UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

| |

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

or

|

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 1-4717

KANSAS CITY SOUTHERN

(Exact name of registrant as specified in its charter)

|

| | |

Delaware (State or other jurisdiction of incorporation or organization) | | 44-0663509 (I.R.S. Employer Identification No.) |

427 West 12th Street, Kansas City, Missouri | 64105 |

| (Address of principal executive offices) | (Zip Code) |

816.983.1303

(Registrant’s telephone number, including area code)

None

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| Title of Each Class | | Name of Each Exchange on Which Registered |

| Preferred Stock, Par Value $25 Per Share, 4%, Noncumulative | | New York Stock Exchange |

| Common Stock, $.01 Per Share Par Value | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | |

Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o | |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

The aggregate market value of common stock held by non-affiliates of the registrant was $6.40 billion at June 30, 2011. There were 109,934,820 shares of $.01 par common stock outstanding at February 1, 2012.

DOCUMENTS INCORPORATED BY REFERENCE

Kansas City Southern’s Definitive Proxy Statement for the 2012 Annual Meeting of Stockholders which will be filed no later than 120 days after December 31, 2011, is incorporated by reference in Parts III.

KANSAS CITY SOUTHERN

2011 FORM 10-K ANNUAL REPORT

Table of Contents

|

| | |

| | | Page |

| | |

| PART I | |

| | | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| PART II | |

| | | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| | |

| PART III | |

| | | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | |

| PART IV | |

| | | |

| Item 15. | | |

| |

COMPANY OVERVIEW

Kansas City Southern, a Delaware corporation, is a holding company with domestic and international rail operations in North America that are strategically focused on the growing north/south freight corridor connecting key commercial and industrial markets in the central United States with major industrial cities in Mexico. As used herein, “KCS” or the “Company” may refer to Kansas City Southern or, as the context requires, to one or more subsidiaries of Kansas City Southern. KCS and its subsidiaries had approximately 6,140 employees on December 31, 2011.

The Kansas City Southern Railway Company (“KCSR”), which was founded in 1887, is a U.S. Class I railroad. KCSR serves a ten-state region in the midwest and southeast regions of the United States and has the shortest north/south rail route between Kansas City, Missouri and several key ports along the Gulf of Mexico in Alabama, Louisiana, Mississippi, and Texas.

KCS controls and owns all of the stock of Kansas City Southern de México, S.A. de C.V. (“KCSM”). Through its 50-year concession from the Mexican government (the “Concession”), which could expire in 2047 unless extended, KCSM operates a key commercial corridor of the Mexican railroad system and has as its core route the most strategic portion of the shortest, most direct rail passageway between Mexico City and Laredo, Texas. KCSM serves most of Mexico’s principal industrial cities and three of its major seaports. KCSM’s rail lines provide exclusive rail access to the United States and Mexico border crossing at Nuevo Laredo, Tamaulipas, the largest rail freight interchange point between the United States and Mexico. Under the Concession, KCSM has the right to control and operate the southern half of the rail bridge at Laredo, Texas, which spans the Rio Grande River between the United States and Mexico.

KCSM provides exclusive rail access to the Port of Lazaro Cardenas on the Pacific Ocean. The Mexican government is developing the port at Lazaro Cardenas principally to serve Mexican markets and as an alternative to the U.S. west coast ports. KCSM is the sole provider of rail service to this port, which provides an alternate route for Asian and South American traffic bound for North America.

The Company wholly owns Mexrail, Inc. (“Mexrail”) which, in turn, wholly owns The Texas Mexican Railway Company (“Tex-Mex”). Tex-Mex owns a 157-mile rail line extending from Laredo, Texas to the port city of Corpus Christi, Texas, which connects the operations of KCSR with KCSM. Through its ownership of Mexrail, the Company owns the northern half of the rail bridge at Laredo, Texas. Laredo is a principal international gateway through which more than half of all rail and truck traffic between the United States and Mexico crosses the border. The Company also controls the southern half of this bridge through its ownership of KCSM.

The KCS coordinated rail network (KCSR, KCSM and Tex-Mex) comprises approximately 6,200 route miles extending from the midwest and southeast portions of the United States south into Mexico and connects with all other Class I railroads, providing shippers with an effective alternative to other railroad routes and giving direct access to Mexico and the southeast and southwest United States through alternate interchange hubs.

Panama Canal Railway Company (“PCRC”), an unconsolidated joint venture company owned equally by KCS and Mi-Jack Products, Inc. (“Mi-Jack”), was awarded a concession from the Republic of Panama to reconstruct and operate the Panama Canal Railway, a 47-mile railroad located adjacent to the Panama Canal that provides international container shipping companies with a railway transportation option in lieu of the Panama Canal. The concession was awarded in 1998 for an initial term of 25 years with an automatic renewal for an additional 25 year term. The Panama Canal Railway is a north-south railroad traversing the Isthmus of Panama between the Atlantic and Pacific Oceans. PCRC’s wholly-owned subsidiary, Panarail Tourism Company (“Panarail”), operates and promotes commuter and tourist passenger service over the Panama Canal Railway.

Other subsidiaries and affiliates of KCS include the following:

| |

| • | Meridian Speedway, LLC (“MSLLC”), a seventy-one percent-owned consolidated affiliate that owns the former KCSR rail line between Meridian, Mississippi and Shreveport, Louisiana, which is the portion of the KCSR rail line between Dallas, Texas and Meridian known as the “Meridian Speedway.” Norfolk Southern Corporation (“NS”) through its wholly-owned subsidiary, The Alabama Great Southern Railroad Company, owns the remaining twenty-nine percent of MSLLC. Ultimately KCS will own seventy percent and NS will own thirty percent of MSLLC upon the contribution of additional capital by NS to MSLLC; |

| |

| • | Pabtex, Inc., a wholly-owned and consolidated owner of a bulk materials handling facility with deep-water access to the Gulf of Mexico at Port Arthur, Texas that stores and transfers petroleum coke from rail cars to ships, primarily for export; |

| |

| • | Trans-Serve, Inc. (doing business as Superior Tie and Timber), a wholly-owned and consolidated operator of a railroad wood-tie treatment facility; |

| |

| • | TransFin Insurance, Ltd., a wholly-owned and consolidated captive insurance company providing property, general liability and certain other insurance coverage to KCS and its subsidiaries and affiliates; |

| |

| • | Southern Capital Corporation, LLC (“Southern Capital”), a fifty percent-owned unconsolidated affiliate that leases locomotives and other equipment; |

| |

| • | Ferrocarril y Terminal del Valle de México, S.A. de C.V. (“FTVM”), a twenty-five percent-owned unconsolidated affiliate that provides railroad services as well as ancillary services in the greater Mexico City area; and |

| |

| • | PTC-220, LLC (“PTC-220”), a fourteen percent-owned unconsolidated affiliate that holds the licenses to large blocks of radio spectrum and other assets for the deployment of positive train control. |

