Kaman Corporation (NASDAQ-GS: KAMN)

Kaman Corporation (NASDAQ-GS: KAMN)

Investor Presentation

May 18, 2010

2

Distribution

56%

Aerospace

44%

2009 Sales

Distribution

14%

Aerospace

86%

2009 Segment

Operating Income*

2009 Sales $1,146 Million

4,373 Employees

Aerospace

Industrial

Distribution

NASDAQ GS: KAMN

KAMAN CORPORATION

* Operating profit after depreciation and before interest and corporate charges.

3

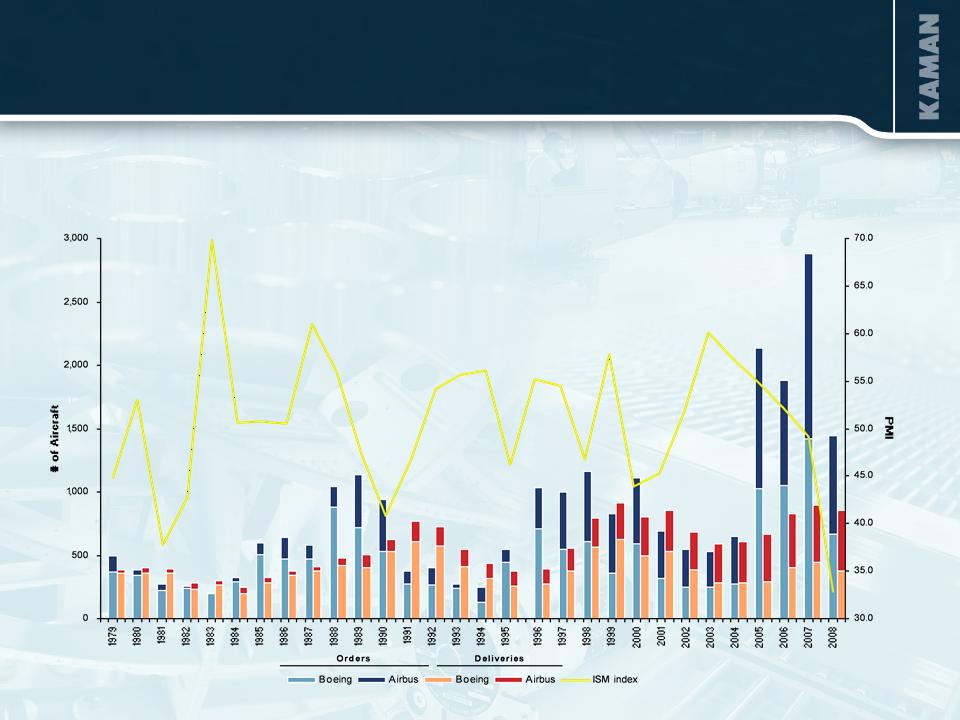

Source: Boeing and Airbus historical data and ISM

Aerospace Orders and Deliveries vs. ISM Index Over Time

WHY TWO BUSINESSES?

4

Source: Bloomberg, Barra, CapitalIQ, Kaman internal assessments, and projections and Goldman Sachs

Note: Aerospace index includes TransDigm, Woodward Governor, Heico, Moog, Curtiss-Wright, AAR Corp, Hexcel, BE Aerospace, Triumph, Esterline, LMI Aerospace, and Spirit.

Note: WACC assumes marginal tax rate of 35%. Assumes barra predicted beta post 2005 and Bloomberg beta pre 2005. Assumes Rf as 30 year treasury rate.

AEROSPACE - Strategic Perspective

(12.0)%

(8.0)%

(4.0)%

0.0%

4.0%

8.0%

12.0%

16.0%

20.0%

24.0%

28.0%

Jun-99

Dec-00

Jun-02

Dec-03

Jun-05

Dec-06

Jun-08

Average WACC

Average ROIC

Kaman Aerospace ROIC

Illustrative ROIC versus WACC Analysis Over Time | Last 10 Years

5

Source: Bloomberg, Barra, CapitalIQ, Kaman internal assessments and projections, and Goldman Sachs

Note: Distribution index includes Fastenal, MSC Industrial, WW Grainger, Genuine Parts, Applied Industrial Technologies, DXP, WESCO, Anixter, Watsco, and Interline.

