Bank of America Merrill Lynch 2019 Global Industrials Conference Industrials Global Bankof Merrill 2019 America Lynch K ANSAS March 2019 19, C ITY S OUTHERN © 2019 Kansas City Southern

website, looking differ at guarantee No Exchange information involving peso political stoppages securities of involving disputes floods technology renew, the transportation over thereof statements similar occur potential This Safe Harbor Statement key . or rail 1 presentation - - dollar by materially . ; which 4717 materials, expressions concession statements market as agreements ; Words and kcsouthern which rail the future and KCS ; ) Commission, of of acts are about infrastructure, exchange and accidents social release the management future industry capital or such any events from and based of in subsequent date contains its factors of are particular to conditions terrorism . such com/investors performance as those with of subsidiaries regulatory KCS’ reflect ; markets involving hereof or the rate intended upon hazardous including “projects,” performance other including customers, that subsidiary, expressed “forward ; business or future has increased reports diesel . ; information ; the could incidents risk Differences unavailability KCS ; responses to KCS’ . or and little level materials, of events “estimates,” fuel its - . environment results, and identify looking Kansas in terrorist affect other Forward computer Annual or ; other of or demand forward dependency or its results trade or currently that accidents no nor to subsidiaries, future railroads City developments statements” including many activities factors of - climate looking Report will control, - actually between “forecasts,” looking will qualified Southern systems in and events they of industries available be on affecting ; and on on toxic traffic these statements war which change achieved necessarily statements ; occur including KCS’ certain the Form within natural may personnel de . third or inhalation All “believes,” forward congestion that United México, rail could to risk could reconciliations be 10 ; the the parties key . management network legislative events : - of K produce are . found prove As competition ; for operation materially States KCS meaning - war suppliers labor be looking S a hazards not, . ; A the “intends,” ; result, ; such caused . is access in to or domestic de the and not difficulties, and and year filings at be and C statements as to ; of outcome differ of obligated actual KCS’ . of fluctuation Asia V accurate and should use GAAP core ended by severe .; to and the regulatory by the the “expects,” and a facilities from or items capital KCS management’s securities rail outcomes number including termination Mexico business consolidation can not weather, December . international of to the equipment indications with shipped in Such ; be claims be update or prices developments events disruptions ; “anticipates,” of the . customer fluctuations found relied laws strikes and forward external hurricanes More of, Securities and by or 31 any that ; of concerning or upon perception results changes on economic, , within availability rail and 2018 the failure litigation forward detailed actually to - facilities the ; looking factors loss in times as, work KCS’ may and and and and (File KCS the the to of in a - 2 © 2019 Kansas City Southern

The The KCS Network . . . . . . and Mexico Class I I railroads Class Mexico and U.S.all including railroads, other withpoints 181 interchange ramps intermodal 11 and centers transload than tomore 140 Service port Ocean Pacific 1 and ports to12 Gulf Service Seamless miles route6,700 1887 in Founded cross - border network 3 © 2019 Kansas City Southern

Solid Investment Thesis Investment Solid cross Best reduction opportunities reduction Railroading capitalize toonScheduled cost Precision Leveraging Track recordof strongandfinancial operating performance growthdrivers withmultiple positioning strategic Excellent Well grade credit credit rating grade investment a commitment towith maintaining balancesheetSolid - - positioned growth story in the industry with unique U.S. unique industry withgrowthstoryin the positioned diversified baseandcustomercommodity mix diversified - border network and the most profitable rail profitable mostnetworkandbordertherail franchise Mexico in - Mexico Mexico 4 © 2019 Kansas City Southern

