Item 8: Changes in and Disagreements with Accountants for Open-End Management Investment Companies.

Not applicable.

Item 9: Proxy Disclosures for Open-End Management Investment Companies.

Not applicable.

Item 10: Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies.

Not applicable. The Trustees’ Fees and Expenses are included in the financial statements filed under Item 7 of this Form.

Item 11: Statement Regarding Basis for Approval of Investment Advisory Contracts.

Trustees Approve Advisory Arrangements – U.S. Growth Fund

The board of trustees of Vanguard U.S. Growth Fund has renewed the fund’s investment advisory arrangements with Jennison Associates LLC (Jennison), Wellington Management Company LLP (Wellington Management), and Baillie Gifford Overseas Ltd. (Baillie Gifford). The board determined that renewing the fund’s advisory arrangements with these advisors was in the best interests of the fund and its shareholders.

The board has also approved an amendment to the fund’s existing investment advisory agreement with Baillie Gifford, changing Baillie Gifford’s performance benchmark from the S&P 500 Index to the Russell 3000 Growth Index. The board noted that the new index is more aligned with Baillie Gifford’s all-cap, high growth investment strategy. The board further noted that there is no expected impact to the fund’s expense ratio as a result of this amendment, though active fund expense ratios are subject to change. The board determined that the foregoing actions were in the best interests of the fund and its shareholders.

The board based its decisions upon an evaluation of each advisor’s investment staff, portfolio management process, and performance. This evaluation included information provided to the board by Vanguard’s Portfolio Review Department, which is responsible for fund and advisor oversight and product management. The Portfolio Review Department met regularly with the advisors and made presentations to the board during the fiscal year that directed the board’s focus to relevant information and topics.

The board, or an investment committee made up of board members, also received information throughout the year during advisor presentations conducted by the Portfolio Review Department. For each advisor presentation, the board was provided with letters and reports that included information about, among other things, the advisory firm and the advisor’s assessment of the investment environment, portfolio performance, and portfolio characteristics.

In addition, the board received periodic reports throughout the year, which included information about the fund’s performance relative to its peers and benchmark, as applicable, and updates, as needed, on the Portfolio Review Department’s ongoing assessment of the advisors.

Prior to their meeting, the trustees were provided with a memo and materials that summarized the information they received over the course of the year. They also considered the factors discussed below, among others. However, no single factor determined whether the board approved the arrangements. Rather, it was the totality of the circumstances that drove the board’s decisions.

Nature, extent, and quality of services

The board reviewed the quality of the fund’s investment management services over both the short and long term, and took into account the organizational depth and stability of each advisor. The board considered the following:

Jennison. Jennison, founded in 1969, is an indirect, wholly-owned subsidiary of Prudential Financial Inc. The firm currently oversees a wide range of equity and fixed income strategies. The Jennison team utilizes internal fundamental research to identify companies that exhibit above-average growth in units, revenues, earnings and/or cash flows. When analyzing a company for purchase or sale, Jennison focuses on the duration of a company’s growth opportunity and seeks to capture inflection points in the company’s growth trajectory. Jennison has managed a portion of the fund since 2014.

Wellington Management. Founded in 1928, Wellington Management is among the nation’s oldest and most respected institutional investment managers. The advisor employs a fundamental research approach to identify companies with sustainable growth advantages and reasonable valuations. Wellington Management identifies companies that have demonstrated above-average growth in the past, followed by a thorough review of each company’s business model and an assessment of its valuation. The goal of this review is to identify companies with high returns on capital, superior business management, and high-quality balance sheets. Wellington Management has managed a portion of the fund since 2010.

Baillie Gifford. Baillie Gifford—a unit of Baillie Gifford & Co., founded in 1908—is among the largest independently owned investment management firms in the United Kingdom. Baillie Gifford aims to deliver outstanding investment performance by identifying exceptional growth companies in the United States and investing in them long enough that the advantages of their business models and strength of their cultures become the dominant drivers of their stock prices. This long-term horizon allows the advisor to harness the asymmetry inherent in equity markets to capture the disproportionate impact of successful investments in the portfolio. Baillie Gifford has managed a portion of the fund since 2014.

The board concluded that each advisor’s experience, stability, depth, and performance, among other factors, warranted continuation of the advisory arrangements.

Investment performance

The board considered the short- and long-term performance, as applicable, of each advisor’s subportfolio, including any periods of outperformance or underperformance compared with a relevant benchmark index and peer group. The board concluded that the performance was such that each advisory arrangement should continue.

