UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-00524

BNY Mellon Investment Funds III

(Exact Name of Registrant as Specified in Charter)

c/o BNY Mellon Investment Adviser, Inc.

240 Greenwich Street

New York, New York 10286

(Address of Principal Executive Offices) (Zip Code)

Deirdre Cunnane, Esq.

240 Greenwich Street

New York, New York 10286

(Name and Address of Agent for Service)

Registrant's Telephone Number, including Area Code: (212) 922-6400

Date of fiscal year end: 10/31

Date of reporting period: 10/31/24

The following N-CSR relates only to the Registrant's series listed below and does not relate to any series of the Registrant with a different fiscal year end and, therefore, different N-CSR reporting requirements. A separate N-CSR will be filed for any series with a different fiscal year end, as appropriate.

BNY Mellon Global Equity Income Fund

BNY Mellon International Bond Fund

FORM N-CSR

Item 1. Reports to Stockholders.

| | |

BNY Mellon Global Equity Income Fund | ANNUAL

SHAREHOLDER

REPORT OCTOBER 31, 2024 |

| | |

Class A – DEQAX

This annual shareholder report contains important information about BNY Mellon Global Equity Income Fund (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at bny.com/investments/literaturecenter. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bny.com.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| | | |

Share Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Class A | $137 | 1.24% |

How did the Fund perform last year?

• For the 12-month period ended October 31, 2024, the Fund’s Class A shares returned 21.18%.

• In comparison, the FTSE World Index returned 33.62% for the same period.

What affected the Fund’s performance?

• Easing U.S. monetary policy and a greater appetite for risk helped drive strong market returns during the period.

• On a sector basis, the Fund benefited most from stock selection in the materials sector, attributable to a gold miner holding and another mining stock that was a takeover target.

• On a country basis, the Fund benefited most from its underweight position in Japan, which underperformed the wider market, and from security selection in Spain.

• On a sector basis, information technology detracted most from relative performance, largely due to zero exposure to two low-yielding Index heavyweights.

| | | |

Not FDIC Insured. Not Bank-Guaranteed. May Lose Value | |

|

| | |

How did the Fund perform over the past 10 years? The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. | Cumulative Performance from November 1, 2014 through October 31, 2024

Initial Investment of $10,000 ![10KLineChartData(FTSE World Index[BroadBasedIndex]|2014-10-31:10000,2015-10-31:10100,2016-10-31:10357,2017-10-31:12811,2018-10-31:12905,2019-10-31:14602,2020-10-31:15224,2021-10-31:21352,2022-10-31:17425,2023-10-31:19408,2024-10-31:25933|BNY Mellon Global Equity Income Fund (Class A)|2014-10-31:9425,2015-10-31:9833,2016-10-31:10453,2017-10-31:11948,2018-10-31:12323,2019-10-31:14030,2020-10-31:12807,2021-10-31:17079,2022-10-31:15911,2023-10-31:16937,2024-10-31:20524) 10KLineChartData(FTSE World Index[BroadBasedIndex]|2014-10-31:10000,2015-10-31:10100,2016-10-31:10357,2017-10-31:12811,2018-10-31:12905,2019-10-31:14602,2020-10-31:15224,2021-10-31:21352,2022-10-31:17425,2023-10-31:19408,2024-10-31:25933|BNY Mellon Global Equity Income Fund (Class A)|2014-10-31:9425,2015-10-31:9833,2016-10-31:10453,2017-10-31:11948,2018-10-31:12323,2019-10-31:14030,2020-10-31:12807,2021-10-31:17079,2022-10-31:15911,2023-10-31:16937,2024-10-31:20524)](https://capedge.com/proxy/N-CSR/0001741773-24-004851/img_2905fd8c9aae4f2.jpg)

Years Ended 10/31 |

The above graph compares a hypothetical $10,000 investment in the Fund’s Class A shares to a hypothetical investment of $10,000 made in the FTSE World Index (the “Index”) on 10/31/2014. The performance shown takes into account the maximum initial sales charge on Class A shares and applicable fees and expenses of the Fund, including management fees and other expenses. The Fund’s performance also assumes the reinvestment of dividends and capital gains. Unlike the Fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index.

| | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS (AS OF 10/31/24) |

Class A Shares | 1YR | 5YR | 10YR |

with Maximum Sales Charge - 5.75% | 14.22% | | 6.64% | | 7.45% | |

without Sales Charge | 21.18% | | 7.91% | | 8.09% | |

FTSE World Index | 33.62% | | 12.17% | | 10.00% | |

The performance data quoted represent past performance, which is no guarantee of future results. For more current information visit bny.com/investments/literaturecenter.

KEY FUND STATISTICS (AS OF 10/31/24)

| | | | |

Fund Size (Millions) | Number of Holdings | Total Advisory Fee Paid During Period | Annual Portfolio Turnover |

$222 | 59 | $2,047,112 | 52.55% |

| | | |

Not FDIC Insured. Not Bank-Guaranteed. May Lose Value | |

|

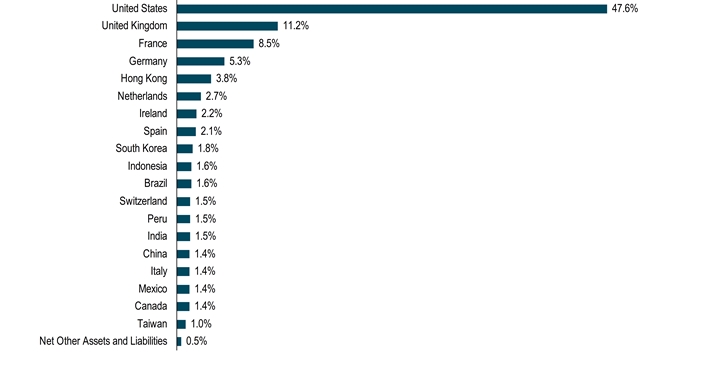

Portfolio Holdings (as of 10/31/24)

Top Ten Holdings (Based on Net Assets)*

![LargestHoldingsData([CME Group, Inc.]:3.2,Sanofi SA:3.2,[Cisco Systems, Inc.]:3,[PepsiCo, Inc.]:2.3,Medtronic PLC:2.2,[Gilead Sciences, Inc.]:2.2,AIA Group Ltd.:2.2,Industria de Diseno Textil SA:2.2,Starbucks Corp.:2.1,[Omnicom Group, Inc.]:2.1) LargestHoldingsData([CME Group, Inc.]:3.2,Sanofi SA:3.2,[Cisco Systems, Inc.]:3,[PepsiCo, Inc.]:2.3,Medtronic PLC:2.2,[Gilead Sciences, Inc.]:2.2,AIA Group Ltd.:2.2,Industria de Diseno Textil SA:2.2,Starbucks Corp.:2.1,[Omnicom Group, Inc.]:2.1)](https://capedge.com/proxy/N-CSR/0001741773-24-004851/img_d2c169645f3f4f2.jpg)

* Excludes money market funds or other short-term securities held for the investment of cash and cash collateral for securities loaned, if any.

| | | |

Not FDIC Insured. Not Bank-Guaranteed. May Lose Value | |

|

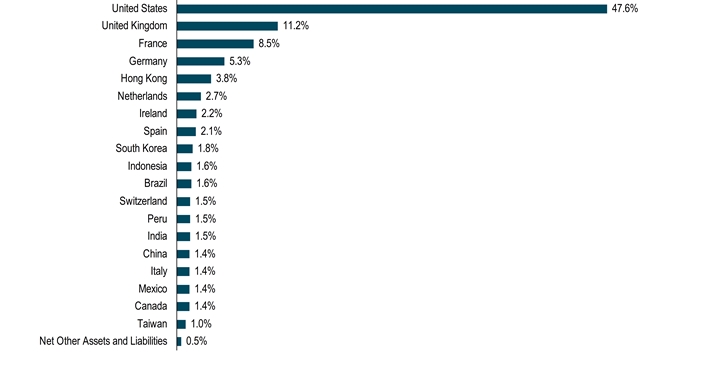

Country Allocation (Based on Net Assets)

For additional information about the Fund, including its prospectus, financial information, portfolio holdings and proxy voting information, please visit bny.com/investments/literaturecenter.

| | |

© 2024 BNY Mellon Securities Corporation, Distributor,

240 Greenwich Street, 9th Floor, NewYork, NY 10286

Code-6175AR1024 |

|

| | |

BNY Mellon Global Equity Income Fund | ANNUAL

SHAREHOLDER

REPORT OCTOBER 31, 2024 |

| | |

Class C – DEQCX

This annual shareholder report contains important information about BNY Mellon Global Equity Income Fund (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at bny.com/investments/literaturecenter. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bny.com.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| | | |

Share Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Class C | $220 | 2.00% |

How did the Fund perform last year?

• For the 12-month period ended October 31, 2024, the Fund’s Class C shares returned 20.29%.

• In comparison, the FTSE World Index returned 33.62% for the same period.

What affected the Fund’s performance?

• Easing U.S. monetary policy and a greater appetite for risk helped drive strong market returns during the period.

• On a sector basis, the Fund benefited most from stock selection in the materials sector, attributable to a gold miner holding and another mining stock that was a takeover target.

• On a country basis, the Fund benefited most from its underweight position in Japan, which underperformed the wider market, and from security selection in Spain.

• On a sector basis, information technology detracted most from relative performance, largely due to zero exposure to two low-yielding Index heavyweights.

| | | |

Not FDIC Insured. Not Bank-Guaranteed. May Lose Value | |

|

| | |

How did the Fund perform over the past 10 years? The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. | Cumulative Performance from November 1, 2014 through October 31, 2024

Initial Investment of $10,000 ![10KLineChartData(FTSE World Index[BroadBasedIndex]|2014-10-31:10000,2015-10-31:10100,2016-10-31:10357,2017-10-31:12811,2018-10-31:12905,2019-10-31:14602,2020-10-31:15224,2021-10-31:21352,2022-10-31:17425,2023-10-31:19408,2024-10-31:25933|BNY Mellon Global Equity Income Fund (Class C)|2014-10-31:10000,2015-10-31:10353,2016-10-31:10921,2017-10-31:12402,2018-10-31:12701,2019-10-31:14352,2020-10-31:13000,2021-10-31:17204,2022-10-31:15907,2023-10-31:16796,2024-10-31:20204) 10KLineChartData(FTSE World Index[BroadBasedIndex]|2014-10-31:10000,2015-10-31:10100,2016-10-31:10357,2017-10-31:12811,2018-10-31:12905,2019-10-31:14602,2020-10-31:15224,2021-10-31:21352,2022-10-31:17425,2023-10-31:19408,2024-10-31:25933|BNY Mellon Global Equity Income Fund (Class C)|2014-10-31:10000,2015-10-31:10353,2016-10-31:10921,2017-10-31:12402,2018-10-31:12701,2019-10-31:14352,2020-10-31:13000,2021-10-31:17204,2022-10-31:15907,2023-10-31:16796,2024-10-31:20204)](https://capedge.com/proxy/N-CSR/0001741773-24-004851/img_3819a827c3e24f2.jpg)

Years Ended 10/31 |

The above graph compares a hypothetical $10,000 investment in the Fund’s Class C shares to a hypothetical investment of $10,000 made in the FTSE World Index (the “Index”) on 10/31/2014. The performance shown takes into account the maximum deferred sales charge on Class C shares and applicable fees and expenses of the Fund, including management fees, 12b-1 fees and other expenses. The Fund’s performance also assumes the reinvestment of dividends and capital gains. Unlike the Fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index.

| | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS (AS OF 10/31/24) |

Class C Shares | 1YR | 5YR | 10YR |

with Maximum Deferred Sales Charge - 1.00% | 19.29% | ** | 7.08% | | 7.29% | |

without Deferred Sales Charge | 20.29% | | 7.08% | | 7.29% | |

FTSE World Index | 33.62% | | 12.17% | | 10.00% | |

| | |

** | The maximum contingent deferred sales charge for Class C shares is 1.00% for shares redeemed within one year of the date purchased. |

The performance data quoted represent past performance, which is no guarantee of future results. For more current information visit bny.com/investments/literaturecenter.

