- RYN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Rayonier (RYN) DEF 14ADefinitive proxy

Filed: 3 Apr 24, 4:29pm

| ☐ | Preliminary Proxy Statement | ||||

| ☐ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14A-6(E)(2)) | ||||

| ☒ | Definitive Proxy Statement | ||||

| ☐ | Definitive Additional Materials | ||||

| ☐ | Soliciting Material Pursuant to §240.14a-12 | ||||

| ☒ | No fee required. | ||||

| ☐ | Fee paid previously with preliminary materials. | ||||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||

|  | |||||||

| Mark D. McHugh | Mark R. Bridwell | |||||||

| President and Chief Executive Officer | Senior Vice President, General Counsel and Corporate Secretary | |||||||

| Rayonier Inc. | Telephone (904) 357-9100 | |||||||

| 1 Rayonier Way | Fax (904) 357-9851 | |||||||

| Wildlight, Florida 32097 | ||||||||

| DATE AND TIME |  | PLACE |  | RECORD DATE | ||||||||||||||||||||||||

| Thursday, May 16, 2024 4:00 p.m. (Eastern Time) | 1 Rayonier Way Wildlight, Florida 32097 | March 15, 2024 Shareholders of record at the close of business on March 15, 2024 are entitled to vote | |||||||||||||||||||||||||||

|  |  |  |  |  | ||||||||||||||||||

| HOW TO VOTE | INTERNET | TELEPHONE | MOBILE DEVICE | AT THE MEETING | |||||||||||||||||||

Stockholder of Record (Registered Holders) | Go to www.proxyvote.com 24/7 | Call 1-800-690-6903 (toll-free) | Scan the QR code  | If you received a printed copy of annual meeting materials, complete, sign, date and mail your proxy card in the postage-paid envelope | Attend the annual meeting and cast your ballot | ||||||||||||||||||

Beneficial Owners (Holders in Street Name) | Follow the instructions provided by your broker, bank or other nominee | Return a properly executed voting instruction form by mail, depending upon the methods your broker, bank or other nominee makes available | To attend the annual meeting, you will need proof of ownership and a legal proxy from your broker, bank or other nominee | ||||||||||||||||||||

| Deadline | 11:59 p.m. Eastern Time on May 15, 2024, if you are a registered holder, and 11:59 p.m. Eastern Time on May 13, 2024 if you hold shares in the Rayonier Investment and Savings Plan for Salaried Employees | If you are a beneficial owner, please refer to the information provided by your broker, bank or other nominee | |||||||||||||||||||||

| 98 | 2.7M | $2.3B | 2nd | ~440 | ||||||||||||||||||||||||||||||

| years in business | acres | acquisitions since 2014 | largest timber REIT | employees | |||||||||||||||||||||||||||||||

Rayonier Inc. is a leading timberland real estate investment trust (REIT) that currently owns, leases or manages approximately 2.7 million acres located in some of the strongest timber markets and most productive softwood timber growing regions throughout the United States and New Zealand. Rayonier was founded in 1926 in Shelton, Washington and today is headquartered in Wildlight, Florida. In addition to our timber operations, we have an established track record of identifying and selling rural and recreational HBU properties across our portfolio at significant premiums to timberland values, and we have further built differentiated in-house real estate development capabilities to pursue land-use entitlements and selective investments in infrastructure to unlock value in high-potential areas. Our portfolio is also well-positioned to provide land-based solutions to support the transition to a low-carbon economy, including solar leases, carbon capture and storage leases, and carbon market opportunities. | |||||||||||||||||||||||||||||||||||

| 2024 Proxy Statement | 1 | |||||||

|  |  | ||||||||||||

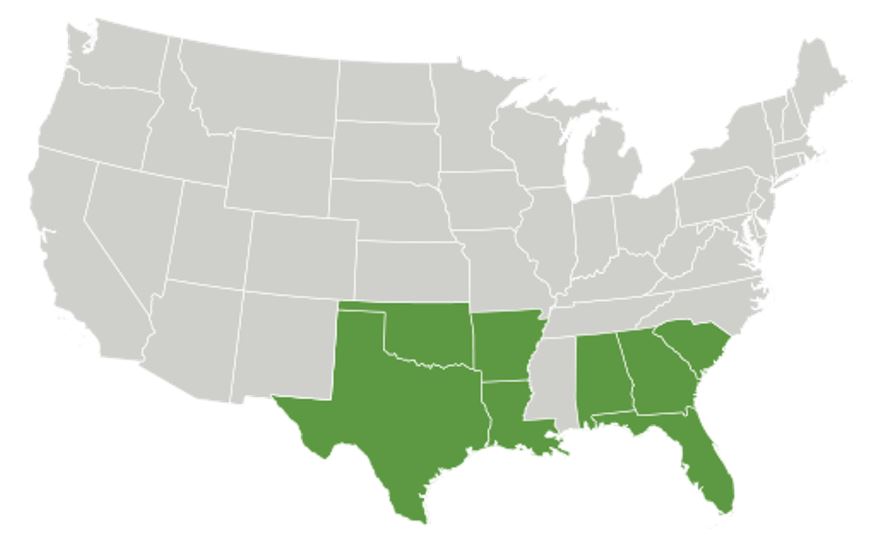

| U.S. SOUTH | U.S. PACIFIC NORTHWEST | NEW ZEALAND | ||||||||||||

•1.85 Million Acres •6.8-7.2 Million Tons Sustainable Yield •67% Planted/Plantable | •418 Thousand Acres •1.25-1.45 Million Tons Sustainable Yield •74% Planted/Plantable | •421 Thousand Acres •2.4-2.7 Million Tons Sustainable Yield •71% Planted/Plantable | ||||||||||||

$173.5M Net Income Attributable to Rayonier | $1.17 EPS | $178.5M Net Income | $298.4M Cash Provided by Operating Activities | |||||||||||||||||

$53.5M* Pro Forma Net Income | $0.36* Pro Forma EPS | $296.5M* Adjusted EBITDA | $163.9M* CAD | |||||||||||||||||

| 2 | Rayonier Inc. | |||||||

| OWN HIGH-QUALITY TIMBERLANDS, MANAGED WITH A LONG-TERM MINDSET | •Manage our timberlands to maximize net present value over the long-term •Properly balance biological growth, harvest cash flow and responsible stewardship | ||||

| ACTIVE PORTFOLIO MANAGEMENT | •Conduct intensive analysis and due diligence to evaluate risks and upside potential •Continually upgrade our portfolio through selective acquisitions and dispositions | ||||

| OPTIMIZE PORTFOLIO VALUE THROUGH DIFFERENTIATED REAL ESTATE PLATFORM | •Identify and monetize lands where premium valuations can be achieved •Selectively pursue entitlements and improvements to enhance long-term value | ||||

| UNLOCK ASSET POTENTIAL THROUGH LAND-BASED SOLUTIONS | •Provide innovative solutions that support the transition to a low-carbon economy •Engage in lease agreements and other transactions that increase cash flow | ||||

| PURSUE NIMBLE APPROACH TO CAPITAL ALLOCATION | •Employ a flexible approach with a view towards building long-term value per share •Evaluate a range of capital allocation alternatives and opportunistically pivot priorities | ||||

| EMPLOY BEST-IN-CLASS STEWARDSHIP AND DISCLOSURE PRACTICES | •Maintain an ongoing commitment to responsible stewardship and sustainable forestry •Provide transparent disclosures and data regarding our long-term sustainability | ||||

| 2024 Proxy Statement | 3 | |||||||

| HOW WE ENGAGE | •In-person and telephonic meetings •Investor conferences •Our annual shareholder meeting •Periodic investor days and "teach-in" sessions | ||||

| ENGAGEMENT IN 2023 | •Participated in nine investor conferences/summits •Participated in numerous one-on-one investor calls and virtual meetings •Held our annual shareholder meeting •Hosted investor meetings with our Board Chair | ||||

| KEY TOPICS OF DISCUSSION | •Financial performance •Business strategy and capital allocation priorities •Governance matters, including leadership succession •Various ESG-related topics, including our Carbon and Sustainability Reports | ||||

| Shareholder Interests | ü | Annual election of directors | ü | Majority voting of all directors | ü | Single class of voting shares | ||||||||||||||

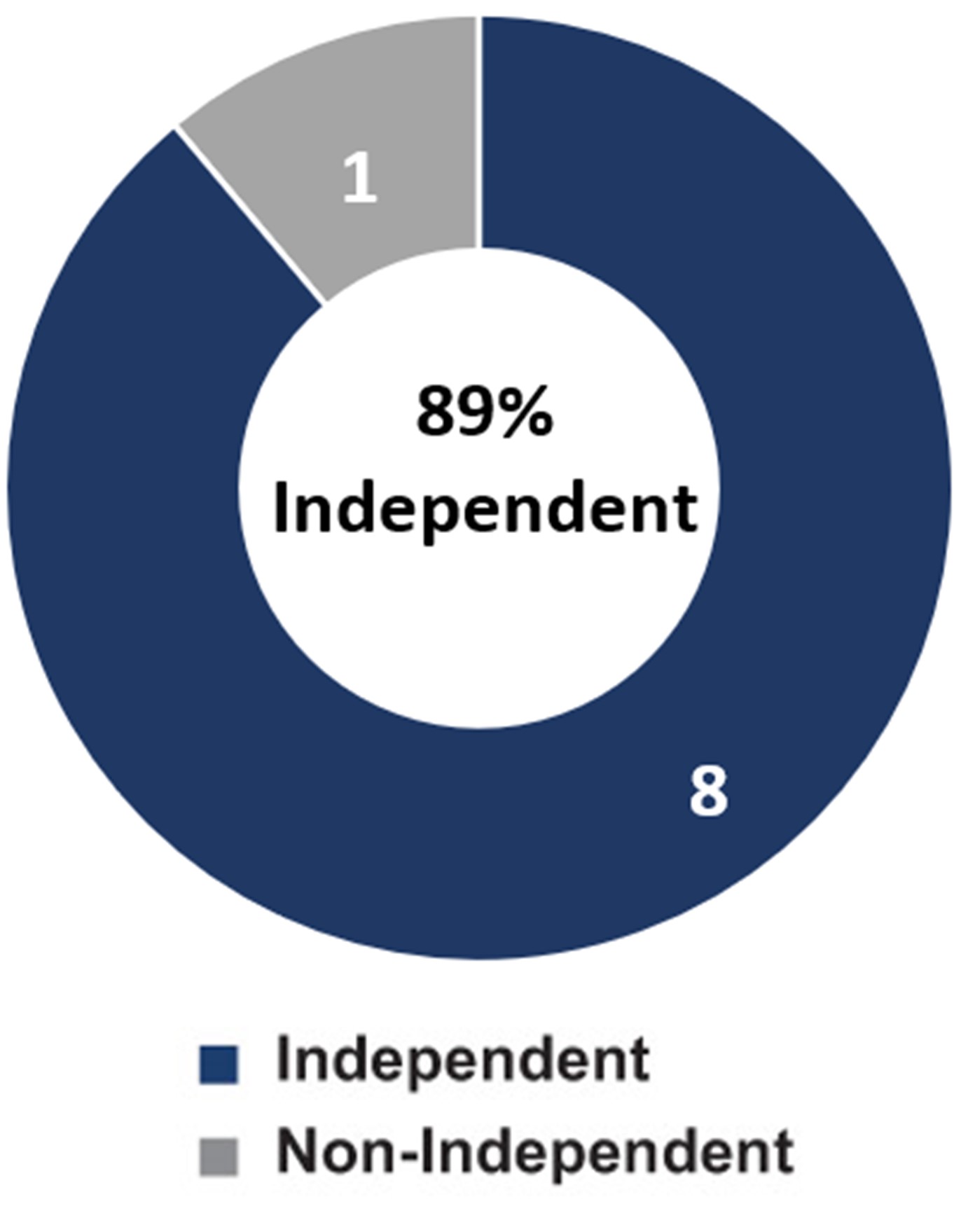

| ü | 8 of 9 director nominees are independent | ü | All members of Board committees (AC, CC and NC) are independent | ü | Stock ownership requirements for directors and executives | |||||||||||||||

| Board Effectiveness & Leadership | ü | Annual review of Board skills, characteristics and experience | ü | Annual Board member independence evaluations | ü | Annual Board self-assessment to ensure effectiveness | ||||||||||||||

