KCS © K A N S A S C IT Y S O U TH E R N Raymond James 42nd Annual Institutional Investors Conference March 2, 2021 Exhibit 99.1

KCS © K A N S A S C IT Y S O U TH E R N Safe Harbor Statement This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended and the Private Securities Litigation Reform Act of 1995. In addition, management may make forward- looking statements orally or in other writing, including, but not limited to, in press releases, quarterly earnings calls, executive presentations, in the annual report to stockholders and in other filings with the Securities and Exchange Commission. Readers can usually identify these forward-looking statements by the use of such words as "may," "will," "should," "likely," "plans," "projects," "expects," "anticipates," "believes" or similar words. These statements involve a number of risks and uncertainties. Actual results could materially differ from those anticipated by such forward-looking statements as a result of a number of factors or combination of factors including, but not limited: public health threats or outbreaks of communicable diseases, such as the ongoing COVID-19 pandemic and its impact on KCS’s business, suppliers, consumers, customers, employees and supply chains; rail accidents or other incidents or accidents on KCS’s rail network or at KCS’s facilities or customer facilities involving the release of hazardous materials, including toxic inhalation hazards; legislative and regulatory developments and disputes, including environmental regulations; loss of the rail concession of Kansas City Southern’s subsidiary, Kansas City Southern de México, S.A. de C.V.; domestic and international economic, political and social conditions; disruptions to the Company’s technology infrastructure, including its computer systems; increased demand and traffic congestion; the level of trade between the United States and Asia or Mexico; fluctuations in the peso-dollar exchange rate; natural events such as severe weather, hurricanes and floods; the outcome of claims and litigation involving the Company or its subsidiaries; competition and consolidation within the transportation industry; the business environment in industries that produce and use items shipped by rail; the termination of, or failure to renew, agreements with customers, other railroads and third parties; fluctuation in prices or availability of key materials, in particular diesel fuel; access to capital; climate change and the market and regulatory responses to climate change; dependency on certain key suppliers of core rail equipment; changes in securities and capital markets; unavailability of qualified personnel; labor difficulties, including strikes and work stoppages; acts of terrorism or risk of terrorist activities, war or other acts of violence; and other factors affecting the operation of the business; and other risks identified in this presentation, in KCS's Annual Report on Form 10-K for the year ended December 31, 2020, and in other reports filed by KCS with the Securities and Exchange Commission. Forward-looking statements reflect the information only as of the date on which they are made. KCS does not undertake any obligation to update any forward-looking statements to reflect future events, developments, or other information. Reconciliation to U.S. GAAP Financial Information In addition to disclosing financial results in accordance with U.S. GAAP, the accompanying presentation contains non-GAAP financial measures. These non-GAAP measures should be viewed as a supplement to and not a substitute for our U.S. GAAP measures of performance and liquidity, and the financial results calculated in accordance with U.S. GAAP and reconciliations from these results should be carefully evaluated. All reconciliations to the most directly comparable financial measures calculated and presented in accordance with U.S. GAAP can be found on the KCS's website in the Investors section. This presentation contains forecasted financial measures within. Operating Ratio, Adjusted Diluted Earnings per Share, and Free Cash Flow are non- GAAP financial measures. The Company did not reconcile these forecasted financial measures to the most comparable GAAP measure because certain information necessary to calculate such measures on a GAAP basis was unavailable or dependent on the timing of future events outside of the Company's control. At the time the Company made these forward looking statements, the GAAP numbers included the strengthening or weakening of the Mexican Peso to U.S. Dollar and changes in fuel price, both of which could have a significant impact on the Company's consolidated results. Therefore, the Company was unable to reconcile, without unreasonable efforts, the forecasted financial measures to the most comparable GAAP measure. 2

