5

• Strong Midwest electric utilities focused on regulated operations in Missouri and Kansas

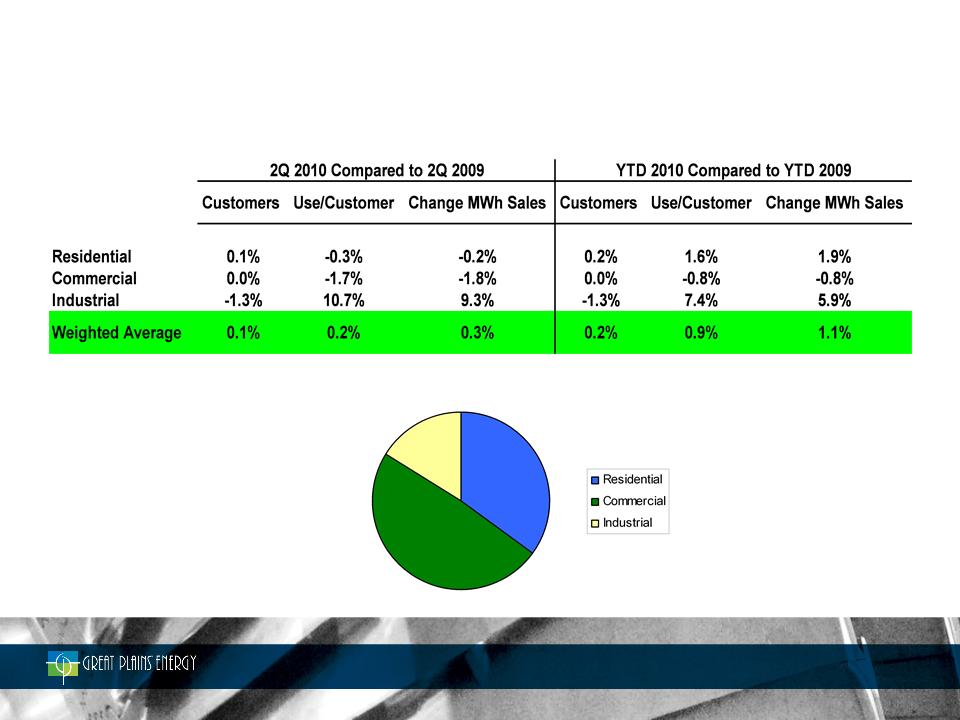

• Diversified customer base includes ~822,000 residential, commercial, and industrial customers

• ~6,000 Megawatts of generation capacity

• Low-cost generation mix: 80% coal, 17% nuclear (Wolf Creek), 2% natural gas/oil and 1% wind in 2009

100% Regulated

Electric Utility

Operations Focus

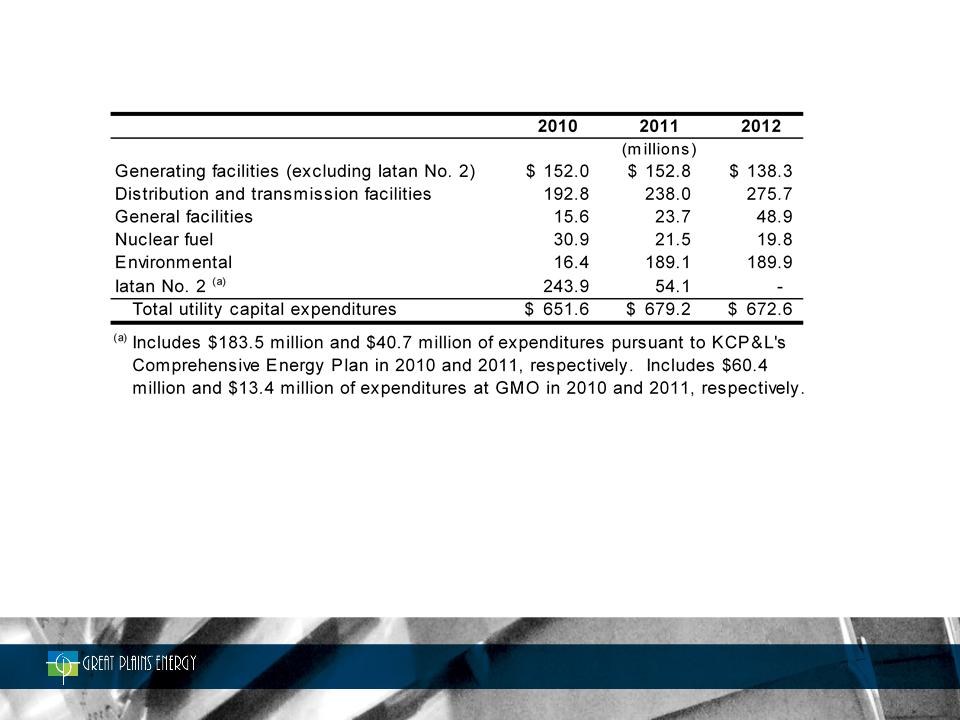

• Growth and stability in earnings driven by sizable regulated investments as part of the Comprehensive Energy Plan

(“CEP”)

