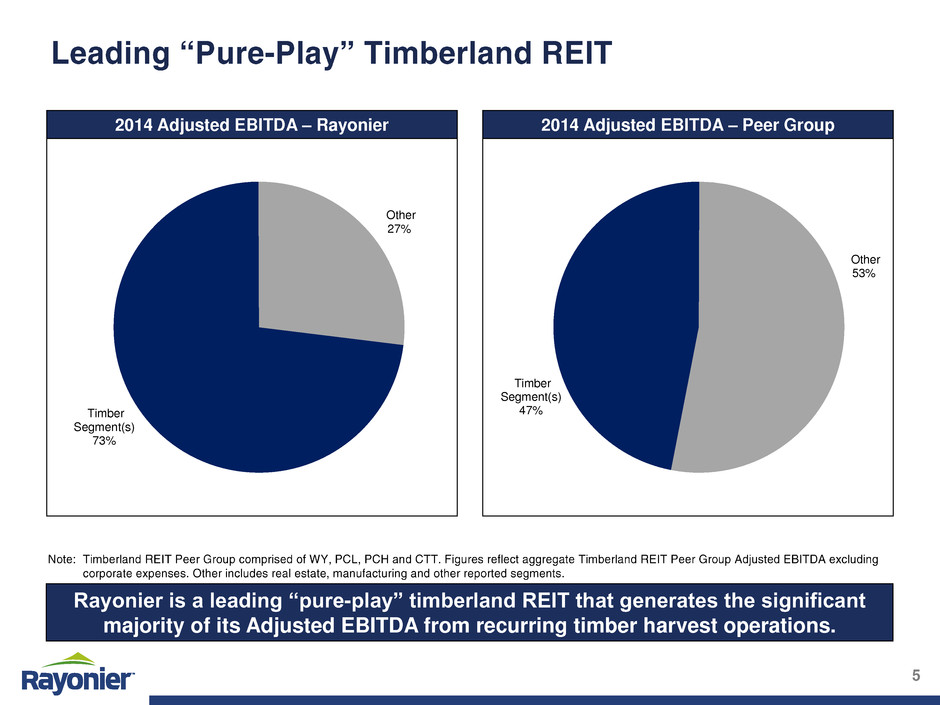

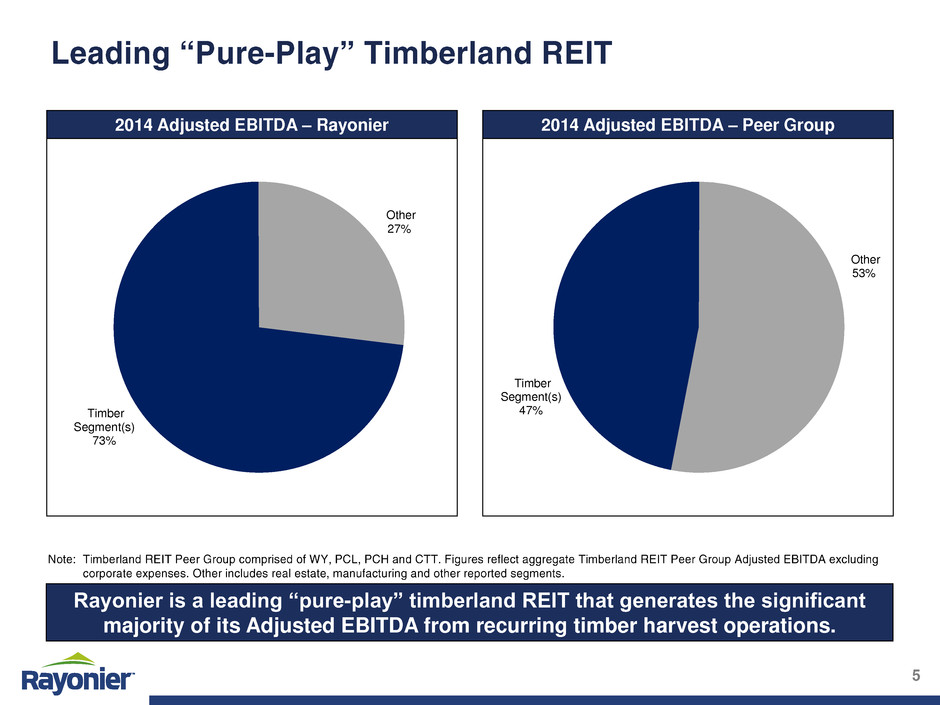

Rayonier is a leading “pure-play” timberland REIT that generates the significant majority of its Adjusted EBITDA from recurring timber harvest operations. Timber Segment(s) 47% Other 53% Timber Segment(s) 73% Other 27% 2014 Adjusted EBITDA – Rayonier 2014 Adjusted EBITDA – Peer Group

Map of Properties Historical Harvest Volume Rayonier’s Southern Timber segment has nearly doubled its EBITDA since 2011, largely driven by acquisitions and significant price gains in key markets. Historical Adjusted EBITDA* (tons in 000s) ($ in millions) 4,930 4,741 5,322 5,292 5,296 3,000 3,500 4,000 4,500 5,000 5,500 2010 2011 2012 2013 2014 $70 $56 $76 $87 $98 – $20 $40 $60 $80 $1 2010 2011 2012 2013 2014 *Non-GAAP measure (see page 50 for definition and pages 53 and 54 for reconciliations).

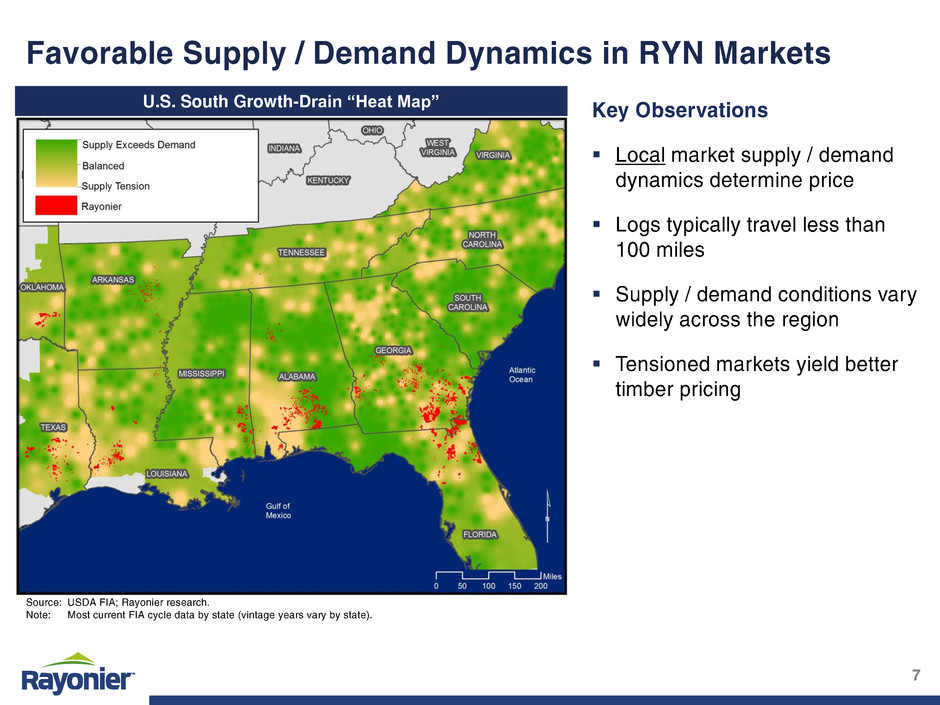

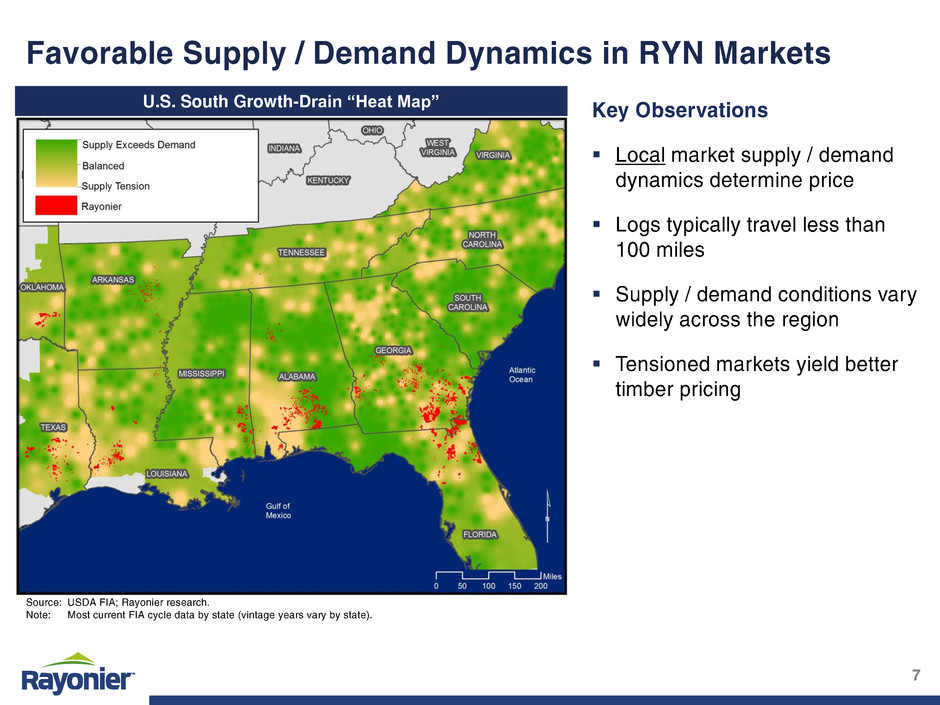

U.S. South Growth-Drain “Heat Map”

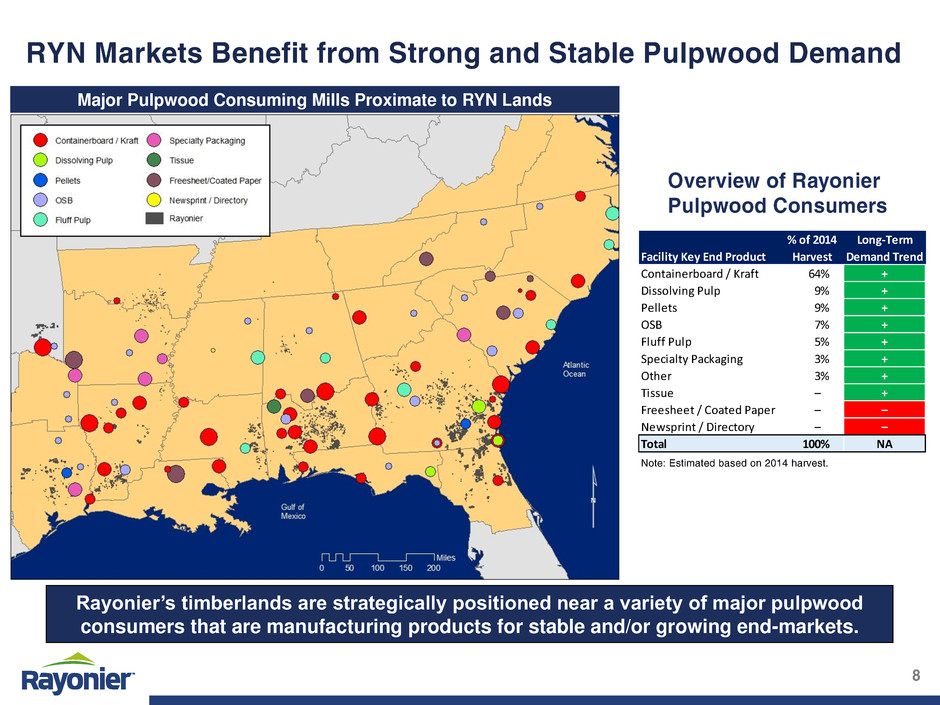

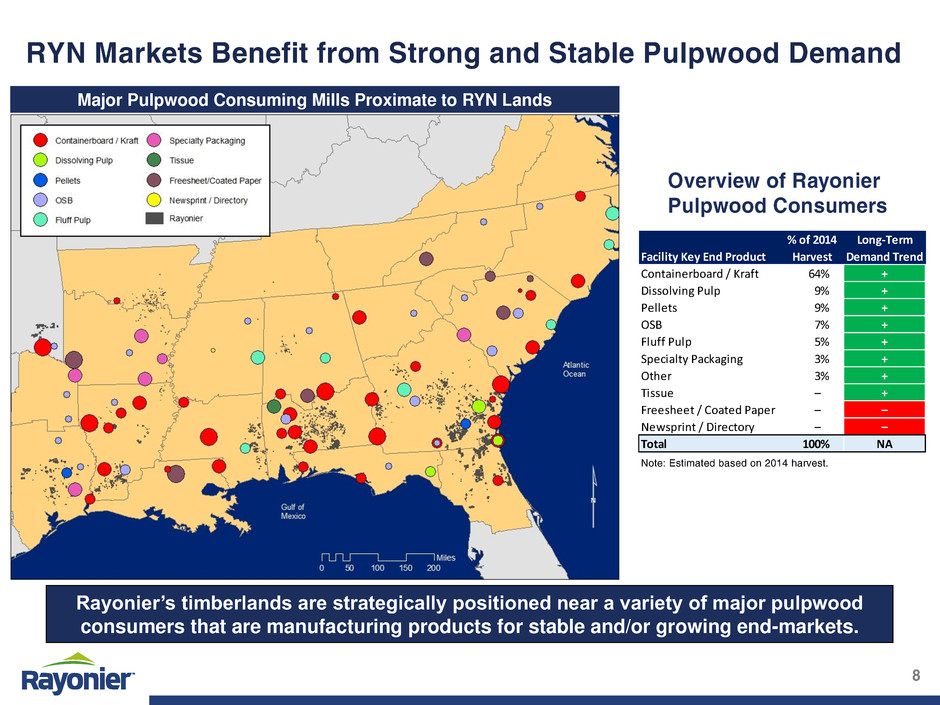

Major Pulpwood Consuming Mills Proximate to RYN Lands % of 2014 Long-Term Facility Key End Product Harvest Demand Trend Containerboard / Kraft 64% + Dissolving Pulp 9% + Pellets 9% + OSB 7% + Fluff Pulp 5% + Specialty Packaging 3% + Other 3% + Tissue – + Freesheet / Coated Paper – – Newsprint / Directory – – Total 100% NA Rayonier’s timberlands are strategically positioned near a variety of major pulpwood consumers that are manufacturing products for stable and/or growing end-markets.

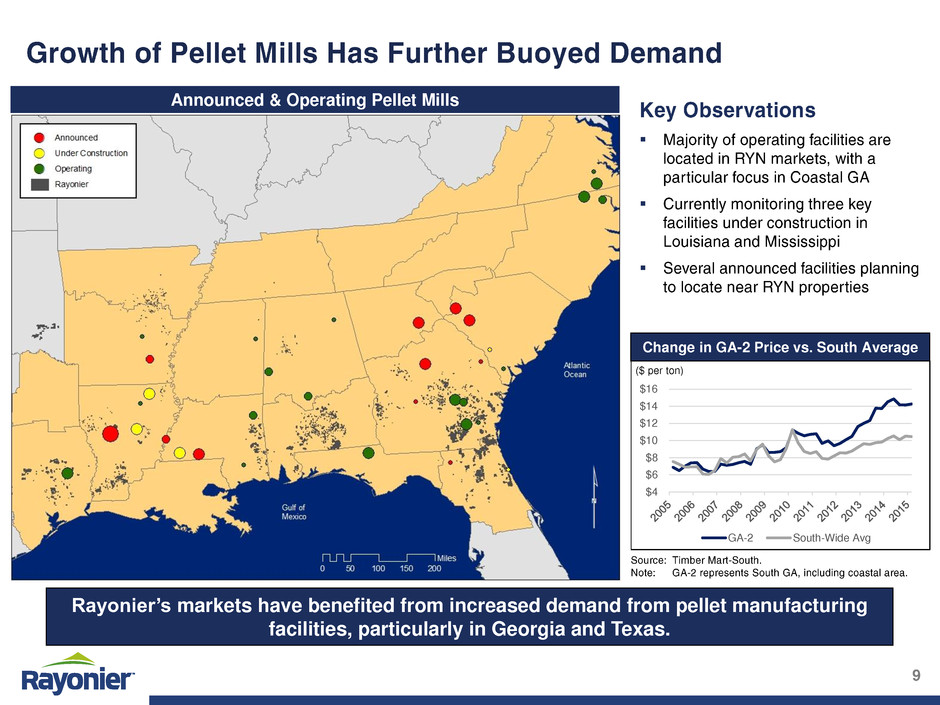

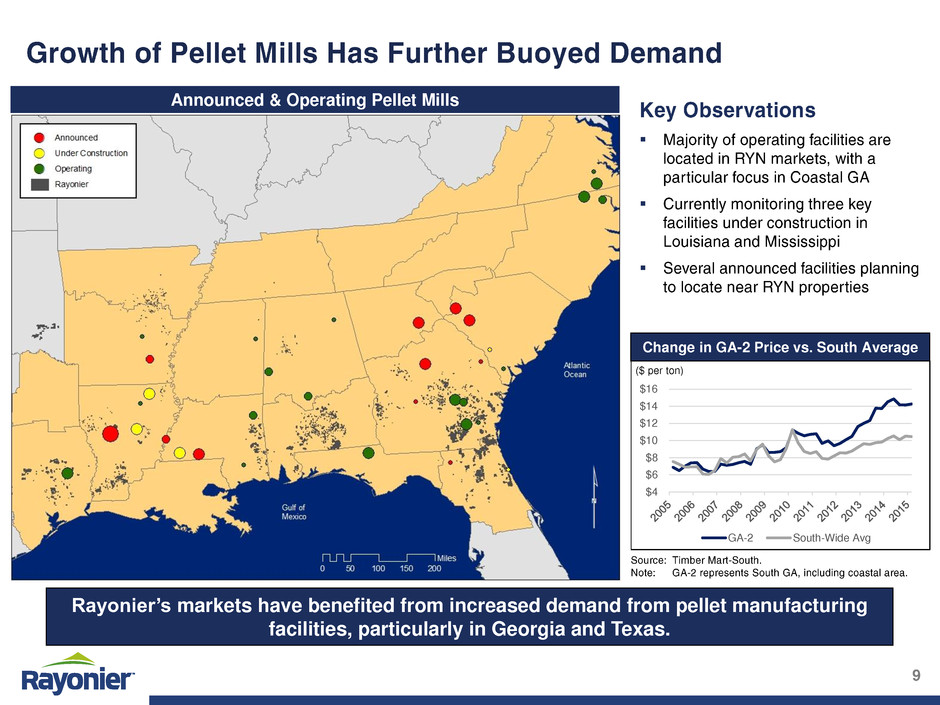

($ per ton) Announced & Operating Pellet Mills Rayonier’s markets have benefited from increased demand from pellet manufacturing facilities, particularly in Georgia and Texas. Change in GA-2 Price vs. South Average $4 $6 $8 $10 $12 $14 $16 GA-2 South-Wide Avg

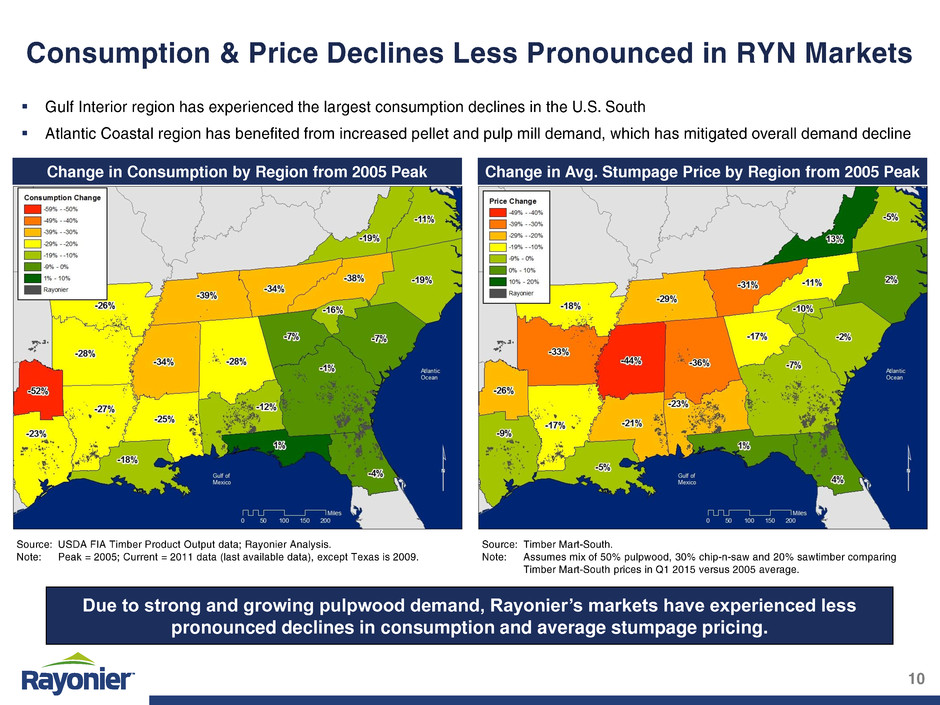

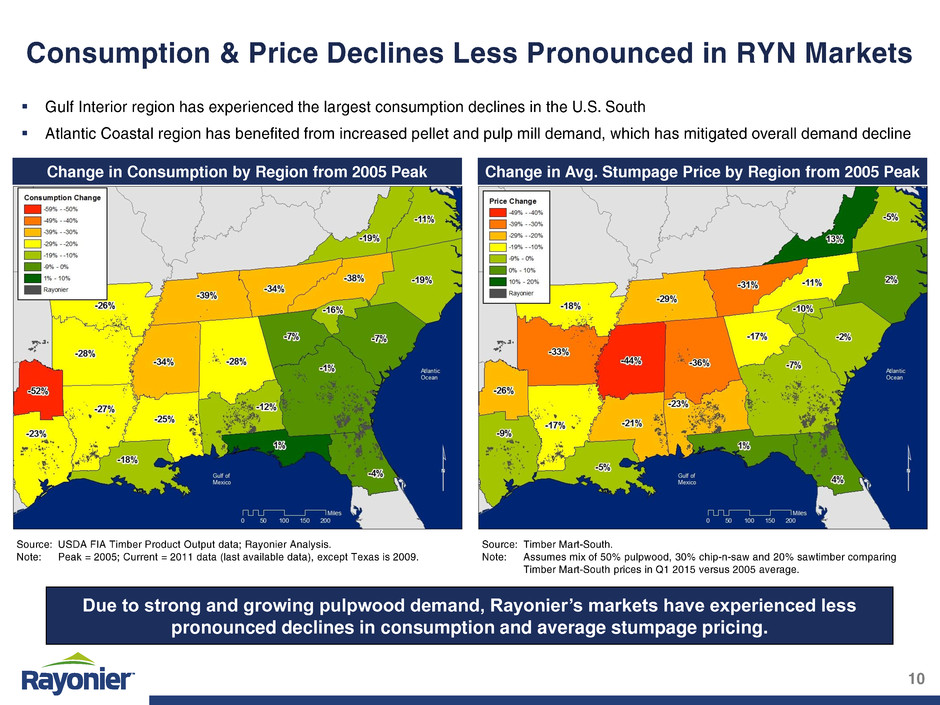

Change in Avg. Stumpage Price by Region from 2005 PeakChange in Consumption by Region from 2005 Peak Due to strong and growing pulpwood demand, Rayonier’s markets have experienced less pronounced declines in consumption and average stumpage pricing.