KEY FUND STATISTICS (AS OF 10/31/24)

| | | | |

Fund Size (Millions) | Number of Holdings | Total Advisory Fee Paid During Period | Annual Portfolio Turnover |

$222 | 59 | $2,047,112 | 52.55% |

| | | |

Not FDIC Insured. Not Bank-Guaranteed. May Lose Value | |

|

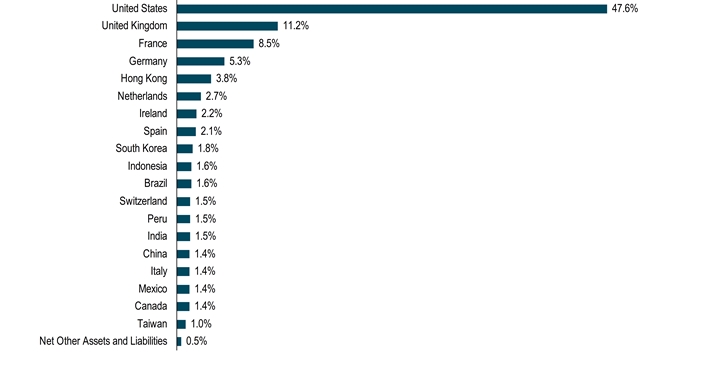

Portfolio Holdings (as of 10/31/24)

Top Ten Holdings (Based on Net Assets)*

![LargestHoldingsData([CME Group, Inc.]:3.2,Sanofi SA:3.2,[Cisco Systems, Inc.]:3,[PepsiCo, Inc.]:2.3,Medtronic PLC:2.2,[Gilead Sciences, Inc.]:2.2,AIA Group Ltd.:2.2,Industria de Diseno Textil SA:2.2,Starbucks Corp.:2.1,[Omnicom Group, Inc.]:2.1) LargestHoldingsData([CME Group, Inc.]:3.2,Sanofi SA:3.2,[Cisco Systems, Inc.]:3,[PepsiCo, Inc.]:2.3,Medtronic PLC:2.2,[Gilead Sciences, Inc.]:2.2,AIA Group Ltd.:2.2,Industria de Diseno Textil SA:2.2,Starbucks Corp.:2.1,[Omnicom Group, Inc.]:2.1)](https://capedge.com/proxy/N-CSR/0001741773-24-004851/img_d2c169645f3f4f2.jpg)

* Excludes money market funds or other short-term securities held for the investment of cash and cash collateral for securities loaned, if any.

| | | |

Not FDIC Insured. Not Bank-Guaranteed. May Lose Value | |

|

Country Allocation (Based on Net Assets)

For additional information about the Fund, including its prospectus, financial information, portfolio holdings and proxy voting information, please visit bny.com/investments/literaturecenter.

| | |

© 2024 BNY Mellon Securities Corporation, Distributor,

240 Greenwich Street, 9th Floor, NewYork, NY 10286

Code-6176AR1024 |

|

| | |

BNY Mellon Global Equity Income Fund | ANNUAL

SHAREHOLDER

REPORT OCTOBER 31, 2024 |

| | |

Class I – DQEIX

This annual shareholder report contains important information about BNY Mellon Global Equity Income Fund (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at bny.com/investments/literaturecenter. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bny.com.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| | | |

Share Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Class I | $106 | 0.96% |

How did the Fund perform last year?

• For the 12-month period ended October 31, 2024, the Fund’s Class I shares returned 21.54%.

• In comparison, the FTSE World Index returned 33.62% for the same period.

What affected the Fund’s performance?

• Easing U.S. monetary policy and a greater appetite for risk helped drive strong market returns during the period.

• On a sector basis, the Fund benefited most from stock selection in the materials sector, attributable to a gold miner holding and another mining stock that was a takeover target.

• On a country basis, the Fund benefited most from its underweight position in Japan, which underperformed the wider market, and from security selection in Spain.

• On a sector basis, information technology detracted most from relative performance, largely due to zero exposure to two low-yielding Index heavyweights.

| | | |

Not FDIC Insured. Not Bank-Guaranteed. May Lose Value | |

|

| | |

How did the Fund perform over the past 10 years? The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. | Cumulative Performance from November 1, 2014 through October 31, 2024

Initial Investment of $10,000 ![10KLineChartData(FTSE World Index[BroadBasedIndex]|2014-10-31:10000,2015-10-31:10100,2016-10-31:10357,2017-10-31:12811,2018-10-31:12905,2019-10-31:14602,2020-10-31:15224,2021-10-31:21352,2022-10-31:17425,2023-10-31:19408,2024-10-31:25933|BNY Mellon Global Equity Income Fund (Class I)|2014-10-31:10000,2015-10-31:10452,2016-10-31:11147,2017-10-31:12780,2018-10-31:13218,2019-10-31:15095,2020-10-31:13807,2021-10-31:18456,2022-10-31:17245,2023-10-31:18397,2024-10-31:22360) 10KLineChartData(FTSE World Index[BroadBasedIndex]|2014-10-31:10000,2015-10-31:10100,2016-10-31:10357,2017-10-31:12811,2018-10-31:12905,2019-10-31:14602,2020-10-31:15224,2021-10-31:21352,2022-10-31:17425,2023-10-31:19408,2024-10-31:25933|BNY Mellon Global Equity Income Fund (Class I)|2014-10-31:10000,2015-10-31:10452,2016-10-31:11147,2017-10-31:12780,2018-10-31:13218,2019-10-31:15095,2020-10-31:13807,2021-10-31:18456,2022-10-31:17245,2023-10-31:18397,2024-10-31:22360)](https://capedge.com/proxy/N-CSR/0001741773-24-004851/img_9258835df93e4f2.jpg)

Years Ended 10/31 |

The above graph compares a hypothetical $10,000 investment in the Fund’s Class I shares to a hypothetical investment of $10,000 made in the FTSE World Index (the “Index”) on 10/31/2014. The performance shown takes into account applicable fees and expenses of the Fund, including management fees and other expenses. The Fund’s performance also assumes the reinvestment of dividends and capital gains. Unlike the Fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index.

| | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS (AS OF 10/31/24) |

Share Class | 1YR | 5YR | 10YR |

Class I Shares | 21.54% | | 8.17% | | 8.38% | |

FTSE World Index | 33.62% | | 12.17% | | 10.00% | |

The performance data quoted represent past performance, which is no guarantee of future results. For more current information visit bny.com/investments/literaturecenter.

KEY FUND STATISTICS (AS OF 10/31/24)

| | | | |

Fund Size (Millions) | Number of Holdings | Total Advisory Fee Paid During Period | Annual Portfolio Turnover |

$222 | 59 | $2,047,112 | 52.55% |

| | | |

Not FDIC Insured. Not Bank-Guaranteed. May Lose Value | |

|

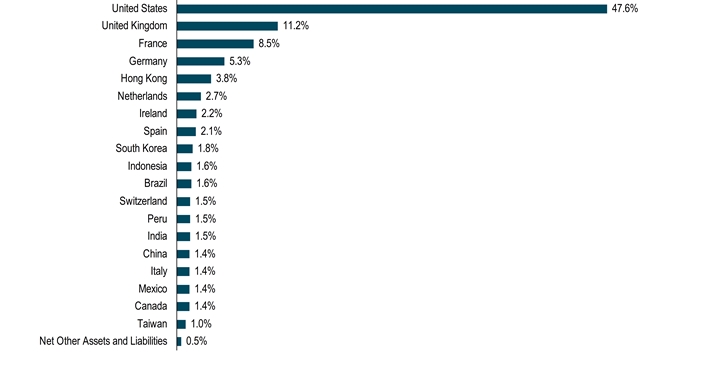

Portfolio Holdings (as of 10/31/24)

Top Ten Holdings (Based on Net Assets)*

![LargestHoldingsData([CME Group, Inc.]:3.2,Sanofi SA:3.2,[Cisco Systems, Inc.]:3,[PepsiCo, Inc.]:2.3,Medtronic PLC:2.2,[Gilead Sciences, Inc.]:2.2,AIA Group Ltd.:2.2,Industria de Diseno Textil SA:2.2,Starbucks Corp.:2.1,[Omnicom Group, Inc.]:2.1) LargestHoldingsData([CME Group, Inc.]:3.2,Sanofi SA:3.2,[Cisco Systems, Inc.]:3,[PepsiCo, Inc.]:2.3,Medtronic PLC:2.2,[Gilead Sciences, Inc.]:2.2,AIA Group Ltd.:2.2,Industria de Diseno Textil SA:2.2,Starbucks Corp.:2.1,[Omnicom Group, Inc.]:2.1)](https://capedge.com/proxy/N-CSR/0001741773-24-004851/img_d2c169645f3f4f2.jpg)

* Excludes money market funds or other short-term securities held for the investment of cash and cash collateral for securities loaned, if any.

| | | |

Not FDIC Insured. Not Bank-Guaranteed. May Lose Value | |

|

Country Allocation (Based on Net Assets)

For additional information about the Fund, including its prospectus, financial information, portfolio holdings and proxy voting information, please visit bny.com/investments/literaturecenter.

| | |

© 2024 BNY Mellon Securities Corporation, Distributor,

240 Greenwich Street, 9th Floor, NewYork, NY 10286

Code-6177AR1024 |

|

| | |

BNY Mellon Global Equity Income Fund | ANNUAL

SHAREHOLDER

REPORT OCTOBER 31, 2024 |

| | |

Class Y – DEQYX

This annual shareholder report contains important information about BNY Mellon Global Equity Income Fund (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at bny.com/investments/literaturecenter. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bny.com.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| | | |

Share Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Class Y | $102 | 0.92% |

How did the Fund perform last year?

