a110812investorpresentat

1 Investor Presentation November 8, 2012

2 Forward Looking Statement This presentation contains "forward-looking statements" within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements also may be included in other publicly available documents from time to time issued by the Company and in oral statements from time to time made by our officers and representatives. These forward-looking statements are intended to provide management's current expectations or plans for the Company's future operating and financial performance, based on assumptions currently believed to be valid. They can be identified by the use of words such as "anticipate," "intend," "plan," "goal," "seek," "believe," "project," "estimate," "expect," "strategy," "future," "likely," "may," "should," "will" and other words of similar meaning in connection with a discussion of future operating or financial performance. Examples of forward looking statements include, among others, statements relating to future sales, earnings, cash flows, results of operations, uses of cash and other measures of financial performance. Because forward-looking statements relate to the future, they are subject to inherent risks, uncertainties and other factors that may cause the Company's actual results and financial condition to differ materially from those expressed or implied in the forward-looking statements. Such risks, uncertainties and other factors include, among others: (i) changes in domestic and foreign economic and competitive conditions in markets served by the Company, particularly the defense, commercial aviation and industrial production markets; (ii) changes in government and customer priorities and requirements (including cost-cutting initiatives, the potential deferral of awards, terminations or reductions of expenditures to respond to the priorities of Congress and the Administration, or budgetary cuts resulting from Congressional actions or automatic sequestration under the Budget Control Act of 2011); (iii) changes in geopolitical conditions in countries where the Company does or intends to do business; (iv) the successful conclusion of competitions for government programs and thereafter contract negotiations with government authorities, both foreign and domestic; (v) the existence of standard government contract provisions permitting renegotiation of terms and termination for the convenience of the government; (vi) the satisfactory conclusion to government inquiries or investigations regarding government programs, including the satisfactory resolution of the Wichita subpoena matter; (vii) risks and uncertainties associated with the successful implementation and ramp up of significant new programs; (viii) potential difficulties associated with variable acceptance test results, given sensitive production materials and extreme test parameters; (ix) the successful resale of the SH-2G(I) aircraft, equipment and spare parts; (x) the receipt and successful execution of production orders for the JPF U.S. government contract, including the exercise of all contract options and receipt of orders from allied militaries, as all have been assumed in connection with goodwill impairment evaluations; (xi) the continued support of the existing K-MAX® helicopter fleet, including sale of existing K-MAX® spare parts inventory; (xii) the accuracy of current cost estimates associated with environmental remediation activities at the Bloomfield, Moosup and New Hartford, CT facilities and our U.K. facilities; (xiii) the profitable integration of acquired businesses into the Company's operations; (xiv) changes in supplier sales or vendor incentive policies; (xv) the effects of price increases or decreases; (xvi) the effects of pension regulations, pension plan assumptions, pension plan asset performance and future contributions; (xvii) future levels of indebtedness and capital expenditures; (xviii) the future availability of credit and the Company's ability to maintain its current credit rating; (xix) the continued availability of raw materials and other commodities in adequate supplies and the effect of increased costs for such items; (xx) the effects of currency exchange rates and foreign competition on future operations; (xxi) changes in laws and regulations, taxes, interest rates, inflation rates and general business conditions; (xxii) future repurchases and/or issuances of common stock; and (xxiii) such other risks and uncertainties as are discussed in Part II, Item 1A. "Risk Factors" of our Quarterly Reports on Form 10-Q for the quarters ended June 29 and September 28, 2012 and in Part I, Item 1A. “Risk Factors” of our Annual Report on Form 10-K for the year ended December 31, 2011. All forward-looking statements made in this presentation are based solely on information that is currently available as of the date of this presentation, and the Company undertakes no obligation to update any such forward-looking statement, whether as a result of new information, future developments or otherwise. Contact: Eric Remington V.P., Investor Relations (860) 243-6334 Eric.Remington@kaman.com

3 Investment Summary • Significant long-term organic growth opportunities in Aerospace and Industrial Distribution • High margin Aerospace bearings business benefiting from increasing commercial aircraft build rates • Select defense platforms ramping up • Industrial Distribution business gaining scale via acquisitions, and adding complementary product platforms • Investing in new product development and applications, acquisitions and technology for long-term growth • Strong balance sheet to drive growth and strategic initiatives • Experienced management team

4 Kaman Corporation Overview • Two core businesses – Aerospace • Manufacturer and subcontractor in the global commercial aerospace and defense market • Diverse customer base of blue chip customers and governments – Industrial Distribution • Third largest distributor in the power transmission/electrical automation and control/fluid power market • Focused on technical differentiation and expansion into higher value products • Publicly listed on the NYSE with a market capitalization of more than $900 million • 2012 expected sales of $1.6 billion; 5,100 employees

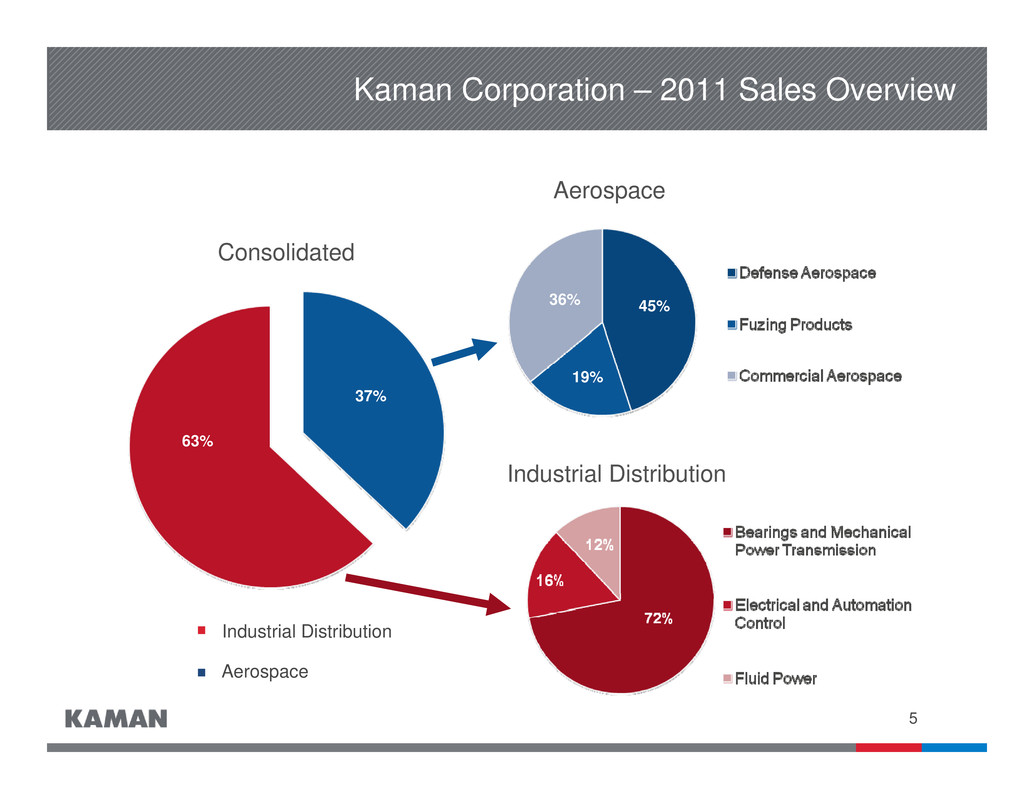

5 12% Aerospace 36% 19% 12% 45% Consolidated Industrial Distribution Kaman Corporation – 2011 Sales Overview 63% 37% Industrial Distribution Aerospace

