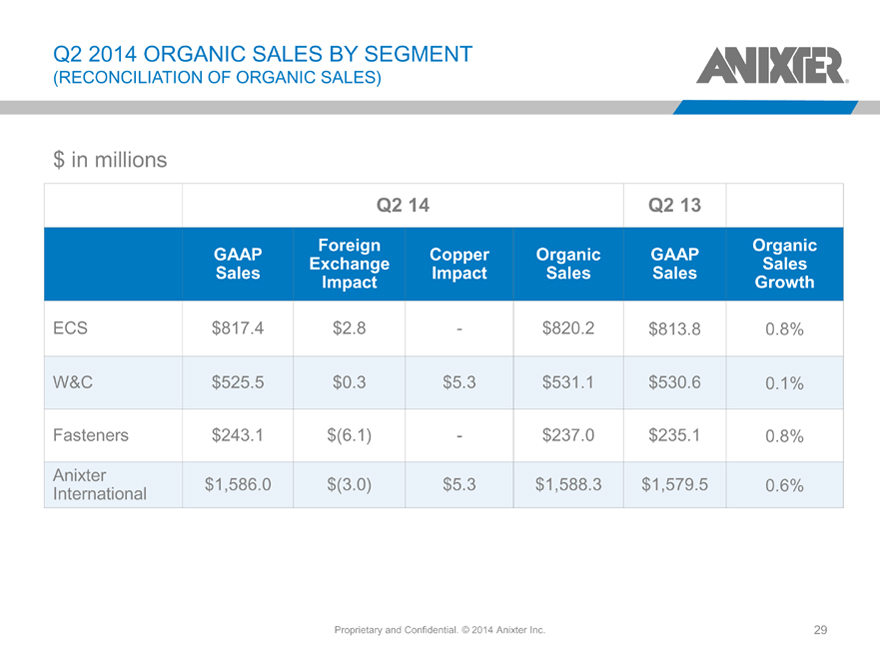

Q2 2014 ORGANIC SALES BY SEGMENT

(RECONCILIATION OF ORGANIC SALES)

$ in millions

Q2 14 Q2 13

Foreign Organic

GAAP Copper Organic GAAP

Exchange Sales

Sales Impact Sales Sales

Impact Growth

ECS $817.4 $2.8 — $820.2 $813.8 0.8%

W&C $525.5 $0.3 $ 5.3 $531.1 $530.6 0.1%

Fasteners $243.1 $(6.1) — $237.0 $235.1 0.8%

Anixter

International $1,586.0 $(3.0) $ 5.3 $1,588.3 $1,579.5 0.6%

Proprietary and Confidential. © 2014 Anixter Inc.

29

|

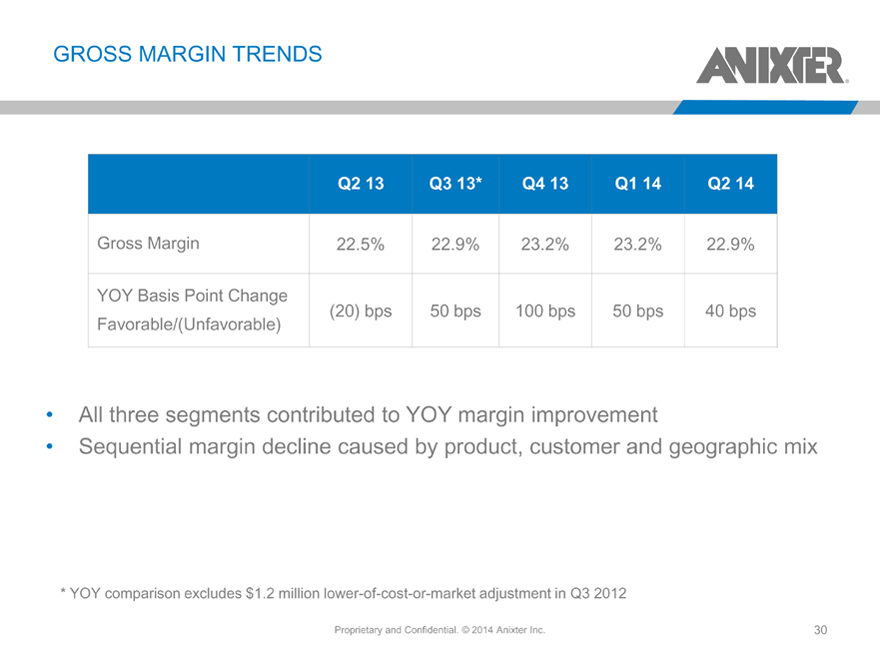

GROSS MARGIN TRENDS

Q2 13 Q3 13* Q4 13 Q1 14 Q2 14

Gross Margin 22.5% 22.9% 23.2% 23.2% 22.9%

YOY Basis Point Change

(20) |

| bps 50 bps 100 bps 50 bps 40 bps |

Favorable/(Unfavorable)

All three segments contributed to YOY margin improvement

Sequential margin decline caused by product, customer and geographic mix

* |

| YOY comparison excludes $1.2 million lower-of-cost-or-market adjustment in Q3 2012 |

Proprietary and Confidential. © 2014 Anixter Inc.