Note: WACC assumes marginal tax rate of 35%. Assumes barra predicted beta post 2005 and Bloomberg beta pre 2005. Assumes Rf as 30 year treasury rate.

INDUSTRIAL DISTRIBUTION - Strategic Perspective

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

Jun-99

Dec-00

Jun-02

Dec-03

Jun-05

Dec-06

Jun-08

Average WACC

Average ROIC

Kaman Industrial Distribution ROIC

Illustrative ROIC versus WACC Analysis Over Time | Last 10 Years

6

AEROSPACE SEGMENT

2009 Sales $501 million

7

Commercial

Military

Business/Regional

28%

69%

3%

Note: Based on 2009 sales

AEROSPACE - Business Mix

8

Manufacture of cockpit

Blade erosion coating

Manufacture and assembly

of tail rotor pylon

of tail rotor pylon

Sub assembly and

joining of fuselage

joining of fuselage

Blade manufacture, repair

and overhaul

and overhaul

Driveline couplings

Bushings

Flight control bearings

Bearing products

AEROSPACE - Programs/Capabilities

9

Fixed trailing edge

Fuel tank access doors

Top covers

Bearing products

Nose landing gear

Rudder

Main landing gear

Flaps

Horizontal stabilizer

Doors

Engine/thrust reverser

Flight controls

AEROSPACE - Programs/Capabilities

10

HARPOON

FMU-139

TOMAHAWK

STANDARD

MISSILE

MISSILE

SLAM-ER

AMRAAM

KPP Fuzes are on a Majority of Major Weapons

Systems

Systems

STANDARD

MISSILE

MISSILE

JPF

SLAM-ER

TOMAHAWK

AMRAAM

MAVERICK

AGM-65M

AEROSPACE - Programs/Capabilities

11

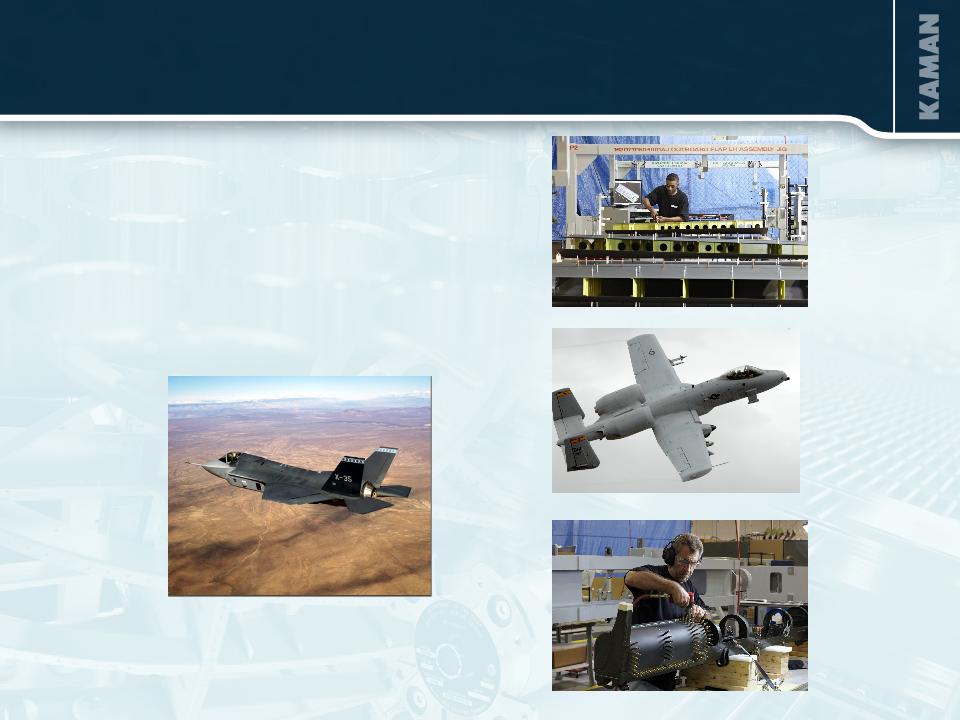

AEROSPACE - Programs/Capabilities

§ Tooling design and manufacture

12

JSF

C-17

A-10

E-2D