• For the 12-month period ended October 31, 2024, the Fund’s Class Y shares returned 21.52%.

• In comparison, the FTSE World Index returned 33.62% for the same period.

What affected the Fund’s performance?

• Easing U.S. monetary policy and a greater appetite for risk helped drive strong market returns during the period.

• On a sector basis, the Fund benefited most from stock selection in the materials sector, attributable to a gold miner holding and another mining stock that was a takeover target.

• On a country basis, the Fund benefited most from its underweight position in Japan, which underperformed the wider market, and from security selection in Spain.

• On a sector basis, information technology detracted most from relative performance, largely due to zero exposure to two low-yielding Index heavyweights.

| | | |

Not FDIC Insured. Not Bank-Guaranteed. May Lose Value | |

|

| | |

How did the Fund perform over the past 10 years? The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. | Cumulative Performance from November 1, 2014 through October 31, 2024

Initial Investment of $1,000,000 ![10KLineChartData(FTSE World Index[BroadBasedIndex]|2014-10-31:1000000,2015-10-31:1010000,2016-10-31:1035654,2017-10-31:1281000,2018-10-31:1290351,2019-10-31:1460032,2020-10-31:1522229,2021-10-31:2134926,2022-10-31:1742313,2023-10-31:1940588,2024-10-31:2593014|BNY Mellon Global Equity Income Fund (Class Y)|2014-10-31:1000000,2015-10-31:1046800,2016-10-31:1117145,2017-10-31:1281142,2018-10-31:1326366,2019-10-31:1515904,2020-10-31:1387507,2021-10-31:1856346,2022-10-31:1734013,2023-10-31:1852099,2024-10-31:2250671) 10KLineChartData(FTSE World Index[BroadBasedIndex]|2014-10-31:1000000,2015-10-31:1010000,2016-10-31:1035654,2017-10-31:1281000,2018-10-31:1290351,2019-10-31:1460032,2020-10-31:1522229,2021-10-31:2134926,2022-10-31:1742313,2023-10-31:1940588,2024-10-31:2593014|BNY Mellon Global Equity Income Fund (Class Y)|2014-10-31:1000000,2015-10-31:1046800,2016-10-31:1117145,2017-10-31:1281142,2018-10-31:1326366,2019-10-31:1515904,2020-10-31:1387507,2021-10-31:1856346,2022-10-31:1734013,2023-10-31:1852099,2024-10-31:2250671)](https://capedge.com/proxy/N-CSR/0001741773-24-004851/img_b1ebc1f005574f2.jpg)

Years Ended 10/31 |

The above graph compares a hypothetical $1,000,000 investment in the Fund’s Class Y shares to a hypothetical investment of $1,000,000 made in the FTSE World Index (the “Index”) on 10/31/2014. The performance shown takes into account applicable fees and expenses of the Fund, including management fees and other expenses. The Fund’s performance also assumes the reinvestment of dividends and capital gains. Unlike the Fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index.

| | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS (AS OF 10/31/24) |

Share Class | 1YR | 5YR | 10YR |

Class Y Shares | 21.52% | | 8.22% | | 8.45% | |

FTSE World Index | 33.62% | | 12.17% | | 10.00% | |

The performance data quoted represent past performance, which is no guarantee of future results. For more current information visit bny.com/investments/literaturecenter.

KEY FUND STATISTICS (AS OF 10/31/24)

| | | | |

Fund Size (Millions) | Number of Holdings | Total Advisory Fee Paid During Period | Annual Portfolio Turnover |

$222 | 59 | $2,047,112 | 52.55% |

| | | |

Not FDIC Insured. Not Bank-Guaranteed. May Lose Value | |

|

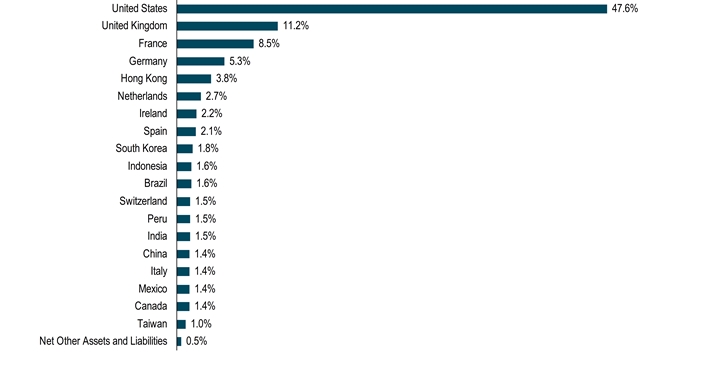

Portfolio Holdings (as of 10/31/24)

Top Ten Holdings (Based on Net Assets)*

![LargestHoldingsData([CME Group, Inc.]:3.2,Sanofi SA:3.2,[Cisco Systems, Inc.]:3,[PepsiCo, Inc.]:2.3,Medtronic PLC:2.2,[Gilead Sciences, Inc.]:2.2,AIA Group Ltd.:2.2,Industria de Diseno Textil SA:2.2,Starbucks Corp.:2.1,[Omnicom Group, Inc.]:2.1) LargestHoldingsData([CME Group, Inc.]:3.2,Sanofi SA:3.2,[Cisco Systems, Inc.]:3,[PepsiCo, Inc.]:2.3,Medtronic PLC:2.2,[Gilead Sciences, Inc.]:2.2,AIA Group Ltd.:2.2,Industria de Diseno Textil SA:2.2,Starbucks Corp.:2.1,[Omnicom Group, Inc.]:2.1)](https://capedge.com/proxy/N-CSR/0001741773-24-004851/img_d2c169645f3f4f2.jpg)

* Excludes money market funds or other short-term securities held for the investment of cash and cash collateral for securities loaned, if any.

| | | |

Not FDIC Insured. Not Bank-Guaranteed. May Lose Value | |

|

Country Allocation (Based on Net Assets)

For additional information about the Fund, including its prospectus, financial information, portfolio holdings and proxy voting information, please visit bny.com/investments/literaturecenter.

| | |

© 2024 BNY Mellon Securities Corporation, Distributor,

240 Greenwich Street, 9th Floor, NewYork, NY 10286

Code-0367AR1024 |

|

| | |

BNY Mellon International Bond Fund | ANNUAL

SHAREHOLDER

REPORT OCTOBER 31, 2024 |

| | |

Class A – DIBAX

This annual shareholder report contains important information about BNY Mellon International Bond Fund (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at bny.com/investments/literaturecenter. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bny.com.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| | | |

Share Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Class A* | $108 | 1.03% |

| | |

* | During the period, fees were waived and/or expenses reimbursed pursuant to an agreement with the Fund’s investment adviser, BNY Mellon Investment Adviser, Inc. If this agreement is not extended in the future, expenses could be higher. |

How did the Fund perform last year?

• For the 12-month period ended October 31, 2024, the Fund’s Class A shares returned 10.24%.

• In comparison, the Bloomberg Global Aggregate ex USD Index (Unhedged) (the “Index”) returned 8.65% for the same period.”

What affected the Fund’s performance?

• The weakening of the U.S. dollar increased the total return of the Fund adding to the impact of a broad-based downtrend in yields.

• The Fund’s performance relative to the Index benefited significantly from overweight U.S. duration exposure, with additional exposure added in October 2023 and April 2024.

• Active positioning in developed-market, inflation-linked products further enhanced the Fund’s relative returns.

• The Fund’s relative performance suffered from underweight exposure to Canadian versus U.S. duration.

• Active foreign exchange positioning also detracted from relative returns.

| | | |

Not FDIC Insured. Not Bank-Guaranteed. May Lose Value | |

|

| | |

How did the Fund perform over the past 10 years? The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. | Cumulative Performance from November 1, 2014 through October 31, 2024

Initial Investment of $10,000 ![10KLineChartData(Bloomberg Global Aggregate ex USD Index (Unhedged)[BroadBasedIndex]|2014-10-31:10000,2015-10-31:9326,2016-10-31:9929,2017-10-31:10054,2018-10-31:9844,2019-10-31:10616,2020-10-31:11143,2021-10-31:10921,2022-10-31:8236,2023-10-31:8449,2024-10-31:9180|BNY Mellon International Bond Fund (Class A)|2014-10-31:9550,2015-10-31:9125,2016-10-31:9433,2017-10-31:9920,2018-10-31:9434,2019-10-31:9915,2020-10-31:10106,2021-10-31:10002,2022-10-31:7661,2023-10-31:7860,2024-10-31:8665) 10KLineChartData(Bloomberg Global Aggregate ex USD Index (Unhedged)[BroadBasedIndex]|2014-10-31:10000,2015-10-31:9326,2016-10-31:9929,2017-10-31:10054,2018-10-31:9844,2019-10-31:10616,2020-10-31:11143,2021-10-31:10921,2022-10-31:8236,2023-10-31:8449,2024-10-31:9180|BNY Mellon International Bond Fund (Class A)|2014-10-31:9550,2015-10-31:9125,2016-10-31:9433,2017-10-31:9920,2018-10-31:9434,2019-10-31:9915,2020-10-31:10106,2021-10-31:10002,2022-10-31:7661,2023-10-31:7860,2024-10-31:8665)](https://capedge.com/proxy/N-CSR/0001741773-24-004851/img_2b1b01ffc2434f3.jpg)

Years Ended 10/31 |

The above graph compares a hypothetical $10,000 investment in the Fund’s Class A shares to a hypothetical investment of $10,000 made in the Bloomberg Global Aggregate ex USD Index (Unhedged) (the “Index”) on 10/31/2014. The performance shown takes into account the maximum initial sales charge on Class A shares and applicable fees and expenses of the Fund, including management fees and other expenses. The Fund’s performance also assumes the reinvestment of dividends and capital gains. Unlike the Fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index.

| | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS (AS OF 10/31/24) |

Class A Shares | 1YR | 5YR | 10YR |

with Maximum Sales Charge - 4.50% | 5.26% | | -3.56% | | -1.42% | |

without Sales Charge | 10.24% | | -2.66% | | -0.97% | |

Bloomberg Global Aggregate ex USD Index (Unhedged) | 8.65% | | -2.87% | | -0.85% | |

The performance data quoted represent past performance, which is no guarantee of future results. For more current information visit bny.com/investments/literaturecenter.

