Exhibit 99.1 KANSAS CITY SOUTHERN BAML 2019 Transportation and Industrials Conference © KANSAS CITYSOUTHERN KCS

Safe Harbor Statement This presentation contains “forward-looking statements” within the meaning of the securities laws concerning potential future events involving KCS and its subsidiaries, which could materially differ from the events that actually occur. Words such as “projects,” “estimates,” “forecasts,” “believes,” “intends,” “expects,” “anticipates,” and similar expressions are intended to identify many of these forward-looking statements. Such forward-looking statements are based upon information currently available to management and management’s perception thereof as of the date hereof. Differences that actually occur could be caused by a number of external factors over which management has little or no control, including: competition and consolidation within the transportation industry; the business environment in industries that produce and use items shipped by rail; loss of the rail concession of KCS’ subsidiary, Kansas City Southern de México, S.A. de C.V.; the termination of, or failure to renew, agreements with customers, other railroads and third parties; access to capital; disruptions to KCS’ technology infrastructure, including its computer systems; natural events such as severe weather, hurricanes and floods; market and regulatory responses to climate change; legislative and regulatory developments and disputes; rail accidents or other incidents or accidents on KCS’ rail network or at KCS’ facilities or customer facilities involving the release of hazardous materials, including toxic inhalation hazards; fluctuation in prices or availability of key materials, in particular diesel fuel; dependency on certain key suppliers of core rail equipment; changes in securities and capital markets; unavailability of qualified personnel; labor difficulties, including strikes and work stoppages; acts of terrorism or risk of terrorist activities; war or risk of war; domestic and international economic, political and social conditions; the level of trade between the United States and Asia or Mexico; fluctuations in the peso-dollar exchange rate; increased demand and traffic congestion; the outcome of claims and litigation involving KCS or its subsidiaries; and other factors affecting the operation of the business. More detailed information about factors that could affect future events may be found in filings by KCS with the Securities and Exchange Commission, including KCS’ Annual Report on Form 10-K for the year ended December 31, 2018 (File No. 1-4717) and subsequent reports. Forward-looking statements are not, and should not be relied upon as, a guarantee of future performance or results, nor will they necessarily prove to be accurate indications of the times at or by which any such performance or results will be achieved. As a result, actual outcomes and results may differ materially from those expressed in forward-looking statements. KCS is not obligated to update any forward- looking statements to reflect future events or developments. All reconciliations to GAAP can be found on the KCS website, kcsouthern.com/investors. © KANSAS ©KANSAS CITYSOUTHERN KCS 2

