October 29, 2013 Quarterly update FY 2013 fourth quarter Exhibit 99.2

Agenda Introduction Glen Ponczak, Vice President, Global Investor Relations Overview Alex Molinaroli, Chief Executive Officer Business results and financial review Bruce McDonald, Executive Vice President and Chief Financial Officer Q&A . 2 FORWARD-LOOKING STATEMENTS Johnson Controls, Inc. has made statements in this document that are forward-looking and, therefore, are subject to risks and uncertainties. All statements in this document other than statements of historical fact are statements that are, or could be, deemed "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. In this document, statements regarding future financial position, sales, costs, earnings, cash flows, other measures of results of operations, capital expenditures or debt levels and plans, objectives, outlook, targets, guidance or goals are forward-looking statements. Words such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “should,” “forecast,” “project” or “plan” or terms of similar meaning are also generally intended to identify forward-looking statements. Johnson Controls cautions that these statements are subject to numerous important risks, uncertainties, assumptions and other factors, some of which are beyond Johnson Controls’ control, that could cause Johnson Controls’ actual results to differ materially from those expressed or implied by such forward- looking statements. These factors include the strength of the U.S. or other economies, automotive vehicle production levels, mix and schedules, energy and commodity prices, availability of raw materials and component products, currency exchange rates, and cancellation of or changes to commercial contracts, as well as other factors discussed in Item 1A of Part I of Johnson Controls’ most recent Annual Report on Form 10-K for the year ended September 30, 2012 and Johnson Controls’ subsequent Quarterly Reports on Form 10-Q. Shareholders, potential investors and others should consider these factors in evaluating the forward-looking statements and should not place undue reliance on such statements. The forward- looking statements included in this document are only made as of the date of this document, and Johnson Controls assumes no obligation, and disclaims any obligation, to update forward-looking statements to reflect events or circumstances occurring after the date of this document.

3 Record FY 2013 results despite a mixed macro environment - (+) North America automotive recovery and continued strong production growth in China - (+) European automotive production levels stabilizing with growth in some countries - (+) U.S. residential HVAC demand - (-) Weak Building Efficiency commercial HVAC markets - (-) Soft aftermarket battery demand in North America 2013 full year results Record sales and earnings 2013 full year Record revenues $42.7 billion Record earnings* $2.66 / share *Excluding non-recurring items and pension / retiree medical mark-to-market. Refer to appendix for non-GAAP reconciliation.

