Filed Pursuant to Rule 424(b)(5)

File No. 333-178979

The information in this prospectus supplement and the accompanying prospectus is not complete and may be changed. This prospectus supplement and the accompanying prospectus are not an offer to sell these securities nor a solicitation of an offer to buy these securities in any jurisdiction where such offer or sale is not permitted.

PRELIMINARY PROSPECTUS SUPPLEMENT TO PROSPECTUS DATED JULY 1, 2014

SUBJECT TO COMPLETION, DATED JULY 1, 2014

Government of Jamaica

US$

% Notes due

The Government of Jamaica is offering US$ of % notes due . The notes will be direct, general, unsecured and unconditional obligations of Jamaica, and will rank at leastpari passu, without any preference among themselves, with all of Jamaica’s other unsecured External Indebtedness (as defined in the accompanying prospectus). Jamaica has pledged its full faith and credit for the due and punctual payment of principal and interest on the notes. Jamaica will pay principal on the notes in three equal installments on July , July and July . Jamaica will pay interest on the outstanding principal of the notes semi-annually in arrears on January and July of each year, commencing on January , 2015 at an annual rate of %. The notes will mature on July , .

The notes are being offered globally for sale in jurisdictions where it is lawful to make such offers and sales. Jamaica intends to apply for the notes to be listed on the Official List of the Luxembourg Stock Exchange and traded on the Euro MTF Market of that exchange.

It is intended that a portion of the notes will be offered and sold outside of the United States to non-U.S. persons in accordance with Regulation S under the Securities Act. Terms used in this paragraph have the meanings given to them in Regulation S under the Securities Act.

Investing in the notes involves risks. See “Risk Factors” beginning on page S-5 of this prospectus supplement.

The notes will contain provisions, commonly known as “collective action clauses,” regarding future modifications to the terms of, or other actions taken in respect of, debt securities issued under the fiscal agency agreement. Under those provisions, modifications or other actions affecting the Reserved Matters listed in the fiscal agency agreement, including modifications to payment and other important terms, may be made to a single series of debt securities issued under the fiscal agency agreement with the consent of the holders of 75% of the aggregate principal amount outstanding of that series, and to two or more series of debt securities issued under the fiscal agency agreement with the consent of the holders of 85% of the aggregate principal amount outstanding of all series that would be affected and 66 2/3% in aggregate principal amount outstanding of each affected series. See “Description of the Debt Securities—Modifications; Collective Action Securities.”

Neither the U.S. Securities and Exchange Commission nor any other regulatory body has approved or disapproved these securities or passed upon the adequacy or accuracy of this prospectus supplement or the prospectus to which it relates. Any representation to the contrary is a criminal offense.

| | | | | | | | |

| | | Per Note | | | Total | |

Public offering price(1) | | | | % | | US$ | | |

Underwriting discounts and commissions | | | | % | | US$ | | |

| | | | | | | | |

Proceeds, before expenses, to Jamaica | | | | % | | US$ | | |

| (1) | Interest on the notes will accrue from July , 2014. |

Delivery of the notes in book entry form will be made on or about July , 2014.

Global Coordinator

Citigroup

Joint Lead Managers and Joint Bookrunners

Citigroup BNP PARIBAS

The date of this prospectus supplement is July , 2014.

ABOUT THIS PROSPECTUS SUPPLEMENT

This document consists of two parts. The first part is this prospectus supplement, which describes the specific terms of this offering. The second part, the accompanying prospectus, gives more general information, some of which may not apply to this offering. If information in this prospectus supplement is inconsistent with the accompanying prospectus, investors should rely on the information in this prospectus supplement. This prospectus supplement, the accompanying prospectus and the documents incorporated by reference into each of them include important information about Jamaica, the notes being offered and other information investors should know before investing in the notes.

INTRODUCTORY STATEMENTS

Jamaica accepts responsibility for the information contained in this prospectus supplement and the prospectus that accompanies it. To the best of the knowledge and belief of the Government of Jamaica (which has taken all reasonable care to ensure that such is the case), the information contained in this prospectus supplement and the accompanying prospectus accurately reflects the facts and does not omit anything likely to affect the import of such information.

The Government of Jamaica is a foreign sovereign government. Foreign sovereign governments are generally immune from lawsuits and from the enforcement of judgments under United States laws; however, foreign sovereign governments may waive this immunity, and limited exceptions to this immunity are set forth in the U.S. Foreign Sovereign Immunities Act of 1976 (the “Foreign Sovereign Immunities Act”). See “Enforcement of Claims” and “Description of the Debt Securities—Enforcement of Claims” in the accompanying prospectus.

The distribution of this prospectus supplement and the accompanying prospectus and the offering of the notes may be legally restricted in some countries. If you wish to distribute this prospectus supplement or the accompanying prospectus, you should observe any applicable restrictions. This prospectus supplement and the accompanying prospectus should not be considered an offer, and it is prohibited to use them to make an offer, in any state or country in which the making of an offer of the notes is prohibited.

Unless otherwise indicated, all references in this prospectus supplement to “JA dollars” and “J$” are to Jamaica dollars, the lawful national currency of the country of Jamaica, and those to “U.S. dollars” or “US$” are to the lawful currency of the United States of America. Unless the context otherwise requires, references to “Jamaica” are references to the Government of Jamaica.

The official exchange rate published by the Bank of Jamaica for U.S. dollars on July 26, 2014 was J$112.03 per US$1.00.

S-1

OFFERING SUMMARY

This summary highlights information contained in this prospectus supplement and the accompanying prospectus and may not contain all of the information that may be important to you. You should read this summary along with the more detailed description appearing elsewhere in this prospectus supplement and in the accompanying prospectus.

| | |

| |

| Issuer | | Government of Jamaica. |

| |

| Notes | | US$ % notes due . |

| |

| Issue Price | | % of the principal amount of the notes plus accrued interest, if any. |

| |

| Maturity Date | | The notes will mature on July and will amortize in three equal installments due July , July and July . |

| |

| Interest | | The notes will bear interest at a rate of % per annum on the outstanding principal amount payable semi-annually in arrears in U.S. dollars on January and July of each year, commencing January , 2015. |

| |

| Withholding Tax and Additional Amounts | | Jamaica will make all payments of principal and interest on the notes without withholding or deduction for any Jamaican taxes, except in certain limited circumstances. See “Description of the Debt Securities—Additional Amounts.” |

| |

| Further Issues | | Jamaica may from time to time, without your consent, increase the size of the issue of the notes, or issue additional debt securities that may be consolidated and form a single series with the outstanding notes. |

| |

Book Entry Delivery, Form and Denominations | | The notes will be issued in fully registered form without interest coupons in minimum denominations of US$200,000 of original principal amount and integral multiples of US$1,000 in excess thereof. The notes will be represented by one or more global notes, registered in the name of Cede & Co. as nominee of DTC. Beneficial interests in the global notes will be shown on, and the transfer thereof will be effected through, records maintained by DTC. See “Global Clearance and Settlement.” |

| |

| Status of the Notes | | The notes will be direct, general, unsecured and unconditional obligations of Jamaica, and will rank at leastpari passu, without any preference among themselves, with all of Jamaica’s other unsecured External Indebtedness. Jamaica has pledged its full faith and credit to make all payments on the notes when due. See “Description of the Debt Securities—Status of the Debt Securities.” |

