1/6 2/6 4/6 5/6 1/4 3/4 1/2 Quarterly update FY 2016 second quarter April 21, 2016 FINAL Exhibit 99.2

Johnson Controls, Inc. — 2 1/6 2/6 4/6 5/6 1/4 3/4 1/2 NO OFFER OR SOLICITATION This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. ADDITIONAL INFORMATION AND WHERE TO FIND IT In connection with the proposed transaction between Johnson Controls, Inc. (“Johnson Controls”) and Tyco International plc (“Tyco”), Tyco has filed with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 that includes a preliminary joint proxy statement of Johnson Controls and Tyco that also constitutes a preliminary prospectus of Tyco (the “Joint Proxy Statement/Prospectus”). These materials are not yet final and will be amended. Johnson Controls and Tyco plan to mail to their respective shareholders the definitive Joint Proxy Statement/Prospectus in connection with the transaction after the registration statement has become effective. INVESTORS AND SECURITY HOLDERS OF JOHNSON CONTROLS AND TYCO ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT JOHNSON CONTROLS, TYCO, THE TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain free copies of the Joint Proxy Statement/Prospectus and other documents filed with the SEC by Johnson Controls and Tyco through the website maintained by the SEC at www.sec.gov. In addition, investors and security holders will be able to obtain free copies of the documents filed with the SEC by Johnson Controls by contacting Johnson Controls Shareholder Services at Shareholder.Services@jci.com or by calling (800) 524-6220 and will be able to obtain free copies of the documents filed with the SEC by Tyco by contacting Tyco Investor Relations at Investorrelations@Tyco.com or by calling (609) 720-4333. April 21, 2016

Johnson Controls, Inc. — 3 1/6 2/6 4/6 5/6 1/4 3/4 1/2 PARTICIPANTS IN THE SOLICITATION Johnson Controls, Tyco and certain of their respective directors, executive officers and employees may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of the respective shareholders of Johnson Controls and Tyco in connection with the proposed transactions, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in the Joint Proxy Statement/Prospectus. Information regarding Johnson Controls’ directors and executive officers is contained in Johnson Controls’ proxy statement for its 2016 annual meeting of shareholders, which was filed with the SEC on December 14, 2015. Information regarding Tyco’s directors and executive officers is contained in Tyco’s proxy statement for its 2016 annual meeting of shareholders, which was filed with the SEC on January 15, 2016. Johnson Controls Cautionary Statement Regarding Forward-Looking Statements There may be statements in this communication that are, or could be, “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and, therefore, subject to risks and uncertainties, including, but not limited to, statements regarding Johnson Controls’ or the combined company’s future financial position, sales, costs, earnings, cash flows, other measures of results of operations, capital expenditures or debt levels are forward- looking statements. Words such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “should,” “forecast,” “project” or “plan” or terms of similar meaning are also generally intended to identify forward-looking statements. Johnson Controls cautions that these statements are subject to numerous important risks, uncertainties, assumptions and other factors, some of which are beyond Johnson Controls’ control, that could cause Johnson Controls April 21, 2016

Johnson Controls, Inc. — 4 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Johnson Controls Cautionary Statement Regarding Forward-Looking Statements (cont.) or the combined company’s actual results to differ materially from those expressed or implied by such forward-looking statements, including, among others, risks related to: Johnson Controls’ and/or Tyco’s ability to obtain necessary regulatory approvals and shareholder approvals or to satisfy any of the other conditions to the transaction on a timely basis or at all, any delay or inability of the combined company to realize the expected benefits and synergies of the transaction, changes in tax laws, regulations, rates, policies or interpretations, the loss of key senior management, anticipated tax treatment of the combined company, the value of the Tyco shares to be issued in the transaction, significant transaction costs and/or unknown liabilities, potential litigation relating to the proposed transaction, the risk that disruptions from the proposed transaction will harm Johnson Controls’ business, competitive responses to the proposed transaction and general economic and business conditions that affect the combined company following the transaction. A detailed discussion of risks related to Johnson Controls’ business is included in the section entitled “Risk Factors” in Johnson Controls’ Annual Report on Form 10-K for the fiscal year ended September 30, 2015 filed with the SEC on November 18, 2015 and Johnson Controls’ quarterly reports on Form 10-Q filed with the SEC after such date, which are available at www.sec.gov and www.johnsoncontrols.com under the “Investors” tab. Any forward-looking statements in this communication are only made as of the date of this communication, unless otherwise specified, and, except as required by law, Johnson Controls assumes no obligation, and disclaims any obligation, to update such statements to reflect events or circumstances occurring after the date of this communication. Statement Required by the Irish Takeover Rules The directors of Johnson Controls accept responsibility for the information contained in this communication. To the best of the knowledge and belief of the directors of Johnson Controls (who have taken all reasonable care to ensure that such is the case), the information contained in this communication is in accordance with the facts and does not omit anything likely to affect the import of such information. April 21, 2016

Johnson Controls, Inc. — 5 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Statement Required by the Irish Takeover Rules (cont.) Centerview Partners LLC is a broker dealer registered with the United States Securities and Exchange Commission and is acting as financial advisor to Johnson Controls and no one else in connection with the proposed transaction. In connection with the proposed transaction, Centerview Partners LLC, its affiliates and related entities and its and their respective partners, directors, officers, employees and agents will not regard any other person as their client, nor will they be responsible to anyone other than Johnson Controls for providing the protections afforded to their clients or for giving advice in connection with the proposed transaction or any other matter referred to in this announcement. Barclays Capital Inc. is a broker dealer registered with the United States Securities and Exchange Commission and is acting as financial advisor to Johnson Controls and no one else in connection with the proposed transaction. In connection with the proposed transaction, Barclays Capital Inc., its affiliates and related entities and its and their respective partners, directors, officers, employees and agents will not regard any other person as their client, nor will they be responsible to anyone other than Johnson Controls for providing the protections afforded to their clients or for giving advice in connection with the proposed transaction or any other matter referred to in this announcement. NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION. This communication is not intended to be and is not a prospectus for the purposes of Part 23 of the Companies Act 2014 of Ireland (the “2014 Act”), Prospectus (Directive 2003/71/EC) Regulations 2005 (S.I. No. 324 of 2005) of Ireland (as amended from time to time) or the Prospectus Rules issued by the Central Bank of Ireland pursuant to section 1363 of the 2014 Act, and the Central Bank of Ireland (“CBI”) has not approved this communication. . April 21, 2016

Johnson Controls, Inc. — 6 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Agenda Second quarter highlights and portfolio updates Alex Molinaroli, President, Chairman and Chief Executive Officer Introduction Kathryn Campbell, Director, Global Investor Relations Business results and financial review Brian Stief, Executive Vice President and Chief Financial Officer Q&A 2 3 4 1 April 21, 2016

