Exhibit 99.1 KANSAS CITY SOUTHERN Deutsche Bank 2019 Global Industrials & Materials Summit © KANSAS CITY SOUTHERN KCS

Safe Harbor Statement This presentation contains “forward-looking statements” within the meaning of the securities laws concerning potential future events involving KCS and its subsidiaries, which could materially differ from the events that actually occur. Words such as “projects,” “estimates,” “forecasts,” “believes,” “intends,” “expects,” “anticipates,” and similar expressions are intended to identify many of these forward-looking statements. Such forward-looking statements are based upon information currently available to management and management’s perception thereof as of the date hereof. Differences that actually occur could be caused by a number of external factors over which management has little or no control, including: competition and consolidation within the transportation industry; the business environment in industries that produce and use items shipped by rail; loss of the rail concession of KCS’ subsidiary, Kansas City Southern de México, S.A. de C.V.; the termination of, or failure to renew, agreements with customers, other railroads and third parties; access to capital; disruptions to KCS’ technology infrastructure, including its computer systems; natural events such as severe weather, hurricanes and floods; market and regulatory responses to climate change; legislative and regulatory developments and disputes; rail accidents or other incidents or accidents on KCS’ rail network or at KCS’ facilities or customer facilities involving the release of hazardous materials, including toxic inhalation hazards; fluctuation in prices or availability of key materials, in particular diesel fuel; dependency on certain key suppliers of core rail equipment; changes in securities and capital markets; unavailability of qualified personnel; labor difficulties, including strikes and work stoppages; acts of terrorism or risk of terrorist activities; war or risk of war; domestic and international economic, political and social conditions; the level of trade between the United States and Asia or Mexico; fluctuations in the peso-dollar exchange rate; increased demand and traffic congestion; the outcome of claims and litigation involving KCS or its subsidiaries; and other factors affecting the operation of the business. More detailed information about factors that could affect future events may be found in filings by KCS with the Securities and Exchange Commission, including KCS’ Annual Report on Form 10-K for the year ended December 31, 2018 (File No. 1-4717) and subsequent reports. Forward-looking statements are not, and should not be relied upon as, a guarantee of future performance or results, nor will they necessarily prove to be accurate indications of the times at or by which any such performance or results will be achieved. As a result, actual outcomes and results may differ materially from those expressed in forward-looking statements. KCS is not obligated to update any forward- looking statements to reflect future events or developments. All reconciliations to GAAP can be found on the KCS website, kcsouthern.com/investors. © KANSAS © KANSAS CITY SOUTHERN KCS 2

