Johnson Controls, Inc. — 1 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Johnson Controls, Inc. — 1 Strategic Review and 2015 Financial Outlook December 2, 2014 Exhibit 99.2

Johnson Controls, Inc. — 3 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Alex Molinaroli Chairman and Chief Executive Officer

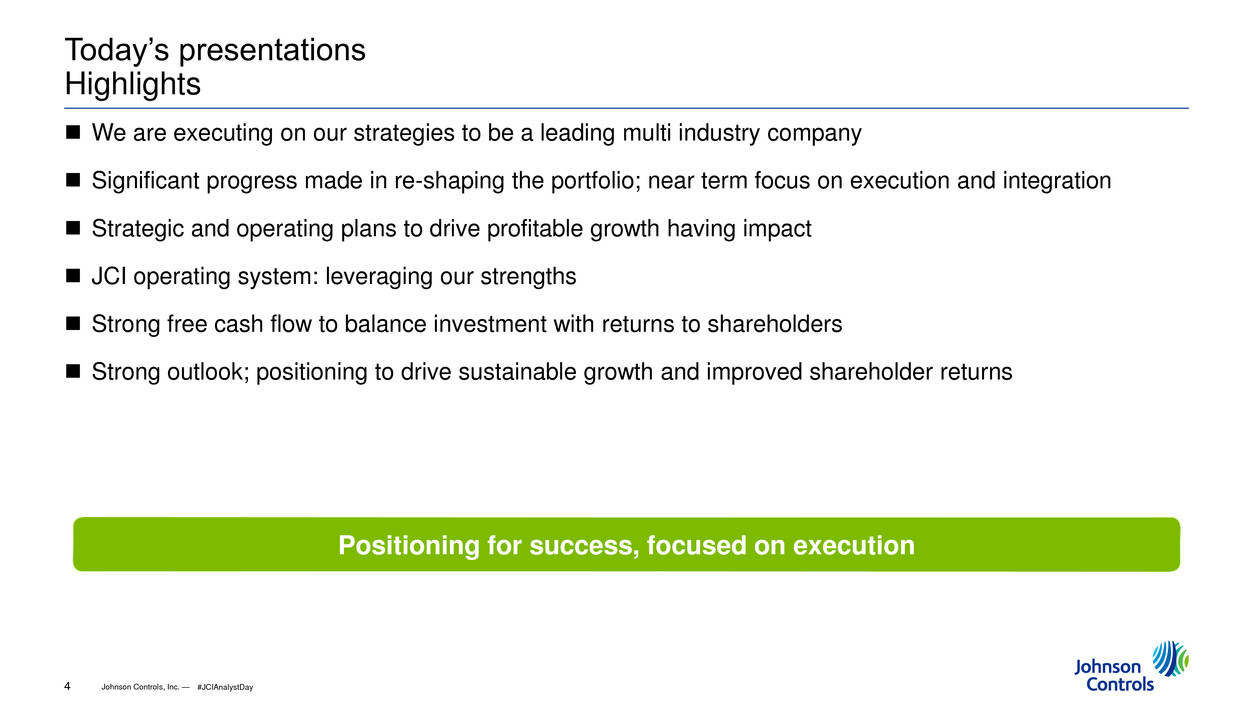

Johnson Controls, Inc. — 4 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Today’s presentations Highlights We are executing on our strategies to be a leading multi industry company Significant progress made in re-shaping the portfolio; near term focus on execution and integration Strategic and operating plans to drive profitable growth having impact JCI operating system: leveraging our strengths Strong free cash flow to balance investment with returns to shareholders Strong outlook; positioning to drive sustainable growth and improved shareholder returns Positioning for success, focused on execution #JCIAnalystDay

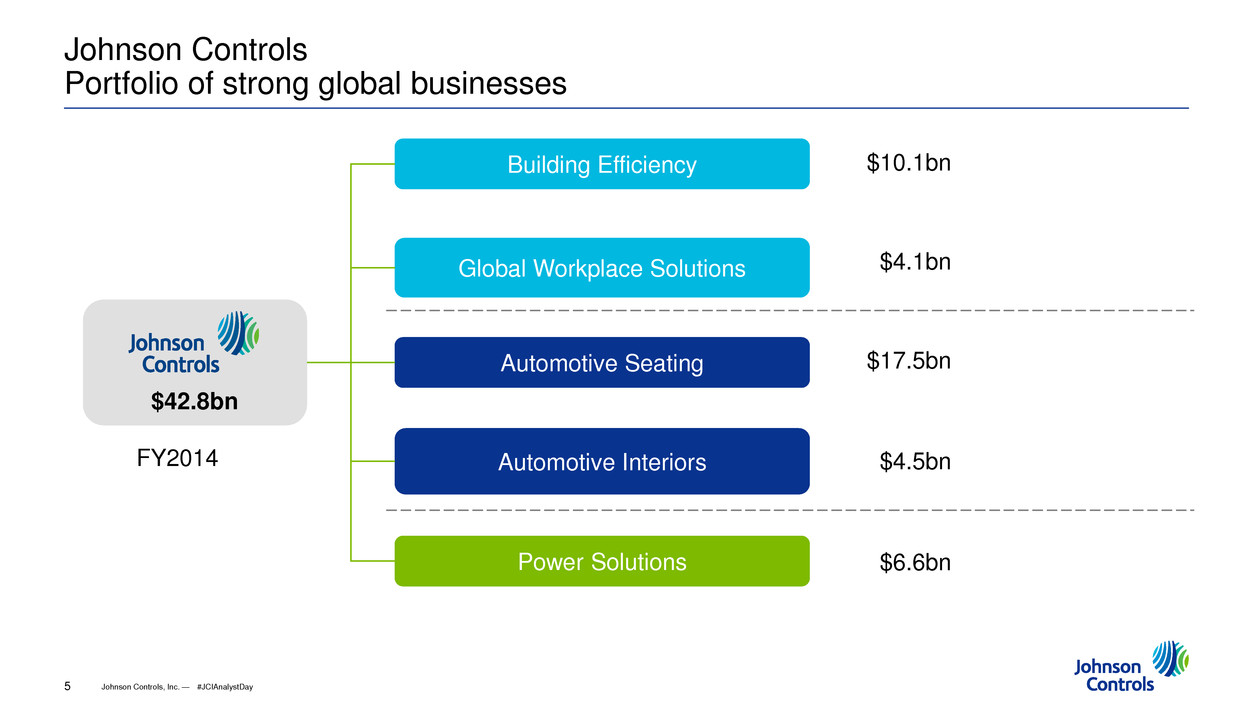

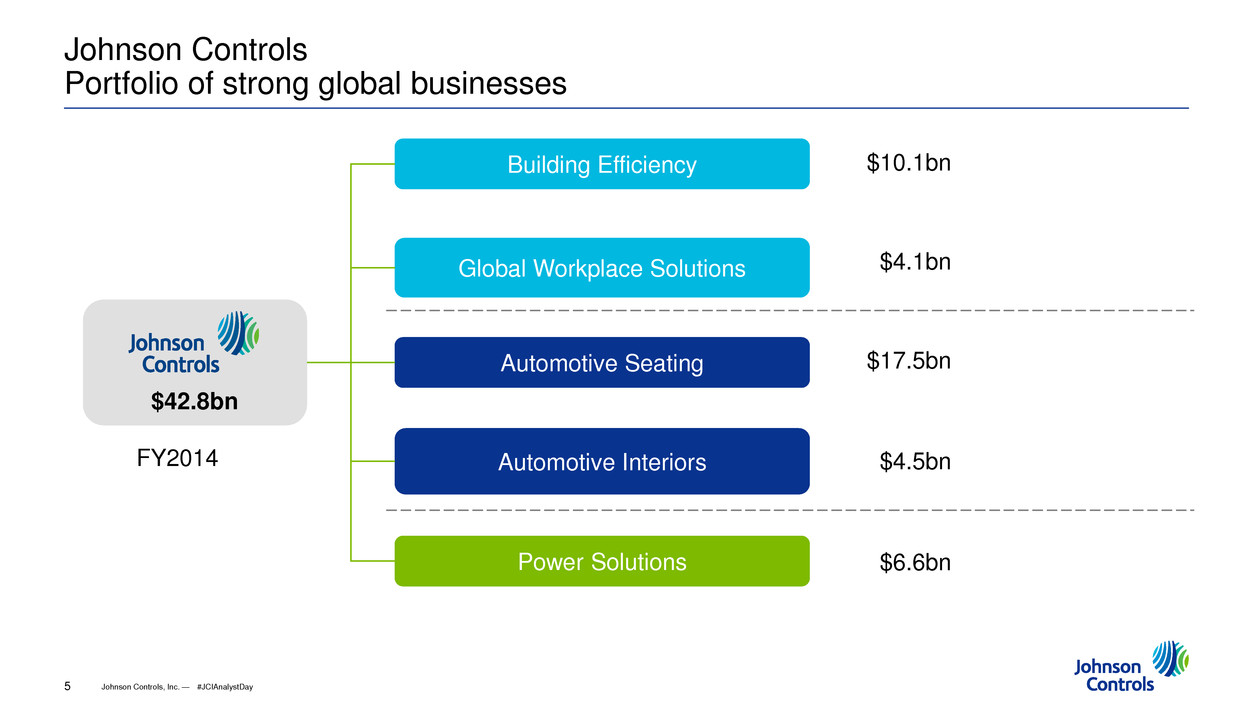

Johnson Controls, Inc. — 5 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Johnson Controls Portfolio of strong global businesses $42.8bn FY2014 Building Efficiency Global Workplace Solutions Automotive Seating Automotive Interiors Power Solutions $10.1bn $4.1bn $17.5bn $4.5bn $6.6bn #JCIAnalystDay

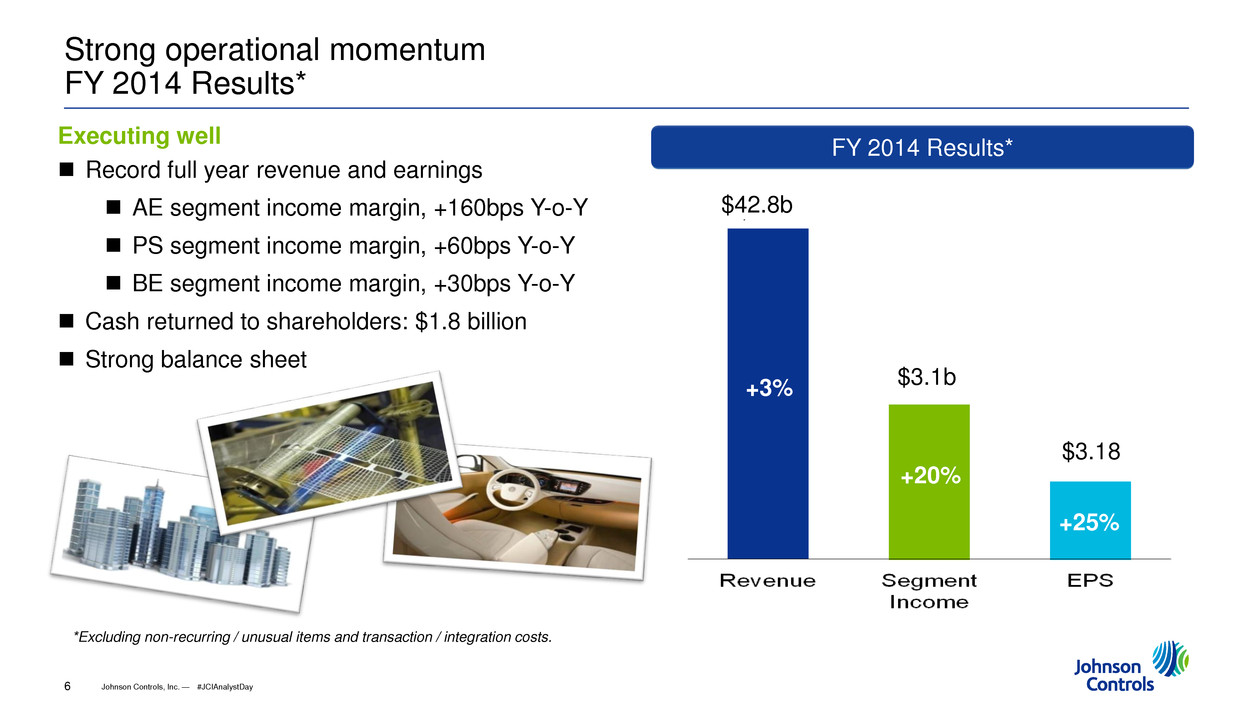

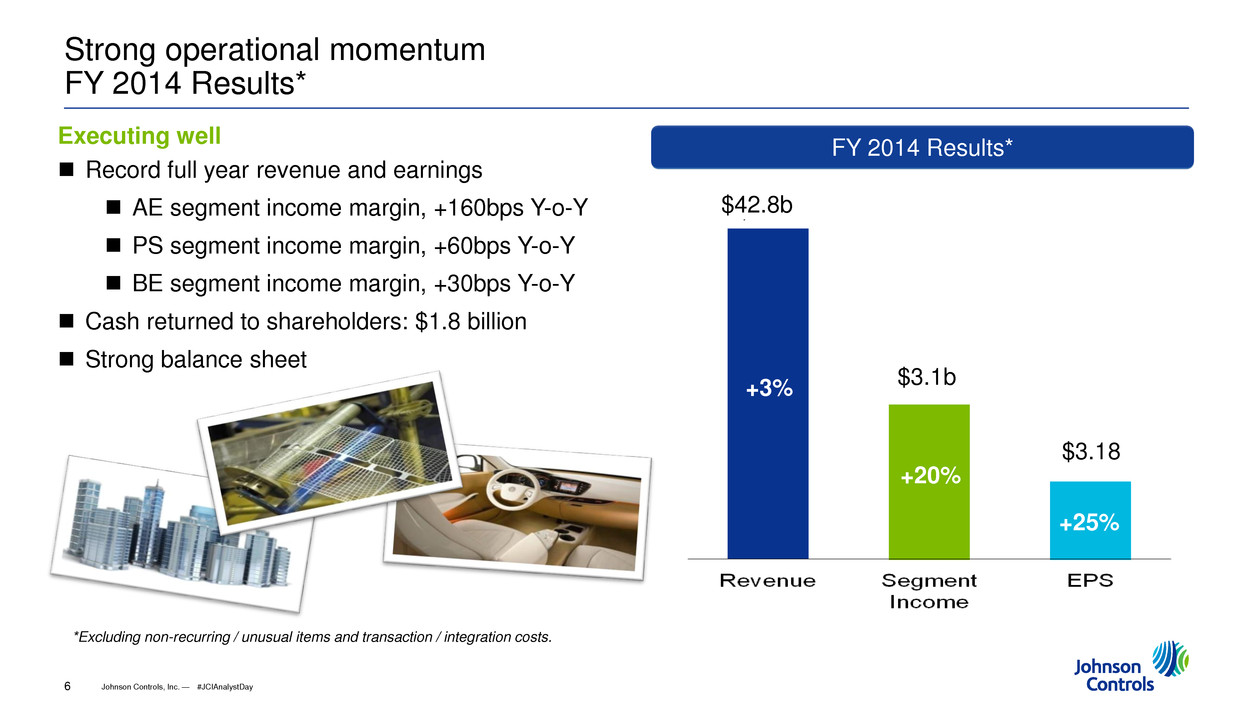

Johnson Controls, Inc. — 6 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Strong operational momentum FY 2014 Results* Executing well Record full year revenue and earnings AE segment income margin, +160bps Y-o-Y PS segment income margin, +60bps Y-o-Y BE segment income margin, +30bps Y-o-Y Cash returned to shareholders: $1.8 billion Strong balance sheet FY 2014 Results* $3.18 $42.8b *Excluding non-recurring / unusual items and transaction / integration costs. $3.1b +3% +20% +25% #JCIAnalystDay

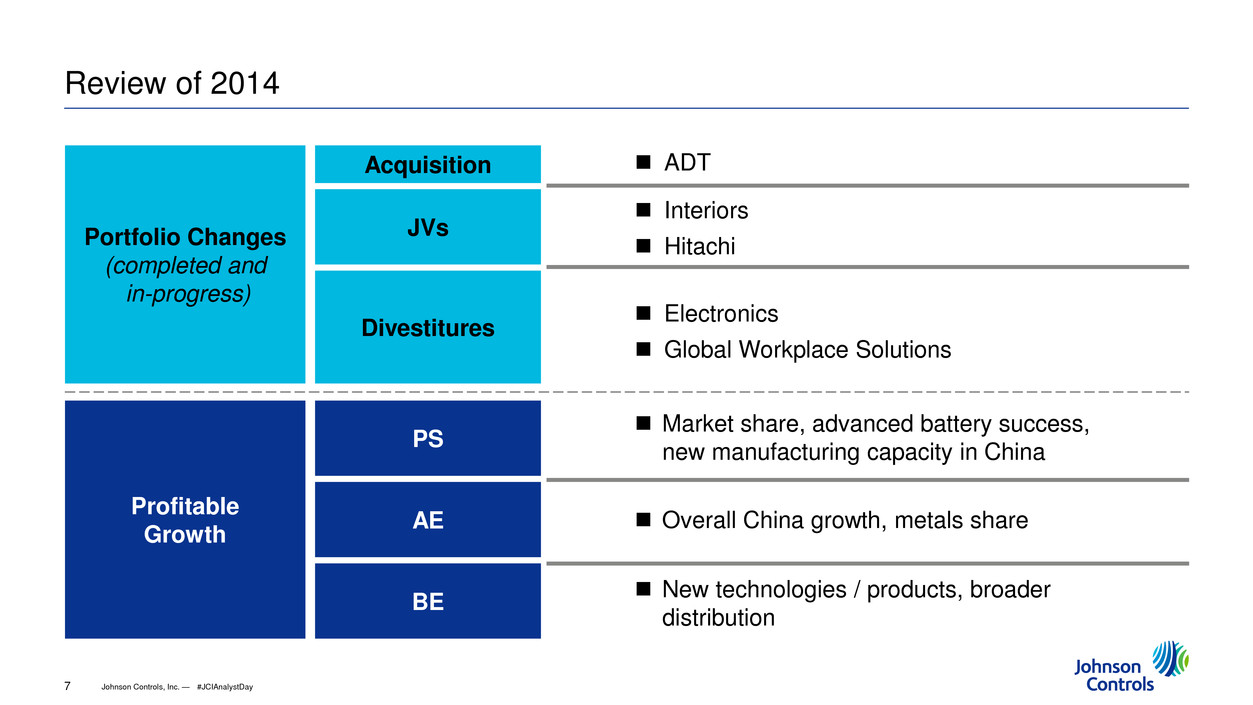

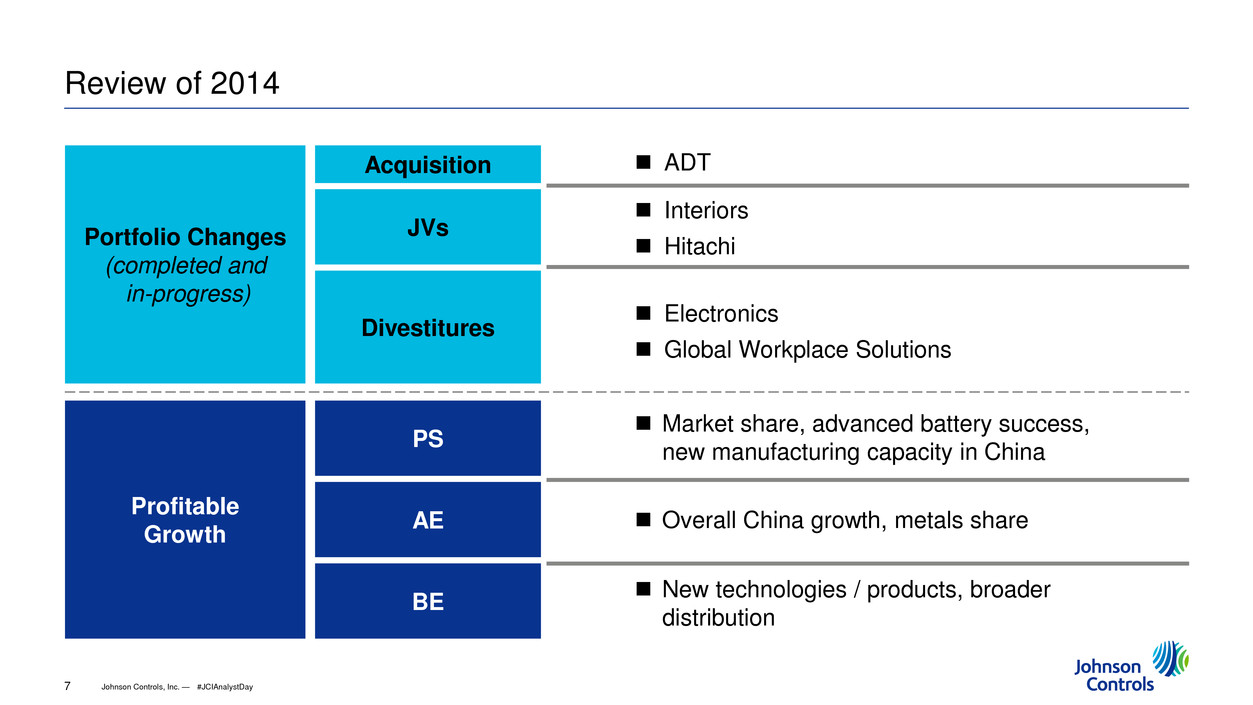

Johnson Controls, Inc. — 7 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Review of 2014 Portfolio Changes (completed and in-progress) Profitable Growth Acquisition JVs Divestitures PS AE BE ADT Interiors Hitachi Electronics Global Workplace Solutions Market share, advanced battery success, new manufacturing capacity in China Overall China growth, metals share New technologies / products, broader distribution #JCIAnalystDay

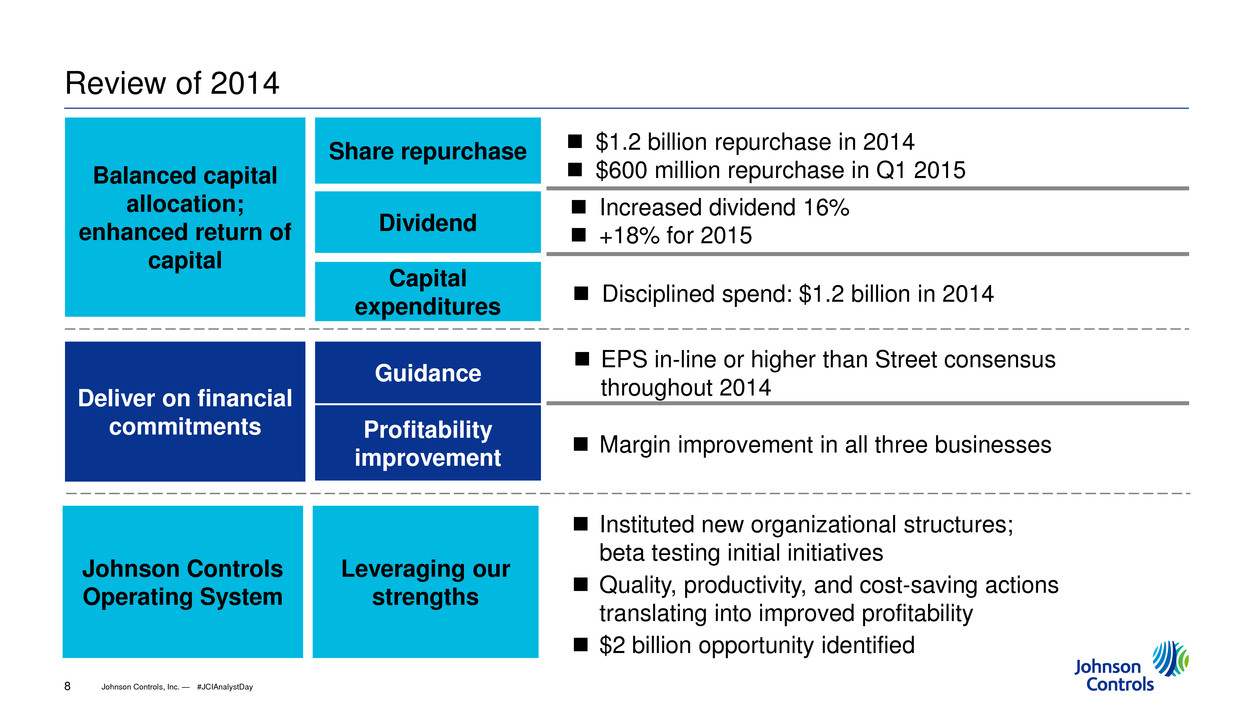

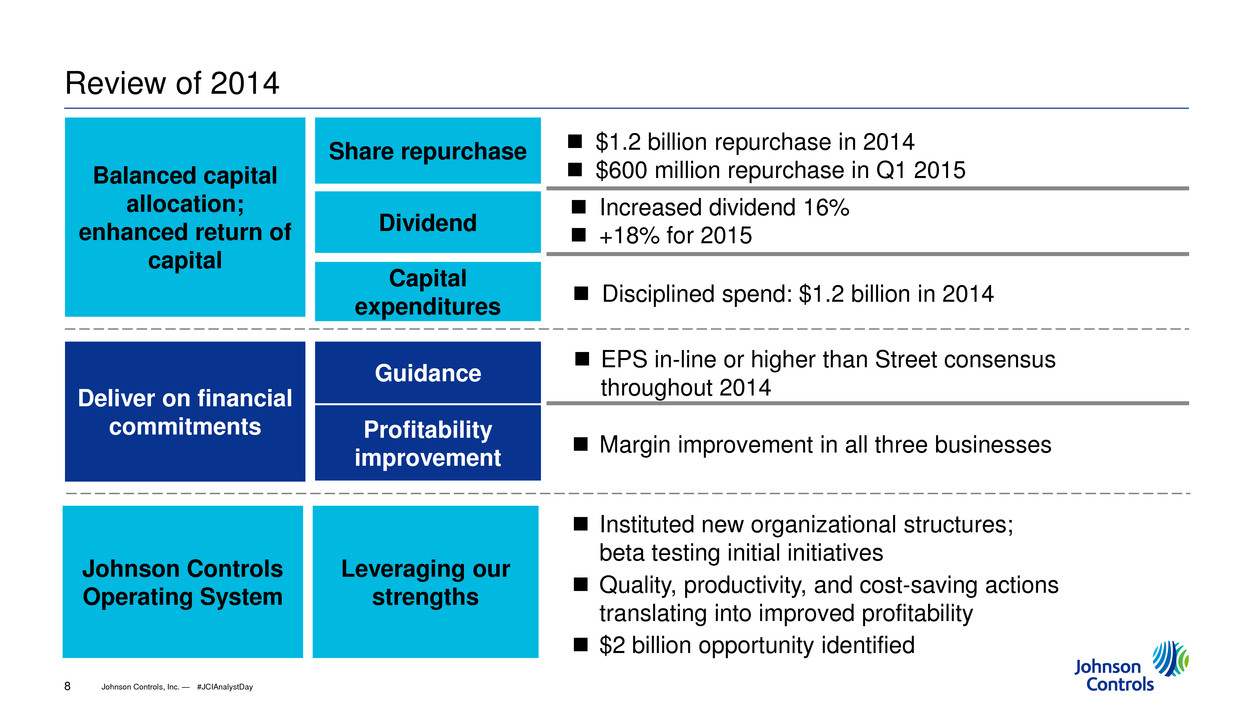

Johnson Controls, Inc. — 8 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Review of 2014 Balanced capital allocation; enhanced return of capital Deliver on financial commitments Share repurchase Dividend Capital expenditures Guidance Profitability improvement $1.2 billion repurchase in 2014 $600 million repurchase in Q1 2015 Increased dividend 16% +18% for 2015 Disciplined spend: $1.2 billion in 2014 EPS in-line or higher than Street consensus throughout 2014 Margin improvement in all three businesses Instituted new organizational structures; beta testing initial initiatives Quality, productivity, and cost-saving actions translating into improved profitability $2 billion opportunity identified Johnson Controls Operating System Leveraging our strengths #JCIAnalystDay

