Graduate of the Hebrew University of Jerusalem in Economics and Accounting (1994), CPA (from 1997), MBA from the Hebrew University of Jerusalem (1998).

Table of Contents

| Chapter | | Page |

| | 1 |

| | 3 |

| | a. | Operational structure | 4 |

| | b. | Valuation methodology | 10 |

| | c. | Business environment | 13 |

| | 18 |

| | a. | Packaging paper and recycling | 18 |

| | b. | Office supplies marketing | 25 |

| | c. | Printing and writing paper | 26 |

| | d. | Packaging and carton products | 33 |

| | e. | Other assets and liabilities | 38 |

| | f. | Financial analysis | 41 |

| | g. | Valuation | 49 |

| | 62 |

| | a. | HOGLA operations | 64 |

| | b. | Financial analysis | 77 |

| | c. | Valuation | 85 |

Appendices

| Appendix A - | Information about Company securities traded on the TEL AVIV Stock Exchange. |

| Appendix B - | Valuation by GIZA-SINGER-EVEN Ltd. of CARMEL Container Systems Ltd. |

| Appendix C - | Examining the need for impairment of the packaging paper operations, according to IAS 36 |

| Appendix D - | Further information pursuant to Securities Regulations (Periodic and immediate reports), 1970 |

The value of HADERA PAPER for its shareholders as of December 31, 2010 is estimated at between NIS 1,657-1,869 million, as follows:

| | | Holding stake | | | High value | | | Low value | |

| | | | | | NIS in millions | |

| Enterprise valuation (EV) - HADERA PAPER, consolidated* | | | | | | 1,460 | | | | 1,332 | |

| Value of excess real estate | | | | | | 74 | | | | 74 | |

| Value of holding stake in CARMEL | | | 100.0 | % | | | 160 | | | | 160 | |

| Value of holding stake in HADERA PAPER PRINTING | | | 75.0 | % | | | 157 | | | | 157 | |

| Liability with respect to MBP | | | | | | | (32 | ) | | | (32 | ) |

| Value of holding stake in FRENKEL | | | 28.9 | % | | | 19 | | | | 19 | |

| Net financial debt | | | | | | | (922 | ) | | | (922 | ) |

| Valuation of HADERA PAPER, consolidated, net | | | | | | | 917 | | | | 789 | |

| Value of holding stake in HOGLA | | | 49.9 | % | | | 977 | | | | 887 | |

| Value of equity, HADERA PAPER | | | | | | | 1,894 | | | | 1,676 | |

| Value of stock options to employees | | | | | | | (25 | ) | | | (19 | ) |

| Value of HADERA PAPER to shareholders | | | | | | | 1,869 | | | | 1,657 | |

* Excluding HADERA PAPER PRINTING, CARMEL and FRENKEL.

HADERA PAPER was valuated using the Discounted Cash Flow method (DCF); for valuation methodology see section 2b above. above.

This valuation of HADERA PAPER is higher by 21% on average than the Company's average market capitalization over the six months preceding the valuation date, and is higher by 89% on average than the Company's shareholder equity as of December 31, 2010, as follows:

| | | Market cap | | | Difference between value in model and market cap | |

| | | | | High value | | | Low value | | | Average | |

| | | NIS in millions | | | NIS in millions | | | | | | | |

| Company value in valuation | | | | | | 1,869 | | | | 1,657 | | | | 1,763 | |

| Market cap* of equity during six months prior to effective date | | | | | | | | | | | | | | | |

| Highest | | | 1,616 | | | | 16 | % | | | 3 | % | | | 9 | % |

| Lowest | | | 1,314 | | | | 42 | % | | | 26 | % | | | 34 | % |

| Average | | | 1,454 | | | | 29 | % | | | 14 | % | | | 21 | % |

| Market cap* as of December 31, 2010 | | | 1,505 | | | | 24 | % | | | 10 | % | | | 17 | % |

| Shareholders' equity on balance sheet as of December 31, 2010 | | | 930 | | | | 101 | % | | | 78 | % | | | 90 | % |

| Value in transaction as of September 30, 2009** | | | 1,147 | | | | 63 | % | | | 44 | % | | | 54 | % |

| Value in valuation as of June 30, 2009** | | | 1,144 | | | | 63 | % | | | 45 | % | | | 54 | % |

| * | Value derived from price of Company share on TEL AVIV Stock Exchange. |

| ** | Value in acquisition of 21.45% of Company shares by CII from Discount Investments was determined taking into account the valuation as of June 30, 2009 which was prepared by myself for negotiations between the parties. |

For further information pursuant to Securities Regulations (Periodic and immediate reports), 1970, see Appendix D.

Between June 30, 2009 and December 31, 2010, the Company's market capitalization increased by 71%; for evolution of share price and trading volume, see Appendix A.

Group company operations are primarily based on the state of Israel's economy, population size, change in living standards and in business activity, change over the past two years in sectors in which the Group operates and change in the Company's production capacity and product mix in the packaging segment.

In the course of the last year, the change was recorded in the economic atmosphere and in investor expectations following the peak of the economic crisis in the years 2008-2009. The rise in stock market indices and in commodity prices in 2010, alongside initial indications of growth in real demand and in the demand for new employees, may serve as a harbinger of the initial emergence from the current economic crisis. Nevertheless, the emergence from the crisis will be slow and will most likely last for several years, during which certain aftershocks may be felt in the global economy.

The most significant event at the company in 2010 was the operation of Machine 8, that effectively doubles the output capacity of packaging paper, as of June 1, 2010. In parallel to the operation of the machine, surplus demand for recycled packaging paper was created on the European market. As a result of the surplus demand for such products, average paper prices overseas and on the local market increased, as paper exports grew by approximately 245% in financial terms in relation to the exports in 2009. The development of new recycled products and primarily substitutes for virgin Kraft liner, serve to diversify the company's product mix, while opening up new market segments and rendering it possible - subject to economic feasibility considerations - to expand the future output capacity using an old machine (Machine 1), without material investments in equipment and new machines.

The impact of the moderating economic crisis on the Hogla business results was relatively slight. The principal raw materials used by Hogla grew more expensive this year, while in parallel Hogla found it difficult to raise the prices of its products due to escalating competition, primarily versus its the central competitor, Procter & Gamble, in the diaper and feminine hygiene sectors. The strengthening local currency in Israel (NIS) vis-à-vis other currencies is harming the competitive capabilities of Hogla in Israel due to the fact that Procter & Gamble products are produced overseas.

In 2010, the company acquired 25.1% of the shares of Hadera Paper Printing and completed a complete tender offer in the United States for Carmel shares.

We have been commissioned by HADERA PAPER Ltd. (hereinafter: "the Company" or "HADERA PAPER") and by CII and Investment Ltd. (hereinafter: "CII") to provide an economic valuation of shareholders' equity of HADERA PAPER as of December 31, 2010. The objective of this valuation is to review the Company valuation and composition there of, pursuant to provisions of international accounting standard IAS 36 "Asset Impairment" for the purpose of IFRS-based financial reporting.

CII' holding stake in Company shares as of December 31, 2010 was 59.1%. On September 30, 2010, CII acquired 21.45% of the Company shares from Discount Investments Ltd. (hereinafter: "DIC") at a Company value of NIS 1,147 million.

| | a. | Operational structure |

HADERA PAPER operates via subsidiaries and associates (hereinafter: "the Group") in the following segments*:

| Operating segment | | Revenues | | | Operating income | | | Net Income | | | Holding | |

| | | 2009 | | | 2010 | | | 2009 | | | 2010 | | | 2009 | | | 2010 | | | stake | |

| | | NIS in millions | | | NIS in millions | | | NIS in millions | | | | | | | |

| Packaging paper and recycling | | | 339 | | | | 511 | | | | (3 | ) | | | 50 | | | | (6 | ) | | | 17 | | | | 100 | % |

| Office equipment marketing | | | 151 | | | | 179 | | | | 4 | | | | 5 | | | | | | | | | 100 | % |

| Packaging and corrugated cardboard | | | 484 | | | | 510 | | | | 15 | | | | 7 | | | | 10 | | | | 3 | | | | **100 | % |

| Writing and printing paper | | | 669 | | | | 729 | | | | 38 | | | | 31 | | | | 28 | | | | 22 | | | | 75 | % |

| Consumables | | | 1,727 | | | | 1,698 | | | | 194 | | | | 187 | | | | 151 | | | | 145 | | | | 49.9 | % |

* Data in this table is for 100% of segment operations, without reversal of inter-company operations.

** Reflects the holding stake in CARMEL.

Packaging paper and recycling

In this segment, the Company produces recycled packaging paper via HADERA PAPER - Packaging Paper & Recycling Ltd. (formerly: HADERA PAPER Industries Ltd. and before that: AIPM Paper Industries (1995) Ltd.") (hereinafter: "Packaging"). Recycled paper is primarily used as raw material in production of corrugated cardboard packaging. Paper waste is collected for recycling by AMNIR Recycling Industries Ltd. (hereinafter: "AMNIR"). This segment also includes operations of HADERA PAPER - Development & Infrastructure Ltd. (hereinafter: "HADERA PAPER Infrastructure"), which provides infrastructure, energy and other services to Group companies. All companies in this segment are wholly-owned by HADERA PAPER.

Office equipment marketing

Graffiti Office Equipment and Paper Marketing Ltd. (hereinafter: "Graffiti"), which is wholly-owned by HADERA PAPER, is engaged in import, marketing and sale of office equipment, primarily to business- and institutional customers.