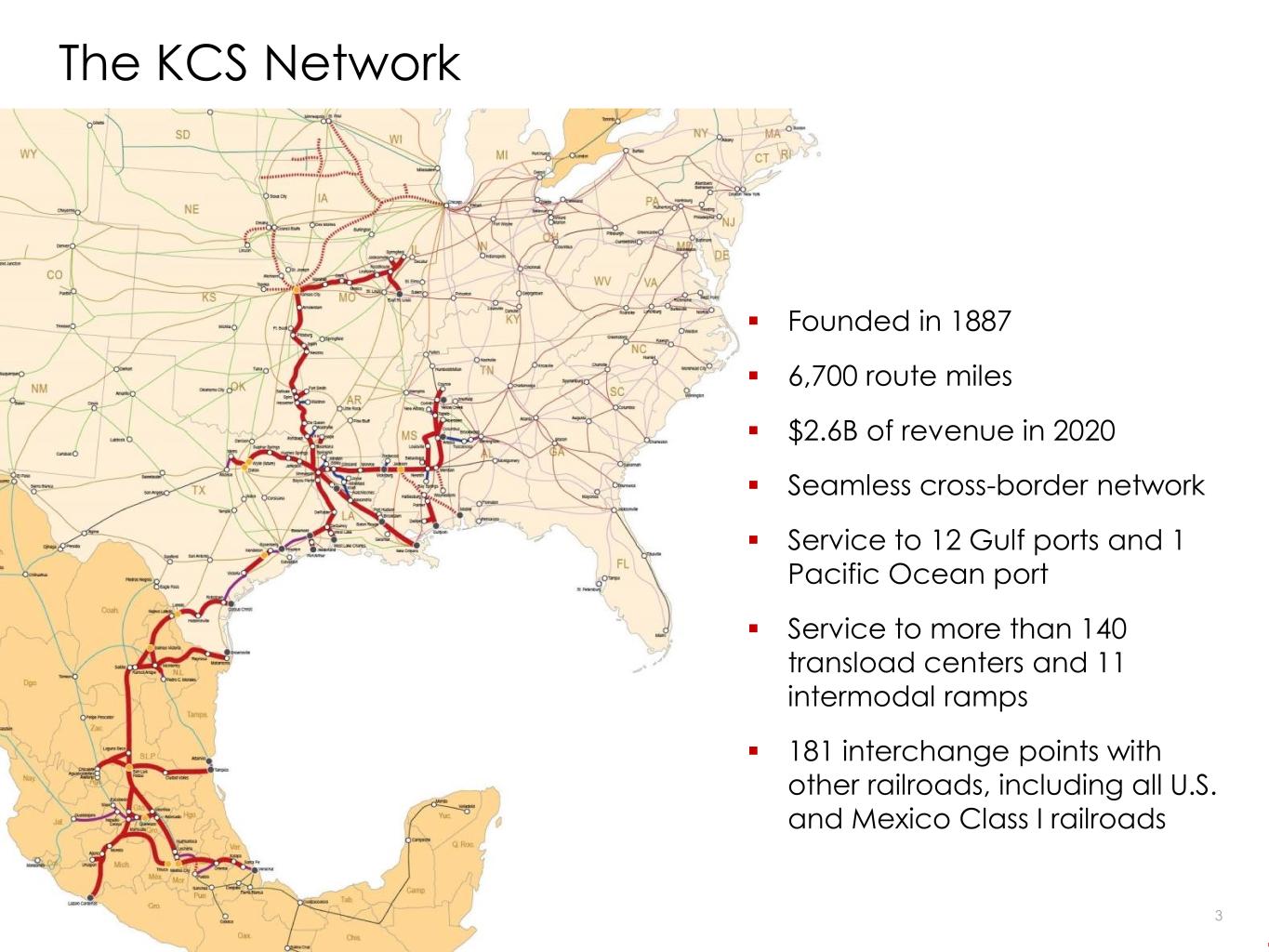

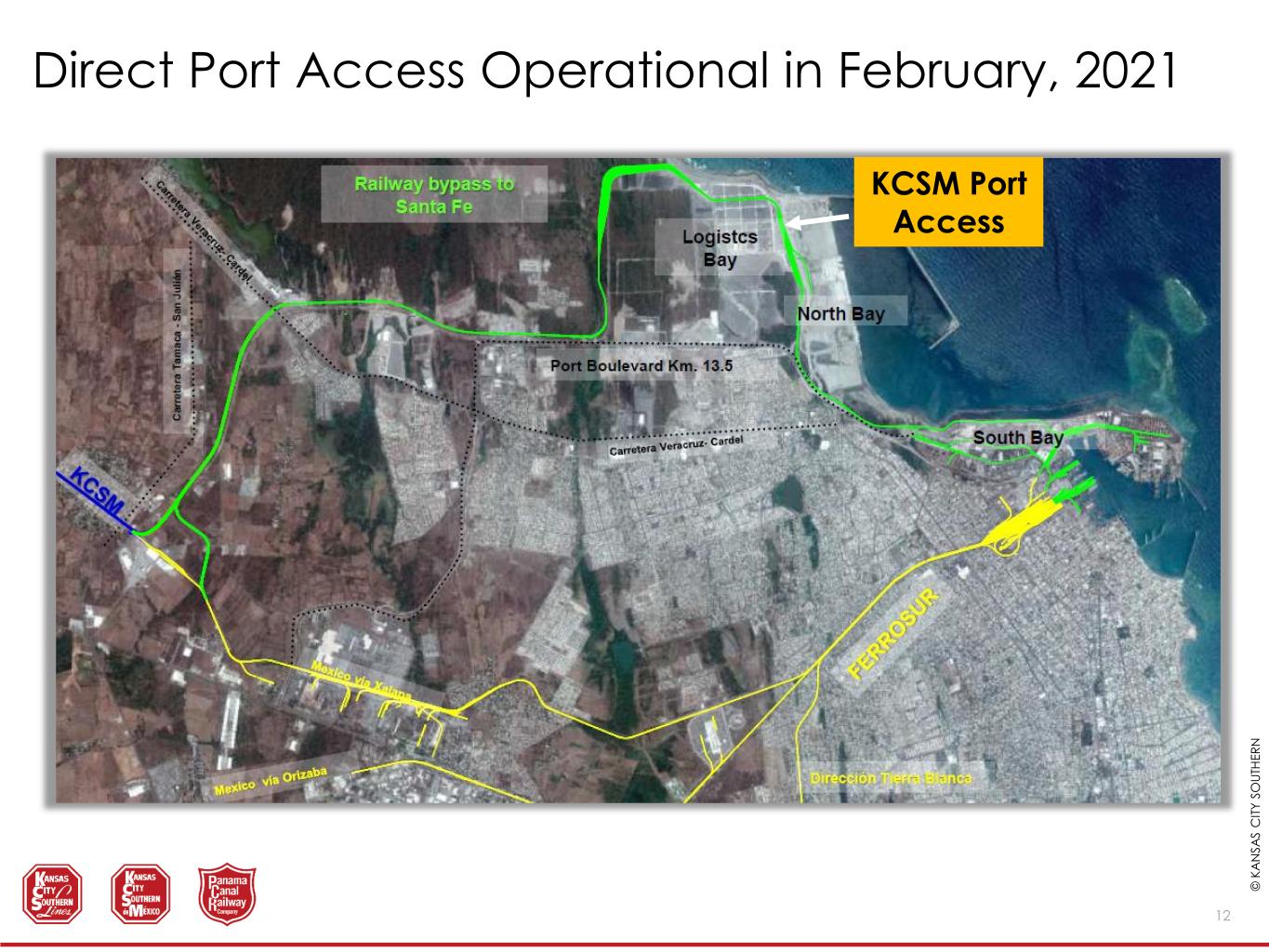

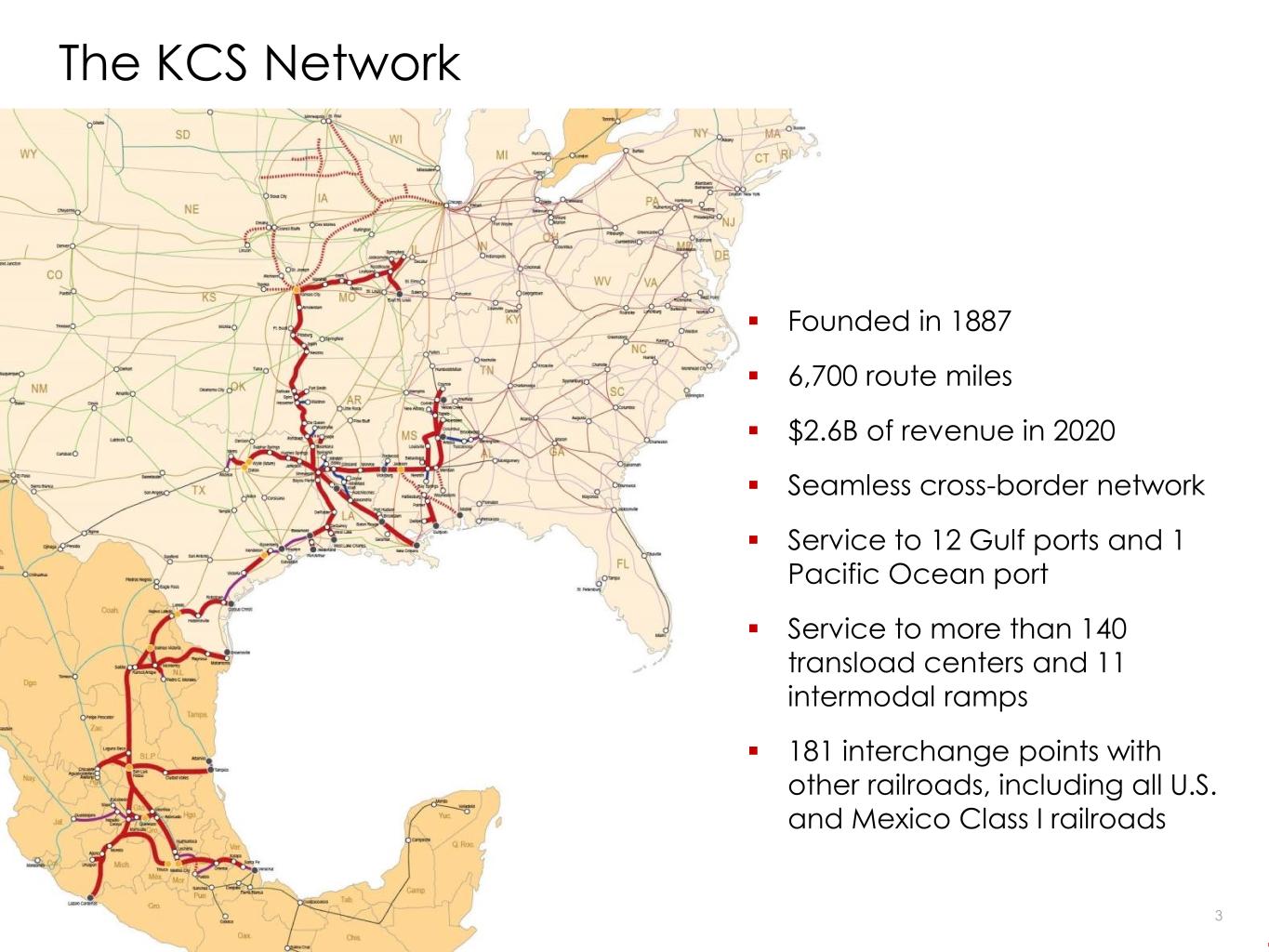

KCS © K A N S A S C IT Y S O U TH E R N The KCS Network Founded in 1887 6,700 route miles $2.6B of revenue in 2020 Seamless cross-border network Service to 12 Gulf ports and 1 Pacific Ocean port Service to more than 140 transload centers and 11 intermodal ramps 181 interchange points with other railroads, including all U.S. and Mexico Class I railroads 3