KEY FUND STATISTICS (AS OF 10/31/24)

| | | | |

Fund Size (Millions) | Number of Holdings | Total Advisory Fee Paid During Period | Annual Portfolio Turnover |

$142 | 369 | $822,249 | 127.52% |

| | | |

Not FDIC Insured. Not Bank-Guaranteed. May Lose Value | |

|

Portfolio Holdings (as of 10/31/24)

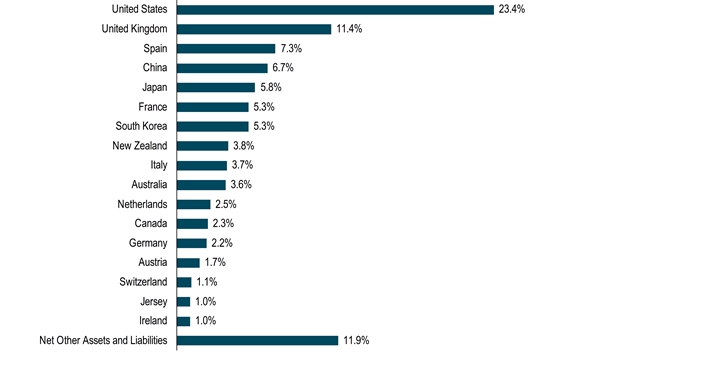

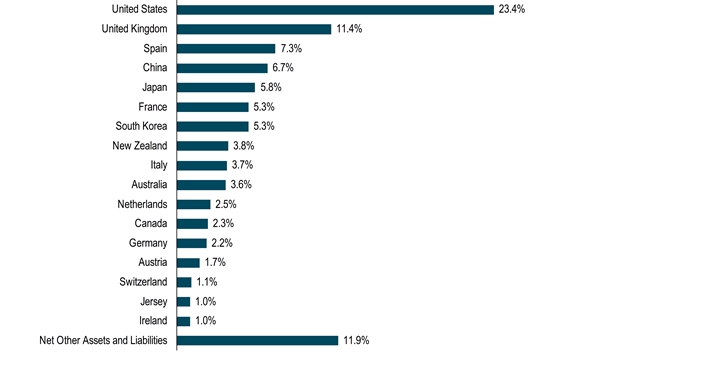

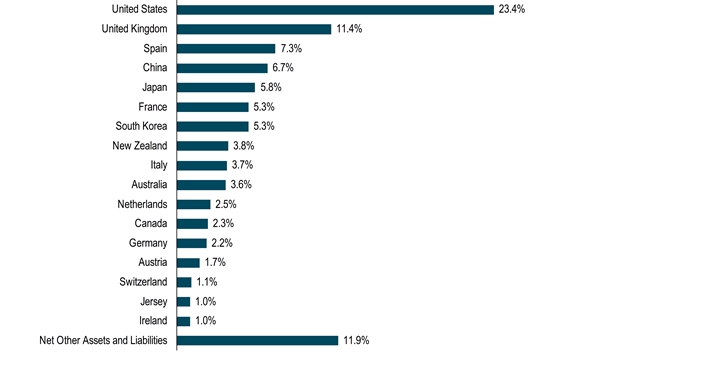

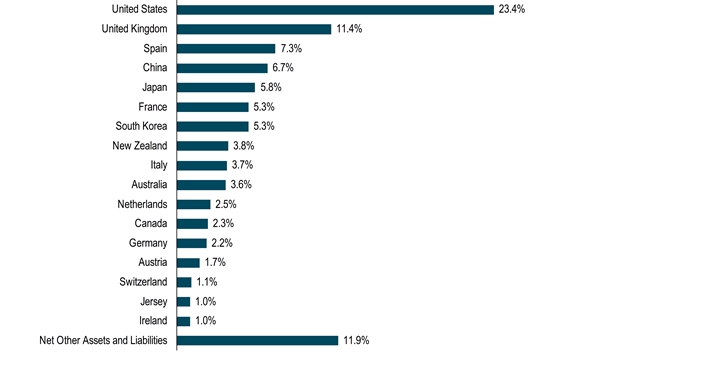

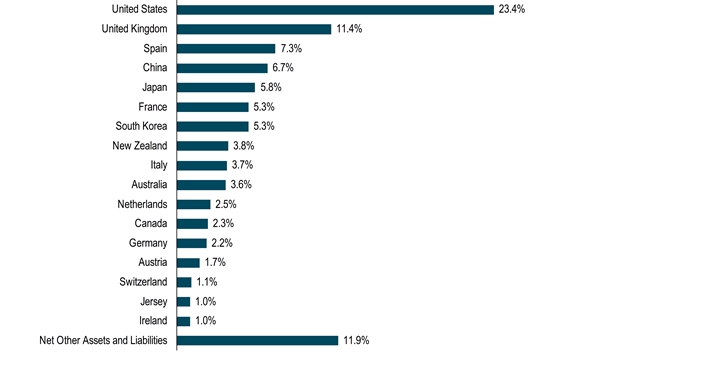

Country Allocation (Based on Net Assets)

| | | |

Not FDIC Insured. Not Bank-Guaranteed. May Lose Value | |

|

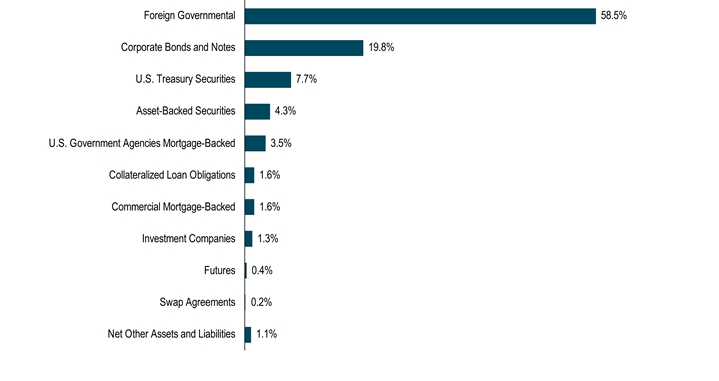

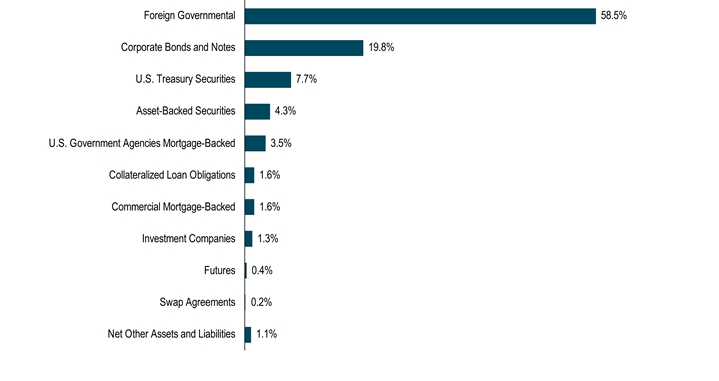

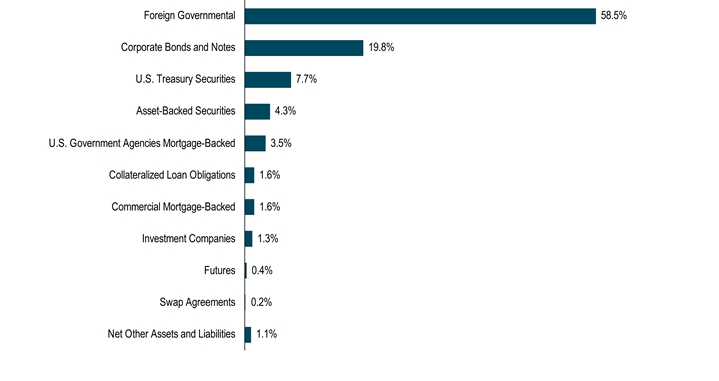

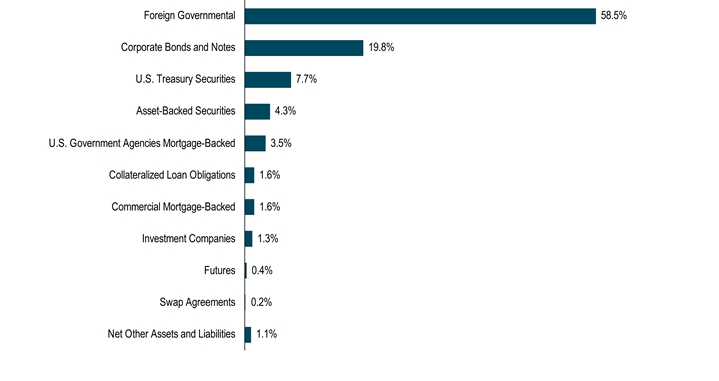

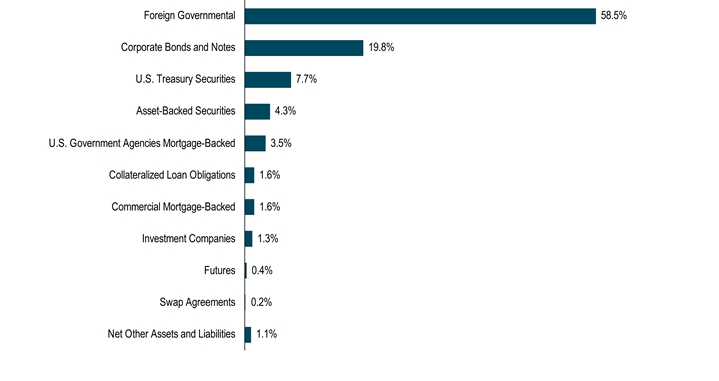

Allocation of Holdings (Based on Net Assets)

For additional information about the Fund, including its prospectus, financial information, portfolio holdings and proxy voting information, please visit bny.com/investments/literaturecenter.

| | |

© 2024 BNY Mellon Securities Corporation, Distributor,

240 Greenwich Street, 9th Floor, NewYork, NY 10286

Code-6091AR1024 |

|

| | |

BNY Mellon International Bond Fund | ANNUAL

SHAREHOLDER

REPORT OCTOBER 31, 2024 |

| | |

Class C – DIBCX

This annual shareholder report contains important information about BNY Mellon International Bond Fund (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at bny.com/investments/literaturecenter. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bny.com.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| | | |

Share Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Class C | $203 | 1.94% |

How did the Fund perform last year?

• For the 12-month period ended October 31, 2024, the Fund’s Class C shares returned 9.23%.

• In comparison, the Bloomberg Global Aggregate ex USD Index (Unhedged) (the “Index”) returned 8.65% for the same period.

What affected the Fund’s performance?

• The weakening of the U.S. dollar increased the total return of the Fund adding to the impact of a broad-based downtrend in yields.

• The Fund’s performance relative to the Index benefited significantly from overweight U.S. duration exposure, with additional exposure added in October 2023 and April 2024.

• Active positioning in developed-market, inflation-linked products further enhanced the Fund’s relative returns.

• The Fund’s relative performance suffered from underweight exposure to Canadian versus U.S. duration.