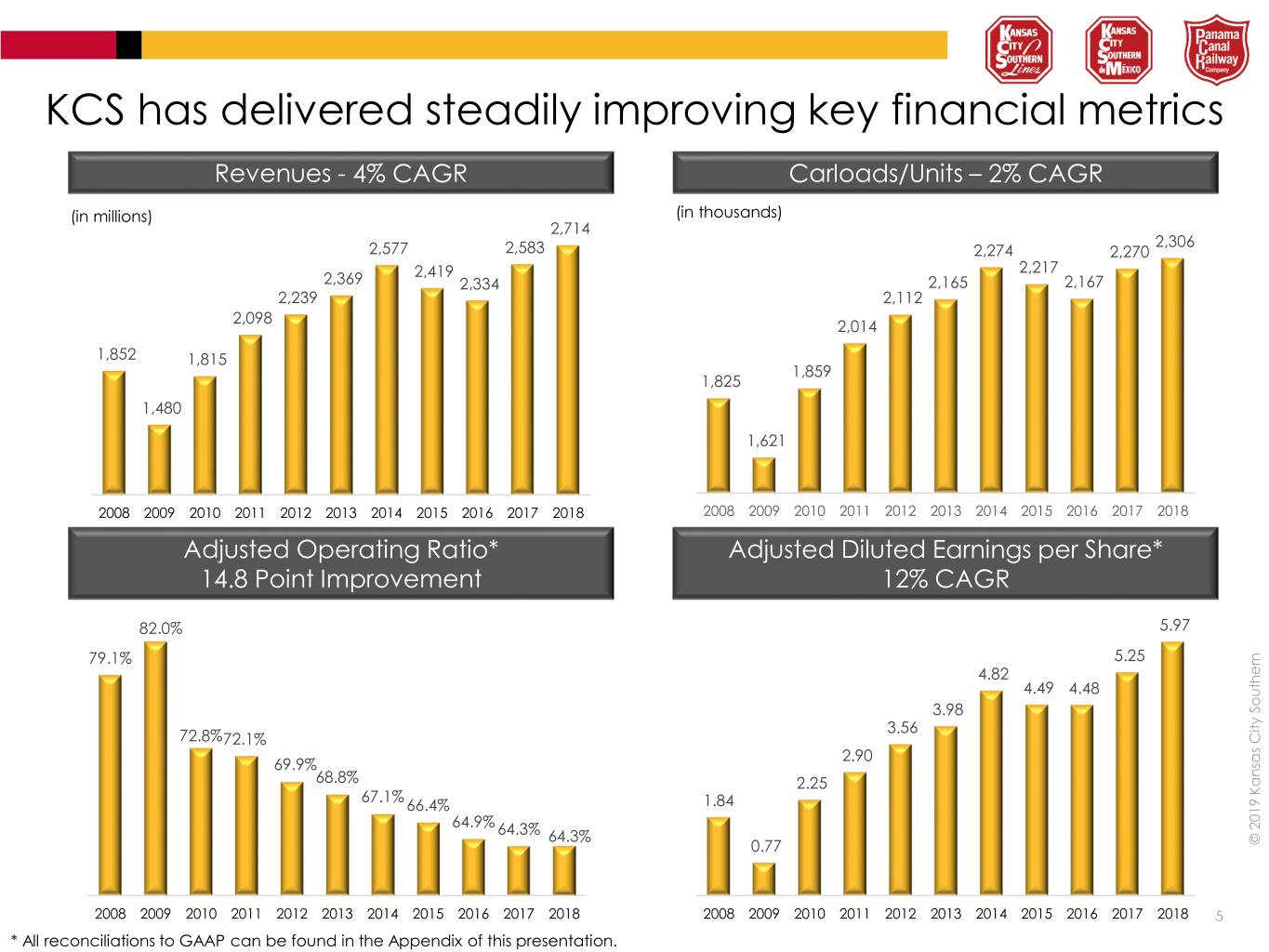

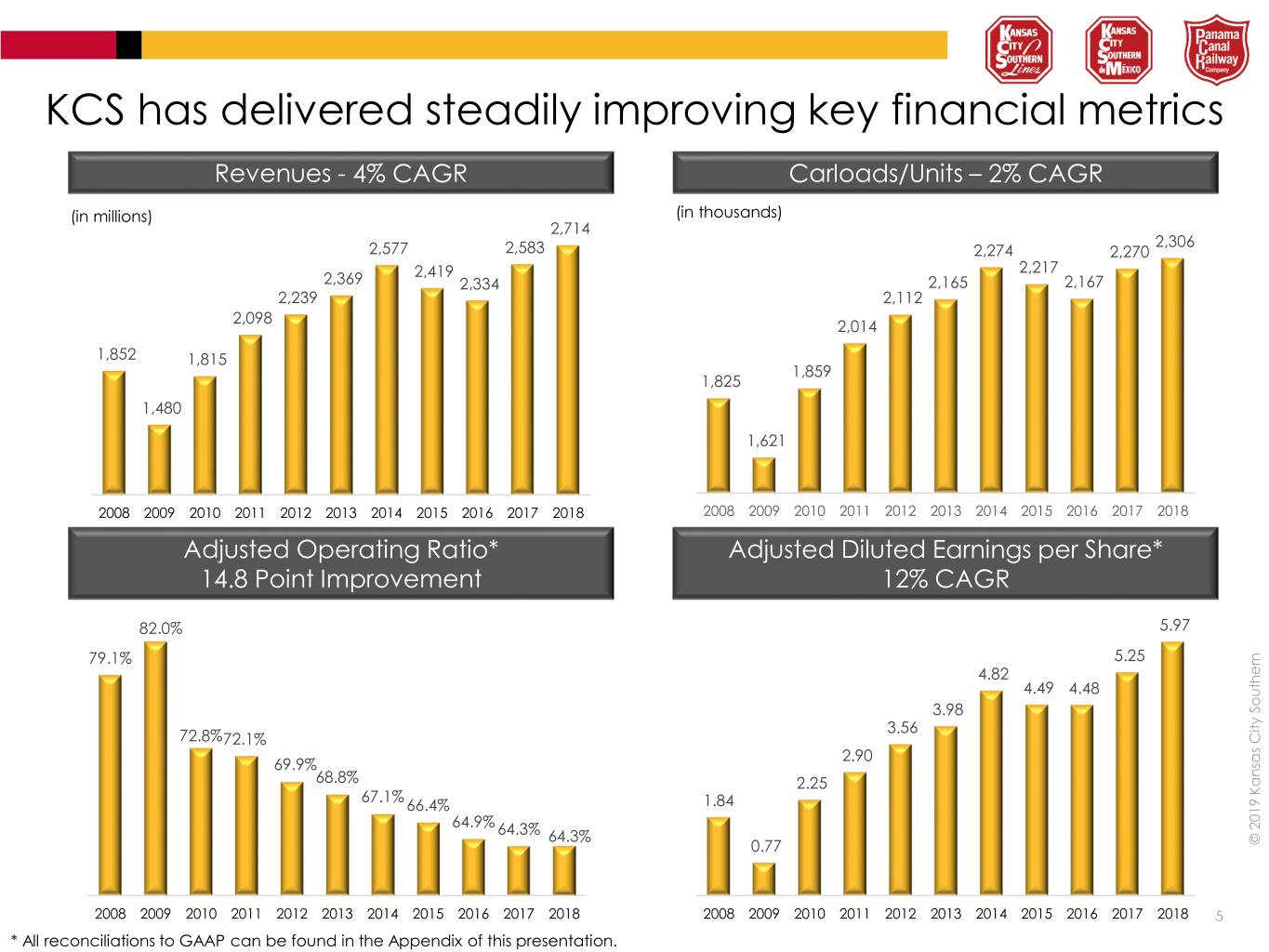

* All reconciliations All*reconciliations tocan GAAP KCS has delivered steadily KCS delivered steadily improving has key financial metrics (inmillions) 79.1% 2008 1,852 1,852 2008 82.0% 2009 1,480 1,480 2009 72.8% Adjusted Adjusted Operating 2010 1,815 1,815 2010 14.8 Point Improvement Revenues 72.1% 2011 2,098 2,098 2011 be found found be 69.9% 2012 2,239 2,239 2012 68.8% 2013 2,369 2,369 2013 - in in the Appendixpresentation. this of 4% CAGR 4% CAGR 67.1% 2014 2,577 2,577 2014 66.4% 2015 2,419 2,419 2015 Ratio* Ratio* 64.9% 2016 2,334 2,334 2016 64.3% 2017 2,583 2,583 2017 64.3% 2018 2,714 2,714 2018 (inthousands) 1,825 1,825 2008 2008 1.84 Adjusted Adjusted Diluted Earnings per Share* 1,621 1,621 2009 2009 0.77 0.77 Carloads/Units 1,859 1,859 2010 2010 2.25 2.25 2,014 2,014 2011 2011 2.90 2.90 12% 12% CAGR 2,112 2,112 2012 2012 3.56 3.56 2,165 2,165 2013 2013 3.98 3.98 – 2,274 2,274 2014 2014 4.82 4.82 2% CAGR 2,217 2,217 2015 2015 4.49 4.49 2,167 2,167 2016 2016 4.48 4.48 2,270 2,270 2017 2017 5.25 5.25 2,306 2,306 2018 2018 5.97 5.97 5 © 2019 Kansas City Southern

Business Update 6 © 2019 Kansas City Southern

. Business Update . . blockages Volumes reduction in in FY 2019reduction headcount Expect YOY coalgrain & products,including refined in high business,growth RPU from impact mix Positive – Impact Impact off to a slow start due to to due a slow start to off of blockages ~5 cents to Q119 , but YOY performance is improving performance is YOY ,but Michoacán Michoacán EPS 7 © 2019 Kansas City Southern

23 25 27 29 18 20 22 24 26 28 Operating Metrics 27.8 23.3 Train Velocity (mph)VelocityTrain Dwell (hrs) 27.6 23.1 26.7 26.1 27.4 21.7 . . − − – – YTD 2019 velocity of velocity 2019YTD dwell 2019YTD initiatives stage as PSR as early well efforts recovery service ongoing tobenefitfrom continuesVelocity flat YOY roughly Improved by PSR initiatives initiatives PSR of benefitsand early terminals, and Sanchezat theMonterrey Driven YoY 6% andImproved by sequentially 17% by continued improvement improvement continuedby 3% sequentially; 3% sequentially; of 21.7 hours 21.7 27.4 MPH 8 © 2019 Kansas City Southern

