Kaman Corporation (NASDAQ-GS: KAMN)

Kaman Corporation (NASDAQ-GS: KAMN)

Investor Presentation

January 12, 2011

2

Investment Summary

§ Significant long-term organic growth opportunities in Aerospace

and Industrial Distribution

and Industrial Distribution

§ High margin Aerospace business anchored by market leading

position in specialty bearings

position in specialty bearings

§ Participation on Military platforms in Aerospace provides recurring

revenue stream

revenue stream

§ Industrial Distribution business benefiting from industrial sector

momentum and gaining scale via recent acquisitions

momentum and gaining scale via recent acquisitions

§ Investing in new product development, new product applications,

acquisitions and technology to position the Company for long-term

growth

acquisitions and technology to position the Company for long-term

growth

§ Strong balance sheet to drive growth and strategic initiatives

3

Operator of two diversified business segments:

(2010 Nine Month YTD Sales $953 Million)

Industrial Distribution

Aerospace

3rd largest power transmission/motion

control industrial distributor in North

America

control industrial distributor in North

America

Manufacturer and subcontractor in the

global commercial and military

aerospace and defense markets

global commercial and military

aerospace and defense markets

64% of 2010 Nine Month YTD Revenue

34% of 2010 Nine Month YTD Operating Profit

36% of 2010 Nine Month YTD Revenue

66% of 2010 Nine Month YTD Operating Profit

Corporate Overview

4

AEROSPACE

2010 Nine Month YTD Sales $340 Million

5

Aerospace Strategy

§ GROWTH - Increased capabilities through both internal

development and acquisitions to win major OEM and Tier 1

programs

development and acquisitions to win major OEM and Tier 1

programs

§ DIVERSIFICATION - Expand commercial content via growth

initiatives to achieve a better balance of aerospace revenues

initiatives to achieve a better balance of aerospace revenues

§ PROFITABILITY - Expand engineering capability to provide

differentiation and improved margins

differentiation and improved margins

6

Progress in Aerospace

§ Global Aerosystems acquisition

- Strongly supports strategic initiative to grow design content for

higher more protected margins (life of program vs. build to print)

higher more protected margins (life of program vs. build to print)

- Strong experienced base of 120 engineers

- Key customer positions

• Boeing, Kawasaki Heavy Industries, Mitsubishi Aircraft Corporation,

Mitsubishi Heavy Industries, Bombardier, Aviation Partners Boeing and

the Department of Defense

Mitsubishi Heavy Industries, Bombardier, Aviation Partners Boeing and

the Department of Defense

§ Team K-Max® awarded deployment contract for two unmanned

aerial systems

aerial systems

§ Building backlog through contract awards and an expanded

customer base

customer base

7

Aerospace End-Markets

Business/

Regional

3%

Military

69%

Commercial

28%

Based on 2009 Sales

8

Fixed trailing edge

Fuel tank access doors

Top covers

Red denotes bearing products

Nose landing gear

Rudder

Main landing gear

Flaps

Horizontal stabilizer

Doors

Engine/thrust reverser

Aircraft Programs/Capabilities

Flight controls

9

Manufacture of cockpit

Blade erosion coating

Manufacture and assembly

of tail rotor pylon

of tail rotor pylon

Sub assembly and

joining of fuselage

joining of fuselage

Blade manufacture,

repair and overhaul

repair and overhaul

Driveline couplings

Bushings

Flight control bearings

Aircraft Programs/Capabilities

Red denotes bearing products

10

Market Leading Self Lube Airframe Bearing

Product Lines

Product Lines

§ Content on virtually every aircraft manufactured today

with a growing installed base

with a growing installed base

§ Proprietary technology:

– KAron® bearing liner system

– KAflex® driveline couplings

– Tufflex® machined driveline couplings

§ 95% of sales are for custom engineered applications

§ Operational excellence through lean manufacturing

§ Industry leading lead times

11

Strong Base Business

§ BLACK HAWK

§ Joint Programmable Fuze (JPF)

§ C-17

12

Growth Programs

§ A-10 re-wing

§ Boeing 787

§ F-35 (Joint Strike Fighter)

§ Airbus A380

§ Bell Helicopters

13

UP

25%

$524 Million

at 10/01/10

$418 Million

at 10/02/09

Opportunities Are Driving Backlog

14

Opportunities - New programs

§ Unmanned K-MAX®

§ SH-2G(I)

