Furmanite Corporation QUARTER AND YEAR ENDED MARCH 31, 2012 Charles R. Cox, Chairman & CEO Joseph E. Milliron, President & COO Robert S. Muff, Principal Financial Officer Exhibit 99.2 |

Certain of the Company’s statements in this presentation are not purely historical, and as such are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These include statements regarding management’s plans, beliefs, expectations, intentions or projections of the future. Forward-looking statements involve risks and uncertainties, including without limitation, the various risks inherent in the Company’s business, and other risks and uncertainties detailed most recently in this presentation and the Company’s Form 10-K as of December 31, 2011 filed with the Securities and Exchange Commission. One or more of these factors could affect the Company’s business and financial results in future periods, and could cause actual results to differ materially from plans and projections. There can be no assurance that the forward-looking statements made in this document will prove to be accurate, and issuance of such forward-looking statements should not be regarded as a representation by the Company, or any other person, that the objectives and plans of the Company will be achieved. All forward-looking statements made in this presentation are based on information presently available to management, and the Company assumes no obligation to update any forward-looking statements. 2 Safe Harbor Statement Safe Harbor Statement |

Furmanite Corporation QUARTER AND YEAR ENDED MARCH 31, 2012 Charles R. Cox, Chairman & CEO 3 |

4 1 st Quarter • Disappointing Quarter with Revenues down $1.3 million; Net Income down $2.9 million, excluding relocation, restructuring and income tax related benefit • Revenue and Net Income miss related primarily to poor Central European markets and delayed turnaround season • Identified Central Europe Q1 “Overhead Cost vs. Market” imbalance issues are currently being addressed. • Lower January and February Revenue in the Americas were not quite offset by a very strong March • No new “problem” projects this quarter Financial Overview |

5 • Significantly worse 1 st quarter overall market conditions in Europe compared to 2009 through 2011 • Unclear future direction in European markets • Additional European restructuring taking place in 2 nd quarter to address probable protracted poor market conditions • Late turnaround season impact expected to be limited to 1 st quarter • Positive trends continue in all other regions and cautious optimism continues • Still not counting on consistently improved markets conditions anywhere Business Conditions |

6 • New Global “One Company” Matrix organizational concept now 50% in place • Service Line (“SL”) Strategies implementation underway • Investment to support SL Strategies still planned for 2012 and 2013 • Values, Culture Change and Overall Growth Strategies Unchanged • Completed Corporate HQ move to Houston in March as scheduled Strategic Update |

7 • Re-balance European cost structure with deteriorating market conditions • Finalize implementation of Global Matrix Organization • Complete appointment of Service Line Teams to implement World Leader Vision • Assemble Senior Leadership Team in new Houston HQ • Embed “Orange Code” Culture, drive growth strategies & project execution excellence around the world 2012 Priorities |

To safely and ethically establish Furmanite as the World leader in all our Service Lines by 2014, through Innovation, Global Teamwork, Market Dominance, Project Excellence and Customer Service Perfection. “The World Leader in All Service Lines by 2014” 8 Furmanite Vision |

Furmanite Corporation QUARTER AND YEAR ENDED MARCH 31, 2012 Financial Review Robert S. Muff, Principal Financial Officer 9 |

Condensed Consolidated Statements of Operations ($ in 000s except percentages and per share amounts) (Unaudited) 10 For the Three Months Ended March 31, 2012 % of Rev 2011 % of Rev Change Revenues $ 71,782 100.0% $ 73,054 100.0% $ (1,272) Operating costs 52,352 72.9% 50,402 69.0% 1,950 Depreciation and amortization expense 2,025 2.8% 1,875 2.6% 150 Selling, general and administrative expense 17,333 24.1% 16,864 23.1% 469 Operating income, excluding relocation and restructuring costs 72 0.1% 3,913 5.3% (3,841) Relocation and restructuring costs 823 1.1% 88 0.1% 735 Operating income (loss) (751) -1.0% 3,825 5.2% (4,576) Interest and other income (expense), net (529) (118) (411) Income (loss) before income taxes (1,280) 3,707 (4,687) Income tax benefit 450 319 131 Net income (loss) $ (830) $ 4,026 $ 4,856 Diluted earnings (loss) per share $ (0.02) $ 0.11 $ (0.13) Adjusted diluted earnings (loss) per share* $ 0.00 $ 0.08 $ (0.08) * Excludes $0.8 million of relocation costs for the three months ended March 31, 2012. Excludes $0.1 million of restructuring costs and $1.2 million of acquisition related income tax benefit for the three months ended March 31, 2011. |