Writing & printing paper

HADERA PAPER owns, as from December 31, 2010, 75% of shares of HADERA PAPER - Printing & Writing Paper Ltd. (formerly: "MONDI HADERA PAPER Ltd.") (hereinafter: "HADERA PAPER PRINTING"), which is engaged in production, marketing and sale of writing- and printing paper. On December 31, 2010, the Company acquired 25.1% of shares of HADERA PAPER PRINTING from MONDI Business Paper Ltd. (hereinafter: "MBP"). After conclusion of this transaction, MBP owns 25% of HADERA PAPER PRINTING; for details see section 3c below.

Packaging and carton products

In this segment, the Company is engaged in production, marketing and sale of corrugated cardboard packaging and sheets via CARMEL Container Systems Ltd. (hereinafter: "CARMEL") and FRENKEL CD Ltd. (hereinafter: "FRENKEL"). Through October 4, 2010, the Company owned 89.3% of CARMEL shares. Upon conclusion of a complete buy-back offer for the remainder CARMEL shares, as from October 4, 2010 HADERA PAPER owns 100% of CARMEL shares. Hadera Paper holds - directly and indirectly - approximately 57.8% of the Frenkel shares while the Company and CARMEL each hold 28.9% of the shares.

Consumables

HADERA PAPER owns 49.9% of HOGLA-Kimberly Ltd. (hereinafter: "HOGLA"), which is engaged in production, marketing and sale in the domestic market of disposable paper products (toilet paper, tissue paper), diapers and wet wipes, female hygiene products, cleaning products etc. 50.1% of HOGLA shares are owned by Kimberly Clark Corp. (hereinafter: "KC").

HOGLA wholly-owns a Turkey-resident company, KIMBERLY-CLARK TUKETIM MALLARI SANAYIVE TICARET (hereinafter: "KCTR"), which is engaged in production, marketing and sale of diapers and female hygiene products in Turkey. KCTR is the sole representative of KC in Turkey.

Inter-company operations

| | - | Purchase of goods and services from Group companies |

Operations of the Company, its subsidiaries and investees (hereinafter jointly: "Group companies") is vertically- and horizontally integrated, and in the normal course of business, Group companies contract the leasing of assets and purchase of goods and services from other Group companies. These are contracted at market terms and conditions.

| | - | Contracting between HOGLA and HADERA PAPER with interested parties |

HOGLA receives from KC R&D services, procurement services, marketing knowledge etc. HOGLA receives from HADERA PAPER various services, including land leases, energy center services, IT and other services.

HADERA PAPER PRINTING receives from MBP procurement services of cellulose and other raw materials via MBP's procurement department. HADERA PAPER PRINTING receives from HADERA PAPER various services, including land leases, energy center services, IT and other services.

| | - | Construction of new logistics center |

In 2008, HADERA PAPER entered into a contract with GAV-YAM Land Ltd.1 for leasing of a dedicated logistics center (hereinafter: "the new logistics center"). The logistics center in MODI'IN covers a built area of 21 thousand m2 over land with an area of 74.5 thousand m2. In the final quarter of 2010, the logistics operations of HADERA PAPER PRINTING and of AMNIR were relocated to the new logistics center, and in the second half of 2011, Graffiti is expected to relocate to the new logistics center.

1 A public company controlled by DIC.

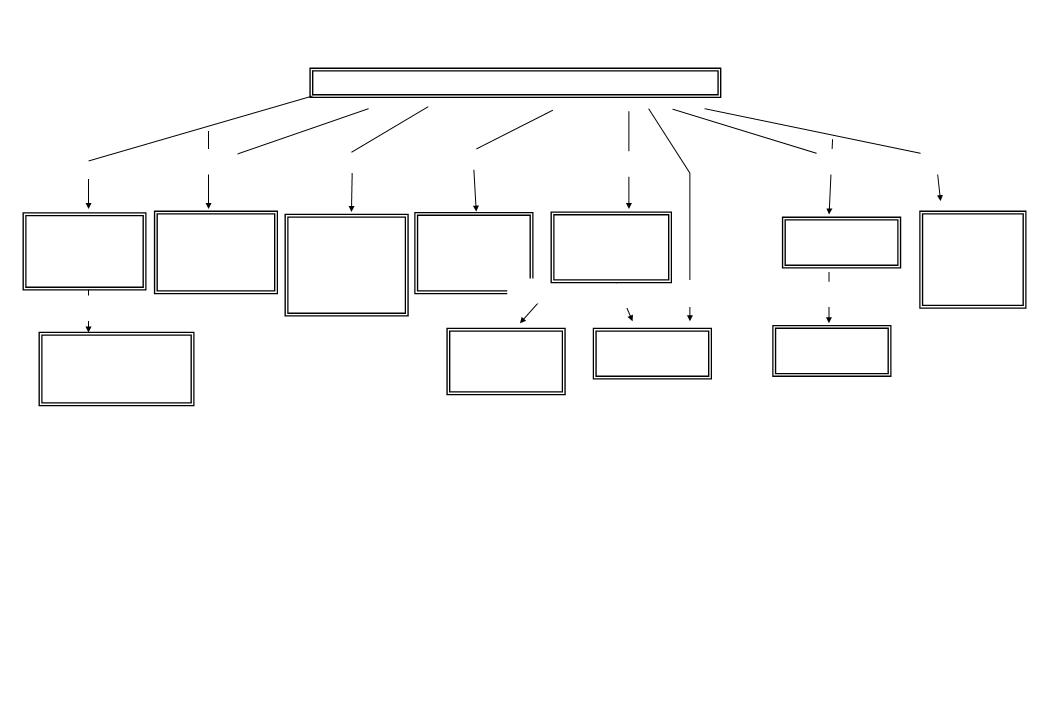

Classification of the major holdings of HADERA PAPER by major operating sector is as follows:

Packaging paper and recycling

Office equipment

marketing

Writing and

printing paper

Packaging and

carton products

HADER PAPER1

HADERA

PAPER

PRINTING

CARMEL

AMNIR

GRAFITTI

PACKAGING

FRENKEL

100%

375%

100%

100%

2100%

Consum-

ables

HOGLA

KCTR

49.9%

100%

28.9%

28.9%

| | 1 | This holding structure only includes the major companies. There are other active companies, wholly owned by some of the aforementioned companies. |

| | 2 | As from October 4, 2010, see section 3d below. |

| | 3 | As from December 31, 2010, see section 3c below. |

| 2 | Due to the fact that control over Hadera Paper Printing was acquired on December 31, 2010, the above consolidated financial statements of the company include the business results of Hadera Paper Packaging based on equity value, while the assets and liabilities of Hadera Paper Printing are consolidated as at the date of the report. The financial statements that serve as the basis for the valuation of the company operations (EV) in Chapter 3 below, present the results and the investment in Hadera Paper Printing, Carmel and Frenkel on the basis of equity value, as stated in Section 1.3, below. |

Below is a summary of consolidated financial statements of the Company2:

| | | 2006 | | | 2007 | | | 2008 | | | 2009 | | | 2010 | |

| | | NIS in Millions | |

| Revenues | | | 530 | | | | 584 | | | | 674 | | | | 892 | | | | 1,121 | |

| Cost of Revenues | | | 419 | | | | 441 | | | | 542 | | | | 766 | | | | 945 | |

| Gross income | | | 111 | | | | 142 | | | | 131 | | | | 126 | | | | 176 | |

| Selling and marketing expenses | | | 31 | | | | 31 | | | | 46 | | | | 72 | | | | 87 | |

| General and administrative expenses | | | 30 | | | | 36 | | | | 55 | | | | 59 | | | | 60 | |

| Other revenues (expenses) | | | 37 | | | | (5 | ) | | | 5 | | | | 20 | | | | 33 | |

| Operating income | | | 88 | | | | 70 | | | | 35 | | | | 15 | | | | 62 | |

| Financing expenses | | | 31 | | | | 21 | | | | 15 | | | | 18 | | | | 45 | |

| Income Before Taxes | | | 57 | | | | 49 | | | | 20 | | | | (3 | ) | | | 17 | |

| Tax expense (benefit) | | | 17 | | | | 18 | | | | 4 | | | | (7 | ) | | | (3 | ) |

| After-tax income of Company and subsidiaries | | | 40 | | | | 31 | | | | 16 | | | | 4 | | | | 20 | |

| Share of net income (loss) of associates | | | (27 | ) | | | 1 | | | | 51 | | | | 87 | | | | 81 | |

| Net income (loss) | | | 13 | | | | 32 | | | | 68 | | | | 91 | | | | 101 | |

| | | | | | | | | | | | | | | | | | | | | |

| Change in revenues | | | 9.9 | % | | | 10.1 | % | | | 15.4 | % | | | 32.4 | % | | | 25.7 | % |

| Gross margin | | | 21.0 | % | | | 24.4 | % | | | 19.5 | % | | | 14.1 | % | | | 15.7 | % |

| Operating margin | | | 16.6 | % | | | 12.0 | % | | | 5.2 | % | | | 1.7 | % | | | 5.5 | % |

| Net margin | | | 2.4 | % | | | 5.4 | % | | | 10.0 | % | | | 10.2 | % | | | 9.0 | % |

| EBITDA | | | 22.6 | % | | | 18.2 | % | | | 14.1 | % | | | 10.5 | % | | | 14.5 | % |

| Effective tax rate | | | 29.5 | % | | | 37.4 | % | | | 18.6 | % | | | 233.3 | % | | | (17.6 | )% |

| | | December 31, 2009 | | | December 31, 2010 | | | | December 31, 2009 | | | December 31, 2010 | |

| | | NIS in Millions | | | | NIS in Millions | |

| Cash and designated deposits | | | 154 | | | | 121 | | Short-term credit from banks | | | 132 | | | | 145 | |