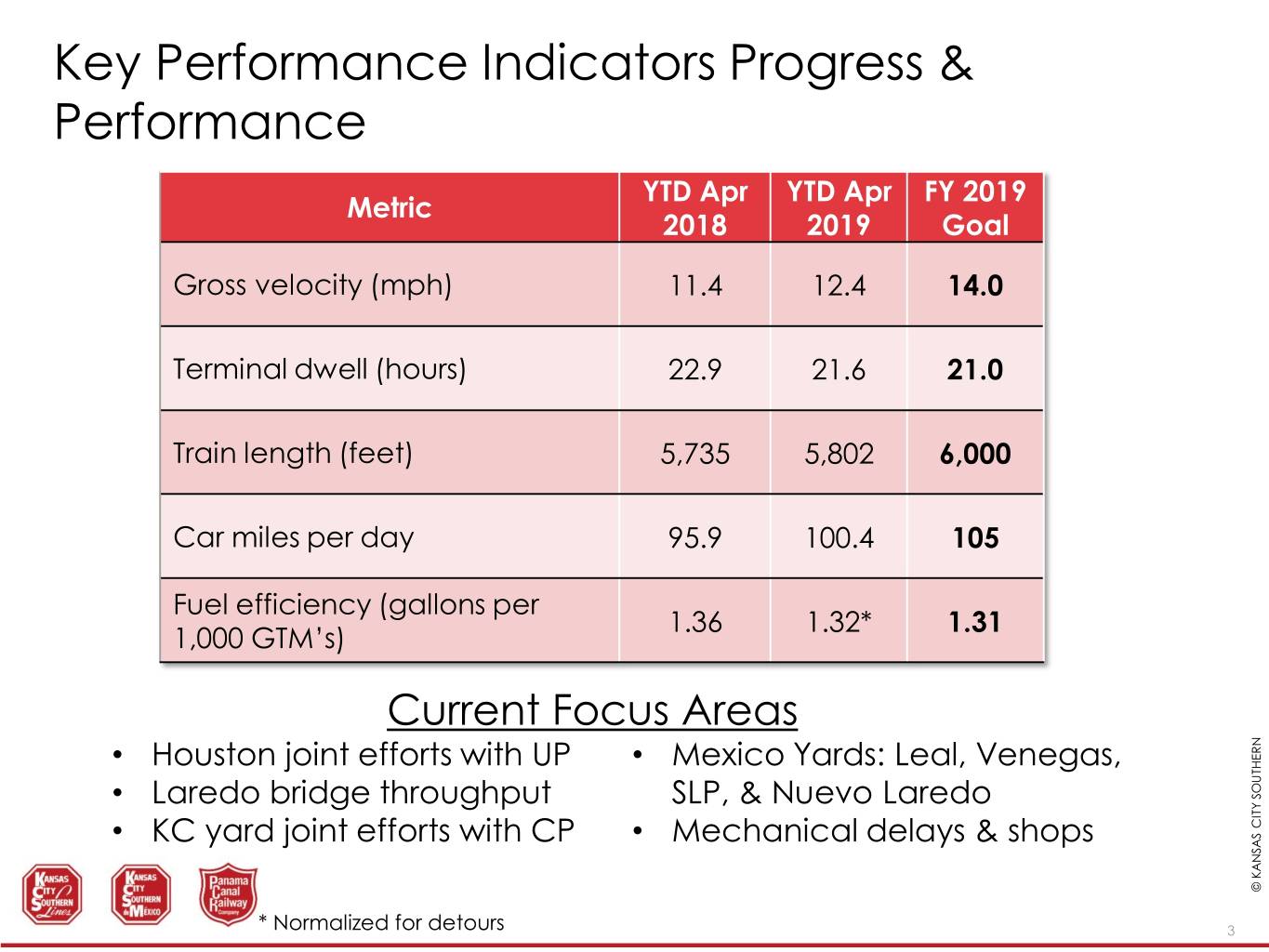

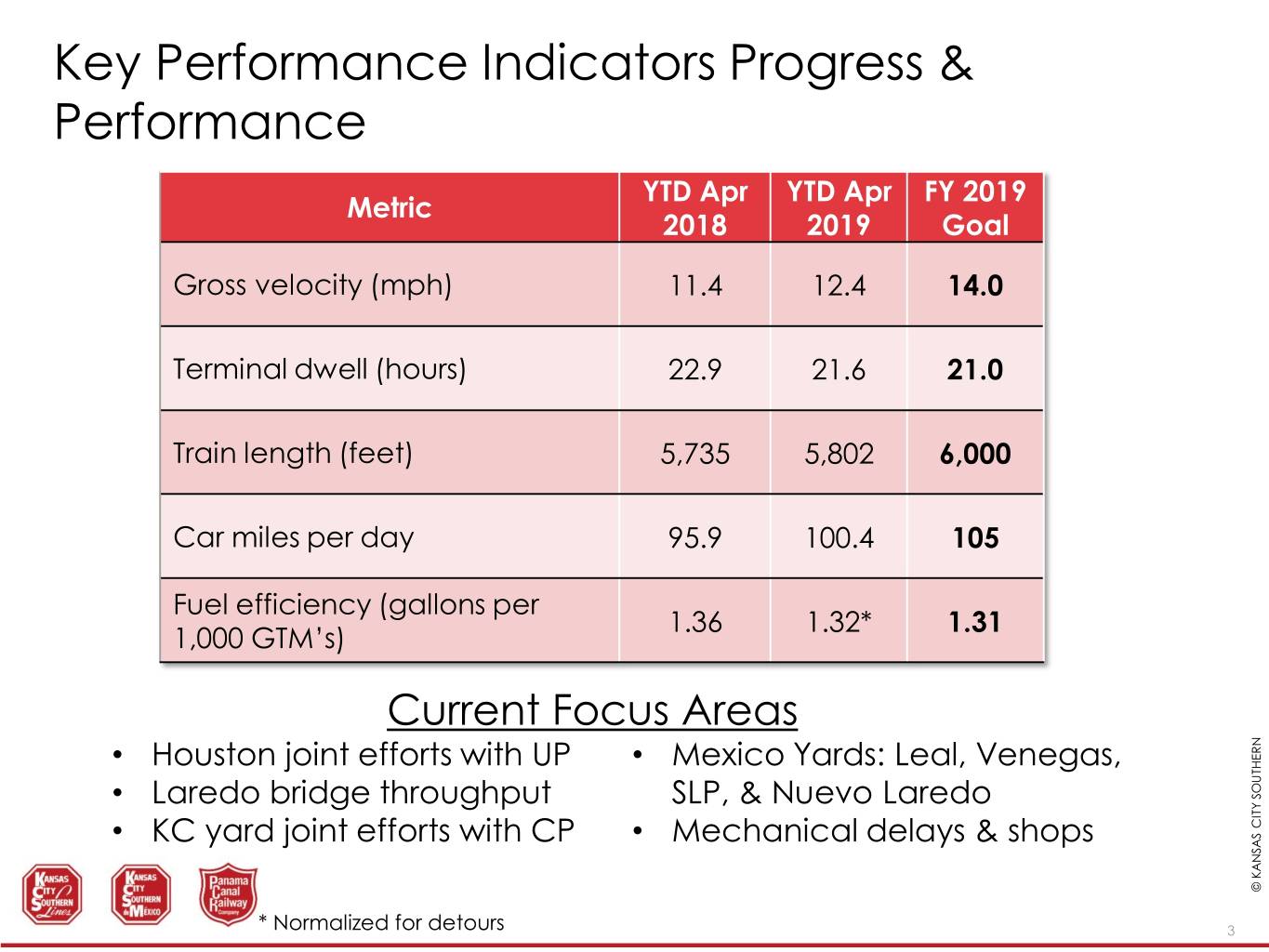

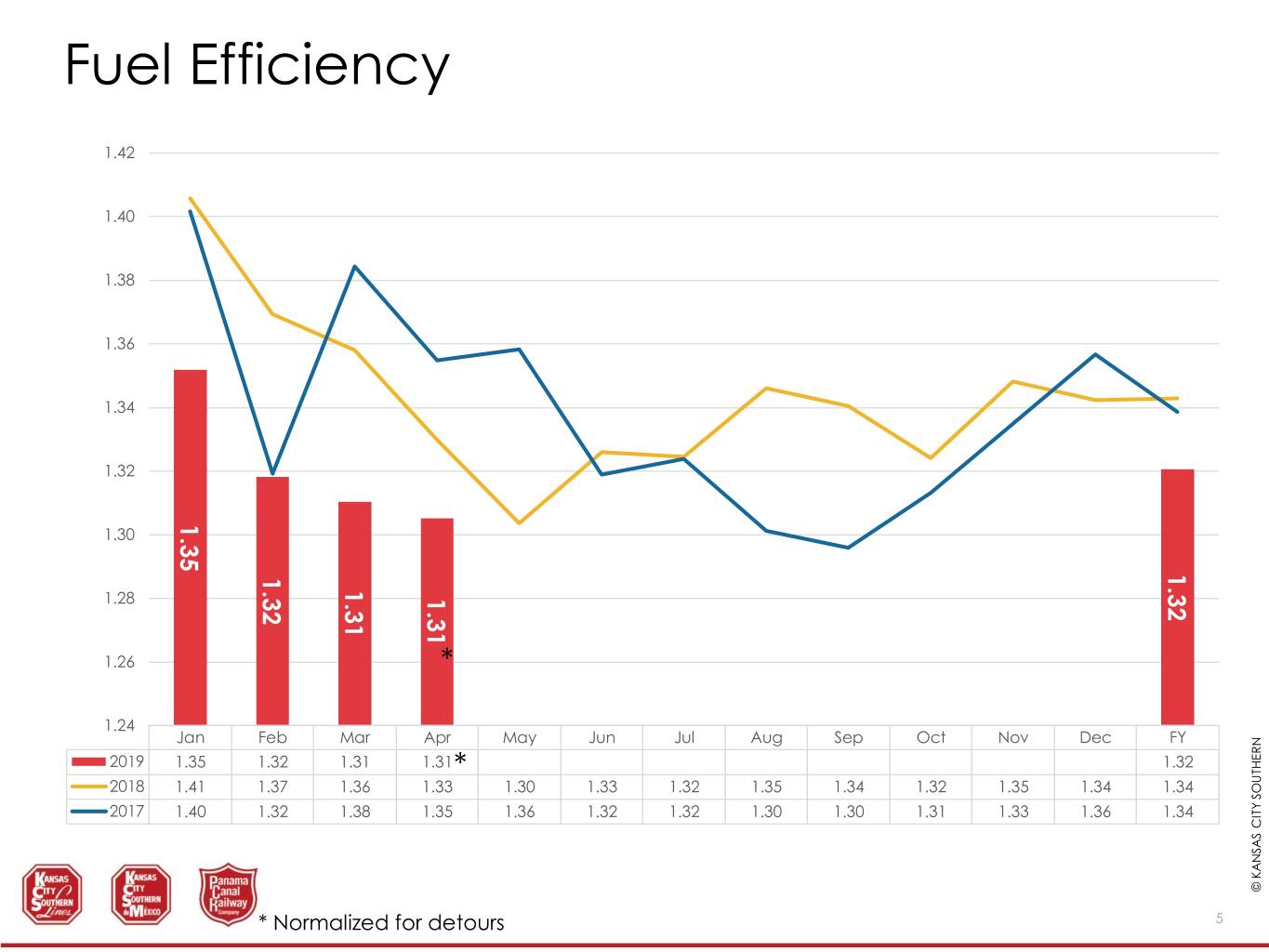

Key Performance Indicators Progress & Performance YTD Apr YTD Apr FY 2019 Metric 2018 2019 Goal Gross velocity (mph) 11.4 12.4 14.0 Terminal dwell (hours) 22.9 21.6 21.0 Train length (feet) 5,735 5,802 6,000 Car miles per day 95.9 100.4 105 Fuel efficiency (gallons per 1.36 1.32* 1.31 1,000 GTM’s) Current Focus Areas • Houston joint efforts with UP • Mexico Yards: Leal, Venegas, • Laredo bridge throughput SLP, & Nuevo Laredo • KC yard joint efforts with CP • Mechanical delays & shops © KANSAS © KANSAS CITYSOUTHERN KCS * Normalized for detours 3