Growth Outlook 9 © 2019 Kansas City Southern

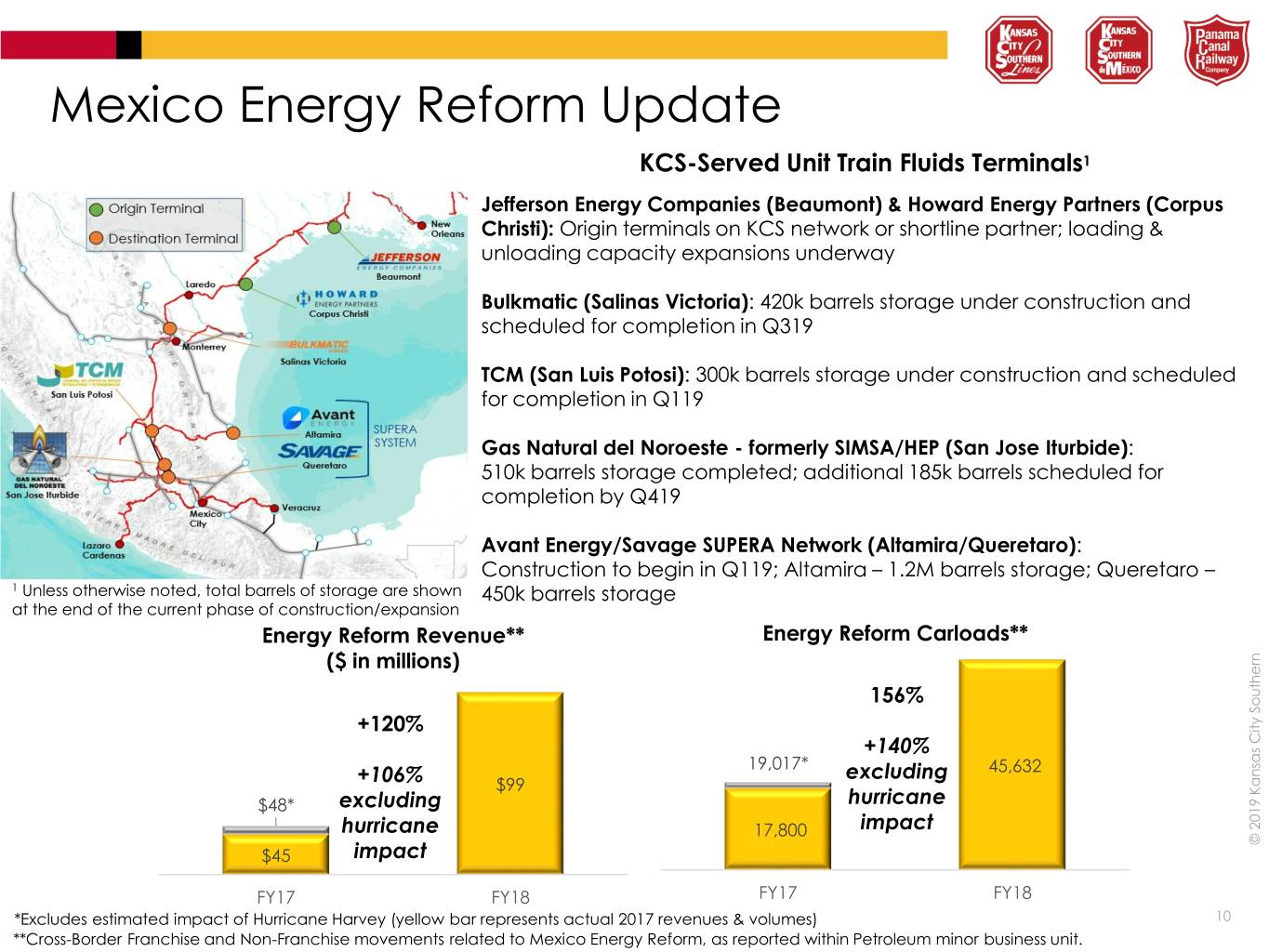

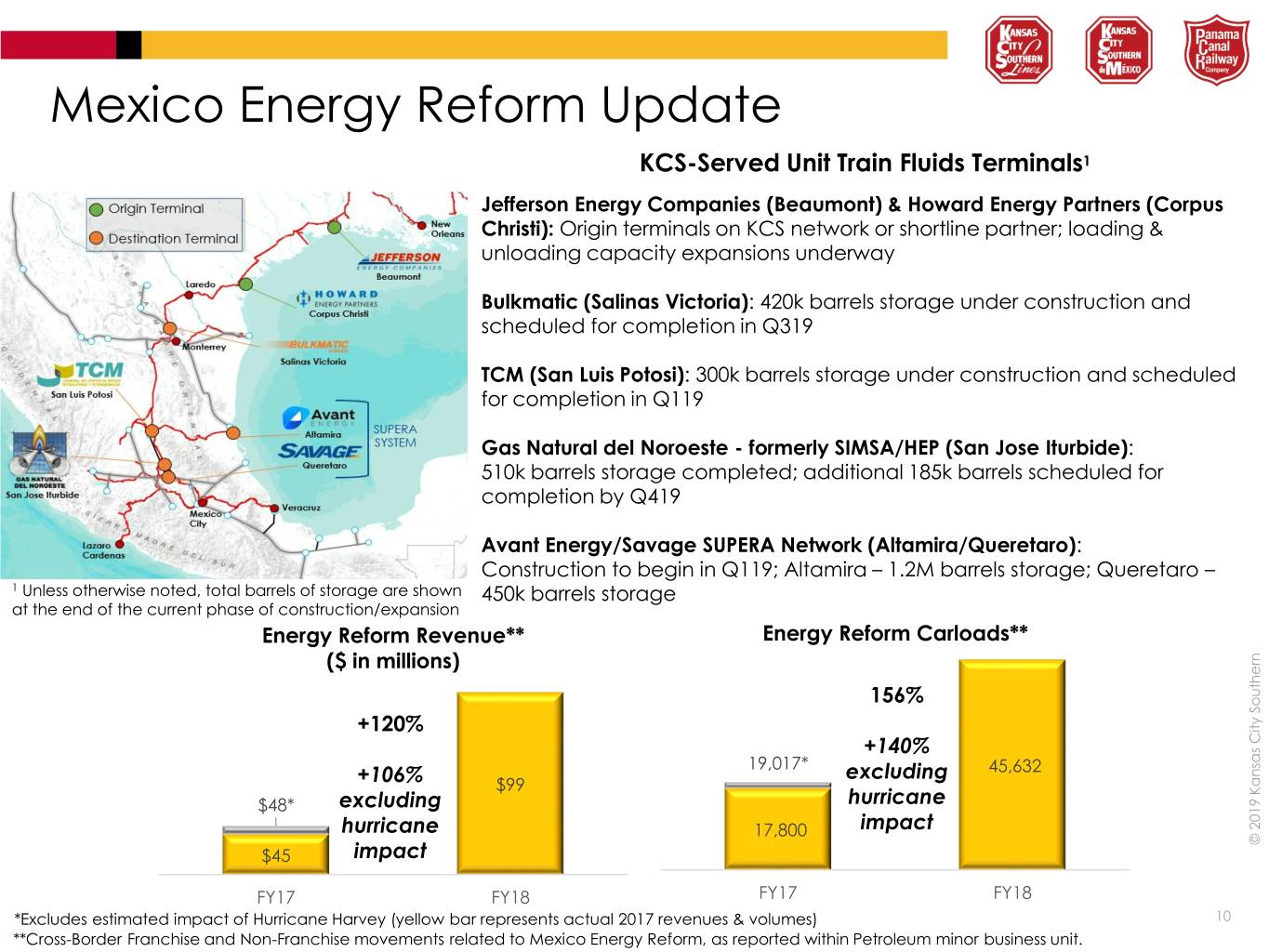

at the end of the current phase of construction/expansion phase of atconstruction/expansion current the the end of 1 **Cross *Excludes estimated*Excludes Unless Unless noted,otherwise total of storagebarrels shown are Mexico Energy ReformUpdate Energy Mexico - Border Franchise Franchise and Non Border impact of Hurricane actual bar represents (yellowHarveyimpact Hurricane of FY17 $48* $45 Energy ReformRevenue** - Franchise movements related to Mexico Energy Reform, as reported within as reported within minorrelated movementsReform,PetroleumtoFranchise Mexico Energy ($ inmillions) excluding hurricane impact +106% +120% 450k Construction Energy/SavageSUPERA Network Avant (Altamira/Queretaro) completion byQ419 510k storage barrels completed; additional 185k scheduled barrels for Gas Noroeste delNatural for completion in Q119 Luis (SanTCM Potosi) scheduled for completion in Q319 Bulkmatic (SalinasVictoria) unloading capacity expansions underway Christi): Jefferson Energy Companies(Beaumont)EnergyHoward & Partners (Corpus FY18 $99 barrels barrels Origin Origin terminals on KCS network or shortline partner;loading & storage to begin in Q119; 2017 KCS revenues & & volumes)revenues : - 300k barrels storage Served Served Unit Train Fluids Terminals - 19,017* :420k barrels storageunder construction and formerly SIMSA/HEP 17,800 FY17 Energy ReformCarloads** Altamira Altamira excluding hurricane impact + 156% – 140% 1.2M barrels storage;Queretaro under construction and scheduled (SanIturbide) Jose b 45,632 FY18 usiness usiness unit. : 1 : – 10 © 2019 Kansas City Southern

2 Source: IHS Markit, Markit, IHS Source: 2 Consulting PLG 1 U.S. Petrochemical Build Outs . . . Ample growth located in Amplegrowth located in Gulf region Coast 2023by 50%growth: Polyethylene projected capacity exports for petrochemical chain diversification Expect network an to playKCS integral role in supply Processes: (1) Autoclave, (2) Tubular, (3) Gas Phase, (4) Slurry Loop (5) Slurry Stirred Tank (6) Solution(6) Tank Stirred Slurry (5) Loop Slurry (4) Phase, Gas (3) Tubular, (2) Autoclave, (1) Processes: Exxon Mobil Equistar Formosa Sasol Formosa Ineos Sasol ExxonMobil Dow Dow Dow CP Chem Dow Company Beaumont,TX LaPorte,TX Point Comfort,TX Charles, Lake LA Point Comfort,TX Park, Deer TX Mont TX Belvieu, Taft,LA Freeport,TX Plaquemine, LA Old TX Ocean, TX Seadrft, City, State 2 : Q42019 Q42019 Q32019 Q32019 Q42018 Q42018 Q42017 Q42017 Q42017 Q32017 Q32017 Q32017 Q32017 Q42016 Startup Capacity 000’s MT 1,300 1,000 650 500 400 420 470 400 470 400 350 60 75 75 1 (5) (3) (3) (3) (5) (3) (2) (3) (2) (4) (6) (2) (3) (4) 11 © 2019 Kansas City Southern