1/6 2/6 4/6 5/6 1/4 3/4 1/2 FY2016 second quarter highlights* 7 Johnson Controls, Inc. - * Excluding transaction / integration / separation costs and non-recurring items Organic growth in all businesses Systems and Service North America revenues up 9% (ex. FX), orders up 7% (ex. FX) Record China volumes in Power Solutions Continued y-o-y profitability improvements Segment margins up 160 bps Adjusted earnings per share up 18% Customers embracing transformation Significant customer wins at Building Efficiency New business awards for Automotive Seating and Interiors Johnson Controls-Hitachi (JCH) joint venture integration exceeding expectations Sustainable tax rate reduction from 19% to 17% Increasing full year guidance April 21, 2016

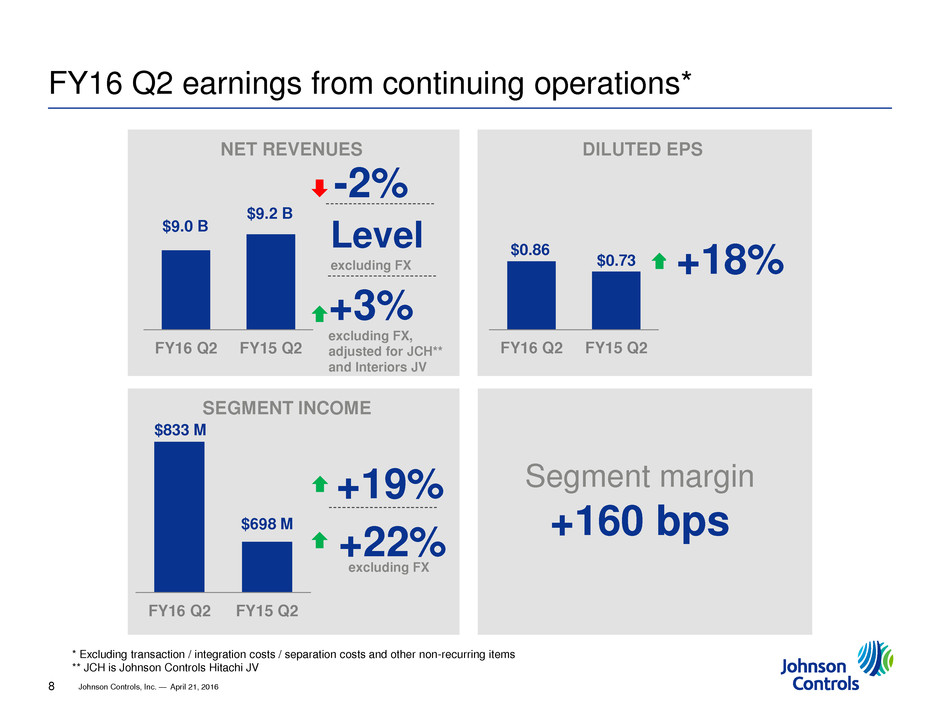

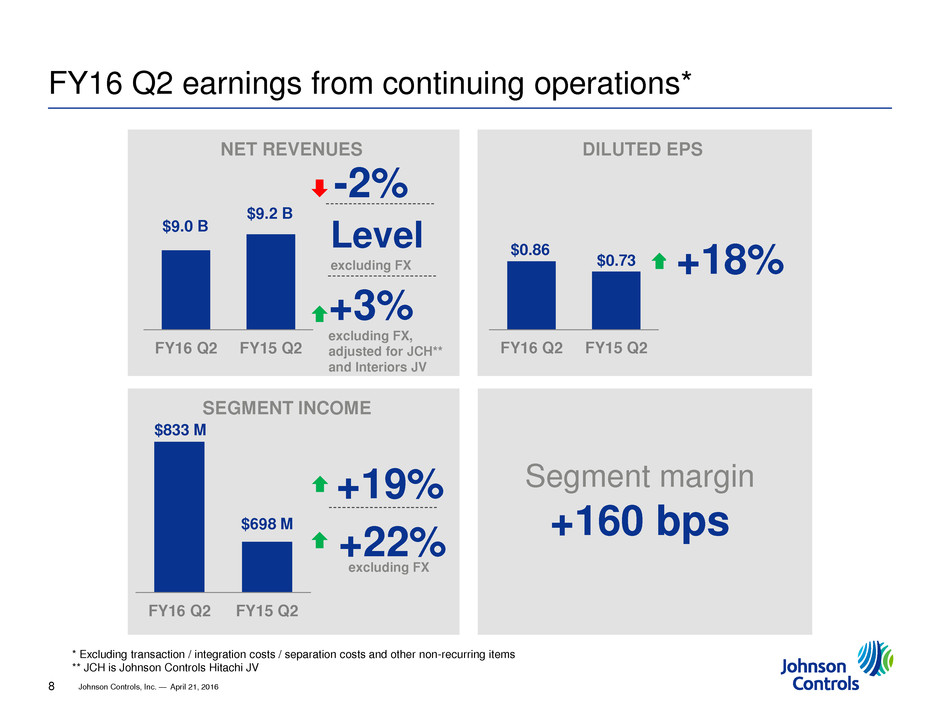

Johnson Controls, Inc. — 8 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Segment margin FY16 Q2 earnings from continuing operations* excluding FX -2% Level +3% FY16 Q2 FY15 Q2 $9.0 B $9.2 B NET REVENUES FY16 Q2 FY15 Q2 $833 M $698 M SEGMENT INCOME +19% +160 bps +18% DILUTED EPS FY16 Q2 FY15 Q2 $0.86 $0.73 * Excluding transaction / integration costs / separation costs and other non-recurring items ** JCH is Johnson Controls Hitachi JV +22% excluding FX excluding FX, adjusted for JCH** and Interiors JV April 21, 2016

Johnson Controls/Tyco Merger* Executing Against Our Day 1 Plan March April May June July August September October November July/August 2016 JCI and Tyco Shareholder meetings to vote on merger October 1, 2016 JCI/Tyco Day 1 legal merger October 2016 BOD meeting to vote on Adient spin-off April 4, 2016 Tyco S-4 initial filing with SEC Clear strategic rationale for merger and multi-industrial transformation Integration principles and governance established Executive Steering Committee and integration teams in place S-4 Registration Statement filed by Tyco HSR regulatory approval received; others proceeding expeditiously On track to deliver $650M of previously announced synergies 9 Johnson Controls, Inc. - April 21, 2016 S-4 Amendments * Reflects anticipated timeline.

Adient Separation on Track* March April May June July August September October November July 1, 2016 Adient’s Operational Day 1 October 31, 2016 Adient’s Legal Day 1 as an independent company April 2016 Adient Form 10 filing with SEC Executive Officers in place; Board of Directors substantially complete Significant progress toward Operational Day 1 Separation costs in-line with previous estimates Effective tax rate to range from 10-12% Key next steps Form 10 expected to be filed by end of April Capital structure under final review Form 10 Amendments 10 Johnson Controls, Inc. - April 21, 2016 * Reflects anticipated timeline.