Typhoon

UH-60

A400

CH-47

AEROSPACE - Principal Military Platforms

Boeing NewGen Tanker

MH-92

13

AEROSPACE - Commercial Significant Platforms

Airbus A320

Boeing 777

Airbus A330

Bell Helicopter

Boeing 787

Boeing 737

Airbus A350

14

AEROSPACE - Kaman Helicopters

Kaman SH-2G Naval Helicopters

§ Support and Upgrades

§ Currently in service with Egypt,

New Zealand, Poland

New Zealand, Poland

§ Remarketing eleven SH-2G(I)s,

formerly Royal Australian Navy aircraft

formerly Royal Australian Navy aircraft

15

Kaman K-MAX®

§ K-MAX Commercial Helicopter

Support

Support

§ Teamed with Lockheed Martin to

develop an unmanned military version

of the K-MAX

develop an unmanned military version

of the K-MAX

§ Successfully demonstrated unmanned

K-MAX to the U.S. Marine Corps in

January 2010

K-MAX to the U.S. Marine Corps in

January 2010

AEROSPACE - Kaman Helicopters

16

AEROSPACE - Market Environment/Opportunities

§ Existing funded programs

- C-17

- JPF

- BLACKHAWK

§ Production ramp up

- A-10 re-wing

- Bell Helicopters

- B787

- JSF

- A380

§ Continuation of outsourcing trend - primes and super tier 1’s

§ Unmanned K-MAX program

§ Sale of SH-2G(I) helicopters

§ Acquisitions providing complementary capabilities and platforms

17

INDUSTRIAL DISTRIBUTION SEGMENT

2009 Sales $645 million

18

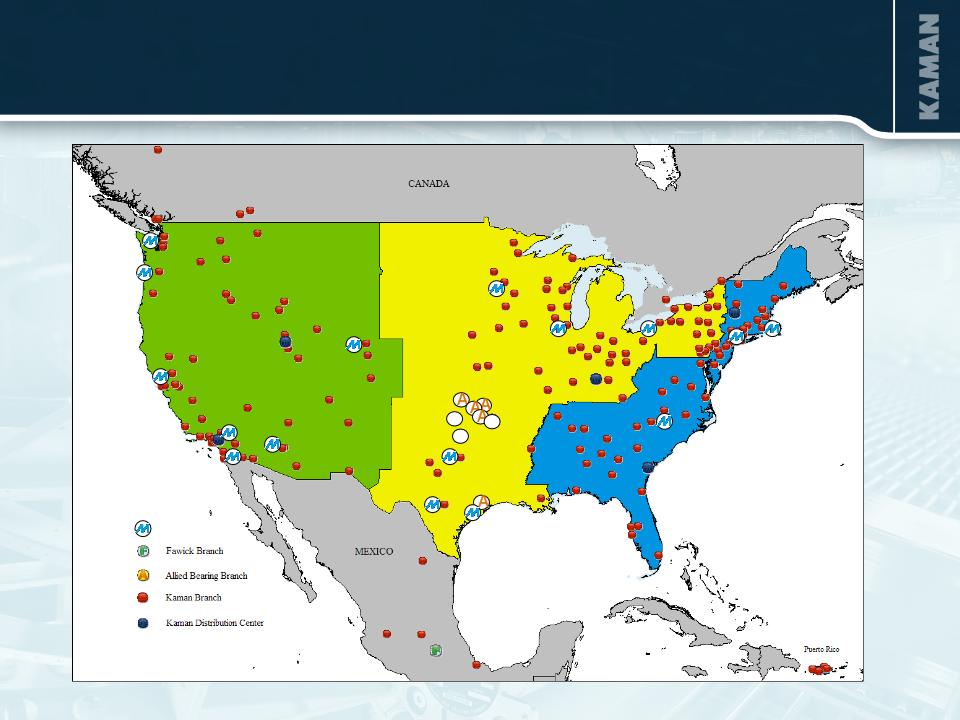

INDUSTRIAL DISTRIBUTION SEGMENT

§ Third largest industrial distribution firm serving $15 billion of a $23 billion power

transmission / motion control market.

transmission / motion control market.