| Trade receivables | | | 324 | | | | 565 | | Current maturities of debentures and long-term borrowing | | | 150 | | | | 176 | |

| Other accounts receivable | | | 99 | | | | 57 | | Trade payables | | | 182 | | | | 341 | |

| Inventory | | | 176 | | | | 344 | | Accounts payable with respect to investment in Machine 8 | | | 74 | | | | 29 | |

| | | | | | | | | | Others | | | 137 | | | | 219 | |

| Total current assets | | | 753 | | | | 1,087 | | Total current liabilities | | | 675 | | | | 910 | |

| Investment in affiliated companies | | | 341 | | | | 237 | | Deferred taxes on income | | | 30 | | | | 45 | |

| Deferred taxes on income | | | 2 | | | | 2 | | Long-term borrowing net of current maturities | | | 226 | | | | 251 | |

| Investment property and leasing fees | | | 30 | | | | 25 | | Debentures | | | 472 | | | | 562 | |

| Intangible and other assets | | | 28 | | | | 38 | | Liabilities with respect to employees, net | | | 15 | | | | 19 | |

| | | | | | | | | | Liability on account of MBP option | | | 12 | | | | 32 | |

| Total long-term investments | | | 401 | | | | 302 | | Total long-term liabilities | | | 755 | | | | 909 | |

| | | | | | | | | | Minority interest | | | 26 | | | | 24 | |

| Fixed assets, net | | | 1,134 | | | | 1,384 | | Shareholders' equity | | | 832 | | | | 930 | |

| Total assets | | | 2,288 | | | | 2,773 | | Total shareholders’ equity and liabilities | | | 2,288 | | | | 2,773 | |

HADERA PAPER has no specified policy with regard to dividend distribution. Since 2007, the Company has not distributed any dividends to shareholders. The Company's distributable earnings as of December 31, 2010 amounted to NIS 506 million.

The Company’s securities are listed for trading on the TEL AVIV Stock Exchange and on the AMEX.

| | b. | Valuation methodology |

The Company valuation was achieved using the discounted cash flow method (DCF), which I believe to be the most appropriate method for valuation of the Company and investees there of; the following valuation methods have been applied:

| Operating segment / asset | | Company | | Valuation method |

| Packaging paper and recycling | | PACKAGING, AMNIR etc. | | DCF |

| Office equipment marketing | | Graffiti | | DCF |

| Consumables | | HOGLA | | DCF |

| Writing & printing paper | | HADERA PAPER PRINTING | | Value in transaction |

| Packaging and corrugated cardboard | | CARMEL | | Independent valuation |

| Packaging and corrugated cardboard | | FRENKEL | | Carrying amount of investment |

| Real estate not used for operations | | HADERA PAPER | | Value in transaction, historical cost |

| Liability with respect to HADERA PAPER PRINTING | | HADERA PAPER | | Independent valuation |

| Employee stock options | | HADERA PAPER | | Black & Scholes |

Discounted Cash Flow method (DCF)

The Discounted Cash Flow method (DCF) assumes that the value of the company to its shareholders is the company's enterprise value (EV) less net financial debt as of the valuation date.

The enterprise value (EV) is determined by discounting free cash flows from normal operations, using the company's weighted average capital cost (WACC). Free cash flows (FCF) are derived from the detailed business forecast for a specified period - in this opinion a business plan was created for 8 years: The years 2011-2017 and the representative year. The representative year in the forecast serves for calculation of the value of the long term operations (residual value).

Free cash flows (FCF) are derived from after-tax operating income after adjustment for depreciation, investment and changes in working capital. We assume that cash flows are received in the middle of each year, on average.

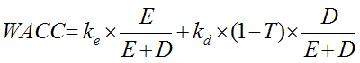

The Weighted Average Cost of capital (WACC) is calculated as follows:

Where:

| | D | - | Estimated value of net financial debt; |

| | E | - | Estimated equity value. |

The equity cost (Ke) is determined based on the CAPM model, as follows:

Where:

| | Rm-Rf | - | Market risk premium for share which is part of the market portfolio; |

| | | - | Beta, coefficiency coordinate of share returns and market portfolio returns. |

Taxation in Israel

This valuation assumes that in 2011-2016, the corporate tax would be reduced, pursuant to the Economic Streamlining Act (Legislation Amendments for Implementing the 2009-2010 Economic Plan), 2009 which was enacted in July 2009. The act stipulates a reduction in corporate tax rate, from 26% in 2009 to 18% in 2016.

The group companies do not possess a valid benefit program, other than accelerated depreciation at immaterial sums and other than accelerated depreciation of the investment in Machine 8 over the course of three years, as stated in Section 3.a.(3), below. For the purpose of this valuation, we assume, based on past experience, that the effective tax rate over the forecast period would be similar to the statutory tax rate, other than the benefit inherent in the accelerated depreciation of Machine 8. Following below are the depreciation rates that served in the valuation:

| | | 2011 | | | 2012 | | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | 2018 | | | Typical year | |

| Effective tax rate in valuation | | | 24.0% | | | | 23.0% | | | | 22.0% | | | | 21.0% | | | | 20.0% | | | | 18.0% | | | | 18.0% | | | | 18.0% | | | | 18.0% | |

Overseas taxation and taxation of value of holding in foreign entity

KCTR is a Turkey-resident company wholly owned by HOGLA. Starting in 2006, a corporate tax rate of 20% applies in Turkey, and dividend distributions to Israeli companies are subject to 10% tax withholding. Carry-forward tax losses in Turkey may be offset against income only over a 5-year term. In 2010, KCTR received demand from Tax Authorities in Turkey concerning payment of back taxes, for details see Section 4.b.(1), below.

Investment by Israeli companies in foreign entities, unlike investment by Israeli companies in Israeli entities, is subject to additional taxation, in the form of a 25% tax on dividends received from overseas. Usually, a credit may be applied for dividend tax paid overseas, such that the total tax liability, in Israel and overseas, shall not exceed 25% (assuming that the dividend tax rate overseas is not higher than 25%). In valuations, it is customary to account for excess tax with respect to investment by Israeli companies in foreign entities.

Due to our estimate that the value of HOGLA's holding stake in KCTR does not materially differ from the carrying amount of investment in KCTR on HOGLA's financial statements, we assumed that taxation of the value of holding in a foreign entity is non-material in this case.

| | c. | The Business Environment |

| | | This valuation was performed during a very challenging period, making it difficult to develop forecasts and estimates of growth rates and profit margins for the sectors. The difficulty stems from the rapid changes and upheavals in the leading economies, including the loss of stability of assets which for generations were considered the cornerstone of the global economy (the US dollar, European government bonds, commodities, etc), dramatic changes in the cost of capital, inflating public debt, doubts on the future of the Euro bloc, political instability in North African and Middle Eastern countries, etc. |

| | | The current crisis broke in late 2007, amid soaring prices of commodities such as oil, wheat and corn and demonstrations were held across the globe, driven by the escalating food prices. This began as a financial crisis, triggered the US sub-prime mortgage market, the collapse of which led to huge write-offs in the balance sheets of global financial institutions. In 2008, the majority of the leading financial institutions needed massive capital injections from governments/central banks in order to survive and maintain regular business activity. Despite government bailout plans, in the US alone more than 330 banks collapsed during 2007-2010, while between July 2004 and February 2007 no bank closed its doors in the US. |

| | | At the same time, central banks in most Western countries took measures to solve the business and consumer credit crisis. The main steps to alleviate the credit crunch included rapid interest rate cuts and expanding credit supply to financial institutions. As a result, the availability of credit in the markets increased and financing costs for borrowers decreased. |

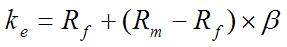

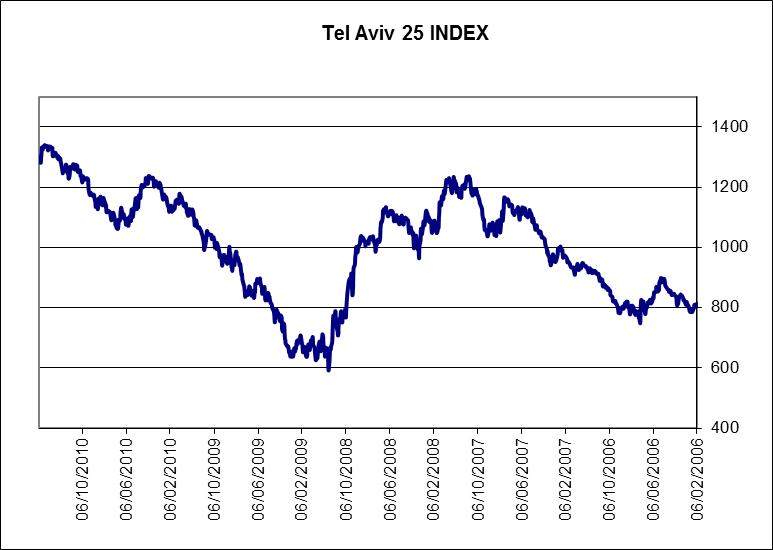

The crisis, which began in the financial markets, expanded into all sectors of the economy, fueling unemployment and pushing down demand. Amid the crisis, the value of financial assets eroded considerably, while the price drops across stock markets culminated in the first half of 2009. As indicated by the S&P 500 Index graph, in the first quarter of 2009 the index was 50% below its peak in late 2007. Since the index bottomed out in 2007, investors' expectations reversed as the S&P 500 rose 85% from its lowest point. From the date of the last Hadera paper valuation, which was carried out on June 30, 2009, the TA-25 Index rose 54%. The graph below shows the development of the TA-25 Index in the last five years:

| | | In 2010 economic indicators seemed to suggest that the global economic crisis was coming to an end. These signs included relatively sharp price gains in global stock markets, interest rate hikes by the central banks of Australia and Canada, indicators of declining unemployment in the US, etc. |

Investors' VIX-Fear Index, which measures the implied volatility in trading of S&P 500 futures on the Chicago Board Options Exchange, fell by one third in the last year and a half. The index peaked at more than 70 points during 2008 but later traded around 30 points in mid-2009. In late 2010 the index fell below 20 points, to its pre-economic crisis levels (10-20 points).