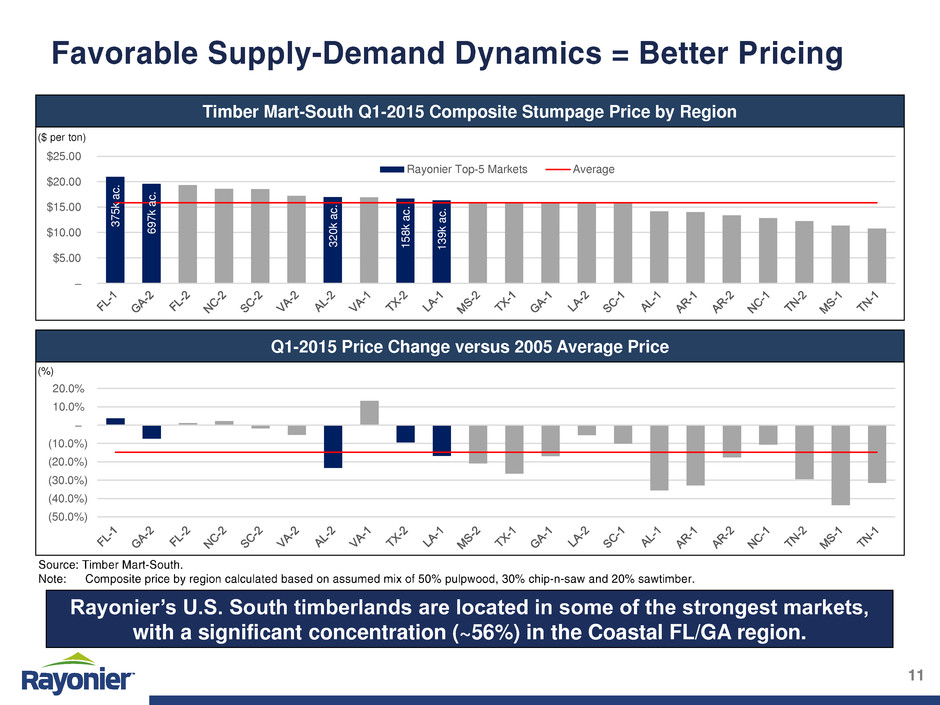

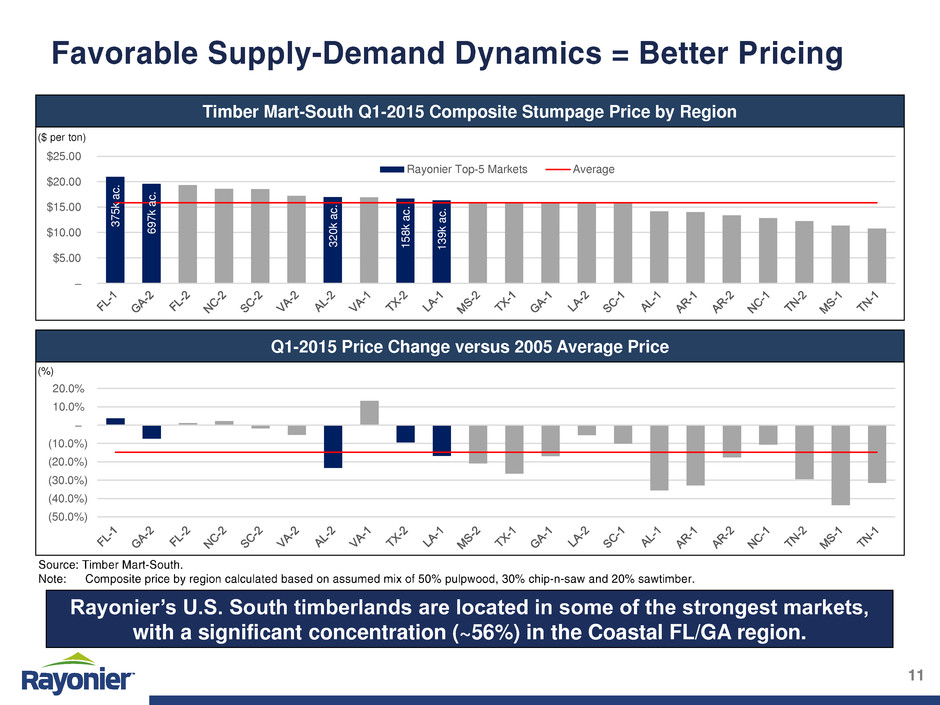

Rayonier’s U.S. South timberlands are located in some of the strongest markets, with a significant concentration (~56%) in the Coastal FL/GA region. Timber Mart-South Q1-2015 Composite Stumpage Price by Region Q1-2015 Price Change versus 2005 Average Price ($ per ton) (%) 375k a c. 697k a c. 320k a c. 158k a c. 139k a c. – $5.00 $10.00 $15.00 $20.00 $25.00 Rayonier Top-5 Markets Average (50.0%) (40.0%) (30.0%) (20.0%) (10. %) – 10.0% 20.0%

U.S. South Pulpwood Pricing – RYN vs. South Avg. U.S. South Sawtimber Pricing – RYN vs. South Avg. Favorable supply-demand dynamics in key Rayonier markets drive significant pricing premiums relative to market averages. ($ per ton) ($ per ton) $8.77 $9.68 $10.35 $14.36 $16.12 $18.48 2012 2013 2014 Timber Mart-South Rayonier $19.29 $20.44 $21.36 $22.52 $24.06 $26.45 2012 2013 2014 Timber Mart-South Rayonier

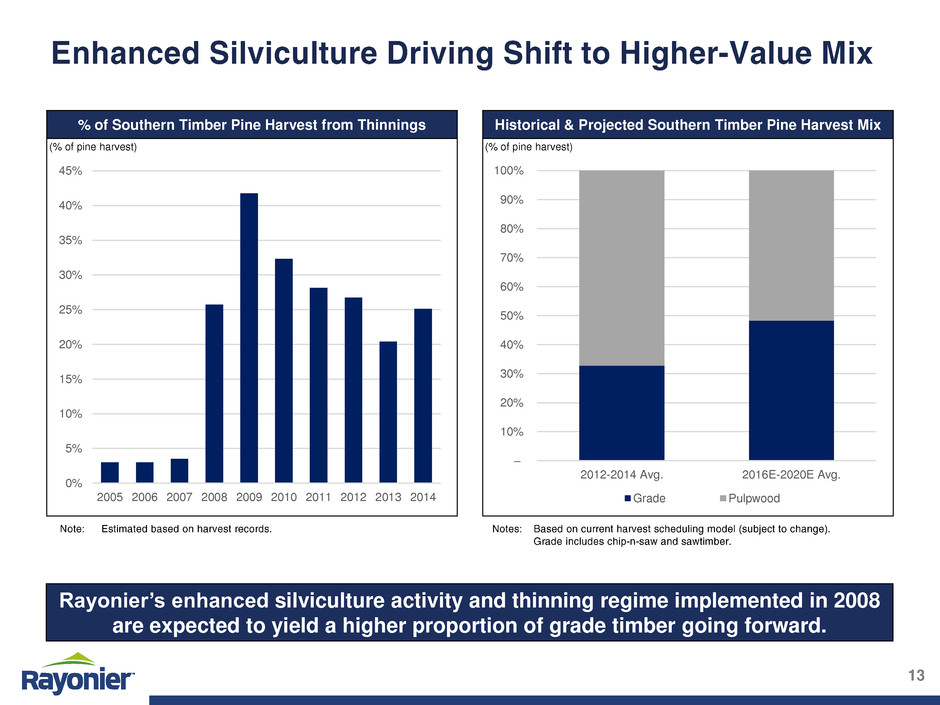

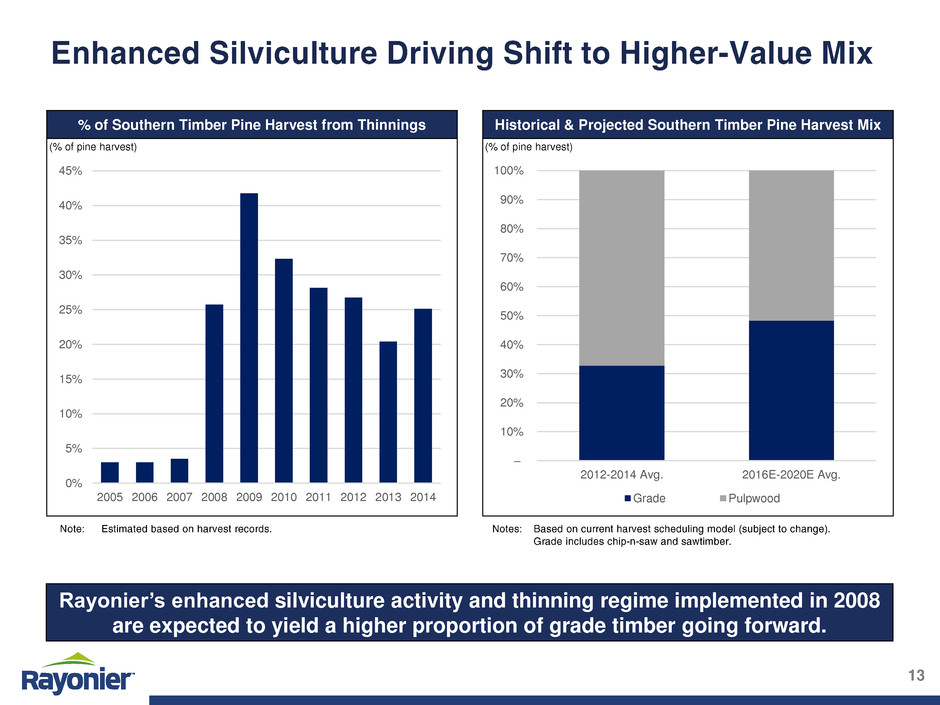

% of Southern Timber Pine Harvest from Thinnings Historical & Projected Southern Timber Pine Harvest Mix Rayonier’s enhanced silviculture activity and thinning regime implemented in 2008 are expected to yield a higher proportion of grade timber going forward. (% of pine harvest) (% of pine harvest) 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 – 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2012-2014 Avg. 2016E-2020E Avg. Grade Pulpwood

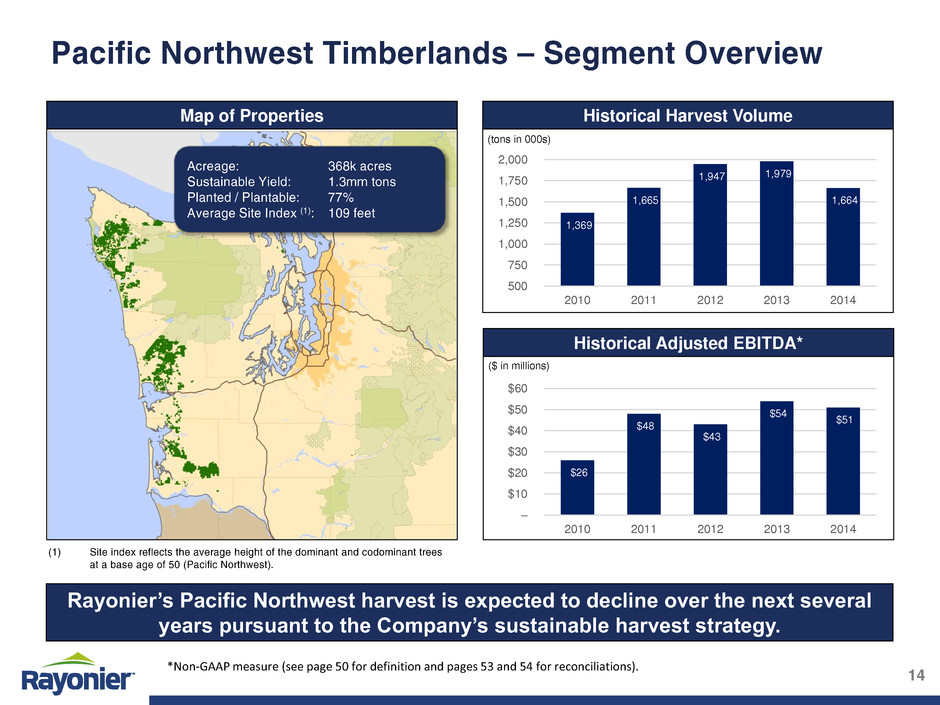

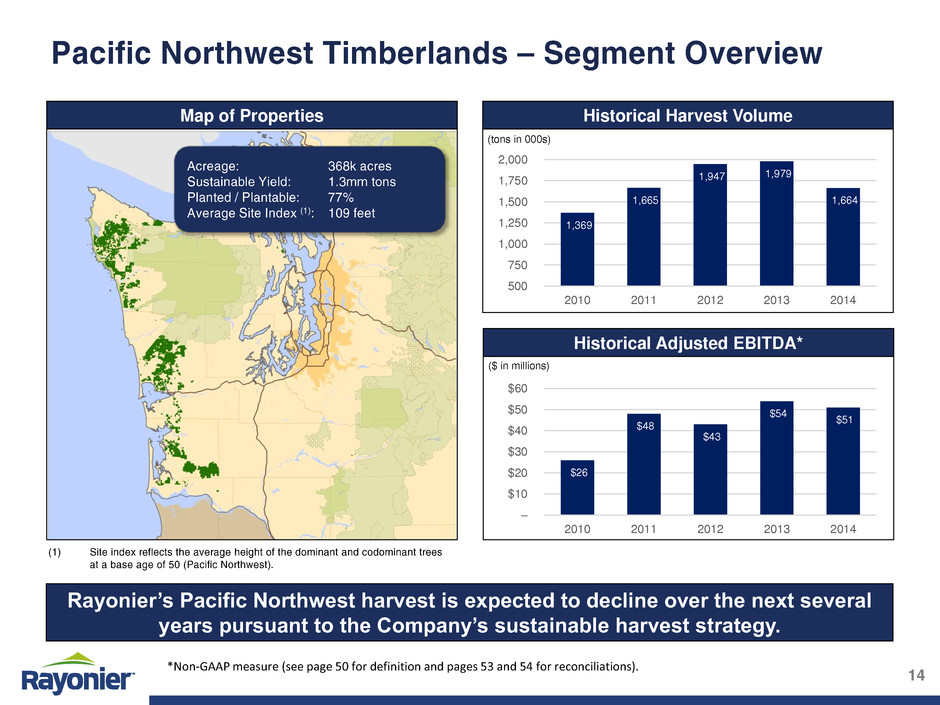

Map of Properties Historical Harvest Volume Rayonier’s Pacific Northwest harvest is expected to decline over the next several years pursuant to the Company’s sustainable harvest strategy. Historical Adjusted EBITDA* (tons in 000s) ($ in millions) 1,369 1,665 1,947 1,979 1,664 500 750 1,000 1,250 1,500 1,750 2,000 2010 2011 2012 2013 2014 $26 $48 $43 $54 $51 – $10 $20 $30 $40 $50 $6 2010 2011 2012 2013 2014 *Non-GAAP measure (see page 50 for definition and pages 53 and 54 for reconciliations).

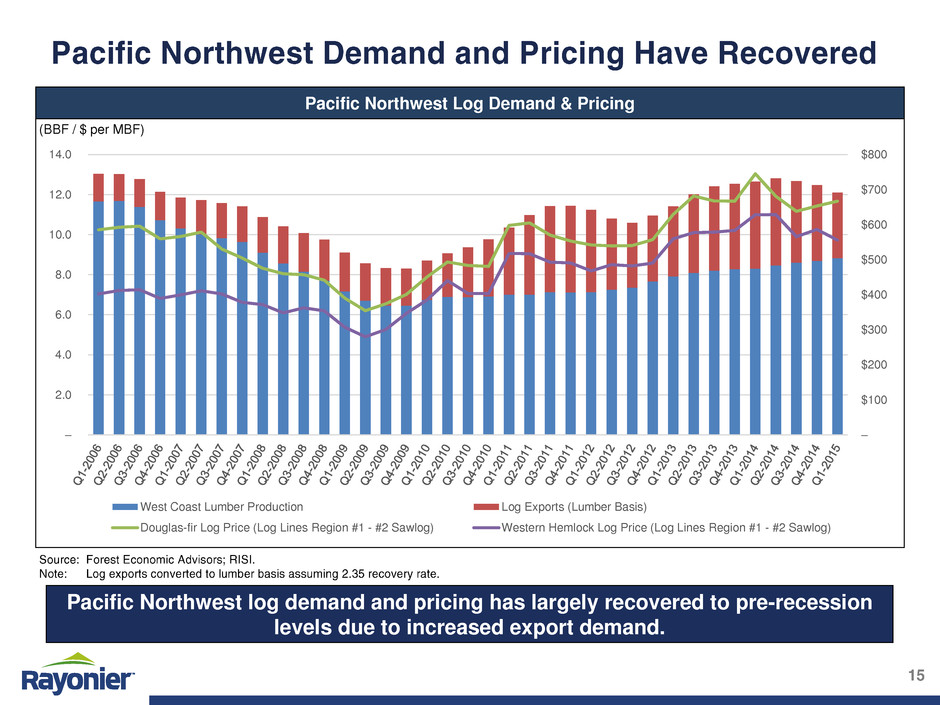

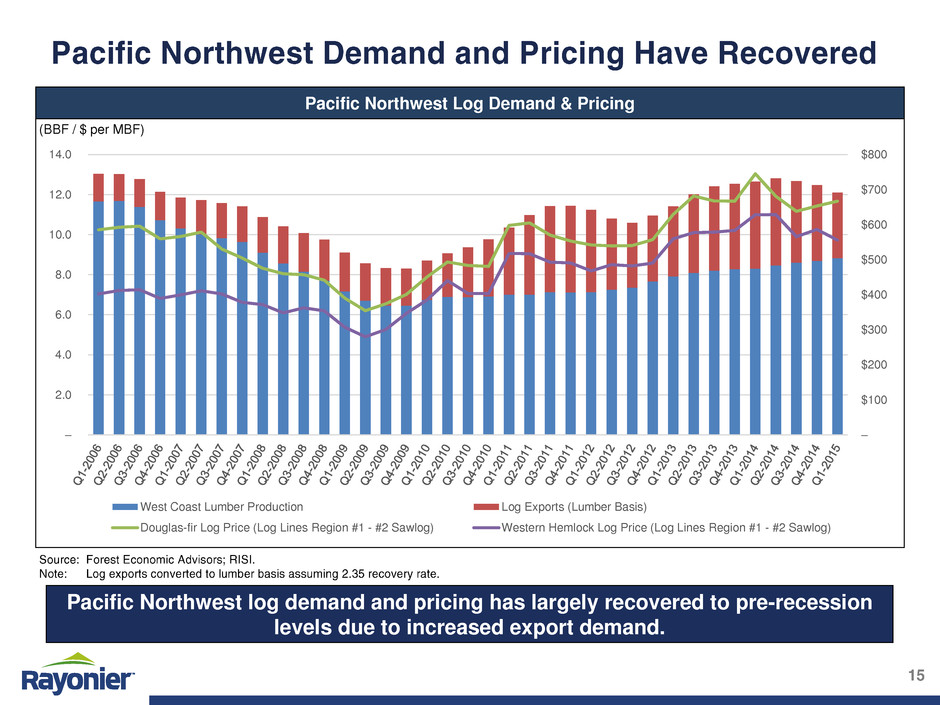

1.4 1.8 1.5 1.4 1.5 ~1.5 Pacific Northwest Log Demand & Pricing (BBF / $ per MBF) Pacific Northwest log demand and pricing has largely recovered to pre-recession levels due to increased export demand. – $100 $200 $300 $400 $500 $600 $700 $800 – 2.0 4.0 6.0 8.0 10.0 12.0 14.0 West Coast Lumber Production Log Exports (Lumber Basis) Douglas-fir Log Price (Log Lines Region #1 - #2 Sawlog) Western Hemlock Log Price (Log Lines Region #1 - #2 Sawlog)

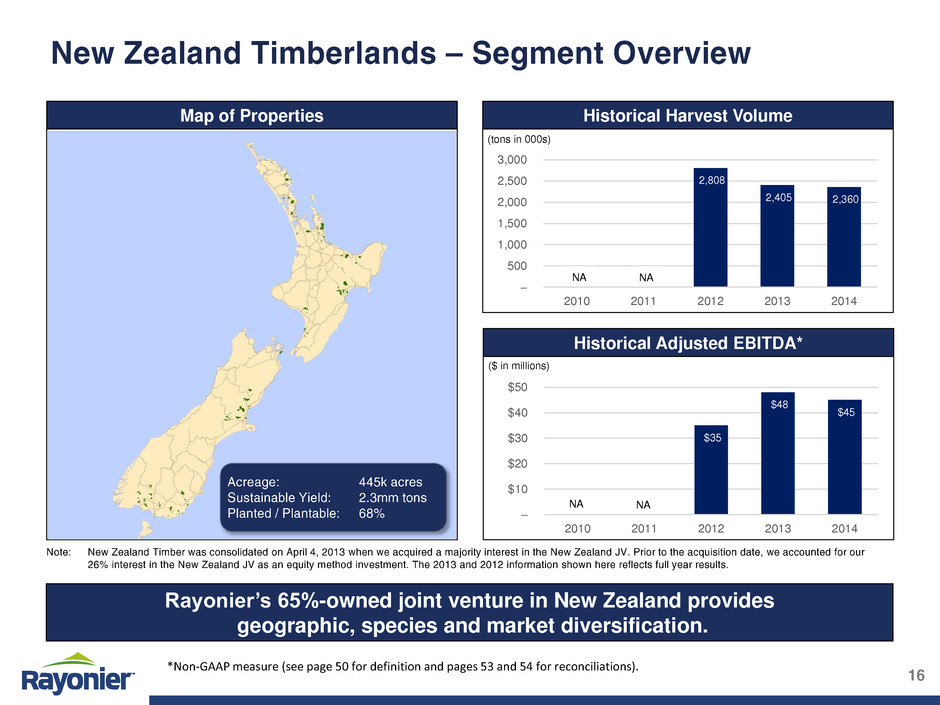

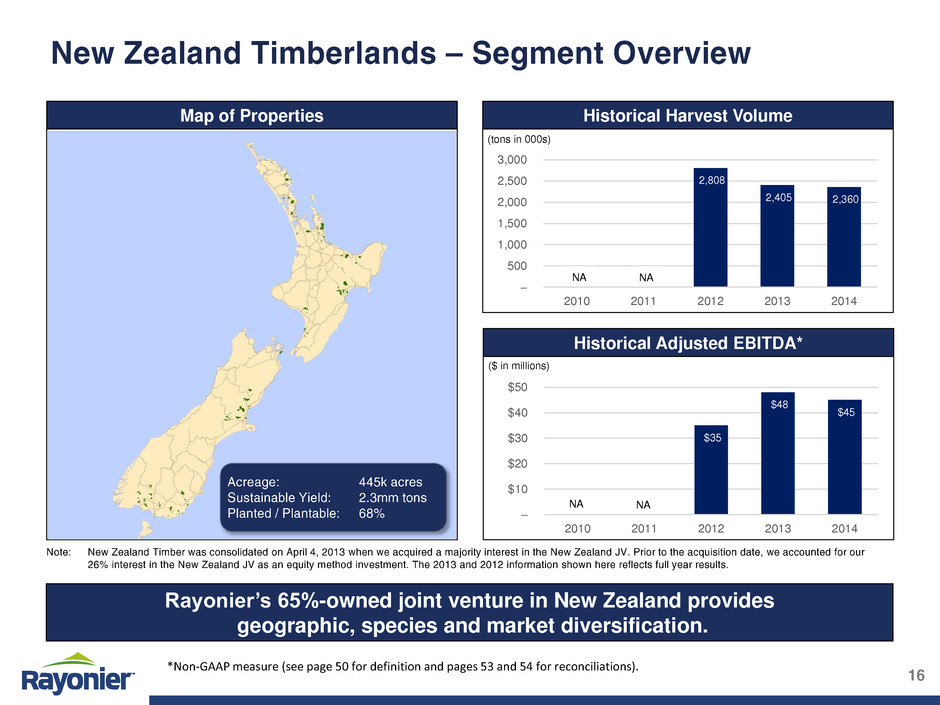

Map of Properties Historical Harvest Volume Rayonier’s 65%-owned joint venture in New Zealand provides geographic, species and market diversification. Historical Adjusted EBITDA* (tons in 000s) ($ in millions) – – 2,808 2,405 2,360 – 500 1,000 1,500 2,000 2,500 3,000 2010 2011 2012 2013 2014 NA NA – – $35 $48 $45 – $10 $20 $30 $40 $50 2010 2011 2012 2013 2014 NA NA *Non-GAAP measure (see page 50 for definition and pages 53 and 54 for reconciliations).