If you can read this Click on the icon to choose a picture or Reset the slide. To Reset: Right click on the slide thumbnail and select ‘reset slide’ or choose the ‘Reset’ button on the ‘Home’ ribbon (next to the font choice box) If you can read this Click on the icon to choose a picture or Reset the slide. To Reset: Right click on the slide thumbnail and select ‘reset slide’ or choose the ‘Reset’ button on the ‘Home’ ribbon (next to the font choice box) 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Johnson Controls, Inc. — Enterprise strategy #JCIAnalystDay

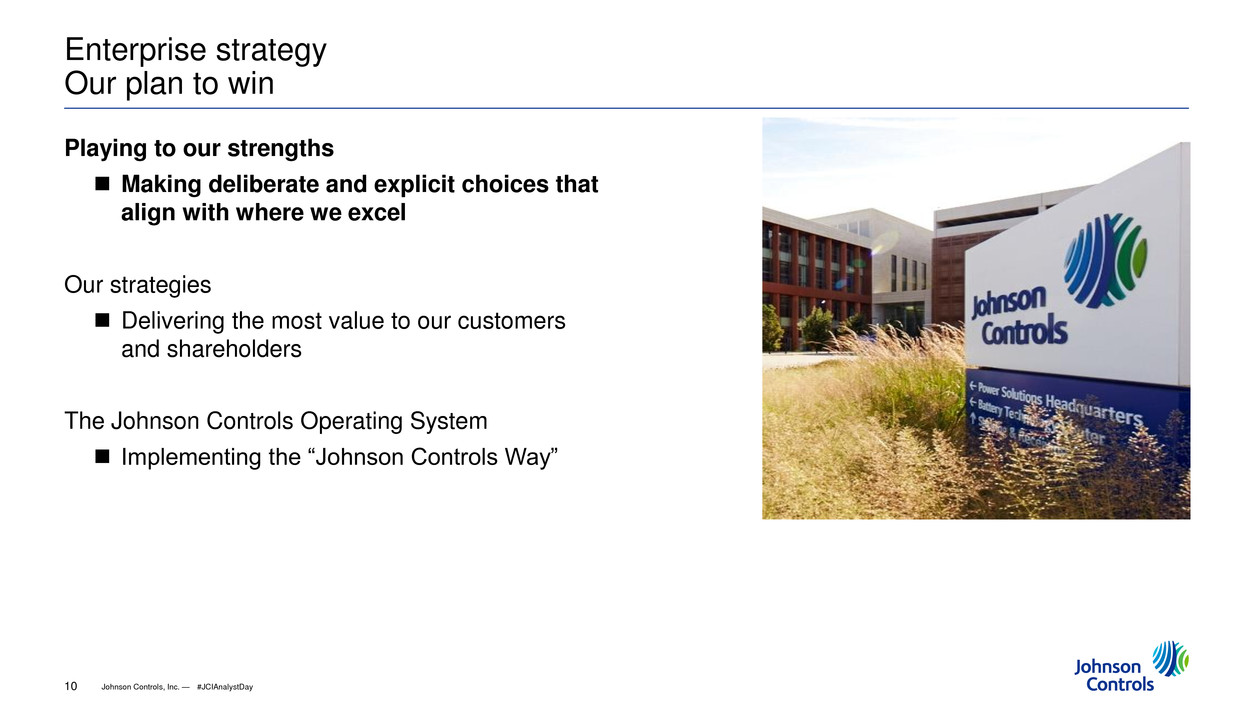

Johnson Controls, Inc. — 10 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Enterprise strategy Our plan to win Playing to our strengths Making deliberate and explicit choices that align with where we excel Our strategies Delivering the most value to our customers and shareholders The Johnson Controls Operating System Implementing the “Johnson Controls Way” #JCIAnalystDay

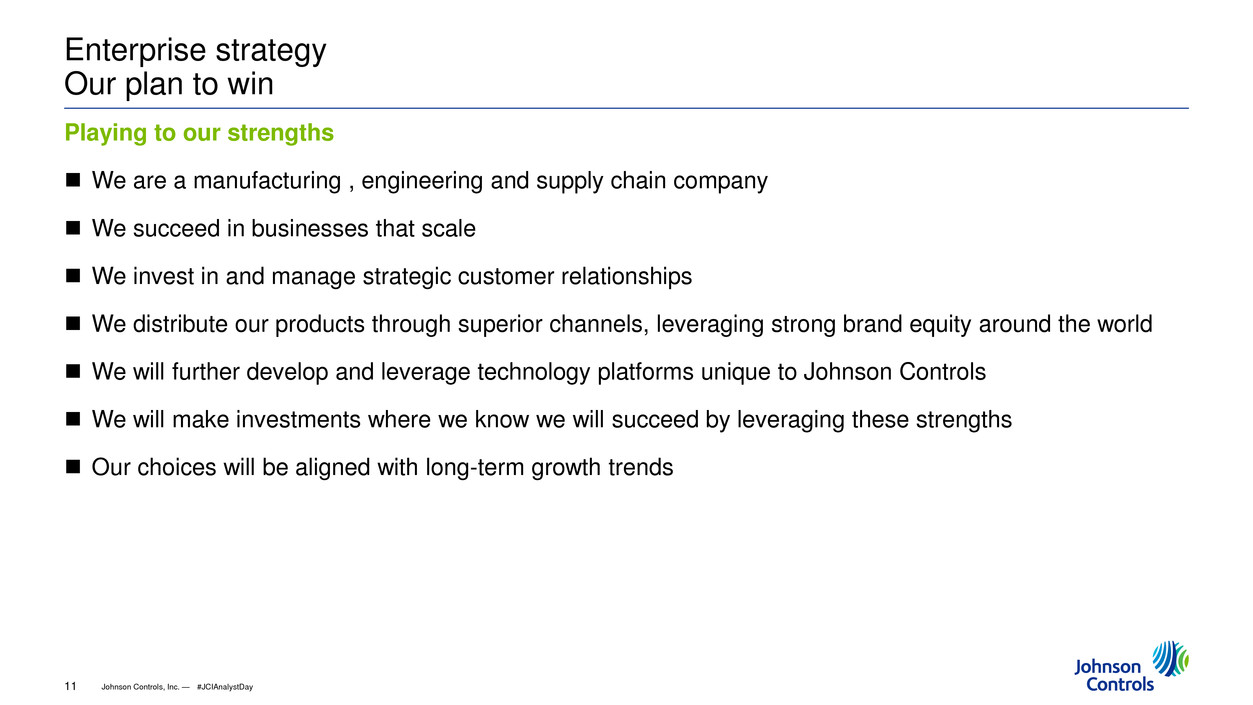

Johnson Controls, Inc. — 11 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Playing to our strengths We are a manufacturing , engineering and supply chain company We succeed in businesses that scale We invest in and manage strategic customer relationships We distribute our products through superior channels, leveraging strong brand equity around the world We will further develop and leverage technology platforms unique to Johnson Controls We will make investments where we know we will succeed by leveraging these strengths Our choices will be aligned with long-term growth trends Enterprise strategy Our plan to win #JCIAnalystDay

Johnson Controls, Inc. — 12 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Making portfolio decisions Align with where we excel Which markets Supported by macro trends; growing above GDP Large enough for sustained organic and inorganic growth Where we can lead China and North American applications Where positioned Defensible advantages Sustainable – long term customer needs served by technologies with long life cycles How does it fit (JCI Operating System drives advantage) Manufacturing and supply chain management Products requiring aftermarket or replacement services Engineered products Where we choose to play Where within markets we will participate Matches our capabilities– where can we win #JCIAnalystDay

Johnson Controls, Inc. — 13 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Rebalancing the portfolio FY 2013 revenues FY2016 revenues (est.) Power Buildings Automotive Operating margin 6.2% Operating margin 9.1% Interiors – Equity JV Hitachi – Consolidated JV GWS - Divested Going forward Less auto centric More product focused More China Resulting portfolio aligns where we excel GWS #JCIAnalystDay

Johnson Controls, Inc. — 14 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Enterprise strategy Our plan to win Playing to our strengths Deliberate and explicit choices that align with where we excel Our strategies Delivering the most value to our customers and shareholders The Johnson Controls Operating System Implementing the “Johnson Controls Way” #JCIAnalystDay

Johnson Controls, Inc. — 15 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Multi-industry strategy Leveraging our portfolio of businesses Each of our core businesses contributes to fundamental capabilities which advantage the enterprise Long-time culture of innovation, best practice sharing and enterprise capability development Each business has unique strengths from which we can extract greater shareholder value Building Efficiency – project management, commercial selling skills and relationship management Power Solutions – continuous improvement, manufacturing and channel management Automotive Experience – manufacturing, engineering, procurement and program management Multi-industry model Leverage scale, expertise and footprint to drive above-market growth and profitability Greater value leveraging the enterprise versus only managing the parts #JCIAnalystDay

Johnson Controls, Inc. — 16 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Executing on our strategies Delivering the most value to our customers and shareholders Market-driven innovation and strategies Customer-driven business models Investments in growth platforms Balanced portfolio Optimized capital allocation Leverage the Johnson Controls Operating System Focused product management and new product development Play-to-win Market and brand leadership in China …with a focus on execution #JCIAnalystDay

Johnson Controls, Inc. — 17 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Executing on our strategies China Asia Pacific, led by China, is the most important region for growth for Johnson Controls over the next 2-3 decades Overweighting our investments in China across all three of our businesses #JCIAnalystDay

Johnson Controls, Inc. — 18 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Executing on our strategies China: the premier growth market Mega trends By the beginning of the next decade…. Real GDP per capita to double (2010 vs. 2020) 275 million additional people moving from rural areas to cities >200 cities with >1 million inhabitants (double) Driving toward energy security and less dependence on carbon based energy sources Impact to our markets World’s largest automotive battery market Automotive production larger than North America and Europe combined (JCI current market share approx. 40%) 35,000 high-rise commercial buildings Source: McKinsey Global Economics Intelligence Report #JCIAnalystDay

Johnson Controls, Inc. — 19 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Executing on our strategies China will continue to be increasingly important Johnson Controls China revenues* * includes non-consolidated JVs at 100%, including proposed automotive interiors joint venture #JCIAnalystDay

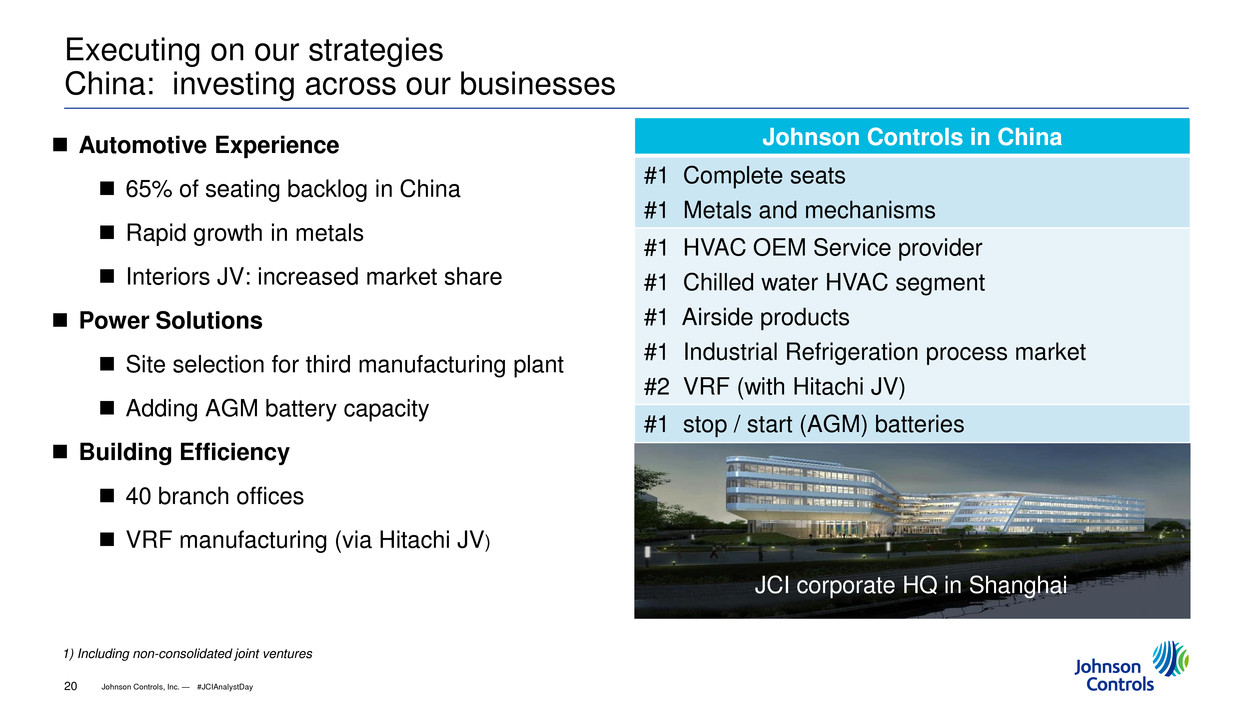

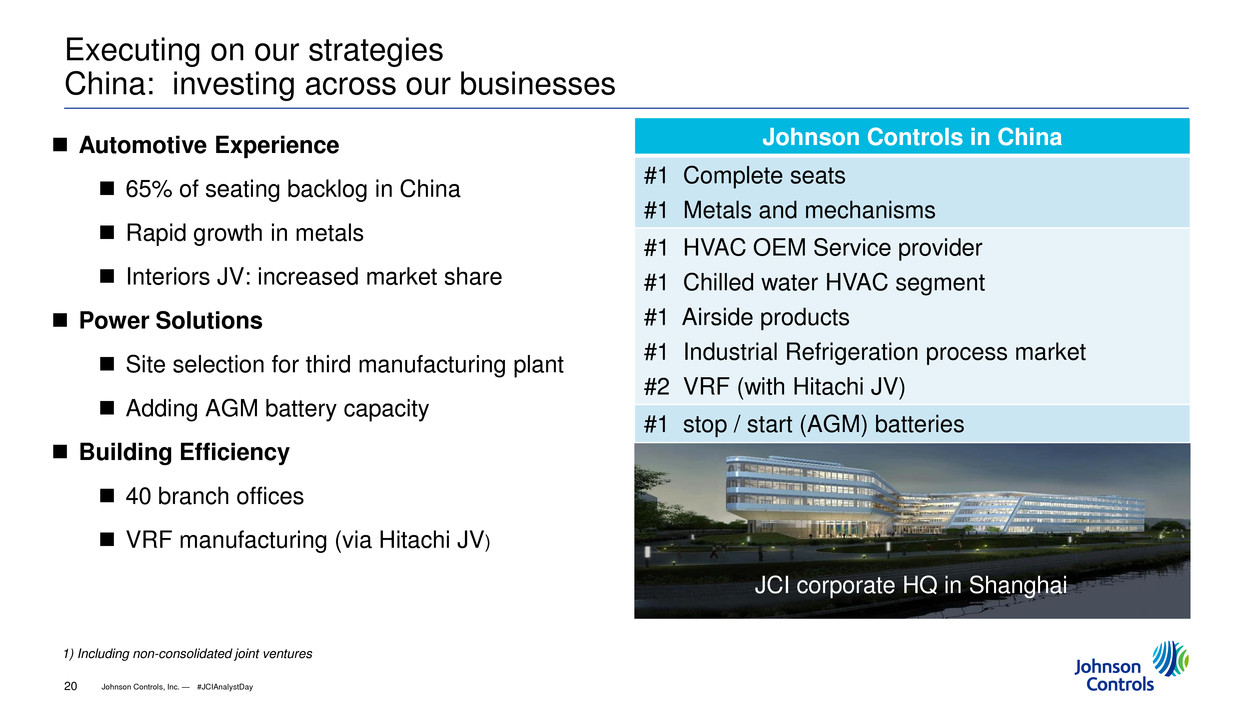

Johnson Controls, Inc. — 20 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Executing on our strategies China: investing across our businesses Automotive Experience 65% of seating backlog in China Rapid growth in metals Interiors JV: increased market share Power Solutions Site selection for third manufacturing plant Adding AGM battery capacity Building Efficiency 40 branch offices VRF manufacturing (via Hitachi JV) 1) Including non-consolidated joint ventures JCI corporate HQ in Shanghai Johnson Controls in China #1 Complete seats #1 Metals and mechanisms #1 HVAC OEM Service provider #1 Chilled water HVAC segment #1 Airside products #1 Industrial Refrigeration process market #2 VRF (with Hitachi JV) #1 stop / start (AGM) batteries #JCIAnalystDay

Johnson Controls, Inc. — 21 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Executing on our strategies Management changes Collaborative culture and environments Vice Chairman: Bruce McDonald Chief Financial Officer: Brian Stief Building Efficiency President: Bill Jackson Vice Chairman Asia and President, AE: Beda Bolzenius Chief Marketing Officer: Kim Metcalf-Kupres Leadership expectations Accountable and decisive Diverse and inclusive Committed to integrity, sustainability and innovation Focused on leader development and succession planning #JCIAnalystDay

Johnson Controls, Inc. — 22 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Enterprise strategy Our plan to win Playing to our strengths Deliberate and explicit choices that align with where we excel Our strategies Delivering the most value to our customers and shareholders The Johnson Controls Operating System Implementing the “Johnson Controls Way” #JCIAnalystDay

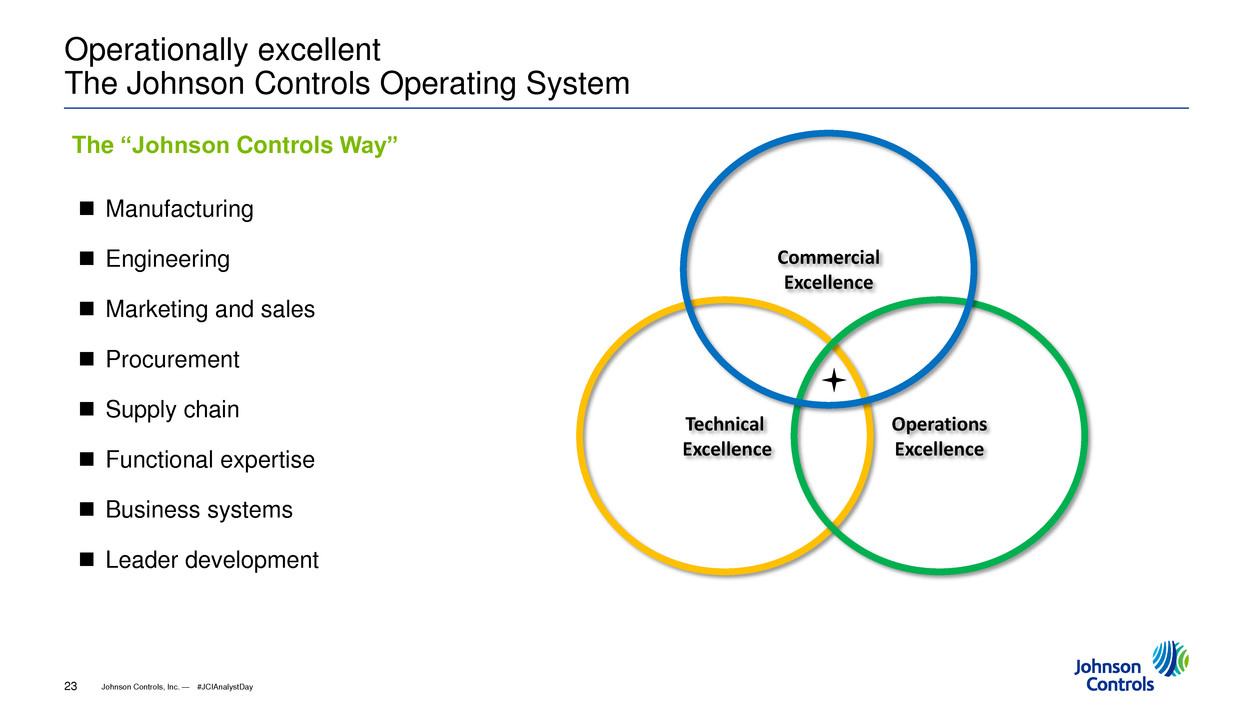

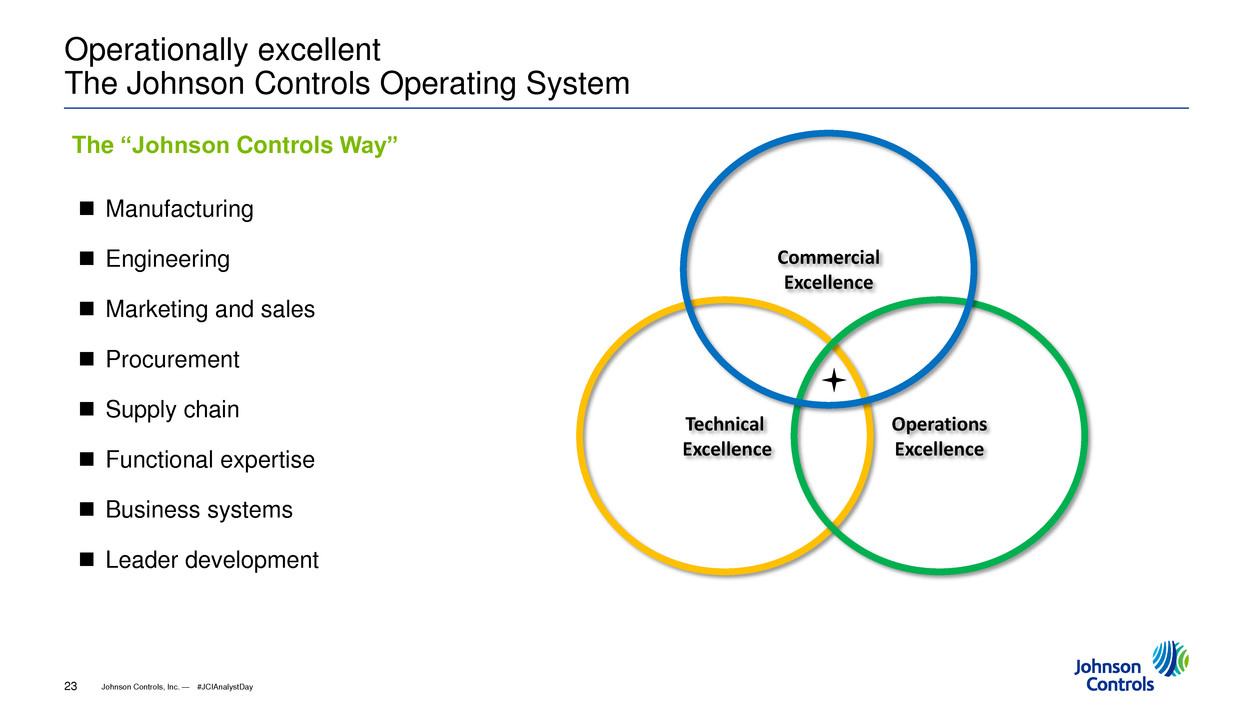

Johnson Controls, Inc. — 23 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Operationally excellent The Johnson Controls Operating System The “Johnson Controls Way” Manufacturing Engineering Marketing and sales Procurement Supply chain Functional expertise Business systems Leader development Technical Excellence Operations Excellence Commercial Excellence #JCIAnalystDay

Johnson Controls, Inc. — 24 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Our strategies result in a compelling outlook Driving top-line growth Attractive industries, markets and geographies Growing faster than our markets Organic and inorganic opportunities Driving bottom line profitability Focus on productivity, execution and scale efficiencies Managing integrated supply chains Vertical integration investments Innovation that drives improved returns Using multiple levers Not dependent on markets to drive earnings growth Shaping our own destiny by improving margins and playing where we can win Fiscal 2015 and beyond Positioning JCI to deliver sustainable growth, improving margins and consistent capital return resulting in compelling long-term returns #JCIAnalystDay

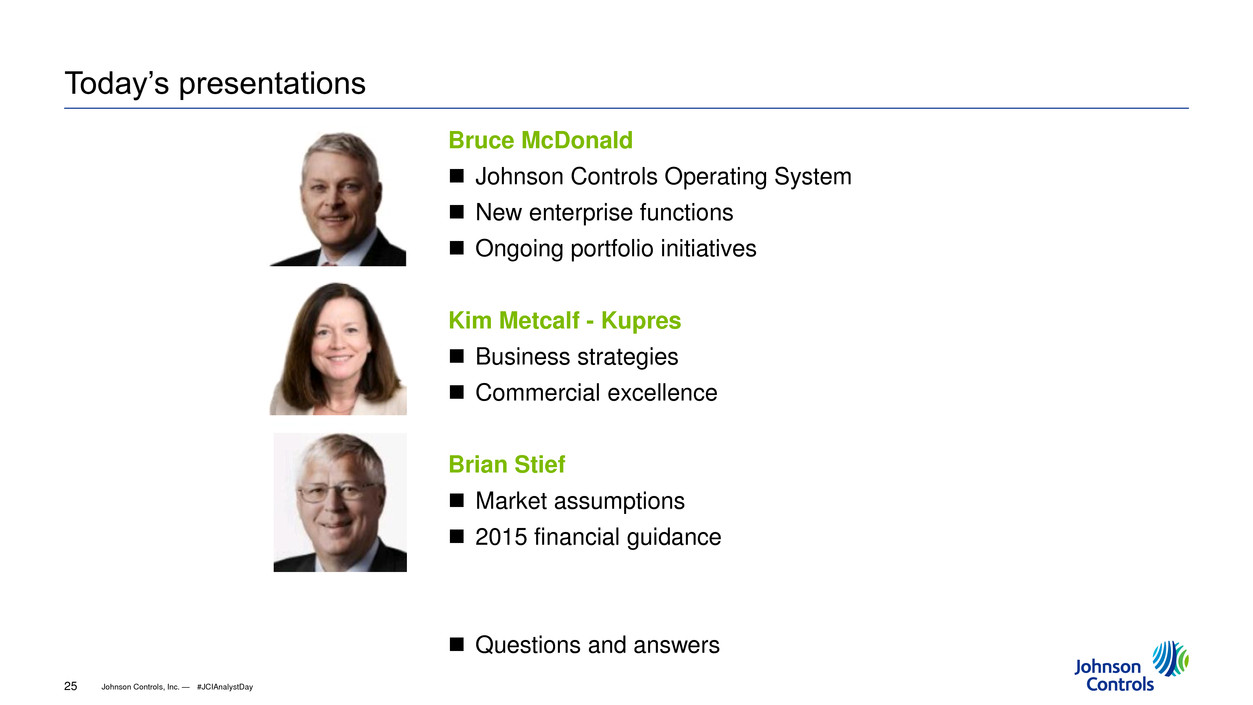

Johnson Controls, Inc. — 25 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Today’s presentations Bruce McDonald Johnson Controls Operating System New enterprise functions Ongoing portfolio initiatives Kim Metcalf - Kupres Business strategies Commercial excellence Brian Stief Market assumptions 2015 financial guidance Questions and answers #JCIAnalystDay