The warning signs at the end of 2010 included, among others, an all-time-high public debt in the US and in other countries, financial woes in the Euro bloc, including a bailout plan offered to some of the Euro countries, soaring unemployment in Europe and lack of government stability in Mediterranean countries.

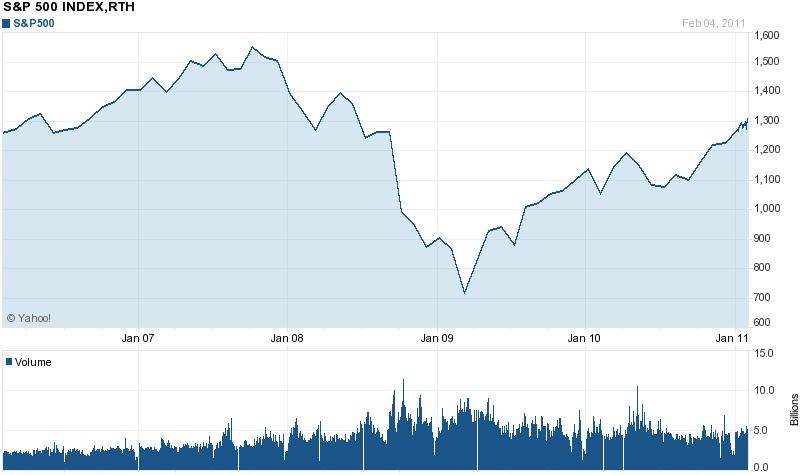

Forecasts by the International Monetary Fund point to 2011-2012 as years of stability, after the negative growth of the years 2008-2009 was curbed in 2010. Below are the global GDP estimates published by the IMF in January 2011:

The low interest rates in the US and other Western countries were first perceived as temporary, but as the crisis progressed, central banks, led by the Federal Reserve and the European Central Bank (ECB) postponed their planned rate hikes. Given the enormity of the public debt, which creates inflationary pressures, raising interest rates will become inevitable in the next few years. The pace of rate increase will be affected by the pace of improvement in the economy and the price indices, but it seems that the interest rate hike will be slower than expectations during the height of the crisis.

In Israel

The global economic crisis had limited repercussions on the Israeli economy. The local stock market reacted sharply to the global crisis, with the TA-25 falling more than 50% in November 2008 from its peak in late 2007. Since the market bottomed out in the last quarter of 2008 and until the end of 2010 the TA-25 index soared 125%, buttressed by economic news that Israel's economy was hit far less than other Western countries. Since the date of the last Hadera Paper valuation, which was carried out on June 30, 2009, the TA-25 Index soared by 54%. The graph below shows the development of TA-25 over the last five years:

Unlike most Western countries, whose real estate markets were also hit by the crisis, Israel recorded relatively sharp gains in property prices. The reasons, inter alia, include a consistently higher demand over supply of residential real estate, the low interest rate and competition between banks over lenient mortgage terms.

The main impact on the economy during the crisis period was the shekel's appreciation against major currencies, especially the US dollar. A small economy, open to free capital movements, with exports being a crucial component of domestic activity, the shekel's appreciation can hurt Israel's competitive status and employment. However, unemployment in Israel is amongst the lowest in the world and at the end of 2010 came at 6.6%, compared to 9.6% in the US and 10% in the Euro bloc.

Over the last two years the Bank of Israel adopted a policy of gradual interest rate hike in order to cool the soaring equity and real estate markets and in the last few months accelerated the pace of rate increase. Naturally, the risk may raise the value of the shekel, thereby hurting the local industry somewhat restricts the Bank of Israel's freedom of action. Below is a development of the Prime interest rate3:

The increase in the Prime interest rate has not yet been reflected in the long-term real interest rate, probably due to inflation expectations in the next few years. A study of the annual structure of the yield-to-maturity of CPI-linked bonds at a fixed interest rate (Sagi and Galil) shows that in each of the years 2007-2010 (except for 2008) the interest rate curve has fallen, all along the curve. At the end of 2010, the yield-to maturity for a period longer than 25 years for CPI-linked government bonds fell to 2.7%, as follows:

3 The Prime interest rate is derived from the Bank of Israel's interest to financial institutions and is used to set the price of unlinked credit at a floating interest rate.

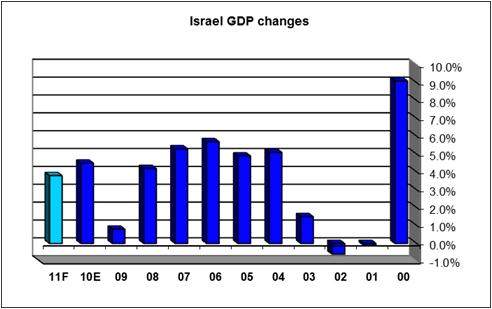

The Bank of Israel's forecast for GDP growth in the next few years points to stability in the growth pace: GDP is projected to grow by 3.8% in 2011 compared to an estimated growth of 4.5% in 2010 and 0.8% in 2009, as follows:

Source: "Israel and the global economy", taken from a lecture by the Bank of Israel's Governor, January 31, 2011

| For the purposes of this valuation it was assumed that in the next few years the slow improvement in the global economy will continue, while Israel will maintain a relatively higher growth pace. It was further assumed that despite nominal interest rate hikes in the years ahead, there will not be any significant change in the real interest rate environment due to inflation expectations. |

| | The Company operates through wholly-controlled companies in two operating segments4: the packaging paper and recycling segment and the office supplies marketing segment, as follows: |

| | a. | Packaging paper and recycling |

| | The following is a summary of the business results of the packaging paper and recycling segment: |

| | | 2006 | | | 2007 | | | 2008 | | | 2009 | | | 2010 | |

| | | NIS in million | |

| Revenues* | | | 412 | | | | 465 | | | | 407 | | | | 339 | | | | 511 | |

| Operating profit | | | 50 | | | | 71 | | | | 39 | | | | (3 | ) | | | 50 | |

| Rate of change in revenues | | | 10.5 | % | | | 13.0 | % | | | (12.5 | )% | | | (16.6 | )% | | | 50.7 | % |

| Operating profit margin | | | 12.2 | % | | | 15.3 | % | | | 9.6 | % | | | (0.9 | )% | | | 9.8 | % |

* Including inter-company sales, in 2010 excluding business results in respect of Machine No. 8 during its testing period | |

| | (1) | The business environment |

| | Hadera Paper is the single manufacturer in Israel of recycled packaging paper made of waste paper and paperboard. Packaging paper consumers in Israel are companies engaged in the manufacture of corrugated board containers and packaging for every sector of the economy. Demand for packaging paper is ultimately dependent on the level of economy activity in agriculture, the food industry and other industries. In fact, the demand for these products stems from domestic and overseas demand for agricultural produce and other consumer goods manufactured in Israel. |

The supply of packaging paper in Israel is driven by domestic production by Hadera Paper and overseas production. Packaging paper is usually imported by manufacturers of corrugated board containers and packaging and includes imports of virgin paper and recycled paper. Packaging paper imports grew in the years 2008-2009 due to excess supply of this paper in Europe. The economic recovery in 2010 created a shortage in packaging paper in Europe, which diminished imports on the one hand and allowed Hadera Paper to scale up their overseas exports, on the other hand.

In the Company's estimation, in 2010 the domestic market grew 3% per annum in quantitative terms. The company's sales to the domestic market rose in 2010 by 40% in quantitative terms from 93,000 tons in 2009 to 129,000 tons in 2010.

4 The following description and analysis of the Company relate to its business activity excluding the operation of Hadera Paper Printing, Carmel and Frankel, the value of the Company's holding therein has been determined separately. For a description of Hadera Paper Printing see section 3c below; for a description of Carmel and Frankel, see section 3d below.

Hadera Paper enjoys the structured advantages of a domestic supplier of packaging paper, which is preferable to imports from the point of view of the customer (saving in transportation costs, availability of local inventory and service) and works to increase its market share in Israel, especially with the manufacture of new products, as specified below:

Excess demand for recycled packaging paper overseas in 2010 allowed the Company to increase its exports from NIS 57 million in 2009 to NIS 197 million5 in 2010. This increase in sales symbolizes the dramatic change in the field of packaging paper since the height of the economic crisis in 2008-2009. During these years, packaging paper was imported to Israel at particularly low prices, exports contracted and this hurt the Company's profits. In January 2009 the Company even filed a complaint with the Commissioner of Trade Levies (Anti-Dumping Restrictions) in the Ministry of Industry and Trade regarding imports of packaging papers at dumping prices from several European countries. After examining this complaint, the Commissioner of Trade Levies decided to launch an investigation at the end of which it imposed a temporary levy on imports of packaging paper from specific countries in Europe. In August 2010, the antitrust supervisor announced that the advisory committee regarding levies and dumping had recommended to impose a levy for a limited period and that the minister of industry trade and employment had received the recommendation. However, following the refusal of the ministry of finance to approve the levy, no dumping levy was imposed on the import of brown paper products.