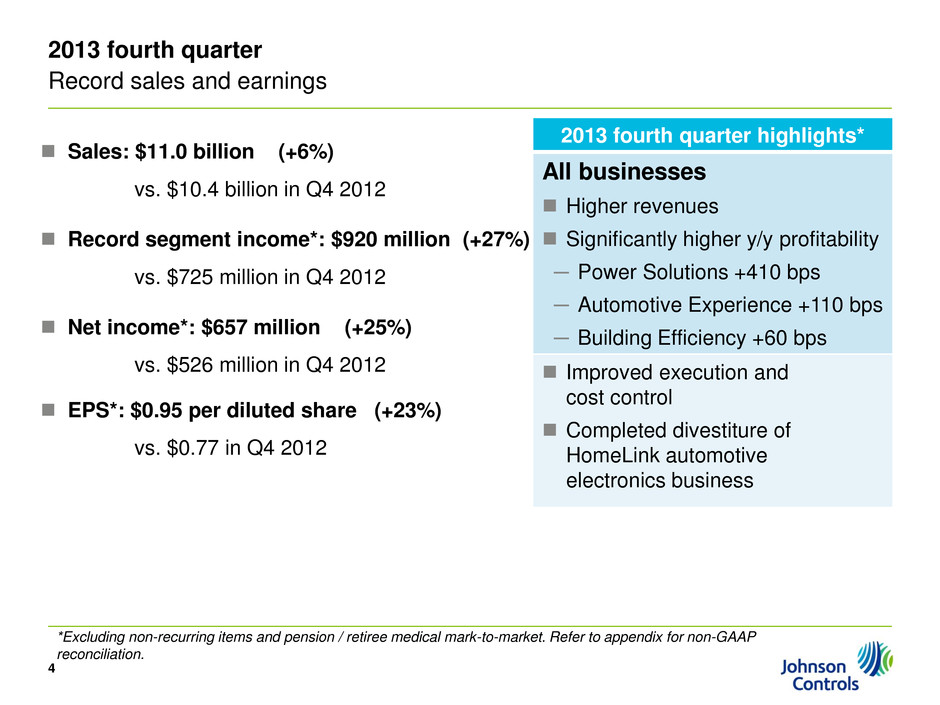

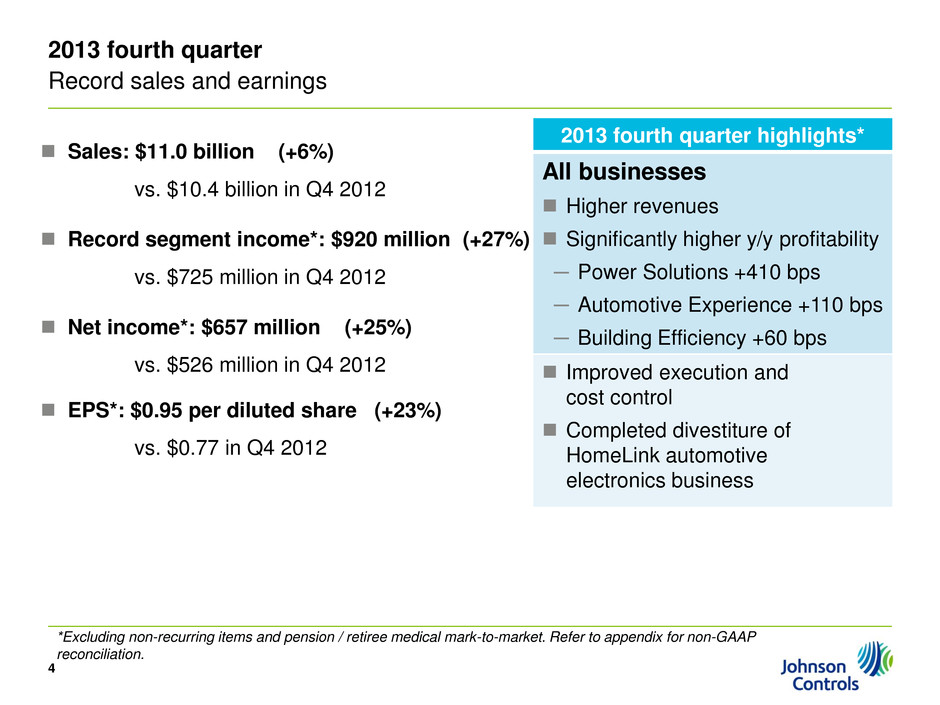

Sales: $11.0 billion (+6%) vs. $10.4 billion in Q4 2012 Record segment income*: $920 million (+27%) vs. $725 million in Q4 2012 Net income*: $657 million (+25%) vs. $526 million in Q4 2012 EPS*: $0.95 per diluted share (+23%) vs. $0.77 in Q4 2012 4 2013 fourth quarter highlights* All businesses Higher revenues Significantly higher y/y profitability ─ Power Solutions +410 bps ─ Automotive Experience +110 bps ─ Building Efficiency +60 bps Improved execution and cost control Completed divestiture of HomeLink automotive electronics business *Excluding non-recurring items and pension / retiree medical mark-to-market. Refer to appendix for non-GAAP reconciliation. 2013 fourth quarter Record sales and earnings

Good momentum Stabilizing markets Operational execution improvements Benefits of cost discipline and pricing initiatives Continued margin expansion across the businesses expected Lower levels of capital expenditures generating stronger cash flows Significant restructuring activities underway Geographic and capacity expansions in emerging markets Continuing to invest for long-term growth and margin expansion Johnson Controls 5 Exploring strategic options for our Automotive Interiors business Expectations entering 2014

31 years of service CEO 2007 – 2013 – Sales 2007: $34.6 billion – Sales 2013: $42.7 billion 6 Thank you, Steve Roell

2013 fourth quarter Power Solutions 2013 2012 Net sales $1.7B $1.6B +9% Global unit shipments higher, with continued soft aftermarket demand in North America – Americas up 1% – Europe and Asia up 11% - 12% – New customer wins – Note: AGM volumes up 33% Improved pricing Segment income $330M $239M +38% Benefits of higher volume, increased vertical integration, cost reduction initiatives and improved pricing and mix U.S. recycling facility start-up costs in 2012 Margins improved 410 bps 7 Florence, South Carolina battery recycling facility