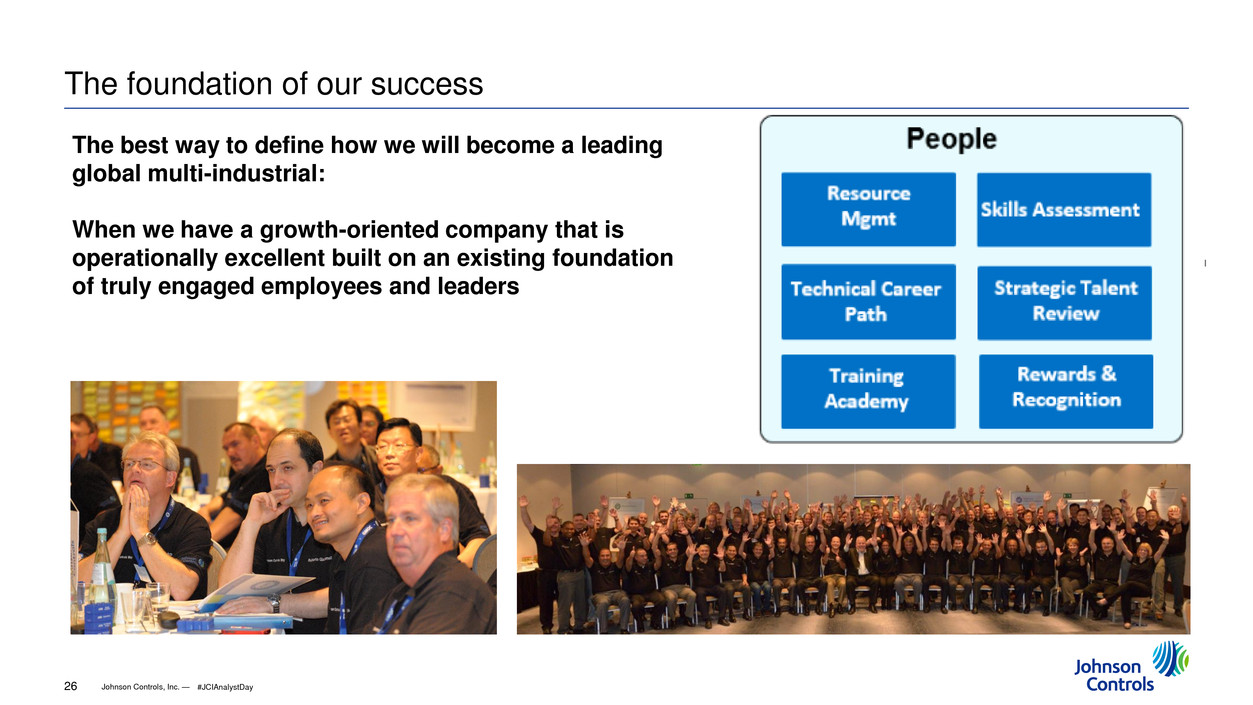

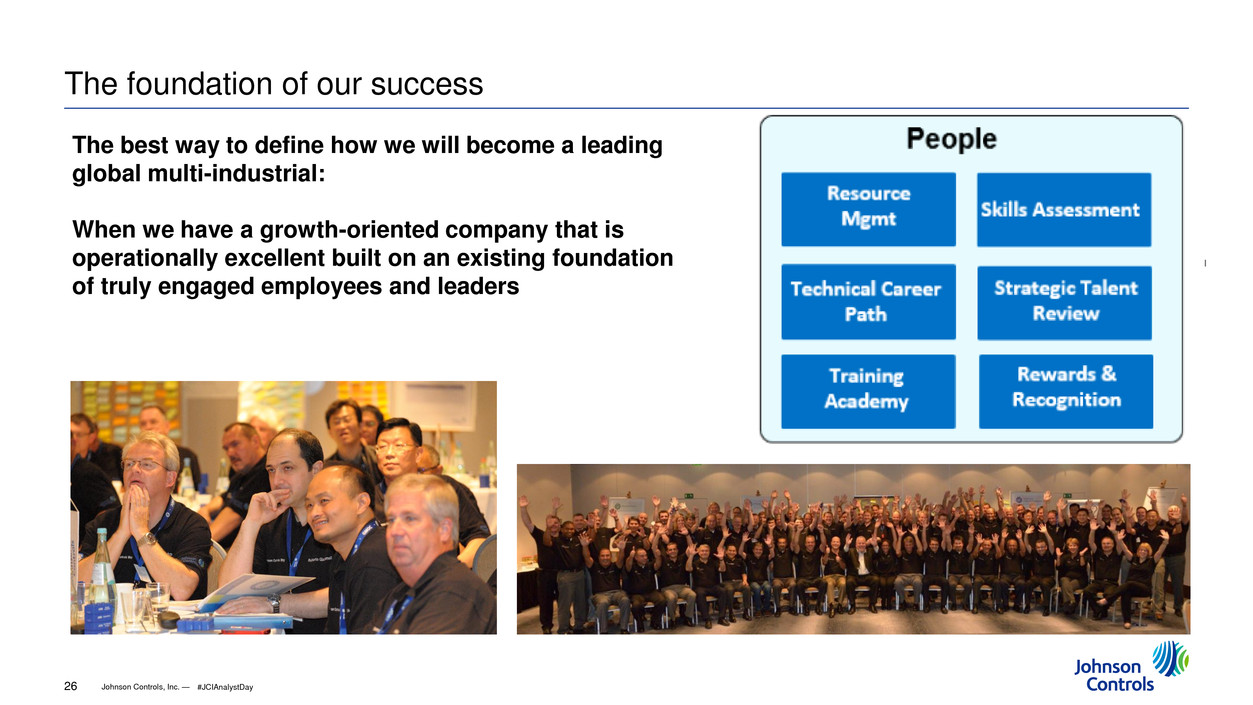

Johnson Controls, Inc. — 26 1/6 2/6 4/6 5/6 1/4 3/4 1/2 The foundation of our success The best way to define how we will become a leading global multi-industrial: When we have a growth-oriented company that is operationally excellent built on an existing foundation of truly engaged employees and leaders #JCIAnalystDay

Johnson Controls, Inc. — 27 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Bruce McDonald Executive Vice President and Vice Chairman

Johnson Controls, Inc. — 28 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Vice Chairman Broadening management bandwidth My new role Working with the business unit presidents to drive operational and financial performance Directing specific enterprise functions and strategic initiatives as part of the Johnson Controls Operating System Procurement Enterprise ERP Portfolio repositioning Corporate development Businesses held as discontinued operations #JCIAnalystDay

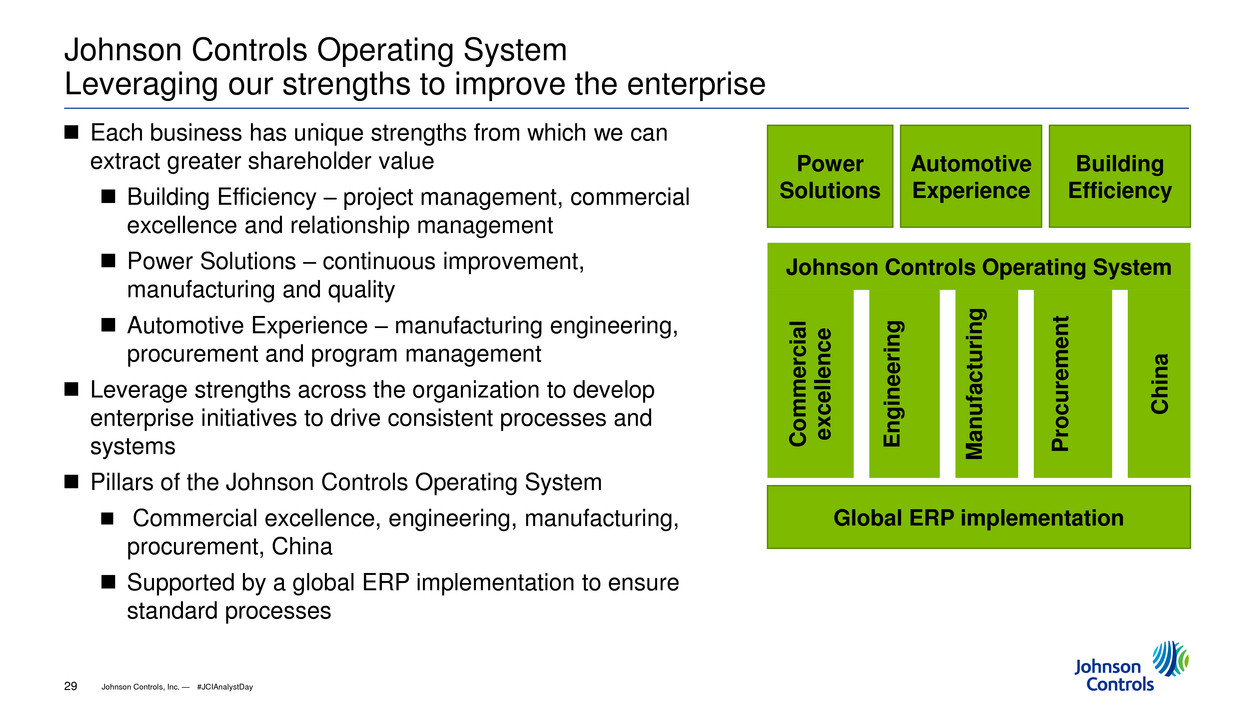

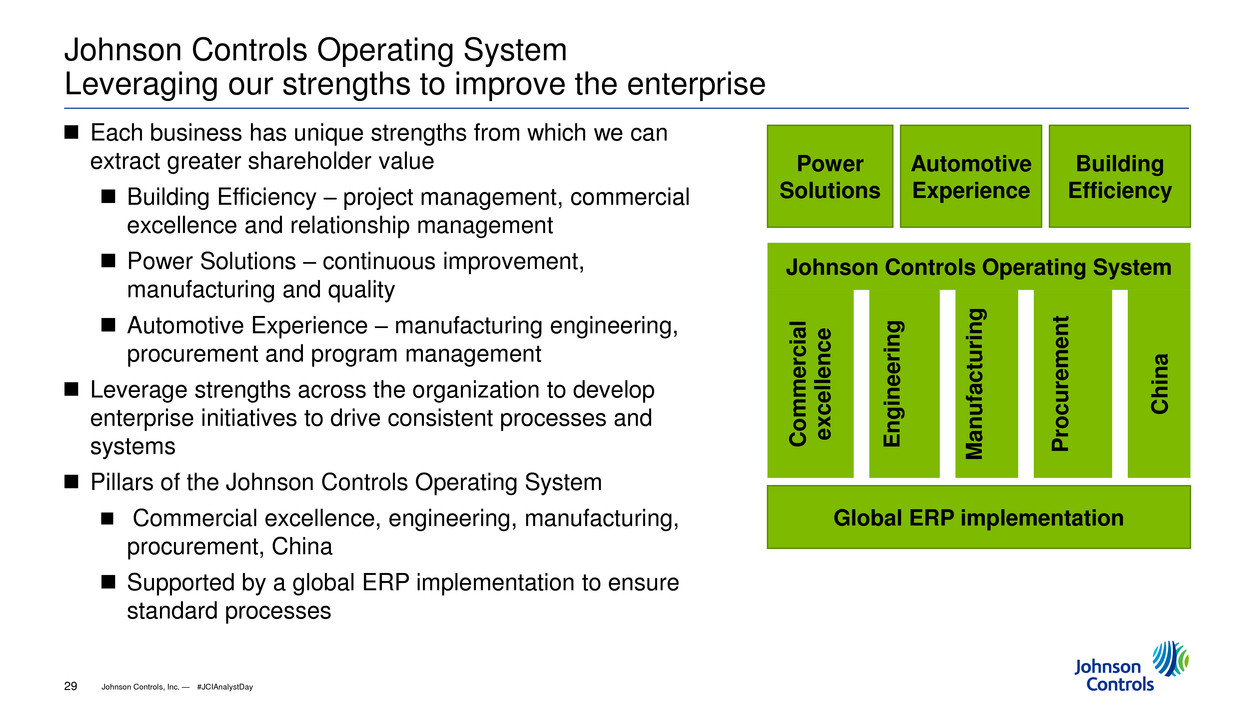

Johnson Controls, Inc. — 29 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Johnson Controls Operating System Leveraging our strengths to improve the enterprise Each business has unique strengths from which we can extract greater shareholder value Building Efficiency – project management, commercial excellence and relationship management Power Solutions – continuous improvement, manufacturing and quality Automotive Experience – manufacturing engineering, procurement and program management Leverage strengths across the organization to develop enterprise initiatives to drive consistent processes and systems Pillars of the Johnson Controls Operating System Commercial excellence, engineering, manufacturing, procurement, China Supported by a global ERP implementation to ensure standard processes Global ERP implementation C omme rc ia l excel lenc e E n gineer in g Manufactur in g Proc u re m en t C hina Johnson Controls Operating System Automotive Experience Power Solutions Building Efficiency #JCIAnalystDay

Johnson Controls, Inc. — 30 1/6 2/6 4/6 5/6 1/4 3/4 1/2 The Johnson Controls Operating System.21 What is it? Why is it different? What will it mean? Central to how we run the company Leverage and build upon in-house best practices Organizational changes Supported by full-time resources Johnson Controls will deliver the strong, consistent performance that defines best-in-class multi-industrial companies Leverage our talent across the organization Rapid M+A integration and synergy capture The Johnson Controls Operating System will deliver sustainable competitive advantages: $2 billion savings opportunity #JCIAnalystDay

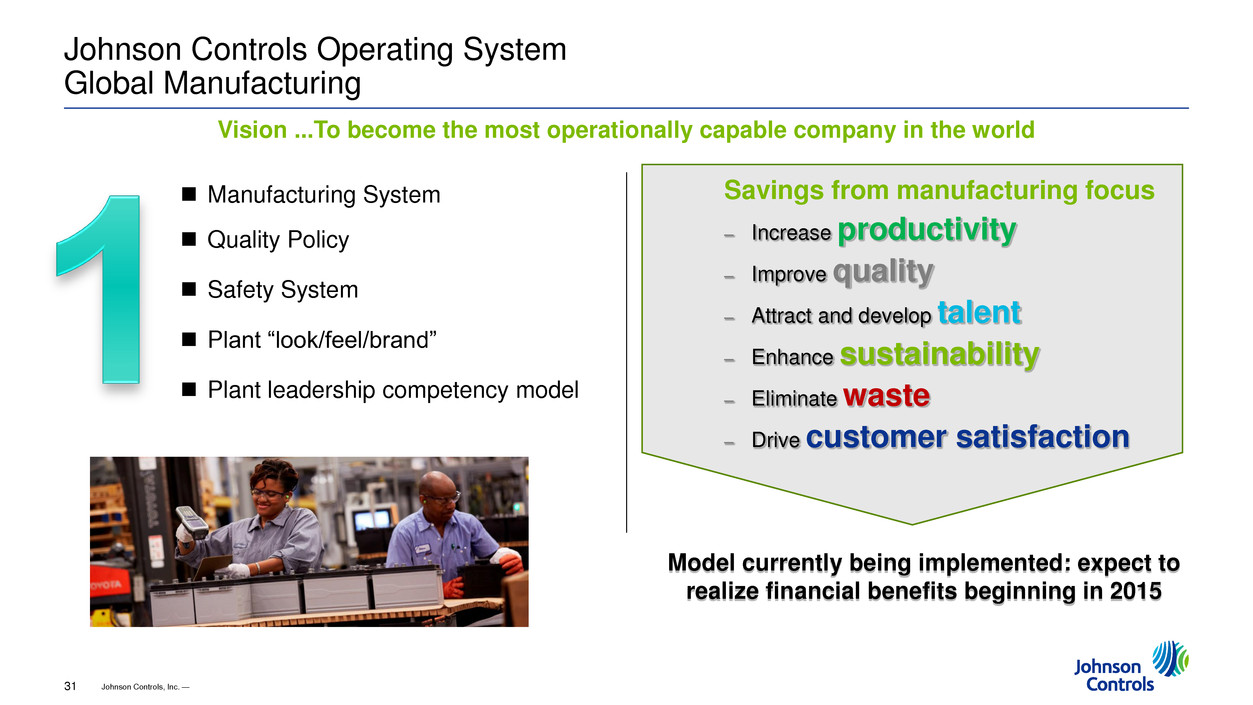

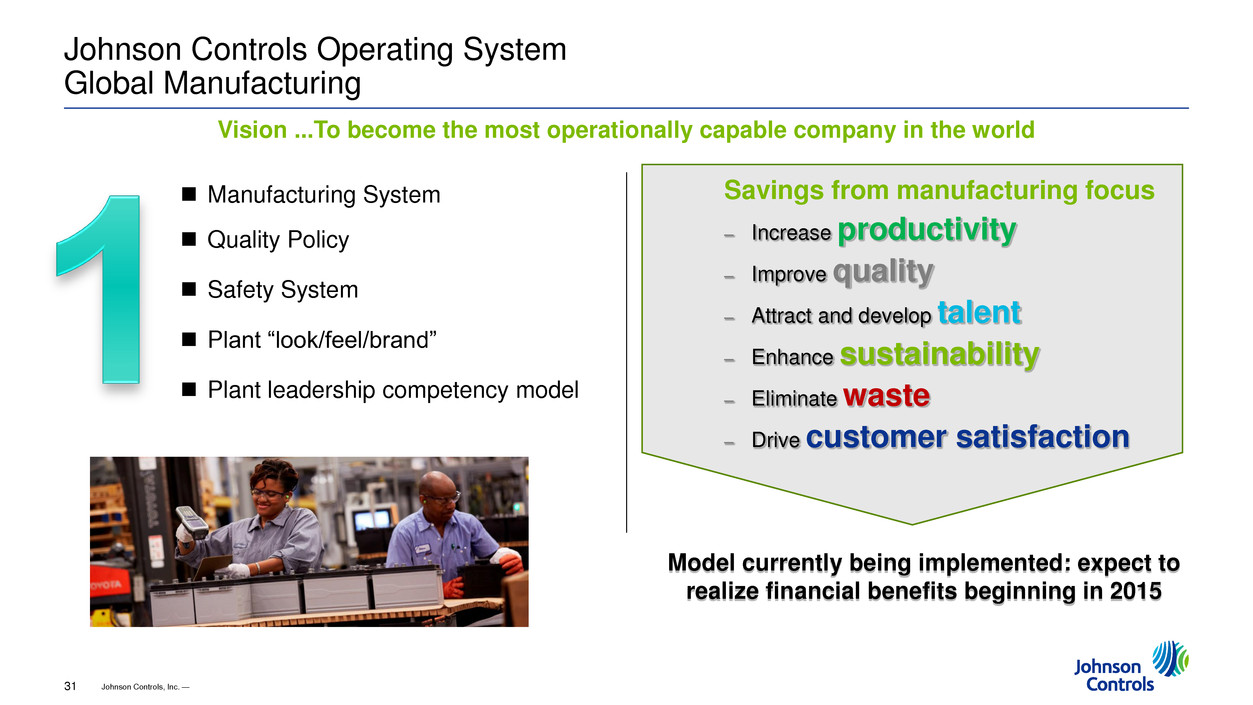

Johnson Controls, Inc. — 31 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Manufacturing System Quality Policy Safety System Plant “look/feel/brand” Plant leadership competency model Johnson Controls Operating System Global Manufacturing Vision ...To become the most operationally capable company in the world Savings from manufacturing focus – Increase productivity – Improve quality – Attract and develop talent – Enhance sustainability – Eliminate waste – Drive customer satisfaction Model currently being implemented: expect to realize financial benefits beginning in 2015

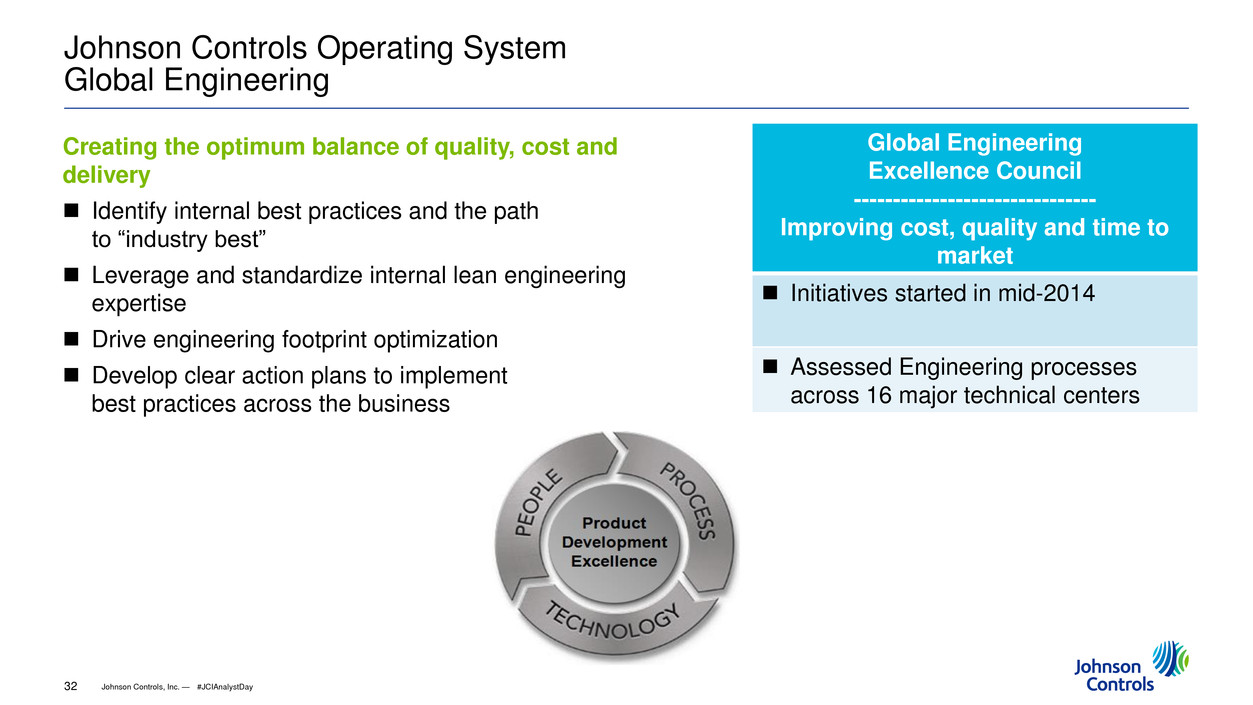

Johnson Controls, Inc. — 32 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Creating the optimum balance of quality, cost and delivery Identify internal best practices and the path to “industry best” Leverage and standardize internal lean engineering expertise Drive engineering footprint optimization Develop clear action plans to implement best practices across the business Johnson Controls Operating System Global Engineering Global Engineering Excellence Council ------------------------------- Improving cost, quality and time to market Initiatives started in mid-2014 Assessed Engineering processes across 16 major technical centers #JCIAnalystDay