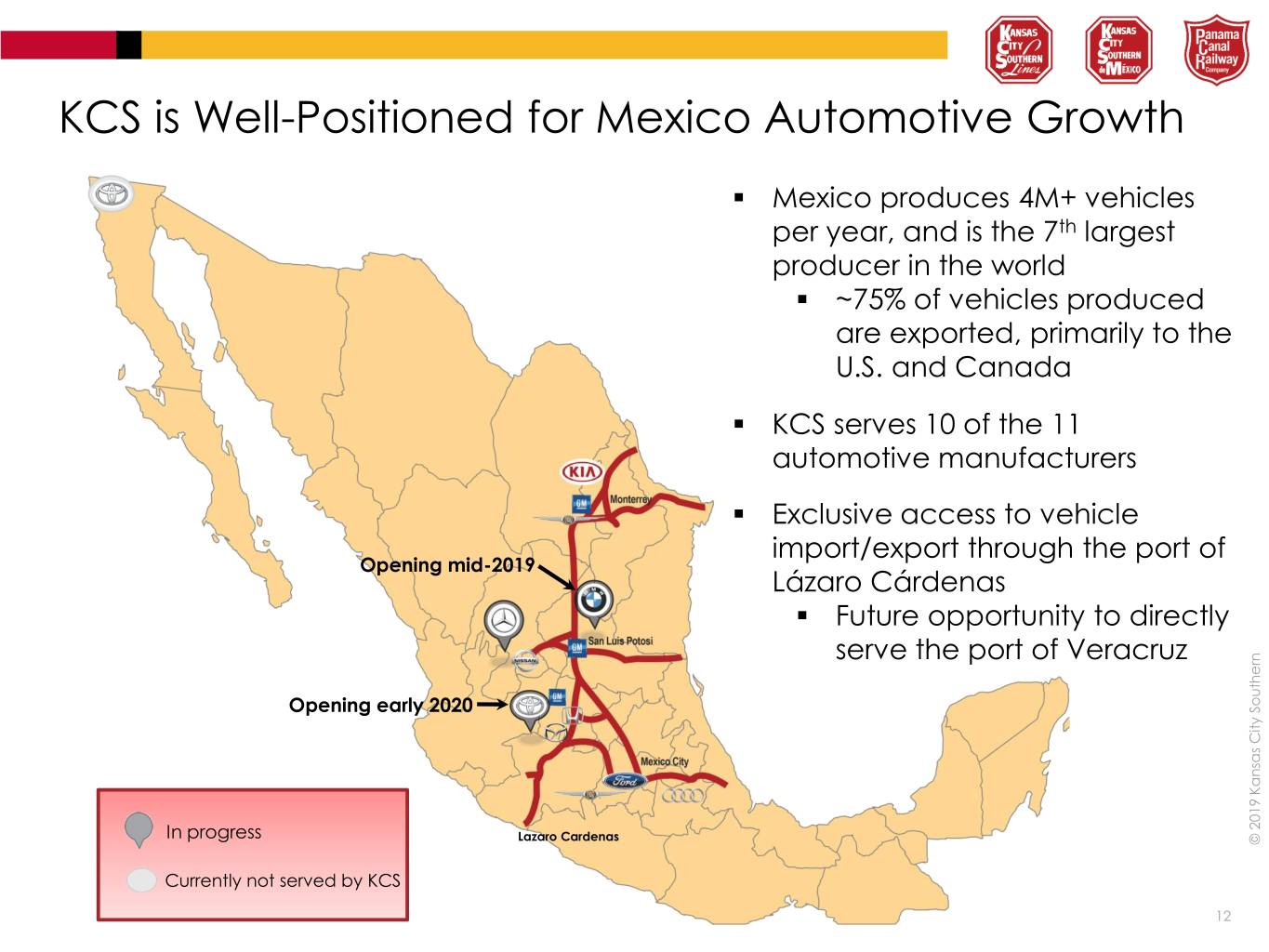

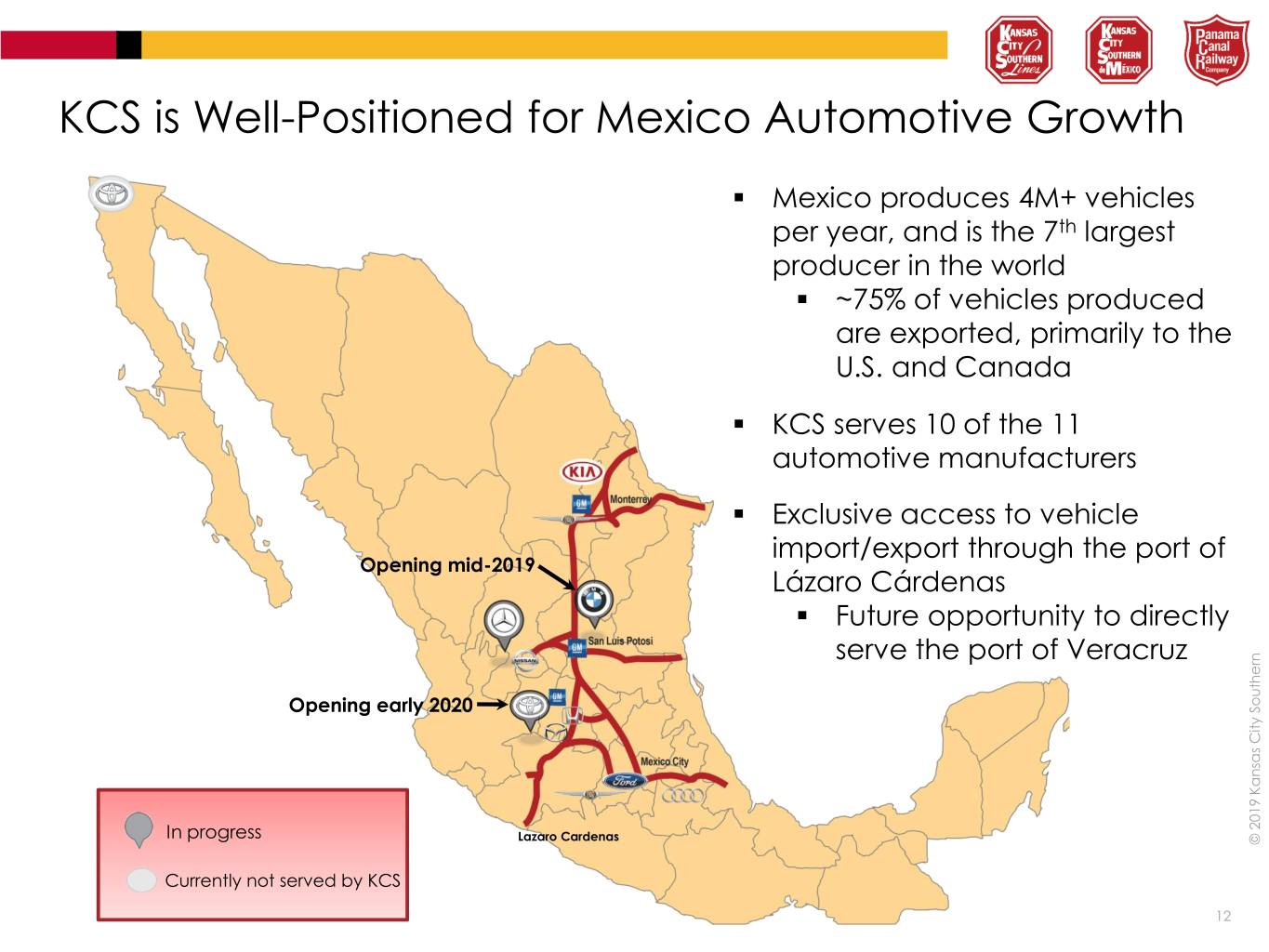

KCS is Wellis KCS Currently not servedKCSnot Currently by In In progress - Opening early 2020 Positioned for Mexico Automotive Growth for Mexico Automotive Positioned Opening mid - 2019 Lazaro Cardenas Lazaro . . . Lázaro theportthrough import/export tovehicle access Exclusive manufacturersautomotive KCS in producer per year,and is the 7 vehicles 4M+ produces Mexico . . serves serves serve theof Veracruzportserve todirectly opportunityFuture U.S.and Canada tothe primarily are exported, ~ 75% of vehicles produced of 75% vehicles Cárdenas 10 the of the world 11 th largest of 12 © 2019 Kansas City Southern

Los Angeles, CA Angeles,Los Servicing Multiple IMCs Stockton, CA Stockton, Portland, OR Portland, Seattle, WA Seattle, L á zaro C zaro San Luis Potosi, SL Potosi, Luis San á Salinas Victoria, NL Salinas Victoria, rdenas, MH rdenas, KCS INTERMODAL NETWORK Laredo, TX Laredo, Shreveport, LA Shreveport, Alliance, TX Toluca, EM Toluca, Kansas City, MO City,Kansas Mexico City, DF City,Mexico Wylie, TX Wylie, Dallas, TX Dallas, Robstown, TX Robstown, Altamira, TM Altamira, Veracruz, VZ Veracruz, East St Louis, ILLouis, St East Kendleton, TX Kendleton, Chicago, ILChicago, Jackson, MS Jackson, Memphis, TN Memphis, New Orleans, LA NewOrleans, Meridian, MS Meridian, Atlanta, GA Atlanta, Detroit, MI Detroit, Marion, OH Marion, KCS Shared Intermodal KCSShared Intermodal Intermodal Intermodal Interchange Brampton, ON Brampton, BNSF Intermodal BNSFIntermodal KCS Intermodal Greencastle, PA Greencastle, NS Rutherford, PA Rutherford, Intermodal Intermodal Facility Montreal, QC Montreal, Savannah, GA Savannah, Jacksonville, FL Jacksonville, NC Charlotte, Bethlehem, PA Bethlehem, Facility Facility Facility Charleston, SC Charleston, Point Syracuse, NY Syracuse, Miami, FL Miami, Baltimore, MDBaltimore, Norfolk, VA Norfolk, Little Ferry, NJ Ferry,Little Croxton, NJ Croxton, Elizabeth, NJ Elizabeth, CSXT Intermodal FEC Intermodal FECIntermodal CN Intermodal CN Intermodal Facility UP Intermodal UP Intermodal Facility Worchester, MA Worchester, Container Container Facility Facility Ports © 2019 Kansas City Southern

