Exhibit 99.1

Kansas City Southern Mike Up church - Executive Vice President & CFO Wells Fargo Securities 2013 Industrial and Construction Conference May 9, 2013

Safe Harbor Statement This presentation contains “forward-looking statements” within the meaning of the securities laws concerning potential future events involving KCS and its subsidiaries, which could materially differ from the events that actually occur. The words “projects,” “estimates,” “forecasts,” “believes,” “intends,” “expects,” “anticipates,” and similar expressions are intended to identify forward-looking statements. Such forward-looking statements are based upon information currently available to management and management’s perception thereof as of the date of this presentation. Differences that actually occur could be caused by a number of external factors over which management has little or no control, including: competition and consolidation within the transportation industry; the business environment in industries that produce and consume rail freight; revocation of the rail concession of KCS’s subsidiary, Kansas City Southern de México, S.A. de C.V.; the termination of, or failure to renew, agreements with customers, other railroads and third parties; interest rates; access to capital; disruptions to KCS’s technology infrastructure, including its computer systems; natural events such as severe weather, hurricanes and floods; market and regulatory responses to climate change; credit risk of customers and counterparties and their failure to meet their financial obligations; legislative and regulatory developments and disputes; rail accidents or other incidents or accidents along KCS’s rail network, facilities or customer facilities involving the release of hazardous materials, including toxic inhalation hazards; fluctuation in prices or availability of key materials, in particular diesel fuel; dependency on certain key suppliers of core rail equipment; changes in securities and capital markets; loss of key personnel; labor difficulties, including strikes and work stoppages; insufficiency of insurance to cover lost revenue, profits or other damages; acts of terrorism or risk of terrorist activities; war or risk of war; domestic and international economic conditions; political and economic conditions in Mexico and the level of trade between the United States and Mexico; the outcome of claims and litigation involving KCS or its subsidiaries; and other factors affecting the operation of the business. More detailed information about these factors may be found in filings by KCS with the Securities and Exchange Commission, including KCS’s Annual Report on Form 10-K for the year ended December 31, 2012 (File No. 1-4717) and subsequent reports. Forward-looking statements are not, and should not be relied upon as, a guarantee of future performance or results, nor will they necessarily prove to be accurate indications of the times at or by which any such performance or results will be achieved. As a result, actual outcomes and results may differ materially from those expressed in forward-looking statements. KCS is not obligated to update any forward-looking statements in this presentation to reflect future events or developments. All reconciliations to GAAP can be found on the KCS website, kcsouthern.com/investors. Kansas City Southern ©2013 2

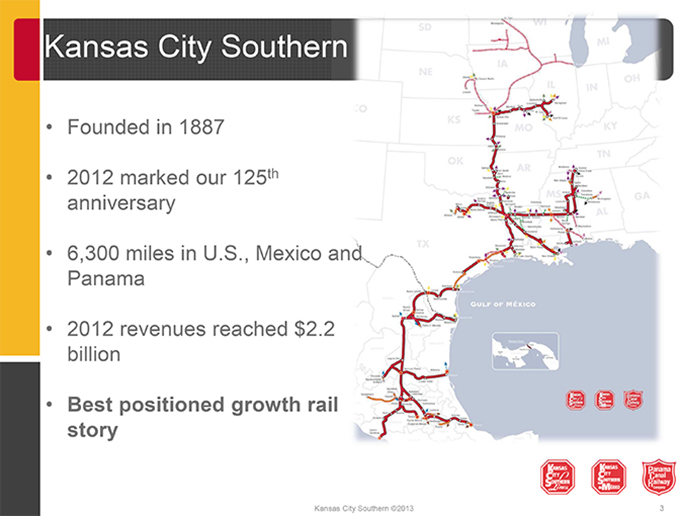

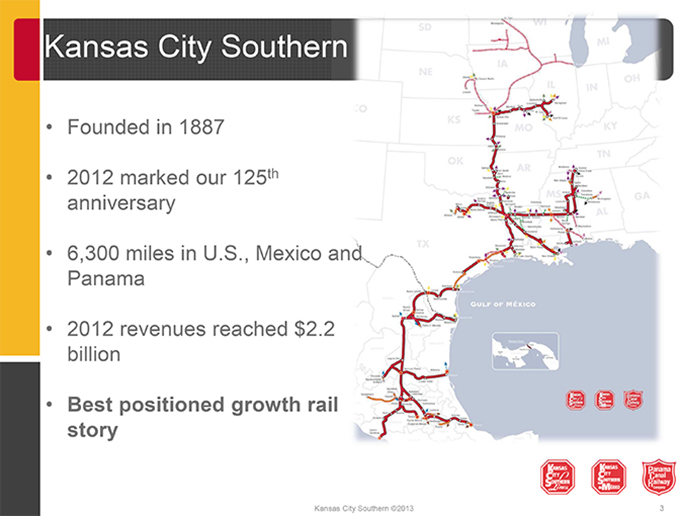

Founded in 1887 2012 marked our 125th anniversary 6,300 miles in U.S., Mexico and Panama 2012 revenues reached $2.2 billion Best positioned growth rail story Kansas City Southern ©2013 3