• Active foreign exchange positioning also detracted from relative returns.

| | | |

Not FDIC Insured. Not Bank-Guaranteed. May Lose Value | |

|

| | |

How did the Fund perform over the past 10 years? The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. | Cumulative Performance from November 1, 2014 through October 31, 2024

Initial Investment of $10,000 ![10KLineChartData(Bloomberg Global Aggregate ex USD Index (Unhedged)[BroadBasedIndex]|2014-10-31:10000,2015-10-31:9326,2016-10-31:9929,2017-10-31:10054,2018-10-31:9844,2019-10-31:10616,2020-10-31:11143,2021-10-31:10921,2022-10-31:8236,2023-10-31:8449,2024-10-31:9180|BNY Mellon International Bond Fund (Class C)|2014-10-31:10000,2015-10-31:9491,2016-10-31:9755,2017-10-31:10217,2018-10-31:9649,2019-10-31:10084,2020-10-31:10208,2021-10-31:10026,2022-10-31:7619,2023-10-31:7748,2024-10-31:8463) 10KLineChartData(Bloomberg Global Aggregate ex USD Index (Unhedged)[BroadBasedIndex]|2014-10-31:10000,2015-10-31:9326,2016-10-31:9929,2017-10-31:10054,2018-10-31:9844,2019-10-31:10616,2020-10-31:11143,2021-10-31:10921,2022-10-31:8236,2023-10-31:8449,2024-10-31:9180|BNY Mellon International Bond Fund (Class C)|2014-10-31:10000,2015-10-31:9491,2016-10-31:9755,2017-10-31:10217,2018-10-31:9649,2019-10-31:10084,2020-10-31:10208,2021-10-31:10026,2022-10-31:7619,2023-10-31:7748,2024-10-31:8463)](https://capedge.com/proxy/N-CSR/0001741773-24-004851/img_e73cb39010a24f3.jpg)

Years Ended 10/31 |

The above graph compares a hypothetical $10,000 investment in the Fund’s Class C shares to a hypothetical investment of $10,000 made in the Bloomberg Global Aggregate ex USD Index (Unhedged) (the “Index”) on 10/31/2014. The performance shown takes into account the maximum deferred sales charge on Class C shares and applicable fees and expenses of the Fund, including management fees, 12b-1 fees and other expenses. The Fund’s performance also assumes the reinvestment of dividends and capital gains. Unlike the Fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index.

| | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS (AS OF 10/31/24) |

Class C Shares | 1YR | 5YR | 10YR |

with Maximum Deferred Sales Charge - 1.00% | 8.23% | ** | -3.44% | | -1.65% | |

without Deferred Sales Charge | 9.23% | | -3.44% | | -1.65% | |

Bloomberg Global Aggregate ex USD Index (Unhedged) | 8.65% | | -2.87% | | -0.85% | |

| | |

** | The maximum contingent deferred sales charge for Class C shares is 1.00% for shares redeemed within one year of the date purchased. |

The performance data quoted represent past performance, which is no guarantee of future results. For more current information visit bny.com/investments/literaturecenter.

KEY FUND STATISTICS (AS OF 10/31/24)

| | | | |

Fund Size (Millions) | Number of Holdings | Total Advisory Fee Paid During Period | Annual Portfolio Turnover |

$142 | 369 | $822,249 | 127.52% |

| | | |

Not FDIC Insured. Not Bank-Guaranteed. May Lose Value | |

|

Portfolio Holdings (as of 10/31/24)

Country Allocation (Based on Net Assets)

| | | |

Not FDIC Insured. Not Bank-Guaranteed. May Lose Value | |

|

Allocation of Holdings (Based on Net Assets)

For additional information about the Fund, including its prospectus, financial information, portfolio holdings and proxy voting information, please visit bny.com/investments/literaturecenter.

| | |

© 2024 BNY Mellon Securities Corporation, Distributor,

240 Greenwich Street, 9th Floor, NewYork, NY 10286

Code-6093AR1024 |

|

| | |

BNY Mellon International Bond Fund | ANNUAL

SHAREHOLDER

REPORT OCTOBER 31, 2024 |

| | |

Class I – DIBRX

This annual shareholder report contains important information about BNY Mellon International Bond Fund (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at bny.com/investments/literaturecenter. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bny.com.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| | | |

Share Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Class I | $88 | 0.84% |

How did the Fund perform last year?

• For the 12-month period ended October 31, 2024, the Fund’s Class I shares returned 10.45%.

• In comparison, the Bloomberg Global Aggregate ex USD Index (Unhedged) (the “Index”) returned 8.65% for the same period.

What affected the Fund’s performance?

• The weakening of the U.S. dollar increased the total return of the Fund adding to the impact of a broad-based downtrend in yields.

• The Fund’s performance relative to the Index benefited significantly from overweight U.S. duration exposure, with additional exposure added in October 2023 and April 2024.

• Active positioning in developed-market, inflation-linked products further enhanced the Fund’s relative returns.

• The Fund’s relative performance suffered from underweight exposure to Canadian versus U.S. duration.

• Active foreign exchange positioning also detracted from relative returns.

| | | |

Not FDIC Insured. Not Bank-Guaranteed. May Lose Value | |

|

| | |

How did the Fund perform over the past 10 years? The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. | Cumulative Performance from November 1, 2014 through October 31, 2024

Initial Investment of $10,000 ![10KLineChartData(Bloomberg Global Aggregate ex USD Index (Unhedged)[BroadBasedIndex]|2014-10-31:10000,2015-10-31:9326,2016-10-31:9929,2017-10-31:10054,2018-10-31:9844,2019-10-31:10616,2020-10-31:11143,2021-10-31:10921,2022-10-31:8236,2023-10-31:8449,2024-10-31:9180|BNY Mellon International Bond Fund (Class I)|2014-10-31:10000,2015-10-31:9593,2016-10-31:9967,2017-10-31:10538,2018-10-31:10061,2019-10-31:10613,2020-10-31:10857,2021-10-31:10780,2022-10-31:8280,2023-10-31:8513,2024-10-31:9403) 10KLineChartData(Bloomberg Global Aggregate ex USD Index (Unhedged)[BroadBasedIndex]|2014-10-31:10000,2015-10-31:9326,2016-10-31:9929,2017-10-31:10054,2018-10-31:9844,2019-10-31:10616,2020-10-31:11143,2021-10-31:10921,2022-10-31:8236,2023-10-31:8449,2024-10-31:9180|BNY Mellon International Bond Fund (Class I)|2014-10-31:10000,2015-10-31:9593,2016-10-31:9967,2017-10-31:10538,2018-10-31:10061,2019-10-31:10613,2020-10-31:10857,2021-10-31:10780,2022-10-31:8280,2023-10-31:8513,2024-10-31:9403)](https://capedge.com/proxy/N-CSR/0001741773-24-004851/img_4599666a2ae34f3.jpg)

Years Ended 10/31 |

The above graph compares a hypothetical $10,000 investment in the Fund’s Class I shares to a hypothetical investment of $10,000 made in the Bloomberg Global Aggregate ex USD Index (Unhedged) (the “Index”) on 10/31/2014. The performance shown takes into account applicable fees and expenses of the Fund, including management fees and other expenses. The Fund’s performance also assumes the reinvestment of dividends and capital gains. Unlike the Fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index.

| | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS (AS OF 10/31/24) |

Share Class | 1YR | 5YR | 10YR |

Class I Shares | 10.45% | | -2.39% | | -0.61% | |

Bloomberg Global Aggregate ex USD Index (Unhedged) | 8.65% | | -2.87% | | -0.85% | |

The performance data quoted represent past performance, which is no guarantee of future results. For more current information visit bny.com/investments/literaturecenter.

KEY FUND STATISTICS (AS OF 10/31/24)

| | | | |

Fund Size (Millions) | Number of Holdings | Total Advisory Fee Paid During Period | Annual Portfolio Turnover |

$142 | 369 | $822,249 | 127.52% |

| | | |

Not FDIC Insured. Not Bank-Guaranteed. May Lose Value | |

|

Portfolio Holdings (as of 10/31/24)

Country Allocation (Based on Net Assets)

| | | |

Not FDIC Insured. Not Bank-Guaranteed. May Lose Value | |

|

Allocation of Holdings (Based on Net Assets)

For additional information about the Fund, including its prospectus, financial information, portfolio holdings and proxy voting information, please visit bny.com/investments/literaturecenter.

| | |

© 2024 BNY Mellon Securities Corporation, Distributor,

240 Greenwich Street, 9th Floor, NewYork, NY 10286

Code-6094AR1024 |

|

| | |

BNY Mellon International Bond Fund | ANNUAL

SHAREHOLDER

REPORT OCTOBER 31, 2024 |

| | |

Class Y – DIBYX

This annual shareholder report contains important information about BNY Mellon International Bond Fund (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at bny.com/investments/literaturecenter. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bny.com.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| | | |

Share Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Class Y | $78 | 0.74% |

How did the Fund perform last year?

• For the 12-month period ended October 31, 2024, the Fund’s Class Y shares returned 10.58%.

• In comparison, the Bloomberg Global Aggregate ex USD Index (Unhedged) (the “Index”) returned 8.65% for the same period.

What affected the Fund’s performance?

• The weakening of the U.S. dollar increased the total return of the Fund adding to the impact of a broad-based downtrend in yields.

• The Fund’s performance relative to the Index benefited significantly from overweight U.S. duration exposure, with additional exposure added in October 2023 and April 2024.

• Active positioning in developed-market, inflation-linked products further enhanced the Fund’s relative returns.

• The Fund’s relative performance suffered from underweight exposure to Canadian versus U.S. duration.