§ 207 branches and 5 distribution centers

§ Major product categories:

- Bearings

- Mechanical and electrical power transmission

- Fluid Power

- Motion control

- Automation

- Material handling

§ Statistics

- $371,000 sales per employee (2009)

- 2,000 employees (approximately one third outside sales)

- 3.5 million SKUs

- 50,000+ customers

19

INDUSTRIAL DISTRIBUTION SEGMENT

A

A

A

Minarik

20

INDUSTRIAL DISTRIBUTION SEGMENT - Key Suppliers

21

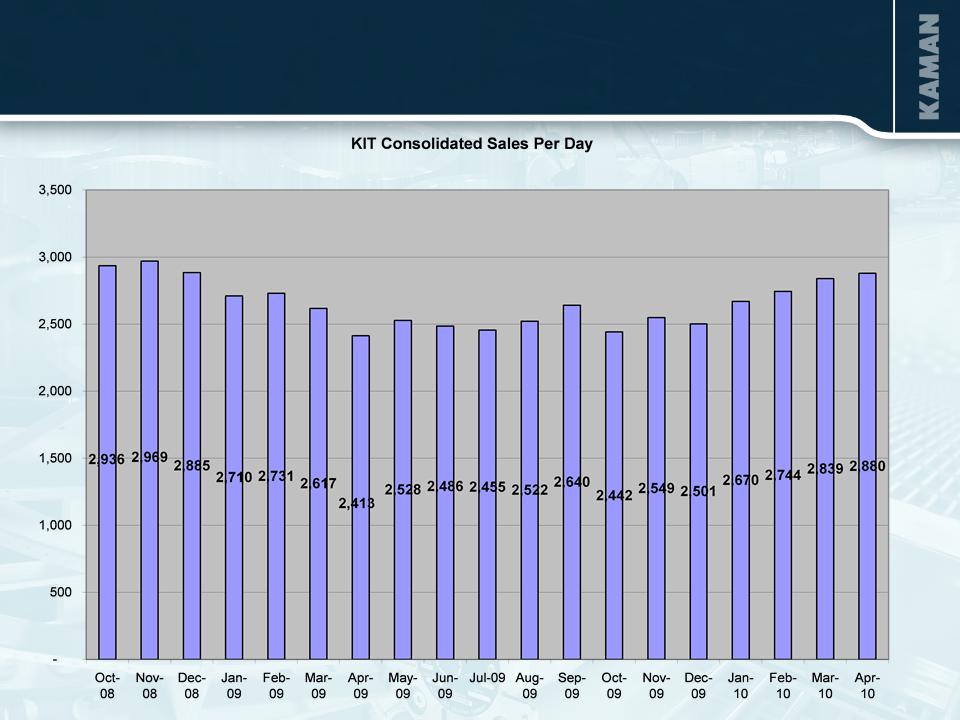

INDUSTRIAL DISTRIBUTION - Market Environment

§ Market recovery - positive ISM index points to improving market

environment

environment

§ Sales per sales day were up 7%, 10%, and 14% sequentially in January,

February and March, respectively, as compared to the fourth quarter of

2009

February and March, respectively, as compared to the fourth quarter of

2009

§ February was the first month of positive year over year sales growth

since October 2008

since October 2008

§ April sales were encouraging

22

SALES PER DAY - $(000)

23

SALES PER DAY GROWTH RATE

24

INDUSTRIAL DISTRIBUTION - Opportunities

§ Broaden our product offerings to gain additional business

from existing customers and new opportunities from a wider

slice of the market

from existing customers and new opportunities from a wider

slice of the market

- Product line additions from vendors such as:

• ASCO/Numatics

• Sheffer Corporation

• GEM® Steam Trap

• Bison Gear

- Launched ReliaMark brand of bearings,

roller chains, oil seals, and shaft collars

§ Recognize sales and cost synergies from the three

acquisitions completed in 2010

acquisitions completed in 2010

§ Expand our geographic footprint through acquisitions in major

industrial markets to enhance our position in the competition

for national and regional accounts

industrial markets to enhance our position in the competition

for national and regional accounts

25

§ Minarik is a national distributor of motion control and automation products

§ 2009 Sales - $84 million

Vision Systems Motors & Gear Motors Actuators

AC & DC Drives Servo Motors Safety

& Controls

ACQUISITIONS - Minarik

26

§ Minarik has 16 stocking distributor locations and 3 Minarik Applied Products

and Systems Centers (MAPS Centers) locations and approx. 215 employees

and Systems Centers (MAPS Centers) locations and approx. 215 employees

§ Expands KIT’s geographic coverage in key markets

§ Adds branch locations in 3 of the top 15 markets where KIT is not well

represented (San Jose, Cleveland, Chicago)

represented (San Jose, Cleveland, Chicago)

ACQUISITIONS - Minarik

27

§ Expands KIT’s product offering

§ Positions Kaman as an industry leader in US motion control and automation

markets

markets

§ Diversifies traditional MRO customer base through primary OEM presence

§ Organizational and cultural fit:

- Minarik will substantially strengthen KIT’s Automation Specialist group

- Minarik is realigning organization in a similar manner as KIT

ACQUISITIONS - Minarik

28

ACQUISITIONS

Business Overview

•Bearing & power transmission dist.

•Headquartered in Tulsa, OK

(October 31) 2007 2008 2009

Sales $28 MM $30 MM $22 MM

•8 branches located in Oklahoma, Arkansas

and Texas; 70+ employees

Strategic Rationale

•Geographic penetration

•Adds volume in our core product lines

•Provides access to chemical and petro-

chemical industries and oil and gas

industries

Transaction Summary

•Transaction closed April 5, 2010

•Purchase price $15MM

Strengths

•Product knowledge in our core bearing

and power transmission product lines

•Vendor authorizations with premier

brands

§ Allied Bearings Supply, Co., Inc.

29

§ Fawick De Mexico

Business Overview

•Mexico City based fluid power distributor

•Headquartered in same building complex

as Kaman’s Delamac business

$ Pesos MM 2008 2009

Sales $43 MM $50 MM

Exchange Rate: 13.4 Pesos / US $

Strategic Rationale

•Adds fluid power to Delamac’s product

offering

•Adds higher margin product lines to

improve overall profitability of Delamac

•Adds exclusive franchises for Mexico

•Ensures that a Delamac competitor does

not occupy the premises

Transaction Summary

•Closed transaction 2/26/10

•Purchase price $4.4MM

Strengths

•Knowledge in fluid power product

applications

•Sales force covers almost all of Mexico

ACQUISITIONS

30

SUMMARY

31

2010 OUTLOOK UPDATE

Aerospace segment

§ We expect full year sales to be approximately flat in comparison to 2009

§ We expect the full year operating margin to be between 15.5% and 16.5%

Industrial Distribution segment

§ We expect full year organic sales growth to be up 6% to 8% for the full year as

compared to 2009

compared to 2009

§ Including completed acquisitions we expect full year sales to be in a range of

$765 million to $785 million

$765 million to $785 million

§ We expect operating margins for the full year of approximately 2.8% to 3.2%

Other

§ We expect corporate expenses, on average, to be in a range of $9.0 million to

$10.0 million per quarter

$10.0 million per quarter

§ We expect full year interest expense to be approximately $10.7 million

32

KAMAN CORPORATION - Summary

§ High margin aerospace business led by specialty bearing product lines

§ Industrial distribution business gaining market share in a fragmented

market via national account growth, geographic and product line

expansion

market via national account growth, geographic and product line

expansion

§ Long-term organic growth opportunities in both segments

§ Potential to further accelerate growth and increase scale through

additional acquisitions

additional acquisitions

§ Initiatives to optimize profit, increase cash flow generation, strengthen

competitive position

competitive position

§ Strong balance sheet to fund growth and strategic initiatives

33

APPENDIX

44%

2009 Sales $1,146 million

34

1 Corporate expense percentage is to Total Sales

(In thousands) SEGMENTS | Net Sales | Operating Income/(Loss) | Operating Margin | |||