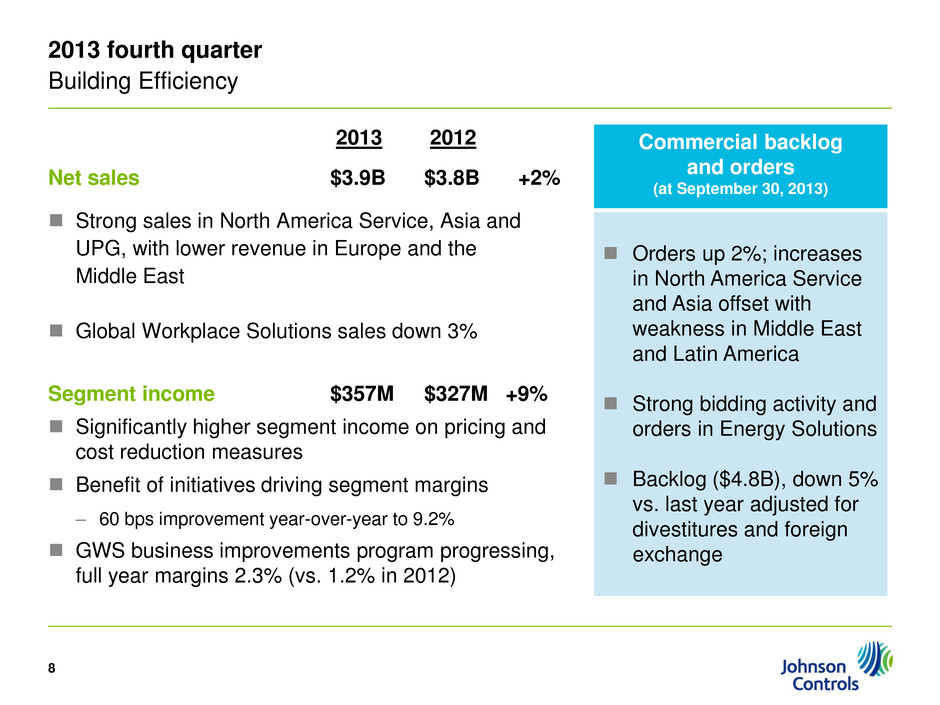

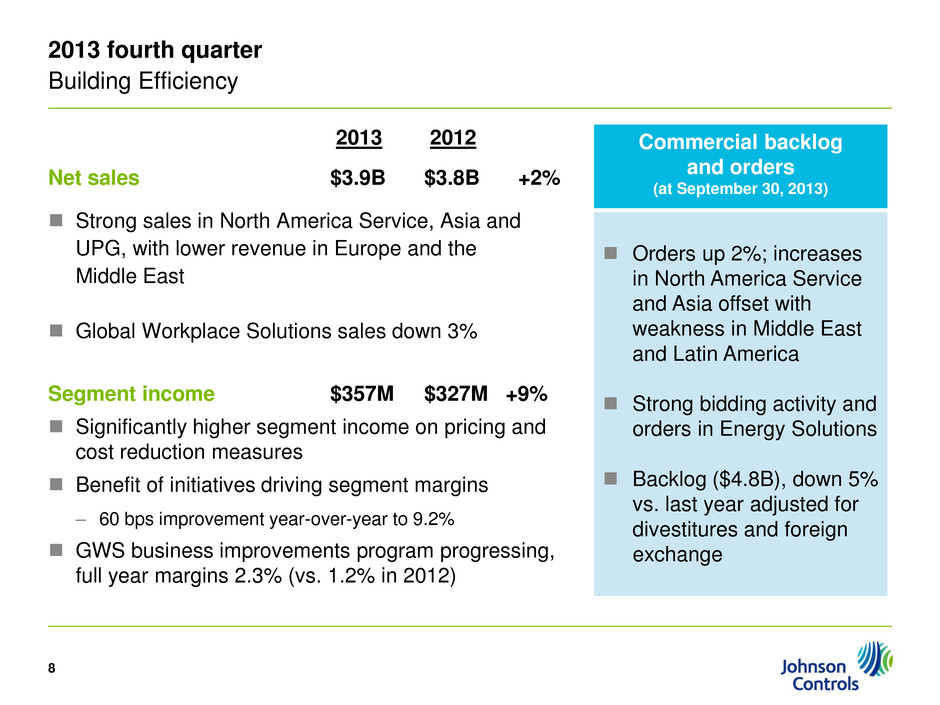

2013 fourth quarter Building Efficiency 2013 2012 Net sales $3.9B $3.8B +2% Strong sales in North America Service, Asia and UPG, with lower revenue in Europe and the Middle East Global Workplace Solutions sales down 3% Segment income $357M $327M +9% Significantly higher segment income on pricing and cost reduction measures Benefit of initiatives driving segment margins – 60 bps improvement year-over-year to 9.2% GWS business improvements program progressing, full year margins 2.3% (vs. 1.2% in 2012) 8 Commercial backlog and orders (at September 30, 2013) Orders up 2%; increases in North America Service and Asia offset with weakness in Middle East and Latin America Strong bidding activity and orders in Energy Solutions Backlog ($4.8B), down 5% vs. last year adjusted for divestitures and foreign exchange