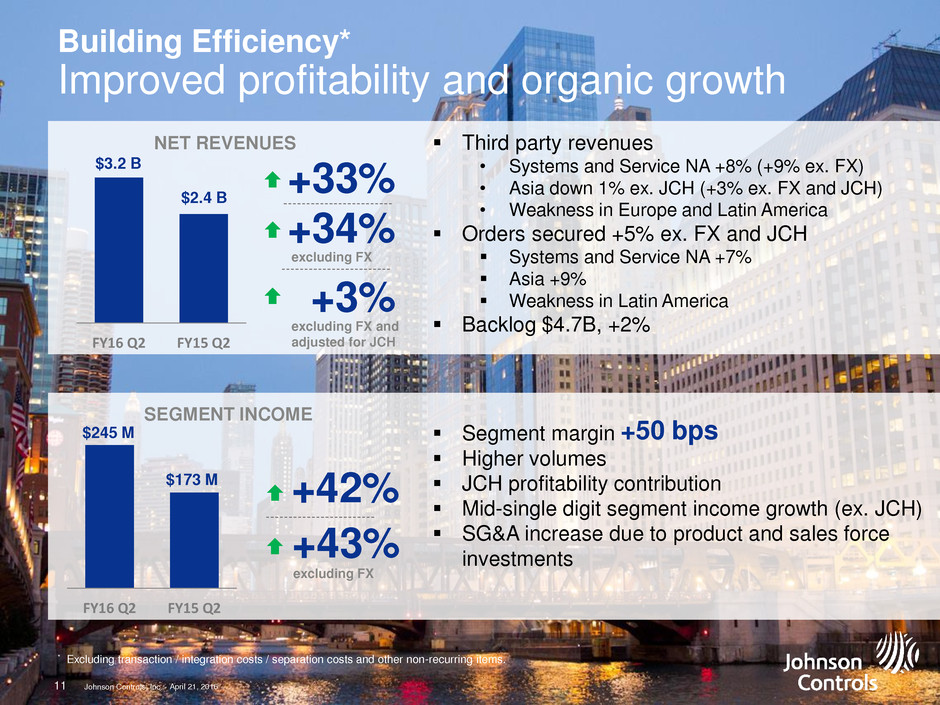

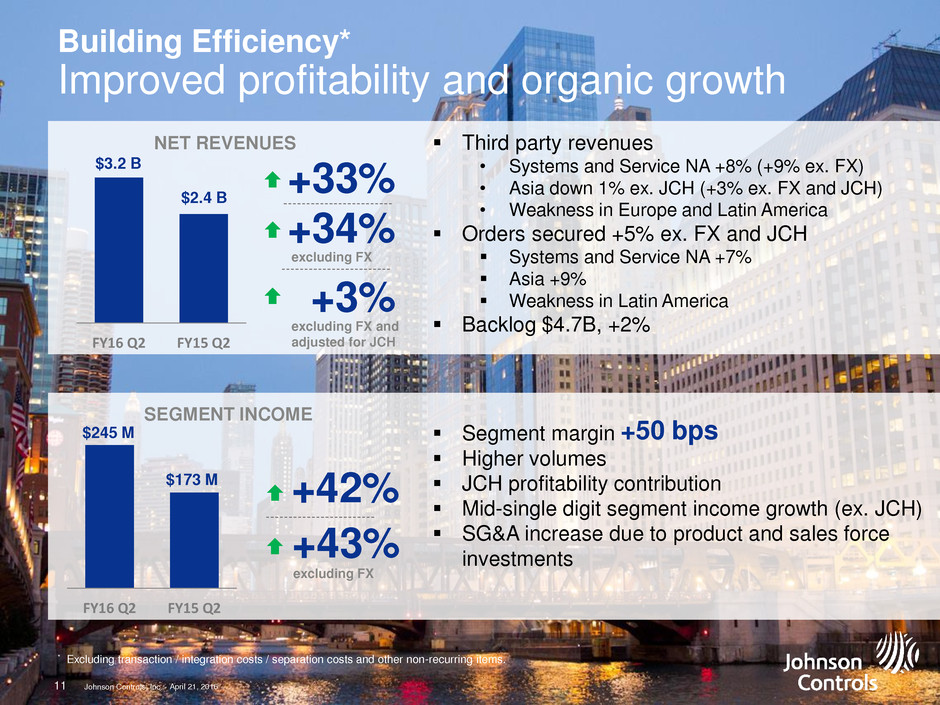

1/6 2/6 4/6 5/6 1/4 3/4 1/2 Building Efficiency* Improved profitability and organic growth +33% +34% +3% FY16 Q2 FY15 Q2 $3.2 B $2.4 B NET REVENUES excluding FX +42% FY16 Q2 FY15 Q2 $245 M $173 M SEGMENT INCOME +43% excluding FX 11 Johnson Controls, Inc. - excluding FX and adjusted for JCH * Excluding transaction / integration costs / separation costs and other non-recurring items. Third party revenues • Systems and Service NA +8% (+9% ex. FX) • Asia down 1% ex. JCH (+3% ex. FX and JCH) • Weakness in Europe and Latin America Orders secured +5% ex. FX and JCH Systems and Service NA +7% Asia +9% Weakness in Latin America Backlog $4.7B, +2% Segment margin Higher volumes JCH profitability contribution Mid-single digit segment income growth (ex. JCH) SG&A increase due to product and sales force investments April 21, 2016 +50 bps