Precision Scheduled Railroading 14 © 2019 Kansas City Southern

reliable service and PSR at KCS: Better • • • • Customer focused Customer Improve Improve Improve KCS’ Mantra: Service KCS’ Mantra: Service Begets Facilitate Facilitate – – – – – Improve Improve improved productivity utilization productivity andimproved asset Increased Be Additional Create ablegrowingmeetsameor todemand with fewerassets cost profile cost asset utilization a more resilient anddependable a more resilient Growth and sustain consistency & reliability of & reliability consistencyservice andsustain profitability driven by volume and revenue growth and growth revenue and by volume profitability driven capacity opportunities capacity for new railroading for more growth network Growth 15 © 2019 Kansas City Southern

*2018 Expense Includes Depreciation Includes *2018Expense PSR Cost Savings OpportunityCategories Yard Yard Employees Consumption Locomotives Category Freight Cars Freight Line Line of Road Employees Fuel 2018 2018 Avg/Total ~1,700 Active ~1,700 Active T&E ~1,600 Active T&E Locomotives ~61,000 Cars ~61,000 ~170 ~170 Support ~150 Support 136 Million136 Employees Employees Gallons Online ~1,100 ~1,100 2018 2018 Expense ~$310M ~$180M ~$180M ~$160M ~$115M * ~$945M 16 © 2019 Kansas City Southern

progress & performance& progress PSR measure to key metrics evaluating KCS is Once targets are finalized for each metric, we will communicate communicate willwe metric, each for finalized are targets Once Monthly carloads / FTE carloads Monthly efficiency Fuel carload online Cars ( lengthTrain (hours)dwell Terminal (m.p.h.)velocity Gross per revenue revenue per Metric feet) targets &progress targets 5,505 2018 26.8 1.34 1.31 25.0 11.1 YTD Feb YTD 5,346 2018 25.2 1.39 1.29 23.3 11.5 YTD Feb YTD 5,505 2019 24.2 1.34 1.40 22.4 12.7 averaging 1.24averaging four weeks positive, with the last trendhas been very however, therecent teacher’s protests; impacted by YTD 2019 negatively 17 © 2019 Kansas City Southern

providing providing Active associatedbenefitsincluding assetimpairment anda likely including locomotives, of or thedisposing impacts of storing the KCS is evaluating horsepower will fleet remaining KCS KCS <1,000 of size fleet a have to goal locomotives;~1,100 of a fleet with effort rationalization its started KCS • • • R Improved expensemaintenance depreciation & Reduced ’ educed initial initial net locomotive locomotive immediate benefit to cost structure cost to benefit immediate leaseexpense labor & fuelefficiency reduction is estimated to be be to is estimated reduction include our most reliable, fuel reliable, mostinclude our f leet : r ationalization ~100 ~100 locomotives - efficient efficient 18 © 2019 Kansas City Southern

reductions & cost efficiencies driving network design service to Changes Projected Projected benefits include: Actions taken: these these trains offer the most opportunity for service Initial service design focusing on Mexico Intermodal & Manifest • • • • • • • • Improved assetutilization Improved crewstartsReduced workReduceevents destinations like Consolidate traffic with intermodal trains utilization of Improve Increased networkcapacity Increased fuel consumptionReduced consistency service Improved Service Service Design Changes reduction reduction of more than week, with week, with line of sight to reducing 100 more 100 100 crew startsper have have resulted in a Starts/Week Starts/Week 28 Crew Crew 28 6 Crew 6 Crew Starts/Week 14 Crew Crew 14 consolidation Starts/Week 50 Crew Crew 50 Starts/Week 8 Crew 8 Crew trains; 19 © 2019 Kansas City Southern