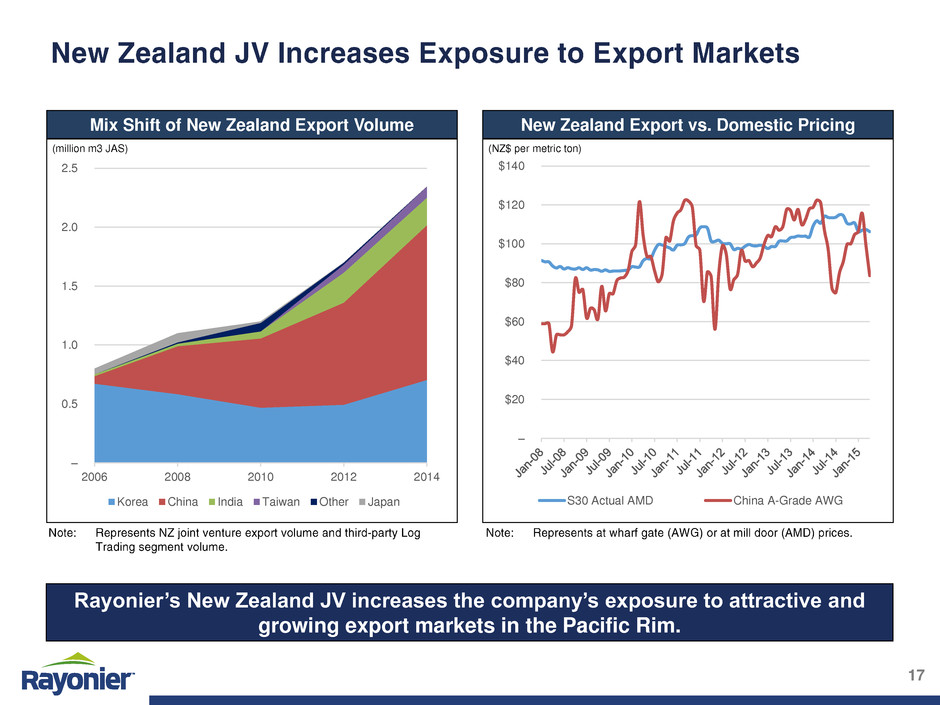

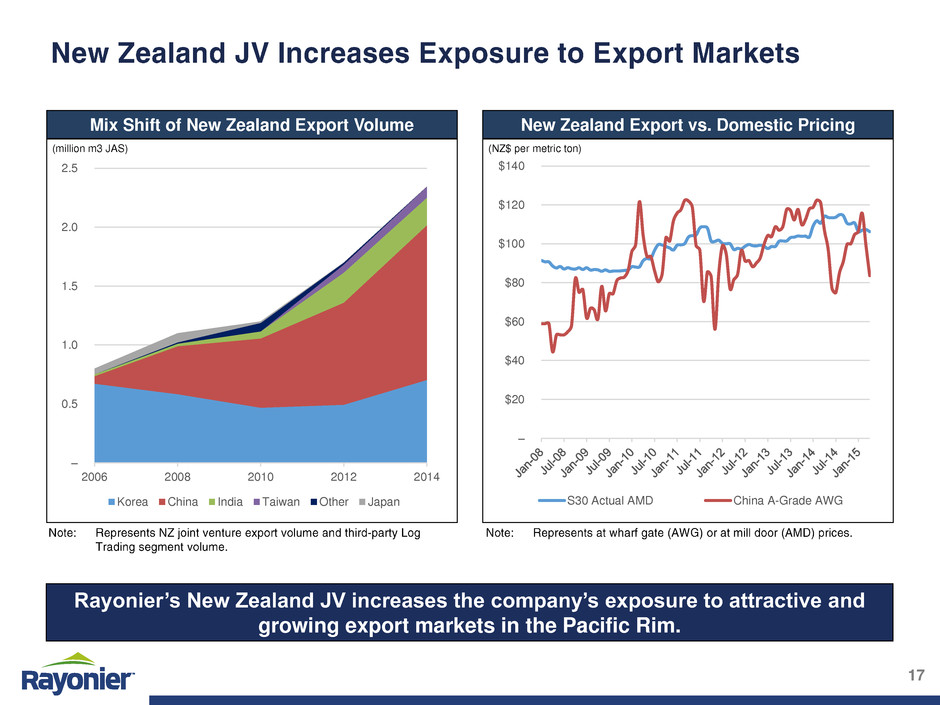

Rayonier’s New Zealand JV increases the company’s exposure to attractive and growing export markets in the Pacific Rim. Mix Shift of New Zealand Export Volume New Zealand Export vs. Domestic Pricing (million m3 JAS) (NZ$ per metric ton) – 0.5 1.0 1.5 2.0 2.5 2006 2008 2010 2012 2014 Korea China India Taiwan Other Japan – $20 $40 $60 $80 $100 $120 $140 S30 Actual AMD China A-Grade AWG

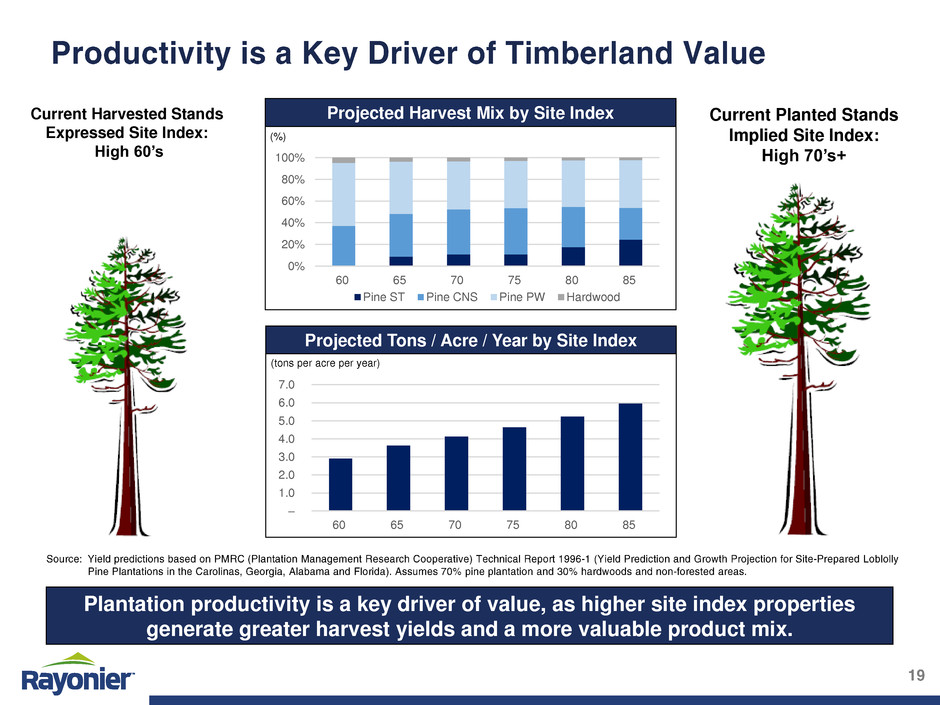

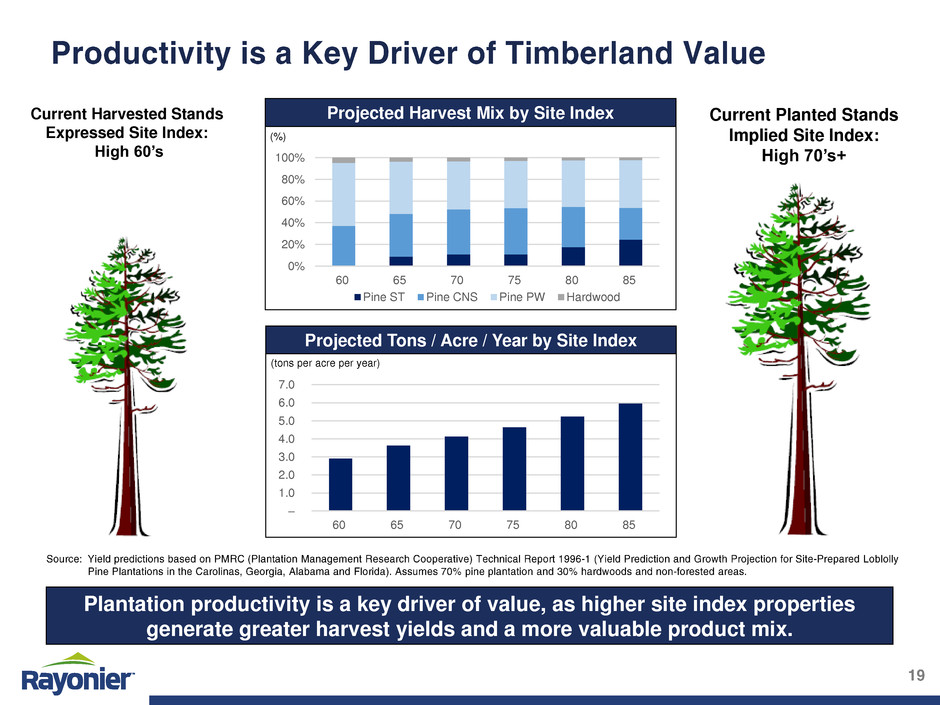

Plantation productivity is a key driver of value, as higher site index properties generate greater harvest yields and a more valuable product mix. Current Harvested Stands Expressed Site Index: High 60’s Current Planted Stands Implied Site Index: High 70’s+ Projected Harvest Mix by Site Index Projected Tons / Acre / Year by Site Index (%) (tons per acre per year) – 1.0 2.0 3.0 4.0 5.0 6.0 7.0 60 65 70 75 80 85 0% 20% 40% 60% 80% 100% 60 65 70 75 80 85 Pine ST Pine CNS Pine PW Hardwood

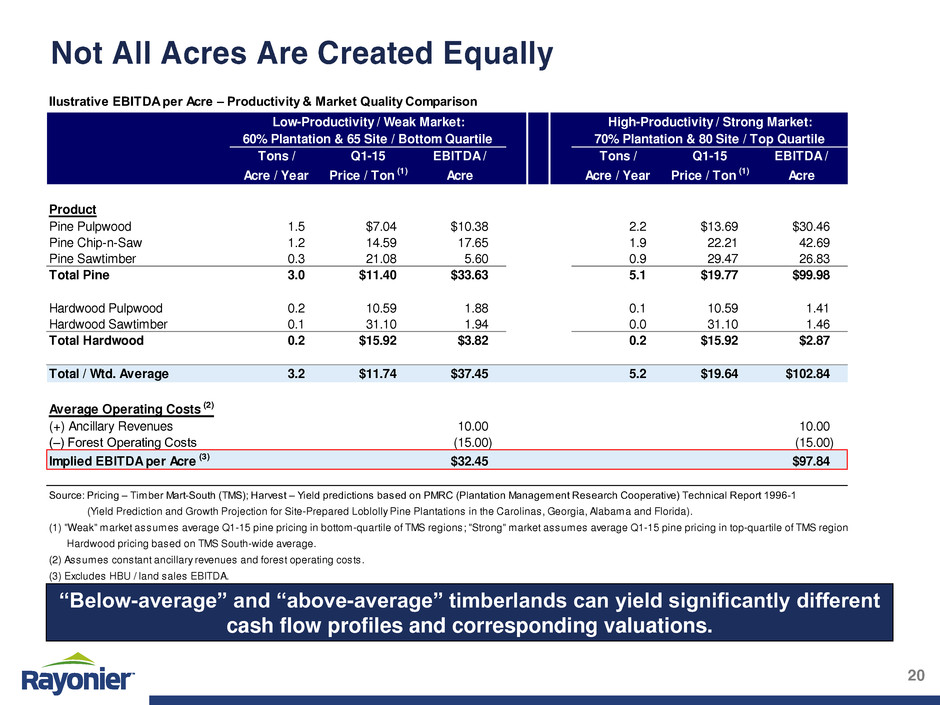

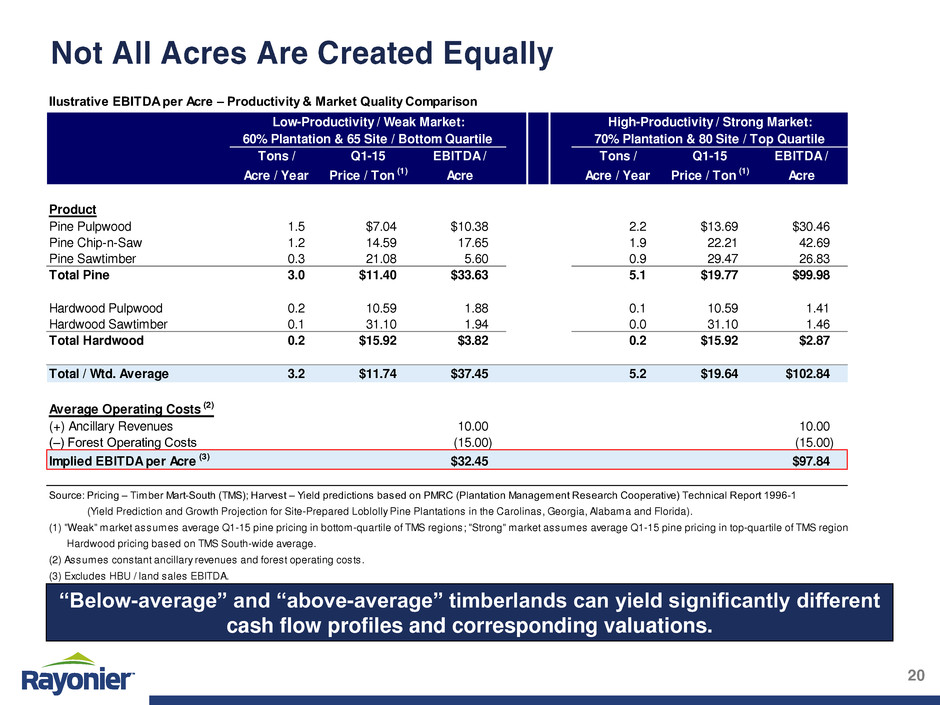

“Below-average” and “above-average” timberlands can yield significantly different cash flow profiles and corresponding valuations. Ilustrative EBITDA per Acre – Productivity & Market Quality Comparison Low-Productivity / Weak Market: High-Productivity / Strong Market: 60% Plantation & 65 Site / Bottom Quartile 70% Plantation & 80 Site / Top Quartile Tons / Q1-15 EBITDA / Tons / Q1-15 EBITDA / Acre / Year Price / Ton (1) Acre Acre / Year Price / Ton (1) Acre Product Pine Pulpwood 1.5 $7.04 $10.38 2.2 $13.69 $30.46 Pine Chip-n-Saw 1.2 14.59 17.65 1.9 22.21 42.69 Pine Sawtimber 0.3 21.08 5.60 0.9 29.47 26.83 Total Pine 3.0 $11.40 $33.63 5.1 $19.77 $99.98 Hardwood Pulpwood 0.2 10.59 1.88 0.1 10.59 1.41 Hardwood Sawtimber 0.1 31.10 1.94 0.0 31.10 1.46 Total Hardwood 0.2 $15.92 $3.82 0.2 $15.92 $2.87 Total / Wtd. Average 3.2 $11.74 $37.45 5.2 $19.64 $102.84 Average Operating Costs (2) (+) Ancillary Revenues 10.00 10.00 (–) Forest Operating Costs (15.00) (15.00) Implied EBITDA per Acre (3) $32.45 $97.84 Source: Pricing – Timber Mart-South (TMS); Harvest – Yield predictions based on PMRC (Plantation Management Research Cooperative) Technical Report 1996-1 Source: (Yield Prediction and Growth Projection for Site-Prepared Loblolly Pine Plantations in the Carolinas, Georgia, Alabama and Florida). (1) "Weak" market assumes average Q1-15 pine pricing in bottom-quartile of TMS regions; "Strong" market assumes average Q1-15 pine pricing in top-quartile of TMS regions. (1) Hardwood pricing based on TMS South-wide average. (2) Assumes constant ancillary revenues and forest operating costs. (3) Excludes HBU / land sales EBITDA.

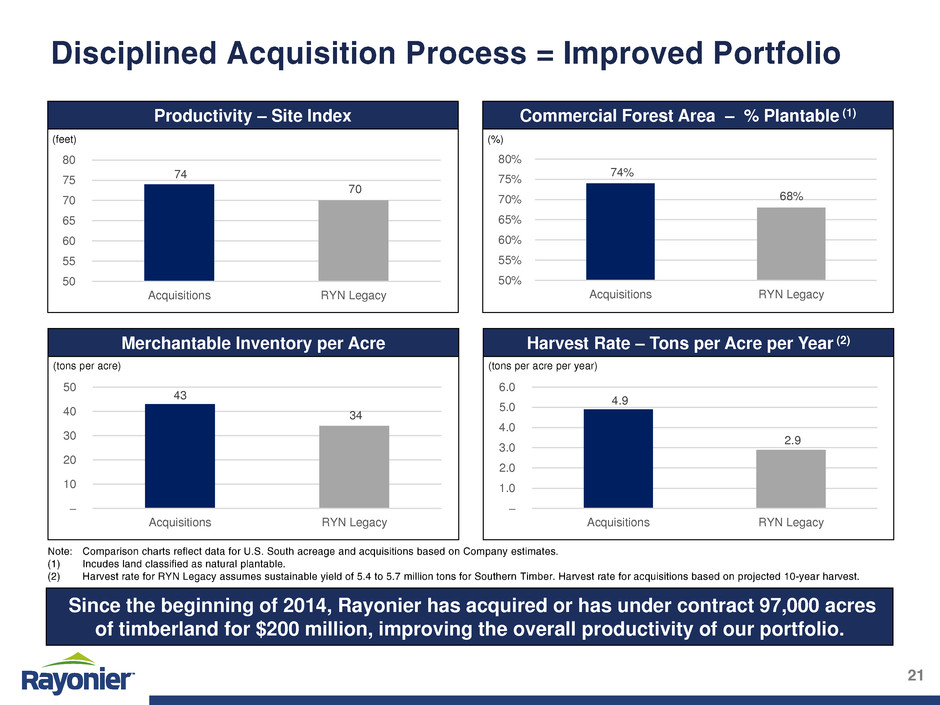

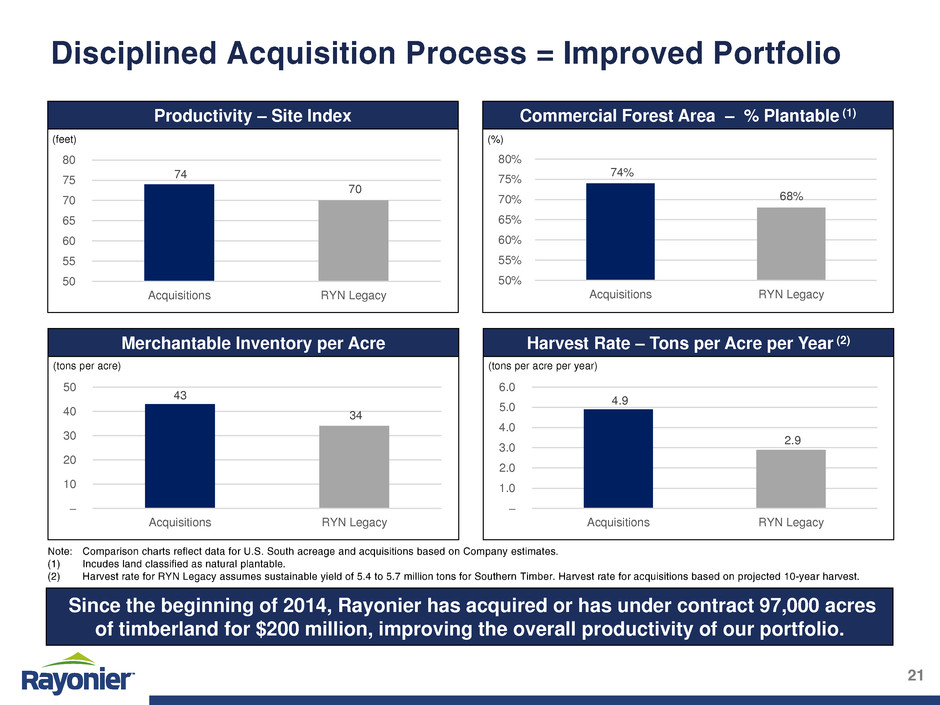

Commercial Forest Area – % Plantable (1) Since the beginning of 2014, Rayonier has acquired or has under contract 97,000 acres of timberland for $200 million, improving the overall productivity of our portfolio. Harvest Rate – Tons per Acre per Year (2) (%) (tons per acre per year) Productivity – Site Index Merchantable Inventory per Acre (feet) (tons per acre) 74 70 50 55 60 65 70 75 80 Acquisitions RYN Legacy 74% 68% 50% 55% 60% 65% 70% 75% 80% Acquisitions RYN Legacy43 34 – 10 20 30 40 50 Acquisitions RYN Legacy 4.9 2.9 – 1.0 2.0 3.0 4.0 5.0 6.0 Acquisitions RYN Legacy

