2

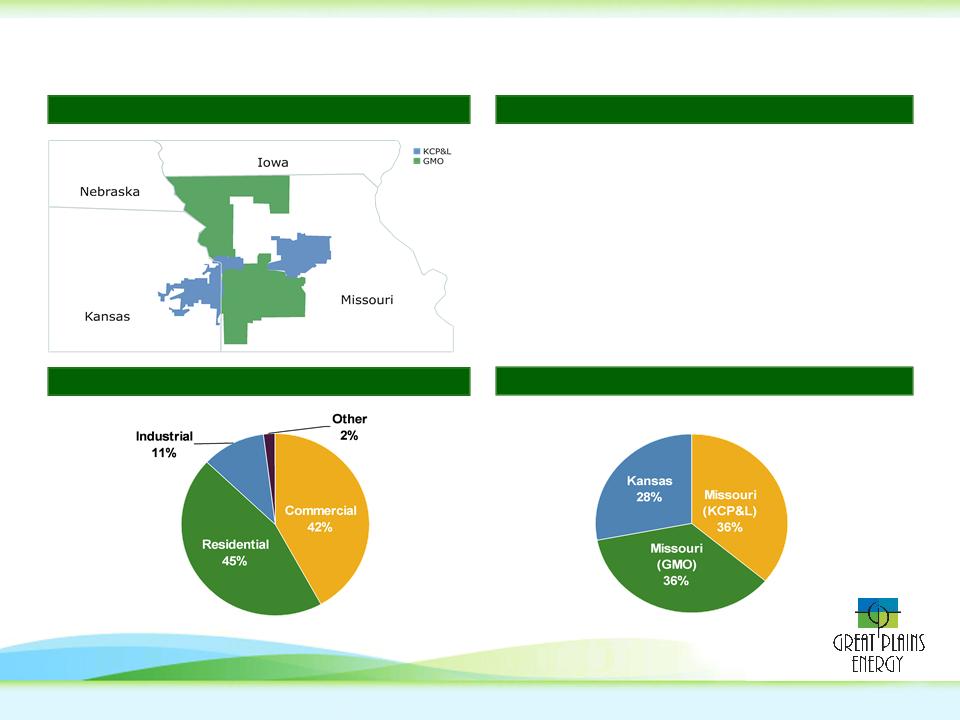

• Strong Midwest electric utilities focused on regulated operations in Missouri and Kansas

• Diversified customer base includes 820,000 residential, commercial, and industrial customers