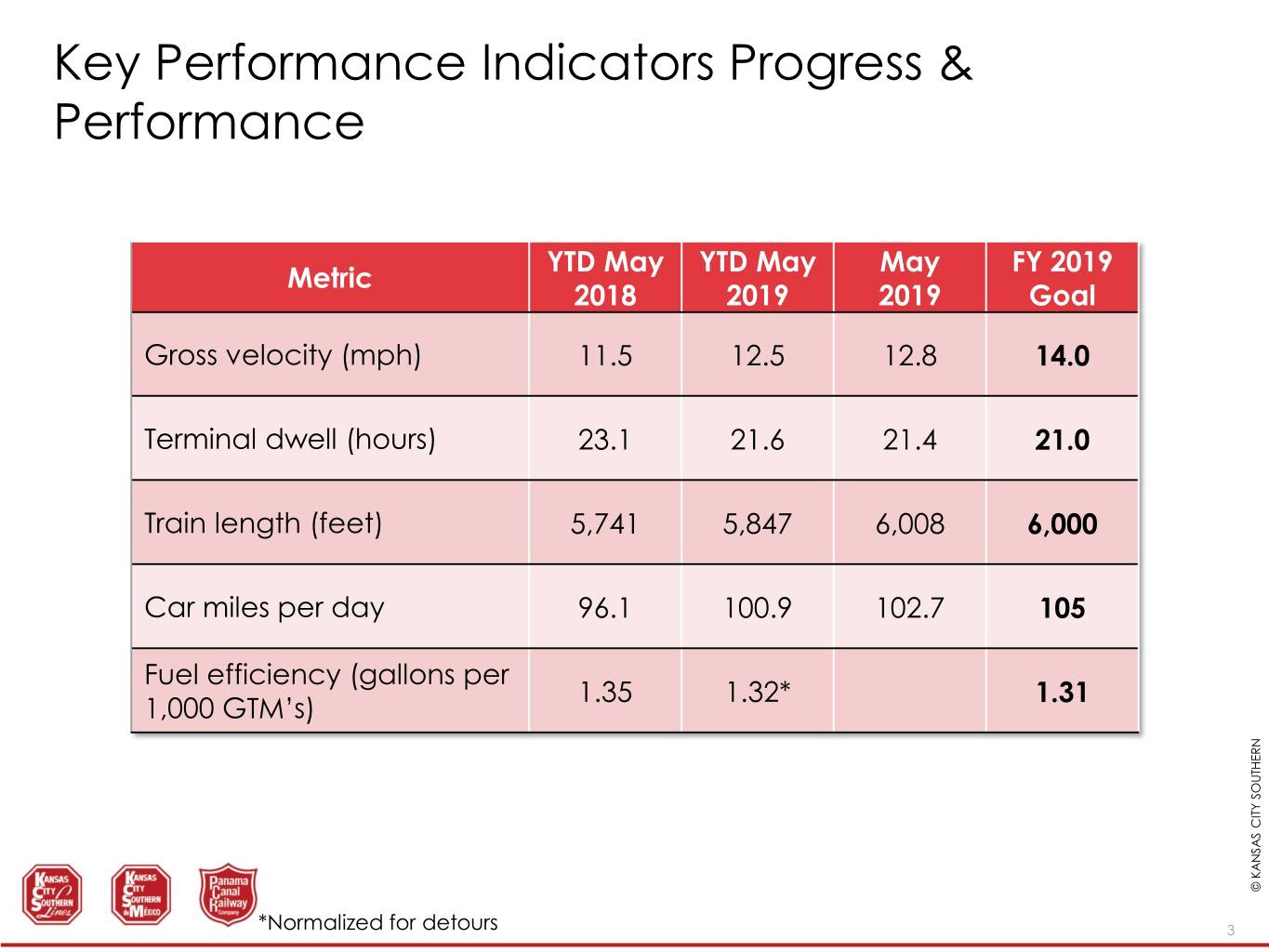

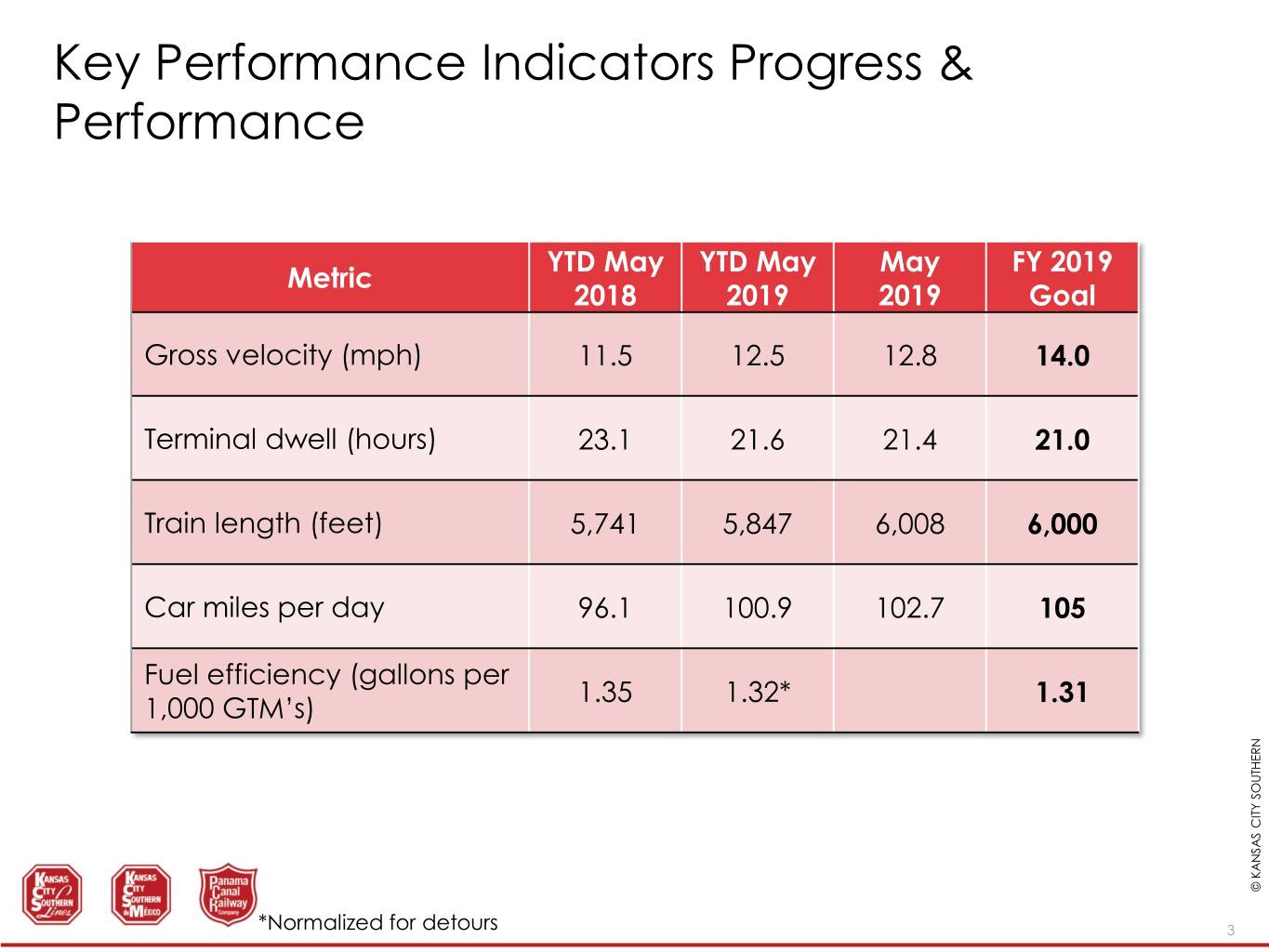

Key Performance Indicators Progress & Performance YTD May YTD May May FY 2019 Metric 2018 2019 2019 Goal Gross velocity (mph) 11.5 12.5 12.8 14.0 Terminal dwell (hours) 23.1 21.6 21.4 21.0 Train length (feet) 5,741 5,847 6,008 6,000 Car miles per day 96.1 100.9 102.7 105 Fuel efficiency (gallons per 1.35 1.32* 1.31 1,000 GTM’s) © KANSAS © KANSAS CITY SOUTHERN KCS *Normalized for detours 3