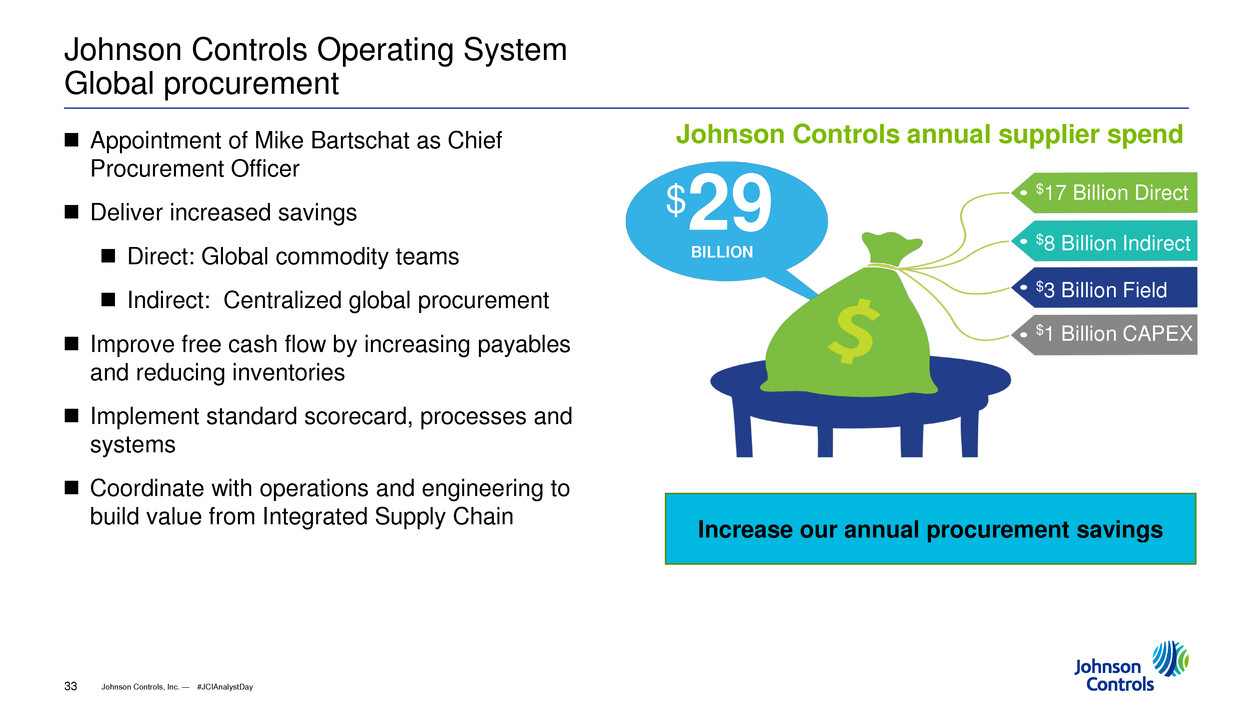

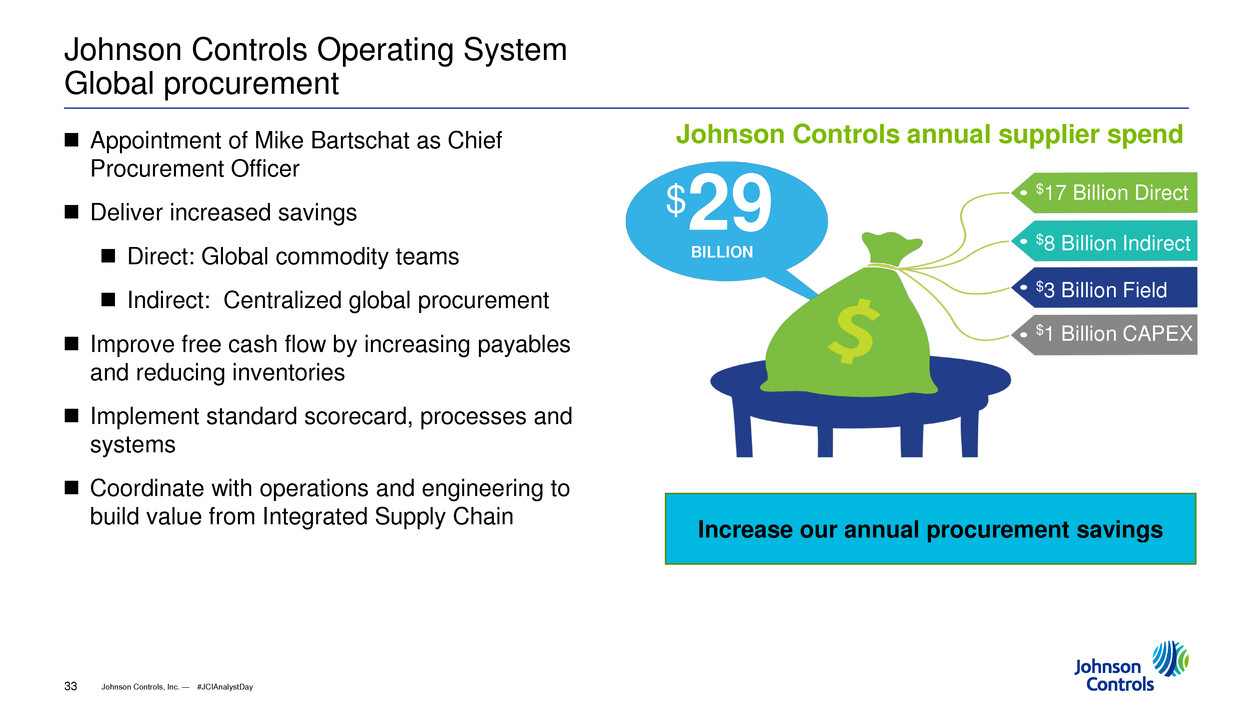

Johnson Controls, Inc. — 33 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Johnson Controls Operating System Global procurement Johnson Controls annual supplier spend Appointment of Mike Bartschat as Chief Procurement Officer Deliver increased savings Direct: Global commodity teams Indirect: Centralized global procurement Improve free cash flow by increasing payables and reducing inventories Implement standard scorecard, processes and systems Coordinate with operations and engineering to build value from Integrated Supply Chain $29 BILLION $17 Billion Direct $3 Billion Field $8 Billion Indirect $1 Billion CAPEX Increase our annual procurement savings #JCIAnalystDay

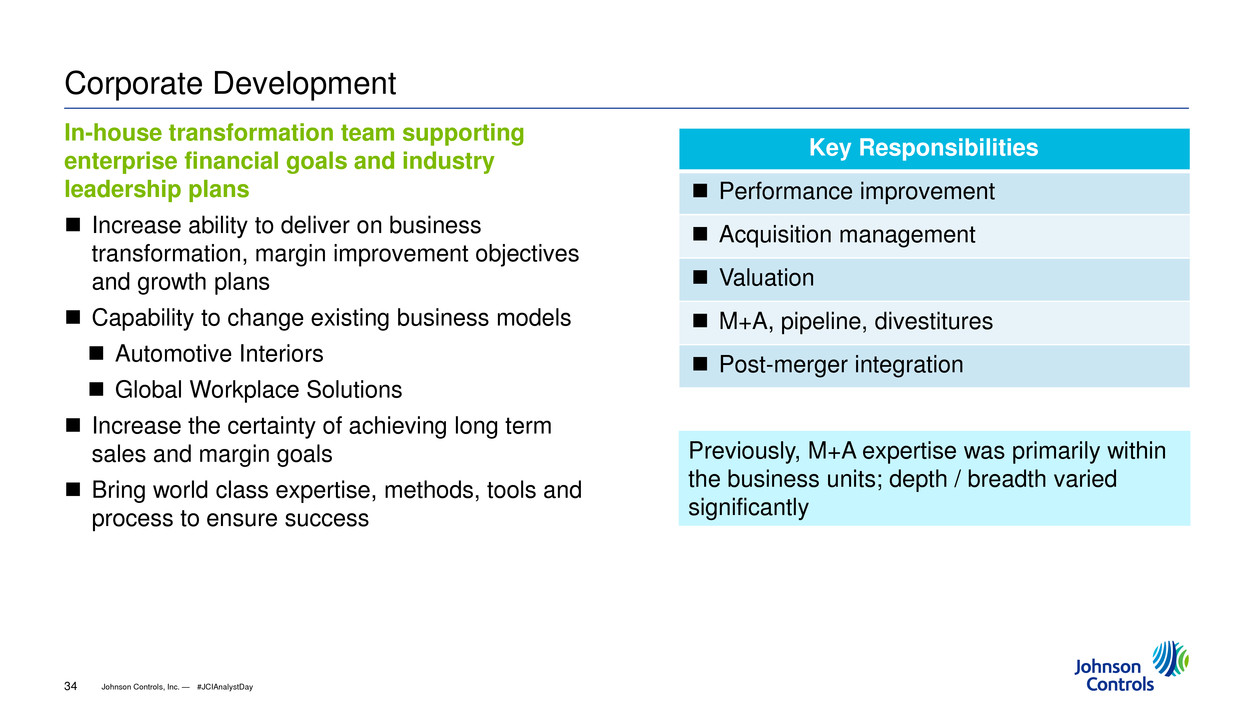

Johnson Controls, Inc. — 34 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Corporate Development In-house transformation team supporting enterprise financial goals and industry leadership plans Increase ability to deliver on business transformation, margin improvement objectives and growth plans Capability to change existing business models Automotive Interiors Global Workplace Solutions Increase the certainty of achieving long term sales and margin goals Bring world class expertise, methods, tools and process to ensure success Key Responsibilities Performance improvement Acquisition management Valuation M+A, pipeline, divestitures Post-merger integration Previously, M+A expertise was primarily within the business units; depth / breadth varied significantly #JCIAnalystDay

Johnson Controls, Inc. — 35 1/6 2/6 4/6 5/6 1/4 3/4 1/2 2015 Corporate Development priorities Complete Interiors transaction Complete Hitachi JV Complete GWS divestiture Deploy pipeline process Identify and prioritize inorganic opportunities #JCIAnalystDay

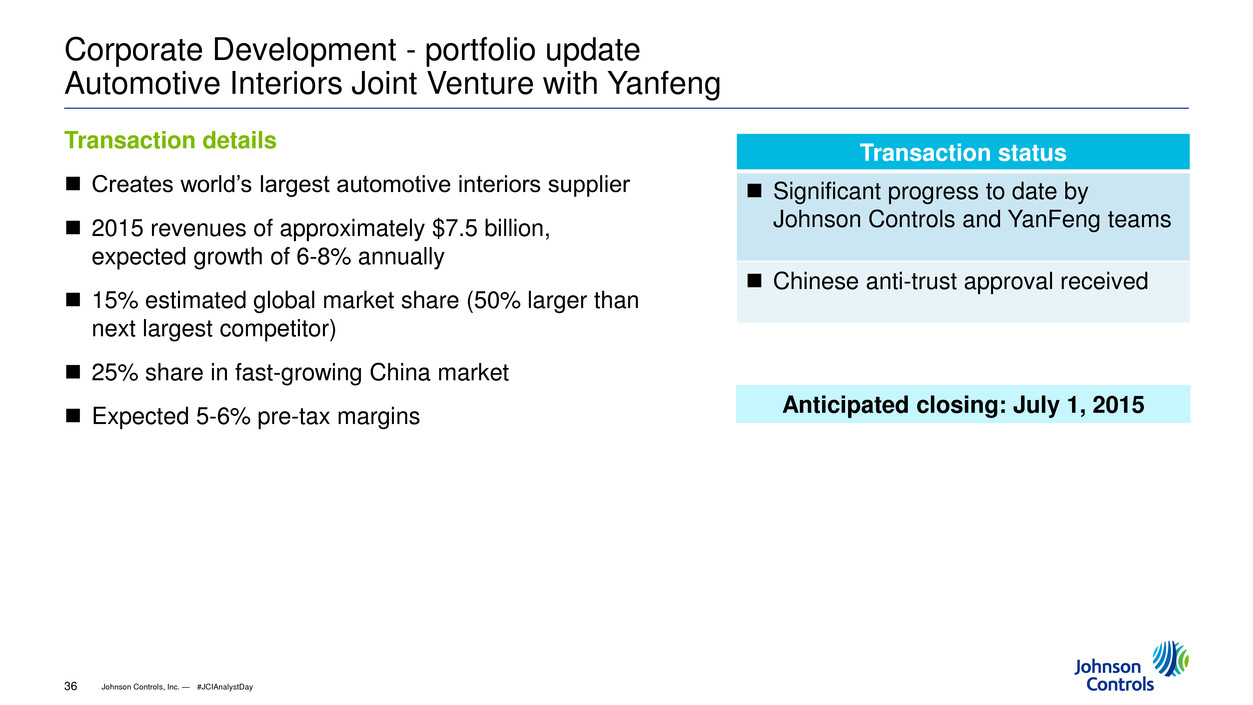

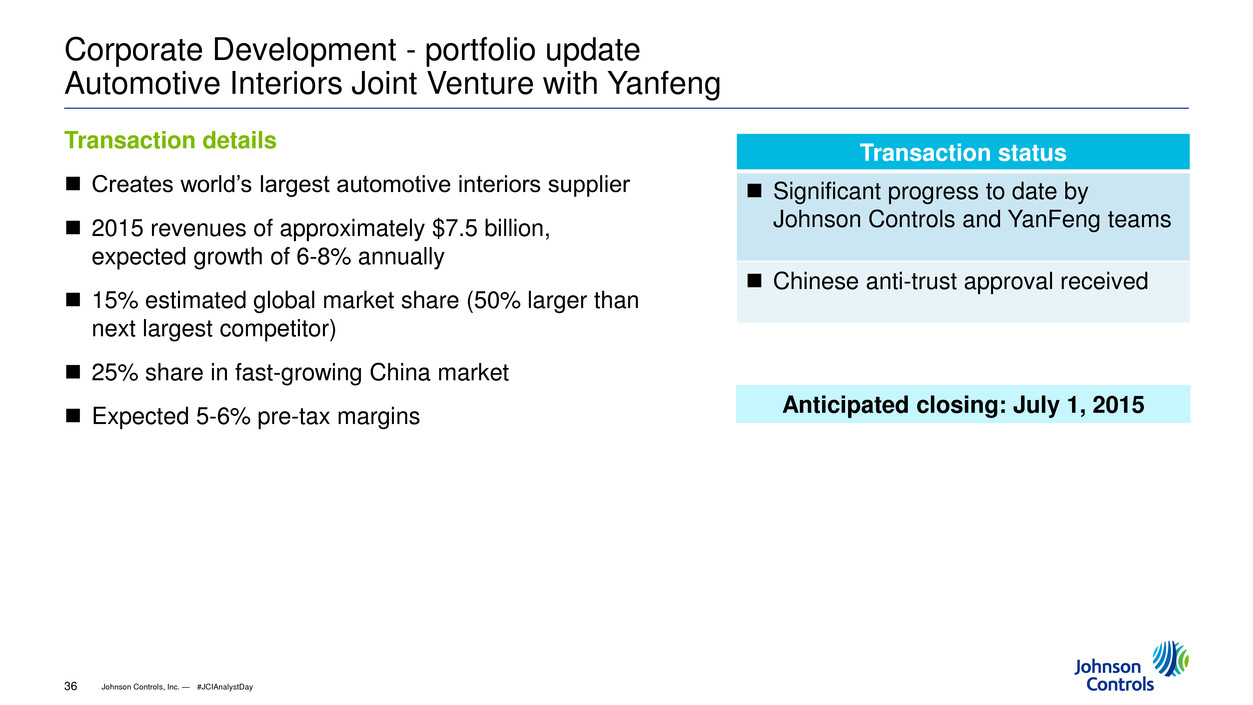

Johnson Controls, Inc. — 36 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Corporate Development - portfolio update Automotive Interiors Joint Venture with Yanfeng Transaction details Creates world’s largest automotive interiors supplier 2015 revenues of approximately $7.5 billion, expected growth of 6-8% annually 15% estimated global market share (50% larger than next largest competitor) 25% share in fast-growing China market Expected 5-6% pre-tax margins Transaction status Significant progress to date by Johnson Controls and YanFeng teams Chinese anti-trust approval received Anticipated closing: July 1, 2015 #JCIAnalystDay

Johnson Controls, Inc. — 37 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Strategic partnership with technology leader Complementary technologies and products to drive growth in Asia Variable refrigerant flow (VRF) Absorption chiller Access to expanded distribution Corporate Development - portfolio update Building Efficiency – Hitachi joint venture Completion expected in fiscal 2015 Johnson Controls / Hitachi joint venture Annual revenues: Approximately $3 billion Ownership Johnson Controls 60% Hitachi 40% #JCIAnalystDay

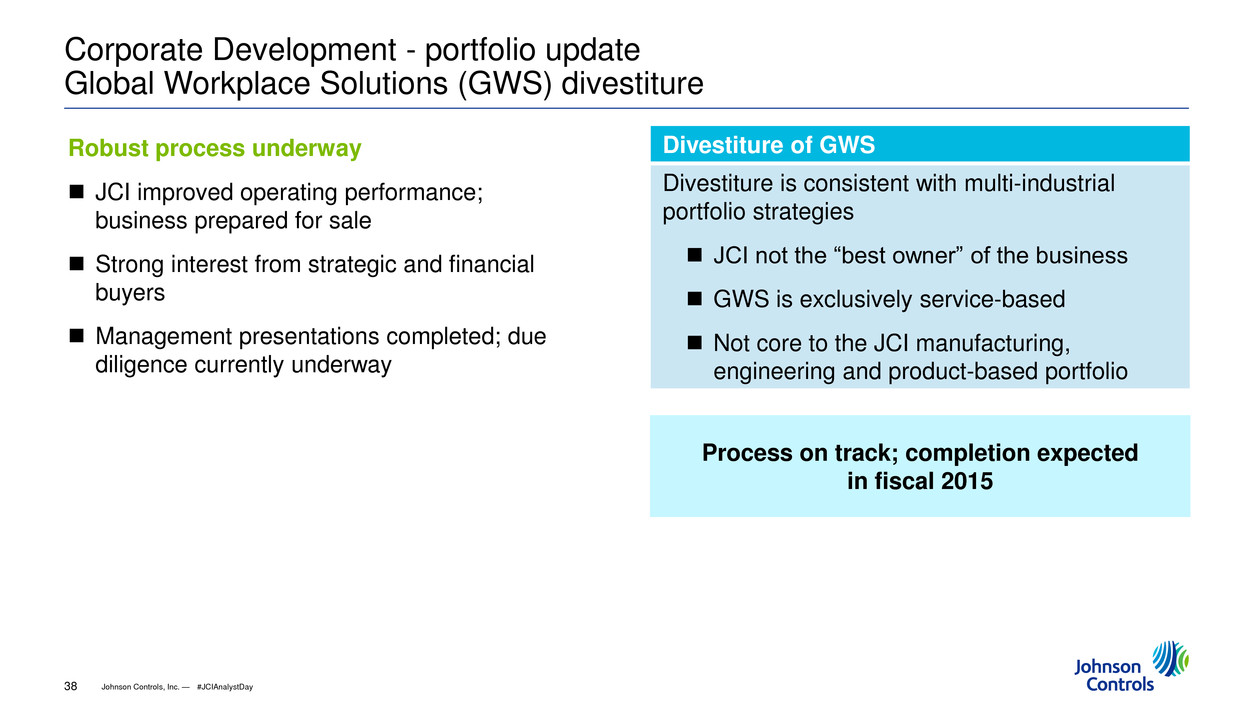

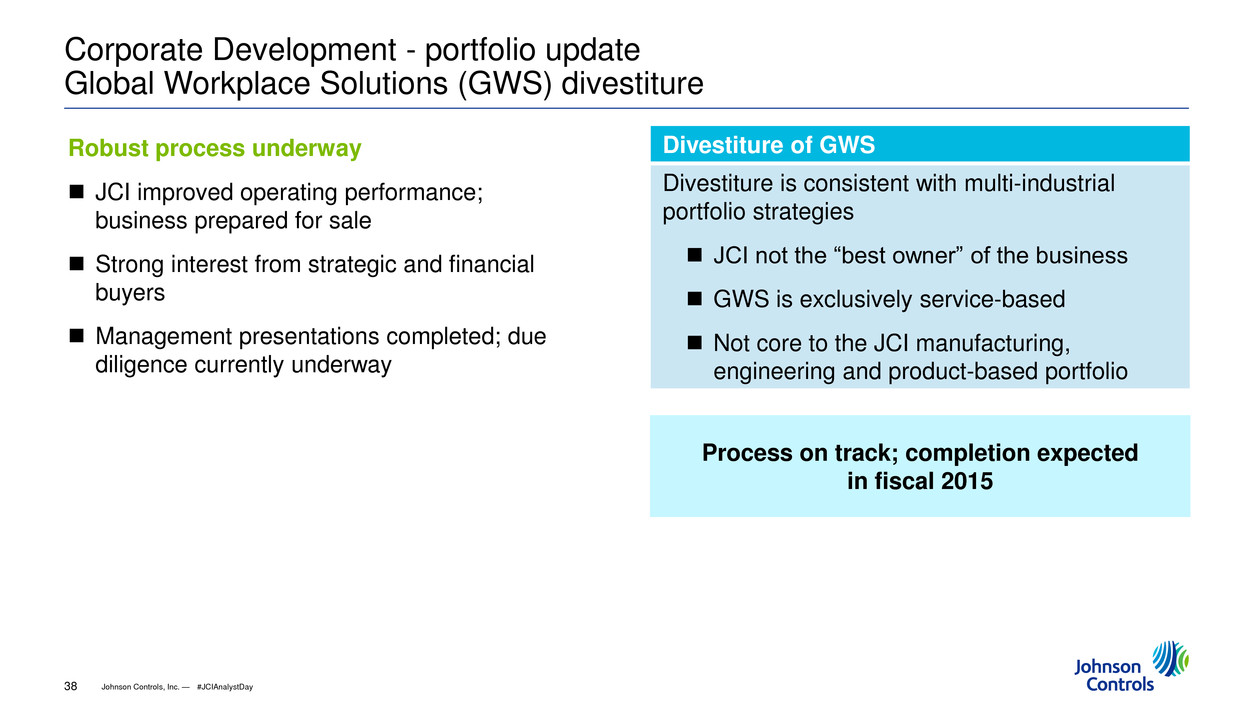

Johnson Controls, Inc. — 38 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Robust process underway JCI improved operating performance; business prepared for sale Strong interest from strategic and financial buyers Management presentations completed; due diligence currently underway Corporate Development - portfolio update Global Workplace Solutions (GWS) divestiture Divestiture of GWS Divestiture is consistent with multi-industrial portfolio strategies JCI not the “best owner” of the business GWS is exclusively service-based Not core to the JCI manufacturing, engineering and product-based portfolio Process on track; completion expected in fiscal 2015 #JCIAnalystDay

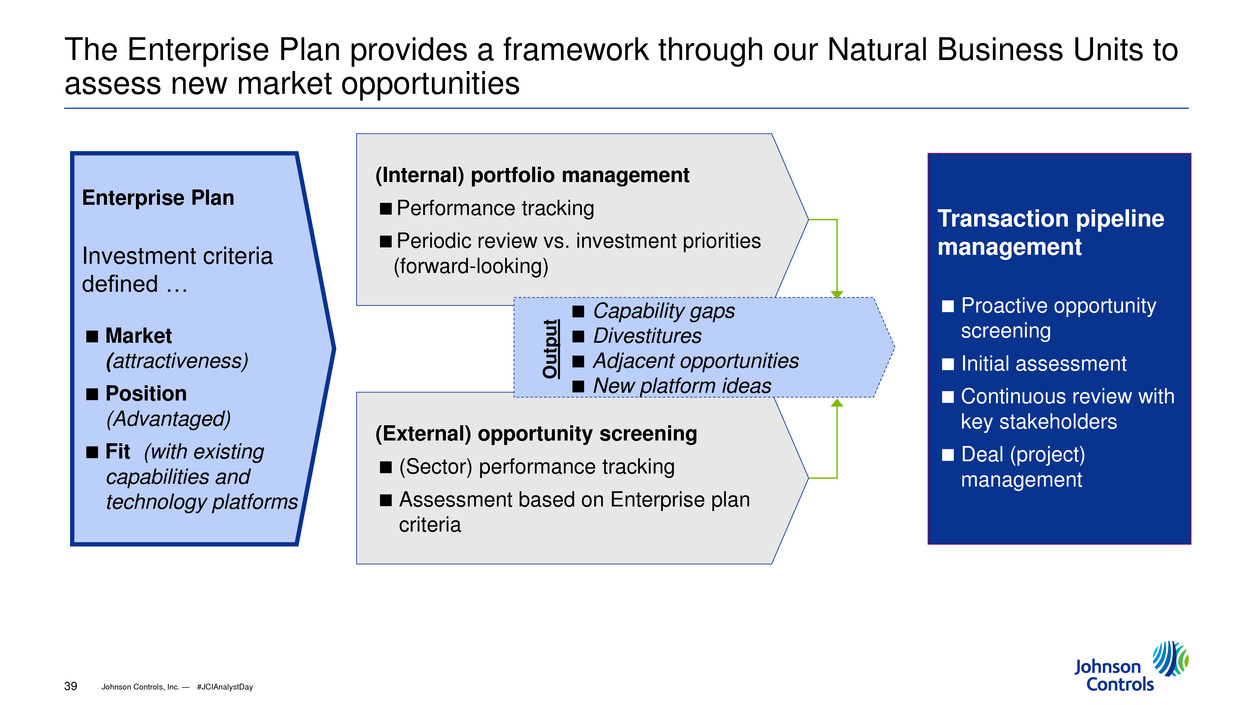

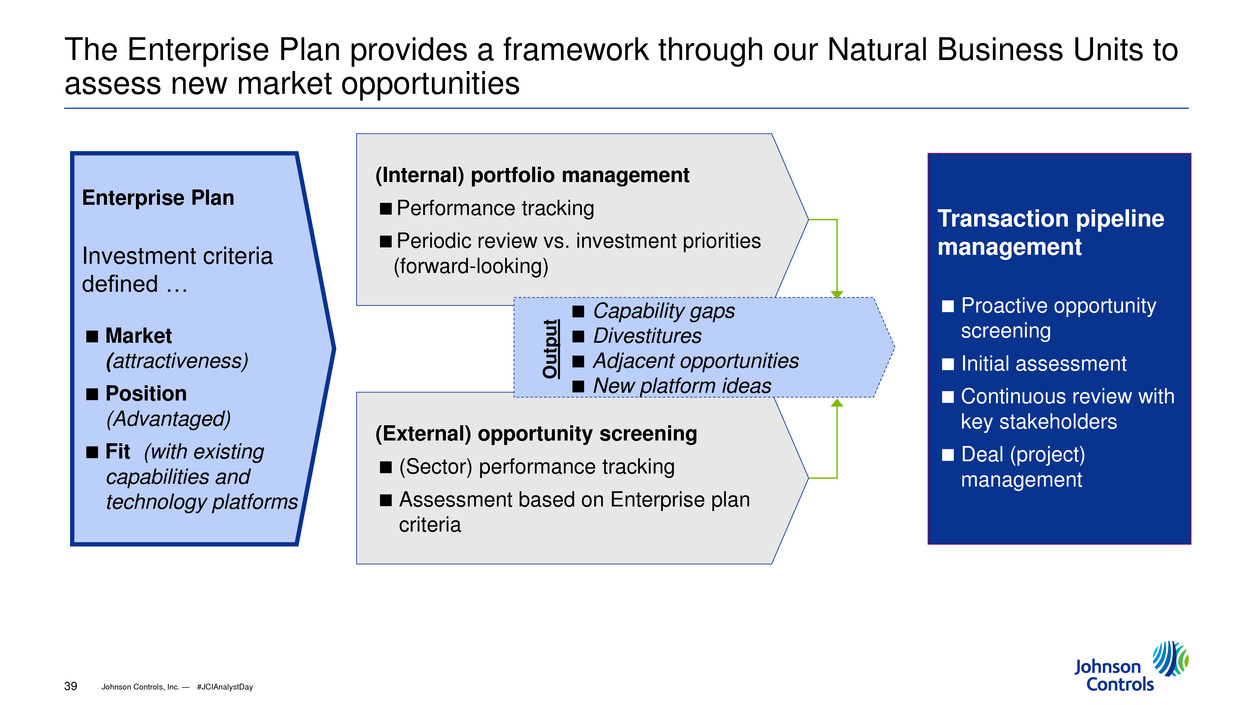

Johnson Controls, Inc. — 39 1/6 2/6 4/6 5/6 1/4 3/4 1/2 The Enterprise Plan provides a framework through our Natural Business Units to assess new market opportunities Enterprise Plan Investment criteria defined … Market (attractiveness) Position (Advantaged) Fit (with existing capabilities and technology platforms Transaction pipeline management Proactive opportunity screening Initial assessment Continuous review with key stakeholders Deal (project) management (Internal) portfolio management Performance tracking Periodic review vs. investment priorities (forward-looking) (External) opportunity screening (Sector) performance tracking Assessment based on Enterprise plan criteria Capability gaps Divestitures Adjacent opportunities New platform ideas Out p u t #JCIAnalystDay