KCS © K A N S A S C IT Y S O U TH E R N BUSINESS UPDATE 4

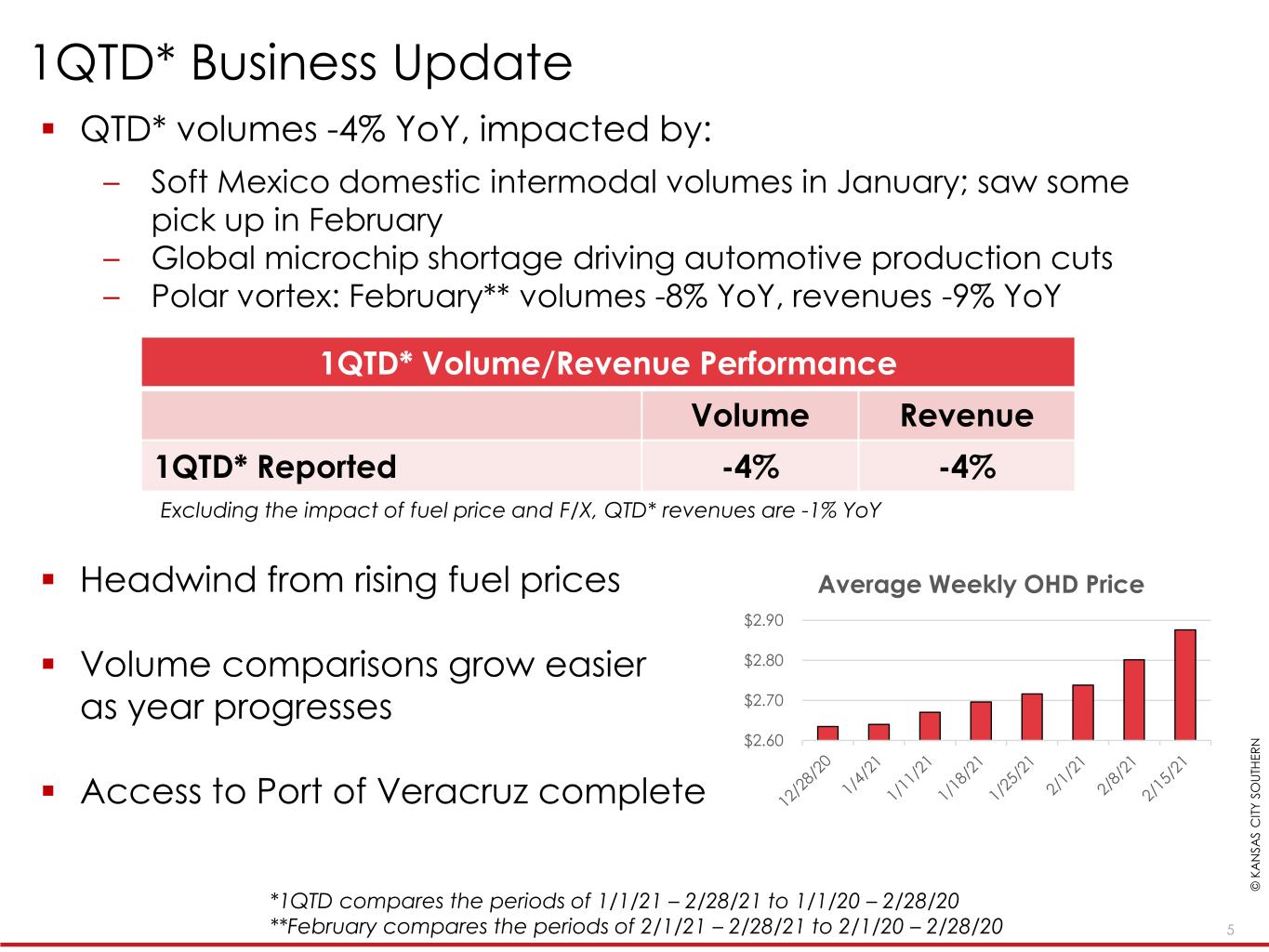

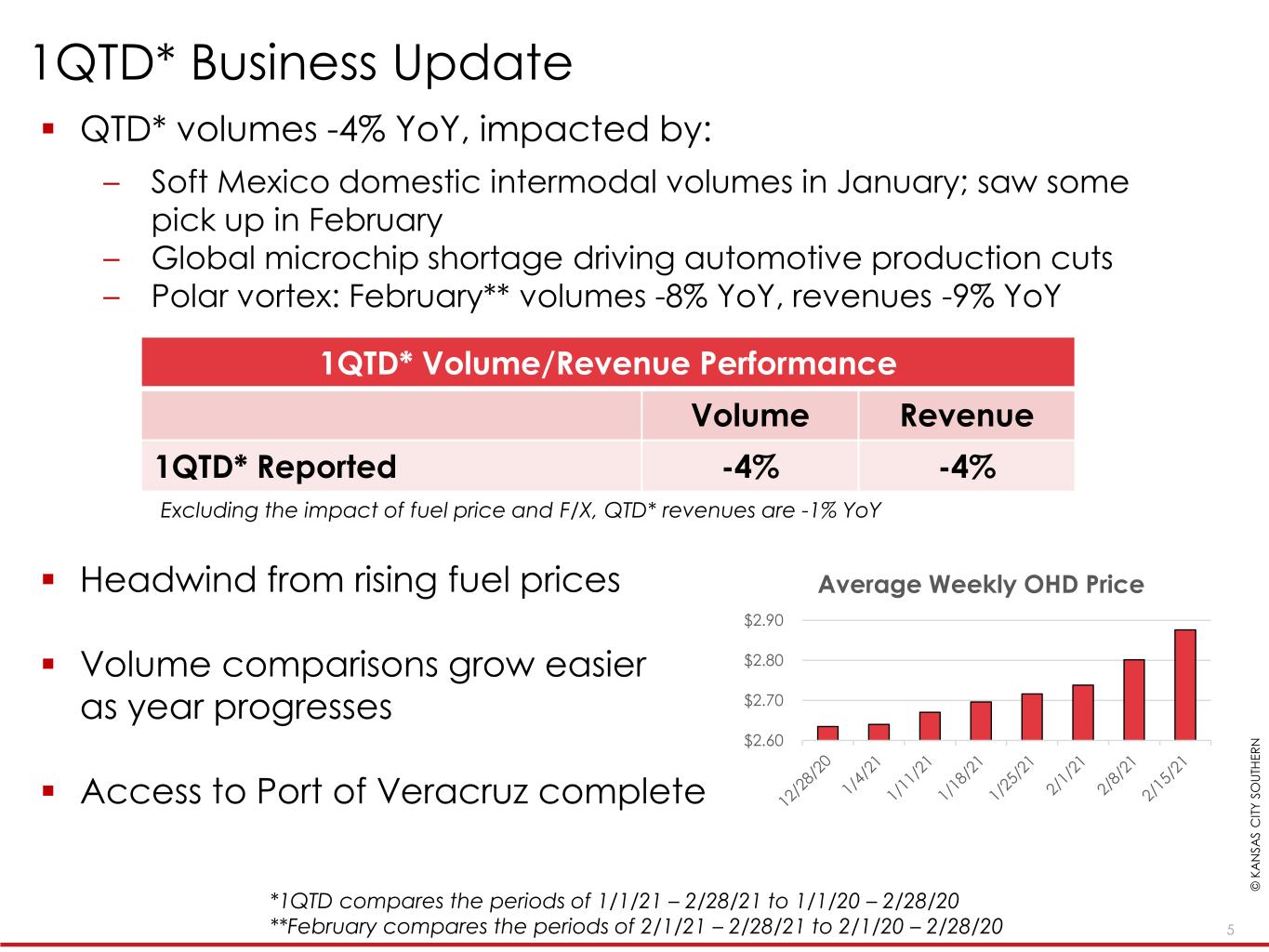

KCS © K A N S A S C IT Y S O U TH E R N QTD* volumes -4% YoY, impacted by: – Soft Mexico domestic intermodal volumes in January; saw some pick up in February – Global microchip shortage driving automotive production cuts – Polar vortex: February** volumes -8% YoY, revenues -9% YoY Headwind from rising fuel prices Volume comparisons grow easier as year progresses Access to Port of Veracruz complete 1QTD* Business Update 5 *1QTD compares the periods of 1/1/21 – 2/28/21 to 1/1/20 – 2/28/20 **February compares the periods of 2/1/21 – 2/28/21 to 2/1/20 – 2/28/20 1QTD* Volume/Revenue Performance Volume Revenue 1QTD* Reported -4% -4% Excluding the impact of fuel price and F/X, QTD* revenues are -1% YoY $2.60 $2.70 $2.80 $2.90 Average Weekly OHD Price