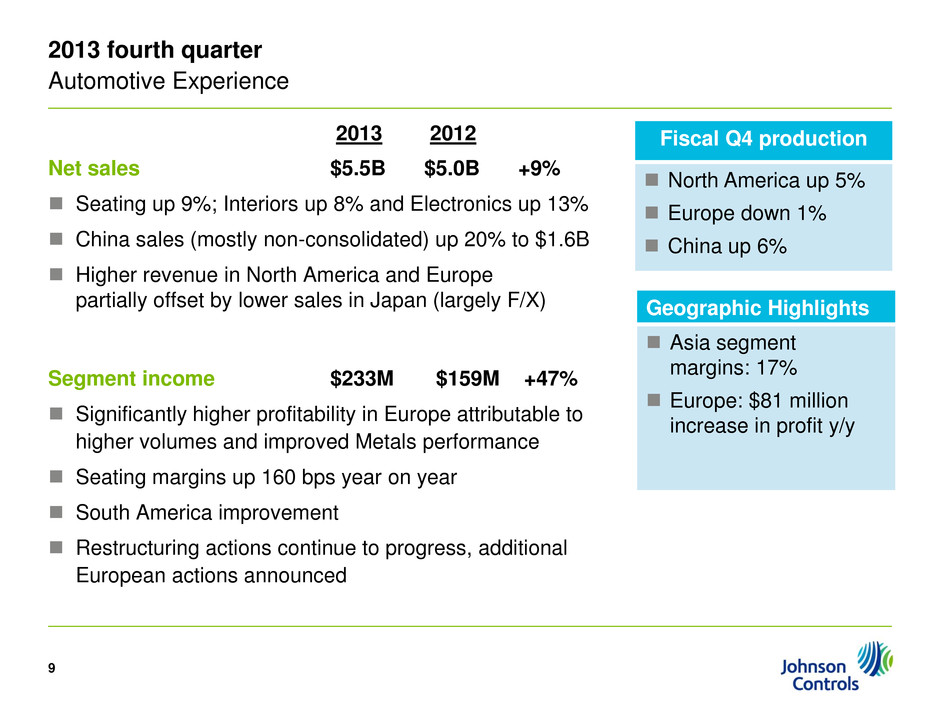

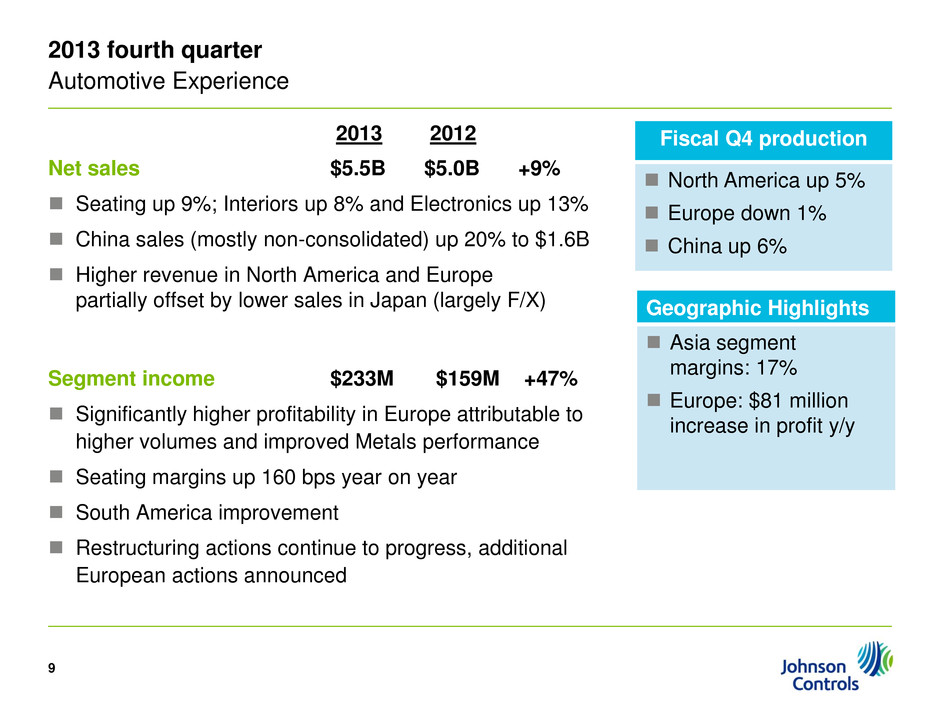

2013 fourth quarter Automotive Experience 2013 2012 Net sales $5.5B $5.0B +9% Seating up 9%; Interiors up 8% and Electronics up 13% China sales (mostly non-consolidated) up 20% to $1.6B Higher revenue in North America and Europe partially offset by lower sales in Japan (largely F/X) Segment income $233M $159M +47% Significantly higher profitability in Europe attributable to higher volumes and improved Metals performance Seating margins up 160 bps year on year South America improvement Restructuring actions continue to progress, additional European actions announced 9 Fiscal Q4 production North America up 5% Europe down 1% China up 6% Geographic Highlights Asia segment margins: 17% Europe: $81 million increase in profit y/y