• Active foreign exchange positioning also detracted from relative returns.

| | | |

Not FDIC Insured. Not Bank-Guaranteed. May Lose Value | |

|

| | |

How did the Fund perform over the past 10 years? The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. | Cumulative Performance from November 1, 2014 through October 31, 2024

Initial Investment of $1,000,000 ![10KLineChartData(Bloomberg Global Aggregate ex USD Index (Unhedged)[BroadBasedIndex]|2014-10-31:1000000,2015-10-31:932600,2016-10-31:992939,2017-10-31:1005450,2018-10-31:984436,2019-10-31:1061616,2020-10-31:1114272,2021-10-31:1092098,2022-10-31:823551,2023-10-31:844881,2024-10-31:917963|BNY Mellon International Bond Fund (Class Y)|2014-10-31:1000000,2015-10-31:960200,2016-10-31:998032,2017-10-31:1056417,2018-10-31:1008667,2019-10-31:1065657,2020-10-31:1090807,2021-10-31:1083717,2022-10-31:833920,2023-10-31:858104,2024-10-31:948891) 10KLineChartData(Bloomberg Global Aggregate ex USD Index (Unhedged)[BroadBasedIndex]|2014-10-31:1000000,2015-10-31:932600,2016-10-31:992939,2017-10-31:1005450,2018-10-31:984436,2019-10-31:1061616,2020-10-31:1114272,2021-10-31:1092098,2022-10-31:823551,2023-10-31:844881,2024-10-31:917963|BNY Mellon International Bond Fund (Class Y)|2014-10-31:1000000,2015-10-31:960200,2016-10-31:998032,2017-10-31:1056417,2018-10-31:1008667,2019-10-31:1065657,2020-10-31:1090807,2021-10-31:1083717,2022-10-31:833920,2023-10-31:858104,2024-10-31:948891)](https://capedge.com/proxy/N-CSR/0001741773-24-004851/img_978405f4d4994f3.jpg)

Years Ended 10/31 |

The above graph compares a hypothetical $1,000,000 investment in the Fund’s Class Y shares to a hypothetical investment of $1,000,000 made in the Bloomberg Global Aggregate ex USD Index (Unhedged) (the “Index”) on 10/31/2014. The performance shown takes into account applicable fees and expenses of the Fund, including management fees and other expenses. The Fund’s performance also assumes the reinvestment of dividends and capital gains. Unlike the Fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index.

| | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS (AS OF 10/31/24) |

Share Class | 1YR | 5YR | 10YR |

Class Y Shares | 10.58% | | -2.30% | | -0.52% | |

Bloomberg Global Aggregate ex USD Index (Unhedged) | 8.65% | | -2.87% | | -0.85% | |

The performance data quoted represent past performance, which is no guarantee of future results. For more current information visit bny.com/investments/literaturecenter.

KEY FUND STATISTICS (AS OF 10/31/24)

| | | | |

Fund Size (Millions) | Number of Holdings | Total Advisory Fee Paid During Period | Annual Portfolio Turnover |

$142 | 369 | $822,249 | 127.52% |

| | | |

Not FDIC Insured. Not Bank-Guaranteed. May Lose Value | |

|

Portfolio Holdings (as of 10/31/24)

Country Allocation (Based on Net Assets)

| | | |

Not FDIC Insured. Not Bank-Guaranteed. May Lose Value | |

|

Allocation of Holdings (Based on Net Assets)

For additional information about the Fund, including its prospectus, financial information, portfolio holdings and proxy voting information, please visit bny.com/investments/literaturecenter.

| | |

© 2024 BNY Mellon Securities Corporation, Distributor,

240 Greenwich Street, 9th Floor, NewYork, NY 10286

Code-0368AR1024 |

|

Item 2. Code of Ethics.

The Registrant has adopted a code of ethics that applies to the Registrant's principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. There have been no amendments to, or waivers in connection with, the Code of Ethics during the period covered by this Report.

Item 3. Audit Committee Financial Expert.

The Registrant's Board has determined that Bradley J. Skapyak, a member of the Audit Committee of the Board, is an audit committee financial expert as defined by the Securities and Exchange Commission (the "SEC"). Mr. Skapyak is "independent" as defined by the SEC for purposes of audit committee financial expert determinations.

Item 4. Principal Accountant Fees and Services.

(a) Audit Fees. The aggregate fees billed for each of the last two fiscal years (the "Reporting Periods") for professional services rendered by the Registrant's principal accountant (the "Auditor") for the audit of the Registrant's annual financial statements or services that are normally provided by the Auditor in connection with the statutory and regulatory filings or engagements for the Reporting Periods, were $84,500 in 2023 and $86,400 in 2024.

(b) Audit-Related Fees. The aggregate fees billed in the Reporting Periods for assurance and related services by the Auditor that are reasonably related to the performance of the audit of the Registrant's financial statements and are not reported under paragraph (a) of this Item 4 were $11,500 in 2023 and $11,900 in 2024. These services consisted of security counts required by Rule 17f-2 under the Investment Company Act of 1940, as amended.

The aggregate fees billed in the Reporting Periods for non-audit assurance and related services by the Auditor to the Registrant's investment adviser (not including any sub-investment adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the Registrant ("Service Affiliates"), that were reasonably related to the performance of the annual audit of the Service Affiliate, which required pre-approval by the Audit Committee were $0 in 2023 and $0 in 2024.

(c) Tax Fees. The aggregate fees billed in the Reporting Periods for professional services rendered by the Auditor for tax compliance, tax advice, and tax planning ("Tax Services") were $0 in 2023 and $0 in 2024. These services consisted of U.S. federal, state and local tax planning, advice and assistance regarding statutory, regulatory or administrative developments. The aggregate fees billed in the Reporting Periods for Tax Services by the Auditor to Service Affiliates, which required pre-approval by the Audit Committee were $0 in 2023 and $0 in 2024.

(d) All Other Fees. The aggregate fees billed in the Reporting Periods for products and services provided by the Auditor, other than the services reported in paragraphs (a) through (c) of this Item, were $0 in 2023 and $0 in 2024.

The aggregate fees billed in the Reporting Periods for Non-Audit Services by the Auditor to Service Affiliates, other than the services reported in paragraphs (b) through (c) of this Item, which required pre-approval by the Audit Committee, were $0 in 2023 and $0 in 2024.

(e)(1) Audit Committee Pre-Approval Policies and Procedures. The Registrant's Audit Committee has established policies and procedures (the "Policy") for pre-approval (within specified fee limits) of the Auditor's engagements for non-audit services to the Registrant and Service Affiliates without specific case-by-case consideration. The pre-approved services in the Policy can include pre-approved audit services, pre-approved audit-related services,

pre-approved tax services and pre-approved all other services. Pre-approval considerations include whether the proposed services are compatible with maintaining the Auditor's independence. Pre-approvals pursuant to the Policy are considered annually.

(e)(2) Note. None of the services described in paragraphs (b) through (d) of this Item 4 were approved by the Audit Committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) None of the hours expended on the principal accountant's engagement to audit the registrant's financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant's full-time, permanent employees.

Non-Audit Fees. The aggregate non-audit fees billed by the Auditor for services rendered to the Registrant, and rendered to Service Affiliates, for the Reporting Periods were $4,074,591 in 2023 and $5,102,266 in 2024.

Auditor Independence. The Registrant's Audit Committee has considered whether the provision of non-audit services that were rendered to Service Affiliates, which were not pre-approved (not requiring pre-approval), is compatible with maintaining the Auditor's independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

Not applicable.

BNY Mellon Global Equity Income Fund

| |

ANNUAL FINANCIALS AND OTHER INFORMATION October 31, 2024 |

| | |

Class | Ticker |

A | DEQAX |

C | DEQCX |

I | DQEIX |

Y | DEQYX |

| |

IMPORTANT NOTICE – CHANGES TO ANNUAL AND SEMI-ANNUAL REPORTS The Securities and Exchange Commission (the “SEC”) has adopted rule and form amendments which have resulted in changes to the design and delivery of annual and semi-annual fund reports (“Reports”). Reports are now streamlined to highlight key information. Certain information previously included in Reports, including financial statements, no longer appear in the Reports but will be available online within the Semi-Annual and Annual Financials and Other Information, delivered free of charge to shareholders upon request, and filed with the SEC. |

| |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.bny.com/investments and sign up for eCommunications. It’s simple and only takes a few minutes. |

| |

The views expressed in this report reflect those of the portfolio manager(s) only through the end of the period covered and do not necessarily represent the views of BNY Mellon Investment Adviser, Inc. or any other person in the BNY Mellon Investment Adviser, Inc. organization. Any such views are subject to change at any time based upon market or other conditions and BNY Mellon Investment Adviser, Inc. disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund in the BNY Mellon Family of Funds are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund in the BNY Mellon Family of Funds. |

| |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

T H E F U N D

Please note the Annual Financials and Other Information only contains Items 7-11 required in

Form N-CSR. All other required items will be filed with the SEC.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

BNY Mellon Global Equity Income Fund

Statement of Investments

October 31, 2024

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 97.7% | | | | | |

Brazil - 1.6% | | | | | |

B3 SA - Brasil Bolsa Balcao | | | | 1,909,104 | | 3,510,487 | |

Canada - 1.4% | | | | | |

Restaurant Brands International, Inc. | | | | 43,769 | | 3,044,134 | |

China - 1.4% | | | | | |

NARI Technology Co. Ltd., Cl. A | | | | 870,400 | | 3,175,734 | |

France - 8.5% | | | | | |

Compagnie de Saint-Gobain SA | | | | 41,911 | | 3,803,438 | |

Publicis Groupe SA | | | | 34,649 | | 3,694,559 | |

Sanofi SA | | | | 66,497 | | 7,016,094 | |

Veolia Environnement SA | | | | 134,757 | | 4,269,167 | |

| | | | | 18,783,258 | |

Germany - 5.3% | | | | | |

DHL Group | | | | 113,789 | | 4,570,955 | |

Muenchener Rueckversicherungs-Gesellschaft AG | | | | 6,308 | | 3,231,907 | |

Siemens AG | | | | 20,489 | | 3,977,265 | |

| | | | | 11,780,127 | |

Hong Kong - 3.8% | | | | | |

AIA Group Ltd. | | | | 600,400 | | 4,777,502 | |

Hong Kong Exchanges & Clearing Ltd. | | | | 89,200 | | 3,564,200 | |

| | | | | 8,341,702 | |

India - 1.5% | | | | | |

Infosys Ltd., ADR | | | | 157,773 | a | 3,299,033 | |

Indonesia - 1.6% | | | | | |

Bank Mandiri Persero TBK PT | | | | 3,872,500 | | 1,651,393 | |

Bank Rakyat Indonesia Persero TBK PT | | | | 6,204,400 | | 1,896,273 | |

| | | | | 3,547,666 | |

Ireland - 2.2% | | | | | |

Medtronic PLC | | | | 54,573 | | 4,870,640 | |

Italy - 1.4% | | | | | |

Enel SpA | | | | 416,731 | | 3,160,797 | |

Mexico - 1.4% | | | | | |

Wal-Mart de Mexico SAB de CV | | | | 1,118,572 | | 3,088,588 | |

Netherlands - 2.7% | | | | | |

ING Groep NV | | | | 130,895 | | 2,221,903 | |

Stellantis NV | | | | 270,857 | | 3,731,663 | |

| | | | | 5,953,566 | |

Peru - 1.5% | | | | | |

Credicorp Ltd. | | | | 17,974 | | 3,309,553 | |

Spain - 2.1% | | | | | |

Industria de Diseno Textil SA | | | | 83,833 | | 4,777,105 | |

Switzerland - 1.5% | | | | | |

Novartis AG | | | | 31,312 | | 3,397,442 | |

Taiwan - 1.0% | | | | | |

ASE Technology Holding Co. Ltd. | | | | 485,000 | | 2,324,604 | |

United Kingdom - 11.2% | | | | | |

Anglo American PLC | | | | 105,701 | | 3,307,208 | |

AstraZeneca PLC | | | | 28,358 | | 4,031,711 | |

3

Statement of Investments (continued)