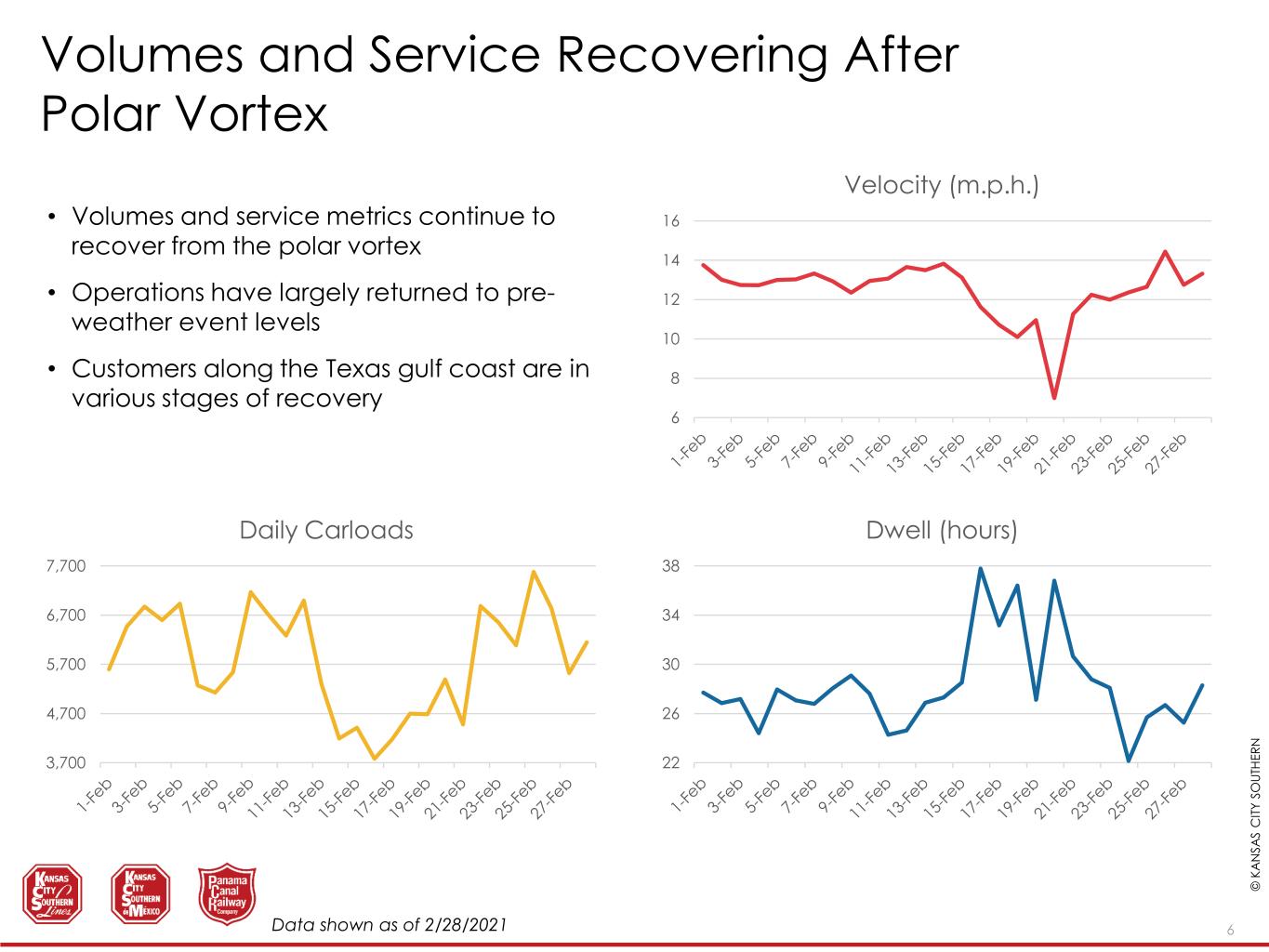

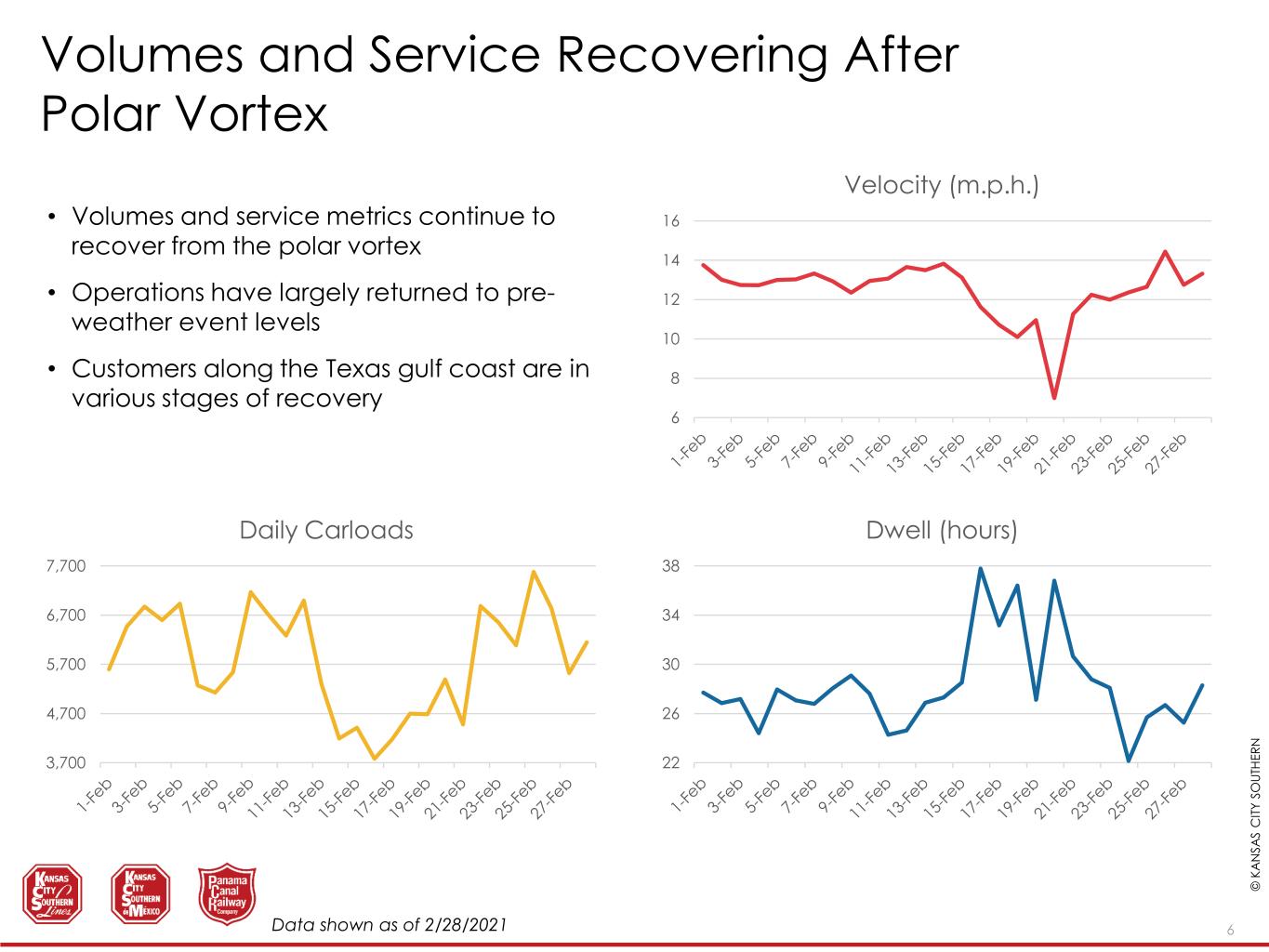

KCS © K A N S A S C IT Y S O U TH E R N Volumes and Service Recovering After Polar Vortex 6 6 8 10 12 14 16 Velocity (m.p.h.) 22 26 30 34 38 Dwell (hours) 3,700 4,700 5,700 6,700 7,700 Daily Carloads • Volumes and service metrics continue to recover from the polar vortex • Operations have largely returned to pre- weather event levels • Customers along the Texas gulf coast are in various stages of recovery Data shown as of 2/28/2021