MARKETS SERVED

|

| |

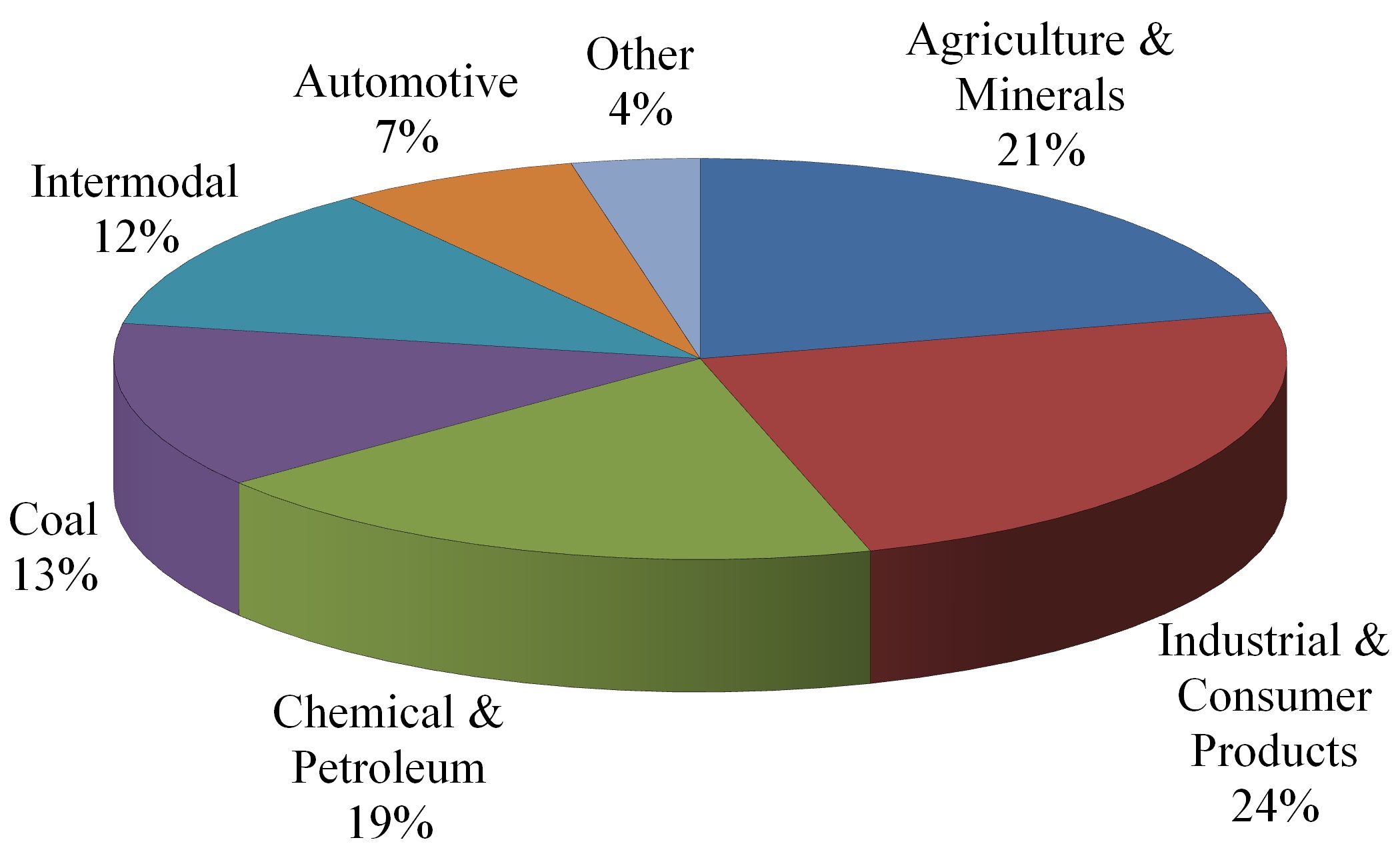

| | 2011 Revenues Business Mix |

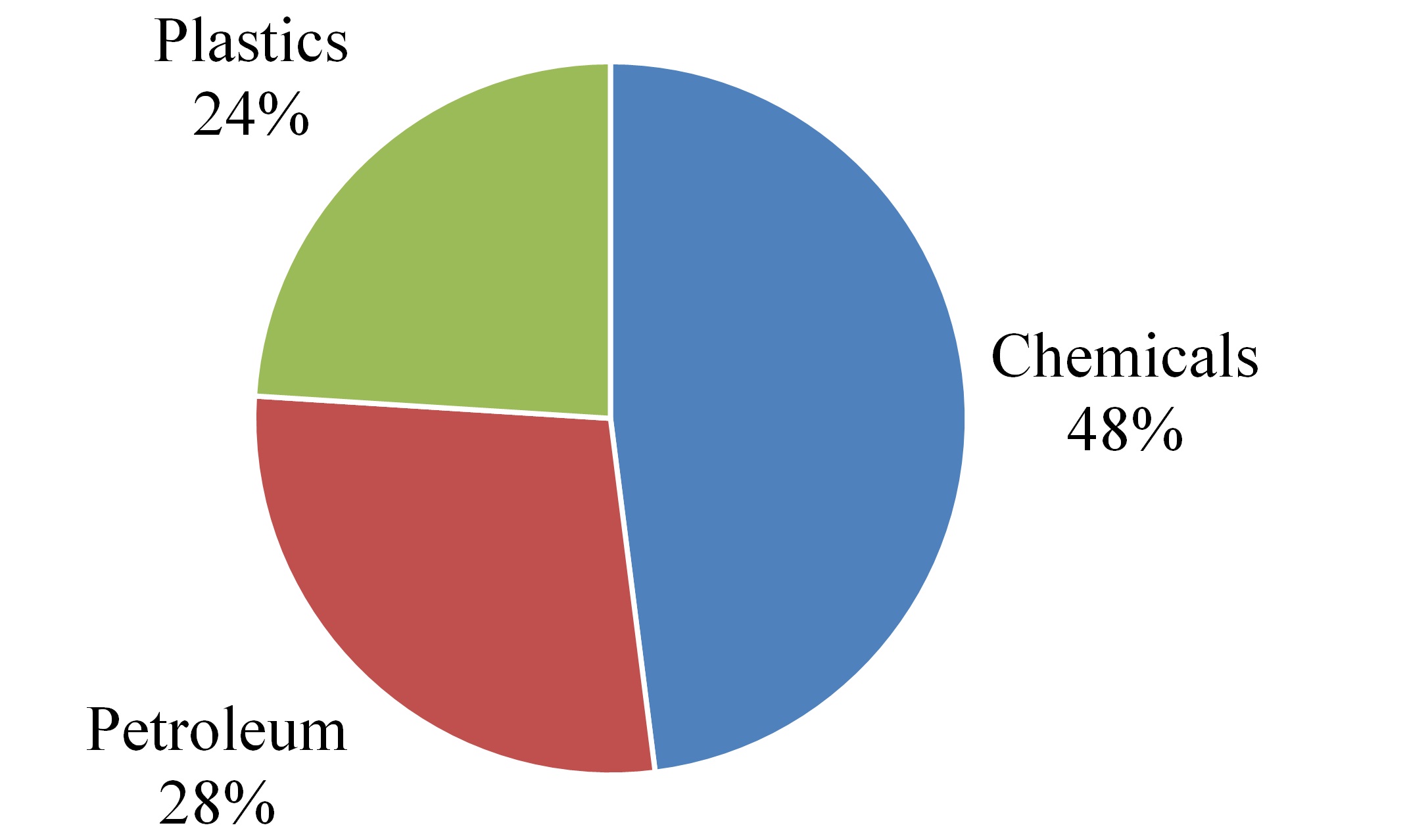

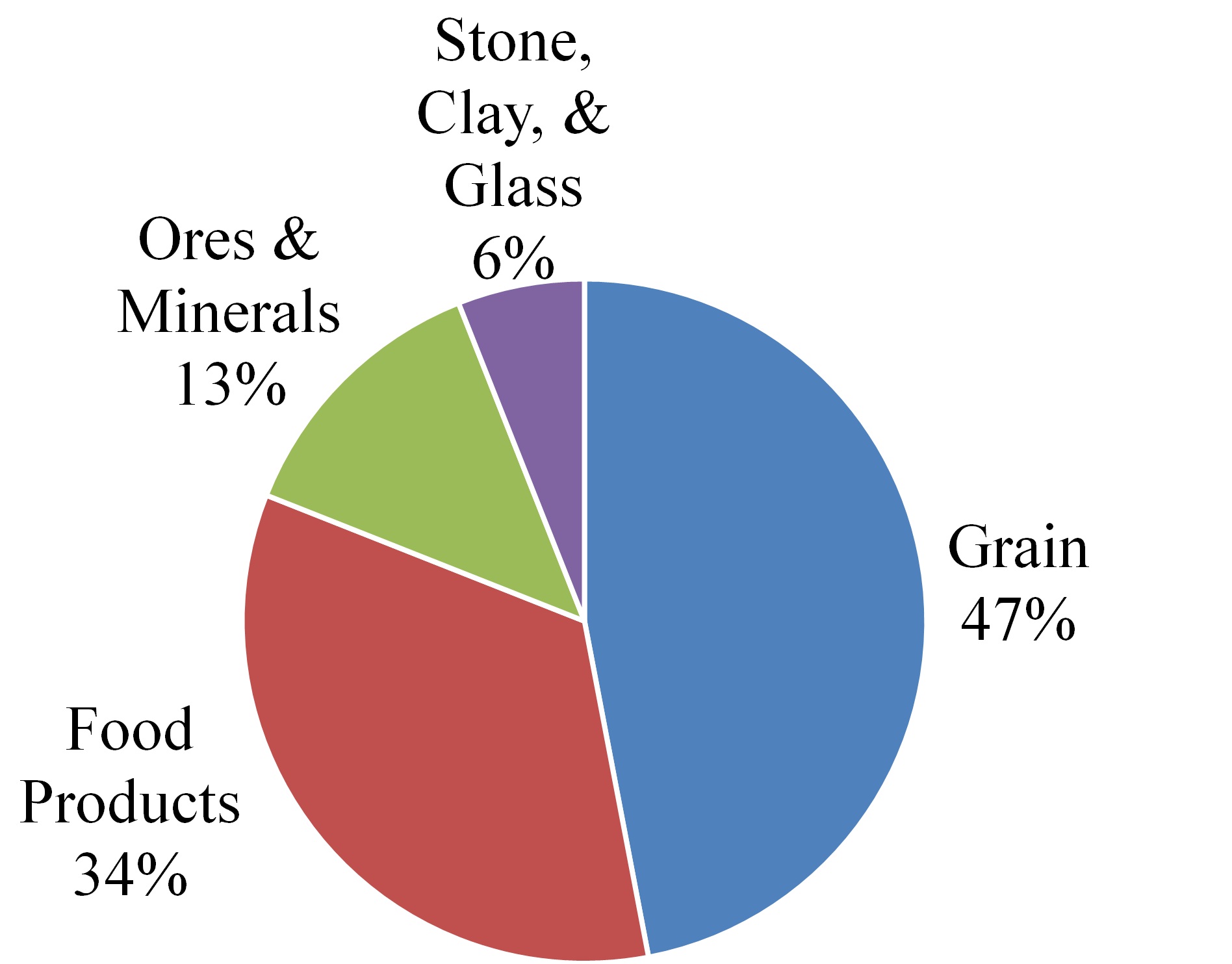

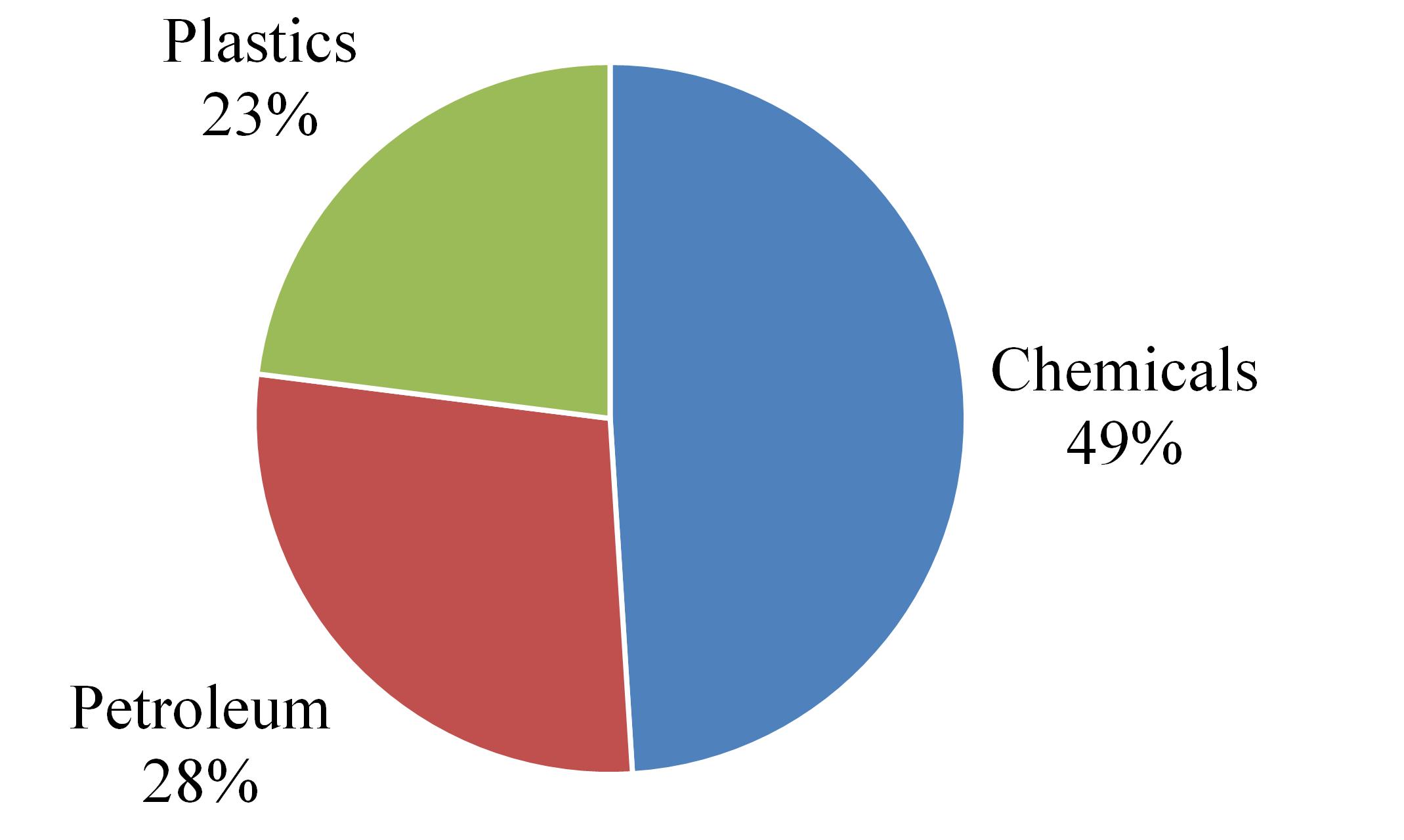

Chemical and petroleum. This sector includes products such as petroleum, rubber, plastics and miscellaneous chemicals. KCS transports these products to markets in the midwest, southeast and northeast United States and throughout Mexico through interchanges with other rail carriers. The products within the chemicals and plastics channels are used in the automotive, housing and packaging industries as well as in the production of other chemicals and plastic products. KCS hauls petroleum products across its network and as petroleum refineries have continued to increase their refining capacity, they have coordinated with KCS to develop additional long-term storage opportunities which complement a fluid freight railroad operation. | |

