5

May 2011 Investor Presentation

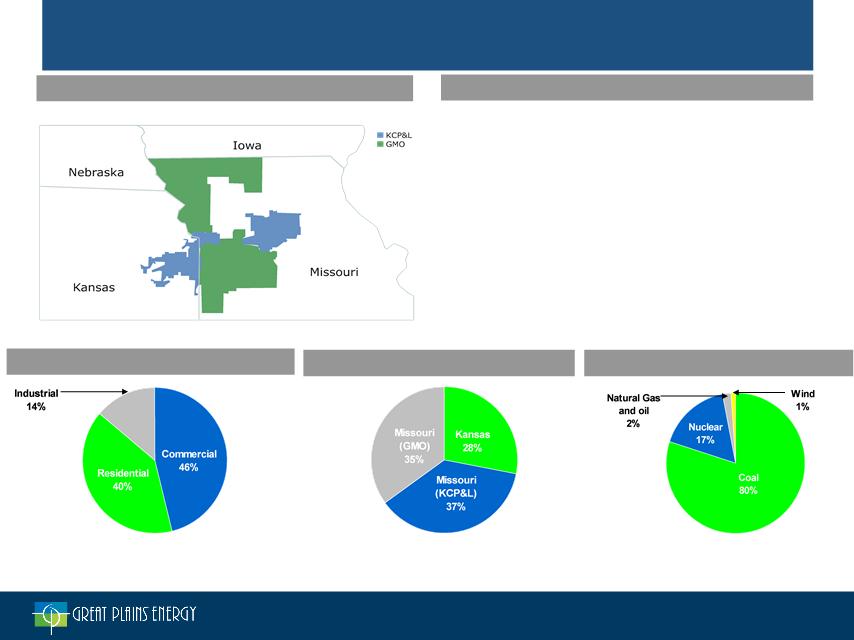

• Strong Midwest electric utilities focused on regulated operations in Missouri and Kansas

• Diversified customer base includes ~824,600 residential, commercial, and industrial customers