Revenues Adjusted for Currency Rates 2012 amounts at 2011 exchange rates ($ in 000s except percentages) (Unaudited) 11 For the Three Months Ended March 31, 2012 2011 Change % Change Revenues Americas $ 40,698 $ 40,227 $ 471 1% EMEA 23,027 24,673 (1,646) -7% Asia-Pacific 8,057 8,154 (97) -1% Total revenues $ 71,782 $ 73,054 $ (1,272) -2% Currency adjusted revenues: Americas $ 40,706 $ 40,227 $ 479 1% EMEA 23,642 24,673 (1,031) -4% Asia-Pacific 7,765 8,154 (389) -5% Total currency adjusted revenues $ 72,113 $ 73,054 $ (941) -1% |

Segment operating results after allocation of headquarter costs ($ in 000s) (Unaudited) 12 For the Three Months Ended March 31, 2012 Americas EMEA Asia-Pacific Corporate & Other Total Operating income (loss) $ 4,355 $ (1,196) $ 226 $ (4,136) $ (751) Allocation of headquarter costs (based on revenues) (2,354) (1,317) (465) 4,136 – Operating income (loss) after allocation of headquarter costs $ 2,001 $ (2,513) $ (239) – $ (751) For the Three Months Ended March 31, 2011 Americas EMEA Asia-Pacific Corporate & Other Total Operating income (loss) $ 5,781 $ 771 $ 484 $ (3,211) $ 3,825 Allocation of headquarter costs (based on revenues) (1,748) (1,105) (358) 3,211 – Operating income (loss) after allocation of headquarter costs $ 4,033 $ (334) $ 126 – $ 3,825 |

Segment operating result comparison after allocation of headquarter costs 2012 amounts at 2011 exchange rates ($ in 000s) (Unaudited) 13 For the Three Months Ended March 31, 2012 2011 Change Operating income (loss) after allocation of headquarter costs: Americas $ 2,001 $ 4,033 $ (2,032) EMEA (2,513) (334) (2,179) Asia-Pacific (239) 126 (365) Total operating income (loss) after allocation of headquarter costs $ (751) $ 3,825 $ (4,576) |

Condensed Consolidated Balance Sheets ($ in 000s) 14 (Unaudited) March 31, December 31, 2012 2011 Change Cash $ 29,517 $ 34,524 $ (5,007) Trade receivables, net 71,626 71,508 118 Inventories 29,342 26,557 2,785 Other current assets 13,409 13,171 238 Total current assets 143,894 145,760 (1,866) Property and equipment, net 34,590 34,060 530 Other assets 27,703 27,412 291 Total assets $ 206,187 $ 207,232 $ (1,045) Total current liabilities $ 40,294 $ 41,999 $ (1,705) Total long-term debt 30,055 31,051 (996) Other liabilities 15,743 15,293 450 Total stockholders' equity 120,095 118,889 1,206 Total liabilities and stockholders' equity $ 206,187 $ 207,232 $ (1,045) |

Condensed Consolidated Statements of Cash Flows ($ in 000s) (Unaudited) 15 For the Three Months Ended March 31, 2012 2011 Change Net income (loss) $ (830) $ 4,026 $ (4,856) Depreciation, amortization and other non-cash items 2,575 1,190 1,385 Working capital changes (2,273) (5,241) 2,968 Net cash used in operating activities (528) (25) (503) Capital expenditures (2,040) (759) (1,281) Acquisition of assets and business, net of cash acquired – (3,921) 3,921 Payments on debt (32,707) (35) (32,672) Proceeds from issuance of debt 30,000 – 30,000 Other, net (148) 32 (180) Effect of exchange rate changes on cash 416 659 (243) Decrease in cash and cash equivalents (5,007) (4,049) (958) Cash and cash equivalents at beginning of period 34,524 37,170 (2,646) Cash and cash equivalents at end of period $ 29,517 $ 33,121 $ (3,604) |