6 2011 Sales: $547 million Aerospace

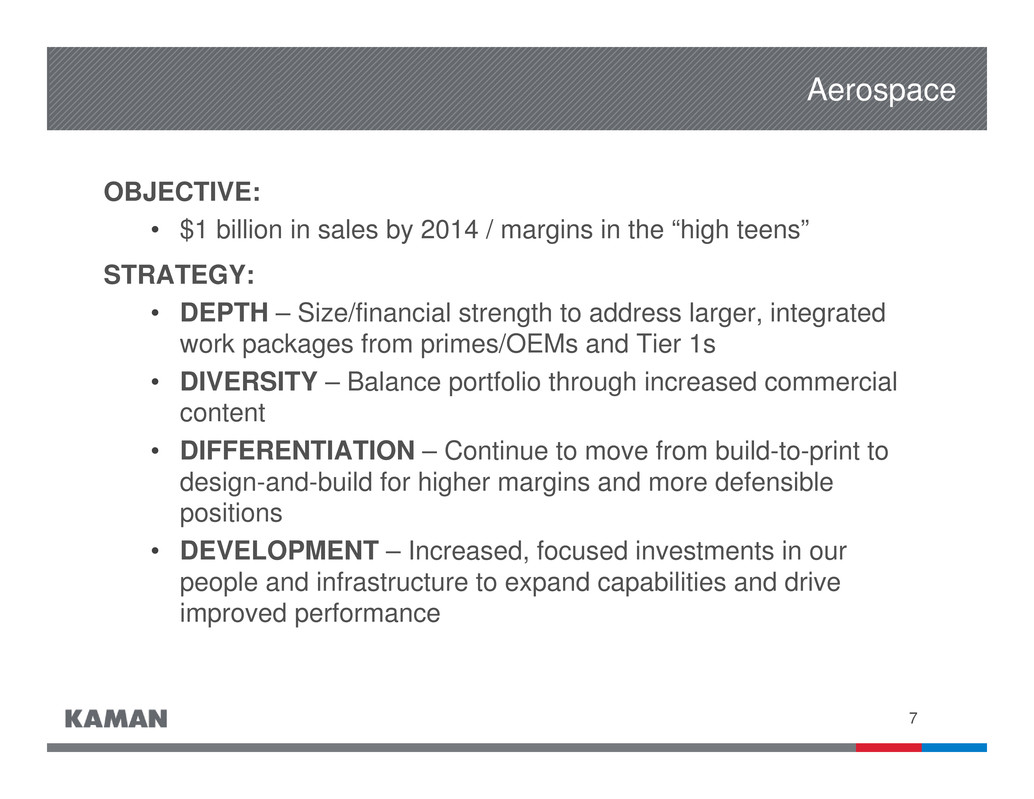

7 Aerospace OBJECTIVE: • $1 billion in sales by 2014 / margins in the “high teens” STRATEGY: • DEPTH – Size/financial strength to address larger, integrated work packages from primes/OEMs and Tier 1s • DIVERSITY – Balance portfolio through increased commercial content • DIFFERENTIATION – Continue to move from build-to-print to design-and-build for higher margins and more defensible positions • DEVELOPMENT – Increased, focused investments in our people and infrastructure to expand capabilities and drive improved performance

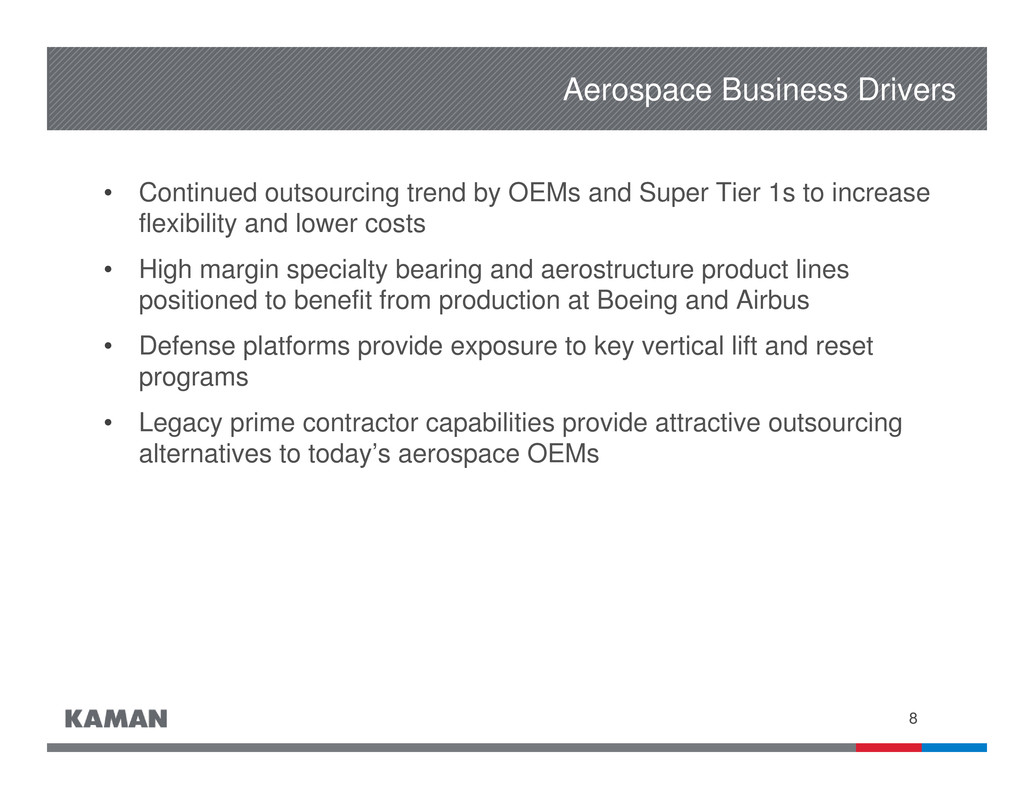

8 Aerospace Business Drivers • Continued outsourcing trend by OEMs and Super Tier 1s to increase flexibility and lower costs • High margin specialty bearing and aerostructure product lines positioned to benefit from production at Boeing and Airbus • Defense platforms provide exposure to key vertical lift and reset programs • Legacy prime contractor capabilities provide attractive outsourcing alternatives to today’s aerospace OEMs

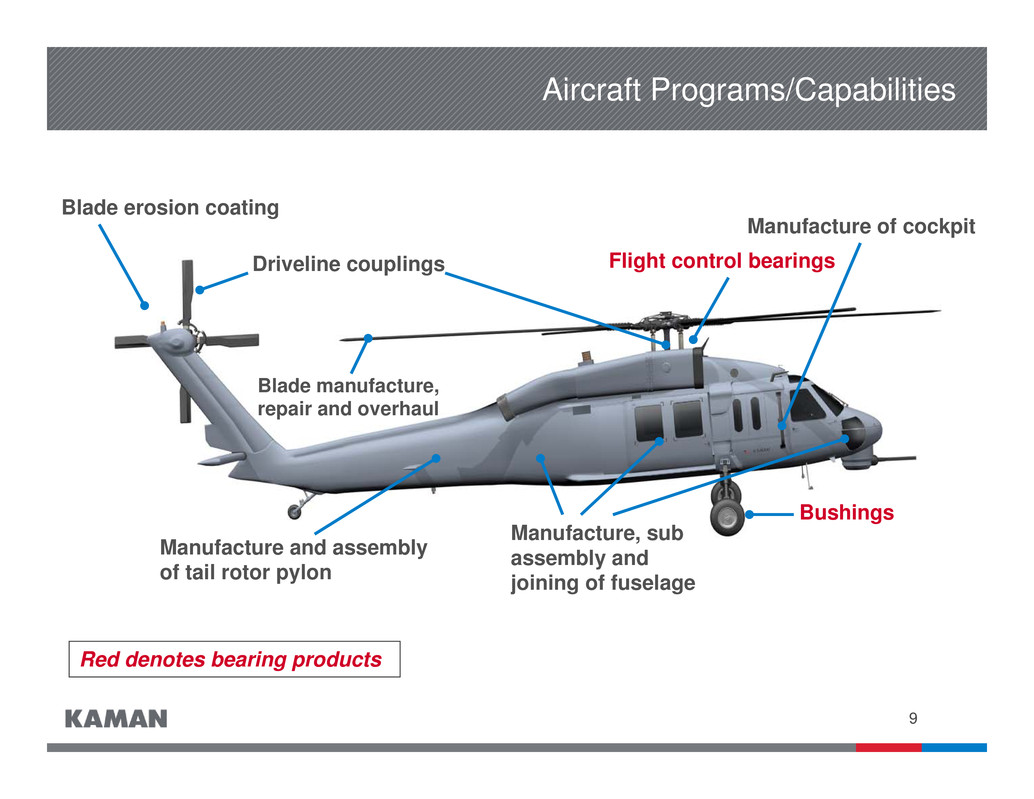

9 Manufacture of cockpit Blade erosion coating Manufacture and assembly of tail rotor pylon Manufacture, sub assembly and joining of fuselage Blade manufacture, repair and overhaul Driveline couplings Bushings Flight control bearings Aircraft Programs/Capabilities Red denotes bearing products

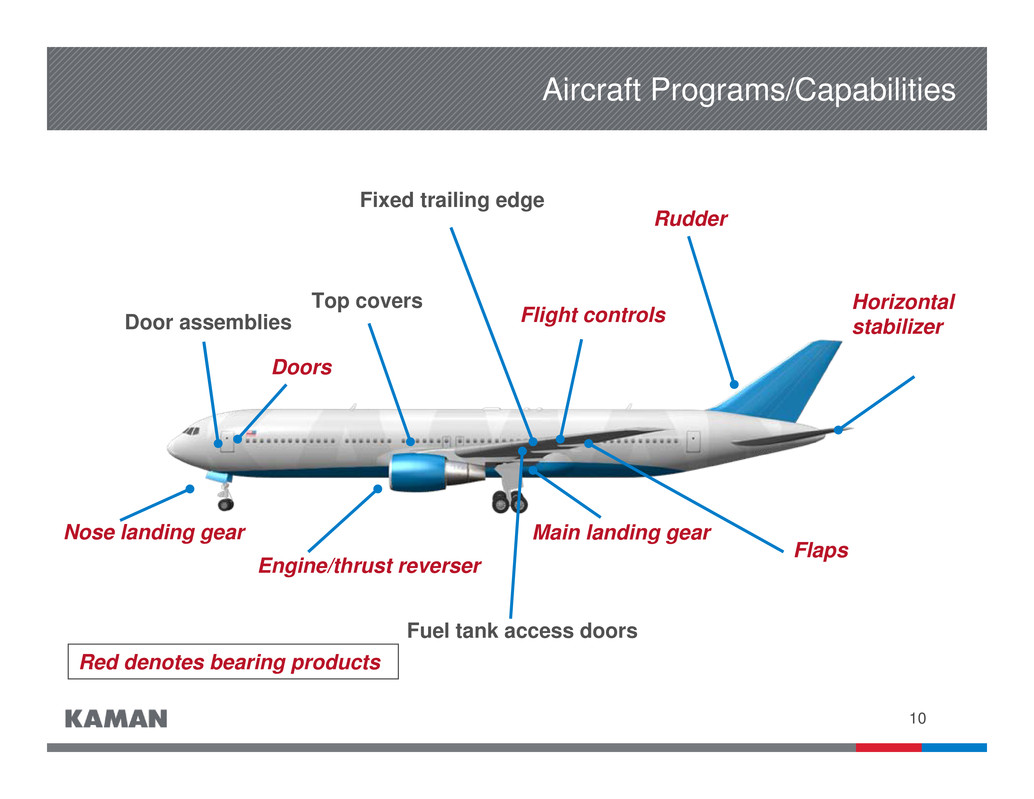

10 Fixed trailing edge Fuel tank access doors Top covers Red denotes bearing products Nose landing gear Horizontal stabilizer Main landing gear Flaps Rudder Door assemblies Engine/thrust reverser Aircraft Programs/Capabilities Flight controls Doors