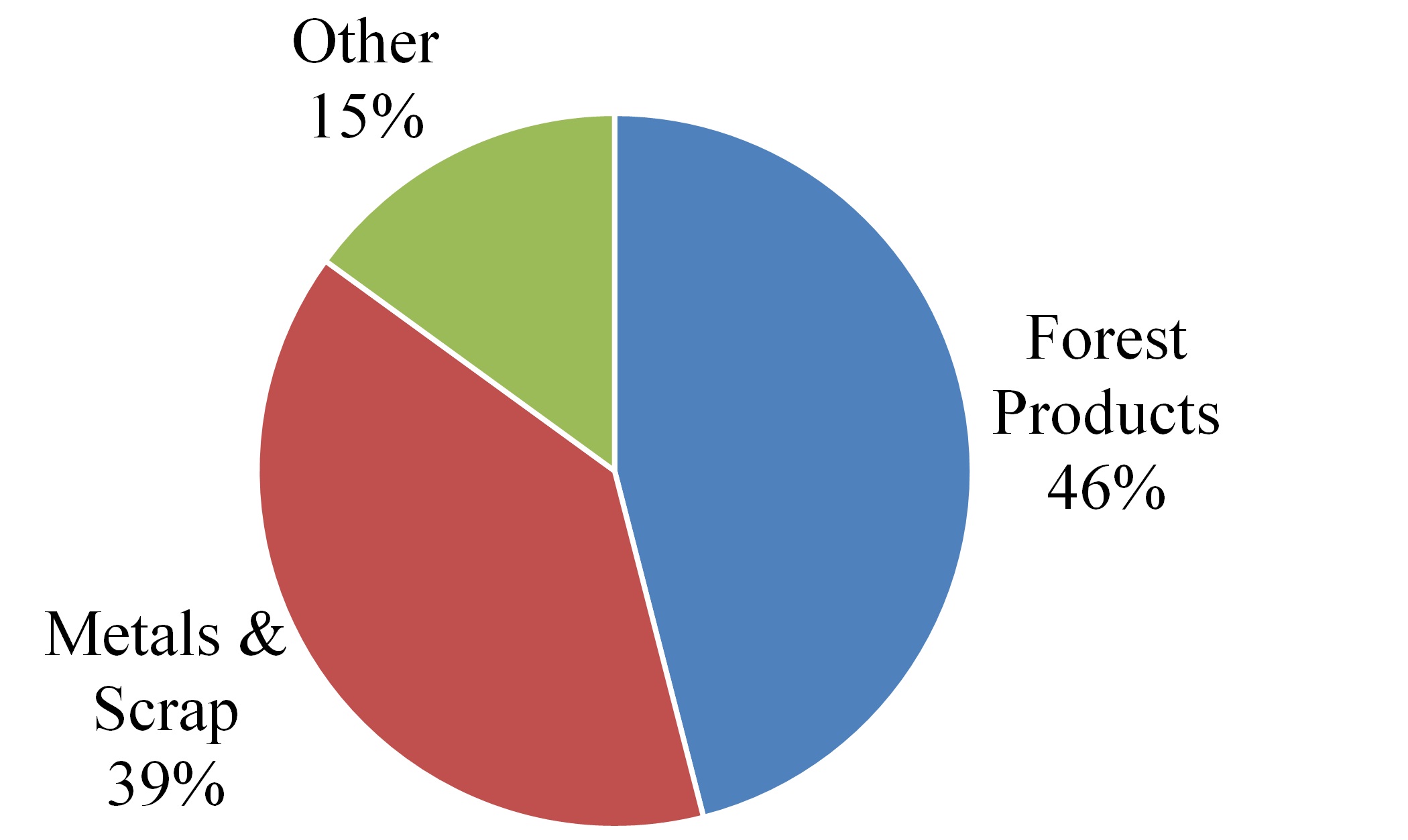

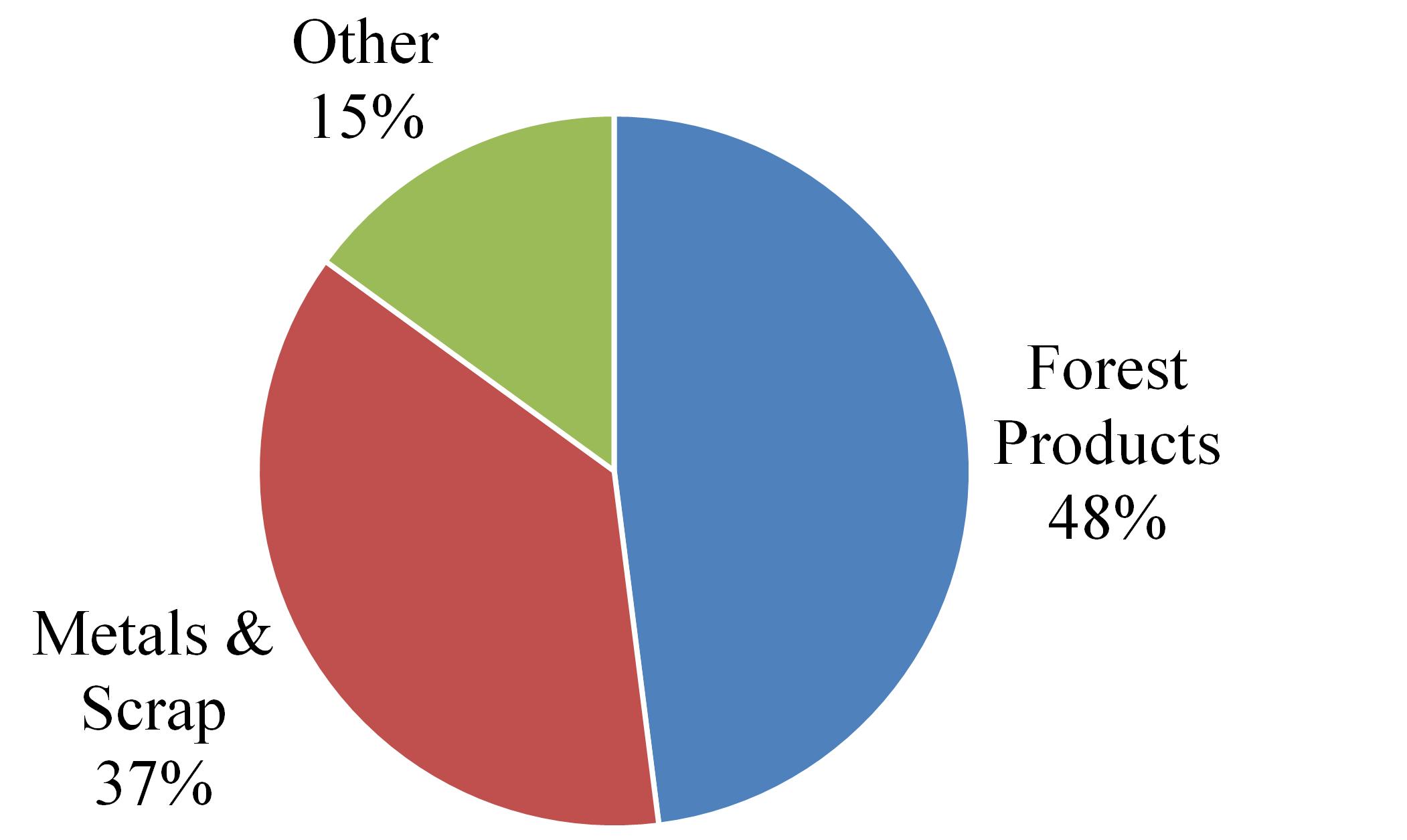

Industrial and consumer products. KCS serves paper mills directly and indirectly through its various short-line connections. KCS’s rail lines run through the heart of the southeast United States timber-producing region. Forest products made from trees in this region are generally less expensive than those from other regions due to lower production costs. As a result, southern yellow pine products from the southeast are increasingly being used instead of western producers that have experienced capacity reductions because of environmental and public policy considerations.

This sector also includes metals and ores such as iron, steel, zinc and copper. The majority of metals, minerals and ores mined, and steel produced in Mexico are consumed within Mexico. The volume of Mexican steel exports fluctuates based on global market prices. Higher-end finished products such as steel coils are used by Mexican manufacturers in automobiles, household appliances and other consumer goods which are imported to the United States through Nuevo Laredo and through the seaports served by KCS’s rail network. KCS also transports steel coils from U.S. based mini-mills in Mississippi and Alabama to Texas and Mexico for appliance and automotive applications.