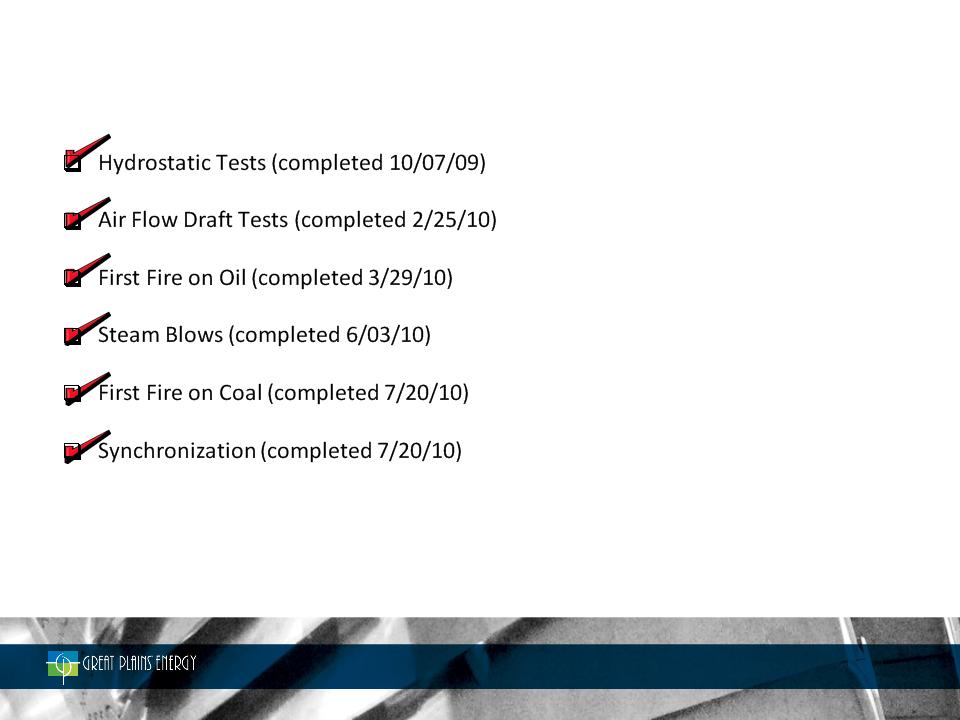

• Wind and environmental retrofit components of CEP in place; Iatan 2 baseload coal plant targeted for

completion later this year

• Anticipated growth beyond 2010 driven by additional environmental capex, transmission opportunities and wind

Attractive Platform for

Long-Term Earnings

Growth

• Successful outcomes in 2006, 2007 and 2008 rate cases in Missouri and Kansas

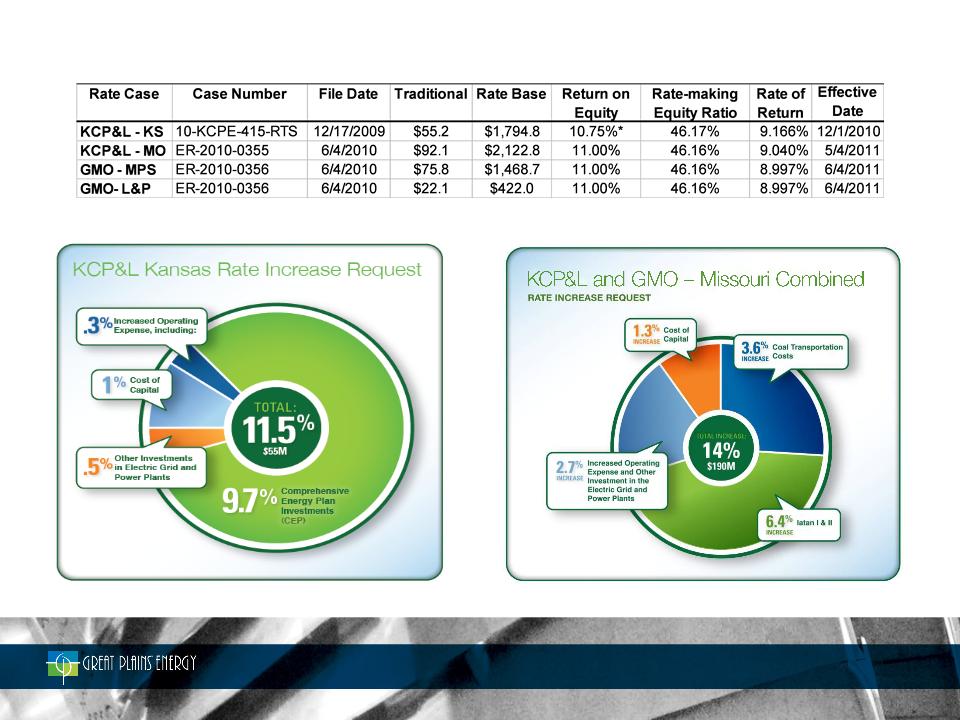

• Combined annual rate increases from 2008 cases of $59mm in Kansas and $159mm in Missouri; new rates

effective August 1st in Kansas and September 1st in Missouri

• $55mm rate increase for KCP&L Kansas filed in 12/09; $190 million rate increase for KCP&L MO and GMO filed 6/10