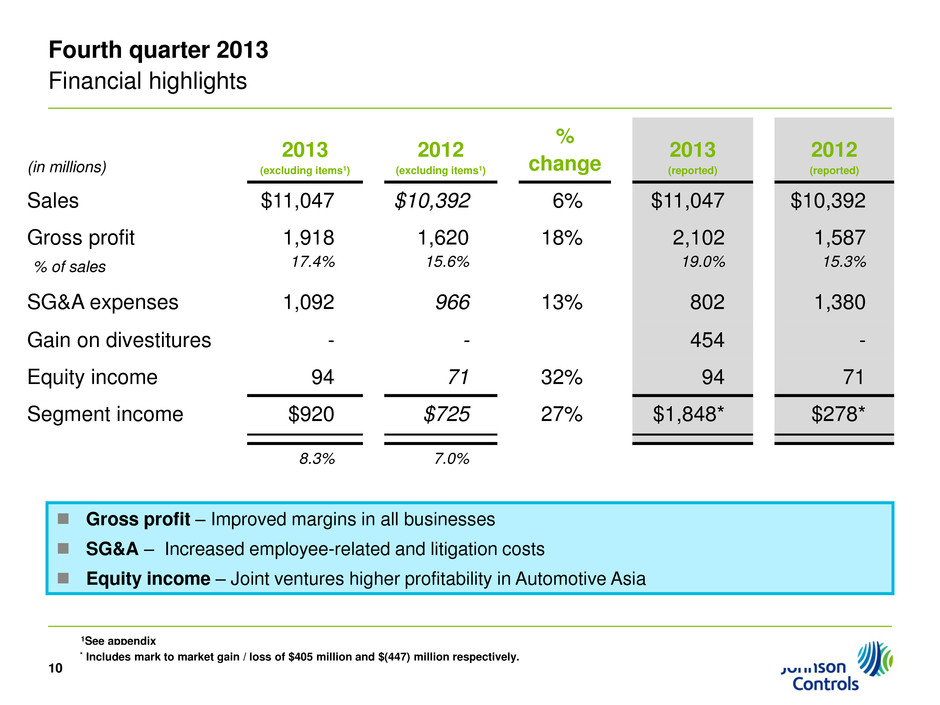

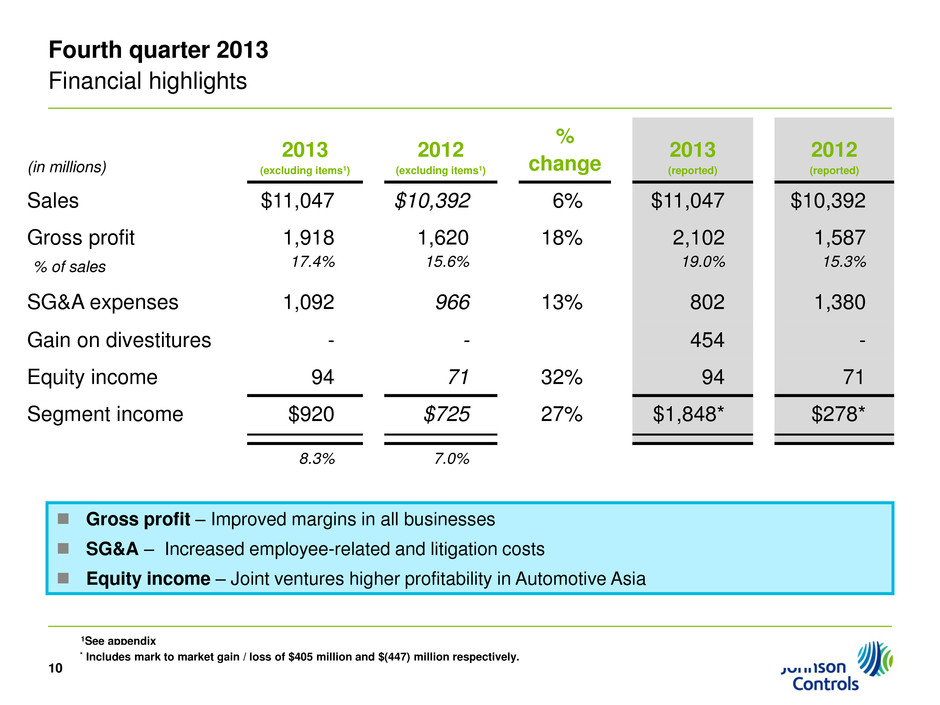

Fourth quarter 2013 Financial highlights 10 Gross profit – Improved margins in all businesses SG&A – Increased employee-related and litigation costs Equity income – Joint ventures higher profitability in Automotive Asia (in millions) 2013 (excluding items1) 2012 (excluding items1) % change 2013 (reported) 2012 (reported) Sales $11,047 $10,392 6% $11,047 $10,392 Gross profit % of sales 1,918 17.4% 1,620 15.6% 18% 2,102 19.0% 1,587 15.3% SG&A expenses 1,092 966 13% 802 1,380 Gain on divestitures - - 454 - Equity income 94 71 32% 94 71 Segment income $920 $725 27% $1,848* $278* 8.3% 7.0% 1See appendix * Includes mark to market gain / loss of $405 million and $(447) million respectively.