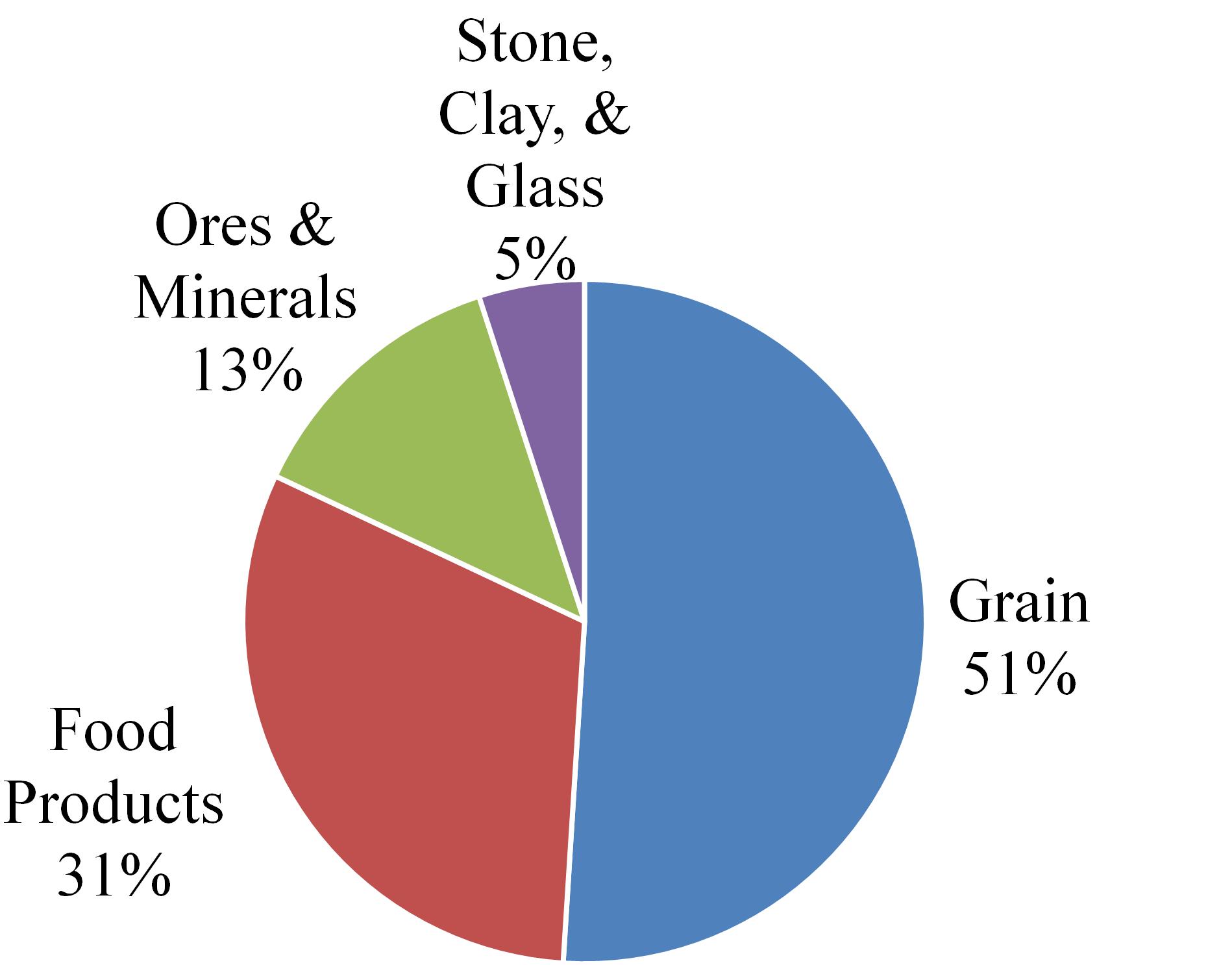

Agriculture and minerals. The agriculture and minerals sector consists primarily of grain and food products. Shipper demand for agriculture products is affected by competition among sources of grain and grain products, as well as price fluctuations in international markets for key commodities. In the United States, KCS’s rail lines receive and originate shipments of grain and grain products for delivery to feed mills serving the poultry industry. KCS currently serves feed mills along its rail lines throughout the midwest and southeast United States, and through its marketing agreements, KCS has access to sources of

corn and other grain in the Midwest. United States export grain shipments and Mexico import grain shipments include primarily corn, wheat, and soybeans transported to Mexico via Laredo and to the Gulf of Mexico. Over the long term, export grain shipments to Mexico are expected to increase as a result of Mexico’s reliance on grain imports and KCS’s coordinated rail network is well positioned to meet these increases in demand. Food products consist mainly of soybean meal, grain meal, oils, canned goods, corn syrup and sugar. Other shipments consist of a variety of products including ores, minerals, clay and glass used across North America.

Coal. KCS hauls unit trains (trains transporting a single commodity from one source to one destination) of coal for nine electric generating plants in the central United States. The coal originates from the Powder River Basin in Wyoming and is interchanged to KCS at Kansas City, Missouri. Coal mined in the midwest United States is transported in non-unit trains to industrial consumers such as paper mills, steel mills, and cement companies. Petroleum coke is also included in the coal sector, which KCS transports from refineries in the United States to cement companies in Mexico as well as to vessels for international distribution through the Pabtex export terminal located in Port Arthur, Texas.

Intermodal. The intermodal freight business consists primarily of hauling freight containers or truck trailers on behalf of steamship lines, motor carriers, and intermodal marketing companies with rail carriers serving as long-distance haulers. KCS serves and supports the U.S. and Mexican markets, as well as cross border traffic between the U.S. and Mexico. In light of the importance of trade between Asia and North America, the Company believes the Port of Lazaro Cardenas continues to be a strategically beneficial location for ocean carriers, manufacturers and retailers. The Company also provides premium service to customers over its line from Dallas through the Meridian Speedway — a critical link in creating the most direct route between the southwest and southeast/northeast U.S.

Automotive. KCS provides rail transportation to every facet of the automotive industry supply chain, including automotive manufacturers, assembly plants and distribution centers throughout North America. Several U.S. automakers have moved assembly plants into central Mexico to take advantage of access to lower costs, which has driven a shift in production and distribution patterns from the U.S. to Mexico. In addition, KCS transports finished vehicles imported and exported to and from Asia through a distribution facility at the Port of Lazaro Cardenas. As the automotive industry shifts production and distribution patterns, KCS is poised to serve the automotive industry’s evolving transportation requirements.

GOVERNMENT REGULATION

The Company’s United States operations are subject to federal, state and local laws and regulations generally applicable to all businesses. Rail operations are also subject to the regulatory jurisdiction of the Surface Transportation Board (“STB”) of the U.S. Department of Transportation (“DOT”), the Federal Railroad Administration of the DOT, the Occupational Safety and Health Administration (“OSHA”), as well as other federal and state regulatory agencies. The STB has jurisdiction over disputes and complaints involving certain rates, routes and services, the sale or abandonment of rail lines, applications for line extensions and construction, and consolidation or merger with, or acquisition of control of, rail common carriers. DOT and OSHA each has jurisdiction under several federal statutes over a number of safety and health aspects of rail operations, including the transportation of hazardous materials. In 2008, the President of the United States signed the Rail Safety Improvement Act of 2008 into law, which, among other things, revises hours of service for train and certain other employees and mandates implementation of positive train control at certain locations by the end of 2015. Positive train control is a technology designed to help prevent train-to-train collisions, overspeed derailments, incursions into rail work zones, and entry into main line track if a switch is misaligned at certain locations, including main line track where toxic inhalation hazard or poison inhalation hazard movements occur or where passenger operations occur. In addition, the Rail Safety Improvement Act of 2008 addresses safety at rail crossings, increases the number of safety related employees of the Federal Railroad Administration, and increases fines that may be levied against railroads for safety violations. State agencies regulate some aspects of rail operations with respect to health and safety in areas not otherwise regulated by federal law.

KCS’s subsidiaries are subject to extensive federal, state and local environmental regulations. These laws cover discharges to water, air emissions, toxic substances, and the generation, handling, storage, transportation and disposal of waste and hazardous materials. These regulations have the effect of increasing the costs, risks and liabilities associated with rail operations. Environmental risks are also inherent in rail operations, which frequently involve transporting chemicals and other hazardous materials.

Primary regulatory jurisdiction for the Company’s Mexican operations is overseen by the Mexican Secretaría de Comunicaciones y Transportes (“Secretary of Communications and Transportation” or “SCT”). The SCT establishes

regulations concerning railway safety and operations, and is responsible for resolving disputes between railways and between railways and customers. In addition, KCSM must register its maximum rates with the SCT and make regular reports to the SCT on investment and traffic volumes. See Note 1 to the Consolidated Financial Statements in Item 8 of this Form 10-K “Description of the Business — The KCSM Concession.”

The Mexican operations are subject to Mexican federal and state laws and regulations relating to the protection of the environment through the establishment of standards for water discharge, water supply, emissions, noise pollution, hazardous substances and transportation and handling of hazardous and solid waste. The Mexican government may bring administrative and criminal proceedings and impose economic sanctions against companies that violate environmental laws, and temporarily or even permanently close non-complying facilities.

Noncompliance with applicable legal provisions may result in the imposition of fines, temporary or permanent shutdown of operations or other injunctive relief, criminal prosecution or the termination of the Concession. KCS believes that facilities which it operates are in compliance with applicable environmental laws, regulations and agency agreements. KCS maintains environmental provisions which are believed by management to be appropriate with respect to known and existing environmental contamination of its properties which KCS may be responsible to remedy. In addition, KCS’s subsidiaries are party to contracts and other legally binding obligations by which previous owners of certain facilities now owned by KCS are responsible to remedy contamination of such sites remaining from their previous ownership. There are currently no material legal or administrative proceedings pending against the Company with respect to any environmental matters and management does not believe that continued compliance with environmental laws will have any material adverse effect on the Company’s consolidated financial statements. KCS cannot predict the effect, if any, that unidentified environmental matters or the adoption of additional or more stringent environmental laws and regulations would have on the Company’s consolidated financial statements.

COMPETITION

The Company competes against other railroads, many of which are much larger and have significantly greater financial and other resources. The railroad industry is dominated by a few very large carriers. The larger western railroads (BNSF Railway Company and Union Pacific Railroad Company), in particular, are significant competitors of KCS because of their substantial resources and competitive routes.

In November 2005, Ferrocarril Mexicano, S.A. de C.V. (“Ferromex”) acquired control of and merged with Ferrosur S.A. de C.V. (“Ferrosur”). In March 2011, the Comisión Federal de Competencia (Mexican Antitrust Commission or “COFECO”) approved the merger between Ferromex and Ferrosur. These merged operations are much larger than KCSM, serving most of the major ports and cities in Mexico and together own fifty percent of FTVM, which serves industries located within Mexico City.

The ongoing impact of past and future rail consolidation is uncertain. However, KCS believes that its investments and strategic alliances continue to competitively position the Company to attract additional rail traffic throughout its rail network.

The Company is subject to competition from motor carriers, barge lines and other maritime shipping, which compete across certain routes in KCS’s operating areas. In the past, truck carriers have generally eroded the railroad industry’s share of total transportation revenues. Intermodal traffic and certain other traffic face highly price sensitive competition, particularly from motor carriers. However, rail carriers, including KCS, have placed an emphasis on competing in the intermodal marketplace and working with motor carriers to provide end-to-end transportation of products.