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 97.7% (continued) | | | | | |

United Kingdom - 11.2% (continued) | | | | | |

BAE Systems PLC | | | | 181,946 | | 2,933,969 | |

Diageo PLC | | | | 111,096 | | 3,463,944 | |

DS Smith PLC | | | | 243,657 | | 1,720,279 | |

GSK PLC | | | | 217,470 | | 3,972,918 | |

Shell PLC | | | | 130,766 | | 4,349,952 | |

Smiths Group PLC | | | | 50,356 | | 999,317 | |

| | | | | 24,779,298 | |

United States - 47.6% | | | | | |

Bristol-Myers Squibb Co. | | | | 56,943 | | 3,175,711 | |

Cisco Systems, Inc. | | | | 123,221 | | 6,748,814 | |

CME Group, Inc. | | | | 31,482 | | 7,094,784 | |

Dominion Energy, Inc. | | | | 76,558 | | 4,557,498 | |

Exelon Corp. | | | | 116,043 | | 4,560,490 | |

Expand Energy Corp. | | | | 41,829 | a | 3,543,753 | |

First Horizon Corp. | | | | 176,149 | | 3,052,662 | |

Gilead Sciences, Inc. | | | | 54,723 | | 4,860,497 | |

International Game Technology PLC | | | | 69,680 | | 1,415,898 | |

International Paper Co. | | | | 64,271 | | 3,569,611 | |

Johnson Controls International PLC | | | | 60,649 | | 4,582,032 | |

JPMorgan Chase & Co. | | | | 14,891 | | 3,304,611 | |

Kenvue, Inc. | | | | 191,203 | | 4,384,285 | |

MetLife, Inc. | | | | 40,605 | | 3,184,244 | |

Molson Coors Beverage Co., Cl. B | | | | 70,670 | | 3,849,395 | |

Omnicom Group, Inc. | | | | 45,669 | | 4,612,569 | |

Paychex, Inc. | | | | 29,711 | a | 4,139,634 | |

PepsiCo, Inc. | | | | 31,004 | | 5,149,144 | |

Phillips 66 | | | | 27,931 | | 3,402,554 | |

Starbucks Corp. | | | | 47,869 | | 4,676,801 | |

Sysco Corp. | | | | 56,621 | | 4,243,744 | |

Texas Instruments, Inc. | | | | 13,690 | | 2,781,260 | |

The Allstate Corp. | | | | 23,792 | | 4,437,684 | |

The Estee Lauder Companies, Inc., Cl. A | | | | 37,546 | | 2,588,421 | |

The Goldman Sachs Group, Inc. | | | | 7,881 | | 4,080,703 | |

The Kraft Heinz Company | | | | 105,843 | | 3,541,507 | |

| | | | | 105,538,306 | |

Total Common Stocks (cost $185,212,034) | | | | 216,682,040 | |

| | | Preferred Dividend

Yield (%) | | | | | |

Preferred Stocks - 1.8% | | | | | |

South Korea - 1.8% | | | | | |

Samsung Electronics Co. Ltd.

(cost $3,791,846) | | 3.39 | | 114,978 | | 3,979,912 | |

Total Investments (cost $189,003,880) | | 99.5% | | 220,661,952 | |

Cash and Receivables (Net) | | .5% | | 1,116,746 | |

Net Assets | | 100.0% | | 221,778,698 | |

ADR—American Depositary Receipt

a Security, or portion thereof, on loan. At October 31, 2024, the value of the fund’s securities on loan was $7,682,500 and the value of the collateral was $8,063,431, consisting of U.S. Government & Agency securities. In addition, the value of collateral may include pending sales that are also on loan.

See notes to financial statements.

4

| | | | | | | |

Affiliated Issuers | | | |

Description | Value ($)

10/31/2023 | Purchases ($)† | Sales ($) | Value ($)

10/31/2024 | Dividends/

Distributions ($) | |

Registered Investment Companies - .0% | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares - .0% | 5,056,622 | 102,493,882 | (107,550,504) | - | 176,336 | |

Investment of Cash Collateral for Securities Loaned - .0% | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares - .0% | 3,751,927 | 85,851,134 | (89,603,061) | - | 16,096 | †† |

Total - .0% | 8,808,549 | 188,345,016 | (197,153,565) | - | 192,432 | |

† Includes reinvested dividends/distributions.

†† Represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of fees and collateral investment expenses, and other payments to and from borrowers of securities.

See notes to financial statements.

5

STATEMENT OF ASSETS AND LIABILITIES

October 31, 2024

| | | | | | | |

| | | | | | |

| | | Cost | | Value | |

Assets ($): | | | | |

Investments in securities—See Statement of Investments

(including securities on loan, valued at $7,682,500)

—Note 1(c): | 189,003,880 | | 220,661,952 | |

Cash denominated in foreign currency | | | 265,916 | | 255,774 | |

Tax reclaim receivable—Note 1(b) | | 1,022,327 | |

Dividends and securities lending income receivable | | 233,529 | |

Receivable for shares of Beneficial Interest subscribed | | 98,108 | |

Prepaid expenses | | | | | 49,092 | |

| | | | | 222,320,782 | |

Liabilities ($): | | | | |

Due to BNY Mellon Investment Adviser, Inc. and affiliates—Note 3(c) | | 183,190 | |

Cash overdraft due to Custodian | | | | | 245,670 | |

Payable for shares of Beneficial Interest redeemed | | 11,719 | |

Trustees’ fees and expenses payable | | 5,493 | |

Other accrued expenses | | | | | 96,012 | |

| | | | | 542,084 | |

Net Assets ($) | | | 221,778,698 | |

Composition of Net Assets ($): | | | | |

Paid-in capital | | | | | 173,726,462 | |

Total distributable earnings (loss) | | | | | 48,052,236 | |

Net Assets ($) | | | 221,778,698 | |

| | | | | | |

Net Asset Value Per Share | Class A | Class C | Class I | Class Y | |

Net Assets ($) | 54,619,277 | 6,643,386 | 155,063,333 | 5,452,702 | |

Shares Outstanding | 3,859,413 | 445,284 | 11,825,145 | 416,122 | |

Net Asset Value Per Share ($) | 14.15 | 14.92 | 13.11 | 13.10 | |

| | | | | |

See notes to financial statements. | | | | | |

6

STATEMENT OF OPERATIONS

Year Ended October 31, 2024

| | | | | | | |

| | | | | | |

| | | | | | |

Investment Income ($): | | | | |

Income: | | | | |

Cash dividends (net of $563,649 foreign taxes withheld at source): | |

Unaffiliated issuers | | | 9,184,280 | |

Affiliated issuers | | | 176,336 | |

Income from securities lending—Note 1(c) | | | 16,096 | |

Total Income | | | 9,376,712 | |

Expenses: | | | | |

Management fee—Note 3(a) | | | 2,047,112 | |

Shareholder servicing costs—Note 3(c) | | | 329,152 | |

Professional fees | | | 130,878 | |

Registration fees | | | 68,968 | |

Custodian fees—Note 3(c) | | | 67,344 | |

Distribution fees—Note 3(b) | | | 65,987 | |

Prospectus and shareholders’ reports | | | 31,750 | |

Trustees’ fees and expenses—Note 3(d) | | | 31,434 | |

Chief Compliance Officer fees—Note 3(c) | | | 22,418 | |

Interest expense—Note 2 | | | 17,253 | |

Loan commitment fees—Note 2 | | | 5,785 | |

Miscellaneous | | | 41,790 | |

Total Expenses | | | 2,859,871 | |

Less—reduction in fees due to

earnings credits—Note 3(c) | | | (1,531) | |

Net Expenses | | | 2,858,340 | |

Net Investment Income | | | 6,518,372 | |

Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

Net realized gain (loss) on investments

and foreign currency transactions | 21,981,568 | |

Net change in unrealized appreciation (depreciation) on

investments and foreign currency transactions | 26,351,220 | |

Net Realized and Unrealized Gain (Loss) on Investments | 48,332,788 | |

Net Increase in Net Assets Resulting from Operations | 54,851,160 | |

| | | | | | |

See notes to financial statements. | | | | | |

7

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | | | |

| | | | Year Ended October 31, |

| | | | 2024 | | 2023 | |

Operations ($): | | | | | | | | |

Net investment income | | | 6,518,372 | | | | 9,344,002 | |

Net realized gain (loss) on investments | | 21,981,568 | | | | 20,155,641 | |

Net change in unrealized appreciation

(depreciation) on investments | | 26,351,220 | | | | (7,308,015) | |

Net Increase (Decrease) in Net Assets

Resulting from Operations | 54,851,160 | | | | 22,191,628 | |

Distributions ($): | |

Distributions to shareholders: | | | | | | | | |

Class A | | | (4,077,865) | | | | (6,289,172) | |

Class C | | | (643,561) | | | | (1,507,041) | |

Class I | | | (20,900,317) | | | | (35,786,288) | |

Class Y | | | (197,767) | | | | (31,402) | |

Total Distributions | (25,819,510) | | | | (43,613,903) | |

Beneficial Interest Transactions ($): | |

Net proceeds from shares sold: | | | | | | | | |

Class A | | | 9,961,053 | | | | 10,814,797 | |

Class C | | | 341,959 | | | | 1,098,580 | |

Class I | | | 37,154,400 | | | | 98,080,046 | |

Class Y | | | 4,228,162 | | | | 1,305,241 | |

Distributions reinvested: | | | | | | | | |

Class A | | | 3,266,664 | | | | 4,976,411 | |

Class C | | | 585,924 | | | | 1,307,842 | |

Class I | | | 17,860,686 | | | | 31,182,104 | |

Class Y | | | 114,547 | | | | 31,236 | |

Cost of shares redeemed: | | | | | | | | |

Class A | | | (13,649,801) | | | | (12,351,641) | |

Class C | | | (5,659,539) | | | | (5,099,790) | |

Class I | | | (182,129,319) | | | | (113,306,838) | |

Class Y | | | (654,255) | | | | (86,119) | |

Increase (Decrease) in Net Assets

from Beneficial Interest Transactions | (128,579,519) | | | | 17,951,869 | |

Total Increase (Decrease) in Net Assets | (99,547,869) | | | | (3,470,406) | |

Net Assets ($): | |

Beginning of Period | | | 321,326,567 | | | | 324,796,973 | |

End of Period | | | 221,778,698 | | | | 321,326,567 | |

Capital Share Transactions (Shares): | |

Class Aa | | | | | | | | |

Shares sold | | | 737,194 | | | | 802,979 | |

Shares issued for distributions reinvested | | | 249,604 | | | | 383,752 | |

Shares redeemed | | | (1,008,591) | | | | (911,608) | |

Net Increase (Decrease) in Shares Outstanding | (21,793) | | | | 275,123 | |

Class Ca | | | | | | | | |

Shares sold | | | 24,368 | | | | 78,377 | |

Shares issued for distributions reinvested | | | 42,736 | | | | 96,370 | |

Shares redeemed | | | (396,511) | | | | (363,823) | |

Net Increase (Decrease) in Shares Outstanding | (329,407) | | | | (189,076) | |

Class I | | | | | | | | |

Shares sold | | | 2,997,821 | | | | 7,847,233 | |

Shares issued for distributions reinvested | | | 1,474,543 | | | | 2,576,385 | |

Shares redeemed | | | (14,764,815) | | | | (8,943,016) | |

Net Increase (Decrease) in Shares Outstanding | (10,292,451) | | | | 1,480,602 | |