Q1 2013 Financial Results & Business Update Kansas City Southern ©2013 4

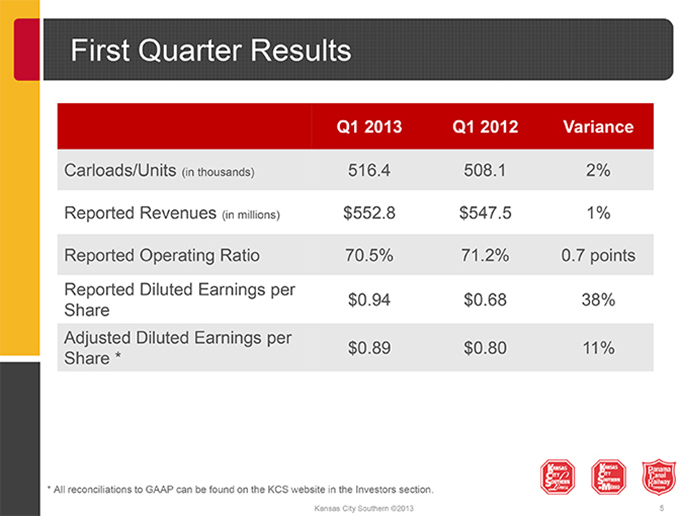

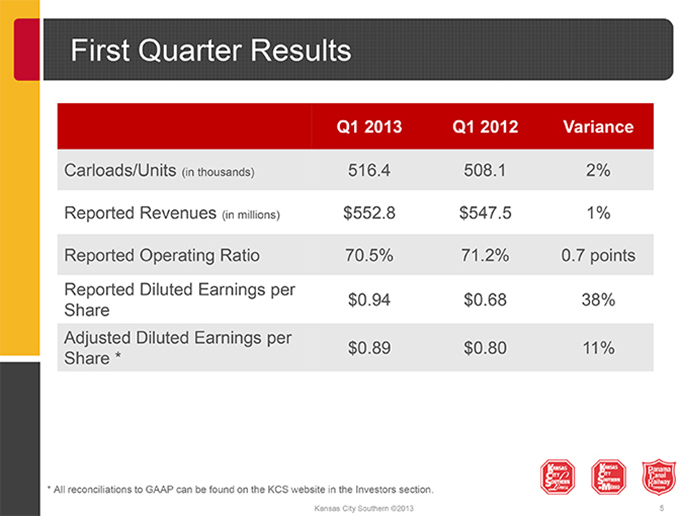

First Quarter Results

Q1 2013 Q1 2012 Variance

Carloads/Units (in thousands) 516.4 508.1 2%

Reported Revenues (in millions) $552.8 $547.5 1%

Reported Operating Ratio 70.5% 71.2% 0.7 points

Reported Diluted Earnings per

$0.94 $0.68 38% Share Adjusted Diluted Earnings per

$0.89 $0.80 11% Share *

* All reconciliations to GAAP can be found on the KCS website in the Investors section.

Kansas City Southern ©2013 5

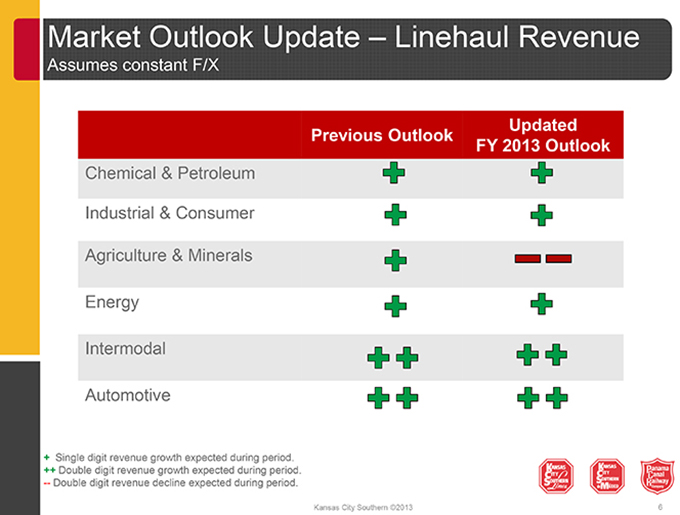

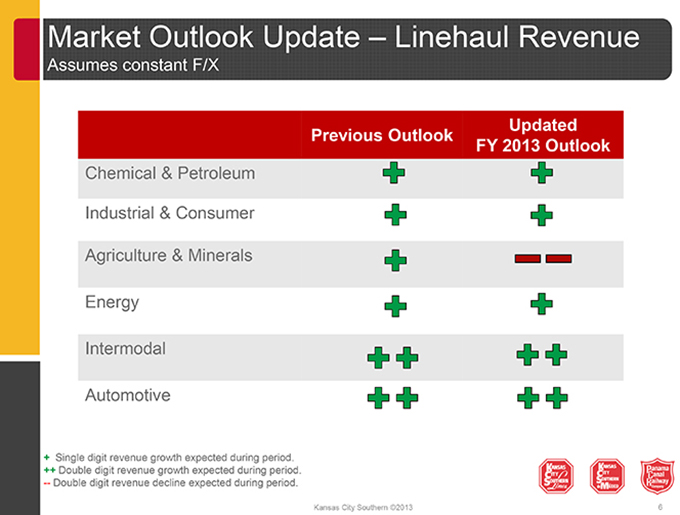

Market Outlook Update – Linehaul Revenue

Assumes constant F/X

Updated Previous Outlook FY 2013 Outlook

Chemical & Petroleum Industrial & Consumer Agriculture & Minerals Energy Intermodal Automotive

+ Single digit revenue growth expected during period.

++ Double digit revenue growth expected during period.

-- Double digit revenue decline expected during period.