The Company is a monopoly in the manufacture and marketing of paper in cylinders and sheets as this term is defined in the Restrictive Trade Practices Law, 1988 (hereinafter – "Antitrust Law"). In 1989 the Company was declared a monopoly in this area by the Antitrust Commissioner and in 1998 this declaration was partially cancelled in connection with the manufacture and marketing of writing and printing papers in cylinders and sheets (the core operation of Hadera Paper Printing). Except for the provisions of the antitrust law, no special instructions were issued to the Company by the Antitrust Commissioner in relation to its monopoly status. The Company is working to cancel the monopoly declaration.

The collection of the main raw material in the manufacture of packaging paper – waste paper and paperboard – is carried out through Amnir. With extensive experience in the field of recycling, in the last few years Amnir expanded its collection capacity and takes steps to identify new waste sources including the import of waste paper to Israel in order to meet the needs of packaging paper production. With the operation of Machine 8, about 78% of the waste paper sold by Amnir is used for the manufacture of packaging paper while only 22% of the waste is sold to external customers, mainly for the production of tissue paper.

Amnir's competitors in the recycling market are: KMM Recycling Enterprises Ltd, Tal-El Collection and Recycling Ltd as well as other rivals that usually focus on a certain geographic area. Amnir's share of the waste paper and paperboard market is estimated by the Company at 61%.

5 About NIS 160 million net of sales during the testing period of Machine no. 8.

In 2007, the Knesset approved an amendment (No. 9) to the Maintenance of Cleanliness Law, 2007 (hereinafter – "the cleanliness law"), which require landfill operators to pay a levy for every ton of waste landfilled. Pursuant to the Cleanliness Law the landfill levy of unsorted waste will be five times higher than the landfill levy for waste residues after sorting. The levy gradually increases from NIS 10 and NIS 0.8 per ton in 2007 to NIS 50 and NIS 4 per ton of unsorted waste and waste residues after sorting, respectively. The Cleanliness law is designed to encourage waste sorting and recycling of waste paper instead of landfilling. During January 2011, the Knesset passed the Packaging Law (hereinafter – "the packaging Law") which imposes direct responsibility on manufacturers and importers in Israel to collect and recycle the packaging waste of their products. The Packaging Law is based on the principle that the manufacturer or importer is responsible for recycling the packaging of the products that were produced or imported by it for sale in Israel and to bear the cost associated with the collection and recycling of the waste. In order to ensure that the undertakings of the manufacturers and importers are met, any such manufacturer or importer must enter into a legal engagement with a known body, that would be a company whose sole purpose would be to uphold the obligations of all the manufacturers and importers with whom it has engaged and that has been recognized by virtue of the Packaging Law. The packaging and arrangements provisions stipulated thereunder with respect to the assignment of responsibility between manufacturers and local municipalities for the handling of waste, determining recycling quotas for each material, assigning duty of separation of the waste at its source and other directives of the Packaging Law - are also expected to increase the supply of waste paper and waste board in the local market.

The percentage of recycling in the total consumption of paper and cardboard in Israel in 2010 is estimated at 40% compared to 57% in West Europe. In 2008, The Confederation of European Paper Industries (CEPI) declared a recycling target of 65% of the cardboard and paper consumed in the EU. These data and the efforts of the Israeli government to encourage recycling in Israel are indicative of considerable potential for continued growth in recycling in this sector.

| | The quality of packaging paper in terms of strength, resistance to humidity, price and other qualities dictates the use of this paper. Packaging paper can be classified into two main product groups: paper used for the manufacture of the external layer of corrugated cardboard and paper used for the manufacture of the external and internal layer of corrugated cardboard. |

Historically, corrugated cardboard was made from Craft Liner paper, which is high-quality virginal paper (mostly made from wood pulp). This paper is not manufactured in Israel. Due to the high price of Craft Liner paper and the trend of recycling materials, the global paper industry has developed recycled packaging paper that are cheaper than Craft Liner: fluting paper, test liner, white liner etc, which account for 70% of the packaging papers used in the manufacture of corrugated cardboard in Israel in quantitative terms. In comparison, the use of recycled packaging paper is sometimes as high as 90%. Until 2010, the packaging paper manufactured by Hadera paper was only suitable for this segment of the market, but with the introduction of new products for serial manufacture, Hadera Paper products can substitute the bulk of packaging papers used in the manufacture of corrugated cardboard.

In the last few years the Company has been engaged in the development of new products from waste paper (100% recycled), to be used as substitutes for virginal paper, mainly Craft Liner. The main advantages of the new products are as follows:

| | √ | Environment-friendly products. Governments encourage the use of recycled products and end customers prefer recycled products to virginal products. This trend is expected to grow in the future. |

| | √ | Substitutes for virginal packaging papers enable the Company to penetrate a new market segment, which is estimated at 30% of the packaging paper market in quantitative terms. Until 2010 this segment was based on imported virginal paper only. Naturally, the penetration of these products into the local industry could take several years. |

| | √ | The potential to increase exports, as evidenced in 2010 in the growing demand overseas for recycled packaging paper. |

| | √ | The price of new products is lower than the price of virginal products. |

| | √ | The specification of new products allow top utilize the production capacity of Machine no. 1 whose operation was discontinued with the operation of Machine no. 8, as set forth below. |

In 2010, for the first time, the Company manufactured and marketed substantial quantities of the new products.

The price of packaging paper in Israel is based on the prices of these products overseas, while taking into account the advantages of working with local suppliers. The price of recycled packaging paper has risen sharply in 2010 while the prices of virginal papers have been eroded.

Amnir's products include waste paper and paperboard as well as plastic waste as well as shredding of material and disposal and shredding of waste paper and magnetic media.

| | (3) | Manufacture, distribution and collection |

| | On June 1, 2010 the testing of the operation of Machine 8, with an annual production capacity of 230,000 ton packaging paper, was completed. The construction of the new machine at a total cost of NIS 690 million was approved in 2007, as part of the Company's forecast that demand for recycled products will grow in the long term. The annual production capacity of packaging paper at year-end 2010 was 320,000 ton. In 2010, due to the testing of the machine, the Company's production capacity was 270,000 ton. The business results of Machine 8 during the testing period were capitalized to the cost of the machine. |

| | Exploiting the potential of the new equipment is subject to the availability of waste paper and paperboard and an increase in Company sales to the local market: - |

| | - | Amnir will continue to increase the pace of collection of waste paper and paperboard. In order to prepare for the operation of Machine 8, in 2008-2009 Amnir accumulated an inventory of waste paper and paperboard which, at year-end 2009, reached 100,000 tons. Most of the inventory was used up during 2010 and at December 31, 2010 Amnir's waste paper inventory is estimated at 15,000 ton. The Company is examining alternatives to supplement the sources of raw materials used in the manufacture of packaging paper, including the import of waste paper and paperboard. In the medium and long term the pace of collection is expected to catch up with the pace of processing of the waste. |

| | - | The Company should encourage local customers to purchase packaging paper manufactured by the Company instead of importing the paper. Despite the clear advantages of buying raw materials from a local supplier, this process is expected to be gradual and until it is completed, the Company will export the excess paper to markets abroad. Export prices are usually lower than prices on the local market, in addition to which the seller incurs the transportation costs. It should be noted that due to the risks involved in international trade, the terms of credit for customers abroad are significantly better than the terms of credit for local customers. The completion of development of new products is expected to facilitate the above process. |

The investments in equipment for Machine 8 are amortized in the financial statements over a period of 25 years while for tax purposes over three years only, by 20%, 40% and 40% each year.

On the eve of the operation of Machine 8, the Company's production capacity reached 150-160 thousand tons per year. Once Machine 8 became operational, the old Machine 1, which had a production capacity of 50-60 thousand tons, was shut down. Machine 1 is operated periodically in order to preserve its production capacity without any significant investment. The old machine is suitable for the manufacture of new products with a relatively high weight per square meter and it may be operated in the future. Since its production capacity is not included in the overall production capacity of 320,000 per year, the operation of machine 1 could save investments in the short and medium term in production equipment.

At the Hadera site Amnir operates a plant for waste paper sorting, cleaning and pressing, paper shredders, magnetic media and other equipment. The production capacity in this site is estimated at 130,000 ton paper per year and only 82% of this capacity was utilized in 2010. In November 2010 Amnir's operation was relocated from Bney Brak to the new logistic center in Modi'in, which has an annual production capacity of 290,000 ton. In 2010, the Bney Brak and Modi’in sites treated 150,000 ton of waste paper, accounting for 52% of the production capacity in the new logistic center. Amnir has a fleet of 612 trucks, while 37 additional trucks are operated by subcontractors.

In addition to the manufacture and recycling of packaging paper, the Company operates an energy center through Hadera Paper Infrastructures, for the generation of steam and electricity and supplies additional services to Group companies (warehouse management, acquisitions, catering, transportation of employees, cleaning, etc). Companies using steam, electricity and other services pay Hadera paper Infrastructures for the cost of the steam and services while inter-company electricity charges are based on electricity fees set by the Israel Electric Corporation (hereinafter – "IEC"). In 2007 the Company began using natural gas in the generation of steam and electricity. The natural gas supply agreement that was signed in 2005 with the Yam Tethys partners is effective until July 1, 2011. The company is conducting negotiations with EMG and with additional potential suppliers regarding the purchase of natural gas by the company for the continued operation, subsequent to the termination of the agreement with Yam Tethys, as well as for the power plant whose construction is being considered by the company, as stated in Section 3.e.(4), below.