S-2

| | |

| |

| Events of Default | | The notes will contain certain events of default, the occurrence of which may permit noteholders to accelerate Jamaica’s obligations under the notes prior to maturity. See “Description of the Debt Securities—Default; Acceleration of Maturity.” |

| |

| Negative Pledge | | The notes will contain certain covenants, including a negative pledge covenant that will restrict Jamaica from creating or permitting to exist (subject to certain exceptions) any security interest on any of its present or future revenue, properties or assets. See “Description of the Debt Securities—Negative Pledge.” |

| |

| Payments of Principal and Interest | | Jamaica will make payments of principal and interest on the notes in U.S. dollars through the paying agent to DTC, which will receive funds for distribution to the holders of the notes as registered with the registrar at the close of business on the fifteenth day preceding the date of payment. |

| |

| Listing | | Jamaica intends to apply to have the notes listed on the Official List of the Luxembourg Stock Exchange and traded on the Euro MTF Market of that exchange. |

| |

| Use of Proceeds | | Jamaica will use the US dollar equivalent to €150 million of the net proceeds from the sale of the notes for the repayment in full of its 10.50% euro bonds due 2014. Jamaica intends to use the remaining net proceeds from the sale of the notes for general purposes of the government, including the refinancing, repurchase or retiring of public indebtedness. |

| |

| Taxation | | See “Taxation” in the companying prospectus for a discussion of the U.S. and Jamaican tax consequences associated with an investment in the notes. Investors should consult their own tax advisors in determining the tax consequences of the purchase, ownership and disposition of the notes. |

| |

| Collective Action Clauses | | The notes will contain provisions, commonly known as “collective action clauses,” regarding future modifications to the terms of, or other actions taken in respect of, debt securities issued under the fiscal agency agreement. Under those provisions, modifications or other actions affecting the Reserved Matters listed in the fiscal agency agreement, including modifications to payment and other important terms, may be made to a single series of debt securities issued under the fiscal agency agreement with the consent of the holders of 75% of the aggregate principal amount outstanding of that series, and to two or more series of debt securities issued under the fiscal agency agreement with the consent of the holders of 85% of the aggregate principal amount outstanding of all series that would be affected and 66 2/3% in aggregate principal amount outstanding of each affected series. See “Description of the Debt Securities—Modifications; Collective Action Securities.” |

S-3

| | |

| |

Fiscal Agent, Principal Paying Agent and Registrar | | Deutsche Bank Trust Company Americas. |

| |

| Paying Agent and Transfer Agent | | Deutsche Bank Luxembourg S.A. |

| |

| Governing Law | | The notes and the fiscal agency agreement are governed by the laws of the State of New York, except with respect to their authorization and execution, which will be governed by the laws of Jamaica. See “Description of the Debt Securities—Governing Law and Submission to Jurisdiction.” |

S-4

RISK FACTORS

Your decision to invest in the notes involves risk. We urge you to read carefully this prospectus supplement and the accompanying prospectus in their entirety and to note, in particular, the following risk factors.

Risk Factors Relating to Jamaica

Any investment in securities of a sovereign in an emerging market, such as the notes, involve significant risks.

Jamaica is an emerging market economy, and investing in securities of emerging markets issuers generally involves a higher degree of risk. Social and macroeconomic factors may also affect economic and fiscal results. Investing in securities of issuers in emerging markets, such as Jamaica, generally involves a higher degree of risk than investments in securities of corporate or sovereign issuers from more developed countries. Factors that adversely affect emerging market countries, such as Jamaica, include, among others, the following:

| | • | | dependence on external financing; |

| | • | | devaluation or depreciation of the currency; |

| | • | | lack of adequate infrastructure necessary to accelerate economic growth; |

| | • | | adverse changes in governmental economic, tax or other policies. |

Any of these factors may have an adverse effect on the condition of Jamaica, while volatility in the markets for securities similar to the notes may adversely affect the liquidity of, and trading market for, the notes.

Developments in Jamaica’s trading partners may materially and adversely affect Jamaica and its ability to service the notes.

If interest rates increase significantly in developed economies, including the United States, Jamaica’s trading partners could find it more difficult and expensive to borrow capital and refinance existing debt, which could adversely affect economic growth in those countries. Decreased growth on the part of Jamaica’s trading partners could have a material adverse effect on the markets for Jamaican exports and, in turn, adversely affect the Jamaican economy. An increase in interest rates in developed economies would also increase Jamaica’s debt service requirements with respect to its debt obligations that accrue interest on a floating rate basis, which could adversely affect the ability of Jamaica to service its public debt generally, including the notes.

S-5

Depreciation or appreciation of the Jamaica dollar could have a material adverse effect on the Jamaican economy and Jamaica’s ability to service the notes.

We cannot assure you that the Jamaica dollar will not depreciate or appreciate significantly in the future. Either a significant appreciation or a significant depreciation could have a material adverse effect on the Jamaican economy and the general ability of Jamaica to service its public debt, including the notes.

Jamaica has experienced economic problems and may continue experiencing economic problems, which may affect Jamaica’s ability to service its debt, including the notes.

Jamaica has experienced volatility in its macroeconomic drivers and has experienced economic crises in recent decades. Preliminary estimates showed that the Jamaican economy expanded by 0.2% in 2013 when compared with 2012. GDP declined by 0.5% in 2012 compared to 2011 and grew by 1.4% in 2011 compared to 2010. Jamaica cannot offer any assurance that the Jamaican economy will grow in the future. Economic growth depends on a variety of factors, including, among others, the sustainability of tourism, the stability and competitiveness of the Jamaica dollar against foreign currencies, confidence among Jamaican consumers and foreign and domestic investors and their rates of investment in Jamaica, the willingness and ability of businesses to engage in new capital spending and the rate of inflation. Some of these factors are outside of Jamaica’s control. If Jamaica experiences economic problems, Jamaica may have difficulty in servicing the notes.

Jamaica faces long-term economic challenges, including:

| | • | | a substantial merchandise trade deficit; |

| | • | | social problems relating to high unemployment, poverty and crime; |

The Jamaican economy remains vulnerable to external shocks, including natural disasters such as hurricanes, which could have a material adverse effect on economic growth and Jamaica’s ability to make payments on its debt, including the notes.

Jamaica’s economy is vulnerable to external shocks. A reduction in tourism, as a result of economic decline in other countries or natural disasters, such as hurricanes, may cause a reduction in revenue and could have an adverse effect on the Jamaican economy. In addition, a significant decline in the economic growth of any of Jamaica’s major trading partners, especially the United States, could have an adverse effect on Jamaica’s balance of trade and adversely affect Jamaica’s economic growth. The United States is Jamaica’s largest export market. Jamaica’s economy also benefits substantially from remittances, which tend to decline during global and U.S. economic downturns. A significant decrease in remittances from Jamaicans living abroad may lead to depreciation of the Jamaica dollar and negatively affect the ability of Jamaica to meet its external debt obligations. Jamaica cannot assure you that events affecting other markets will not have a material adverse effect on Jamaica’s growth and its ability to service its public debt, including the notes.

Jamaica may be unable to obtain financing on satisfactory terms in the future and its ability to service its public debt may be adversely affected.

Jamaica’s future fiscal results (i.e., tax receipts excluding interest payments on Jamaica’s public debt) may be insufficient to meet its debt service obligations and it may have to rely in part on additional financing from the domestic and international capital markets on satisfactory terms in order to meet its future debt service obligations. In the future, Jamaica may not be able or willing to access the international capital markets, and this may have a material adverse effect on Jamaica’s ability to service its public debt, including the notes.

S-6

Jamaica receives financing from international lending agencies and multilateral institutions, including the International Monetary Fund. If such support is unavailable in the future, Jamaica may have difficulty in servicing the notes.

Jamaica receives budgetary financing from multilateral, including from the IMF, and other official institutions, and balance of payment support from the IMF, both under the Extended Fund Facility (“EFF”). Jamaica’s failure to meet the targets set out under the EFF or delays in approvals by the IMF in its periodic review of Jamaica’s progress in meeting such targets may result in no disbursements or delays in disbursements under the EFF, and may also lead other multilateral and official sector agencies to suspend or delay disbursements. If economic assistance from multilateral and other official institutions is unavailable in the future, Jamaica may have difficulty in servicing its debts, including the notes. For further details on the EFF, see “Recent Developments—The Jamaican Economy—IMF Arrangements.”

Jamaica relies heavily on foreign oil supplies, which may be disrupted or increase in cost in the future.

Jamaica is dependent on oil imports to satisfy domestic energy consumption. Jamaica receives approximately 90% of its energy requirements from imported oil. In August 2005, Jamaica entered into the PetroCaribe Agreement under which the government of Venezuela has agreed to make available to Jamaica a portion of the value of Jamaica’s purchases of oil as a concessionary loan facility, the terms of which are determined by the prevailing price per barrel of oil internationally. Jamaica cannot guarantee that this agreement, or any future agreement with Venezuela or any other country, will not be terminated. Furthermore, any disruption of oil supplies or a significant increase in international oil prices may have a material adverse effect on the Jamaican economy and Jamaica’s ability to service its debts, including the notes.