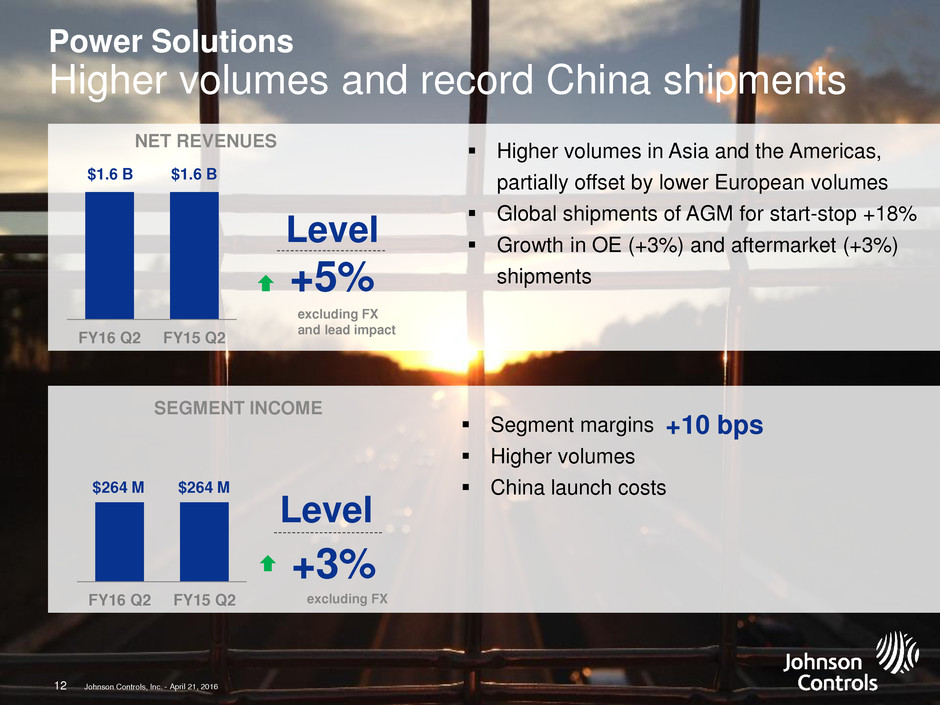

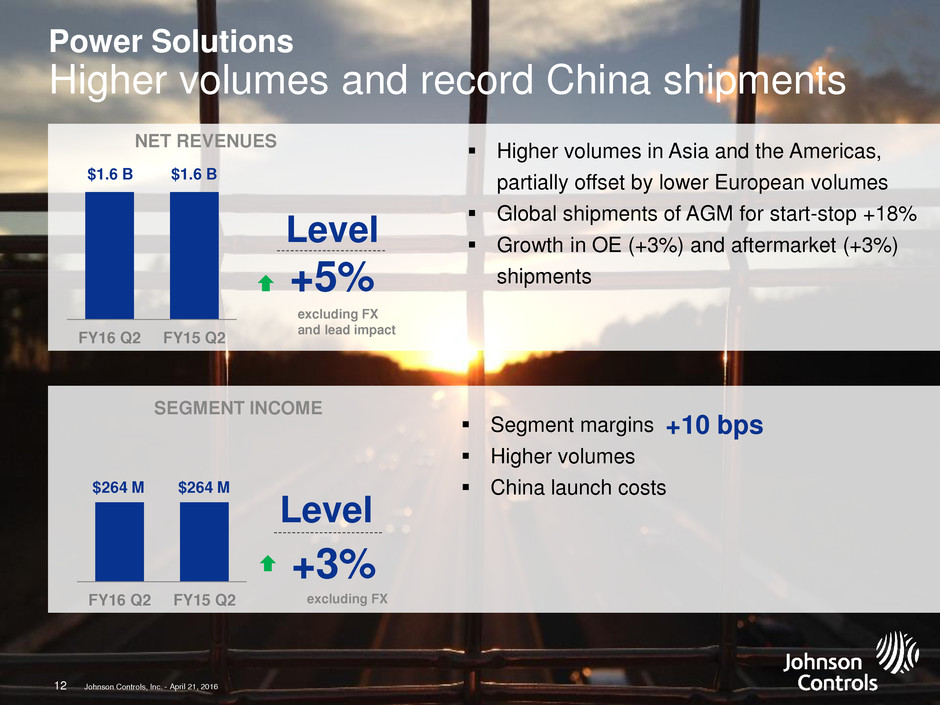

1/6 2/6 4/6 5/6 1/4 3/4 1/2 Power Solutions Higher volumes and record China shipments Segment margins Higher volumes China launch costs Level +5% FY16 Q2 FY15 Q2 $1.6 B $1.6 B NET REVENUES excluding FX and lead impact Level FY16 Q2 FY15 Q2 $264 M $264 M SEGMENT INCOME +3% excluding FX 12 Johnson Controls, Inc. - +10 bps Higher volumes in Asia and the Americas, partially offset by lower European volumes Global shipments of AGM for start-stop +18% Growth in OE (+3%) and aftermarket (+3%) shipments April 21, 2016