While deregulation of U.S. freight rates has enhanced the ability of railroads to compete with each other and with alternative modes of transportation, this increased competition has generally resulted in downward pressure on freight rates since deregulation. Competition with other railroads and other modes of transportation is generally based on the rates charged, the quality and reliability of the service provided and the quality of the carrier’s equipment for certain commodities.

RAIL SECURITY

The Company and its rail subsidiaries have made a concentrated, multi-disciplinary effort since the terrorist attacks on the United States on September 11, 2001, to continue securing the Company’s assets and personnel against the risk of terrorism and other security risks. Many of the specific measures the Company utilizes for these efforts are required to be kept confidential through arrangements with government agencies, such as the Department of Homeland Security (“DHS”), or through jointly-developed and implemented strategies and plans with connecting carriers. To protect the confidentiality and sensitivity of the

efforts the Company has made to safeguard against terrorism and other security incidents, the following paragraphs will provide only a general overview of some of these efforts. KCSR and KCSM utilize a security plan based on an industry wide security plan developed by Association of American Railroads (“AAR”) members which focuses on comprehensive risk assessments in five areas — hazardous materials; train operations; critical physical assets; military traffic; and information technology and communications. The security plan is kept confidential, with access to the plan tightly limited to members of management with direct security and anti-terrorism implementation responsibilities. KCSR and KCSM participate with other AAR members in periodic drills under the industry plan to test and refine its various provisions.

The Company’s security activities range from periodically mailing each employee a security awareness brochure (which is also posted under the “Employees” tab on the Company’s internet website, www.kcsouthern.com) to its ongoing implementation of security plans for rail facilities in areas labeled by the DHS as High Threat Urban Areas (“HTUAs”). The Company’s other activities to bolster security against terrorism include, but are not limited to, the following:

| |

| • | Conferring regularly with other railroads’ security personnel and with industry experts on security issues; |

| |

| • | Routing shipments of certain chemicals, which might be toxic if inhaled, pursuant to federal regulations; |

| |

| • | Initiating a series of over 20 voluntary action items agreed to between AAR and DHS as enhancing security in the rail industry; |

| |

| • | Conducting constant security training as part of the scheduled training for operating employees and managers; |

| |

| • | Developing a multi-layered security model using high-speed digital imaging, system velocity, covert and overt security filters to mitigate the risk of illicit activity; and |

| |

| • | Implementation of a Tactical Intelligence Center by KCSM, training core members in new technology helping to prevent, detect, deter and respond to illicit activities. |

In addition, the Company employs a Director of Homeland Security to oversee the ongoing and increasingly complex security efforts of the Company in both the United States and Mexico. The Company identified and retained an individual to fill the position who has an extensive law enforcement background, including being formerly employed as an analyst with the Federal Bureau of Investigation (“FBI”) for 12 years. This member of management remains a member of the FBI’s Joint Terrorism Task Force and is a valuable asset to the Company in developing and implementing anti-terrorism and other security initiatives.

While the risk of theft and vandalism is higher in Mexico, KCSM remains among the safest methods of transportation for freight shipments in Mexico. KCSM’s record in rail safety is due in large part to the implementation of a multi-layered, safety and security process throughout the KCSM network. In addition to having its own internal system, the process is connected to, and supported by a high level of federal, state and local law enforcement. A primary focus of this effort involves maintaining train velocity, which reduces the likelihood for incidents to occur.

RAILWAY LABOR ACT

Labor relations in the U.S. railroad industry are subject to extensive governmental regulation under the Railway Labor Act (“RLA”). Under the RLA, national labor agreements are renegotiated on an industry-wide scale when they become open for modification, but their terms remain in effect until new agreements are reached or the RLA’s procedures (which include mediation, cooling-off periods, and the possibility of presidential intervention) are exhausted. Contract negotiations with the various unions generally take place over an extended period of time and the Company rarely experiences work stoppages during negotiations. Wages, health and welfare benefits, work rules and other issues have traditionally been addressed during these negotiations.

COLLECTIVE BARGAINING

Approximately 80% of KCSR employees are covered by collective bargaining agreements. KCSR participates in industry-wide bargaining as a member of the National Carriers’ Conference Committee. Long-term settlement agreements were reached during 2007 and 2008 covering all of KCSR's unionized work force through June 30, 2010. These agreements continue in effect until new agreements are reached. Labor negotiations in the rail industry are governed by the RLA, which bars strikes or other self-help until exhaustion of mandatory procedures. Contract negotiations with the various unions generally take place over an extended period of time and have not historically resulted in any strike, boycott, or other disruption in the Company’s business operations.

The nation's largest freight railroads, including KCSR, have been in national (multi-employer) bargaining with the rail unions since January 2010. In September 2011, the railroads ratified the agreement with the largest union, the United Transportation Union, which represents about one third of the KCSR employees covered by this bargaining agreement. On November 5, 2011, a Presidential Emergency Board (“PEB”) appointed by President Obama issued recommendations to resolve the disputes between the U.S. railroads and the 12 unions that had not yet reached agreements. As of December 31, 2011, tentative agreements were reached with 11 of those 12 unions. As of the date of this filing, these agreements have been ratified and will be in effect through 2015.

On February 2, 2012, the railroad industry reached a tentative agreement with the remaining union. The union will commence ratification of this tentative agreement by its members.

KCSM union employees are covered by one labor agreement, which was signed on June 23, 1997, between KCSM and the Sindicato de Trabajadores Ferrocarrileros de la República Mexicana (Mexican Railroad Union), for a term of 50 years, for the purpose of regulating the relationship between the parties. Approximately 80% of KCSM employees are covered by this labor agreement. The compensation terms under this labor agreement are subject to renegotiation on an annual basis and all other benefits are subject to negotiation every two years. In October 2011, compensation terms and all other benefits covering the period from July 1, 2011 through June 30, 2012 and the period from July 1, 2011 through June 30, 2013, respectively, were finalized between KCSM and the Mexican Railroad Union. The union labor negotiation with the Mexican Railroad Union has not historically resulted in any strike, boycott, or other disruption in KCSM’s business operations.

EXECUTIVE OFFICERS OF KCS AND SUBSIDIARIES

All executive officers are elected annually and serve at the discretion of the Board of Directors. All of the executive officers have employment agreements with KCS and/or its subsidiaries. The mailing address of the principal executive officers other than Mr. Zozaya is 427 W. 12th Street, Kansas City, Missouri 64105. Mr. Zozaya’s mailing address is Montes Urales No. 625, Col. Lomas de Chapultepec, C.P. 11000, Mexico D.F.

Michael R. Haverty — Executive Chairman of the Board — 67 — Served in this capacity since August 1, 2010. Mr. Haverty has been a director of KCS since May 1995 and has served as Chairman of the Board of KCS since January 1, 2001. From July 12, 2000 until July 31, 2010, Mr. Haverty served as Chief Executive Officer of KCS. Mr. Haverty served as President of KCS from July 2000 to June 2006. Mr. Haverty served as Executive Vice President of KCS from May 1995 until July 2000, and as President and Chief Executive Officer of KCSR from 1995 to 2005 and as a director of KCSR since 1995. He has served as Chairman of the Board of KCSR since 1999. Since April 1, 2005, Mr. Haverty has served as Chairman of the Board of KCSM. Mr. Haverty has served as a director of the PCRC since 1996 and as Co-Chairman of the Board of Directors of that company since 1999. Mr. Haverty has served as Co-Chairman of Panarail since 2000.

David L. Starling — President and Chief Executive Officer — 62 — Served in this capacity since August 1, 2010. Mr. Starling has been a director of KCS since May 6, 2010. He served as President and Chief Operating Officer of KCS from July 1, 2008 through August 1, 2010. Mr. Starling has also served as a Director, President and Chief Executive Officer of KCSR since July 1, 2008. He has also served as Vice Chairman of the Board of Directors of KCSM since September 2009. Mr. Starling has served as Vice Chairman of the Board of Directors of PCRC and Panarail since July 2008. Prior to joining KCS, Mr. Starling served as President and Director General of PCRC from 1999 through June 2008.

David R. Ebbrecht — Executive Vice President Operations - 45 - Served in this capacity since March 2011. Mr. Ebbrecht served as Senior Vice President of Operations of KCSR from August 2009 until March 2011. He served as Vice President of Transportation of KCSR from March 2008 until August 2009. From January 2007 until March 2008, Mr. Ebbrecht served as Assistant Vice President in various departments for KCSR including logistics, business development and operations. He joined KCSR in January 2001. Prior to joining KCSR, Mr. Ebbrecht served in various leadership positions at CSX Corporation, Inc.

Warren K. Erdman — Executive Vice President — Administration and Corporate Affairs — 53 — Served in this capacity since April 2010. Mr. Erdman served as Executive Vice President — Corporate Affairs from October 2007 until April 2010. He served as Senior Vice President — Corporate Affairs of KCS and KCSR from January 2006 to September 2007. Mr. Erdman served as Vice President — Corporate Affairs of KCS from April 15, 1997 to December 31, 2005 and as Vice President — Corporate Affairs of KCSR from May 1997 to December 31, 2005. Prior to joining KCS, Mr. Erdman served as Chief of Staff to United States Senator Kit Bond of Missouri from 1987 to 1997.

Patrick J. Ottensmeyer — Executive Vice President Sales and Marketing — 54 — Served in this capacity since October 16, 2008. Mr. Ottensmeyer joined KCS in May 2006 as Executive Vice President and Chief Financial Officer. Prior to joining KCS, Mr. Ottensmeyer served as Chief Financial Officer of Intranasal Therapeutics, Inc. from 2001 to May 2006. From 2000 to 2001, he served as Corporate Vice President Finance and Treasurer for Dade-Behring Holdings, Inc. From 1993 to 1999, Mr. Ottensmeyer served as Vice President Finance and Treasurer at Burlington Northern Santa Fe Corporation and BNSF Railway and their predecessor companies.

Michael W. Upchurch — Executive Vice President and Chief Financial Officer — 51 — Served in this capacity since October 16, 2008. Mr. Upchurch joined KCS in March 2008 as Senior Vice President Purchasing and Financial Management. Prior to joining KCS, Mr. Upchurch served as Senior Vice President Finance of Red Development LLC, from December 2007 through February 2008. From September 2006 through December 2007, Mr. Upchurch worked as an independent consultant providing financial consulting services. From 1990 through September 2006, Mr. Upchurch served in various senior financial leadership positions at Sprint Nextel Corporation and its predecessor, Sprint Corporation, including Senior Vice President Financial Operations, Senior Vice President Finance Sprint Business Solutions and Senior Vice President Finance Long Distance Division.