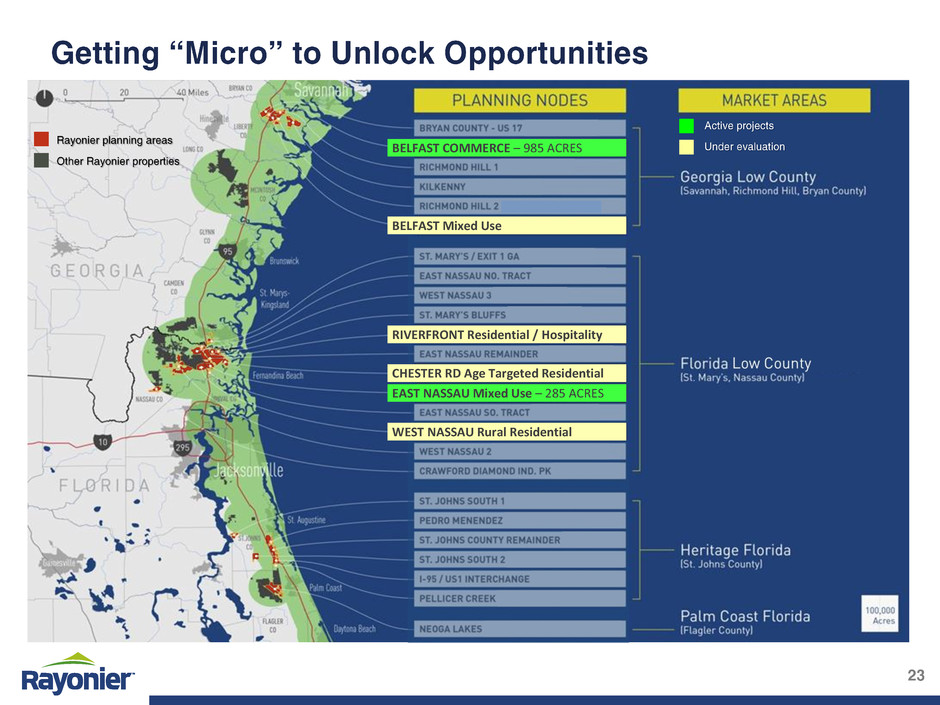

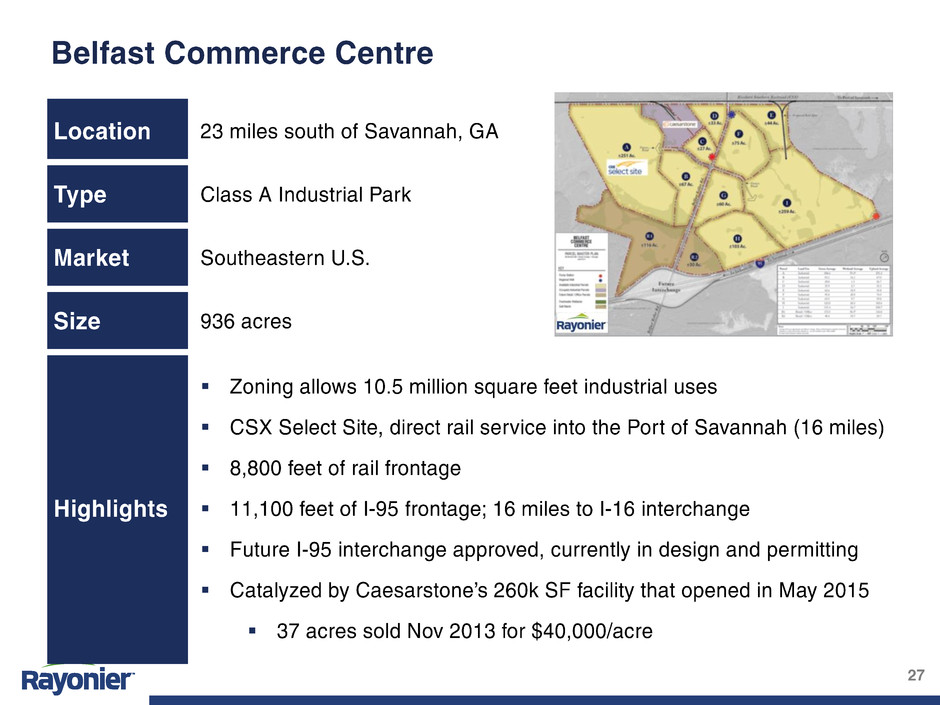

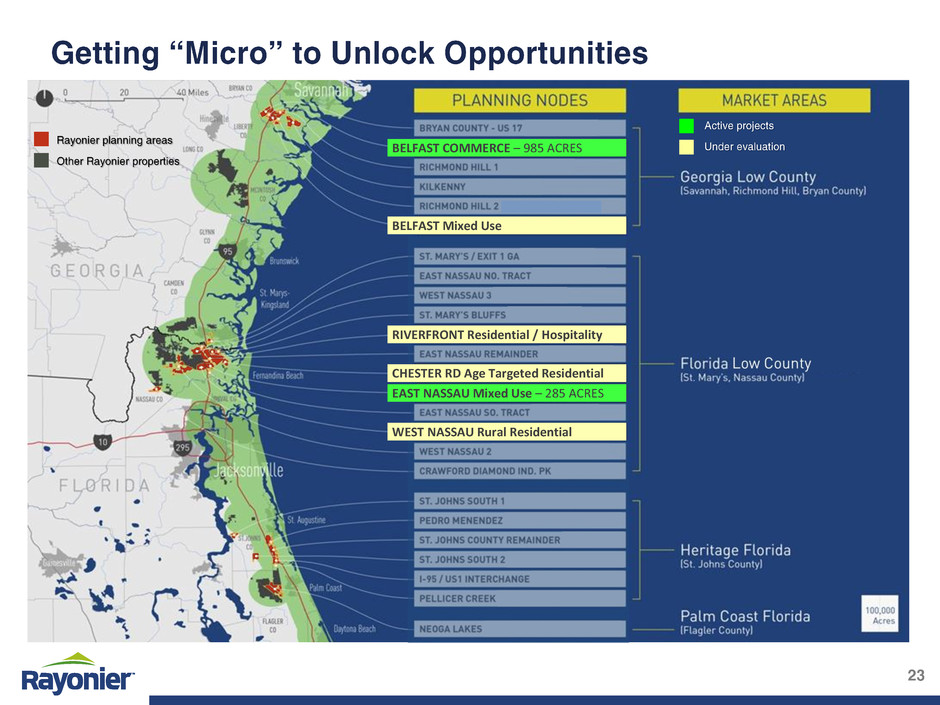

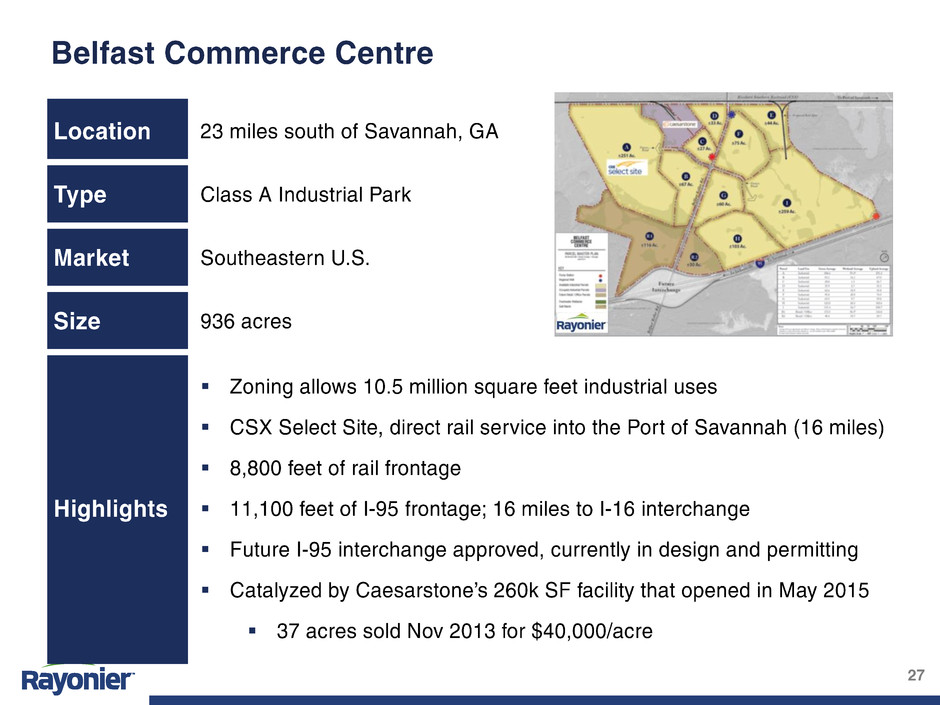

RIVERFRONT Residential / Hospitality CHESTER RD Age Targeted Residential WEST NASSAU Rural Residential EAST NASSAU Mixed Use – 285 ACRES BELFAST COMMERCE – 985 ACRES BELFAST Mixed Use

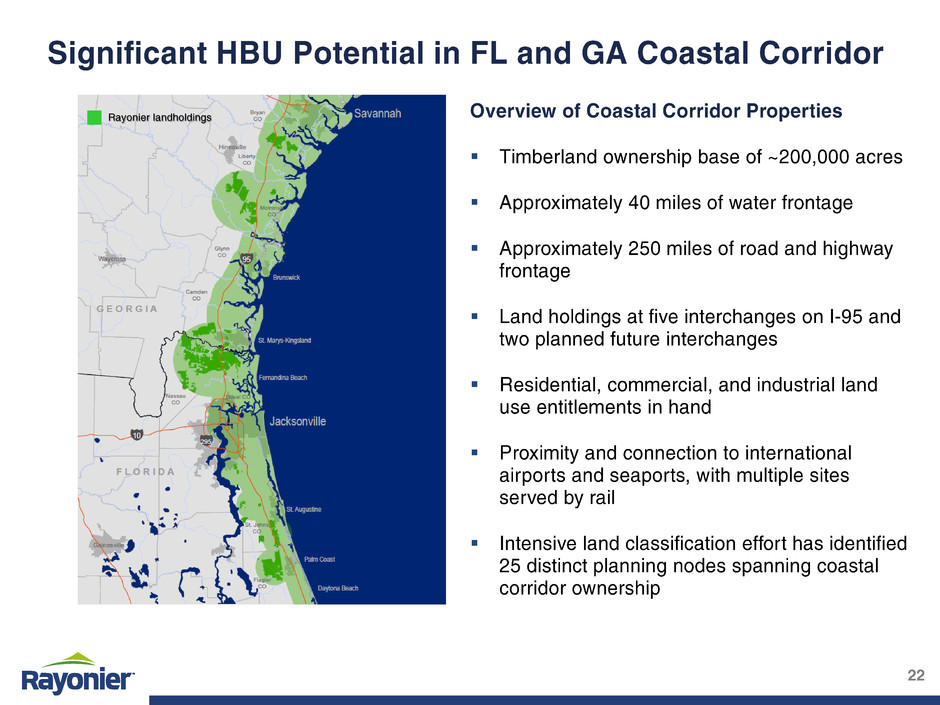

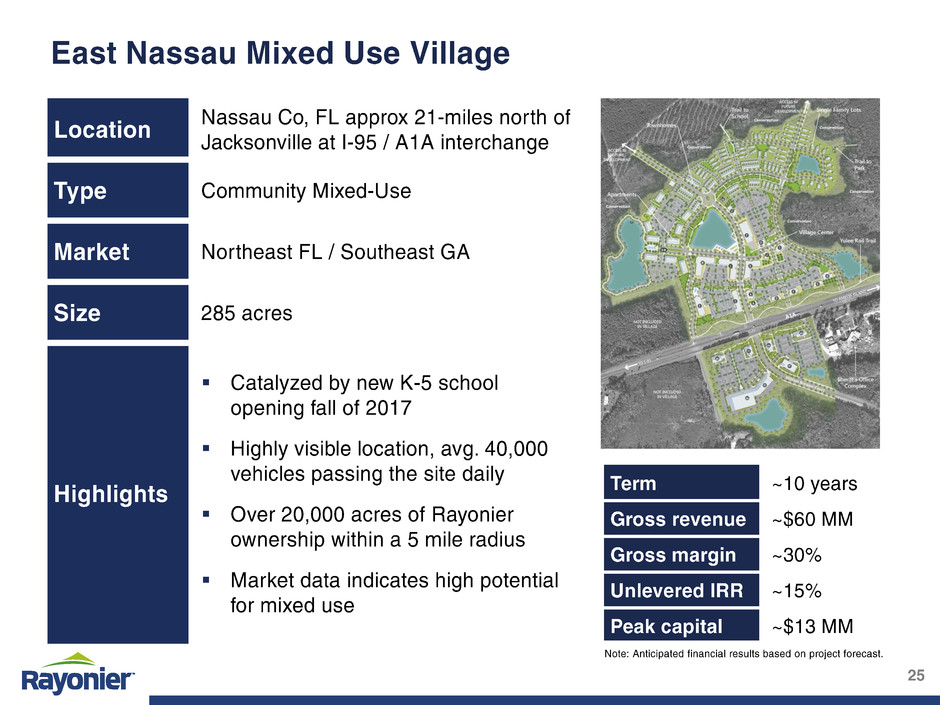

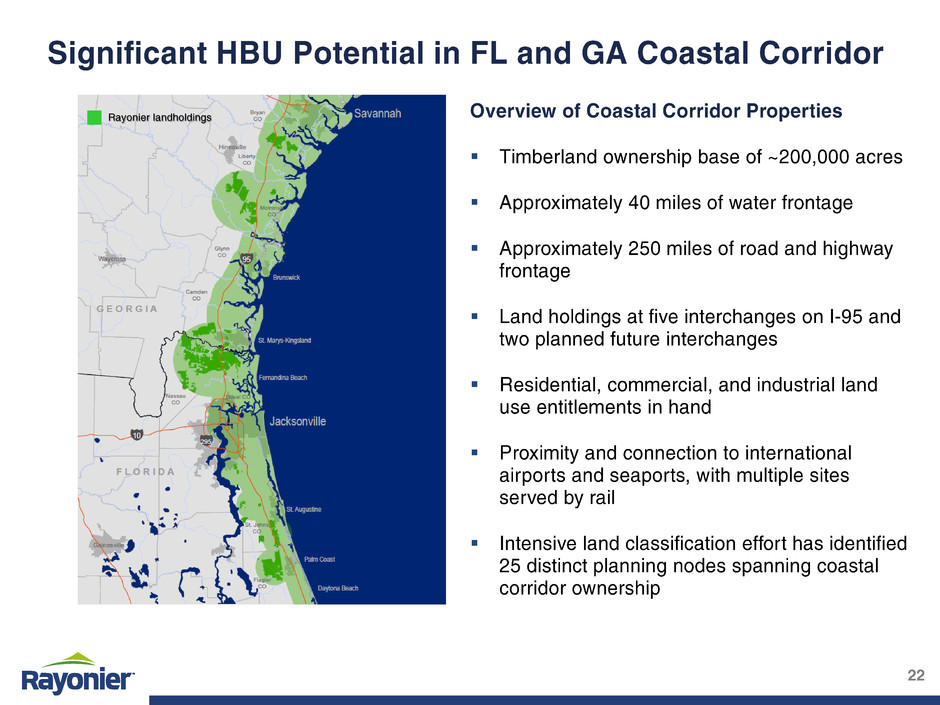

Within Rayonier’s 200,000-acre coastal corridor portfolio, we have undertaken two projects comprising roughly 1,220 net developable acres. Coastal corridor 200,000 gross acres Planning nodes 25 92,100 gross acres High potential sites 4 8,500 gross acres Active projects 2 1,860 gross acres 1,220 net acres

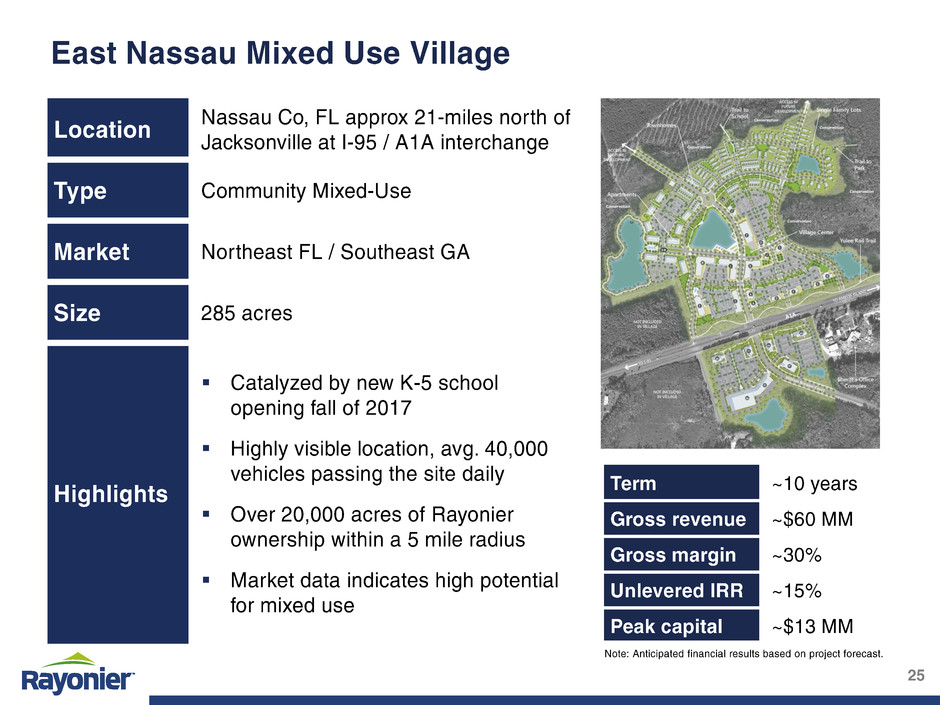

JACKSONVILLE DOWNTOWN JACKSONVILLE INT’L AIRPORT ~ 20 mile Radius MSA boundary Other Rayonier properties Rayonier planning areas AMELIA ISLAND East Nassau Mixed-Use Village Growth Trajectory

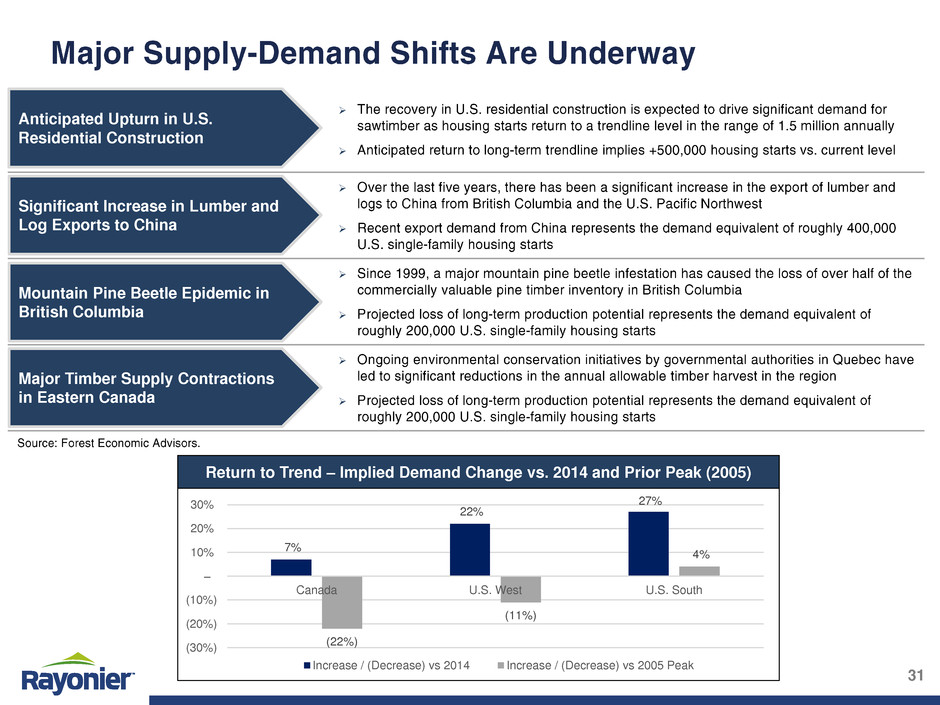

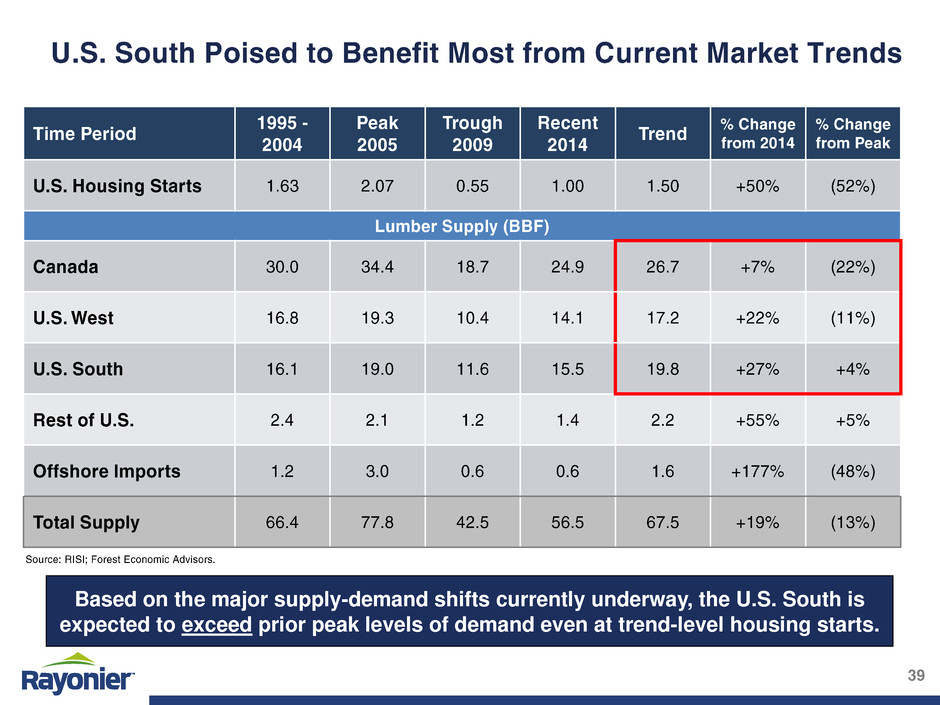

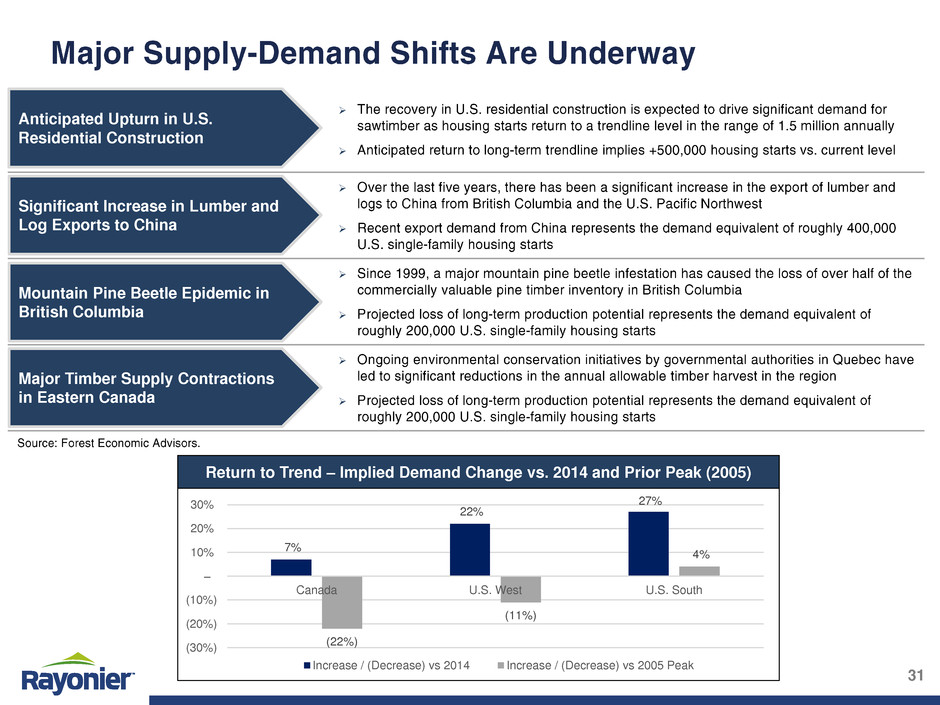

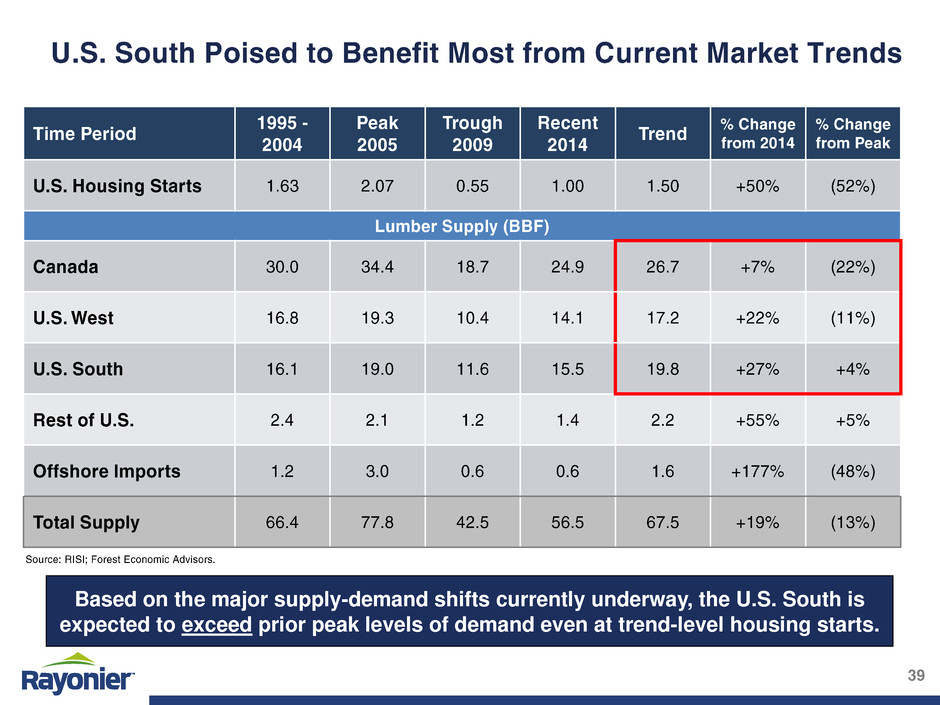

Anticipated Upturn in U.S. Residential Construction Mountain Pine Beetle Epidemic in British Columbia Significant Increase in Lumber and Log Exports to China Major Timber Supply Contractions in Eastern Canada Return to Trend – Implied Demand Change vs. 2014 and Prior Peak (2005) 7% 22% 27% (22%) (11%) 4% (30%) (20%) (10%) 10% 20% 30% Canada U.S. West U.S. South Increase / (Decrease) vs 2014 Increase / (Decrease) vs 2005 Peak

- 0.5 1.0 1.5 2.0 2.5 1960’s 1970’s 1980’s 1990’s 2000’s 2010’s Decade Averages Annual Housing Starts 1.4 1.8 1.5 1.4 1.5 ~1.5 Annual U.S. Housing Starts & Decade Averages (starts in millions) Housing Starts Still ~33% Below Trendline 2014: 1.0MM Housing starts have begun to recover and are expected to return to a trendline level of 1.5mm+ over the next several years.