§ Airbus A350

§ JSF STOVL lift fan application

§ AW 169

§ Sukhoi Superjet 100

15

INDUSTRIAL DISTRIBUTION

2010 Nine Month YTD Sales $613 Million

16

Deliver Profitable Growth

Profitability

Operating ROS 3.4% à 7.0%

I

II

III

Strategic Pricing

Management

Management

Optimized Supply

Chain & Logistics

Chain & Logistics

Higher Margin Product

Lines

Lines

Global Sourcing /

Leverage purchasing

Leverage purchasing

9

10

11

12

Growth

Sales $800M+ à $1.5B

2

3

4

1

Productivity

Sales/employee $430k à $600k

6

7

8

5

Industrial Distribution Strategy

17

Executing Strategy and Building Network

18

§ Third largest industrial distribution firm serving $15 billion of the $23

billion power transmission / motion control market.

billion power transmission / motion control market.

§ 207 branches and 5 distribution centers

§ Major product categories:

- Bearings

- Mechanical and electrical power transmission

- Fluid Power

- Motion control

- Automation

- Material handling

§ Metrics:

- $371,000 sales per employee (2009)

- 2,000 employees (approximately one third outside sales)

- 3.5 million SKUs

- 50,000+ customers

Industrial Distribution Overview

19

Industrial Distribution

20

§ Organic growth strong

- Q310 up 17.1%, Q210 up 17.5%

- OEM markets extremely strong Q310 OEM sales (base business) up 45%

- MRO markets turned positive in Q2

- Sales trends remained consistent in Q410

- Broad based growth across geographies and end markets

§ Acquisitions accelerating top line and building scale

- Added geographic coverage, product line expansions, strong franchises

- Acquisitions expected to add $95 to $100 million in 2010

- Minarik and Allied expected to be accretive in 2010

Growing via Positive Sector Fundamentals

and Acquisitions

and Acquisitions

21

Industrial Distribution

Organic Sales Per Day Trends

Organic Sales Per Day Trends

22

Industrial Distribution

Growth Opportunities

Growth Opportunities

§ Broaden product offering organically and through acquisition to win

additional business from existing customers and gain market share

additional business from existing customers and gain market share

§ Enhance margins through new higher margin product lines, a focus

on pricing management and leverage from higher sales

on pricing management and leverage from higher sales

§ Recognize sales and cost synergies from the three acquisitions

completed in 2010

completed in 2010

§ Expand geographic footprint through additional acquisitions to

enhance Kaman’s position in the competition for national accounts

enhance Kaman’s position in the competition for national accounts

§ Improve productivity through technology investments to enhance

return on sales

return on sales

23

Metrics That Impact Management

Compensation

Compensation

§ 71% of CEO’s compensation in 2009 was performance related

§ Annual cash incentive

– Return on investment (Corporate* and Business Units)

– EPS growth (Corporate*)

– EPS performance against plan (Corporate*)

– Growth in operating income (Business Units)

– Annual objectives determined by business priorities (Business Units)

§ Long-term incentives

– Return on investment*

– Growth in EPS*

– Total shareholder return*

*Based on multi-year comparisons against the Russell 2000 index

24

Investment Merits

§ Leading Market Position in Both Business Segments

§ Two Distinct Markets Balance Overall Company Performance

§ Continued Focus on Profit Optimization, Increasing Cash

Flows

Flows

and Strengthening Competitive Position

§ Strong Liquidity and Conservative Financial Profile

§ Disciplined and Focused Acquisition Strategy

§ Experienced Management Team

25

Acquisitions

3 Acquisitions Completed to Date in 2010:

§ Minarik (April 30, 2010)

- Only national distributor of motion control & automation products

- 2009 sales: $84 million; Purchase price: $42.5 million

- Expands geographic coverage in 3 of the top 15 markets where Kaman has not been

well represented (e.g. San Jose, Cleveland, Chicago)

well represented (e.g. San Jose, Cleveland, Chicago)

- Diversifies traditional MRO customer base through primary OEM presence

- Expands product offering; positions Kaman as a leader in motion control &

automation

automation

§ Allied Bearings Supply (April 5, 2010)

- Distributor of bearings, power transmission, material handling, and industrial supplies