Q1 2010 | Q1 2009 | Q1 2010 | Q1 2009 | Q1 2010 | Q1 2009 | |

Industrial Distribution | $179,259 | $176,906 | $4,812 | $2,779 | 2.7% | 1.6% |

Aerospace | 97,513 | 117,129 | 9,633 | 15,297 | 9.9% | 13.1% |

Net gain/(loss) on sale of assets | 576 | 93 | ||||

Corporate expense | (10,528) | (8,766) | 1 (3.8%) | 1(3.0%) | ||

Sales/Op. inc. from continuing ops | $276,772 | $294,035 | $4,493 | $9,403 | 1.6% | 3.2% |

INCOME STATEMENT HIGHLIGHTS

For the quarters ended April 2, 2010 and April 3, 2009

For the quarters ended April 2, 2010 and April 3, 2009

35

1 Corporate expense percentage is to Total Sales

(In thousands) SEGMENTS | Net Sales | Operating Income/(Loss) | Operating Margin | |||

2009 | 2008 | 2009 | 2008 | 2009 | 2008 | |

Industrial Distribution | $645,535 | $776,970 | $12,612 | $35,397 | 2.0% | 4.6% |

Aerospace | 500,696 | 476,625 | 74,996 | 61,608 | 15.0% | 12.9% |

Net gain/(loss) on sale of assets | (4) | 221 | ||||

Corporate expense | (33,662) | (31,960) | 1 (2.9%) | 1(2.5%) | ||

Sales/Op. inc. from continuing ops | $1,146,231 | $1,253,595 | $53,942 | $65,266 | 4.7% | 5.2% |

INCOME STATEMENT HIGHLIGHTS

For the years ended December 31

For the years ended December 31

36

(In Millions) | As of 04/02/10 | As of 12/31/09 | As of 12/31/08 |

Cash and Cash Equivalents | $18.3 | $18.0 | $8.2 |

Notes Payable and Long-term Debt | $88.6 | $63.6 | $94.2 |

Shareholders’ Equity | $333.0 | $312.9 | $274.3 |

Debt as % of Total Capitalization | 21.0% | 16.9% | 25.6% |

Capital Expenditures | $3.6 | $13.6 | $16.0 |

Depreciation & Amortization | $4.5 | $16.1 | $12.8 |

BALANCE SHEET AND CAPITAL FACTORS

37

Sales

EPS

Stock Price (one year)

Return on Invested Capital

PERFORMANCE METRICS

38

Pension Plans

39

Bloomfield, CT

700,000 sq ft

•Mechanical

•Composites

•Large Assembly

Wichita, KS

168,000 sq ft

•Composites

•Structural

Bondments

•Composite

Assemblies

Jacksonville, FL

220,000 sq ft

•Fabrication-

ØMachining

ØSheet Metal Form

ØExtrusion

•Assembly

ØMajor Subs

ØFinal Structure

•Product Integration

Darwen, UK

208,000 sq ft

•Composites

•Metal Fabrication

•Tooling

•Assembly

AEROSPACE - Primary Facilities

•Helicopter assembly

and test facilities

•Bearing manufacturing

40

Manchester, UK

63,000 sq ft

•Aerospace

manufacturing

facility

manufacturing

facility

Orlando, FL

90,000 sq ft

•Bomb safe and

arming device

manufacturing

facility

arming device

manufacturing

facility

80 acre test range

Middletown, CT

202,000 sq ft

•Manufacturing facility

•Missile safe and

arming devices

arming devices

•Bomb safe and

arming devices

arming devices

•Ruggedized

memory

products

memory

products

•Measuring

products

products

Dachsbach, Germany

30,000 sq ft

•Manufacturing facility

•Spherical

bearings

bearings

•Ball bearings

•Rod ends

•Bushings

•Specialty

components

components

AEROSPACE - Primary Facilities

41

FORWARD-LOOKING STATEMENTS

This presentation contains forward-looking information relating to the company's business and prospects, including the Aerospace and