30

|

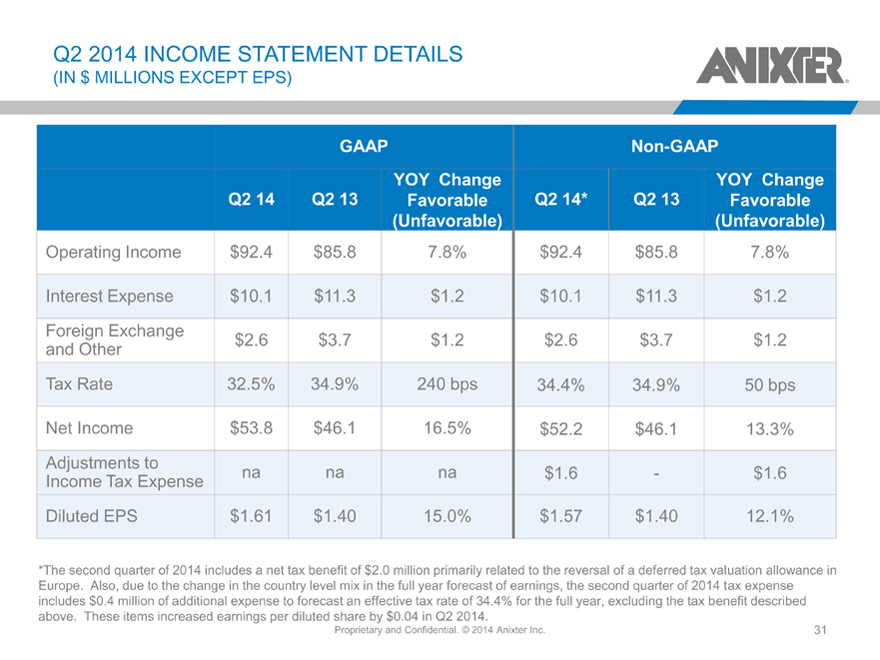

Q2 2014 INCOME STATEMENT DETAILS

(IN $ MILLIONS EXCEPT EPS)

GAAP Non-GAAP

YOY Change YOY Change

Q2 14 Q2 13 Favorable Q2 14* Q2 13 Favorable

(Unfavorable) (Unfavorable)

Operating Income $92.4 $85.8 7.8% $92.4 $85.8 7.8%

Interest Expense $10.1 $11.3 $ 1.2 $10.1 $11.3 $1.2

Foreign Exchange

and Other $2.6 $3.7 $ 1.2 $2.6 $3.7 $1.2

Tax Rate 32.5% 34.9% 240 bps 34.4% 34.9% 50 bps

Net Income $53.8 $46.1 16.5% $52.2 $46.1 13.3%

Adjustments to

Income Tax Expense na na na $1.6 — $1.6

Diluted EPS $1.61 $1.40 15.0% $1.57 $1.40 12.1%

*The second quarter of 2014 includes a net tax benefit of $2.0 million primarily related to the reversal of a deferred tax valuation allowance in Europe. Also, due to the change in the country level mix in the full year forecast of earnings, the second quarter of 2014 tax expense includes $0.4 million of additional expense to forecast an effective tax rate of 34.4% for the full year, excluding the tax benefit described above. These items increased earnings per diluted share by $0.04 in Q2 2014.

Proprietary and Confidential. © 2014 Anixter Inc.