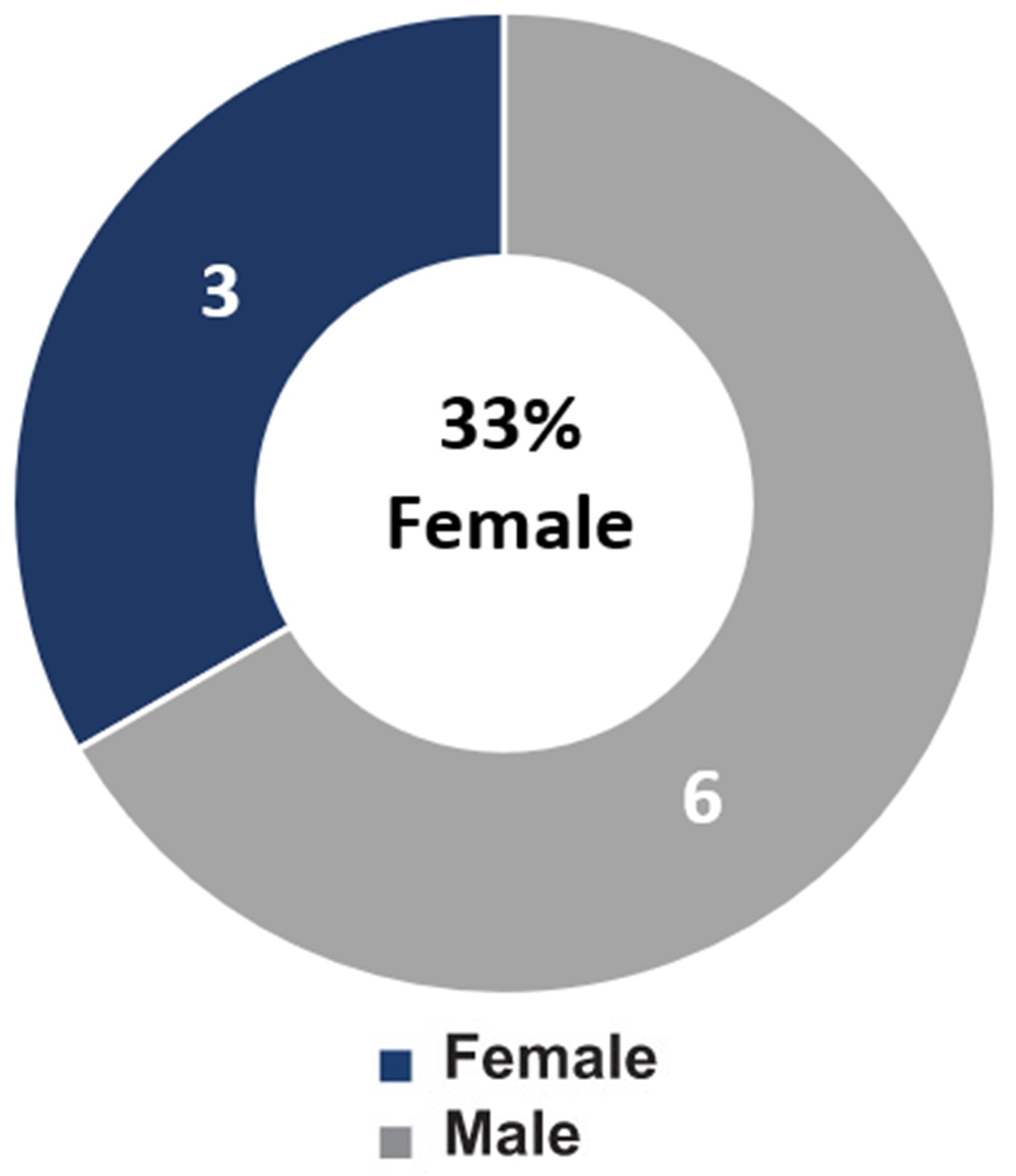

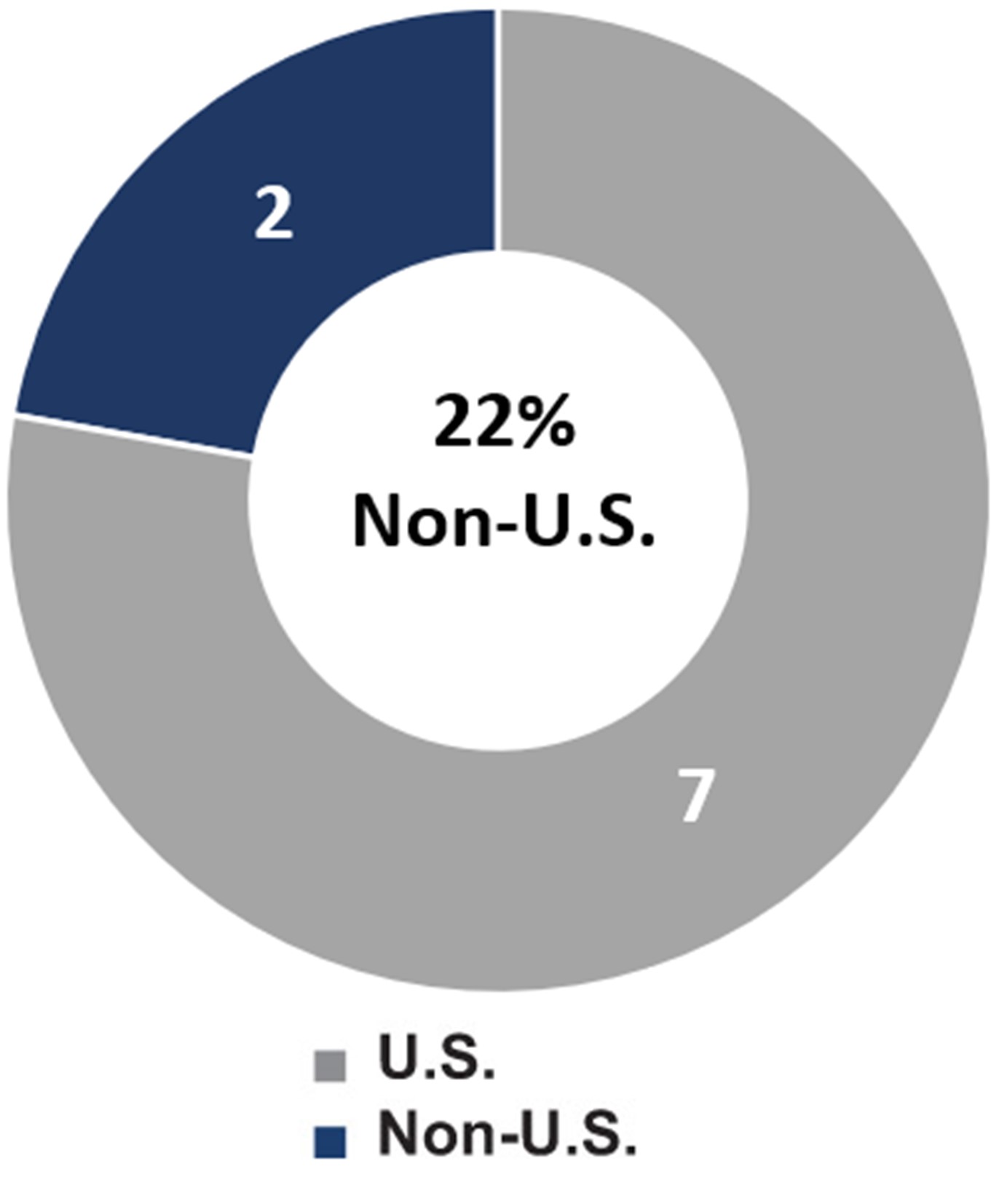

| ü | Gender, racial and national origin diversity reflected in Board composition | ü | Separation of Board chairman and CEO | ü | All directors attended more than 75% of meetings in 2023 | |||||||||||||||

| ü | Regular executive sessions of independent directors and committees | ü | Comprehensive Code of Conduct and Corporate Governance Guidelines | ü | Board oversight of ESG and commitment to corporate social responsibility | |||||||||||||||

| Compensation Policies | ü | Pay-for-performance philosophy with focus on long-term value creation | ü | Compensation “clawback” policy | ü | Policy prohibiting hedging or pledging of shares by executives or directors | ||||||||||||||

| ü | Regular engagement with independent compensation consultant | ü | Majority of Board compensation consists of stock | ü | Performance share awards capped if TSR is negative | |||||||||||||||

| 4 | Rayonier Inc. | |||||||

| Our Board of Directors (“Board”) recommends that you vote “FOR” each of the director nominees. | ||||

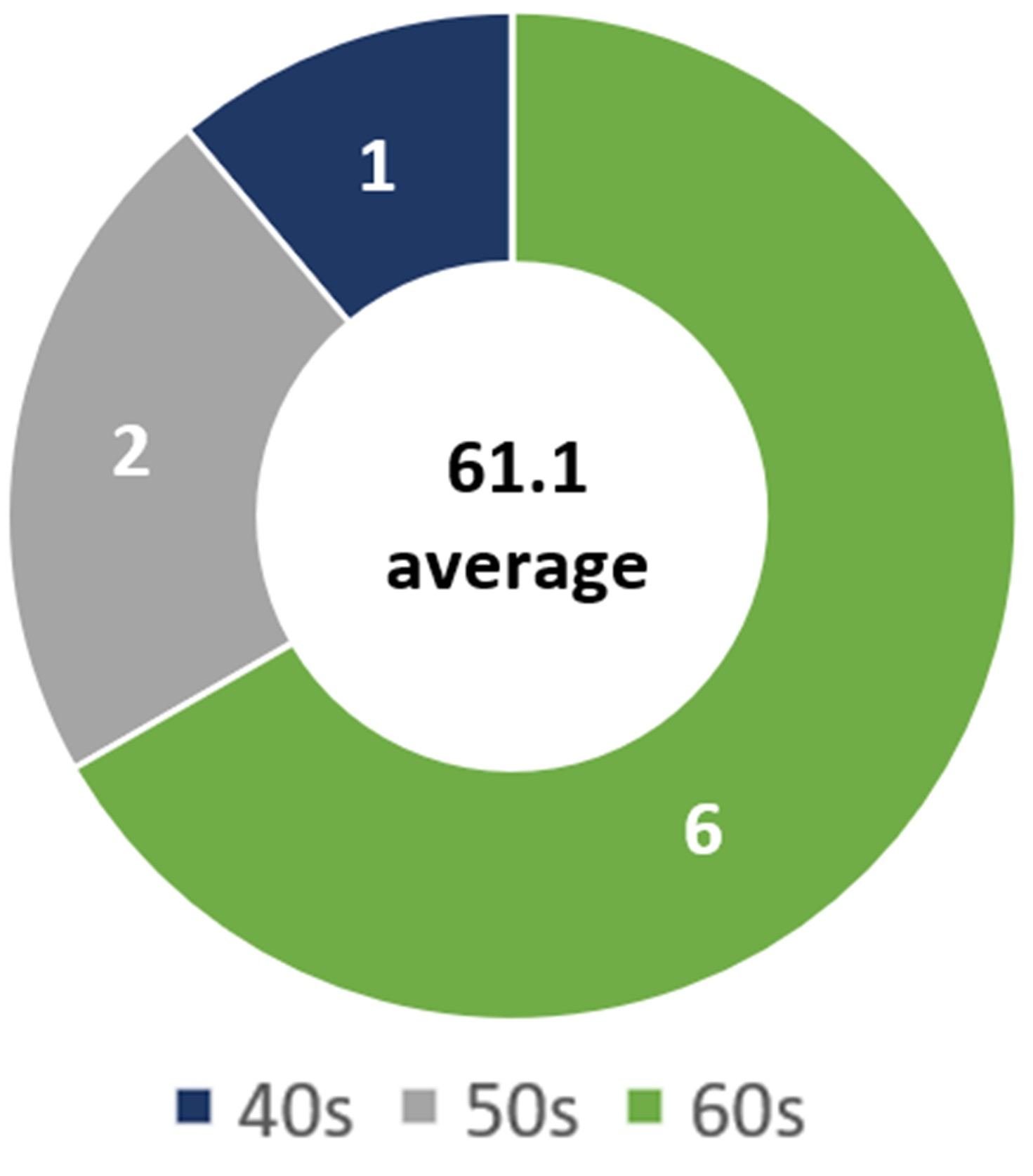

| NAME AND PRINCIPAL OCCUPATION | AGE | DIRECTOR SINCE | INDEPENDENT | OTHER PUBLIC COMPANY BOARDS | COMMITTEE MEMBERSHIP | |||||||||||||||||||||

| AUDIT | COMPENSATION & MANAGEMENT DEVELOPMENT | NOMINATING & CORPORATE GOVERNANCE | ||||||||||||||||||||||||

| Scott R. Jones Retired President, Forest Capital Partners | 65 | 2014;  since 20241 |  | — |  |  | |||||||||||||||||||

| Keith E. Bass CEO, Mattamy Homes US; Managing Partner, Mill Creek Capital LLC | 59 | 2017 |  | 1 |  | ||||||||||||||||||||

| Gregg A. Gonsalves Advisory Partner, Integrated Capital LLC | 56 | 2022 |  | 1 |   |  | |||||||||||||||||||

| V. Larkin Martin Managing Partner, Martin Farm; Vice President, The Albemarle Corporation | 60 | 2007 |  | 1 |  |  | |||||||||||||||||||

| Mark D. McHugh President and CEO, Rayonier Inc. | 48 | 2024 | — | ||||||||||||||||||||||

| Meridee A. Moore Senior Managing Member and Chief Investment Officer, Watershed Asset Management, LLC | 66 | 2021 |  | — |   |  | |||||||||||||||||||

| Ann C. Nelson Retired Lead Audit Partner, KPMG LLP | 64 | 2020 |  | 1 |   |  | |||||||||||||||||||

| Matthew J. Rivers Part-time Forestry Advisor, Drax Group | 66 | 2021 |  | — |  |  | |||||||||||||||||||

| Andrew G. Wiltshire Founding Partner, Folium Capital LLC; Principal in the management and governance of a private orchard, farming, and forestry company located in New Zealand | 66 | 2015 |  | — |  |  | |||||||||||||||||||