Industrial Distribution businesses, operating cash flow, and other matters that involve a number of uncertainties that may cause actual results

to differ materially from expectations. Those uncertainties include, but are not limited to: 1) the successful conclusion of competitions for

government programs and thereafter contract negotiations with government authorities, both foreign and domestic; 2) political conditions in

countries where the company does or intends to do business; 3) standard government contract provisions permitting renegotiation of terms

and termination for the convenience of the government; 4) domestic and foreign economic and competitive conditions in markets served by

the company, particularly the defense, commercial aviation and industrial production markets; 5) risks associated with successful

implementation and ramp up of significant new programs; 6) management's success in increasing the volume of profitable work at the

Aerospace Wichita facility; 7) successful negotiation of the Sikorsky Canadian MH-92 program price; 8) successful resale of the SH-2G(I)

aircraft, equipment and spare parts; 9) receipt and successful execution of production orders for the JPF U.S. government contract,

including the exercise of all contract options and receipt of orders from allied militaries, as all have been assumed in connection with goodwill

impairment evaluations; 10) satisfactory resolution of the company’s litigation relating to the FMU-143 program; 11) continued support of the

existing K-MAX helicopter fleet, including sale of existing K-MAX spare parts inventory; 12) cost estimates associated with environmental

remediation activities at the Bloomfield, Moosup and New Hartford, CT facilities and our U.K. facilities; 13) profitable integration of acquired

businesses into the company's operations; 14) changes in supplier sales or vendor incentive policies; 15) the effects of price increases or

decreases; 16) the effects of pension regulations, pension plan assumptions and future contributions; 17) future levels of indebtedness and

capital expenditures; 18) continued availability of raw materials and other commodities in adequate supplies and the effect of increased costs

for such items; 19) the effects of currency exchange rates and foreign competition on future operations; 20) changes in laws and regulations,

taxes, interest rates, inflation rates and general business conditions; 21) future repurchases and/or issuances of common stock; and 22) other

risks and uncertainties set forth in the company's annual, quarterly and current reports, and proxy statements. Any forward-looking

information provided in this presentation should be considered with these factors in mind. The company assumes no obligation to update any

forward-looking statements contained in this presentation.

Industrial Distribution businesses, operating cash flow, and other matters that involve a number of uncertainties that may cause actual results

to differ materially from expectations. Those uncertainties include, but are not limited to: 1) the successful conclusion of competitions for

government programs and thereafter contract negotiations with government authorities, both foreign and domestic; 2) political conditions in

countries where the company does or intends to do business; 3) standard government contract provisions permitting renegotiation of terms

and termination for the convenience of the government; 4) domestic and foreign economic and competitive conditions in markets served by

the company, particularly the defense, commercial aviation and industrial production markets; 5) risks associated with successful

implementation and ramp up of significant new programs; 6) management's success in increasing the volume of profitable work at the

Aerospace Wichita facility; 7) successful negotiation of the Sikorsky Canadian MH-92 program price; 8) successful resale of the SH-2G(I)

aircraft, equipment and spare parts; 9) receipt and successful execution of production orders for the JPF U.S. government contract,

including the exercise of all contract options and receipt of orders from allied militaries, as all have been assumed in connection with goodwill

impairment evaluations; 10) satisfactory resolution of the company’s litigation relating to the FMU-143 program; 11) continued support of the

existing K-MAX helicopter fleet, including sale of existing K-MAX spare parts inventory; 12) cost estimates associated with environmental

remediation activities at the Bloomfield, Moosup and New Hartford, CT facilities and our U.K. facilities; 13) profitable integration of acquired

businesses into the company's operations; 14) changes in supplier sales or vendor incentive policies; 15) the effects of price increases or

decreases; 16) the effects of pension regulations, pension plan assumptions and future contributions; 17) future levels of indebtedness and

capital expenditures; 18) continued availability of raw materials and other commodities in adequate supplies and the effect of increased costs

for such items; 19) the effects of currency exchange rates and foreign competition on future operations; 20) changes in laws and regulations,

taxes, interest rates, inflation rates and general business conditions; 21) future repurchases and/or issuances of common stock; and 22) other

risks and uncertainties set forth in the company's annual, quarterly and current reports, and proxy statements. Any forward-looking

information provided in this presentation should be considered with these factors in mind. The company assumes no obligation to update any

forward-looking statements contained in this presentation.

###

Contact: Eric Remington, V.P.

Investor Relations

(860) 243-6334

Eric.Remington@kaman.com