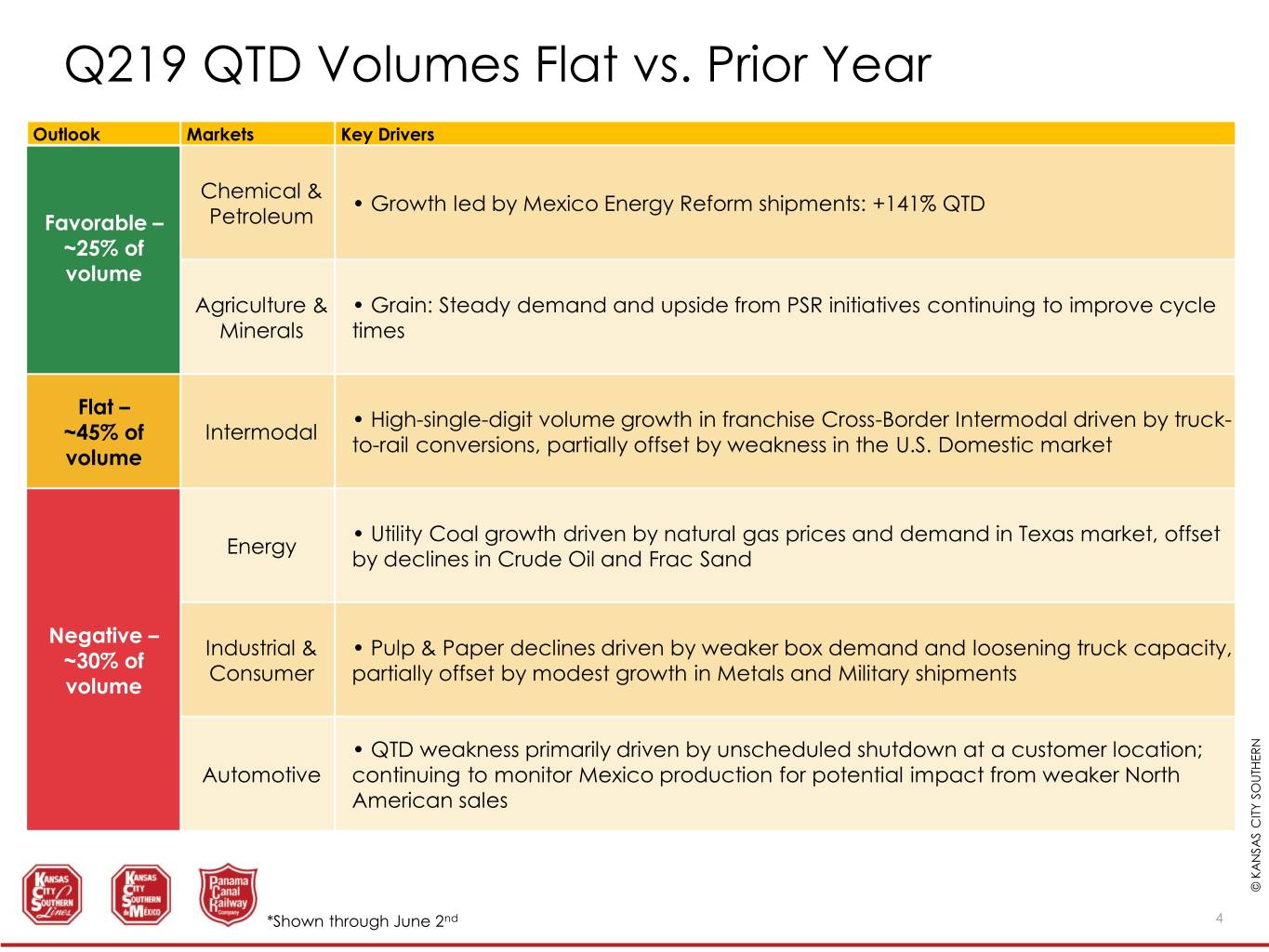

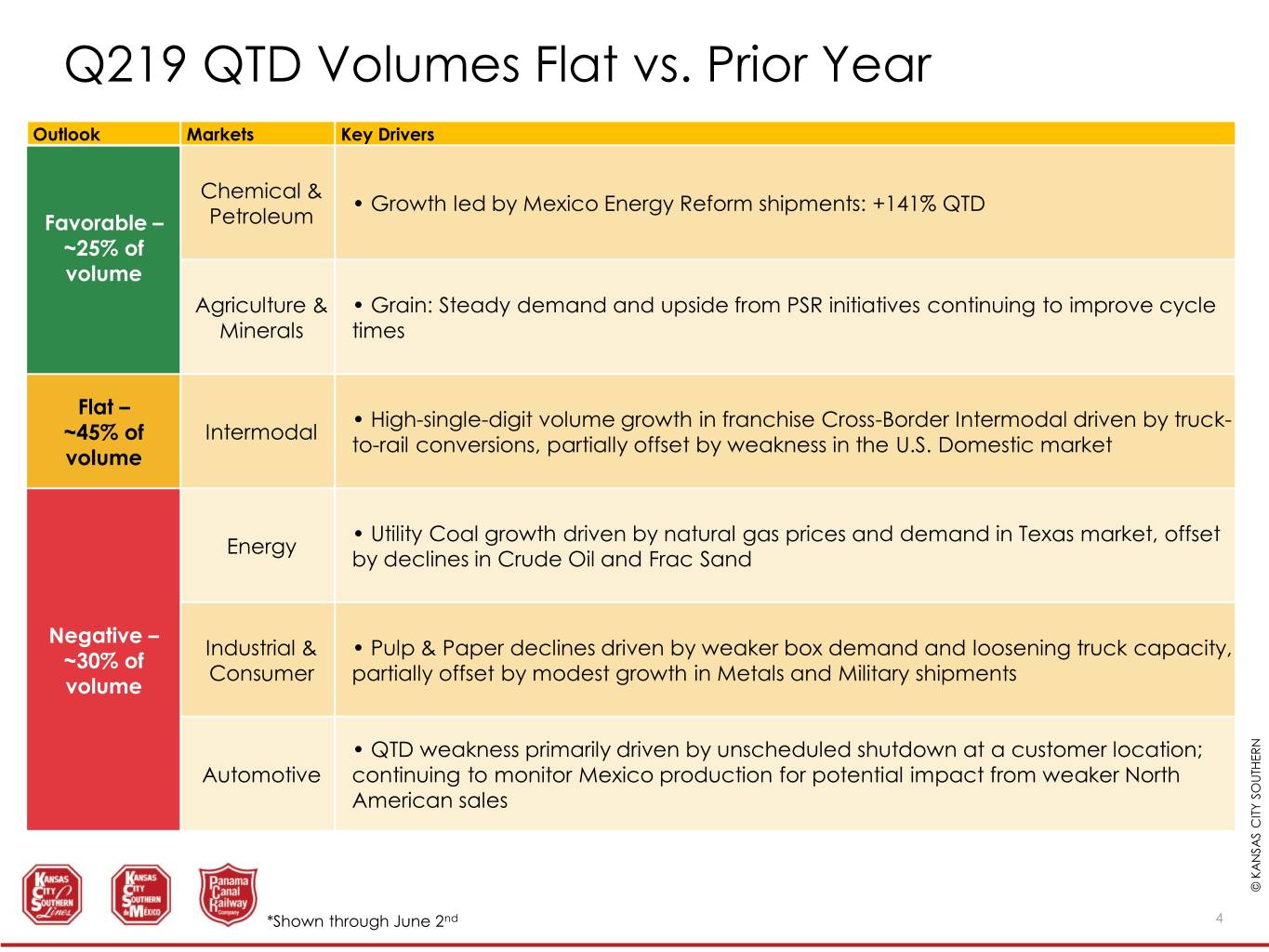

Q219 QTD Volumes Flat vs. Prior Year Outlook Markets Key Drivers Chemical & • Growth led by Mexico Energy Reform shipments: +141% QTD Favorable – Petroleum ~25% of volume Agriculture & • Grain: Steady demand and upside from PSR initiatives continuing to improve cycle Minerals times Flat – • High-single-digit volume growth in franchise Cross-Border Intermodal driven by truck- ~45% of Intermodal to-rail conversions, partially offset by weakness in the U.S. Domestic market volume • Utility Coal growth driven by natural gas prices and demand in Texas market, offset Energy by declines in Crude Oil and Frac Sand Negative – Industrial & • Pulp & Paper declines driven by weaker box demand and loosening truck capacity, ~30% of Consumer partially offset by modest growth in Metals and Military shipments volume • QTD weakness primarily driven by unscheduled shutdown at a customer location; Automotive continuing to monitor Mexico production for potential impact from weaker North American sales © KANSAS © KANSAS CITY SOUTHERN KCS *Shown through June 2nd 4

Refined Fuels Imports to MX – Unit Train Service Beaumont, TX Houston, TX Port Arthur, TX Corpus Christi, TX Salinas Victoria, NL San Luis Potosi, SL San Jose Iturbide, GJ Tula, HG Origin Terminal Destination Terminal © KANSAS CITY SOUTHERN KCS 5