Risks Related to the Notes

The notes will contain provisions regarding acceleration and voting on amendments, modifications and waivers, which are commonly referred to as “collective action clauses,” under which certain key terms of the notes may be amended, including the maturity date, interest rate and other payment terms, without your consent.

The notes will contain provisions, commonly known as “collective action clauses,” regarding future modifications to the terms of, or other actions taken in respect of, debt securities issued under the fiscal agency agreement. Under those provisions, modifications or other actions affecting the Reserved Matters listed in the fiscal agency agreement, including modifications to payment and other important terms, may be made to a single series of debt securities issued under the fiscal agency agreement with the consent of the holders of 75% of the aggregate principal amount outstanding of that series, and to two or more series of debt securities issued under the fiscal agency agreement with the consent of the holders of 85% of the aggregate principal amount outstanding of all series that would be affected and 66 2/3% in aggregate principal amount outstanding of each affected series. See “Description of the Debt Securities—Modifications; Collective Action Securities.”

It may be difficult or impossible to enforce judgments of courts of the United States and other jurisdictions against Jamaica.

Jamaica is a foreign sovereign government. Foreign sovereign governments and agencies and instrumentalities thereof are generally immune from lawsuits and from the enforcement of judgments under U.S. law, but may waive this immunity or may be subject to limited exceptions to this immunity, as set forth in the U.S. Foreign Sovereign Immunities Act of 1976, as amended, or the Foreign Sovereign Immunities Act.

S-7

Jamaica, except as provided below, irrevocably waives and agrees not to plead any immunity, including sovereign immunity, from the jurisdiction of any state or federal court in the Borough of Manhattan, the City of New York, to which it might otherwise be entitled in any action arising out of or based upon the notes to the fullest extent permitted by applicable law. However, Jamaica reserves the right to plead sovereign immunity under the Foreign Sovereign Immunities Act with respect to actions brought against us or it under U.S. federal securities laws or any state securities laws. In the absence of a waiver of immunity by Jamaica with respect to such actions, it would not be possible to obtain a U.S. judgment in such action unless a court were to determine that Jamaica is not entitled to sovereign immunity under the Foreign Sovereign Immunities Act with respect to that action. Moreover, it may not be possible to enforce a judgment obtained under the Foreign Sovereign Immunities Act against Jamaica’s property located in the United States except under the limited circumstances specified in the Foreign Sovereign Immunities Act.

If an active trading market for the notes does not develop, the market price and liquidity of the notes may be adversely affected.

Currently there is no market for the notes. Application has been made to have the notes listed on the Official List of the Luxembourg Stock Exchange and traded on the Euro MTF Market of that exchange. Even if the notes become listed on this exchange, Jamaica may delist the notes. A trading market for the notes may not develop, or if a market for the notes were to develop, the notes may trade at a discount from their initial offering price, depending upon many factors, including prevailing interest rates, the market for similar securities, general economic conditions and Jamaica’s financial condition. The underwriters are not under any obligation to make a market with respect to the notes, and Jamaica cannot assure you that trading markets will develop or be maintained. Accordingly, Jamaica cannot assure you as to the development or liquidity of any trading market for the notes. If an active market for the notes does not develop or is interrupted, the market price and liquidity of the notes may be adversely affected.

Recent U.S. federal court decisions create uncertainty regarding the meaning of ranking provisions and could potentially reduce or hinder the ability of sovereign issuers, including Jamaica, to restructure their public sector debt.

In ongoing litigation in the U.S. federal courts in New York captionedNML Capital, Ltd. v. Republic of Argentina, the U.S. federal courts ruled that the ranking clause in defaulted bonds issued by the Republic of Argentina prevents the Republic of Argentina from making payments in respect of exchanged bonds that were later issued by the Republic of Argentina unless the Republic of Argentina makes pro rata payments in respect of certain defaulted bonds, which rankpari passu with the exchanged bonds.

An equal ranking provision similar to the provision litigated inNML Capital, Ltd. v. Republic of Argentina will be contained in the notes and has been contained in other securities previously issued by Jamaica. To ensure clarity on the point, Jamaica has always intended that the equal ranking provision would permit it to redeem or to make principal and interest payments in respect of some of its external debt without making ratable payments in respect of other external debt.

Nonetheless, the decision inNML Capital, Ltd. v. Republic of Argentina could potentially hinder or impede future sovereign debt restructurings and distressed debt management, including those of Jamaica, unless sovereign issuers obtain the requisite creditor consents under their debt that include collective action clauses, such as the collective action clause contained in the notes. See “Description of the Debt Securities—Modifications; Collective Action Securities.” Jamaica cannot predict how this decision may impact any debt restructuring it may undertake in the future.

S-8

RECENT DEVELOPMENTS

The information included in this section supplements the information about Jamaica contained in Jamaica’s annual report for the year ended March 31, 2014 on Form 18-K filed with the SEC on May 30, 2014. To the extent the information in this section is inconsistent with the information contained in such annual report, the information in this section replaces such information. No significant changes to the information provided in Jamaica’s annual report for the year ended March 31, 2014 on Form 18-K filed with the SEC on May 30, 2014 have occurred. Initially capitalized terms used in this section have the respective meaning assigned to those terms in such annual report.

THE JAMAICAN ECONOMY

IMF Arrangements

On June 20, 2014, the IMF Board completed the Article IV Consultation and fourth review of Jamaica’s economic performance under the EFF arrangement. The completion of the review enabled the disbursement of SDR 45.95 million (approximately US$70.9 million) on June 24, 2014, which brought total disbursements under the EFF arrangement to SDR 268.59 million (approximately US$414.4 million). For additional details on the EFF, see “Form 18-K—Exhibit (d)—The Jamaican Economy–IMF Arrangements.”

General

As part of the ERP, the Government has continued to focus investment in, among others, the consolidation of Jamaica as a logistics hub for shipment and information technology. Achievements in the consolidation of Jamaica as a logistics hub for shipment include:

| | • | | commencement of the bidding process for the possible divestment of the Kingston Container Terminal; |

| | • | | a non-binding framework agreement with the China Harbour and Engineering Company for the development of a US$1.5 billion transshipment port and industrial and commercial zone project; |

| | • | | a framework study for the development of special economic zones, which will be discussed in Parliament; and |

| | • | | cabinet approval to begin the process for a possible divestment of the Norman Manley International Airport. |

With respect to investment in information technology, the following steps have been taken:

| | • | | the Development Bank of Jamaica has approved six projects and is considering two additional applications with a total estimated investment of US$33 million that is expected to create approximately 8,000 new jobs; |

| | • | | pro-free zone investment initiatives by the Government, including economic free zones, in which no tax on profits is paid, and exemptions from general consumption tax and common external tariff; and |

| | • | | the Jamaica Promotions Corporation (“JAMPRO”) assisted five new entrants to the Jamaican market, including two software development firms and three outsourcing companies. |

S-9

Noble and Alcoa

On June 13, 2014, Alcoa World Alumina LLC. (“Alcoa”) advised the Government that, along with the other shareholder Alcoa Caribbean Alumina Holdings LLC, on June 10, 2014, it had entered into a non-binding letter of intent to sell the majority of its 55% interest in Jamalco through the sale of the majority of its equity interest in its subsidiary Alcoa Minerals of Jamaica LLC (“AMJ”) to Noble Resources UK Limited and/or one or more of its affiliates. Jamalco is a bauxite mining and alumina refining joint venture between Alcoa, through its subsidiary AMJ, and the Government of Jamaica, through its wholly owned company, Clarendon Aluminum Production Limited, which holds the remaining 45% interest in Jamalco. Alcoa is expected to retain a minority interest in AMJ in the first instance and will continue to serve as Jamalco’s managing operator for at least two years following the sale.The sale is subject to binding agreements being reached between the parties to the transaction and the consent of the Government, and other approvals.” See “Form 18-K—Exhibit (d)—The Jamaican Economy—Principal Sectors of the Economy—Mining and Quarrying.”