Furmanite Corporation QUARTER AND YEAR ENDED MARCH 31, 2012 Operations Review Joseph E. Milliron, President and Chief Operating Officer 16 |

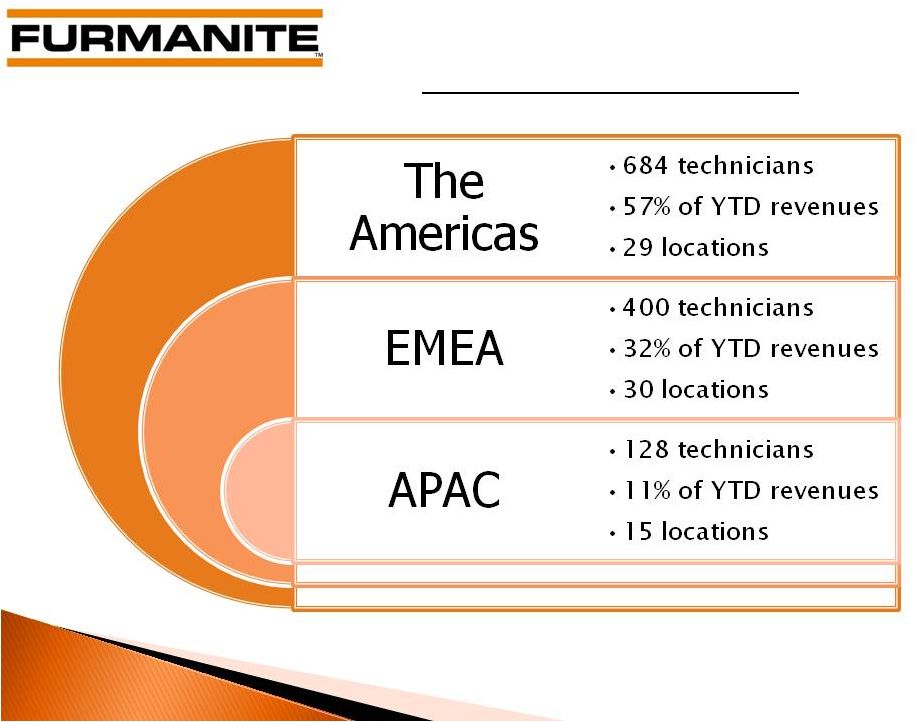

17 at March 31, 2012 • 1,659 total employees, including temporary technicians – 3 higher than March 31, 2011 • 1,212 technicians, including temporary technicians – 18 higher than March 31, 2011 • 447 selling, general and administrative (SG&A) personnel – 15 less than March 31, 2011 Costs aligned with revenues |