• ~6,000 Megawatts of generation capacity

• Low-cost generation mix - projected 76% coal, 17% nuclear (Wolf Creek) in 2009

100% Regulated

Electric Utility

Operations Focus

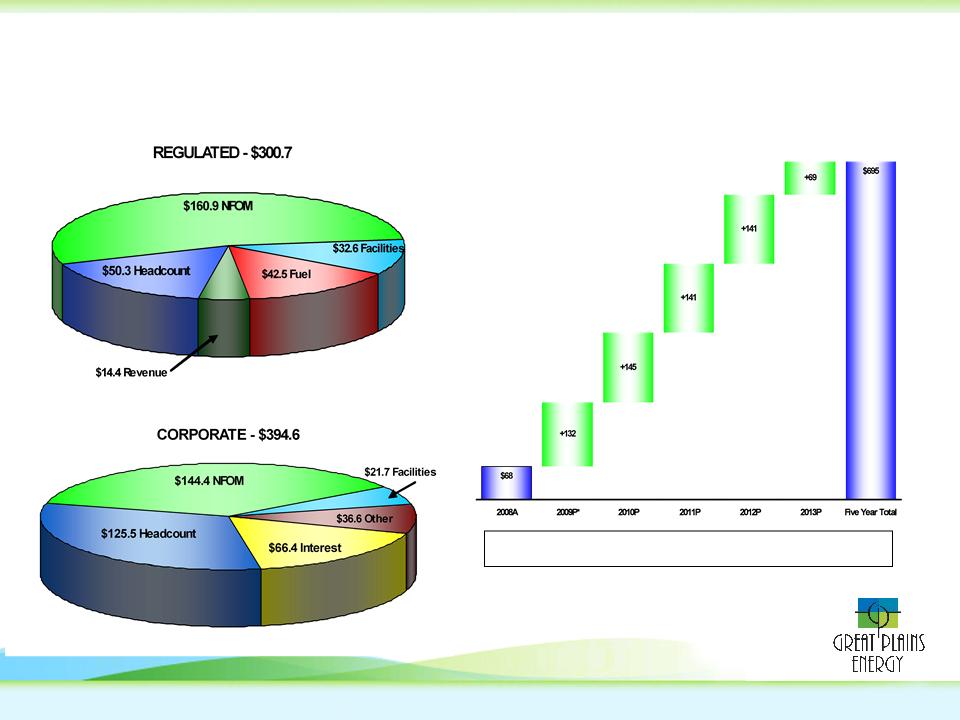

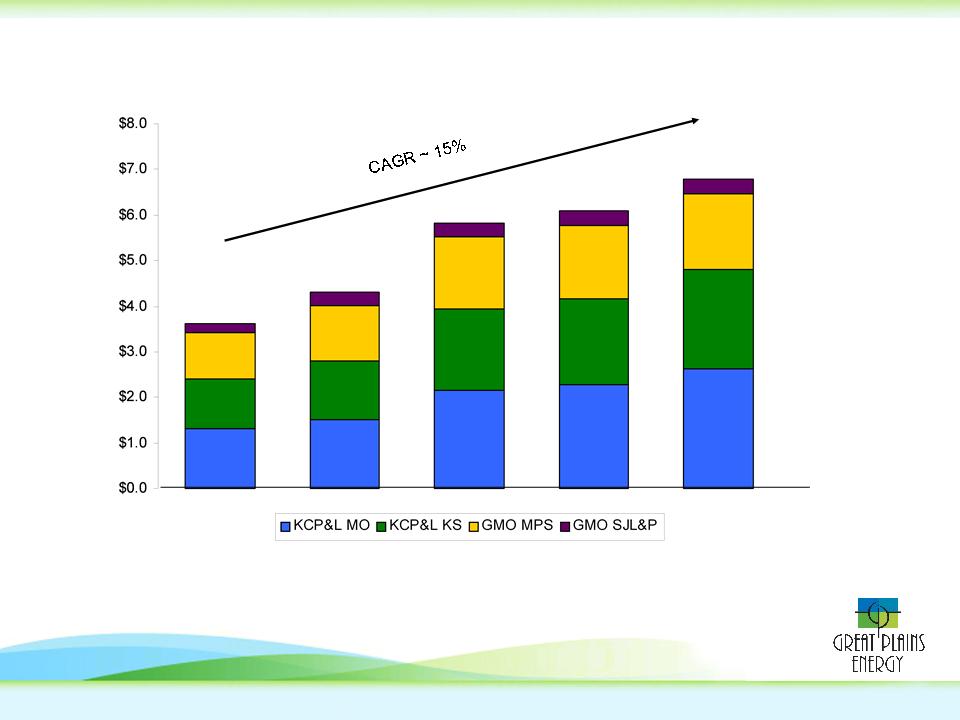

• Significant projected rate base growth from $3.6bn in 2008 to $6.8bn in 2012 - 15% CAGR

• Growth and stability in earnings driven by sizable regulated investments as part of the Comprehensive

Energy Plan (“CEP”)