S-10

INCORPORATION BY REFERENCE

The SEC allows Jamaica to incorporate by reference some information that Jamaica files with the SEC. Jamaica can disclose important information to you by referring you to those documents. Jamaica’s SEC filings are available to the public from the SEC’s website at http://www.sec.gov. Exhibit C and Exhibit D to Jamaica’s annual report on Form 18-K for the year ended March 31, 2014, as amended, filed with the SEC on May 30, 2014, is considered part of and incorporated by reference in this prospectus supplement and the accompanying prospectus. You may also obtain copies of documents incorporated by reference, free of charge, at the office of the Luxembourg paying agent specified on the inside back cover of this prospectus supplement or from the website of the Luxembourg Stock Exchange athttp://www.bourse.lu.

S-11

USE OF PROCEEDS

The amount of the net proceeds from the sale of the notes, after deducting underwriting commissions and expenses, is expected to be approximately US$ �� . Jamaica will use the US dollar equivalent to €150 million of the net proceeds from the sale of the notes for the repayment in full of its 10.50% euro bonds due 2014. Jamaica intends to use the remaining net proceeds from the sale of the notes for general purposes of the government, including the refinancing, repurchase or retiring of public indebtedness.

S-12

DESCRIPTION OF THE NOTES

General

The notes will be issued under a fiscal agency agreement, to be dated on or about July , 2014 among Jamaica, Deutsche Bank Trust Company Americas, as fiscal agent, principal paying agent and registrar, and Deutsche Bank Luxembourg S.A. as paying agent and a transfer agent.

The notes are a series of debt securities more fully described in the accompanying prospectus, except to the extent indicated below. The following statements are subject to the provisions of the fiscal agency agreement and the notes. This summary does not purport to be complete and the description below may not contain all of the information that is important to you as a potential investor in the notes. On July 11, 2013, Jamaica filed the form of fiscal agency agreement, which includes a form of the notes, with the U.S. Securities and Exchange Commission as an exhibit to Jamaica’s post-effective amendment to its Schedule B. You should refer to the executed fiscal agency agreement and form of notes that Jamaica will file as an exhibit to an amendment to Jamaica’s annual report on Form 18-K for the fiscal year ended March 31, 2014 for more complete information concerning the fiscal agency agreement and the notes. Capitalized terms not defined below shall have the respective meanings given in the accompanying prospectus.

The notes will:

| | • | | be issued in an aggregate principal amount of US$ ; |

| | • | | bear interest at % per year on the outstanding principal amount from July , 2014; |

| | • | | mature on July and amortize in three equal installments on July , July and July ; |

| | • | | pay interest on January and July of each year, commencing January , 2015; |

| | • | | pay interest to the persons in whose names the notes are registered on the record date, which is the close of business on the preceding December or June (whether or not a business day), as the case may be. Interest will be calculated on the basis of a 360-day year, consisting of twelve 30-day months; and |

| | • | | contain “collective action clauses” under which Jamaica may amend or obtain waivers of the payment provisions of the notes and certain other terms with consent of less than all of the holders of the notes. |

Jamaica intends to apply for the notes to be listed on the Official List of the Luxembourg Stock Exchange and traded on the Euro MTF Market of that exchange. In addition, Jamaica will maintain a paying agent and transfer agent in Luxembourg so long as any of the bonds are admitted to trading on the Euro MTF Market and the rules of the Luxembourg Stock Exchange so require.

Book Entry

Jamaica will issue the notes in the form of one or more fully registered global notes. Jamaica will deposit the global notes with DTC and register the global notes in the name of Cede & Co. as DTC’s nominee. Beneficial interests in the global notes will be represented by, and transfers thereof will be effected only through, book-entry accounts maintained by DTC and its participants.

S-13

Certificated Securities

In circumstances detailed in the accompanying prospectus (see “Description of the Debt Securities—Global Securities—Registered Ownership of the Global Security”), Jamaica may issue certificated securities. In that event, Jamaica will issue certificated securities in denominations of US$200,000 and integral multiples of US$1,000. The holders of certificated securities shall present directly at the corporate trust office of the fiscal agent, at the office of the Luxembourg paying and transfer agent or at the office of any other transfer agent as Jamaica may designate from time to time all requests for the registration of any transfer of such securities, for the exchange of such securities for one or more new certificated securities in a like aggregate principal amount and in authorized denominations and for the replacement of such securities in the cases of mutilation, destruction, loss or theft. Certificated securities issued as a result of any partial or whole transfer, exchange or replacement of the notes will be delivered to the holder at the corporate trust office of the fiscal agent, at the office of the Luxembourg paying and transfer agent or at the office of any other transfer agent, or (at the risk of the holder) sent by mail to such address as is specified by the holder in the holder’s request for transfer, exchange or replacement.

Registration and Payments

Jamaica will pay each installment amount of a note on the applicable payment date in immediately available funds in the City of New York upon presentation of the note at the office of the fiscal agent in the City of New York or, subject to applicable law and regulations, at the office outside the United States of any paying agent, including the Luxembourg paying agent (if the notes are admitted for trading on the Euro MTF Market, and the rules of the Luxembourg Stock Exchange so require).

Jamaica will appoint the fiscal agent as registrar, principal paying agent and transfer agent of the notes. In these capacities, the fiscal agent will, among other things:

| | • | | maintain a record of the aggregate holdings of notes represented by the global notes and any certificated notes and accept notes for exchange and registration of transfer; |

| | • | | ensure that payments of principal and interest in respect of the notes received by the fiscal agent from Jamaica are duly paid to the depositaries for the securities or their respective nominees and any other holders of any notes; and |

| | • | | transmit to Jamaica any notices from holders of any of the notes. |

If the notes are admitted for trading on the Euro MTF Market, and the rules of the Luxembourg Stock Exchange so require, Jamaica will appoint and maintain a paying agent and a transfer agent in Luxembourg, who shall initially be Deutsche Bank Luxembourg S.A. Holders of certificated securities will be able to receive payments thereon and effect transfers thereof at the offices of the Luxembourg paying and transfer agent. For so long as the notes are listed on the Luxembourg Stock Exchange, Jamaica will publish any change as to the identity of the Luxembourg paying and transfer agent in a leading newspaper in Luxembourg, which is expected to be thed’Wort, or on the website of the Luxembourg Stock Exchange (www.bourse.lu).

Redemption and Sinking Fund

Jamaica may not redeem the notes prior to maturity. Jamaica will not provide a sinking fund for the amortization and retirement of the notes.

S-14

Regarding the Fiscal Agent

The fiscal agent has its principal corporate trust office at Deutsche Bank Trust Company Americas, Trust & Securities Services, 60 Wall Street, 27th Floor-MS NYC60-2710, New York, NY 10005. Jamaica will at all times maintain a paying agent and a transfer agent in the City of New York or the State of New Jersey which will, unless otherwise provided, be the fiscal agent. Jamaica may maintain deposit accounts and conduct other banking transactions in the ordinary course of business with the fiscal agent. The fiscal agent will be the agent of Jamaica, not a trustee for holders of any notes. Accordingly, the fiscal agent will not have the same responsibilities or duties to act for such holders as would a trustee, except that monies held by the fiscal agent as payment of principal or interest on the notes shall be held by the fiscal agent in trust for the holders of the notes.

The fiscal agency agreement is not required to be qualified under the U.S. Trust Indenture Act of 1939. Accordingly, the fiscal agency agreement may not contain all of the provisions that could be beneficial to holders of the notes that would be contained in an indenture qualified under the Trust Indenture Act.

Notices

All notices will be published in London in theFinancial Times, in the City of New York inThe Wall Street Journaland, so long as the notes are admitted for trading on the Euro MTF, in Luxembourg in theLuxemburger Wort. If Jamaica cannot, for any reason, publish notice in any of these newspapers, it will choose an appropriate alternate English language newspaper of general circulation, and notice in that newspaper will be considered valid notice. Notice will be considered made as of the first date of its publication.

Further Issues

Jamaica may from time to time, without your consent, create and issue additional debt securities having the same terms and conditions as the notes offered by this prospectus supplement (or the same except for the amount of the first interest payment). Jamaica may consolidate the additional debt securities to form a single series with the outstanding notes.