Kansas City Southern ©2013 6

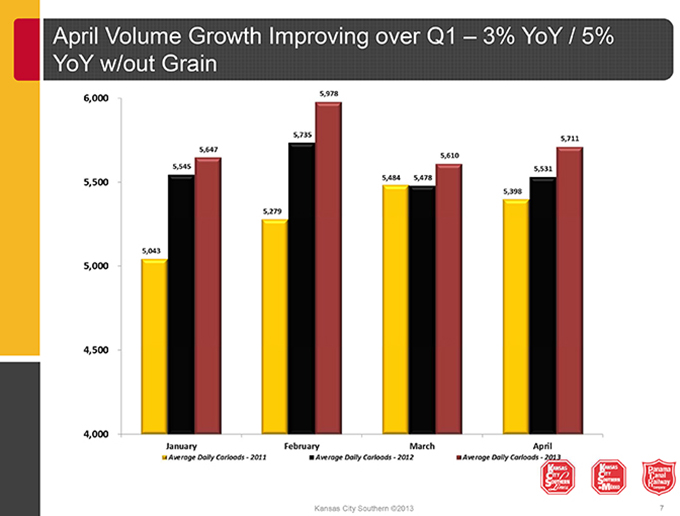

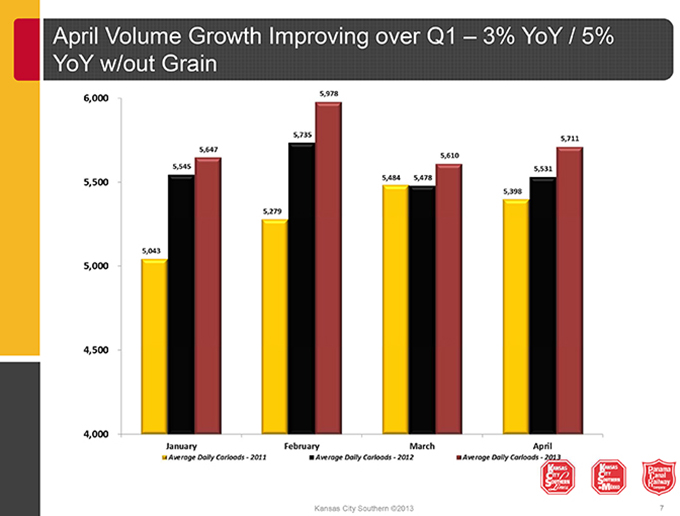

April Volume Growth Improving over Q1 – 3% YoY / 5% YoY w/out Grain

Kansas City Southern ©2013 7

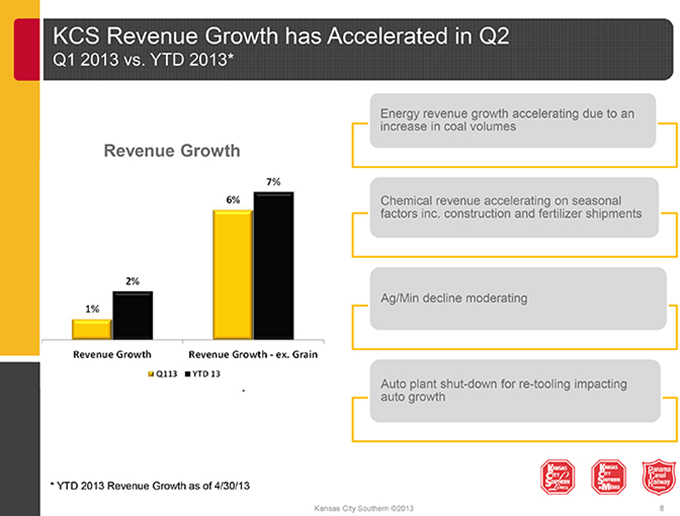

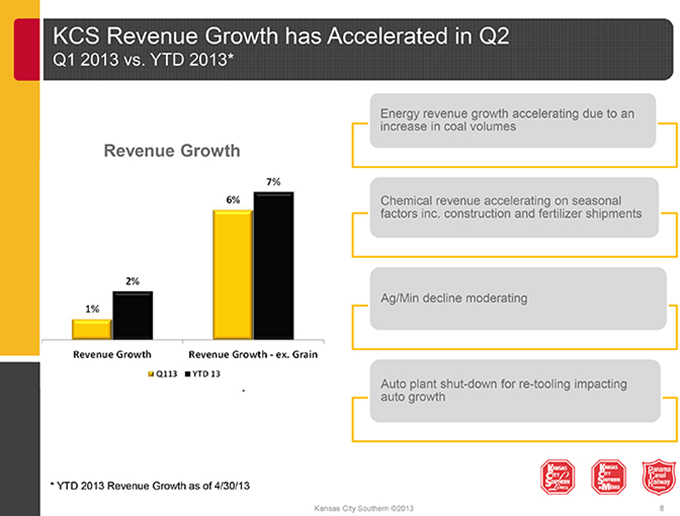

KCS Revenue Growth has Accelerated in Q2

Q1 2013 vs. YTD 2013*

Energy revenue growth accelerating due to an increase in coal volumes

Revenue Growth

Chemical revenue accelerating on seasonal factors inc. construction and fertilizer shipments

Ag/Min decline moderating

Auto plant shut-down for re-tooling impacting * auto growth

* YTD 2013 Revenue Growth as of 4/30/13

Kansas City Southern ©2013 8

Capital Structure & Credit

Kansas City Southern ©2013 9

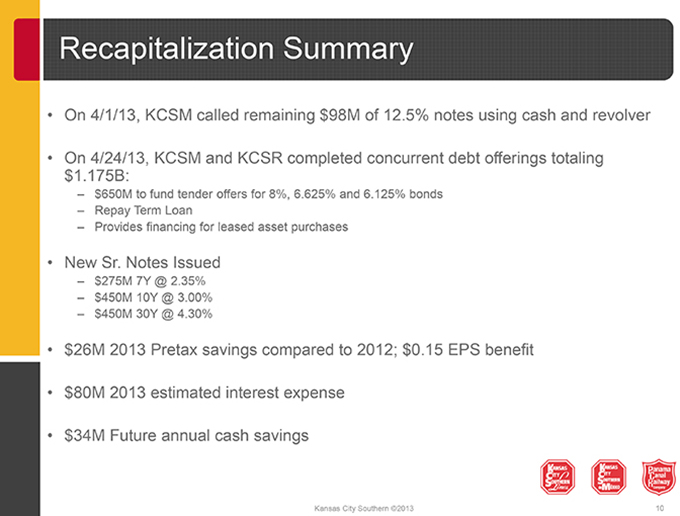

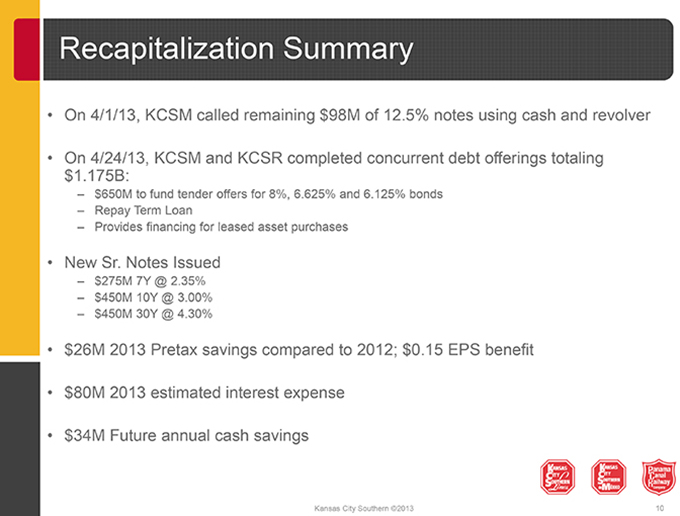

Recapitalization Summary

On 4/1/13, KCSM called remaining $98M of 12.5% notes using cash and revolver

On 4/24/13, KCSM and KCSR completed concurrent debt offerings totaling $1.175B:

– $650M to fund tender offers for 8%, 6.625% and 6.125% bonds

– Repay Term Loan

– Provides financing for leased asset purchases

New Sr. Notes Issued

– $275M 7Y @ 2.35%

– $450M 10Y @ 3.00%

– $450M 30Y @ 4.30%

$26M 2013 Pretax savings compared to 2012; $0.15 EPS benefit

$80M 2013 estimated interest expense

$34M Future annual cash savings

Kansas City Southern ©2013 10

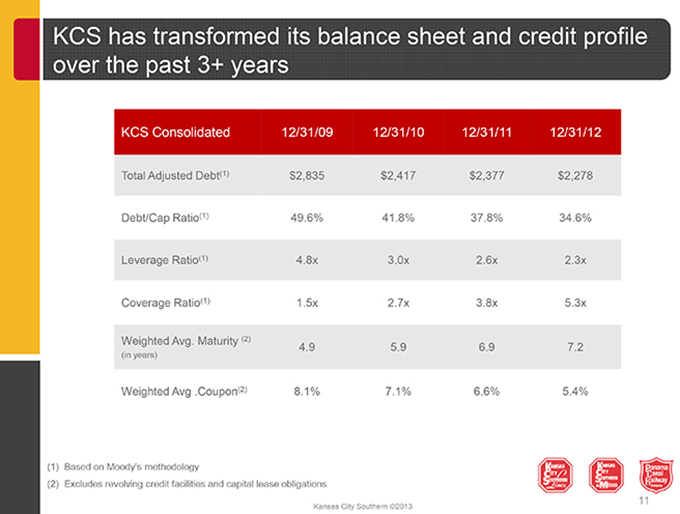

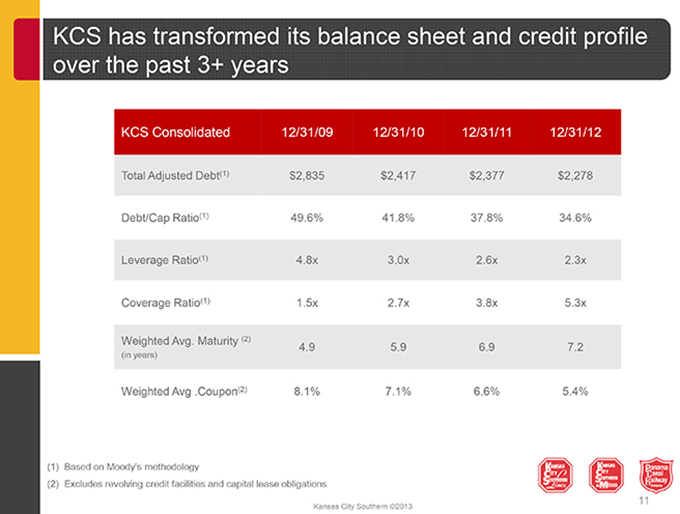

KCS has transformed its balance sheet and credit profile over the past 3+ years

KCS Consolidated 12/31/09 12/31/10 12/31/11 12/31/12

Total Adjusted Debt(1) $2,835 $2,417 $2,377 $2,278 Debt/Cap Ratio(1) 49.6% 41.8% 37.8% 34.6% Leverage Ratio(1) 4.8x 3.0x 2.6x 2.3x

Coverage Ratio(1) 1.5x 2.7x 3.8x 5.3x

Weighted Avg. Maturity (2)

4.9 5.9 6.9 7.2

(in years)

Weighted Avg .Coupon(2) 8.1% 7.1% 6.6% 5.4%

(1) Based on Moody’s methodology

(2) Excludes revolving credit facilities and capital lease obligations

11

Kansas City Southern ©2013

Comparing KSU’s Financing to its Rail Peers

Significant Tenor Extension at Attractive Coupons

30

Weighted Average Maturity Comparison (years)

24 Peer average = 16.3 years

24.3y 18

15.6y 16.8y

12 13.9y 14.2y 14.3y

13.1y

6 7.2y 0

Weighted Average Coupon Comparison (%)

Peer average = 5.68%

7.5%

6.0%

4.5% 6.32% 5.93% 5.63% 5.49% 5.40% 5.36% 5.36%

3.0% 3.73%

1.5%

0.0%

SOURCE: Bloomberg, Company Filings

Kansas City Southern ©2013 12

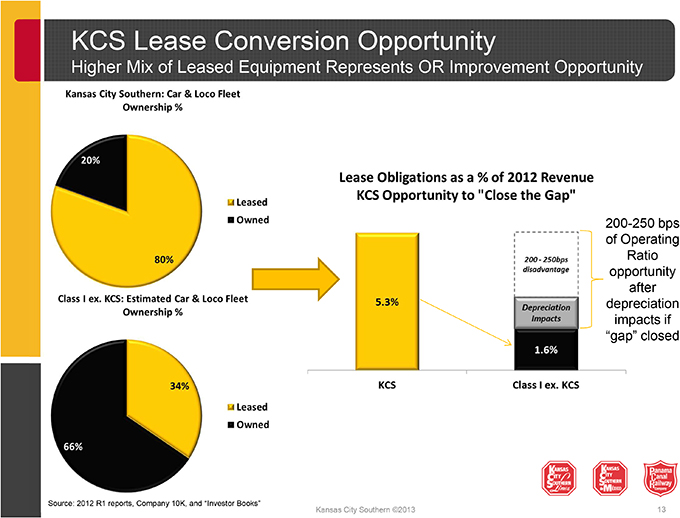

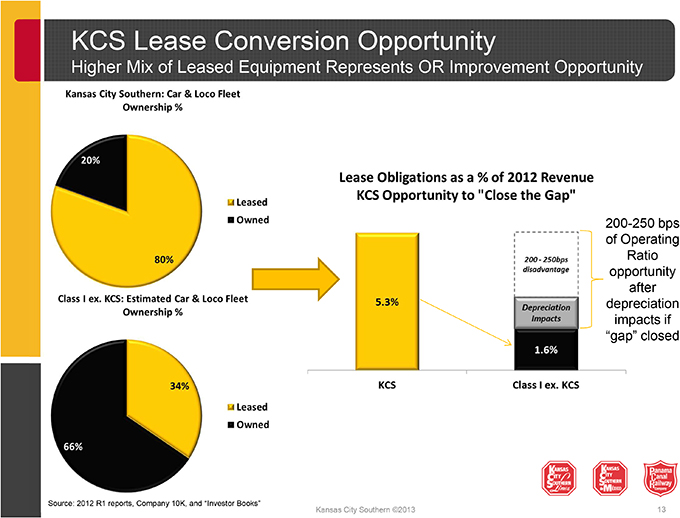

KCS Lease Conversion Opportunity

Higher Mix of Leased Equipment Represents OR Improvement Opportunity

200-250 bps of Operating Ratio opportunity after depreciation impacts if “gap” closed

Source: 2012 R1 reports, Company 10K, and “Investor Books”