Cost

The board concluded that the fund’s expense ratio was below the average expense ratio charged by funds in its peer group and that the fund’s advisory fee rate was also below the peer-group average.

The board did not consider the profitability of Jennison, Wellington Management, or Baillie Gifford in determining whether to approve the advisory fees, because the advisors are independent of Vanguard, and the advisory fees are the result of arm’s-length negotiations.

The benefit of economies of scale

The board concluded that the fund’s shareholders benefit from economies of scale because of breakpoints in the advisory fee schedules for Jennison, Wellington Management, and Baillie Gifford. The breakpoints reduce the effective rate of the fees as the fund’s assets managed by each advisor increase.

The board will consider whether to renew the advisory arrangements again after a one-year period.

Trustees Approve Advisory Arrangements – International Growth Fund

The board of trustees of Vanguard International Growth Fund has renewed the fund’s investment advisory arrangements with Baillie Gifford Overseas Ltd. (Baillie Gifford) and Schroder Investment Management North America Inc. (Schroder Inc.), as well as the sub-advisory agreement with Schroder Investment Management North America Ltd. (Schroder Ltd.). The board determined that renewing the fund’s advisory arrangements was in the best interests of the fund and its shareholders.

The board based its decisions upon an evaluation of each advisor’s investment staff, portfolio management process, and performance. This evaluation included information provided to the board by Vanguard’s Portfolio Review Department, which is responsible for fund and advisor oversight and product management. The Portfolio Review Department met regularly with the advisors and made presentations to the board during the fiscal year that directed the board’s focus to relevant information and topics.

The board, or an investment committee made up of board members, also received information throughout the year during advisor presentations conducted by the Portfolio Review Department. For each advisor presentation, the board was provided with letters and reports that included information about, among other things, the advisory firm and the advisor’s assessment of the investment environment, portfolio performance, and portfolio characteristics.

In addition, the board received periodic reports throughout the year, which included information about the fund’s performance relative to its peers and benchmark, as applicable, and updates, as needed, on the Portfolio Review Department’s ongoing assessment of the advisors.

Prior to their meeting, the trustees were provided with a memo and materials that summarized the information they received over the course of the year. They also considered the factors discussed below, among others. However, no single factor determined whether the board approved the arrangements. Rather, it was the totality of the circumstances that drove the board’s decisions.

Nature, extent, and quality of services

The board reviewed the quality of the fund’s investment management services over both the short and long term, and took into account the organizational depth and stability of each advisor. The board considered the following:

Baillie Gifford. Baillie Gifford—a unit of Baillie Gifford & Co., founded in 1908—is among the largest independently owned investment management firms in the United Kingdom. Baillie Gifford uses fundamental research to make long-term investments in companies that have above-average growth potential resulting from sustainable competitive advantages, special cultures and management, or competitive strength in underestimated technology shifts. Baillie Gifford believes that equities’ asymmetrical return pattern means that alpha is generated by focusing on the upside and the potential to earn exponential returns rather than being overly concerned with avoiding losing investments. The advisor takes a bottom-up, stock-driven approach to sector and country allocation. Baillie Gifford has advised a portion of the fund since 2003.

Schroder. Schroders plc, the parent company of Schroder Inc. and Schroder Ltd. (collectively, Schroder), was founded in 1804 in London, England. Schroder specializes in global equity and fixed income management and seeks to invest in securities of international companies where it has identified a significant growth gap, which is defined as forward earnings growth that is not yet recognized by the market. Schroder believes that market inefficiencies often drive material differences between underlying company fundamentals and market estimates. The advisor also believes that in-depth fundamental research, incorporating a comprehensive macroeconomic viewpoint and a robust framework of fundamental risk analysis, is the most reliable means of finding those companies and identifying the growth gap. Schroder Inc. has advised the fund since its inception in 1981, and its affiliate Schroder Ltd. has advised the fund since 2003.

The board concluded that each advisor’s experience, stability, depth, and performance, among other factors, warranted continuation of the advisory arrangements.

Investment performance

The board considered the short- and long-term performance of each advisor’s subportfolio, including any periods of outperformance or underperformance compared with a relevant benchmark index and peer group. The board concluded that the performance was such that each advisory arrangement should continue.

Cost

The board concluded that the fund’s expense ratio was below the average expense ratio charged by funds in its peer group and that the fund’s advisory fee rate was also below the peer-group average.

The board did not consider the profitability of Baillie Gifford or Schroder in determining whether to approve the advisory fees, because the firms are independent of Vanguard and the advisory fees are the result of arm’s-length negotiations.