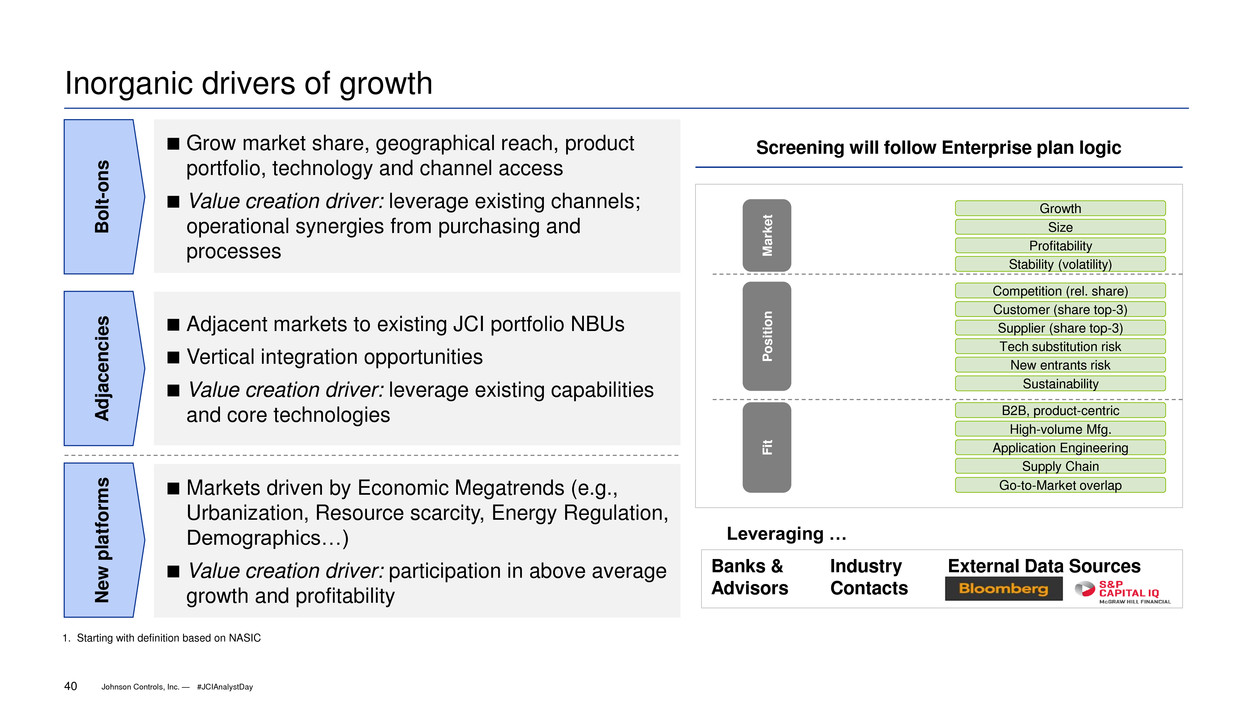

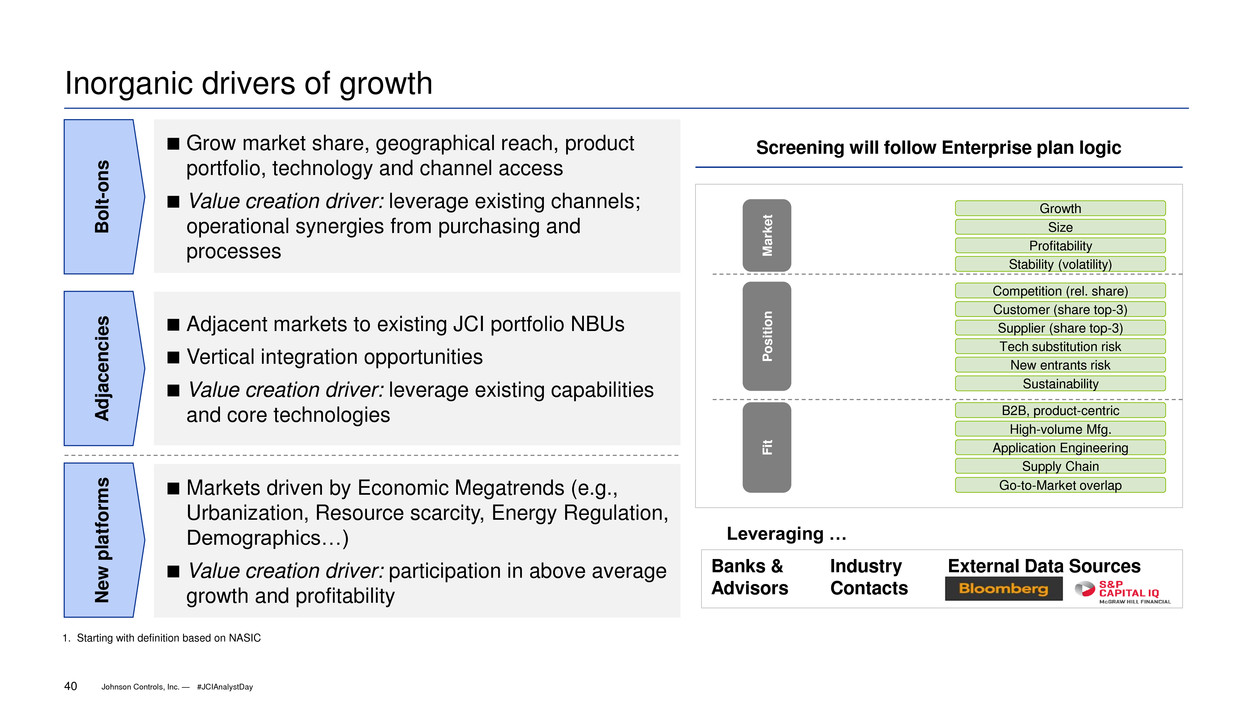

Johnson Controls, Inc. — 40 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Inorganic drivers of growth A d jace n c ie s Ne w pla tfor m s B o lt -o n s Adjacent markets to existing JCI portfolio NBUs Vertical integration opportunities Value creation driver: leverage existing capabilities and core technologies Grow market share, geographical reach, product portfolio, technology and channel access Value creation driver: leverage existing channels; operational synergies from purchasing and processes Markets driven by Economic Megatrends (e.g., Urbanization, Resource scarcity, Energy Regulation, Demographics…) Value creation driver: participation in above average growth and profitability Screening will follow Enterprise plan logic Banks & Industry External Data Sources Advisors Contacts M a rk e t P o siti o n F it Growth Size Profitability Stability (volatility) Competition (rel. share) Customer (share top-3) Supplier (share top-3) Tech substitution risk New entrants risk B2B, product-centric High-volume Mfg. Application Engineering Supply Chain Go-to-Market overlap Sustainability Leveraging … 1. Starting with definition based on NASIC #JCIAnalystDay

Johnson Controls, Inc. — 41 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Kim Metcalf-Kupres Vice President and Chief Marketing Officer

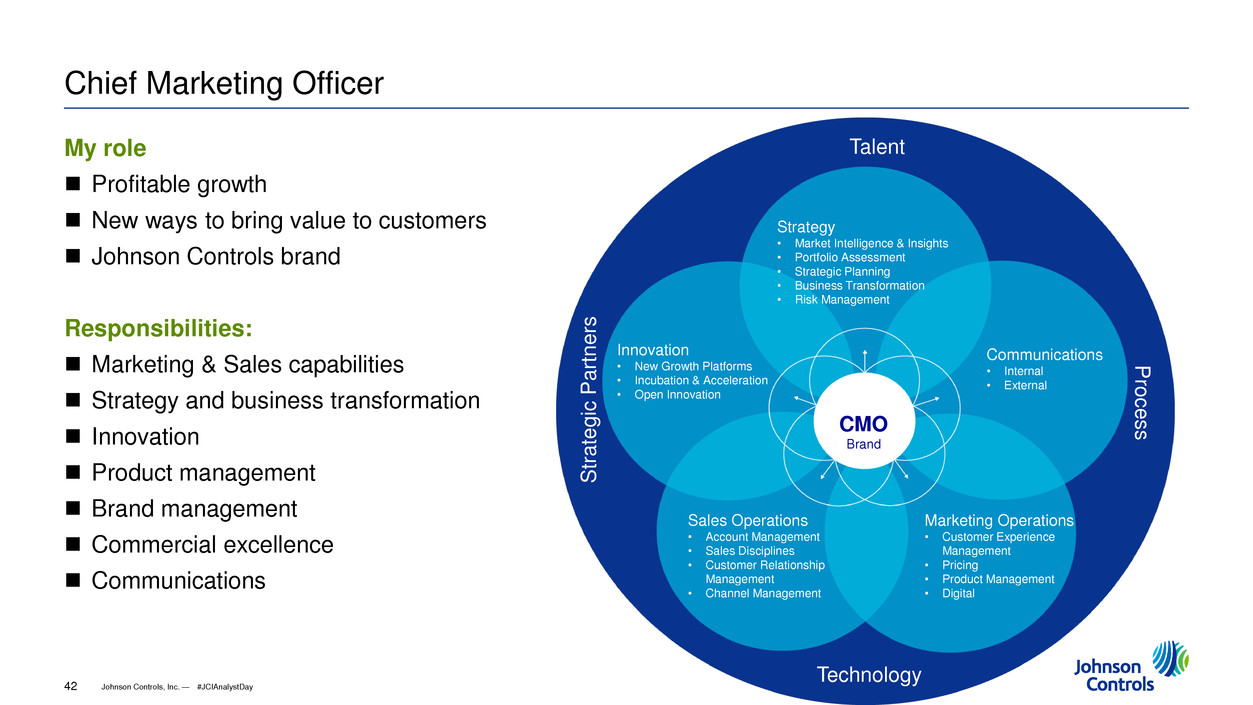

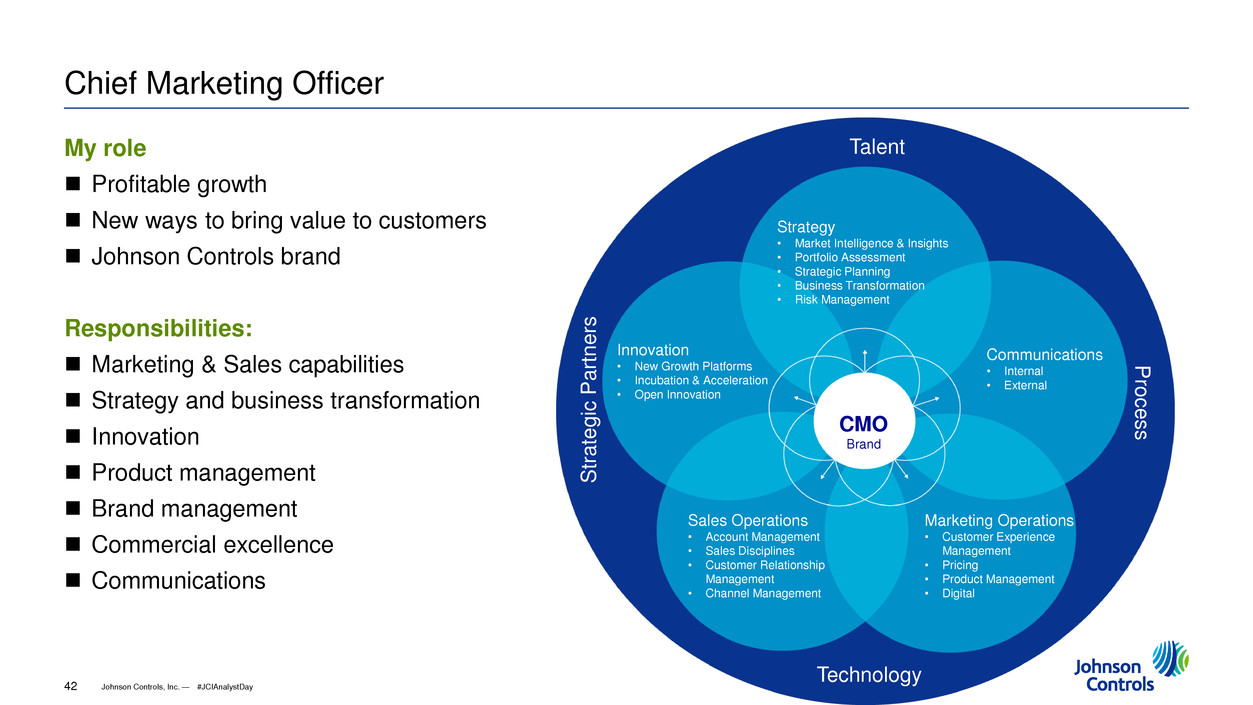

Johnson Controls, Inc. — 42 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Chief Marketing Officer My role Profitable growth New ways to bring value to customers Johnson Controls brand Responsibilities: Marketing & Sales capabilities Strategy and business transformation Innovation Product management Brand management Commercial excellence Communications Talent Technology CMO Brand Strategy • Market Intelligence & Insights • Portfolio Assessment • Strategic Planning • Business Transformation • Risk Management Innovation • New Growth Platforms • Incubation & Acceleration • Open Innovation Communications • Internal • External Sales Operations • Account Management • Sales Disciplines • Customer Relationship Management • Channel Management Marketing Operations • Customer Experience Management • Pricing • Product Management • Digital Pro c e s s Strateg ic Partner s #JCIAnalystDay

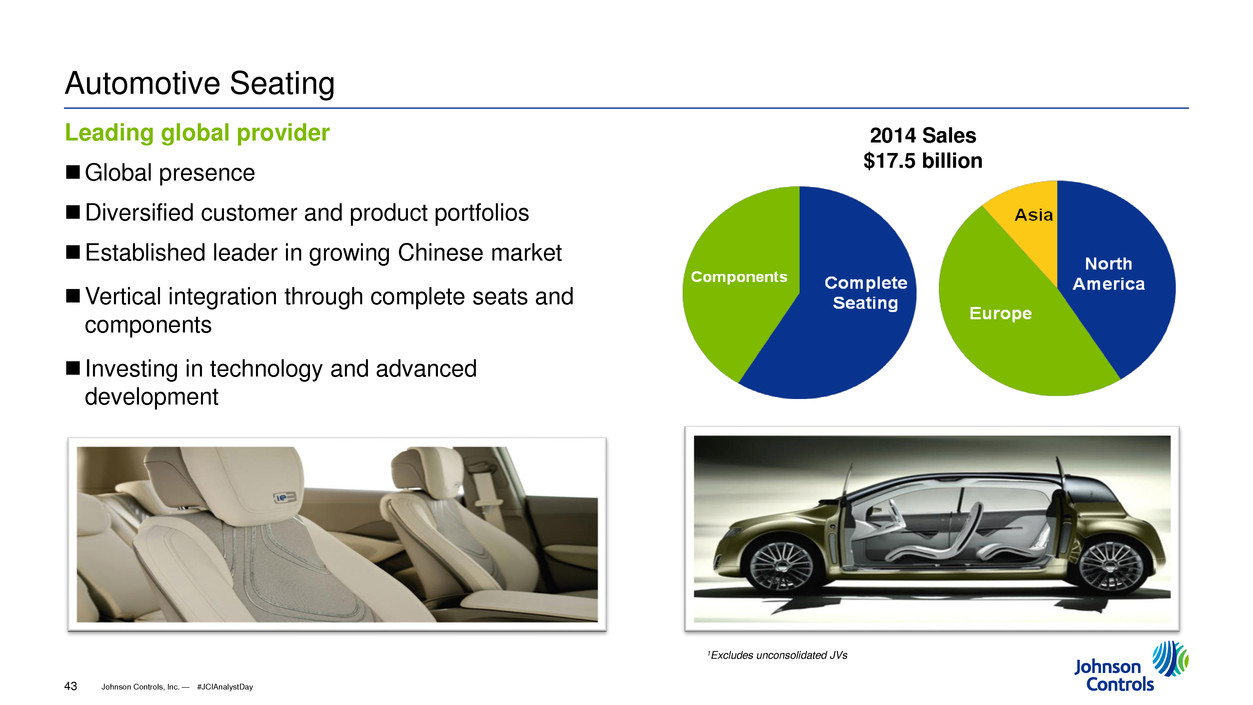

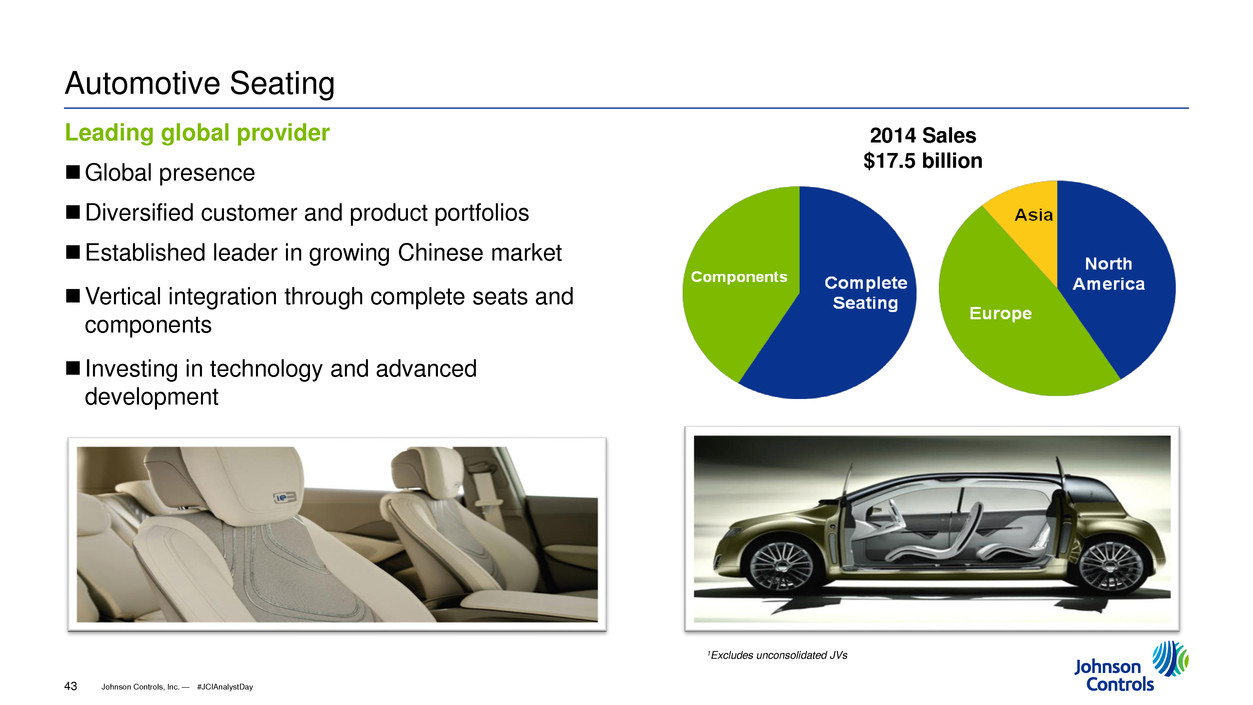

Johnson Controls, Inc. — 43 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Automotive Seating Leading global provider Global presence Diversified customer and product portfolios Established leader in growing Chinese market Vertical integration through complete seats and components Investing in technology and advanced development 5% 2014 Sales $17.5 billion 1Excludes unconsolidated JVs #JCIAnalystDay

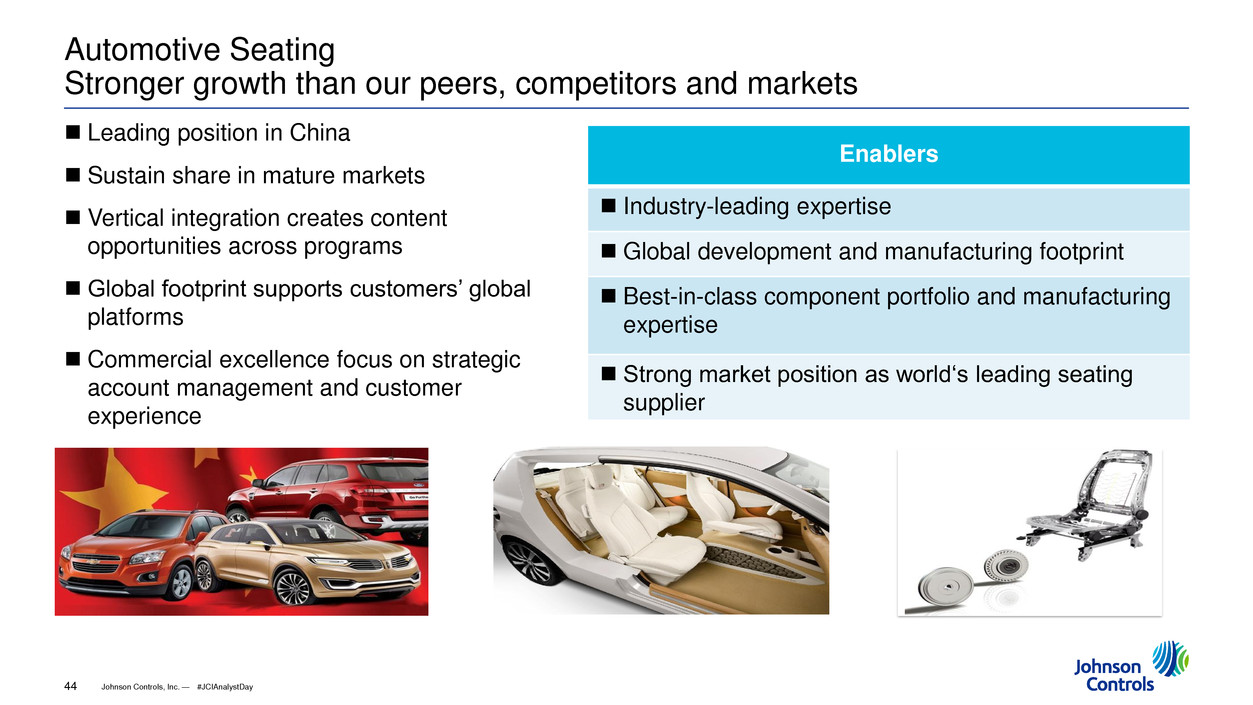

Johnson Controls, Inc. — 44 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Automotive Seating Stronger growth than our peers, competitors and markets #JCIAnalystDay Leading position in China Sustain share in mature markets Vertical integration creates content opportunities across programs Global footprint supports customers’ global platforms Commercial excellence focus on strategic account management and customer experience Enablers Industry-leading expertise Global development and manufacturing footprint Best-in-class component portfolio and manufacturing expertise Strong market position as world‘s leading seating supplier

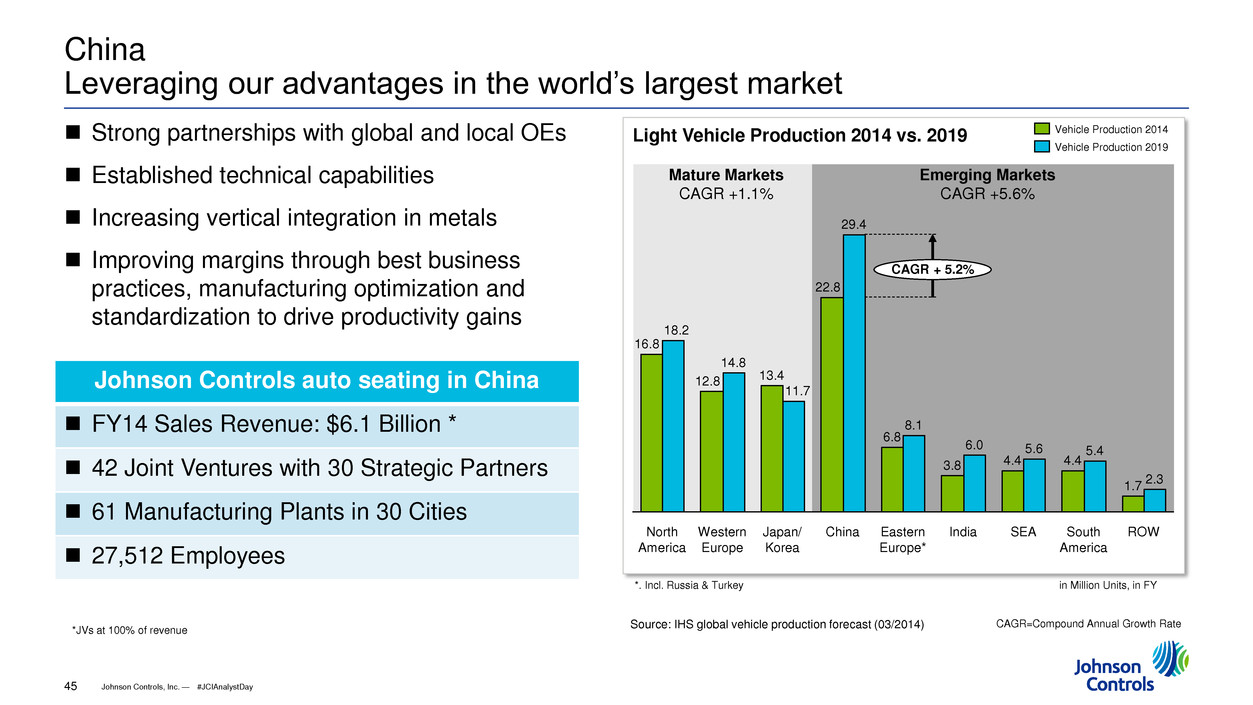

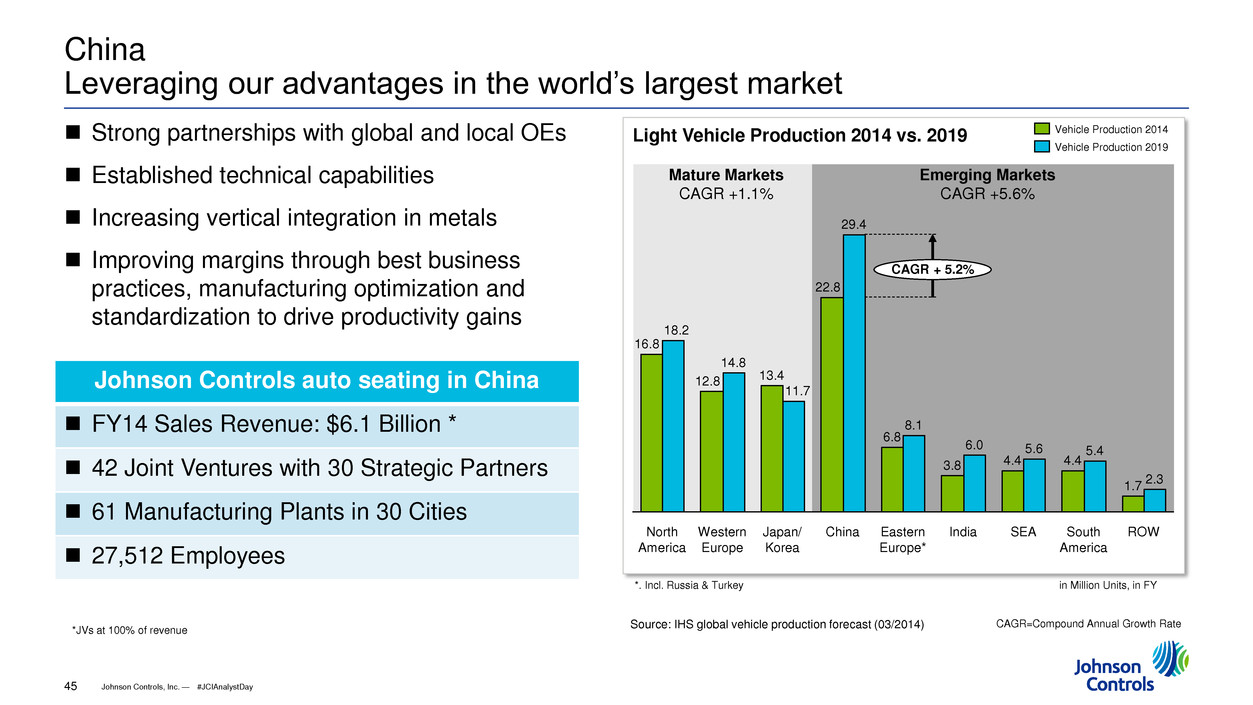

Johnson Controls, Inc. — 45 1/6 2/6 4/6 5/6 1/4 3/4 1/2 China Leveraging our advantages in the world’s largest market Strong partnerships with global and local OEs Established technical capabilities Increasing vertical integration in metals Improving margins through best business practices, manufacturing optimization and standardization to drive productivity gains **. Incl. Russia & Turkey in Million Units, in FY 3.8 CAGR + 5.2% ROW 2.3 1.7 South America 5.4 4.4 SEA 5.6 4.4 India 6.0 Eastern Europe* 8.1 6.8 China 29.4 22.8 Japan/ Korea 11.7 13.4 Western Europe 14.8 12.8 North America 18.2 16.8 Vehicle Production 2019 Vehicle Production 2014 Mature Markets CAGR +1.1% Emerging Markets CAGR +5.6% Light Vehicle Production 2014 vs. 2019 CAGR=Compound Annual Growth Rate Source: IHS global vehicle production forecast (03/2014) Johnson Controls auto seating in China FY14 Sales Revenue: $6.1 Billion * 42 Joint Ventures with 30 Strategic Partners 61 Manufacturing Plants in 30 Cities 27,512 Employees *JVs at 100% of revenue #JCIAnalystDay