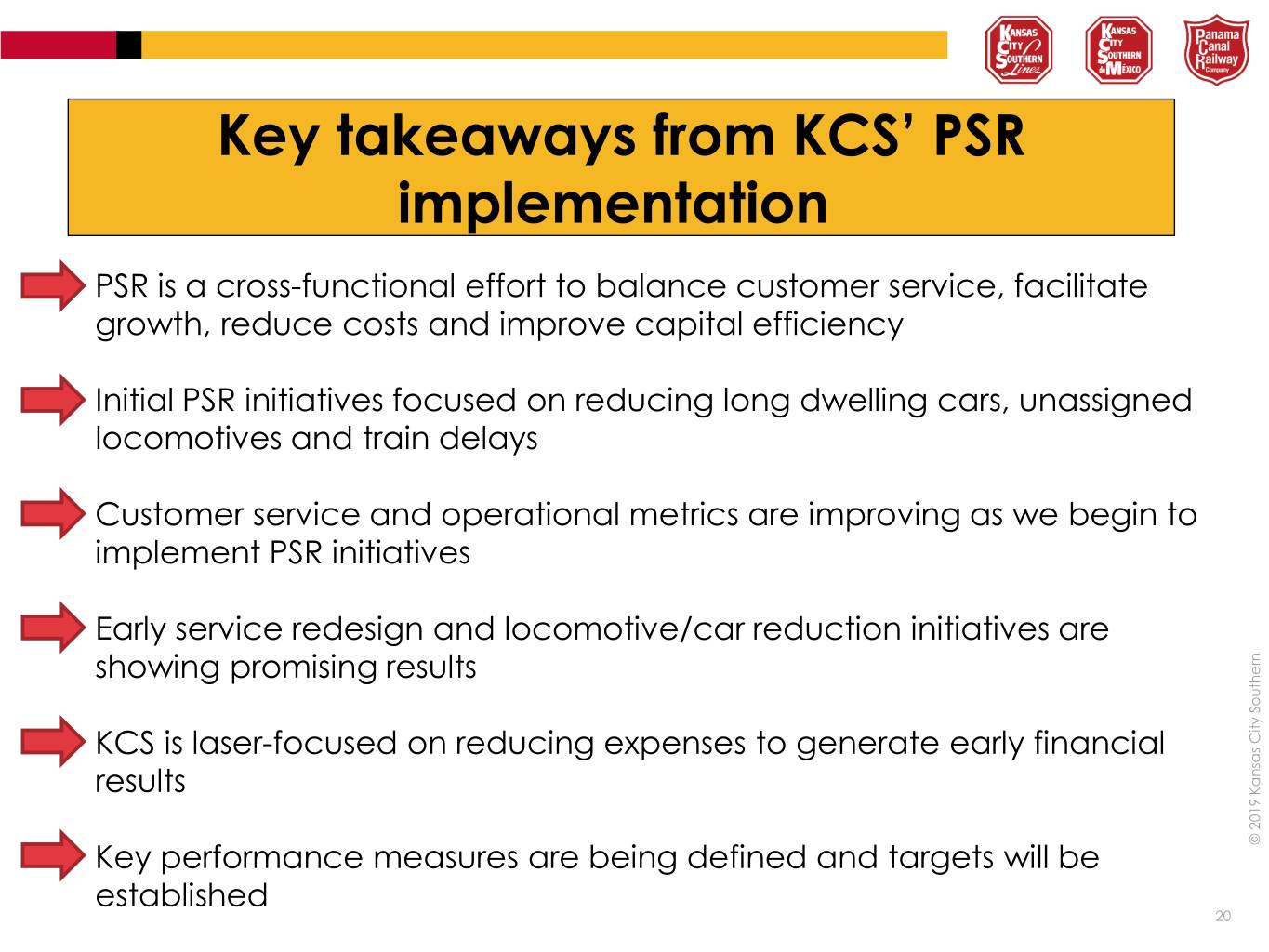

• established Key results KCS promising resultsshowing Early service initiatives PSR implement Customer reducegrowth, PSR locomotives locomotives trainand delays cars,unassigned long dwelling on reducing focused PSR Initial initiatives is is a performance measures are being defined and targets will bewill targets and defined are performancemeasures being is is laser cross Key service andoperational to service improving begin arewe metrics as - focused - redesign redesign functional takeaways costs implementation on reducing expenses to generate early financial early generatefinancial to expenses on reducing and improve andcapital improve and locomotive/car reduction initiatives areandlocomotive/car initiatives reduction effortbalance facilitateto service, customer from efficiency KCS’ PSR KCS’ 20 © 2019 Kansas City Southern