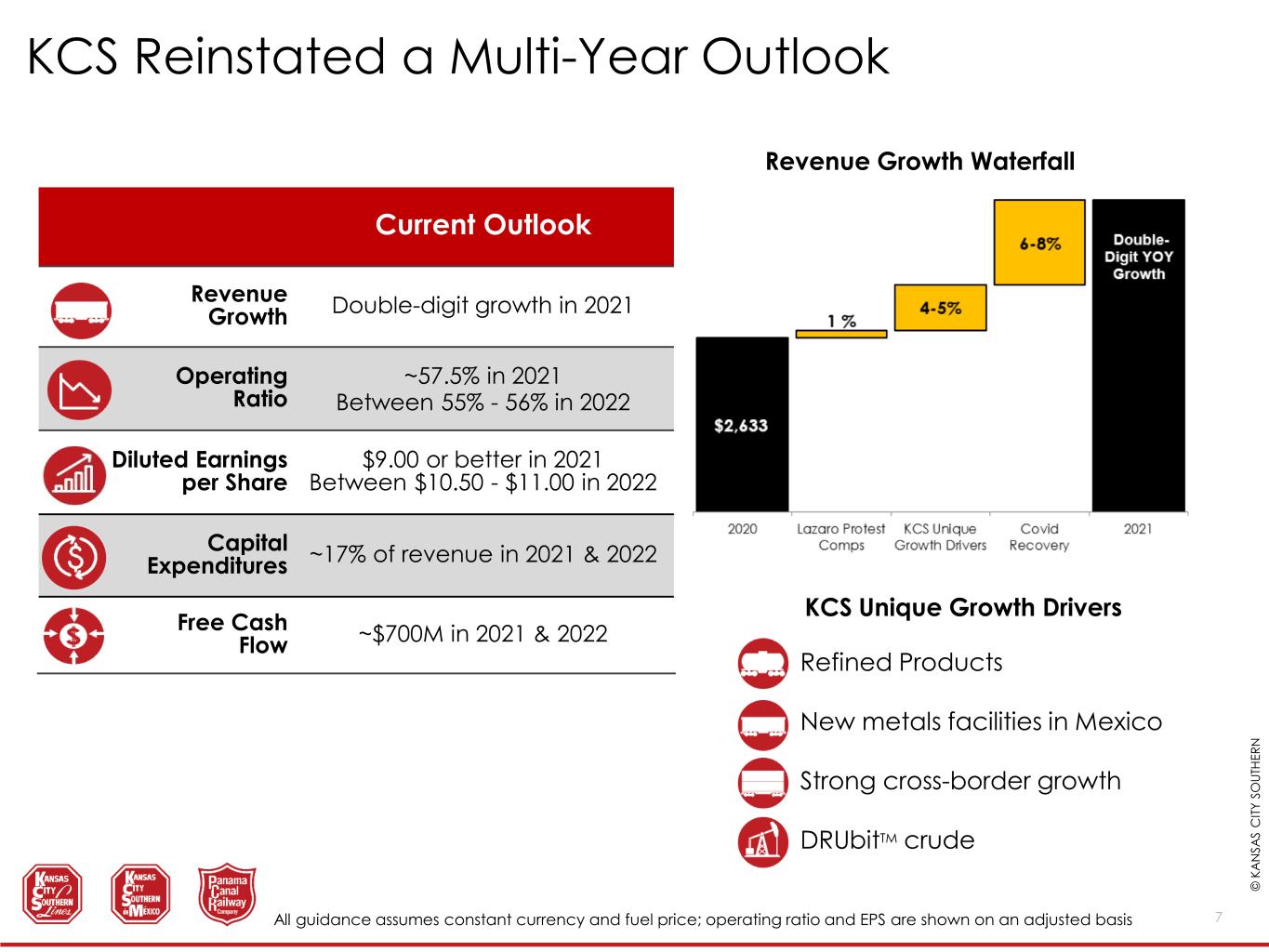

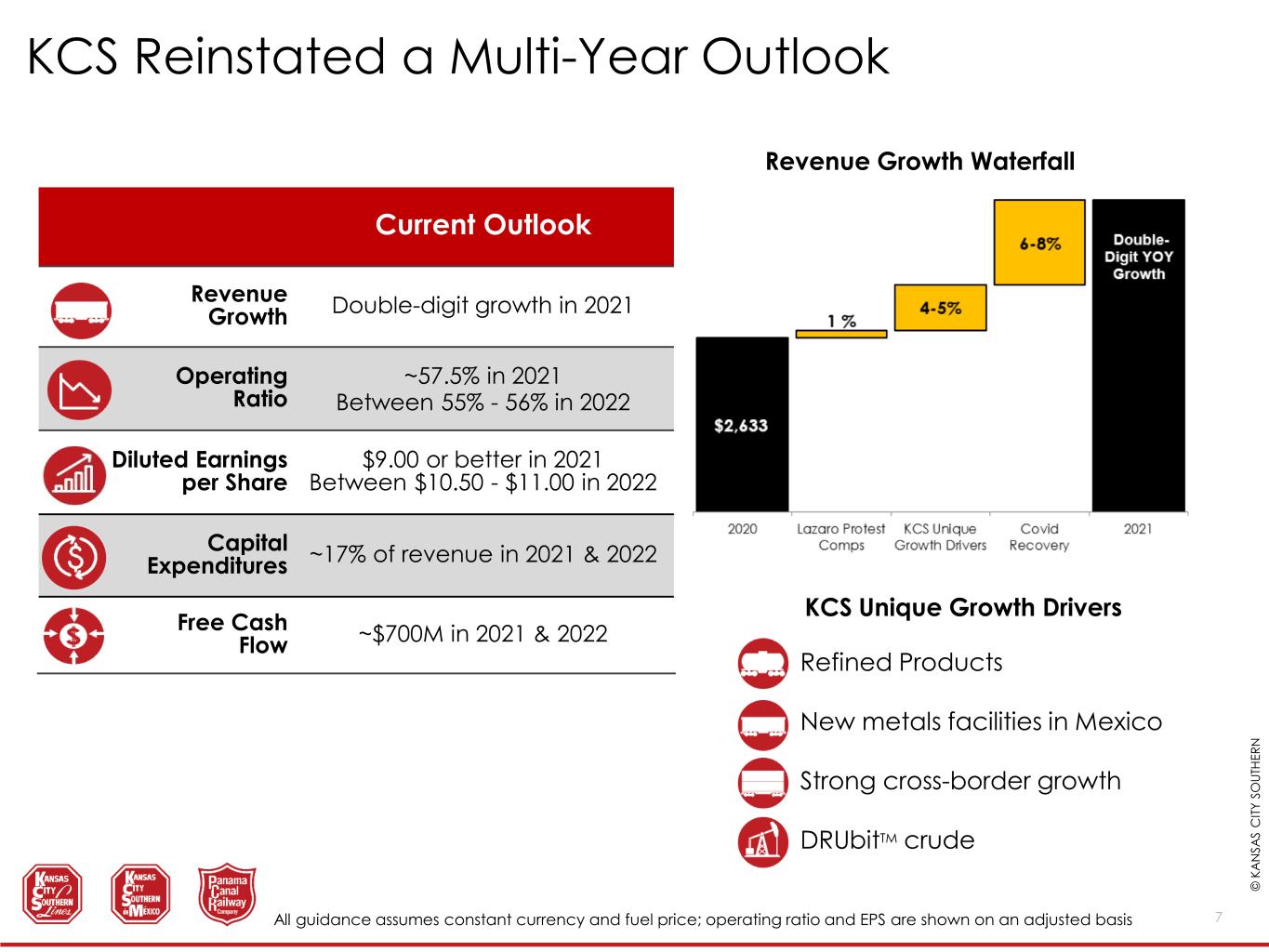

KCS © K A N S A S C IT Y S O U TH E R N KCS Unique Growth Drivers Refined Products New metals facilities in Mexico Strong cross-border growth DRUbitTM crude KCS Reinstated a Multi-Year Outlook 7 Current Outlook Revenue Growth Double-digit growth in 2021 Operating Ratio ~57.5% in 2021 Between 55% - 56% in 2022 Diluted Earnings per Share $9.00 or better in 2021 Between $10.50 - $11.00 in 2022 Capital Expenditures ~17% of revenue in 2021 & 2022 Free Cash Flow ~$700M in 2021 & 2022 All guidance assumes constant currency and fuel price; operating ratio and EPS are shown on an adjusted basis Revenue Growth Waterfall