11 Aerospace Acquisition Program 2008 – 2011 • Three recent acquisitions: – Brookhouse (U.K.) – Global Aerosystems – Vermont Composites • Annual sales acquired, $115 million • Average size, in sales of $39 million • Average purchase price of $47 million, for a total of $140 million Manufacture & Mold Tooling Assembly & Tooling Certification Support Aftermarket MRO Design Manufacture & Mold Tooling Assembly & Tooling Certification Support Aftermarket MRO Life Cycle Management Capability

12 Unmanned K-MAX® • Kaman/Lockheed have developed an unmanned military version of the K-MAX helicopter • Two K-MAXs have been performing unmanned cargo resupply missions in Afghanistan since December 2011 – The aircraft have successfully delivered more than 2.0 million pounds of cargo in over 600 missions – Demonstration deployment extended through March 2013 • Lockheed Martin awarded unmanned K-MAX development contracts – $47 million Army contract to develop autonomous technologies – Under contract for Autonomous Aerial Cargo Utility System (AACUS) program with the Office of Naval Research to test and demonstrate autonomous system technology

13 • USAF bomb fuze of choice • USAF inventory levels are less than half desired quantity • USAF reprogramming $20 million to JPF procurement • $92 million backlog through 2013 • Kaman is sole source, negotiating four year follow-on contact • 23 foreign customers Bomb Compatibility - JDAM - Paveway II and III - GBU-10, 12, 16, 24, 27, 28, 31, 32, 38, 54 - BLU-109, 110, 111, 113, 117, 121, 122, 126 - MK82/BSU-49, MK83/BSU-85, MK84/BSU-50 JPF Program

14 Aerospace – Budget Impact on Defense Programs • Key defense programs less impacted by proposed budget cuts – Joint Programmable Fuze – backlog into 2013, foreign demand, continued sole source – F-35 (Joint Strike Fighter) – incremental business at any production level – A-10 – reset, new business – AH-1Z – new business • Broadly diverse revenue base mitigates risk from large program cancellations • Risk to revenue from sequestration is believed to be $25 million in 2013, less than 2% of expected consolidated revenue

15 Market leading self lube airframe bearing product lines • Content on virtually every aircraft manufactured today with a growing installed base • Approximately 75% of sales are for commercial applications • Proprietary technology: – KAron® bearing liner system – KAflex® and Tufflex® flexible couplings • 95% of sales are for custom engineered applications • Operational excellence through lean manufacturing • World class application engineers and material scientists developing new applications

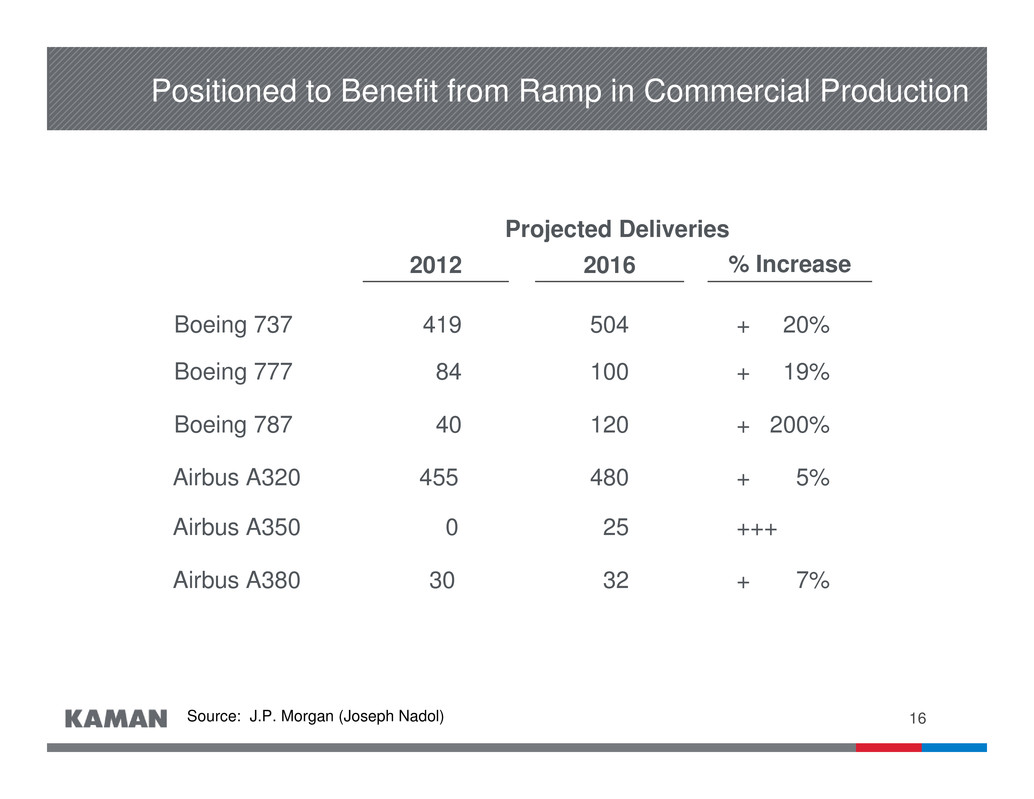

16 Positioned to Benefit from Ramp in Commercial Production Projected Deliveries 2012 2016 % Increase Boeing 737 419 504 + 20% Boeing 777 84 100 + 19% Boeing 787 40 120 + 200% Airbus A320 455 480 + 5% Airbus A350 0 25 +++ Airbus A380 30 32 + 7% Source: J.P. Morgan (Joseph Nadol)

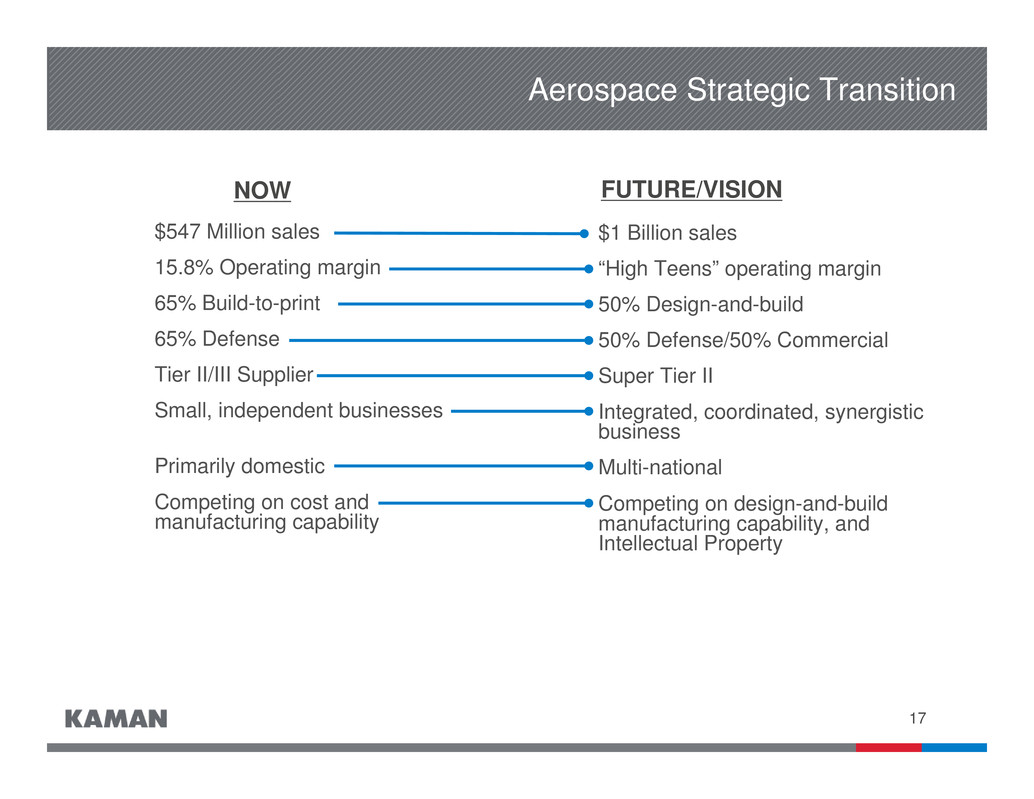

17 Aerospace Strategic Transition $1 Billion sales “High Teens” operating margin 50% Design-and-build 50% Defense/50% Commercial Super Tier II Integrated, coordinated, synergistic business Multi-national Competing on design-and-build manufacturing capability, and Intellectual Property NOW FUTURE/VISION $547 Million sales 15.8% Operating margin 65% Build-to-print 65% Defense Tier II/III Supplier Small, independent businesses Primarily domestic Competing on cost and manufacturing capability