Johnson Controls, Inc. — 46 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Automotive Seating Operational Excellence Improving profitability through better quality, cost, productivity, speed Driving sustainable improvement in our global Metals business Improvements in South America following commercial and restructuring initiatives Commercial disciplines and processes Continuous improvement culture Procurement management and savings Best practices support enterprise operating systems for manufacturing and supply chain excellence #JCIAnalystDay

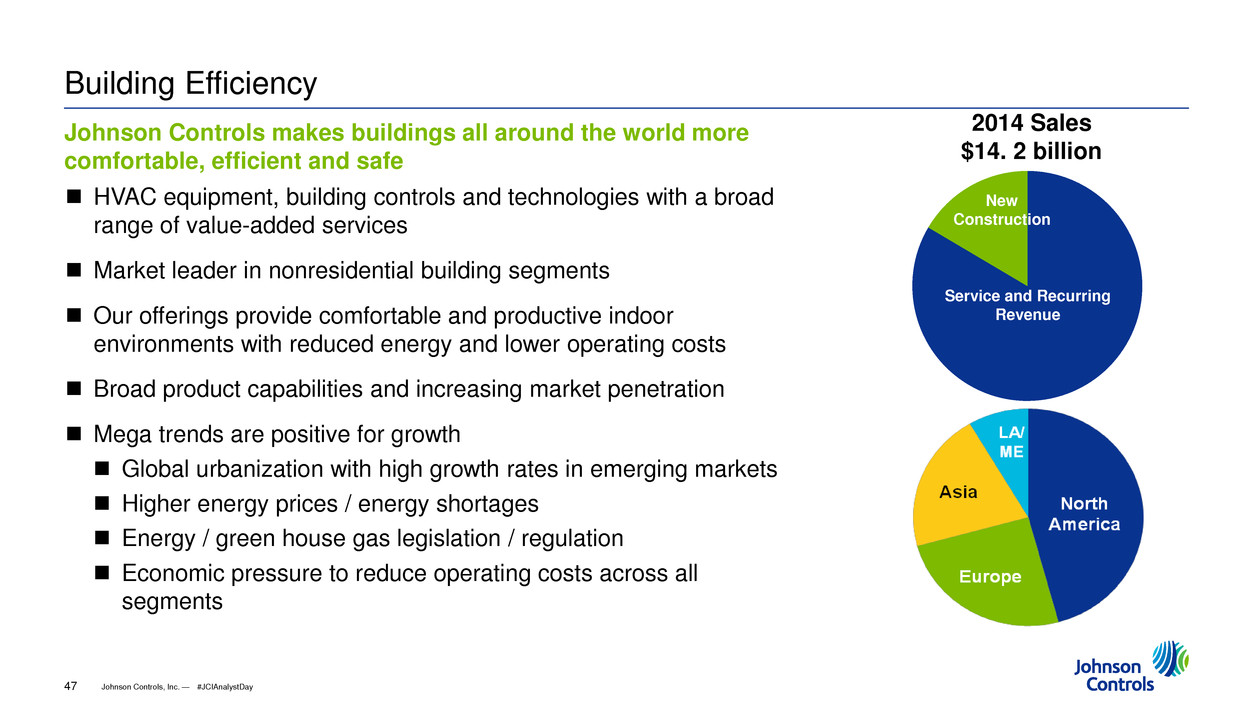

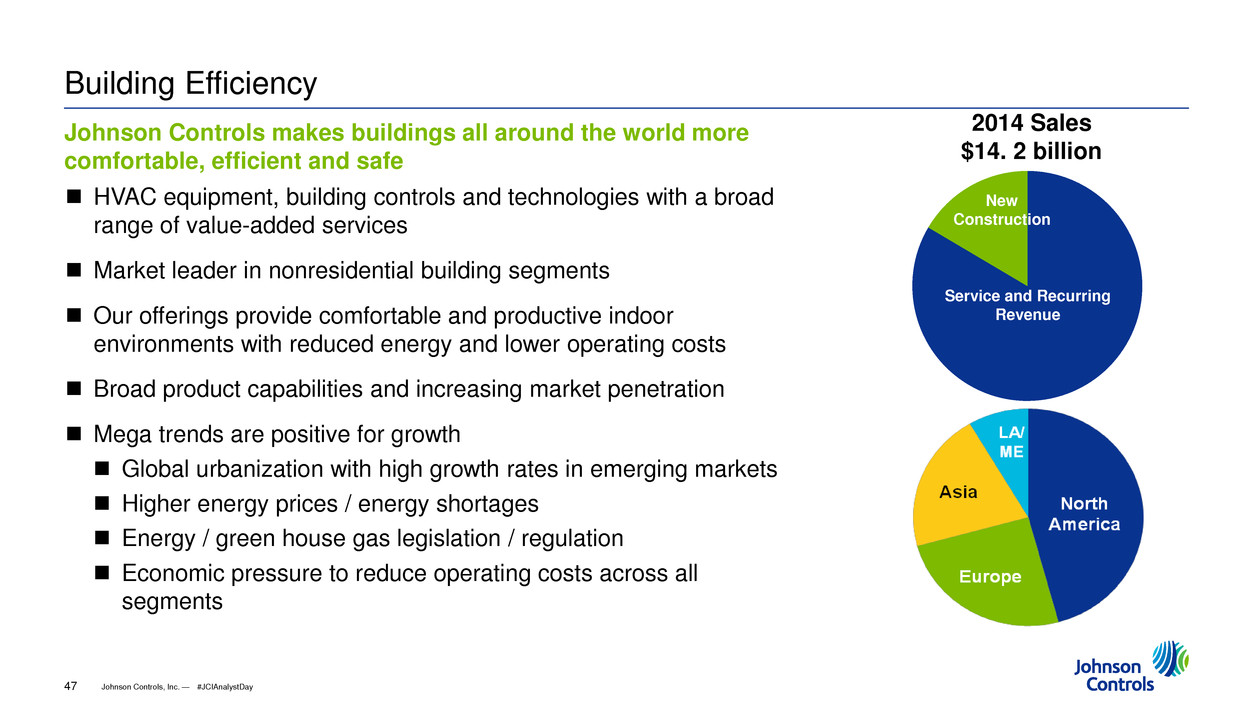

Johnson Controls, Inc. — 47 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Building Efficiency Johnson Controls makes buildings all around the world more comfortable, efficient and safe HVAC equipment, building controls and technologies with a broad range of value-added services Market leader in nonresidential building segments Our offerings provide comfortable and productive indoor environments with reduced energy and lower operating costs Broad product capabilities and increasing market penetration Mega trends are positive for growth Global urbanization with high growth rates in emerging markets Higher energy prices / energy shortages Energy / green house gas legislation / regulation Economic pressure to reduce operating costs across all segments 2014 Sales $14. 2 billion Service and recurring revenues New Construction Service and Recurring Revenue New Construction #JCIAnalystDay

Johnson Controls, Inc. — 48 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Building Efficiency Investing for profitable growth Strategic choices Winning in North America Systems & Service North America branch channel Expanding independent channels Growth platforms in China and rest of Asia Increasing product focus Chillers + parts Controls + contracting HVAC products and services Variable Refrigerant Flow (VRF) Air Distribution products Optimizing market coverage globally Beyond large / complex building market focus Appropriate channels to best serve local markets #JCIAnalystDay

Johnson Controls, Inc. — 49 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Building Efficiency Refining our operating models around selected products and local markets Product Businesses Compete on product Technology leadership Application coverage Differentiated features Product cost Ease of installation / field cost Operating cost implications (e.g. energy efficiency) Different categories are regional or global in scope and competition Field Businesses Compete on expertise, customer service and relationships Proven track record Local delivery capability Cost competitiveness Ability to influence requirements and selection (for construction events) Buildings are by nature local, and most owners operate locally Field businesses are most often local firms or networks of local operations #JCIAnalystDay

Johnson Controls, Inc. — 50 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Building Efficiency Strong presence and well-positioned for growth in China 40 Branch office locations Wuxi Factories, R&D Center Guangzhou Factory Shenzhen Beijing Dalian Qingdao Shijiazhuang Xi’an Chengdu Wuhan Xiamen Hangzhou Shanghai Shantou Jinan Zhengzhou Hefei Tangshan Taiyuan Inner Mongolia Lanzhou Yinchuan Tianjin Shenyang Changchun Nanchang Foshan Changsha Huizhou Haikou Zhuhai Suzhou Nanjing Guangzhou Zhongshan Dongguan Nanning Kunming Guiyang Xinjiang Chongqing Harbin Opportunities Strategies Urbanization driving expansion of T2+ cities 350 million people expected to move by 2025 50,000 new high-rise buildings by 2025 50% of all 10+ story buildings globally through 2020 High growth HVAC segments e.g. Variable Refrigerant Flow (VRF) Government focus on energy and environment Direct sales and service branch network Independent channels expansion Mid-market portfolio expansion incl. VRF, screw chiller, mid-market building automation Energy efficient /sustainable offerings #JCIAnalystDay

Johnson Controls, Inc. — 51 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Air Distribution Technologies Strategic product focus and broadened distribution Products: Brands: Strong third-party distribution channels: +185 non-residential sales relationships +4,000 residential distributor locations #JCIAnalystDay

Johnson Controls, Inc. — 52 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Hitachi Joint Venture Strategic product focus and broadened distribution Johnson Controls - Hitachi JV MOU Complementary commercial and residential HVAC technologies, especially VRF More solutions for our customers Best in class distribution channels and strong brands Expanded manufacturing capabilities #JCIAnalystDay

Johnson Controls, Inc. — 53 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Power Solutions Global market leader for vehicle energy storage systems, providing superior customer value at the best delivered cost 35% global market share for SLI batteries Strategic customer relationships and world class aftermarket business Original equipment batteries for top automakers worldwide Superior portfolio of aftermarket consumer brands VARTA®, LTH®, Heliar®, Optima®, Energizer®, Champion® Technology leader PowerFrame® grid technology Advanced lead acid: Absorbent Glass Mat (AGM), Enhanced Flooded Batteries (EFB) Lithium ion advanced batteries Quality, cost leadership Expanding global footprint 2014 Sales $6.6 billion Americas Europe Asia Aftermarket Original Equipment #JCIAnalystDay

Johnson Controls, Inc. — 54 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Power Solutions Global growth platforms Mature Markets – North America & Western Europe Leverage core strengths to expand value delivery, reinforce strategic customer relationships and grow Invest for high growth in China Product & Technology Offer a complete portfolio of energy storage solutions to suit evolving requirements of current and future powertrains Best in class vertical integration, components and recycling capabilities Emerging Markets Strong local positions in South America, Middle East and India Support growth in Eastern Europe, Southeast Asia and Africa through imports leveraging global footprint Prioritize investments as markets continue to develop #JCIAnalystDay

Johnson Controls, Inc. — 55 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Investing in manufacturing and distribution Original Equipment Strategic relationships Advanced technology Aftermarket Continue building VARTA brand in China Expand distribution network in all regions Extend product portfolio to mid-tier segments Components & Supply Chain Drive cost and quality as factories mature Develop regional supply chain capabilities Continue to explore and prioritize investments in expansion and vertical integration Power Solutions Positioning for aggressive growth in China 36 40 45 50 54 59 64 70 21 23 25 27 29 31 32 35 57 63 70 76 83 90 97 104 2013 2014 2015 2016 2017 2018 2019 2020 Chinese Automotive Battery Market Forecast Aftermarket OE Largest automotive battery market in the world by 2020 Positioning Power Solutions expected to reach 25% market share by 2020 #JCIAnalystDay

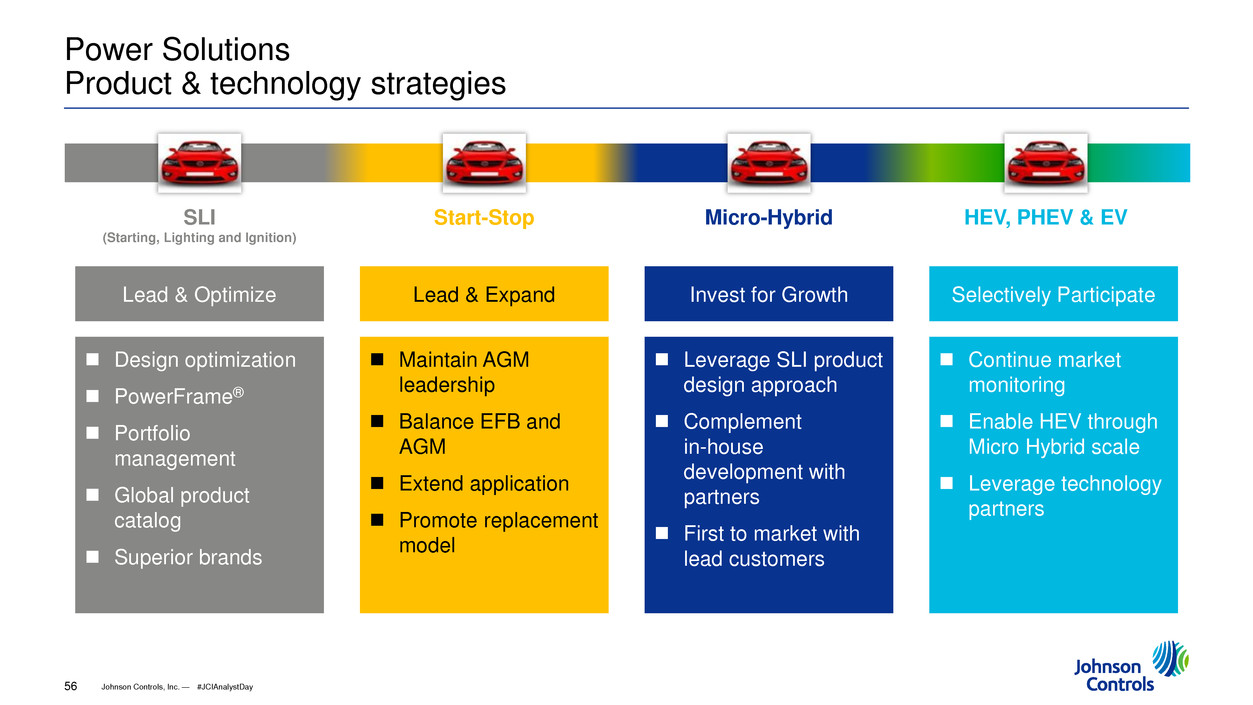

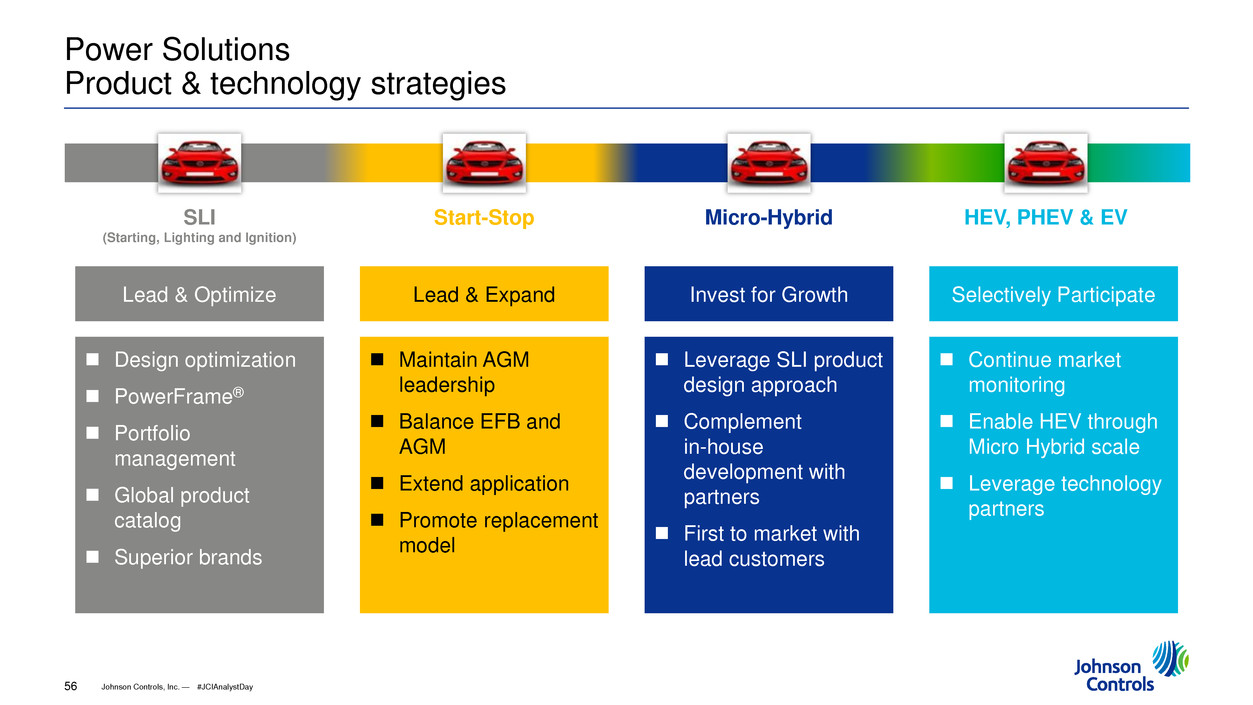

Johnson Controls, Inc. — 56 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Power Solutions Product & technology strategies Lead & Optimize Lead & Expand Invest for Growth Selectively Participate Design optimization PowerFrame® Portfolio management Global product catalog Superior brands Maintain AGM leadership Balance EFB and AGM Extend application Promote replacement model Leverage SLI product design approach Complement in-house development with partners First to market with lead customers Continue market monitoring Enable HEV through Micro Hybrid scale Leverage technology partners SLI (Starting, Lighting and Ignition) Start-Stop Micro-Hybrid HEV, PHEV & EV #JCIAnalystDay

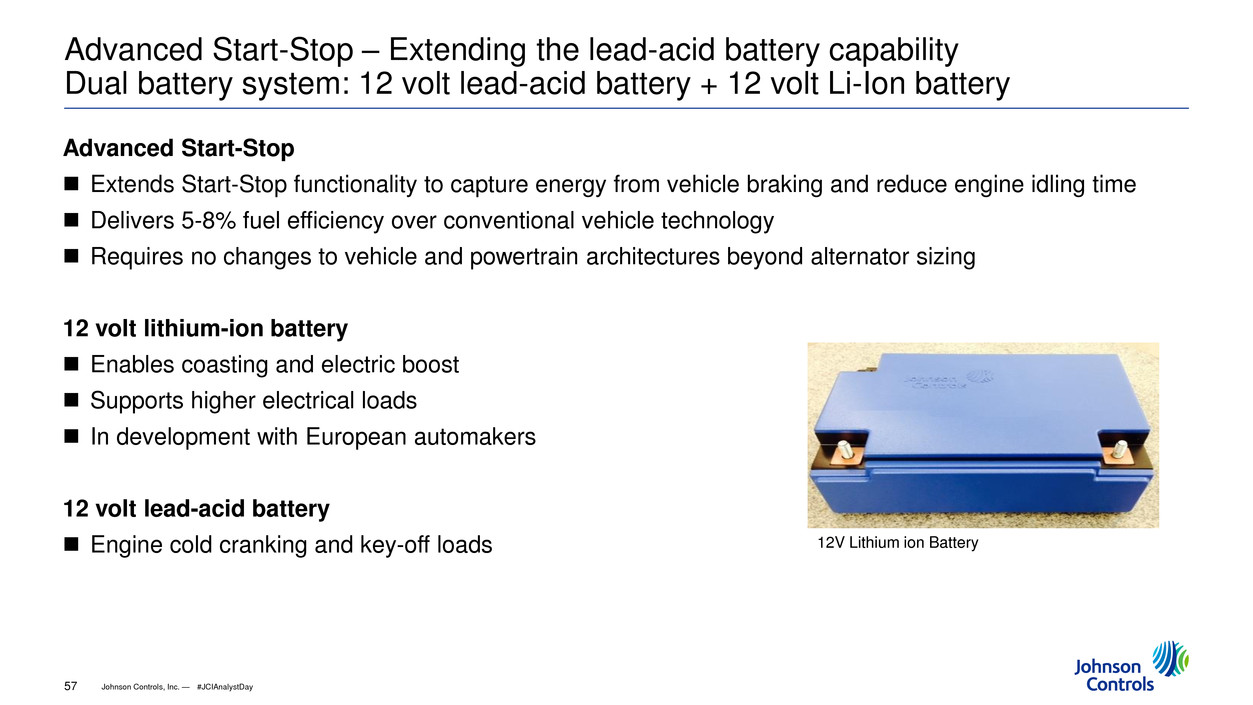

Johnson Controls, Inc. — 57 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Advanced Start-Stop – Extending the lead-acid battery capability Dual battery system: 12 volt lead-acid battery + 12 volt Li-Ion battery Advanced Start-Stop Extends Start-Stop functionality to capture energy from vehicle braking and reduce engine idling time Delivers 5-8% fuel efficiency over conventional vehicle technology Requires no changes to vehicle and powertrain architectures beyond alternator sizing 12 volt lithium-ion battery Enables coasting and electric boost Supports higher electrical loads In development with European automakers 12 volt lead-acid battery Engine cold cranking and key-off loads 12V Lithium ion Battery #JCIAnalystDay

Johnson Controls, Inc. — 58 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Portfolio of strong global businesses, serving attractive end markets Johnson Controls businesses Executing focused strategies for profitable growth Developing new ways to bring value to customers Differentiating core capabilities Attractive, sustainable returns for our shareholders #JCIAnalystDay

Johnson Controls, Inc. — 59 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Brian J. Stief Executive Vice President and Chief Financial Officer

Johnson Controls, Inc. — 60 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Philosophies and personal background Consistent execution - no surprises Deliver on commitments - accountability Focus on value creation PricewaterhouseCoopers (1979 – 2010); admitted to partnership in 1989 Served primarily global MNCs in the consumer and industrial products industries (Caterpillar, Johnson Controls, Miller Brewing, etc.) Held various Office Managing Partner and regional leadership roles at PwC Joined Johnson Controls in 2010 as VP & Corporate Controller Executive Vice President and Chief Financial Officer, September 2014 Philosophies Personal Background #JCIAnalystDay

Johnson Controls, Inc. — 61 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Johnson Controls financial model Clear portfolio choices, with a focus on where we can win and making the required investments Support business and operating model changes Significant attention to margin enhancement through cost reduction, commercial discipline and efficiency improvements; several initiatives underway Balanced allocation of capital to ensure highest return on investments; bias toward Building Efficiency and Power Solutions in the future Consistent and sustainable returns to our shareholders #JCIAnalystDay