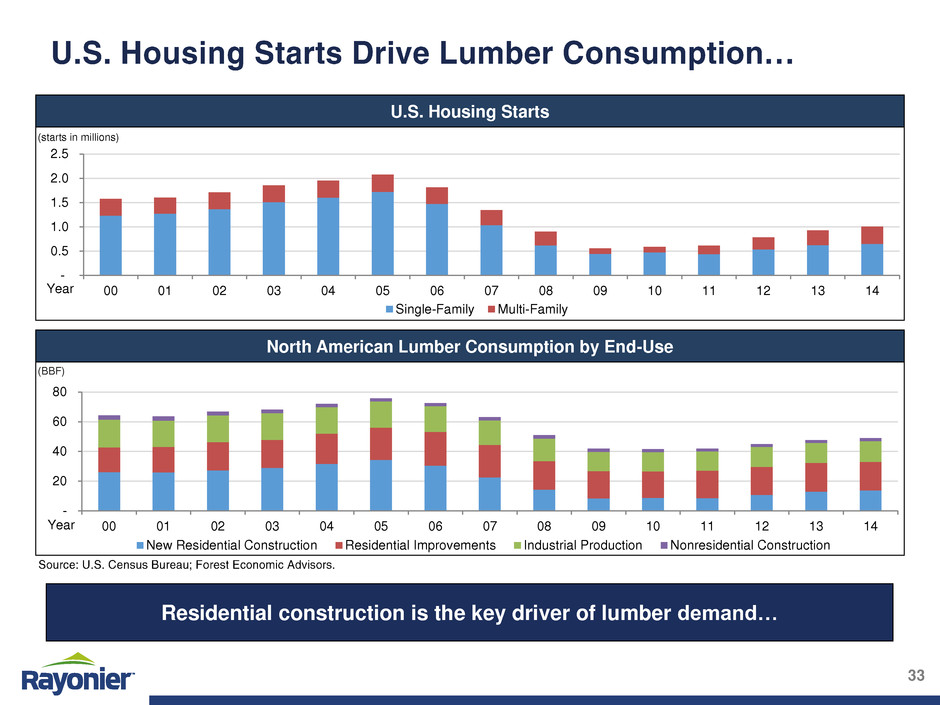

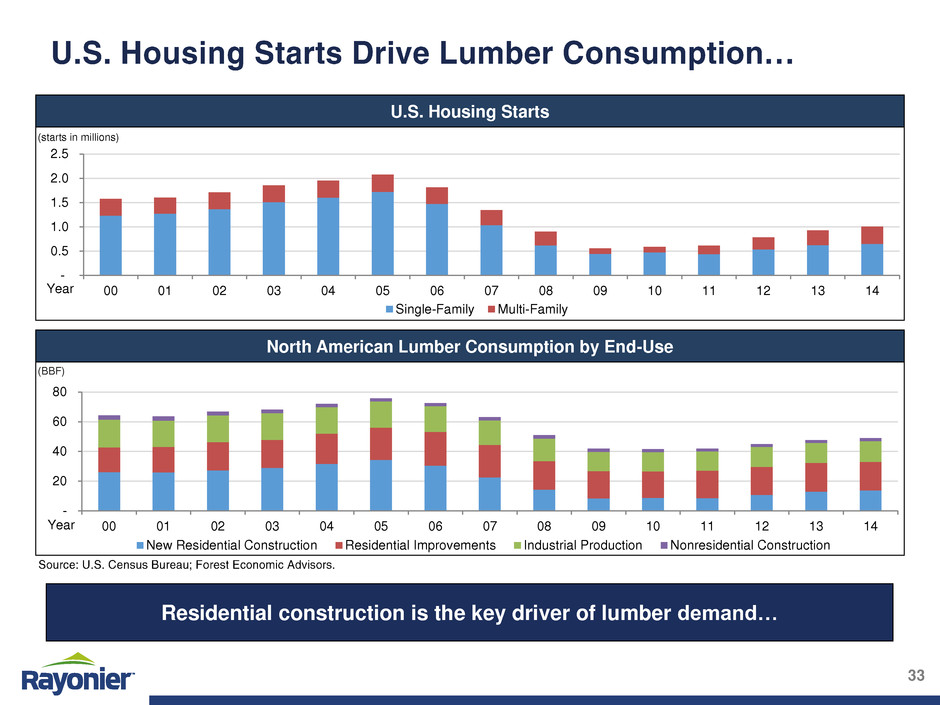

Residential construction is the key driver of lumber demand… U.S. Housing Starts North American Lumber Consumption by End-Use (starts in millions) (BBF) - 0.5 1.0 1.5 2.0 2.5 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 Single-Family Multi-Family Year - 20 40 60 80 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 New Residential Construction Residential Improvements Industrial Production Nonresidential Construction Year

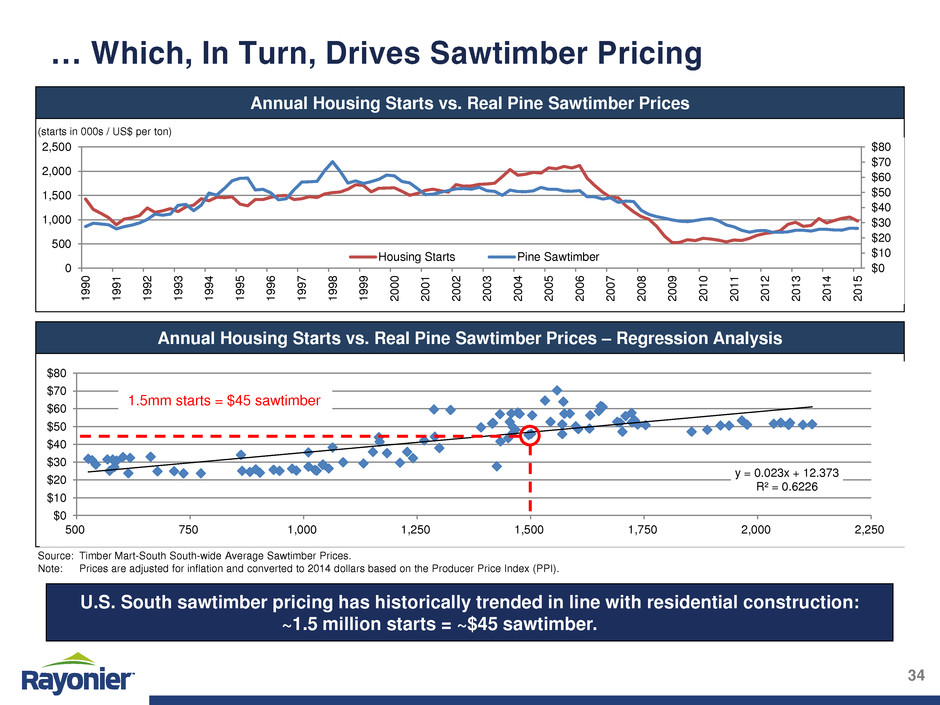

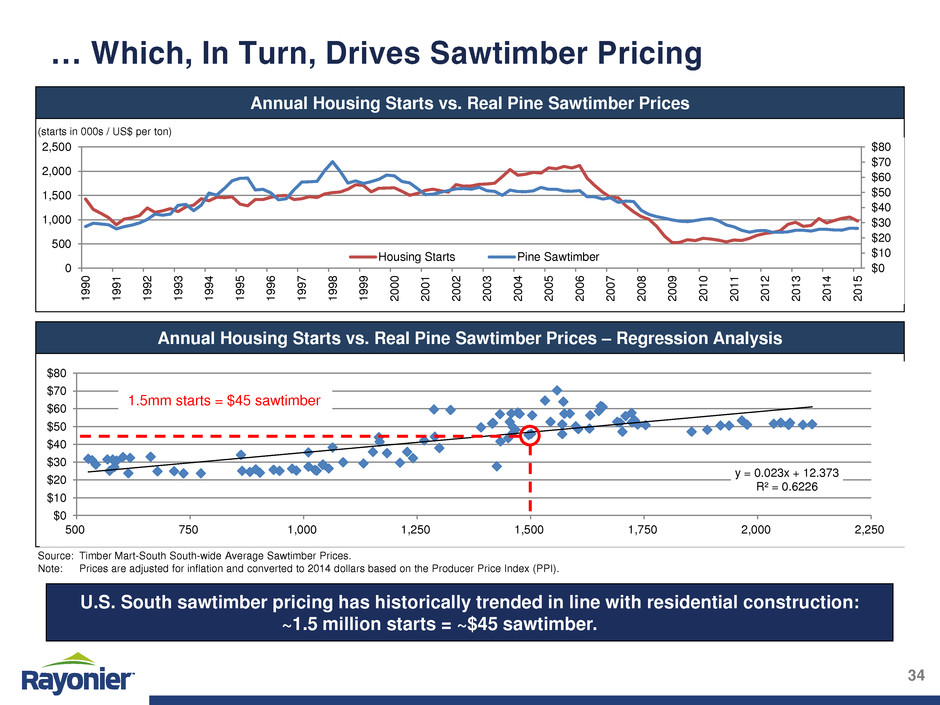

U.S. South sawtimber pricing has historically trended in line with residential construction: ~1.5 million starts = ~$45 sawtimber. y = 0.023x + 12.373 R² = 0.6226 $0 $10 $20 $30 $40 $50 $60 $70 $80 500 750 1,000 1,250 1,500 1,750 2,000 2,250 1.5mm starts = $45 sawtimber $0 $10 $20 $30 $40 $50 $60 $70 $80 0 5 0 1,000 1,500 2,000 2,500 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Housing Starts Pine Sawtimber Annual Housing Starts vs. Real Pine Sawtimber Prices Annual Housing Starts vs. Real Pine Sawtimber Prices – Regression Analysis (starts in 000s / US$ per ton) Source: Timber Mart-South South-wide Average Sawtimber Prices. Note: Prices are adjusted for inflation and converted to 2014 dollars based on the Producer Price Index (PPI).

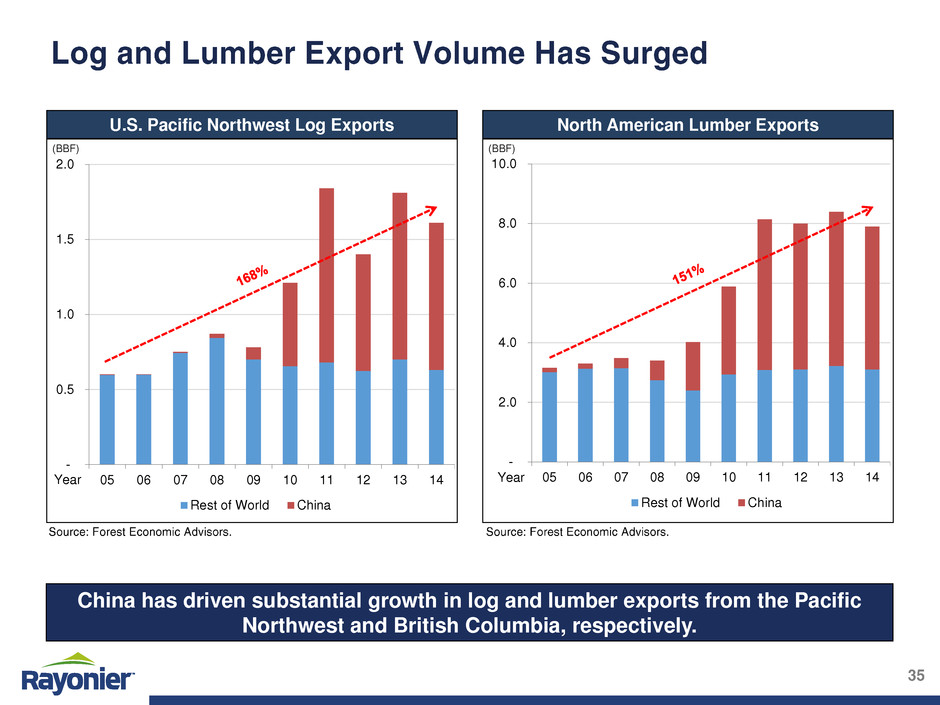

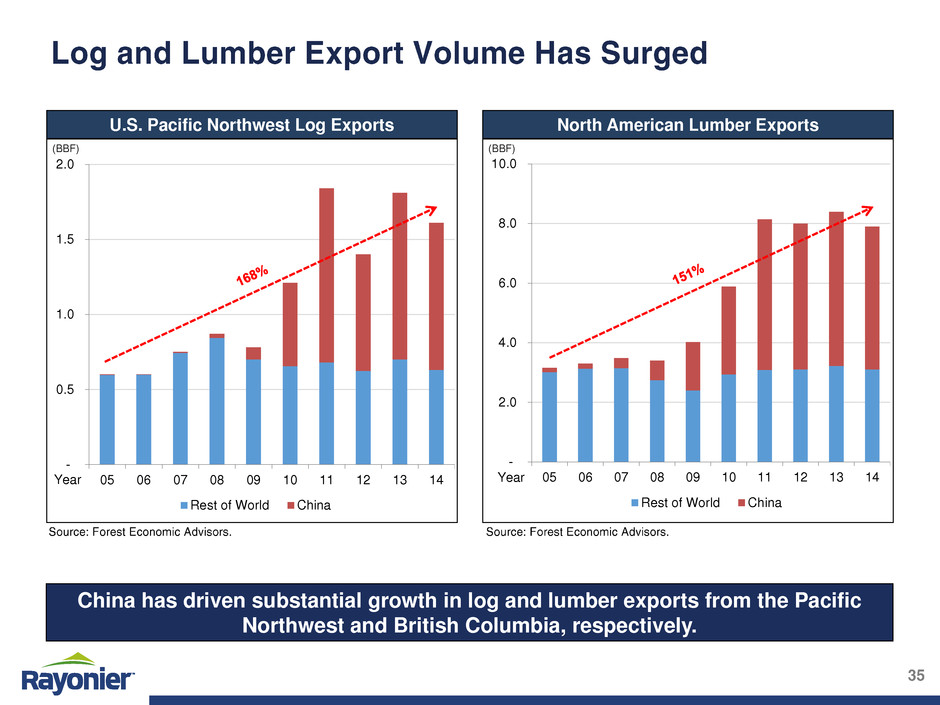

China has driven substantial growth in log and lumber exports from the Pacific Northwest and British Columbia, respectively. U.S. Pacific Northwest Log Exports North American Lumber Exports (BBF) (BBF) - 0.5 1.0 1.5 2.0 05 06 07 08 09 10 11 12 13 14 Rest of World China Year - 2.0 4.0 6.0 8.0 10.0 05 06 07 08 09 10 11 12 13 14 Rest of World China Year

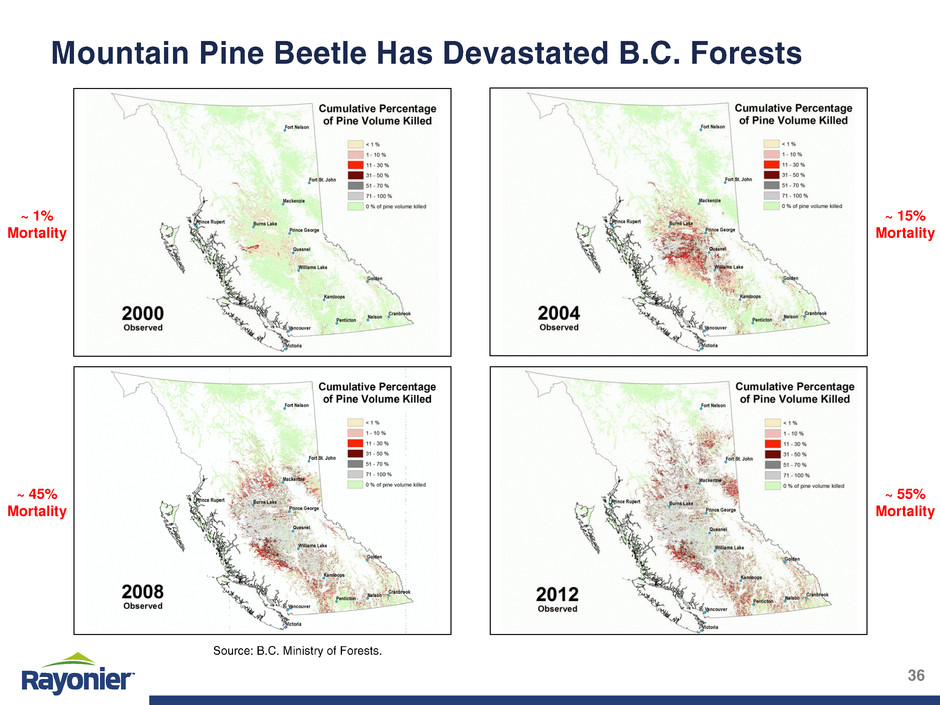

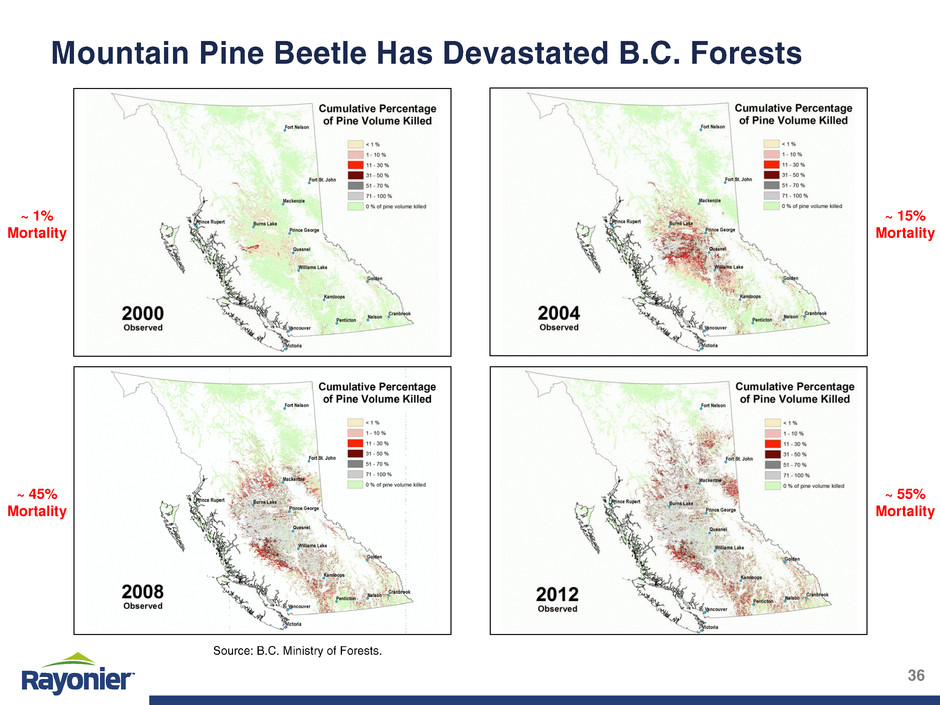

~ 1% Mortality ~ 45% Mortality ~ 15% Mortality ~ 55% Mortality

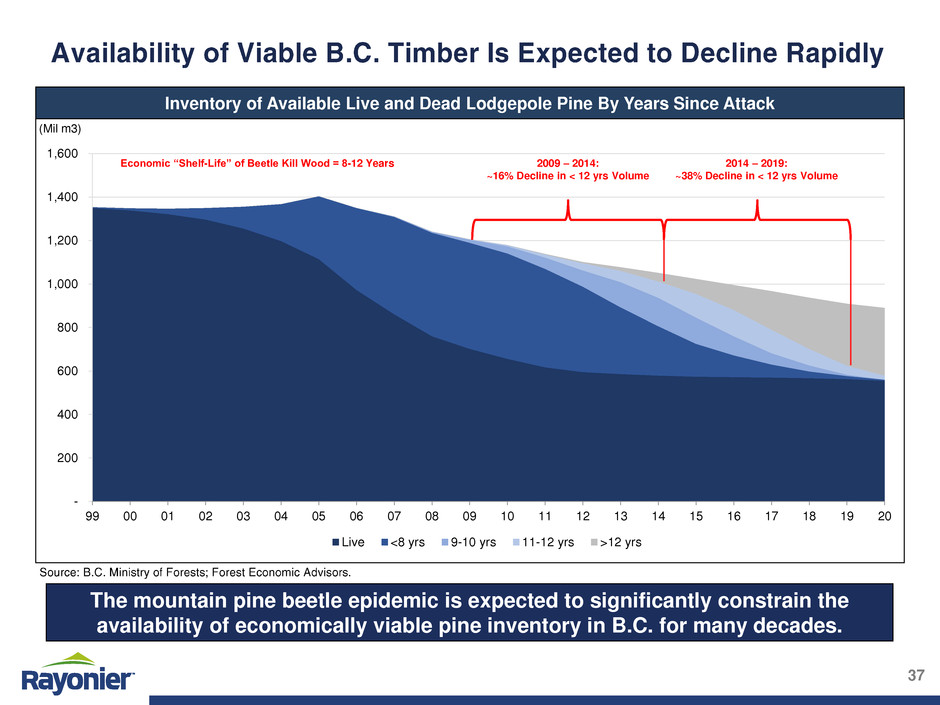

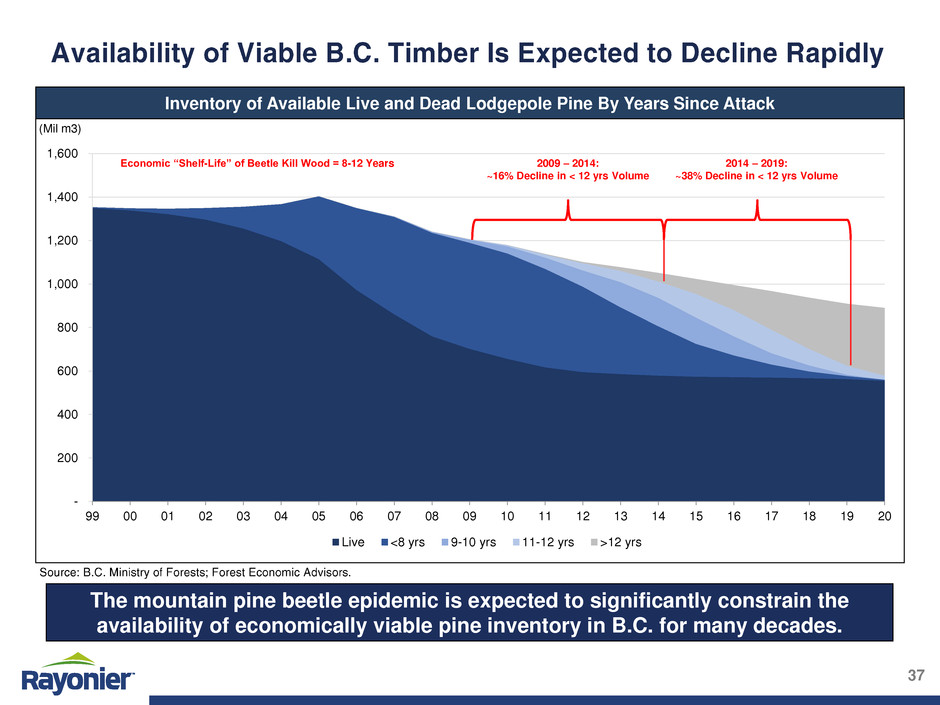

1.4 1.8 1.5 1.4 1.5 ~1.5 Inventory of Available Live and Dead Lodgepole Pine By Years Since Attack (Mil m3) The mountain pine beetle epidemic is expected to significantly constrain the availability of economically viable pine inventory in B.C. for many decades. - 200 400 600 800 1,000 1,200 1,400 1,600 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 Live <8 yrs 9-10 yrs 11-12 yrs >12 yrs 2009 – 2014: ~16% Decline in < 12 yrs Volume 2014 – 2019: ~38% Decline in < 12 yrs Volume Economic “Shelf-Life” of Beetle Kill Wood = 8-12 Years

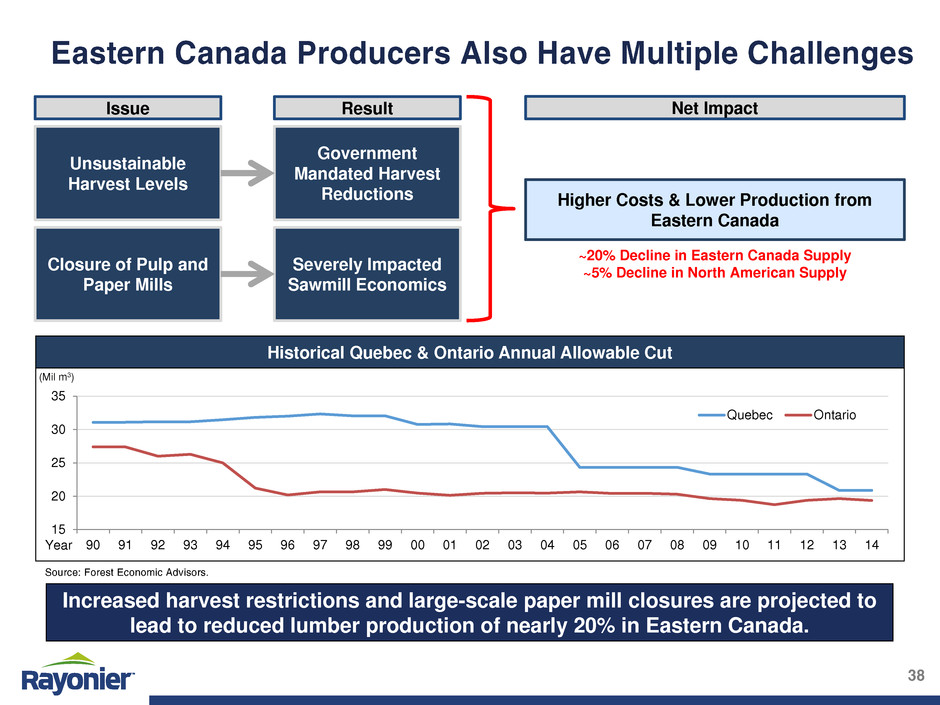

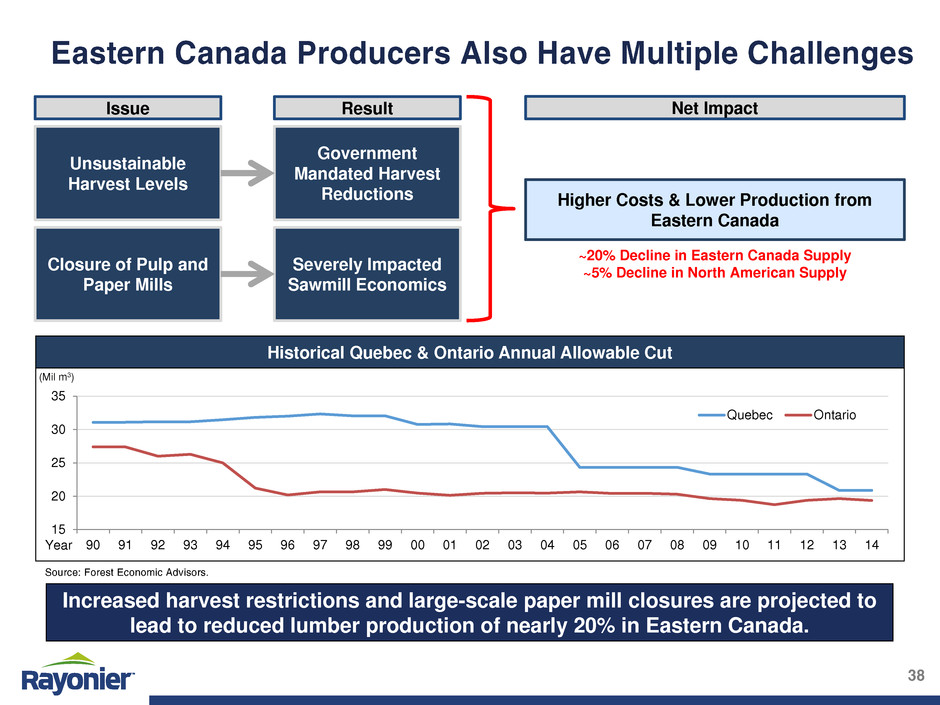

Increased harvest restrictions and large-scale paper mill closures are projected to lead to reduced lumber production of nearly 20% in Eastern Canada. Unsustainable Harvest Levels Higher Costs & Lower Production from Eastern Canada Issue Government Mandated Harvest Reductions Result Closure of Pulp and Paper Mills Severely Impacted Sawmill Economics Net Impact ~20% Decline in Eastern Canada Supply ~5% Decline in North American Supply Historical Quebec & Ontario Annual Allowable Cut (Mil m3) 15 20 25 30 35 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 Quebec Ontario Year

Based on the major supply-demand shifts currently underway, the U.S. South is expected to exceed prior peak levels of demand even at trend-level housing starts.