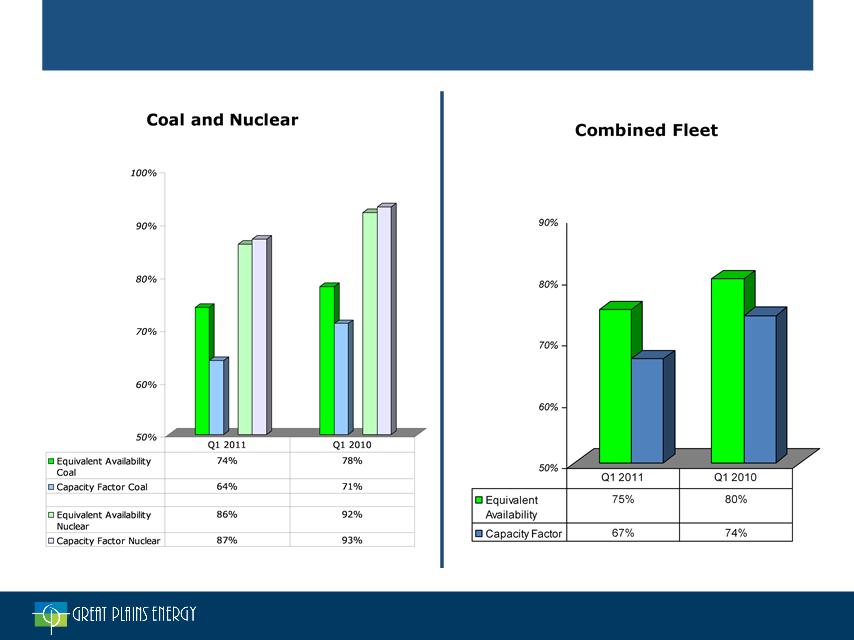

• ~6,600 Megawatts of generation capacity

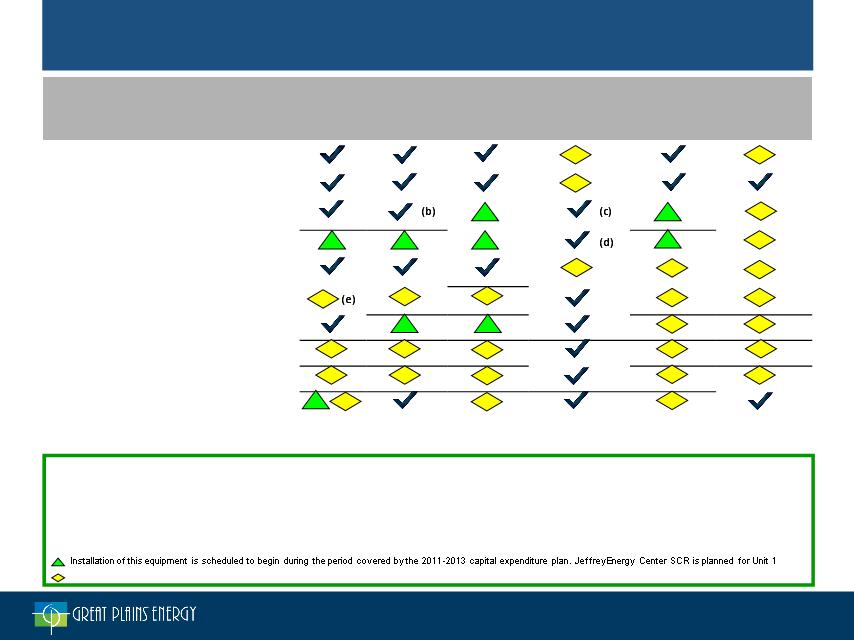

• Low-cost generation mix: 80% coal, 17% nuclear (Wolf Creek), 2% natural gas/oil and 1% wind in 2010