18 Industrial Distribution 2011 Sales: $951 Million

19 Industrial Distribution Overview • Industrial distribution business with a $35 billion served market via three platforms – Bearings and mechanical power transmission – Fluid power – Electrical automation and control • Major product categories – Bearings – Mechanical and electrical power transmission – Fluid Power – Motion control – Automation – Material handling – Electrical control and power distribution • 241 locations and 5 distribution centers • Executing growth strategy to achieve long-term sales and profit objectives

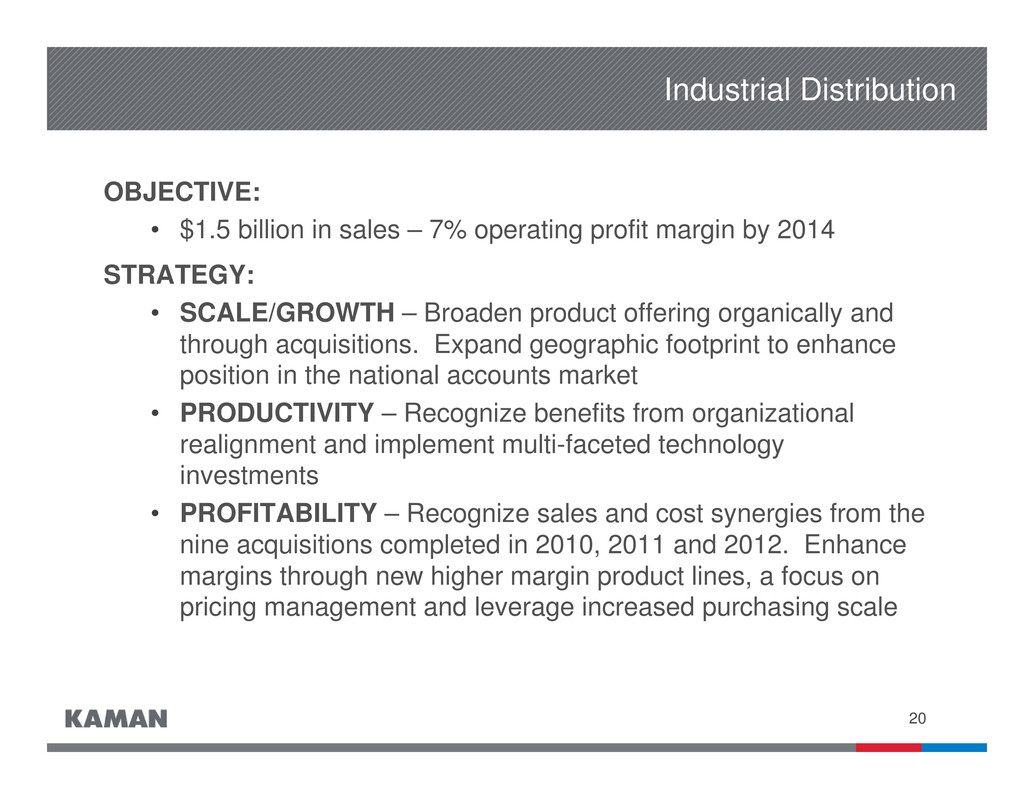

20 Industrial Distribution OBJECTIVE: • $1.5 billion in sales – 7% operating profit margin by 2014 STRATEGY: • SCALE/GROWTH – Broaden product offering organically and through acquisitions. Expand geographic footprint to enhance position in the national accounts market • PRODUCTIVITY – Recognize benefits from organizational realignment and implement multi-faceted technology investments • PROFITABILITY – Recognize sales and cost synergies from the nine acquisitions completed in 2010, 2011 and 2012. Enhance margins through new higher margin product lines, a focus on pricing management and leverage increased purchasing scale

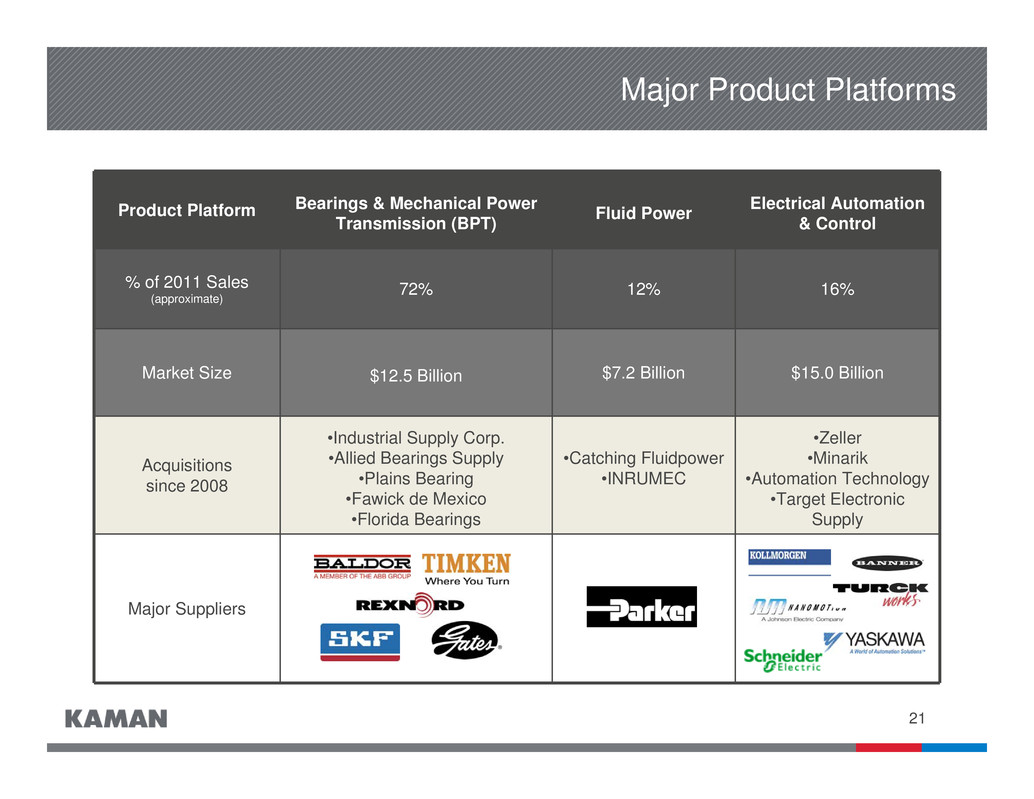

21 Major Product Platforms Product Platform Bearings & Mechanical Power Transmission (BPT) Fluid Power Electrical Automation & Control % of 2011 Sales (approximate) 72% 12% 16% Market Size $12.5 Billion $7.2 Billion $15.0 Billion Acquisitions since 2008 •Industrial Supply Corp. •Allied Bearings Supply •Plains Bearing •Fawick de Mexico •Florida Bearings •Catching Fluidpower •INRUMEC •Zeller •Minarik •Automation Technology •Target Electronic Supply Major Suppliers