José Guillermo Zozaya Delano — President and Executive Representative — KCSM — 59 — Has served in this position since April 20, 2006. Mr. Zozaya has 35 years of experience in law and government relations, most recently as the legal and government relations director for ExxonMobil México, S.A. de C.V., where he spent nine years prior to joining KCSM.

John E. Derry — Senior Vice President Human Resources — 44 — Served in this capacity since July 2008. He served as Vice President of Human Resources from February 2008 until July 2008. Mr. Derry joined KCS from YRC Worldwide, Inc. where he served in various Human Resource functions from January 2004 to February 2008. From September 2006 to February 2008, Mr. Derry served as Vice President of Human Resources for Yellow Transportation. Prior to joining YRC Worldwide, Inc. Mr. Derry spent 17 years with General Mills Inc. in various operations, labor relations and human resource roles.

Mary K. Stadler — Senior Vice President and Chief Accounting Officer — 52 — Served in this capacity since March 2, 2009. From April 1990 through August 2008, Ms. Stadler served in various finance leadership positions at Sprint Nextel Corporation and its predecessor, Sprint Corporation, including Vice President — Finance Operations and most recently served as its Vice President — Assistant Controller.

William J. Wochner — Senior Vice President and Chief Legal Officer — 64 — Served in this capacity since February 2007. He served as Vice President and Interim General Counsel from December 2006 to January 2007. From September 2006 to December 2006, Mr. Wochner served as Vice President and Associate General Counsel. From March 2005 to September 2006, Mr. Wochner served as Vice President Sales and Marketing/Contracts for KCSR. From February 1993 to March 2005, Mr. Wochner served as Vice President and General Solicitor of KCSR.

There are no arrangements or understandings between the executive officers and any other person pursuant to which the executive officer was or is to be selected as an officer of KCS, except with respect to the executive officers who have entered into employment agreements designating the position(s) to be held by the executive officer.

None of the above officers is related to another, or to any of the directors of KCS, by family.

AVAILABLE INFORMATION

KCS’s website (www.kcsouthern.com) provides at no cost KCS’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, and amendments to those reports, as soon as reasonably practicable after the electronic filing of these reports is made with the Securities and Exchange Commission. In addition, KCS’s corporate governance guidelines, ethics and legal compliance policy, and the charters of the Audit Committee, the Finance Committee, the Nominating and Corporate Governance Committee and the Compensation and Organization Committee of the Board of Directors are available on KCS’s website. These guidelines, policies and charters are available in print without charge to any stockholder requesting them. Written requests for these materials may be made to the Corporate Secretary, P.O. Box 219335, Kansas City, Missouri 64121-9335 (or if by express delivery to 427 West 12th Street, Kansas City, Missouri 64105). From time to time, KCS publicly designates material information by posting it on the website, kcsouthern.com/investors, in lieu of press releases.

See Item 8, Financial Statements and Supplementary Data — Note 1 “Description of the Business” and Note 18 “Geographic Information” for more information on the description and general development of the Company’s business and financial information about geographic areas.

Risks Related to an Investment in KCS’s Common Stock

The price of KCS’s common stock may fluctuate significantly, which may make it difficult for investors to resell common stock when they want to or at prices they find attractive.

The price of KCS’s common stock on the New York Stock Exchange (“NYSE”), listed under the ticker symbol “KSU”, constantly changes. The Company expects that the market price of its common stock will continue to fluctuate.

The Company’s stock price can fluctuate as a result of a variety of factors, many of which are beyond KCS’s control. These factors include, but are not limited to:

| |

| • | quarterly variations in operating results; |

| |

| • | operating results that vary from the expectations of management, securities analysts, ratings agencies and investors; |

| |

| • | changes in expectations as to future financial performance, including financial estimates by management, securities analysts, ratings agencies and investors; |

| |

| • | developments generally affecting the railroad industry; |

| |

| • | announcements by KCS or its competitors of significant contracts, acquisitions, joint marketing relationships, joint ventures or capital commitments; |

| |

| • | the assertion or resolution of significant claims or proceedings involving KCS; |

| |

| • | KCS’s dividend policy and limitations on the payment of dividends; |

| |

| • | future sales of KCS’s equity or equity-linked securities; |

| |

| • | the issuance of common stock in payment of dividends on preferred stock or upon conversion of preferred stock or convertible debt; and |

| |

| • | general domestic and international economic conditions including the availability of short- and long-term financing. |

In addition, from time to time the stock market in general has experienced extreme volatility that has often been unrelated to the operating performance of a particular company. These broad market fluctuations may adversely affect the market price of KCS’s common stock.

KCS’s ability to pay cash dividends on its common stock is currently limited to the “Available Basket Amount” as defined in the KCSR Credit Agreement.

KCS has agreed, and may agree in the future, to limitations on its ability to pay cash dividends on its common stock. In addition, to maintain its credit ratings, the Company may be limited in its ability to pay cash dividends on its common stock so that it can maintain an appropriate level of liquidity or debt.

Sales of substantial amounts of KCS’s common stock in the public market could adversely affect the prevailing market price of the common stock.

As of December 31, 2011, there were 6,414,464 shares of common stock issued or reserved for issuance under the 1991 Amended and Restated Stock Option and Performance Award Plan, the 2008 Stock Option and Performance Award Plan and the 2009 Employee Stock Purchase Plan, and 1,863,360 shares of common stock held by executive officers and directors outside those plans. Sales of common stock by employees upon exercise of their options, sales by executive officers and directors subject to compliance with Rule 144 under the Securities Act, and sales of common stock that may be issued upon conversion of the outstanding preferred stock, or the perception that such sales could occur, may adversely affect the market price of KCS’ common stock.

KCS has provisions in its charter and bylaws that could deter, delay or prevent a third party from acquiring a controlling interest in KCS and that could deprive an investor of an opportunity to obtain a takeover premium for shares of KCS’s common stock.

KCS has provisions in its charter and bylaws that may delay or prevent unsolicited takeover bids from third parties, including provisions providing for a classified board and supermajority stockholder approval requirements in order to increase the size of the board of directors, abolish cumulative voting, abolish the classification of the Board, or affect certain merger, consolidation or sale transactions. The bylaws provide that a stockholder must give the Company advance written notice of its intent to nominate a director or raise a matter at an annual meeting. These provisions may deprive KCS’s stockholders of an opportunity to sell their shares at a premium over prevailing market prices.

Risks Related to KCS’s Business

KCS competes against other railroads and other transportation providers.

The Company’s domestic and international operations are subject to competition from other railroads, particularly Union Pacific Railroad Company (“UP”) and BNSF Railway Company (“BNSF”) in the United States and Ferromex and Ferrosur in Mexico, as well as from truck carriers, barge lines, and other maritime shippers. Many of KCS’s rail competitors are much larger and have significantly greater financial and other resources than KCS, which may enable rail competitors to reduce rates and make KCS’s freight services less competitive. KCS’s ability to respond to competitive pressures by matching rate reductions and decreasing rates without adversely affecting gross margins and operating results will depend on, among other things, the ability to reduce operating costs. KCS’s failure to respond to competitive pressures, and particularly rate competition, in a timely manner could have a material adverse effect on the Company’s consolidated financial statements.

The railroad industry is dominated by a few large carriers. These larger railroads could attempt to use their size and pricing power to block other railroads’ access to efficient gateways and routing options that are currently and have historically been available. In addition, if there is future consolidation in the railroad industry in the United States or Mexico, there can be no assurance that it will not have an adverse effect on the Company’s consolidated financial statements.

Trucking, maritime, and barge competitors, while able to provide rate and service competition to the railroad industry, are able to use public rights-of-way, require substantially smaller capital investment and maintenance expenditures than railroads and allow for more frequent and flexible scheduling. Continuing competitive pressures, any reduction in margins due to competitive pressures, future improvements that increase the quality of alternative modes of transportation in the locations in which the Company operates, or legislation or regulations that provide motor carriers with additional advantages, such as increased size of vehicles and reduced weight restrictions, could result in downward pressure on freight rates, which in turn could have a material adverse effect on the Company’s consolidated financial statements.

A central part of KCS’s growth strategy is based upon the conversion of truck traffic to rail. There can be no assurance the Company will succeed in its efforts to convert traffic from truck to rail transport or that the customers already converted will be retained. If the railroad industry in general is unable to preserve its competitive advantages vis-à-vis the trucking industry, projected revenue growth could be adversely affected. Additionally, revenue growth could be affected by, among other factors, an expansion in the availability, or an improvement in the quality, of the trucking services offered by carriers resulting from regulatory and administrative interpretations and implementation of certain provisions of the North American Free Trade Agreement (“NAFTA”), and KCS’s inability to grow its existing customer base and capture additional cargo transport market share because of competition from the shipping industry and other railroads.

KCSM’s Mexican Concession is subject to revocation or termination in certain circumstances which would prevent KCSM from operating its railroad and would have a material adverse effect on the Company’s consolidated financial statements.

KCSM operates under the Concession granted by the Mexican government in June 1997, which is renewable for additional periods of up to 50 years, subject to certain conditions. The Concession gives KCSM exclusive rights to provide freight transportation services over its rail lines for the first 30 years of the 50-year Concession, subject to certain trackage and haulage rights granted to other concessionaires. The SCT, which is principally responsible for regulating railroad services in Mexico, has broad powers to monitor KCSM’s compliance with the Concession, and it can require KCSM to supply it with any technical, administrative and financial information it requests. Among other obligations, KCSM must comply with the investment commitments established in its business plan, which forms an integral part of the Concession, and must update the

plan every five years. The SCT treats KCSM’s business plans confidentially. The SCT also monitors KCSM’s compliance with efficiency and safety standards established in the Concession. The SCT reviews, and may amend, these standards every five years.

The Mexican Railroad Services Law and regulations provide the Mexican government certain rights in its relationship with KCSM under the Concession, including the right to take over the management of KCSM and its railroad in certain extraordinary cases, such as imminent danger to national security. In the past, the Mexican government has used such power with respect to other privatized industries, including the telecommunications industry, to ensure continued service during labor disputes. In addition, under Article 47 of the Mexican Railroad Services Law and its regulations, the SCT, in consultation with COFECO, reserves the right to set service rates if it determines that effective competition does not exist in the Mexican railroad industry. COFECO, however, has not published guidelines regarding the factors that constitute a lack of competition. It is therefore unclear under what particular circumstances COFECO would deem a lack of competition to exist. If the SCT intervenes and sets service rates, the rates it sets may be too low to allow KCSM to operate profitably.