Appendix 21 © 2019 Kansas City Southern

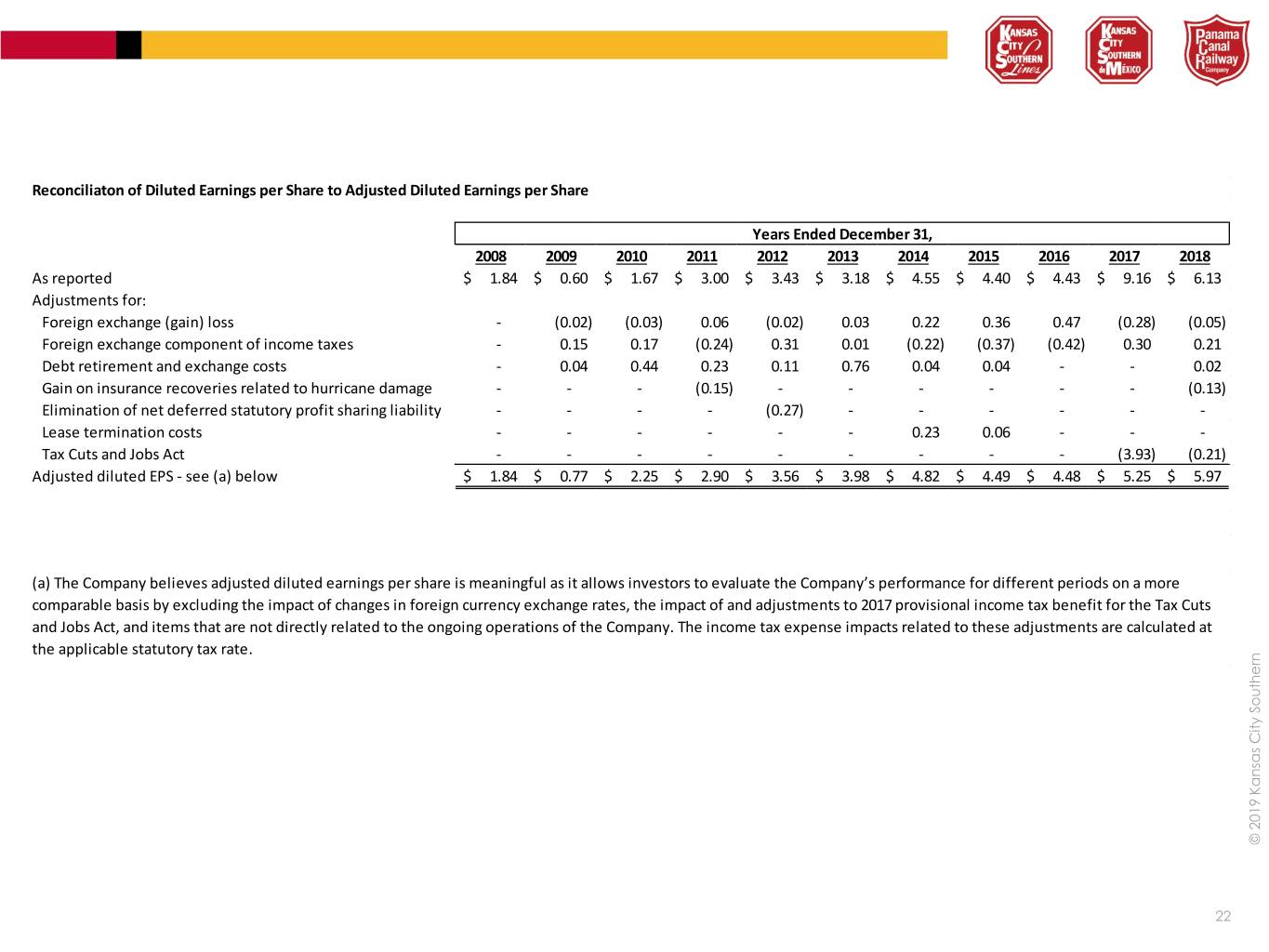

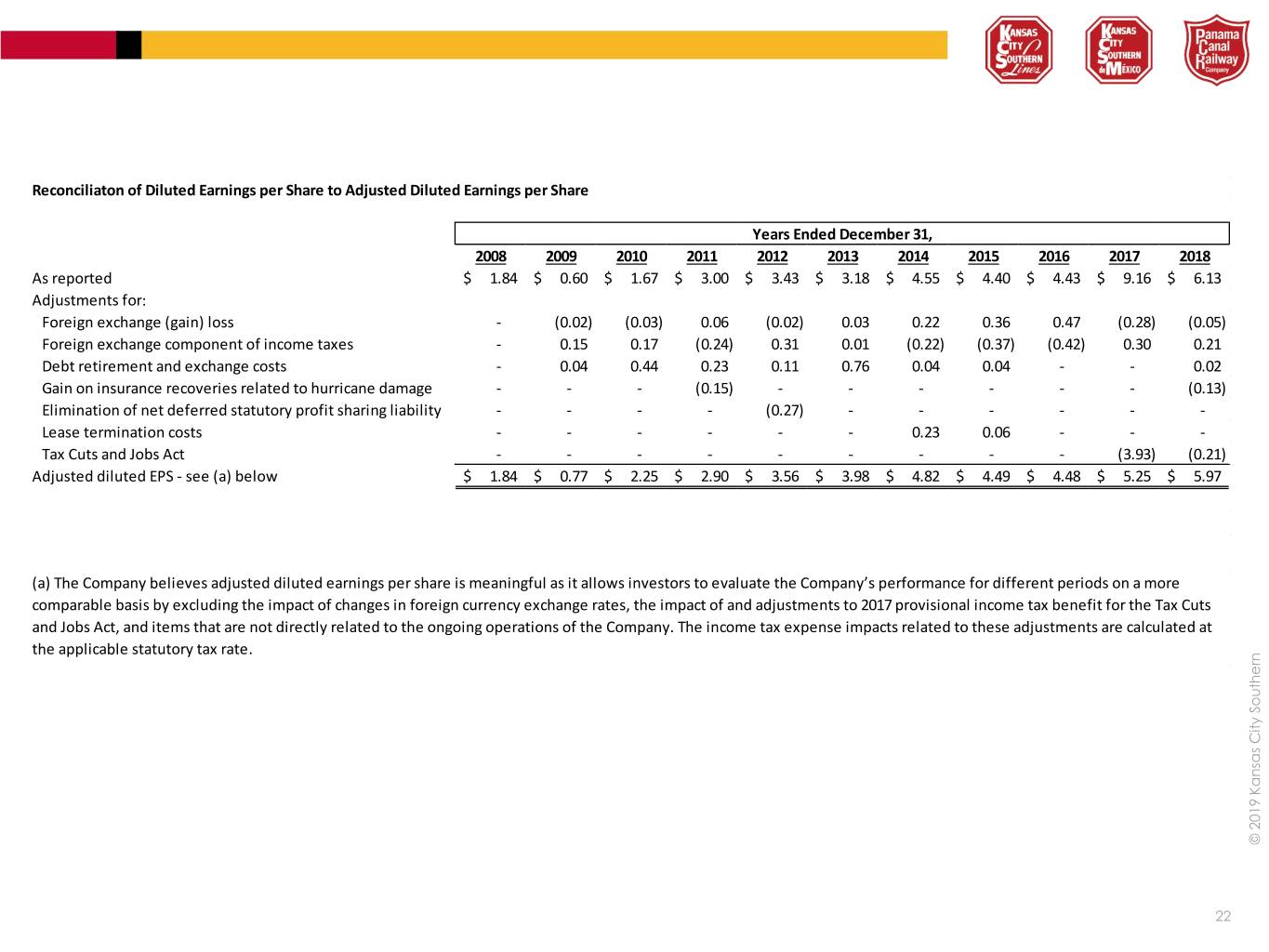

the applicable statutory tax rate. applicable the are at calculated adjustments to these impacts related tax expense Company. The income the of operations to and ongoing that the Act, Jobs and related are items not directly for Tax impact to currencythe rates, the and 2017Cuts of impact adjustments the exchange changes foreign of in tax benefit income by comparable excluding basis provisional (a) The Company believes adjusted diluted earnings per share is meaningful as it allows investors to evaluate the Company’s performance for different periods on a more below (a) EPS - see diluted Adjusted for: Adjustments As reported Reconciliaton of Diluted Earnings per Share to Adjusted Diluted Earnings per Share Tax Cuts and ActJobs costs termination Lease statutorysharing liability profit deferred net of Elimination to hurricane damagerelated Gain on recoveries insurance costs and exchange Debt retirement taxes income of component exchange Foreign loss (gain) exchange Foreign $ $ 2008 1.84 1.84 - - - - - - - $ $ 2009 (0.02) 0.77 0.04 0.15 0.60 - - - - $ $ 2010 (0.03) 2.25 0.44 0.17 1.67 - - - - $ $ 2011 (0.15) (0.24) 2.90 0.23 0.06 3.00 - - - $ $ Years Ended December 31, 2012 (0.27) (0.02) 3.56 0.11 0.31 3.43 - - - $ $ 2013 3.98 0.76 0.01 0.03 3.18 - - - - $ $ 2014 (0.22) 4.82 0.23 0.04 0.22 4.55 - - - $ $ 2015 (0.37) 4.49 0.06 0.04 0.36 4.40 - - - $ $ 2016 (0.42) 4.48 0.47 4.43 - - - - - $ $ 2017 (3.93) (0.28) 5.25 0.30 9.16 - - - - $ $ 2018 (0.21) (0.13) (0.05) 5.97 0.02 0.21 6.13 - - 22 © 2019 Kansas City Southern

(b) Operating ratio is calculated by dividing operating expenses by revenues; or in the case of adjusted operating ratio, adjusted operating expenses divided by adjusted revenues. by adjusted divided expenses operating ratio, adjusted operating or case the adjusted of in by revenues; expenses operating by dividing ratio calculated is Operating (b) Company. the of operations to ongoing the that related are items not directly on a periods