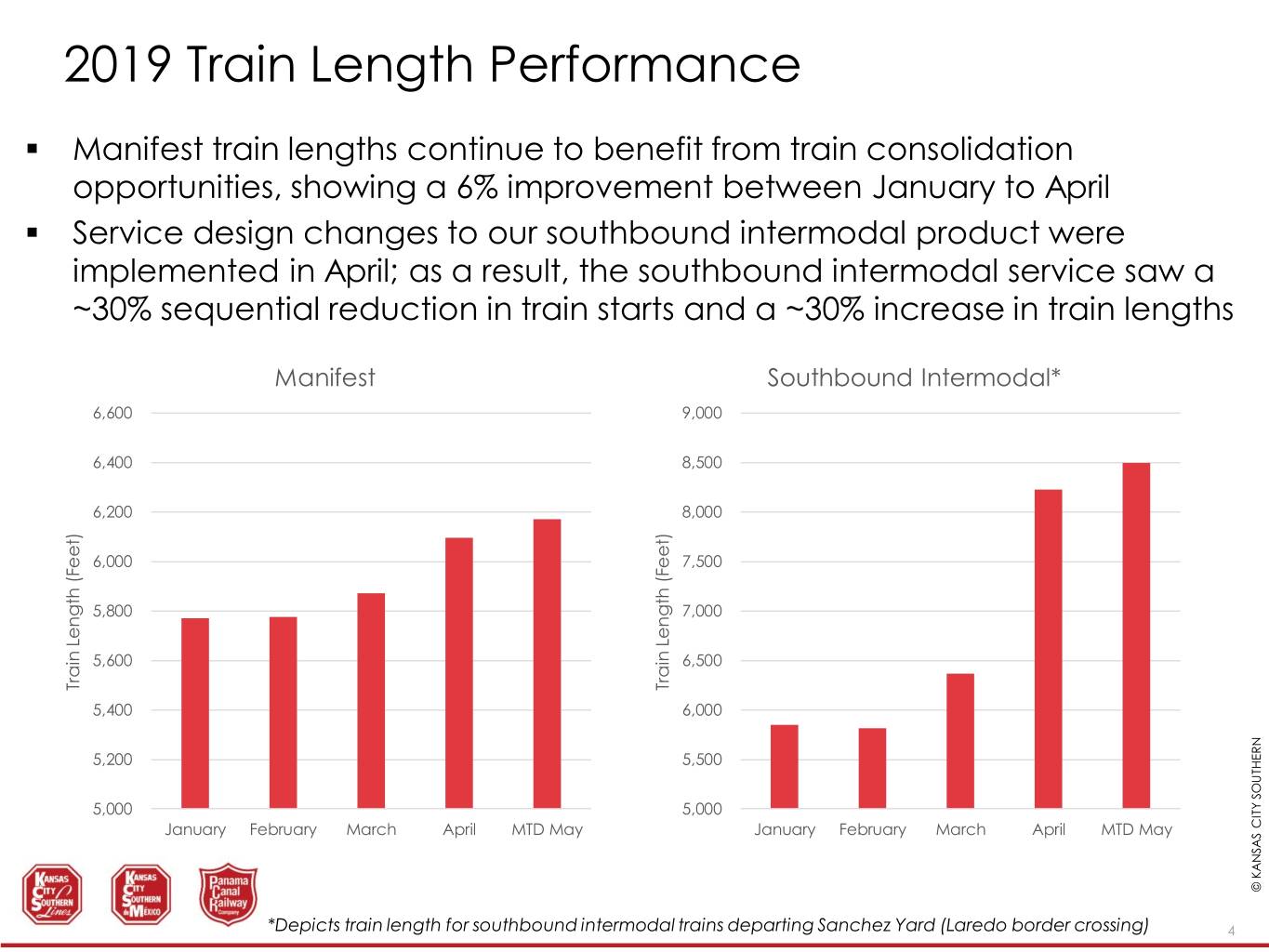

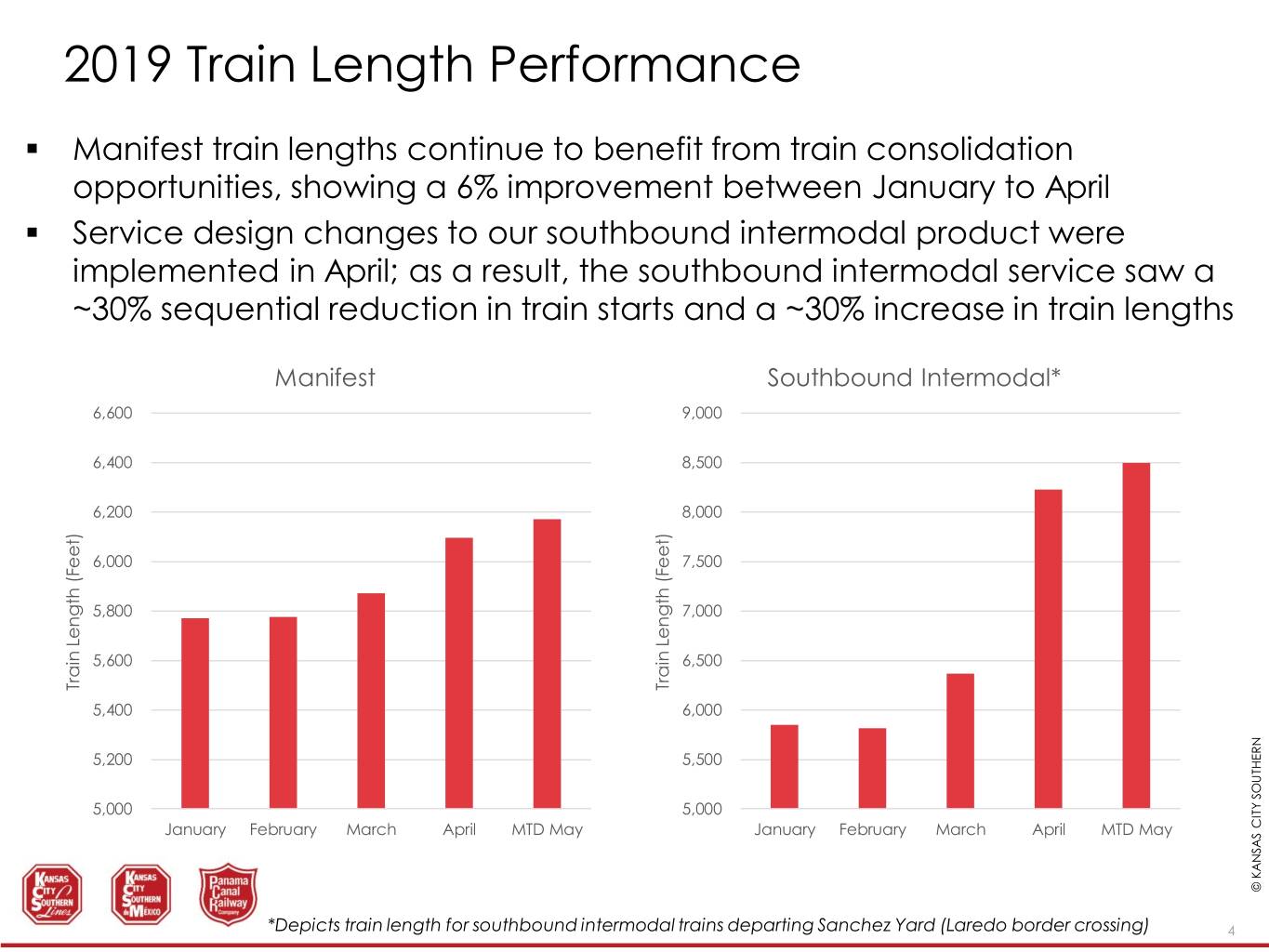

2019 Train Length Performance . Manifest train lengths continue to benefit from train consolidation opportunities, showing a 6% improvement between January to April . Service design changes to our southbound intermodal product were implemented in April; as a result, the southbound intermodal service saw a ~30% sequential reduction in train starts and a ~30% increase in train lengths Manifest Southbound Intermodal* 6,600 9,000 6,400 8,500 6,200 8,000 6,000 7,500 5,800 7,000 5,600 6,500 Train Length (Feet) Length Train (Feet) Length Train 5,400 6,000 5,200 5,500 5,000 5,000 January February March April MTD May January February March April MTD May © KANSAS © KANSAS CITYSOUTHERN KCS *Depicts train length for southbound intermodal trains departing Sanchez Yard (Laredo border crossing) 4