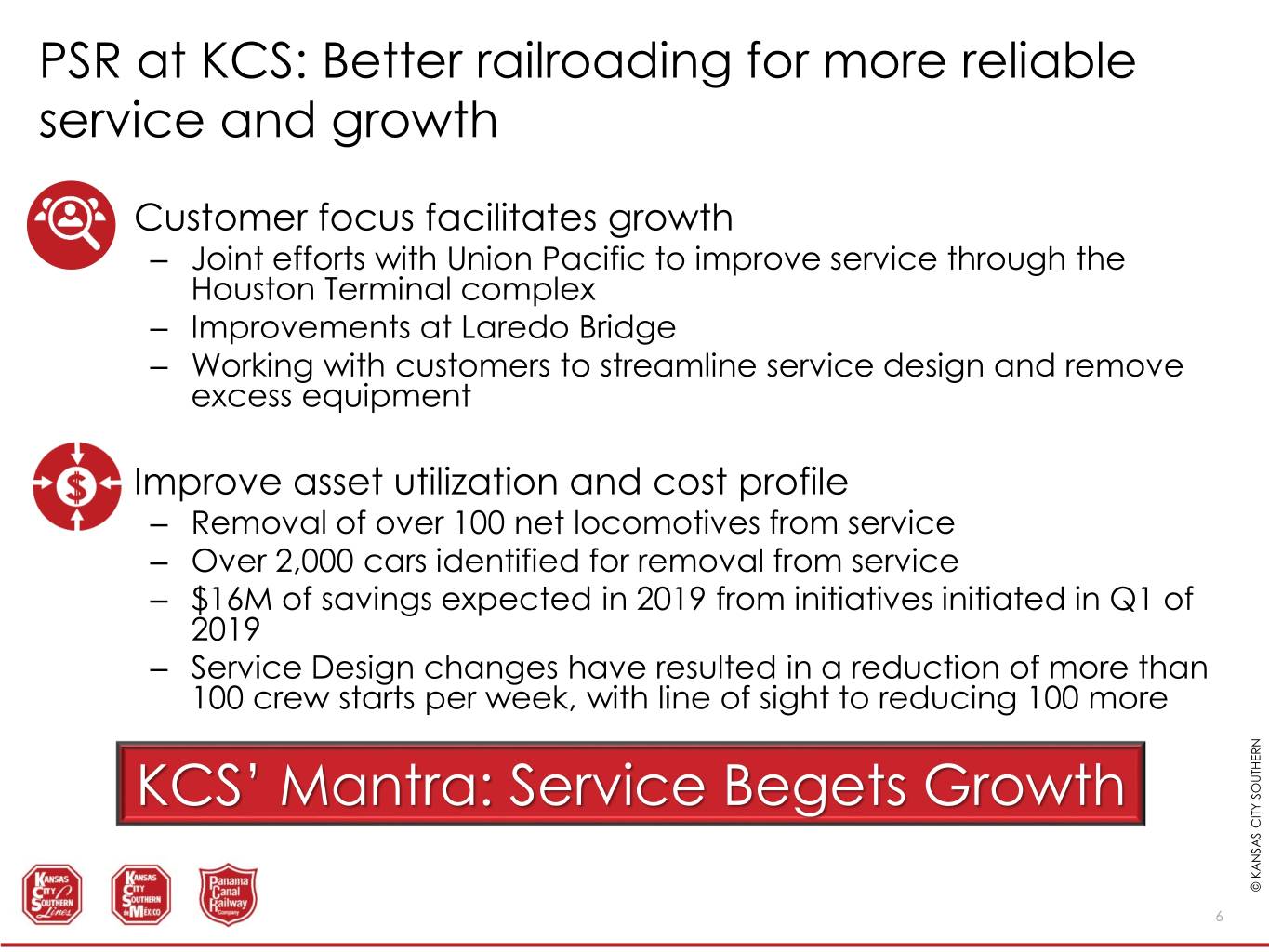

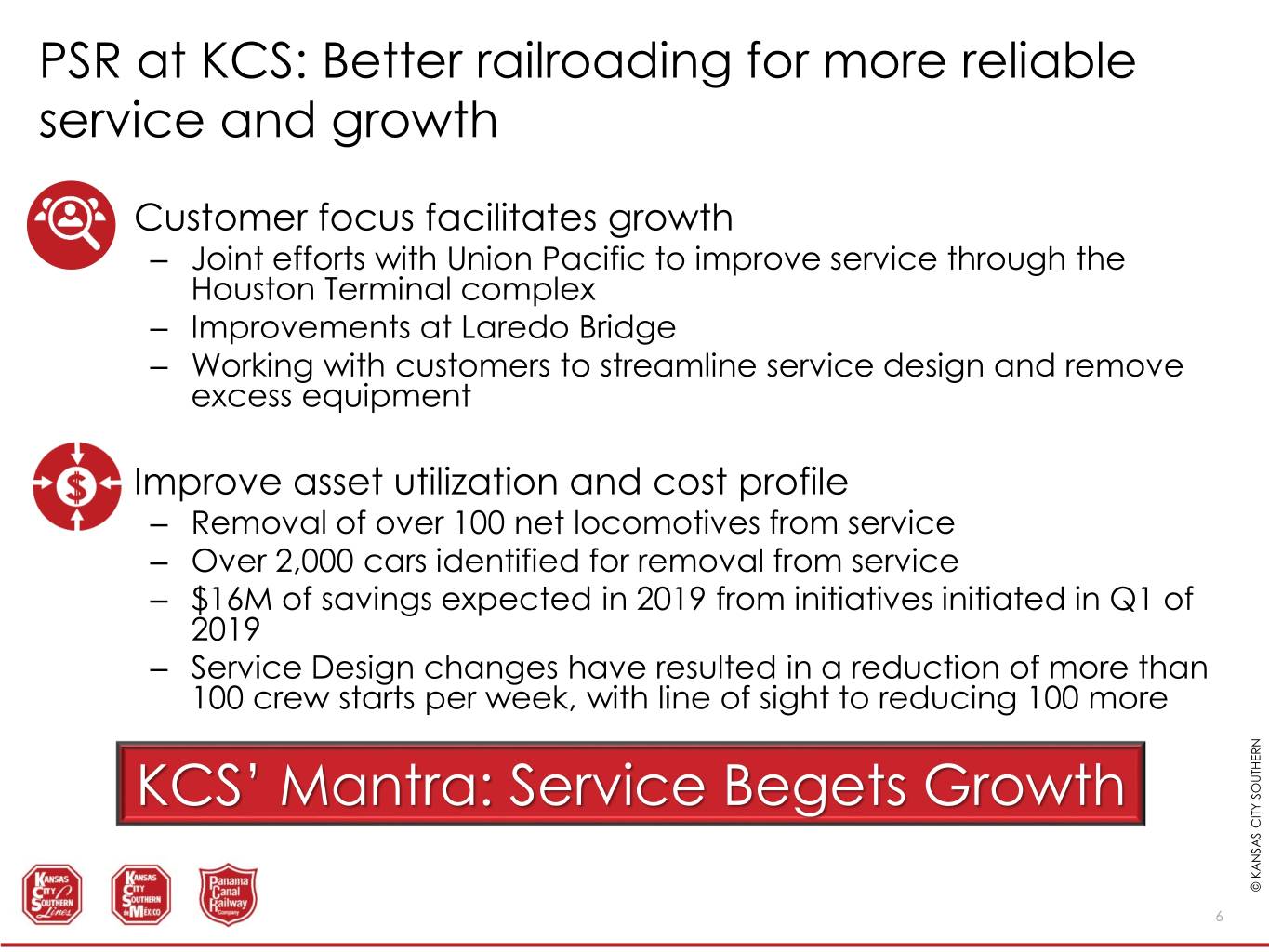

PSR at KCS: Better railroading for more reliable service and growth • Customer focus facilitates growth – Joint efforts with Union Pacific to improve service through the Houston Terminal complex – Improvements at Laredo Bridge – Working with customers to streamline service design and remove excess equipment • Improve asset utilization and cost profile – Removal of over 100 net locomotives from service – Over 2,000 cars identified for removal from service – $16M of savings expected in 2019 from initiatives initiated in Q1 of 2019 – Service Design changes have resulted in a reduction of more than 100 crew starts per week, with line of sight to reducing 100 more KCS’ Mantra: Service Begets Growth © KANSAS © KANSAS CITY SOUTHERN KCS 6