31

|

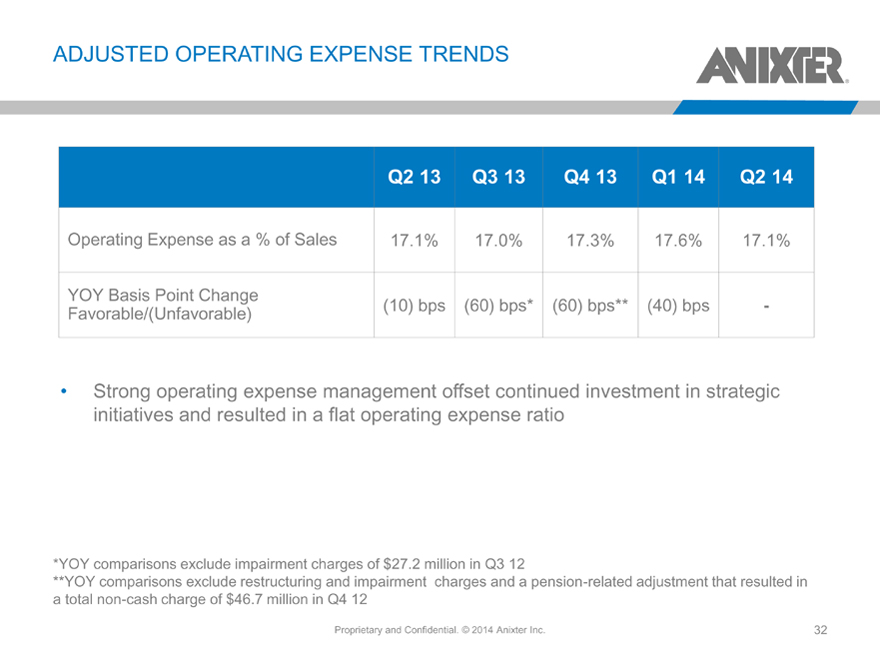

ADJUSTED OPERATING EXPENSE TRENDS

Q2 13 Q3 13 Q4 13 Q1 14 Q2 14

Operating Expense as a % of Sales 17.1% 17.0% 17.3% 17.6% 17.1%

YOY Basis Point Change

Favorable/(Unfavorable) (10) bps (60) bps* (60) bps** (40) bps -

Strong operating expense management offset continued investment in strategic initiatives and resulted in a flat operating expense ratio

*YOY comparisons exclude impairment charges of $27.2 million in Q3 12

**YOY comparisons exclude restructuring and impairment charges and a pension -related adjustment that resulted in a total non-cash charge of $46.7 million in Q4 12

Proprietary and Confidential. © 2014 Anixter Inc.

32

|

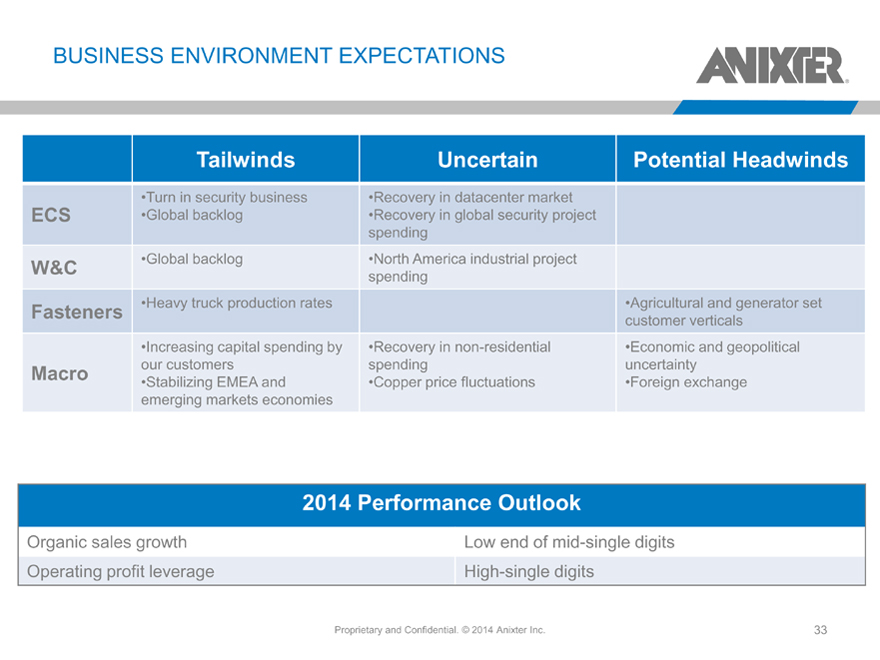

BUSINESS ENVIRONMENT EXPECTATIONS

Tailwinds Uncertain Potential Headwinds

Turn in security business Recovery in datacenter market

ECS Global backlog Recovery in global security project

spending

W&C Global backlog North America industrial project

spending

Fasteners Heavy truck production rates Agricultural and generator set

customer verticals

Increasing capital spending by Recovery in non -residential Economic and geopolitical

Macro our customers spending uncertainty

Stabilizing EMEA and Copper price fluctuations Foreign exchange

emerging markets economies

2014 Performance Outlook

Organic sales growth Low end of mid-single digits

Operating profit leverage High-single digits

Proprietary and Confidential. © 2014 Anixter Inc.