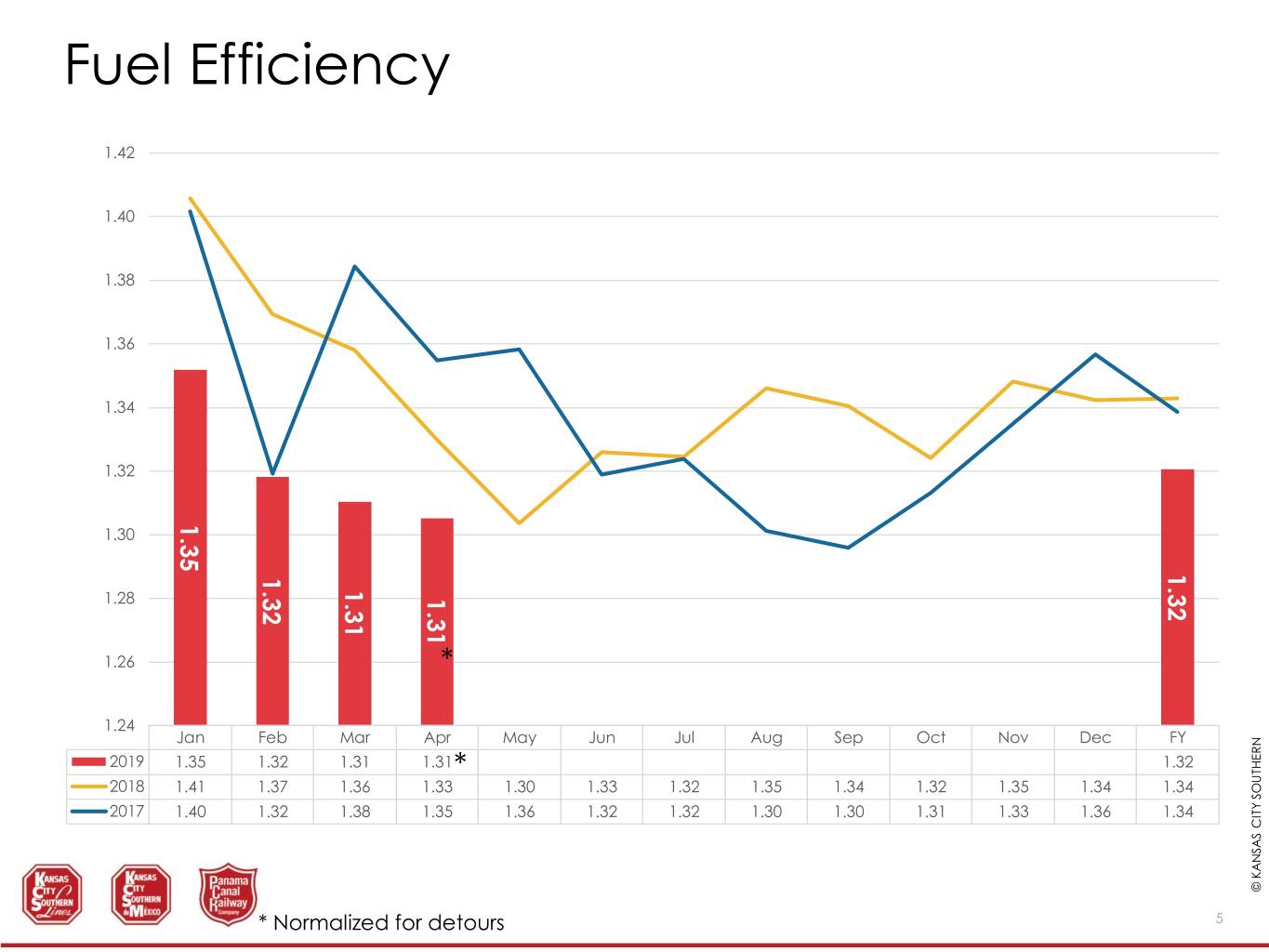

Fuel Efficiency 1.42 1.40 1.38 1.36 1.34 1.32 1.35 1.30 1.32 1.32 1.31 1.28 1.31 1.26 * 1.24 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec FY 2019 1.35 1.32 1.31 1.31* 1.32 2018 1.41 1.37 1.36 1.33 1.30 1.33 1.32 1.35 1.34 1.32 1.35 1.34 1.34 2017 1.40 1.32 1.38 1.35 1.36 1.32 1.32 1.30 1.30 1.31 1.33 1.36 1.34 © KANSAS ©KANSAS CITYSOUTHERN KCS * Normalized for detours 5