As of March 31, 2012 18 Global Service Network |

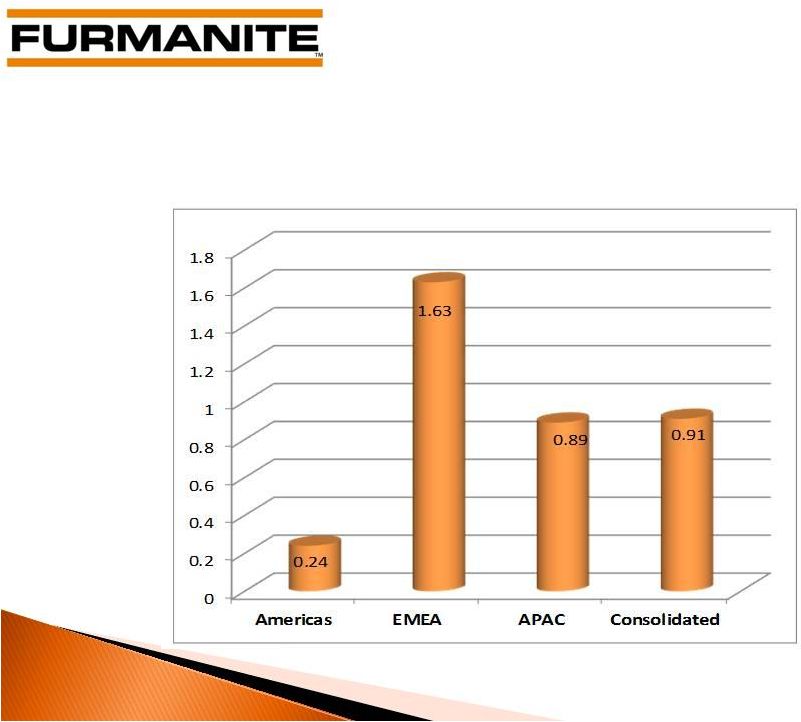

19 TRIR TRIR SAFETY: 2010 Around the World |

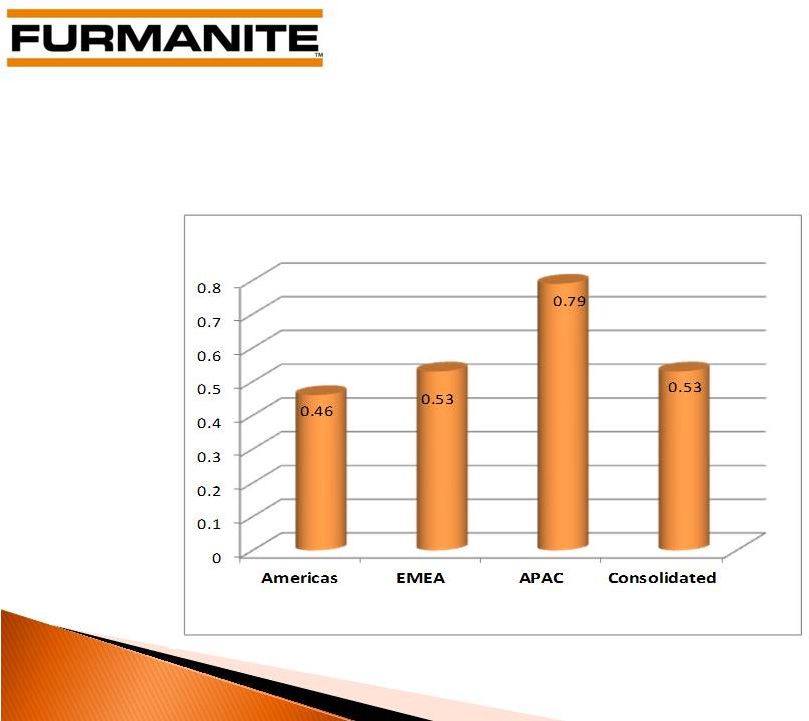

20 TRIR TRIR SAFETY: 2011 Around the World |

21 Total Americas EMEA APAC On-line Services 1 Qtr. 2012 $ 30,145 $ 16,647 $ 9,302 $ 4,196 On-line Services 1 Qtr. 2011 27,924 15,945 9,470 2,509 Variance $ 2,221 $ 702 $ (168) $ 1,687 On-line Services YTD 2012 $ 124,836 $ 67,139 $ 43,909 $ 13,788 On-line Services YTD 2011 104,651 51,076 37,051 16,524 Variance $ 20,185 $ 16,063 $ 6,858 $ (2,736) Business and Geographic Data – On-line¹ Services Revenues ($ in 000’s) (Unaudited) 1 Formerly referred to as under-pressure services st st |

Business and Geographic Data – Off-line¹ Services Revenues ($ in 000’s) (Unaudited) 22 1 Formerly referred to as turnaround services Total Americas EMEA APAC Off-line Services 1 Qtr. 2012 $ 28,718 $ 17,070 $ 8,472 $ 3,176 Off-line Services 1 Qtr. 2011 32,500 18,364 10,096 4,040 Variance $ (3,782) $ (1,294) $ (1,624) $ (864) Off-line Services YTD 2012 $ ___,___ $ __,___ $ __,___ $ __,___ Off-line Services YTD 2011 __,___ __,___ __,___ __,___ Variance $ _,___ $ _,___ $ _,___ $ _,___ st st |

Furmanite Corporation Review of 1Q 2012 May 8, 2012 www.furmanite.com 23 |