33

|

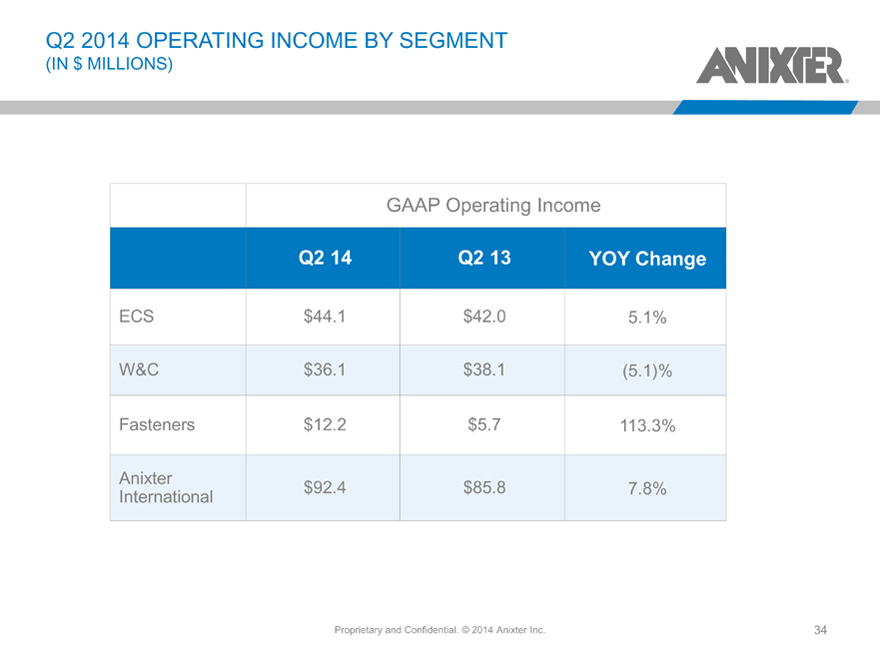

Q2 2014 OPERATING INCOME BY SEGMENT

(IN $ MILLIONS)

GAAP Operating Income

Q2 14 Q2 13 YOY Change

ECS $ 44.1 $42.0 5.1%

W&C $ 36.1 $38.1 (5.1)%

Fasteners $ 12.2 $5.7 113.3%

Anixter

International $ 92.4 $85.8 7.8%

Proprietary and Confidential. © 2014 Anixter Inc.

34

|

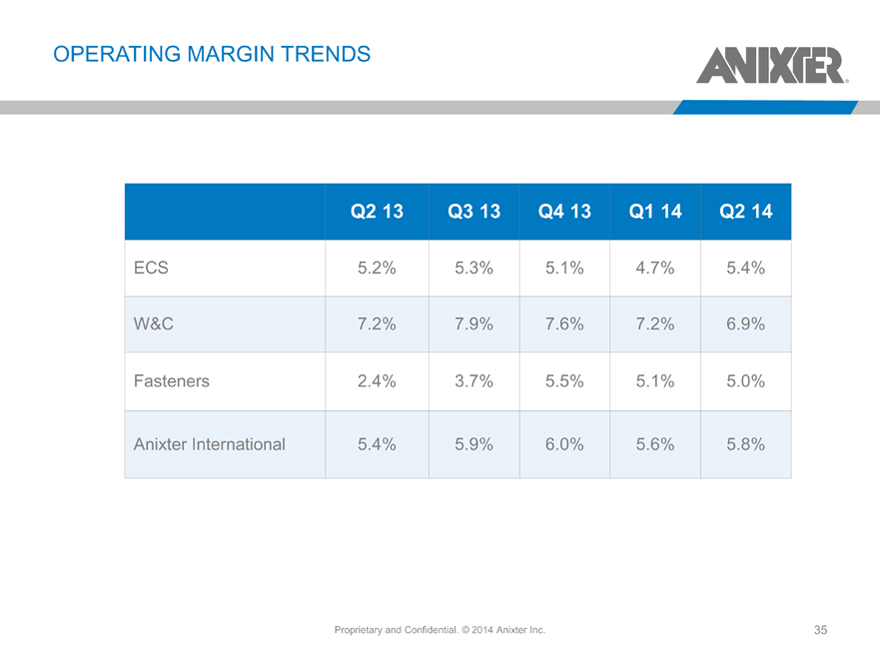

OPERATING MARGIN TRENDS

Q2 13 Q3 13 Q4 13 Q1 14 Q2 14

ECS 5.2% 5.3% 5.1% 4.7% 5.4%

W&C 7.2% 7.9% 7.6% 7.2% 6.9%

Fasteners 2.4% 3.7% 5.5% 5.1% 5.0%

Anixter International 5.4% 5.9% 6.0% 5.6% 5.8%

Proprietary and Confidential. © 2014 Anixter Inc.