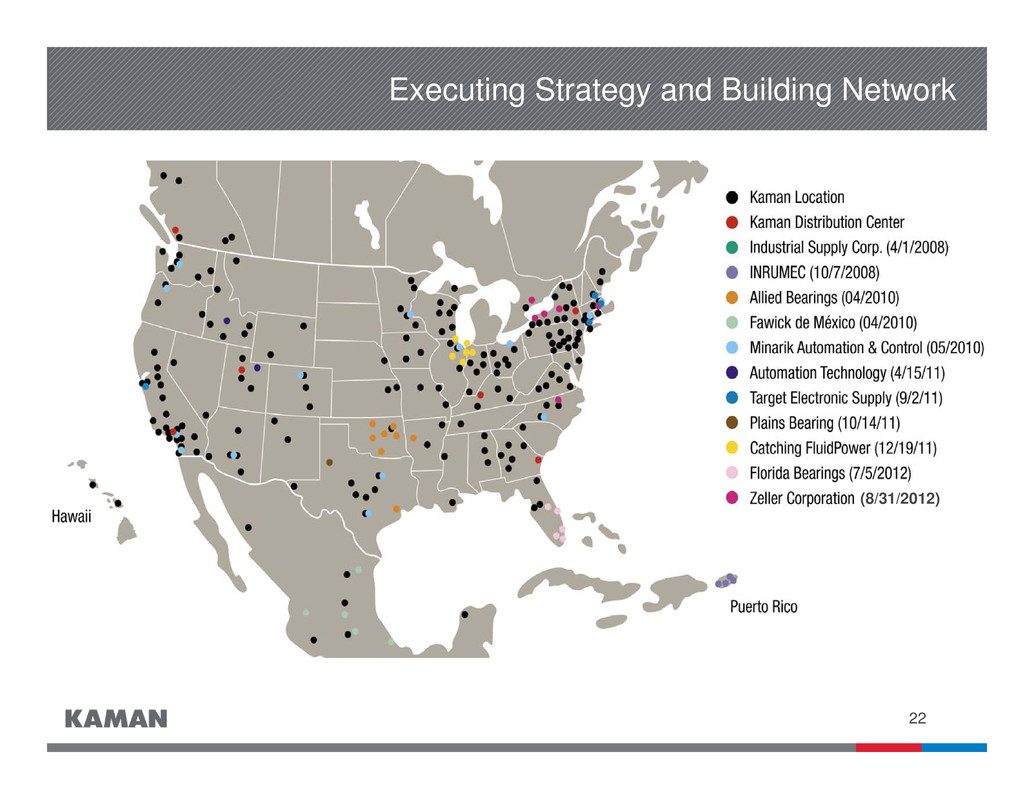

22 Executing Strategy and Building Network (8/31/2012)

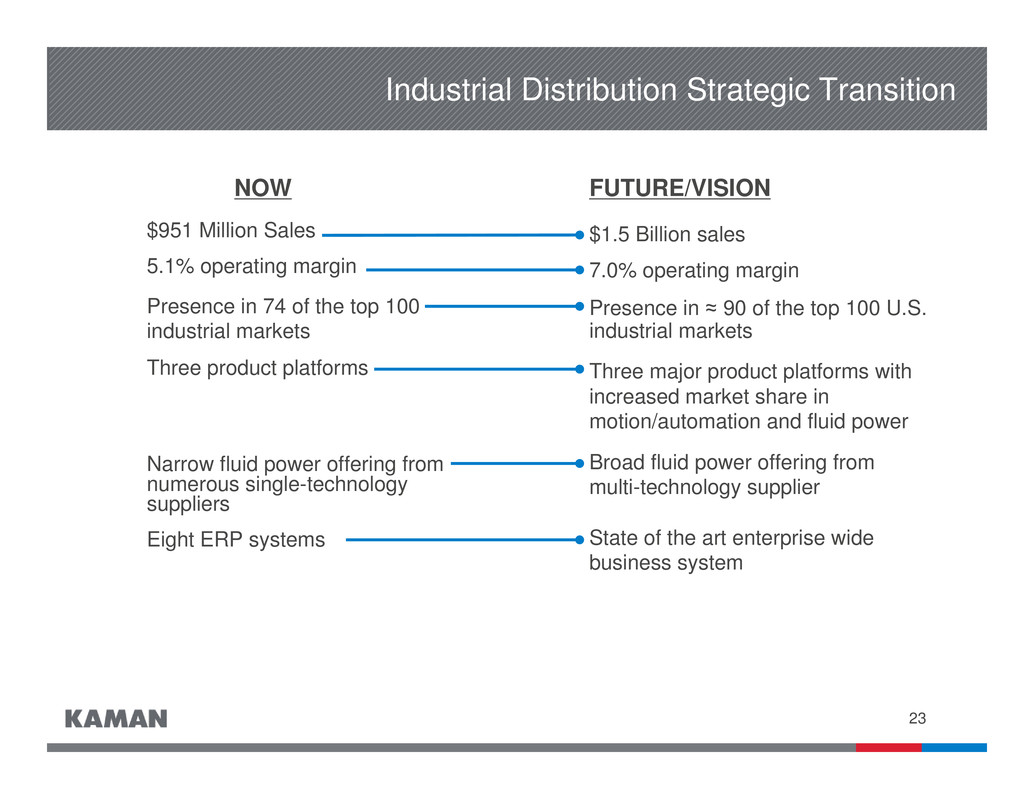

23 Industrial Distribution Strategic Transition $951 Million Sales 5.1% operating margin Presence in 74 of the top 100 industrial markets Three product platforms Narrow fluid power offering from numerous single-technology suppliers Eight ERP systems NOW FUTURE/VISION $1.5 Billion sales 7.0% operating margin Presence in ≈ 90 of the top 100 U.S. industrial markets Three major product platforms with increased market share in motion/automation and fluid power Broad fluid power offering from multi-technology supplier State of the art enterprise wide business system

24 Industrial Distribution Opportunities • Broaden product offering organically and through acquisition to win additional business from existing customers and gain market share • Enhance margins through new higher margin product lines, a focus on pricing management and leverage from higher sales • Expand higher margin fluid power business via Parker national reseller agreement • Recognize sales and cost synergies from the nine acquisitions completed in 2010, 2011 and 2012 • Expand geographic footprint through additional acquisitions to enhance Kaman’s position in the competition for national accounts • Improve productivity through technology investments to enhance return on sales

25 Kaman Investment Merits • A Leading Market Position in Both Business Segments • Continued Focus on Profit Optimization, Increasing Cash Flows and Strengthening Competitive Position • Strong Liquidity and Conservative Financial Profile – Investment Grade Rating (BBB-/Stable) • Disciplined and Focused Acquisition Strategy • Experienced Management Team

26 Financial Summary

27 Outlook • The Company's expectations for 2012 are as follows: – Aerospace • Sales of $585 million to $595 million • Operating margins of 15.7% to 16.0% – Industrial Distribution • Sales of $1,040 million to $1,055 million • Operating margins of 5.1% to 5.3% – Interest expense of approximately $11.5 million – Corporate expenses of approximately $49 million – Tax rate of 34.5% to 35.0% – Free cash flow of $25 million to $30 million

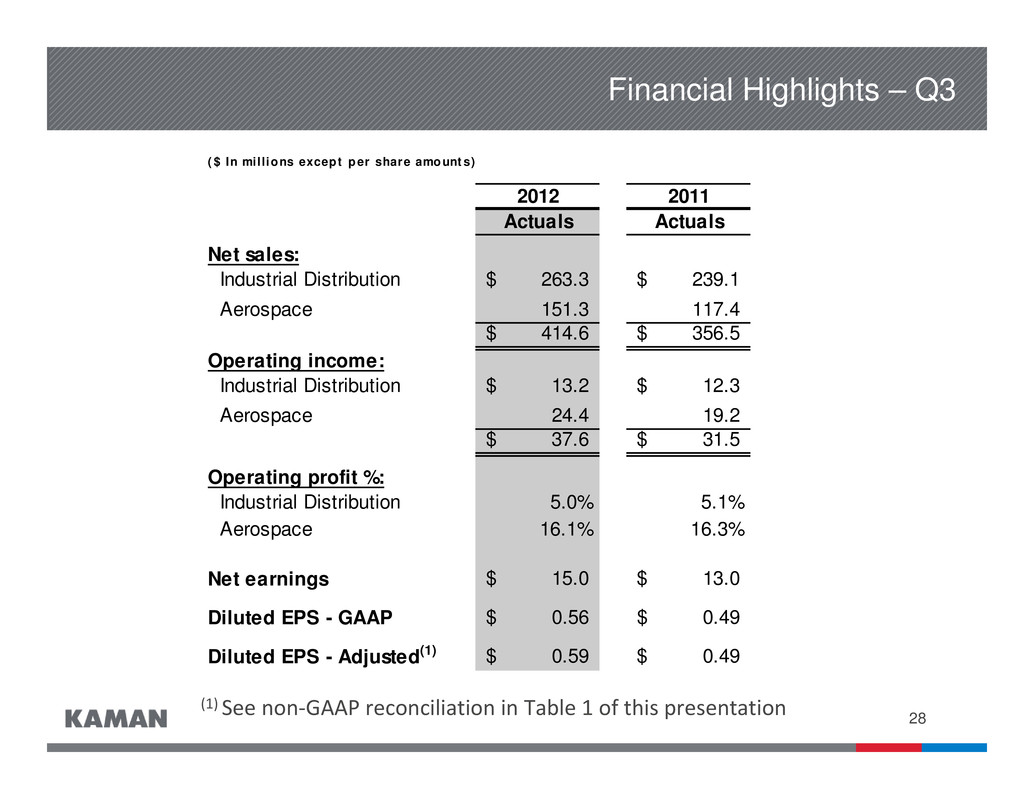

28 ( $ In mill ions except p er share amount s) 2011 Actuals Actuals Net sales: Industrial Distribution 263.3$ 239.1$ Aerospace 151.3 117.4 414.6$ 356.5$ Operating income: Industrial Distribution 13.2$ 12.3$ Aerospace 24.4 19.2 37.6$ 31.5$ Operating profit %: Industrial Distribution 5.0% 5.1% Aerospace 16.1% 16.3% Net earnings 15.0$ 13.0$ Diluted EPS - GAAP 0.56$ 0.49$ Diluted EPS - Adjusted(1) 0.59$ 0.49$ 2012 Financial Highlights – Q3 (1) See non‐GAAP reconciliation in Table 1 of this presentation