100% Regulated

Electric Utility

Operations Focus

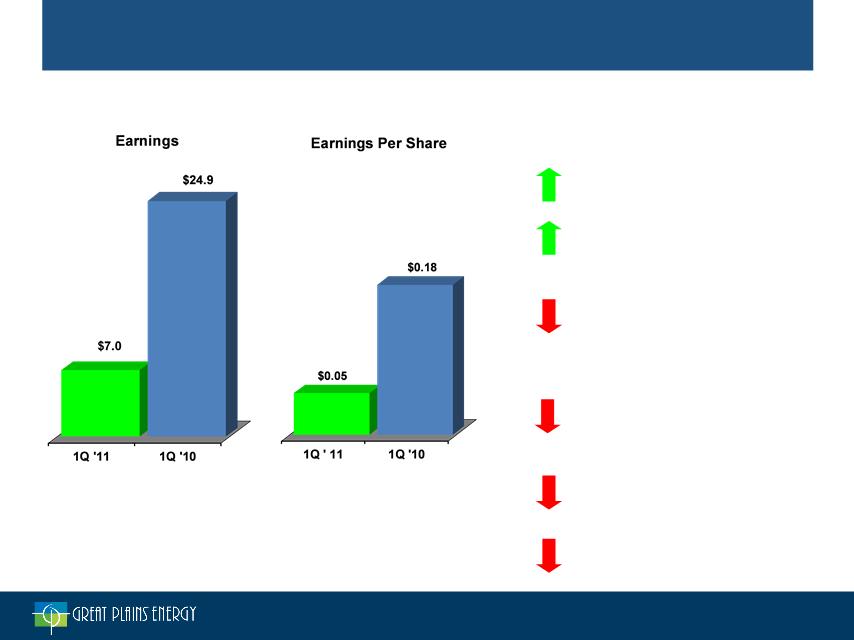

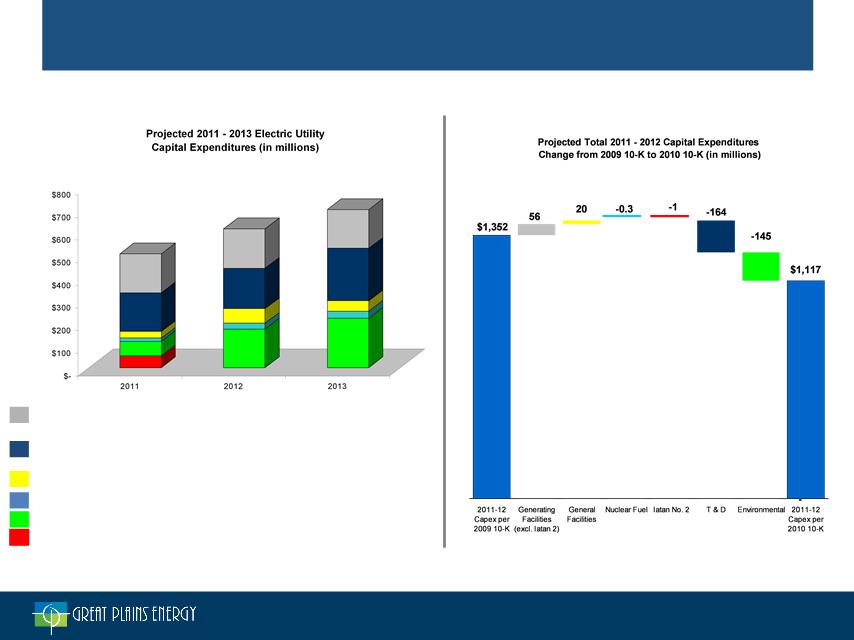

• Growth and stability in earnings driven by sizable regulated investments as part of the Comprehensive Energy Plan

(“CEP”)

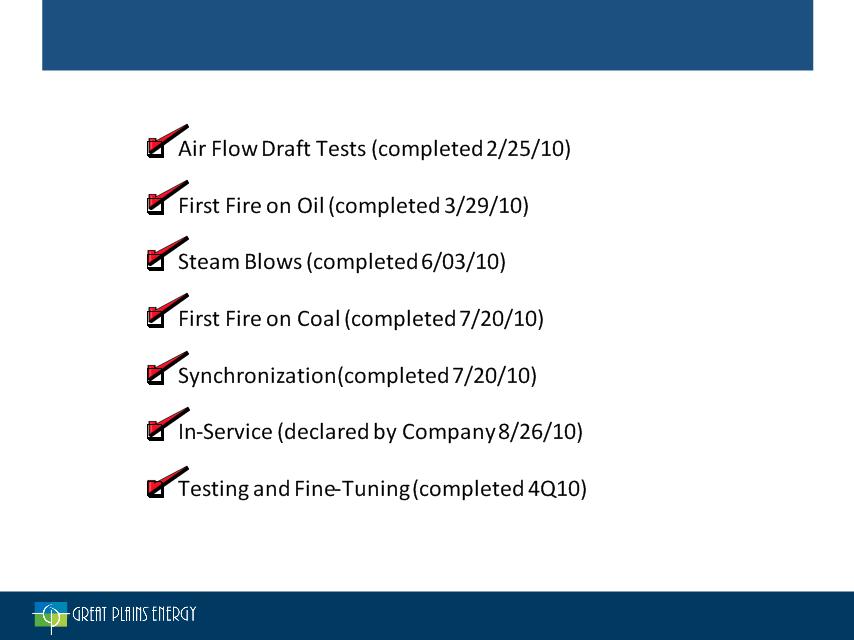

– Wind, environmental retrofits and Iatan 2 baseload coal plant all in-service

• Organic growth potential through environmental, transmission, renewable energy and on-going reliability-related

investment

Attractive Platform for

Long-Term Earnings

Growth

• Constructive outcomes in 2006, 2007 and 2008 rate cases in Missouri and Kansas

• Recent cases

– Kansas - In 2010, the KCC authorized a revenue increase of $22 million and brought Iatan 2 into rate base

with minimal disallowance

– Missouri - In 2011, the MPSC authorized revenue increases totaling $94.2 million for KCP&L -MO and GMO