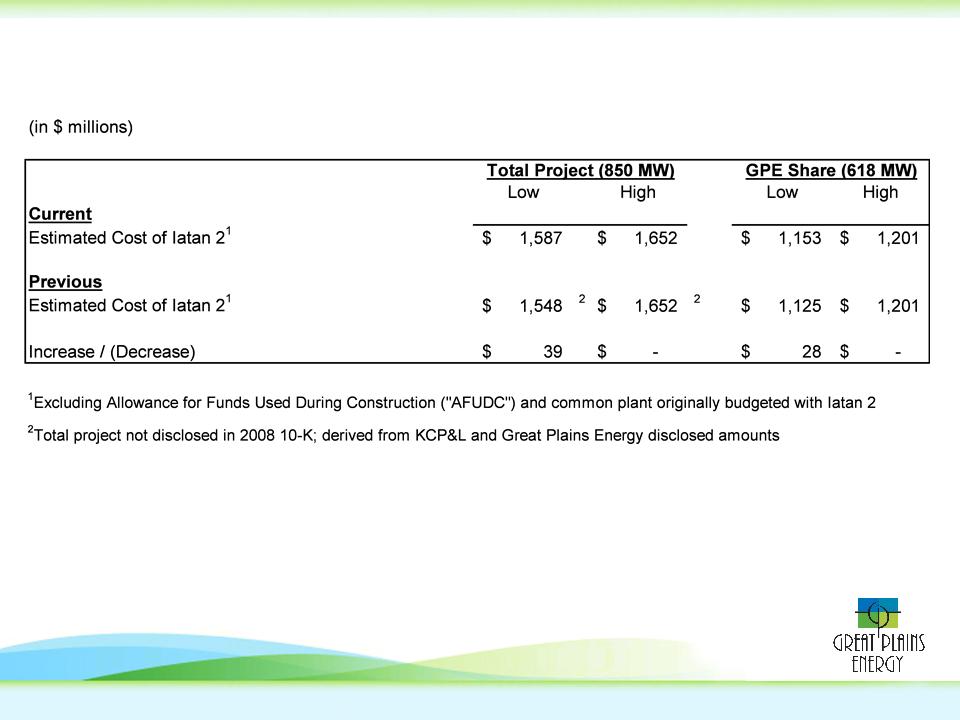

• Wind and environmental retrofit components of CEP in place; Iatan 2 baseload coal plant

targeted for completion in late summer 2010

• Anticipated growth beyond 2010 driven by additional environmental capex and wind

Attractive Platform for

Long-Term Earnings

Growth

• Successful outcomes in 2006, 2007 and 2008 rate cases in Missouri and Kansas

• Combined annual rate increases from 2008 cases of $59mm in Kansas and $159mm in Missouri; new

rates effective August 1st in Kansas and September 1st in Missouri

Focused Regulatory

Approach

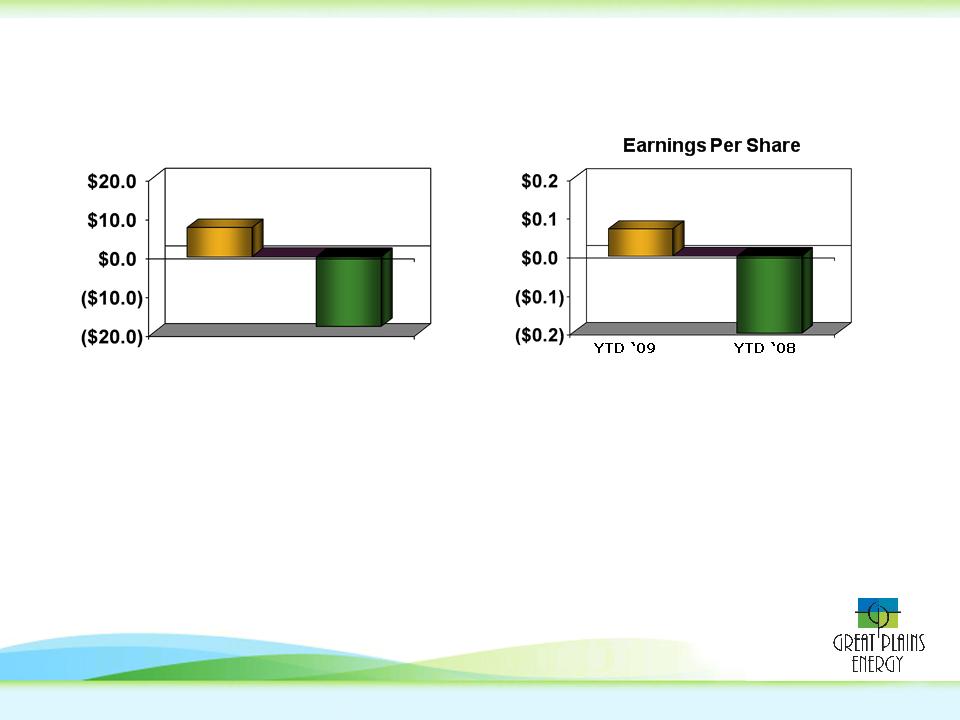

• Cash flow and earnings heavily driven by regulated operations and cost recovery mechanisms

• Ample liquidity currently available under $1.5bn credit facilities

• Sustainable dividend and pay-out, right-sized to fund growth and to preserve liquidity

• Committed to maintaining current investment grade credit ratings

Stable and Improving

Financial Position

Great Plains Energy Overview