The benefit of economies of scale

The board concluded that the fund’s shareholders benefit from economies of scale because of breakpoints in the advisory fee schedules for Baillie Gifford and Schroder. The breakpoints reduce the effective rate of the fees as the fund’s assets managed by each advisor increase.

The board will consider whether to renew the advisory arrangements again after a one-year period.

Trustees Approve Advisory Arrangement – FTSE Social Index Fund

The board of trustees of Vanguard FTSE Social Index Fund has renewed the fund’s investment advisory arrangement with The Vanguard Group, Inc. (Vanguard), through its Equity Index Group. The board determined that continuing the fund’s internalized management structure was in the best interests of the fund and its shareholders.

The board based its decision upon an evaluation of the advisor’s investment staff, portfolio management process, and performance. This evaluation included information provided to the board by Vanguard’s Portfolio Review Department, which is responsible for fund and advisor oversight and product management. The Portfolio Review Department met regularly with the advisor and made presentations to the board during the fiscal year that directed the board’s focus to relevant information and topics.

The board, or an investment committee made up of board members, also received information throughout the year through advisor presentations conducted by the Portfolio Review Department. For each advisor presentation, the board was provided with letters and reports that included information about, among other things, the advisory firm and the advisor’s assessment of the investment environment, portfolio performance, and portfolio characteristics.

In addition, the board received periodic reports throughout the year, which included information about the fund’s performance relative to its peers and benchmark, as applicable, and updates, as needed, on the Portfolio Review Department’s ongoing assessment of the advisor.

Prior to their meeting, the trustees were provided with a memo and materials that summarized the information they received over the course of the year. They also considered the factors discussed below, among others. However, no single factor determined whether the board approved the arrangement. Rather, it was the totality of the circumstances that drove the board’s decision.

Nature, extent, and quality of services

The board reviewed the quality of the fund’s investment management services over both the short and long term, and took into account the organizational depth and stability of the advisor. The board considered that Vanguard has been managing investments for more than four decades. The Equity Index Group adheres to a sound, disciplined investment management process; the team has considerable experience, stability, and depth.

The board concluded that Vanguard’s experience, stability, depth, and performance, among other factors, warranted continuation of the advisory arrangement.

Investment performance

The board considered the short- and long-term performance of the fund, including any periods of outperformance or underperformance compared with its target index and peer group. The board concluded that the performance was such that the advisory arrangement should continue.

Cost

The board concluded that the fund’s expense ratio was below the average expense ratio charged by funds in its peer group and that the fund’s advisory expenses were also below the peer-group average.

The board does not conduct a profitability analysis of Vanguard because of Vanguard’s unique structure. Unlike most other mutual fund management companies, Vanguard is owned by the funds it oversees.

The benefit of economies of scale

The board concluded that the fund’s arrangement with Vanguard ensures that the fund will realize economies of scale as it grows, with the cost to shareholders declining as fund assets increase.

The board will consider whether to renew the advisory arrangement again after a one-year period.