| MEETINGS IN 2023 | BOARD—12 | 9 | 5 | 4 | ||||||||||||||||||||||

| Committee Chair |  | Committee Member |  | Chairman of the Board of Directors |  | Audit Committee financial expert | ||||||||||||||||

| 2024 Proxy Statement | 5 | |||||||

|  |  |  |  | ||||||||||||||||||||||||||||||||||

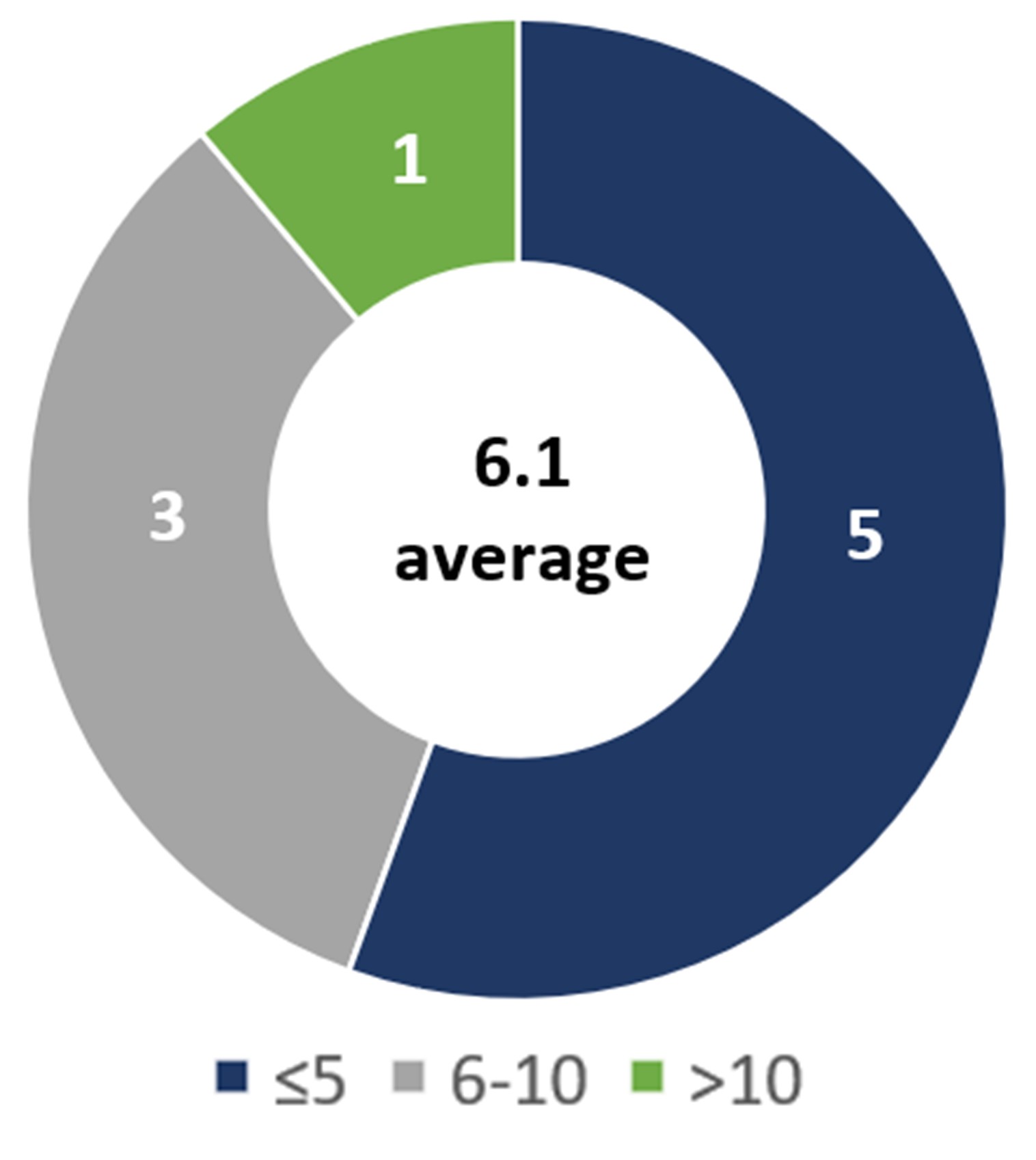

| INDEPENDENCE | GENDER DIVERSITY | NATIONAL ORIGIN | AGE | TENURE | ||||||||||||||||||||||||||||||||||

|  |  |  |  | ||||||||||||||||||||||||||||||||||

|  |  |  |  |  |  |  |  | ||||||||||||||||||||||||

| DIRECTOR SKILLS AND EXPERIENCE | JONES | BASS | GONSALVES | MARTIN | MCHUGH | MOORE | NELSON | RIVERS | WILTSHIRE | # | ||||||||||||||||||||||

| Current or Former Outside Public Company CEO |  | 1 | ||||||||||||||||||||||||||||||

| Outside Public Company Board |  |  |  |  |  | 5 | ||||||||||||||||||||||||||

| Audit Committee Financial Expert |  |  |  | 3 | ||||||||||||||||||||||||||||

| Corporate Finance |  |  |  |  | 4 | |||||||||||||||||||||||||||

| REIT |  |  |  |  |  | 5 | ||||||||||||||||||||||||||

| Timber / Forestry Industry |  |  |  |  |  |  | 6 | |||||||||||||||||||||||||

| Land Based Solutions |  |  |  |  |  |  | 6 | |||||||||||||||||||||||||

| Real Estate Development |  |  |  |  |  | 5 | ||||||||||||||||||||||||||

| Environmental Policy and/or Compliance |  |  |  |  |  |  | 6 | |||||||||||||||||||||||||

| International |  |  | 2 | |||||||||||||||||||||||||||||

| Customer Supply Chain |  |  | 2 | |||||||||||||||||||||||||||||

| Racial, Gender, and National Origin Diversity |  |  |  |  |  |  | 6 | |||||||||||||||||||||||||

| IDENTITY / DEMOGRAPHICS | ||||||||||||||||||||||||||||||||

| Gender | Male | Male | Male | Female | Male | Female | Female | Male | Male | |||||||||||||||||||||||

| Race/Ethnicity | White | White | Black | White | White | White | White | White | White | |||||||||||||||||||||||

| Nationality | U.S. | U.S. | U.S. | U.S. | U.S. | U.S. | U.S. | U.K. | New Zealand | |||||||||||||||||||||||

| 6 | Rayonier Inc. | |||||||

| Our Board recommends that you vote “FOR” the non-binding advisory approval of the compensation of our named executive officers. | ||||

| Our Board recommends that you vote “FOR” the ratification of Ernst & Young, LLP to serve as our independent registered public accounting firm for 2024. | ||||

| 2024 Proxy Statement | 7 | |||||||

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE FOLLOWING NOMINEES. | ||

| 8 | Rayonier Inc. | |||||||

| Scott R. Jones Needham, Massachusetts Age: 65 Director Since: 2014 | Board Committees: | Other public directorships: | ||||||||||||||||||||

| • | Chair of the Board3 | • | None | ||||||||||||||||||||

| • | Compensation | ||||||||||||||||||||||

| • | Nominating | ||||||||||||||||||||||

| Professional Highlights: | |||||||||||||||||||||||

| President of Forest Capital Partners, a forest investment firm, from 2000 to 2018; President and Chief Executive Officer of Timberland Growth Corporation, a timberland REIT joint venture, from 1998 to 2000 | |||||||||||||||||||||||

Mr. Jones has substantial expertise in forest management, technology and innovations, as well as forest and real estate investments. He is particularly well-suited to help the Board with investment decisions and to oversee the management of the Company’s forest resources and real estate businesses. | |||||||||||||||||||||||

| Keith E. Bass Tampa, Florida Age: 59 Director Since: 2017 | Board Committees: | Other public directorships: | ||||||||||||||||||||

| • | Chair of Compensation | • | Xenia Hotels and Resorts | ||||||||||||||||||||

| Professional Highlights: | |||||||||||||||||||||||

| CEO of Mattamy Homes US since 2020 and Managing Partner of Mill Creek Capital LLC, a private equity and consulting firm, since 2017; President and CEO of WCI Communities, Inc., from 2012 to 2017; President of Pinnacle Land Advisors from 2011 to 2012; held various key positions with The Ryland Group from 2003 to 2011 | |||||||||||||||||||||||

Mr. Bass has extensive expertise in the real estate industry. He has led organizations with more than $2 billion in annual revenue, built lean operations and created long-term operational roadmaps to position companies to thrive in any market climate. Mr. Bass brings a broad real estate perspective to the Board’s evaluation of investment opportunities. | |||||||||||||||||||||||

| Gregg A. Gonsalves Davie, Florida Age: 56 Director Since: 2022 | Board Committees: | Other public directorships: | ||||||||||||||||||||

| • | Audit | • | RREEF Property Trust, Inc. | ||||||||||||||||||||

| • | Compensation | ||||||||||||||||||||||

| Professional Highlights: | |||||||||||||||||||||||

| Advisory Partner at Integrated Capital, LLC, a leading, hotel-focused, private real estate advisory and investment firm, since 2013; Goldman, Sachs & Co. from 1993-2011, most recently as the Partner responsible for Goldman’s Real Estate Mergers & Acquisitions Business | |||||||||||||||||||||||

Mr. Gonsalves brings substantial experience and expertise in capital markets and mergers and acquisitions across a variety of industries, with particular expertise in the REIT sector. | |||||||||||||||||||||||

| 2024 Proxy Statement | 9 | |||||||

| V. Larkin Martin Courtland, Alabama Age: 60 Director Since: 2007 | Board Committees: | Other public directorships: | ||||||||||||||||||||

| • | Compensation | • | Truxton Trust | ||||||||||||||||||||

| • | Nominating | ||||||||||||||||||||||

| Professional Highlights: | |||||||||||||||||||||||

| Managing Partner of Martin Farm and Vice President of The Albemarle Corporation, family businesses with interests in agriculture and timberland, since 1990; Chair of the Board of Directors of the Federal Reserve Bank of Atlanta from 2007 to 2008 | |||||||||||||||||||||||

Ms. Martin has direct operating experience in the land-based businesses of agriculture and timberland management, particularly in the southeastern United States, together with an understanding of national and regional financial markets. Ms. Martin’s skill set adds substantial value to Board discussions regarding our forest resources business, as well as overall economic forces and trends impacting the Company. | |||||||||||||||||||||||

| Mark D. McHugh Tampa, Florida Age: 48 Director Since: 2024 | Board Committees: | Other public directorships: | |||||||||||||||||

| • | None | • | None | |||||||||||||||||

| Professional Highlights: | ||||||||||||||||||||

| President, Chief Executive Officer and Director of the Company since 2024; President and Chief Financial Officer of the Company from 2023 to 2024; Senior Vice President and Chief Financial Officer of the Company from 2014 to 2023 | ||||||||||||||||||||

Mr. McHugh has over 20 years of experience in finance and capital markets, focused primarily on the forest products and REIT sectors. He joined Rayonier from Raymond James, where he served as Managing Director in the Real Estate Investment Banking group, responsible for the firm's timberland and agriculture sector coverage. Prior to Raymond James, he worked in the Investment Banking division of Credit Suisse, focused on the paper and forest products sectors. | ||||||||||||||||||||

| Meridee A. Moore San Francisco, California Age: 66 Director Since: 2021 | Board Committees: | Other public directorships: | ||||||||||||||||||||

| • | Chair of | • | None | ||||||||||||||||||||

| Nominating | |||||||||||||||||||||||

| • | Audit | ||||||||||||||||||||||

| Professional Highlights: | |||||||||||||||||||||||

Founder, Senior Managing Member and Chief Investment Officer of Watershed Asset Management, LLC, since 2002; Partner and Portfolio Manager of Farallon Capital Management, L.L.C. from 1992 to 2002; held various positions in the Investment Banking Division of Lehman Brothers from 1985 to 1991 | |||||||||||||||||||||||

Ms. Moore has more than 25 years of principal investing experience in public and private equity and debt, real estate and other complex assets and financings. She has served on several public company boards in the real estate, finance and utilities industries. Ms. Moore has also served on or chaired public company audit, compensation and nominating and governance committees. | |||||||||||||||||||||||

| 10 | Rayonier Inc. | |||||||

| Ann C. Nelson Boise, Idaho Age: 64 Director Since: 2020 | Board Committees: | Other public directorships: | ||||||||||||||||||||

| • | Chair of Audit | • | Clearwater Paper Corporation | ||||||||||||||||||||

| • | Compensation | ||||||||||||||||||||||

| Professional Highlights: | |||||||||||||||||||||||

| More than 35 years of senior leadership and management experience (25 as an audit partner); Lead Audit Partner with KPMG LLP on many global publicly traded companies, including Weyerhaeuser Company, Plum Creek Timber Company, Inc. and Potlatch Corporation | |||||||||||||||||||||||