Kansas City Southern ©2013 13

Strategic Growth Areas

Kansas City Southern ©2013 14

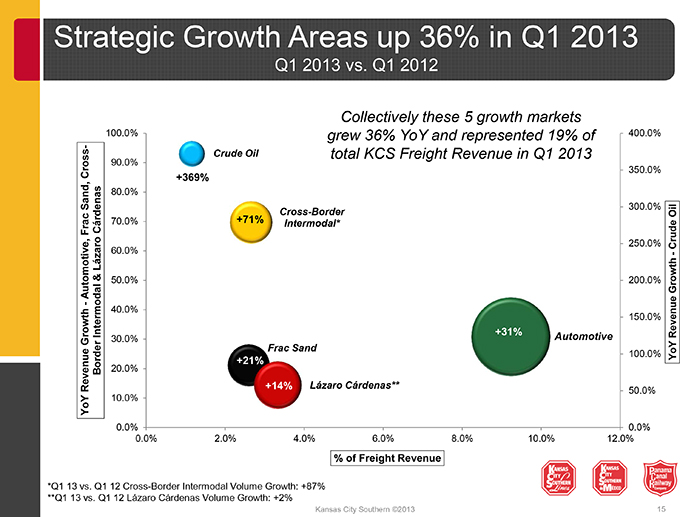

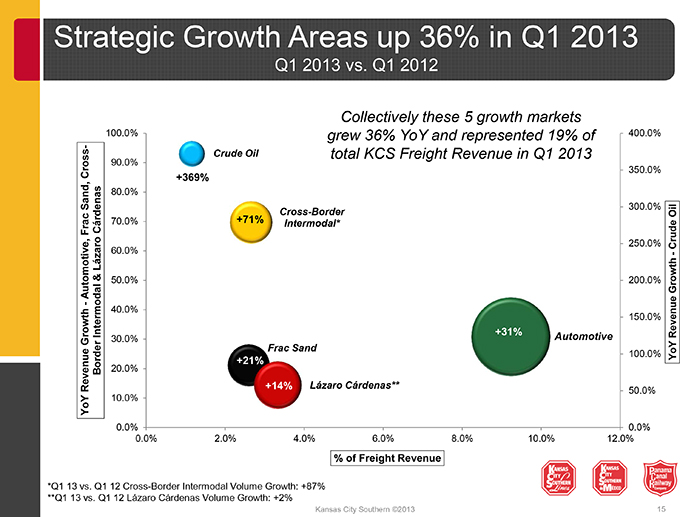

Strategic Growth Areas up 36% in Q1 2013

Q1 2013 vs. Q1 2012

Collectively these 5 growth markets

100.0% grew 36% YoY and represented 19% of 400.0%

Cross-

Crude Oil total KCS Freight Revenue in Q1 2013

90.0%

+369% 350.0% 80.0% Sand, 300.0%

Cross-Border Oil

Frac Cárdenas 70.0% +71% Intermodal*

250.0% Crude 60.0% -

Lázaro & 50.0% 200.0% Growth

Automotive,

- 40.0%

+35% 150.0%

Intermodal +31% Revenue

Growth 30.0% Automotive

Frac Sand

+21% 100.0% YoY

Border 20.0%

Revenue +14% Lázaro Cárdenas**

50.0% YoY 10.0% 0.0% 0.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0%

% of Freight Revenue

*Q1 13 vs. Q1 12 Cross-Border Intermodal Volume Growth: +87% **Q1 13 vs. Q1 12 Lázaro Cárdenas Volume Growth: +2%

Kansas City Southern ©2013 15

Automotive Franchise

Kansas City Southern ©2013 16

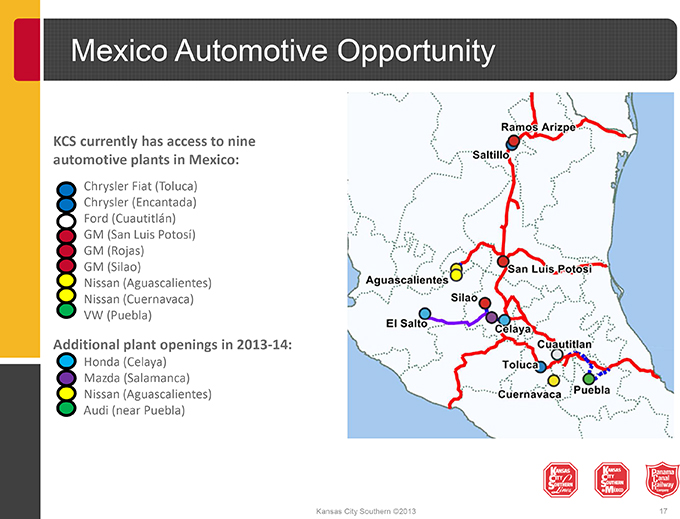

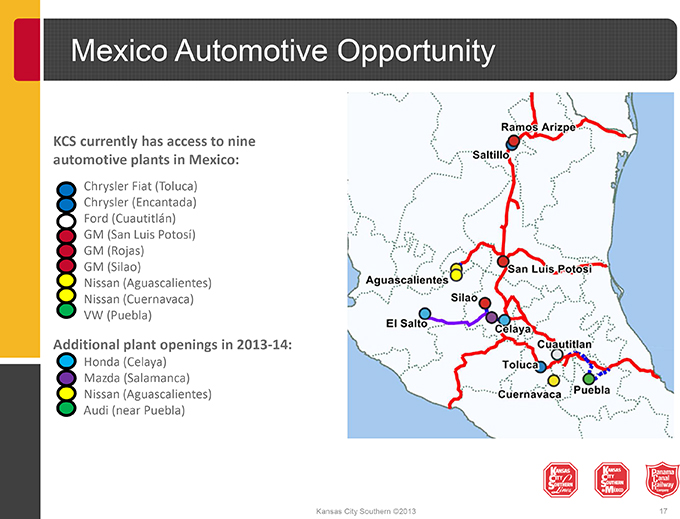

Mexico Automotive Opportunity

KCS currently has access to nine automotive plants in Mexico:

Chrysler Fiat (Toluca) Chrysler (Encantada) Ford (Cuautitlán) GM (San Luis Potosí) GM (Rojas) GM (Silao) Nissan (Aguascalientes) Nissan (Cuernavaca) VW (Puebla)

Additional plant openings in 2013-14:

Honda (Celaya) Mazda (Salamanca) Nissan (Aguascalientes) Audi (near Puebla)

Kansas City Southern ©2013 17

New Auto Plant Openings

HONDA MAZDA NISSAN AUDI

Celaya, Mexico Salamanca, Mexico Aguascalientes, Mexico San Jose Chiapa, Opens February 2014 Opens Q1 2014 Opens December 2013 Puebla, Mexico Est. Production: 280K Est. Production: 185K Est. Production: 149K Groundbreaking: 5/4/13 Opens: 2016 Est. Production: 150K

Source: Company press releases, Autocast (Est. 2015 auto production), Google Earth