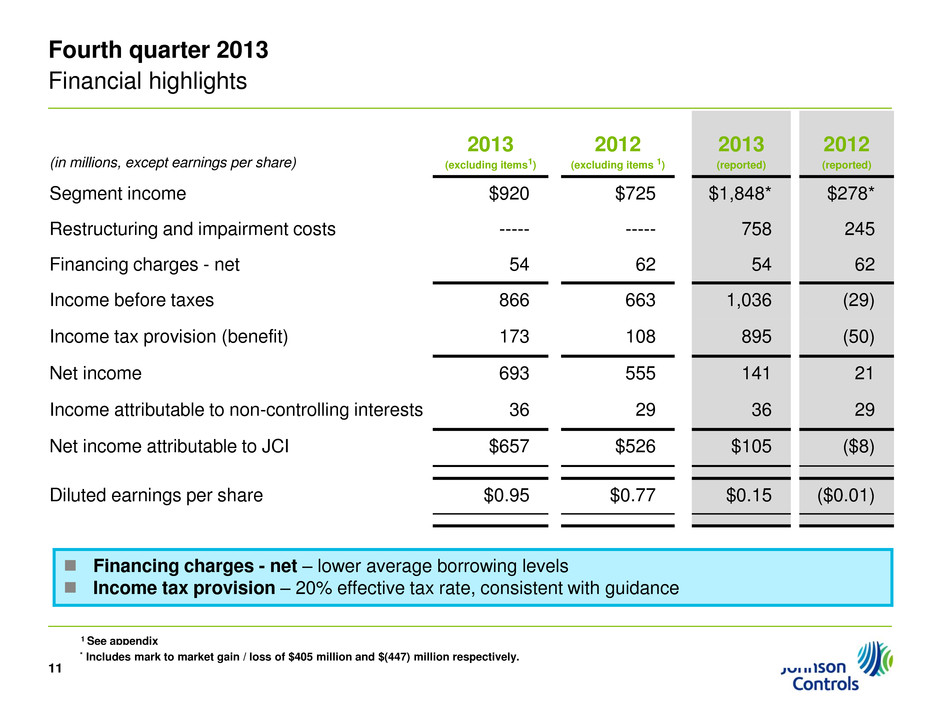

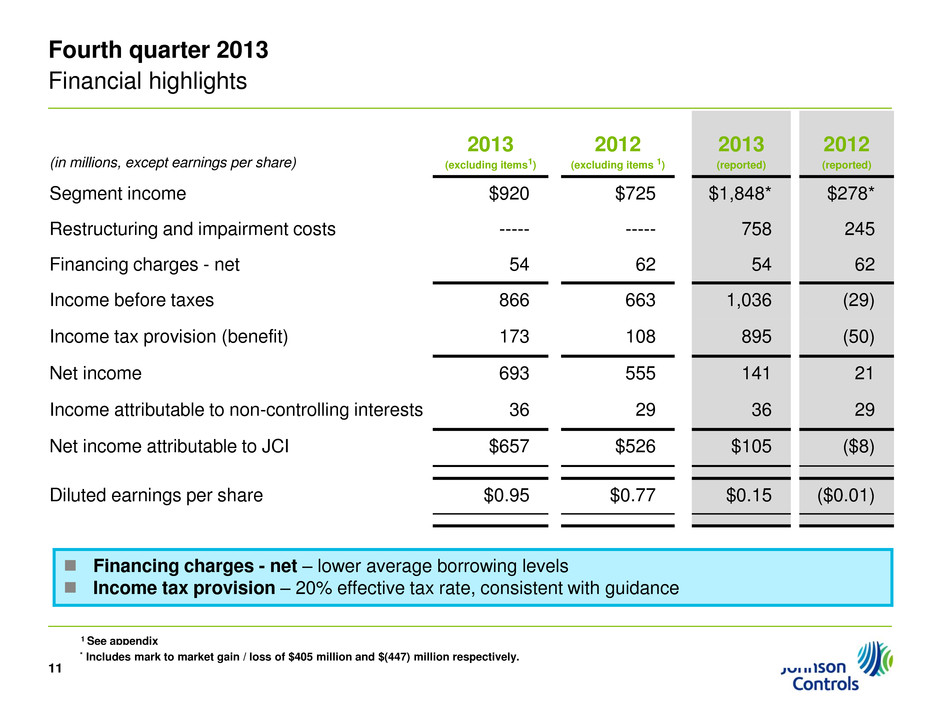

Fourth quarter 2013 Financial highlights Financing charges - net – lower average borrowing levels Income tax provision – 20% effective tax rate, consistent with guidance (in millions, except earnings per share) 2013 (excluding items1) 2012 (excluding items 1) 2013 (reported) 2012 (reported) Segment income $920 $725 $1,848* $278* Restructuring and impairment costs ----- ----- 758 245 Financing charges - net 54 62 54 62 Income before taxes 866 663 1,036 (29) Income tax provision (benefit) 173 108 895 (50) Net income 693 555 141 21 Income attributable to non-controlling interests 36 29 36 29 Net income attributable to JCI $657 $526 $105 ($8) Diluted earnings per share $0.95 $0.77 $0.15 ($0.01) 1 See appendix 11 * Includes mark to market gain / loss of $405 million and $(447) million respectively.

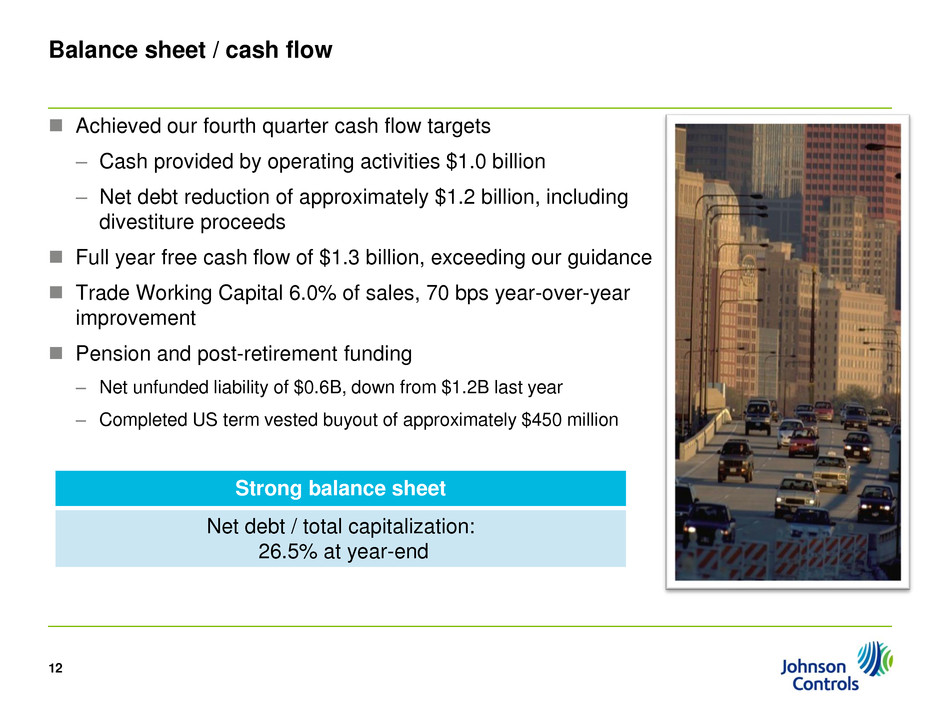

Balance sheet / cash flow Achieved our fourth quarter cash flow targets – Cash provided by operating activities $1.0 billion – Net debt reduction of approximately $1.2 billion, including divestiture proceeds Full year free cash flow of $1.3 billion, exceeding our guidance Trade Working Capital 6.0% of sales, 70 bps year-over-year improvement Pension and post-retirement funding – Net unfunded liability of $0.6B, down from $1.2B last year – Completed US term vested buyout of approximately $450 million 12 Strong balance sheet Net debt / total capitalization: 26.5% at year-end

Expectations looking forward Strong momentum, with confidence in Q1 outlook – Expect continued sequential profitability improvements in Automotive Experience – In Building Efficiency, our pipeline supports further improvement in our orders; Q1 revenue growth anticipated with further margin expansion – Expect GWS transformation margin improvement – Power Solutions expected to continue delivering strong y/y improvement – Restructuring initiatives remain on track 2014 Outlook – Q1 EPS up approximately 30% (up 35% adjusting for HomeLink divestiture) – Detailed guidance to be provided at December 18th New York Analyst meeting 13 New York Analyst Meeting December 18th 2013 Stage 37, Midtown New York City 8 a.m. Eastern