Ms. Nelson brings expertise to the Board in areas of auditing, accounting and financial reporting, internal controls and corporate governance. In addition, she has board experience by way of the Boise Chamber of Commerce (Chairman of the Board and past Treasurer/Audit Committee chair over an eight-year period). Ms. Nelson also has significant experience in the forest products industry, including but not limited to timber REITs. | |||||||||||||||||||||||

| Matthew J. Rivers Bembridge, Isle of Wright, UK Age: 66 Director Since: 2021 | Board Committees: | Other public directorships: | ||||||||||||||||||||

| • | Audit | • | None | ||||||||||||||||||||

| • | Nominating | ||||||||||||||||||||||

| Professional Highlights: | |||||||||||||||||||||||

| Part-time Forestry Advisor at Drax Group since 2022; part-time Director of Alternative Fuel Origination from 2020 to 2022; Group Special Advisor, from 2017 to 2020; held various positions, including Director of Fuel Procurement and Director Corporate Affairs with Drax plc, from 2011 to 2017; Executive Chairman of the upstream supply business in the USA, Drax Biomass International, from 2011 to 2016 | |||||||||||||||||||||||

Mr. Rivers brings international experience in forest management, timber markets, biomass supply chain development, energy and forest related sustainability, public affairs and communications. | |||||||||||||||||||||||

| Andrew G. Wiltshire Blenheim, New Zealand Age: 66 Director Since: 2015 | Board Committees: | Other public directorships: | ||||||||||||||||||||

| • | Audit | • | None | ||||||||||||||||||||

| • | Nominating | ||||||||||||||||||||||

| Professional Highlights: | |||||||||||||||||||||||

| Founding Partner of Folium Capital LLC since 2016; management and governance of a private orchard, farming and forestry company with operations in New Zealand; Managing Director and Head of Alternative Assets at the Harvard Management Company, the investment company that is responsible for managing Harvard University’s endowment and related financial assets, from 2001 to 2015 | |||||||||||||||||||||||

Mr. Wiltshire has extensive expertise in the areas of managing and investing in forestry, timberlands, real estate and natural resources. Mr. Wiltshire brings a valuable perspective to the Board’s evaluation of investment opportunities and oversight of the Company’s forest resources and real estate businesses. | |||||||||||||||||||||||

| 2024 Proxy Statement | 11 | |||||||

| • | annual cash retainer of $65,000, payable in equal quarterly installments; | ||||

| • | annual cash retainers to members of the Audit, Compensation and Nominating Committees of $13,500, $7,500 and $5,000, respectively, payable in equal quarterly installments; | ||||

| • | annual cash retainers for the chairs of the Audit, Compensation and Nominating Committees of $18,000, $12,000 and $10,000, respectively, payable in equal quarterly installments; | ||||

| • | an additional annual cash retainer for the Chair of the Board of $75,000, payable in equal quarterly installments; and | ||||

| • | restricted stock award equivalent to $116,000 based on grant date value, vesting upon issuance and to be held until the earlier of four years from the date of issuance or a director’s departure from the Board. | ||||

| 12 | Rayonier Inc. | |||||||

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($) (1) | All Other Compensation ($) | Total ($) | ||||||||||||||||||||||||||||

| Bass, Keith E. | 84,500.00 | (2) | 116,013.87 | — | 200,513.87 | |||||||||||||||||||||||||||

| Fraser, Dod A. | 161,000.00 | (2) | 116,013.87 | — | 277,013.87 | |||||||||||||||||||||||||||

| Gonsalves, Gregg A. | 75,102.74 | 172,020.71 | — | 247,123.45 | ||||||||||||||||||||||||||||

| Jones, Scott R. | 77,500.00 | 116,013.87 | — | 193,513.87 | ||||||||||||||||||||||||||||

| Martin, V. Larkin | 77,500.00 | 116,013.87 | — | 193,513.87 | ||||||||||||||||||||||||||||

| Moore, Meridee A. | 93,500.00 | (2) | 116,013.87 | — | 209,513.87 | |||||||||||||||||||||||||||

| Nelson, Ann C. | 104,000.00 | (2) | 116,013.87 | — | 220,013.87 | |||||||||||||||||||||||||||

Nunes, David L.(3) | — | — | — | — | ||||||||||||||||||||||||||||

| Rivers, Matthew J. | 83,500.00 | 116,013.87 | — | 199,513.87 | ||||||||||||||||||||||||||||

| Wiltshire, Andrew G. | 83,500.00 | 116,013.87 | — | 199,513.87 | ||||||||||||||||||||||||||||

| (1) | Represents the aggregate grant date fair value computed in accordance with FASB ASC Topic 718. A discussion of the assumptions used in calculating these values may be found in Note 19 “Incentive Stock Plans” included in the notes to financial statements in our 2023 Annual Report on Form 10-K. Stock awards reflect the January 2023 award of 1,564 shares of restricted stock to Mr. Gonsalves and the May 2023 awards of 3,871 shares of restricted stock to each director vesting immediately upon issuance of the grant, and which shares shall be required to be held until the earlier of four years from the grant or the departure of a director from Rayonier. | ||||

| (2) | Includes $18,000.00 in Audit Chair fees for Ms. Nelson; $12,000.00 in Compensation Chair fees for Mr. Bass; $10,000.00 in Nominating and Corporate Governance Chair fees for Ms. Moore; and $75,000.00 in Non-Executive Chairman fees for Mr. Fraser. | ||||

| (3) | Mr. Nunes, as an executive officer of Rayonier, was not compensated for service as a director in 2023. See the Summary Compensation Table on page 34 for compensation information relating to Mr. Nunes during 2023. | ||||

| 2024 Proxy Statement | 13 | |||||||

| 14 | Rayonier Inc. | |||||||

Name of Committees and Members | Functions of the Committees | |||||||||||||

AUDIT: Ann C. Nelson, Chair Dod A. Fraser Gregg A. Gonsalves Meridee A. Moore Matthew J. Rivers Andrew G. Wiltshire No. of Meetings in 2023: 9 | This committee is responsible for overseeing our accounting and financial reporting policies and processes, disclosure controls and procedures, and internal controls over financial reporting, including: | |||||||||||||

| • | discussing audited annual financial statements and quarterly financial statements with the Company and the independent auditors, as well as making a recommendation to the Board regarding the inclusion of same in the annual Form 10-K; | | ||||||||||||

| • | reviewing with the independent auditors results of their annual audit of the Company’s financial statements and audit of internal control over financial reporting and the required communications under (i) Auditing Standards No. 1301 and (ii) Public Company Accounting Oversight Board rules regarding the independence of the independent auditors; | |||||||||||||

| • | reviewing with management and the independent auditors (i) all significant issues, deficiencies and material weaknesses in the design or operation of internal controls and (ii) any fraud, whether or not material, that involves management or other employees who have a significant role in the Company’s internal controls; | |||||||||||||

| • | reviewing with the independent auditors any audit problems or difficulties and the Company’s response; | |||||||||||||

| • | resolving any disagreements between management and the independent auditors regarding financial reporting; | |||||||||||||

| • | reviewing with management and the independent auditors (i) major issues regarding accounting principles and financial statement presentations, including any significant changes in the selection or application of accounting principles, (ii) all critical accounting policies and practices and all significant financial reporting issues and judgments made in connection with the preparation of the financial statements, (iii) alternative treatments within generally accepted accounting principles that have been discussed with management, ramifications of the use of alternative disclosures and treatments, and the treatment preferred by the independent auditors, (iv) the effect of regulatory and accounting initiatives, as well as any significant off-balance sheet structures on the Company’s financial statements, and (v) other material written communications between the independent auditors and management; and | |||||||||||||

| • | reviewing press releases, guidance, rating agency and investor presentations and other public disclosures of financial information, with particular attention to any use of “pro forma” or “adjusted” non-GAAP information. | |||||||||||||

COMPENSATION AND MANAGEMENT DEVELOPMENT: Keith E. Bass, Chair Dod A. Fraser Gregg A. Gonsalves Scott R. Jones V. Larkin Martin Ann C. Nelson No. of Meetings in 2023: 5 | This committee is responsible for overseeing the compensation and benefits of employees and directors, including: | |||||||||||||

| • | evaluating management performance, succession and development matters; | |||||||||||||

| • | establishing executive compensation; | |||||||||||||

| • | reviewing the Compensation Discussion and Analysis included in the annual proxy statement; | |||||||||||||

| • | approving individual compensation actions for all senior executives other than our CEO; | |||||||||||||

| • | recommending compensation actions regarding our CEO for approval by our non-management directors; and | |||||||||||||

| • | reviewing and recommending to the Board the compensation of our non-management directors. | |||||||||||||

NOMINATING AND CORPORATE GOVERNANCE: Meridee A. Moore, Chair Scott R. Jones V. Larkin Martin Matthew J. Rivers Andrew G. Wiltshire No. of Meetings in 2023: 4 | This committee is responsible for advising the Board with regard to board structure, composition and governance, including: | |||||||||||||

| • | establishing criteria for Board nominees and identifying qualified individuals for nomination to the Board; | |||||||||||||

| • | recommending the composition of Board committees; | |||||||||||||

| • | overseeing processes to evaluate Board and committee effectiveness; | |||||||||||||

| • | reviewing Environmental, Social and Governance ("ESG") risks significant to the Company and overseeing the responsibilities of the Board committees with respect to such risks; | |||||||||||||

| • | overseeing our corporate governance structure and practices, including our Corporate Governance Principles; | |||||||||||||

| • | reviewing and approving changes to the charters of the other Board committees; and | |||||||||||||

| • | reviewing, approving, and overseeing transactions between the Company and any related person. | |||||||||||||

| 2024 Proxy Statement | 15 | |||||||

| • | Serving as the leader of the Board and overseeing and coordinating the work of the Board and its committees; | ||||

| • | Serving as a liaison between the CEO, other members of senior management, the independent directors and the committee chairs; | ||||

| • | Being available to serve as an advisor to the CEO; | ||||

| • | Presiding at all meetings of the Board, including executive sessions of the independent directors; | ||||

| • | Setting meeting agendas for the Board; | ||||

| • | Approving meeting schedules to assure that there is sufficient time for discussion of all agenda items; | ||||

| • | Presiding at all meetings of the shareholders; | ||||

| • | Recommending to the Board agendas for shareholder meetings and providing leadership to the Board on positions the Board should take on issues to come before shareholder meetings; | ||||

| • | Participating in discussions with the Nominating Committee on matters related to Board and committee composition and with the Nominating Committee and the Compensation Committee on matters related to the hiring, evaluation, compensation and termination of, and succession planning for the CEO; and | ||||

| • | Being available for consultation and direct communication with major shareholders or external groups. | ||||

| 16 | Rayonier Inc. | |||||||

| COMMITTEES | PRIMARY AREAS OF RISK OVERSIGHT | ||||

| Audit Committee | The Audit Committee is responsible for risks associated with financial and accounting matters, specifically financial reporting, disclosure controls and procedures for environmental and sustainability initiatives, internal controls, disclosure, tax, legal and compliance risks. The Board has also given the Audit Committee primary responsibility for overseeing the Company’s ERM program and the ERM Committee. With this responsibility, the Audit Committee monitors the Company’s significant business risks, including financial, operational, privacy, cybersecurity, business continuity, legal, regulatory, and reputational exposures and reviews the steps management has taken to monitor and control these exposures. | ||||

| Compensation Committee | The Compensation Committee is responsible for risks related to compensation policies and practices, including incentive-related risks, and oversees risks associated with talent management and succession planning. The Compensation Committee also oversees an annual risk assessment of the Company’s compensation policies and practices that is prepared by the ERM Committee. | ||||

| Nominating Committee | The Nominating Committee is responsible for risks associated with corporate governance matters, related party transactions, Board effectiveness and organization, director independence and director succession planning. The Nominating Committee is also responsible for oversight of ESG risks significant to the Company, including climate related risks, as well as the responsibilities of the other Board committees with respect to such risks. | ||||

| ERM Committee | The ERM Committee is responsible for identifying and assessing the material risks facing the Company and providing periodic reports regarding such risks to the Audit Committee for review and evaluation of risk identification and mitigation strategies. The ERM Committee also completes an annual risk assessment with regard to the Company’s overall compensation policies and practices, which is reviewed by the Compensation Committee. | ||||

| 2024 Proxy Statement | 17 | |||||||

| 18 | Rayonier Inc. | |||||||

| 2024 Proxy Statement | 19 | |||||||

| 20 | Rayonier Inc. | |||||||

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE PROPOSAL TO APPROVE, ON A NON-BINDING ADVISORY BASIS, THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS AS DISCLOSED IN THIS PROXY STATEMENT. | ||

| Name | Title | ||||

| David L. Nunes | Chief Executive Officer (1) | ||||

| Mark D. McHugh | President and Chief Financial Officer (1) | ||||

| Douglas M. Long | Executive Vice President and Chief Resource Officer | ||||

| W. Rhett Rogers | Senior Vice President, Portfolio Management | ||||

| Mark R. Bridwell | Senior Vice President, General Counsel and Corporate Secretary | ||||

| (1) | The titles above are as of December 31, 2023. See "CEO and CFO Transitions" on page 23 for additional information regarding the transition and the related compensation arrangements effective April 1, 2024. | ||||

| 2024 Proxy Statement | 21 | |||||||

| CD&A TABLE OF CONTENTS | |||||

| 22 | Rayonier Inc. | |||||||

| WHAT WE DO | WHAT WE DON’T DO | ||||||||||

| ü | Pay for performance with focus on long-term value creation | O | No employment agreements | ||||||||

| O | No single-trigger change in control provisions for equity awards | ||||||||||

| ü | Maintain robust share ownership requirements | ||||||||||

| O | No excise tax gross-ups | ||||||||||

| ü | Maintain a comprehensive clawback policy | O | No hedging or pledging of Company stock | ||||||||