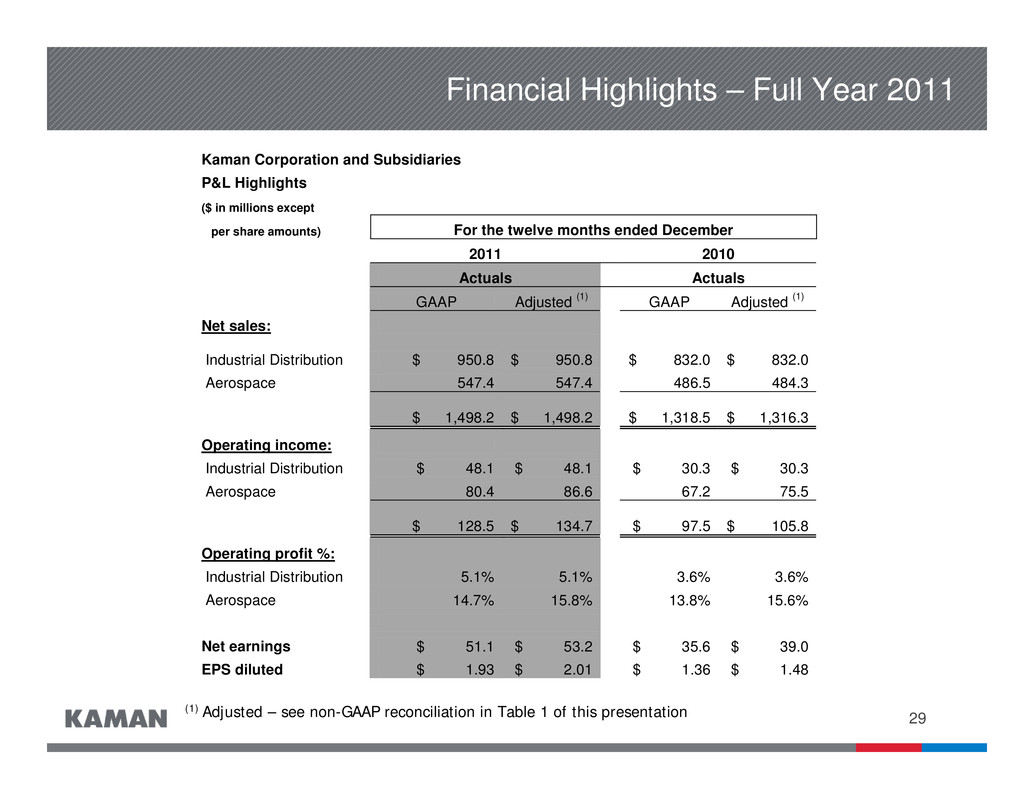

29 Financial Highlights – Full Year 2011 (1) Adjusted – see non-GAAP reconciliation in Table 1 of this presentation Kaman Corporation and Subsidiaries P&L Highlights ($ in millions except per share amounts) For the twelve months ended December 2011 2010 Actuals Actuals GAAP Adjusted (1) GAAP Adjusted (1) Net sales: Industrial Distribution $ 950.8 $ 950.8 $ 832.0 $ 832.0 Aerospace 547.4 547.4 486.5 484.3 $ 1,498.2 $ 1,498.2 $ 1,318.5 $ 1,316.3 Operating income: Industrial Distribution $ 48.1 $ 48.1 $ 30.3 $ 30.3 Aerospace 80.4 86.6 67.2 75.5 $ 128.5 $ 134.7 $ 97.5 $ 105.8 Operating profit %: Industrial Distribution 5.1% 5.1% 3.6% 3.6% Aerospace 14.7% 15.8% 13.8% 15.6% Net earnings $ 51.1 $ 53.2 $ 35.6 $ 39.0 EPS diluted $ 1.93 $ 2.01 $ 1.36 $ 1.48

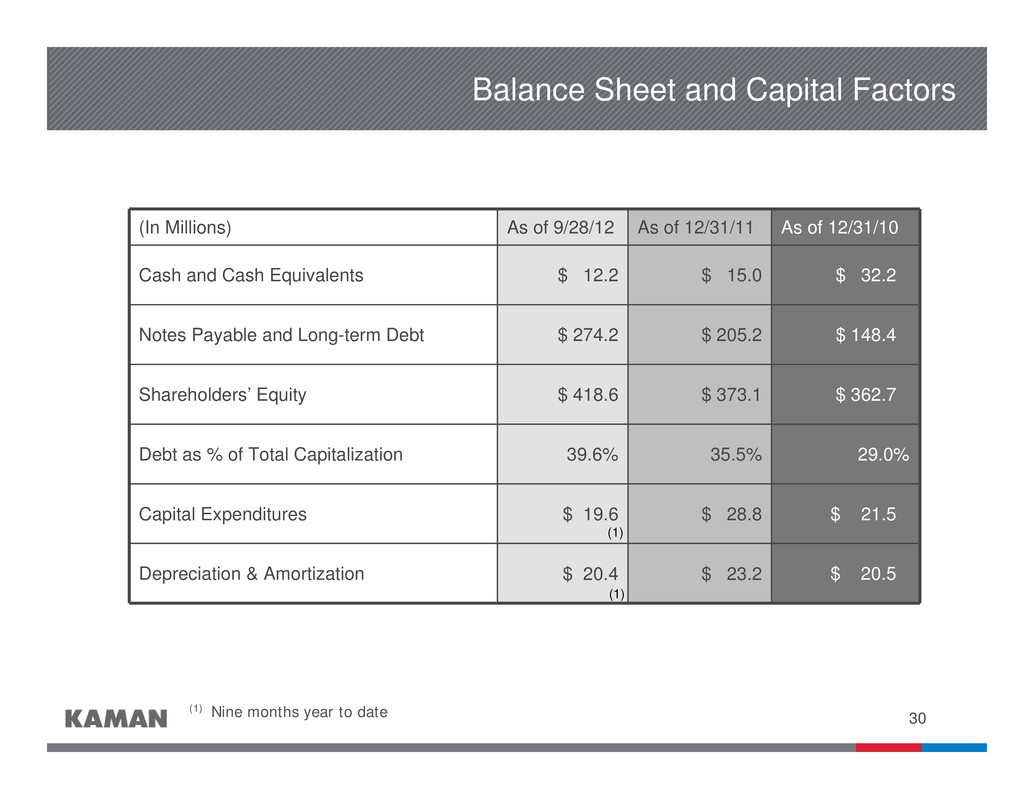

30 Balance Sheet and Capital Factors (In Millions) As of 9/28/12 As of 12/31/11 As of 12/31/10 Cash and Cash Equivalents $ 12.2 $ 15.0 $ 32.2 Notes Payable and Long-term Debt $ 274.2 $ 205.2 $ 148.4 Shareholders’ Equity $ 418.6 $ 373.1 $ 362.7 Debt as % of Total Capitalization 39.6% 35.5% 29.0% Capital Expenditures $ 19.6 $ 28.8 $ 21.5 Depreciation & Amortization $ 20.4 $ 23.2 $ 20.5 (1) Nine months year to date (1) (1)

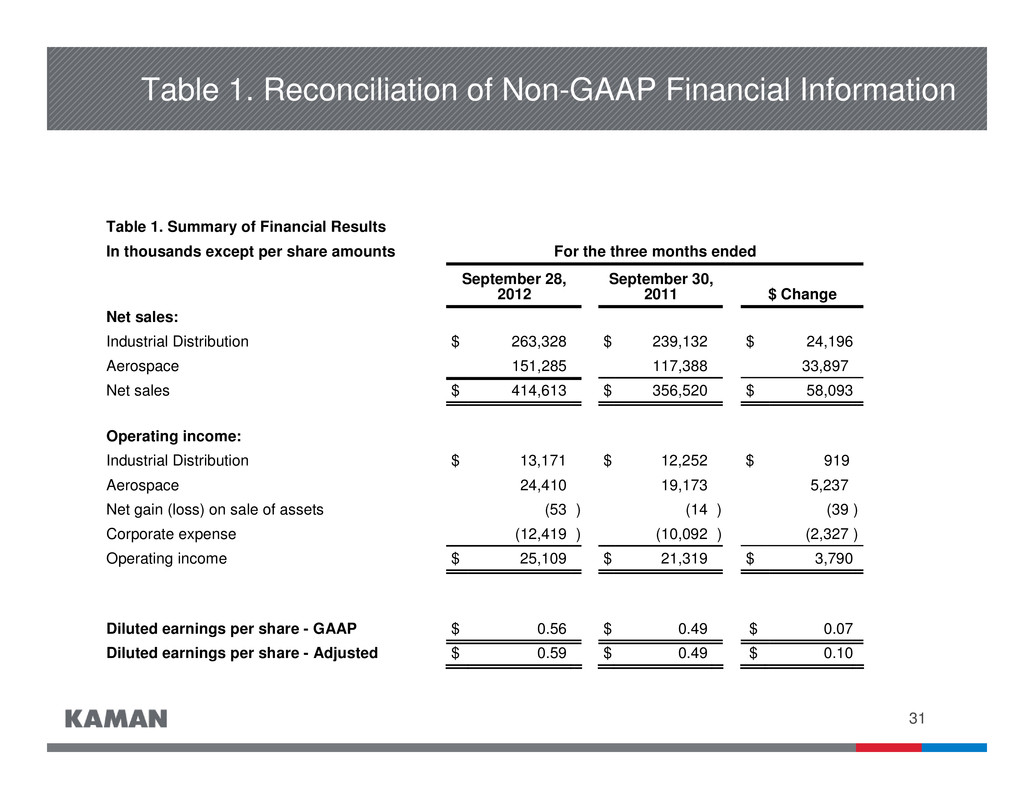

31 Table 1. Reconciliation of Non-GAAP Financial Information Table 1. Summary of Financial Results In thousands except per share amounts For the three months ended September 28, 2012 September 30, 2011 $ Change Net sales: Industrial Distribution $ 263,328 $ 239,132 $ 24,196 Aerospace 151,285 117,388 33,897 Net sales $ 414,613 $ 356,520 $ 58,093 Operating income: Industrial Distribution $ 13,171 $ 12,252 $ 919 Aerospace 24,410 19,173 5,237 Net gain (loss) on sale of assets (53 ) (14 ) (39 ) Corporate expense (12,419 ) (10,092 ) (2,327 ) Operating income $ 25,109 $ 21,319 $ 3,790 Diluted earnings per share - GAAP $ 0.56 $ 0.49 $ 0.07 Diluted earnings per share - Adjusted $ 0.59 $ 0.49 $ 0.10