35

|

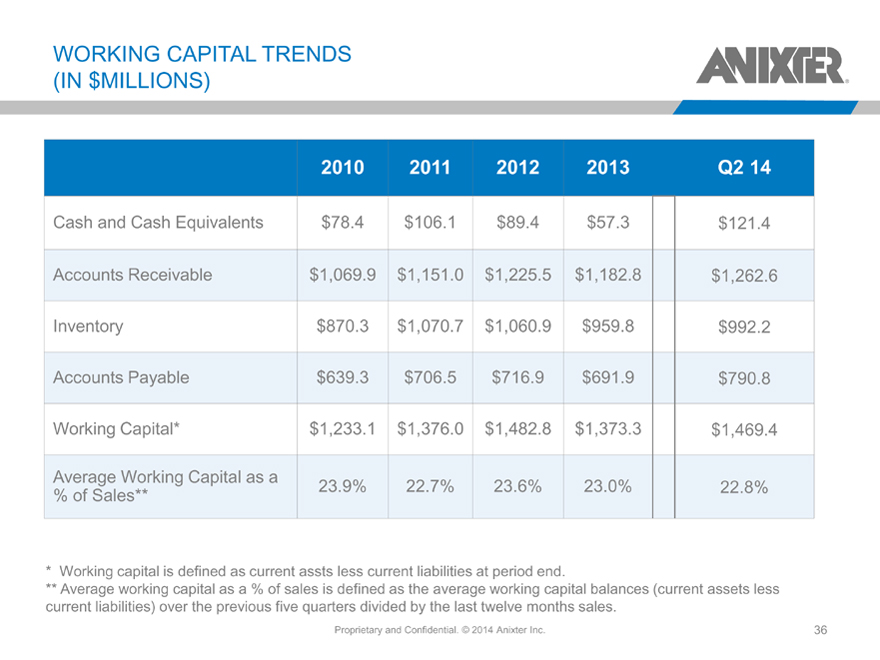

WORKING CAPITAL TRENDS (IN $MILLIONS)

2010 2011 2012 2013 Q2 14

Cash and Cash Equivalents $78.4 $106.1 $89.4 $57.3 $121.4

Accounts Receivable $1,069.9 $1,151.0 $1,225.5 $1,182.8 $1,262.6

Inventory $870.3 $1,070.7 $1,060.9 $959.8 $992.2

Accounts Payable $639.3 $706.5 $716.9 $691.9 $790.8

Working Capital* $1,233.1 $1,376.0 $1,482.8 $1,373.3 $1,469.4

Average Working Capital as a

% of Sales** 23.9% 22.7% 23.6% 23.0% 22.8%

* |

| Working capital is defined as current assts less current liabilities at period end. |

** Average working capital as a % of sales is defined as the average working capital balances (current assets less current liabilities) over the previous five quarters divided by the last twelve months sales.

Proprietary and Confidential. © 2014 Anixter Inc.

36

|

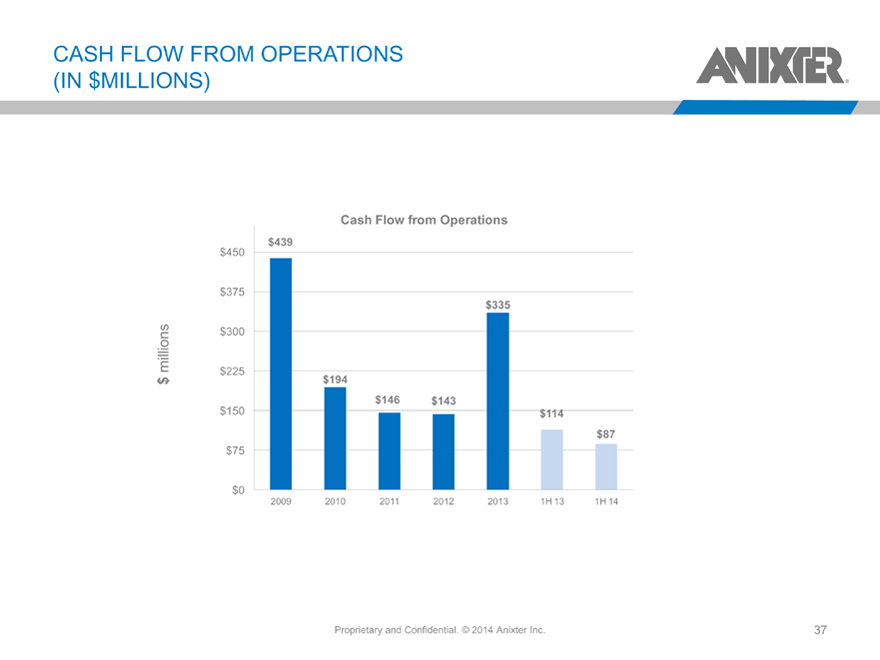

CASH FLOW FROM OPERATIONS (IN $MILLIONS)

Cash Flow from Operations

$439

$450

$375

$335

$300

millions $225

$ $194

$146 $143

$150 $114

$87

$75

$0

2009 2010 2011 2012 2013 1H 13 1H 14

Proprietary and Confidential. © 2014 Anixter Inc.

37

|

2H 2014 Outlook

Proprietary and Confidential. © 2014 Anixter Inc.