ü | Avoid compensation practices that encourage inappropriate risk | O | No excessive executive perquisites | ||||||||

| O | No repricing of underwater options | ||||||||||

| ü | Engage an independent compensation consultant and conduct an annual compensation review | ||||||||||

| ü | Maintain an independent Compensation Committee | ||||||||||

| ü | Cap performance share awards payable if total shareholder return for the period is negative | ||||||||||

| 2024 Proxy Statement | 23 | |||||||

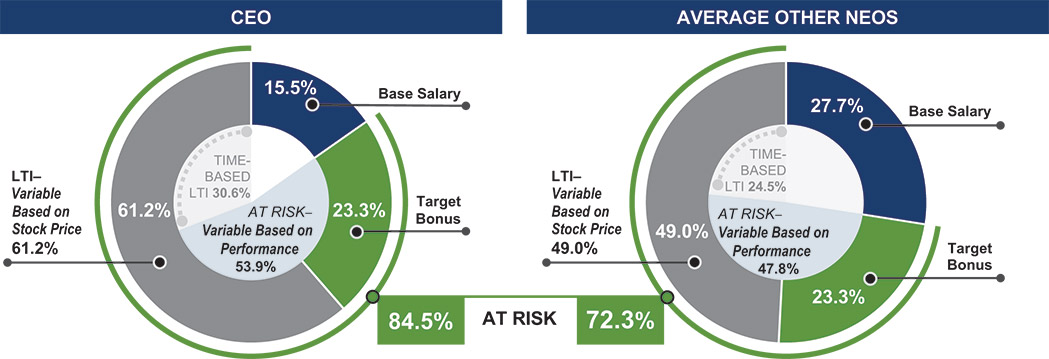

| TYPE | COMPONENT | DESCRIPTION | PURPOSE | |||||||||||

◄ FIXED ► | Current Year Performance | BASE SALARY | •Fixed cash compensation that recognizes level of responsibilities, experience, expertise and individual performance •Evaluated against external market data annually | •Helps attract and retain talented executives | ||||||||||

◄ VARIABLE ► | ANNUAL BONUS PROGRAM | •“At risk” performance-based cash compensation | •Rewards achievement of key annual financial metrics and strategic initiatives •ESG-related initiatives are incorporated into the strategic objective component of our program | |||||||||||

| Long-Term Incentive | PERFORMANCE SHARES (50%) | •“At risk” equity-based stock compensation | •Encourages and rewards long-term performance •Aligns management interests with those of our investors •Promotes an ownership mentality that fosters the long-term perspective necessary for sustained success •Promotes retention with multi-year vesting schedules | |||||||||||

| TIME-BASED RESTRICTED STOCK UNITS (50%) | •Ultimate value of these awards depends upon our performance in delivering value to shareholders both in absolute terms through restricted stock units and relative to our peers through performance shares | |||||||||||||

| 24 | Rayonier Inc. | |||||||

| Named Executive Officer | Base Salary (Effective 4/1/23) | ||||

| David Nunes | $900,000 | ||||

| Mark McHugh | $570,000 | ||||

| Doug Long | $475,000 | ||||

| Rhett Rogers | $425,000 | ||||

| Mark Bridwell | $425,000 | ||||

| Threshold | Target | Maximum | |||||||||

| Adjusted EBITDA Performance (70%) | |||||||||||

| Percentage of Budgeted Adjusted EBITDA Achieved | 80% of Budget | Budget | 110% of Budget | ||||||||

| Bonus Pool Funding Level | 35% of Target Awards | 70% of Target Awards | 105% of Target Awards | ||||||||

| Strategic Objectives / Quality of Earnings Assessment (30%) | |||||||||||

| Bonus Pool Funding Level | 0% of Target Awards | 30% of Target Awards | 45% of Target Awards | ||||||||

| Total | 35% of Target Awards | 100% of Target Awards | 150% of Target Awards | ||||||||

| 2024 Proxy Statement | 25 | |||||||

| 26 | Rayonier Inc. | |||||||

| Named Executive Officer | 2023 Performance Shares Target Value (1) | 2023 Restricted Stock Units Target Value (1) | Total Long-Term Incentive Target Value | ||||||||

| David Nunes | $1,775,000 | $1,775,000 | $3,550,000 | ||||||||

| Mark McHugh | $650,000 | $650,000 | $1,300,000 | ||||||||

| Doug Long | $425,000 | $425,000 | $850,000 | ||||||||

| Rhett Rogers | $325,000 | $325,000 | $650,000 | ||||||||

| Mark Bridwell | $275,000 | $275,000 | $550,000 | ||||||||

| 2024 Proxy Statement | 27 | |||||||

| Percentile Rank | Payout Level (Expressed As Percent of Target Award Shares) | ||||

75th and Above | 175% | ||||

51st – 74th | 100% (plus 3% for each incremental percentile position over the 50th Percentile) | ||||

50th | 100% | ||||

26th – 49th | 50% (plus 2% for each incremental percentile position over the 25th Percentile) | ||||

25th | 50% | ||||

Below 25th | 0% | ||||

| 28 | Rayonier Inc. | |||||||

| Performance Share Peer Group | |||||||||||

| PotlatchDeltic Corporation (5x) | Weyerhaeuser (5x) | ||||||||||

| Acadia Realty Trust | Diversified Healthcare Trust | Iron Mountain Incorporated | RPT Realty | ||||||||

| Agree Realty Corporation | Douglas Emmett, Inc. | JBG SMITH Properties | Ryman Hospitality Properties, Inc. | ||||||||

| Alexander & Baldwin, Inc. | Easterly Government Properties, Inc. | Kilroy Realty Corporation | Sabra Health Care REIT, Inc. | ||||||||

| Alexander's, Inc. | EastGroup Properties, Inc. | Kimco Realty Corporation | Safehold Inc. | ||||||||

| Alexandria Real Estate Equities, Inc. | Elme Communities | Kite Realty Group Trust | Saul Centers, Inc. | ||||||||

| Alpine Income Property Trust, Inc. | Empire State Realty Trust, Inc. | Lamar Advertising Company | SBA Communications Corporation | ||||||||

| American Assets Trust, Inc. | EPR Properties | Life Storage, Inc. | Service Properties Trust | ||||||||

| American Homes 4 Rent | Equinix, Inc. | LTC Properties, Inc. | Simon Property Group, Inc. | ||||||||

| American Tower Corporation | Equity LifeStyle Properties, Inc. | LXP Industrial Trust | SITE Centers Corp. | ||||||||

| Americold Realty Trust, Inc. | Equity Residential | Medical Properties Trust, Inc. | SL Green Realty Corp. | ||||||||

| Apartment Income REIT Corp. | Essential Properties Realty Trust, Inc. | Mid-America Apartment Communities, Inc. | Spirit Realty Capital, Inc. | ||||||||

| Apartment Investment and Management Co. | Essex Property Trust, Inc. | National Health Investors, Inc. | STAG Industrial, Inc. | ||||||||

| Apple Hospitality REIT, Inc. | Extra Space Storage Inc. | National Retail Properties, Inc. | Summit Hotel Properties, Inc. | ||||||||

| Armada Hoffler Properties, Inc. | Farmland Partners Inc. | National Storage Affiliates Trust | Sun Communities, Inc. | ||||||||

| Ashford Hospitality Trust, Inc. | Federal Realty Investment Trust | NETSTREIT Corp. | Sunstone Hotel Investors, Inc. | ||||||||

| AvalonBay Communities, Inc. | First Industrial Realty Trust, Inc. | NexPoint Residential Trust, Inc. | Tanger Factory Outlet Centers, Inc. | ||||||||

| Boston Properties, Inc. | Four Corners Property Trust, Inc. | Office Properties Income Trust | Terreno Realty Corporation | ||||||||

| Braemar Hotels & Resorts Inc. | Franklin Street Properties Corp. | Omega Healthcare Investors, Inc. | The Macerich Company | ||||||||

| Brandywine Realty Trust | Gaming and Leisure Properties, Inc. | One Liberty Properties, Inc. | The Necessity Retail REIT, Inc. | ||||||||

| Brixmor Property Group Inc. | Getty Realty Corp. | Orion Office REIT Inc. | UDR, Inc. | ||||||||

| Broadstone Net Lease, Inc. | Gladstone Commercial Corporation | Outfront Media Inc. | UMH Properties, Inc. | ||||||||

| BRT Apartments Corp. | Gladstone Land Corporation | Paramount Group, Inc. | Uniti Group Inc. | ||||||||

| Camden Property Trust | Global Medical REIT Inc. | Park Hotels & Resorts Inc. | Universal Health Realty Income Trust | ||||||||

| CareTrust REIT, Inc. | Global Net Lease, Inc. | Pebblebrook Hotel Trust | Urban Edge Properties | ||||||||

| CBL & Associates Properties, Inc. | Healthcare Realty Trust Incorporated | Phillips Edison & Company, Inc. | Urstadt Biddle Properties Inc. | ||||||||

| Centerspace | Healthpeak Properties, Inc. | Physicians Realty Trust | Ventas, Inc. | ||||||||

| Chatham Lodging Trust | Hersha Hospitality Trust | Piedmont Office Realty Trust, Inc. | Veris Residential, Inc. | ||||||||

| City Office REIT, Inc. | Highwoods Properties, Inc. | Plymouth Industrial REIT, Inc. | VICI Properties Inc. | ||||||||

| Community Healthcare Trust Inc. | Host Hotels & Resorts, Inc. | Postal Realty Trust, Inc. | Vornado Realty Trust | ||||||||

| Corporate Office Properties Trust | Hudson Pacific Properties, Inc. | Prologis, Inc. | W. P. Carey Inc. | ||||||||

| Cousins Properties Incorporated | Independence Realty Trust, Inc. | Public Storage | Welltower Inc. | ||||||||

| Crown Castle Inc. | INDUS Realty Trust, Inc. | Realty Income Corporation | Whitestone REIT | ||||||||

| CTO Realty Growth, Inc. | Industrial Logistics Properties Trust | Regency Centers Corporation | Xenia Hotels & Resorts, Inc. | ||||||||

| CubeSmart | Innovative Industrial Properties, Inc. | Retail Opportunity Investments Corp. | |||||||||

| DiamondRock Hospitality Company | InvenTrust Properties Corp. | Rexford Industrial Realty, Inc. | |||||||||

| Digital Realty Trust, Inc. | Invitation Homes Inc. | RLJ Lodging Trust | |||||||||

| 2024 Proxy Statement | 29 | |||||||

| • | the Rayonier Investment and Savings Plan for Salaried Employees (our 401(k) plan); | ||||

| • | the Rayonier Inc. Supplemental Savings Plan; | ||||

| • | the Retirement Plan for Salaried Employees of Rayonier; | ||||

| • | the Rayonier Excess Benefit Plan; and | ||||

| • | the Rayonier Salaried Retiree Medical Plan. | ||||

| 30 | Rayonier Inc. | |||||||

| 2024 Proxy Statement | 31 | |||||||

| Position | Ownership Requirement | ||||

| Chief Executive Officer | 8x | ||||

| President | 6x | ||||

| Executive Vice Presidents & Chief Financial Officer | 4x | ||||

| Senior Vice Presidents | 3x | ||||

| Vice Presidents | 2x | ||||

| 32 | Rayonier Inc. | |||||||

| Keith E. Bass, Chair | Dod A. Fraser | ||||

| Scott R. Jones | V. Larkin Martin | ||||

| Ann C. Nelson | Gregg A. Gonsalves | ||||

| 2024 Proxy Statement | 33 | |||||||

| Name and Principal Position | Year | Salary | Bonus | Stock Awards (1) (2) | Option Awards | Non-Equity Incentive Plan Compensation (3) | Change in Pension Value & Non-qualified Deferred Compensation Earnings (4) | All Other Compensation (5) | Total | ||||||||||||||||||||||||||||||||||||||

| David Nunes | 2023 | $ | 900,000 | — | $ | 3,786,040 | — | $ | 1,431,000 | — | $ | 168,676 | $ | 6,285,716 | |||||||||||||||||||||||||||||||||

| Chief Executive | 2022 | $ | 887,500 | — | $ | 3,337,902 | — | $ | 1,352,551 | — | $ | 173,288 | $ | 5,751,241 | |||||||||||||||||||||||||||||||||

| Officer | 2021 | $ | 843,750 | — | $ | 2,735,312 | — | $ | 1,582,032 | — | $ | 155,387 | $ | 5,316,481 | |||||||||||||||||||||||||||||||||

| Mark McHugh | 2023 | $ | 565,000 | — | $ | 1,386,461 | — | $ | 598,901 | — | $ | 70,947 | $ | 2,621,309 | |||||||||||||||||||||||||||||||||

| President & Chief | 2022 | $ | 543,750 | — | $ | 1,251,702 | — | $ | 552,451 | — | $ | 68,488 | $ | 2,416,391 | |||||||||||||||||||||||||||||||||

| Financial Officer | 2021 | $ | 521,250 | — | $ | 980,582 | — | $ | 664,594 | — | $ | 60,101 | $ | 2,226,527 | |||||||||||||||||||||||||||||||||

