3

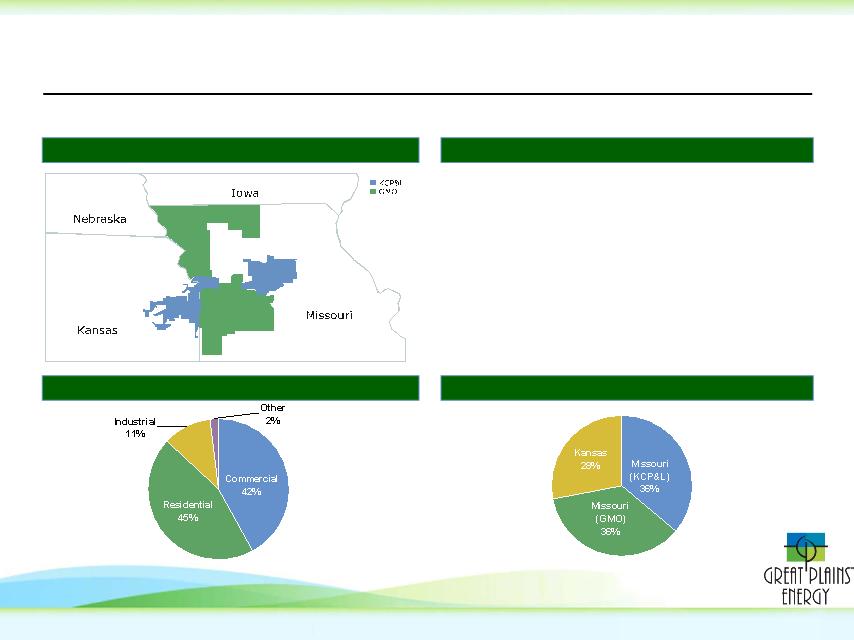

• Strong Midwest electric utility holding company focused on regulated operations in Missouri and Kansas

• Diversified customer base includes 820,000 residential, commercial, and industrial customers

• ~6,000 Megawatts of generation capacity

• Low-cost generation mix - projected 76% coal, 17% nuclear (Wolf Creek) in 2009

100% Regulated

Electric Utility

Operations Focus

• Significant projected rate base growth from $3.6bn in 2008 to $6.8bn in 2012 - 15% CAGR

• Growth and stability in earnings driven by sizable regulated investments as part of the Comprehensive

Energy Plan (“CEP”)

• Wind and environmental retrofit components of CEP in place; Iatan 2 baseload coal plant

targeted for completion in summer 2010

• Anticipated growth beyond 2010 driven by additional environmental capex and wind

Attractive Platform

for Long-Term

Earnings Growth

Focused Regulatory

Approach

Stable and Improving

Financial Position

• Successful outcomes in 2006 and 2007 rate cases in Missouri and Kansas

• Combined annual rate increase of $159mm recently authorized in Missouri; new rates effective September 2009

• Settlement talks in process regarding $72mm increase requested in Kansas; hearings scheduled to begin June

22 with new rates expected to be effective mid-August

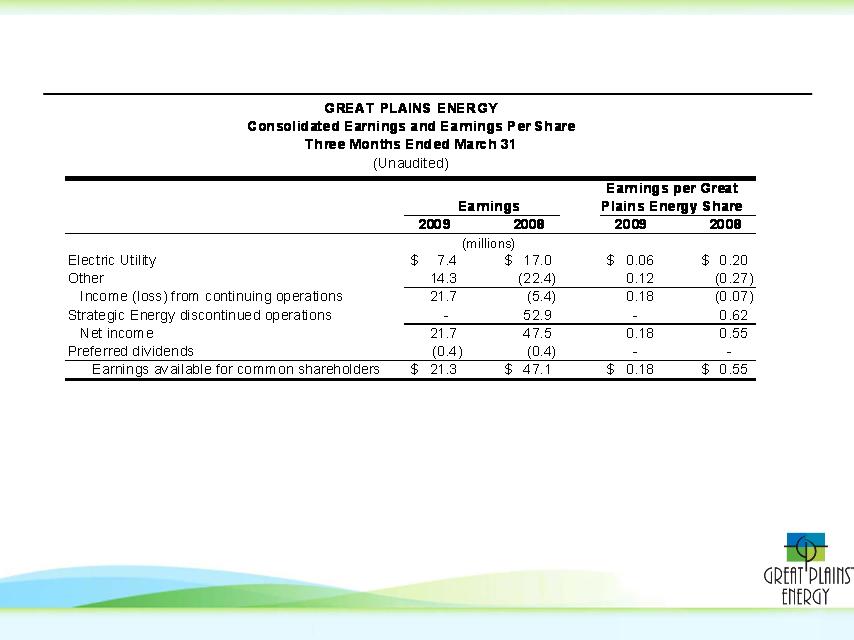

• Cash flow and earnings heavily driven by regulated operations and rate recovery mechanisms