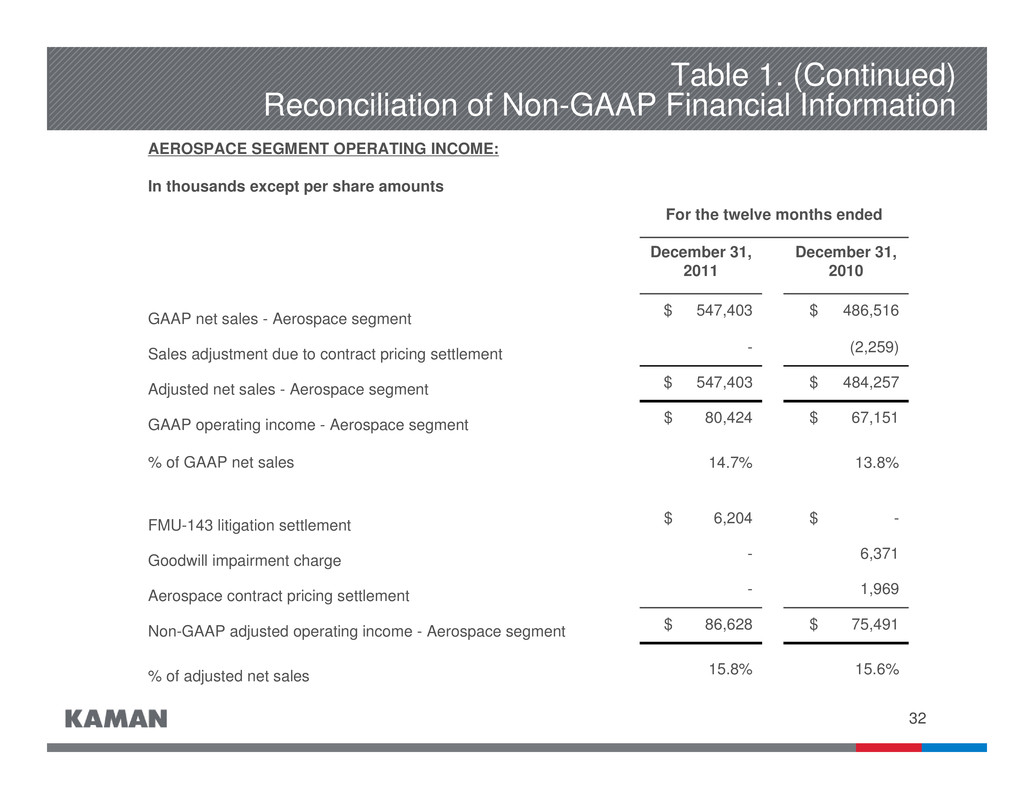

32 AEROSPACE SEGMENT OPERATING INCOME: In thousands except per share amounts For the twelve months ended December 31, 2011 December 31, 2010 GAAP net sales - Aerospace segment $ 547,403 $ 486,516 Sales adjustment due to contract pricing settlement - (2,259) Adjusted net sales - Aerospace segment $ 547,403 $ 484,257 GAAP operating income - Aerospace segment $ 80,424 $ 67,151 % of GAAP net sales 14.7% 13.8% FMU-143 litigation settlement $ 6,204 $ - Goodwill impairment charge - 6,371 Aerospace contract pricing settlement - 1,969 Non-GAAP adjusted operating income - Aerospace segment $ 86,628 $ 75,491 % of adjusted net sales 15.8% 15.6% Table 1. (Continued) Reconciliation of Non-GAAP Financial Information

33 Appendix I

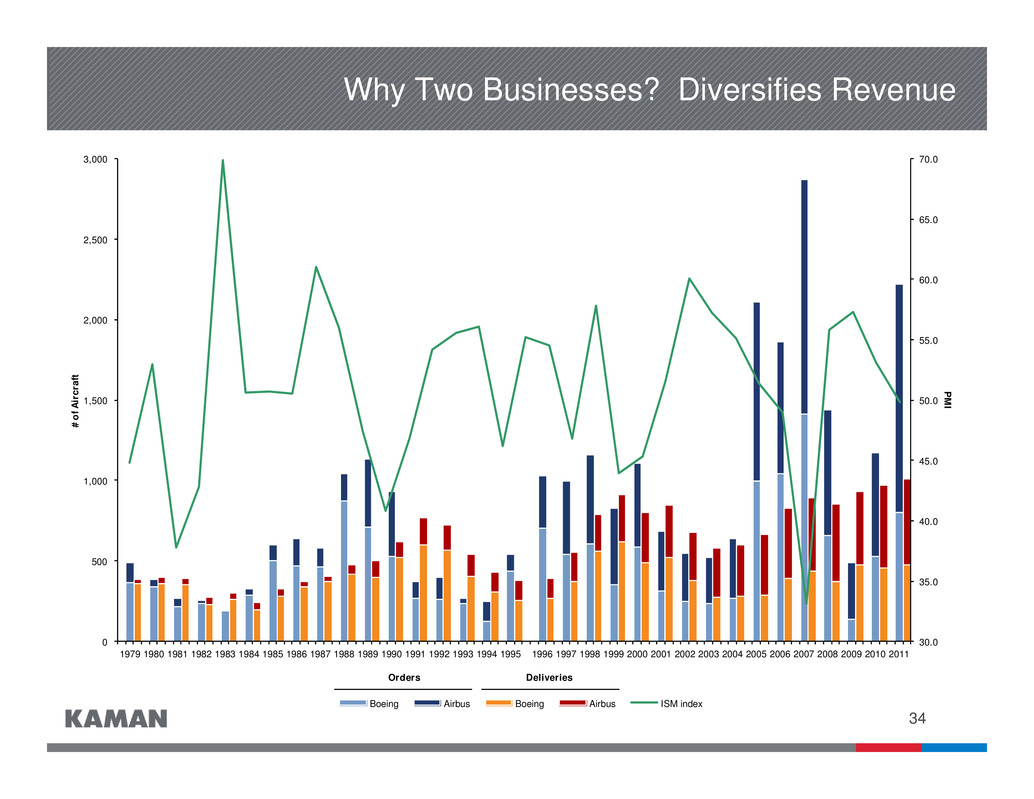

34 Why Two Businesses? Diversifies Revenue 30.0 35.0 40.0 45.0 50.0 55.0 60.0 65.0 70.0 0 500 1,000 1,500 2,000 2,500 3,000 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 P M I # o f A i r c r a f t Boeing Airbus Boeing Airbus ISM index Orders Deliveries

35 Appendix II Acquisition of Zeller Corporation

36 Acquisition of Assets of Zeller Corporation - Overview • KIT-Zeller acquired certain assets of Zeller Corporation on August 31, 2012 • Zeller offers value added distribution of electrical and automation components and engineered systems, encompassing the following technologies: – Motion control – PLC based automation – Machine vision – Electrical controls – Power distribution products • Premier distribution partner • Zeller also represents other quality manufacturers including: – Kollmorgen – Phoenix Contact – Rittal – Sick • KIT-Zeller is expected to contribute approximately $24 million in revenue to Kaman’s 2012 results • KIT-Zeller generates an operating profit margin higher than that of Kaman’s overall Industrial Distribution segment

37 Zeller - Capabilities and Offerings • Value Add – Design for manufacturing – Outsourcing support – Compliance and conformance (CE, UL, NEC) – Comprehensive solutions • Automation and Control – Developing, designing and building A/C systems on any platform – Robotics and single/multi-axis motion systems from front-end development to installation and commissioning • Machine Vision – Broad experience implementing machine vision and auto ID solutions – Vision Studio® - unique, proprietary Zeller front end user interface that provides a gateway to other automation & control devices • Process Control – Experience in waste water, industrial applications, system integration, SCADA, networking and telemetry