- 2009 sales: $22 million; Purchase price: $15 million

- Expands Kaman’s coverage in Oklahoma, Arkansas and Texas

- Adds volume in core product lines and provides access to chemical and petro-

chemical industries and oil and gas industries

chemical industries and oil and gas industries

§ Fawick de Mexico (February 26, 2010)

- Mexico City based fluid power distributor with coverage throughout most of Mexico

- 2009 sales: ~$4 million (USD); Purchase price: ~$5.0 million (USD)

26

FINANCIAL SUMMARY

36%

2010 Nine Month YTD Sales $953 Million

27

(1) Corporate expense percentage is to Total Sales

(2) As Adjusted

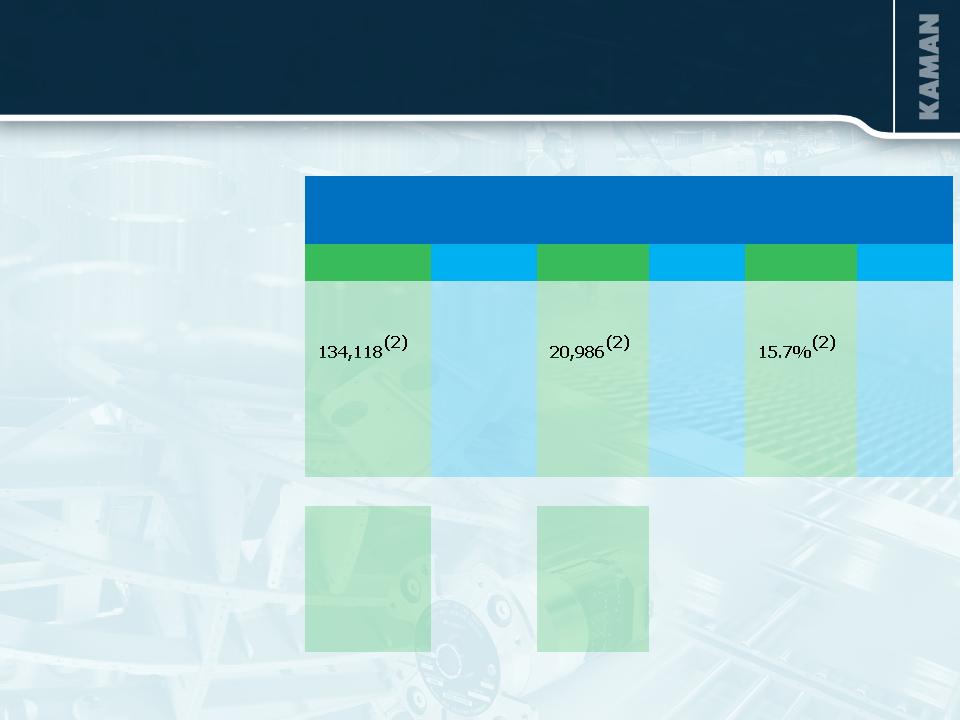

SEGMENT PERFORMANCE (In thousands) | Net Sales | Operating Income/(Loss) | Operating Margin | |||

Q3 2010 | Q3 2009 | Q3 2010 | Q3 2009 | Q3 2010 | Q3 2009 | |

Industrial Distribution | $ 223,127 | $ 162,921 | $ 8,494 | $ 3,388 | 3.8% | 2.1% |

Aerospace | 126,980 | 20,986(2) | 19,906 | 15.7%(2) | 15.7% | |

Net gain/(loss) on sale of assets | (5) | (3) | ||||

Corporate expense | (7,914) | (8,625) | (2.2%)(1) | (3.0%)(1) | ||

Sales/Op. inc. from continuing ops | $357,245(2) | $ 289,901 | $ 21,561(2) | $ 14,666 | 6.0% | 5.1% |