Appendix

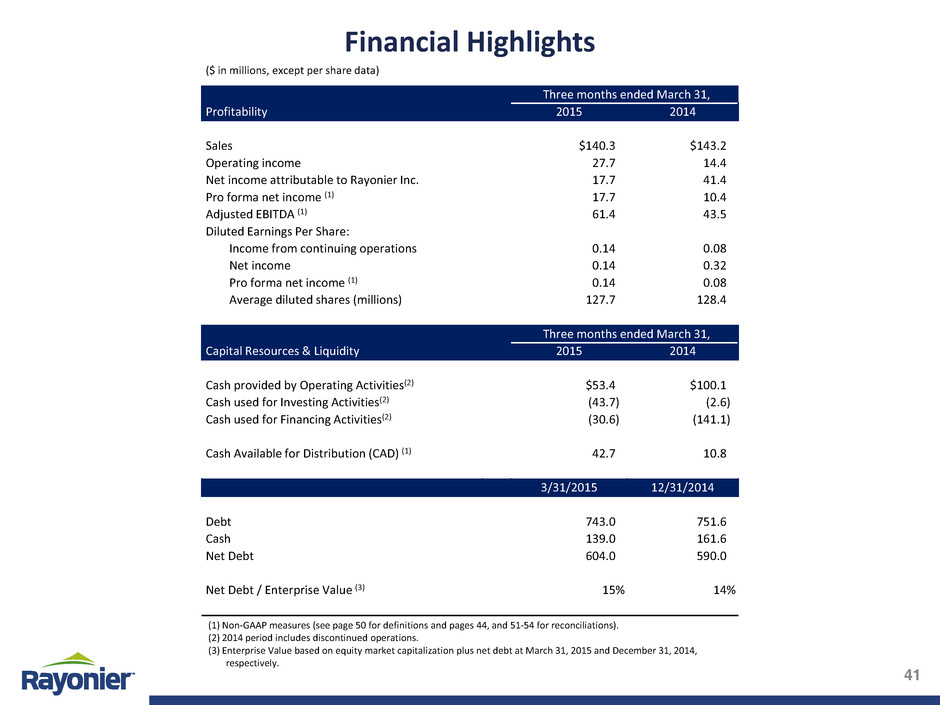

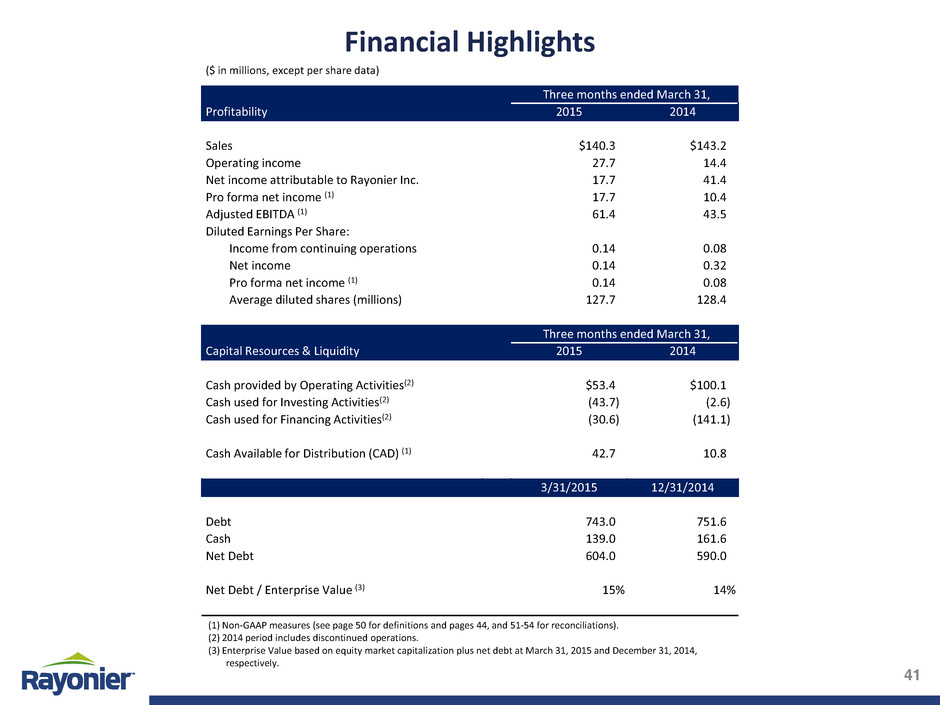

Financial Highlights ($ in millions, except per share data) Three months ended March 31, Profitability 2015 2014 Sales $140.3 $143.2 Operating income 27.7 14.4 Net income attributable to Rayonier Inc. 17.7 41.4 Pro forma net income (1) 17.7 10.4 Adjusted EBITDA (1) 61.4 43.5 Diluted Earnings Per Share: Income from continuing operations 0.14 0.08 Net income 0.14 0.32 Pro forma net income (1) 0.14 0.08 Average diluted shares (millions) 127.7 128.4 Three months ended March 31, Capital Resources & Liquidity 2015 2014 Cash provided by Operating Activities(2) $53.4 $100.1 Cash used for Investing Activities(2) (43.7) (2.6) Cash used for Financing Activities(2) (30.6) (141.1) Cash Available for Distribution (CAD) (1) 42.7 10.8 3/31/2015 12/31/2014 Debt 743.0 751.6 Cash 139.0 161.6 Net Debt 604.0 590.0 Net Debt / Enterprise Value (3) 15% 14% (1) Non-GAAP measures (see page 50 for definitions and pages 44, and 51-54 for reconciliations). (2) 2014 period includes discontinued operations. (3) Enterprise Value based on equity market capitalization plus net debt at March 31, 2015 and December 31, 2014, respectively.

Variance Analysis – 4Q 2014 to 1Q 2015 Operating Income ($ in millions) Southern Timber Pacific Northwest Timber New Zealand Timber Real Estate Trading Corporate and Other Total 4Q14 Operating income $13.5 $3.7 $2.9 $2.6 ($0.3) ($8.2) $14.2 Pro forma adjustments(1) — — — — — 2.4 2.4 Pro forma operating Income(2) $13.5 $3.7 $2.9 $2.6 ($0.3) ($5.8) $16.6 Volume/Mix (1.0) — (4.0) 2.3 — — (2.7) Price 1.0 (1.9) 3.7 8.4 — — 11.2 Cost 0.3 0.5 1.0 0.3 — (0.2) 1.9 Non-timber income (1.1) 0.3 0.6 — — — (0.2) Foreign exchange — — 0.2 — 0.1 — 0.3 Depreciation, depletion & amortization (0.3) — 0.6 (0.7) — 0.1 (0.3) Non-cash cost of land and real estate development costs recovered upon sale — — 2.2 (0.3) — — 1.9 Other — — (1.5) — 0.5 — (1.0) 1Q15 Operating Income $12.4 $2.6 $5.7 $12.6 $0.3 ($5.9) $27.7 Adjusted EBITDA (2) ($ in millions) Southern Timber Pacific Northwest Timber New Zealand Timber Real Estate Trading Corporate and Other Total 4Q14 Adjusted EBITDA $28.3 $7.5 $13.8 $7.2 ($0.3) ($5.6) $50.9 Volume/Mix (1.8) — (5.9) 4.5 — — (3.2) Price 1.0 (1.9) 3.7 8.4 — — 11.2 Cost 0.3 0.5 1.0 0.3 — (0.2) 1.9 Non-timber income (1.1) 0.3 0.6 — — — (0.2) Foreign exchange — — 0.2 — 0.1 — 0.3 Other — — 0.3 (0.3) 0.5 — 0.5 Adjusted EBITDA variance (1.6) (1.1) (0.1) 12.9 0.6 (0.2) 10.5 1Q15 Adjusted EBITDA $26.7 $6.4 $13.7 $20.1 $0.3 ($5.8) $61.4 (4) (3) (1) Internal review and restatement costs in 2014. (2) Non-GAAP measures (see page 50 for definitions and pages 51-54 for reconciliations). (3) Primarily related to timber sold in conjunction with the relinquishment of a forestry right. (4) Includes $1.9 million of timber basis sold in conjunction with the relinquishment of a forestry right.

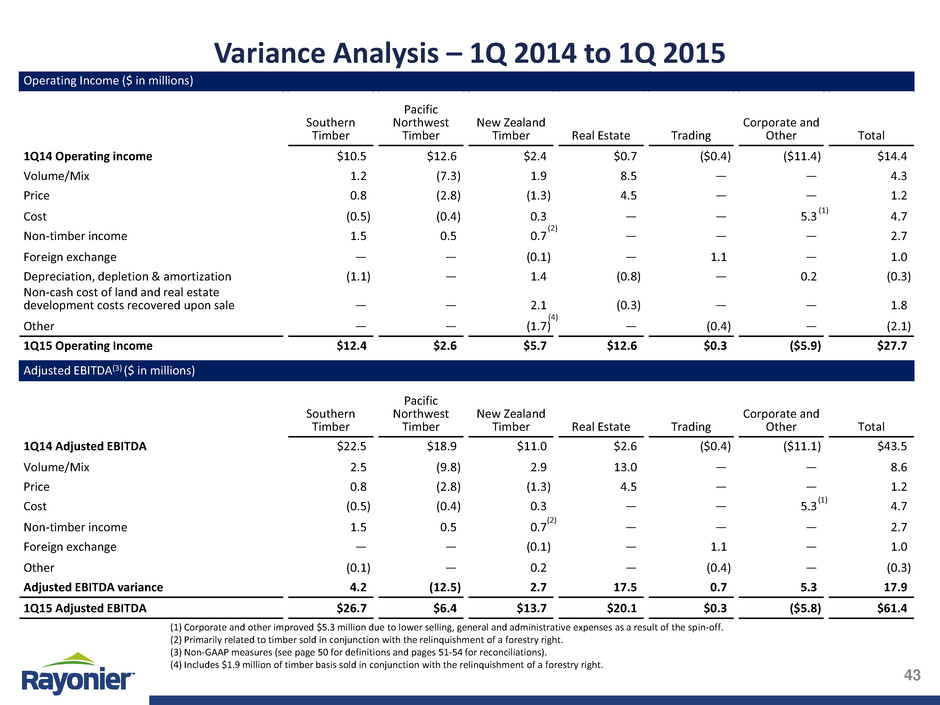

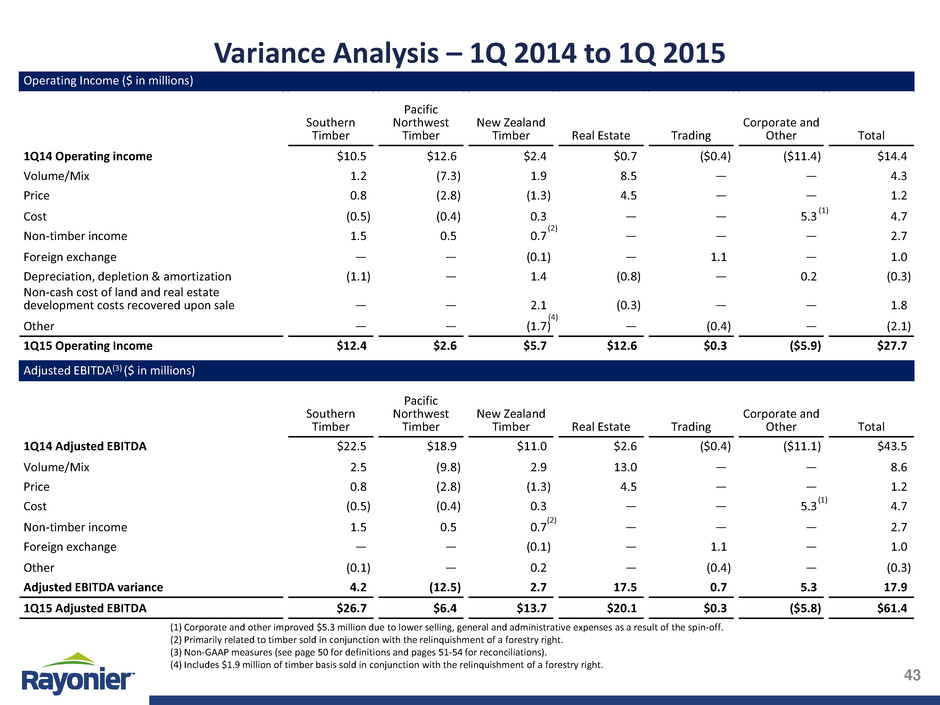

Variance Analysis – 1Q 2014 to 1Q 2015 Operating Income ($ in millions) Southern Timber Pacific Northwest Timber New Zealand Timber Real Estate Trading Corporate and Other Total 1Q14 Operating income $10.5 $12.6 $2.4 $0.7 ($0.4) ($11.4) $14.4 Volume/Mix 1.2 (7.3) 1.9 8.5 — — 4.3 Price 0.8 (2.8) (1.3) 4.5 — — 1.2 Cost (0.5) (0.4) 0.3 — — 5.3 4.7 Non-timber income 1.5 0.5 0.7 — — — 2.7 Foreign exchange — — (0.1) — 1.1 — 1.0 Depreciation, depletion & amortization (1.1) — 1.4 (0.8) — 0.2 (0.3) Non-cash cost of land and real estate development costs recovered upon sale — — 2.1 (0.3) — — 1.8 Other — — (1.7) — (0.4) — (2.1) 1Q15 Operating Income $12.4 $2.6 $5.7 $12.6 $0.3 ($5.9) $27.7 Adjusted EBITDA(3) ($ in millions) Southern Timber Pacific Northwest Timber New Zealand Timber Real Estate Trading Corporate and Other Total 1Q14 Adjusted EBITDA $22.5 $18.9 $11.0 $2.6 ($0.4) ($11.1) $43.5 Volume/Mix 2.5 (9.8) 2.9 13.0 — — 8.6 Price 0.8 (2.8) (1.3) 4.5 — — 1.2 Cost (0.5) (0.4) 0.3 — — 5.3 4.7 Non-timber income 1.5 0.5 0.7 — — — 2.7 Foreign exchange — — (0.1) — 1.1 — 1.0 Other (0.1) — 0.2 — (0.4) — (0.3) Adjusted EBITDA variance 4.2 (12.5) 2.7 17.5 0.7 5.3 17.9 1Q15 Adjusted EBITDA $26.7 $6.4 $13.7 $20.1 $0.3 ($5.8) $61.4 (1) Corporate and other improved $5.3 million due to lower selling, general and administrative expenses as a result of the spin-off. (2) Primarily related to timber sold in conjunction with the relinquishment of a forestry right. (3) Non-GAAP measures (see page 50 for definitions and pages 51-54 for reconciliations). (4) Includes $1.9 million of timber basis sold in conjunction with the relinquishment of a forestry right. (1) (1) (2) (2) (4)

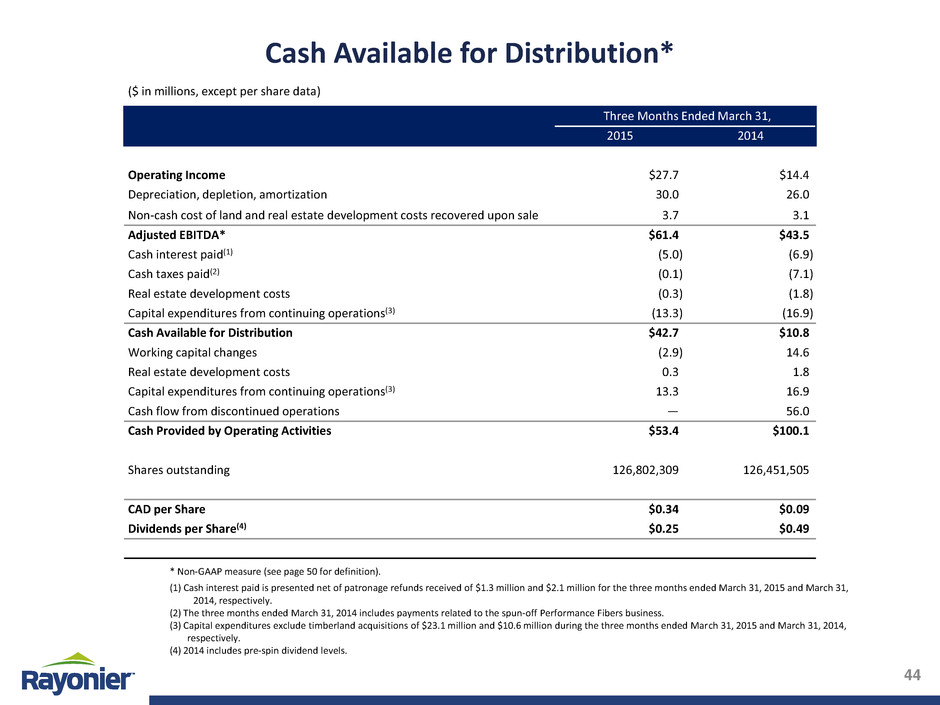

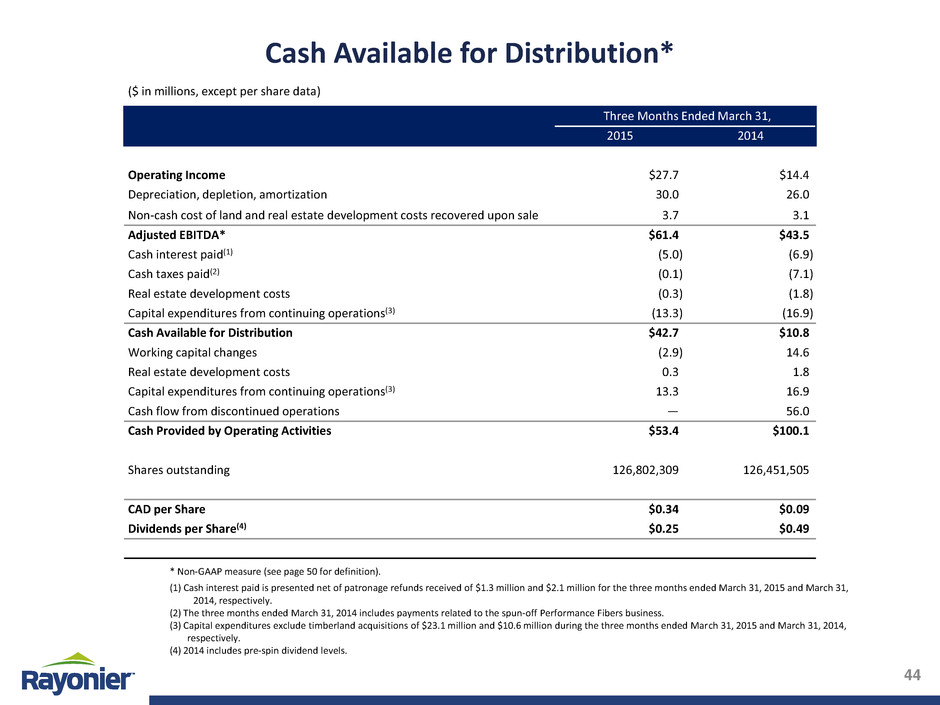

Cash Available for Distribution* ($ in millions, except per share data) Three Months Ended March 31, 2015 2014 Operating Income $27.7 $14.4 Depreciation, depletion, amortization 30.0 26.0 Non-cash cost of land and real estate development costs recovered upon sale 3.7 3.1 Adjusted EBITDA* $61.4 $43.5 Cash interest paid(1) (5.0) (6.9) Cash taxes paid(2) (0.1) (7.1) Real estate development costs (0.3) (1.8) Capital expenditures from continuing operations(3) (13.3) (16.9) Cash Available for Distribution $42.7 $10.8 Working capital changes (2.9) 14.6 Real estate development costs 0.3 1.8 Capital expenditures from continuing operations(3) 13.3 16.9 Cash flow from discontinued operations — 56.0 Cash Provided by Operating Activities $53.4 $100.1 Shares outstanding 126,802,309 126,451,505 CAD per Share $0.34 $0.09 Dividends per Share(4) $0.25 $0.49 * Non-GAAP measure (see page 50 for definition). (1) Cash interest paid is presented net of patronage refunds received of $1.3 million and $2.1 million for the three months ended March 31, 2015 and March 31, 2014, respectively. (2) The three months ended March 31, 2014 includes payments related to the spun-off Performance Fibers business. (3) Capital expenditures exclude timberland acquisitions of $23.1 million and $10.6 million during the three months ended March 31, 2015 and March 31, 2014, respectively. (4) 2014 includes pre-spin dividend levels.