Under the Concession, KCSM has the right to operate its rail lines, but it does not own the land, roadway or associated structures. If the Mexican government legally terminates the Concession, it would own, control, and manage such public domain assets used in the operation of KCSM’s rail lines. All other property not covered by the Concession, including all locomotives and railcars otherwise acquired, would remain KCSM’s property. In the event of early termination, or total or partial revocation, the Mexican government would have the right to cause the Company to lease all service-related assets to it for a term of at least one year, automatically renewable for additional one-year terms up to five years. The amount of the rent would be determined by experts appointed by KCSM and the Mexican government. The Mexican government must exercise this right within four months after early termination or revocation of the Concession. In addition, the Mexican government would also have a right of first refusal with respect to certain transfers by KCSM of railroad equipment within 90 days after revocation of the Concession.

The Mexican government may also temporarily seize control of KCSM’s rail lines and its assets in the event of a natural disaster, war, significant public disturbance or imminent danger to the domestic peace or economy. In such a case, the SCT may restrict KCSM’s ability to exploit the Concession in such manner as the SCT deems necessary under the circumstances, but only for the duration of any of the foregoing events. Mexican law requires that the Mexican government pay compensation if it effects a statutory appropriation for reasons of the public interest. With respect to a temporary seizure due to any cause other than international war, the Mexican Railroad Services Law and regulations provide that the Mexican government will indemnify an affected concessionaire for an amount equal to damages caused and losses suffered. However, these payments may not be sufficient to compensate KCSM for its losses and may not be timely made.

The SCT may revoke the Concession if KCSM is sanctioned on three distinct occasions for unjustly interrupting the operation of its rail lines or for charging tariffs higher than the tariffs it has registered with the SCT. In addition, the SCT may revoke the Concession if, among other things, KCSM is sanctioned on five distinct occasions because KCSM restricts the ability of other Mexican rail operators to use its rail lines; KCSM fails to make payments for damages caused during the performance of services; KCSM fails to comply with any term or condition of the Mexican Railroad Services Law and regulations or the Concession; KCSM fails to make the capital investments required under its five-year business plan filed with the SCT; or KCSM fails to maintain an obligations compliance bond and insurance coverage as specified in the Mexican Railroad Services Law and regulations. In addition, the Concession would revoke automatically if KCSM changes its nationality or assigns or creates any lien on the Concession, or if there is a change in control of KCSM without the SCT’s approval. The SCT may also terminate the Concession as a result of KCSM’s surrender of its rights under the Concession, or for reasons of public interest or upon KCSM’s liquidation or bankruptcy. If the Concession is terminated or revoked by the SCT for any reason, KCSM would receive no compensation and its interest in its rail lines and all other fixtures covered by the Concession, as well as all improvements made by it, would revert to the Mexican government. Revocation or termination of the Concession would prevent KCSM from operating its railroad and would materially adversely affect the Mexican operations and the ability to make payments on KCSM’s debt as well as materially adversely affect the Company’s consolidated financial statements.

KCS’s business strategy, operations and growth rely significantly on agreements with other railroads and third parties.

Operation of KCS’s rail network and its plans for growth and expansion rely significantly on agreements with other railroads and third parties, including joint ventures and other strategic alliances, as well as interchange, trackage rights, haulage rights and marketing agreements with other railroads and third parties that enable KCS to exchange traffic and utilize trackage

the Company does not own. KCS’s ability to provide comprehensive rail service to its customers depends in large part upon its ability to maintain these agreements with other railroads and third parties. The termination of, or the failure to renew, these agreements could adversely affect KCS’s consolidated financial statements. KCS is also dependent in part upon the financial strength and efficient performance of other railroads. There can be no assurance that KCS will not be materially adversely affected by operational or financial difficulties of other railroads.

KCSM’s operations are subject to certain trackage rights, haulage rights and interline service agreements with another Mexican rail carrier, some of which are in dispute.

Through KCSM’s Concession from the Mexican government, KCSM is required to grant short and long distance trackage rights to Ferromex. Applicable law stipulates that Ferromex similarly is required to grant to KCSM rights to use portions of their tracks. These trackage rights have been granted under the Concession. The rates to be charged for use of the Trackage Rights after January 1, 2009, were agreed to by KCSM and Ferromex pursuant to the Trackage Rights Agreement, dated February 9, 2010. The Trackage Rights Agreement did not establish rates that may be charged for the right to use the trackage rights for the periods beginning in 1998 through December 31, 2008.

If KCSM cannot reach an agreement with Ferromex for rates applicable for services prior to January 1, 2009, which are not subject to the Trackage Rights Agreement, the SCT is entitled to set the rates in accordance with Mexican law and regulations, which rates may not adequately compensate KCSM. KCSM is currently involved in legal proceedings with the SCT and discussions with Ferromex regarding the rates payable to each other for trackage rights, interline services and haulage rights for periods prior to January 1, 2009. Certain of these disputes continue under litigation. Any resolution of such procedures adverse to KCSM could have a material adverse effect on its consolidated financial statements in a particular quarter or fiscal year.

KCS’s flexibility to operate its business could be reduced by provisions in its debt obligations.

KCS’s debt instruments contain covenants which restrict or prohibit certain actions (“negative covenants”), including, but not limited to, KCS’s ability to incur debt, create or suffer to exist liens, make prepayments of particular debt, pay dividends, make investments, engage in transactions with stockholders and affiliates, issue capital stock, sell certain assets, engage in mergers and consolidations or in sale-leaseback transactions. KCS’s debt instruments also contain covenants requiring KCS to, among other things, maintain specified financial ratios (“affirmative covenants”). Failure to comply with these negative and affirmative covenants could result in an event of default that, if not cured or waived, could restrict the Company’s access to liquidity and have a material adverse effect on the Company’s business or prospects. If the Company does not have enough cash to service its debt or fund other liquidity needs, KCS may be required to take actions such as requesting a waiver from lenders, reducing or delaying capital expenditures, selling assets, restructuring or refinancing all or part of the existing debt, or seeking additional equity capital. KCS cannot assure that any of these remedies can be effected on commercially reasonable terms or at all.

The failure of a bank to fund all or a portion of a request by KCS to borrow money under its existing revolving credit facilities could reduce KCS’s ability to fund capital expenditures or otherwise properly fund its operations.

The Company and its subsidiaries are in an industry that requires continuing infrastructure improvements and acquisitions of capital assets, necessitating substantial expenditure of cash. KCS has existing revolving credit facilities with multiple banking institutions to provide additional liquidity. If any of the banking institutions that are a party to such credit facilities fails to fund its pro rata share of a request by KCS to borrow money under its credit facilities, KCS’s ability to fund capital expenditures, fund its operations and pay debt service could be reduced, each of which could have a material adverse effect on KCS’s consolidated financial statements.

The failure of any bank or money market instrument in which the Company maintains deposits could reduce the amount of cash the Company has available to pay distributions, fund its operations, pay debt service and make additional investments.

Given the developments in the financial markets, financial institutions have additional capital risks. The Company has diversified its holdings of cash and cash equivalents among several banking institutions and money market instruments in an attempt to minimize its exposure. All of the Company’s bank deposits in the United States are fully insured by the Federal Deposit Insurance Corporation or “FDIC” (FDIC insurance is unlimited through the end of 2012 for non-interest bearing deposit accounts). However, the Company’s investments in money market instruments are insured only up to $500,000 and

deposits in Mexican financial institutions are not insured. The loss of the Company’s deposits resulting from the failure of an institution or fund could reduce the amount of cash the Company has available to adequately fund its activities, distribute or invest and could have a material adverse effect on KCS’s consolidated financial statements.

A downturn in the debt capital markets or a downgrade of the Company’s credit ratings may increase the cost of borrowing and make financing difficult to obtain.

Events in the financial markets may have an adverse impact on the debt capital markets and, as a result, credit may become more expensive and difficult to obtain. Lenders may impose more stringent restrictions on the terms of credit and there may be a general reduction in the amount of credit available in the markets in which KCS conducts business. Also, the Company and its securities are rated by Standard & Poor’s Rating Services (“S&P”) and Moody’s Investors Service (“Moody’s”). These ratings impact the Company’s cost of funds and its access to the debt capital markets. The negative impact of tightening credit markets, adverse changes in the debt capital markets generally and/or a downgrade of the Company’s credit ratings may have a material adverse effect on KCS’s consolidated financial statements resulting from, but not limited to, an inability to finance capital expansion on favorable terms, if at all, reduced liquidity as a result of limited alternatives to refinance short-term debt, increased financing costs and/or financial terms with increasingly restrictive covenants.

KCS’s business is capital intensive.

The Company’s business is capital intensive and requires substantial ongoing expenditures for, among other things, additions and improvements to roadway, structures and technology, acquisitions, and maintenance and repair of equipment and the rail system. KCS’s failure to make necessary capital expenditures to maintain its operations could impair its ability to serve existing customers, accommodate increases in traffic volumes or result in increased derailments.

KCSM’s Concession from the Mexican government requires KCSM to make investments and undertake capital projects. If KCSM fails to make such capital investments, KCSM’s business plan commitments with the Mexican government may be at risk, requiring KCSM to seek waivers of its business plan. There is no assurance that such waivers, if requested, would be granted by the SCT. KCSM may defer capital expenditures under its business plan with the permission of the SCT. However, the SCT might not grant this permission, and any failure by KCSM to comply with the capital investment commitments in its business plan could result in sanctions imposed by the SCT, and could result in revocation of the Concession if sanctions are imposed on five distinct occasions. The Company cannot assure that the Mexican government would grant any such permission or waiver. If such permission or waiver is not obtained in any instance and KCSM is sanctioned, its Concession might be at risk of revocation, which would materially adversely affect KCS’s consolidated financial statements. See “KCSM’s Mexican Concession is subject to revocation or termination in certain circumstances” above.

KCS has funded, and expects to continue to fund capital expenditures with operating cash flows, debt and equity financing and equipment leases. KCS may not be able to generate sufficient cash flows from its operations or obtain sufficient funds from external sources to fund capital expenditure requirements. Even if financing is available, it may not be obtainable on acceptable terms and within the limitations contained in the indentures and other agreements relating to KCS’s existing debt.

KCS is dependent on certain key suppliers of core rail equipment.

KCS relies on a limited number of suppliers of core rail equipment (including locomotives, rolling stock equipment, rail and ties). The capital intensive nature and complexity of such equipment creates high barriers of entry for any potential new suppliers. If any of KCS’s suppliers discontinue production or experience capacity or supply shortages, this could result in increased costs or difficulty in obtaining rail equipment and materials, which could have a material adverse effect on KCS’s consolidated financial statements.

KCS depends on the stability, availability and security of its information technology systems to operate its business.