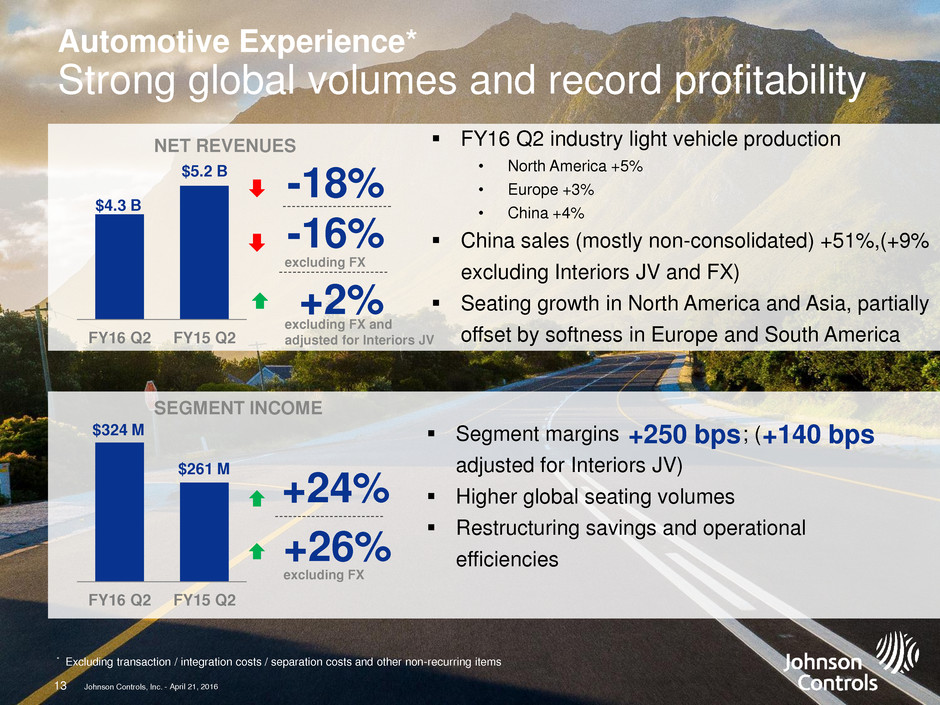

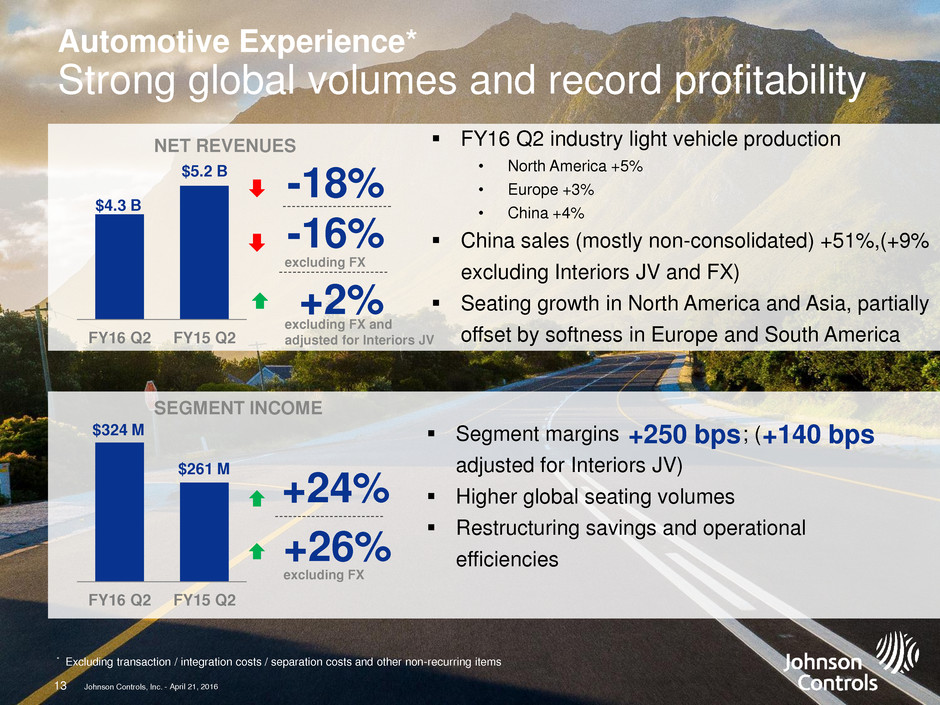

1/6 2/6 4/6 5/6 1/4 3/4 1/2 Automotive Experience* Strong global volumes and record profitability -18% -16% +2% FY16 Q2 FY15 Q2 $4.3 B $5.2 B NET REVENUES excluding FX +24% FY16 Q2 FY15 Q2 $324 M $261 M SEGMENT INCOME +26% excluding FX 13 Johnson Controls, Inc. - excluding FX and adjusted for Interiors JV FY16 Q2 industry light vehicle production • North America +5% • Europe +3% • China +4% China sales (mostly non-consolidated) +51%,(+9% excluding Interiors JV and FX) Seating growth in North America and Asia, partially offset by softness in Europe and South America Segment margins ; ( adjusted for Interiors JV) Higher global seating volumes Restructuring savings and operational efficiencies +250 bps +140 bps April 21, 2016 * Excluding transaction / integration costs / separation costs and other non-recurring items

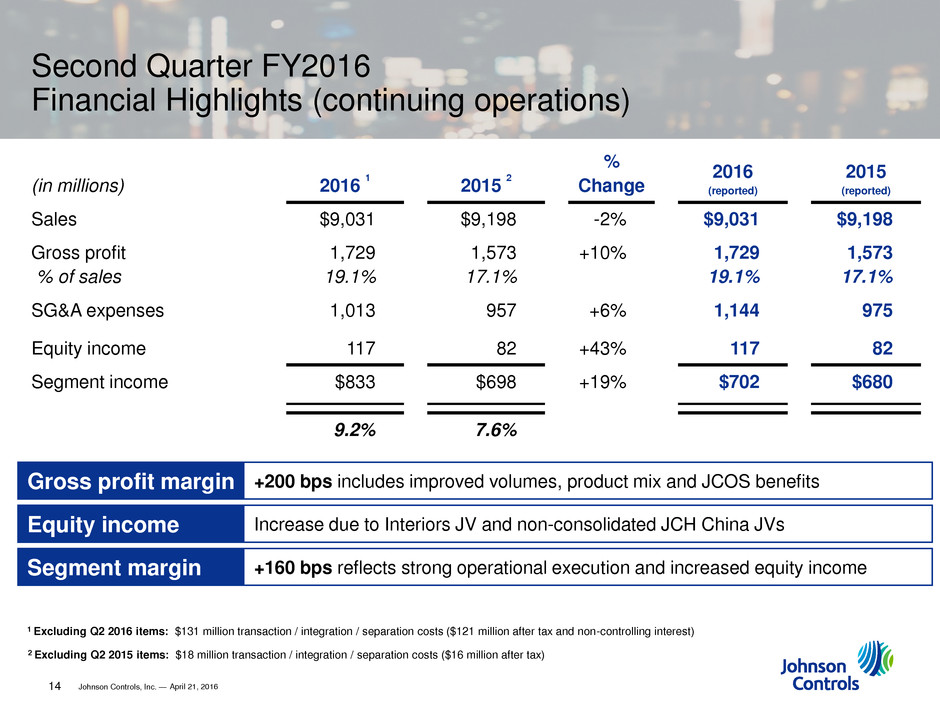

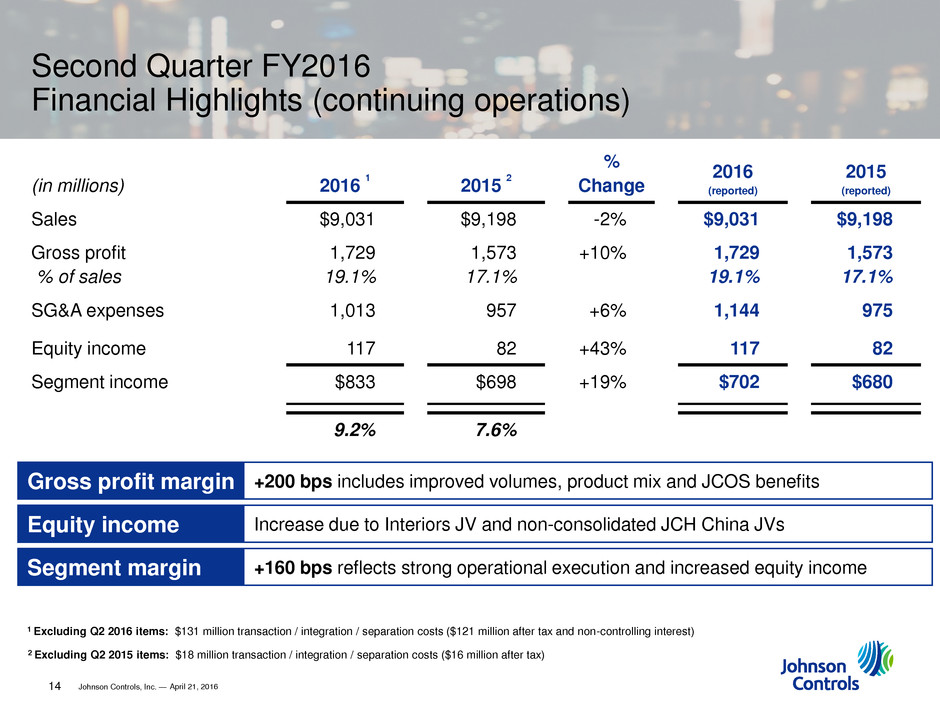

Johnson Controls, Inc. — 14 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Second Quarter 2015 Financial Highlights (continuing operations) Second Quarter FY2016 Financial Highlights (continuing operations) 1 Excluding Q2 2016 items: $131 million transaction / integration / separation costs ($121 million after tax and non-controlling interest) (in millions) 2016 1 2015 2 % Change 2016 (reported) 2015 (reported) Sales $9,031 $9,198 -2% $9,031 $9,198 Gross profit % of sales 1,729 19.1% 1,573 17.1% +10% 1,729 19.1% 1,573 17.1% SG&A expenses 1,013 957 +6% 1,144 975 Equity income 117 82 +43% 117 82 Segment income $833 $698 +19% $702 $680 9.2% 7.6% 2 Excluding Q2 2015 items: $18 million transaction / integration / separation costs ($16 million after tax) Gross profit margin +200 bps includes improved volumes, product mix and JCOS benefits Equity income Increase due to Interiors JV and non-consolidated JCH China JVs Segment margin +160 bps reflects strong operational execution and increased equity income April 21, 2016