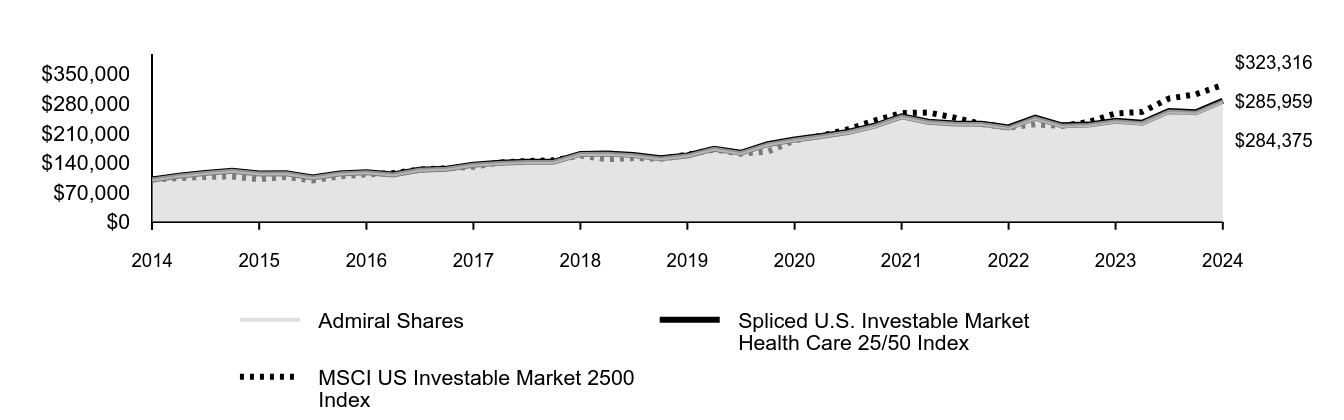

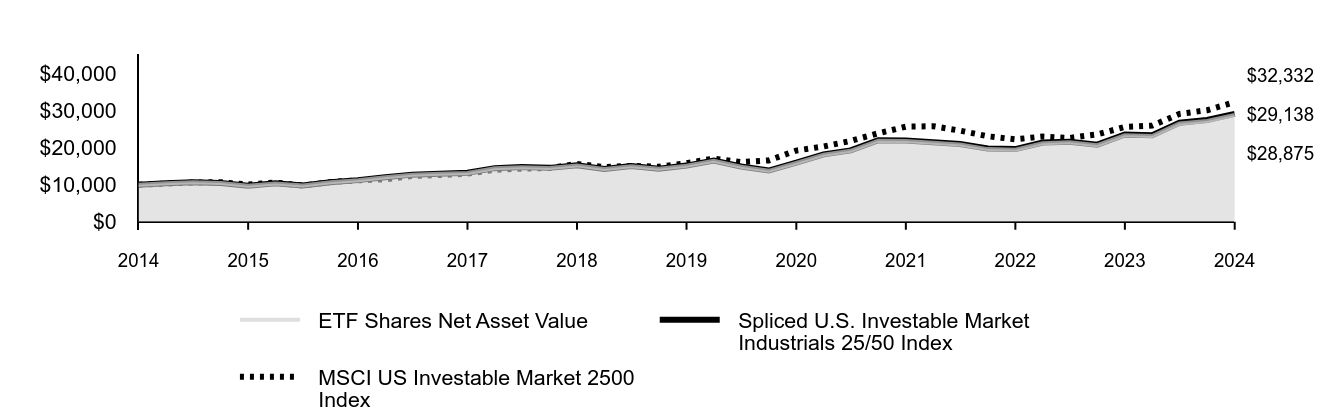

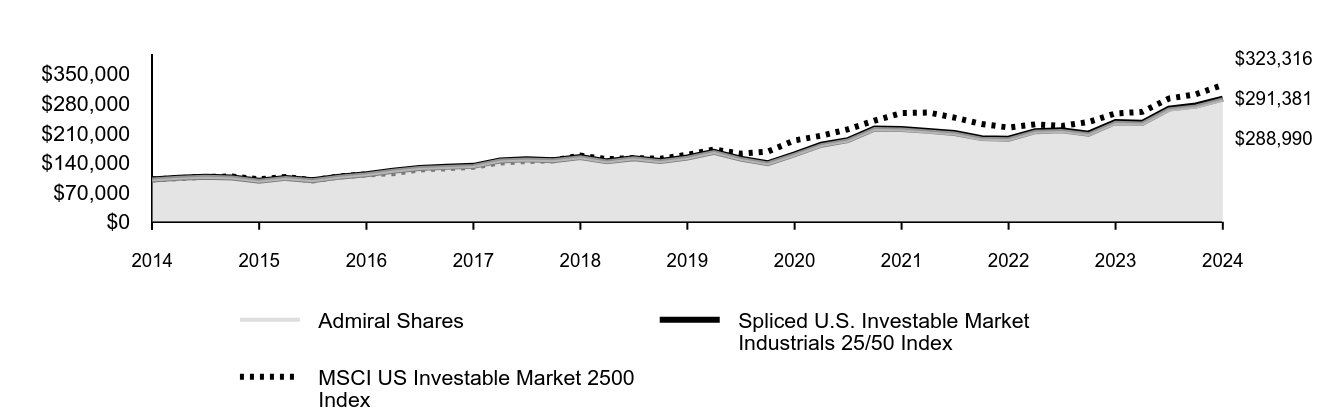

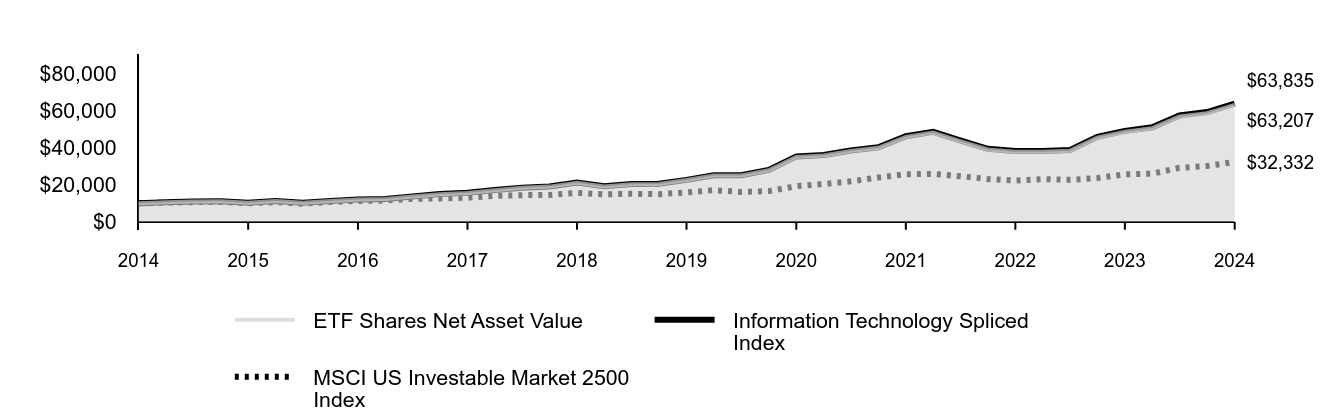

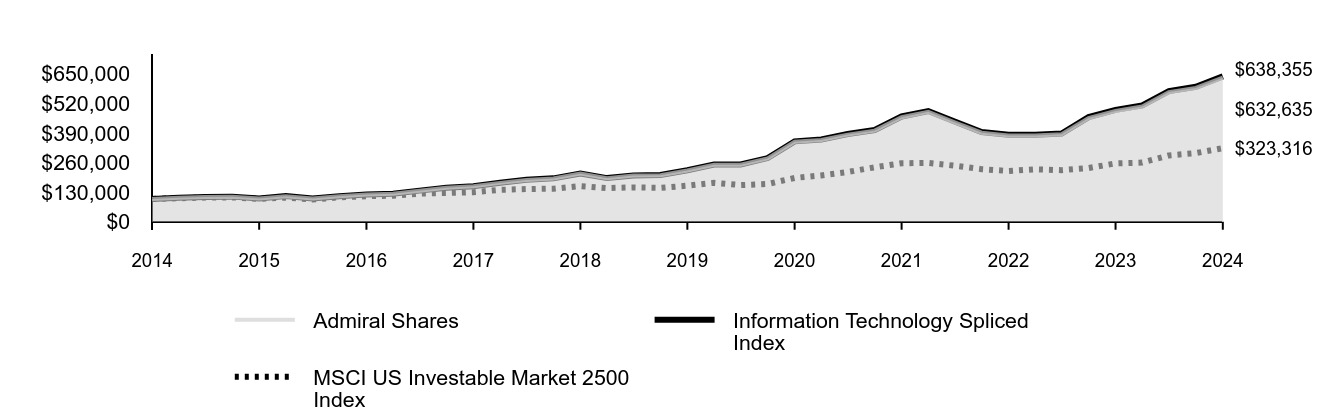

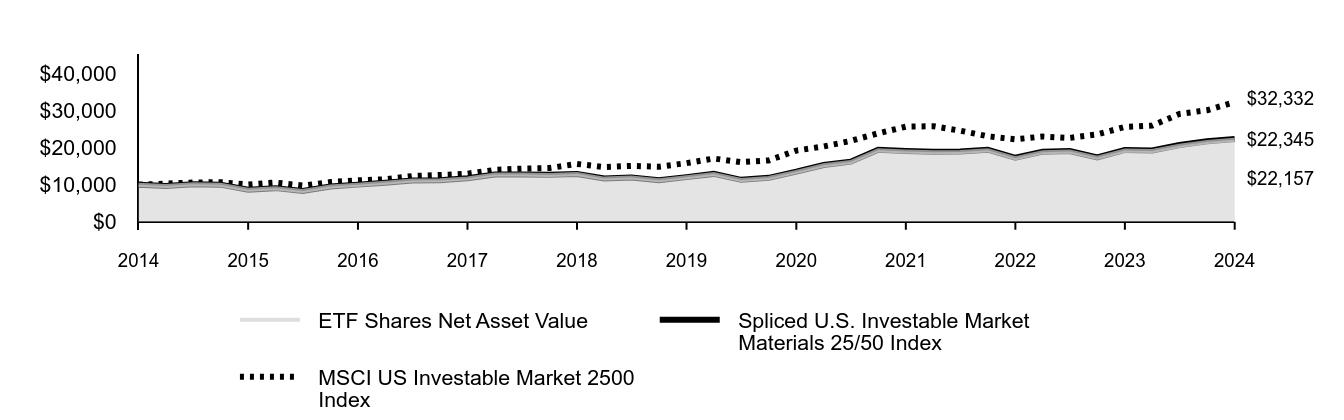

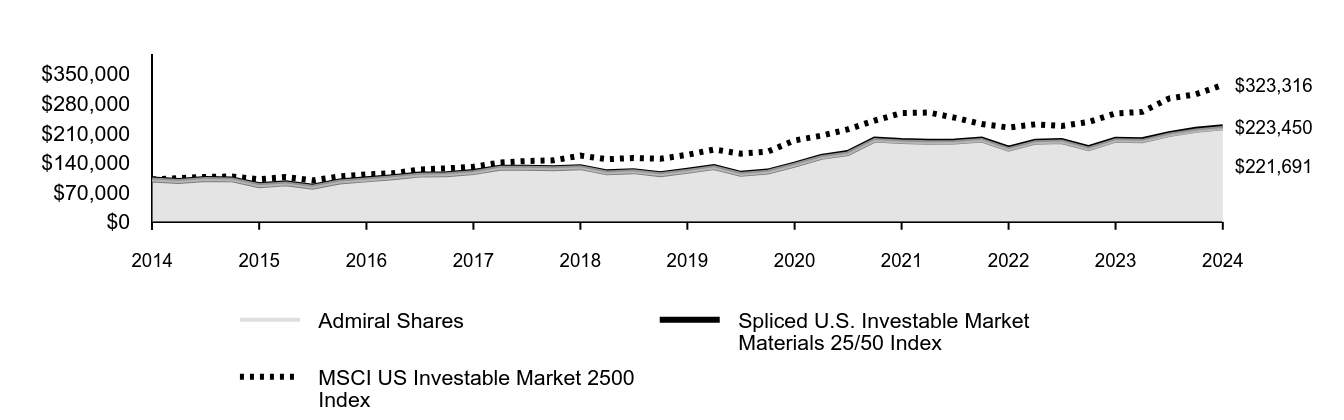

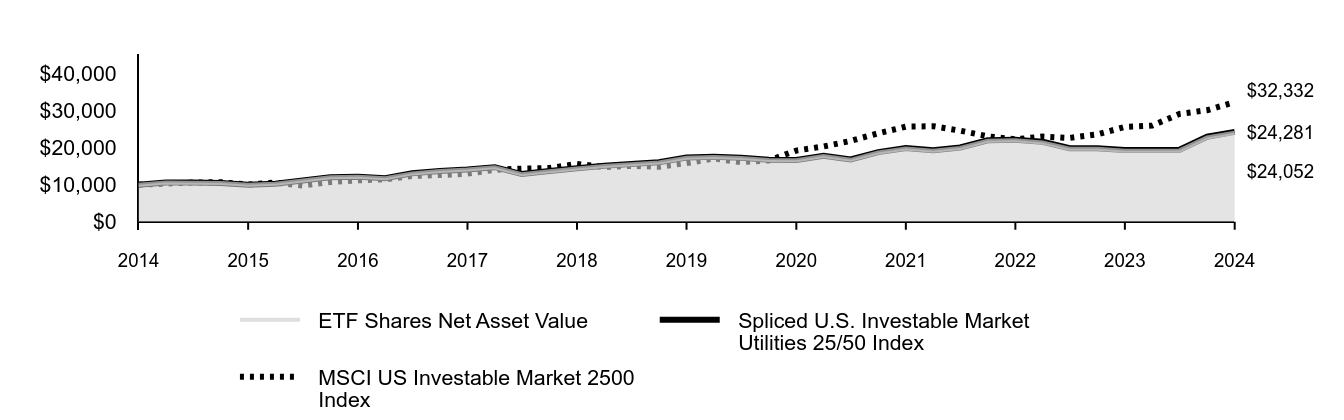

Trustees Approve Advisory Arrangements – U.S. Sector Index Funds

The board of trustees of Vanguard Communication Services Index Fund, Vanguard Consumer Discretionary Index Fund, Vanguard Consumer Staples Index Fund, Vanguard Energy Index Fund, Vanguard Financials Index Fund, Vanguard Health Care Index Fund, Vanguard Industrials Index Fund, Vanguard Information Technology Index Fund, Vanguard Materials Index Fund, and Vanguard Utilities Index Fund has renewed each fund’s investment advisory arrangement with The Vanguard Group, Inc. (Vanguard), through its Equity Index Group. The board determined that continuing each fund’s internalized management structure was in the best interests of the fund and its shareholders.