Class Y | | | | | | | | |

Shares sold | | | 339,025 | | | | 107,428 | |

Shares issued for distributions reinvested | | | 9,238 | | | | 2,584 | |

Shares redeemed | | | (51,119) | | | | (6,925) | |

Net Increase (Decrease) in Shares Outstanding | 297,144 | | | | 103,087 | |

| | | | | | | | | |

a | During the period ended October 31, 2024, 2,547 Class C shares representing $38,984 were automatically converted to 2,687 Class A shares. | |

See notes to financial statements. | | | | | | | | |

8

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share. Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions.

| | | | | | | |

| | |

| | | Year Ended October 31, |

Class A Shares | | 2024 | 2023 | 2022 | 2021 | 2020 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 12.64 | 13.51 | 16.25 | 12.40 | 13.99 |

Investment Operations: | | | | | | |

Net investment incomea | | .30 | .35 | .26 | .28 | .26 |

Net realized and unrealized gain (loss) on investments | | 2.27 | .53 | (1.25) | 3.84 | (1.45) |

Total from Investment Operations | | 2.57 | .88 | (.99) | 4.12 | (1.19) |

Distributions: | | | | | | |

Dividends from net investment income | | (.33) | (.33) | (.25) | (.27) | (.27) |

Dividends from net realized gain on investments | | (.73) | (1.42) | (1.50) | - | (.13) |

Total Distributions | | (1.06) | (1.75) | (1.75) | (.27) | (.40) |

Net asset value, end of period | | 14.15 | 12.64 | 13.51 | 16.25 | 12.40 |

Total Return (%)b | | 21.18 | 6.45 | (6.84) | 33.36 | (8.72) |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses to average net assets | | 1.24 | 1.19 | 1.17 | 1.18 | 1.19 |

Ratio of net expenses to average net assets | | 1.24 | 1.19 | 1.17 | 1.18 | 1.19 |

Ratio of net investment income to average net assets | | 2.23 | 2.59 | 1.79 | 1.77 | 1.95 |

Portfolio Turnover Rate | | 52.55 | 60.96 | 52.78 | 26.61 | 18.42 |

Net Assets, end of period ($ x 1,000) | | 54,619 | 49,055 | 48,725 | 55,804 | 44,269 |

a Based on average shares outstanding.

b Exclusive of sales charge.

See notes to financial statements.

9

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | |

| | |

| | | Year Ended October 31, |

Class C Shares | | 2024 | 2023 | 2022 | 2021 | 2020 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 13.26 | 14.09 | 16.86 | 12.85 | 14.47 |

Investment Operations: | | | | | | |

Net investment incomea | | .21 | .26 | .15 | .15 | .17 |

Net realized and unrealized gain (loss) on investments | | 2.39 | .55 | (1.29) | 4.00 | (1.51) |

Total from Investment Operations | | 2.60 | .81 | (1.14) | 4.15 | (1.34) |

Distributions: | | | | | | |

Dividends from net investment income | | (.21) | (.22) | (.13) | (.14) | (.15) |

Dividends from net realized gain on investments | | (.73) | (1.42) | (1.50) | - | (.13) |

Total Distributions | | (.94) | (1.64) | (1.63) | (.14) | (.28) |

Net asset value, end of period | | 14.92 | 13.26 | 14.09 | 16.86 | 12.85 |

Total Return (%)b | | 20.29 | 5.59 | (7.54) | 32.34 | (9.42) |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses to average net assets | | 2.00 | 1.96 | 1.94 | 1.95 | 1.94 |

Ratio of net expenses to average net assets | | 2.00 | 1.96 | 1.94 | 1.95 | 1.94 |

Ratio of net investment income to average net assets | | 1.50 | 1.82 | 1.02 | .97 | 1.21 |

Portfolio Turnover Rate | | 52.55 | 60.96 | 52.78 | 26.61 | 18.42 |

Net Assets, end of period ($ x 1,000) | | 6,643 | 10,274 | 13,578 | 18,165 | 24,255 |

a Based on average shares outstanding.

b Exclusive of sales charge.

See notes to financial statements.

10

| | | | | | | |

| | |

| | Year Ended October 31, |

Class I Shares | | 2024 | 2023 | 2022 | 2021 | 2020 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 11.78 | 12.71 | 15.39 | 11.76 | 13.30 |

Investment Operations: | | | | | | |

Net investment incomea | | .31 | .36 | .28 | .30 | .28 |

Net realized and unrealized gain (loss) on investments | | 2.12 | .50 | (1.17) | 3.64 | (1.39) |

Total from Investment Operations | | 2.43 | .86 | (.89) | 3.94 | (1.11) |

Distributions: | | | | | | |

Dividends from net investment income | | (.37) | (.37) | (.29) | (.31) | (.30) |

Dividends from net realized gain on investments | | (.73) | (1.42) | (1.50) | - | (.13) |

Total Distributions | | (1.10) | (1.79) | (1.79) | (.31) | (.43) |

Net asset value, end of period | | 13.11 | 11.78 | 12.71 | 15.39 | 11.76 |

Total Return (%) | | 21.54 | 6.68 | (6.56) | 33.67 | (8.53) |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses to average net assets | | .96 | .94 | .92 | .93 | .94 |

Ratio of net expenses to average net assets | | .96 | .93 | .92 | .93 | .94 |

Ratio of net investment income to average net assets | | 2.46 | 2.86 | 2.05 | 2.02 | 2.22 |

Portfolio Turnover Rate | | 52.55 | 60.96 | 52.78 | 26.61 | 18.42 |

Net Assets, end of period ($ x 1,000) | | 155,063 | 260,597 | 262,292 | 234,242 | 190,883 |

a Based on average shares outstanding.

See notes to financial statements.

11

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | |

| | |

| | | Year Ended October 31, |

Class Y Shares | | 2024 | 2023 | 2022 | 2021 | 2020 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 11.78 | 12.70 | 15.39 | 11.75 | 13.29 |

Investment Operations: | | | | | | |

Net investment incomea | | .34 | .26 | .24 | .30 | .32 |

Net realized and unrealized gain (loss) on investments | | 2.08 | .61 | (1.14) | 3.65 | (1.42) |

Total from Investment Operations | | 2.42 | .87 | (.90) | 3.95 | (1.10) |

Distributions: | | | | | | |

Dividends from net investment income | | (.37) | (.37) | (.29) | (.31) | (.31) |

Dividends from net realized gain on investments | | (.73) | (1.42) | (1.50) | - | (.13) |

Total Distributions | | (1.10) | (1.79) | (1.79) | (.31) | (.44) |

Net asset value, end of period | | 13.10 | 11.78 | 12.70 | 15.39 | 11.75 |

Total Return (%) | | 21.52 | 6.81 | (6.59) | 33.79 | (8.47) |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses to average net assets | | .92 | .92 | .85 | .92 | .85 |

Ratio of net expenses to average net assets | | .92 | .91 | .85 | .92 | .85 |

Ratio of net investment income to average net assets | | 2.71 | 2.67 | 1.96 | 2.03 | 2.48 |

Portfolio Turnover Rate | | 52.55 | 60.96 | 52.78 | 26.61 | 18.42 |

Net Assets, end of period ($ x 1,000) | | 5,453 | 1,401 | 202 | 42 | 27 |

a Based on average shares outstanding.

See notes to financial statements.

12

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

BNY Mellon Global Equity Income Fund (the “fund”) is a separate diversified series of BNY Mellon Investment Funds III (the “Trust”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering four series, including the fund. The fund’s investment objective is to seek total return (consisting of capital appreciation and income). BNY Mellon Investment Adviser, Inc. (the “Adviser”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY”), serves as the fund’s investment adviser. Newton Investment Management Limited (the “Sub-Adviser” or “NIM”), an indirect wholly-owned subsidiary of BNY and an affiliate of the Adviser, serves as the fund’s sub-adviser. NIM has entered into a sub-sub-investment advisory agreement with its affiliate, Newton Investment Management North America, LLC (“NIMNA”), which enables NIMNA to provide certain advisory services to the Sub-Adviser for the benefit of the fund, including, but not limited to, portfolio management services. NIMNA is subject to the supervision of NIM and the Adviser. NIMNA is also an affiliate of the Adviser. NIMNA’s principal office is located at BNY Mellon Center, 201 Washington Street, Boston, MA 02108. NIMNA is an indirect subsidiary of BNY.

BNY Mellon Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Adviser, is the distributor of the fund’s shares. The fund is authorized to issue an unlimited number of $.001 par value shares of Beneficial Interest in each of the following classes of shares: Class A, Class C, Class I and Class Y. Class A and Class C shares are sold primarily to retail investors through financial intermediaries and bear Distribution and/or Shareholder Services Plan fees. Class A shares generally are subject to a sales charge imposed at the time of purchase. Class A shares bought without an initial sales charge as part of an investment of $1 million or more may be charged a contingent deferred sales charge (“CDSC”) of 1.00% if redeemed within one year. Class C shares are subject to a CDSC imposed on Class C shares redeemed within one year of purchase. Class C shares automatically convert to Class A shares eight years after the date of purchase, without the imposition of a sales charge. Class I shares are sold primarily to bank trust departments and other financial service providers (including BNY and its affiliates), acting on behalf of customers having a qualified trust or an investment account or relationship at such institution, and bear no Distribution or Shareholder Services Plan fees. Class Y shares are sold at net asset value per share generally to institutional investors, and bear no Distribution or Shareholder Services Plan fees. Class I and Class Y shares are offered without a front-end sales charge or CDSC. Other differences between the classes include the services offered to and the expenses borne by each class, the allocation of certain transfer agency costs and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Trust accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the SEC under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund is an investment company and applies the accounting and reporting guidance of the FASB ASC Topic 946 Financial Services-Investment Companies. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.