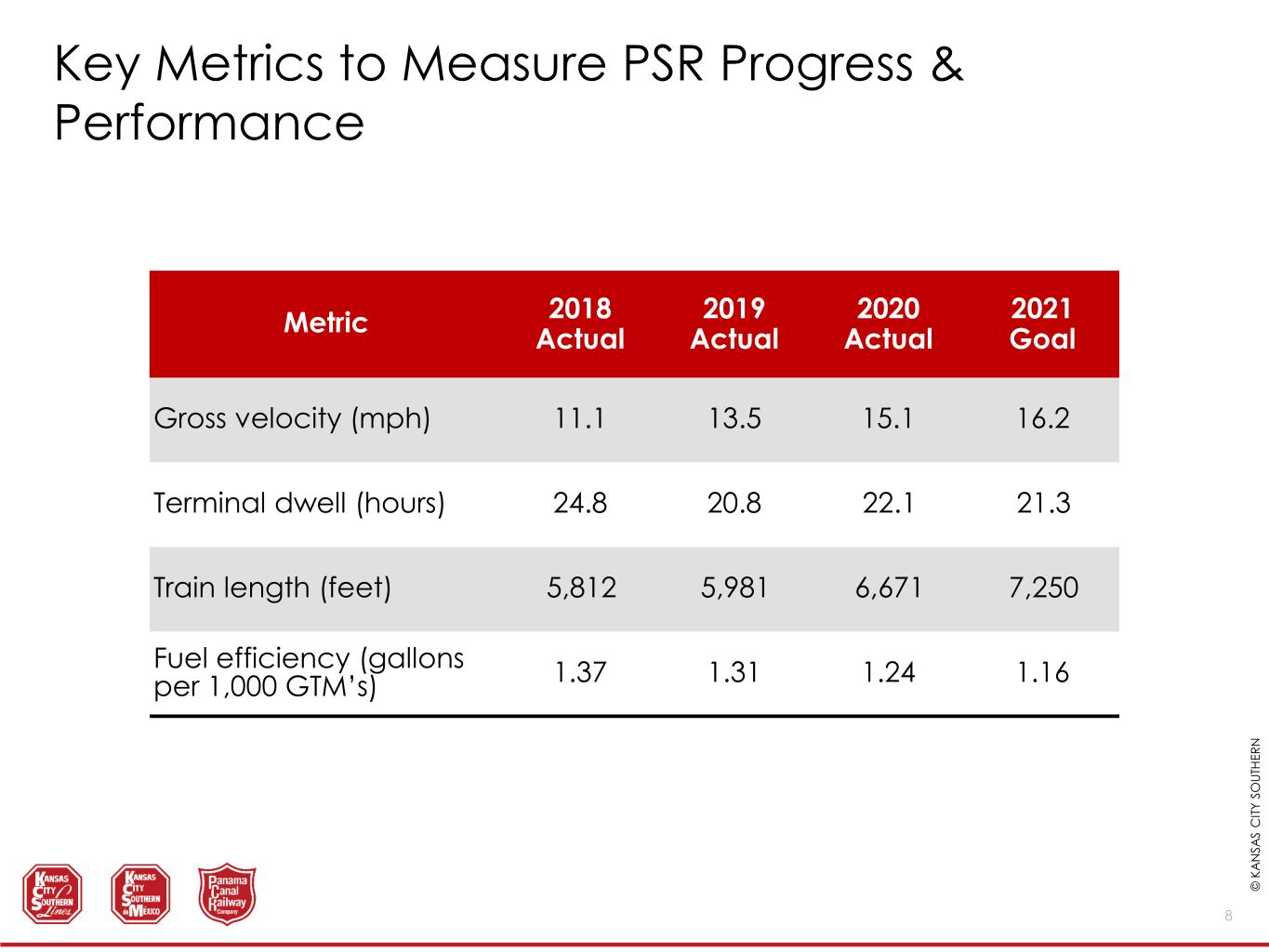

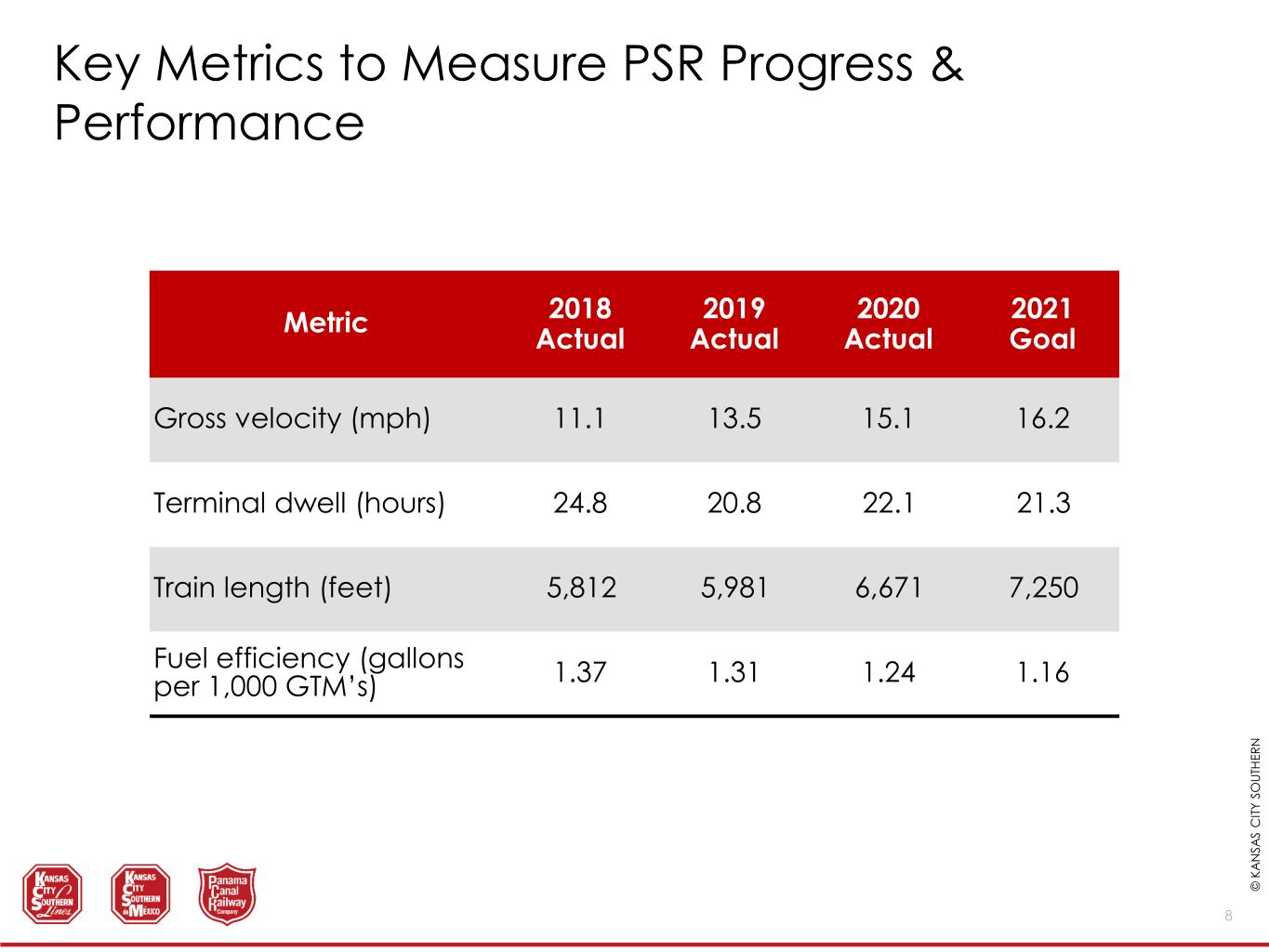

KCS © K A N S A S C IT Y S O U TH E R N Metric 2018 Actual 2019 Actual 2020 Actual 2021 Goal Gross velocity (mph) 11.1 13.5 15.1 16.2 Terminal dwell (hours) 24.8 20.8 22.1 21.3 Train length (feet) 5,812 5,981 6,671 7,250 Fuel efficiency (gallons per 1,000 GTM’s) 1.37 1.31 1.24 1.16 Key Metrics to Measure PSR Progress & Performance 8