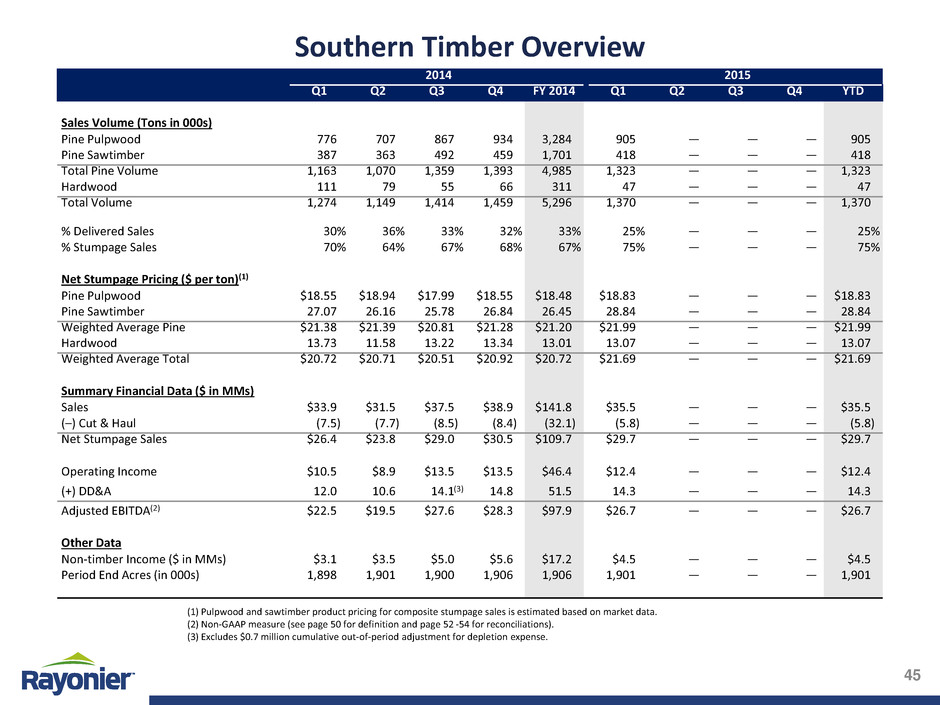

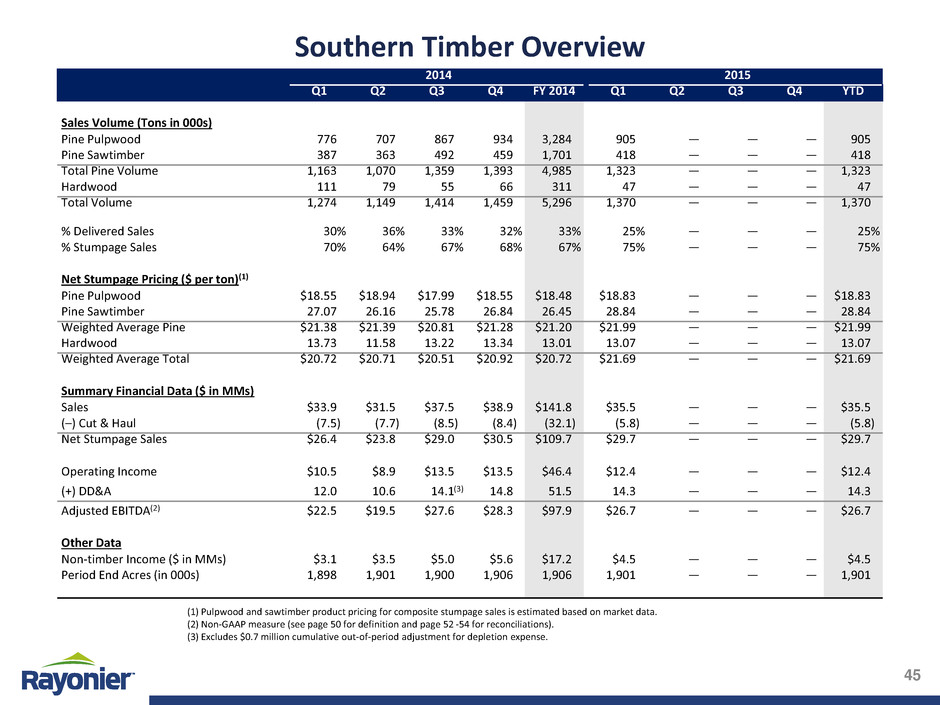

Southern Timber Overview 2014 2015 Q1 Q2 Q3 Q4 FY 2014 Q1 Q2 Q3 Q4 YTD Sales Volume (Tons in 000s) Pine Pulpwood 776 707 867 934 3,284 905 — — — 905 Pine Sawtimber 387 363 492 459 1,701 418 — — — 418 Total Pine Volume 1,163 1,070 1,359 1,393 4,985 1,323 — — — 1,323 Hardwood 111 79 55 66 311 47 — — — 47 Total Volume 1,274 1,149 1,414 1,459 5,296 1,370 — — — 1,370 % Delivered Sales 30% 36% 33% 32% 33% 25% — — — 25% % Stumpage Sales 70% 64% 67% 68% 67% 75% — — — 75% Net Stumpage Pricing ($ per ton)(1) Pine Pulpwood $18.55 $18.94 $17.99 $18.55 $18.48 $18.83 — — — $18.83 Pine Sawtimber 27.07 26.16 25.78 26.84 26.45 28.84 — — — 28.84 Weighted Average Pine $21.38 $21.39 $20.81 $21.28 $21.20 $21.99 — — — $21.99 Hardwood 13.73 11.58 13.22 13.34 13.01 13.07 — — — 13.07 Weighted Average Total $20.72 $20.71 $20.51 $20.92 $20.72 $21.69 — — — $21.69 Summary Financial Data ($ in MMs) Sales $33.9 $31.5 $37.5 $38.9 $141.8 $35.5 — — — $35.5 (–) Cut & Haul (7.5) (7.7) (8.5) (8.4) (32.1) (5.8) — — — (5.8) Net Stumpage Sales $26.4 $23.8 $29.0 $30.5 $109.7 $29.7 — — — $29.7 Operating Income $10.5 $8.9 $13.5 $13.5 $46.4 $12.4 — — — $12.4 (+) DD&A 12.0 10.6 14.1 14.8 51.5 14.3 — — — 14.3 Adjusted EBITDA(2) $22.5 $19.5 $27.6 $28.3 $97.9 $26.7 — — — $26.7 Other Data Non-timber Income ($ in MMs) $3.1 $3.5 $5.0 $5.6 $17.2 $4.5 — — — $4.5 Period End Acres (in 000s) 1,898 1,901 1,900 1,906 1,906 1,901 — — — 1,901 (1) Pulpwood and sawtimber product pricing for composite stumpage sales is estimated based on market data. (2) Non-GAAP measure (see page 50 for definition and page 52 -54 for reconciliations). (3) Excludes $0.7 million cumulative out-of-period adjustment for depletion expense. (3)

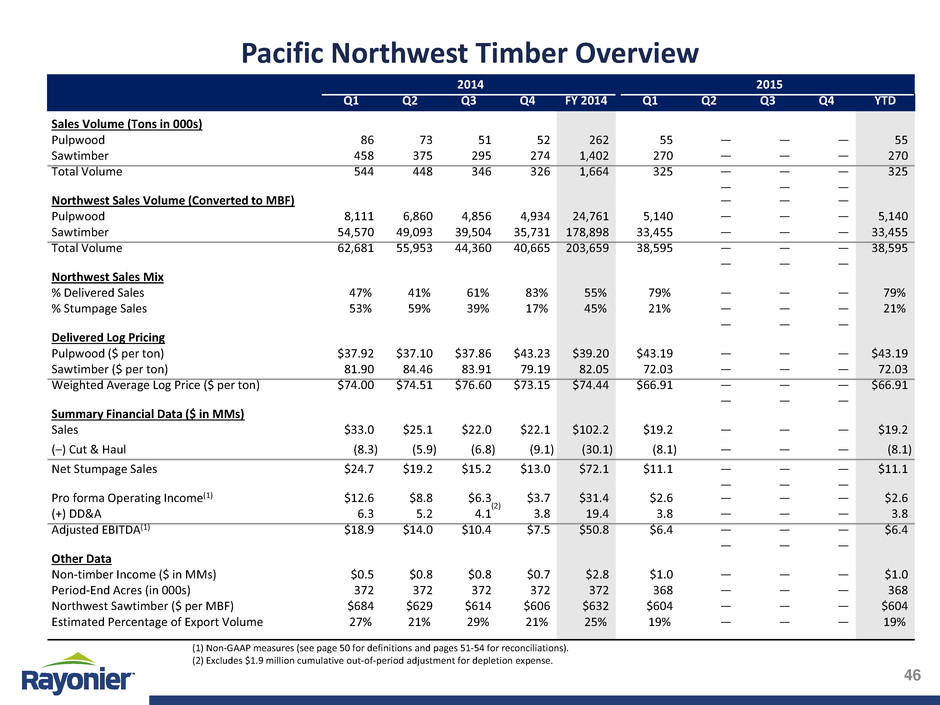

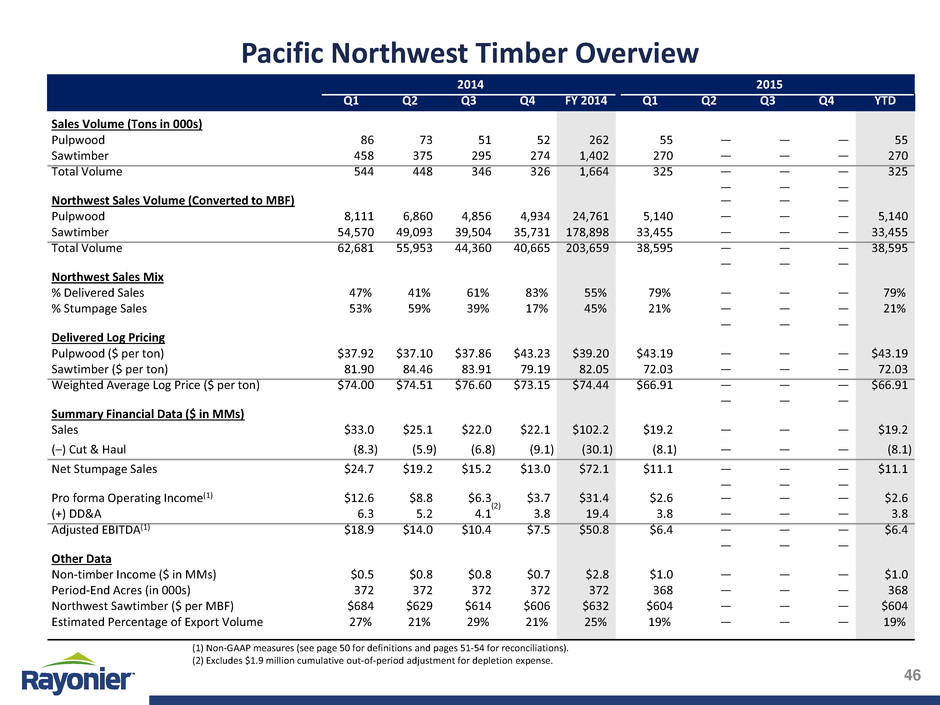

Pacific Northwest Timber Overview 2014 2015 Q1 Q2 Q3 Q4 FY 2014 Q1 Q2 Q3 Q4 YTD Sales Volume (Tons in 000s) Pulpwood 86 73 51 52 262 55 — — — 55 Sawtimber 458 375 295 274 1,402 270 — — — 270 Total Volume 544 448 346 326 1,664 325 — — — 325 — — — Northwest Sales Volume (Converted to MBF) — — — Pulpwood 8,111 6,860 4,856 4,934 24,761 5,140 — — — 5,140 Sawtimber 54,570 49,093 39,504 35,731 178,898 33,455 — — — 33,455 Total Volume 62,681 55,953 44,360 40,665 203,659 38,595 — — — 38,595 — — — Northwest Sales Mix % Delivered Sales 47% 41% 61% 83% 55% 79% — — — 79% % Stumpage Sales 53% 59% 39% 17% 45% 21% — — — 21% — — — Delivered Log Pricing Pulpwood ($ per ton) $37.92 $37.10 $37.86 $43.23 $39.20 $43.19 — — — $43.19 Sawtimber ($ per ton) 81.90 84.46 83.91 79.19 82.05 72.03 — — — 72.03 Weighted Average Log Price ($ per ton) $74.00 $74.51 $76.60 $73.15 $74.44 $66.91 — — — $66.91 — — — Summary Financial Data ($ in MMs) Sales $33.0 $25.1 $22.0 $22.1 $102.2 $19.2 — — — $19.2 (–) Cut & Haul (8.3) (5.9) (6.8) (9.1) (30.1) (8.1) — — — (8.1) Net Stumpage Sales $24.7 $19.2 $15.2 $13.0 $72.1 $11.1 — — — $11.1 — — — Pro forma Operating Income(1) $12.6 $8.8 $6.3 $3.7 $31.4 $2.6 — — — $2.6 (+) DD&A 6.3 5.2 4.1 3.8 19.4 3.8 — — — 3.8 Adjusted EBITDA(1) $18.9 $14.0 $10.4 $7.5 $50.8 $6.4 — — — $6.4 — — — Other Data Non-timber Income ($ in MMs) $0.5 $0.8 $0.8 $0.7 $2.8 $1.0 — — — $1.0 Period-End Acres (in 000s) 372 372 372 372 372 368 — — — 368 Northwest Sawtimber ($ per MBF) $684 $629 $614 $606 $632 $604 — — — $604 Estimated Percentage of Export Volume 27% 21% 29% 21% 25% 19% — — — 19% (1) Non-GAAP measures (see page 50 for definitions and pages 51-54 for reconciliations). (2) Excludes $1.9 million cumulative out-of-period adjustment for depletion expense. (2)

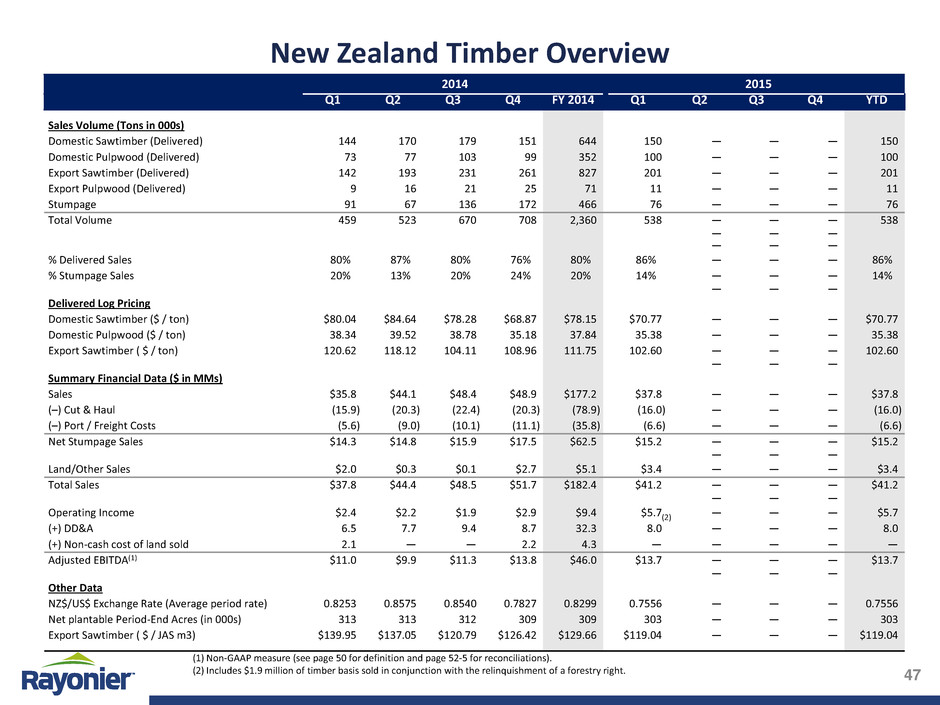

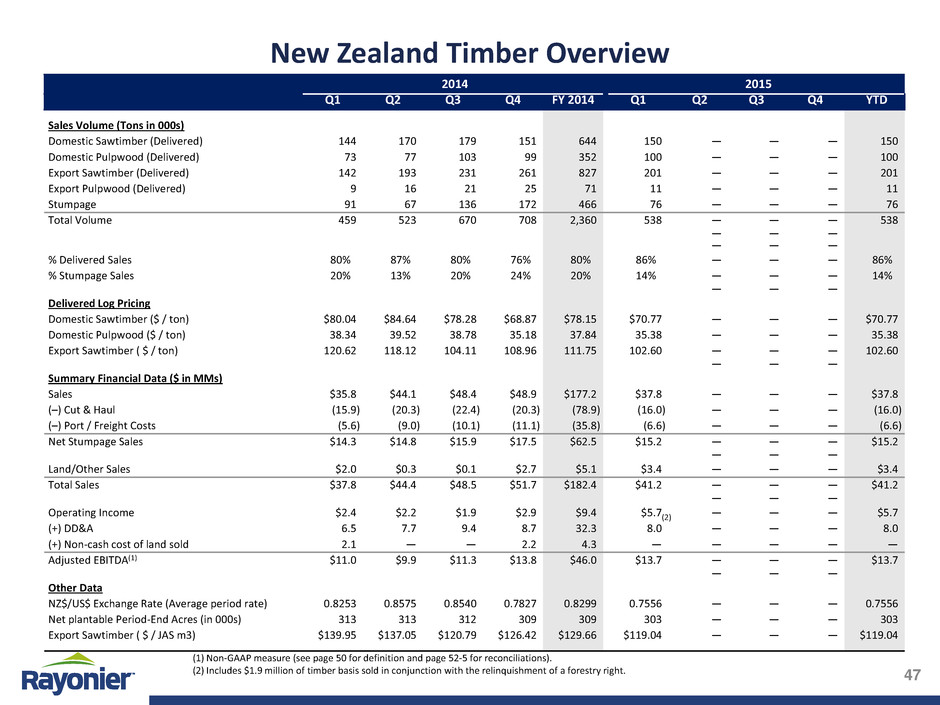

New Zealand Timber Overview 2014 2015 Q1 Q2 Q3 Q4 FY 2014 Q1 Q2 Q3 Q4 YTD Sales Volume (Tons in 000s) Domestic Sawtimber (Delivered) 144 170 179 151 644 150 — — — 150 Domestic Pulpwood (Delivered) 73 77 103 99 352 100 — — — 100 Export Sawtimber (Delivered) 142 193 231 261 827 201 — — — 201 Export Pulpwood (Delivered) 9 16 21 25 71 11 — — — 11 Stumpage 91 67 136 172 466 76 — — — 76 Total Volume 459 523 670 708 2,360 538 — — — 538 — — — — — — % Delivered Sales 80% 87% 80% 76% 80% 86% — — — 86% % Stumpage Sales 20% 13% 20% 24% 20% 14% — — — 14% — — — Delivered Log Pricing Domestic Sawtimber ($ / ton) $80.04 $84.64 $78.28 $68.87 $78.15 $70.77 — — — $70.77 Domestic Pulpwood ($ / ton) 38.34 39.52 38.78 35.18 37.84 35.38 — — — 35.38 Export Sawtimber ( $ / ton) 120.62 118.12 104.11 108.96 111.75 102.60 — — — 102.60 — — — Summary Financial Data ($ in MMs) Sales $35.8 $44.1 $48.4 $48.9 $177.2 $37.8 — — — $37.8 (–) Cut & Haul (15.9) (20.3) (22.4) (20.3) (78.9) (16.0) — — — (16.0) (–) Port / Freight Costs (5.6) (9.0) (10.1) (11.1) (35.8) (6.6) — — — (6.6) Net Stumpage Sales $14.3 $14.8 $15.9 $17.5 $62.5 $15.2 — — — $15.2 — — — Land/Other Sales $2.0 $0.3 $0.1 $2.7 $5.1 $3.4 — — — $3.4 Total Sales $37.8 $44.4 $48.5 $51.7 $182.4 $41.2 — — — $41.2 — — — Operating Income $2.4 $2.2 $1.9 $2.9 $9.4 $5.7 — — — $5.7 (+) DD&A 6.5 7.7 9.4 8.7 32.3 8.0 — — — 8.0 (+) Non-cash cost of land sold 2.1 — — 2.2 4.3 — — — — — Adjusted EBITDA(1) $11.0 $9.9 $11.3 $13.8 $46.0 $13.7 — — — $13.7 — — — Other Data NZ$/US$ Exchange Rate (Average period rate) 0.8253 0.8575 0.8540 0.7827 0.8299 0.7556 — — — 0.7556 Net plantable Period-End Acres (in 000s) 313 313 312 309 309 303 — — — 303 Export Sawtimber ( $ / JAS m3) $139.95 $137.05 $120.79 $126.42 $129.66 $119.04 — — — $119.04 (1) Non-GAAP measure (see page 50 for definition and page 52-5 for reconciliations). (2) Includes $1.9 million of timber basis sold in conjunction with the relinquishment of a forestry right. (2)

Timber Segments Selected Operating Information ($ in millions) Three Months Ended 3/31/2015 12/31/2014 3/31/2014 Depreciation, Depletion and Amortization Southern Timber $14.3 $14.8 $12.0 Pacific Northwest Timber 3.8 3.8 6.3 New Zealand Timber 8.0 8.7 6.5 Total $26.1 $27.3 $24.8 Capital Expenditures U.S. Timber Reforestation, Silviculture & Other Capital Expenditures $4.8 $6.6 $5.4 Property Taxes, Lease Payments & Allocated Overhead 5.5 5.3 6.3 Timberland Acquisitions 23.1 36.5 10.6 Subtotal U.S. Timber $33.4 $48.4 $22.3 New Zealand Timber Reforestation, Silviculture & Other Capital Expenditures $1.5 $2.6 $1.8 Property Taxes, Lease Payments & Allocated Overhead 1.2 2.2 1.3 Timberland Acquisitions — — — Subtotal New Zealand Timber $2.7 $4.8 $3.1 Total Timber Segments Capital Expenditures $36.1 $53.2 $25.4

Real Estate Overview 2014 2015 Q1 Q2 Q3 Q4 FY 2014 Q1 Q2 Q3 Q4 YTD Sales ($ in MMs) Improved Development(1) — — — — — — — — — — Unimproved Development 0.1 1.4 1.4 1.9 4.8 4.8 — — — 4.8 Rural 5.1 5.4 25.1 5.4 41.0 6.8 — — — 6.8 Non-strategic / Timberlands 0.3 27.2 0.3 3.7 31.5 12.2 — — — 12.2 Total Sales $5.5 $34.0 $26.8 $11.0 $77.3 $23.8 — — — $23.8 Sales (Development / Rural Only) $5.2 $6.8 $26.5 $7.3 $45.8 $11.6 — — — $11.6 Acres Sold Improved Development(1) — — — — — — — — — — Unimproved Development 27 68 203 554 852 409 — — — 409 Rural 1,733 2,030 11,685 2,629 18,077 2,877 — — — 2,877 Non-strategic / Timberlands 362 23,185 234 2,138 25,919 4,111 — — — 4,111 Total Acres Sold 2,122 25,283 12,122 5,321 44,848 7,397 — — — 7,397 Acres Sold (Development / Rural Only) 1,760 2,098 11,888 3,183 18,929 3,286 — — — 3,286 — — — Percentage of U.S. South acreage sold(2) 0.1% 0.1% 0.7% 0.2% 1.2% 0.2% — — — 0.2% Price per Acre ($ per acre) Improved Development(1) — — — — — — — — — — Unimproved Development $5,259 $20,897 $6,660 $3,389 $5,623 $11,781 — — — $11,781 Rural 2,958 2,654 2,146 2,040 2,265 2,368 — — — 2,368 Non-strategic / Timberlands 723 1,174 1,100 1,779 1,217 2,957 — — — 2,957 Weighted Avg. (Total) $2,606 $1,345 $2,202 $2,075 $1,723 $3,216 — — — $3,216 Weighted Avg. (Development / Rural)(3) $2,994 $3,245 $2,223 $2,275 $2,417 $3,540 — — — $3,540 (1) Reflects land with capital invested in infrastructure improvements. (2) Calculated as development / rural acres sold (excluding sales in the Pacific Northwest region) over U.S. South acres owned. (3) Excludes Improved Development.

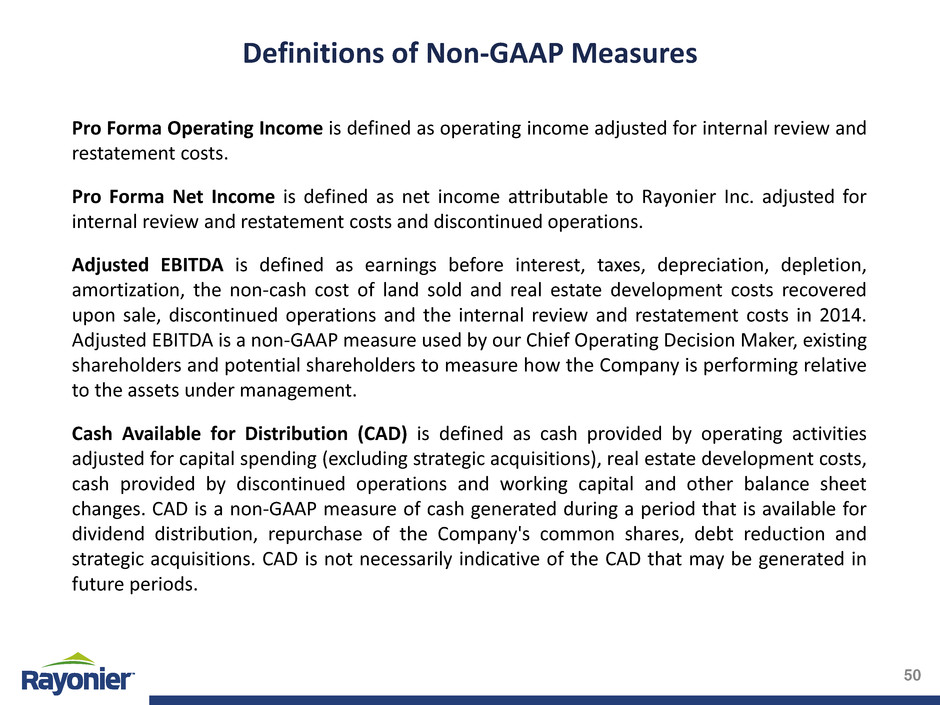

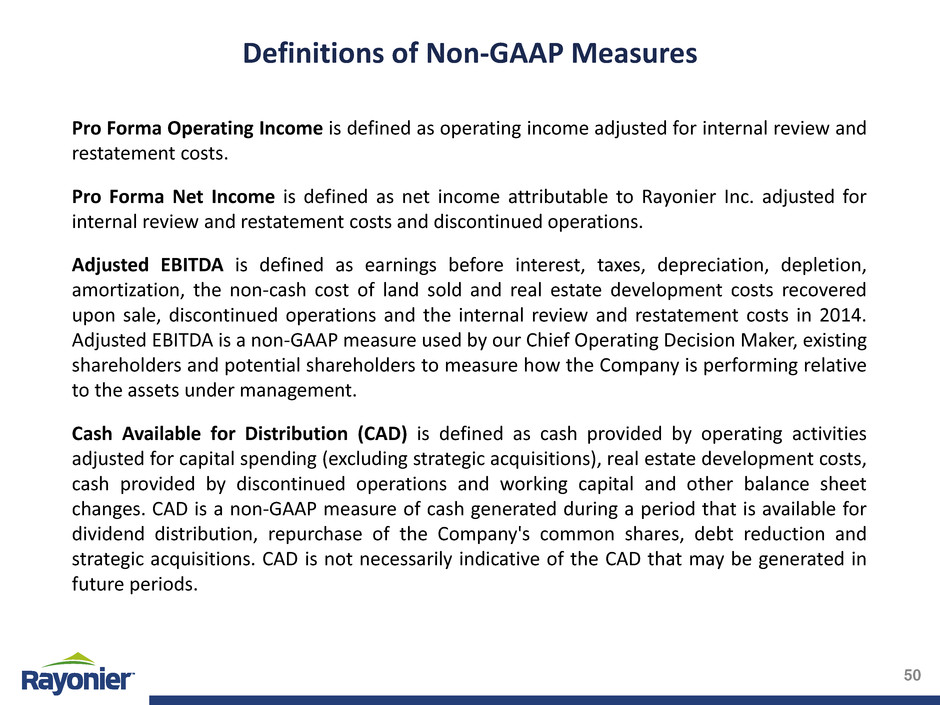

Definitions of Non-GAAP Measures Pro Forma Operating Income is defined as operating income adjusted for internal review and restatement costs. Pro Forma Net Income is defined as net income attributable to Rayonier Inc. adjusted for internal review and restatement costs and discontinued operations. Adjusted EBITDA is defined as earnings before interest, taxes, depreciation, depletion, amortization, the non-cash cost of land sold and real estate development costs recovered upon sale, discontinued operations and the internal review and restatement costs in 2014. Adjusted EBITDA is a non-GAAP measure used by our Chief Operating Decision Maker, existing shareholders and potential shareholders to measure how the Company is performing relative to the assets under management. Cash Available for Distribution (CAD) is defined as cash provided by operating activities adjusted for capital spending (excluding strategic acquisitions), real estate development costs, cash provided by discontinued operations and working capital and other balance sheet changes. CAD is a non-GAAP measure of cash generated during a period that is available for dividend distribution, repurchase of the Company's common shares, debt reduction and strategic acquisitions. CAD is not necessarily indicative of the CAD that may be generated in future periods.