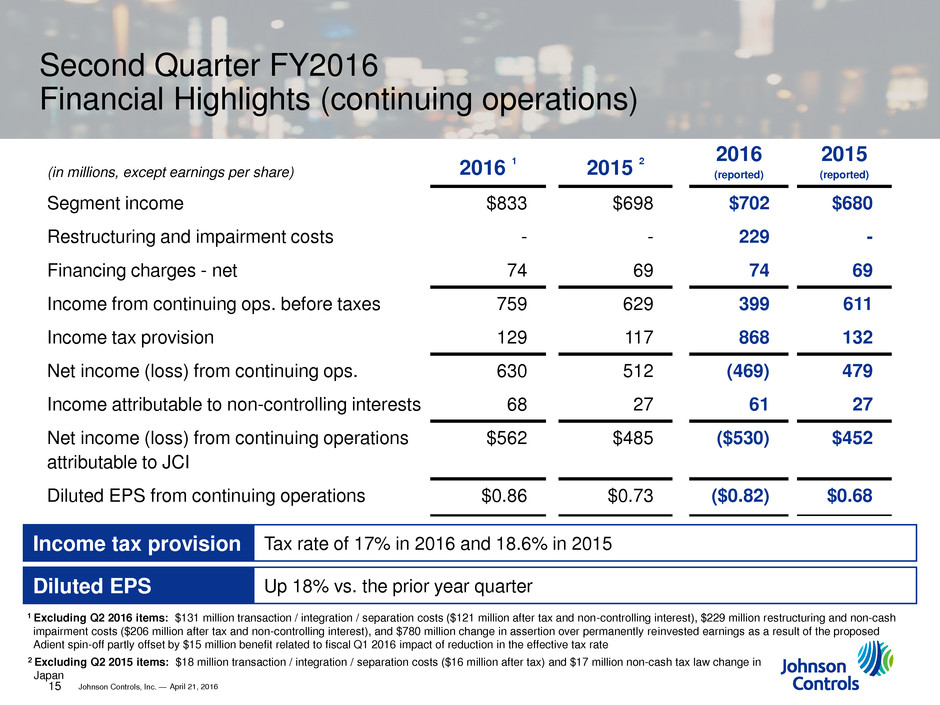

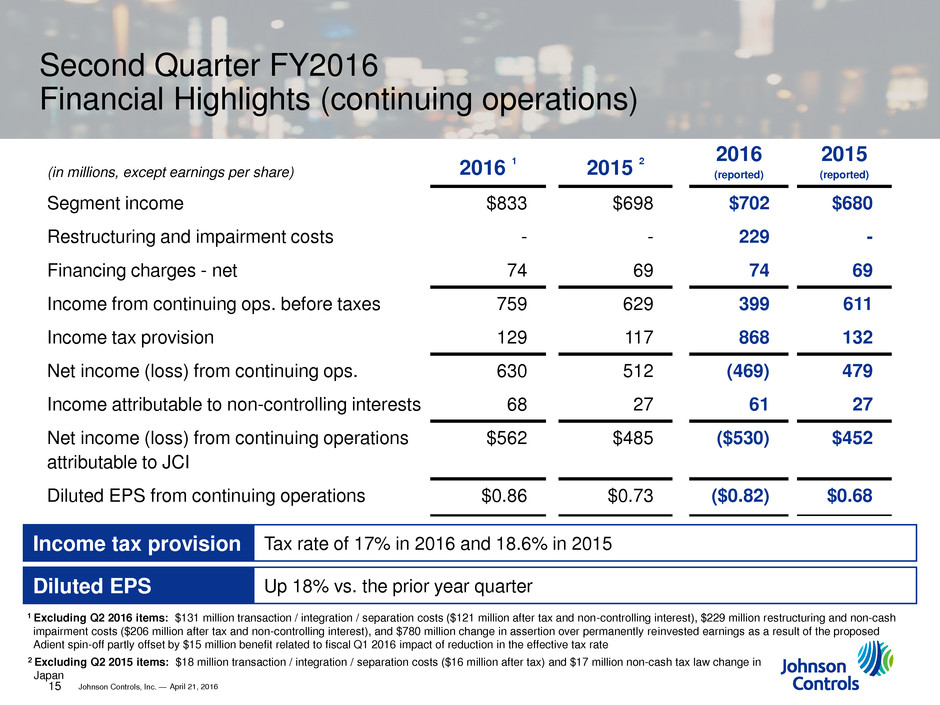

Johnson Controls, Inc. — 15 1/6 2/6 4/6 5/6 1/4 3/4 1/2 (in millions, except earnings per share) 2016 1 2015 2 2016 (reported) 2015 (reported) Segment income $833 $698 $702 $680 Restructuring and impairment costs - - 229 - Financing charges - net 74 69 74 69 Income from continuing ops. before taxes 759 629 399 611 Income tax provision 129 117 868 132 Net income (loss) from continuing ops. 630 512 (469) 479 Income attributable to non-controlling interests 68 27 61 27 Net income (loss) from continuing operations attributable to JCI $562 $485 ($530) $452 Diluted EPS from continuing operations $0.86 $0.73 ($0.82) $0.68 Second Quarter 2015 Financial Highlights (continuing operations) Second Quarter FY2016 Financial Highlights (continuing operations) Income tax provision Tax rate of 17% in 2016 and 18.6% in 2015 Diluted EPS Up 18% vs. the prior year quarter 1 Excluding Q2 2016 items: $131 million transaction / integration / separation costs ($121 million after tax and non-controlling interest), $229 million restructuring and non-cash impairment costs ($206 million after tax and non-controlling interest), and $780 million change in assertion over permanently reinvested earnings as a result of the proposed Adient spin-off partly offset by $15 million benefit related to fiscal Q1 2016 impact of reduction in the effective tax rate 2 Excluding Q2 2015 items: $18 million transaction / integration / separation costs ($16 million after tax) and $17 million non-cash tax law change in Japan April 21, 2016

Johnson Controls, Inc. — 16 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Second Quarter 2015 Financial Highlights (continuing operations) Balance Sheet and Cash Flow Strong balance sheet Net debt to capitalization of 40.0% at 3/31/16 vs prior year of 41.2% and 39.1% at 12/31/15 Net debt of $6.7B at both 3/31/16 and 12/31/15 Capex of $0.3B in the quarter; in line with expectations Free Cash Flow of $0.4B versus prior year Q2 of $0.1B Plan to resume share repurchases; $0.5B by end of fiscal 2016 April 21, 2016