S-15

GLOBAL CLEARANCE AND SETTLEMENT

DTC, Euroclear and Clearstream, Luxembourg have established links among themselves to facilitate the initial settlement of the notes and cross-market transfers of the notes in secondary market trading. DTC will be linked to JPMorgan Chase Bank, a New York banking corporation, as depositary of the Euroclear System (“Euroclear”), and Citibank, N.A. as depository for Clearstream Banking, société anonyme (“Clearstream, Luxembourg”) (the “Clearing System Depositories”).

Although DTC, Euroclear and Clearstream, Luxembourg have agreed to the procedures provided below to facilitate transfers of notes among participants of DTC, Euroclear and Clearstream, Luxembourg, they are under no obligation to perform such procedures. In addition, such procedures may be modified or discontinued at any time. Neither Jamaica nor the Fiscal Agent will have any responsibility for the performance by DTC, Euroclear or Clearstream, Luxembourg or their respective participants or indirect participants of the respective obligations under the rules and procedures governing their operations.

The Clearing Systems

The Depository Trust Company. DTC is:

| | • | | a limited-purpose trust company organized under the New York Banking Law; |

| | • | | a “banking organization” under the New York Banking Law; |

| | • | | a member of the Federal Reserve System; |

| | • | | a “clearing corporation” under the New York Uniform Commercial Code; and |

| | • | | a “clearing agency” registered under Section 17A of the U.S. Securities Exchange Act of 1934. |

DTC was created to hold securities for its participants and facilitate the clearance and settlement of securities transactions between its participants. It does this through electronic book-entry changes in the accounts of its direct participants, eliminating the need for physical movement of securities certificates. DTC is owned by a number of its direct participants and by the New York Stock Exchange, Inc., the American Stock Exchange, Inc. and the National Association of Securities Dealers, Inc.

DTC can act only on behalf of its direct participants, who in turn act on behalf of indirect participants and certain banks. In addition, unless a global security is exchanged in whole or in part for a definitive security, it may not be physically transferred, except as a whole among DTC, its nominees and their successors. Therefore, your ability to pledge a beneficial interest in the global notes to persons that do not participate in the DTC system, and to take other actions, may be limited because you will not possess a physical certificate that represents your interest.

Euroclear and Clearstream, Luxembourg. Like DTC, Euroclear and Clearstream, Luxembourg hold securities for their participants and facilitate the clearance and settlement of securities transactions between their participants through electronic book-entry changes in their accounts. Euroclear and Clearstream, Luxembourg provide various services to their participants, including the safekeeping, administration, clearance and settlement and lending and borrowing of internationally traded securities. Euroclear and Clearstream, Luxembourg participants are financial institutions such as underwriters, securities brokers and dealers, banks, trust companies and other organizations. The underwriters for the notes may be a participant in Euroclear or Clearstream, Luxembourg. Other banks, brokers, dealers and trust companies have indirect access to Euroclear or Clearstream, Luxembourg by clearing through or maintaining a custodial relationship with a Euroclear or Clearstream, Luxembourg participant.

S-16

Initial Settlement

If you plan to hold your interests in the notes through DTC, you will follow the settlement practices applicable to global security issues. If you plan to hold your interests in the notes through Euroclear or Clearstream, Luxembourg, you will follow the settlement procedures applicable to conventional Eurobonds in registered form. If you are an investor on the settlement date, you will pay for the notes by wire transfer and the entity through which you hold your interests in the notes will credit your securities custody account.

Secondary Market Trading

The purchaser of notes determines the place of delivery in secondary market trading. Therefore, it is important for you to establish at the time of the trade where both the purchaser’s and seller’s accounts are located to ensure that settlement can be made on the desired value date (i.e., the date specified by the purchaser and seller on which the price of the securities is fixed).

Trading between DTC purchasers and sellers. DTC participants will transfer interests in the notes among themselves in the ordinary way according to the rules and operating procedures of DTC governing global security issues. Participants will pay for these transfers by wire transfer.

Trading between Euroclear and/or Clearstream, Luxembourg participants. Euroclear and Clearstream, Luxembourg participants will transfer interests in the notes among themselves in the ordinary way according to the rules and operating procedures of Euroclear and Clearstream, Luxembourg governing conventional Eurobonds. Participants will pay for these transfers by wire transfer.

Trading between a DTC seller and a Euroclear or Clearstream, Luxembourg purchaser. When the notes are to be transferred from the account of a DTC participant to the account of a Euroclear or Clearstream, Luxembourg participant, the purchaser must first send instructions to Euroclear or Clearstream, Luxembourg through a participant at least one business day before the settlement date. Euroclear or Clearstream, Luxembourg will then instruct its depositary to receive the notes and make payment for them. On the settlement date, the depositary will make payment to the DTC participant’s account and the notes will be credited to the depositary’s account. After settlement has been completed, DTC will credit the notes to Euroclear or Clearstream, Luxembourg; Euroclear or Clearstream, Luxembourg will credit the notes, in accordance with its usual procedures, to the participant’s account; and the participant will then credit the purchaser’s account. These notes credits will appear the next day (European time) after the settlement date. The cash debit from the account of Euroclear or Clearstream, Luxembourg will be back-valued to the value date, which will be the preceding day if settlement occurs in New York. If settlement is not completed on the intended value date (i.e., the trade fails), the cash debit will instead be valued at the actual settlement date.

Participants in Euroclear and Clearstream, Luxembourg will need to make funds available to Euroclear or Clearstream, Luxembourg in order to pay for the notes by wire transfer on the value date. The most direct way of doing this is to preposition funds (i.e., have funds in place at Euroclear or Clearstream, Luxembourg before the value date), either from cash on hand or from existing lines of credit. Under this approach, however, participants may take on credit exposure to Euroclear and Clearstream, Luxembourg until the notes are credited to their accounts one day later.

As an alternative, if Euroclear or Clearstream, Luxembourg has extended a line of credit to a participant, the participant may decide not to preposition funds, but to allow Euroclear or Clearstream, Luxembourg to draw on the line of credit to finance settlement for the notes. Under this procedure, Euroclear or Clearstream, Luxembourg would charge the participant overdraft

S-17

charges for one day, assuming that the overdraft would be cleared when the notes were credited to the participant’s account. However, interest on the notes would accrue from the value date. Therefore, in many cases the interest income on notes which the participant earns during that one-day period will substantially reduce or offset the amount of the participant’s overdraft charges. Of course, this result will depend on the cost of funds (i.e., the interest rate that Euroclear or Clearstream, Luxembourg charges) to each participant.

Since the settlement will occur during New York business hours, a DTC participant selling an interest in the notes can use its usual procedures for transferring global securities to the Clearing System Depositaries of Euroclear or Clearstream, Luxembourg for the benefit of Euroclear participants or Clearstream, Luxembourg participants. The DTC seller will receive the sale proceeds on the settlement date. Thus, to the DTC seller, a cross-market sale will settle no differently than a trade between two DTC participants.

Finally, day traders that use Euroclear or Clearstream, Luxembourg and that purchase notes from DTC participants for credit to Euroclear participants or Clearstream, Luxembourg participants should note that these trades will automatically fail on the sale side unless one of three steps is taken:

| | • | | borrowing through Euroclear or Clearstream, Luxembourg for one day, until the purchase side of the day trade is reflected in their Euroclear account or Clearstream, Luxembourg account, in accordance with the clearing system’s customary procedures; |

| | • | | borrowing the notes in the United States from a DTC participant no later than one day prior to settlement, which would give the notes sufficient time to be reflected in the borrower’s Euroclear account or Clearstream, Luxembourg account in order to settle the sale side of the trade; or |

| | • | | staggering the value dates for the buy and sell sides of the trade so that the value date of the purchase from the DTC participant is at least one day prior to the value date for the sale to the Euroclear participant or Clearstream, Luxembourg participant. |

Trading between a Euroclear or Clearstream, Luxembourg seller and a DTC purchaser. Due to time zone differences in their favor, Euroclear and Clearstream, Luxembourg participants can use their usual procedures to transfer securities through their Clearing System Depositaries to a DTC participant. The seller must first send instructions to Euroclear or Clearstream, Luxembourg through a participant at least one business day before the settlement date. Euroclear or Clearstream, Luxembourg will then instruct its depositary to credit the notes to the DTC participant’s account and receive payment. The payment will be credited in the account of the Euroclear or Clearstream, Luxembourg participant on the following day, but the receipt of the cash proceeds will be back-valued to the value date, which will be the preceding day if settlement occurs in New York. If settlement is not completed on the intended value date (i.e., the trade fails), the receipt of the cash proceeds will instead be valued at the actual settlement date.