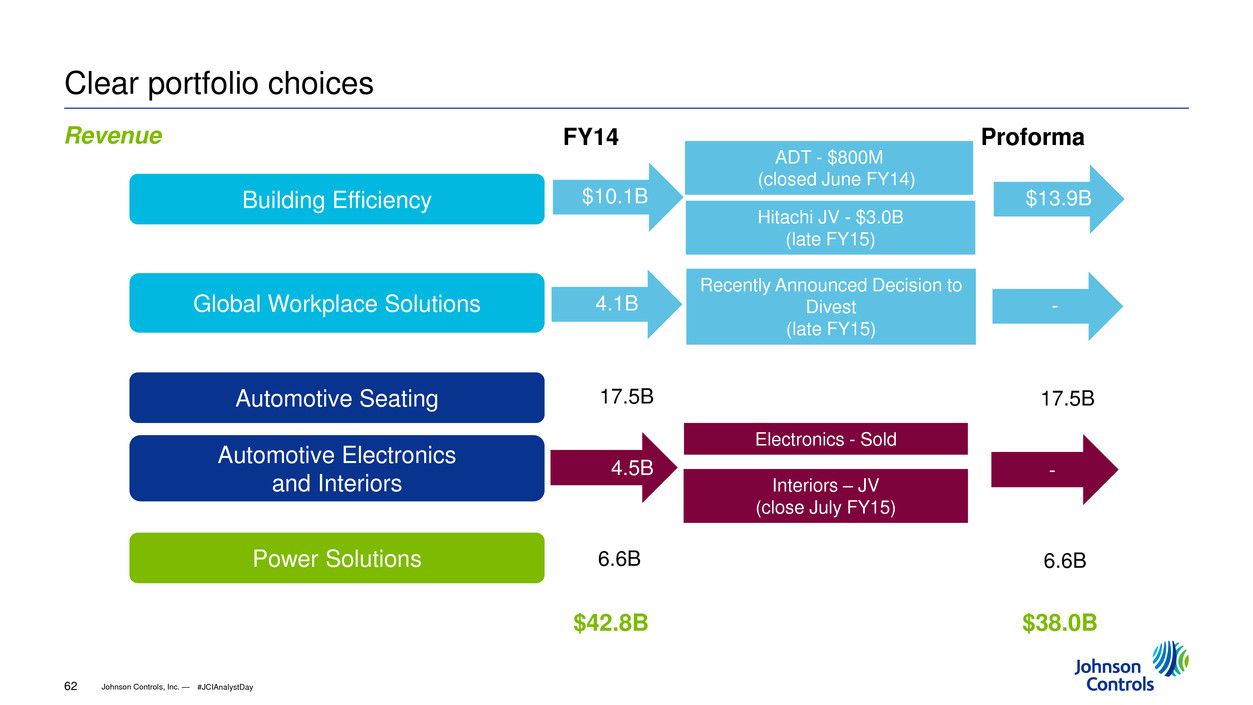

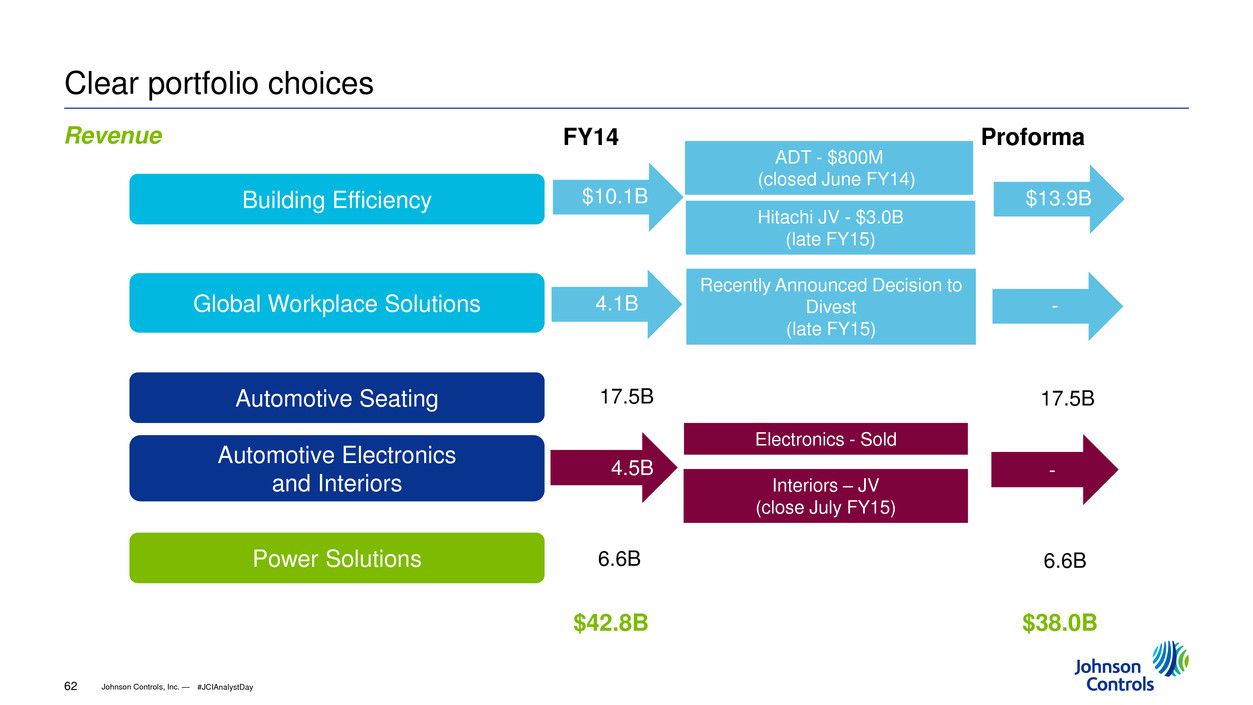

Johnson Controls, Inc. — 62 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Clear portfolio choices Building Efficiency Global Workplace Solutions Automotive Seating Automotive Electronics and Interiors Power Solutions $10.1B 17.5B 4.5B 6.6B Electronics - Sold Interiors – JV (close July FY15) Hitachi JV - $3.0B (late FY15) ADT - $800M (closed June FY14) 4.1B Recently Announced Decision to Divest (late FY15) $13.9B 17.5B - 6.6B - FY14 $42.8B Proforma $38.0B Revenue #JCIAnalystDay

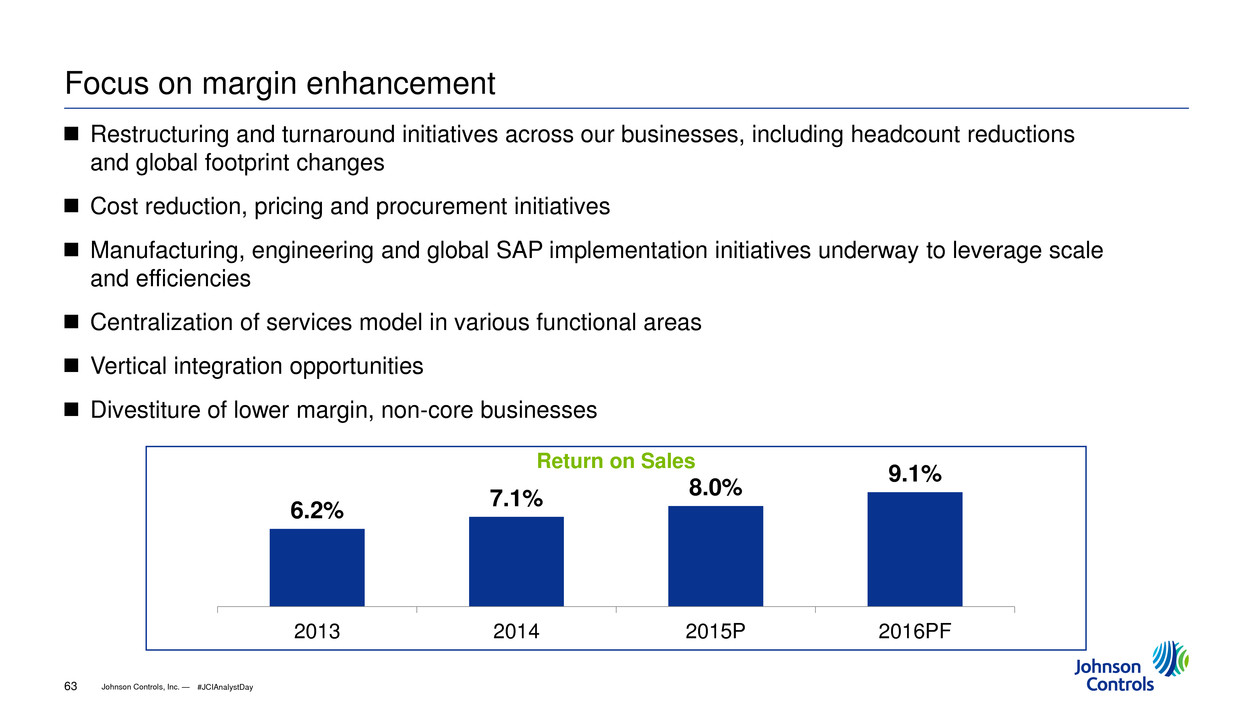

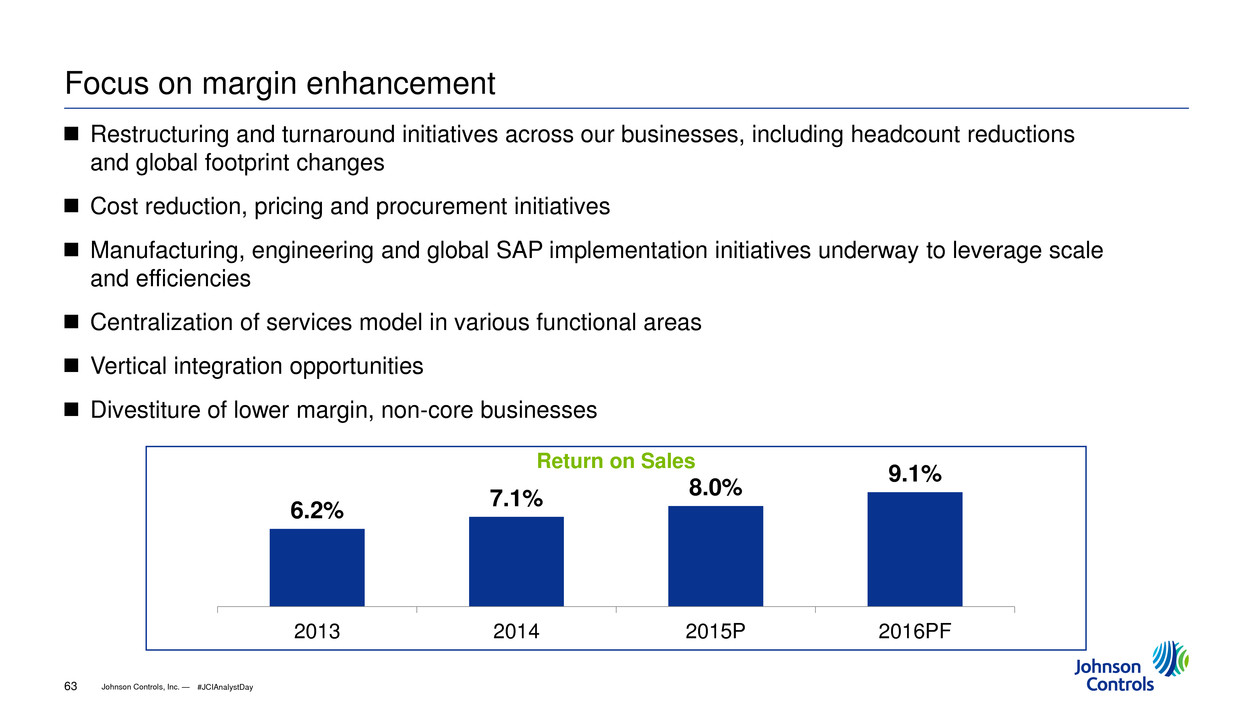

Johnson Controls, Inc. — 63 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Focus on margin enhancement Restructuring and turnaround initiatives across our businesses, including headcount reductions and global footprint changes Cost reduction, pricing and procurement initiatives Manufacturing, engineering and global SAP implementation initiatives underway to leverage scale and efficiencies Centralization of services model in various functional areas Vertical integration opportunities Divestiture of lower margin, non-core businesses 6.2% 7.1% 8.0% 9.1% 2013 2014 2015P 2016PF Return on Sales #JCIAnalystDay

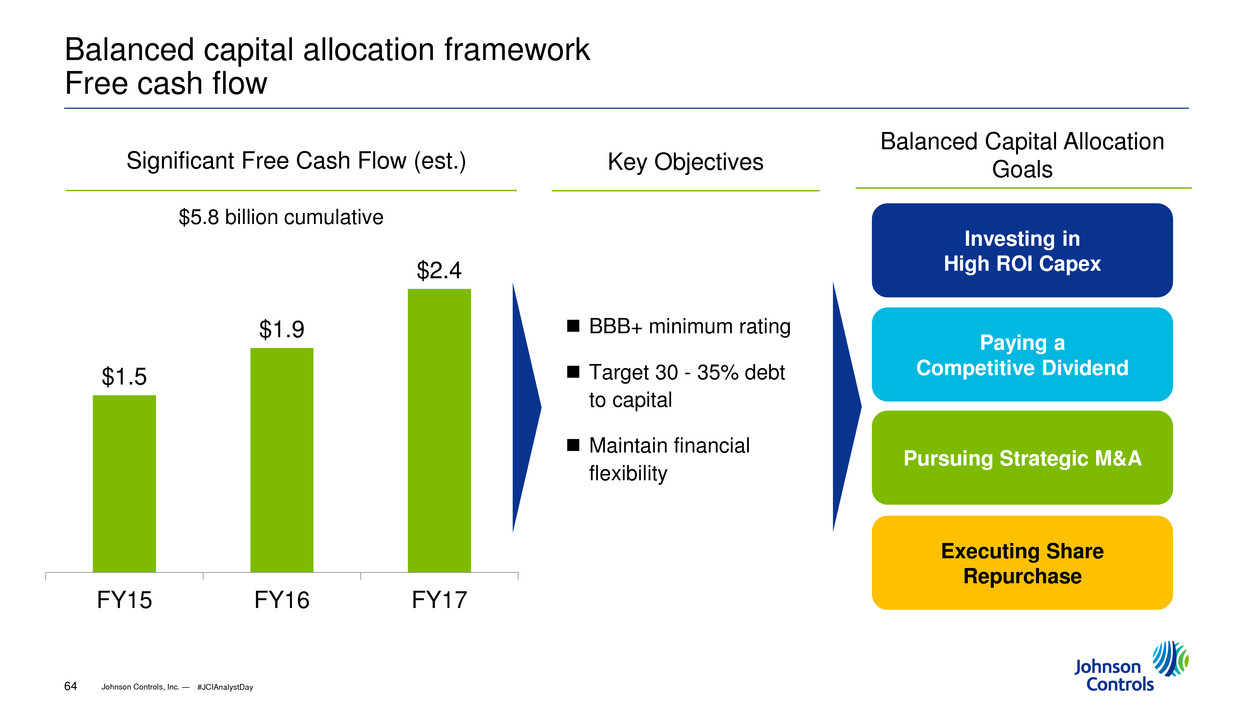

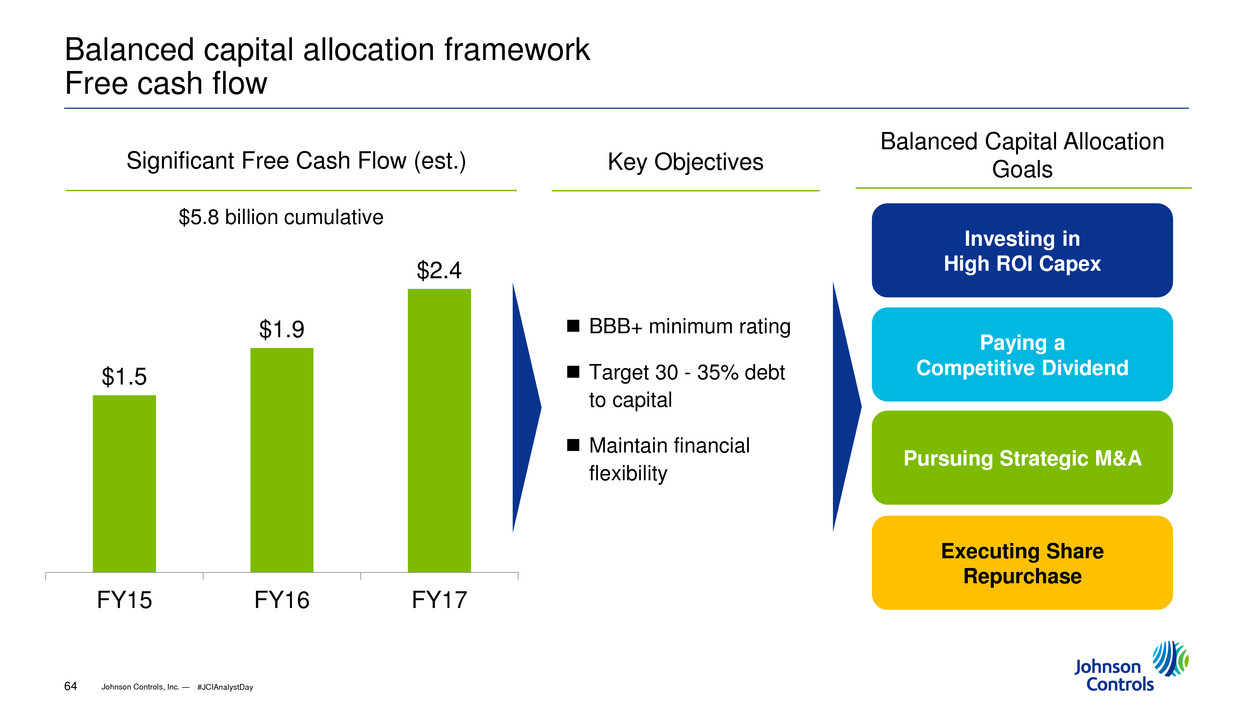

Johnson Controls, Inc. — 64 1/6 2/6 4/6 5/6 1/4 3/4 1/2 $1.5 $1.9 $2.4 FY15 FY16 FY17 Balanced capital allocation framework Free cash flow Significant Free Cash Flow (est.) Key Objectives Balanced Capital Allocation Goals $5.8 billion cumulative BBB+ minimum rating Target 30 - 35% debt to capital Maintain financial flexibility Investing in High ROI Capex Pursuing Strategic M&A Paying a Competitive Dividend Executing Share Repurchase #JCIAnalystDay

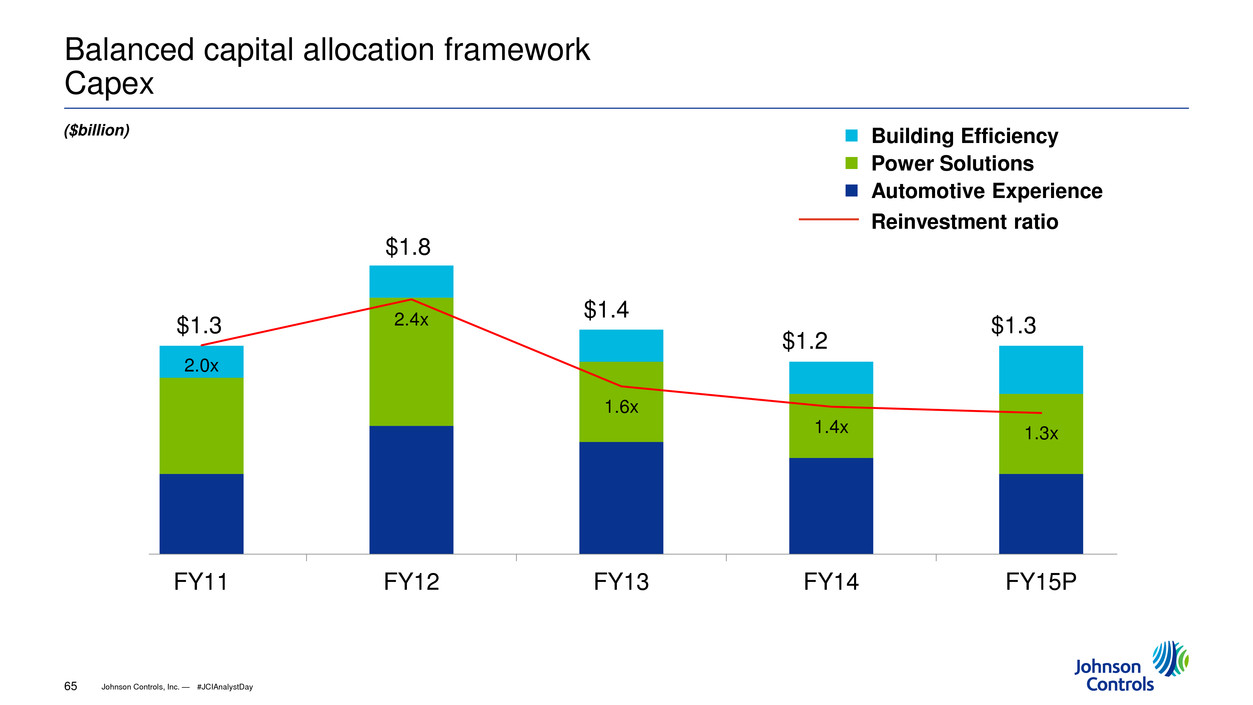

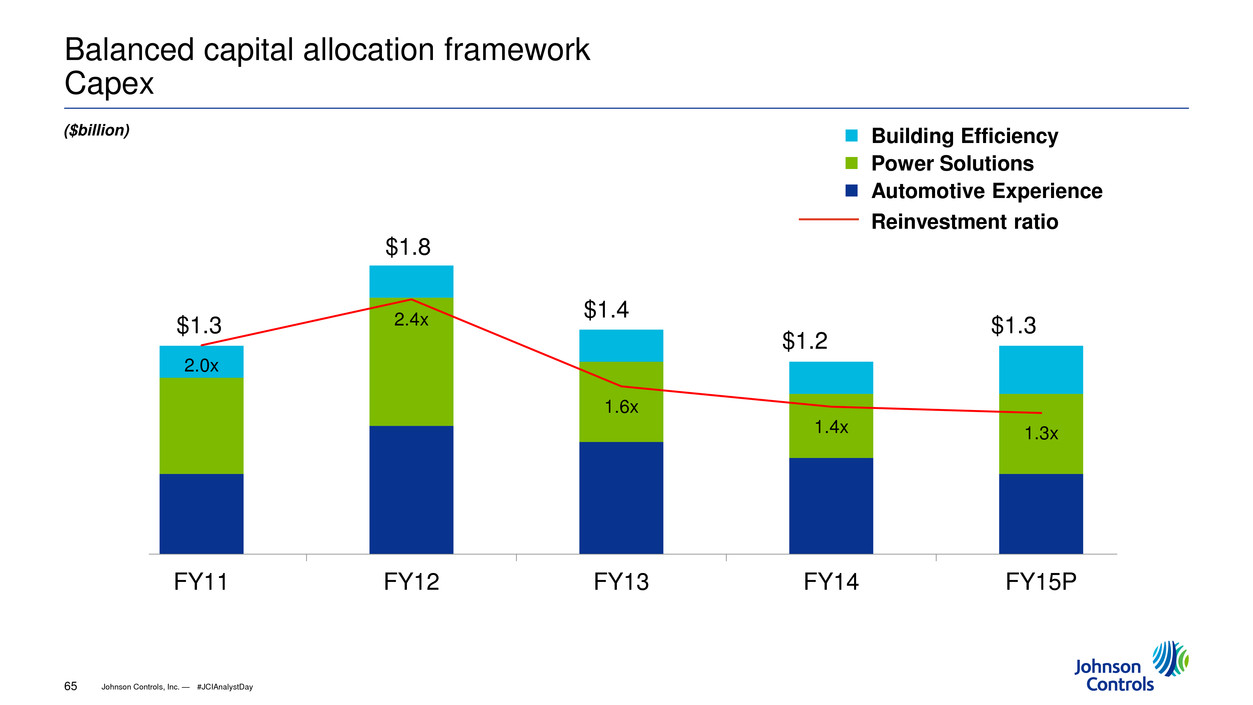

Johnson Controls, Inc. — 65 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Balanced capital allocation framework Capex ($billion) $1.3 $1.8 $1.4 $1.2 $1.3 2.0x 2.4x 1.6x 1.4x 1.3x 0 0.5 1 1.5 2 2.5 3 0 0.2 0.4 0.6 0.8 1 1.2 1.4 1.6 1.8 2 FY11 FY12 FY13 FY14 FY15P Building Efficiency Power Solutions Automotive Experience Reinvestment ratio #JCIAnalystDay

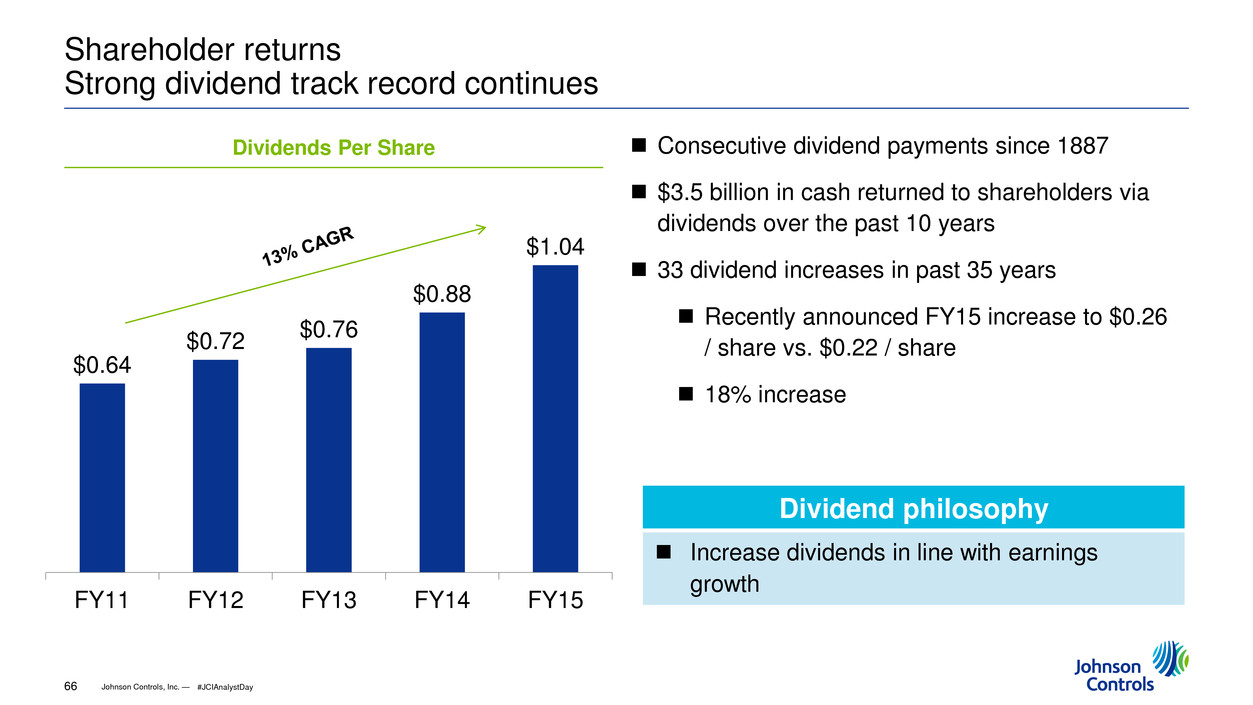

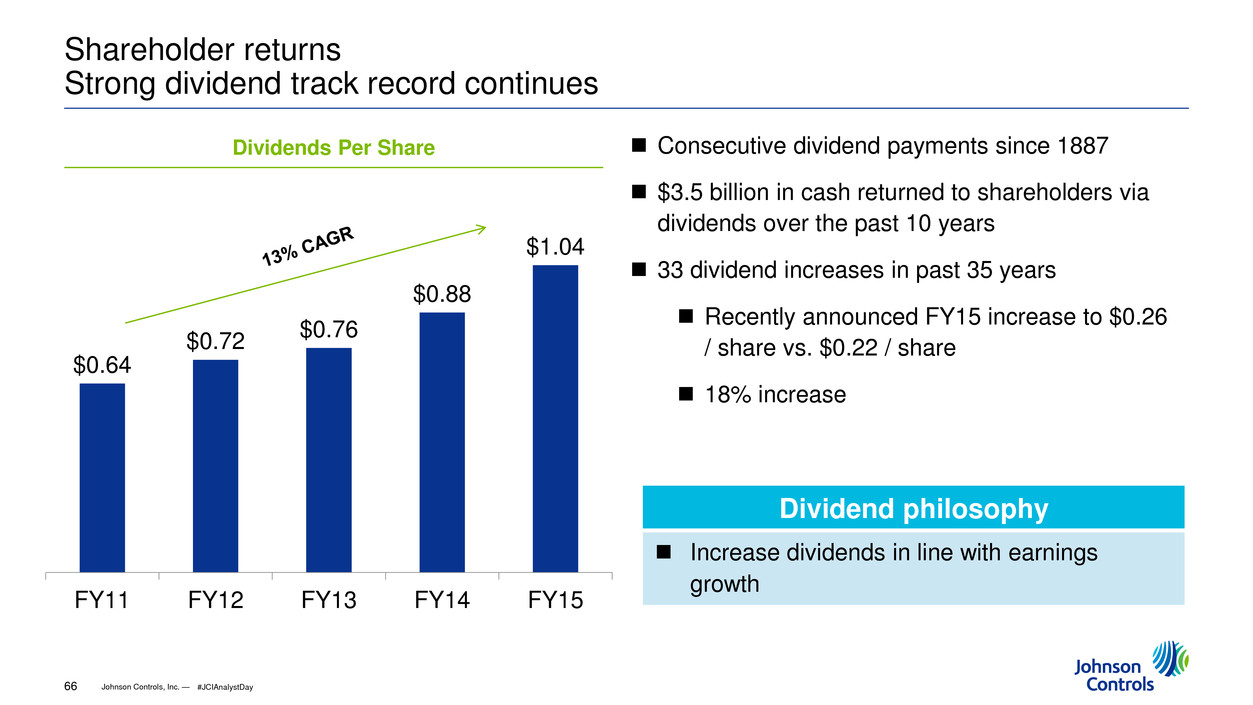

Johnson Controls, Inc. — 66 1/6 2/6 4/6 5/6 1/4 3/4 1/2 $0.64 $0.72 $0.76 $0.88 $1.04 FY11 FY12 FY13 FY14 FY15 Shareholder returns Strong dividend track record continues Dividends Per Share Consecutive dividend payments since 1887 $3.5 billion in cash returned to shareholders via dividends over the past 10 years 33 dividend increases in past 35 years Recently announced FY15 increase to $0.26 / share vs. $0.22 / share 18% increase Dividend philosophy Increase dividends in line with earnings growth #JCIAnalystDay