Kansas City Southern ©2013 18

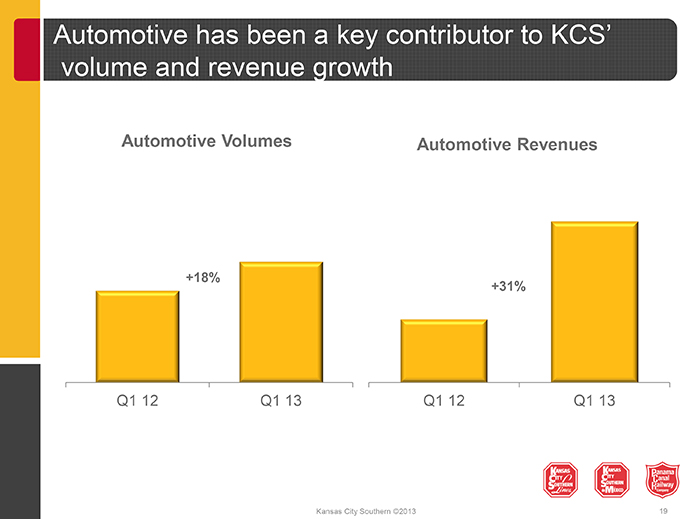

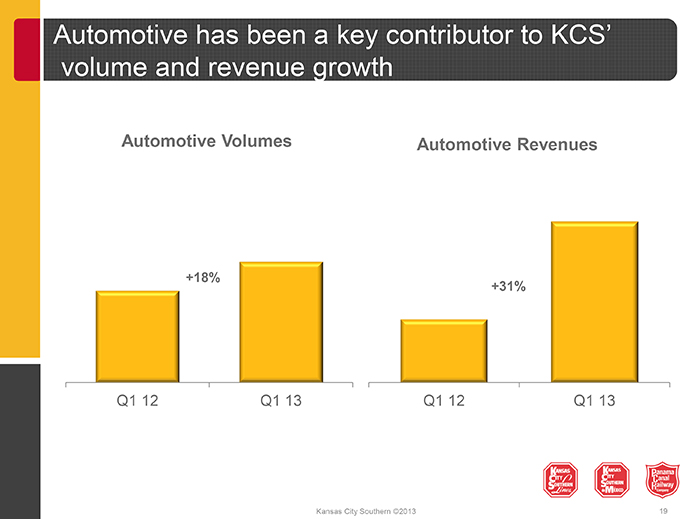

Automotive has been a key contributor to KCS’ volume and revenue growth

Automotive Volumes Automotive Revenues

+18%

+31%

Q1 12 Q1 13 Q1 12 Q1 13

Kansas City Southern ©2013 19

Cross Border Intermodal

Kansas City Southern ©2013 20

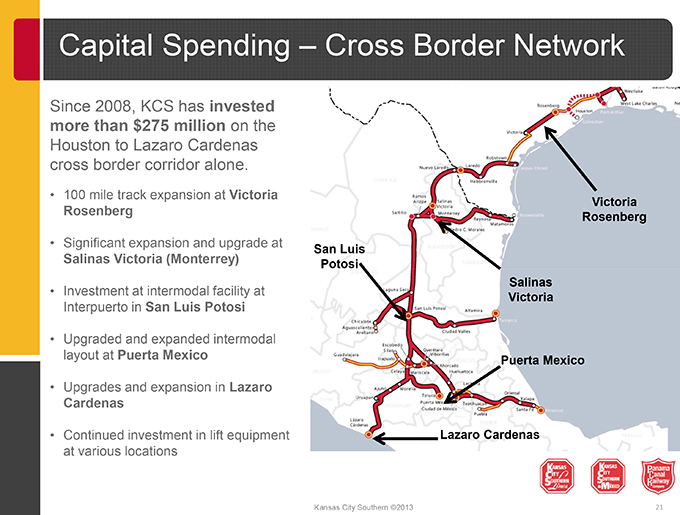

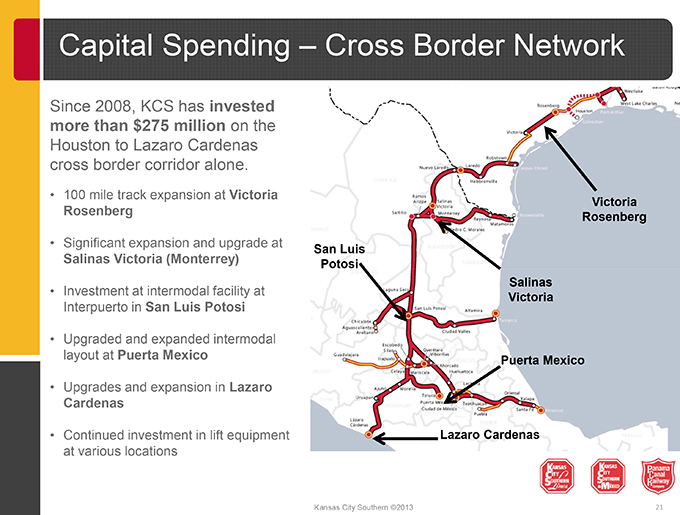

Capital Spending – Cross Border Network

Since 2008, KCS has invested more than $275 million on the

Houston to Lazaro Cardenas cross border corridor alone.