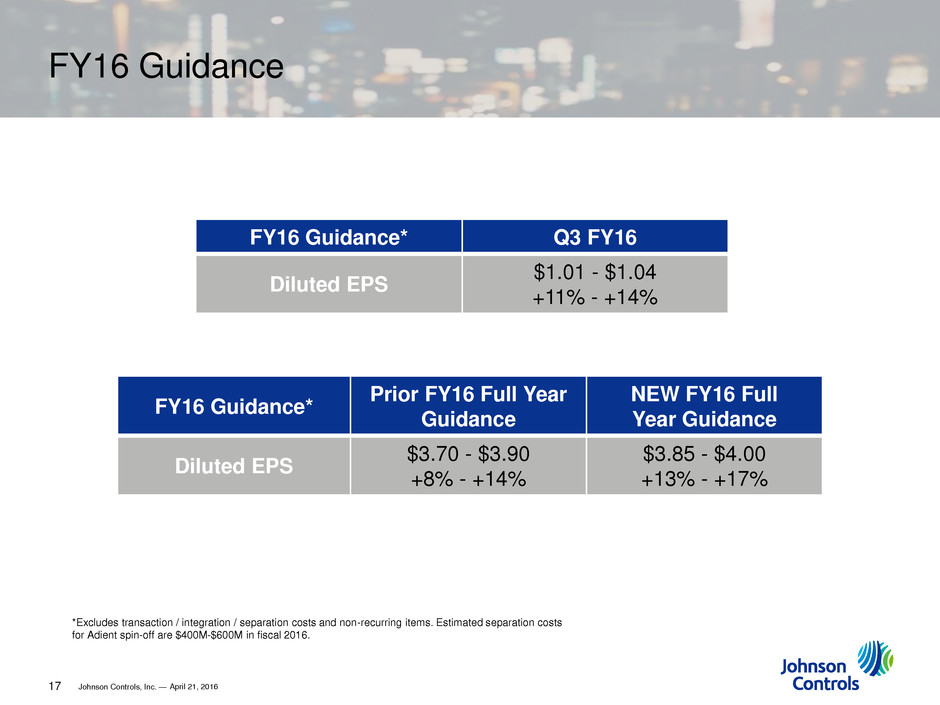

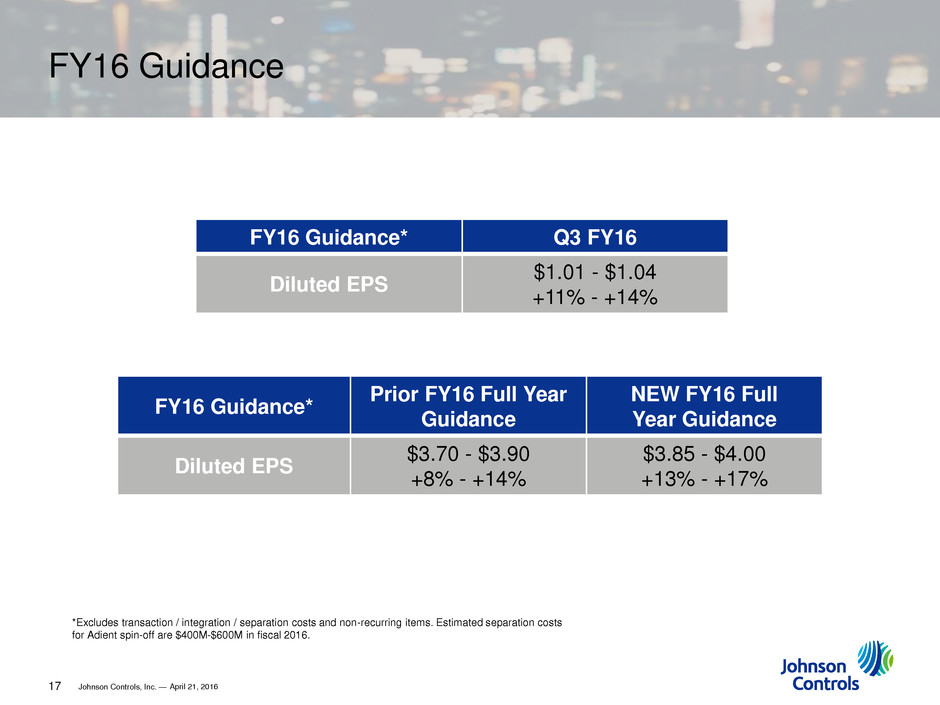

Johnson Controls, Inc. — 17 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Second Quarter 2015 Financial Highlights (continuing operations) FY16 Guidance FY16 Guidance* Q3 FY16 Diluted EPS $1.01 - $1.04 +11% - +14% *Excludes transaction / integration / separation costs and non-recurring items. Estimated separation costs for Adient spin-off are $400M-$600M in fiscal 2016. FY16 Guidance* Prior FY16 Full Year Guidance NEW FY16 Full Year Guidance Diluted EPS $3.70 - $3.90 +8% - +14% $3.85 - $4.00 +13% - +17% April 21, 2016

