This presentation and the statements to be made by Great Plains Energy that are not based on historical facts are forward-looking, may

involve risks and uncertainties, and are intended to be as of the date when made. Forward-looking statements include, but are not limited

to, statements regarding projected delivered volumes and margins, the outcome of regulatory proceedings, cost estimates of the

comprehensive energy plan and other matters affecting future operations. In connection with the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995, the registrants are providing a number of important factors that could cause actual results to differ

materially from the provided forward-looking information. These important factors include: future economic conditions in the regional,

national and international markets, including but not limited to region

al and national wholesale electricity markets; market perception of the

energy industry, Great Plains Energy and KCP&L; changes in business strategy, operations or development plans; effects of current or

proposed state and federal legislative and regulatory actions or developments, including, but not limited to, deregulation, re-regulation and

restructuring of the electric utility industry; decisions of regulators regarding rates KCP&L can charge for electricity; adverse changes in

applicable laws, regulations, rules, principles or practices governing tax, accounting and environmental matters including, but not limited to,

air and water quality; financial market conditions and performance including, but not limited to, changes in interest rates and in availability

and cost of capital and the effects on pension plan assets and costs; credit ratings; inflation rates; effectiveness of risk management

policies and procedures and the ability of counterparties to satisfy their contrac

tual commitments; impact of terrorist acts; increased

competition including, but not limited to, retail choice in the electric utility industry and the entry of new competitors; ability to carry out

marketing and sales plans; weather conditions including weather-related damage; cost, availability, quality and deliverability of fuel; ability

to achieve generation planning goals and the occurrence and duration of unplanned generation outages; delays in the anticipated in-service

dates and cost increases of additional generating capacity; nuclear operations; ability to enter new markets successfully and capitalize on

growth opportunities in non-regulated businesses and the effects of competition; workforce risks including compensation and benefits costs;

performance of projects undertaken by non-regulated businesses and the success of efforts to invest in and develop new opportunities; the

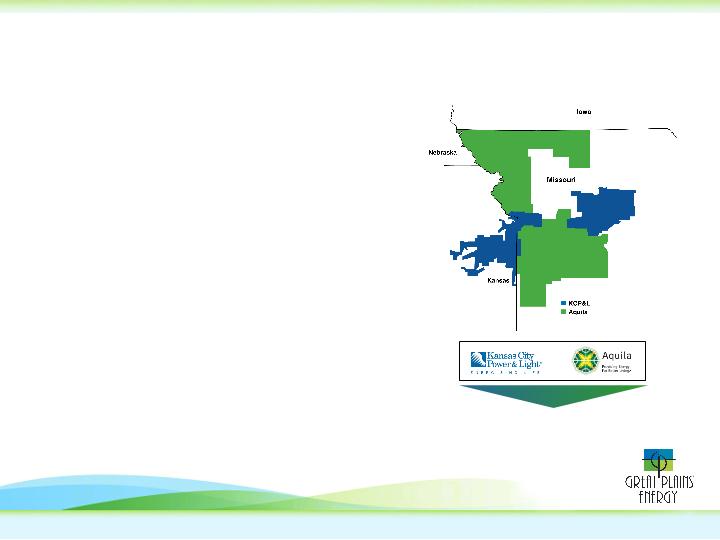

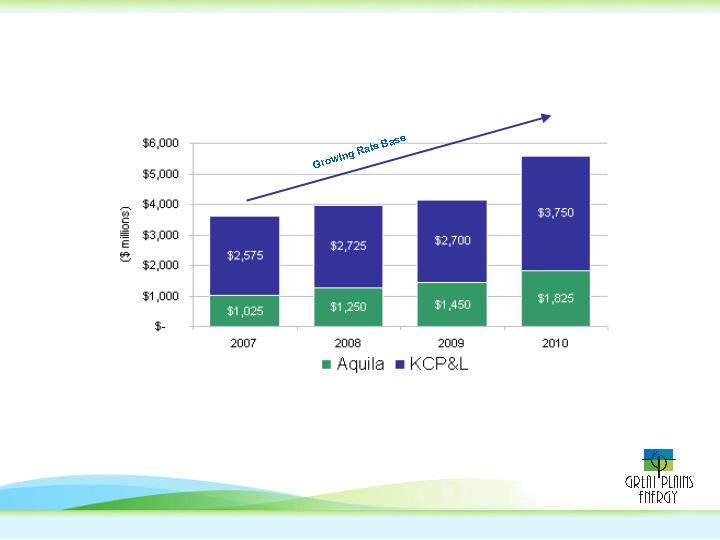

ability to successfully complete merger, acquisition or divestiture plans (including the acquisition o

f Aquila, Inc., and Aquila’s sale of assets

to Black Hills Corporation) and other risks and uncertainties.

This list of factors is not all-inclusive because it is not possible to predict all factors. Part II Item 1A Risk Factors included in Great Plains

Energy’s Form 10-Q for the period ended September 30, 2007, together with the risk factors included in the 2006 Form 10-K for Great

Plains Energy under Part I Item 1A, should be carefully read for further understanding of potential risks to Great Plains Energy. Other

periodic reports filed by Great Plains Energy with the Securities and Exchange Commission (SEC) should also be read for more information

regarding risk factors. Great Plains Energy undertakes no obligation to publicly update or revise any forward-looking statement, whether as

a result of new information, future events or otherwise.