100 mile track expansion at Victoria

Rosenberg Victoria

Rosenberg

Significant expansion and upgrade at

Salinas Victoria (Monterrey) San Luis

Potosi

Salinas

Investment at intermodal facility at

Interpuerto in San Luis Potosi Victoria

Upgraded and expanded intermodal layout at Puerta Mexico

Puerta Mexico

Upgrades and expansion in Lazaro Cardenas

Continued investment in lift equipment Lazaro Cardenas at various locations

Kansas City Southern ©2013 21

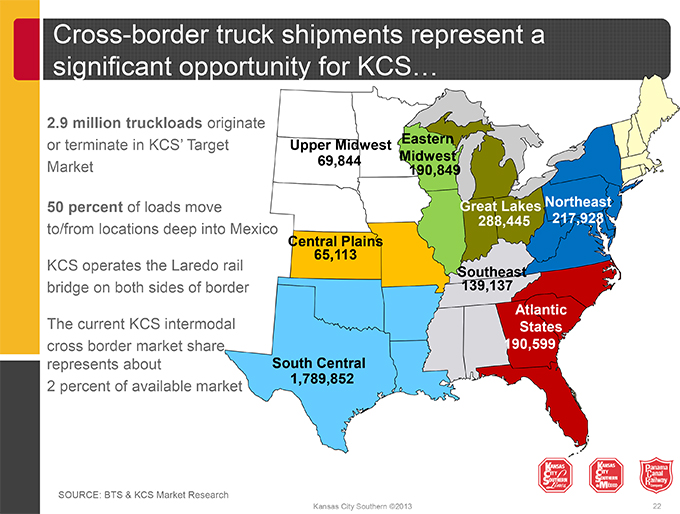

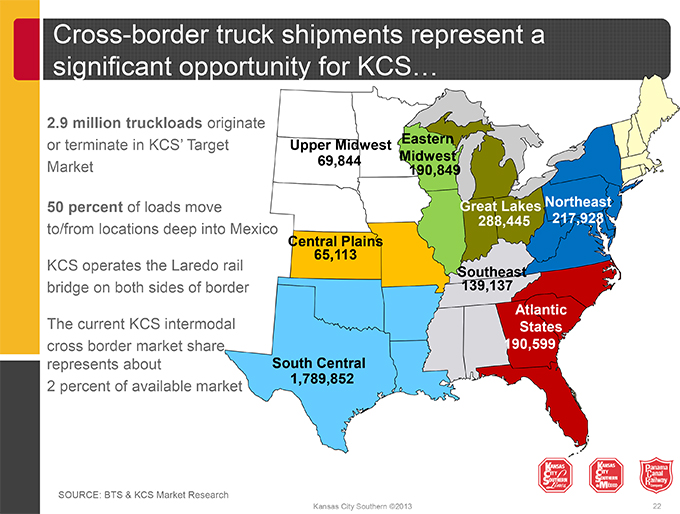

Cross-border truck shipments represent a

significant opportunity for KCS…

2.9 million truckloads originate

or terminate in KCS’ Target Upper Midwest Eastern

69,844 Midwest

Market 190,849

155K

50 percent of loads move Great LakesNortheast

to/from locations deep into Mexico 134K 288,445 217,928

Central Plains

65,113

KCS operates the Laredo rail Southeast

bridge on both sides of border 139,137

Atlantic

The current KCS intermodal States

cross border market share 190,599

represents about South Central

1,742K

2 percent of available market 1,789,852

SOURCE: BTS & KCS Market Research

Kansas City Southern ©2013 22

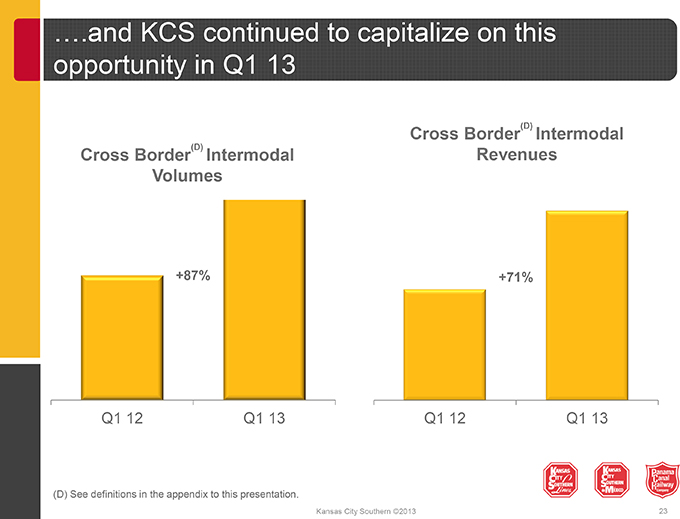

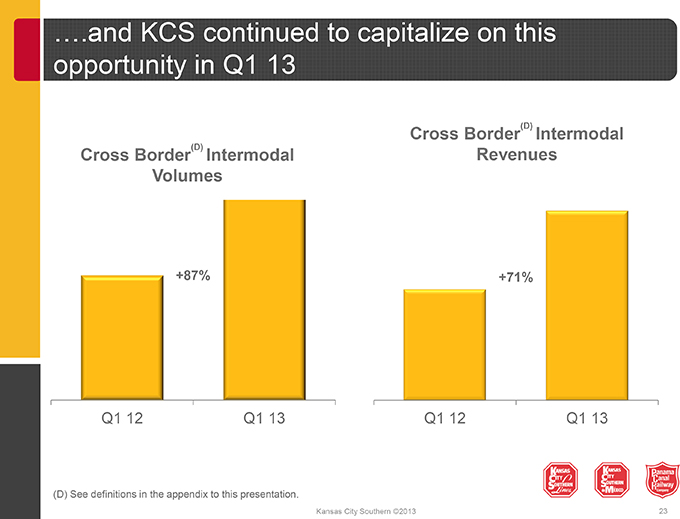

….and KCS continued to capitalize on this opportunity in Q1 13

(D)

Cross Border Intermodal

(D)

Cross Border Intermodal Revenues Volumes

+87% +71%

Q1 12 Q1 13 Q1 12 Q1 13

(D) See definitions in the appendix to this presentation.

Kansas City Southern ©2013 23

Lázaro Cárdenas

Kansas City Southern ©2013 24

Lázaro Cárdenas Development Plans

• APM Terminals signed second container concession contract in August 2012 and will invest $900m in the project

• In October 2012, SSA Marine won a concession to develop, operate and maintain a Specialized Auto Terminal capable of handling up to 750,000 autos annually

• Hutchinson Port Holdings plans to have five new vessel cranes installed in Q2 2013