Focused Regulatory

Approach

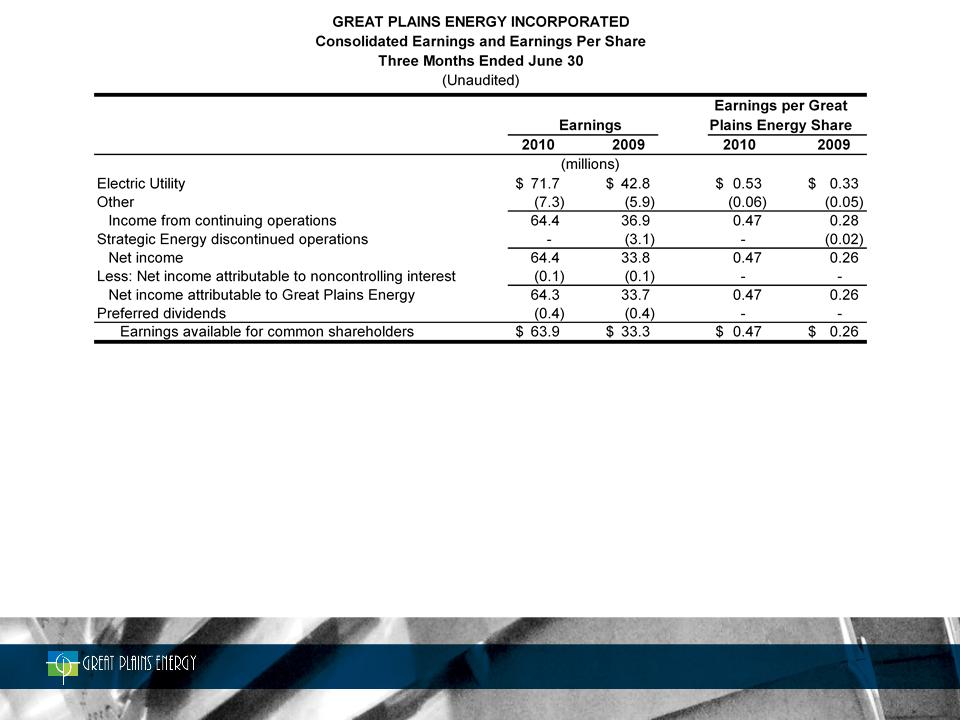

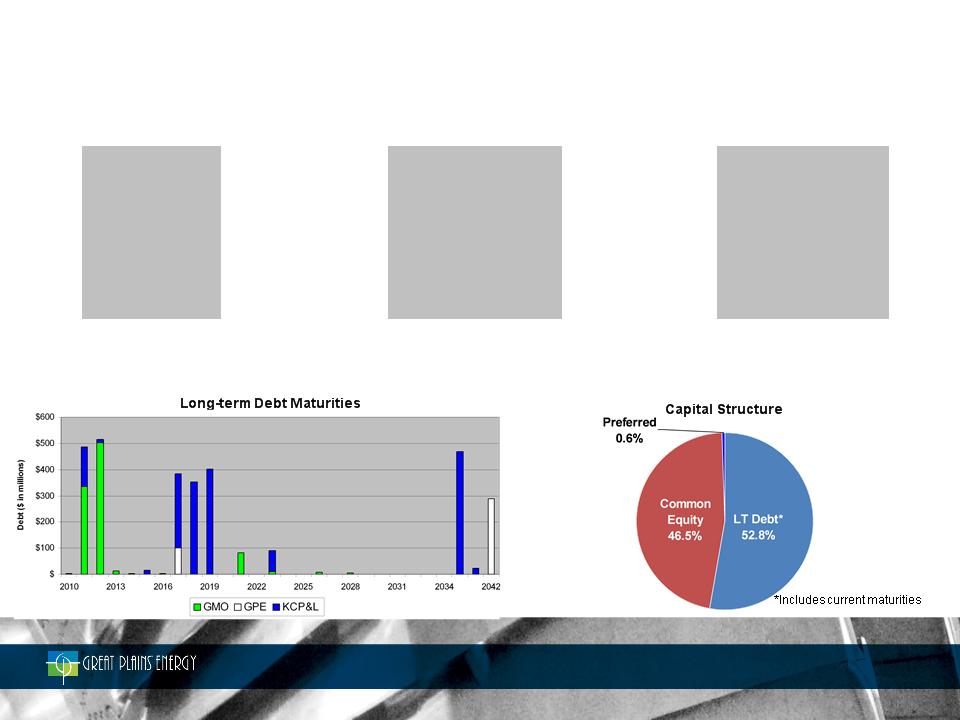

• Cash flow and earnings heavily driven by regulated operations and cost recovery mechanisms

• Ample liquidity currently available under $1.25bn credit facilities

• Sustainable dividend and pay-out, right-sized to fund growth and to preserve liquidity

• Recent shift in outlook from Negative to Stable at Moody’s and S&P

Stable and Improving

Financial Position

August 2010 Investor Presentation

Strong Platform for Long-Term Growth