The board based its decisions upon an evaluation of the advisor’s investment staff, portfolio management process, and performance. This evaluation included information provided to the board by Vanguard’s Portfolio Review Department, which is responsible for fund and advisor oversight and product management. The Portfolio Review Department met regularly with the advisor and made presentations to the board during the fiscal year that directed the board’s focus to relevant information and topics.

The board, or an investment committee made up of board members, also received information throughout the year through advisor presentations conducted by the Portfolio Review Department. For each advisor presentation, the board was provided with letters and reports that included information about, among other things, the advisory firm and the advisor’s assessment of the investment environment, portfolio performance, and portfolio characteristics.

In addition, the board received periodic reports throughout the year, which included information about each fund’s performance relative to its peers and benchmark, as applicable, and updates, as needed, on the Portfolio Review Department’s ongoing assessment of the advisor.

Prior to their meeting, the trustees were provided with a memo and materials that summarized the information they received over the course of the year. They also considered the factors discussed below, among others. However, no single factor determined whether the board approved the arrangements. Rather, it was the totality of the circumstances that drove the board’s decisions.

Nature, extent, and quality of services

The board reviewed the quality of each fund’s investment management services over both the short and long term, and took into account the organizational depth and stability of the advisor. The board considered that Vanguard has been managing investments for more than four decades. The Equity Index Group adheres to a sound, disciplined investment management process; the team has considerable experience, stability, and depth.

The board concluded that Vanguard’s experience, stability, depth, and performance, among other factors, warranted continuation of each advisory arrangement.

Investment performance

The board considered the short- and long-term performance of each fund, including any periods of outperformance or underperformance compared with its target index and peer group. The board concluded that the performance was such that each advisory arrangement should continue.

Cost

The board concluded that each fund’s expense ratio was below the average expense ratio charged by funds in its peer group and that each fund’s advisory expenses were also below the peer-group average.

The board does not conduct a profitability analysis of Vanguard because of Vanguard’s unique structure. Unlike most other mutual fund management companies, Vanguard is owned by the funds it oversees.

The benefit of economies of scale

The board concluded that each fund’s arrangement with Vanguard ensures that the funds will realize economies of scale as they grow, with the cost to shareholders declining as fund assets increase.

The board will consider whether to renew the advisory arrangements again after a one-year period.