GAAP reconciliation: As reported Aerospace | $ 136,418 | $ 19,017 | ||||

Aerospace contract settlement | (2,259) | 1,969 | ||||

Adjusted - Aerospace | $ 134,118(2) | $ 20,986(2) | ||||

Recent Results

28

(In Millions) | As of 10/01/10 | As of 12/31/09 | As of 12/31/08 |

Cash and Cash Equivalents | $ 11.9 | $ 18.0 | $ 8.2 |

Notes Payable and Long-term Debt | $ 106.3 | $ 63.6 | $ 94.2 |

Shareholders’ Equity | $ 353.4 | $ 312.9 | $ 274.3 |

Debt as % of Total Capitalization | 23.1% | 16.9% | 25.6% |

Capital Expenditures | $14.5(1) | $ 13.6 | $ 16.0 |

Depreciation & Amortization | $15.3(1) | $ 16.1 | $ 12.8 |

Balance Sheet and Capital Factors

(1)YTD at 10/1/10

29

APPENDIX

30

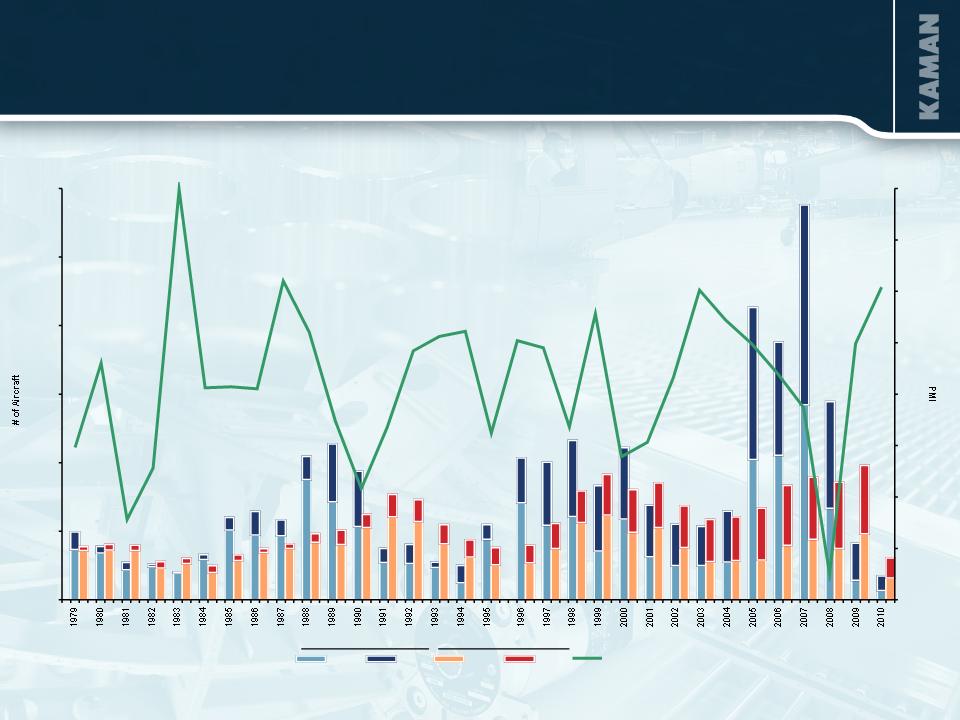

Source: Boeing and Airbus historical data and ISM

Aerospace Orders and Deliveries vs. ISM Index

Why Two Businesses? Diversifies Revenue

0

500

1,000

1,500

2,000

2,500

3,000

30.0

35.0

40.0

45.0

50.0

55.0

60.0

65.0

70.0

Boeing

Airbus

Boeing

Airbus

ISM index

Orders

Deliveries

31

Kamatics Lean Journey

§ Bloomfield Kamatics facility has successfully

implemented lean manufacturing processes

implemented lean manufacturing processes

§ Since introducing lean in 2000 Kamatics has:

- Doubled sales

- Increased return on identifiable assets by more than

5,400 basis points

5,400 basis points

- Kept headcount constant

- Doubled sales per employee

- Increased on-time deliveries to more than 90% from less

than 50%

than 50%

- Developed industry leading lead-times of 4-8 weeks from

12-18 weeks

12-18 weeks

32

Aerospace Awards

§ UTC Supplier Gold at Kamatics

§ Top 100 Supplier to Sikorsky

- Kamatics

- Aerostructures - Jacksonville

§ Aviation Week - Top Performing Companies

- 2009 Five-Year Most Improved

33

34

Recent JPF Contract Awards

35

FORWARD-LOOKING STATEMENTS

This presentation contains forward-looking information relating to the company's business and prospects, including the Aerospace and Industrial