KCS © K A N S A S C IT Y S O U TH E R N PORT OF VERACRUZ 9

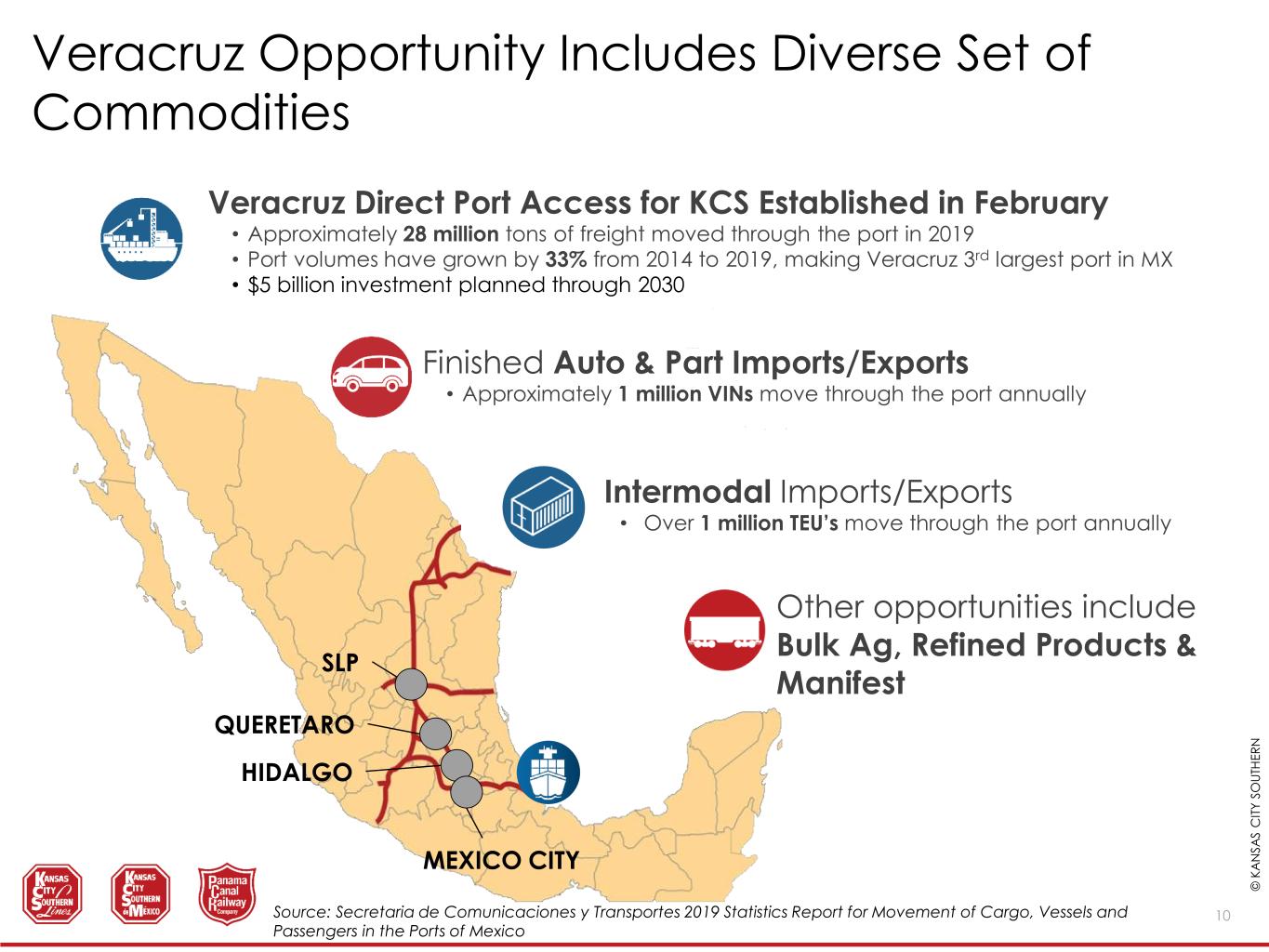

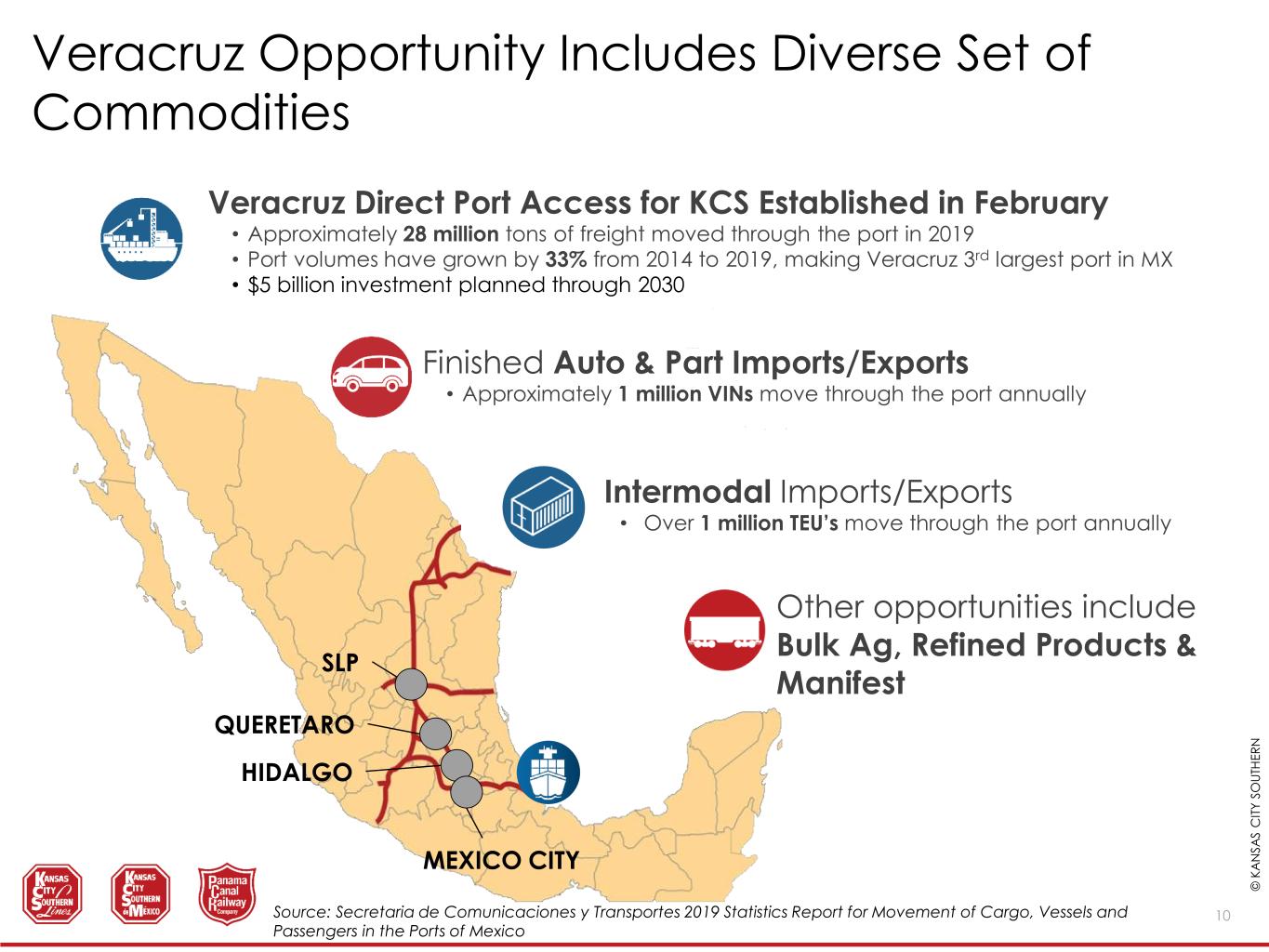

KCS © K A N S A S C IT Y S O U TH E R N Veracruz Opportunity Includes Diverse Set of Commodities 10 Finished Auto & Part Imports/Exports • Approximately 1 million VINs move through the port annually Intermodal Imports/Exports • Over 1 million TEU’s move through the port annually Veracruz Direct Port Access for KCS Established in February • Approximately 28 million tons of freight moved through the port in 2019 • Port volumes have grown by 33% from 2014 to 2019, making Veracruz 3rd largest port in MX • $5 billion investment planned through 2030 SLP MEXICO CITY HIDALGO QUERETARO Other opportunities include Bulk Ag, Refined Products & Manifest Source: Secretaria de Comunicaciones y Transportes 2019 Statistics Report for Movement of Cargo, Vessels and Passengers in the Ports of Mexico

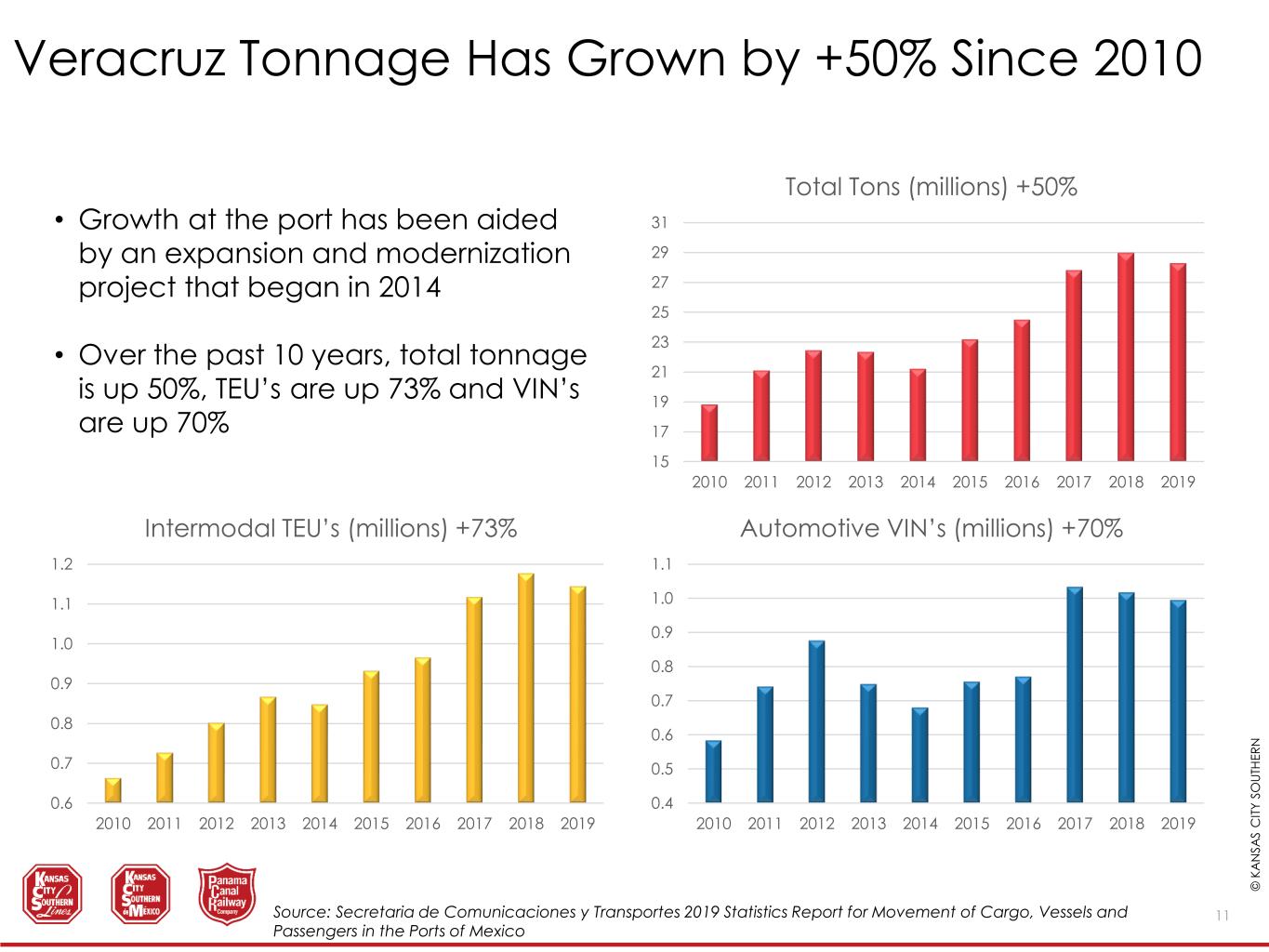

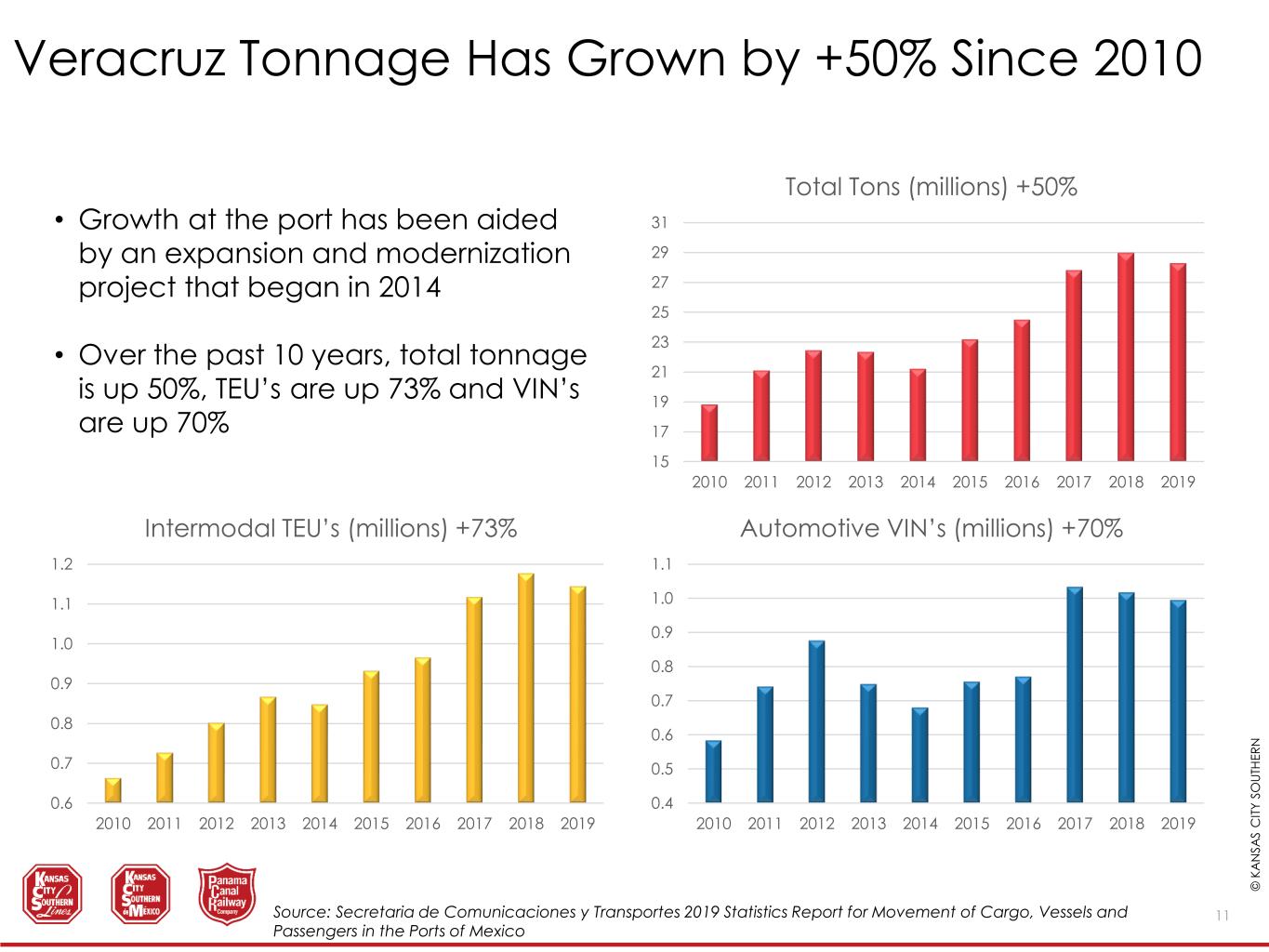

KCS © K A N S A S C IT Y S O U TH E R N 11 15 17 19 21 23 25 27 29 31 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Total Tons (millions) +50% 0.6 0.7 0.8 0.9 1.0 1.1 1.2 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Intermodal TEU’s (millions) +73% 0.4 0.5 0.6 0.7 0.8 0.9 1.0 1.1 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Automotive VIN’s (millions) +70% Veracruz Tonnage Has Grown by +50% Since 2010 • Growth at the port has been aided by an expansion and modernization project that began in 2014 • Over the past 10 years, total tonnage is up 50%, TEU’s are up 73% and VIN’s are up 70% Source: Secretaria de Comunicaciones y Transportes 2019 Statistics Report for Movement of Cargo, Vessels and Passengers in the Ports of Mexico