If the Euroclear or Clearstream, Luxembourg participant selling the notes has a line of credit with Euroclear or Clearstream, Luxembourg and elects to be in debit for the notes until it receives the sale proceeds in its account, then the back-valuation may substantially reduce or offset any overdraft charges that the participant incurs over that one-day period.

S-18

UNDERWRITING

Jamaica has entered into an underwriting agreement with Citigroup Global Markets Inc. and BNP Paribas Securities Corp. as joint lead underwriters, dated July , 2014, relating to the offering and sale of the notes. In the underwriting agreement, Jamaica has agreed to sell the notes to the underwriters, and each underwriter, severally and not jointly, has agreed to purchase from Jamaica the amount of notes set forth opposite such underwriter’s name in the table below.

| | | | |

Underwriters | | Principal

Amount of

Notes | |

Citigroup Global Markets Inc. | | US$ | | |

BNP Paribas Securities Corp. | | US$ | | |

| | | | |

Total | | US$ | | |

| | | | |

The notes will be issued in fully registered form without interest coupons in minimum denominations of US$200,000 of original principal amount and integral multiples of US$1,000 in excess thereof.

The obligations of the underwriters under the underwriting agreement, including their agreement to purchase the notes from Jamaica, are subject to the satisfaction of certain conditions in the underwriting agreement. If the conditions are met, the underwriters have agreed to purchase all of the notes.

The underwriters have advised Jamaica that they propose to offer the notes to the public at the public offering price that appears on the cover page of this prospectus supplement. As compensation to the underwriters, Jamaica will pay to the underwriters a selling commission in the aggregate amount of US$ . After the initial public offering, the underwriters may change the public offering price and any other selling terms.

In the underwriting agreement, Jamaica has agreed that Jamaica will indemnify the underwriters against certain liabilities, including liabilities under Securities Act, or contribute to payments which the underwriters may be required to make in respect of any of those liabilities.

Jamaica intends to apply for the notes to be listed on the Official List of the Luxembourg Stock Exchange and traded on the Euro MTF Market of that exchange in accordance with its rules.

In connection with the offering, the underwriters may engage in short sales, stabilizing transactions and purchases to cover positions created by short sales in accordance with Regulation M under the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”). Short sales involve the sale by the underwriters of a greater aggregate principal amount of notes than it is required to purchase in the offering. Stabilizing transactions consist of certain bids or purchases made for the purpose of preventing or retarding a decline in the market price of the notes while the offering is in progress. These activities by the underwriters may stabilize, maintain or otherwise affect the market price of the notes. As a result, the price of the notes may be higher than the price that otherwise might exist in the open market. If these activities are commenced, they may be discontinued by the underwriters at any time. These transactions may be effected on the Euro MTF, the alternative market of the Luxembourg Stock Exchange, in the over-the-counter market or otherwise.

It is intended that a portion of the notes will be offered and sold outside of the United States to non-U.S. persons in accordance with Regulation S under the Securities Act. Terms used in this paragraph have the meanings given to them in Regulation S under the Securities Act.

S-19

It is expected that delivery of the notes will be made on July , 2014 which will be the fifth business day in the United States following the date of pricing of the notes (“T+5”). Under Rule 15c6-1 under the Exchange Act, trades in the secondary market in the United States generally are required to settle in three business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers wishing to trade notes prior to the third U.S. business day before July , 2014 will be required, by virtue of the fact that the notes will initially settle in T+5, to specify an alternative settlement cycle at the time of any such trade to prevent a failed settlement. Purchasers of notes wishing to make such trades should consult their own advisors.

The underwriters and/or their affiliates have provided, and expect to provide in the future, financial advisory, investment banking and general banking services to Jamaica and its governmental agencies and instrumentalities, for which they have received and expect to receive customary fees and commission. The underwriters and their affiliates may, from time to time, engage in transactions with and perform services for Jamaica in the ordinary course of business.

In relation to each Member State of the European Economic Area which has implemented the Prospectus Directive (each, a “Relevant Member State”), each underwriter has represented and agreed that with effect from and including the date on which the Prospectus Directive is implemented in that Relevant Member State (the “Relevant Implementation Date”) it has not made and will not make an offer of notes which are the subject of the offering contemplated by this prospectus supplement as completed by the final terms in relation thereto to the public in that Relevant Member State except that it may, with effect from and including the Relevant Implementation Date, make an offer of such notes to the public in that Relevant Member State:

| | • | | at any time to any legal entity which is a qualified investor as defined in the Prospectus Directive; |

| | • | | at any time to fewer than 100 or, if the Relevant Member State has implemented the relevant provision of the 2010 PD Amending Directive, 150, natural or legal persons (other than qualified investors as defined in the Prospectus Directive), subject to obtaining the prior consent of the relevant underwriter or underwriters nominated by the Issuer for any such offer; or |

| | • | | at any time in any other circumstances falling within Article 3(2) of the Prospectus Directive, |

provided that no such offer of notes referred to above shall require the Issuer or any underwriter to publish a prospectus pursuant to Article 3 of the Prospectus Directive, or supplement a prospectus pursuant to Article 16 of the Prospectus Directive.

For the purposes of this provision, the expression an offer of notes to the public in relation to any notes in any Relevant Member State means the communication in any form and by any means of sufficient information on the terms of the offer and the notes to be offered so as to enable an investor to decide to purchase or subscribe the notes, as the same may be varied in that Member State by any measure implementing the Prospectus Directive in that Member State, the expression Prospectus Directive means Directive 2003/71/EC (and amendments thereto, including the 2010 PD Amending Directive, to the extent implemented in the Relevant Member State), and includes any relevant implementing measure in the Relevant Member State and the expression 2010 PD Amending Directive means Directive 2010/73/EU.

Each underwriter has represented and agreed that:

| | • | | it has only communicated or caused to be communicated and will only communicate or cause to be communicated an invitation or inducement to engage in investment activity (within the meaning of Section 21 of the Financial Services and Markets Act 2000 (the “FSMA”)) received by it in connection with the issue or sale of any notes in circumstances in which Section 21(1) of the FSMA does not apply to the Issuer; and |

| | • | | it has complied and will comply with all applicable provisions of the FSMA with respect to anything done by it in relation to such notes in, from or otherwise involving the United Kingdom. |

S-20

VALIDITY OF THE NOTES

The validity of the notes will be passed upon on behalf of Jamaica as to Jamaican law by the Attorney General’s Department of Jamaica, and as to New York State law by Allen & Overy LLP, United States counsel to Jamaica. The validity of the notes will be passed upon for the underwriters, as to matters of New York State law, by Gibson, Dunn & Crutcher LLP, United States counsel for the underwriters and, as to matters of Jamaican law, by Patterson Mair Hamilton, Jamaican counsel to the underwriters.

GENERAL INFORMATION

1. The notes have been accepted for clearance through The Depository Trust Corporation, Euroclear and Clearstream, Luxembourg. The CUSIP number is , the Common Code number is , and the International Securities Identification Number (ISIN) is .

2. The Public Debt Management Act, 2012, also referred to as government authorizations, authorized the creation and issue of the notes.

3. Except as disclosed in this prospectus supplement and the accompanying prospectus, there has been no material adverse change in the fiscal condition or affairs of Jamaica which is material in the context of the issue of the notes since May 30, 2014.

4. Jamaica intends to apply for the notes to be listed on the Official List of the Luxembourg Stock Exchange and to be traded on the Euro MTF Market of that exchange. Copies of the following documents will, so long as any notes are admitted for trading on the Euro MTF, be available for inspection during usual business hours at the specified office of Deutsche Bank Luxembourg S.A. in Luxembourg:

| | • | | the Registration Statement, which includes the fiscal agency agreement and the form of the underwriting agreement as exhibits thereto; and |

| | • | | government authorizations. |

In addition, so long as any of the notes are admitted for trading on the Euro MTF, copies of Jamaica’s latest economic reports for each year (as and when available) will be available at the offices of the listing agent in Luxembourg during normal business hours on any weekday. The underwriting agreement and the fiscal agency agreement shall also be available free of charge at the office of the listing agent and any paying and transfer agent in Luxembourg.