Distribution businesses, operating cash flow, and other matters that involve a number of uncertainties that may cause actual results to differ materially

from expectations. Those uncertainties include, but are not limited to: 1) the successful conclusion of competitions for government programs and

thereafter contract negotiations with government authorities, both foreign and domestic; 2) political conditions in countries where the company does or

intends to do business; 3) standard government contract provisions permitting renegotiation of terms and termination for the convenience of the

government; 4) domestic and foreign economic and competitive conditions in markets served by the company, particularly the defense, commercial

aviation and industrial production markets; 5) risks associated with successful implementation and ramp up of significant new programs; 6) potential

difficulties associated with variable acceptance test results, given sensitive production materials and extreme test parameters; 7) management's success

in increasing the volume of profitable work at the Wichita facility; 8) successful resale of the SH-2G(I) aircraft, equipment and spare parts; 9) receipt and

successful execution of production orders for the JPF U.S. government contract, including the exercise of all contract options and receipt of orders from

allied militaries, as all have been assumed in connection with goodwill impairment evaluations; 10) satisfactory resolution of the company’s litigation

relating to the FMU-143 program; 11) continued support of the existing K-MAX helicopter fleet, including sale of existing K-MAX spare parts inventory;

12) cost estimates associated with environmental remediation activities at the Bloomfield, Moosup and New Hartford, CT facilities and our U.K. facilities;

13) profitable integration of acquired businesses into the company's operations; 14) changes in supplier sales or vendor incentive policies; 15) the effects

of price increases or decreases; 16) the effects of pension regulations, pension plan assumptions and future contributions; 17) future levels of

indebtedness and capital expenditures; 18) continued availability of raw materials and other commodities in adequate supplies and the effect of

increased costs for such items; 19) the effects of currency exchange rates and foreign competition on future operations; 20) changes in laws and

regulations, taxes, interest rates, inflation rates and general business conditions; 21) future repurchases and/or issuances of common stock; and 22)

other risks and uncertainties set forth in the company's annual, quarterly and current reports, proxy statements and other filings with the U.S. Securities

and Exchange Commission. Any forward-looking information provided in this presentation should be considered with these factors in mind. The company

assumes no obligation to update any forward-looking statements contained in this presentation.

Distribution businesses, operating cash flow, and other matters that involve a number of uncertainties that may cause actual results to differ materially

from expectations. Those uncertainties include, but are not limited to: 1) the successful conclusion of competitions for government programs and

thereafter contract negotiations with government authorities, both foreign and domestic; 2) political conditions in countries where the company does or

intends to do business; 3) standard government contract provisions permitting renegotiation of terms and termination for the convenience of the

government; 4) domestic and foreign economic and competitive conditions in markets served by the company, particularly the defense, commercial

aviation and industrial production markets; 5) risks associated with successful implementation and ramp up of significant new programs; 6) potential

difficulties associated with variable acceptance test results, given sensitive production materials and extreme test parameters; 7) management's success

in increasing the volume of profitable work at the Wichita facility; 8) successful resale of the SH-2G(I) aircraft, equipment and spare parts; 9) receipt and

successful execution of production orders for the JPF U.S. government contract, including the exercise of all contract options and receipt of orders from

allied militaries, as all have been assumed in connection with goodwill impairment evaluations; 10) satisfactory resolution of the company’s litigation

relating to the FMU-143 program; 11) continued support of the existing K-MAX helicopter fleet, including sale of existing K-MAX spare parts inventory;

12) cost estimates associated with environmental remediation activities at the Bloomfield, Moosup and New Hartford, CT facilities and our U.K. facilities;

13) profitable integration of acquired businesses into the company's operations; 14) changes in supplier sales or vendor incentive policies; 15) the effects

of price increases or decreases; 16) the effects of pension regulations, pension plan assumptions and future contributions; 17) future levels of

indebtedness and capital expenditures; 18) continued availability of raw materials and other commodities in adequate supplies and the effect of

increased costs for such items; 19) the effects of currency exchange rates and foreign competition on future operations; 20) changes in laws and

regulations, taxes, interest rates, inflation rates and general business conditions; 21) future repurchases and/or issuances of common stock; and 22)

other risks and uncertainties set forth in the company's annual, quarterly and current reports, proxy statements and other filings with the U.S. Securities

and Exchange Commission. Any forward-looking information provided in this presentation should be considered with these factors in mind. The company

assumes no obligation to update any forward-looking statements contained in this presentation.

Contact: Eric Remington

V.P., Investor Relations

(860) 243-6334

Eric.Remington@kaman.com