The price of natural gas used in the generation of steam and electricity by Hadera Paper Infrastructures is expected to increase. The cost of purchasing natural gas for the operation of the packaging paper segment in 2010 was NIS 30 million.

| | There are five manufacturers of packaging paper and corrugated board containers in Israel: Carmel, Kargal Ltd6, Best Carton Ltd, Y.M.A 1990 Manufacture of Packaging Products Ltd and Ordea Print Industries Ltd. These companies purchase the products manufactured by Hadera Paper while importing virginal and recycled packaging paper from Germany, Spain, Austria, Italy, France and China. |

| | The Company's customers manufacture corrugated board through corrugators. They process the corrugated board into board containers for their customers or sell the corrugated boards to small processers, which manufacture packaging for niche or small end customers. |

| | Corrugated board containers are hygienic, disposable packages, which are relatively cheap and considered environment-friendly. Board containers are used in every sector of industry. The food and beverage industry and agricultural industry represent the biggest demand for corrugated board containers in Israel. Additional sectors that widely use corrugated board containers are: cosmetics, technology and industry. The import of board containers is not economically feasible due to the volume of the product, lack of supply availability and other factors, while its global price serves as a "shadow price" for the local product (in practice, imports are limited). |

| | Demand for packaging paper stems from the basic consumption of food, beverages and agricultural produce and the use of substitutes (plastic containers, nylon bags etc). Demand is also affected by the extent of agricultural and industrial exports. For example, the rapid growth of agricultural exports in the last few years (exports of niche crops such as peppers, where farmers enjoy a high profit margin) has boosted demand for high-quality corrugated board containers. On the other hand – the relocation of industrial production from Israel to overseas markets, the import of packaged products and the increase in the price of water for agricultural uses is hurting the packaging sector. |

| | The operation of Machine 8 has made the packaging segment Amnir's main customer, with 78% of Amnir's sales channeled to this segment in quantitative terms. Other Amnir customers include: Hogla, Shaniv Paper Industries Ltd, Panda Paper Enterprises (1997) Ltd and Jerusalem White Paper 2000 Ltd. |

6 About 26% of Kargal's share capital are held by CII, controlling shareholder of the company

| | - | The Company's products are intended for the local market and are based on local raw materials. |

| | - | The successful operation of Machine 8 has doubled the Company's packaging paper production capacity. |

| | - | A "green" image due to the use of waste paper as the main raw material and recycling activity. |

| | - | The Company's product mix is complete following the development of a recycled packaging paper as a substitute for virginal paper. |

| | - | High entry barriers in the packaging paper segment including hefty investments in production and availability of waste paper and paperboard. Major manufacturers of packaging paper will have a small chance of successfully entering the market. |

| | - | Amnir is branded as the leading waste paper and paperboard collector in Israel. |

Weaknesses

| | - | The Company is dependent on a natural gas supplier and the gas price after July 1, 2011, when the current gas agreement ends. Disruptions in the gas supply and higher gas costs could have an adverse impact on the Company's business results. |

| | - | Statutory limitations applicable to the Company by virtue of its status as a declared monopoly in the manufacture and marketing of papers in cylinders and sheets. |

Opportunities

| | - | The successful testing of Machine 8 has occurred at a time of economic recovery, which increases the Company's chance of expanding its market share in Israel. |

| | - | The development of new products that replace virginal paper could potentially increase sales to the local market by dozens of percents. |

| | - | The marketing of new products overseas as "green" products that substitute virginal paper. |

| | - | Increased collection of waste paper and paperboard in the next few years owing to higher collection capacity and the entry into force of the Cleanliness Law and the Packaging Law. |

Threats

| | - | The advent of a double dip recession will hurt demand for packaging paper in Israel and overseas. |

| | - | Exposure to the price of packaging paper overseas. |

| | - | Unlike the white paper industry, where there is high correlation between the product's price and the cost of the main raw material – wood pulp, in the recycled paper industry, the correlation between the cost of waste paper and the product's price is relatively low. A decline in the prices of products could hurt the Company's profitability. |

| | - | Imports of packaging paper by manufacturers of corrugated board containers and packaging at cheaper prices. |

| | - | Lack of available sources of raw materials for the operation of the new machine and the need to import waste paper. |

| | - | A sharp increase in the price of natural gas which is used to operate the energy center, once the current agreement with the Yam Tethys partnership ends in June 2011. |

| | b. | Marketing of office supplies |

| | The revenues of the office supplies marketing segment have grown by a double digit rate in the last few years while the operating profitability margin has been maintained at a range of 2.5%-3.5%, as follows: |

| | | 2006 | | | 2007 | | | 2008 | | | 2009 | | | 2010 | |

| | | NIS in million | |

| Revenues | | | 122 | | | | 119 | | | | 131 | | | | 151 | | | | 179 | |

| Operating profit | | | 0 | | | | 1 | | | | 3 | | | | 5 | | | | 5 | |

| Rate of change in revenues | | | 7.4 | % | | | (2.5 | )% | | | 9.9 | % | | | 15.5 | % | | | 18.5 | % |

| Operating profit margin | | | 0.0 | % | | | 0.7 | % | | | 2.4 | % | | | 3.3 | % | | | 2.8 | % |

| | (1) | The business environment |

| | Graffiti is engaged in the acquisition, imports, marketing and sale of office supplies and related products, mainly in the institutional market. The marketing and sale of office equipment is primarily carried out through participation in tenders, exhibitions, catalogues, websites and sales people. Graffiti provides services to large business customers (government offices, banks, health funds, etc) which usually offer the winning bidder a two-four year contract. In 2010 and 2009, Graffiti's revenues as a result of winning tenders accounted for 32% and 34% of its total revenues, respectively. |

| | Graffiti offerings consist of about 12,000 items including, among others, dry food products and beverages and cleaning products. The marketed items are acquired from local suppliers (Hadera Paper Printing, Hogla, office equipment importers, consumer electronics importers, food and beverage manufacturers and others) or imported through a wholly-owned subsidiary which represents Artline, Mitsubishi, Max, Sneider and other international brands in Israel. Graffiti is not dependent on any of its suppliers. |

| | Graffiti's main competitors are: Kravitz (1974) Ltd, Office Depot (Israel) Ltd, New Horizon Ltd, Pythagoras (1986) Ltd, Arta Graphics Art and Office Equipment Ltd, Lautman Rimon Ltd, Fun Manufacture and Imports of Office Supplies Ltd and additional office supplies marketers, some operating in niche markets. |

| | In November 2010 Office Depot (Israel) Ltd was acquired by the New Hamashbir Lazarchan Ltd and Office Depot customers were added to the acquirer's consumer club. At this stage it is unclear how this acquisition will affect activity in the institutional market in which Graffiti specializes. |

| | Graffiti operates several sites, the main one located in Park Afek in Rosh Ha'ayin, which houses Graffiti's main logistic centre, including a warehouse, sales and management centre. Graffiti is in the process of building a new logistic centre in Modi’in, as stated in section 2.a, above. The transition to the new logistic centre is scheduled for the second half of 2011, right after the lease agreement in Park Afek expires. Graffiti plans to consolidate its operations in the new logistic center. Graffiti's distribution centre includes 38 distribution vehicles. |

Graffiti's business operation is seasonal while its revenues in the second half of the year are usually higher than those in the first half.

| | - | A strong brand among business and institutional customers; services provided countrywide. |

| | - | Exclusive franchise to import several international brands such as Artline and Mitsubishi (Uni-ball pens). |

Weaknesses

| | - | Very low entry barriers to the office supplies sector and fierce competition, primarily in the center of Israel. |

| | - | Strong competitors with long-standing brands such as Office Depot and Kravitz. |

Opportunities

| | - | Graffiti is taking advantage of the market decentralization and its own economies of scale to promote growth through mergers and acquisitions. |

| | - | It is also using the advantages of the new logistic center to reduce operating costs. The new logistic center is expected to computerize and streamline inventory and order management. |

Threats

| | - | Graffiti is exposed to customers from every sector of the economy. The collapse of companies during the economic crisis, especially in the real estate, diamond and technology sectors, and the cutback in procurement budgets among institutional and business customers could hurt Graffiti's day-to-day operations and its assets (trade receivable). |

| | - | The acquisition of Office Depot by the New Hamashbir Lazarchan could escalate competition in the market. |

| | c. | Printing and Writing Paper |

| | Until 1999 the Printing and Writing Paper segment (hereinafter – "printing paper") was managed as a division of Hadera Paper and as part of its core business. In 1999 Mondi Business Paper Ltd (formerly Neusiedler AG) (hereinafter – "MBP") acquired 50.1% of the division which, on the eve of the transaction, was transferred to Hadera Paper – Printing and Writing Paper Ltd (formerly – Mondi Hadera Paper Ltd) (hereinafter – "Hadera Paper Printing"), which was established for that purpose. On December 31, 2010 the Company acquired 25.1% of the shares of Hadera Paper Printing from MBP for a consideration of €10.4 million and as of that date the Company holds 75% of the shares of Hadera Paper Printing. |

| | As part of acquiring 25.1% of the shares, Hadera paper Printing gave MBP a put option to sell its remaining holdings in Hadera Paper Printing to the Company (hereinafter – "undertaking to MBP"). The price of exercise of the option was set as the market value of Hadera Paper Printing after deducting 20% but no less than a fixed amount, as it is defined in the purchase agreement. The put option will be blocked for the first three years from the date of closing of the transaction, and shall be exercisable at any time thereafter. |

| | | 2006 | | | 2007 | | | 2008 | | | 2009 | | | 2010 | |

| | | NIS in million | |

| Revenues | | | 712 | | | | 770 | | | | 732 | | | | 669 | | | | 729 | |

| Operating profit | | | (2 | ) | | | 34 | | | | 34 | | | | 40 | | | | 31 | |

| Rate of change in revenues | | | 7.3 | % | | | 8.2 | % | | | (4.9 | )% | | | (8.6 | )% | | | 8.9 | % |

| Operating profit margin | | | (0.3 | )% | | | 4.4 | % | | | 4.7 | % | | | 6.0 | % | | | 4.2 | % |