5. Deutsche Bank Luxembourg S.A. has been appointed as the Luxembourg paying agent. For so long as any of the notes are admitted for trading on the Euro MTF and the rules of the Euro MTF so require, Jamaica will maintain a paying agent in Luxembourg.

S-21

PROSPECTUS

Government of Jamaica

US$1,000,000,000

Debt Securities

Jamaica may offer up to US$1,000,000,000 of its debt securities for sale, purchase or exchange from time to time based on information contained in this prospectus and various prospectus supplements. Such offers may include debt securities in exchange for other debt securities issued or guaranteed by Jamaica. The debt securities will be direct, general, unsecured and unconditional obligations of Jamaica, and will rank at leastpari passu, without any preference among themselves, with all of Jamaica’s other unsecured External Indebtedness (as defined) of Jamaica. Jamaica has pledged its full faith and credit for the due and punctual payment of principal of and interest on the debt securities.

The fiscal agency agreement described in this prospectus contains provisions, commonly known as “collective action clauses,” regarding future modifications to the terms of, or other actions taken in respect of, the debt securities issued thereunder that are described herein beginning on page 12. Under these provisions, modifications or other actions affecting the reserved matters listed in the fiscal agency agreement, including, but not limited to, modifications to payment and other important terms, may be made to a single series of debt securities issued under the fiscal agency agreement with the consent of the holders of 75% in aggregate principal amount outstanding of that series, and to two or more series of debt securities issued under the fiscal agency agreement with the consent of the holders of 85% in aggregate principal amount outstanding of all affected series and 66 2/3% in aggregate principal amount outstanding of each affected series.

Jamaica will provide specific terms of these debt securities in supplements to this prospectus. You should read this prospectus and any prospectus supplement carefully before you invest. This prospectus may not be used to make offers or sales of securities unless accompanied by a prospectus supplement. You should not assume the information contained in this prospectus is accurate as of any date other than the date on the front of this document. Information contained in this prospectus is subject to completion or amendment. We will update this prospectus as necessary while it is in use.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense

The date of this prospectus is July 1, 2014.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that Jamaica filed with the United States Securities and Exchange Commission, or the SEC, under a “shelf” registration process. Under this shelf process, Jamaica may sell, from time to time, any of the debt securities described in this prospectus in one or more offerings up to a total US dollar equivalent amount of US$1,000,000,000. This prospectus provides you with basic information about Jamaica and a general description of the debt securities Jamaica may offer. Each time Jamaica sells, purchases or exchanges securities under this shelf process, it will provide a prospectus supplement that will contain updated information about Jamaica, if necessary, and specific information about the terms of that offering. Before you invest, you should read both this prospectus and any prospectus supplement.

Any information in this prospectus may be updated or changed in a prospectus supplement, in which case the more recent information will apply.

WHERE YOU CAN FIND MORE INFORMATION

Jamaica files Annual Reports with the Securities and Exchange Commission (the “SEC”). These reports and any amendments to these reports include certain financial, statistical and other information about Jamaica and may be accompanied by exhibits. You may read and copy any document Jamaica files with the SEC at the SEC’s public reference room at 100 F Street NE, Washington, DC 20549. You may also obtain copies of the same documents from the public reference room in Washington by paying a fee. Please call the SEC at 1-202-942-8090 for further information on the public reference room.

The SEC allows Jamaica to “incorporate by reference” in this prospectus the information Jamaica files with it. This means that Jamaica can disclose important information to you by referring you to those documents. Information that is incorporated by reference is an important part of this prospectus. Jamaica incorporates by reference the following documents:

| | • | | Jamaica’s Annual Report on Form 18-K for the year ended March 31, 2014, file 001-04165; and |

| | • | | All amendments to Jamaica’s Annual report on Form 18-K for the year ended March 31, 2014 filed prior to the date of this prospectus. |

Jamaica also incorporates by reference all future annual reports and amendments to annual reports until it sells all of the debt securities covered by this prospectus. Each time Jamaica files a document with the SEC that is incorporated by reference, the information in that document automatically updates the information contained in previously filed documents.

2

You may request a free copy of these filings by writing or calling Jamaica at:

Dian Black

30 National Heroes Circle

P.O Box 512

Kingston, Jamaica

Fax: (876) 9325975

Telephone: (876) 9325402

You should rely only on the information incorporated by reference or contained in this prospectus or any prospectus supplement. Jamaica has not authorized anyone to provide you with different or additional information. Jamaica is not making an offer of the debt securities in any state where the offer is not permitted by law. You should not assume that the information in this prospectus or any prospectus supplement is accurate as of any date other than the date on the front of those documents.

ENFORCEMENT OF CLAIMS

It may be difficult for investors to obtain or realize upon judgments of courts in the United States against Jamaica. The Government of Jamaica is a foreign sovereign government, which are generally immune from lawsuits and from the enforcement of judgments under United States law. Foreign sovereign governments, however, may waive this immunity and limited exceptions to this immunity are set forth in the US Foreign Sovereign Immunities Act of 1976, or the Immunities Act.

Except as provided below, Jamaica will irrevocably waive and agree not to plead any immunity (including sovereign immunity) from the jurisdiction of any state or federal court in the Borough of Manhattan, The City of New York, to which it might otherwise be entitled in any action arising out of or based upon the debt securities, to the fullest extent permitted by applicable law. However, Jamaica reserves the right to plead sovereign immunity under the Immunities Act with respect to actions brought against it under United States federal securities laws or any state securities laws. In the absence of a waiver of immunity by Jamaica with respect to such actions, it would not be possible to obtain a US judgment in such action unless a court were to determine that Jamaica is not entitled to sovereign immunity under the Immunity Act with respect to that action. Even if you obtained a US judgment in any such suit, you may not be able to enforce the judgment in Jamaica. Moreover, you may not be able to enforce a judgment obtained under the Immunities Act against Jamaica’s property located in the United States except under the limited circumstances specified in the Immunities Act.

Jamaica will, in the fiscal agency agreement (as defined in Description of the Debt Securities) and in the debt securities, irrevocably submit to the jurisdiction of any state or federal court in the Borough of Manhattan, The City of New York, in respect of any claim or action arising out of or based upon the fiscal agency agreement or the debt securities which may be instituted by any holder of a debt security, such as, for example, a claim for breach of any obligation under the fiscal agency agreement or the debt securities. Any process or other legal summons in connection with any such action may be served upon Jamaica by delivery of letters rogatory to the Consul General of Jamaica in New York, New York or by any other means that may have become permissible under the laws of the State of New York and Jamaica at the time of such service. However, Jamaica has not consented to service for suits made under the US federal or state securities laws and, as explained above, Jamaica’s waiver of immunity does not extend to those actions.

3

A judgment obtained in New York against Jamaica can be sued upon in the courts of Jamaica as a valid cause of action. Furthermore, a Jamaican court, subject to certain conditions, will grant a judgment in Jamaica without any re-trial or reexamination of the merits of the original action. Jamaica is also subject to suit in competent courts in Jamaica. Section 20(4) of the Crown Proceedings Act provides that no execution or attachment shall be issued by any court in Jamaica for the purpose of enforcing payment by Jamaica of any money or costs. Execution or attachment means a legal process whereby the debtor property is taken under an order of the court and may be sold to satisfy the judgment debt. No such order can be made against Jamaica. Instead, the Crown Proceedings Act provides that where in any civil proceedings by or against Jamaica, any order (including an order for costs) is made by any court in Jamaica in favor of any person against Jamaica, the proper officer of the court shall, on an application and after taxing of costs, issue a certificate to such person which may be served upon the Attorney General of Jamaica. If the order provides for the payment of money or costs, the Ministry of Finance and Planning shall pay the amount due to such person. It is possible that the courts of Jamaica may not enforce the judgments of a foreign court against Jamaica on the grounds of public policy where Jamaica has not appeared in the relevant proceedings or has unsuccessfully claimed immunity in such proceedings and has not otherwise submitted to the jurisdiction of such foreign court.