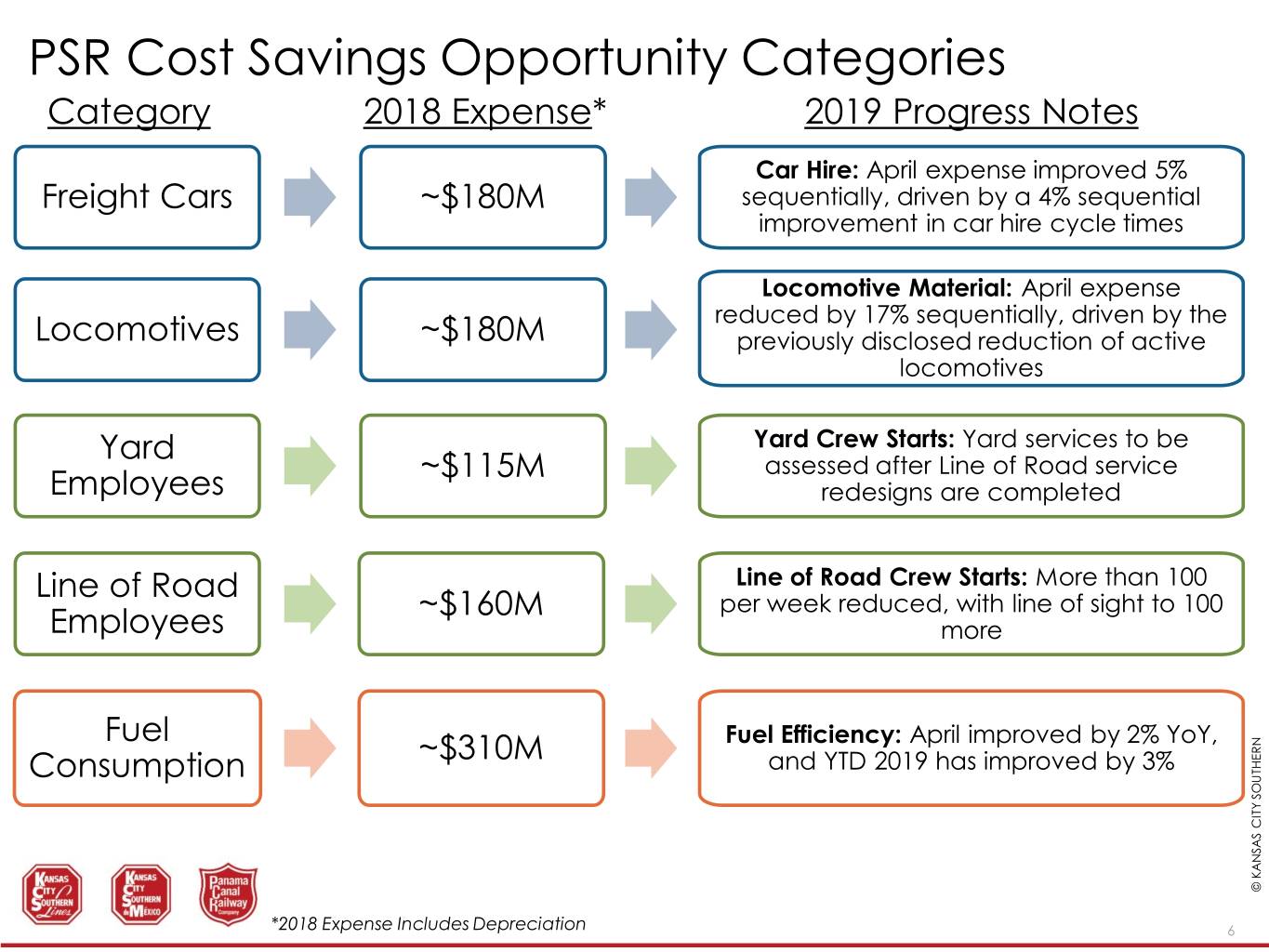

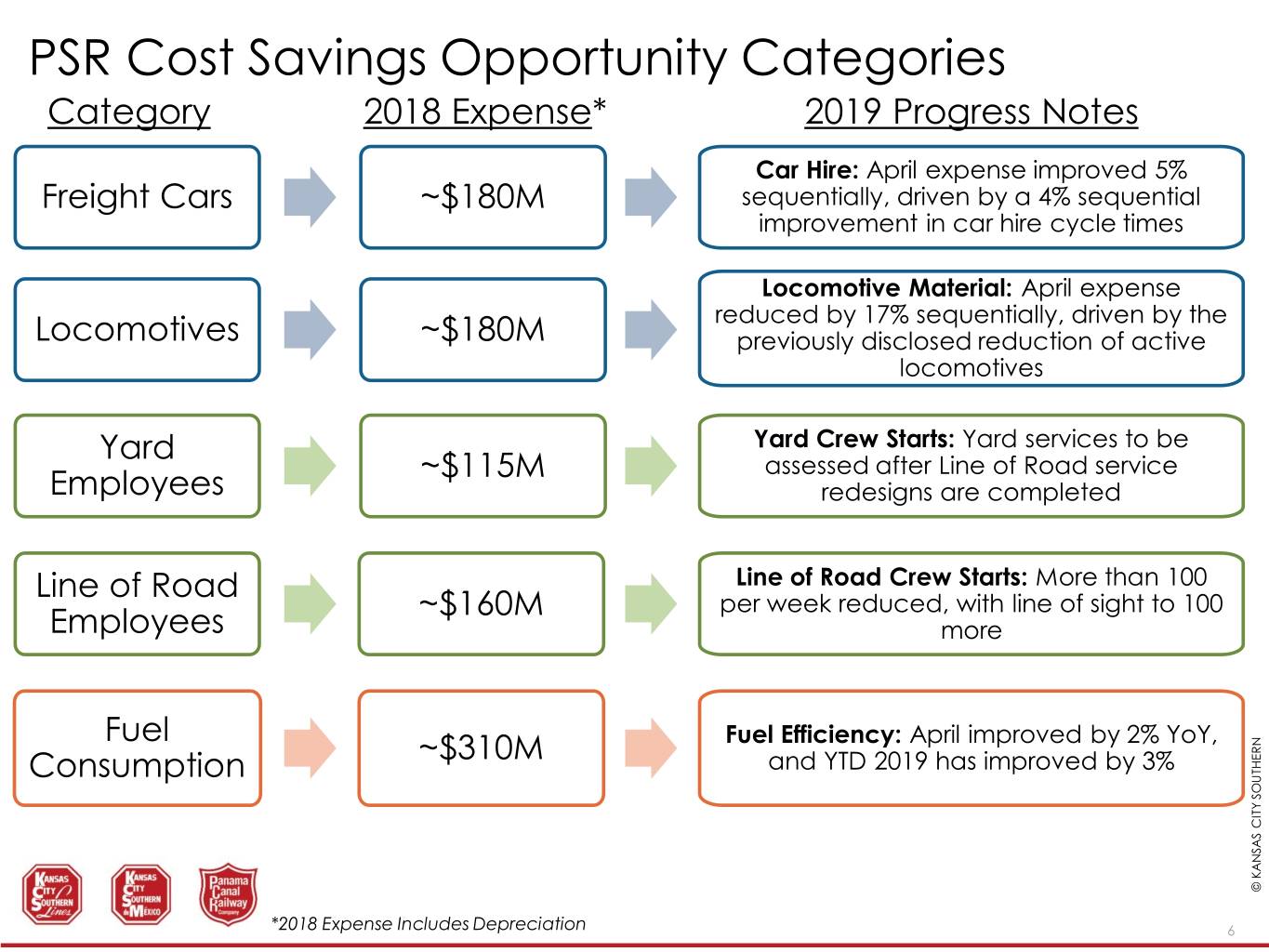

PSR Cost Savings Opportunity Categories Category 2018 Expense* 2019 Progress Notes Car Hire: April expense improved 5% Freight Cars ~$180M sequentially, driven by a 4% sequential improvement in car hire cycle times Locomotive Material: April expense reduced by 17% sequentially, driven by the Locomotives ~$180M previously disclosed reduction of active locomotives Yard Yard Crew Starts: Yard services to be ~$115M assessed after Line of Road service Employees redesigns are completed Line of Road Line of Road Crew Starts: More than 100 ~$160M per week reduced, with line of sight to 100 Employees more Fuel ~$310M Fuel Efficiency: April improved by 2% YoY, Consumption and YTD 2019 has improved by 3% © KANSAS ©KANSAS CITYSOUTHERN KCS *2018 Expense Includes Depreciation 6