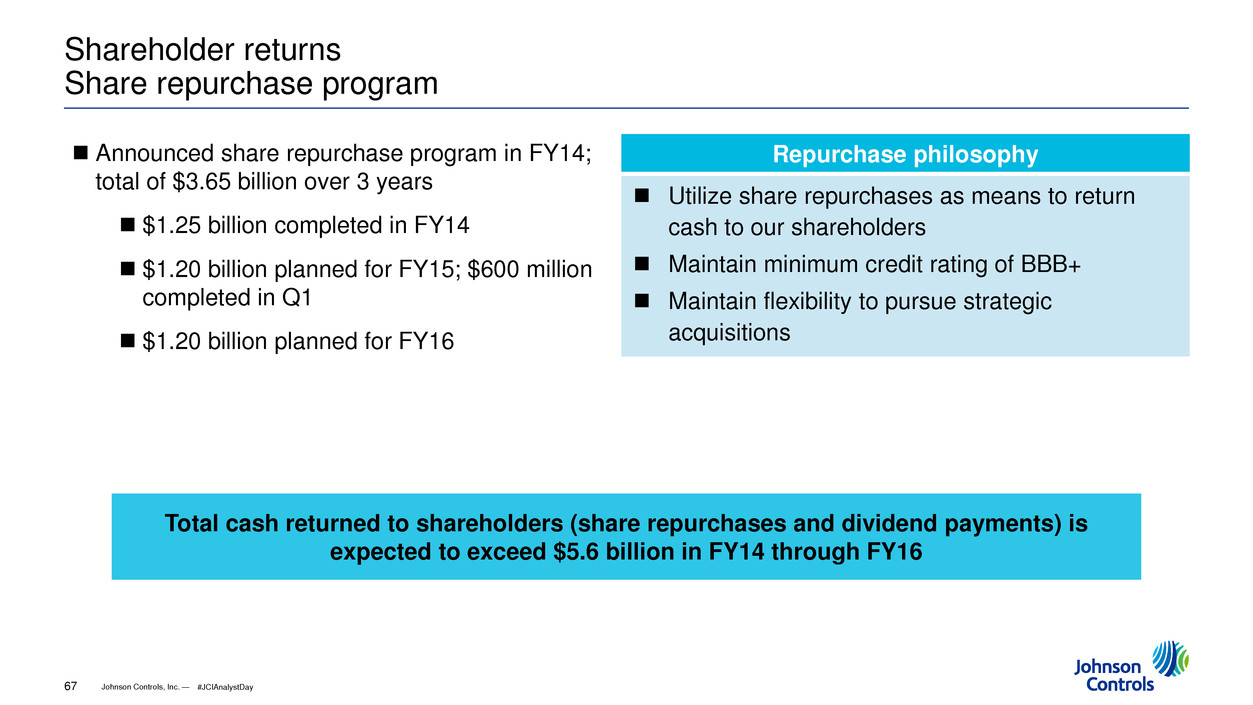

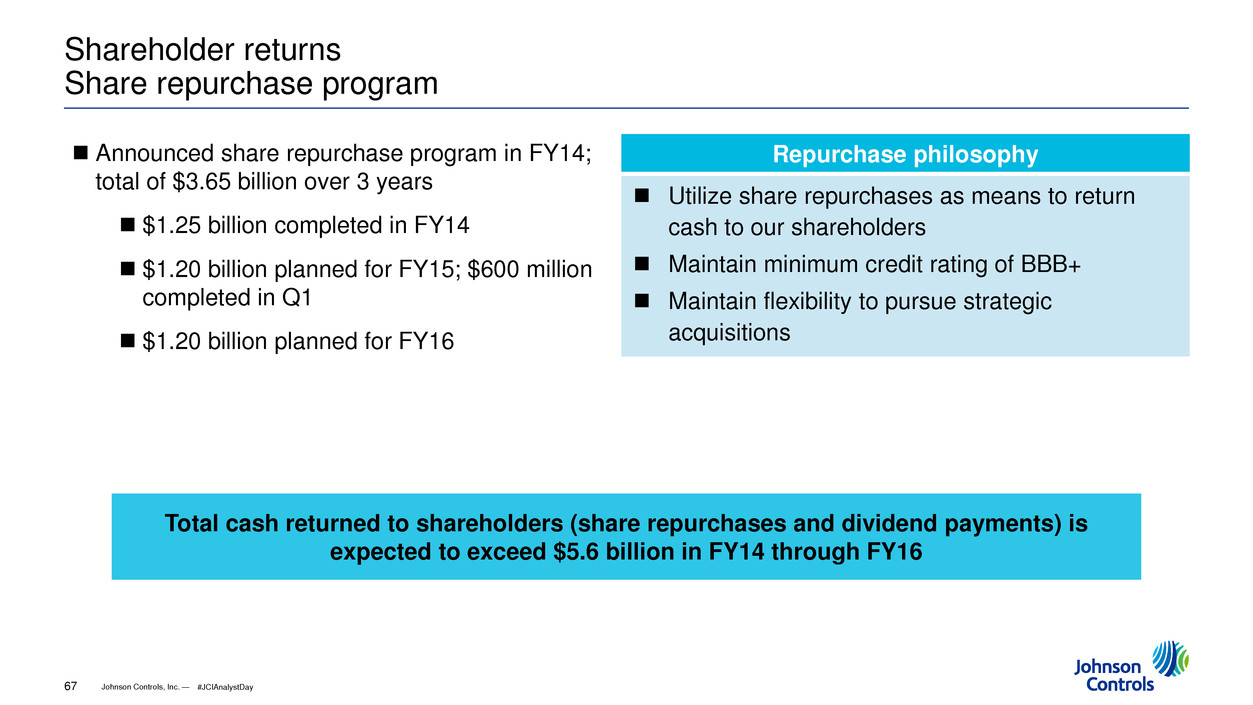

Johnson Controls, Inc. — 67 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Shareholder returns Share repurchase program Announced share repurchase program in FY14; total of $3.65 billion over 3 years $1.25 billion completed in FY14 $1.20 billion planned for FY15; $600 million completed in Q1 $1.20 billion planned for FY16 Total cash returned to shareholders (share repurchases and dividend payments) is expected to exceed $5.6 billion in FY14 through FY16 Repurchase philosophy Utilize share repurchases as means to return cash to our shareholders Maintain minimum credit rating of BBB+ Maintain flexibility to pursue strategic acquisitions #JCIAnalystDay

Johnson Controls, Inc. — 68 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Entering FY15 Good Momentum Improving late-cycle markets Operational improvements continue Expect margin expansion across our businesses Investing for long-term growth and margin expansion Stronger cash flow generation Benefits of cost discipline and pricing initiatives Solid progress on portfolio changes Taking Actions Portfolio – Interiors joint venture, Hitachi joint venture, GWS divestiture and ADT integration Execute restructuring and cost reduction activities Further investments in emerging markets Continuation of share repurchase program Focus on trade working capital improvements Strategic acquisitions #JCIAnalystDay

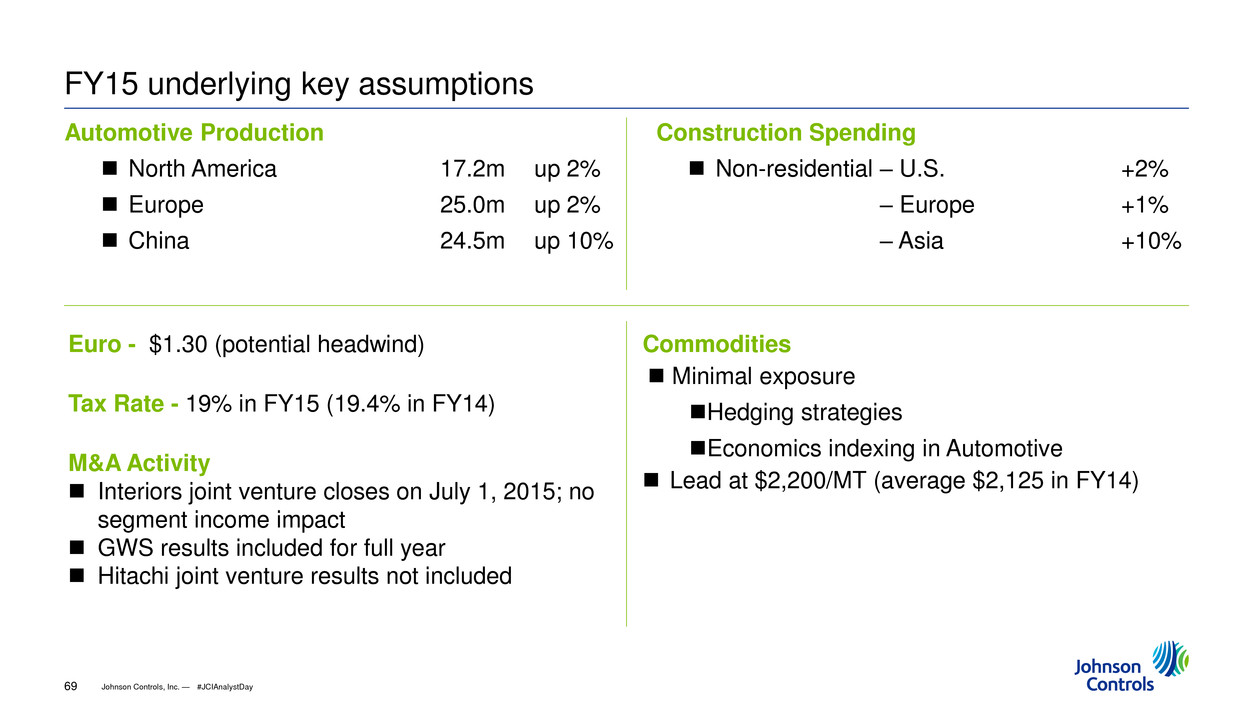

Johnson Controls, Inc. — 69 1/6 2/6 4/6 5/6 1/4 3/4 1/2 FY15 underlying key assumptions Automotive Production North America 17.2m up 2% Europe 25.0m up 2% China 24.5m up 10% Construction Spending Non-residential – U.S. +2% Non-residential – Europe +1% Non-residential – Asia +10% Commodities Minimal exposure Hedging strategies Economics indexing in Automotive Lead at $2,200/MT (average $2,125 in FY14) Euro - $1.30 (potential headwind) Tax Rate - 19% in FY15 (19.4% in FY14) M&A Activity Interiors joint venture closes on July 1, 2015; no segment income impact GWS results included for full year Hitachi joint venture results not included #JCIAnalystDay

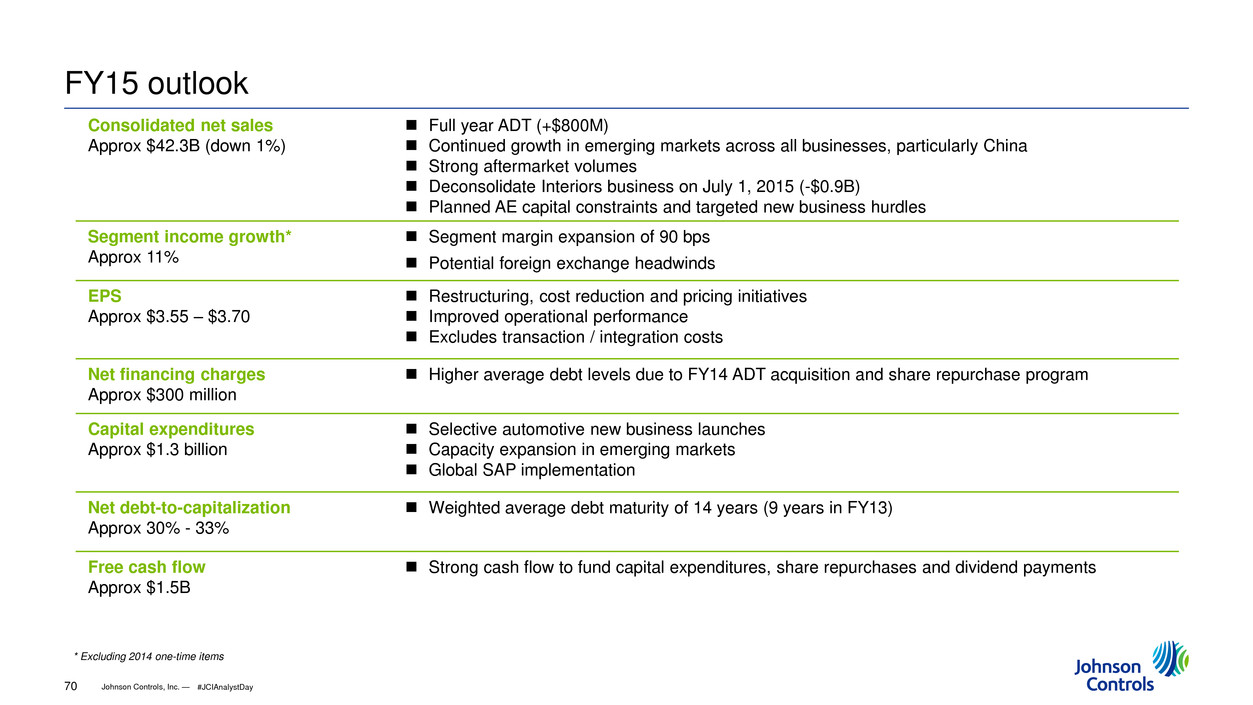

Johnson Controls, Inc. — 70 1/6 2/6 4/6 5/6 1/4 3/4 1/2 FY15 outlook Consolidated net sales Approx $42.3B (down 1%) Full year ADT (+$800M) Continued growth in emerging markets across all businesses, particularly China Strong aftermarket volumes Deconsolidate Interiors business on July 1, 2015 (-$0.9B) Planned AE capital constraints and targeted new business hurdles Segment income growth* Approx 11% Segment margin expansion of 90 bps Potential foreign exchange headwinds EPS Approx $3.55 – $3.70 Restructuring, cost reduction and pricing initiatives Improved operational performance Excludes transaction / integration costs Net financing charges Approx $300 million Higher average debt levels due to FY14 ADT acquisition and share repurchase program Capital expenditures Approx $1.3 billion Selective automotive new business launches Capacity expansion in emerging markets Global SAP implementation Net debt-to-capitalization Approx 30% - 33% Weighted average debt maturity of 14 years (9 years in FY13) Free cash flow Approx $1.5B Strong cash flow to fund capital expenditures, share repurchases and dividend payments * Excluding 2014 one-time items #JCIAnalystDay

Johnson Controls, Inc. — 71 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Building Efficiency - excluding Global Workplace Solutions (GWS) FY15 financial outlook Sales growth of 9% to 11% (2% to 4% ex ADT) Modest North America market recovery Growth in China strong, but slowing Strong emerging market growth; Middle East and Latin America markets under pressure Margin expansion to 9.4% - 9.6% Pricing and business model changes – North America reorganization Benefits of cost reduction, procurement and restructuring initiatives Improved Middle East performance Building Efficiency segment reporting under review #JCIAnalystDay

Johnson Controls, Inc. — 72 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Building Efficiency (excluding GWS) Mid-term outlook (through FY19) Sales growth of 6% to 7% Late-cycle market recovery ADT synergies Growth in emerging markets Margin expansion to 11.0% - 12.0% Average annual improvement of 40 to 50 bps ADT margins accretive Johnson Controls Operating System benefits Continuous improvement and supply chain management Pricing and cost reduction initiatives Emerging market growth #JCIAnalystDay

Johnson Controls, Inc. — 73 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Automotive Experience - Seating FY15 financial outlook Sales decline of 5% to 6% Higher volumes in North America and Europe Continued growth in emerging markets, particularly China Planned capital constraints and targeted new business hurdles Margin expansion to 5.4% - 5.7% Ongoing operational improvements Metals and South America turnaround programs Restructuring benefits Procurement initiatives Strong performance in China joint ventures Continued pricing pressure #JCIAnalystDay

Johnson Controls, Inc. — 74 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Automotive Experience - Seating Mid-term outlook (through FY19) Sales growth of 2% to 3% Strong global production volumes Impact of lower capital expenditures and targeted new business hurdles Margin expansion to 7.0% - 8.0% Average annual improvement of 50 to 60 bps Improved Metals and European profitability Johnson Controls Operating System benefits Operational improvements Commercial discipline Strong performance in China joint ventures Seating: Three-year backlog $3.4 billion vs. $2.5 billion in prior year 65% in China #JCIAnalystDay

Johnson Controls, Inc. — 75 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Power Solutions 2015 financial outlook Sales growth of 8% to 10% (7% to 9% ex lead) Higher volumes across all regions and channels Continued improvement in China Market share growth Increasing production of AGM batteries Margin expansion to 16.4% - 16.6% (16.5% - 16.7% ex lead) Operating leverage Volume increases Improving China profitability / AGM volume growth Operational improvements Vertical integration Procurement initiatives Manufacturing efficiencies Pricing and cost reduction initiatives Continued China and advanced battery investments #JCIAnalystDay

Johnson Controls, Inc. — 76 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Power Solutions Mid-term outlook (through FY19) Sales growth of 5% to 6% Growth in China and other emerging markets Continued market share gains Advanced Battery volumes Margin expansion to 18.0% - 19.0% Average annual improvement of 50 bps Improved product mix (AGM) Johnson Controls Operating System benefits Cost reduction initiatives Continued investment in Advanced Battery technologies #JCIAnalystDay

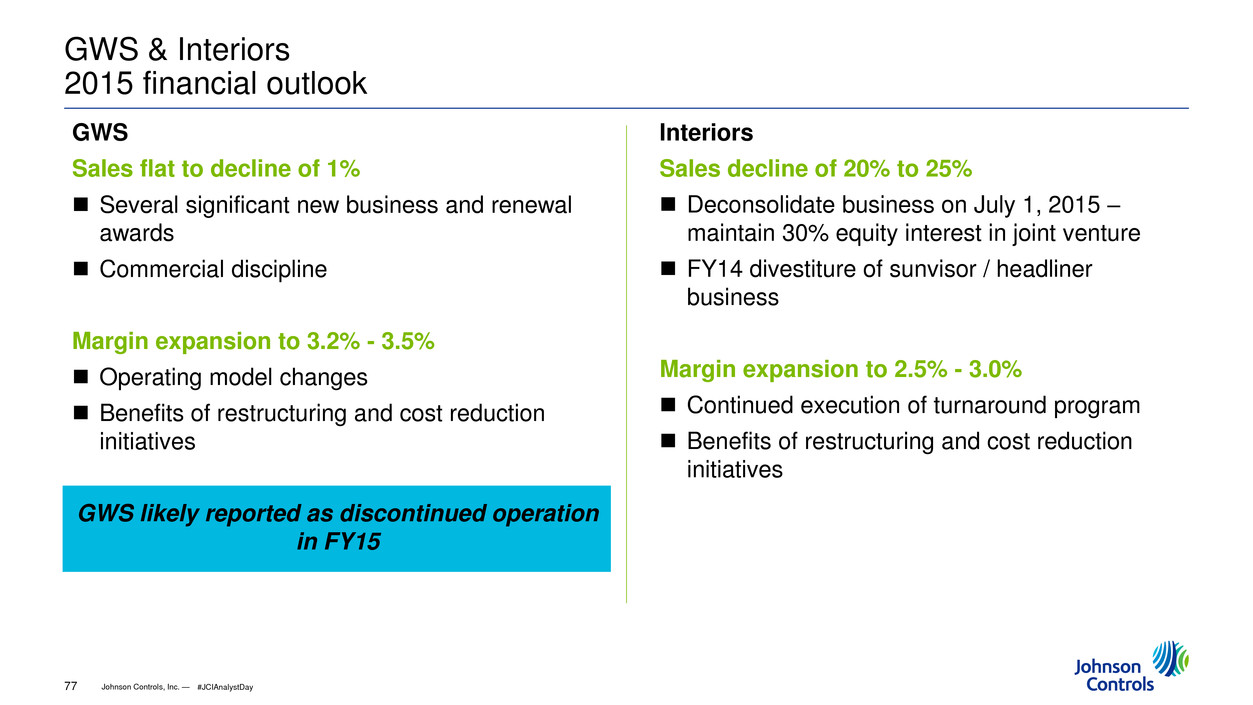

Johnson Controls, Inc. — 77 1/6 2/6 4/6 5/6 1/4 3/4 1/2 GWS & Interiors 2015 financial outlook GWS Sales flat to decline of 1% Several significant new business and renewal awards Commercial discipline Margin expansion to 3.2% - 3.5% Operating model changes Benefits of restructuring and cost reduction initiatives GWS likely reported as discontinued operation in FY15 Interiors Sales decline of 20% to 25% Deconsolidate business on July 1, 2015 – maintain 30% equity interest in joint venture FY14 divestiture of sunvisor / headliner business Margin expansion to 2.5% - 3.0% Continued execution of turnaround program Benefits of restructuring and cost reduction initiatives #JCIAnalystDay

Johnson Controls, Inc. — 78 1/6 2/6 4/6 5/6 1/4 3/4 1/2 China sales at 100% ($billion) 2011 2012 2013 2014 2015 2015 $1.1B Segment Income at 100% $5.1 $5.8 $6.9 $8.5 $10.7 pro-forma $13.7 #JCIAnalystDay

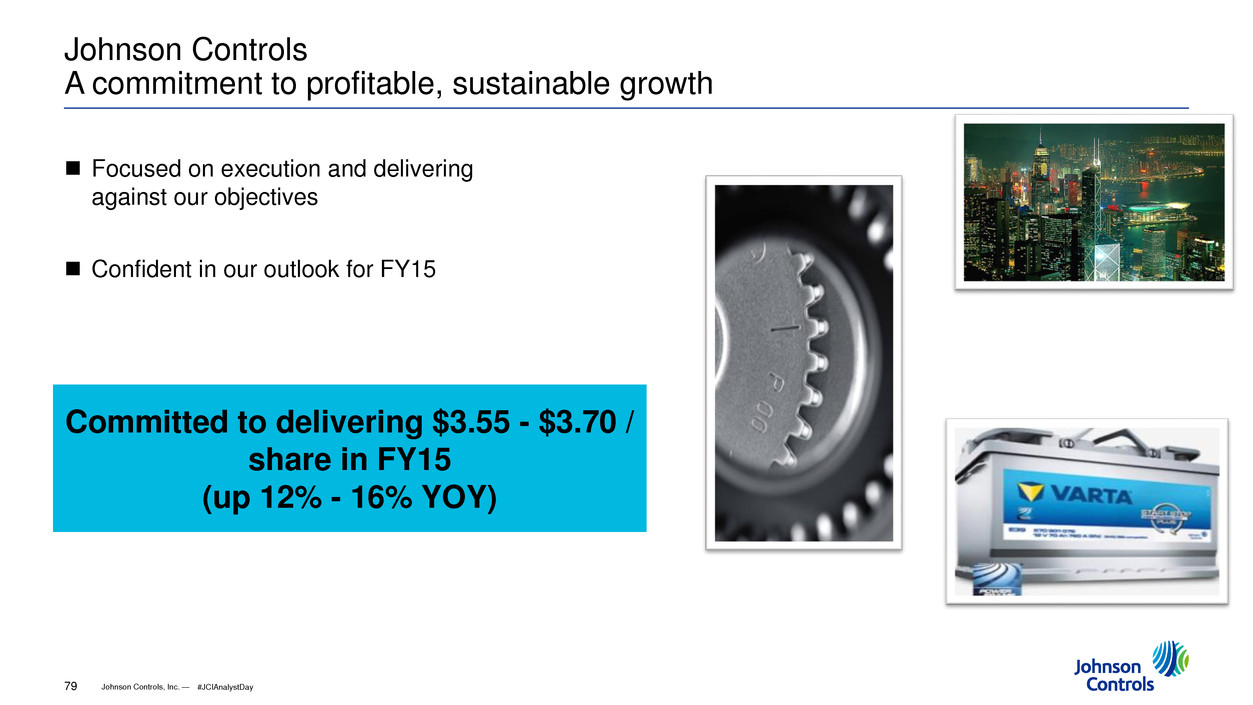

Johnson Controls, Inc. — 79 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Johnson Controls A commitment to profitable, sustainable growth Focused on execution and delivering against our objectives Confident in our outlook for FY15 Committed to delivering $3.55 - $3.70 / share in FY15 (up 12% - 16% YOY) #JCIAnalystDay

Johnson Controls, Inc. — 80 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Johnson Controls, Inc. — 80 Driving sustainable growth and returns in attractive global markets where we can win