KCS relies on information technology in all aspects of its business. A significant disruption or failure of its information technology systems, including its computer hardware, software and communications equipment, could result in service interruptions, safety failures, security failures, regulatory compliance failures or other operational difficulties.

The security risks associated with information technology systems have increased in recent years because of the increased sophistication and activities of perpetrators of cyber attacks. A failure in or breach of KCS’s information technology security systems, or those of its third party service providers, as a result of cyber attacks or unauthorized access to its network could

disrupt KCS’s business, result in the disclosure or misuse of confidential or proprietary information, increase its costs and/or cause losses. KCS also confronts the risk that a terrorist or other third parties may seek to use its property, including KCS’s information technology systems, to inflict major harm.

KCS continually takes steps to make appropriate enhancements to its information technology systems; however, KCS’s systems may be vulnerable to disruption, failure or unauthorized access which could have a material adverse effect on KCS’s consolidated financial statements.

KCS’s business may be adversely affected by changes in general economic, weather or other conditions.

KCS’s operations may be adversely affected by changes in the economic conditions of the industries and geographic areas that produce and consume the freight that KCS transports. The relative strength or weakness of the United States and Mexican economies affects the businesses served by KCS. Prolonged negative changes in domestic and global economic conditions or disruptions of either or both of the financial and credit markets, including the availability of short and long-term debt financing, may affect KCS, as well as the producers and consumers of the commodities that KCS transports and may have a material adverse effect on KCS’s consolidated financial statements.

The transportation industry is highly cyclical, generally tracking the cycles of the world economy. Although transportation markets are affected by general economic conditions, there are numerous specific factors within each particular market that may influence operating results. Some of KCS’s customers do business in industries that are highly cyclical, including the oil and gas, automotive, housing and agriculture industries. Any downturn in these industries could have a material adverse effect on operating results. Also, some of the products transported have had a historical pattern of price cyclicality which has typically been influenced by the general economic environment and by industry capacity and demand. For example, global steel and petrochemical prices have decreased in the past, and reduced demand for automotive vehicles and related shipments may result in decreased prices. KCS cannot assure that prices and demand for these products will not decline in the future, adversely affecting those industries and, in turn, the Company’s consolidated financial statements.

Traffic congestion experienced in the U.S. or Mexican railroad system may result in overall traffic congestion which would impact the ability to move traffic to and from Mexico and adversely affect KCS’s operations. This system congestion may also result in certain equipment shortages. Any similar congestion experienced by railroads in Mexico could have an adverse effect on the Company’s consolidated financial statements. In addition, the growth of cross border traffic in recent years has contributed to congestion on the international bridge at the Nuevo Laredo-Laredo border gateway, which is expected to continue in the near future. This may adversely affect KCS’s consolidated financial statements.

The Company’s operations may also be affected by natural disasters or adverse weather conditions. The Company operates in and along the Gulf of Mexico, and its facilities may be adversely affected by hurricanes, floods and other extreme weather conditions that could also adversely affect KCS’s shipping, agricultural, chemical and other customers. Significant reductions in the volume of rail shipments due to economic, weather, or other conditions could have a material adverse effect on KCS’s consolidated financial statements.

KCS’s business may be affected by market and regulatory responses to climate change.

KCS’s operations may be adversely affected by restrictions, caps, taxes, or other controls on emissions of greenhouse gases, including diesel exhaust. Restrictions on emissions could also affect KCS’s customers that use commodities that KCS transports to produce energy, use significant amounts of energy in producing or delivering the commodities KCS transports, or manufacture or produce goods that consume significant amounts of energy or burn fossil fuels, including coal-fired power plants, chemical producers, farmers and food producers, and automakers and other manufacturers. Significant cost increases, government regulation, or changes of consumer preferences for goods or services relating to alternative sources of energy or emissions reductions could materially affect the markets for the commodities KCS transports, which in turn could have a material adverse effect on KCS’s consolidated financial statements. Government incentives encouraging the use of alternative sources of energy could also affect certain customers and their respective markets for certain commodities KCS transports in an unpredictable manner that could alter traffic patterns, including, for example, the impacts of ethanol incentives on farming and ethanol producers. Any of these factors, individually or in conjunction with one or more of the other factors, or other unforeseen impacts of climate change could have a material adverse effect on KCS’s consolidated financial statements.

KCS is exposed to the credit risk of its customers and counterparties and their failure to meet their financial obligations could adversely affect KCS’s consolidated financial statements.

KCS’s business is subject to credit risk including the risk that a customer or counterparty will fail to meet its obligations when due. Customers and counterparties that owe the Company money may default on their obligations to the Company due to bankruptcy, lack of liquidity, operational failure or other reasons. Although the Company has procedures for reviewing its receivables and credit exposures to specific customers and counterparties to address present credit concerns, default risk may arise from events or circumstances that are difficult to detect or foresee. Some of the Company’s risk management methods depend upon the evaluation of information regarding markets, clients or other matters that are publicly available or otherwise accessible by the Company. That information may not, in all cases, be accurate, complete, up-to-date or properly evaluated. In addition, concerns about, or a default by, one customer or counterparty could lead to significant liquidity problems, losses or defaults by other customers or counterparties, which in turn could adversely affect the Company. The Company may be materially and adversely affected in the event of a significant default by its customers and counterparties.

KCS’s business is subject to regulation by international, federal, state and local regulatory agencies, including environmental, health, safety laws and regulations and tax that could require KCS to incur material costs or liabilities.

KCS is subject to governmental regulation by international, federal, state and local regulatory agencies with respect to its railroad operations, including the Department of Transportation and the Department of Homeland Security in the United States and the Secretary of Communications and Transportation in Mexico, as well as a variety of health, safety, labor, environmental, and other matters. Government regulation of the railroad industry is a significant determinant of the competitiveness and profitability of railroads. As part of the Rail Safety Improvement Act of 2008 in the United States, Class I railroad carriers and passenger and commuter rail operators must implement positive train control (a technology designed to help prevent train-to-train collisions, overspeed derailments, incursions into rail work zones, and entry into main line track if a switch is misaligned) at certain locations (including main line track where toxic inhalation hazard or poison inhalation hazard movements occur or where passenger operations occur) by the end of 2015, which will add to operating costs, increase the number of employees the Company employs and require KCS to invest significant amounts of money into new safety technology. KCS’s inadvertent failure or inability to comply with applicable laws and regulations could have a material adverse effect on the Company’s consolidated financial statements and operations, including limitations on operating activities until compliance with applicable requirements is achieved. These government agencies may change the legislative or regulatory framework within which the Company operates without providing any recourse for any adverse effects on the Company’s business that occur as a result of such change. Additionally, some of the regulations require KCS to obtain and maintain various licenses, permits and other authorizations. Any failure to maintain these licenses, permits, and other authorizations could adversely affect KCS’s business.

From time to time, certain KCS facilities have not been in compliance with environmental, health and safety laws and regulations and there can be no assurance that KCS will always be in compliance with such laws and regulations in the future. Environmental liability under federal and state law in the United States can also extend to previously owned or operated properties, leased properties and properties owned by third parties, as well as to properties currently owned and used by the Company. Environmental liabilities may also arise from claims asserted by adjacent landowners or other third parties. Given the nature of its business, the Company incurs, and expects to continue to incur, environmental compliance costs, including, in particular, costs necessary to maintain compliance with requirements governing chemical and hazardous material shipping operations, refueling operations and repair facilities. KCS presently has environmental investigation and remediation obligations at certain sites, and will likely incur such obligations at additional sites in the future. Liabilities accrued for environmental costs represent the Company’s best estimate of the probable future obligation for the remediation and settlement of these sites. Although the recorded liability is the best estimate of all probable costs, clean-up costs may exceed such estimates, due to various factors such as evolving environmental laws and regulations, changes in technology, the extent of other parties’ participation, developments in environmental surveys and studies, and the extent of corrective action that may ultimately be required. New laws and regulations, stricter enforcement of existing requirements, accidental spills, releases or violations or the discovery of previously unknown contamination could require KCS to incur costs or subject KCS to liabilities that could have a material adverse effect on KCS’s consolidated financial statements.

The Company’s Mexican operations are subject to Mexican federal and state laws and regulations relating to the protection of the environment, including standards for, among other things, water discharge, water supply, emissions, noise pollution, hazardous substances and transportation and handling of hazardous and solid waste. Under applicable Mexican law and regulations, administrative and criminal proceedings may be brought and economic sanctions imposed against companies that violate environmental laws, and non-complying facilities may be temporarily or permanently closed. KCSM is also subject

to the laws of various jurisdictions and international conferences with respect to the discharge of materials into the environment and to environmental laws and regulations issued by the governments of each of the Mexican states in which KCSM’s facilities are located. The terms of KCSM’s Concession from the Mexican government also impose environmental compliance obligations on KCSM. The Company cannot predict the effect, if any, that unidentified environmental matters or the adoption of additional or more stringent environmental laws and regulations would have on KCS’s consolidated financial statements. Failure to comply with any environmental laws or regulations may result in the termination of KCSM’s Concession or in fines or penalties that may affect profitability.

KCS is subject to income taxes as well as non-income based taxes, in both the United States and Mexico. Changes in tax rates, enactment of new tax laws, and revisions of tax regulations could have a material adverse effect on the Company’s consolidated financial statements. Although KCS believes its tax estimates are reasonable, the final determination of tax audits, claims or litigation could differ from what is reflected in KCS’s income tax provisions and accruals.

KCS, as a common carrier by rail, is required by United States and Mexican laws to transport hazardous materials, which could expose KCS to significant costs and claims.

Under United States federal statutes and applicable Mexican laws, KCS’s common carrier responsibility requires it to transport hazardous materials. Any rail accident or other incident or accident on KCS’s network, facilities, or at the facilities of KCS’s customers involving the release of hazardous materials, including toxic inhalation hazard (or TIH) materials, could involve significant costs and claims for personal injury, property damage, and environmental penalties and remediation, which could have a material adverse effect on KCS’s consolidated financial statements.

KCS’s business is vulnerable to rising fuel costs and disruptions in fuel supplies. Any significant increase in the cost of fuel that is not adequately covered by fuel surcharges, or severe disruption of fuel supplies, would have a material adverse effect on KCS’s consolidated financial statements.

KCS incurs substantial fuel costs in its railroad operations and these costs represent a significant portion of its transportation expenses. Significant price increases for fuel may have a material adverse effect on operating results. If KCS is unable to recapture its costs of fuel from its customers, operating results could be materially adversely affected. In addition, a severe disruption of fuel supplies resulting from supply shortages, political unrest, a disruption of oil imports, weather events, war, or otherwise, and the resulting impact on fuel prices could materially adversely affect KCS’s consolidated financial statements.