Appendix

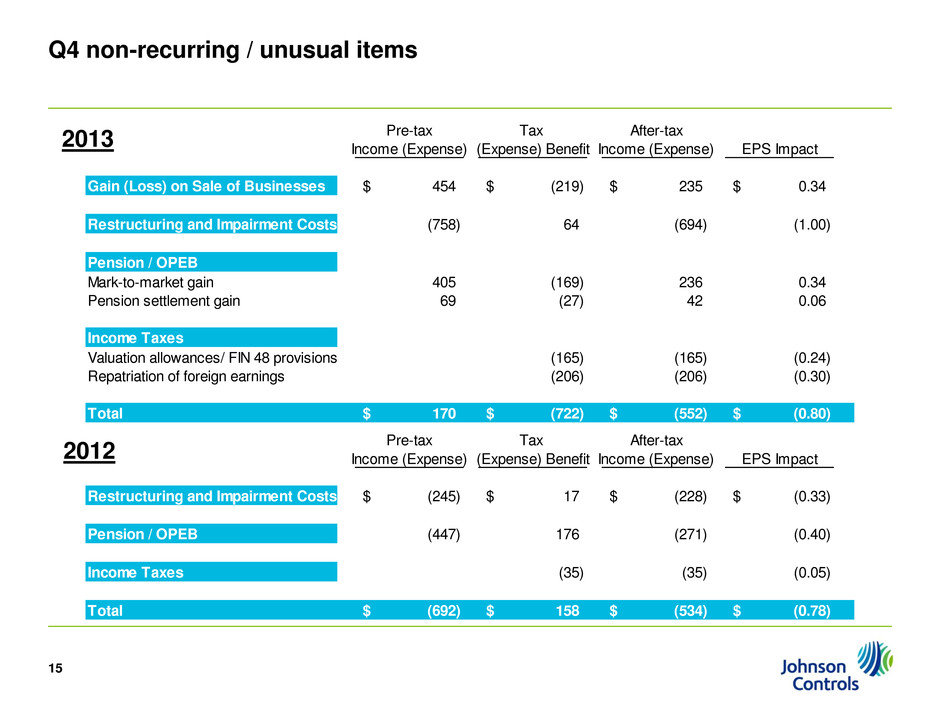

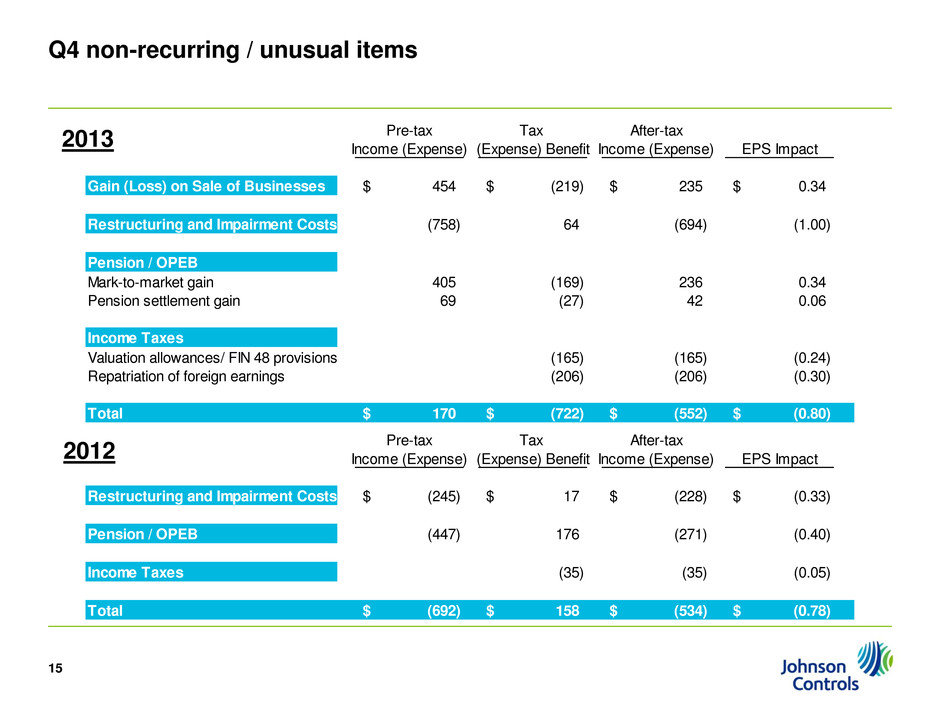

Pre-tax Tax After-tax Income (Expense) (Expense) Benefit Income (Expense) EPS Impact Gain (Loss) on Sale of Businesses 454$ (219)$ 235$ 0.34$ Restructuring and Impairment Costs (758) 64 (694) (1.00) Pension / OPEB Mark-to-market gain 405 (169) 236 0.34 Pension settlement gain 69 (27) 42 0.06 Income Taxes Valuation allowances/ FIN 48 provisions (165) (165) (0.24) Repatriation of foreign earnings (206) (206) (0.30) Total 170$ (722)$ (552)$ (0.80)$ Q4 non-recurring / unusual items 15 2013 Pre-tax Tax After-tax Income (Expense) (Expense) Benefit Income (Expense) EPS Impact Restructuring and Impairment Costs (245)$ 17$ (228)$ (0.33)$ Pension / OPEB (447) 176 (271) (0.40) Income Taxes (35) (35) (0.05) Total (692)$ 158$ (534)$ (0.78)$ 2012