Except for historical information contained in this document, statements made in this document are “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (“PSLRA”). A forward-looking

statement is a statement that is not a historical fact and, without limitation, includes any statement that may predict,

forecast, indicate or imply future results, performance or achievements, and may contain words like: “believe,”

“anticipate,” “expect,” “estimate,” “project,” “will,” “shall” and other words or phrases with similar meaning. We

claim the protection afforded by the safe harbor for forward-looking statements provided by the PSLRA.

Forward-looking statements involve risks and uncertainties that may cause actual results to differ materially from the

results contained in the forward-looking statements. Risks and uncertainties that may cause actual results to vary

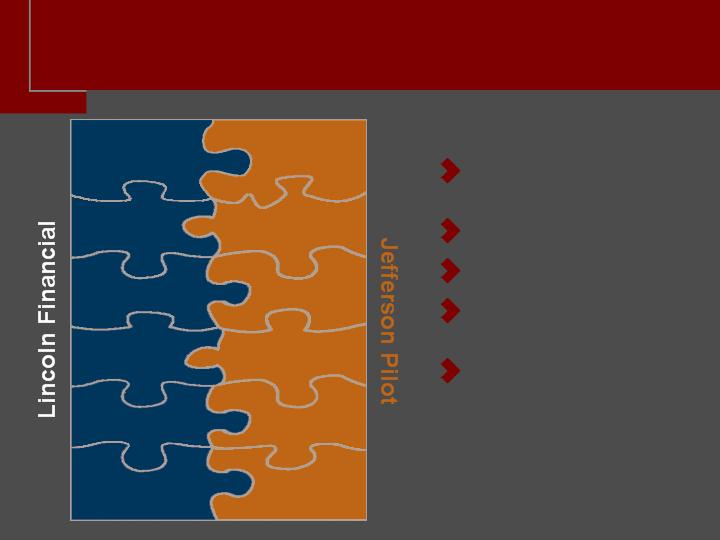

materially, some of which are described within the forward-looking statements include, among others: (1) the Lincoln

shareholders may not approve the issuance of shares in connection with the merger and/or the Jefferson-Pilot

shareholders may not approve and adopt the merger agreement and the transactions contemplated by the merger

agreement at the special shareholder meetings; (2) we may be unable to obtain regulatory approvals required for the

merger, or required regulatory approvals may delay the merger or result in the imposition of conditions that could

have a material adverse effect on the combined company or cause us to abandon the merger; (3) we may be unable

to complete the merger or completing the merger may be more costly than expected because, among other reasons,

conditions to the closing of the merger may not be satisfied; (4) problems may arise with the ability to successfully

integrate Lincoln’s and Jefferson-Pilot’s businesses, which may result in the combined company not operating as

effectively and efficiently as expected; (5) the combined company may not be able to achieve the expected synergies

from the merger or it may take longer than expected to achieve those synergies; (6) the merger may involve

unexpected costs or unexpected liabilities, or the effects of purchase accounting may be different from our

expectations; (7) the credit and insurer financial strength ratings of the combined company and its subsidiaries may

be different from what the companies expect; and (8) the combined company may be adversely affected by future

legislative, regulatory, or tax changes as well as other economic, business and/or competitive factors.

The risks included here are not exhaustive. The Registration Statement on Form S-4 (Registration No. 333-130226)

filed by Lincoln with the SEC on December 8, 2005, as well as annual reports on Form 10-K, current reports on Form

8-K and other documents filed by Lincoln and Jefferson-Pilot with the Securities and Exchange Commission include

additional factors that could impact our businesses and financial performance. Given these risks and uncertainties,

you should not place undue reliance on forward-looking statements as a prediction of actual results. In addition, we

disclaim any obligation to update any forward-looking statements to reflect events or circumstances that occur after

the date of this document, except as may be required by law.

Forward Looking Statements

Disclaimer