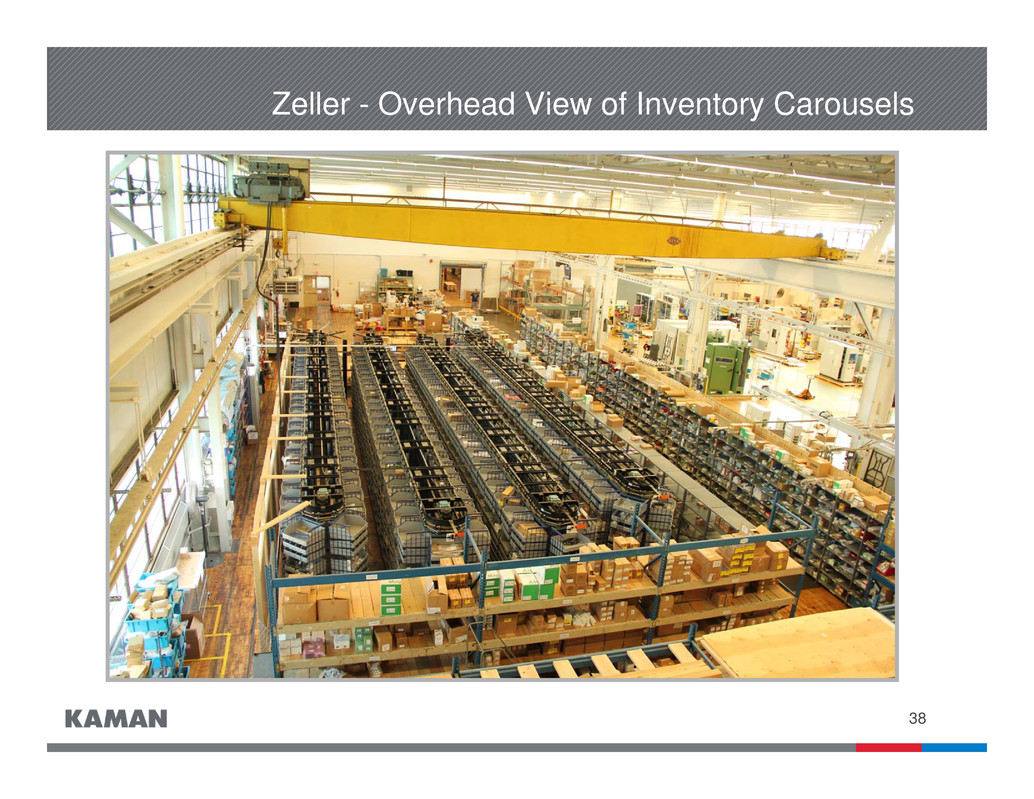

38 Zeller - Overhead View of Inventory Carousels

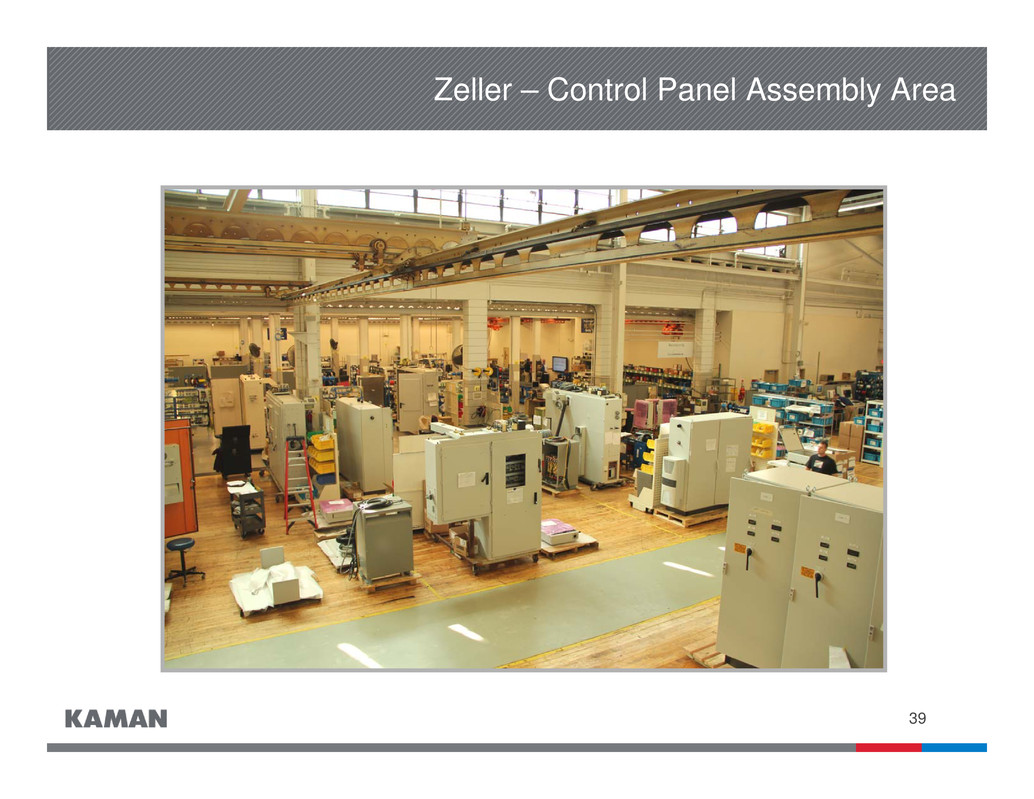

39 Zeller – Control Panel Assembly Area

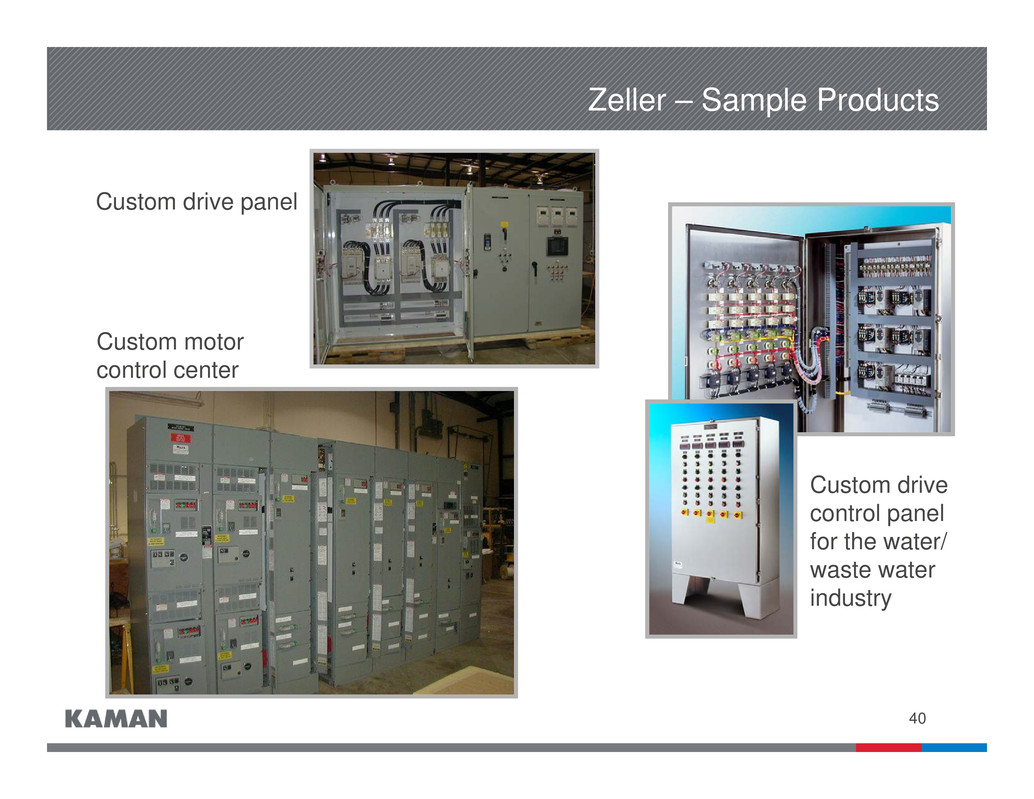

40 Zeller – Sample Products Custom motor control center Custom drive panel Custom drive control panel for the water/ waste water industry

41 • Builds scale in Kaman’s automation and control (A&C) market segment • Expands Kaman’s A&C served market to $15 billion by adding electric control capabilities • Adds Schneider as key vendor • Establishes scale in value-added solutions • Establishes Kaman as a provider of electrical controls products • Expected to yield sales synergy opportunities from Kaman’s national sales force Zeller - Summary of Merits

42 Appendix III Executive Compensation & Corporate Governance

43 Executive Compensation Aligned with Shareholder Interests • Alignment with the market allows Company to attract and retain key talent • Company and individual performance drive base salary, annual cash incentives and long-term incentives • Total compensation only reaches the median of market when Company financial performance also is at the median of similar sized industrial companies • The direct linkage to company financial performance serves shareholder interests • SERP and Pensions benefit accruals ended in 2010 • Perquisites have essentially been eliminated for executive officers (MERP, financial counseling, tax planning)

44 Compensation Components • Base Salary • Annual Cash Incentive • Long-Term Incentive • Benefit Plans – Same plans as all other employees • Car Allowance – Limited to executive officers and business unit heads • Perquisites – Other executive perquisites eliminated • Management Agreements – Limited to six key executives • All compensation components compared to industrial surveys of similar sized companies every 2-3 years • Total compensation is driven by company and individual performance • 75% of CEO’s compensation in 2011 was performance related Targeted at the median of industrial companies of similar size

45 Performance-Driven Annual Cash Incentive • Annual cash incentive driven by financial performance – Corporate – compared against the 5-year average of Russell 2000: • Return on Investment • EPS growth • EPS performance against plan • Individual Performance – Business Units – compared against the 3-year moving average of past performance • Return on Investment • Growth in operating income • Additional annual objectives determined by business priorities • Reviewed and approved by the Personnel and Compensation Committee of the Board of Directors

46 Corporate Governance • Strong and Independent Board of Directors • Nine members; eight are independent with no relationship to the Company other than Board service • Independent Lead Director in place since 2002 • Board has majority voting policy for director elections • Directors have broad senior leadership qualifications: – Chief executive or chief financial officer roles – Industry experience includes aerospace, defense, engineering, distribution and financial services, both domestic and international • Virtually all directors serve on the board of other public companies (generally not more than three)