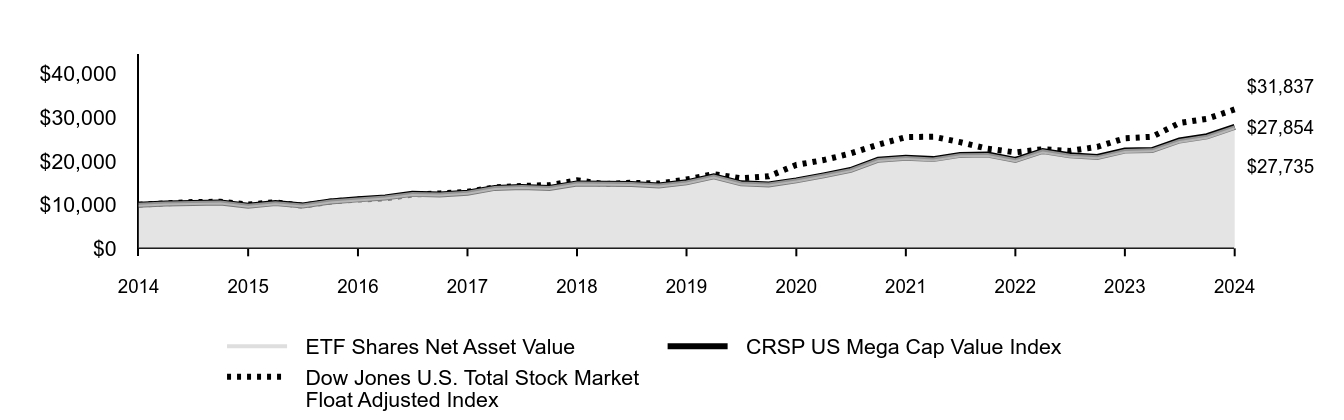

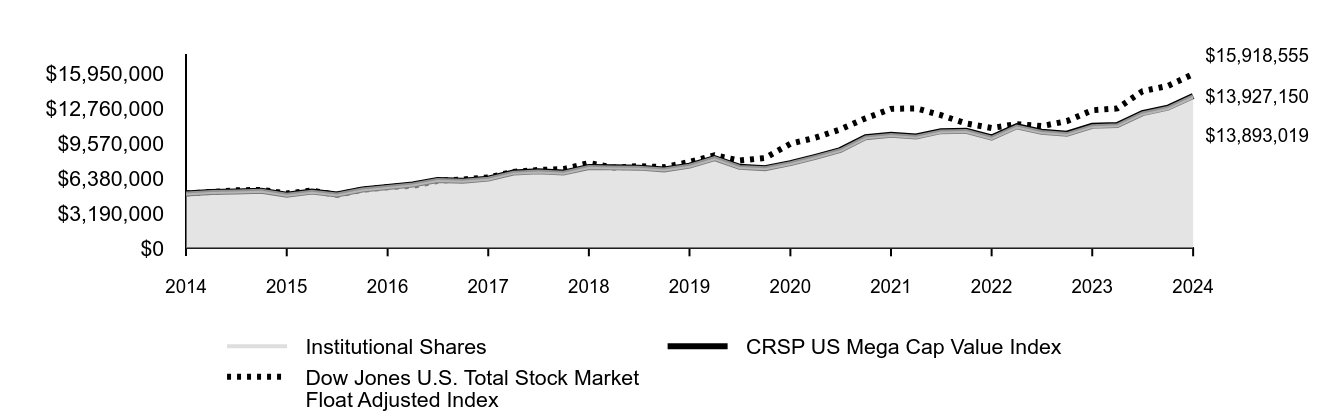

Trustees Approve Advisory Arrangements – Mega Cap Index Funds

The board of trustees of Vanguard Mega Cap Index Fund, Vanguard Mega Cap Growth Index Fund, and Vanguard Mega Cap Value Index Fund has renewed each fund’s investment advisory arrangement with The Vanguard Group, Inc. (Vanguard), through its Equity Index Group. The board determined that continuing each fund’s internalized management structure was in the best interests of the fund and its shareholders.

The board based its decisions upon an evaluation of the advisor’s investment staff, portfolio management process, and performance. This evaluation included information provided to the board by Vanguard’s Portfolio Review Department, which is responsible for fund and advisor oversight and product management. The Portfolio Review Department met regularly with the advisor and made presentations to the board during the fiscal year that directed the board’s focus to relevant information and topics.

The board, or an investment committee made up of board members, also received information throughout the year through advisor presentations conducted by the Portfolio Review Department. For each advisor presentation, the board was provided with letters and reports that included information about, among other things, the advisory firm and the advisor’s assessment of the investment environment, portfolio performance, and portfolio characteristics.

In addition, the board received periodic reports throughout the year, which included information about each fund’s performance relative to its peers and benchmark, as applicable, and updates, as needed on the Portfolio Review Department’s ongoing assessment of the advisor.

Prior to their meeting, the trustees were provided with a memo and materials that summarized the information they received over the course of the year. They also considered the factors discussed below, among others. However, no single factor determined whether the board approved the arrangements. Rather, it was the totality of the circumstances that drove the board’s decisions.

Nature, extent, and quality of services

The board reviewed the quality of each fund’s investment management services over both the short and long term, and took into account the organizational depth and stability of the advisor. The board considered that Vanguard has been managing investments for more than four decades. The Equity Index Group adheres to a sound, disciplined investment management process; the team has considerable experience, stability, and depth.

The board concluded that Vanguard’s experience, stability, depth, and performance, among other factors, warranted continuation of each advisory arrangement.

Investment performance

The board considered the short- and long-term performance of each fund, including any periods of outperformance or underperformance compared with its target index and peer group. The board concluded that the performance was such that each advisory arrangement should continue.

Cost

The board concluded that each fund’s expense ratio was below the average expense ratio charged by funds in its peer group and that each fund’s advisory expenses were also below the peer-group average.

The board does not conduct a profitability analysis of Vanguard because of Vanguard’s unique structure. Unlike most other mutual fund management companies, Vanguard is owned by the funds it oversees.

The benefit of economies of scale

The board concluded that each fund’s arrangement with Vanguard ensures that the funds will realize economies of scale as they grow, with the cost to shareholders declining as fund assets increase.

The board will consider whether to renew the advisory arrangements again after a one-year period.