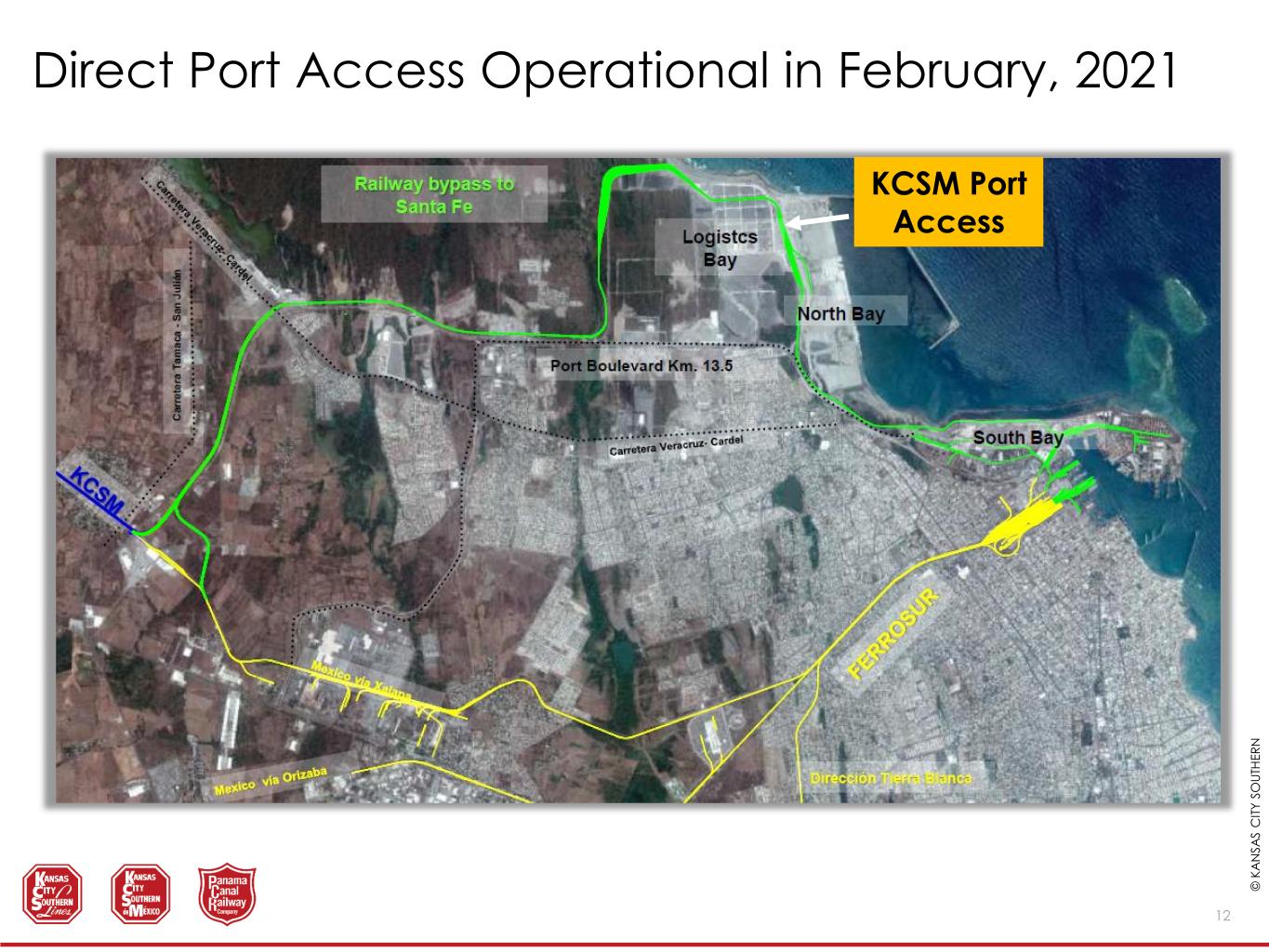

KCS © K A N S A S C IT Y S O U TH E R N 12 Direct Port Access Operational in February, 2021 KCSM Port Access

KCS © K A N S A S C IT Y S O U TH E R N 13 Original Port Expanded & Modernized Port Port Expansion & Modernization Began in 2014 KCSM Port Access

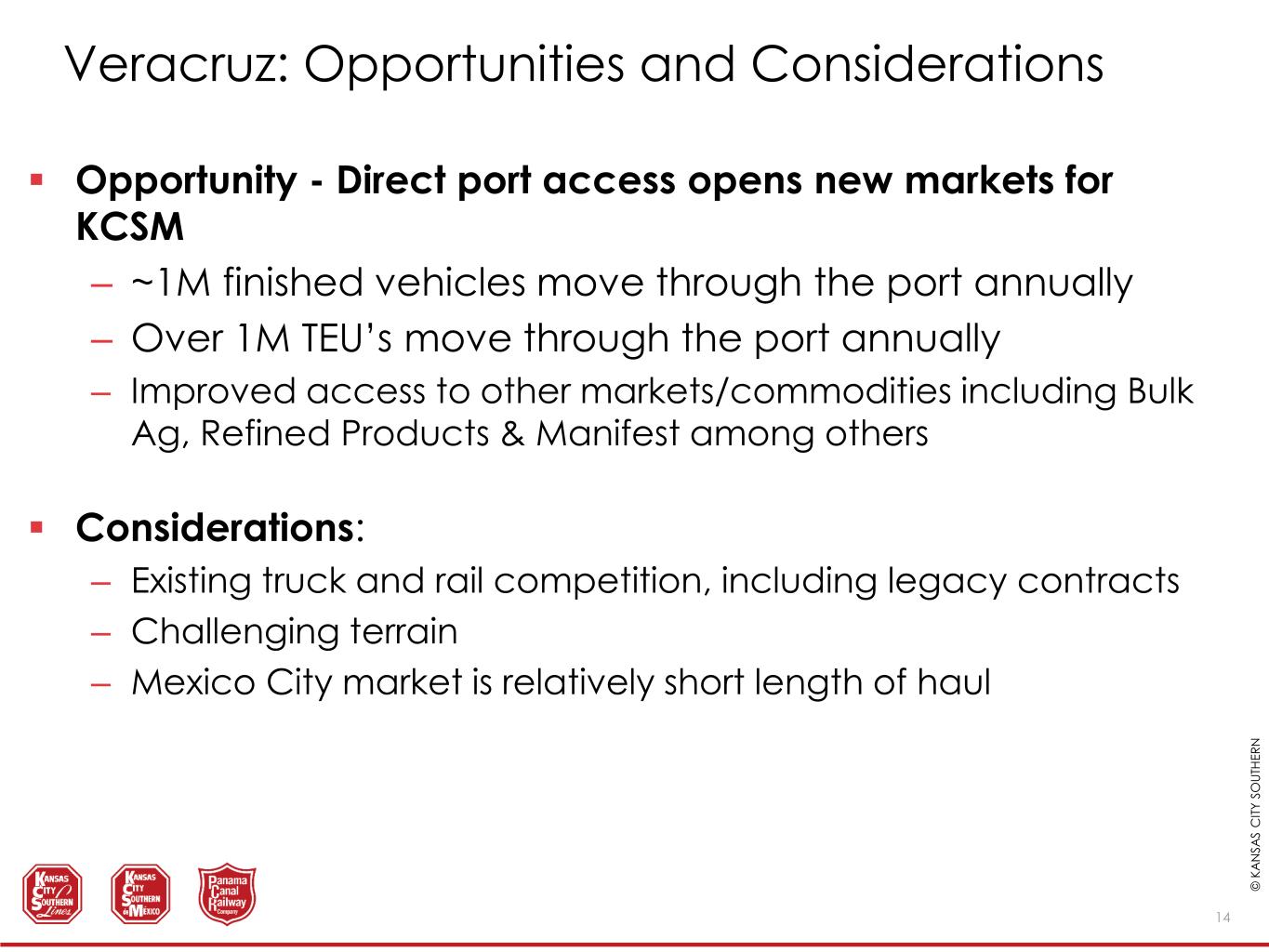

KCS © K A N S A S C IT Y S O U TH E R N Opportunity - Direct port access opens new markets for KCSM – ~1M finished vehicles move through the port annually – Over 1M TEU’s move through the port annually – Improved access to other markets/commodities including Bulk Ag, Refined Products & Manifest among others Considerations: – Existing truck and rail competition, including legacy contracts – Challenging terrain – Mexico City market is relatively short length of haul Veracruz: Opportunities and Considerations 14