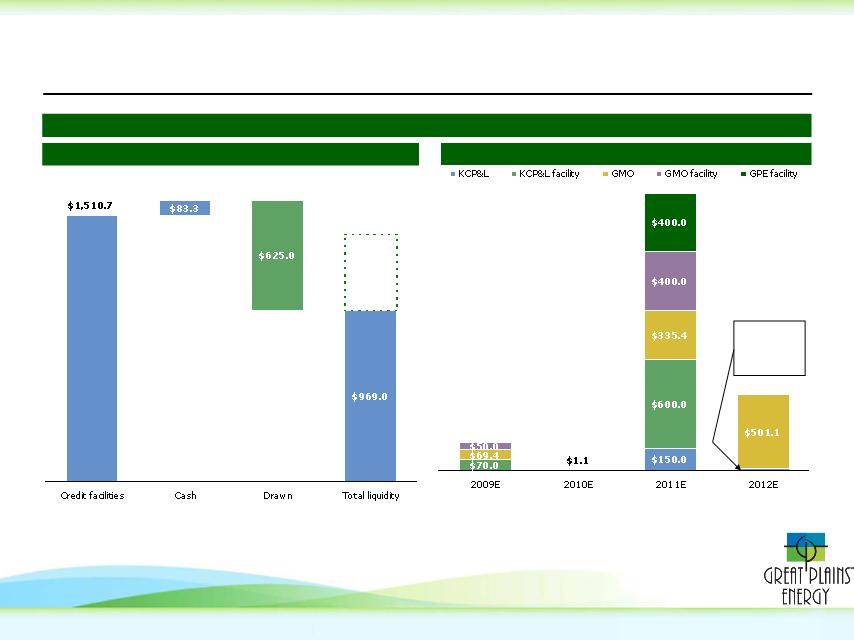

• Ample liquidity available under $1.5bn revolving credit facilities

• Sustainable dividend and pay-out, right-sized to fund growth and to preserve liquidity

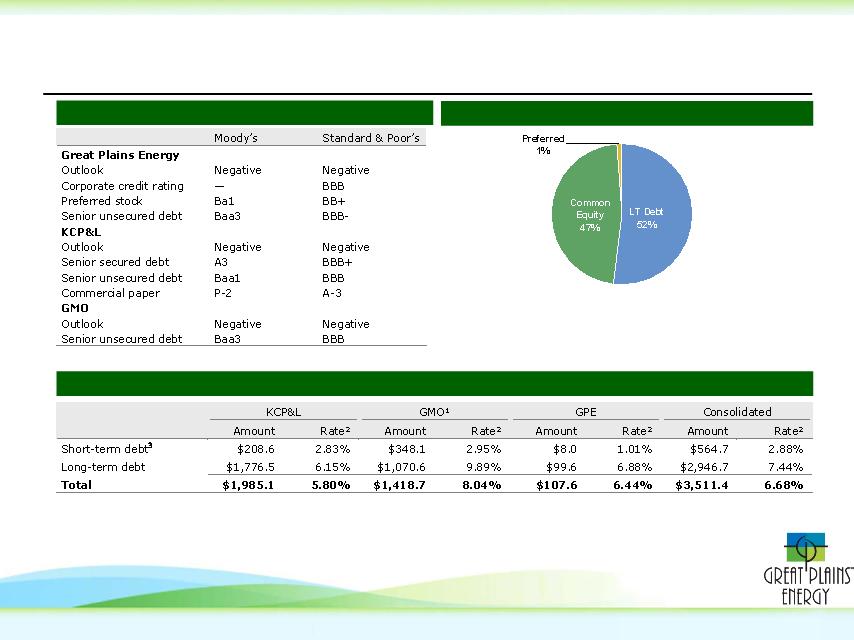

• Committed to maintaining current investment grade credit ratings

Key Investment Highlights