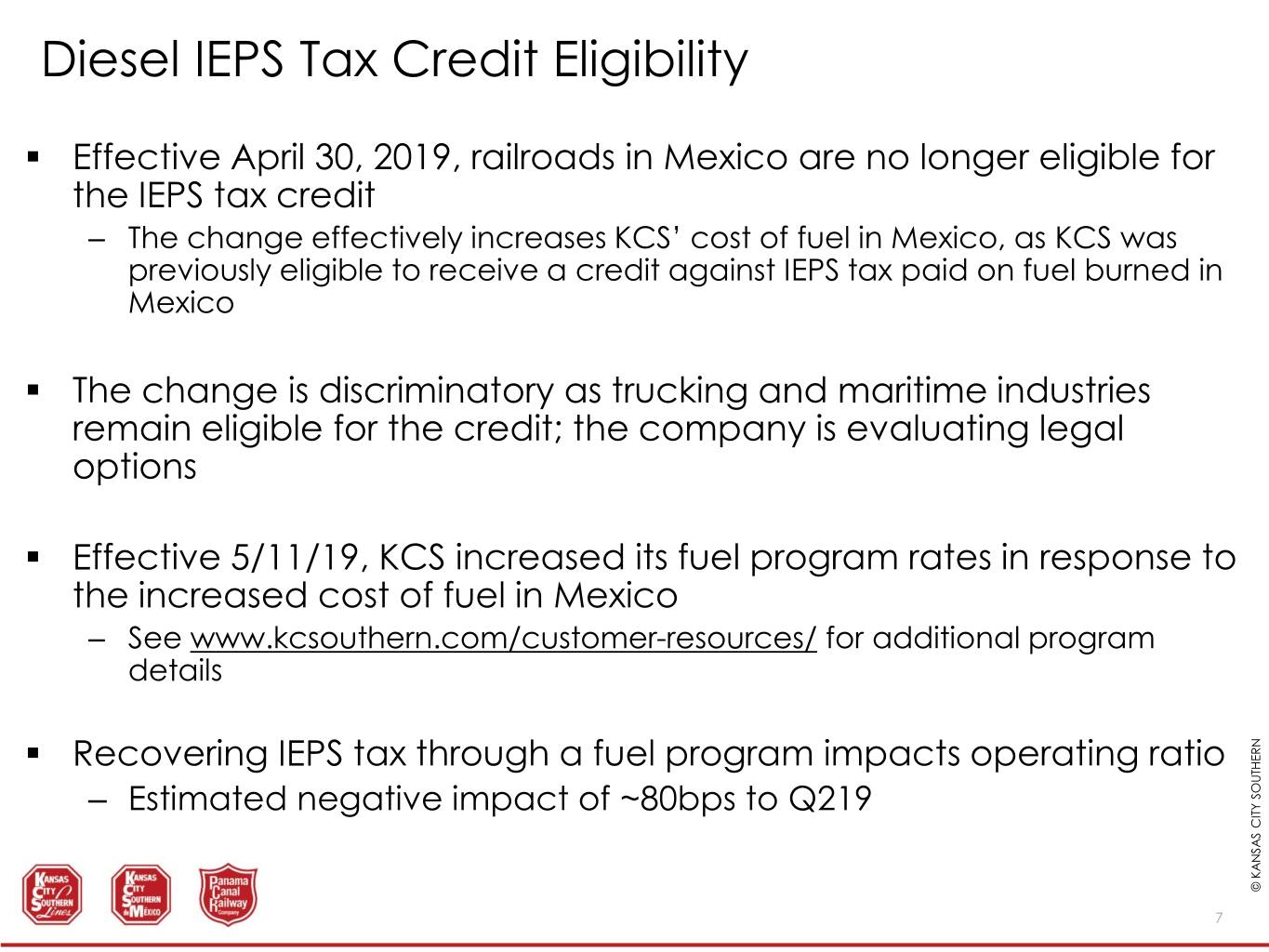

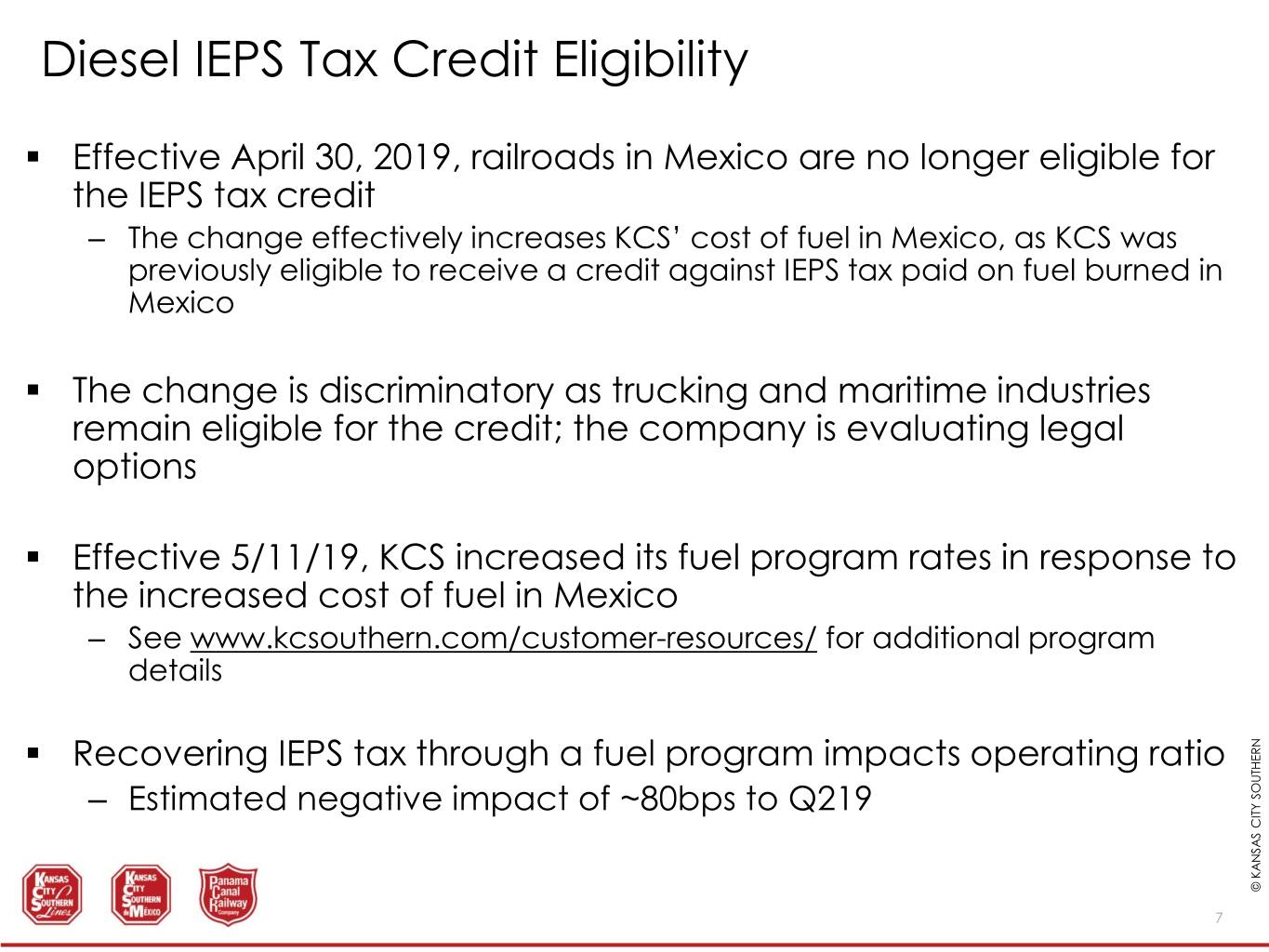

Diesel IEPS Tax Credit Eligibility . Effective April 30, 2019, railroads in Mexico are no longer eligible for the IEPS tax credit – The change effectively increases KCS’ cost of fuel in Mexico, as KCS was previously eligible to receive a credit against IEPS tax paid on fuel burned in Mexico . The change is discriminatory as trucking and maritime industries remain eligible for the credit; the company is evaluating legal options . Effective 5/11/19, KCS increased its fuel program rates in response to the increased cost of fuel in Mexico – See www.kcsouthern.com/customer-resources/ for additional program details . Recovering IEPS tax through a fuel program impacts operating ratio – Estimated negative impact of ~80bps to Q219 © KANSAS © KANSAS CITY SOUTHERN KCS 7

2018 Kansas City Southern Cross-Border Carloads Total Cross-Border Carloads* 41% of Total Carloads NB Cross-Border Carloads SB Cross-Border Carloads 16% of Total Carloads 25% of Total Carloads Other Other Grain & Food Products Automotive Intermodal Chemicals Intermodal Metals & Scrap © KANSAS © KANSAS CITY SOUTHERN KCS *Includes cross-border franchise & non-franchise carloads 8

© KANSAS © KANSAS CITY SOUTHERN KCS 9