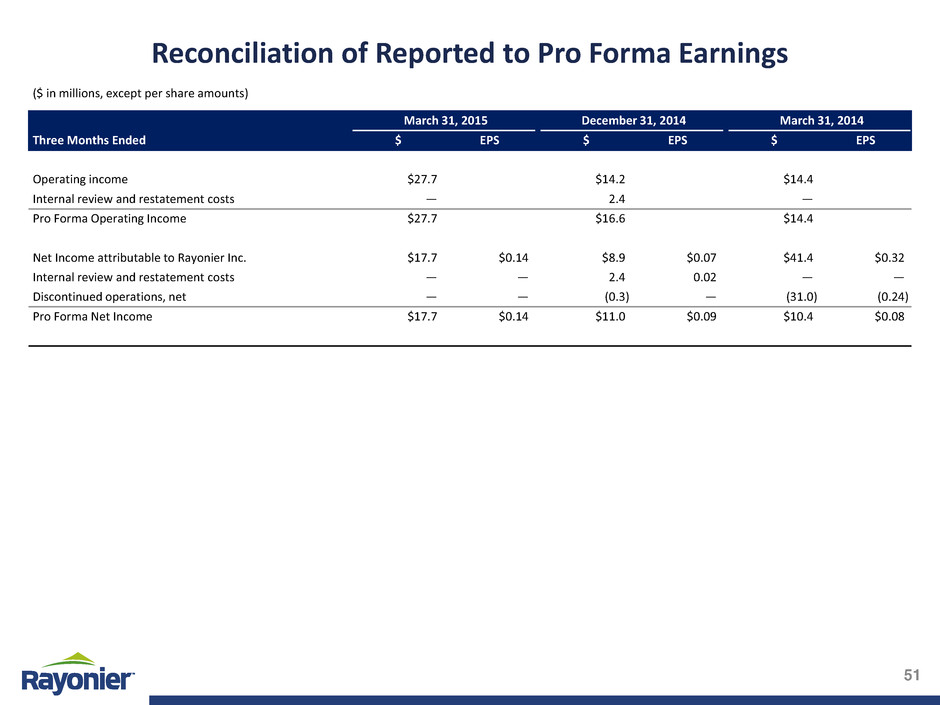

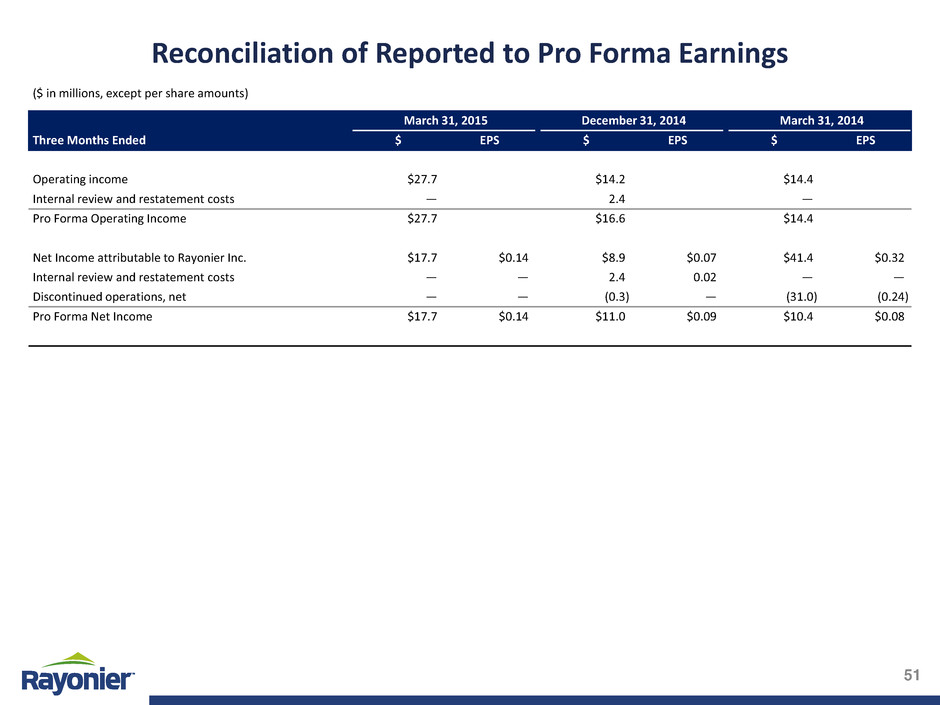

Reconciliation of Reported to Pro Forma Earnings ($ in millions, except per share amounts) March 31, 2015 December 31, 2014 March 31, 2014 Three Months Ended $ EPS $ EPS $ EPS Operating income $27.7 $14.2 $14.4 Internal review and restatement costs — 2.4 — Pro Forma Operating Income $27.7 $16.6 $14.4 Net Income attributable to Rayonier Inc. $17.7 $0.14 $8.9 $0.07 $41.4 $0.32 Internal review and restatement costs — — 2.4 0.02 — — Discontinued operations, net — — (0.3) — (31.0) (0.24) Pro Forma Net Income $17.7 $0.14 $11.0 $0.09 $10.4 $0.08

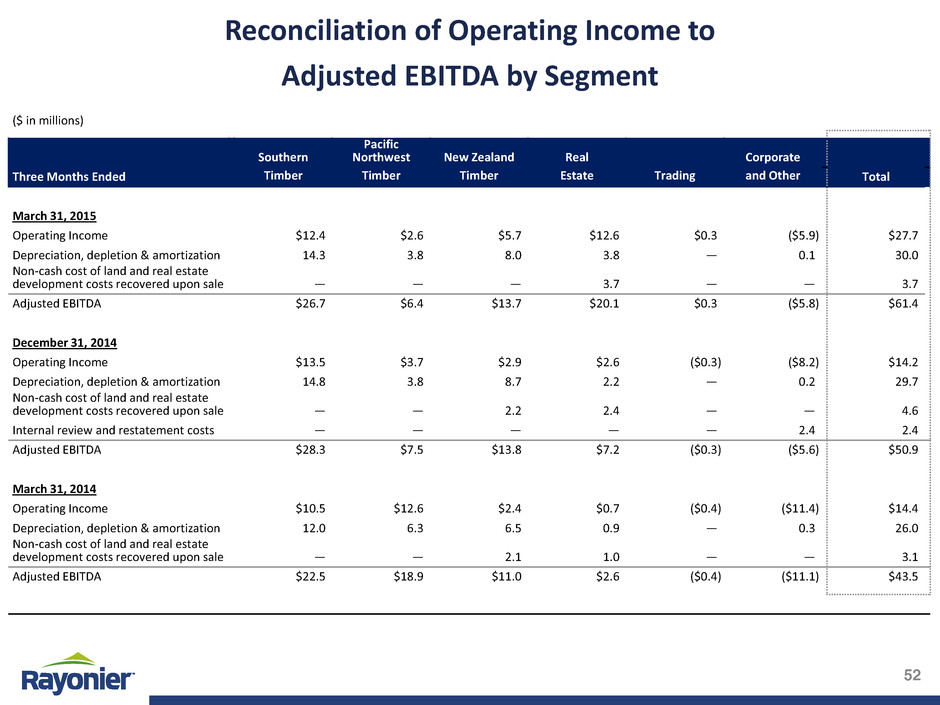

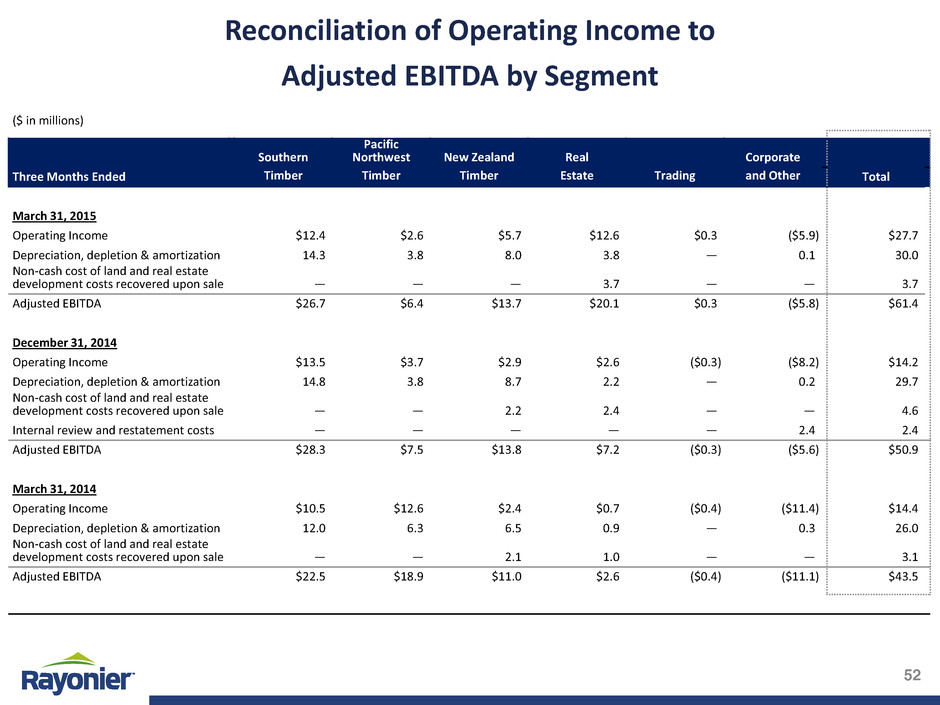

Reconciliation of Operating Income to Adjusted EBITDA by Segment ($ in millions) Southern Pacific Northwest New Zealand Real Corporate Three Months Ended Timber Timber Timber Estate Trading and Other Total March 31, 2015 Operating Income $12.4 $2.6 $5.7 $12.6 $0.3 ($5.9) $27.7 Depreciation, depletion & amortization 14.3 3.8 8.0 3.8 — 0.1 30.0 Non-cash cost of land and real estate development costs recovered upon sale — — — 3.7 — — 3.7 Adjusted EBITDA $26.7 $6.4 $13.7 $20.1 $0.3 ($5.8) $61.4 December 31, 2014 Operating Income $13.5 $3.7 $2.9 $2.6 ($0.3) ($8.2) $14.2 Depreciation, depletion & amortization 14.8 3.8 8.7 2.2 — 0.2 29.7 Non-cash cost of land and real estate development costs recovered upon sale — — 2.2 2.4 — — 4.6 Internal review and restatement costs — — — — — 2.4 2.4 Adjusted EBITDA $28.3 $7.5 $13.8 $7.2 ($0.3) ($5.6) $50.9 March 31, 2014 Operating Income $10.5 $12.6 $2.4 $0.7 ($0.4) ($11.4) $14.4 Depreciation, depletion & amortization 12.0 6.3 6.5 0.9 — 0.3 26.0 Non-cash cost of land and real estate development costs recovered upon sale — — 2.1 1.0 — — 3.1 Adjusted EBITDA $22.5 $18.9 $11.0 $2.6 ($0.4) ($11.1) $43.5

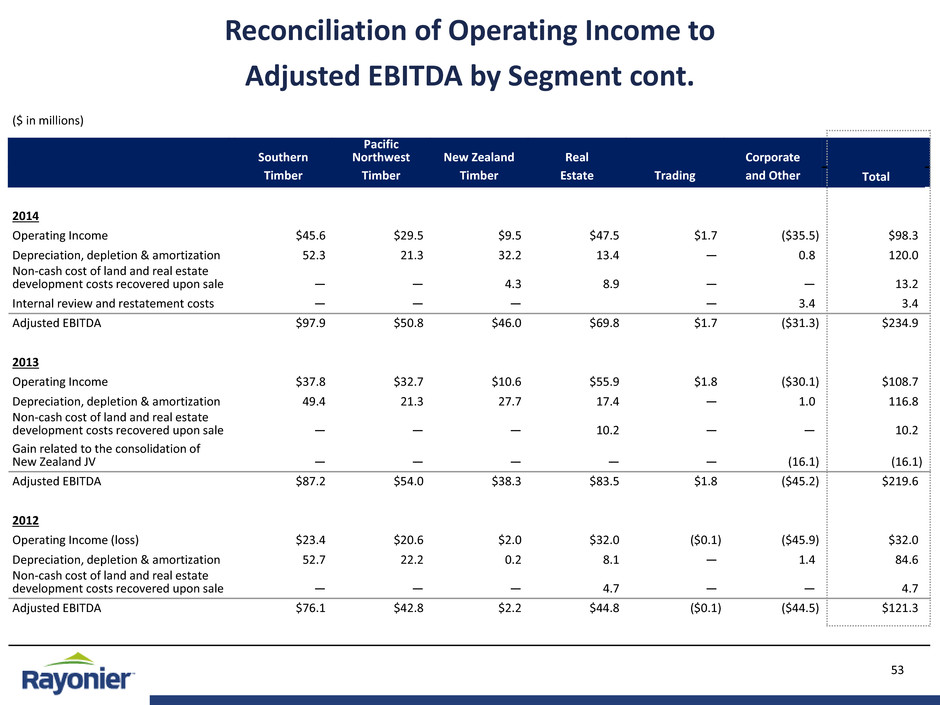

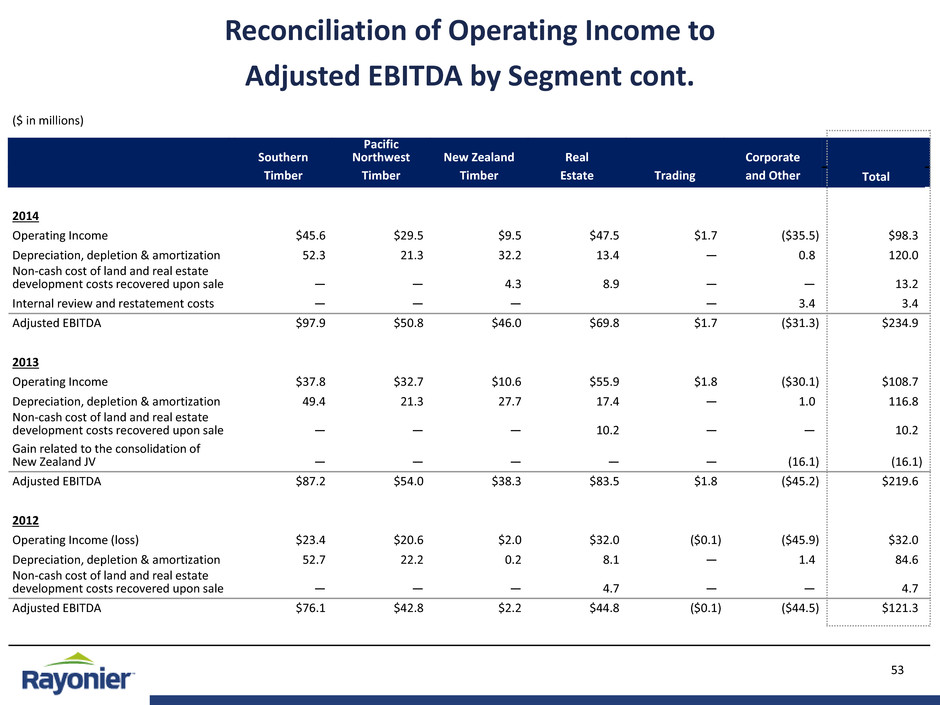

Reconciliation of Operating Income to Adjusted EBITDA by Segment cont. ($ in millions) Southern Pacific Northwest New Zealand Real Corporate Timber Timber Timber Estate Trading and Other Total 2014 Operating Income $45.6 $29.5 $9.5 $47.5 $1.7 ($35.5) $98.3 Depreciation, depletion & amortization 52.3 21.3 32.2 13.4 — 0.8 120.0 Non-cash cost of land and real estate development costs recovered upon sale — — 4.3 8.9 — — 13.2 Internal review and restatement costs — — — — 3.4 3.4 Adjusted EBITDA $97.9 $50.8 $46.0 $69.8 $1.7 ($31.3) $234.9 2013 Operating Income $37.8 $32.7 $10.6 $55.9 $1.8 ($30.1) $108.7 Depreciation, depletion & amortization 49.4 21.3 27.7 17.4 — 1.0 116.8 Non-cash cost of land and real estate development costs recovered upon sale — — — 10.2 — — 10.2 Gain related to the consolidation of New Zealand JV — — — — — (16.1) (16.1) Adjusted EBITDA $87.2 $54.0 $38.3 $83.5 $1.8 ($45.2) $219.6 2012 Operating Income (loss) $23.4 $20.6 $2.0 $32.0 ($0.1) ($45.9) $32.0 Depreciation, depletion & amortization 52.7 22.2 0.2 8.1 — 1.4 84.6 Non-cash cost of land and real estate development costs recovered upon sale — — — 4.7 — — 4.7 Adjusted EBITDA $76.1 $42.8 $2.2 $44.8 ($0.1) ($44.5) $121.3 53

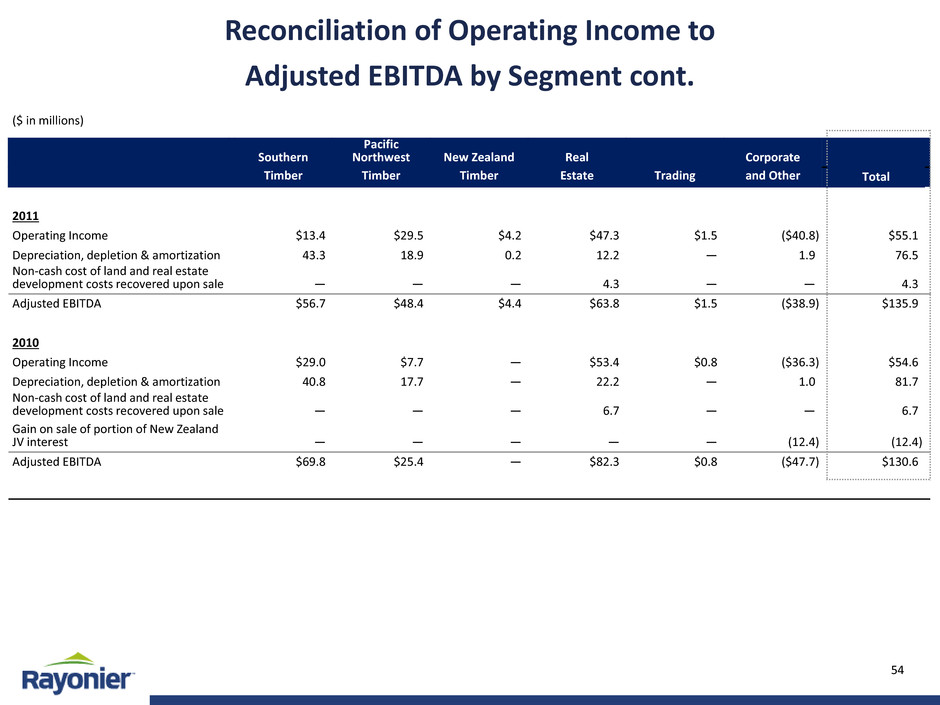

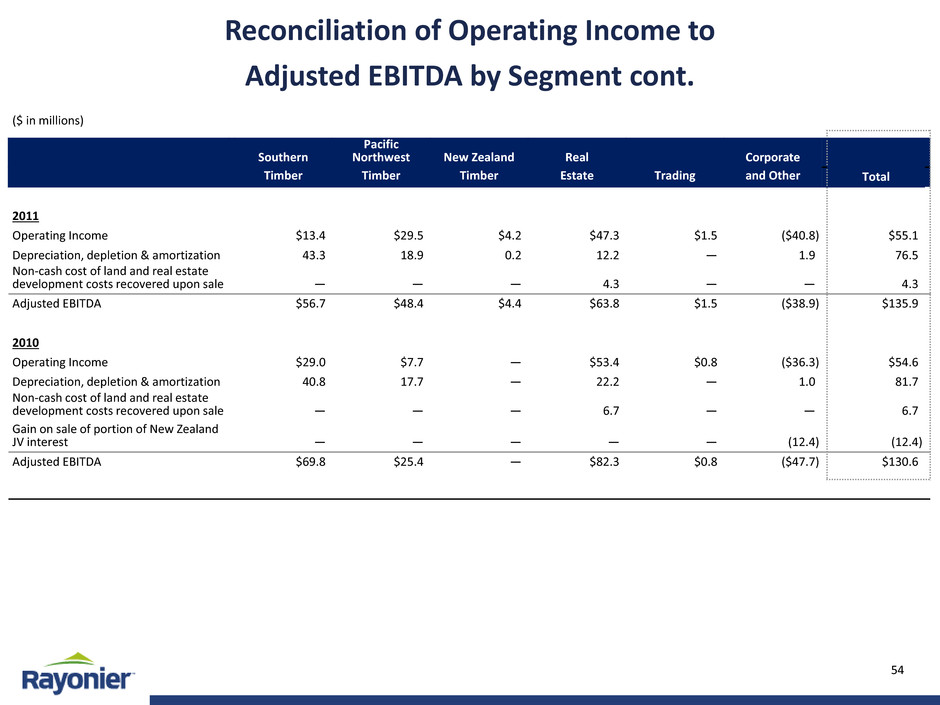

Reconciliation of Operating Income to Adjusted EBITDA by Segment cont. ($ in millions) Southern Pacific Northwest New Zealand Real Corporate Timber Timber Timber Estate Trading and Other Total 2011 Operating Income $13.4 $29.5 $4.2 $47.3 $1.5 ($40.8) $55.1 Depreciation, depletion & amortization 43.3 18.9 0.2 12.2 — 1.9 76.5 Non-cash cost of land and real estate development costs recovered upon sale — — — 4.3 — — 4.3 Adjusted EBITDA $56.7 $48.4 $4.4 $63.8 $1.5 ($38.9) $135.9 2010 Operating Income $29.0 $7.7 — $53.4 $0.8 ($36.3) $54.6 Depreciation, depletion & amortization 40.8 17.7 — 22.2 — 1.0 81.7 Non-cash cost of land and real estate development costs recovered upon sale — — — 6.7 — — 6.7 Gain on sale of portion of New Zealand JV interest — — — — — (12.4) (12.4) Adjusted EBITDA $69.8 $25.4 — $82.3 $0.8 ($47.7) $130.6 54