38

|

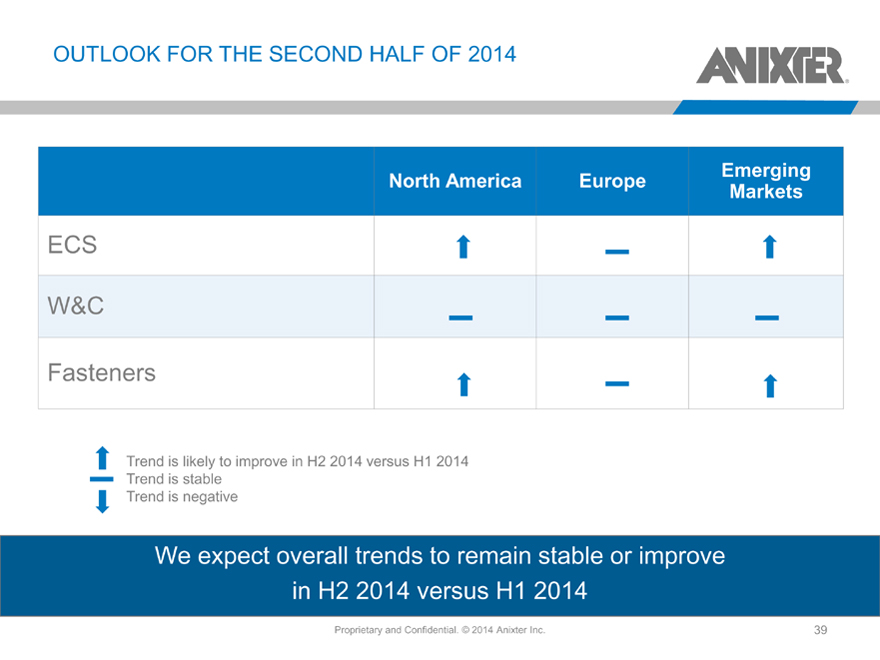

OUTLOOK FOR THE SECOND HALF OF 2014

Emerging

North America Europe Markets

ECS

W&C

Fasteners

Trend is likely to improve in H2 2014 versus H1 2014 Trend is stable Trend is negative

We expect overall trends to remain stable or improve in H2 2014 versus H1 2014

Proprietary and Confidential. © 2014 Anixter Inc.

39

|

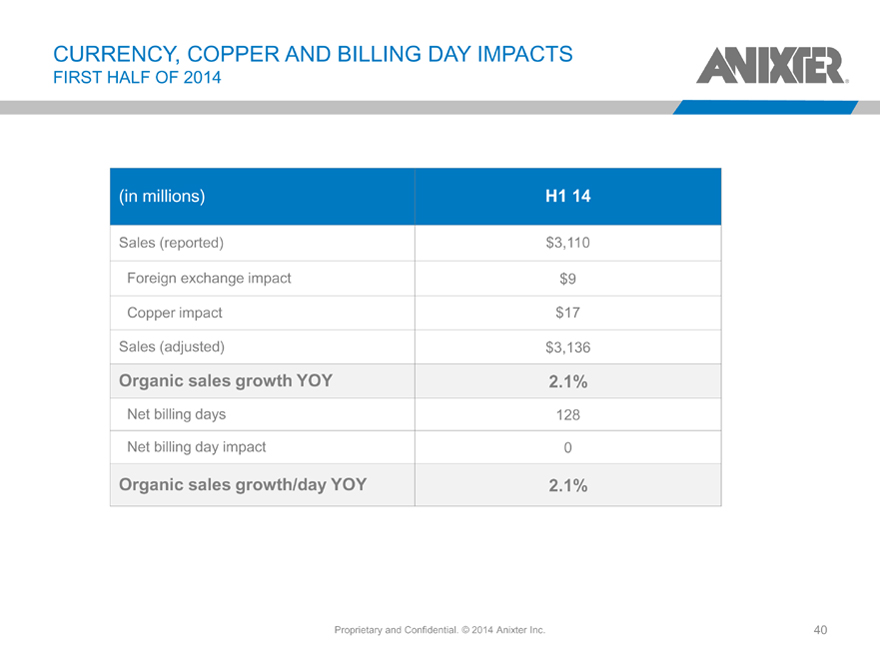

CURRENCY, COPPER AND BILLING DAY IMPACTS

FIRST HALF OF 2014

(in millions) H1 14

Sales (reported) $3,110

Foreign exchange impact $9

Copper impact $17

Sales (adjusted) $3,136

Organic sales growth YOY 2.1%

Net billing days 128

Net billing day impact 0

Organic sales growth/day YOY 2.1%

Proprietary and Confidential. © 2014 Anixter Inc.

40

|

OUTLOOK FOR THE SECOND HALF OF 2014

To help level-set and provide clarity, we are providing further insight into our estimates of the impacts of foreign exchange, copper and net billing days on second half 2014 organic growth metrics We are not setting a precedent and do not intend to provide EPS guidance Will continue to provide directional guidance on organic revenue growth and operating profit leverage The impact of FX, copper and billing days is projected to have a much different impact on the second half compared to the first half

Proprietary and Confidential. © 2014 Anixter Inc.