by more comparable excluding basis different Company's the for performance to evaluate investors as allow they and ratio are operating income meaningful operating expenses, revenues, operating adjusted The Company (a) believes below and (a) (b) ratio see - operating Adjusted as ratio reported (b) Operating below (a) see - income operating Adjusted as income reported Operating below (a) see - expenses operating Adjusted for: Adjustments as reported expenses Operating ($ millions) in Expenses Reconciliation of Operating toExpenses Adjusted Operating below (a) see - revenues Adjusted impact from Hurricane for estimated Alex Adjustment as reported Revenues ($ millions) in Reconciliation of toRevenues Adjusted Revenues Gain on insurance recoveries related to hurricane damagerelated Gain on recoveries insurance costs termination Lease statutorysharing liability profit deferred net of Elimination benefit expense Post-employment impact Estimated from Hurricane Alex $ $ $ $ $ 2008 2008 1,464.7 1,464.7 1,852.1 1,852.1 387.4 387.4 79.1% 79.1% - - - - - - $ $ $ $ $ 2009 2009 1,213.4 1,213.4 1,480.2 1,480.2 266.8 266.8 82.0% 82.0% - - - - - - $ $ $ $ $ 2010 2010 1,345.5 1,328.3 1,847.8 1,814.8 502.3 486.5 72.8% 73.2% 11.0 33.0 6.2 - - - $ $ $ $ $ 2011 2011 1,512.3 1,486.7 2,098.3 2,098.3 586.0 611.6 72.1% 70.9% 25.6 - - - - - $ $ $ $ $ 2012 2012 1,565.7 1,522.7 2,238.6 2,238.6 Years Ended December 31, Years Ended December 31, 672.9 715.9 69.9% 68.0% 43.0 - - - - - $ $ $ $ $ 2013 2013 1,630.7 1,630.7 2,369.3 2,369.3 738.6 738.6 68.8% 68.8% - - - - - - $ $ $ $ $ 2014 2014 1,729.7 1,768.0 2,577.1 2,577.1 847.4 809.1 67.1% 68.6% (38.3) - - - - - $ $ $ $ $ 2015 2015 1,605.4 1,615.0 2,418.8 2,418.8 813.4 803.8 66.4% 66.8% (9.6) - - - - - $ $ $ $ $ 2016 2016 1,515.7 1,515.7 2,334.2 2,334.2 818.5 818.5 64.9% 64.9% - - - - - - $ $ $ $ $ 2017 2017 1,661.3 1,661.3 2,582.9 2,582.9 921.6 921.6 64.3% 64.3% - - - - - - $ $ $ $ $ 2018 2018 1,745.6 1,727.7 2,714.0 2,714.0 968.4 986.3 64.3% 63.7% 17.9 23 - - - - - © 2019 Kansas City Southern

24 © 2019 Kansas City Southern ©2019 Kansas City Southern