SOURCE: APM Terminals Press Release dated November 12, 2012; sct.gob.mx

Kansas City Southern ©2013 25

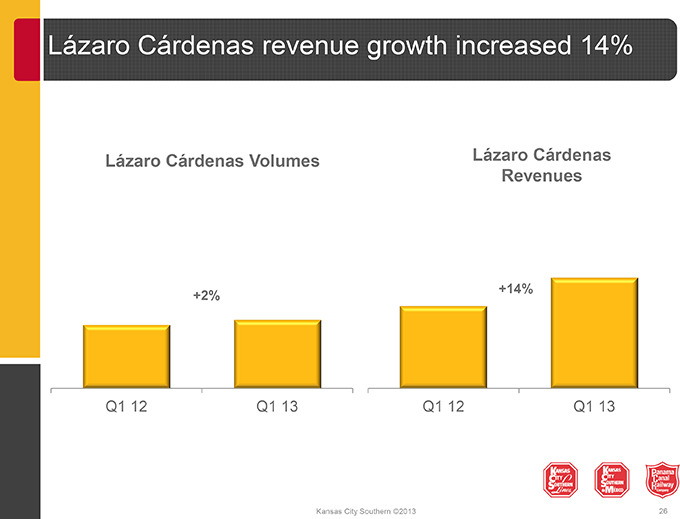

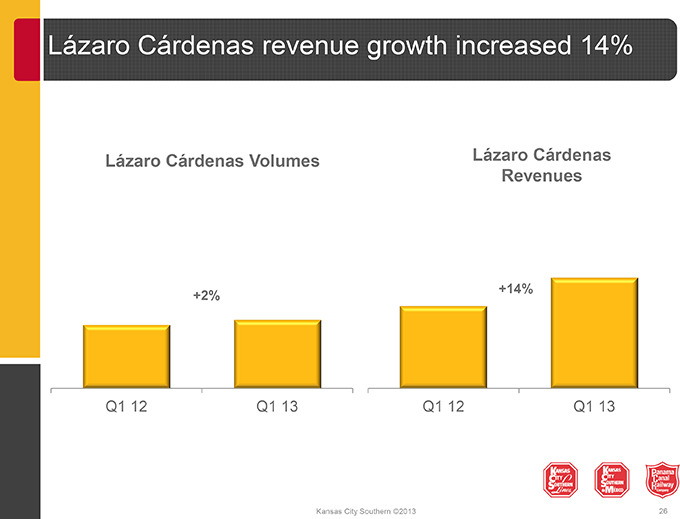

Lázaro Cárdenas revenue growth increased 14%

Lázaro Cárdenas Volumes Lázaro Cárdenas Revenues

+14% +2%

Q1 12 Q1 13 Q1 12 Q1 13

Kansas City Southern ©2013 26

Energy

Kansas City Southern ©2013 27

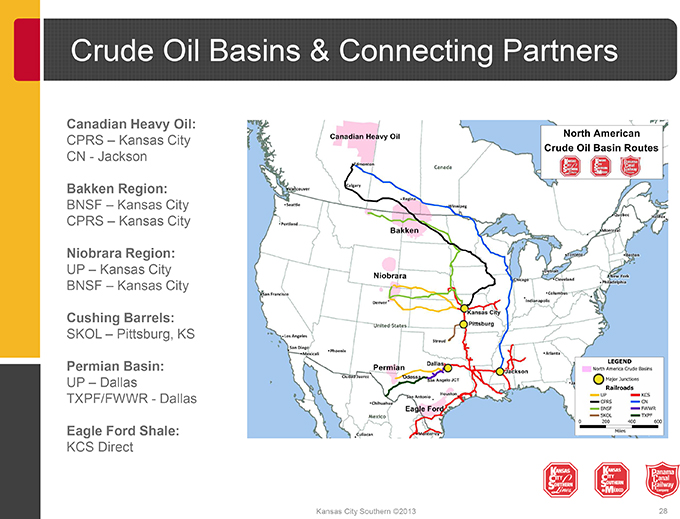

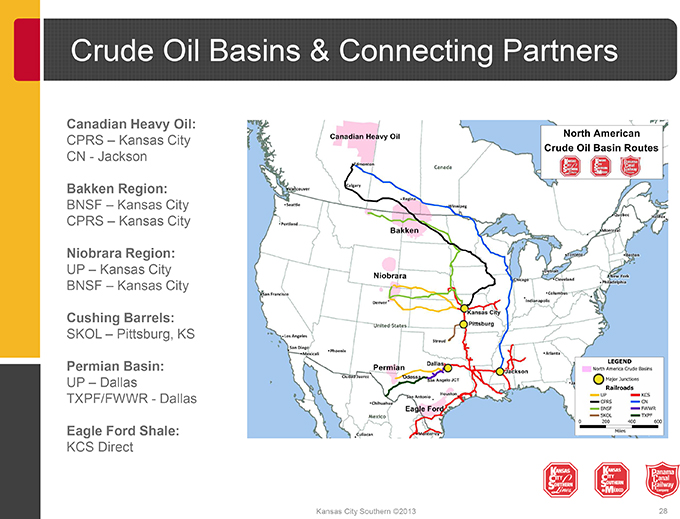

Crude Oil Basins & Connecting Partners

Canadian Heavy Oil:

CPRS – Kansas City CN - Jackson

Bakken Region:

BNSF – Kansas City CPRS – Kansas City

Niobrara Region:

UP – Kansas City BNSF – Kansas City

Cushing Barrels:

SKOL – Pittsburg, KS

Permian Basin:

UP – Dallas

TXPF/FWWR - Dallas

Eagle Ford Shale:

KCS Direct

Kansas City Southern ©2013 28

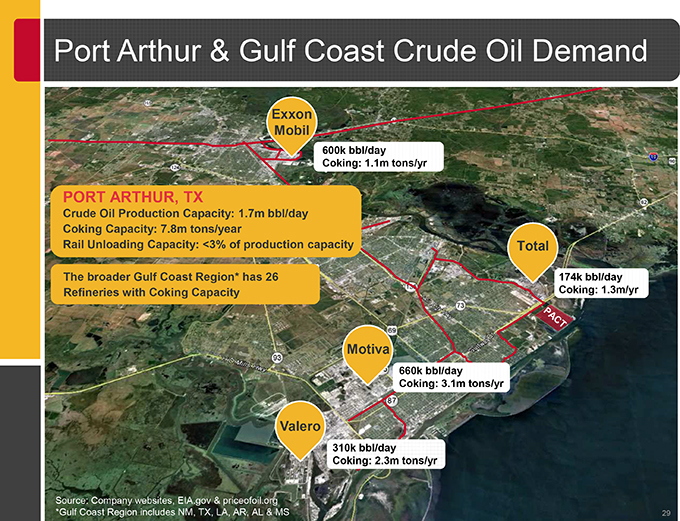

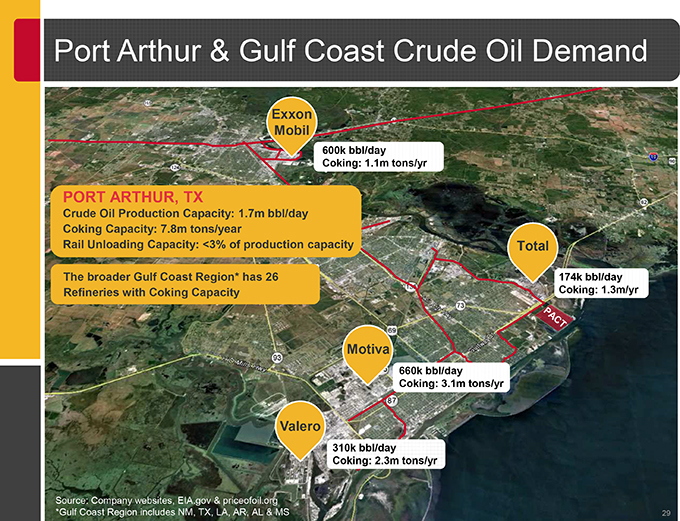

Port Arthur & Gulf Coast Crude Oil Demand

Exxon Mobil

600k bbl/day

Coking: 1.1m tons/yr

PORT ARTHUR, TX

Crude Oil Production Capacity: 1.7m bbl/day Coking Capacity: 7.8m tons/year

Rail Unloading Capacity: <3% of production capacity Total

The broader Gulf Coast Region* has 26 174k bbl/day Refineries with Coking Capacity Coking: 1.3m/yr

Motiva

660k bbl/day

Coking: 3.1m tons/yr

Valero

310k bbl/day

Coking: 2.3m tons/yr

Source: Company websites, EIA.gov & priceofoil.org

*Gulf Coast Region includes NM, TX, LA, AR, AL & MS 29

Conclusion

Kansas City Southern ©2013 30

KSU Investment Highlights

Best-positioned growth story in the industry with unique U.S.-Mexico cross-border network and the most profitable rail franchise in Mexico

Track record of strong financial and operating performance

Well-diversified customer base and commodity mix

Excellent strategic positioning with multiple growth drivers

Solid balance sheet with a commitment to maintaining investment grade credit rating

Kansas City Southern ©2013 31