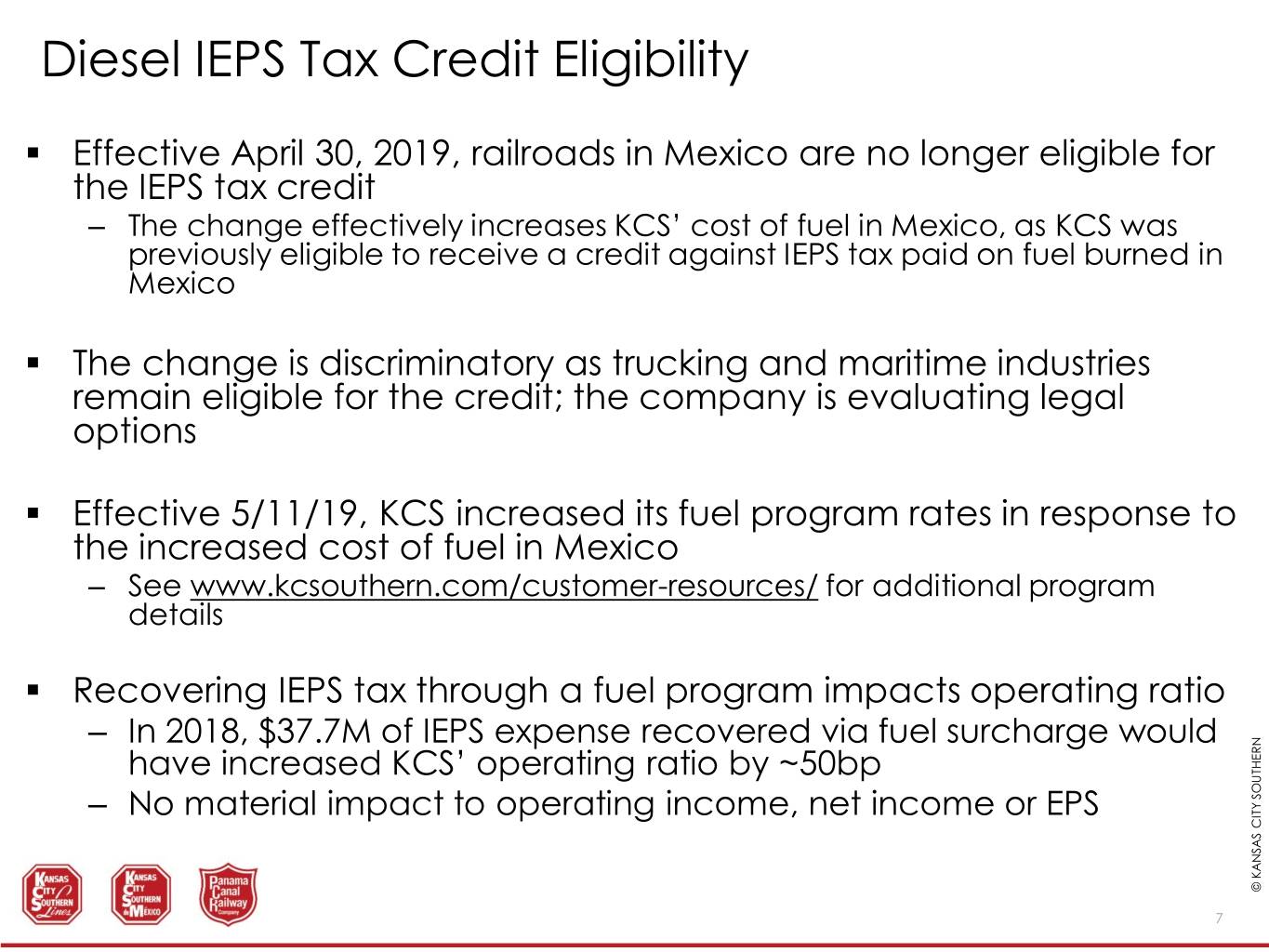

Diesel IEPS Tax Credit Eligibility . Effective April 30, 2019, railroads in Mexico are no longer eligible for the IEPS tax credit – The change effectively increases KCS’ cost of fuel in Mexico, as KCS was previously eligible to receive a credit against IEPS tax paid on fuel burned in Mexico . The change is discriminatory as trucking and maritime industries remain eligible for the credit; the company is evaluating legal options . Effective 5/11/19, KCS increased its fuel program rates in response to the increased cost of fuel in Mexico – See www.kcsouthern.com/customer-resources/ for additional program details . Recovering IEPS tax through a fuel program impacts operating ratio – In 2018, $37.7M of IEPS expense recovered via fuel surcharge would have increased KCS’ operating ratio by ~50bp – No material impact to operating income, net income or EPS © KANSAS ©KANSAS CITYSOUTHERN KCS 7

© KANSAS ©KANSAS CITYSOUTHERN KCS 8