41

|

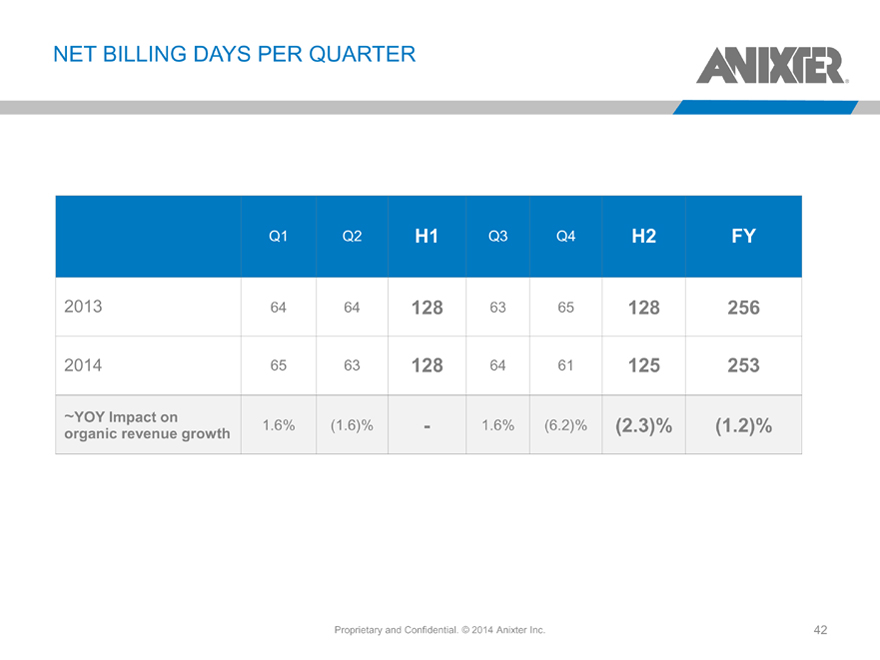

NET BILLING DAYS PER QUARTER

Q1 Q2 H1 Q3 Q4 H2 FY

2013 64 64 128 63 65 128 256

2014 65 63 128 64 61 125 253

~YOY Impact on 1.6% (1.6)% — 1.6% (6.2)% (2.3)% (1.2)%

organic revenue growth

Proprietary and Confidential. © 2014 Anixter Inc.

42

|

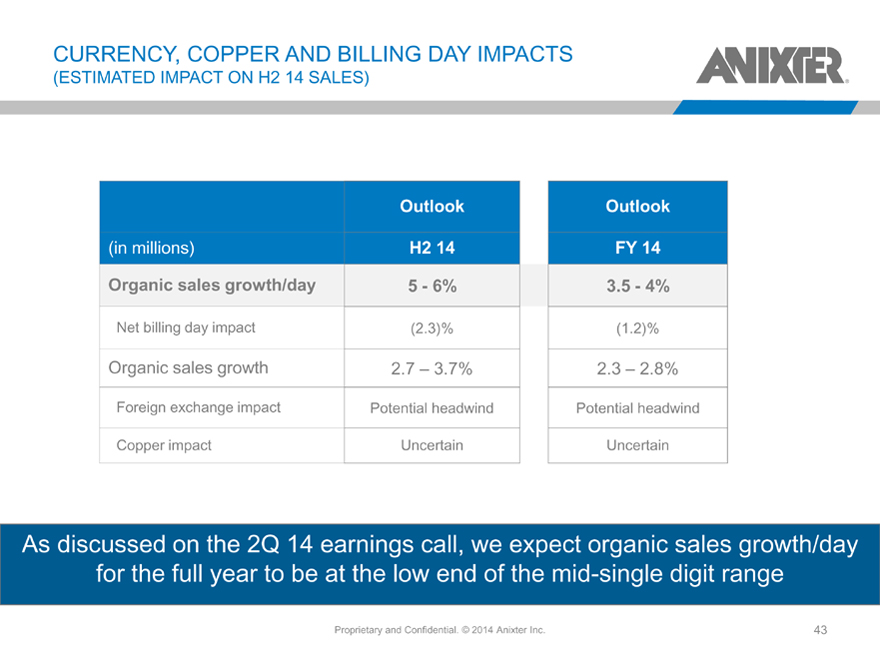

CURRENCY, COPPER AND BILLING DAY IMPACTS

(ESTIMATED IMPACT ON H2 14 SALES)

Outlook Outlook

(in millions) H2 14 FY 14

Organic sales growth/day 5—6% 3.5—4%

Net billing day impact (2.3)% (1.2)%

Organic sales growth 2.7 – 3.7% 2.3 – 2.8%

Foreign exchange impact Potential headwind Potential headwind

Copper impact Uncertain Uncertain

As discussed on the 2Q 14 earnings call, we expect organic sales growth/day for the full year to be at the low end of the mid-single digit range

Proprietary and Confidential. © 2014 Anixter Inc.