| Doug Long | 2023 | $ | 471,250 | — | $ | 906,559 | — | $ | 499,526 | $ | 306,656 | $ | 57,138 | $ | 2,241,129 | ||||||||||||||||||||||||||||||||

| EVP & Chief | 2022 | $ | 453,750 | — | $ | 730,152 | — | $ | 461,011 | — | $ | 59,041 | $ | 1,703,954 | |||||||||||||||||||||||||||||||||

| Resource Officer | 2021 | $ | 431,250 | — | $ | 567,713 | — | $ | 549,844 | — | $ | 58,319 | $ | 1,607,126 | |||||||||||||||||||||||||||||||||

| Rhett Rogers | 2023 | $ | 421,250 | — | $ | 693,231 | — | $ | 312,568 | $ | 66,660 | $ | 44,998 | $ | 1,538,707 | ||||||||||||||||||||||||||||||||

| SVP, Portfolio | 2022 | $ | 405,000 | — | $ | 521,550 | — | $ | 288,036 | — | $ | 39,823 | $ | 1,254,409 | |||||||||||||||||||||||||||||||||

| Management | 2021 | $ | 386,250 | — | $ | 412,869 | — | $ | 318,657 | — | $ | 40,806 | $ | 1,158,582 | |||||||||||||||||||||||||||||||||

| Mark Bridwell | 2023 | $ | 421,250 | — | $ | 586,601 | — | $ | 267,915 | — | $ | 46,701 | $ | 1,322,467 | |||||||||||||||||||||||||||||||||

| SVP, General | 2022 | $ | 405,000 | — | $ | 469,377 | — | $ | 246,888 | — | $ | 49,030 | $ | 1,170,295 | |||||||||||||||||||||||||||||||||

| Counsel & Corp | 2021 | $ | 386,250 | — | $ | 387,074 | — | $ | 318,657 | — | $ | 45,159 | $ | 1,137,140 | |||||||||||||||||||||||||||||||||

| Secretary | |||||||||||||||||||||||||||||||||||||||||||||||

| (1) | Represents the aggregate grant date fair value for performance share and restricted stock unit awards, computed in accordance with FASB ASC Topic 718 granted in 2023, 2022 and 2021. For 2023, the Stock Awards column includes the grant date fair value of performance shares at target and restricted stock unit awards as follows: | |||||||||||||

| Performance Shares | Restricted Stock Units | |||||||||||||||||||

| Mr. Nunes | $ | 2,011,056 | $ | 1,774,984 | ||||||||||||||||

| Mr. McHugh | $ | 736,456 | $ | 650,005 | ||||||||||||||||

| Mr. Long | $ | 481,543 | $ | 425,016 | ||||||||||||||||

| Mr. Rogers | $ | 368,228 | $ | 325,003 | ||||||||||||||||

| Mr. Bridwell | $ | 311,589 | $ | 275,012 | ||||||||||||||||

| Performance share payouts are based on market conditions, and as such, the awards are valued using a Monte Carlo simulation model. A discussion of the assumptions used in calculating these values may be found in the “Incentive Stock Plans” section included in the notes to our financial statements included in our Annual Reports on Form 10-K for the fiscal years ended December 31, 2023, 2022 and 2021. | ||||||||||||||

| (2) | For 2023, the following amounts reflect the grant date fair value of the performance share awards, assuming that the highest level of performance is achieved under the 2023 Performance Share Award Program: Mr. Nunes, $3,106,221; Mr. McHugh, $1,137,509; Mr. Long, $743,778; Mr. Rogers, $568,755; and Mr. Bridwell, $481,272. | |||||||||||||

| (3) | Represents awards under the 2023, 2022 and 2021 bonus programs discussed in the CD&A beginning on page 22. | |||||||||||||

| (4) | For Messrs. Long and Rogers, these amounts represent the annual change in actuarial present value of the participant’s pension benefit under the Company’s retirement plans. In October 2023, Mr. Long began receiving monthly pension payments which totaled $16,486 for 2023. A discussion on this may be found in "Pension Benefits" on page 39. For 2022 and 2021, Messrs. Long and Rogers' aggregate change in pension value was negative. In accordance with SEC rules, the value shown in the table for 2022 and 2021 is zero. The actual change in pension value from December 31, 2021 to December 31, 2022 for Mr. Long was $(455,606) and for Mr. Rogers was $(209,175). The actual change in pension value from December 31, 2020 to December 31, 2021 for Mr. Long was $(191,084) and for Mr. Rogers was $(85,787). | |||||||||||||

| 34 | Rayonier Inc. | |||||||

| (5) | For each year presented, these amounts include Company contributions to the Rayonier Investment and Savings Plan for Salaried Employees, our 401(k) Plan; Company contributions to the Rayonier Excess Savings and Deferred Compensation Plan; interest paid on dividend equivalents; and the costs of executive physical examinations. The amounts reflect 401(k) Plan Company contributions as follows: for 2023: Messrs. Nunes, McHugh, Long, Rogers and Bridwell: $21,780; for 2022: Messrs. Nunes, McHugh, Long, Rogers and Bridwell: $20,130; for 2021: Messrs. Nunes, McHugh, Long, Rogers and Bridwell: $19,140; The amounts reflect Excess Savings Company contributions as follows: for 2023: Mr. Nunes, $126,888, Mr. McHugh, $42,284, Mr. Long, $31,451, Mr. Rogers, $19,848, Mr. Bridwell, $22,317; for 2022: Mr. Nunes, $142,859, Mr. McHugh, $44,845, Mr. Long, $36,210, Mr. Rogers, $18,471, and Mr. Bridwell, $27,631; for 2021: Mr. Nunes, $132,869, Mr. McHugh, $39,985, Mr. Long, $38,616, Mr. Rogers, $21,441, and Mr. Bridwell, $25,531. The amount reflects interest paid on dividend equivalents associated with performance shares as follows: for 2023: Mr. Nunes, $18,603, Mr. McHugh, $6,883, Mr. Long $3,907, Mr. Rogers, $2,604 and Mr. Bridwell, $2,604; for 2022: Mr. Nunes, $9,757, Mr. McHugh, $3,513, Mr. Long, $1,951, Mr. Rogers, $1,171, and Mr. Bridwell, $1,268; for 2021: Mr. Nunes, $3,378, Mr. McHugh, $976, Mr. Long, $563, Mr. Rogers, $225, and Mr. Bridwell, $488. All amounts reflect actual expenses incurred and paid by the Company in providing these benefits. | |||||||||||||

| • | The median of the annual total compensation of all employees of our Company (other than our CEO) was $141,306; and | ||||

| • | The annual total compensation of our CEO, as reported in the Summary Compensation Table above, was $6,285,716. | ||||

| • | We determined that, as of December 31, 2020, our employee population consisted of 413 employees, with 76% of these individuals located in the United States and 24% located in New Zealand. This population consisted of our full-time and part-time employees. We selected December 31, 2020 as the date upon which we would identify the “median employee”. | ||||

| • | To identify the median employee from our employee population, we compared the amount of salary paid in 2020, the annual cash incentive compensation awarded for 2020, and the grant date value of equity awards granted in 2020 for each employee. In making this determination, we annualized the compensation of one part-time and 77 full-time employees who were hired in 2020 but did not work for us for the entire fiscal year. We did not make any cost-of-living adjustments in identifying the median employee. | ||||

| • | Once we identified our median employee, we combined all of the elements of such employee’s compensation for 2023 in accordance with the requirements of Item 402(c)(2)(x) of Regulation S-K using the same calculation for annual total compensation as is used for the Summary Compensation Table. | ||||

| • | With respect to the annual total compensation of our CEO, we used the amount reported in the “Total” column of Summary Compensation Table above. | ||||

| 2024 Proxy Statement | 35 | |||||||

| Estimated Future Payouts Under Non-Equity Incentive Plan Awards (1) | Estimated Future Payouts Under Equity Incentive Plan Awards (2) | All Other Stock Awards: Number of Shares of Stock or Units (#) (3) | Grant Date Fair Value of Stock Awards (4) | ||||||||||||||||||||||||||||||||||||||||||||

| Name | Grant Date | Approval Date | Thres- hold | Target | Maxi- mum | Thres- hold (#) | Target (#) | Maxi- mum (#) | |||||||||||||||||||||||||||||||||||||||

| David Nunes | — | — | $ | 472,500 | $ | 1,350,000 | $ | 2,025,000 | |||||||||||||||||||||||||||||||||||||||

| 4/3/2023 | 2/17/2023 | 26,772 | 53,544 | 93,702 | $ | 2,011,056 | |||||||||||||||||||||||||||||||||||||||||

| 4/3/2023 | 2/17/2023 | 53,544 | $ | 1,774,984 | |||||||||||||||||||||||||||||||||||||||||||

| Mark McHugh | — | — | $ | 197,750 | $ | 565,000 | $ | 847,500 | |||||||||||||||||||||||||||||||||||||||

| 4/3/2023 | 2/17/2023 | 9,804 | 19,608 | 34,314 | $ | 736,456 | |||||||||||||||||||||||||||||||||||||||||

| 4/3/2023 | 2/17/2023 | 19,608 | $ | 650,005 | |||||||||||||||||||||||||||||||||||||||||||

| Doug Long | — | — | $ | 164,938 | $ | 471,250 | $ | 706,875 | |||||||||||||||||||||||||||||||||||||||

| 4/3/2023 | 2/17/2023 | 6,411 | 12,821 | 22,437 | $ | 481,543 | |||||||||||||||||||||||||||||||||||||||||

| 4/3/2023 | 2/17/2023 | 12,821 | $ | 425,016 | |||||||||||||||||||||||||||||||||||||||||||

| Rhett Rogers | — | — | $ | 103,206 | $ | 294,875 | $ | 442,312 | |||||||||||||||||||||||||||||||||||||||

| 4/3/2023 | 2/17/2023 | 4,902 | 9,804 | 17,157 | $ | 368,228 | |||||||||||||||||||||||||||||||||||||||||

| 4/3/2023 | 2/17/2023 | 9,804 | $ | 325,003 | |||||||||||||||||||||||||||||||||||||||||||

| Mark Bridwell | — | — | $ | 88,462 | $ | 252,750 | $ | 379,125 | |||||||||||||||||||||||||||||||||||||||

| 4/3/2023 | 2/17/2023 | 4,148 | 8,296 | 14,518 | $ | 311,589 | |||||||||||||||||||||||||||||||||||||||||

| 4/3/2023 | 2/17/2023 | 8,296 | $ | 275,012 | |||||||||||||||||||||||||||||||||||||||||||

| (1) | Reflects potential awards under the Rayonier Non-Equity Incentive Plan. Awards can range from 0% to 150% of the target award. Where performance achievement is below threshold on all metrics under the program, the participant will earn zero payout. See the “Annual Bonus Program” section of the CD&A beginning on page 25. The actual amount earned by each named executive officer for 2023 is reflected in the Summary Compensation Table on page 34 under the “Non-Equity Incentive Plan Compensation” column. | ||||

| (2) | Reflects potential awards, in number of shares, under the 2023 Performance Share Award Program. Awards can range from 50% to 175% of the target award. Where performance achievement is below threshold, no performance shares will be earned. Please refer to the “Performance Shares” section of the CD&A beginning on page 27. | ||||

| (3) | Reflects awards of time-based restricted stock units, in number of shares, granted as part of our 2023 long-term incentive program. Please refer to the "Time-Based Restricted Stock Units" section of the CD&A beginning on page 27. | ||||

| (4) | Reflects the grant date fair value of each equity award computed in accordance with FASB ASC Topic 718. Values for equity incentive plan awards subject to market conditions are valued using a Monte Carlo simulation model. | ||||

| 36 | Rayonier Inc. | |||||||

Option Awards | Stock Awards | ||||||||||||||||||||||||||||

Equity Incentive Plan Awards | |||||||||||||||||||||||||||||

| Name | Grant Date | Number of Securities Underlying Unexer- cised Options (#) Exercisable | Number of Securities Underlying Unexer- cised Options (#) Unexer- cisable | Option Exercise Price | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#) (1) | Market Value of Shares or Units of Stock That Have Not Vested (3) | Number of Unearned Shares or Units of Stock That Have Not Vested (#) (2) | Market Value of Shares or Units That Have Not Vested (3) | ||||||||||||||||||||

| David Nunes | 4/3/2023 | 53,544(A) | $ | 1,788,905 | 53,544 | $ | 1,788,905 | ||||||||||||||||||||||

| 4/1/2022 | 28,695(B) | $ | 958,700 | 38,259 | $ | 1,278,233 | |||||||||||||||||||||||

| 4/1/2021 | 19,723(C) | $ | 658,945 | 69,031 | $ | 2,306,309 | |||||||||||||||||||||||

| 4/1/2020 | 30,345(D) | $ | 1,013,826 | ||||||||||||||||||||||||||

| 4/1/2019 | 10,502(E) | $ | 350,872 | ||||||||||||||||||||||||||

| Mark McHugh | 4/3/2023 | 19,608(A) | $ | 655,103 | 19,608 | $ | 655,103 | ||||||||||||||||||||||