The value of the Company's holdings in the shares of Hadera Paper Printing and the value of the option given to MBP were recorded in the financial statements as of the transaction date, December 31, 2010, based on the paper on the Purchase Price Allocation (PPA) of Mondi Hadera Paper Ltd, which was prepared by Giza Even Singer Ltd. Due to the fact that the date of financial reporting and the closing date of the translation are identical, no adjustments were made to the value of investment in Mondi in the company balance sheet as at December 31, 2010. The value of holdings in Hadera Paper Printing and the undertaking in respect of the MBP option in this valuation were also determined based on the results of the above PPA. |

Below is a description of the business activity of Hadera Paper Printing and a summary of its financial statements:

| | (1) | The business environment |

| | Hadera Paper Printing is engaged in the manufacture, imports, marketing and sale of writing and printing paper and the only manufacturer in Israel that specializes in the manufacture of these products. The main product offered by Hadera Paper Printing is uncoated white paper made of pulp, weighting 70-90 grams per square meters, which is the most common paper in Israel for these uses. To supplement its products basket Hadera paper Printing imports high-density paper, coated paper, colored paper and other types of paper and imports the surplus white paper it manufactures. |

| | Hadera Paper Printing's competitors in the domestic market are the leading paper importers in Israel: Niris Ltd, Ronimer Ltd, Elenfer Trading, Mey Hanachal Ltd, B.O.R. Rose Brotherhood Ltd and others. Some of the competing imports are based on spot transactions for inventories in Europe, and carried out by office supplies and paper distributors. The volume of these imports changes from one year to the next as a function of the availability and price of white paper in Europe. |

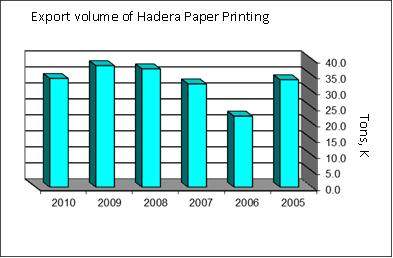

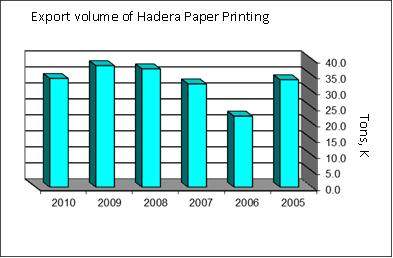

| | In the last few years Hadera Paper has been working to expand its exports. In 2007-2008 the company's products were exported directly rather than through MBP, with most of the exports directed to Mediterranean Basin countries: Cyprus, Egypt and Jordan. In 2010 efforts were made to shift exports to the US, which offered higher profit margins. Exports to the US in 2010 accounted for 66% of total exports compared to 90% of exports to Egypt and Jordan in 2008-2009. The following graph a development of the company's exports in the last few years: |

The price of writing and printing paper is usually derived from excess production capacity in the sector. Due to the high transportation costs, Israel is mainly affected by excess production costs in Europe. RISI, which specializes in economic reviews for the paper industry, published a forecast at the end of 2010 according to which demand for writing and printing paper in Europe will remain relatively stable in the foreseeable future due to the transition of consumers to substitute products such as digital media. This situation is expected to maintain excess production capacity, at the level recorded in late 2010, about 10% of installed production capacity.

Domestic demand for the products of Hadera Paper Printing mainly stems from economic activity and the size of the population, and is affected by long-term trends such as environmental conservation, printed media consumption habits, demand for books, etc. Very few changes are expected in demand for printing and writing paper in Israel, with erosion in demand for paper per capita on the one hand, and population growth on the other.

The supply of printing and writing paper products in Israel is derived from the production capacity of Hadera Paper Printing and the volume of imported paper. The volume of import is affected by the difference between the price of white paper overseas and its price in Israel, exchange rates, transportation costs and other factors. Excess demand/supply overseas is derived from the level of demand and the pace of construction/shutting down of production plants, mainly in Europe. Hadera Paper Printing estimates its share of the domestic market at 50%.

| | Hadera Paper Printing operates in four segments of the Israeli market: |

Marketing of white paper manufactured by Hadera Paper Printing and imported coated paper. The paper is usually supplied in large sheets or cylinders.

Marketing and sale of writing paper for private and office uses (mainly A4) to office supply retailers. Hadera Paper Printing's customers include the three biggest office supply retailers in Israel: Office Depot, Kravitz and Graffiti, smaller retailers and large business and institutional customers such as government offices, banks, etc.

| | - | Independent distributors |

Hadera Paper Printing markets its products to small customers through independent distributors.

| | - | Paper product manufacturers |

In this segment Hadera Paper Printing markets white paper to manufacturers of paper products: envelopes, notebooks and writing pads, and to businesses specializing in digital printing (office letterheads, greeting cards, etc).

In Israel, Hadera Paper Printing possesses approximately 450 customers, with the central customers being printing houses (approximately 21%), paper wholesalers (approximately 19%), office supplies wholesalers (approximately 32%), manufacturers of paper products (approximately 28%) and end users.

| | (3) | Raw materials and suppliers |

| | Hadera Paper Printing's main raw material is pulp which on average constitutes 50% of the cost of production. Hadera Paper Printing purchases pulp from several suppliers, mainly European, as part of MBP's long-term purchase agreements and in its opinion, is not dependent on these suppliers or on MBP. |

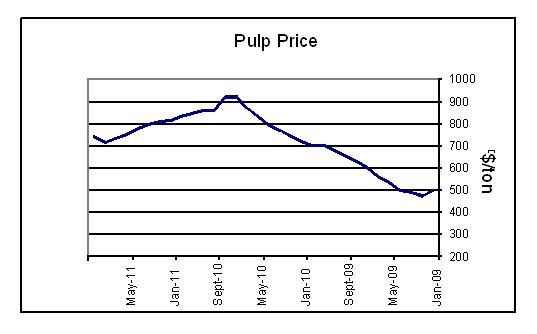

| | | The price of pulp soared in 2007 and in the first half of 2008 amid the steep rise in the prices of most commodities and fell in the second half of 2008 and in the first half of 2009. In the second half of 2009 pulp prices began climbing again, a trend which continued until the last quarter of 2010. The graph below is a development of global pulp prices in 2009-2010 and a forecast for 2011: |

| | Additional raw materials in the manufacture of white paper are chemical substances, mainly chalk and starch. These materials are acquired from two local manufacturers, Oumia Shfeya Ltd and Galam Ltd. These are the sole manufacturers of these materials in Israel and therefore Hadera Paper Printing is dependent on these suppliers. |

| | Hadera Paper Printing buys electricity and steam from Hadera Paper Infrastructures7. At the end of 2007 Hadera Paper's energy center began using natural gas instead of fuel oil. As a result, in 2008 Hadera paper Printing's energy costs began dropping. Once the natural gas agreement with the Yam Tethys partners expires in 2011, energy prices are expected to increase. The company is conducting negotiations with several entities regarding the purchase of natural gas, as stated in Section 3.a.(3), above. |

| | Hadera Paper Printing uses MBP's purchase system to buy imported pulp and chemicals. For these services Hadera Paper Printing pays MBP a fee at the rate of 1% of the purchase volume. Hadera Paper Printing works with three major pulp suppliers overseas and in its opinion, it is not dependent on any of these pulp suppliers. No change is anticipated in the purchasing of pulp via MBP as a result of the transition of 75% of the holdings in Hadera Paper Printing to Hadera Paper as of December 31, 2010. |

| | Most of the raw materials used in the manufacture of white paper are commodities or their prices are derived from the prices of commodities, and they are stated in foreign currency. On the other hand, the prices of Hadera Paper's products on the local market are stated in shekels and are not directly linked to the prices of commodities. As a result, Hadera Paper Printing is exposed to fluctuations in the prices of pulp and chemical as well as fluctuations in currency exchange rates. Hadera Paper Printing is also exposed to energy prices, mainly electricity and steam. |

| | (4) | Production and distribution |

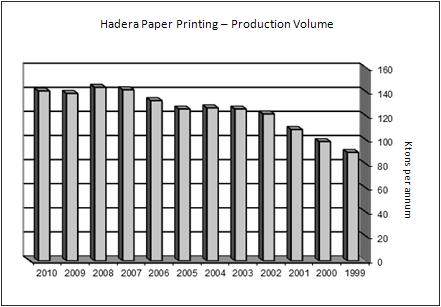

| | Hadera Paper Printing's production plant is located in Hadera and has a fully-utilized production capacity of 141,000 ton. In 1999 the plant's production capacity was 90,000 ton per year, but owing to MBP's know-how, its production capacity rose to 120,000 ton per year. In 2005 the plant's production capacity was increased by 20,000 ton per year as a result of improvements in the paper machine and optimization of the production process with a $12 million investment. In the last few years, the production capacity remained stable, as follows: |

| | Until the last quarter of 2010, the company's products in Israel were distributed from three sites in Hadera, Holon and Haifa. In the fourth quarter Hadera Paper Printing relocated its operation to the new logistic center in Modi’in. |

| | - | The sole manufacturer of writing and printing paper in Israel. |

| | - | The required capital investment constitutes a high entry barrier for paper manufacturers and consequently, the odds of building an additional white paper plant in Israel are slim. |