43

|

Appendix

Proprietary and Confidential. © 2014 Anixter Inc.

44

|

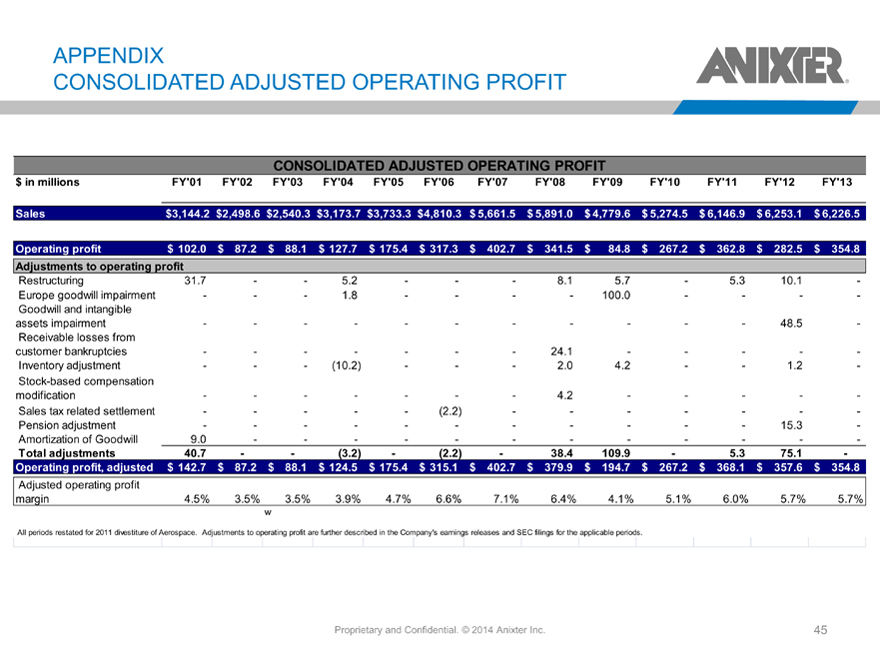

APPENDIX

CONSOLIDATED ADJUSTED OPERATING PROFIT

CONSOLIDATED ADJUSTED OPERATING PROFIT

$ in millions FY’01 FY’02 FY’03 FY’04 FY’05 FY’06 FY’07 FY’08 FY’09 FY’10 FY’11 FY’12 FY’13

Sales $3,144.2 $2,498.6 $2,540.3 $3,173.7 $3,733.3 $4,810.3 $ 5,661.5 $ 5,891.0 $ 4,779.6 $ 5,274.5 $ 6,146.9 $ 6,253.1 $ 6,226.5

Operating profit $ 102.0 $ 87.2 $ 88.1 $ 127.7 $ 175.4 $ 317.3 $ 402.7 $ 341.5 $ 84.8 $ 267.2 $ 362.8 $ 282.5 $ 354.8

Adjustments to operating profit

Restructuring 31.7 — — 5.2 ——— 8.1 5.7 — 5.3 10.1 -

Europe goodwill impairment —— — 1.8 ———— 100.0 ——— -

Goodwill and intangible

assets impairment —— —————— ——— 48.5 -

Receivable losses from

customer bankruptcies —— ————— 24.1 ———— -

Inventory adjustment —— — (10.2) ——— 2.0 4.2 —— 1.2 -

Stock-based compensation

modification —— ————— 4.2 ———— -

Sales tax related settlement —— ——— (2.2) —— ———— -

Pension adjustment —— —————— ——— 15.3 -

Amortization of Goodwill 9.0 — —————— ———— -

Total adjustments 40.7 — — (3.2) — (2.2) — 38.4 109.9 — 5.3 75.1 -

Operating profit, adjusted $ 142.7 $ 87.2 $ 88.1 $ 124.5 $ 175.4 $ 315.1 $ 402.7 $ 379.9 $ 194.7 $ 267.2 $ 368.1 $ 357.6 $ 354.8

Adjusted operating profit

margin 4.5% 3.5% 3.5% 3.9% 4.7% 6.6% 7.1% 6.4% 4.1% 5.1% 6.0% 5.7% 5.7%

All periods restated for 2011 divestiture of Aerospace. Adjustments to operating profit are further described in the Company’s earnings releases and SEC filings for the applicable periods.

Proprietary and Confidential. © 2014 Anixter Inc.

45

|

Investor Contacts:

Ted Dosch EVP and CFO

Ted.dosch@anixter.com

224-521-4291

Lisa Micou Meers, CFA VP of Investor Relations

Lisa.meers@anixter.com

224-521-8895

46