| 4/1/2022 | 10,761(B) | $ | 359,525 | 14,347 | $ | 479,333 | |||||||||||||||||||||||

| 4/1/2021 | 7,071(C) | $ | 236,242 | 24,747 | $ | 826,789 | |||||||||||||||||||||||

| 4/1/2020 | 11,228(D) | $ | 375,127 | ||||||||||||||||||||||||||

| 4/1/2019 | 3,781(E) | $ | 126,323 | ||||||||||||||||||||||||||

| Doug Long | 4/3/2023 | 12,821(A) | $ | 428,350 | 12,821 | $ | 428,350 | ||||||||||||||||||||||

| 4/1/2022 | 6,277(B) | $ | 209,715 | 8,369 | $ | 279,608 | |||||||||||||||||||||||

| 4/1/2021 | 4,094(C) | $ | 136,781 | 14,327 | $ | 478,673 | |||||||||||||||||||||||

| 4/1/2020 | 6,372(D) | $ | 212,889 | ||||||||||||||||||||||||||

| 4/1/2019 | 2,101(E) | $ | 70,194 | ||||||||||||||||||||||||||

| Rhett Rogers | 4/3/2023 | 9,804(A) | $ | 327,552 | 9,804 | $ | 327,552 | ||||||||||||||||||||||

| 4/1/2022 | 4,484(B) | $ | 149,810 | 5,978 | $ | 199,725 | |||||||||||||||||||||||

| 4/1/2021 | 2,977(C) | $ | 99,462 | 10,420 | $ | 348,116 | |||||||||||||||||||||||

| 4/1/2020 | 4,248(D) | $ | 141,926 | ||||||||||||||||||||||||||

| 4/1/2019 | 1,261(E) | $ | 42,130 | ||||||||||||||||||||||||||

| 1/2/2014 | 1,664 | $31.28 | 1/2/2024 | ||||||||||||||||||||||||||

| Mark Bridwell | 4/3/2023 | 8,296(A) | $ | 277,169 | 8,296 | $ | 277,169 | ||||||||||||||||||||||

| 4/1/2022 | 4,035(B) | $ | 134,809 | 5,380 | $ | 179,746 | |||||||||||||||||||||||

| 4/1/2021 | 2,791(C) | $ | 93,247 | 9,769 | $ | 326,366 | |||||||||||||||||||||||

| 4/1/2020 | 4,248(D) | $ | 141,926 | ||||||||||||||||||||||||||

| 4/1/2019 | 1,366(E) | $ | 45,638 | ||||||||||||||||||||||||||

| (1) | (A) Amounts reflect time-based restricted stock units granted as part of our 2023 long-term incentive program on April 3, 2023, which vest 25% per year over four years. | ||||

| (B) Amounts reflect time-based restricted stock units granted as part of our 2022 long-term incentive program on April 1, 2022, which vest 25% per year over four years. | |||||

| (C) Amounts reflect time-based restricted stock units granted as part of our 2021 long-term incentive program on April 1, 2021, which vest 25% per year over four years. | |||||

| (D) Amounts reflect time-based restricted stock units granted as part of our 2020 long-term incentive program on April 1, 2020, which vest in equal one-third increments on the third, fourth, and fifth anniversaries of the grant date. | |||||

| (E) Amounts reflect time-based restricted stock units granted as part of our 2019 long-term incentive program on April 1, 2019, which vest in equal one-third increments on the third, fourth, and fifth anniversaries of the grant date. | |||||

| 2024 Proxy Statement | 37 | |||||||

| (2) | Represents awards under the Performance Share Award Program for 2021, 2022 and 2023, each with a 36-month performance period commencing on April 1 and ending on March 31 of the applicable years. Awards for the relevant performance share program period are immediately vested following the performance period upon the Compensation Committee’s certification of performance results and the amount earned, but commencing with the 2021 awards, earned shares are subject to a one-year post-vesting holding period. Under the Performance Share Award Program, the actual award value for 2023, 2022 and 2021 can range from 50% to 175% of target. No shares will be earned under these awards if performance achievement is below threshold with respect to the applicable program. See the “Performance Shares” section of the CD&A beginning on page 27. The number of shares reported for the 2023 and 2022 Performance Share Award Program reflects the target payout level of 100%, and for 2021 Performance Share Award Program reflects the maximum payout level of 175%, based on performance during the performance periods through December 31, 2023. The actual number of shares earned under each Performance Share Award Program will be determined following the completion of the applicable performance period based on our relative TSR performance. | ||||

| (3) | Value based on the December 31, 2023 closing share price of $33.41. | ||||

Option Awards | Stock Awards | ||||||||||||||||||||||

| Name | Number of Shares Acquired on Exercise (#) | Value Realized on Exercise | Number of Shares Acquired on Vesting (#) | Value Realized on Vesting (1) | |||||||||||||||||||

| David Nunes | — | — | 126,802 | $ | 4,145,204 | ||||||||||||||||||

| Mark McHugh | — | — | 46,221 | $ | 1,510,585 | ||||||||||||||||||

| Doug Long | — | — | 26,303 | $ | 859,669 | ||||||||||||||||||

| Rhett Rogers | — | — | 17,331 | $ | 566,317 | ||||||||||||||||||

| Mark Bridwell | — | — | 17,697 | $ | 578,491 | ||||||||||||||||||

| (1) | The amounts shown represent the value realized by our named executive officers upon vesting of restricted stock and restricted stock units, along with payouts under the 2020 Performance Share Award Program. Performance shares under our 2020 Performance Share Award Program paid out at 110.2% based on our TSR for the three year period (4/1/2020 - 3/31/2023) of 60.54% which placed us at the 53.1% percentile among our peer group. The amounts shown are calculated using the closing market price of our common shares on the vesting date and do not take into account tax obligations that arise upon vesting. | ||||

| 38 | Rayonier Inc. | |||||||

| Name | Plan Name | Number of Years Credited Service (#) | Present Value of Accumulated Benefit (1) | Payments During Last Fiscal Year (2) | |||||||||||||||||||

| Doug Long | Rayonier Salaried Employees Retirement Plan | 21.6 | $1,088,322 | $16,486 | |||||||||||||||||||

| Rayonier Excess Benefit Plan | $73,613 | — | |||||||||||||||||||||

| Rhett Rogers | Rayonier Salaried Employees Retirement Plan | 15.5 | $356,459 | — | |||||||||||||||||||

| Rayonier Excess Benefit Plan | — | — | |||||||||||||||||||||

| (1) | Determined using the assumptions that applied for FASB ASC Topic 715-30 disclosure as of December 31, 2023. For December 31, 2023, an interest rate of 4.96% was used for Mr. Long and 5.06% for Mr. Rogers, and the mortality assumptions were the Pri-2012 mortality tables with a fully generational projection using scale MP-2021. Since the Plan is terminating, a liability load of 20% for active participants and 5% for Mr. Long was used to reflect annuity provider charges to cover expenses, profit, and conservatism. Mortality is assumed from that date only. Benefits are assumed to be paid in the normal form of payment which is a life annuity for single employees and the 90/50 survivor form for married employees. | ||||

| (2) | In conjunction with the announced termination of our Retirement Plan in 2023, all active and term-vested participants were offered a one-time termination window to elect to receive their pension benefit payment. Participants were provided the following options: (1) to receive their entire benefit as an immediate, one-time lump sum payment; (2) to receive their benefit as an immediate monthly annuity; or (3) to choose to do nothing and not make an election during the Retirement Plan termination window. Mr. Long elected the immediate monthly annuity option and began receiving monthly payments of $5,495 in October 2023. | ||||

| 2024 Proxy Statement | 39 | |||||||

| Name | Executive Contributions in Last FY (1) | Registrant Contributions in Last FY (1) | Aggregate Earnings in Last FY | Aggregate Withdrawals / Distributions in Last FY | Aggregate Balance at Last FYE (2) | ||||||||||||||||||||||||||||||||||||

| David Nunes | $ | 105,153 | $ | 126,888 | $ | 79,070 | — | $ | 1,743,779 | ||||||||||||||||||||||||||||||||

| Mark McHugh | $ | 28,400 | $ | 42,284 | $ | 18,948 | — | $ | 433,647 | ||||||||||||||||||||||||||||||||

| Doug Long | $ | 14,250 | $ | 31,451 | $ | 11,136 | — | $ | 259,696 | ||||||||||||||||||||||||||||||||

| Rhett Rogers | $ | 12,750 | $ | 19,848 | $ | 6,292 | — | $ | 152,930 | ||||||||||||||||||||||||||||||||

| Mark Bridwell | $ | 11,682 | $ | 22,317 | $ | 13,292 | — | $ | 301,413 | ||||||||||||||||||||||||||||||||

| (1) | All executive and Company contributions in the last fiscal year are reflected as compensation in the Summary Compensation Table on page 34. | ||||

| (2) | To the extent that a participant was a named executive officer in prior years, executive and Company contributions included in the Aggregate Balance at Last FYE column have been reported as compensation in the Summary Compensation Table for the applicable year. The Rayonier Inc. Supplemental Savings Plan (“Supplemental Savings Plan”) is a nonqualified, unfunded plan that consists of two components—an Excess Savings component (a supplement to the Rayonier Investment and Savings Plan for Salaried Employees (“Savings Plan”) and an Excess Base Salary and Bonus Deferral component. | ||||

| 40 | Rayonier Inc. | |||||||

| Name | Scheduled Severance (1) | Bonus Severance (2) | Pension / 401(k) Benefit (3) | Medical / Welfare and Outplacement Benefits (4) | Acceleration of Equity Awards (5) | ||||||||||||||||||||||||||||||||||||||||||

David Nunes Involuntary or voluntary for good reason termination within 24 months after change in control | $ | 2,700,000 | $ | 4,394,003 | $ | 310,020 | $ | 84,212 | $ | 10,144,696 | |||||||||||||||||||||||||||||||||||||

Mark McHugh Involuntary or voluntary for good reason termination within 24 months after change in control | $ | 1,710,000 | $ | 1,753,135 | $165,454 | $ | 86,450 | $ | 3,713,547 | ||||||||||||||||||||||||||||||||||||||

Doug Long Involuntary or voluntary for good reason termination within 24 months after change in control | $ | 1,425,000 | $ | 1,454,695 | $ | 137,691 | $ | 86,066 | $ | 2,244,559 | |||||||||||||||||||||||||||||||||||||

Rhett Rogers Involuntary or voluntary for good reason termination within 24 months after change in control | $ | 850,000 | $ | 590,735 | $ | 73,822 | $ | 59,201 | $ | 1,636,271 | |||||||||||||||||||||||||||||||||||||

Mark Bridwell Involuntary or voluntary for good reason termination within 24 months after change in control | $ | 850,000 | $ | 570,750 | $ | 73,223 | $ | 31,102 | $ | 1,476,071 | |||||||||||||||||||||||||||||||||||||

| (1) | Represents the executive’s base pay times the applicable tier multiplier under the Executive Severance Pay Plan (3 times for Tier I, 2 times for Tier II). As of December 31, 2023, Messrs. Nunes, McHugh and Long are included as Tier I executives, and Messrs. Rogers and Bridwell are included as a Tier II executives. | ||||

| (2) | Represents the applicable tier multiplier (3 times for Tier I and 2 times for Tier II) times the Applicable Bonus Amount. The Applicable Bonus Amount is the greater of: (i) the average of the bonus amounts actually paid in the three year period comprised of the year of the qualifying event and the two immediately preceding calendar years, (ii) the target bonus for the year in which the change in control occurred, or (iii) the target bonus in the year of termination. Named executive officers also receive a pro-rata bonus amount equal to the Applicable Bonus Amount multiplied by a fraction, the numerator of which is the number of months lapsed in the then current year prior to the qualifying termination and the denominator of which is twelve. | ||||

| (3) | Represents three additional years of participation in the Savings Plan at the executive’s current contribution level. | ||||

| (4) | Represents: (i) the present value of the annual Company contribution to health and welfare plans times the applicable tier multiplier and (ii) up to $30,000 in outplacement services. | ||||

| (5) | Restricted stock units and performance shares were valued using the closing price of the Company stock on December 29, 2023. Under the Executive Severance Pay Plan, upon a qualifying termination following a change in control, (i) all outstanding restricted stock units vest in full; (ii) with respect to any performance shares for which the performance period is more than 50% complete, the shares vest based on actual performance achievement or, if greater, at target; and (iii) with respect to any performance shares for which the performance period is not more than 50% complete, the performance shares vest at target. For purposes of this table, 2023 and 2022 performance shares were valued at target; given that 2021 performance shares are trending above target, they are valued at the maximum payout level of 175%. | ||||