and brought Iatan 2 into rate base with minimal disallowance

Diligent Regulatory

Approach

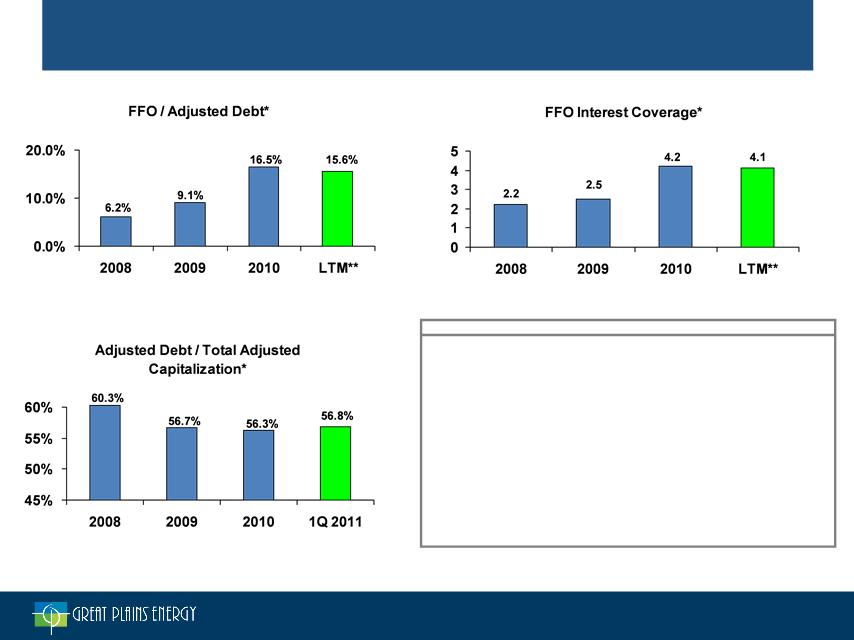

• Cash flow and earnings heavily driven by regulated operations and cost recovery mechanisms

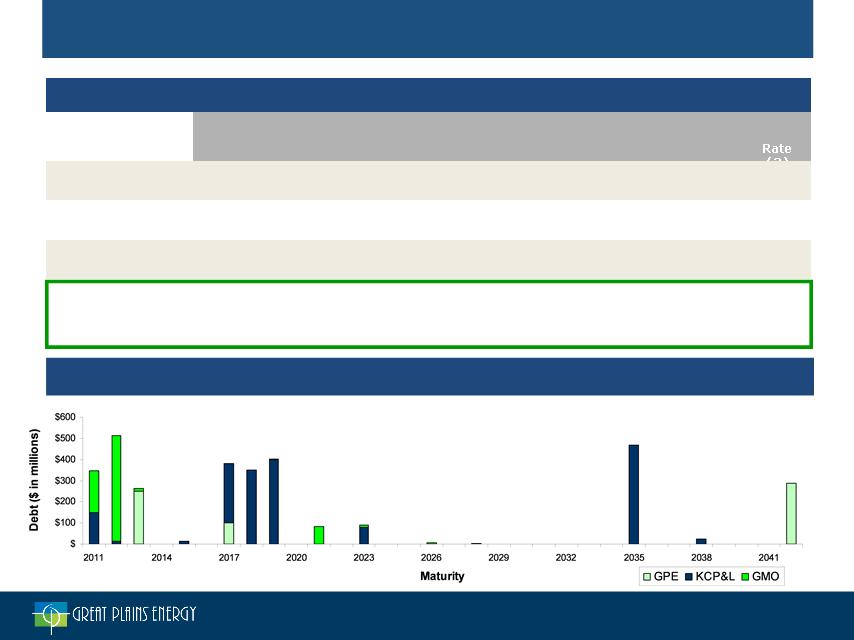

• Ample liquidity currently available under $1.25bn credit facilities

• Sustainable dividend and pay-out, right-sized to fund growth and to preserve liquidity

• Stable Outlook at Moody’s and S&P

Improved Financial

Position

Strong Platform