| | - | 25% of the shares of Hadera Paper Printing are owned by MBP, one of the leading global manufacturers of printing and writing paper. Hadera Paper Printing has access to MBP's international know-how and purchase system. |

| | - | The company's papers are notable for their high quality. |

| | - | A diverse products basket |

Weaknesses

| | - | Full utilization of production capacity, increasing production above the potential in the optimization of the production process requires investments in the paper machines. |

| | - | The main raw material – pulp, is imported to Israel. The chances of significantly expanding the plant or acquiring a new paper machine are slim. |

| | - | Dependence on two chemical suppliers with local production plants. |

| | - | Exposure to prices of raw materials, exchange rates and energy prices. |

Opportunities

| | - | Additional expansion of production capacity through optimization of the process at a small investment. |

| | - | Waning demand for Hadera Paper's products in the medium and long term due to changes in consumers' preferences, the "green" trend and a shift to digital media. |

| | - | Competing imports from Europe at cheaper prices. |

| | - | A deepening economic crisis will erode domestic demand for printing and writing paper or create large paper surpluses in Europe. |

| | - | Deterioration of the security situation in the region could impact direct exports. |

| | (6) | Summary of business results and financial situation |

| | The following tables include a summary of the consolidated financial statements of Hadera Paper Printing: |

| | | 2006 | | | 2007 | | | 2008 | | | 2009 | | | 2010 | |

| | | NIS in million | |

| Revenues | | | 712 | | | | 770 | | | | 732 | | | | 669 | | | | 729 | |

| Cost of revenues | | | 660 | | | | 688 | | | | 650 | | | | 579 | | | | 640 | |

| Gross profit | | | 52 | | | | 82 | | | | 83 | | | | 91 | | | | 88 | |

| Selling and marketing expenses | | | 45 | | | | 38 | | | | 38 | | | | 40 | | | | 43 | |

| Administrative and general expenses | | | 9 | | | | 11 | | | | 10 | | | | 11 | | | | 14 | |

| Other income (expenses) | | | - | | | | - | | | | (1 | ) | | | - | | | | - | |

| Operating profit (loss) | | | (2 | ) | | | 34 | | | | 34 | | | | 40 | | | | 31 | |

| Financing expenses | | | 7 | | | | 8 | | | | 8 | | | | 11 | | | | 2 | |

| Pre-tax income (expenses) | | | (9 | ) | | | 25 | | | | 26 | | | | 29 | | | | 29 | |

| Tax expenses (income) | | | (1 | ) | | | 7 | | | | 7 | | | | 1 | | | | 7 | |

| Net income (loss) | | | (8 | ) | | | 18 | | | | 19 | | | | 28 | | | | 22 | |

| EBITDA | | | 9 | | | | 44 | | | | 46 | | | | 52 | | | | 43 | |

| Rate of change in revenues | | | 7.3 | % | | | 8.2 | % | | | (4.9 | )% | | | (8.6 | )% | | | 8.9 | % |

| Gross profit margin | | | 7.3 | % | | | 10.6 | % | | | 11.3 | % | | | 13.6 | % | | | 12.1 | % |

| Operating profit margin | | | (0.3 | )% | | | 4.4 | % | | | 4.7 | % | | | 6.0 | % | | | 4.2 | % |

| Net income margin | | | (1.1 | )% | | | 2.3 | % | | | 2.6 | % | | | 4.2 | % | | | 3.0 | % |

| EBITDA margin | | | 1.3 | % | | | 5.8 | % | | | 6.2 | % | | | 7.8 | % | | | 5.9 | % |

| Effective tax rate | | | 12.5 | % | | | 28.6 | % | | | 26.8 | % | | | 2.1 | % | | | 24.9 | % |

| | | 31/12/09 | | | 31/12/10 | | | | 31/12/09 | | | 31/12/10 | |

| | | NIS million | | | | NIS million | |

| Cash and cash equivalents | | | 17 | | | | 13 | | Short-term bank credit | | | 69 | | | | 93 | |

| Trade receivable | | | 184 | | | | 176 | | Current maturities of long-term credit | | | 11 | | | | 4 | |

| Other receivables | | | 2 | | | | 6 | | Suppliers and service providers | | | 106 | | | | 120 | |

| Inventory | | | 108 | | | | 162 | | Commercial debt to Hadera Paper | | | 58 | | | | 55 | |

| | | | | | | | | | Declared dividend | | | - | | | | 9 | |

| | | | | | | | | | Other | | | 26 | | | | 30 | |

| Total current | | | 312 | | | | 356 | | Total current maturities | | | 269 | | | | 309 | |

| assets | | | | | | | | | Deferred income tax | | | 23 | | | | 22 | |

| | | | | | | | | | Long-term credit net of current maturities | | | 13 | | | | 9 | |

| Intangible assets | | | 3 | | | | 3 | | Liabilities in respect of employees, net | | | 2 | | | | 3 | |

| Total long-term investments | | | 3 | | | | 3 | | Total long-term liabilities | | | 38 | | | | 34 | |

| Fixed assets, net | | | 147 | | | | 146 | | Shareholders' equity | | | 155 | | | | 163 | |

| Total assets | | | 462 | | | | 506 | | Total equity and liabilities | | | 462 | | | | 506 | |

| | d. | Packaging and carton products |

Carmel Containers was established in 1983 and is engaged in the planning, manufacture, marketing and sale of containers, corrugated cardboard panels, wooden surfaces and other products. In 1986 its shares were listed for trading on the AMEX in the US, in 2005 they were delisted from trading and on October 4, 2010 a public purchase offer for 10.7% of the shares was completed. As of the date of this opinion, the Company holds 100% of the shares of Carmel. Below is a summary of Carmel's business results:

| | | 2006 | | | 2007 | | | 2008 | | | 2009 | | | 2010 | |

| | | NIS million | |

| Revenues | | | 420 | | | | 471 | | | | 418 | | | | 383 | | | | 397 | |

| Operating profit | | | 17 | | | | 14 | | | | (7 | ) | | | 13 | | | | 4 | |

| Rate of change in revenues | | | 1.1 | % | | | 12.3 | % | | | (11.4 | )% | | | (8.3 | )% | | | 3.7 | % |

| Operating profit margin | | | 4.0 | % | | | 3.0 | % | | | (1.7 | )% | | | 3.4 | % | | | 1.0 | % |

Frenkel is engaged in the planning, manufacture, marketing and sale of shelf cardboard packaging, stands for the display of products on the selling floor, etc. Frenkel was established following a merger between C.D. Packaging Systems Ltd and Frenkel and Sons Ltd in January 2006. On the eve of the transaction, C.D. Packaging Systems Ltd was owned by the Company (50%) and Carmel (50%) while Frenkel and Sons Ltd was controlled by a third party. Following the transaction, the Company and Carmel each hold 28.9% of the shares of Frenkel, while Frenkel and Sons Ltd hold the remaining 42.2%. Below is a summary of Frenkel's business results:

| | | 2006 | | | 2007 | | | 2008 | | | 2009 | | | 2010 | |

| | | NIS million | |

| Revenues | | | 113 | | | | 123 | | | | 117 | | | | 120 | | | | 131 | |

| Operating profit | | | (1 | ) | | | 1 | | | | 1 | | | | 2 | | | | 3 | |

| Rate of change in revenues | | NR | | | | 8.6 | % | | | (4.4 | )% | | | 2.3 | % | | | 9.2 | % |

| Operating profit margin | | | (0.6 | )% | | | 0.9 | % | | | 0.6 | % | | | 1.7 | % | | | 2.3 | % |

The value of the Company's holdings in Carmel in this valuation was determined based on the valuation of Carmel Containers Ltd, which was prepared by Giza Singer Even Ltd, enclosed as Appendix B. The value of the Company's holdings in Frenkel was determined, due to lack of materiality, based on the balance of investment in Frenkel in the Company's balance sheets at December 31, 2010 |

Below is a description of the business activity of Carmel and Frenkel and a summary of their financial statements:

| | (1) | The business environment |

| | In the Company's estimation, in 2010 the local packaging market grew at a rate of 3% as a result of higher demand for food and beverages, agricultural and technological products, among others. |

| | Carmel's competitors in the corrugated market are four local manufacturers of corrugated cardboard and its products: Kargal Ltd8, Best Carton Ltd, Y.M.A. 1990 Manufacturing of Packaging Products Ltd and Ordea Print Industries Ltd. These companies manufacture corrugated cardboard panels and containers and sell the containers to customers that use them for packaging purposes, and the corrugated cardboard panels to companies that manufacture small series of containers for small customers. The entry barrier to the corrugated cardboard market is relatively high because of the need to invest in corrugators. Small corrugators have a production capacity of 40,000 ton per year while bigger corrugators produce up to 80,000 ton per year. Investing in a corrugator requires the manufacturer to sell large volumes to customers in a saturated market and therefore entails a high risk. |

| | The import of paper and cardboard packaging is limited due to their physical volume and the high availability required for packaging products. Several companies import packaging products directly but the volume of these imports is small. |

| | Carmel's customers in the corrugated cardboard market include leading food and beverage companies, agricultural wholesalers, farmers, technology companies, government offices and banks. Its customers in the corrugated cardboard panels are companies that process the panels into packaging products and printing companies that use corrugated cardboard as a raw material for printing or adhering. |

8 About 26% of Kargal's share capital is held by CII Ltd., the controlling shareholder of the company

| | Carmel has 250 active customers, with revenues from the 20 biggest customers accounting for more than 50% of Carmel's total income. Although sales to one customer represented 12.7% of Carmel's revenues in 2010, it is not dependent on a single customer. The packaging products are sold by sales persons and in exhibitions and trade fairs, while some customers conduct periodic tenders among packaging suppliers. |