FORWARD-LOOKING STATEMENTS

This prospectus may contain forward-looking statements.

Forward-looking statements are statements that are not about historical facts, including statements about Jamaica’s beliefs and expectations. These statements are based on current plans, estimates and projections, and therefore, you should not place undue reliance on them. Forward-looking statements speak only as of the date they are made. Jamaica undertakes no obligation to update publicly any of the forward-looking statements in light of new information or future events, including changes in Jamaica’s economic policy or budget, or to reflect the occurrence of unanticipated events.

Forward-looking statements involve inherent risks and uncertainties. Jamaica cautions you that a number of important factors could cause actual results to differ materially from those expressed in any forward-looking statement. These factors include, but are not limited to:

| | • | | adverse external factors, such as any continuing terrorist attacks in the United States or elsewhere, acts of war, any general slowdown in the US or global economies, low alumina and bauxite prices and a fall in tourism; and |

| | • | | adverse domestic factors, such as social and political unrest in Jamaica, high domestic interest rates, climatic events and exchange rate volatility. |

4

GENERAL DESCRIPTION OF JAMAICA

The information set forth below is not complete and is qualified by the more detailed information contained in the Government of Jamaica’s Annual Report on Form 18-K for the fiscal year ended March 31, 2014, as amended from time to time, and the other documents incorporated by reference in this prospectus.

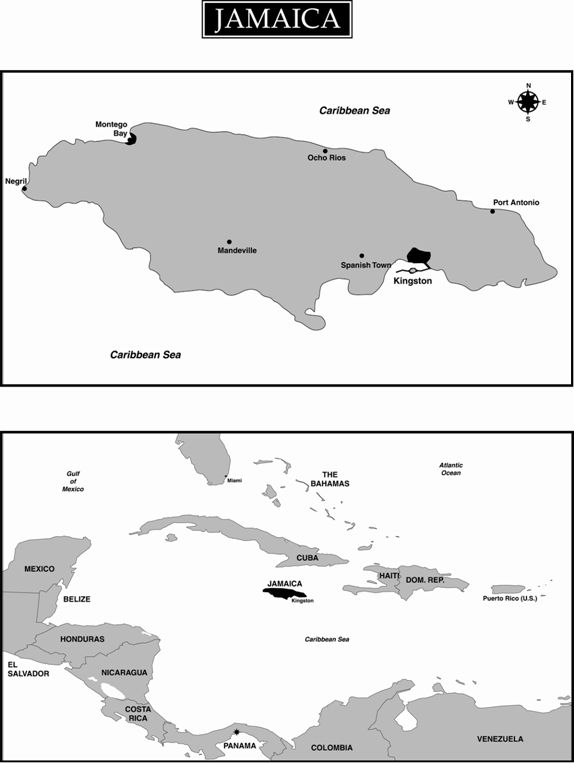

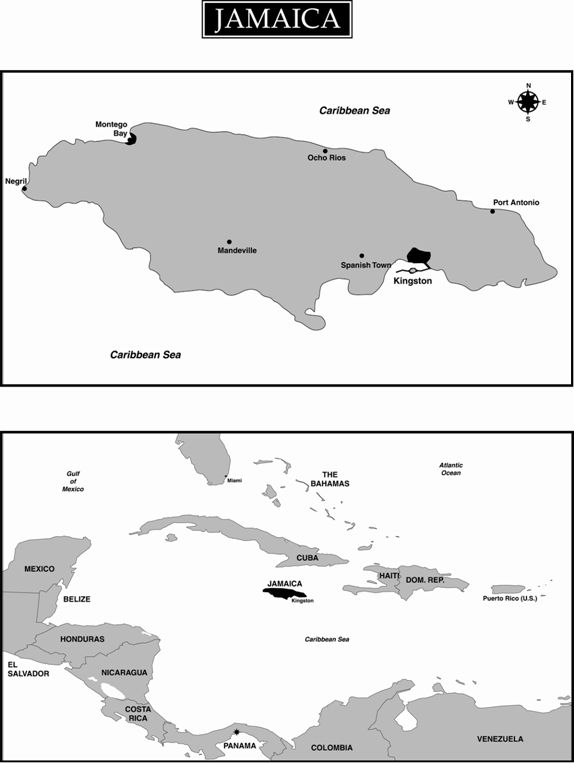

Jamaica, the third largest island in the Caribbean Sea, is located 558 miles (898 kilometers) southeast of Miami, Florida, 90 miles (144.8 kilometers) south of Cuba and 100 miles (160.9 kilometers) southwest of Haiti. The island has an area of 4,411 square miles (11,420 square kilometers). At December 31, 2013, Jamaica’s population was estimated at 2,717,990. Jamaica’s official language is English, and a majority of the population speaks a dialect.

Jamaica operates as a mixed, free market economy with state enterprises as well as private sector businesses. Major sectors of the Jamaican economy include agriculture, mining, manufacturing, tourism and financial and insurance services. Beginning in the second half of 2007, the short-term funding markets in the United States encountered several issues, leading to liquidity disruptions in various markets. In particular, subprime mortgage loans in the United States began to face increased rates of delinquency, foreclosure and loss. These and other related events have had a significant adverse impact on the international economic environment, which has also had an impact on Jamaica’s economy.

Gross domestic product, or GDP, increased by 0.2% in 2013 as compared to 2012, mainly as a result of an improvement in the macroeconomic environment . GDP declined 0.5% in 2012 to J$731.0 billion as compared to J$734.5 billion in 2011. GDP increased by 1.4% to J$734.5 billion in 2011 from $724.4 billion in 2010. The numbers in this paragraph are given at constant 2007 prices.

At March 31, 2014, Jamaica’s domestic debt, which excludes government-guaranteed securities, was approximately J$1,024.5 billion. At December 31, 2013, domestic debt was J$1,054.2billion, an increase of 5.9% when compared to the domestic debt level at December 31, 2012. In addition to this level of domestic debt, Jamaica has guaranteed certain financial obligations of public sector entities, which carry out major infrastructure projects from time to time. At March 31, 2014, the extent of these internal guarantees was approximately J$35.8 billion.

At March 31, 2014, the total of external debt was US$8,409.7 million, of which 90.2% was denominated in US dollars, 6.0% was denominated in Euro, 1.1% was denominated in Yen and 1.8% was denominated in Chinese Yuan. At December 31, 2013, public sector external debt was US$8,310.0 million, an increase of 0.7% from December 31, 2012, of which 82.3% was denominated in US dollars, 62.3% was denominated in Euro, 1.1% denominated in Yen and 1.8% was denominated in Chinese Yuan. Bilateral and multilateral obligations of US$4,265.4 million represented the largest creditor category of Jamaica’s public sector external debt, and accounted for 52.0% of total public sector external debt at December 31, 2013 while bond issuances of US$3,636.8 million accounted for 43.8%. Multilateral indebtedness was US$3,410.0 million, an increase of 4.5% over December 31, 2012.

Jamaica’s total public sector debt as a percentage of nominal GDP increased to 59.0% on December 31, 2013, from 56.0% at December 31, 2012. Public sector domestic debt and public sector external debt as a percentage of nominal GDP decreased to 74.2% and increased to 59.0%, at December 31, 2013, respectively, from 75.8% and 56.0% at December 31, 2012, respectively. External debt as a percentage of exports of goods and services increased to 129.5% on December 31, 2013, from 113.7% on December 31, 2012. External debt service payments as a percentage of exports of goods and services decreased to 6.4% during 2013 from 6.9% during 2012.

5

Jamaica has never defaulted on any of its external or domestic debt obligations, which under the Jamaican Constitution are paid without any requirement of Parliamentary approval, directly from revenue and assets of Jamaica, before funds are available to Jamaica for other policies and programs. Since 1993, Jamaica has been involved in only two debt restructurings, which occurred in January 2010 and February 2013.

Inflation for 2013 was 9.5% based on the Consumer Price Index. The 2013 inflation rate represented an increase of 18.8% over the 8.0% rate recorded in 2012, which in turn represented an increase of 33.3% over the 6.0% rate recorded in 2011.