- KAMN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Kaman (KAMN) 8-KOther Events

Filed: 7 Sep 06, 12:00am

For the Three Months Ended | For the Six Months Ended | |||

In millions, except per share data | June 30, 2006 | July 1, 2005 | June 30, 2006 | July 1, 2005 |

| Net Sales | $ 293.0 | $ 271.3 | $ 589.6 | $ 534.6 |

% change | 8.0% | 9.6% | 10.3% | 8.5% |

| Gross Profit | $ 80.5 | $ 70.7 | $ 161.9 | $ 141.6 |

% of net sales | 27.5% | 26.1% | 27.5% | 26.5% |

| Selling, general & administrative | ||||

| expenses (S,G&A) | $ 67.0 | $ 64.0 | $ 137.1 | $ 126.2 |

% of net sales Operating Income % of net sales | 22.9% $ 14.0 4.8% | 23.6% $ 7.3 2.7% | 23.2% $ 25.7 4.3% | 23.6% $ 16.5 3.1% |

| Interest expense, net | 1.6 | 0.6 | 2.9 | 1.4 |

| Other expense, net | 0.3 | 0.5 | 0.6 | 0.7 |

| Net earnings | $ 7.5 | $ 2.8 | $ 13.4 | $ 7.5 |

| Net earnings per share - basic | $ .31 | $ .12 | $ .56 | $ .33 |

| Net earnings per share - diluted | $ .31 | $ .12 | $ .55 | $ .33 |

For the Six Months Ended June 30, 2006 | ||||||

(In millions) | Sales | Operating Income | Operating Margin | |||

1H/06 | 1H/05 | 1H/06 | 1H/05 | 1H/06 | 1H/05 | |

Aerospace | $148.0 | $141.7 | $20.7 | $17.2 | 14.0% | 12.1% |

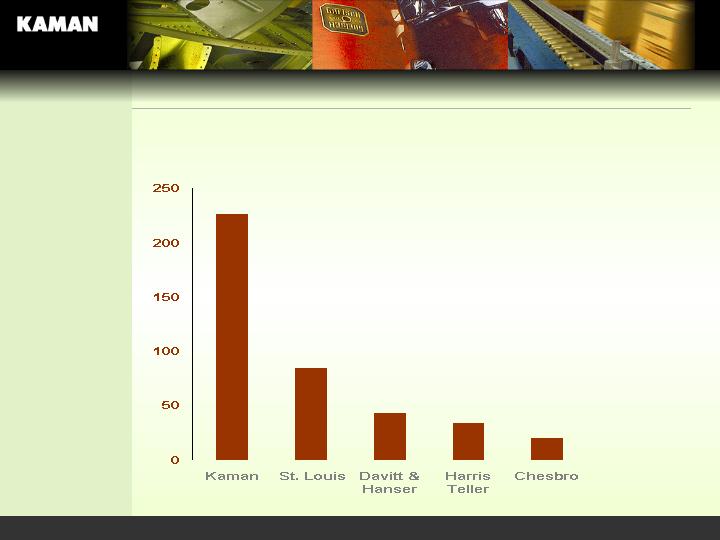

Industrial Distribution | 341.1 | 313.5 | 20.1 | 16.9 | 5.9% | 5.4% |

Music | 100.5 | 79.4 | 2.9 | 4.4 | 2.9% | 5.6% |

Corporate Expense | (18.1) | (22.1) | 1 (3.1%) | 1 (4.1%) | ||

Total | $589.6 | $534.6 | 2 $25.7 | 2 $16.5 | 4.3% | 3.1% |

For the Six Months Ended June 30, 2006 | ||||||

(In millions) | Sales | Operating Income | Operating Margin | |||

1H/06 | 1H/05 | 1H/06 | 1H/05 | 1H/06 | 1H/05 | |

Aerospace | $148.0 | $141.7 | $20.7 | $17.2 | 14.0% | 12.1% |

Industrial Distribution | 341.1 | 313.5 | 20.1 | 16.9 | 5.9% | 5.4% |

Music | 100.5 | 79.4 | 2.9 | 4.4 | 2.9% | 5.6% |

Corporate Expense | (18.1) | (22.1) | 1 (3.1%) | 1 (4.1%) | ||

Total | $589.6 | $534.6 | 2 $25.7 | 2 $16.5 | 4.3% | 3.1% |

GAAP reconciliation applicable to the six months ended June 30, 2006 This table provides a reconciliation of reported Net Earnings determined under applicable generally accepted accounting principles (GAAP) to net earnings adjusted for the affect of various discrete items. | |||

Earnings Before Income Taxes | Net Earnings | Net Earnings Per Share Diluted | |

| As Reported | $22.2 | $13.4 | $0.56 |

| Add: | |||

| Addition to Loss Reserve: Australia | 5.3 | 3.2 | 0.13 |

Stock Appreciation Rights: Deductible and Non- Deductible | 0.5 | 0.4 | 0.02 |

| Subtract: | |||

| Gain from Capitalized Freight Adjustment | (1.6) | (0.9) | (0.04) |

| Recovery of Recapitalization Legal Fees | (0.5) | (0.5) | (0.02) |

| As Adjusted | $26.0 | $15.6 | $0.66 |

For the Three Months Ended June 30, 2006 | ||||||

(In millions) | Sales | Operating Income | Operating Margin | |||

2Q/06 | 2Q/05 | 2Q/06 | 2Q/05 | 2Q/06 | 2Q/05 | |

Aerospace | $74.4 | $76.0 | $ 10.7 | $ 9.5 | 14.3% | 12.5% |

Industrial Distribution | 170.5 | 157.5 | 9.3 | 8.4 | 5.4% | 5.3% |

Music | 48.1 | 37.8 | 1.6 | 1.9 | 3.4% | 4.9% |

Corporate Expense | (7.6) | (12.6) | 1 (2.6%) | 1(4.6%) | ||

Total | $293.0 | $271.3 | $14.0 | 2 $7.3 | 4.8% | 2.7% |

As of 6/30/06 | As of 3/31/06 | As of 12/31/05 | |

Bank Debt, Notes Payable and Debentures | $101.4 | $103.5 | $64.8 |

Shareholders’ Equity | $281.1 | $274.0 | $269.8 |

Debt as % of Total Capitalization | 26.5% | 27.4% | 19.4% |

Capital Expenditures | $5.0 | $1.7 | $9.9 |

Depreciation & Amortization | $5.2 | $2.5 | $9.6 |