| 2024 Proxy Statement | 41 | |||||||

| 42 | Rayonier Inc. | |||||||

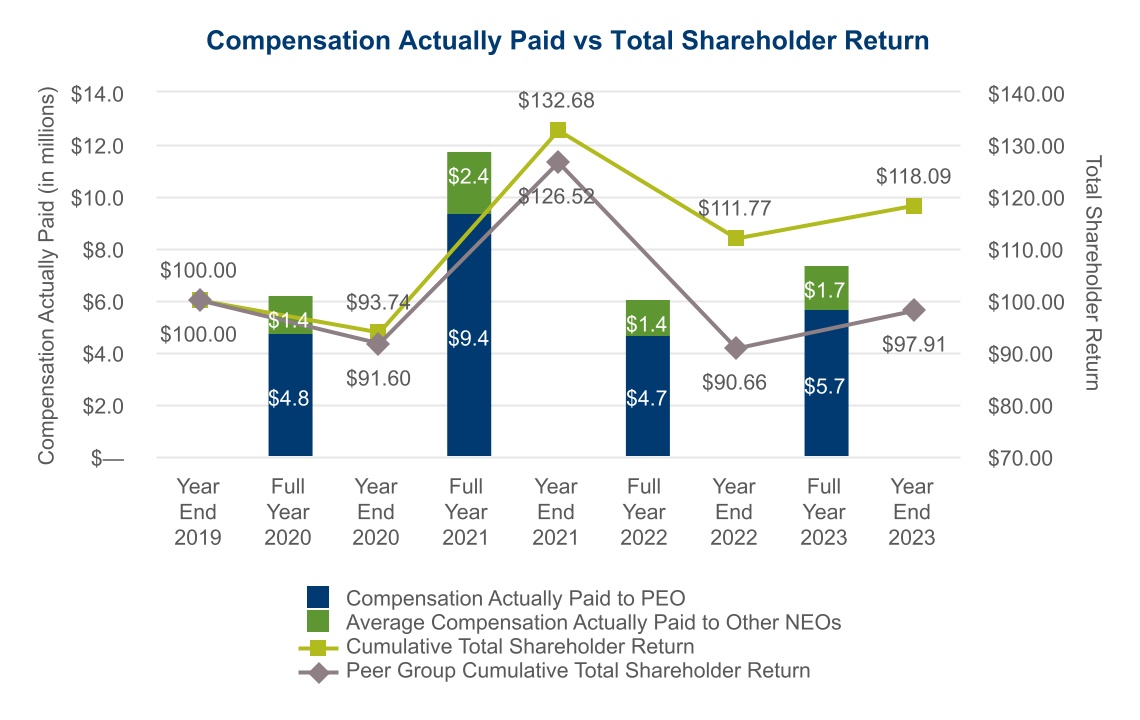

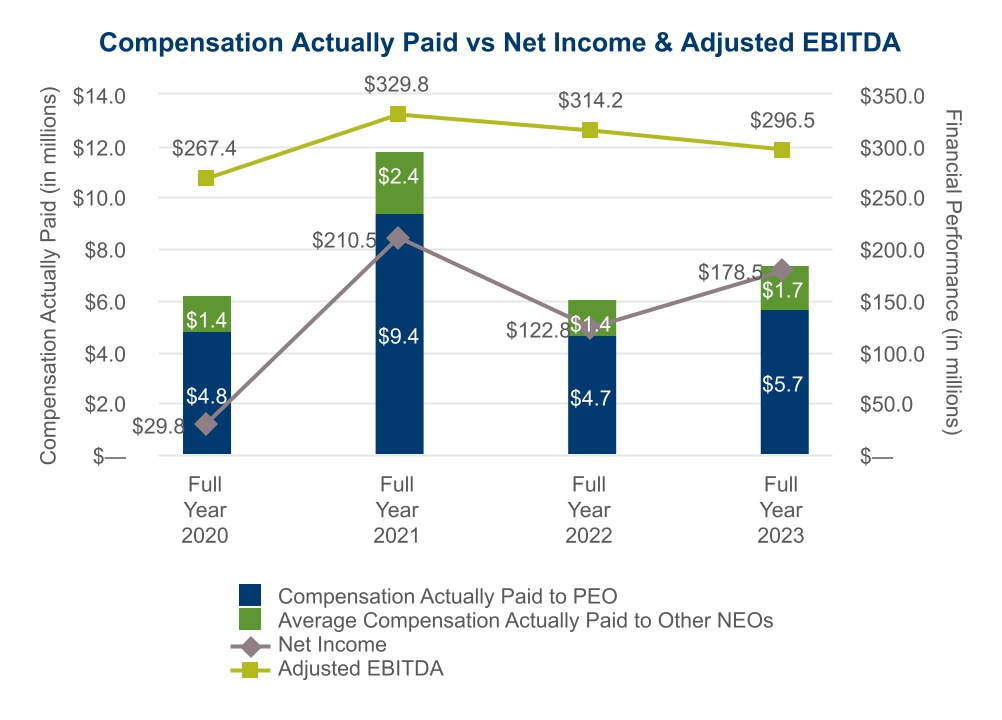

| Year | Summary Compensation Table Total for PEO (1) | Compensation Actually Paid to PEO (2) | Average Summary Compensation Table Total for Other NEOs (1) | Average Compensation Actually Paid to Other NEOs (2) | Value of Initial Fixed $100 Investment Based On: | Net Income (in millions) | Adjusted EBITDA (4) (in millions) | |||||||||||||||||||

| Total Shareholder Return | Peer Group Total Shareholder Return (3) | |||||||||||||||||||||||||

| 2023 | $6,285,716 | $5,746,248 | $1,930,903 | $1,720,720 | $118.09 | $97.91 | $178.5 | $296.5 | ||||||||||||||||||

| 2022 | $5,751,241 | $4,677,297 | $1,636,262 | $1,396,101 | $111.77 | $90.66 | $122.8 | $314.2 | ||||||||||||||||||

| 2021 | $5,316,481 | $9,416,465 | $1,532,344 | $2,390,845 | $132.68 | $126.52 | $210.5 | $329.8 | ||||||||||||||||||

| 2020 | $5,410,816 | $4,802,112 | $1,588,249 | $1,401,149 | $93.74 | $91.60 | $29.8 | $267.4 | ||||||||||||||||||

| (1) | For 2023, 2022, 2021 and 2020, Mr. Nunes is included in the PEO columns and Messrs. McHugh, Long, Rogers and Bridwell are included in the Other NEOs columns. | ||||

| (2) | The dollar amounts reported represent the amount of “compensation actually paid”, as computed in accordance with Item 402(v) of Regulation S-K. The dollar amounts do not reflect the actual amount of compensation earned by or paid to our NEOs during the applicable year. The value represents the Summary Compensation Table totals for the applicable year less the pension and stock award columns, plus: (a) the fair value of stock awards calculated by taking the year end fair value of stock awards granted during the year, plus the change in fair value during the fiscal year for outstanding awards granted in prior years, plus for any awards vested during the year, the change in fair value during the fiscal year through the date of vesting; and (b) the aggregate of the service costs attributable to services rendered during the year for pension plan participants which is $0 since our plan was frozen on December 31, 2016. Performance share awards were valued using a Monte Carlo simulation model. A reconciliation of the adjustments are summarized in the following table: | ||||

| Year | Summary Compensation Table Total | Deductions | Additions | Compensation Actually Paid | ||||||||||||||||||||||

| Summary Compensation Table Stock Awards | Summary Compensation Table Pension | Year End Fair Value of Equity Awards Granted in the Year | Year over Year Change in Fair Value of Outstanding Unvested Equity Awards Granted in Prior Years | Year over Year Change in Fair Value of Equity Awards Granted in Prior Years that Vested in the Year | Value of Dividends Paid on Equity Awards not Otherwise Reflected in Fair Value or Total Compensation | |||||||||||||||||||||

| PEO | ||||||||||||||||||||||||||

| 2023 | $6,285,716 | $3,786,040 | — | $3,709,528 | $176,590 | ($801,783) | $162,237 | $5,746,248 | ||||||||||||||||||

| 2022 | $5,751,241 | $3,337,902 | — | $2,727,867 | ($1,270,246) | $649,325 | $157,012 | $4,677,297 | ||||||||||||||||||

| 2021 | $5,316,481 | $2,735,312 | — | $3,377,761 | $3,284,367 | $32,246 | $140,922 | $9,416,465 | ||||||||||||||||||

| 2020 | $5,410,816 | $3,002,811 | — | $3,848,497 | ($245,490) | ($1,325,975) | $117,075 | $4,802,112 | ||||||||||||||||||

| Other NEOs | ||||||||||||||||||||||||||

| 2023 | $1,930,903 | $893,213 | $93,329 | $875,162 | $37,866 | ($172,494) | $35,825 | $1,720,720 | ||||||||||||||||||

| 2022 | $1,636,262 | $743,195 | — | $607,369 | ($268,765) | $131,238 | $33,192 | $1,396,101 | ||||||||||||||||||

| 2021 | $1,532,344 | $587,060 | — | $724,944 | $685,016 | $6,725 | $28,876 | $2,390,845 | ||||||||||||||||||

| 2020 | $1,588,249 | $645,592 | $102,227 | $827,410 | ($41,785) | ($247,873) | $22,967 | $1,401,149 | ||||||||||||||||||

| (3) | The peer group represents the FTSE NAREIT All Equity REIT Index. | ||||

| (4) | Adjusted EBITDA is defined as earnings before interest, taxes, depreciation, depletion, amortization, the non-cash cost of land and improved development, non-operating income and expense, operating (income) loss attributable to NCI in Timber Funds, gain associated with the multi-family apartment complex sale attributable to noncontrolling interests, the gain on investment in Timber Funds, Fund II Timberland Dispositions, costs related to the merger with Pope Resources, timber write-offs resulting from casualty events, and Large Dispositions. | ||||

| 2024 Proxy Statement | 43 | |||||||

| 44 | Rayonier Inc. | |||||||

| 2024 Proxy Statement | 45 | |||||||

| Plan category | (A) Number of securities to be issued upon exercise of outstanding options, warrants and rights | (B) Weighted average exercise price of outstanding options, warrants and rights | (C) Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (A)) | |||||||||||||||||||||||||||||

| Equity compensation plans approved by security holders | 1,172,459 | (1) | $31.83 | 2,473,806 | (2) | |||||||||||||||||||||||||||

| Equity compensation plans not approved by security holders | N/A | N/A | N/A | |||||||||||||||||||||||||||||

| Total | 1,172,459 | $31.83 | 2,473,806 | |||||||||||||||||||||||||||||

| (1) | Consists of 24,724 outstanding stock options awarded under the Rayonier Incentive Stock Plan, 666,810 performance shares (assuming maximum payout) and 480,925 restricted stock units awarded under the Rayonier Incentive Stock Plan and the 2023 Rayonier Incentive Stock Plan. The weighted-average exercise price in column (B) does not take performance shares or restricted stock units into account. | ||||

| (2) | Consists of shares available for future issuance under the 2023 Rayonier Incentive Stock Plan. | ||||

| 46 | Rayonier Inc. | |||||||

| • | the scope of and overall plans for the annual audit; | |||||||

| • | the pre-approved non-audit services that Ernst & Young, LLP provides to the Company and related fees to ensure their compatibility with Ernst & Young’s independence; | |||||||

| • | the appropriateness of Ernst & Young’s fees; | |||||||

| • | Ernst & Young’s historical and recent performance on the Company’s audit; | |||||||

| • | Ernst & Young’s tenure as our independent auditor and the benefits of having a long-tenured auditor; and | |||||||

| • | Ernst & Young’s independence from the Company and management. | |||||||

| Our Board recommends that you vote “FOR” the ratification of Ernst & Young, LLP to serve as our independent registered public accounting firm for 2024. | ||||

| 2024 Proxy Statement | 47 | |||||||

| 1. | The Audit Committee has reviewed and discussed the audited financial statements of the Company, as of December 31, 2023 and 2022, and for each of the three years in the period ended December 31, 2023, with management and its independent registered public accounting firm; | ||||

| 2. | The Audit Committee has discussed with its independent registered public accounting firm the matters required by Statement of Auditing Standards No. 1301, Communications with Audit Committees, as amended; | ||||

| 3. | The Audit Committee has received from and discussed with its independent registered public accounting firm the written disclosures and the letter required by applicable requirements of the Public Company Accounting Oversight Board ("PCAOB") regarding the independent accountant’s communications with audit committees concerning independence and has held discussions with its independent registered public accounting firm regarding its independence; and | ||||

| 4. | Based upon the review and discussions described in paragraphs (1) through (3) above and the Audit Committee’s discussions with management, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, for filing with the SEC. | ||||

| 48 | Rayonier Inc. | |||||||

| 2023 | 2022 | |||||||||||||||||||

| Audit fees | $ | 1,822,500 | $ | 1,774,677 | ||||||||||||||||

| Tax fees | 270,837 | 78,257 | ||||||||||||||||||

| All other fees | 7,403 | 2,830 | ||||||||||||||||||

| $ | 2,100,740 | $ | 1,855,764 | |||||||||||||||||

| 2024 Proxy Statement | 49 | |||||||

Beneficial Ownership | |||||||||||||||||||||||||||||||||||

| Name of Beneficial Owner | (A) Number of Shares Beneficially Owned | (B) Column (A) as Percent of Class | (C) Exercisable Stock Options (1) | (D) Sum of Columns (A) and (C) as Percent of Class | |||||||||||||||||||||||||||||||

| Keith E. Bass | 20,515 | * | — | * | |||||||||||||||||||||||||||||||

| Dod A. Fraser | 32,479 | * | — | * | |||||||||||||||||||||||||||||||

| Gregg A. Gonsalves | 5,435 | * | — | * | |||||||||||||||||||||||||||||||

| Scott R. Jones | 49,941 | (2) | * | — | * | ||||||||||||||||||||||||||||||

| V. Larkin Martin | 46,063 | * | — | * | |||||||||||||||||||||||||||||||

| Meridee A. Moore | 87,890 | (3) | * | — | * | ||||||||||||||||||||||||||||||

| Ann C. Nelson | 23,715 | * | — | * | |||||||||||||||||||||||||||||||