1/6 2/6 4/6 5/6 1/4 3/4 1/2 Appendix

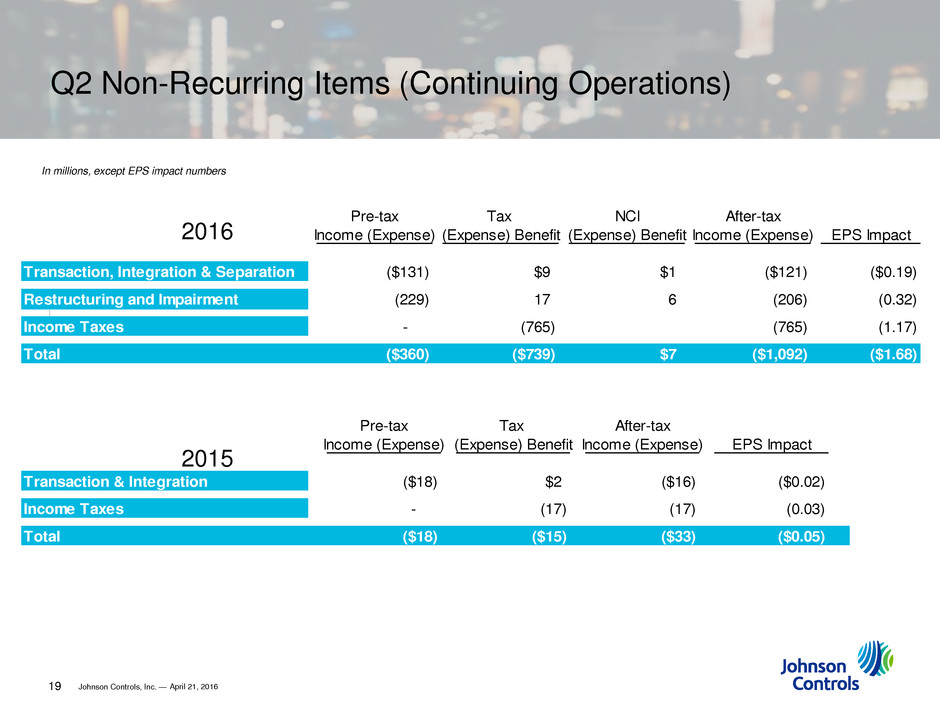

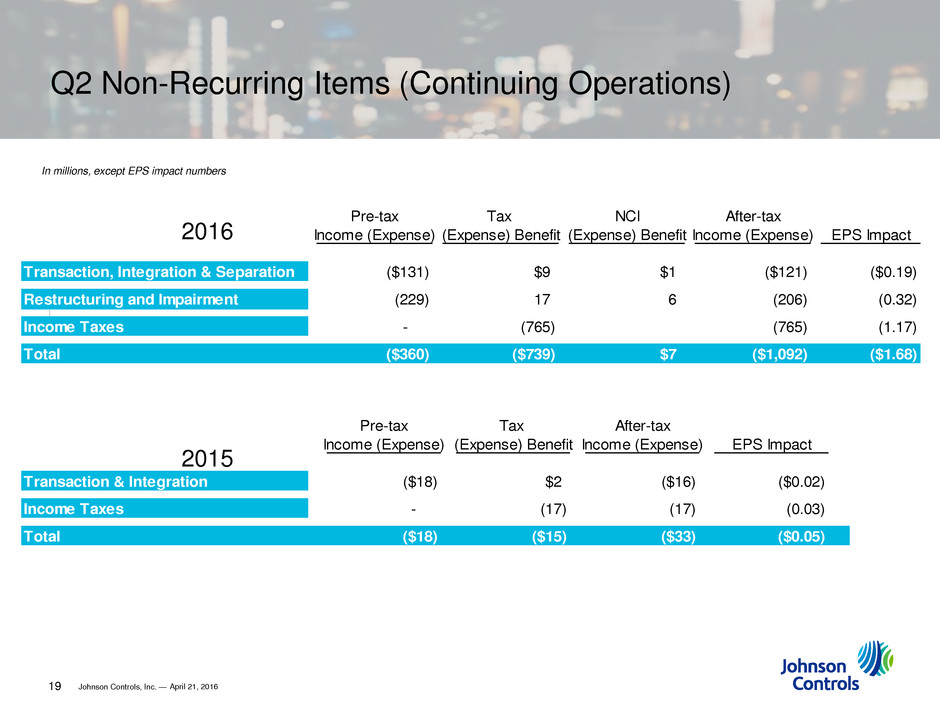

Johnson Controls, Inc. — 19 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Second Quarter 2015 Financial Highlights (continuing operations) Q2 Non-Recurring Items (Continuing Operations) Pre-tax Tax NCI After-tax Income (Expense) (Expense) Benefit (Expense) Benefit Income (Expense) EPS Impact Transaction, Integration & Separation ($131) $9 $1 ($121) ($0.19) Restructuring and Impairment (229) 17 6 (206) (0.32) Income Taxes - (765) (765) (1.17) Total ($360) ($739) $7 ($1,092) ($1.68)Pre-tax Tax After-tax Income (Expense) (Expense) Benefit Income (Expense) EPS Impact Transaction & Integration ($18) $2 ($16) ($0.02) Income Taxes - (17) (17) (0.03) Total ($18) ($15) ($33) ($0.05) 2016 2015 April 21, 2016 In millions, except EPS impact numbers

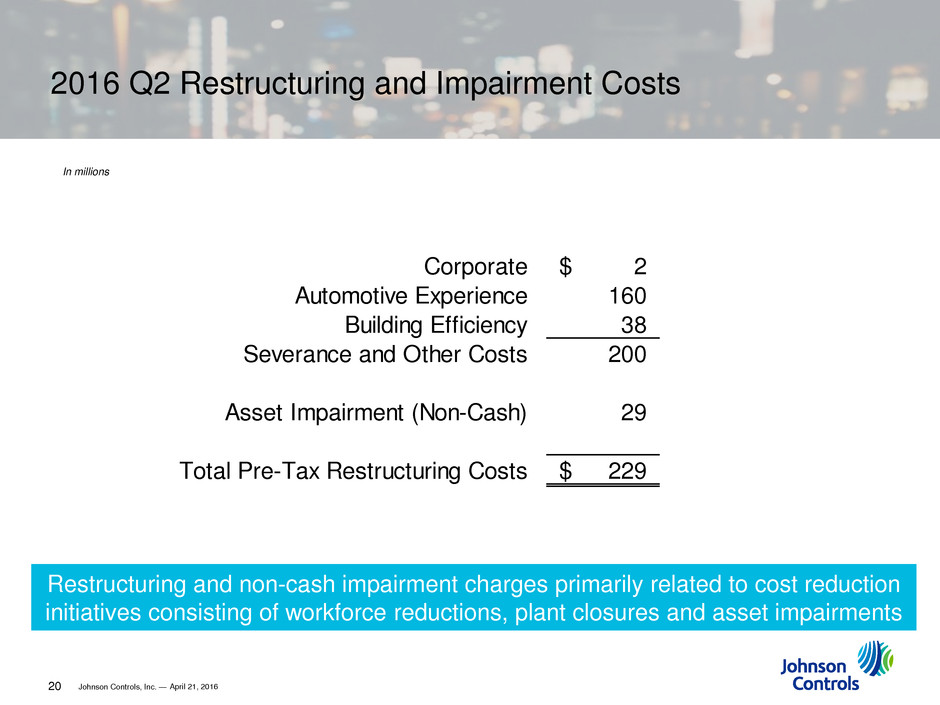

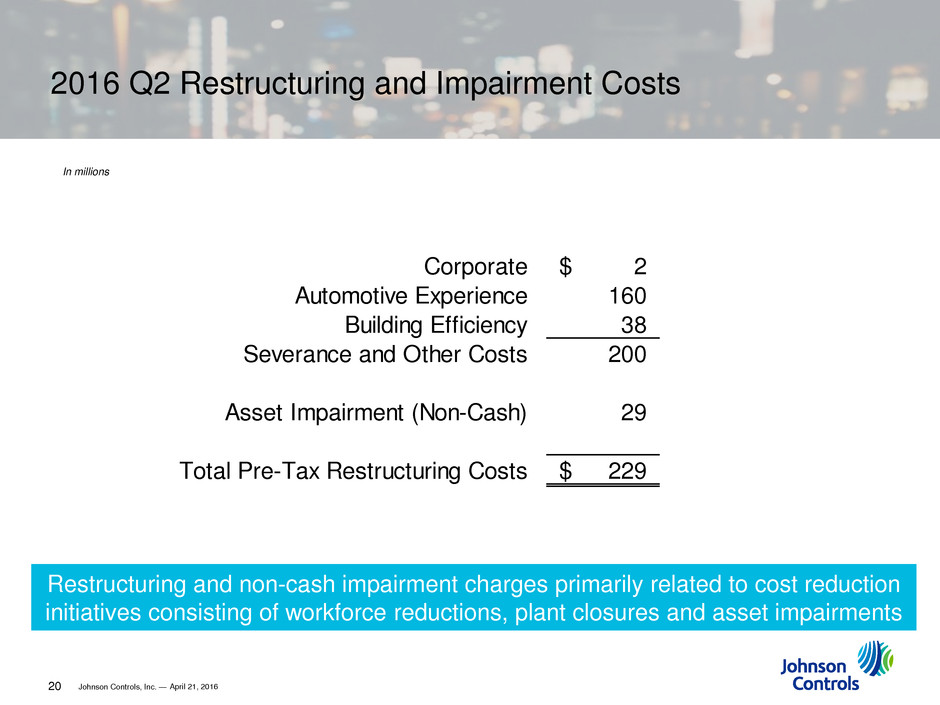

Johnson Controls, Inc. — 20 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Second Quarter 2015 Financial Highlights (continuing operations) 2016 Q2 Restructuring and Impairment Costs Restructuring and non-cash impairment charges primarily related to cost reduction initiatives consisting of workforce reductions, plant closures and asset impairments April 21, 2016 Corporate 2$ Automotive Experience 160 Building Efficiency 38 Severance and Other Costs 200 Asset Impairment (Non-Cash) 29 Total Pre-Tax Restructuring Costs 229$ In millions

1/6 2/6 4/6 5/6 1/4 3/4 1/2 johnsoncontrols.com/investors @JCI_IR